Please wait

ICOS

Corporation Analysis

Materials

Prepared For ISS

November 28, 2006

This

analysis is

being provided at the unsolicited request of Institutional Shareholder Services

for

additional

information regarding HealthCor's previously

announced intention to vote

against

the proposed

acquisition of ICOS Corporation by Eli Lilly. In agreeing to meet with

ISS,

HealthCor

is not

engaging in a proxy solicitation within the meaning of

Rule

14a-1(l) under

the Securities Exchange Act of 1934.

1

Table

of

Contents

Executive

Summary

ICOS

Corporation

Erectile

Dysfunction

Market

Valuation

Considerations

Dissenters’

Rights

Broker

Models

HealthCor

13D

Filings

2

Executive

Summary

As

filed with the

SEC, HealthCor Management owns over 3.3MM shares of ICOS

(>5%) and we

intend to vote against the proposed acquisition of ICOS by Eli Lilly

We

believe that the

earnings power of the Lilly ICOS JV is greater than the public

markets had

discounted on October 16, 2006

Included

in

ICOS Proxy statement – ICOS acknowledges that its internal

expectation for

EPS in 2007 exceeds the consensus Wall Street estimates by at

least 22%

This

transaction was announced three days before LLY-ICOS earnings which were

significantly above expectations

Furthermore

–

we

believe that other compelling evidence is the material earnings

accretion

being forecast for the shareholders of Eli Lilly by Wall Street analysts

(see

Appendix, Nov. 2 13D letter, exhibit B for detail)

Finally

–

we

are

very troubled by the “Amended and Restated Change in Control and

Severance

Agreement” - which effectively provides greater financial gains for

senior

management as a result of the anticipated sale of the Company

3

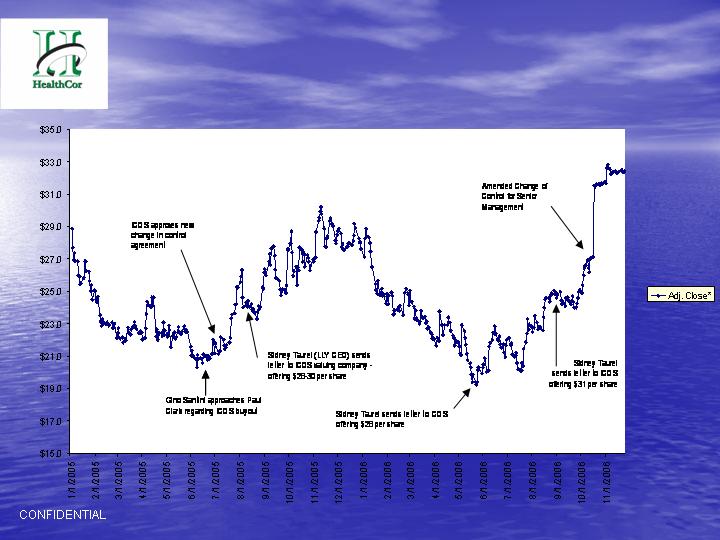

Executive

Summary

ICOS

Share

Price

4

Table

of

Contents

Executive

Summary

ICOS

Corporation

Erectile

Dysfunction

Market

Valuation

Considerations

Dissenters’

Rights

Broker

Models

HealthCor

13D

Filings

5

ICOS

Overview

ICOS

Corporation is

a biotechnology

company whose primary asset is its

50% of the joint

venture profits from

Lilly ICOS

Lilly

ICOS markets

and sells the

erectile dysfunction drug Cialis

Total

Cialis sales

were $746.6M in

2005 and are forecast by Wall Street

analysts to grow by

27% to

approximately $950M in 2006

Cialis’

