Third Quarter 2025 Earnings Presentation October 29, 2025 .2

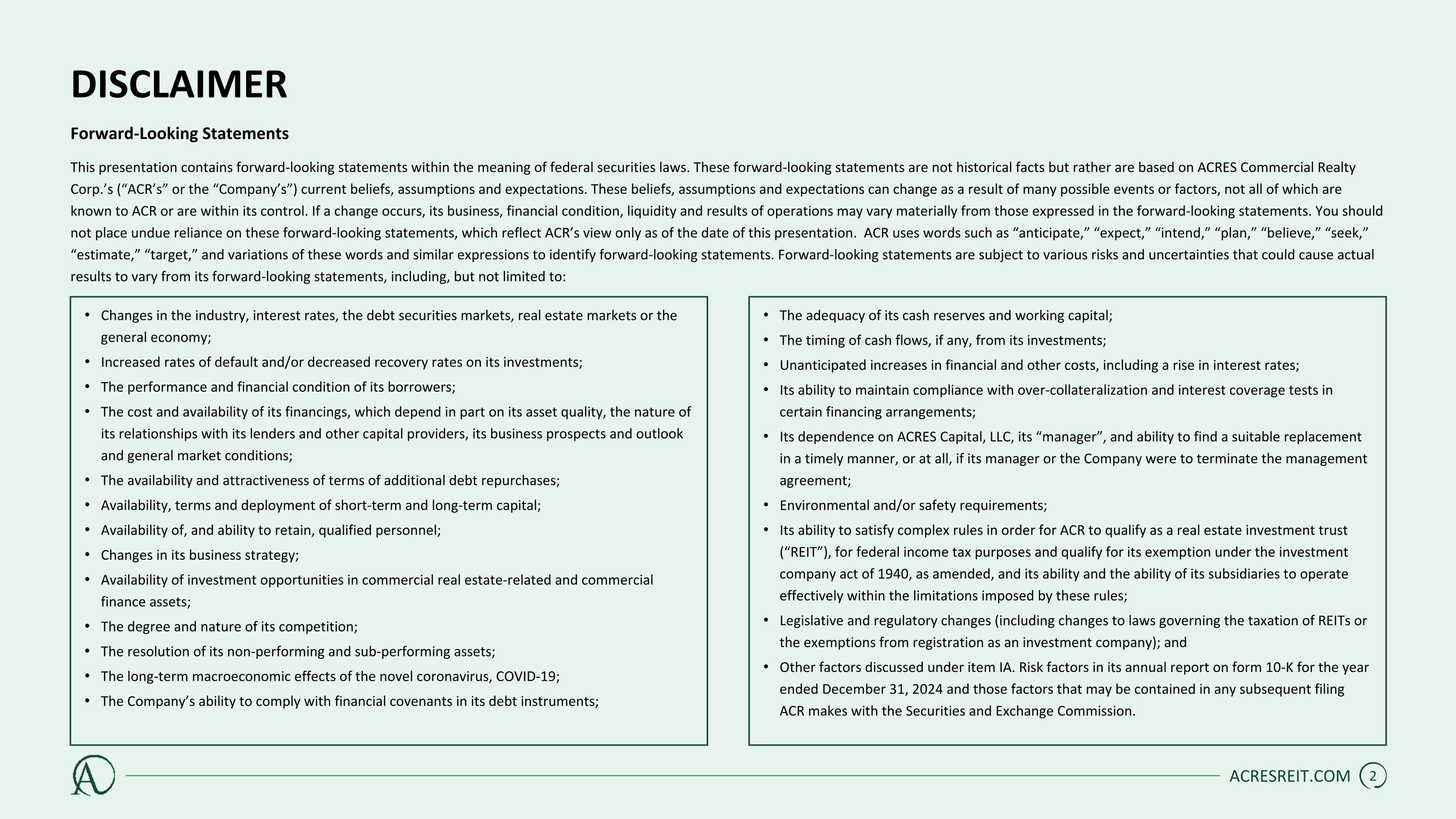

DISCLAIMER Forward-Looking Statements This presentation contains forward-looking statements within the meaning of federal securities laws. These forward-looking statements are not historical facts but rather are based on ACRES Commercial Realty Corp.’s (“ACR’s” or the “Company’s”) current beliefs, assumptions and expectations. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to ACR or are within its control. If a change occurs, its business, financial condition, liquidity and results of operations may vary materially from those expressed in the forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect ACR’s view only as of the date of this presentation. ACR uses words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “target,” and variations of these words and similar expressions to identify forward-looking statements. Forward-looking statements are subject to various risks and uncertainties that could cause actual results to vary from its forward-looking statements, including, but not limited to: The adequacy of its cash reserves and working capital; The timing of cash flows, if any, from its investments; Unanticipated increases in financial and other costs, including a rise in interest rates; Its ability to maintain compliance with over-collateralization and interest coverage tests in certain financing arrangements; Its dependence on ACRES Capital, LLC, its “manager”, and ability to find a suitable replacement in a timely manner, or at all, if its manager or the Company were to terminate the management agreement; Environmental and/or safety requirements; Its ability to satisfy complex rules in order for ACR to qualify as a real estate investment trust (“REIT”), for federal income tax purposes and qualify for its exemption under the investment company act of 1940, as amended, and its ability and the ability of its subsidiaries to operate effectively within the limitations imposed by these rules; Legislative and regulatory changes (including changes to laws governing the taxation of REITs or the exemptions from registration as an investment company); and Other factors discussed under item IA. Risk factors in its annual report on form 10-K for the year ended December 31, 2024 and those factors that may be contained in any subsequent filing ACR makes with the Securities and Exchange Commission. Changes in the industry, interest rates, the debt securities markets, real estate markets or the general economy; Increased rates of default and/or decreased recovery rates on its investments; The performance and financial condition of its borrowers; The cost and availability of its financings, which depend in part on its asset quality, the nature of its relationships with its lenders and other capital providers, its business prospects and outlook and general market conditions; The availability and attractiveness of terms of additional debt repurchases; Availability, terms and deployment of short-term and long-term capital; Availability of, and ability to retain, qualified personnel; Changes in its business strategy; Availability of investment opportunities in commercial real estate-related and commercial finance assets; The degree and nature of its competition; The resolution of its non-performing and sub-performing assets; The long-term macroeconomic effects of the novel coronavirus, COVID-19; The Company’s ability to comply with financial covenants in its debt instruments; ACRESREIT.COM

DISCLAIMER Forward-Looking Statements (continued) In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this presentation might not occur and actual results, performance or achievement could differ materially from those anticipated or implied in the forward-looking statements. The Company undertakes no obligation, and specifically disclaims any obligation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Past Performance Past performance is not indicative of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. Notes on Presentation This presentation contains information regarding financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”), which management believes is relevant to assessing ACR’s financial performance. Please refer to page 17 for the reconciliation of Net Income (Loss), a GAAP financial measure, to Earnings Available for Distribution (“EAD”), a non-GAAP financial measure. Unless otherwise indicated, information included in this presentation is at or for the period ended September 30, 2025. Definitions Refer to page 20 for a description of certain terms not otherwise defined or footnoted, including EAD, Benchmark Rate, Book Value, and other key terms. This presentation is for informational purposes only and does not constitute an offer to sell or the solicitation of any offer to buy any securities of ACR or any other entity. Any offering of securities would be made pursuant to separate documentation and any such securities would not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. No Offer or Sale of Securities ACRESREIT.COM

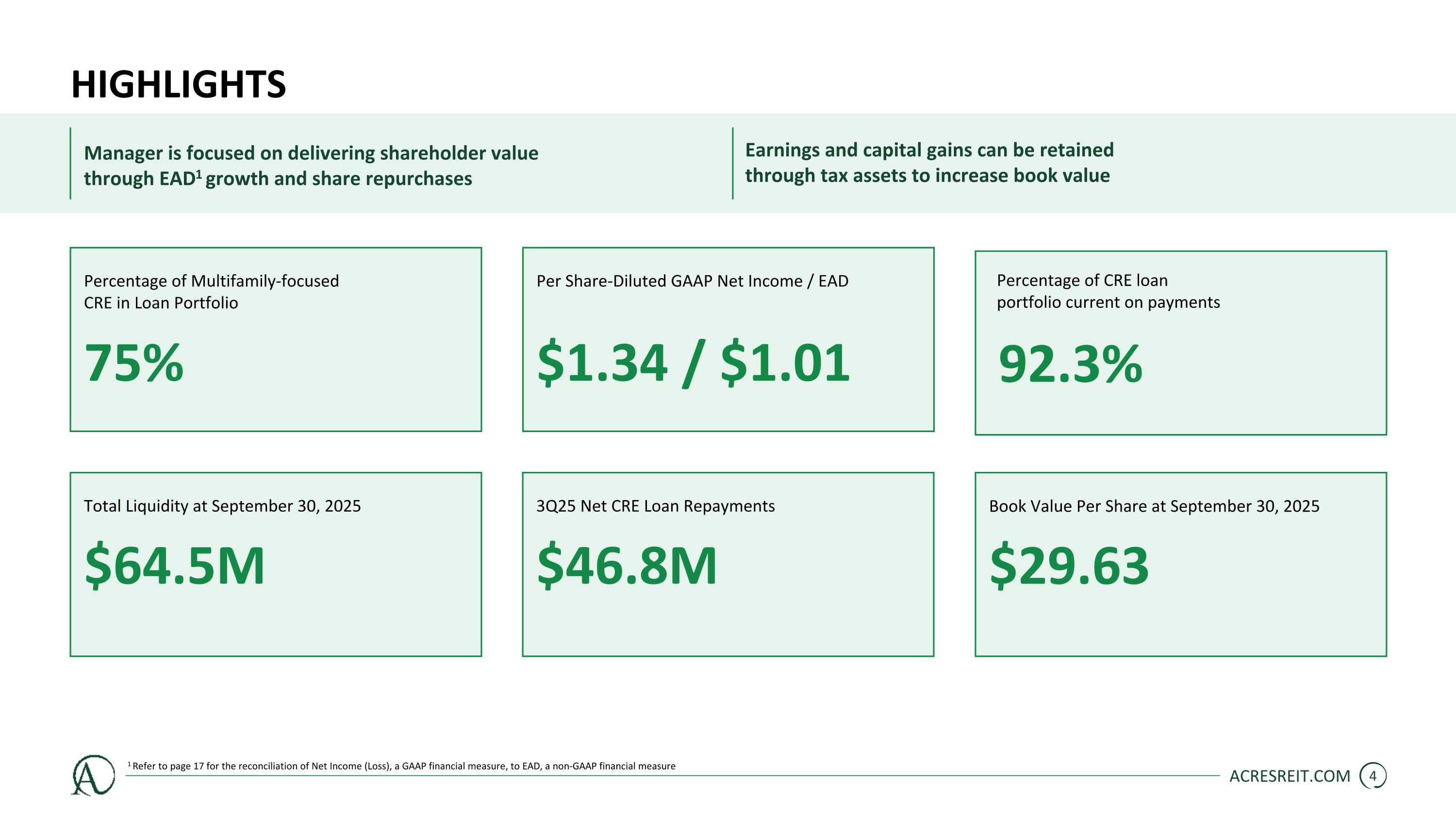

Highlights Earnings and capital gains can be retained through tax assets to increase book value Manager is focused on delivering shareholder value through EAD1 growth and share repurchases ACRESREIT.COM Percentage of Multifamily-focused CRE in Loan Portfolio 75% Per Share-Diluted GAAP Net Income / EAD $1.34 / $1.01 3Q25 Net CRE Loan Repayments $46.8M $29.63 Book Value Per Share at September 30, 2025 Total Liquidity at September 30, 2025 $64.5M 1 Refer to page 17 for the reconciliation of Net Income (Loss), a GAAP financial measure, to EAD, a non-GAAP financial measure Percentage of CRE loan portfolio current on payments 92.3%

