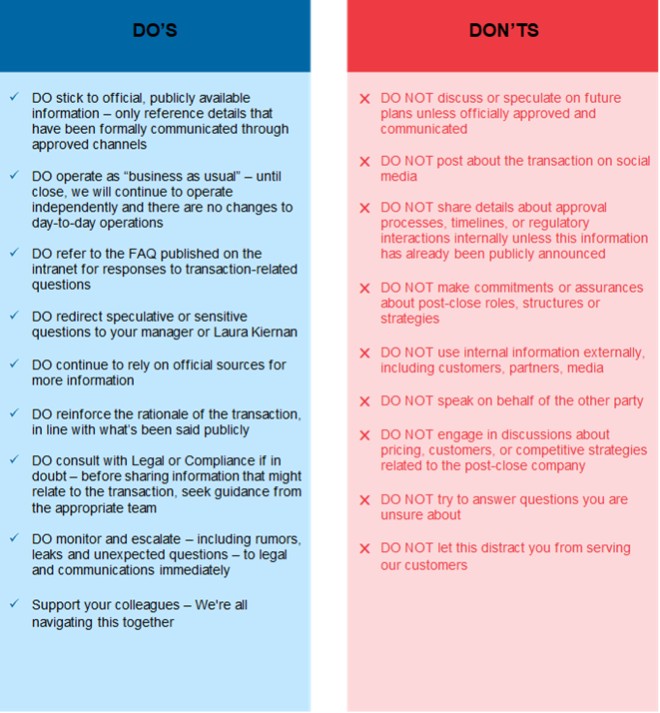

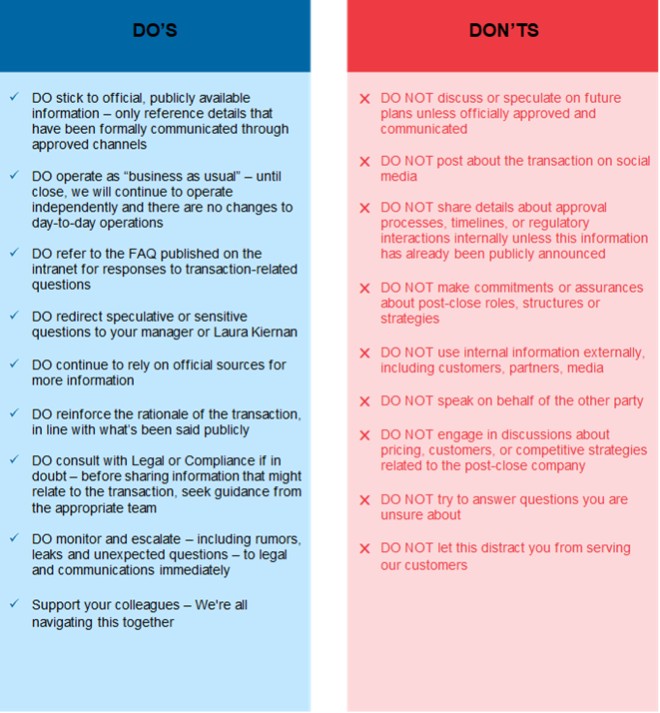

Do’s and Dont’s

It is essential that leaders set the tone by carefully following established protocols and guidelines in every communication and activity between announcement and close.

5

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Pursuant to §240.14a-12 |

CLEAR CHANNEL OUTDOOR HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

This Schedule 14A relates solely to preliminary communications made prior to furnishing stockholders of Clear Channel Outdoor Holdings, Inc., a Delaware corporation (the “Company”) with a definitive proxy statement related to a proposed transaction with Madison Parent Inc., a Delaware corporation (“Parent”), and Madison Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”) pursuant to which Merger Sub will be merged with and into the Company (the “Merger”), with the Company surviving as a wholly owned subsidiary of Parent.

