Merging for Power Propelling our Energy Infrastructure Growth Pillar Forward + .2

Forward Looking Statement Certain statements in this release contain or are based on "forward-looking" information within the meaning of the Private Securities Litigation Reform Act of 1995. These statements reflect our belief and assumptions as to future events that may not prove to be accurate. Actual performance and results may differ materially from those results anticipated by our guidance and other forward-looking statements made in this release depending on a variety of factors, including, but not limited to: our ability to complete and integrate this transaction; our ability to complete the intended permanent financing; developments in the U.S. government defense and non-defense budgets, including budget reductions, sequestration, implementation of spending limits or changes in budgetary priorities, future delays in the U.S. government budget process, or the U.S. government’s failure to raise the debt ceiling, which increases the possibility of a default by the U.S. government on its debt obligations, related credit-rating downgrades, or an economic recession; uncertainties in tax due to new tax legislation or other regulatory developments; deterioration of economic conditions or weakening in credit or capital markets; uncertainty in the consequences of current and future geopolitical events; inflationary pressures and fluctuations in interest rates; delays in the U.S. government contract procurement process or the award of contracts and delays or loss of contracts as a result of competitor protests; changes in U.S. government procurement rules, regulations and practices; our compliance with various U.S. government and other government procurement rules and regulations; governmental reviews, audits and investigations of our company; our ability to effectively compete and win contracts with the U.S. government and other customers; our ability to respond rapidly to emerging technology trends, including the use of artificial intelligence; our reliance on information technology spending by hospitals/healthcare organizations; our reliance on infrastructure investments by industrial and natural resources organizations; energy efficiency and alternative energy sourcing investments; investments by U.S. government and commercial organizations in environmental impact and remediation projects; the effects of an epidemic, pandemic or similar outbreak may have on our business, financial position, results of operations and/or cash flows; our ability to attract, train and retain skilled employees, including our management team, and to obtain security clearances for our employees; our ability to accurately estimate costs, including cost increases due to inflation, associated with our firm-fixed-price contracts and other contracts; resolution of legal and other disputes with our customers and others or legal or regulatory compliance issues; cybersecurity, data security or other security threats, system failures or other disruptions of our business; our compliance with international, federal, state and local laws and regulations regarding privacy, data security, protection, storage, retention, transfer, disposal and other processing, technology protection and personal information; the damage and disruption to our business resulting from natural disasters and the effects of climate change; our ability to effectively acquire businesses and make investments; our ability to maintain relationships with prime contractors, subcontractors and joint venture partners; our ability to manage performance and other risks related to customer contracts; the failure of our inspection or detection systems to detect threats; the adequacy of our insurance programs, customer indemnifications or other liability protections designed to protect us from significant product or other liability claims, including cybersecurity attacks; our ability to manage risks associated with our international business; our ability to comply with the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act of 2010 and similar worldwide anti-corruption and anti-bribery laws and regulations; our ability to protect our intellectual property and other proprietary rights by third parties of infringement, misappropriation or other violations by us of their intellectual property rights; our ability to prevail in litigation brought by third parties of infringement, misappropriation or other violations by us of their intellectual property rights; our ability to declare or increase future dividends based on our earnings, financial condition, capital requirements and other factors, including compliance with applicable law and our agreements; our ability to grow our commercial health and infrastructure businesses, which could be negatively affected by budgetary constraints faced by hospitals and by developers of energy and infrastructure projects; our ability to successfully integrate acquired businesses; and our ability to execute our business plan and long-term management initiatives effectively and to overcome these and other known and unknown risks described in our Securities and Exchange Commission filings. Leidos to Acquire ENTRUST Solutions Group

