Please wait

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

|

| | |

o | | Preliminary Proxy Statement |

| | |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

þ | | Definitive Proxy Statement |

| | |

o | | Definitive Additional Materials |

| | |

o | | Soliciting Material Pursuant to §240.14a-12 |

WESTERN REFINING, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | |

þ | | No fee required. |

| | |

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

April 22, 2015

To Our Shareholders:

On behalf of the Board of Directors, I cordially invite all shareholders to attend the 2015 Annual Meeting of Shareholders (the "Annual Meeting") of Western Refining, Inc. (the "Company") to be held on June 2, 2015, at 8:30 a.m. MDT at the Plaza Theater, located at 125 Pioneer Plaza, El Paso, Texas 79901. The Company's proxy materials, as well as the Company's 2014 Annual Report, are available to shareholders online at www.proxydocs.com/wnr. You may also request a paper copy of the proxy materials and 2014 Annual Report free of charge by sending an email containing the 12 digit control number included on the Notice of Internet Availability of Proxy Materials (the "Notice") you received to paper@investorelections.com, by calling 866-648-8133, by requesting a paper copy online at www.investorelections.com/wnr or by writing to Lowry Barfield, Secretary, at the Company's corporate headquarters located at 123 W. Mills Avenue, Suite 200, El Paso, Texas 79901. The Company's 2014 Annual Report is not a part of its proxy soliciting materials.

Your vote is important, and you are encouraged to vote as early as possible. Even if you plan to attend the Annual Meeting, you are requested to vote your proxy in advance by one of the methods described in the Notice and the Company's Proxy Statement. If you attend the Annual Meeting after having submitted your proxy card, you may revoke your proxy, if you wish, and vote in person. If you would like to attend the Annual Meeting and your shares are not registered in your own name, please ask the brokerage firm, trust, bank or other nominee that holds your shares to provide you with evidence of your share ownership.

Thank you for your support.

Sincerely yours,

Paul L. Foster

Executive Chairman and

Chairman of the Board

El Paso, Texas

April 22, 2015

NOTICE OF THE 2015

ANNUAL MEETING OF SHAREHOLDERS

June 2, 2015

____________________________________________________

To the Shareholders of Western Refining, Inc.:

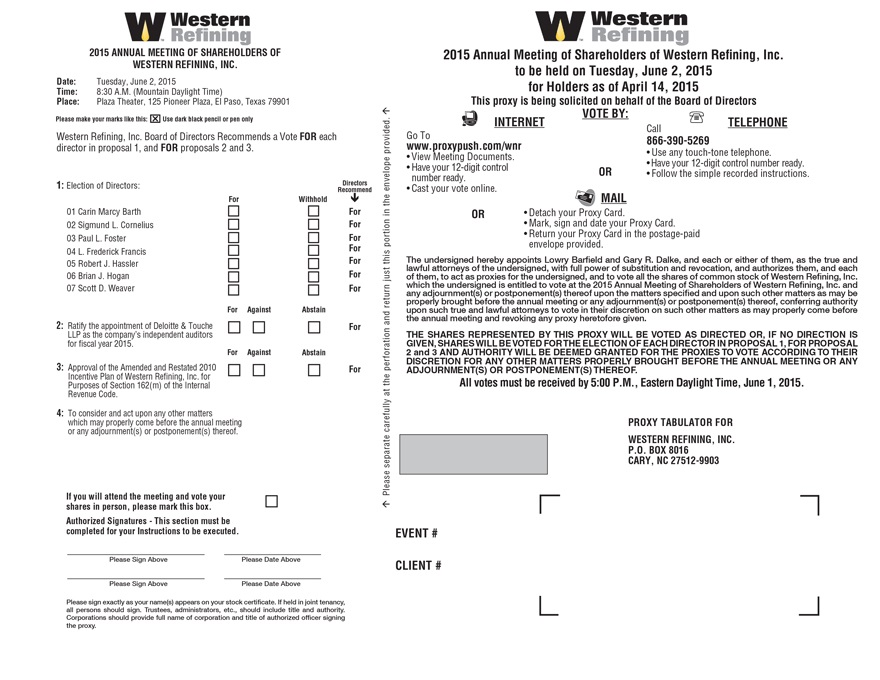

The 2015 Annual Meeting of Shareholders (the "Annual Meeting") of Western Refining, Inc. (the "Company") will be held at 8:30 a.m. MDT on June 2, 2015, at the Plaza Theater, located at 125 Pioneer Plaza, El Paso, Texas 79901. At the Annual Meeting you will be asked to:

|

| |

1. | Elect seven directors to hold office until the 2016 Annual Meeting of Shareholders; |

| |

2. | Ratify the appointment of Deloitte & Touche LLP as the Company's independent auditors for fiscal year 2015; |

| |

3. | Approve the Amended and Restated 2010 Incentive Plan of Western Refining, Inc. for the purposes of Section 162(m) of the Internal Revenue Code; and |

| |

4. | Consider any other matters or transact any other business that may properly come before the Annual Meeting, or any postponement(s) or adjournment(s) thereof. |

| |

The Company is pleased to continue to take advantage of Securities and Exchange Commission rules that allow the Company to furnish its proxy materials online. Should you wish to receive a paper copy of the Company's proxy materials and/or 2014 Annual Report free of charge, please send an email containing the 12 digit control number included on the Notice of Internet Availability of Proxy Materials you received to paper@investorelections.com, call 866-648-8133, request a copy online at www.investorelections.com/wnr or write to me at the Company's corporate headquarters located at 123 W. Mills Avenue, Suite 200, El Paso, Texas 79901.

Only shareholders of record at the close of business on April 14, 2015, are entitled to receive notice of and vote at the Annual Meeting and at any postponement(s) or adjournment(s) of the Annual Meeting. If you were a shareholder at the close of business on April 14, 2015, it is important that you vote your shares as soon as possible using one of the methods set forth in the Company's Proxy Statement, which include by telephone at 866-390-5269, online at www.proxypush.com/wnr or, if you received a paper copy of the proxy materials including a proxy card, by signing and returning your proxy card. Please refer to the specific voting information that is contained in the Proxy Statement for additional details regarding voting your shares. Details regarding admission to the Annual Meeting and the business to be conducted at the Annual Meeting are provided in the Proxy Statement. Your vote is important and you are encouraged to vote your shares as soon as possible, even if you plan to attend the Annual Meeting in person.

By Order of the Board of Directors,

Lowry Barfield

Senior Vice President - Legal, General Counsel and Secretary

El Paso, Texas

April 22, 2015

YOUR VOTE IS IMPORTANT

PLEASE VOTE AS PROMPTLY AS POSSIBLE

TABLE OF CONTENTS

|

| |

| Page |

General Information | |

The Board and its Committees | |

Corporate Governance Guidelines and Code of Business Conduct and Ethics | |

Proposal 1: Election of Directors | |

2014 Director Compensation | |

Executive Compensation and Other Information | |

Compensation Discussion and Analysis | |

Compensation Committee Report | |

Executive Compensation | |

2014 Summary Compensation Table | |

Grants of Plan-Based Awards - Fiscal 2014 | |

Outstanding Equity Awards at Fiscal 2014 Year End | |

Option Exercises and Stock Vesting - Fiscal 2014 | |

Non-Qualified Deferred Compensation - Fiscal 2014 | |

Potential Payments Upon Termination or Change of Control | |

Security Ownership of Certain Beneficial Owners and Management | |

Compensation Committee Interlocks and Insider Participation | |

Certain Relationships and Related Transactions | |

Proposal 2: Ratification of Appointment of Independent Auditors | |

Audit Committee Report | |

Proposal 3: Approval of the Amended and Restated 2010 Incentive Plan of Western Refining, Inc. for Purposes of Section 162(m) of the Internal Revenue Code | |

Section 16(a) Beneficial Ownership Reporting Compliance | |

Proposals of Shareholders for the 2016 Annual Meeting of Shareholders | |

Annual Report | |

Appendix A — Amended and Restated 2010 Incentive Plan of Western Refining, Inc. | |

Appendix B — Reconciliation of Adjusted EBITDA to Net Income | |

2015 Proxy Card | |

PROXY STATEMENT

FOR THE 2015 ANNUAL MEETING OF SHAREHOLDERS OF

WESTERN REFINING, INC.

