UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

dELiA*s, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

May 14, 2010

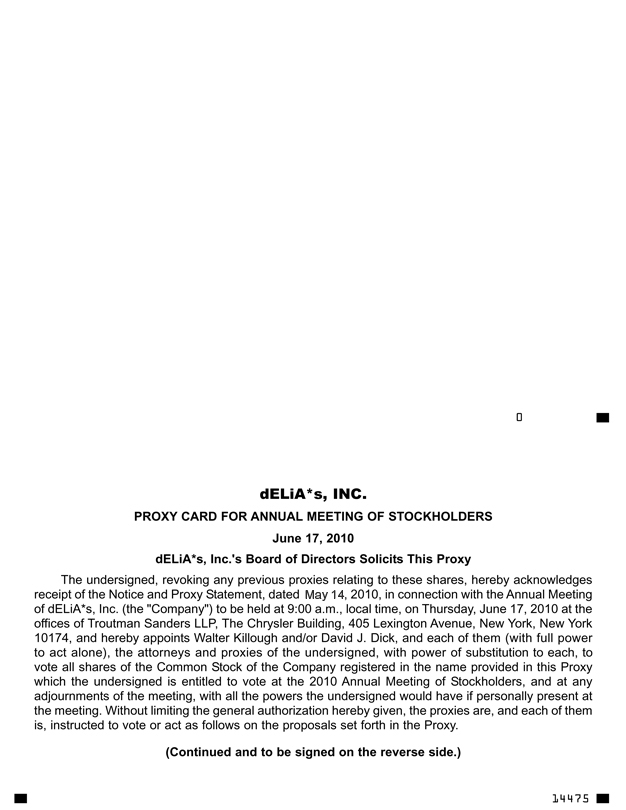

Dear Stockholder,

It is my pleasure to invite you to dELiA*s’ 2010 Annual Meeting of Stockholders.

We will hold the Annual Meeting at 9:00 a.m., local time, on Thursday, June 17, 2010, at the offices of Troutman Sanders LLP, The Chrysler Building, 405 Lexington Avenue, New York, New York 10174. In addition to the formal items of business, we will review the major developments of the past year and answer your questions.

This booklet includes our Notice of Annual Meeting and Proxy Statement (containing important information about the matters to be acted upon at the Annual Meeting), and is accompanied by our Annual Report for the fiscal year ended January 30, 2010 and proxy card. The Proxy Statement describes the business that we will conduct at the Annual Meeting and provides information about us that you should consider when you vote your shares.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please complete, date, sign and return the enclosed proxy card promptly in accordance with the instructions set forth on the card. This will ensure your proper representation at the Annual Meeting. If you attend the Annual Meeting and prefer to vote in person, you may do so.

Thank you for your ongoing support of dELiA*s. We look forward to seeing you at the Annual Meeting.

Sincerely,

Walter Killough

Chief Executive Officer

YOUR VOTE IS IMPORTANT.

PLEASE RETURN YOUR PROXY PROMPTLY.

NOTICE OF 2010 ANNUAL MEETING OF STOCKHOLDERS

| Date: |

Thursday, June 17, 2010 | |

| Time: |

9:00 a.m., local time | |

| Place: |

Troutman Sanders LLP The Chrysler Building 405 Lexington Avenue New York, New York 10174 |

Dear Stockholder:

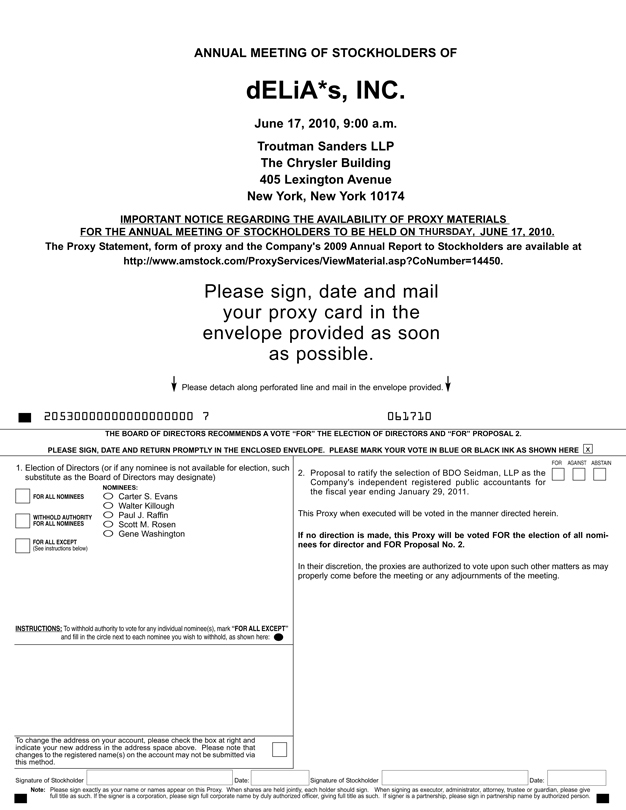

At our Annual Meeting, we will ask you to:

| • | elect five members to our Board of Directors as named in the attached proxy statement to serve until the 2011 Annual Meeting of Stockholders and until their successors are duly elected and qualified; |

| • | ratify the appointment of BDO Seidman, LLP as our independent registered public accountants for the fiscal year ending January 29, 2011; and |

| • | transact any other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

The Board of Directors has fixed the close of business on April 23, 2010 as the record date for identifying those stockholders entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof. The Proxy Statement, the accompanying form of proxy card and our Annual Report for the fiscal year ended January 30, 2010 will be mailed to all stockholders of record on or about May 14, 2010.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 17, 2010.

THE PROXY STATEMENT AND OUR 2009 ANNUAL REPORT ARE AVAILABLE AT

HTTP:WWW.AMSTOCK.COM/PROXYSERVICES/VIEWMATERIAL.ASP?CONUMBER=14450

| BY ORDER OF THE BOARD OF DIRECTORS |

|

| Marc G. Schuback |

| Vice President, General Counsel and Secretary |

May 14, 2010

| Page | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 2 | ||

| 2 | ||

| 2 | ||

| How Does the Board of Directors Recommend That I Vote on the Proposals? |

2 | |

| 2 | ||

| 3 | ||

| 3 | ||

| Will My Shares be Voted if I Don’t Provide My Proxy or Instruction Form? |

3 | |

| 3 | ||

| 4 | ||

| 4 | ||

| 4 | ||

| 4 | ||

| How Do I Obtain an Electronic Copy of the 2009 Annual Report? |

4 | |

| 5 | ||

| CORPORATE GOVERNANCE AND INFORMATION ABOUT DIRECTORS AND EXECUTIVE OFFICERS |

7 | |

| 7 | ||

| 9 | ||

| 10 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| 14 | ||

| 14 | ||

| 17 | ||

| 18 | ||

| 19 | ||

| Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table |

19 | |

| 24 | ||

| 25 | ||

| 25 | ||

| 26 | ||

| 27 | ||

| 27 | ||

| DISCUSSION OF PROPOSALS RECOMMENDED BY THE BOARD OF DIRECTORS |

28 | |

| 28 | ||

| 28 | ||

| 28 | ||

| 29 | ||

| 29 | ||

| 30 | ||

| 30 | ||

| 30 |

i

PROXY STATEMENT FOR THE dELiA*s, INC.

2010 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why Did You Send Me This Proxy Statement?

We sent you this Proxy Statement and the enclosed proxy card because the Board of Directors of dELiA*s, Inc. (“dELiA*s”, the “Company”, “us”, “our” or “we”) is soliciting your proxy to vote at our 2010 Annual Meeting of Stockholders (the “Annual Meeting”) and any adjournments or postponements of the Annual Meeting. This Proxy Statement along with the accompanying Notice of Annual Meeting of Stockholders summarizes the purposes of the Annual Meeting and the information you need to know to vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card in accordance with the instructions set forth on the proxy card or, if you own shares in “street name”, you will need to instruct your bank, broker or other nominee to vote your shares, as described below.