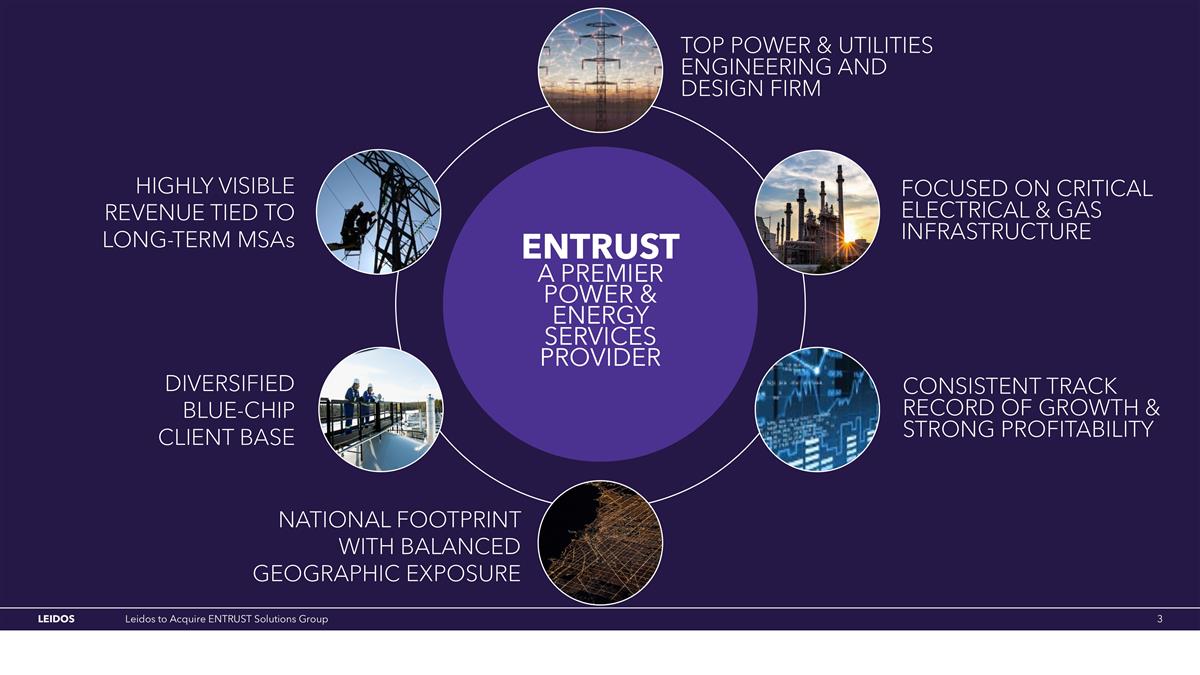

Leidos to Acquire ENTRUST Solutions Group ENTRUST A PREMIER POWER & ENERGY SERVICES PROVIDER FOCUSED ON CRITICAL ELECTRICAL & GAS INFRASTRUCTURE CONSISTENT TRACK RECORD OF GROWTH & STRONG PROFITABILITY TOP POWER & UTILITIES ENGINEERING AND DESIGN FIRM DIVERSIFIED BLUE-CHIP CLIENT BASE HIGHLY VISIBLE REVENUE TIED TO LONG-TERM MSAs NATIONAL FOOTPRINT WITH BALANCED GEOGRAPHIC EXPOSURE

Compelling move to advance our energy leadership Leidos to Acquire ENTRUST Solutions Group Fully aligned with our NorthStar 2030 strategy 1 Complementary capabilities and customers 2 Transformational investment in Energy 4 3 Cultural alignment enables rapid integration Enhanced scale in a fragmented market 5 Strong return on invested capital while preserving balance sheet capacity