June 2, 2015

__________________________

GENERAL INFORMATION

Introduction

The Board of Directors (the "Board") of Western Refining, Inc. (the "Company" or "WNR") is soliciting proxies to be voted at the 2015 Annual Meeting of Shareholders (the "Annual Meeting" or the "2015 Annual Meeting") of the Company to be held on June 2, 2015, at the Plaza Theater, located at 125 Pioneer Plaza, El Paso, Texas 79901, beginning at 8:30 a.m. MDT and at any adjournment(s) or postponement(s) of the Annual Meeting. The Company is mailing the Notice of Internet Availability of Proxy Materials (the "Notice") to all shareholders of record at the close of business on April 14, 2015, on or about April 22, 2015. On this date, you will have the ability to access all of the Company's proxy materials and its 2014 Annual Report online at www.proxydocs.com/wnr. At the Annual Meeting, shareholders will be requested to:

|

| |

1. | Elect seven directors to hold office until the 2016 Annual Meeting of Shareholders; |

| |

2. | Ratify the appointment of Deloitte & Touche LLP ("Deloitte") as the Company's independent auditors for fiscal year 2015; and |

| |

3. | Approve the Amended and Restated 2010 Incentive Plan of Western Refining, Inc. (the "Amended 2010 LTIP") for purposes of Section 162(m) of the Internal Revenue Code. |

| |

Shareholders will also consider any other matters that may properly come before the Annual Meeting.

How does the Board recommend that I vote?

The Board recommends a vote:

| |

• | FOR Proposal 1 to elect seven directors to hold office until the 2016 Annual Meeting of Shareholders; |

| |

• | FOR the ratification of Deloitte as the Company's independent auditors for 2015; and |

| |

• | FOR the approval of the Amended 2010 LTIP for purposes of Section 162(m) of the Internal Revenue Code. |

Who is entitled to vote at the Annual Meeting?

The Board has set April 14, 2015, as the record date for the Annual Meeting. If you were a shareholder at the close of business on April 14, 2015, you are entitled to vote at the Annual Meeting. As of the record date, 95,508,434 shares of the common stock of the Company were issued and eligible to vote at the Annual Meeting. As of the record date, there were 50 shareholders of record. Holders of the Company's common stock are entitled to one vote per share, exercisable in person or by proxy. There are a total of 95,508,434 votes entitled to be cast at the Annual Meeting. Shareholders do not have cumulative voting rights.

How many shares must be present to hold the Annual Meeting?

In accordance with the Company's Bylaws, shares equal to at least a majority of its outstanding shares of common stock as of the record date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This is called a quorum. Your shares are counted as present at the Annual Meeting if:

| |

• | You have voted online in accordance with the instructions set forth in this Proxy Statement; |

| |

• | You have voted by telephone in accordance with the instructions set forth in this Proxy Statement; |

| |

• | You have properly submitted a proxy card by mail; or |

| |

• | You are present and vote in person at the Annual Meeting. |

Votes withheld from any nominee, abstentions, and broker non-votes will be counted for purposes of determining the presence or absence of a quorum for transaction of business at the Annual Meeting. Broker non-votes are further discussed below.

How do I vote my shares?

If you were a shareholder of record at the close of business on April 14, 2015, you can vote your shares by any one of the following methods:

| |

1. | Online at www.proxypush.com/wnr; or |

| |

2. | By telephone at 866-390-5269; or |

| |

3. | In the event you received a paper copy of the proxy materials, by signing and returning your proxy card; or |

| |

4. | By attending the Annual Meeting in person and completing a floor ballot. |

Even if you currently plan to attend the Annual Meeting, the Company recommends that you also submit your proxy by one of the methods described in items (1) through (3) above so that your vote will be counted if you later decide not to attend the Annual Meeting. If you hold your shares in street name, you may vote your shares in person at the Annual Meeting only if you obtain a signed letter or other proxy from your brokerage firm, bank or other nominee giving you the right to vote the shares at the Annual Meeting.

Can I change or revoke my vote after submitting my proxy?

Yes. You may revoke your proxy and change your vote at any time before your proxy is voted at the Annual Meeting. You can change your vote in any of the following ways:

| |

• | Online at www.proxypush.com/wnr or by telephone at 866-390-5269 in which case only your latest online or telephone proxy submitted prior to being voted at the Annual Meeting will be counted; |

| |

• | Delivering to the Company's Secretary a written revocation notice with a date later than the date of your proxy card; |

| |

• | Signing and delivering to the Company's Secretary a later-dated proxy card relating to the same shares; or |

| |

• | Attending the Annual Meeting in person and either submitting a new proxy card or submitting a written revocation at the Annual Meeting and then voting your shares in person by completing a floor ballot. |

How can I attend the Annual Meeting?

Space limitations make it necessary to limit attendance at the Annual Meeting to shareholders, although each shareholder may be accompanied by one guest. Admission to the Annual Meeting will be on a first-come, first-served basis. Registration and seating will begin at 8:00 a.m. MDT on June 2, 2015. Shareholders must present valid picture identification, such as a driver's license or passport, before being admitted to the Annual Meeting. If you hold your shares in street name, you will also need proof of ownership in order to attend the Annual Meeting. A recent brokerage statement or letter from the brokerage firm, bank or nominee are examples of proof of ownership. Cameras, recording devices and other similar electronic devices are prohibited.

Why have I received the Notice? How do I request a paper copy of the proxy materials and 2014 Annual Report?

Pursuant to rules adopted by the Securities and Exchange Commission (the "SEC"), the Company has elected to provide its proxy materials over the Internet. Accordingly, the Company has sent a Notice to its shareholders. All shareholders may access the proxy materials on the website referred to in the Notice: www.proxydocs.com/wnr. Shareholders may also request a paper copy of the proxy materials and 2014 Annual Report free of charge by sending an email containing the 12 digit control number included on the Notice to paper@investorelections.com, by calling 866-648-8133, by requesting a paper copy online at www.investorelections.com/wnr or by writing to: Lowry Barfield, Secretary, at the Company's corporate headquarters located at 123 W. Mills Avenue, Suite 200, El Paso, Texas 79901. Instructions on how to access the proxy materials online or request a paper copy of the proxy materials may also be found in the Notice. In addition, shareholders may request paper copies of proxy materials or to receive proxy materials by email on an ongoing basis. The Company encourages shareholders to access the proxy materials online to help reduce the costs the Company incurs in printing and mailing paper copies of the proxy materials and 2014 Annual Report.

What is the difference between a shareholder of record and a “street name” holder?

If your shares are registered directly in your name, you are considered the shareholder of record with respect to those shares. If your shares are held in a stock brokerage account or by a bank or other nominee, then the brokerage firm, bank or other nominee is considered to be the shareholder of record with respect to those shares. You, however, are still considered the beneficial owner of those shares, and your shares are said to be held in “street name.” Street name holders generally cannot vote their shares directly and must instead instruct their brokerage firm, bank or other nominee how to vote their shares.

What is a broker non-vote?

If you hold your shares in street name and do not provide voting instructions to your brokerage firm, bank or nominee, your shares will not be voted on any proposal on which your brokerage firm, bank or nominee does not have discretionary authority to vote under the rules of the New York Stock Exchange (the "NYSE"). In this situation, a "broker non-vote" occurs. Of the three Proposals included in this Proxy Statement, Proposals 1 and 3 are "non-discretionary" items, and absent specific voting instructions from beneficial owners, NYSE member brokerage firms, banks or nominees may not vote on such Proposals. Proposal 2 is a "discretionary" item and, absent specific voting instructions from beneficial owners, NYSE member brokerage firms, banks or nominees may vote on this Proposal in their discretion.

What vote is required for the matters brought before the Annual Meeting to be approved?