On or about May 14, 2010, we will begin sending this Proxy Statement, the attached Notice of Annual Meeting and the enclosed proxy card to all stockholders of record as of the close of business on April 23, 2010. Although not part of this Proxy Statement, we also will send our Annual Report for the fiscal year ended January 30, 2010 (the “2009 Annual Report”).

What Information is Contained in These Materials?

The information included in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of our most highly paid executive officers and our directors, and certain other required information. The 2009 Annual Report includes our audited consolidated financial statements.

Only stockholders of record of dELiA*s common stock, $.001 par value per share (“Common Stock”), at the close of business on April 23, 2010, or the “record date”, are entitled to vote at the Annual Meeting. The Common Stock is our only authorized class of voting stock. As of April 23, 2010, we had 31,310,091 shares of Common Stock outstanding.

Stockholder of Record: Shares Registered in Your Name

If on April 23, 2010 your shares were registered directly in your name with the Company’s transfer agent, American Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to complete, sign and date the enclosed proxy card and to return it promptly in the envelope provided.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Nominee

If on April 23, 2010 your shares were registered in the name of your broker, bank, or other nominee, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank, or other nominee on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your bank, broker or other nominee or you bring a letter from the bank, broker or nominee indicating that you were the beneficial owner of the shares on April 23, 2010, the record date for voting.

1

Can I Attend the Annual Meeting?

You are invited to attend the Annual Meeting if you are a stockholder of record or a beneficial owner as of April 23, 2010. If you are a stockholder of record, you must bring proof of identification. If you hold your shares through a broker, bank or other nominee, you will need to provide proof of ownership by bringing either a copy of the voting instruction form provided by your broker, bank, or other nominee or a copy of a brokerage statement showing your share ownership as of April 23, 2010.

Each share of Common Stock that you own entitles you to one vote.

Stockholder of Record: Shares Registered in Your Name

Whether or not you plan to attend the Annual Meeting, we urge you to complete, sign and date the enclosed proxy card and to return it promptly in the envelope provided. Returning the proxy card will not affect your right to attend the Annual Meeting and vote. If your shares are registered directly in your name through our stock transfer agent, American Stock Transfer & Trust Company, or if you have stock certificates, you may vote by completing, signing and mailing the enclosed proxy card in the envelope provided. Your proxy will be voted in accordance with your instructions. If you sign the proxy card, but do not specify how you want your shares voted, they will be voted as recommended by our Board of Directors. If you attend the Annual Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the meeting.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply complete, sign and date the enclosed proxy card and return it promptly in accordance with the instructions of your broker, bank or other nominee.

How Does the Board of Directors Recommend That I Vote on the Proposals?

If we receive a properly completed proxy card in time to vote your “proxies”, Walter Killough, our Chief Executive Officer, and/or David J. Dick, our Chief Financial Officer and Treasurer, will vote the shares as you or your bank, broker or other nominee have directed. If we receive a properly completed proxy card but no specific choices are made, your proxies will vote those shares as recommended by the Board of Directors as follows:

| • | “FOR” the election of the five nominees for director; and |

| • | “FOR” ratification of the appointment of BDO Seidman, LLP as our independent registered public accountants for the fiscal year ending January 29, 2011. |

If any other matter is presented at the Annual Meeting, your proxies will vote in accordance with their best judgment. As of the date of this Proxy Statement, we knew of no matters to be acted on at the Annual Meeting other than those discussed in this Proxy Statement.

If you are a record holder and you give us your proxy, you may revoke it at any time before it is exercised. You may revoke your proxy in any one of the following three ways:

| • | you may send in another proxy with a later date; |

| • | you may notify our Secretary in writing before the Annual Meeting that you have revoked your proxy; or |

| • | you may vote in person at the Annual Meeting. Attending the Annual Meeting in person will not in and of itself revoke a previously submitted proxy unless you specifically request it. |

2

As noted above, if your shares are held in street name, you must follow the instructions provided by your bank, broker, or other nominee in order to revoke your proxy.

What if I Receive More Than One Proxy Card?

If you hold shares of our Common Stock in more than one account, whether as a record holder or in street name, you may receive more than one proxy card, or voting instruction form. If you choose to vote by proxy, which we recommend, please vote in the manner described under “How Do I Vote By Proxy?” for each account to ensure that all of your shares are voted.

If you hold shares in your own name (rather than in street name) and you plan to attend the Annual Meeting and vote in person, we will give you a ballot when you arrive. However, if your shares are held in the name of your broker, bank or other nominee, you are not the stockholder of record and you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your bank, broker or other nominee or you bring a letter from the bank, broker or nominee indicating that you were the beneficial owner of the shares on April 23, 2010, the record date for voting.

Will My Shares be Voted if I Don’t Provide My Proxy or Instruction Form?

Registered Stockholders. If your shares are registered in your name, your shares will not be voted unless you provide a proxy or vote in person at the Annual Meeting.

Beneficial Owners. If you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee, in order to ensure your shares are voted in the way you would like, you must provide voting instructions to your bank, broker or other nominee by the deadline provided in the materials you receive from your bank, broker or other nominee. If you do not provide voting instructions to your bank, broker or other nominee, whether your shares can be voted by such person depends on the type of item being considered for vote.

Non-Discretionary Items. Proposal 1, the election of directors, is a non-discretionary item and may not be voted on by brokers, banks or other nominees who have not received specific voting instructions from you.

Discretionary Items. Proposal 2, the ratification of the appointment of the independent registered public accountants, is a discretionary item. Generally, brokers, banks and other nominees that do not receive voting instructions from you may vote on this proposal in their discretion. If your bank, broker or other nominee does not receive instructions from you and it chooses not to vote on a matter for which it has discretionary voting authority, this is referred to as a “broker non-vote”. Broker non-votes are not counted in determining the shares that are entitled to vote on any matter that may be presented at the Annual Meeting. Accordingly, as to Proposal 2, broker non-votes will have no effect on the outcome of the vote.

What Vote is Required to Approve Each Proposal?

Proposal 1: Elect Five Directors.

The five nominees for director who receive the most votes (also known as a “plurality” of the votes) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of directors.

3

Proposal 2: Ratify Selection of Independent Registered Public Accountants.

The affirmative vote of a majority of the shares of Common Stock present, in person or by proxy at the Annual Meeting, and entitled to vote is required to ratify the selection of our independent registered public accountants. You may vote either FOR or AGAINST ratification, or you may ABSTAIN. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, the resulting broker non-votes will not be considered as entitled to be voted on this matter and will have no effect on the results of this vote. However, since a majority of shares of Common Stock present, in person or by proxy at the Annual Meeting, and entitled to vote is required to ratify the selection of our independent registered public accountants, shares that are voted to abstain will have the effect of a vote against ratification.

We are not required to obtain the approval of our stockholders to select our independent registered public accountants. However, if our stockholders do not ratify the selection of BDO Seidman, LLP as our independent registered public accountants for the fiscal year ending January 29, 2011, our Audit Committee will reconsider its selection.

We will keep all the proxies, ballots and voting tabulations private. We let only our Inspector of Election (a representative of American Stock Transfer & Trust Company, our transfer agent) examine these documents. We will, however, forward to management any written comments you make on the proxy card or elsewhere.

Where Can I Find the Voting Results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting and will publish final results in a Current Report on Form 8-K that we expect to file within four business days of the Annual Meeting.

Who Pays the Costs of Soliciting These Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will reimburse them for their expenses.

What Constitutes a Quorum for the Meeting?