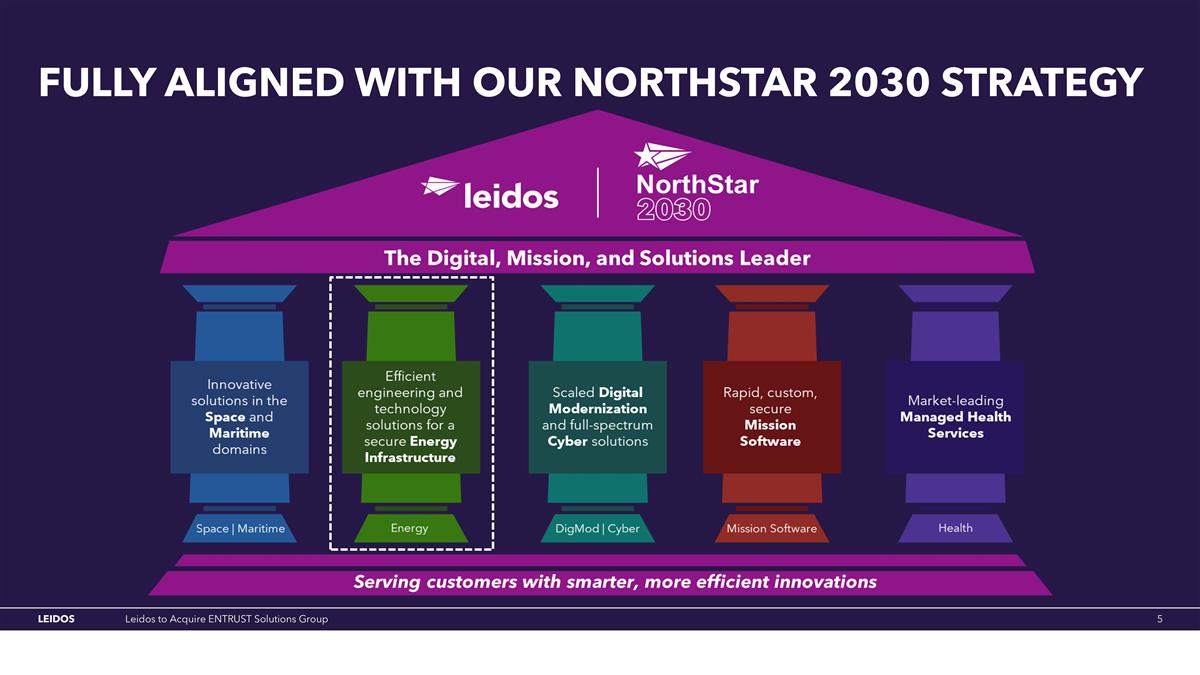

Fully aligned with our northstar 2030 strategy Leidos to Acquire ENTRUST Solutions Group