Proposal 1 requires the affirmative vote of holders of a plurality of the common stock present or represented by proxy at the Annual Meeting and entitled to vote to elect each director nominee and abstentions and broker non-votes will not be taken into account in determining the outcome of the election of directors. Proposals 2 and 3 require the affirmative vote of the holders of a majority of the common stock present or represented by proxy at the meeting and entitled to vote, and abstentions have the effect of a negative vote and broker non-votes will not be taken into account.

How are votes counted?

In advance of the meeting, the Company will appoint an inspector of elections to count all the votes cast at the meeting and to report on the results. The inspector of elections will tabulate all votes cast in person, online, by telephone or by submission of a properly executed proxy before the closing of the polls at the Annual Meeting.

What if I submit my proxy but I do not specify how I want my shares voted?

If you do not specify how you want to vote your shares, the Company will vote them:

| |

• | Proposal 1 - FOR each of the nominees for director; |

| |

• | Proposal 2 - FOR the ratification of Deloitte as the Company's independent auditors for 2015; and |

| |

• | Proposal 3 - FOR the approval of the Amended 2010 LTIP for purposes of Section 162(m) of the Internal Revenue Code. |

If other matters requiring the vote of shareholders properly come before the Annual Meeting, it is the intention of the persons named on the proxy card to vote proxies held by them in accordance with their best judgment.

Who pays for the cost of proxy preparation and solicitation?

The Company will pay all costs of proxy preparation and solicitation. The Company may also distribute proxy materials through brokerage firms, custodians and other similar parties to the owners of the Company's stock, and will reimburse such parties for their reasonable out-of-pocket expenses incurred in forwarding proxy materials to the Company's shareholders.

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on June 2, 2015.

This Proxy Statement and other proxy materials, as well as the Company's 2014 Annual Report, are available at www.proxydocs.com/wnr. The Company encourages you to access and review all of the important information contained in the proxy materials before voting. If you want to receive an additional paper or email copy of the proxy materials and the Company's 2014 Annual Report, you must request one. There is no charge to you for requesting an additional copy. Please make your request for an additional copy by sending an email containing the 12 digit control number included on the Notice of Internet Availability of Proxy Materials you received to paper@investorelections.com, by calling 866-648-8133, by requesting a paper copy online at www.investorelections.com/wnr or by writing to Lowry Barfield, Secretary, at the Company's corporate headquarters located at 123 W. Mills Avenue, Suite 200, El Paso, Texas 79901 on or before May 20, 2015 to facilitate delivery before the Annual Meeting.

THE BOARD AND ITS COMMITTEES

Leadership Structure

During 2014, the Board consisted of seven independent, non-employee directors (Ms. Barth and Messrs. Cornelius, Francis, Hassler, Hogan, Sanders, and Schmidt) and three employee directors (Messrs. Foster, Stevens and Weaver). Mr. Schmidt retired from the Board and Mr. Hassler was appointed to the Board on November 10, 2014.

The Board is led by the Company's Executive Chairman and Chairman of the Board, Paul L. Foster. In January 2010, the Board separated the position of Chairman of the Board from the position of Chief Executive Officer by naming Mr. Foster as Executive Chairman of the Company and appointing Jeff A. Stevens as President and Chief Executive Officer. This action enables Mr. Stevens to focus his time and attention on leading the Company, and allows Mr. Foster to focus on leading the Board while still working with Mr. Stevens and other members of the Company's executive management to provide high-level strategy and guidance for the Company. Messrs. Foster and Stevens have an excellent working relationship and utilize their combined 60-years' plus of experience in petroleum refining and marketing to provide sound and effective stewardship of both the Company and its Board.

In accordance with the Company's Bylaws and Corporate Governance Guidelines, the Nominating and Corporate Governance Committee (the "Governance Committee") and the Board will continue to periodically evaluate the Company's leadership structure. The Board currently believes separation of the roles of Chief Executive Officer and Chairman of the Board is in the best interest of the Company and its shareholders. However, the Company's Bylaws permit those roles to be filled by the same or different individuals, which allows the Board flexibility to determine from time to time whether the two roles should be combined or separated based upon circumstances. While the Board recognizes that different structures may be appropriate for companies in different situations, the Board is confident that its current leadership structure is best for the Company and its shareholders at this time.

The Board

The Board meets throughout the year on a set schedule. The Board also holds special meetings and acts by unanimous written consent from time to time, as appropriate. The independent directors regularly meet in executive sessions and Carin M. Barth presides at these executive sessions. The Board held nine meetings during fiscal year 2014. Each director is expected to attend each meeting of the Board, those committees on which he or she serves and each annual meeting of shareholders. In 2014, all directors attended at least 75% of the meetings of the Board and the committees on which such directors served. All directors, except Messrs. Sanders and Schmidt, attended the 2014 Annual Meeting of Shareholders.

Independent Directors

The Board has affirmatively determined that Ms. Barth and Messrs. Cornelius, Francis, Hassler, Hogan, and Sanders are each independent under the rules and regulations of the NYSE, the SEC and Company guidelines. In addition, during his tenure on the Board in 2014, the Board affirmatively determined that Mr. Schmidt was independent under the rules and regulations of the NYSE, the SEC, and Company guidelines. The Board has also affirmatively determined that Ms. Barth and Messrs. Hogan and Cornelius meet the requirements for outside directors under the Internal Revenue Service (the "IRS") rules and regulations. In reaching these determinations, the Board affirmatively determined that the individuals it considers independent have no material relationship with the Company or management of the Company, either directly or as a partner, shareholder or officer of an organization that has a relationship or has engaged in transactions with the Company or with management of the Company. The Board based this determination and its independence determinations on a review of all of the relevant facts and circumstances, including the responses of the directors to questions regarding their employment history, compensation, affiliations and family and other relationships.

Committees of the Board

The Board has three standing committees: the Audit Committee, the Compensation Committee and the Governance Committee. Each of these standing committees has a written charter that may be found on the Company's website at www.wnr.com. In addition, paper copies of the charters are available free of charge to all shareholders by calling

(915) 534-1400 or by writing to Lowry Barfield, Secretary, at the Company's corporate headquarters located at 123 W. Mills Avenue, Suite 200, El Paso, Texas 79901. Each committee reviews the adequacy of its charter on an annual basis, in addition to evaluating its performance and reporting to the Board on such evaluation. All of the members of each of the Company's committees are independent and non-employee directors as defined by the rules and regulations of the NYSE, the SEC, and Company guidelines. All of the members of the Compensation Committee are outside directors as defined by the rules and regulations of the IRS. The Governance Committee reviews regularly the membership on each of the Board's three standing committees.

On November 10, 2014, upon recommendation from the Governance Committee, the Board approved the following Board standing committee composition:

|

| | | | | |

Director | Audit | | Compensation | | Governance |

Carin M. Barth | C | | X | | — |

Sigmund L. Cornelius | X | | X | | — |

Paul L. Foster | — | | — | | — |

L. Frederick Francis | X | | — | | C |

Robert J. Hassler | — | | — | | X |

Brian J. Hogan | X | | C | | — |

William D. Sanders | — | | — | | X |

Jeff A. Stevens | — | | — | | — |

Scott D. Weaver | — | | — | | — |

C: Chairperson

X: Member

Audit Committee. The Audit Committee met ten times during fiscal year 2014, either in person or by telephone. Among other responsibilities, the Audit Committee:

| |

• | Is directly responsible for the appointment, compensation, retention and oversight of the independent auditors; |

| |

• | Evaluates the qualifications, performance and independence of the independent auditors and pre-approves the services (audit and non-audit) provided by the independent auditors; |

| |

• | Discusses with management, internal auditors and independent auditors the Company's accounting principles and financial statement presentations and the critical accounting policies and practices of the Company; |

| |

• | Reviews with management, internal auditors and independent auditors the Company's annual and quarterly financial statements; |

| |

• | Evaluates the performance, responsibilities, budget and staffing of the Company's internal audit team; |

| |

• | Establishes procedures for and oversees handling complaints including, whistleblower hotline complaints regarding accounting, internal accounting controls and auditing matters; |

| |

• | Establishes procedures for the confidential, anonymous submission by both employees of the Company and non-employees of concerns regarding accounting or auditing matters; |

| |

• | Reviews and assesses the Company's policies and practices with respect to risk assessment and risk management; and |

| |

• | Prepares the Audit Committee report for the Company's annual proxy statement, including recommending to the Board whether the annual financial statements should be included in the Company's annual report. |

In performing its functions and to promote the independence of the audit, the Audit Committee consults separately and jointly with the independent auditors, the Company's internal auditors, the Company's Chief Financial Officer and other members of the Company's management. The Board has determined that each of Ms. Barth and Messrs. Cornelius, Francis and Hogan are each "financially literate" and Ms. Barth is an "audit committee financial expert," as those terms are defined in the rules and regulations of the SEC.