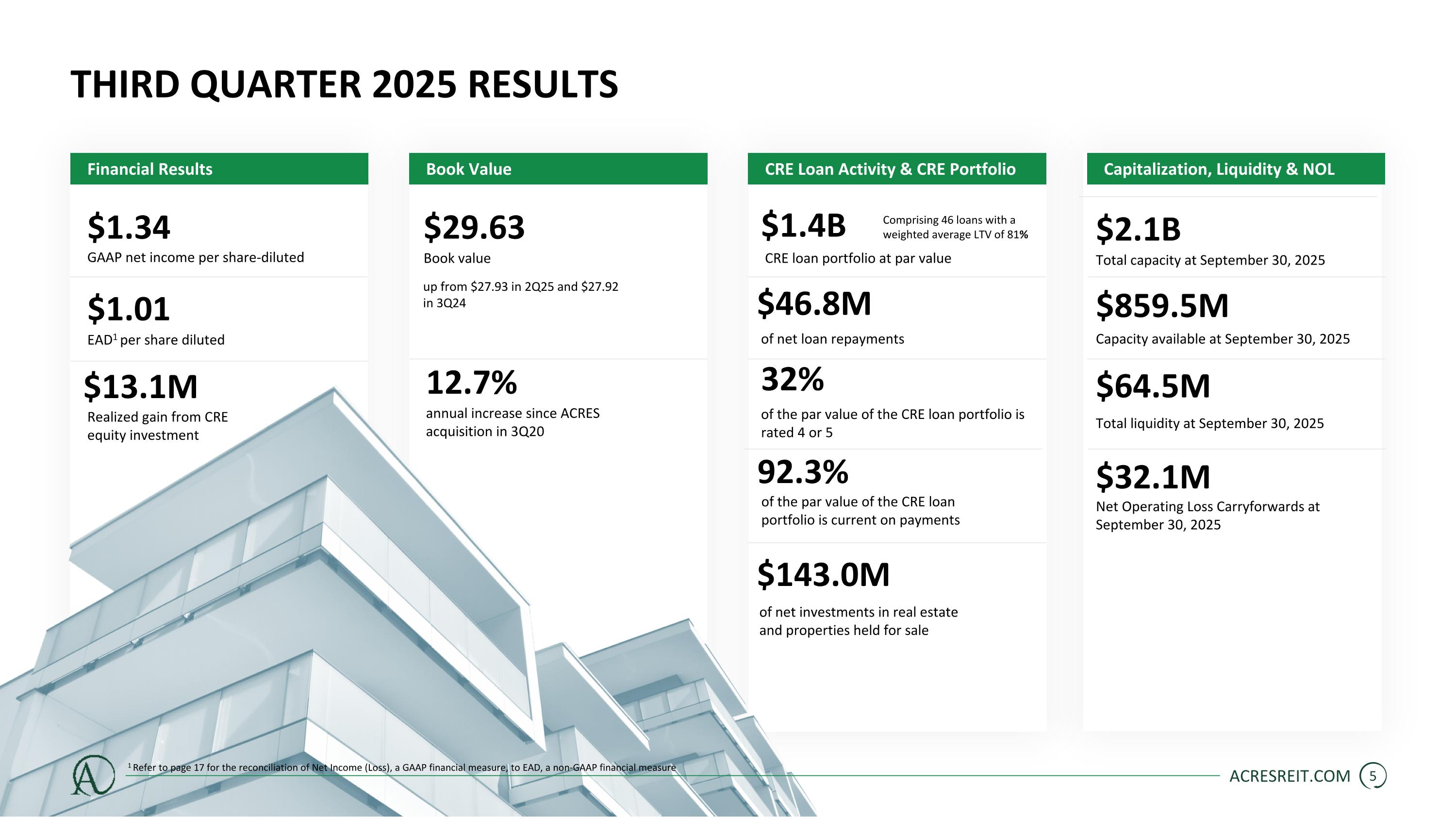

$1.4B Third Quarter 2025 Results Financial Results Book Value CRE Loan Activity & CRE Portfolio Capitalization, Liquidity & NOL ACRESREIT.COM Total liquidity at September 30, 2025 $64.5M $143.0M of net investments in real estate and properties held for sale 92.3% of the par value of the CRE loan portfolio is current on payments of the par value of the CRE loan portfolio is rated 4 or 5 32% Comprising 46 loans with a weighted average LTV of 81% CRE loan portfolio at par value $46.8M of net loan repayments 12.7% annual increase since ACRES acquisition in 3Q20 $29.63 Book value up from $27.93 in 2Q25 and $27.92 in 3Q24 EAD1 per share diluted $1.01 $1.34 GAAP net income per share-diluted 1 Refer to page 17 for the reconciliation of Net Income (Loss), a GAAP financial measure, to EAD, a non-GAAP financial measure $32.1M Net Operating Loss Carryforwards at September 30, 2025 Total capacity at September 30, 2025 $2.1B $859.5M Capacity available at September 30, 2025 $13.1M Realized gain from CRE equity investment

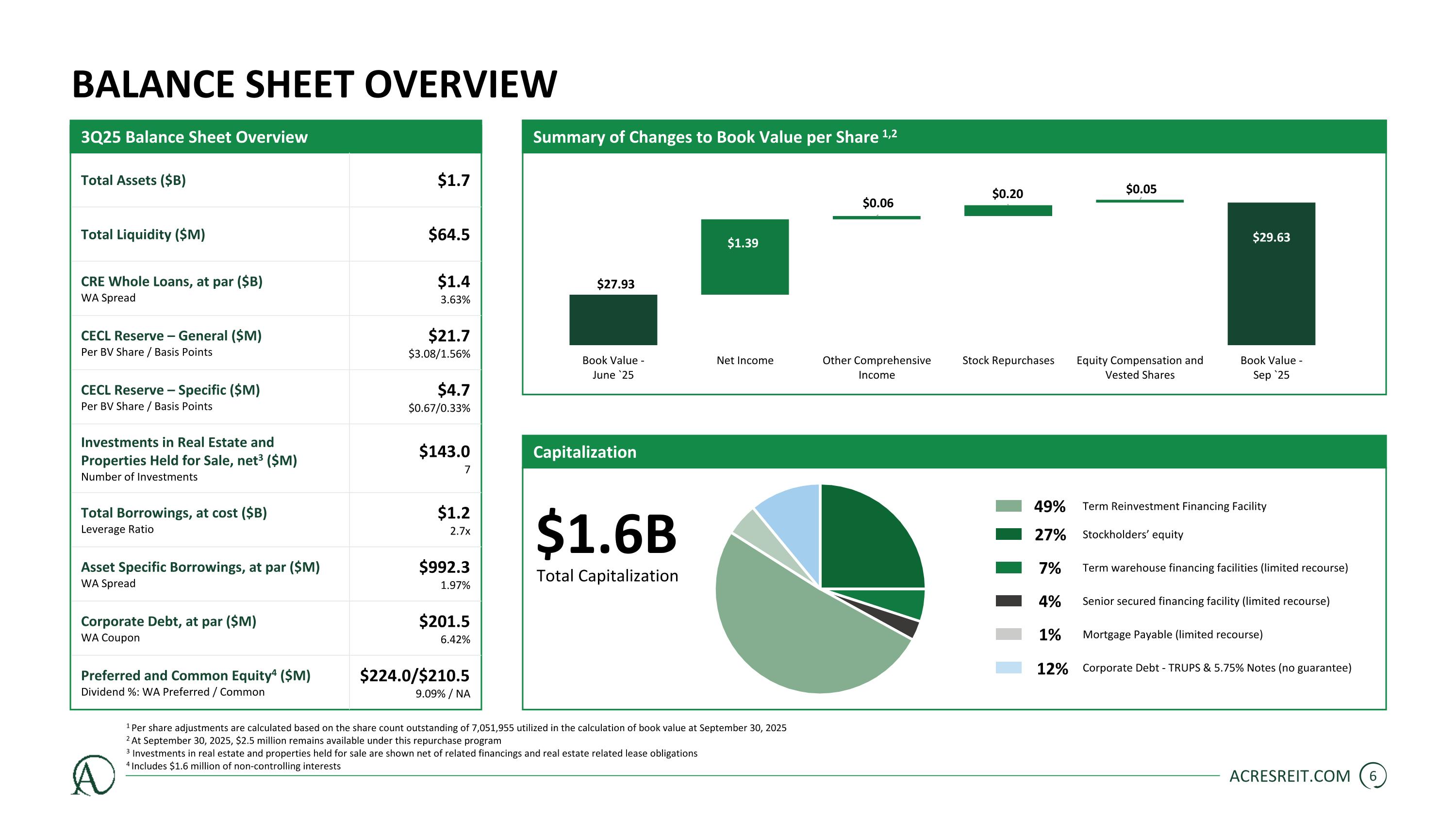

BALANCE SHEET Overview 3Q25 Balance Sheet Overview Summary of Changes to Book Value per Share 1,2 Total Assets ($B) $1.7 Total Liquidity ($M) $64.5 CRE Whole Loans, at par ($B) WA Spread $1.4 3.63% CECL Reserve – General ($M) Per BV Share / Basis Points $21.7 $3.08/1.56% CECL Reserve – Specific ($M) Per BV Share / Basis Points $4.7 $0.67/0.33% Investments in Real Estate and Properties Held for Sale, net3 ($M) Number of Investments $143.0 7 Total Borrowings, at cost ($B) Leverage Ratio $1.2 2.7x Asset Specific Borrowings, at par ($M) WA Spread $992.3 1.97% Corporate Debt, at par ($M) WA Coupon $201.5 6.42% Preferred and Common Equity4 ($M) Dividend %: WA Preferred / Common $224.0/$210.5 9.09% / NA ACRESREIT.COM 1 Per share adjustments are calculated based on the share count outstanding of 7,051,955 utilized in the calculation of book value at September 30, 2025 2 At September 30, 2025, $2.5 million remains available under this repurchase program 3 Investments in real estate and properties held for sale are shown net of related financings and real estate related lease obligations 4 Includes $1.6 million of non-controlling interests Capitalization Total Capitalization $1.6B Stockholders’ equity 27% Term warehouse financing facilities (limited recourse) 7% Senior secured financing facility (limited recourse) 4% Mortgage Payable (limited recourse) 1% Corporate Debt - TRUPS & 5.75% Notes (no guarantee) 12% Term Reinvestment Financing Facility 49%