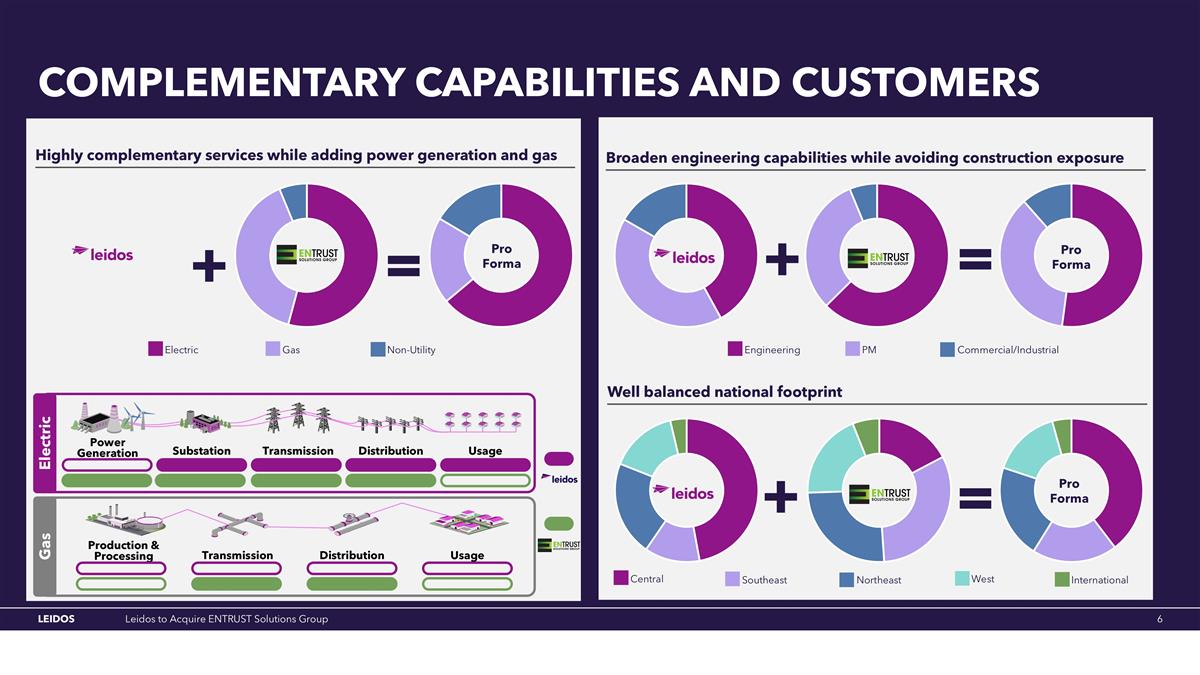

Complementary capabilities and customers Leidos to Acquire ENTRUST Solutions Group Highly complementary services while adding power generation and gas Broaden engineering capabilities while avoiding construction exposure Well balanced national footprint Pro Forma Pro Forma Non-Utility Electric Gas Engineering PM Commercial/Industrial West Central Southeast Northeast International Pro Forma Power Generation Substation Transmission Distribution Usage Electric Gas Production & Processing Transmission Distribution Usage

Leidos to Acquire ENTRUST Solutions Group Cultural Alignment enables Rapid Integration Similar cultures, compensation, skill bases, and approach to the engineering services market 3,100+ employees with a complementary mix of engineering and Program Management skills National footprint aligned with client needs Agile employee base and flexible work model support dynamically allocating talent Strong Business Development culture focused on growing Master Service Agreements Retention and development initiatives drive quality, lower turnover, and scale to meet client demand