Compensation Committee. The Compensation Committee met five times in fiscal year 2014, either in person or by telephone. Among other responsibilities, the Compensation Committee:

| |

• | Reviews and approves the Company's compensation and benefits policies generally, including any incentive compensation and equity-based plans that are subject to Board approval; |

| |

• | Reviews and approves all compensation for the CEO and each of the Company's executive officers; |

| |

• | Reviews and makes recommendations to the Board with respect to the compensation of non-employee directors; |

| |

• | Reviews periodically, in consultation with the Company's CEO, the Company's management succession planning including policies for CEO selection and succession; |

| |

• | Reviews and assesses risks arising from the Company's compensation policies and practices; and |

| |

• | Prepares the Compensation Committee report for the Company's annual proxy statement and reviews and discusses the Compensation Discussion and Analysis within the Company's annual proxy statement with management and recommends to the Board its inclusion in the Company's annual proxy statement. |

Under its charter, the Compensation Committee may delegate its authority to subcommittees, the chair of the committee, or to one or more officers of the Company to make grants of equity awards to non-named executive officers and non-Section 16 officers under the Company's incentive or equity-based plans and only in accordance with the terms of such plans. The Compensation Committee is only permitted to delegate its authority when it deems such delegation to be appropriate and in the best interests of the Company.

Governance Committee. The Governance Committee met four times in fiscal year 2014, either in person or by telephone. Among other responsibilities, the Governance Committee:

| |

• | Recommends criteria for the selection of candidates to the Board and identifies individuals qualified to become members of the Board consistent with such criteria; |

| |

• | Recommends to the Board the nominees to stand for election as directors at the next annual meetings of shareholders at which directors are to be elected or to fill any vacancies or newly created directorships that may occur between such meetings; |

| |

• | Reviews and evaluates the size, composition, function and duties of the Board consistent with its needs; |

| |

• | Makes recommendations to the Board regarding the composition of the committees of the Board in light of current challenges and needs of the Board, the Company and each committee and considers the rotation of committee members and committee chairs; |

| |

• | Makes recommendations to the Board as to determinations of director independence including reviewing potential conflicts of interest involving directors; |

| |

• | Adopts and reviews policies and procedures regarding the consideration of candidates recommended by shareholders; |

| |

• | Develops and recommends to the Board Corporate Governance Guidelines, and various codes of business conduct and ethics and reviews and oversees compliance with such guidelines and codes; and |

| |

• | Leads the Board and its committees in their annual self-evaluation procedures. |

Risk Oversight

The Board considers oversight of risk management efforts to be a responsibility of the entire Board as well as its committees. The Board's role in risk oversight includes receiving regular reports from its committees and members of senior management on areas of material risk to the Company, including operational, financial, liquidity, credit, legal and regulatory, strategic, commercial, enterprise and reputational risks. The Board (or the appropriate committee, in the case of risks that are under the purview of a particular committee) receives these reports from the appropriate members of management to enable the Board and, as appropriate, its committees to understand and oversee risk identification, risk management and risk mitigation strategies. When a report is reviewed at the committee level, the chairman of that committee subsequently reports on the matter to the Board. This enables both the Board and its committees to coordinate the Board's risk oversight role.

The Audit Committee assists the Board in monitoring and assessing the Company's financial, commercial, liquidity, credit, regulatory, enterprise and other risks and in developing guidelines and policies to govern processes for managing these risks. The Audit Committee discusses the Company's policies with respect to risk assessment and risk management in general, as well as with respect to the specific risks the Audit Committee oversees. The Audit Committee also regularly discusses risk management in the context of compliance and internal controls. In May 2010, the Company formed the Enterprise Risk and Compliance Committee (the "ERCC") for the purpose of assisting the Company in evaluating and maintaining compliance with significant applicable legal, ethical and regulatory requirements. The ERCC is chaired by the Company's Compliance Officer and consists of key management employees from across the Company and is responsible for helping the Company (1) identify principal compliance risks based on the Company's businesses, customers, geographic operations, distribution channels and other factors identified by the ERCC; (2) provide input and oversight on Company policies and procedures relating to compliance with relevant laws, regulations and ethical standards and discuss and recommend new or revisions to policies and procedures relating to compliance; (3) assist

with the implementation and monitoring of an annual compliance operating plan; and (4) providing additional guidance to the Company on compliance related matters. The ERCC meets regularly and also regularly reports to the CEO and the Audit Committee and its chair, Ms. Barth, on its meetings and activities. The Audit Committee regularly reports to the Board on its discussions and oversight relating to risk as well as its discussions and oversight relating to the ERCC.

The Governance Committee assists the Board in monitoring the Company's risks incident to its board and committee structures and governance structures and processes. The Governance Committee discusses risk management in the context of general governance matters, Board succession planning and committee service by directors, among other topics. The Governance Committee regularly reports to the Board on its discussions and oversight.

The Compensation Committee assists the Board in monitoring the risks associated with the Company's compensation policies and practices as well as executive officer succession planning. The Compensation Committee reviews the design and goals of the Company's compensation programs and practices in the context of possible risks to the Company's financial and reputational well-being as well as possible risks to the continuity of the Company's management. The Compensation Committee regularly reports to the Board on its discussions and oversight.

Diversity

While the Company does not have a specific policy regarding diversity of its Board members and nominees, over the years the Governance Committee has sought and nominated candidates with varying viewpoints, professional experiences, ethnicity, age, race, backgrounds, education, skill sets and gender or other diversity criteria. Among other criteria, the Governance Committee seeks candidates who have business and/or professional knowledge and experience applicable to the Company's business and the goals and interests of its shareholders; are well regarded in their communities with a long-term, good reputation for the highest ethical standards; possess common sense and good judgment; have a positive record of accomplishment in present and prior positions; offer diverse viewpoints; have an excellent reputation for preparation, attendance, participation, interest and initiative on other boards on which they may serve; and have the time, energy, interest and willingness to become involved in the Company's business and future. The Governance Committee periodically assesses whether the Board and its Committees possess the right diversity of skills and backgrounds for the current issues facing the Company, including through its annual Board and Committee Self-Assessment Questionnaires.

Communications with the Board

The Board has established a process for interested parties to communicate with the Board including the Chairman and non-management directors. Any interested party wishing to communicate with the Board or the non-management directors as a group should send any communication to the Company's Secretary, at the Company's corporate headquarters, located at 123 W. Mills Avenue, Suite 200, El Paso, Texas 79901. The Secretary will forward such communication to the Board or to any individual director or directors to whom the communication is directed, unless the Secretary determines that the communication does not relate to Company business or affairs or the functioning or constitution of the full Board or any of its committees, relates to routine or insignificant matters that do not warrant the attention of the directors, is an advertisement or other commercial solicitation or communication, is frivolous or offensive or is otherwise not appropriate for delivery to the directors. The director or directors who receive any such communication will have discretion to determine whether the subject matter of the communication should be brought to the attention of the full Board or one or more of its committees and whether any response to the person sending the communication is appropriate. Any such response will be made through the Secretary and only in accordance with the Company's policies and procedures as well as all applicable law and regulations relating to the disclosure of information.