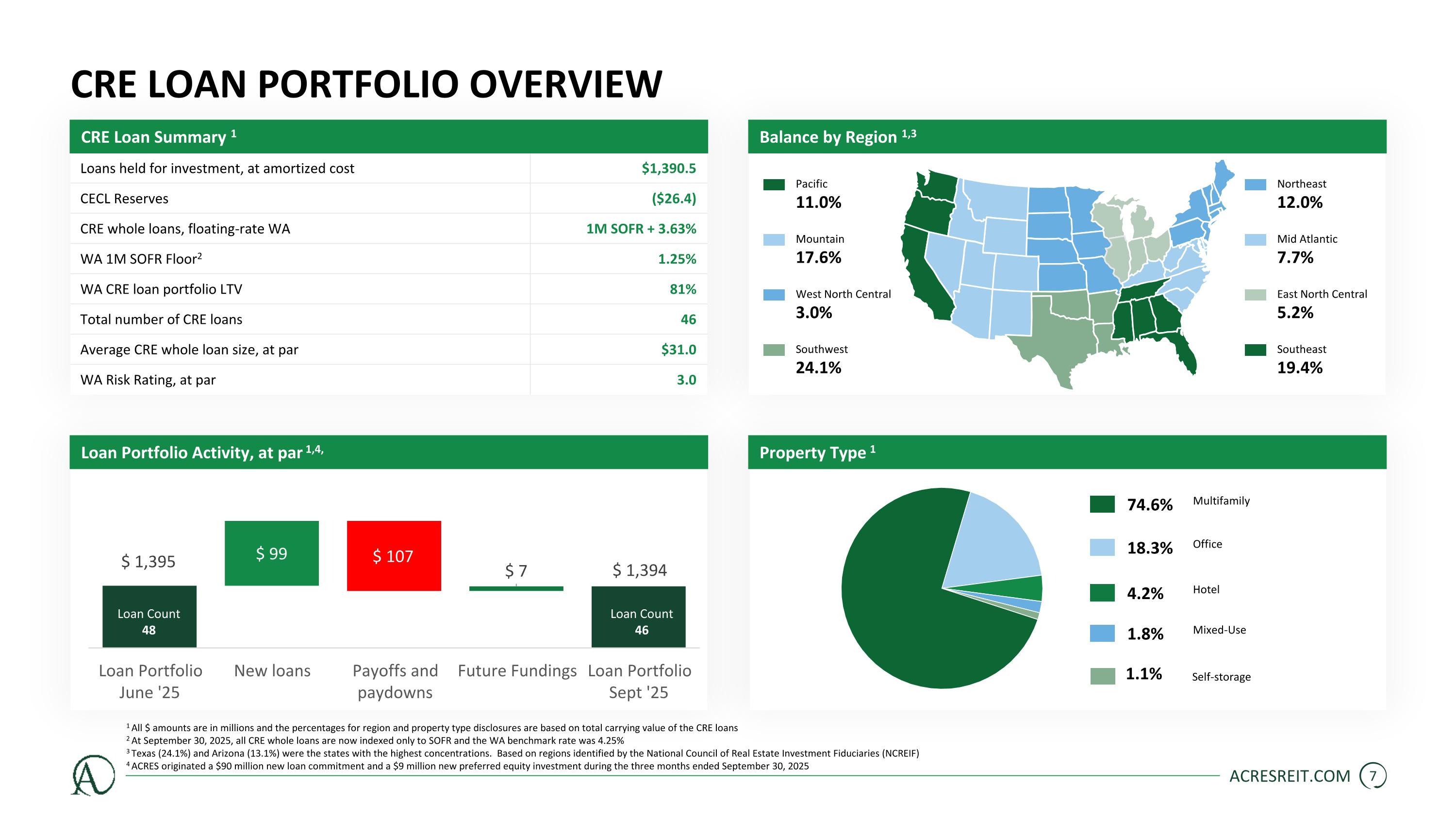

Loans held for investment, at amortized cost $1,390.5 CECL Reserves ($26.4) CRE whole loans, floating-rate WA 1M SOFR + 3.63% WA 1M SOFR Floor2 1.25% WA CRE loan portfolio LTV 81% Total number of CRE loans 46 Average CRE whole loan size, at par $31.0 WA Risk Rating, at par 3.0 CRE Loan Portfolio Overview CRE Loan Summary 1 Balance by Region 1,3 ACRESREIT.COM 1 All $ amounts are in millions and the percentages for region and property type disclosures are based on total carrying value of the CRE loans 2 At September 30, 2025, all CRE whole loans are now indexed only to SOFR and the WA benchmark rate was 4.25% 3 Texas (24.1%) and Arizona (13.1%) were the states with the highest concentrations. Based on regions identified by the National Council of Real Estate Investment Fiduciaries (NCREIF) 4 ACRES originated a $90 million new loan commitment and a $9 million new preferred equity investment during the three months ended September 30, 2025 Loan Count 48 Loan Count 46 Loan Portfolio Activity, at par 1,4, Property Type 1 Pacific 11.0% Mountain 17.6% Southwest 24.1% West North Central 3.0% East North Central 5.2% Southeast 19.4% Mid Atlantic 7.7% Northeast 12.0% Multifamily 74.6% Office 18.3% Self-storage 1.1% Hotel 4.2% Mixed-Use 1.8%

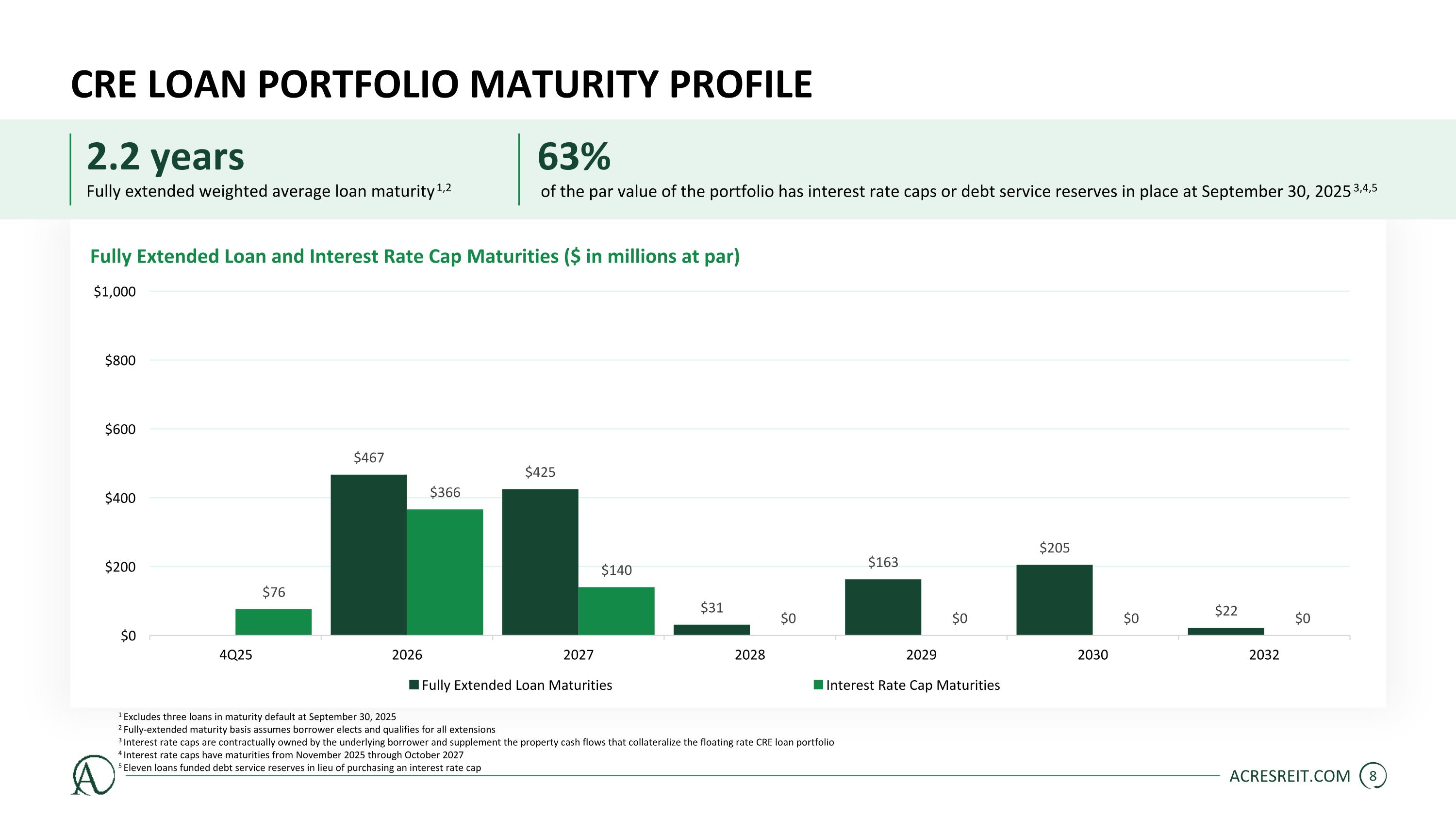

Fully Extended Loan and Interest Rate Cap Maturities ($ in millions at par) CRE Loan Portfolio Maturity Profile ACRESREIT.COM 1 Excludes three loans in maturity default at September 30, 2025 2 Fully-extended maturity basis assumes borrower elects and qualifies for all extensions 3 Interest rate caps are contractually owned by the underlying borrower and supplement the property cash flows that collateralize the floating rate CRE loan portfolio 4 Interest rate caps have maturities from November 2025 through October 2027 5 Eleven loans funded debt service reserves in lieu of purchasing an interest rate cap Fully extended weighted average loan maturity 1,2 of the par value of the portfolio has interest rate caps or debt service reserves in place at September 30, 2025 3,4,5 2.2 years 63%