This Schedule 14A filing consists of a toolkit circulated to managers of the Company containing Frequently Asked Questions and other talking points related to the Merger on February 12, 2026.

* * *

Announced Acquisition of Clear Channel

Manager Toolkit

Note to Managers: This document is for use by Clear Channel managers in speaking with their direct reports about the transaction. It is intended for manager use only and should not be distributed or forwarded.

If a question is asked that is not covered in this document, please do not speculate or make up an answer. Instead, take note of the question and respond with the following: “I don’t have the information to answer your question, and I don’t want to provide any information that may not be accurate. I am happy to pass your question along and get back to you.”

Please refer all questions you are unable to answer to Daniel Samovici.

Talking Points

| • | As you’re aware, Clear Channel has entered into an agreement to be acquired by Mubadala Capital, a global alternative asset management platform with deep experience in media and technology, in partnership with TWG Global. |

| • | This moment marks the beginning of a new chapter for Clear Channel. |

| • | It is a recognition of your hard work and dedication to redefining the out-of-home advertising industry. It is also a recognition of the changes we’ve made to transform our business. |

| • | Mubadala Capital brings not only a global investment platform, but significant resources, and deep experience building and scaling enduring businesses with discipline. |

| • | TWG Global brings industry expertise and strong networks in the media, advertising and technology sectors. |

| • | Following the close, Wade Davis, an accomplished media and technology executive who currently serves as the Vice Chairman of TelevisaUnivision and previously served as the CFO of Viacom, is expected to join as Executive Chairman. |

| • | Please know that with this transaction, our mission, our values and our commitment to connecting brands with audiences in meaningful, measurable ways will not change. |

| • | We expect the transaction to occur by the end of the third quarter of 2026, subject to completion of closing conditions. |

| • | Until closing, we will continue to operate independently as a publicly traded company: it is business as usual. |

| • | I ask that you remain focused on delivering strong growth and great results for our customers and supporting each other. |

| • | I understand that you’ll have questions – some of which we may not have immediate answers for. |

| • | In the meantime, as a reminder, if you receive any external inquiries related to the transaction or the buyers, please direct them to Daniel Samovici in Legal. |

| • | Thank you for the work you do every day and the contributions you make to our company. |

| • | We have an incredible team and I am enthusiastic about what is ahead and grateful for your continued dedication as we enter this new chapter together. |

FAQs

| 1. | What does this transaction mean for employees? What happens between now and closing? |

| • | This moment marks the beginning of a new, exciting chapter for Clear Channel. |

| • | Mubadala Capital brings significant resources and industry connections, and their support will help us enhance our financial flexibility, support ongoing deleveraging efforts, and reposition us to pursue new avenues of growth after the closing. |

| • | With their support, we’ll be able to better serve our customers and communities. |

| • | The transaction is expected to close by the end of the third quarter of 2026, subject to shareholder and regulatory approvals and other customary closing conditions. |

| • | Until then, it is business as usual – we will continue to operate independently as a publicly traded company. |

| • | It is important we remain focused on delivering strong growth and great results for our customers, creating great inventory and supporting each other. |

2

| 2. | What differences should be expected with Clear Channel as a privately held company? |

| • | As a privately held company, our stock will no longer be listed on the NYSE once the transaction is complete. |

| • | Since we will no longer be a public company at that point, we won’t report quarterly or annual earnings in the same way, and we won’t disclose the same amount of financial information to the public. |

| • | Should our publicly-traded debt remain outstanding, we will continue to comply with its obligations under those debt agreements. |

| • | We believe that under this new ownership structure we will have enhanced strategic and financial flexibility to execute our vision. |

| 3. | Are we going to continue with our growth initiatives and investing in new solutions? |

| • | We remain committed to our strategy, and Mubadala Capital’s resources will help accelerate Clear Channel’s digital transformation and strategic initiatives. |

| 4. | Will Clear Channel remain headquartered in San Antonio? What about our other offices? |