CORPORATE GOVERNANCE

Corporate Governance Guidelines

The Company has adopted a set of Corporate Governance Guidelines. A copy of the Corporate Governance Guidelines may be found on the Company's website at www.wnr.com. In addition, paper copies of the Corporate Governance Guidelines are available to all shareholders free of charge by calling (915) 534-1400 or by writing to Lowry Barfield, Secretary, at the Company's corporate headquarters located at 123 W. Mills Avenue, Suite 200, El Paso, Texas 79901. The guidelines set out the Company's and the Board's thoughts on, among other things, the following:

| |

• | The role of the Board and management; |

| |

• | The functions of the Board and its committees and the expectations the Company has for its directors; |

| |

• | The selection of directors, the Chairman of the Board and the Chief Executive Officer and the qualifications for directors to sit on the standing committees of the Board; |

| |

• | Independence requirements, election terms, retirement of directors, stock ownership requirements, management succession and executive sessions for non-management directors; |

| |

• | Compensation of directors; and |

| |

• | Evaluation of director performance. |

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics that applies to all directors, officers and employees as well as a Code of Ethics for the Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer. These codes are posted on the Company's website at www.wnr.com. In addition, paper copies of these codes are available to all shareholders free of charge by calling (915) 534-1400 or by writing to Lowry Barfield, Secretary, at the Company's corporate headquarters located at 123 W. Mills Avenue, Suite 200, El Paso, Texas 79901. The Company will, within the time periods proscribed by the SEC and the NYSE, timely post on its website at www.wnr.com any amendments to these codes and any waiver applicable to any of the Company's Chief Executive Officer, Chief Financial Officer or Principal Accounting Officer.

PROPOSAL 1:

ELECTION OF DIRECTORS

Nominees

The Company currently has nine directors. At the Company's 2014 Annual Meeting of Shareholders ("2014 Annual Meeting"), the Company's shareholders approved an amendment to the Company's Certificate of Incorporation to declassify the Company's Board, such that directors will continue to serve the remainder of their current terms, but will become subject to re-election on an annual basis for a one-year term following the expiration of their current terms. Pursuant to the Company's Bylaws, vacancies and newly created directorships which may occur in between annual meetings may be filled by the Board and each director so appointed shall serve for a term which will expire at the next annual meeting of shareholders following such appointment. Notwithstanding the foregoing, in all cases, each director will hold office until his or her successor is duly elected and qualified, or until his or her earlier resignation or removal. Mr. Hassler was appointed to the Board on November 10, 2014, to fill a newly created directorship and, accordingly, his current term expires at the 2015 Annual Meeting. As a result of the above, the following seven nominees are standing for election at the 2015 Annual Meeting and, if elected, will serve for a one-year term expiring at the 2016 annual meeting of shareholders (the "2016 Annual Meeting"): Carin Marcy Barth, Sigmund L. Cornelius, Paul L. Foster, L. Frederick Francis, Robert J. Hassler, Brian J. Hogan, and Scott D. Weaver.

Mr. Stevens' current term expires at the 2016 Annual Meeting, at which time he will become subject to election on an annual basis for a one-year term.

The Company's Corporate Governance Guidelines provide, among other things, that a director may serve on the Board until he or she reaches the age of 72; provided, however, that a person who reaches the age of 72 while a director may serve the remainder of his or her then-current term. Mr. Sanders has reached this age and, in accordance with the Company's Corporate Governance Guidelines, will serve the remainder of his current term which expires at the 2016 Annual Meeting.

The Nomination Process

The Governance Committee has procedures for identifying and evaluating nominees to serve as directors. First, the Governance Committee determines the needs of the Board. Qualifications for consideration as a Board nominee vary according to the particular areas of expertise being sought as a complement to the existing Board composition. At a minimum, however, candidates must satisfy the following criteria:

| |

• | have business and/or professional knowledge and experience applicable to the Company's business and the goals and interests of its shareholders; |

| |

• | be well regarded in the community, with a long-term, good reputation for the highest ethical standards; |

| |

• | possess common sense and good judgment; |

| |

• | have a positive record of accomplishment in present and prior positions; |

| |

• | have an excellent reputation for preparation, attendance, participation, interest and initiative on other boards on which he or she may serve; and |

| |

• | have the time, energy, interest and willingness to become involved in the Company’s business and future. |

The Governance Committee will consider nominees properly recommended by a shareholder who is entitled to vote at a meeting of shareholders called for the election of directors. Nominations made by a shareholder must be made by giving notice in writing to the Company's Secretary before the later to occur of: (i) 60 days prior to the date of the meeting of shareholders called for the election of directors; or (ii) 10 days after the Board makes public disclosure of the date of such meeting. In no event shall the public disclosure of an adjournment or postponement of an annual meeting of shareholders commence a new time period for the giving of a shareholder's notice as described above. Subject to the bylaws, such shareholder's notice must set forth the following information as to each person whom the shareholder proposes to nominate for election or re-election as a director: (i) the name, age, business address and residence address of such person; (ii) the principal occupation or employment of such person; (iii) the class and number of shares of capital stock of the Company that are then beneficially owned by such person; (iv) any other information relating to such person that is required by law or regulation to be disclosed in solicitations of proxies for the election of directors; and (v) such person's written consent to being named as a nominee for election as a director and to serve as a director if elected. Such shareholder’s notice must also set forth the following information as to the shareholder giving the notice: (i) the name and address, as they appear in the Company's stock records, of such shareholder;

(ii) the class and number of shares of capital stock of the Company that are then beneficially owned by such shareholder; (iii) a description of all arrangements or understandings between such shareholder and each nominee for election as a director and any other person or persons (naming such person or persons) relating to the nomination proposed to be made by such shareholder; and (iv) any other information required by law or regulation to be provided by a shareholder intending to nominate a person for election as a director of the Company. Additional information is provided in the Company's bylaws and any nominations must be made in accordance with the Company's bylaws. The Governance Committee does not evaluate potential nominees for director differently based on whether they are recommended by the Company's officers or directors or by a shareholder.

The Governance Committee recommended to the Board the nomination of Ms. Barth and Messrs. Foster, Francis, Cornelius, Hassler, Hogan, and Weaver for director at the 2015 Annual Meeting and the Board, upon the recommendation of the Governance Committee, nominated each director for election at the 2015 Annual Meeting to serve for a one-year term expiring at the 2016 Annual Meeting. Each of the nominees have consented to being named as nominees and have indicated their intention to serve if elected.

Unless otherwise instructed, the proxy holders will vote for the election of the following directors: Ms. Barth and Messrs. Foster, Francis, Cornelius, Hassler, Hogan, and Weaver. If for any reason any of the nominees should become unable to serve as a director prior to the Annual Meeting, the proxy holders may vote for the election of a substitute nominee designated by the Board or the Board may reduce its size.