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of our Common Stock as of the record date is necessary to constitute a quorum at the Annual Meeting. Votes of stockholders of record who are present at the Annual Meeting in person or by proxy, abstentions and broker non-votes will be counted for purposes of determining whether a quorum exists.

On the record date, there were 31,310,091 shares of our Common Stock outstanding and entitled to vote. Thus, 15,655,047 shares of our Common Stock must be represented by proxy or by stockholders present at the Annual Meeting to have a quorum. If there is no quorum, the chairman of the Annual Meeting or holders of a majority of the votes present at the Annual Meeting may adjourn the Annual Meeting to another time or date.

How do I Obtain an Electronic Copy of the 2009 Annual Report?

An electronic copy of our 2009 Annual Report is available through the Investor Relations section of our website at www.deliasinc.com. In addition, you can also find a copy of our 2009 Annual Report on the Internet through the Securities and Exchange Commission’s (the “SEC”) electronic data system at www.sec.gov.

4

INFORMATION ABOUT dELiA*s SECURITY OWNERSHIP

The following table sets forth certain information with respect to the beneficial ownership of our Common Stock as of April 23, 2010 (other than as noted below) for (a) each of our named executive officers, as defined in the Summary Compensation Table below, (b) each of our directors, (c) all of our current directors and executive officers as a group and (d) each stockholder known by us to own beneficially more than 5% of our Common Stock. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. We deem shares of Common Stock that may be acquired by an individual or group within 60 days of April 23, 2010, pursuant to the exercise of options or warrants or conversion of convertible securities, to be outstanding for the purpose of computing the percentage ownership of such individual or group, but these shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table. Except as indicated in the footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of Common Stock shown to be beneficially owned by them based on information provided to us by such stockholders or on information contained in filings by them with the SEC. Percentage of ownership is based on 31,310,091 shares of Common Stock outstanding on April 23, 2010.

Except where indicated in the footnotes below, the address for each director and executive officer listed is: c/o dELiA*s, Inc., 50 West 23rd Street, New York, New York 10010.

| Common Shares Beneficially Owned | ||||||

| Name of Beneficial Owner |

Number | Percentage (%) | ||||

| Executive Officers and Directors: |

||||||

| Robert E. Bernard |

2,051,620 | (1) | 6.6 | % | ||

| Carter S. Evans |

85,784 | (2) | * | |||

| Walter Killough |

722,663 | (3) | 2.3 | % | ||

| Paul J. Raffin |

70,415 | (4) | * | |||

| Scott M. Rosen |

78,784 | (5) | * | |||

| Gene Washington |

78,034 | (6) | * | |||

| Michele Donnan Martin |

162,500 | (7) | * | |||

| David J. Dick |

30,000 | (8) | * | |||

| Marc G. Schuback |

15,000 | (9) | * | |||

| All current directors and executive officers as a group (8 persons) |

1,243,180 | 4.0 | % | |||

| Five Percent Stockholders: |

||||||

| Royce & Associates, LLC |

3,003,469 | (10) | 9.6 | % | ||

| T2 Partners Management LP |

2,934,297 | (11) | 9.4 | % | ||

| Wells Fargo & Company |

2,402,067 | (12) | 7.7 | % | ||

| North Run Capital LP |

2,005,000 | (13) | 6.4 | % | ||

| * | Less than 1%. |

| (1) | Mr. Bernard served as our Chief Executive Officer until May 14, 2010. Includes 1,845,935 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. Also includes 1,625 shares held by Mr. Bernard’s wife and 32,270 shares held in trust for the benefit of Mr. Bernard’s children, as to which shares Mr. Bernard disclaims beneficial ownership. |

| (2) | Includes 48,039 shares of restricted stock and 5,000 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

| (3) | Includes 705,767 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

| (4) | Includes 48,039 shares of restricted stock and 2,500 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

| (5) | Includes 48,039 shares of restricted stock and 5,000 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

5

| (6) | Includes 48,039 shares of restricted stock and 3,750 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

| (7) | Includes 25,000 shares of restricted stock and 137,500 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

| (8) | Shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

| (9) | Shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

| (10) | Based on a Schedule 13G filed with the SEC on January 25, 2010. According to this Schedule 13G, Royce & Associates LLC, an investment adviser registered under the Investment Company Act of 1940, has sole voting and dispositive power with respect to such shares, and the interest of one account, Royce Opportunity Fund, an investment company registered under the Investment Company Act of 1940, which is managed by Royce & Associates LLC, amounted to 2,037,584 shares of Common Stock. The address of Royce & Associates, LLC is 745 Fifth Avenue, New York, New York 10151. |

| (11) | Based on a Schedule 13G jointly filed with the SEC on February 16, 2010 by Whitney R. Tilson, Glenn H. Tongue, T2 Partners Management, LP, T2 Partners Management, LP, T2 Qualified Plan, LP, a Delaware limited partnership, T2 Accredited Fund, LP, a Delaware limited partnership, Tilson Offshore Fund, Ltd., a Cayman Islands limited company and Tilson Focus Fund, a registered investment company. According to the Schedule 13G, Whitney R. Tilson and Glenn H. Tongue control T2 Partners Management, LP, T2 Partners Management, LLC and T2 Partners Group, LLC; T2 Partners Management, LLC is the General Partner for T2 Accredited Fund, LP and T2 Qualified Fund, LP; and T2 Partners Group, LLC controls T2 Partners Management, LP. The address of each of the above individuals and entities is 145 East 57th Street, Tenth Floor, New York, New York 10022. |

| (12) | Based on a Schedule 13G filed with the SEC on January 22, 2010 by Wells Fargo & Company on behalf of itself and on behalf of the following subsidiaries: Wells Capital Management Incorporated, Wells Fargo Funds Management, LLC, Wachovia Bank, National Association and Wells Fargo Advisors, LLC. According to this Schedule 13G, Wells Fargo & Company has sole voting power with respect to 2,324,230 of such shares and sole dispositive power with respect to 2,405,575 of such shares and Wells Capital Management Incorporated has sole voting power with respect to 1,725,782 of such shares and sole dispositive power with respect to 2,312,848 of such shares. The address of Wells Fargo and Company is 420 Montgomery Street, San Francisco, California 94104. |

| (13) | Based on a Schedule 13G jointly filed with the SEC on December 11, 2009 by North Run Advisors, LLC, a Delaware limited liability company (“North Run”), North Run GP, LP, a Delaware limited partnership (the “GP”), North Run Capital, LP, a Delaware limited partnership (the “Investment Manager”), Todd B. Hammer and Thomas B. Ellis. According to this Schedule 13G, each of the above named persons and entities has shared voting and dispositive power with respect to such shares. According to Schedule 13G, (i) Todd B. Hammer and Thomas B. Ellis are the principals and sole members and limited partners, as applicable, of North Run, the GP and the Investment Manager and North Run is the general partner for both the GP and the Investment Manager. The address of each of the above individuals and entities is One International Place, Suite 2401, Boston, Massachusetts 02110. |

6

CORPORATE GOVERNANCE AND INFORMATION ABOUT DIRECTORS AND EXECUTIVE OFFICERS

Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that our business is to be managed by, or under the direction of, our Board of Directors. Each member of our Board of Directors is elected at each annual meeting of stockholders to serve until the Company’s next annual meeting and until their respective successors have been duly elected and qualified. Our Board of Directors currently consists of five members: Carter S. Evans, Walter Killough, Paul J. Raffin, Scott M. Rosen and Gene Washington.

Based upon a review by the Board of Directors of all relevant information, the Board of Directors has determined that each of Messrs. Evans, Rosen, Raffin and Washington meets the requirements for independence under the rules of The Nasdaq Stock Market for board members and for members of the committees of the Board of Directors on which each serves, and that Mr. Rosen qualifies as an “audit committee financial expert” as that term is defined in the rules and regulations of the SEC.