| • | Yes. Clear Channel will remain headquartered in San Antonio, Texas, and we do not anticipate changes to our office locations at this time. |

| 5. | Will our leadership or reporting structure change? Will Scott remain CEO? |

| • | Following the close of the transaction, Wade Davis, an accomplished media and technology executive who currently serves as the Vice Chairman of TelevisaUnivision and previously served as the CFO of Viacom, is expected to join Clear Channel as Executive Chairman. |

| • | Beyond that, Mubadala Capital has not informed us of any planned changes following closing. |

| • | It’s important to remember that it remains business as usual until closing, which we expect to happen by the end of the third quarter of 2026. |

| 6. | Will compensation or benefits change? |

| • | There are no immediate changes to compensation or benefits as a result of this announcement. |

| • | Any decisions made regarding compensation or benefits will be communicated clearly. |

3

| 7. | What happens to vested and unvested stock options and RSUs and any other stock owned? |

| • | Under the merger agreement, outstanding stock options and RSUs will generally be treated as follows: |

| • | All outstanding stock options have an exercise price that is higher than the price of $2.43 per share that is being paid to purchase the Company’s shares at Closing (i.e., the stock options are expected to be “out-of-the-money” or “underwater”). As such, all outstanding stock options will be cancelled without payment. |

| • | All outstanding unvested RSUs will vest in connection with the closing and RSU holders will be paid an amount (less applicable taxes, deductions and withholdings) equal to (i) the number of RSUs subject to their award, multiplied by (ii) $2.43. |

| • | Additional detail will be provided to RSU holders directly |

| • | Vested RSUs and other owned shares will receive $2.43 per share at closing, just like all other shareholders. |

| • | Any equity awards that are granted after the date of the agreement may be subject to different terms, which will be communicated in connection with the grant of any such equity awards. |

| • | If you have questions about the terms of your equity awards, please contact your manager. |

| 8. | What should I do if a customer or partner asks me about the transaction? |

| • | Please direct any customer or partner inquiries to their designated contact or Daniel Samovici. We will provide talking points and support for these conversations. |

| 9. | Who can employees contact with additional questions? |

| • | Employees can reach out to their manager or email Daniel Samovici for more information. |

4

Do’s and Dont’s

It is essential that leaders set the tone by carefully following established protocols and guidelines in every communication and activity between announcement and close.

5

IMPORTANT LEGENDS

Cautionary Statement Concerning Forward-Looking Statements

Certain statements in this communication, including statements regarding the proposed acquisition of Clear Channel Outdoor Holdings, Inc. (“Clear Channel” or the “Company”) by the investor group (the “Merger”), common shareholder approvals for the Merger, any expected timetable for completing the Merger, the expected benefits of the Merger and any other statements regarding Clear Channel’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical fact constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. The words “expect,” “anticipate,” “estimate,” “believe,” “forecast,” “goal,” “intend,” “objective,” “plan,” “project,” “deliver,” “seek,” “strategy,” “target,” “will” and similar words and expressions are intended to identify such forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond Clear Channel’s control and are difficult to predict. These risks and uncertainties include, but are not limited to: uncertainties associated with the proposed Merger, including the failure to consummate the Merger in a timely manner or at all, could adversely affect Clear Channel’s business, results of operations, financial condition, and the trading price of Clear Channel’s common stock; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement governing the Merger (the “Merger Agreement”), including circumstances requiring Clear Channel to pay a termination fee pursuant to the Merger Agreement; failure to satisfy the conditions precedent to consummate the Merger, including the adoption of the Merger Agreement by the affirmative vote (in person or by proxy) of the holders of a majority of the outstanding shares of Clear Channel’s common stock and obtaining required regulatory approvals; the risk that restrictions on the operation of Clear Channel’s business during the pendency of the Merger may impact Clear Channel’s ability to pursue certain business opportunities or strategic transactions or undertake certain actions Clear Channel might otherwise have taken; potential litigation relating to, or other unexpected costs resulting from, the Merger; the risk that any announcements relating to the Merger could have adverse effects on the market price of Clear Channel’s common stock, credit ratings or operating results; and the risk that the Merger and its announcement could have an adverse effect on the ability of Clear Channel to retain and hire key personnel, to retain customers and to maintain relationships with business partners, suppliers and customers. Clear Channel can give no assurance that the conditions to the Merger will be satisfied or that it will close within the anticipated time period.