A brief description of each of the nominees background and business experience is set forth below.

|

| | | | |

| | Age | | |

Nominee | | (as of March 31, 2015) | | Principal Occupation and Business Experience |

Sigmund L. Cornelius, Director | | 60 | | Sigmund L. Cornelius has served as a director of the Company since January 2012. He has over thirty years' experience in the oil and gas industry. In April 2014, Mr. Cornelius was appointed President and Chief Operating Officer of Freeport LNG, a privately held company involved in liquefied natural gas imports and exports. Prior to this, he worked in various positions with ConocoPhillips, an integrated oil and gas company, from 1980 to 2010. From October 2008 to December 2010, Mr. Cornelius served as Senior Vice President, Finance and Chief Financial Officer of ConocoPhillips. Prior to that, he served as Senior Vice President, Planning, Strategy and Corporate Affairs of ConocoPhillips since September 2007, having previously served as President, Exploration and Production - Lower 48 since 2006. He served as President, Global Gas of ConocoPhillips since 2004 and prior to that served as President, Lower 48 Latin America and Midstream since 2003. From 1980 to 2003, he served in a number of commercial, operational and administrative positions in the Midstream and Upstream businesses in both domestic and international locations. Mr. Cornelius currently serves on the boards of directors of Carbo Ceramics, Inc., a publicly traded company that manufactures ceramic proppant used in fracturing wells; Parallel Energy Trust, a publicly traded Canadian oil and gas income trust; and NiSource Inc., a publicly traded energy holding company. Mr. Cornelius previously served as a director of USEC Inc., a publicly traded uranium enrichment company, from February 2011 to September 2014, and DCP Midstream GP, LLC from November 2007 to October 2008. Except as noted above, Mr. Cornelius has not served as a director of a publicly traded company or a registered investment company in the past five years. Mr. Cornelius' extensive experience in the oil and gas industry including service in various financial, commercial, operational and administrative positions over the past thirty years, as well as his board service on other public company boards, are key attributes, among others, that make him well qualified to serve as a director of the Company. |

| | | | |

|

| | | | |

Robert J. Hassler, Director | | 63 | | Robert J. Hassler has served as a director of the Company since November 10, 2014. For 33 years, from 1975 to 2008, Mr. Hassler served in various senior management positions in refining and marketing, as well as exploration and production, with ConocoPhillips, an integrated oil and gas company. From 2006 to 2008, Mr. Hassler served as the President, European Refining and Marketing for ConocoPhillips. From April 2009 to August 2011, Mr. Hassler served as a director of SulphCo, Inc., a publicly traded start-up technology company in the oil and gas sector. Except as noted above, in the past five years, Mr. Hassler has not served as a director of a publicly traded company other than the Company or as a director of a registered investment company. Mr. Hassler's extensive experience in the oil and gas industry including in the refining and marketing of refined products are key attributes that make him well qualified to serve as a director of the Company. |

| | | | |

Brian J. Hogan, Director | | 53 | | Brian J. Hogan has served as a director of the Company since January 2006. Since 1986, he has served as an officer of, and since 1990, as President and Chief Executive Officer of, Hogan Truck Leasing, Inc., a full-service truck leasing and transportation company. Mr. Hogan also serves as a director and Chairman of AmeriQuest Corp., a transportation and logistics resource company. In addition, he serves as a board member of Parkside Bank and Trust and the St. Louis Children's Hospital Foundation; as well as serving on the boards of directors of various transportation and leasing industry professional associations and charitable organization boards. In the past five years, Mr. Hogan has not served as a director of a publicly traded company other than the Company or as a director of a registered investment company. Mr. Hogan's experience with transportation and logistics matters, his experience in operating a truck leasing and transportation company and his previous experience serving on various bank executive committees are key attributes that make him well qualified to serve as a director of the Company. |

| | | | |

Scott D. Weaver, Director | | 56 | | Scott D. Weaver has served as a director of the Company since September 2005. Mr. Weaver has served as one of the Company's executive officers since September 2005, and is currently the Company's Vice President, Assistant Treasurer and Assistant Secretary. From 2000 to August 2005, he served as Chief Financial Officer, Treasurer and Secretary of one of the Company's affiliates. Mr. Weaver also served as Chief Administrative Officer from September 2005 to December 2007 and as interim Treasurer from September 2009 to January 2010. From December 2013 to April 2014, Mr. Weaver served as Interim Vice President - Administration of NTGP and NTE (each defined below). Mr. Weaver currently serves on the boards of directors of Encore Wire Corporation, a publicly traded copper wire manufacturing company; WIG Holdings, Inc., a privately held insurance holding company; and Vomaris Innovations, Inc., a privately held medical device company. Mr. Weaver sits on the board of directors of the Company's affiliated subsidiaries, WRGP (defined below), NTGP and NTE. Except as noted above, Mr. Weaver has not served as a director of a public company or a registered investment company in the past five years. Mr. Weaver's extensive understanding of our business and operations as well as the production and marketing of crude oil and refined products, his experience as the Chief Financial Officer and director of other public entities, his experience in serving as the Chief Financial Officer, Treasurer and Secretary of one of the Company's affiliates, his extensive understanding of the business and operations of the Company and his knowledge of public company finance matters are key attributes among others that make him well qualified to serve as a director of the Company. |

| | | | |

|

| | | | |

Carin Marcy Barth, Director | | 52 | | Carin Marcy Barth has served as a director of the Company since March 2006. Ms. Barth is President of LB Capital, Inc., a private equity firm she co-founded in 1988. Currently, Ms. Barth serves as a director on the boards of directors of Bill Barrett Corporation, a public oil and natural gas exploration and development company; Strategic Growth Bank Incorporated and its affiliate, Capital Bank, N.A; The Welch Foundation; and the Ronald McDonald House of Houston. She served as Commissioner of the Department of Public Safety for the State of Texas from March 2008 until May 2014. She served as a member of the Board of Regents of Texas Tech University from 1999 to 2005 and was Chairman of the University's endowment from 2001 to 2005, 2006 to 2010, and was again appointed as Chairman in 2012. During 2004 to 2005, Ms. Barth took a leave of absence from LB Capital, Inc., to serve as Chief Financial Officer of the U.S. Department of Housing and Urban Development in Washington, D.C. From September 2006 to July 2007, she also served as Interim Senior Vice President of Finance and Administration (CFO) at Texas Southern University. Ms. Barth also served as a director of Encore Bancshares, Inc., from 2009 to 2012, and Amegy Bank of Texas from 2001 to 2005. Except as listed above, Ms. Barth has not served as a director of a publicly traded company or a registered investment company in the past five years. Ms. Barth's experience in varied financial matters, including as chief financial officer for several entities, her experience with mergers and acquisitions, her experience in operating a private capital company and her service on numerous public and private company boards are key attributes, among others, that make her well qualified to serve as a director of the Company. |

| | | | |

Paul L. Foster, Chairman of the Board, Director and Executive Chairman | | 57 | | Paul L. Foster has served as Chairman of the Company's Board since September 2005. Mr. Foster served as the Company's Chief Executive Officer from September 2005 until January 2010, when he was appointed Executive Chairman of the Company. Mr. Foster also served as President from September 2005 to February 2009. Previously, Mr. Foster was the President and Chief Executive Officer of one of the Company's affiliates. Mr. Foster has served on the board of directors of the University of Texas System Board of Regents since 2007, and he is currently Chairman of such board. He also serves on the board of directors of WestStar Bank, an El Paso-based bank; as Chairman of the board of directors of Vomaris Innovations, Inc., a privately held medical device company; on the board of directors of the Federal Reserve Bank of Dallas - El Paso Branch; and on various other civic and professional organizations. Mr. Foster has spent virtually his entire career working in the refined product production and marketing industry. He is the original founder of the Company and has been involved in all aspects of the Company's operations since 2005 and in all aspects of its affiliates' operations since 1997. Mr. Foster sits on the board of directors of the Company's affiliated subsidiaries, WRGP, NTGP and NTE. Except as provided above, Mr. Foster has not served as a director of a public company or a registered investment company in the past five years. Mr. Foster's leadership and industry experience, including his considerable understanding of the production and marketing of refined products and his extensive history with and shareholdings in the Company are key attributes, among others, that make him well qualified to serve as a director of the Company. Mr. Foster also has extensive leadership and industry experience. |

| | | | |

|

| | | | |

L. Frederick Francis, Director | | 58 | | L. Frederick Francis has served as a director of the Company since February 2006. He is Executive Chairman of WestStar Bank, an El Paso-based bank, and Chairman of the board of directors and Chief Executive Officer of WestStar Bank Holding Company, Inc., the parent holding company of WestStar Bank. Mr. Francis is also Chairman of Francis Properties, Ltd., and Francis Holdings LLC, companies primarily involved in family investments. In addition, he serves on the board of directors of the Medical Center of the Americas Foundation, the Board of Regents of the Texas Tech University System, where he is past Chairman, the board of directors of Sierra Medical Center/Providence Memorial Hospital, where he is also a past Chairman, and the Greater El Paso Chamber of Commerce Foundation. He also serves on the boards of many other civic and charitable organizations. In the past five years, Mr. Francis has not served as a director of a publicly traded company other than the Company or as a director of a registered investment company. Mr. Francis' experience in running and working with financial institutions, his extensive background in working with financial matters and his experience on numerous boards of directors are key attributes that make him well qualified to serve as a director of the Company. |

The affirmative vote of holders of a plurality of the common stock present or represented by proxy at the Annual Meeting and entitled to vote is required for the election of each director nominee. Therefore, abstentions and broker non-votes will not be taken into account in determining the outcome of the election of directors.