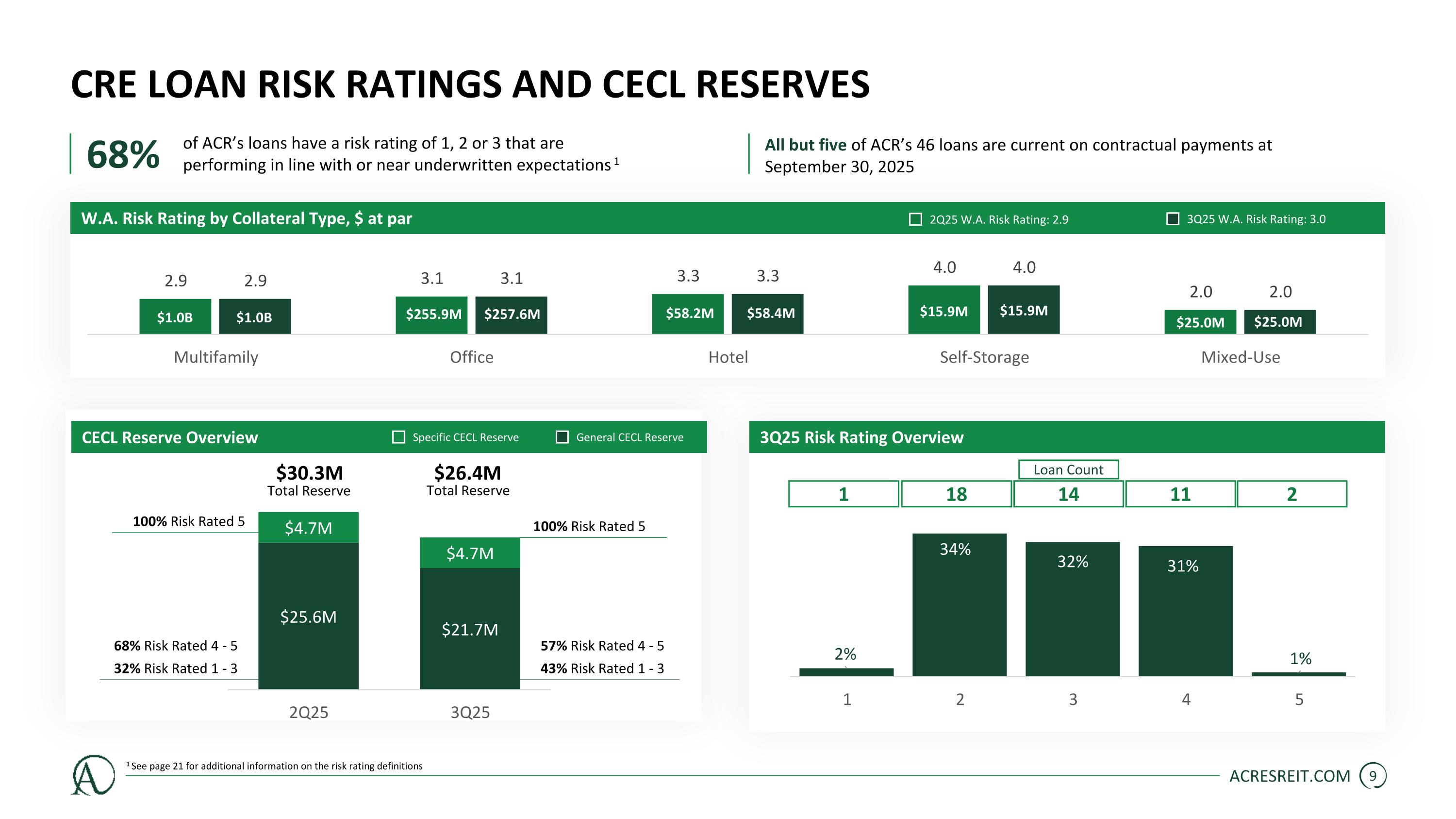

CRE Loan Risk Ratings and CECL Reserves All but five of ACR’s 46 loans are current on contractual payments at September 30, 2025 CECL Reserve Overview ACRESREIT.COM 1 See page 21 for additional information on the risk rating definitions W.A. Risk Rating by Collateral Type, $ at par 3Q25 W.A. Risk Rating: 3.0 2Q25 W.A. Risk Rating: 2.9 of ACR’s loans have a risk rating of 1, 2 or 3 that are performing in line with or near underwritten expectations 1 68% Specific CECL Reserve General CECL Reserve Total Reserve $30.3M Total Reserve $26.4M 100% Risk Rated 5 100% Risk Rated 5 68% Risk Rated 4 - 5 32% Risk Rated 1 - 3 57% Risk Rated 4 - 5 43% Risk Rated 1 - 3 3Q25 Risk Rating Overview $1.0B $1.0B $257.6M $255.9M $58.2M $58.4M $15.9M $15.9M Loan Count 11 18 2 14 1 $25.0M $25.0M

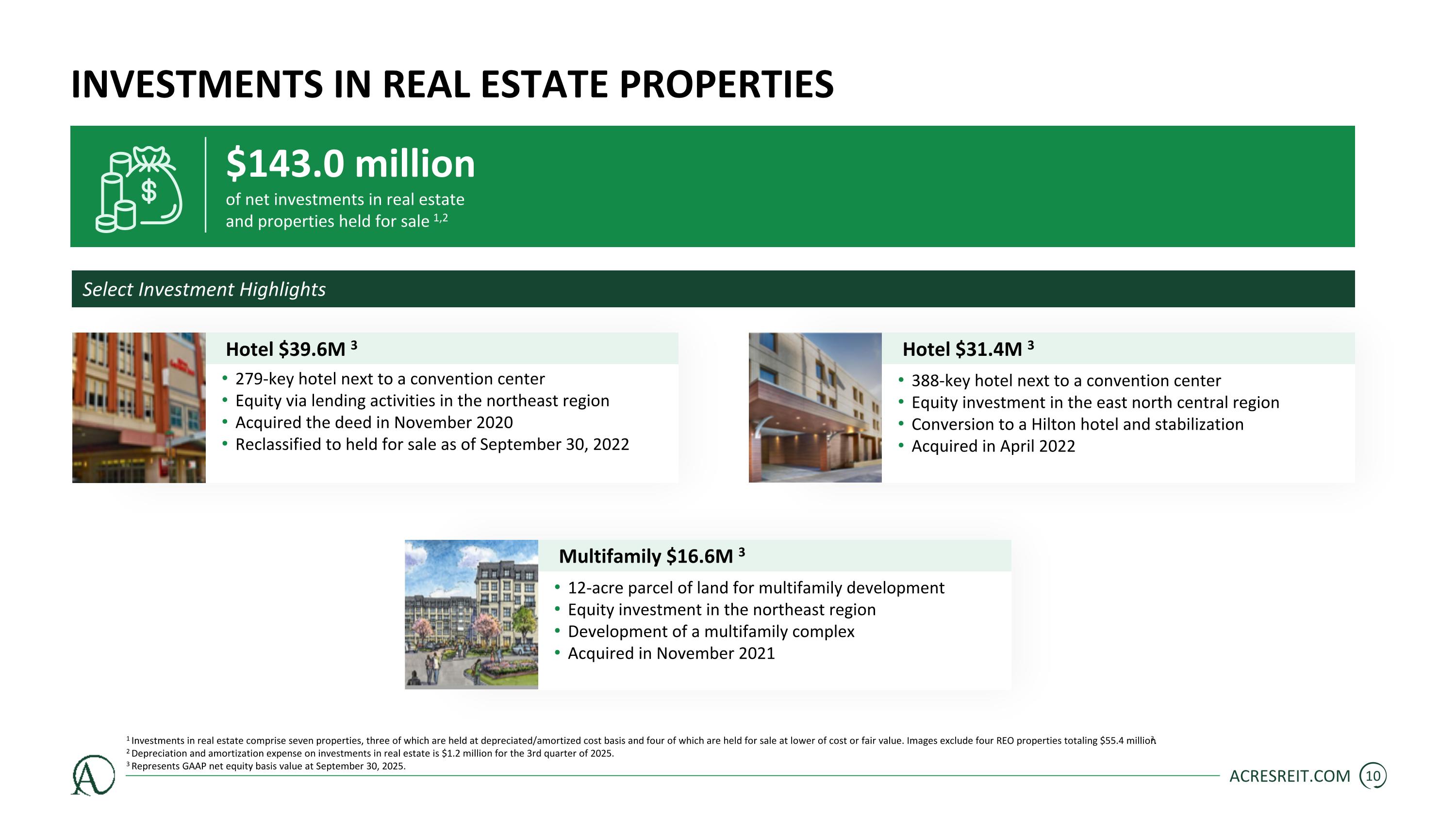

Investments in Real Estate Properties $143.0 million of net investments in real estate and properties held for sale 1,2 388-key hotel next to a convention center Equity investment in the east north central region Conversion to a Hilton hotel and stabilization Acquired in April 2022 ACRESREIT.COM 1 Investments in real estate comprise seven properties, three of which are held at depreciated/amortized cost basis and four of which are held for sale at lower of cost or fair value. Images exclude four REO properties totaling $55.4 million3. 2 Depreciation and amortization expense on investments in real estate is $1.2 million for the 3rd quarter of 2025. 3 Represents GAAP net equity basis value at September 30, 2025. Hotel $31.4M 3 Hotel $39.6M 3 Multifamily $16.6M 3 12-acre parcel of land for multifamily development Equity investment in the northeast region Development of a multifamily complex Acquired in November 2021 279-key hotel next to a convention center Equity via lending activities in the northeast region Acquired the deed in November 2020 Reclassified to held for sale as of September 30, 2022 Select Investment Highlights