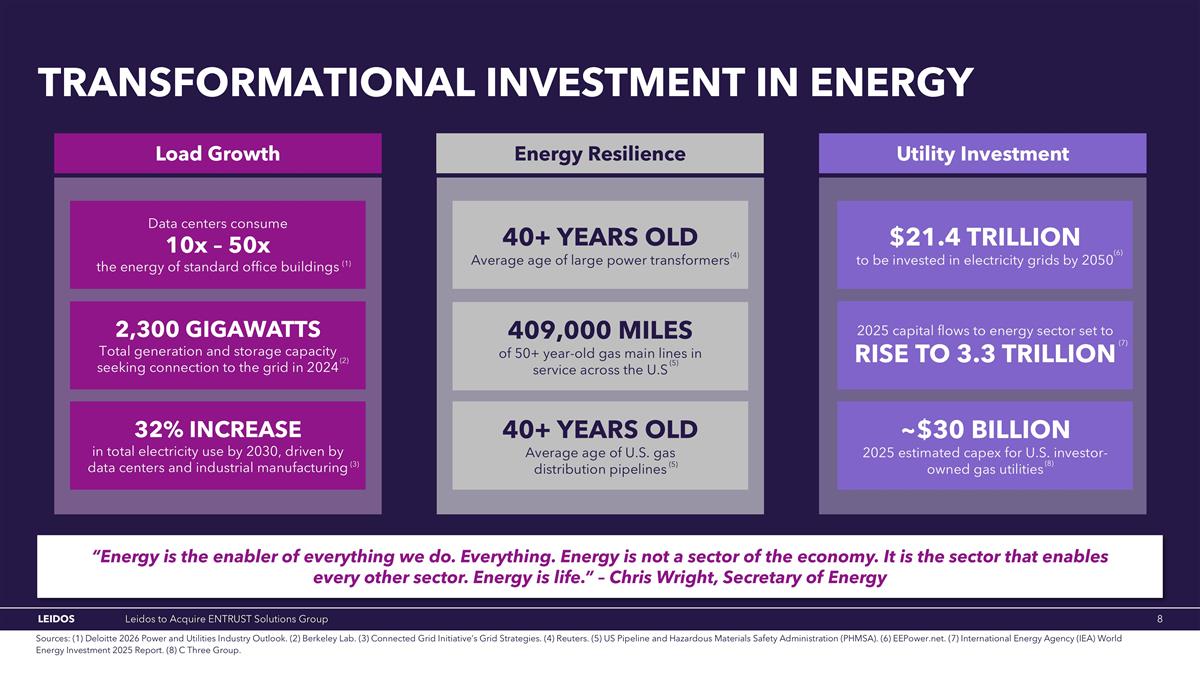

“Energy is the enabler of everything we do. Everything. Energy is not a sector of the economy. It is the sector that enables every other sector. Energy is life.” – Chris Wright, Secretary of Energy $21.4 TRILLION to be invested in electricity grids by 2050 ~$30 BILLION 2025 estimated capex for U.S. investor-owned gas utilities 40+ YEARS OLD Average age of U.S. gas distribution pipelines 409,000 MILES of 50+ year-old gas main lines in service across the U.S Transformational Investment in Energy Load Growth Data centers consume 10x – 50x the energy of standard office buildings (6) (6) 32% INCREASE in total electricity use by 2030, driven by data centers and industrial manufacturing (3) (7) Energy Resilience (8) (4) (5) (5) Leidos to Acquire ENTRUST Solutions Group Utility Investment 40+ YEARS OLD Average age of large power transformers 2025 capital flows to energy sector set to RISE TO 3.3 TRILLION (7) 2,300 GIGAWATTS Total generation and storage capacity seeking connection to the grid in 2024 (2) (4) Leidos to Acquire ENTRUST Solutions Group (1) Sources: (1) Deloitte 2026 Power and Utilities Industry Outlook. (2) Berkeley Lab. (3) Connected Grid Initiative’s Grid Strategies. (4) Reuters. (5) US Pipeline and Hazardous Materials Safety Administration (PHMSA). (6) EEPower.net. (7) International Energy Agency (IEA) World Energy Investment 2025 Report. (8) C Three Group.

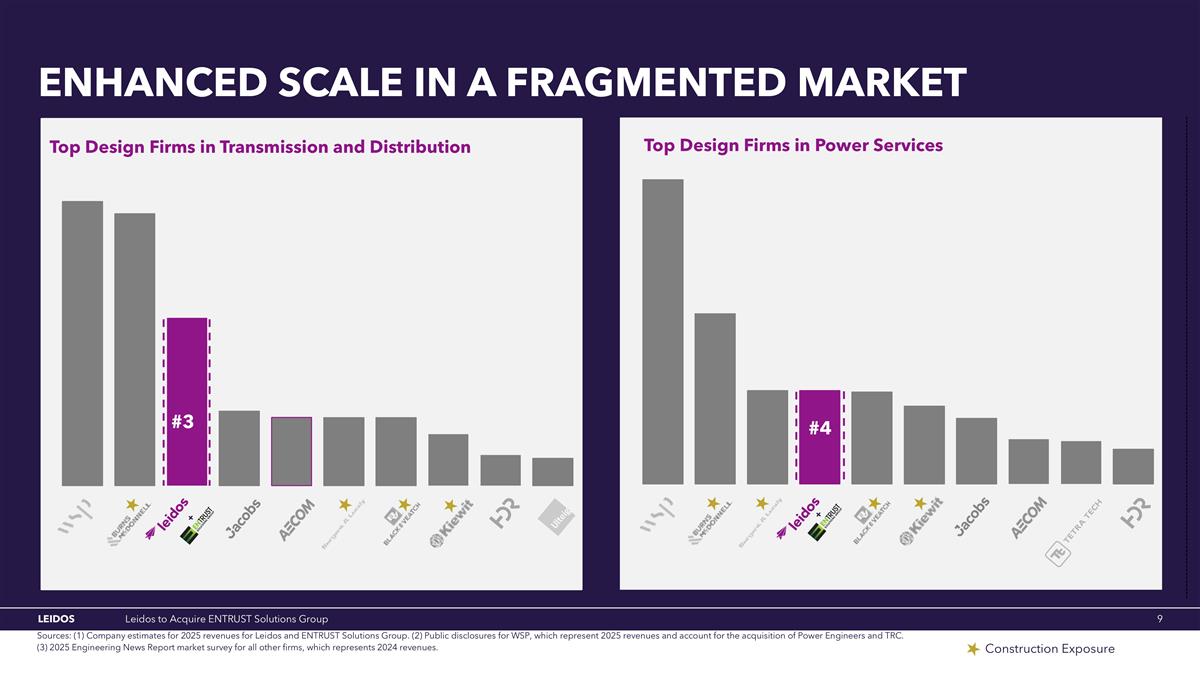

enhanced scale in a fragmented market Construction Exposure Sources: (1) Company estimates for 2025 revenues for Leidos and ENTRUST Solutions Group. (2) Public disclosures for WSP, which represent 2025 revenues and account for the acquisition of Power Engineers and TRC. (3) 2025 Engineering News Report market survey for all other firms, which represents 2024 revenues. Leidos to Acquire ENTRUST Solutions Group Top Design Firms in Power Services #4 + Top Design Firms in Transmission and Distribution + #3