The Board unanimously recommends a vote “FOR” each of its nominees for director.

Other Directors

The Board's other directors who are not subject to re-election and whose terms will continue after the Annual Meeting are listed below, including a brief description of their background and business experience:

|

| | | |

| Age | | |

Name | (as of March 31, 2015) | Position | Expiration of Current Term (1) |

William D. Sanders | 73 | Director | 2016 |

Jeff A. Stevens | 51 | Director, President and Chief Executive Officer | 2016 |

_______________________________________

| |

(1) | Each director's term of office expires in the year set forth opposite his or her name. Each director serves until his or her successor is chosen and qualified or until his or her earlier resignation or removal. |

William D. Sanders has served as a director of the Company since February 2007. Mr. Sanders is Chairman of Strategic Growth Bank Incorporated (also serving as a director of its affiliate entities). He also is Chairman of his private family business entities. He is Trustee of the Borderplex Community Trust, a civically-formed real estate investment trust organized to acquire, develop and manage real estate in the downtown El Paso, Texas area. Previously, Mr. Sanders served as a Trustee of Verde Realty, a real estate investment trust focused on the U.S.-Mexico border region until 2012, and also was the founder, Chairman and Chief Executive Officer of Security Capital Group Incorporated, which was sold to GE Capital Corporation in 2002. Founded in 1991, Security Capital had controlling interests in eighteen public and private fully-integrated real estate operating companies, eight of which were NYSE listed companies. He is a past Chairman of the National Association of Real Estate Investment Trusts (NAREIT) and also served on the Board of Trustees of the University of Chicago. He currently is Trustee Emeritus of the Cornell University Board of Trustees. Except as listed above, Mr. Sanders has not served as a director of a publicly traded company or a registered investment company in the past five years. Mr. Sanders' extensive experience in successfully building and managing public companies, understanding public company governance issues, leadership positions in numerous organizations and extensive experience in real estate investment and development are key attributes, among others, that make him well qualified to serve as a director of the Company.

Jeff A. Stevens has served as a director of the Company since September 2005, as the Company's President since February 2009 and as Chief Executive Officer since January 2010. Previously, Mr. Stevens served as Chief Operating Officer since April 2008, as Executive Vice President of the Company since September 2005 and as Executive Vice President of one of the Company's affiliates since 2000. In July 2013, Mr. Stevens was appointed the President and Chief Executive Officer of WRGP and in November 2013, Mr. Stevens was appointed to the board of directors of NTGP and NTE. Mr. Stevens also serves on the board of directors of Vomaris Innovations, Inc., a privately held medical device company. Mr. Stevens has spent his entire career working in the refined product production and marketing industry. He has been involved in all aspects of the Company's operations since 2005 and in all aspects of its affiliates' operations since 2000. Except as provided above, in the past five years, Mr. Stevens has not served as a director of a publicly traded company or a registered investment company. Mr. Stevens' extensive understanding of the production and marketing of refined products and his extensive history with the Company are key attributes, among others, that make him well qualified to serve as a director of the Company. Mr. Stevens also brings to the Board extensive experience in the energy industry, corporate strategy and business development.

2014 DIRECTOR COMPENSATION

Non-Employee Director Compensation Process

The compensation the Company pays to its non-employee directors is designed to attract and retain nationally recognized, highly qualified directors to lead the Company, to meaningfully align the interests of those directors with the interests of shareholders and to be demonstrably fair to both the Company and its non-employee directors. In setting non-employee director compensation, the Compensation Committee and the Board consider these factors, as well as the significant amount of time that directors spend fulfilling their duties to the Company, the skill and experience required of the directors and other factors. Non-employee director compensation typically consists of both cash and equity components.

The Compensation Committee evaluates non-employee director compensation and makes its recommendations to the Company's full Board, which then sets the non-employee director compensation. In developing and making its recommendations to the Board, the Compensation Committee follows a process similar to the process it follows for setting named executive officer compensation, which is discussed under "Compensation Discussion and Analysis" below. The Compensation Committee relies upon various sources of information and advice including the advice of independent consultants, comparative surveys, third party proprietary databases providing comparative information, the current economic conditions and industry environment in which the Company operates and the Compensation Committee members' common sense, experience and judgment. Generally, the Compensation Committee anticipates receiving a full report and recommendation provided by an independent compensation consultant every three years. with interim annual updates. To the extent the Compensation Committee perceives there are major shifts in compensation trends or desires to make significant modifications to non-employee director compensation, the Compensation Committee may decide, in its discretion, to retain independent compensation consultants to provide full or partial reports and analyses more often.

Non-Employee Director Compensation for 2014

Consistent with the process described above, the Compensation Committee retained Pearl Meyer & Partners ("PM&P") as its independent compensation consultant in the fall of 2012 to provide an analysis of the Company's non-employee director compensation, comparative data and associated recommendations. PM&P issued its report on the Company's non-employee director compensation in October 2012. In setting non-employee director compensation for 2014, the Compensation Committee and the Board considered the information and analysis of PM&P in the October 2012 report as well as the other factors and objectives discussed above.

In November 2013, the Board elected to maintain the 2013 level of non-employee director compensation for 2014. As in previous years, each non-employee director was given the option to defer the settlement of some or all of his or her 2014 compensation pursuant to the terms of the Western Refining, Inc. Non-Employee Director Deferred Compensation Plan (the "Director Deferred Compensation Plan"). For 2014, each non-employee director received the following compensation:

| |

• | An annual retainer of $75,000 |

| |

• | A restricted stock unit ("RSU") award that vests after one year and has a market value at the time of grant equal to $150,000 (based on the closing market price of the Company's common stock on the date of grant) |

| |

• | For the Audit Committee chair, an additional cash retainer equal to $20,000 |

| |

• | For each of the Compensation Committee and the Governance Committee chairs, an additional cash retainer equal to $15,000. |

The 2014 RSU awards granted to non-employee directors included the right to accrue cash dividend equivalents which only vest and payout if and when the associated RSUs ultimately vest. Dividend equivalents that relate to the RSUs will be forfeited to the extent the RSUs are forfeited.

In 2014, none of the Company's directors were granted or held any options or stock appreciation rights and none of the directors participated in a Company pension plan.

The following table reflects all compensation granted to each non-employee director during 2014.

2014 NON-EMPLOYEE DIRECTOR COMPENSATION

|

| | | | | | | | | | | |

| Fees Earned or Paid in Cash | | Stock Awards | | All Other Compensation | | Total |