Based upon the recommendation of the Corporate Governance and Nominating Committee of our Board of Directors, the Board approved the nomination of each of Messrs. Evans, Killough, Raffin, Rosen and Washington for election at the Annual Meeting until the Company’s 2011 Annual Meeting and until their respective successors have been duly elected and qualified.

The names of our current directors and director nominees and certain information about them, including their positions on standing committees of the Board of Directors, are set forth below:

| Name |

Age | Position | ||

| Carter S. Evans (1) |

60 | Chairman and Director | ||

| Walter Killough |

55 | Chief Executive Officer and Director | ||

| Paul J. Raffin (2) |

56 | Director | ||

| Scott M. Rosen (3) |

51 | Director | ||

| Gene Washington (4) |

63 | Director |

| (1) | Member of the Compensation Committee, Corporate Governance and Nominating Committee and Chairman of the Audit Committee. |

| (2) | Member of the Corporate Governance and Nominating Committee. |

| (3) | Member of the Audit Committee, Compensation Committee and Chairman of the Corporate Governance and Nominating Committee. |

| (4) | Member of the Audit Committee and Chairman of the Compensation Committee. |

The following is a brief summary of the background of each of our current directors and director nominees:

Carter S. Evans has served as a director since February 2006 and was appointed our Chairman of the Board in July 2008. He is currently a Managing Director with Alvarez & Marsal, LLC, a New York-based provider of specialized debtor management and advisory services, a position he has held since January 1995. Prior to joining Alvarez & Marsal, he has over 20 years experience in workouts and turnarounds serving in various capacities at Chemical Bank and later Lehman Brothers. He commenced his career at Price Waterhouse & Co. He has previously served on the Boards of Timex Group B.V., Pratt-Read Corp. and the successor to US Financial. During his career, Mr. Evans has served as President of the Arrow Shirt Company and Arrow International (both part of Cluett American Group). He was also actively involved in numerous restructurings, including those of Chrysler, International Harvester, Federated Department Stores, Allied Stores and General Homes. Mr. Evans brings to the Board of Directors substantial experience advising various types of businesses, including retail businesses, in the management advisory, workout and turnaround areas while at Alvarez & Marsal, Lehman Brothers and Chemical Bank. He also has prior financial experience as an auditor at Price Waterhouse & Co. and has served as the Chief Financial Officer of Bridge Information Systems, Inc. and the President of Physician Computer Network, Inc. both

7

while at Alvarez & Marsal. Mr. Evans has served as a director of several public and private companies including Pratt-Read Corp., Timex Group BV and Duckwall Alco Stores. He served as Chairman of Duckwall Alco Stores and at Timex BV he served on the Audit, Corporate Governance and Compensation (Chairman) Committees.

Walter Killough has served as our Chief Executive Officer since May 14, 2010 and as a director since December 2005. Mr. Killough was our Chief Operating Officer from December 2005 until May 14, 2010. Mr. Killough joined Alloy, Inc. in March 2003 as a consultant, and served as the Chief Operating Officer of its Retail and Direct Consumer Division from October 2003 until December 2005. Prior to joining Alloy, Mr. Killough was at J.Crew Group, Inc. for 14 years. He was appointed its Chief Operating Officer in 2001, and prior to that served as an executive vice president. As its Chief Operating Officer, he was responsible for all sourcing, catalog circulation and production, warehouse and distribution, retail and direct planning and logistics. Mr. Killough has unique knowledge of the Company and its operations, having served as our Chief Operating Officer since the Spinoff and more recently as our Chief Executive Officer. His insight and understanding of our businesses is invaluable to the Board in evaluating and directing the Company’s present and future operations. He also has had significant experience in senior operational and leadership positions at J.Crew Group, Inc. which, like the Company, had both a direct to consumer business and retail store business.

Paul J. Raffin has served as a director since November 2007. Currently, Mr. Raffin is the President and Chief Executive Officer of DZ Holdings, Inc., a global company with headquarters in Shanghai, China providing supply chain management services and product and branding services. From January 2008 through November 2009, Mr. Raffin was the Global Group Chief Executive Officer of Frette Inc., a provider of luxury linens. From February 2007 to January 2008, Mr. Raffin served as Chief Executive Officer of Frette North America. From December 1997 to January 2007 he served in various positions at Limited Brands, Inc., most recently as President of the Express, Inc. division. Prior thereto, he was President, Mail Order of J.Crew Group, Inc.; President of Gant, a division of Crystal Brands; and President of the Colours and Coloursport Division of Colours by Alexander Julian. Mr. Raffin previously served as a director of The Bombay Company, Inc., which was a retailer of home furnishings. Mr. Raffin has substantial experience in the retail and apparel businesses both domestically and internationally as a result of his senior leadership positions at Frette Inc., the Express Division of Limited Stores, Inc. and J.Crew Group, Inc., as well as public company board experience, having previously served on the Board of Directors of The Bombay Company, Inc.

Scott M. Rosen has been a director since December 2005. Mr. Rosen has served as Chief Operating Officer of Equinox Holdings, Inc., a New York-based operator of upscale fitness clubs, since January 2005. Before that, Mr. Rosen was Executive Vice President and Chief Financial Officer of Equinox Holdings, Inc., which he joined in September 2003. Prior to joining Equinox, Mr. Rosen was most recently Executive Vice President/Chief Financial Officer of J.Crew Group, Inc. where he worked from 1994 to September 2003. Prior to joining J. Crew, Mr. Rosen was Vice President and Divisional Controller for the Women’s Sportswear Group division of Liz Claiborne, Inc. Mr. Rosen is a non-practicing certified public accountant. Mr. Rosen brings to his duties as a director substantial financial experience as a result of his senior financial leadership positions as Executive Vice President and Chief Financial Officer of Equinox Holdings, Chief Financial Officer of J.Crew Group, Inc., and Vice President and Divisional Controller for the Women’s Sportswear Group division of Liz Claiborne, Inc. Mr. Rosen also has senior leadership and operational experience as a result of his current position as Chief Operating Officer of Equinox Holdings.

Gene Washington has served as a director since September 2006. Mr. Washington is currently the Principal of the Gene Washington Consulting Group. From June 1994 until his retirement in March 2009, Mr. Washington served as the Director of Football Operations with the National Football League in New York. He previously served as a professional sportscaster and as Assistant Athletic Director for Stanford University prior to assuming his position with the NFL in 1994. Mr. Washington has served as a director of Goodrich Petroleum Corporation, a NYSE-listed oil and gas company, since 2003; has served as a director of GP Strategies Corporation, a NYSE listed company, since 2007 and also served as a director of the former New York Bancorp, Inc. Mr. Washington has substantial and varied experience as a result of his leadership positions at large organizations, such as the

8

National Football League and Stanford University. He also brings to the Board valuable experience as a director of publicly traded companies, including Goodrich Petroleum Corporation (where he is a member of the Nominating and Corporate Governance Committee and Chairman of the Compensation Committee), GP Strategies Corporation (where he is a member of the Compensation and Audit Committees), as well as his prior service on the board of New York Bancorp, Inc.

Committees of the Board of Directors and Meetings

Meeting Attendance. During the fiscal year ended January 30, 2010, there were four meetings of our Board of Directors. The Board of Directors also acted by unanimous written consent, pursuant to Delaware law, on four occasions during this period. Each director was in attendance, either in person or via telephone, at 75% or more of the total number of meetings of the Board and of committees of the Board on which he served during the fiscal year ended January 30, 2010. The Board has adopted a policy under which each member of the Board is strongly encouraged to attend each annual meeting of our stockholders. All of the members of our Board of Directors standing for re-election attended our 2009 annual meeting of stockholders.