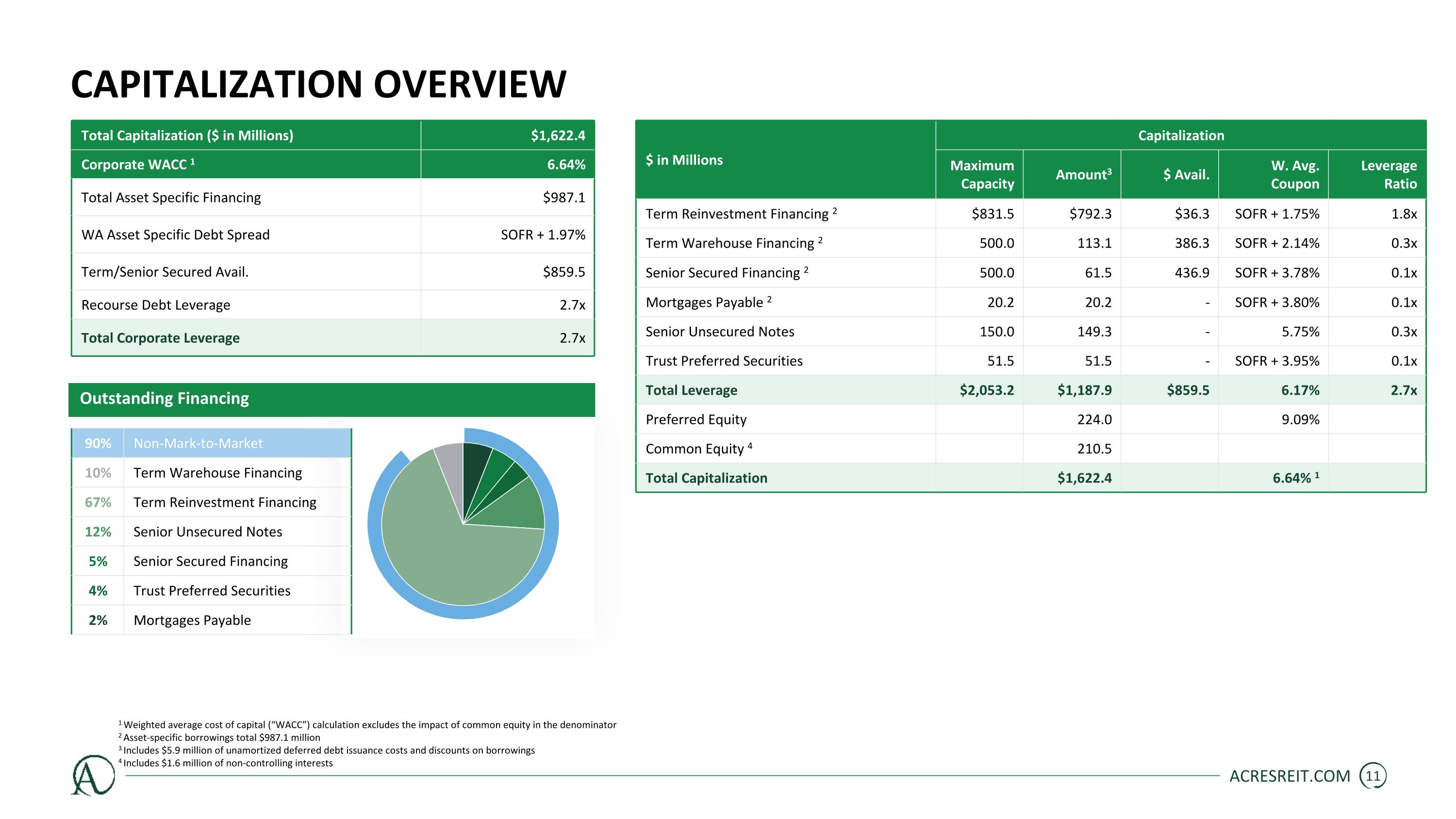

Capitalization Overview $ in Millions Capitalization Maximum Capacity Amount3 $ Avail. W. Avg. Coupon Leverage Ratio Term Reinvestment Financing 2 $831.5 $792.3 $36.3 SOFR + 1.75% 1.8x Term Warehouse Financing 2 500.0 113.1 386.3 SOFR + 2.14% 0.3x Senior Secured Financing 2 500.0 61.5 436.9 SOFR + 3.78% 0.1x Mortgages Payable 2 20.2 20.2 - SOFR + 3.80% 0.1x Senior Unsecured Notes 150.0 149.3 - 5.75% 0.3x Trust Preferred Securities 51.5 51.5 - SOFR + 3.95% 0.1x Total Leverage $2,053.2 $1,187.9 $859.5 6.17% 2.7x Preferred Equity 224.0 9.09% Common Equity 4 210.5 Total Capitalization $1,622.4 6.64% 1 Total Capitalization ($ in Millions) $1,622.4 Corporate WACC 1 6.64% Total Asset Specific Financing $987.1 WA Asset Specific Debt Spread SOFR + 1.97% Term/Senior Secured Avail. $859.5 Recourse Debt Leverage 2.7x Total Corporate Leverage 2.7x ACRESREIT.COM 1 Weighted average cost of capital (“WACC”) calculation excludes the impact of common equity in the denominator 2 Asset-specific borrowings total $987.1 million 3 Includes $5.9 million of unamortized deferred debt issuance costs and discounts on borrowings 4 Includes $1.6 million of non-controlling interests Outstanding Financing 90% Non-Mark-to-Market 10% Term Warehouse Financing 67% Term Reinvestment Financing 12% Senior Unsecured Notes 5% Senior Secured Financing 4% Trust Preferred Securities 2% Mortgages Payable

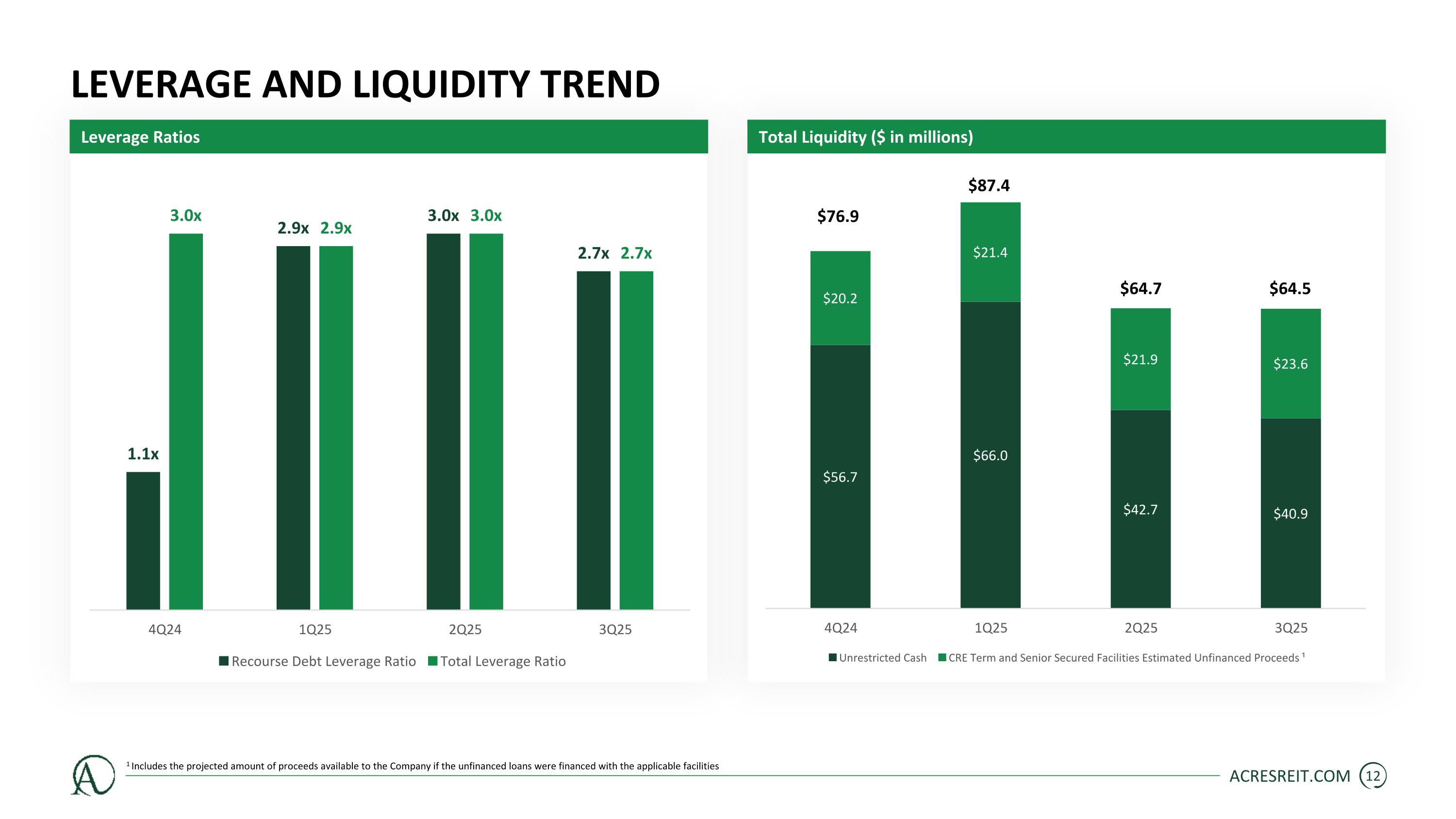

Leverage AND Liquidity Trend ACRESREIT.COM 1 Includes the projected amount of proceeds available to the Company if the unfinanced loans were financed with the applicable facilities $64.7 $76.9 $87.4 $ in millions Leverage Ratios Total Liquidity ($ in millions) $64.5

