Exhibit (c)(12)

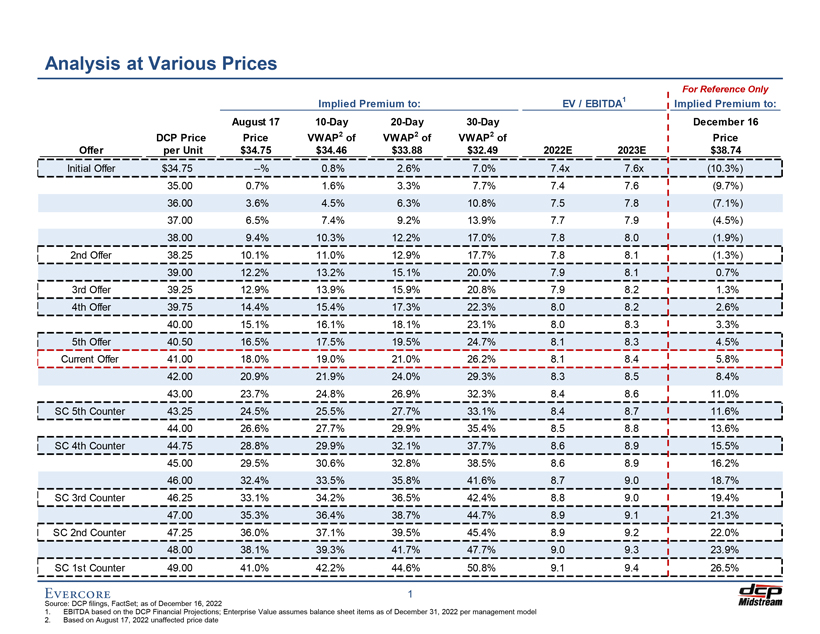

Exhibit (c)(12) Preliminary Draft – Confidential Analysis at Various Prices For Reference Only Implied Premium to: EV / EBITDA1 Implied Premium to: August 17 10-Day 20-Day 30-Day December 16 DCP Price Price VWAP2 of VWAP2 of VWAP2 of Price Offer per Unit $34.75 $34.46 $33.88 $32.49 2022E 2023E $38.74 Initial Offer $34.75 —% 0.8% 2.6% 7.0% 7.4x 7.6x (10.3%) 35.00 0.7% 1.6% 3.3% 7.7% 7.4 7.6 (9.7%) 36.00 3.6% 4.5% 6.3% 10.8% 7.5 7.8 (7.1%) 37.00 6.5% 7.4% 9.2% 13.9% 7.7 7.9 (4.5%) 38.00 9.4% 10.3% 12.2% 17.0% 7.8 8.0 (1.9%) 2nd Offer 38.25 10.1% 11.0% 12.9% 17.7% 7.8 8.1 (1.3%) 39.00 12.2% 13.2% 15.1% 20.0% 7.9 8.1 0.7% 3rd Offer 39.25 12.9% 13.9% 15.9% 20.8% 7.9 8.2 1.3% 4th Offer 39.75 14.4% 15.4% 17.3% 22.3% 8.0 8.2 2.6% 40.00 15.1% 16.1% 18.1% 23.1% 8.0 8.3 3.3% 5th Offer 40.50 16.5% 17.5% 19.5% 24.7% 8.1 8.3 4.5% Current Offer 41.00 18.0% 19.0% 21.0% 26.2% 8.1 8.4 5.8% 42.00 20.9% 21.9% 24.0% 29.3% 8.3 8.5 8.4% 43.00 23.7% 24.8% 26.9% 32.3% 8.4 8.6 11.0% SC 5th Counter 43.25 24.5% 25.5% 27.7% 33.1% 8.4 8.7 11.6% 44.00 26.6% 27.7% 29.9% 35.4% 8.5 8.8 13.6% SC 4th Counter 44.75 28.8% 29.9% 32.1% 37.7% 8.6 8.9 15.5% 45.00 29.5% 30.6% 32.8% 38.5% 8.6 8.9 16.2% 46.00 32.4% 33.5% 35.8% 41.6% 8.7 9.0 18.7% SC 3rd Counter 46.25 33.1% 34.2% 36.5% 42.4% 8.8 9.0 19.4% 47.00 35.3% 36.4% 38.7% 44.7% 8.9 9.1 21.3% SC 2nd Counter 47.25 36.0% 37.1% 39.5% 45.4% 8.9 9.2 22.0% 48.00 38.1% 39.3% 41.7% 47.7% 9.0 9.3 23.9% SC 1st Counter 49.00 41.0% 42.2% 44.6% 50.8% 9.1 9.4 26.5% 1 Source: DCP filings, FactSet; as of December 16, 2022 1. EBITDA based on the DCP Financial Projections; Enterprise Value assumes balance sheet items as of December 31, 2022 per management model 2. Based on August 17, 2022 unaffected price date