Audit Committee. Our Audit Committee met nine times during the fiscal year ended January 30, 2010. This committee currently has three members, Carter S. Evans (Chairman), Scott M. Rosen and Gene Washington. Our Audit Committee reviews, acts on and reports to the Board of Directors with respect to the integrity of our financial statements and the financial reporting process and various auditing and accounting matters, including the selection of our independent auditors, the scope of the annual audits, fees to be paid to the auditors, the performance of our independent auditors and our accounting practices. The Audit Committee operates pursuant to a written charter, which was adopted December 5, 2005. The Audit Committee charter is publicly available on our website at www.deliasinc.com in the corporate governance section of our investor relations pages.

Compensation Committee. Our Compensation Committee met one time during the fiscal year ended January 30, 2010. This committee currently has three members, Gene Washington (Chairman), Carter S. Evans and Scott M. Rosen. Our Compensation Committee is authorized to annually review and make recommendations to the Board of Directors with respect to the compensation of directors, executive officers and other key employees and approve and administer our cash incentive, employee benefit and stock incentive plans, including the dELiA*s, Inc. Amended and Restated 2005 Stock Incentive Plan (the “2005 Plan”). The Compensation Committee may designate one or more subcommittees, consisting of one or more members of the Compensation Committee, to exercise the powers and authority of the Compensation Committee. The Board of Directors adopted a Compensation Committee charter on December 5, 2005. The Compensation Committee charter is publicly available on our website at www.deliasinc.com in the corporate governance section of our investor relations pages.

Corporate Governance and Nominating Committee. Our Corporate Governance and Nominating Committee held one meeting during the fiscal year ended January 30, 2010. Our Corporate Governance and Nominating Committee is currently comprised of Scott M. Rosen (Chairman), Carter S. Evans and Paul J. Raffin. The Corporate Governance and Nominating Committee operates pursuant to a written charter adopted on December 5, 2005. The Corporate Governance and Nominating Committee charter is publicly available on our website at www.deliasinc.com in the corporate governance section of our investor relations pages.

The Corporate Governance and Nominating Committee is responsible for, among other things, (1) reviewing the appropriate size, function and needs of the Board, (2) developing the Board’s policy regarding tenure and retirement of directors, (3) establishing criteria for evaluating and selecting new members of the Board, subject to Board approval thereof, (4) identifying and recommending to the Board for approval individuals qualified to become members of the Board , consistent with criteria established by the Committee and the Board, (5) overseeing the evaluation of management and the Board, and (6) monitoring and making recommendations to the Board on matters relating to corporate governance.

9

The Corporate Governance and Nominating Committee may consider all factors it deems relevant in assessing potential candidates, such as a candidate’s integrity and judgment, business and professional skills and experience, independence, knowledge of the industry in which we operate, possible conflicts of interest, diversity, the extent to which the candidate would fill a present need on the Board, and concern for the long-term interests of stockholders. The Corporate Governance and Nominating Committee does not assign specific weights to particular criteria and no particular factor is necessarily applicable to all prospective nominees. The Corporate Governance and Nominating Committee believes that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. While the Corporate Governance and Nominating Committee does not have a formal diversity policy with respect to director nominations, as noted above, it considers diversity, which it defines broadly to include an appropriate combination of business and professional skill, experience, viewpoint and the other items noted above, as well as traditional diversity concepts such as race, as one of a number of factors it considers to indentify qualified nominees for director.

If a stockholder wishes to nominate a candidate to be considered for election as a director at the 2011 Annual Meeting of Stockholders using the procedures set forth in our Amended and Restated Bylaws, it must follow the procedures described therein under the section entitled “Certain Matters Pertaining to Stockholder Business and Nominations.” To be timely, a stockholder’s notice nominating a candidate for election to the Board of Directors at an annual meeting must be delivered to the our Secretary at our principal executive offices not later than the close of business on the 45th day nor earlier than the close of business on the 75th day prior to the first anniversary of the preceding year’s mailing date for stockholder proxy materials. In the event that the date of the annual meeting is more than 30 days before or more than 60 days after the date of the annual meeting in the preceding year, or if an annual meeting was not held in the preceding year, notice by the stockholder to be timely must be delivered by the later of (a) the close of business on the 90th day prior to the date of such stockholders’ meeting or (b) the close of business on the 10th day following the day on which public announcement of the date of such meeting is first made by us. A stockholder’s notice must contain the information set forth in the Amended and Restated Bylaws under the section entitled “Certain Matters Pertaining to Stockholder Business and Nominations.”

In general, the Corporate Governance and Nominating Committee will consider all recommendations submitted by stockholders in the same manner and under the same process as any other recommendations submitted from other sources, including current directors, officers and employees, following which it will select candidates to be recommended for nomination to the Board according to the requirements and qualification criteria established by the Corporate Governance and Nominating Committee. However, the Corporate Governance and Nominating Committee is under no obligation to recommend any particular candidate for nomination.

Board Leadership Structure and Role in Risk Oversight

Board Leadership Structure. Our Board of Directors has a general policy that the positions of the Chairman and Chief Executive Officer should be held by separate persons. However, this general policy serves as part of a flexible framework within which the Board may conduct its business, and is not a binding legal obligation. Our Board believes that it should have the flexibility to make its determination as to whether these positions should be held by separate persons or one person at any given point in time in the way that it believes best to provide appropriate leadership for us at that time.

The Board of Directors has established a structure whereby our Chairman position is a non-executive position held by an independent director, Carter S. Evans. The Board has continued this separation, as it currently believes that having a Chairman independent of management helps ensure critical advice, independent thinking and independent oversight as we continue to implement our strategic plans, and allows our Chief Executive Officer to more closely focus on our day-to-day business. Our Chairman’s primary responsibilities are to preside at meetings of the Board and of the non-management and independent Board members, serve as the principal

10

liaison between our Chief Executive Officer and management, on the one hand, and the Board, on the other hand, and provide not only our other directors, but also our stockholders with an independent leadership contact. The Board of Directors recognizes that there could be circumstances in the future that would lead it to combine the positions of Chairman of the Board and Chief Executive Officer.

Board of Directors’ Role in Risk Oversight. Our Board of Director’s role in risk management is primarily one of oversight with the day-to-day responsibility for risk management implemented by our management team. At regularly scheduled meetings, the Board receives management updates on our business operations, financial results and strategy and discusses risks related to the business. In carrying out its risk oversight function, our Board of Directors has three standing committees: Audit, Compensation and Corporate Governance and Nominating, each of which is responsible for risk oversight within that committee’s area of responsibility.

As part of its responsibilities, the Audit Committee oversees our financial policies, including financial risk management. The Audit Committee assists our Board in its oversight of risk management by discussing with management, particularly the Chief Financial Officer, our guidelines and policies regarding financial and enterprise risk management and risk appetite, including major risk exposures and the steps management has taken to monitor and control risk exposures. The Audit Committee also annually receives and considers a report from Grant Thornton LLP, our outsourced internal auditors, regarding the Company’s internal controls over financial reporting, as well as a risk assessment and plan jointly prepared by Grant Thornton and management. The Audit Committee discusses these items with Grant Thornton, BDO Seidman and Company management.

Each of the other committees of our Board of Directors considers risks within its areas of responsibility as follows. The Compensation Committee oversees risk management as it relates to our compensation plans, policies and practices in connection with structuring our executive compensation programs and reviewing our incentive compensation programs for other employees and has reviewed with management whether our compensation programs may create incentives for our employees to take excessive or inappropriate risks which could have a material adverse effect on the Company. The Compensation Committee has concluded that our compensation policies and practices are not reasonably likely to have a material adverse effect on the Company. The Corporate Governance and Nominating Committing Committee considers risks relating to board membership and corporate governance.