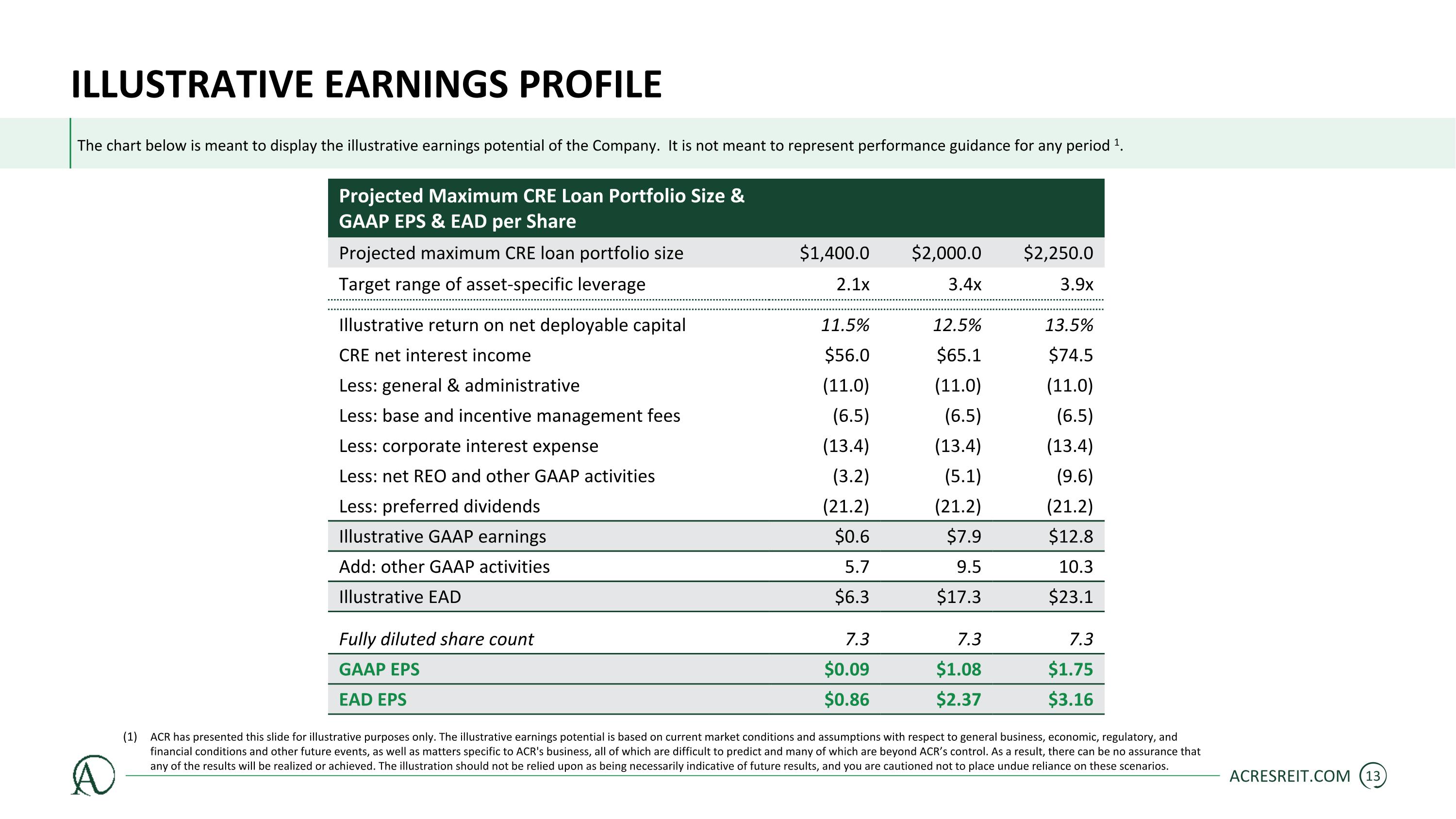

Illustrative EARNINGS PROFILE ACRESREIT.COM Projected Maximum CRE Loan Portfolio Size & GAAP EPS & EAD per Share Projected maximum CRE loan portfolio size $1,400.0 $2,000.0 $2,250.0 Target range of asset-specific leverage 2.1x 3.4x 3.9x Illustrative return on net deployable capital 11.5% 12.5% 13.5% CRE net interest income $56.0 $65.1 $74.5 Less: general & administrative (11.0) (11.0) (11.0) Less: base and incentive management fees (6.5) (6.5) (6.5) Less: corporate interest expense (13.4) (13.4) (13.4) Less: net REO and other GAAP activities (3.2) (5.1) (9.6) Less: preferred dividends (21.2) (21.2) (21.2) Illustrative GAAP earnings $0.6 $7.9 $12.8 Add: other GAAP activities 5.7 9.5 10.3 Illustrative EAD $6.3 $17.3 $23.1 Fully diluted share count 7.3 7.3 7.3 GAAP EPS $0.09 $1.08 $1.75 EAD EPS $0.86 $2.37 $3.16 ACR has presented this slide for illustrative purposes only. The illustrative earnings potential is based on current market conditions and assumptions with respect to general business, economic, regulatory, and financial conditions and other future events, as well as matters specific to ACR's business, all of which are difficult to predict and many of which are beyond ACR’s control. As a result, there can be no assurance that any of the results will be realized or achieved. The illustration should not be relied upon as being necessarily indicative of future results, and you are cautioned not to place undue reliance on these scenarios. The chart below is meant to display the illustrative earnings potential of the Company. It is not meant to represent performance guidance for any period 1.

Appendix ACRESREIT.COM

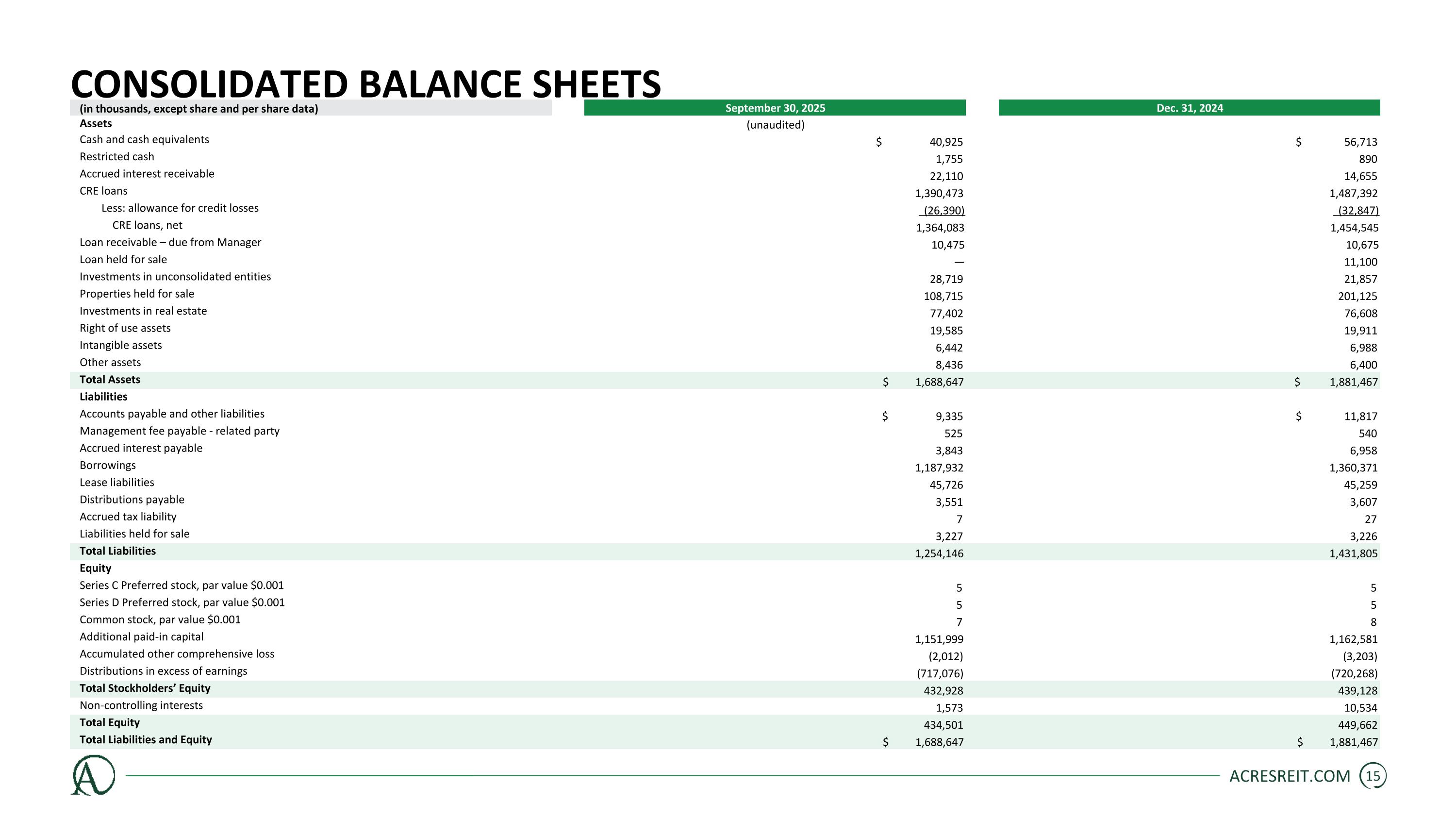

Consolidated Balance Sheets ACRESREIT.COM (in thousands, except share and per share data) September 30, 2025 Dec. 31, 2024 Assets (unaudited) Cash and cash equivalents $ 40,925 $ 56,713 Restricted cash 1,755 890 Accrued interest receivable 22,110 14,655 CRE loans 1,390,473 1,487,392 Less: allowance for credit losses (26,390) (32,847) CRE loans, net 1,364,083 1,454,545 Loan receivable – due from Manager 10,475 10,675 Loan held for sale — 11,100 Investments in unconsolidated entities 28,719 21,857 Properties held for sale 108,715 201,125 Investments in real estate 77,402 76,608 Right of use assets 19,585 19,911 Intangible assets 6,442 6,988 Other assets 8,436 6,400 Total Assets $ 1,688,647 $ 1,881,467 Liabilities Accounts payable and other liabilities $ 9,335 $ 11,817 Management fee payable - related party 525 540 Accrued interest payable 3,843 6,958 Borrowings 1,187,932 1,360,371 Lease liabilities 45,726 45,259 Distributions payable 3,551 3,607 Accrued tax liability 7 27 Liabilities held for sale 3,227 3,226 Total Liabilities 1,254,146 1,431,805 Equity Series C Preferred stock, par value $0.001 5 5 Series D Preferred stock, par value $0.001 5 5 Common stock, par value $0.001 7 8 Additional paid-in capital 1,151,999 1,162,581 Accumulated other comprehensive loss (2,012) (3,203) Distributions in excess of earnings (717,076) (720,268) Total Stockholders’ Equity 432,928 439,128 Non-controlling interests 1,573 10,534 Total Equity 434,501 449,662 Total Liabilities and Equity $ 1,688,647 $ 1,881,467