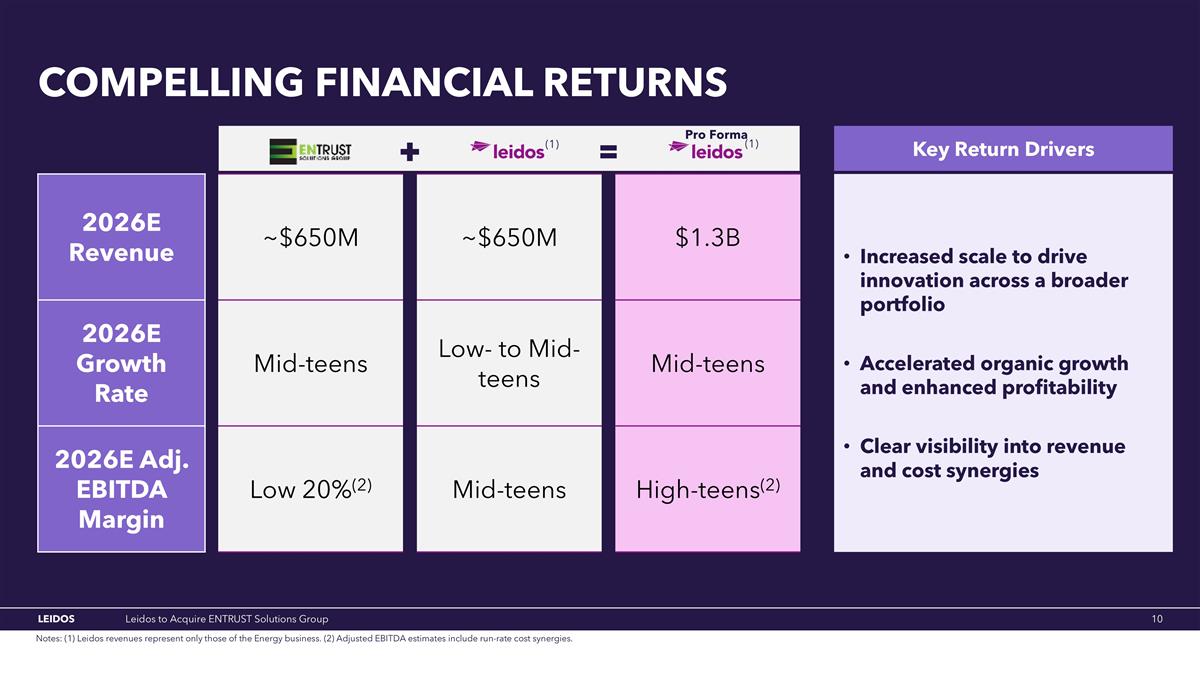

compelling financial returns Leidos to Acquire ENTRUST Solutions Group Increased scale to drive innovation across a broader portfolio Accelerated organic growth and enhanced profitability Clear visibility into revenue and cost synergies Key Return Drivers 2026E Revenue ~$650M ~$650M $1.3B 2026E Growth Rate Mid-teens Low- to Mid-teens Mid-teens 2026E Adj. EBITDA Margin Low 20%(2) Mid-teens High-teens(2) Pro Forma (1) Leidos to Acquire ENTRUST Solutions Group (1) Notes: (1) Leidos revenues represent only those of the Energy business. (2) Adjusted EBITDA estimates include run-rate cost synergies.