Codes of Business Conduct and Ethics

We have adopted a Code of Business Conduct, applicable to all employees, as well as a Code of Ethics for Principal Executive Officers and Senior Financial Officers within the meaning of Item 406(b) of Regulation S-K. This Code of Ethics applies to our principal executive officer, principal financial officer, principal accounting officer and others performing similar functions. The Code of Business Conduct and the Code of Ethics each are publicly available on our website at www.deliasinc.com in the corporate governance section of our investor relations pages.

Communicating with Our Directors

We have adopted a policy regarding stockholder communications with directors. Pursuant to that policy, stockholders who wish to communicate with the Board of Directors as a whole, with any committee of the Board of Directors, with the non-management members of the Board of Directors as a group or with specified non-management directors should do so by sending any communication to dELiA*s, Inc. Board of Directors, c/o Corporate Secretary, 50 West 23rd Street, New York, NY 10010, or by sending an email to legal@deliasinc.com.

Any such communication should state the name and address of, and the number of shares beneficially owned by, the stockholder making the communication. Such communication will be forwarded to the full Board of Directors, a Board committee, the non-management directors or to any individual non-management director or directors, in each case to whom the communication is directed, unless the communication is unduly hostile,

11

threatening, illegal or similarly inappropriate, or is not related to the duties and responsibilities of the Board of Directors, in which case the communication may be discarded or appropriate legal action may be taken regarding the communication.

Director compensation consists principally of cash, an award of options to purchase shares of our Common Stock and awards of shares of restricted stock. The Company’s non-employee directors received the following amounts of compensation for our fiscal year ended January 30, 2010:

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1)(2) | Option Awards ($)(1)(3) | Total ($) | ||||

| Carter S. Evans |

58,000 | 50,000 | — | 108,000 | ||||

| Paul J. Raffin |

36,000 | 50,000 | — | 86,000 | ||||

| Scott M. Rosen |

58,000 | 50,000 | — | 108,000 | ||||

| Gene Washington |

50,000 | 50,000 | — | 100,000 |

| (1) | The amounts shown in this column reflect the grant date fair value of the stock awards and option awards pursuant to the provisions of the Financial Accounting Standards Board Accounting Standards Codification Topic 718. See footnote 11 to our audited financial statements beginning on page F-21 of our 2009 Annual Report. |

| (2) | Each of Messrs. Evans, Raffin, Rosen and Washington were awarded 26,738 shares of restricted stock in January 2010. The restrictions on these shares lapse equally on each of the first three anniversaries of the grant date. |

| (3) | Each of the named directors was granted options to purchase 5,000 shares of Common Stock upon commencement of service on the Board of Directors. The options vest in equal annual installments on each of the first four anniversaries of the date of grant and expire on the tenth anniversary of the date of grant. As of January 30, 2010, options to purchase 3,750 shares of Common Stock were vested with respect to each of Messrs. Evans and Washington, options to purchase 5,000 shares of Common Stock were vested with respect to Mr. Rosen and options to purchase 2,500 shares of Common Stock were vested with respect to Mr. Raffin. |

Equity Compensation

Upon their commencement of service, non-employee directors each receive a grant of options to purchase 5,000 shares of our Common Stock under the 2005 Plan. These options vest equally on each of the first four anniversaries of the grant date, provided that the optionee is still a non-employee director at the opening of business on each such date. Options granted to these directors entitle them to purchase shares of our Common Stock at an exercise price equal to the fair market value of such shares on the date of grant.

For each subsequent year of service, each non-employee director will receive, without cost to such director, the number of shares of our Common Stock that could be purchased for $50,000 at the closing price of such Common Stock on the trading date immediately preceding the award of such shares. These restricted stock shares will be issued pursuant to one or more of our existing stock incentive plans, as such plans may be amended from time to time. These shares will be subject to lapsing rights of repurchase on our part under the applicable plan documents, which repurchase right will entitle us to repurchase the shares for $0.001 per share and which rights will lapse equally on each of the first three anniversaries of the grant date. Such shares will also be subject to the terms and conditions of the plan under which they are awarded and the execution and delivery of restricted stock agreements relating to such shares. The grant date for these restricted stock awards is the first business day of each calendar year. Accordingly, in fiscal 2009, each of Messrs. Evans, Raffin, Rosen and Washington received an award of 26,738 restricted shares on January 4, 2010.

12

Cash Compensation

Each non-employee director receives an annual retainer of $24,000, payable in equal quarterly installments, and a fee of $1,000 for each meeting of the Board of Directors he attends in person or by telephone. Each non-employee director also receives an annual retainer of $8,000, payable in equal quarterly installments, for each committee on which such director serves, and an additional $6,000 annual retainer, payable in equal quarterly installments, for each committee of which such director serves as the chairman.

Directors who are also our employees do not receive any fees or other compensation for service on our Board of Directors or its committees. We reimburse all directors for reasonable out-of-pocket expenses incurred in attending board or committee meetings.

13

Compensation Discussion and Analysis

Compensation Objectives

The Company’s compensation policy for executive officers is designed to achieve the following objectives:

| • | to reward executives consistent with the Company’s annual and long-term performance goals; |

| • | to recognize individual initiative, leadership and achievement; and |

| • | to provide competitive compensation that will attract and retain qualified executives, all with a view to enhancing the profitability of the Company and increasing stockholder value. |

To achieve these objectives, the Company’s overall compensation program aims to pay its executive officers competitively, consistent with the Company’s growth and their contribution to that growth. Accordingly, the Company relies on programs that provide compensation in the form of both cash and equity, although the Compensation Committee has not adopted any formal guidelines for determining aggregate compensation of executive officers or for allocating total compensation between cash and equity or long-term and current compensation.

Executive Officer Compensation Program

The Compensation Committee has the primary authority to determine and recommend to the Board of Directors the compensation awards available to the Company’s executive officers. The Compensation Committee performs annual reviews of executive compensation to confirm the competitiveness of the overall executive compensation packages as compared with companies which are similarly situated to the Company in terms of industry, size and stage of development and which compete with the Company for prospective employees. To aid the Compensation Committee in making its determination, the Chief Executive Officer provides recommendations to the Compensation Committee regarding the compensation of all executive officers, excluding himself, based on annual reviews by such executive officers’ respective supervisors, and discussions with those supervisors and our Vice President, Human Resources.

The compensation program for executive officers currently consists of three elements: (1) base salary, which, if not set by the terms of employment agreements between us and our executive officers, is set on an annual basis; (2) annual incentive compensation, in the form of cash bonuses, which is contingent and based primarily on achievement of predetermined financial and operational objectives as set forth in the Company’s management incentive plan; and (3) long-term incentive compensation, in the form of stock options granted when the executive officer joins the Company and stock options and/or restricted stock granted periodically thereafter with the objective of aligning the executive officers’ long-term interests with those of the stockholders and encouraging the achievement of superior results over an extended period. The Compensation Committee reviews at least annually the elements of compensation for its executive officers.

To the extent not pre-determined under the terms of employment agreements with our named executive officers, the amount of each compensation element selected for the executive officers is developed on an individual, case-by-case basis utilizing a number of factors, including available data for comparable companies (as noted below) and the Company’s performance and objectives, as well as the compensation committee’s determination with respect to each executive’s individual contributions to the Company’s performance and objectives. Individual performance factors include the achievement of financial metrics contained in our annual operating plan, day-to-day performance of job functions and performance against any personal performance objectives that may be set from time to time for a particular year. Goals are both objective and subjective in nature and, accordingly, the evaluation of performance by any individual is in part subjective. The achievement or failure to achieve performance objectives is considered as only one factor in the Compensation Committee’s determination of the aggregate compensation of our named executive officers.