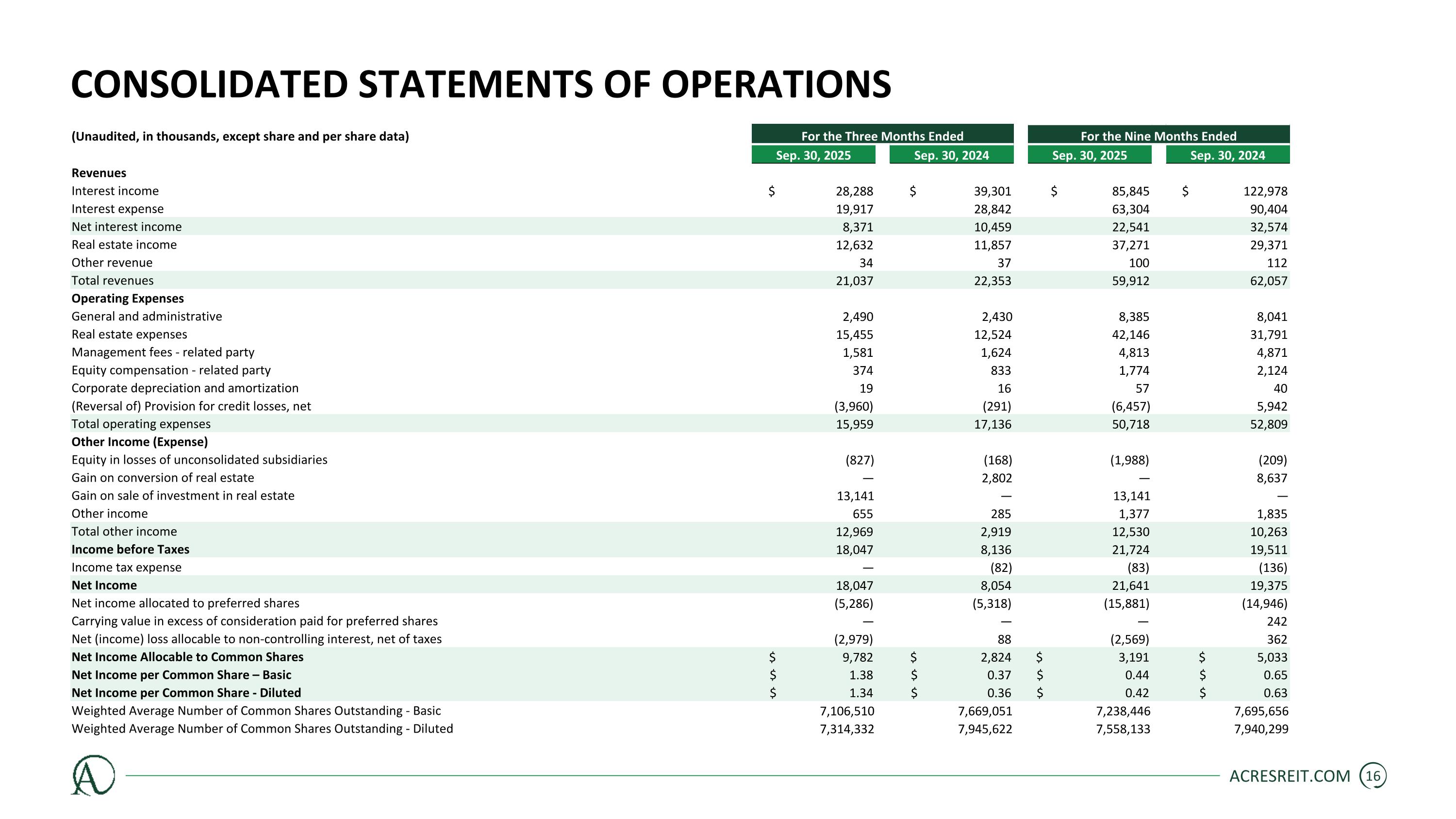

Consolidated Statements of Operations ACRESREIT.COM (Unaudited, in thousands, except share and per share data) For the Three Months Ended For the Nine Months Ended Sep. 30, 2025 Sep. 30, 2024 Sep. 30, 2025 Sep. 30, 2024 Revenues Interest income $ 28,288 $ 39,301 $ 85,845 $ 122,978 Interest expense 19,917 28,842 63,304 90,404 Net interest income 8,371 10,459 22,541 32,574 Real estate income 12,632 11,857 37,271 29,371 Other revenue 34 37 100 112 Total revenues 21,037 22,353 59,912 62,057 Operating Expenses General and administrative 2,490 2,430 8,385 8,041 Real estate expenses 15,455 12,524 42,146 31,791 Management fees - related party 1,581 1,624 4,813 4,871 Equity compensation - related party 374 833 1,774 2,124 Corporate depreciation and amortization 19 16 57 40 (Reversal of) Provision for credit losses, net (3,960) (291) (6,457) 5,942 Total operating expenses 15,959 17,136 50,718 52,809 Other Income (Expense) Equity in losses of unconsolidated subsidiaries (827) (168) (1,988) (209) Gain on conversion of real estate — 2,802 — 8,637 Gain on sale of investment in real estate 13,141 — 13,141 — Other income 655 285 1,377 1,835 Total other income 12,969 2,919 12,530 10,263 Income before Taxes 18,047 8,136 21,724 19,511 Income tax expense — (82) (83) (136) Net Income 18,047 8,054 21,641 19,375 Net income allocated to preferred shares (5,286) (5,318) (15,881) (14,946) Carrying value in excess of consideration paid for preferred shares — — — 242 Net (income) loss allocable to non-controlling interest, net of taxes (2,979) 88 (2,569) 362 Net Income Allocable to Common Shares $ 9,782 $ 2,824 $ 3,191 $ 5,033 Net Income per Common Share – Basic $ 1.38 $ 0.37 $ 0.44 $ 0.65 Net Income per Common Share - Diluted $ 1.34 $ 0.36 $ 0.42 $ 0.63 Weighted Average Number of Common Shares Outstanding - Basic 7,106,510 7,669,051 7,238,446 7,695,656 Weighted Average Number of Common Shares Outstanding - Diluted 7,314,332 7,945,622 7,558,133 7,940,299

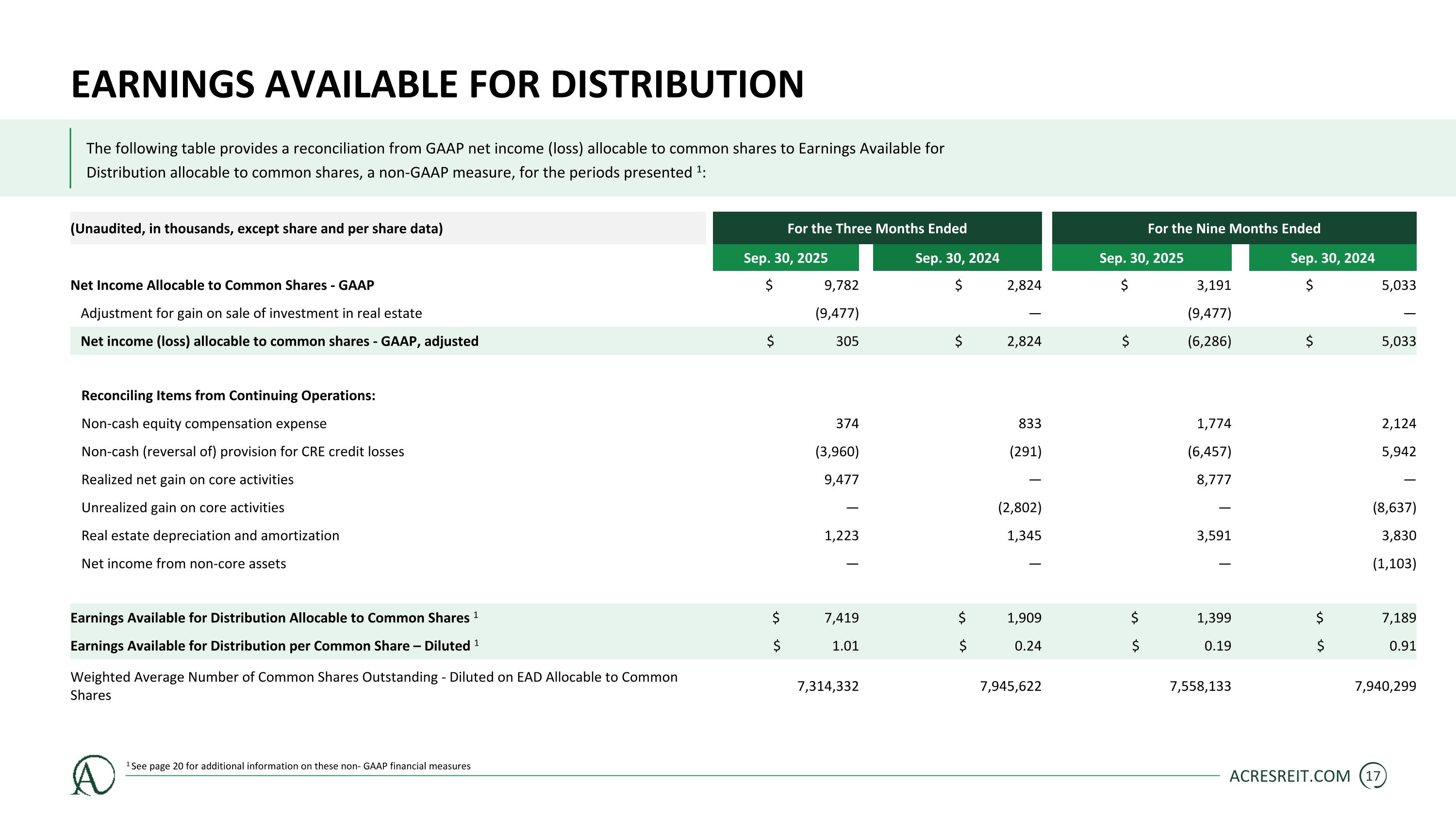

Earnings Available for Distribution ACRESREIT.COM 1 See page 20 for additional information on these non- GAAP financial measures (Unaudited, in thousands, except share and per share data) For the Three Months Ended For the Nine Months Ended Sep. 30, 2025 Sep. 30, 2024 Sep. 30, 2025 Sep. 30, 2024 Net Income Allocable to Common Shares - GAAP $ 9,782 $ 2,824 $ 3,191 $ 5,033 Adjustment for gain on sale of investment in real estate (9,477) — (9,477) — Net income (loss) allocable to common shares - GAAP, adjusted $ 305 $ 2,824 $ (6,286) $ 5,033 Reconciling Items from Continuing Operations: Non-cash equity compensation expense 374 833 1,774 2,124 Non-cash (reversal of) provision for CRE credit losses (3,960) (291) (6,457) 5,942 Realized net gain on core activities 9,477 — 8,777 — Unrealized gain on core activities — (2,802) — (8,637) Real estate depreciation and amortization 1,223 1,345 3,591 3,830 Net income from non-core assets — — — (1,103) Earnings Available for Distribution Allocable to Common Shares 1 $ 7,419 $ 1,909 $ 1,399 $ 7,189 Earnings Available for Distribution per Common Share – Diluted 1 $ 1.01 $ 0.24 $ 0.19 $ 0.91 Weighted Average Number of Common Shares Outstanding - Diluted on EAD Allocable to Common Shares 7,314,332 7,945,622 7,558,133 7,940,299 The following table provides a reconciliation from GAAP net income (loss) allocable to common shares to Earnings Available for Distribution allocable to common shares, a non-GAAP measure, for the periods presented 1:

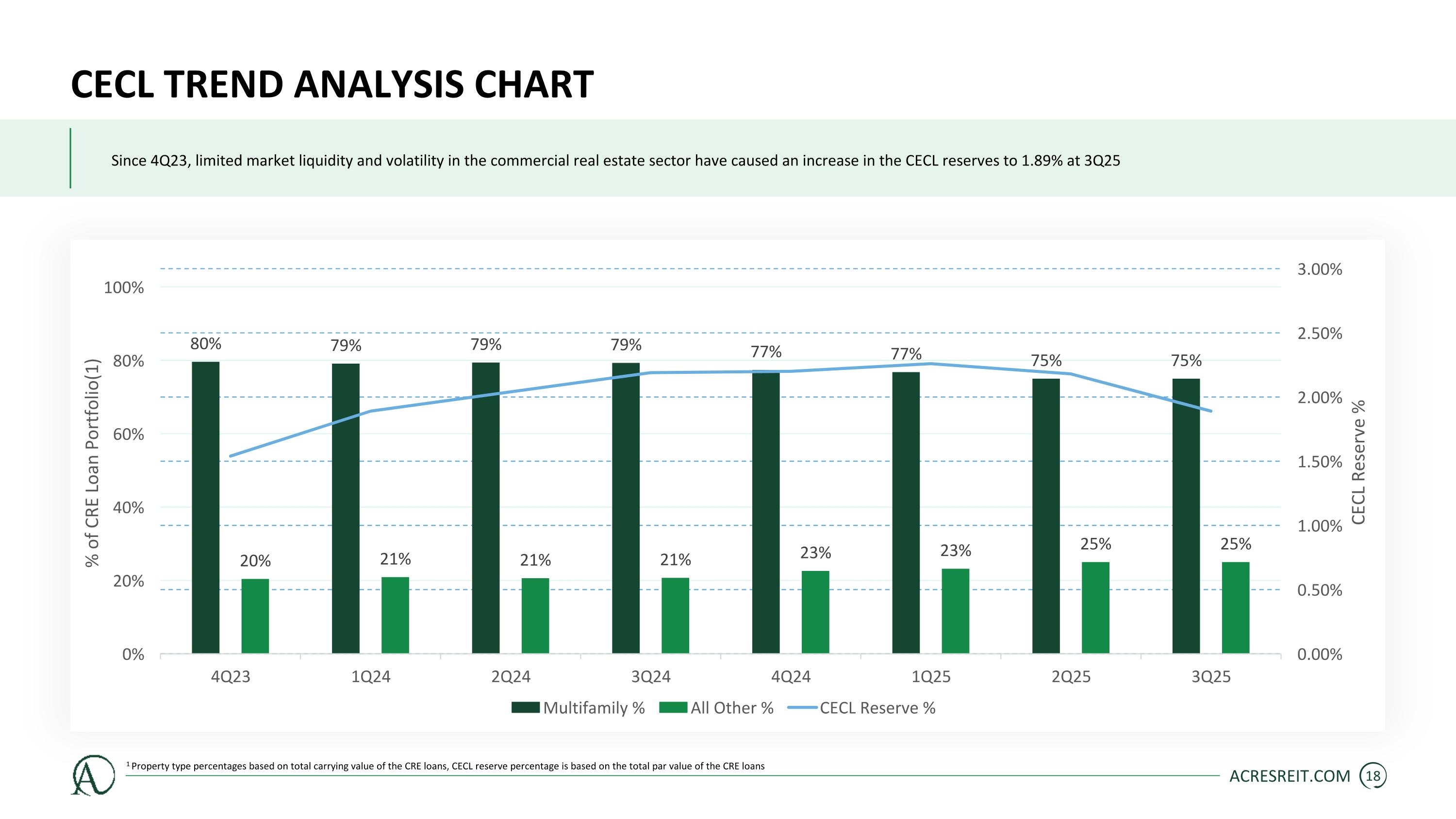

CECL Trend Analysis Chart ACRESREIT.COM 1 Property type percentages based on total carrying value of the CRE loans, CECL reserve percentage is based on the total par value of the CRE loans Since 4Q23, limited market liquidity and volatility in the commercial real estate sector have caused an increase in the CECL reserves to 1.89% at 3Q25

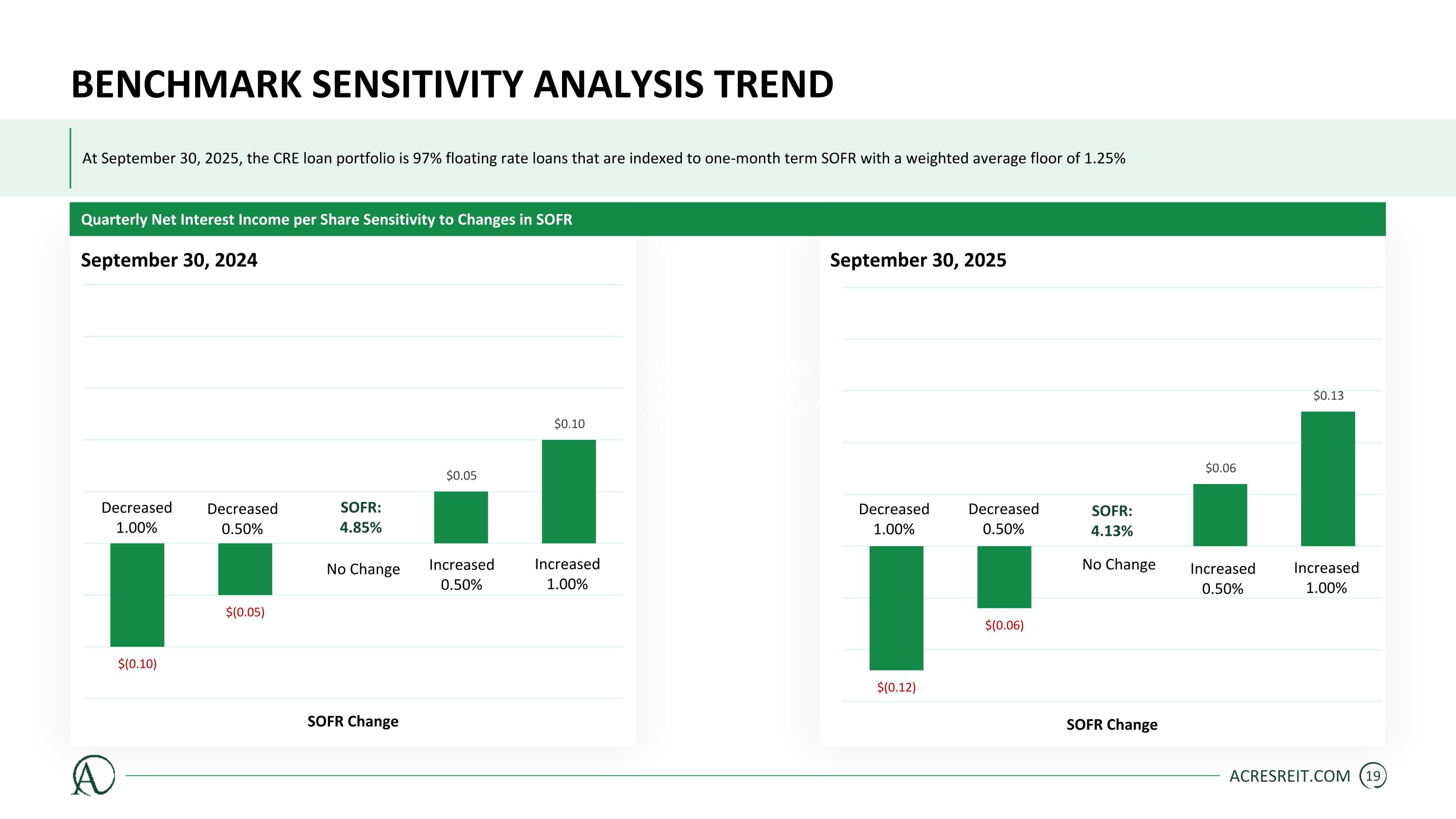

Benchmark Sensitivity Analysis Trend At September 30, 2025, the CRE loan portfolio is 97% floating rate loans that are indexed to one-month term SOFR with a weighted average floor of 1.25% SOFR Change Decreased 1.00% No Change Decreased 0.50% Increased 0.50% Increased 1.00% SOFR: 4.85% SOFR Change Decreased 1.00% No Change Decreased 0.50% Increased 0.50% Increased 1.00% SOFR: 4.13% ACRESREIT.COM September 30, 2024 September 30, 2025 Quarterly Net Interest Income per Share Sensitivity to Changes in SOFR Change to a positive correlation to net interest income assuming a 0.50% to 1.00% increase to SOFR

Key Definitions Earnings Available for Distribution: Earnings Available for Distribution (“EAD”) is a non-GAAP financial measure that the Company uses to evaluate its operating performance. EAD excludes the effects of certain transactions and GAAP adjustments that it believes are not necessarily indicative of its current CRE loan portfolio and other CRE-related investments and operations. EAD excludes income (loss) from all non-core assets comprising of investments and securities owned by the Company at the initial measurement date of December 31, 2016 in commercial finance, middle market lending, residential mortgage lending, certain legacy CRE loans and other non-CRE assets designated as assets held for sale. EAD, for reporting purposes, is defined as GAAP net income (loss) allocable to common shares, excluding (i) non-cash equity compensation expense, (ii) unrealized gains and losses, (iii) non-cash provisions for loan losses, (iv) non-cash impairments on securities, (v) non-cash amortization of discounts or premiums associated with borrowings, (vi) net income or loss from a limited partnership interest owned at the initial measurement date, (vii) net income or loss from non-core assets, (viii) real estate depreciation and amortization, (ix) foreign currency gains or losses and (x) income or loss from discontinued operations. EAD may also be adjusted periodically to exclude certain one-time events pursuant to changes in GAAP and certain non-cash items. Although pursuant to the Fourth Amended and Restated Management Agreement the Company calculates the Manager’s incentive compensation using EAD excluding incentive fees payable to the Manager, the Company includes incentive fees payable to the Manager in EAD for reporting purposes. Secured Overnight Finance Rate: Secured Overnight Finance Rate (“SOFR”) refers to the collective one-month Term Secured Overnight Finance Rate that are used as benchmarks on the originated loans. Book Value : Book value is presented per common share, excluding unvested restricted stock and including warrants to purchase common stock. The measure refers to common stock book value, which is calculated as total stockholders’ equity less preferred stock equity. Leverage ratio is calculated as the respective period ended borrowings over total equity. Asset-specific leverage ratio excludes corporate debt from the calculation. Leverage Ratio: ACRESREIT.COM Current Expected Credit Losses: Current Expected Credit Losses (‘CECL”) refers to the provision to earnings in order to estimate expected losses.

Other Disclosures Rating 1: Property performance has surpassed underwritten expectations Occupancy is stabilized, the property has had a history of consistently high occupancy, and the property has a diverse and high-quality tenant mix Rating 2: Property performance is consistent with underwritten expectations and covenants and performance criteria are being met or exceeded Occupancy is stabilized, near stabilized or is on track with underwriting Rating 3: Property performance lags behind underwritten expectations Occupancy is not stabilized and the property has some tenancy rollover Rating 4: Property performance significantly lags behind underwritten expectations. Performance criteria and loan covenants have required occasional waivers Occupancy is not stabilized and the property has a large amount of tenancy rollover Rating 5: Property performance is significantly worse than underwritten expectations. The loan is not in compliance with loan covenants and performance criteria and may be in default. Expected sale proceeds would not be sufficient to pay off the loan at maturity The property has a material vacancy rate and significant rollover of remaining tenants An updated appraisal is required upon designation and updated on an as-needed basis CRE loans are collateralized by a diversified mix of real estate properties and are assessed for credit quality based on the collective evaluation of several factors, including but not limited to: collateral performance relative to underwritten plan, time since origination, current implied and/or re-underwritten loan-to-collateral value ratios, loan structure and exit plan. Depending on the loan’s performance against these various factors, loans are rated on a scale from 1 to 5, with loans rated 1 representing loans with the highest credit quality and loans rated 5 representing loans with the lowest credit quality. The factors evaluated provide general criteria to monitor credit migration in the Company’s loan portfolio; as such, a loan’s rating may improve or worsen, depending on new information received. The criteria set forth below should be used as general guidelines, and therefore not every loan will have all of the characteristics described in each category below. Commercial Real Estate Loans Risk Ratings ACRESREIT.COM

Additional information is available at the Company’s website. Contact Information Headquarters: 390 RXR Plaza Uniondale, NY 11556 Investor Relations: ir@acresreit.com 516-862-2385 New York Stock Exchange: Common Stock Symbol: ACR Pref. Stock Symbols: ACRPrC & ACRPrD ACRES Commercial Realty Corp. is a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate mortgage loans and equity investments in commercial real estate property through direct ownership and joint ventures. www.acresreit.com