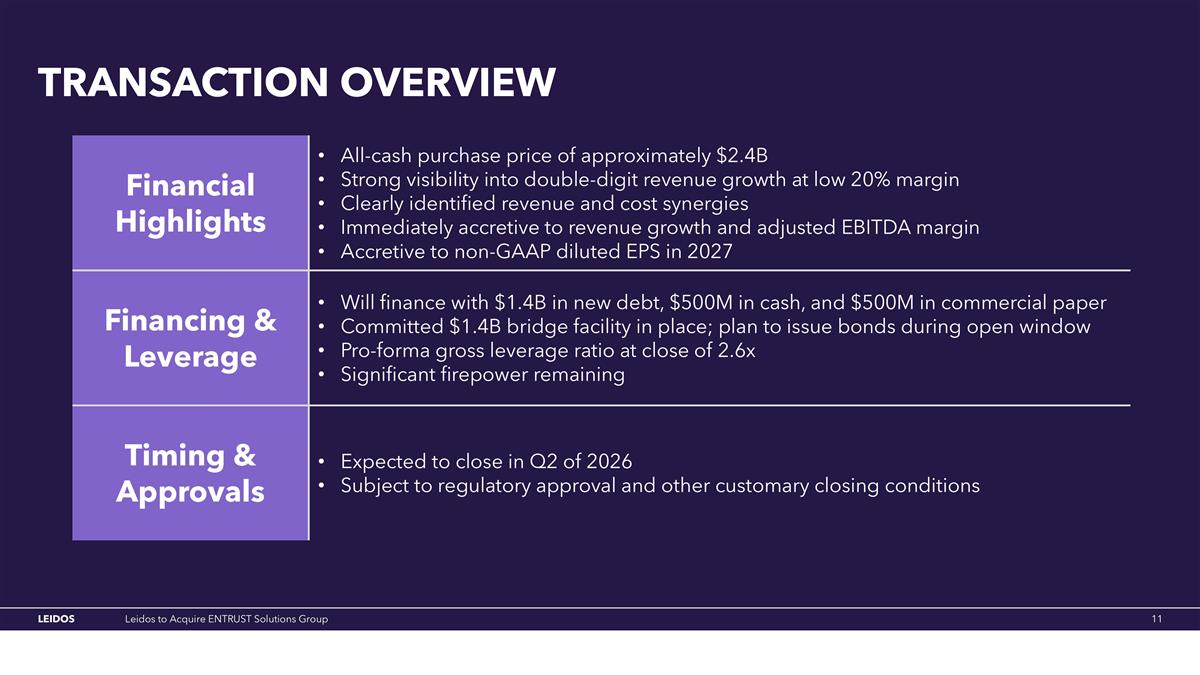

Transaction overview Leidos to Acquire ENTRUST Solutions Group Financial Highlights All-cash purchase price of approximately $2.4B Strong visibility into double-digit revenue growth at low 20% margin Clearly identified revenue and cost synergies Immediately accretive to revenue growth and adjusted EBITDA margin Accretive to non-GAAP diluted EPS in 2027 Financing & Leverage Will finance with $1.4B in new debt, $500M in cash, and $500M in commercial paper Committed $1.4B bridge facility in place; plan to issue bonds during open window Pro-forma gross leverage ratio at close of 2.6x Significant firepower remaining Timing & Approvals Expected to close in Q2 of 2026 Subject to regulatory approval and other customary closing conditions Leidos to Acquire ENTRUST Solutions Group

THANK YOU Leidos to Acquire ENTRUST Solutions Group

Leidos to Acquire ENTRUST Solutions Group Definitions of non-gaap measures Leidos uses adjusted EBITDA, adjusted EBITDA margin, and non-GAAP diluted EPS, which are not measures of financial performance under generally accepted accounting principles in the U.S. and, accordingly, these measures should not be considered in isolation or as a substitute for the comparable GAAP measures and should be read in conjunction with Leidos's consolidated financial statements prepared in accordance with GAAP. Management believes that these non-GAAP measures provide another representation of the results of operations and financial condition, including its ability to comply with financial covenants. These non-GAAP measures are frequently used by financial analysts covering Leidos and its peers. The computation of non-GAAP measures may not be comparable to similarly titled measures reported by other companies, thus limiting their use for comparability. Adjusted EBITDA is computed by excluding the following items from income before income taxes: acquisition, integration and restructuring costs; amortization of acquired intangible assets; gain on sale of intangible assets; asset impairment charges; interest expense; interest income; depreciation expense; and amortization of internally developed intangible assets. Adjusted EBITDA margin is computed by dividing adjusted EBITDA by revenues. Non-GAAP diluted EPS is computed by dividing net income attributable to Leidos common stockholders, adjusted for acquisition, integration and restructuring costs; amortization of acquired intangible assets; gain on sale of intangible assets; asset impairment charges; and the related tax impacts, by the diluted weighted average number of common shares outstanding. Leidos to Acquire ENTRUST Solutions Group