14

Our Chief Executive Officer and the President of our dELiA*s brand each are employed pursuant to an individual employment agreement. Until his employment ended on May 14, 2010, our former Chief Executive Officer also was employed pursuant to an individual employment agreement. The agreements were separately negotiated with the Compensation Committee based on the individual named executive officer’s circumstances, including the need to initially attract the individual (which takes into account the then current compensation package of the individual at his or her former employer), and then to retain the individual, as well as the individual’s scope of responsibilities and hierarchy within the Company’s organizational structure.

The Compensation Committee considers various factors in determining the annual compensation for executive officers, including the balance between providing short-term incentives and long-term parallel investment with stockholders to align the interests of management with stockholders. In making its decisions on compensation for the Company’s named executive officers that are not set by applicable employment agreements or arrangements, the compensation committee has considered an annual, industry-based compensation survey published by Mercer, the annual Mercer US Retail Compensation and Benefits Survey, or the Mercer Survey, in order to obtain a general understanding of compensation at the businesses covered by the Mercer Survey, and pays particular attention to the range of overall compensation between the 25th percentile and the 75th percentile set forth in the Mercer Survey with a focus on the mean. The Mercer Survey is conducted by the compensation and benefits consulting firm Mercer in partnership with the National Retail Federation. Mercer collected data from approximately 180 retail companies with which we may compete for managerial and executive talent. However, while the Mercer Survey provides general frames of reference for the Compensation Committee to consider as it makes compensation decisions, the Compensation Committee has not chosen a peer group of companies for comparison to the compensation of our named executive officers, nor has it historically made any of its decisions based on particular companies that participate in the Mercer Study. Accordingly, the Compensation Committee does not view the names of each of the approximately 180 participants in the study to be material to an understanding of our compensation policies or the Compensation Committee’s decision-making process. The substantial part of the Compensation Committee’s compensation decisions is primarily based on internal discussions among its members, management, and the particular individual involved.

Elements of Compensation

Base Salary. Base salaries for executive officers are targeted at competitive market levels for their respective positions, levels of responsibility and experience utilizing relevant market data. In addition to external market data, the Compensation Committee also reviews dELiA*s’ financial performance and individual performance when considering the adjustment of base salaries annually. For fiscal 2009, the Compensation Committee did not grant any discretionary increases in the base salary for our named executive officers. The base salaries for the named executive officers were set forth in employment agreements and offer letters between the Company and those named executive officers.

Bonus Compensation. Bonus compensation is primarily based on the Company’s achievement of predetermined financial, operational and strategic performance objectives. Giving greatest weight to the attainment of financial targets, the Compensation Committee may also award bonuses based on various operational and strategic objectives, such as management efficiency, and the ability to motivate others and build a strong management team, develop and maintain the skills necessary to work in a high-growth company, recognize and pursue new business opportunities and initiate and implement programs to enhance the Company’s growth and success. The Compensation Committee considers the award of bonuses on an annual basis. The Compensation Committee believes that the payment of annual bonuses in cash provides incentives that are important to retain executive officers and reward them for short-term Company performance. The Compensation Committee did not grant any discretionary bonuses for our named executive officers for fiscal 2009.

During fiscal 2009, the independent members of our Board of Directors approved the Company’s 2009 Management Incentive Plan, or 2009 MIP Plan, which established a bonus plan for the payment to the named executive officers and certain other of our employees of cash bonus awards based upon the achievement of

15

specified Earnings Before Interest, Taxes, Depreciation and Amortization, or EBITDA, levels. The threshold, target and stretch EBITDA levels were set by the independent members of our Board of Directors at specified amounts in excess of EBITDA levels contained in our internal, annual operating plan for fiscal 2009. EBITDA is calculated by taking our Operating (Loss) Income and adding back the amounts of depreciation and amortization, impairment of long-lived assets (if any) and stock-based compensation, in each case as set forth in our annual, audited consolidated statements of operations and consolidated statements of cash flows.

We did not achieve any of the specified EBITDA levels during fiscal 2009 and, accordingly, no amounts were payable under the 2009 MIP Plan. However, set forth below are the percentages of base salary each of the our named executive officers would have received under the Plan for the fiscal year ended January 30, 2010 if we had achieved the specified EBITDA levels:

| Name |

Threshold EBITDA |

Target EBITDA |

Stretch EBITDA |

||||||

| Robert E. Bernard |

45 | % | 90 | % | 120 | % | |||

| Walter Killough |

30 | % | 60 | % | 80 | % | |||

| Michele Donnan Martin |

30 | % | 60 | % | 80 | % | |||

| David J. Dick |

15 | % | 30 | % | 40 | % | |||

| Marc G. Schuback |

15 | % | 30 | % | 40 | % |

Long–Term Incentive Compensation. The Compensation Committee administers the 2005 Plan, which provides for the grant of both restricted stock and options, on a tax–deferred basis. The 2005 Plan provides that (1) the exercise price of options granted under the 2005 Plan must equal at least 100% of the fair market value of the Common Stock at the time of grant, and (2) the exercise price of awards granted under the 2005 Plan may not be lowered without the approval of the Company’s stockholders.

Long-term incentive compensation, in the form of stock options and restricted stock grants, allows the executive officers to share in the appreciation in the value of the Company’s Common Stock. The Board of Directors believes that the issuance of stock options and restricted stock aligns executive officers’ interests with those of the stockholders, and provides incentives to those executive officers to maximize stockholder value. In addition, the Board of Directors believes that equity ownership by executive officers helps to balance the short-term focus of annual incentive compensation with a longer term view and may help to retain key executive officers.

When establishing grant levels, the Compensation Committee considers general corporate performance, the level of seniority, experience and responsibilities, existing levels of stock ownership, previous grants, vesting schedules of outstanding options and restricted stock and the current stock price.

It is the standard policy of the Company to make an initial stock option grant to all executive officers at the time they commence employment with the Company, consistent with the number of options granted to executive officers in similarly situated companies at similar levels of seniority. In addition, the Compensation Committee may also make performance–based grants of options and/or restricted stock throughout the year. In making such performance–based grants, individual contributions to the Company’s financial, operational and strategic objectives are considered.

During fiscal 2009 the Compensation Committee granted to David J. Dick an option to purchase 80,000 shares of Common Stock that vest over a period of four years in annual installments that commenced on February 2, 2010. Mr. Dick’s grant of stock options during fiscal 2009 was made in connection with his appointment as the Company’s Chief Financial Officer and Treasurer. In addition, during fiscal 2009 the Compensation Committee granted an option to Marc G. Schuback to purchase 10,000 shares of Common Stock. This grant was based on a positive review of his day-to-day performance in fiscal 2008 as the Company’s general counsel.

16

Other Compensation. The Company’s executive officers are entitled to the various benefits offered by the Company from time to time to its employees, including medical, dental, life, accidental death and dismemberment, and disability insurance, and to participate in the Company’s 401(k) plan for its full-time employees. In addition, under the terms of his employment agreement, Mr. Bernard received $20,000 per annum for application to a term life insurance policy for the benefit of a beneficiary to be designated by Mr. Bernard.

Certain Accounting and Tax Considerations. The Compensation Committee is aware that base salary, bonuses, stock-based awards, and other elements of the Company’s compensation programs for executive officers generate charges to earnings under generally accepted accounting principles (including as provided in ASC 718). The Compensation Committee generally does not adjust compensation components based on accounting factors. With respect to the tax treatment of compensation, the Compensation Committee will consider the tax effect of types of compensation, including whether it should structure incentive compensation to secure the deduction for performance-based compensation under Section 162(m) of the Internal Revenue Code of 1986, as amended. Section 162(m) denies a deduction for compensation paid to an executive officer in a taxable year if that compensation is in excess of $1,000,000, unless the excess amount meets the definition of “performance-based compensation.” It is the Compensation Committee’s present intention that, as long as consistent with its overall compensation objectives, substantially all executive compensation will be deductible for federal income tax purposes. It is possible, however, that portions of any future grants or awards may not qualify as performance-based compensation and, when combined with other compensation to an executive officer, may exceed this limitation in any particular year.