Various risks that could cause future results to differ from those expressed by the forward-looking statements included in this communication are described in the section entitled “Item 1A. Risk Factors” of the Company’s reports filed with the U.S. Securities and Exchange Commission (the “SEC”), including the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, as well as other risks and forward-looking statements in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended on September 30, 2025, the Company’s Quarterly Report on Form 10-Q for the quarterly period ended on June 30, 2025 and the Company’s Quarterly Report on Form 10-Q for the quarterly period ended on March 31, 2025 and in other reports and filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this communication or the date of any document referred to in this communication. Except as required by applicable law, the Company does not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or otherwise.

Additional Information and Where to Find It

This communication is being made with respect to the proposed Merger and related transactions (collectively, the “proposed transaction”) involving Clear Channel and Mubadala

6

Capital. In accordance with the Merger Agreement, a meeting of the common shareholders of Clear Channel will be announced as promptly as practicable to seek Clear Channel common shareholder approval in connection with the proposed transaction. Clear Channel intends to file relevant materials with the SEC, including preliminary and definitive proxy statements relating to the proposed transaction. The definitive proxy statement will be mailed to Clear Channel’s common shareholders. This communication is not a substitute for the proxy statement or any other document that may be filed by Clear Channel with the SEC.

BEFORE MAKING ANY DECISION, CLEAR CHANNEL COMMON SHAREHOLDERS ARE URGED TO CAREFULLY READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT AS, IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Any vote in respect of resolutions to be proposed at Clear Channel’s common shareholder meeting to approve the proposed transaction or other proposals in relation to the proposed transaction should be made only on the basis of the information contained in Clear Channel’s proxy statement. You will be able to obtain a free copy of the proxy statement and other related documents (when available) filed by Clear Channel with the SEC at the website maintained by the SEC at www.sec.gov or by accessing the Investor Relations section of Clear Channel’s website at https://investor.clearchannel.com/.

Participants in the Solicitation

Clear Channel and its directors and executive officers and certain of its employees may be deemed to be participants in the solicitation of proxies from Clear Channel’s common shareholders in connection with the proposed transaction. Information regarding Clear Channel’s directors and executive officers is set forth under the captions “Composition of the Board of Directors,” “Proposal 1 — Election of Directors,” “Our NEOs,” “Compensation Discussion and Analysis,” “Compensation Committee Report,” “Executive Compensation Tables,” “Director Compensation” and “Security Ownership of Certain Beneficial Owners and Management” in the definitive proxy statement for Clear Channel’s 2025 Annual Meeting of Shareholders, filed with the SEC on April 10, 2025 (the “Annual Meeting Proxy Statement”), which can be found here, and in Clear Channel’s Current Reports on Form 8-K filed with the SEC on July 23, 2025 and December 19, 2025. To the extent the holdings of Clear Channel’s securities by its directors or executive officers have changed since the amounts set forth in the Annual Meeting Proxy Statement, such changes have been or will be reflected on Forms 3, 4 and 5, filed with the SEC (which are included in the EDGAR Search Results here).

These documents may be obtained free of charge from the SEC’s website at www.sec.gov or by accessing the Investor Relations section of Clear Channel’s website at https://investor.clearchannel.com/. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the proxy statement that Clear Channel expects to file in connection with the proposed transaction and other relevant materials Clear Channel may file with the SEC.

7