Name | ($)(1) | | ($)(2)(3) | | ($)(4) | | ($) |

Carin M. Barth | 95,000 |

| | 150,000 |

| | 231 |

| | 245,231 |

|

Sigmund L. Cornelius | 75,000 |

| | 150,000 |

| | 210 |

| | 225,210 |

|

L. Frederick Francis | 90,000 |

| | 150,000 |

| | 222 |

| | 240,222 |

|

Brian J. Hogan | 90,000 |

| | 150,000 |

| | 168 |

| | 240,168 |

|

William D. Sanders | 75,000 |

| | 150,000 |

| | — |

| | 225,000 |

|

Ralph A. Schmidt | 75,000 |

| | 150,000 |

| | 168 |

| | 225,168 |

|

Robert J. Hassler | — |

| | 150,000 |

| | — |

| | 150,000 |

|

_______________________________________

| |

(1) | The amounts in this column represent the annual cash retainer and committee fees for Board and committee service paid to each director in 2014. Mr. Hassler did not receive any fees during 2014 because he was appointed as a non-employee director on November 10, 2014. |

| |

(2) | On June 25, 2014, each of the non-employee directors, except for Mr. Hassler, received a grant of 3,901 RSUs, representing his or her annual RSU grant of $150,000, based on the closing stock price on the grant date. Mr. Hassler received a grant of 3,273 RSUs, representing his annual RSU grant of $150,000, based on the closing stock price on the grant date of November 10, 2014. |

| |

(3) | The grant date fair value is computed in accordance with Financial Accounting Standards Codification Topic 718, Compensation - Stock Compensation ("FASB ASC Topic 718"). The values for the RSU awards reflect the aggregate grant date fair values of the awards. The RSUs will vest in full twelve months after the grant date. |

| |

(4) | The Company paid cash dividends to shareholders in 2014. The amounts in this column includes dividends paid in 2014 on shares underlying grants of restricted stock, except for Messrs. Cornelius and Hassler who did not have any unvested grants of restricted stock. Certain of the directors' RSUs award agreements provide for dividend equivalents on unvested RSUs, however, such rights are settled if and when the RSUs vest and are not reflected in this column. |

Messrs. Foster, Stevens and Weaver, all of whom are executive officers of the Company, do not receive compensation for their service as directors of the Company. Mr. Stevens is a named executive officer and disclosure of his compensation is provided in the tables contained in "Executive Compensation and Other Information" below. All directors are reimbursed for all reasonable out-of-pocket expenses that they incur in attending meetings and serving on the Board.

NON-EMPLOYEE DIRECTORS' OUTSTANDING EQUITY AWARDS AT FISCAL 2014 YEAR END

|

| | | | | |

| Stock Awards |

| Number of Shares or Units of Stock That Have Not Vested | | Market Value of Shares or Units of Stock That Have Not Vested |

Name | (#)(1) | | ($)(2) |

Carin M. Barth | 3,901 |

| | 147,380 |

|

Sigmund L. Cornelius | 3,901 |

| | 147,380 |

|

L. Frederick Francis | 3,901 |

| | 147,380 |

|

Brian J. Hogan | 3,901 |

| | 147,380 |

|

William D. Sanders | 3,901 |

| | 147,380 |

|

Robert J. Hassler | 3,273 |

| | 123,654 |

|

| |

(1) | Total number of shares or units of stock consists of grants of RSUs. Equity awards of RSUs granted to non-employee directors generally will vest in full twelve months after the grant date. |

| |

(2) | The market value of these unvested shares of restricted stock and RSUs was calculated by multiplying the number of shares or units by $37.78, the closing price of a share of our common stock on December 31, 2014, the last business day of the fiscal year. |

Director Stock Ownership Requirements

The Company's Corporate Governance Guidelines include minimum stock ownership requirements for directors. Under these requirements, directors must own shares of common stock of the Company at a level equal to three times the director's annual cash retainer. These requirements must be met as of the later of August 26, 2015, or within five years from appointment or election for newly appointed or elected directors. The requirements may be satisfied with common stock that is owned directly or indirectly (e.g., by a spouse or a trust) by the director, shares that are time-vested restricted stock, RSUs or shares that are held in a retirement or deferred compensation account. Unexercised options and unearned performance shares are not counted toward meeting these requirements. The Governance Committee is responsible for monitoring and enforcing these requirements. As of the date of this Proxy Statement, all directors satisfy these minimum stock ownership requirements or are within the period permitted to meet these requirements.

Compensation for Service as Director of Western Refining Logistics GP, LLC

Messrs. Stevens, Foster and Weaver have served as directors of Western Refining Logistics GP, LLC ("WRGP"), the general partner of Western Refining Logistics, LP ("WNRL") since July 2013. Directors of WRGP receive compensation for their services as directors unless they are also executive officers or employees of WRGP. Mr. Stevens, who is an executive officer of WRGP, does not receive compensation for his service as a director of WRGP. Messrs. Foster and Weaver, who are not executive officers or employees of WRGP, receive compensation for their services as directors of WRGP, which for 2014 consisted of:

| |

• | A cash retainer of $50,000 per year, paid quarterly in arrears; |

| |

• | An additional cash payment of $1,500 for each board of directors meeting attended; and |

| |

• | An annual grant under the WNRL 2013 Long-Term Incentive Plan ("WNRL LTIP") of phantom units with a fair market value equal to approximately $60,000 on the date of grant which generally vest at the end of the quarter in which the one-year anniversary of the date of grant occurs. |

In August 2014, each of Messrs. Foster and Weaver received a grant of 1,721 phantom units, representing the annual phantom unit award grant of $60,000, based on the grant price of $34.87. As of December 31, 2014, this annual phantom unit award was the only outstanding award for each of Messrs. Foster and Weaver. These phantom unit awards included dividend equivalents, which entitle Messrs. Foster and Weaver to receive cash at the time of vesting equal to the amount of any cash distributions made by WNRL during the period the dividend equivalent is outstanding. These dividend equivalents will be forfeited to the extent the award is forfeited. For 2014, Messrs. Foster and Weaver each received $121,185 in total compensation for their service as non-employee directors of WRGP.

In February 2015, the board of directors of WRGP evaluated its non-employee director compensation for 2015, and made the following adjustments: (i) increased the cash retainer to $65,000 per year, paid quarterly in arrears; and (ii)

increased the annual grant under the WNRL LTIP to a number of phantom units with a fair market value equal to approximately $75,000 at the date of grant which generally vest at the end of the quarter in which the one-year anniversary of the date of grant occurs.

The Company expects that to the extent Messrs. Foster and Weaver continue to serve as directors of WRGP, they will continue to be eligible to receive compensation in future years for service as a director on the WRGP board of directors. The form and amount of director compensation is established by WRGP not the Board.

Compensation for Service as a Director of Northern Tier Energy GP LLC

In November 2013, Messrs. Foster, Stevens, Weaver and Barfield were each appointed as directors of Northern Tier Energy GP LLC ("NTGP"), the general partner of Northern Tier Energy LP ("NTI") and Northern Tier Energy LLC ("NTE"), a wholly-owned operating subsidiary of NTI. Directors of NTGP receive compensation for their services as directors unless they are also executive officers or employees of NTGP. Messrs. Foster, Stevens, Weaver and Barfield, who are not executive officers or employees of NTGP, receive compensation for their services as directors of NTGP, which for 2014 included:

| |

• | A cash retainer of $60,000 per year, paid quarterly in arrears; |

| |

• | An award of restricted units under the Northern Tier Energy LP 2012 Long-Term Incentive Plan ("NTI LTIP"), which restricted units vested in full on January 3, 2015; and |

| |

• | An additional cash retainer of $10,000 to the chairman of the NTGP Governance Committee, payable quarterly. |

On January 3, 2014, Messrs. Foster, Stevens and Barfield each received an award of 4,129 restricted common units from NTI, as compensation for their service as directors of NTGP and on June 17, 2014, Mr. Weaver received an award of 4,129 restricted common units, all of which vested in January 2015 and which included quarterly distributions in 2014 on the unvested restricted units. Restricted common units represent limited partner interests in NTI. In 2014, total compensation for service as a non-employee director of NTGP was $173,920 for each of Messrs. Foster, Stevens and Barfield and $169,422 for Mr. Weaver.

For 2015, the board of directors of NTGP adjusted non-employee director compensation as follows: (i) increased the annual retainer to $70,000, payable quarterly in arrears, and (ii) elected to award time-based phantom units that vest in full on the third Wednesday of January 2016 with a fair market value equal to $110,000 at the time of grant. Except for these changes, the board of directors of NTGP did not make any other changes to non-employee director compensation.

In addition, the Company expects that to the extent that Messrs. Foster, Stevens, Weaver and Barfield continue to serve as directors of NTGP, they will continue to be eligible to receive compensation in future years for service as a director on the NTGP board of directors. The form and amount of director compensation is established by NTGP not the Board.

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Identification of Executive Officers

The Company's executive officers are as follows (as of March 31, 2015):

|

| | |