The Compensation Committee of our Board of Directors has reviewed and discussed the Compensation Discussion and Analysis with management. Based on this review and discussions, the Compensation Committee recommended to our Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

The Compensation Committee

Gene Washington, Chairman

Carter S. Evans

Scott M. Rosen

17

The information under this heading summarizes the compensation awarded, paid to or earned during our last fiscal year by our former and current Chief Executive Officer, our Chief Financial Officer, and certain other of our executive officers, whom we collectively refer to as our “named executive officers,” for services rendered to the Company during the fiscal years ended January 30, 2010, January 31, 2009 and February 2, 2008.

| Name and Principal Position |

Year | Salary ($) |

Bonus ($) |

Option and Stock Awards ($)(1) |

Non-Equity Incentive Plan Compensation ($) |

All Other Compensation ($) |

Total ($) | |||||||||||

| Robert E. Bernard |

2009 | 650,000 | — | — | — | 21,500 | (4) | 671,500 | ||||||||||

| Former Chief Executive Officer (2) |

2008 | 607,500 | 216,625 | (3) | 300,710 | — | 27,000 | (4) | 1,151,835 | |||||||||

| 2007 | 600,000 | — | — | — | 28,673 | (4) | 628,673 | |||||||||||

| Walter Killough |

2009 | 400,000 | — | — | — | 1,154 | (5) | 401,154 | ||||||||||

| Chief Executive Officer (2) |

2008 | 378,796 | 216,625 | (3) | 180,527 | — | 6,491 | (5) | 782,439 | |||||||||

| 2007 | 375,000 | — | — | — | — | 375,000 | ||||||||||||

| Michele Donnan Martin (6) |

2009 | 500,000 | — | — | 180,000 | (6) | — | 680,000 | ||||||||||

| President, dELiA*s Brand |

2008 | 500,000 | — | 120,000 | (6) | — | 620,000 | |||||||||||

| 2007 | 9,615 | — | 202,714 | (8) | — | — | 212,329 | |||||||||||

| David J. Dick (6) |

2009 | 279,519 | — | 78,862 | 25,500 | (9) | 796 | (10) | 384,677 | |||||||||

| Chief Financial Officer and Treasurer |

2008 | — | — | — | — | — | — | |||||||||||

| 2007 | — | — | — | — | — | — | ||||||||||||

| Marc G. Schuback (6) |

2009 | 285,000 | — | 9,360 | — | 822 | (11) | 295,182 | ||||||||||

| Vice President, General Counsel and Secretary |

2008 | 284,808 | 42,750 | (3) | 8,308 | — | 7,452 | (11) | 343,318 | |||||||||

| 2007 | 124,808 | — | 38,204 | — | 529 | (11) | 163,541 |

| (1) | The amount shown in this column represents the grant date fair value of option awards and restricted stock awards (to Ms. Martin only), as determined pursuant to ASC 718. A discussion of the assumptions used in calculating these values may be found in footnote 11 to our audited consolidated financial statements beginning on page F-21 of our Annual Report on Form 10-K for the fiscal year ended January 30, 2010. |

| (2) | Mr. Bernard served as our Chief Executive Officer during fiscal 2009. His employment with us ended on May 14, 2010, on which date Mr. Killough was appointed as our Chief Executive Officer. Mr. Killough served as our Chief Operating Officer during fiscal 2009 and until his appointment as our Chief Executive Officer. |

| (3) | Represents special bonus awarded in consideration of performance in connection with the sale of the Company’s former CCS business. |

| (4) | For fiscal 2009, represents $20,000 paid to Mr. Bernard to be applied to a term life insurance policy for the benefit of a beneficiary to be designated by Mr. Bernard and $1,500 represents the company match pursuant to the Company’s 401(K) plan. For 2008, represents $20,000 paid to Mr. Bernard to be applied to a term life insurance policy for the benefit of a beneficiary to be designated by Mr. Bernard and $7,000 represents the amount of the Company match pursuant to the Company’s 401(K) plan. For 2007, represents $20,000 paid to Mr. Bernard to be applied to a term life insurance policy for the benefit of a beneficiary to be designated by Mr. Bernard and $8,673 represents the amount of the Company match pursuant to the Company’s 401(K) plan. |

| (5) | Represents the amount of the Company match pursuant to the Company’s 401(K) plan. |

| (6) | Represents the portion of Ms. Martin’s guaranteed annual incentive award payable in 2008 and 2009 as specified in her employment agreement. |

| (7) | Ms. Martin’s employment with the Company commenced January 28, 2008. Mr. Dick became our Chief Financial Officer and Treasurer on February 2, 2009. Mr. Schuback’s employment with the Company commenced August 15, 2007. |

| (8) | Ms. Martin was granted options to purchase 275,000 shares of our Common Stock at an exercise price of $1.96 per share and was granted 25,000 shares of restricted stock upon the commencement of her employment with the Company on January 28, 2008. |

| (9) | Represents Mr. Dick’s guaranteed annual incentive award payable in 2009 as specified in his offer letter. |

| (10) | Represents the amount of the Company match pursuant to the Company’s 401(K) plan. |

| (11) | Represents the amount of the Company match pursuant to the Company’s 401(K) plan. |

18

The following tables set forth information concerning grants of plan-based awards made by the Company during the fiscal year ended January 30, 2010 to the named executive officers.

| Name |

Grant Date | All Other Option Awards: Number of Securities Underlying Options (#) |

Exercise or Base Price of Option Awards ($/sh) |

Grant Date Fair Value of Option Awards ($)(1) | ||||

| Robert E. Bernard |

— | — | — | — | ||||

| Walter Killough |

— | — | — | — | ||||

| Michele Donnan Martin |

— | — | — | — | ||||

| David J. Dick |

02/02/2009 | 80,000 | 1.99 | 78,862 | ||||

| Marc G. Schuback |

05/15/2009 | 10,000 | 1.89 | 9,360 |

| (1) | The amounts shown in this column reflect the grant date fair value of option awards pursuant to the provisions of the Financial Accounting Standards Board Accounting Standards Codification Topic 718. See footnote 11 to our audited financial statements beginning on page F-21 of our 2009 Annual Report. |

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table

Employment Agreements

On December 2, 2008, the Company entered into a new employment agreement (the “Bernard Agreement”) with Robert Bernard, our former Chief Executive Officer, which replaced an agreement with Mr. Bernard previously in effect. Under the Bernard Agreement, Mr. Bernard was entitled to receive a base salary of not less than $650,000, subject to annual review by the Compensation Committee of the Board of Directors. Mr. Bernard also was entitled to participate in the Company’s Management Incentive Plan each year during the term of his employment, subject to the terms and conditions of that plan governing eligibility and participation, with a target annual incentive award opportunity of not less than 90% of his base salary. In addition, Mr. Bernard was eligible to receive stock incentive awards under the 2005 Plan and other benefits as were made available to the Company’s employees generally. Pursuant to the terms of the Bernard Agreement, on December 2, 2008, Mr. Bernard received an initial grant of options to purchase 304,000 shares of Common Stock. These options have an exercise price per share of $2.13, are fully vested, and expire on May 13, 2011. During the term of the Bernard Agreement, the Company was required to nominate Mr. Bernard to serve as a member of the Board at each annual meeting of stockholders. Upon the termination of Mr. Bernard’s employment on May 14, 2010, he resigned from the Board.