gross

margins are

approximately 92%

ICOS

does have other

research

programs which have provided a

negative drain on earnings –

nonetheless the company is now

profitable

6

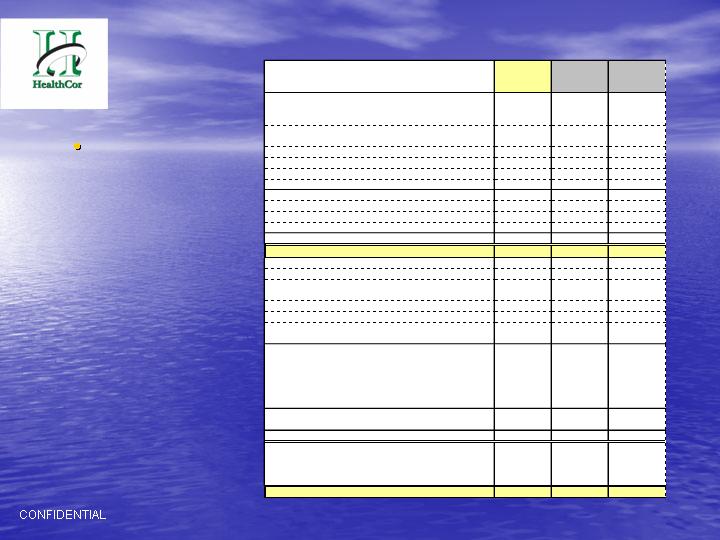

Lilly

ICOS Net Income

Forecasts

2006

2007

2008

UBS

292.9

400.9

522.2

Growth

36.9%

30.2%

Morgan

Stanley

293.8

318.2

428.6

Growth

8.3%

34.7%

Cowen

274.4

376.5

489.2

Growth

37.2%

29.9%

Mean

287.0

365.2

480.0

Growth

27.2%

31.4%

50%

Share to ICOS

143.5

182.6

240.0

Shares

Outstanding

65.5

65.5

65.5

EPS

Contribution from JV

2.19

2.79

3.66

Growth

27.2%

31.4%

Lilly

offer Price

32.0

32.0

32.0

Offer

Price / JV

EPS

14.6x

11.5x

8.7x

ICOS

3Q

2006 Results

7

ICOS

Q3 EPS of .15

were much higher

than consensus EPS

of .07 due to

leverage at

the JV

level

Sep

Sep

3Q06

3Q06

Difference

E

A

CIALIS

Lilly

ICOS

(US)

95.3

94.9

(0.4)

Lilly

ICOS (Rest of North

America)

17.9

20.2

2.3

Lilly

ICOS (North

America)

114.2

115.2

1.0

Lilly

ICOS

(Europe)

72.9

75.4

2.6

Lilly

ICOS (North America

& Europe)

187.7

190.6

2.9

Lilly

Territories

(ROW)

52.7

55.0

2.3

TOTAL

CIALIS

SALES

240.5

245.6

5.2

Collaboration

Revenues

17.1

16.4

(0.7)

Licenses

of

technology

-

Contract

manufacturing

4.2

4.3

0.0

Co-promotion

services

0.7

-

(0.7)

TOTAL

REVENUES

21.5

20.6

(0.8)

FC

SALES

(10/24/06)

21.0

(0.3)

R&D

25.9

25.3

(0.6)

Sales

and

Marketing

13.8

13.2

(0.6)

General

and

Administrative

8.4

8.1

(0.3)

Total

- S&M /

G&A

21.1

21.3

0.2

Cost

of

manufacturing

3.1

4.6

1.6

Stock

compensation

expense

7.3

(7.3)

TOTAL

OPERATING

EXPENSES

49.7

51.3

1.5

OPERATING

INCOME/(LOSS)

(28.3)

(30.6)

(2.4)

Equity

in Profits/(Losses) of

Affiliates

34.7

40.0

5.2

Gain

on sale of partnership

interests

-

Interest

expense

(1.5)

(1.7)

(0.2)

Interest

and other

income

2.2

2.3

0.1

TOTAL

INTEREST & OTHER

INCOME

0.1

0.6

0.5

INCOME/(LOSS)

BEFORE INCOME

TAXES

6.6

9.9

3.4

Income

Taxes

Provision/(Gain)

0.5

0.2

(0.2)

Tax

Rate

5.0%

2.2%

NET

INCOME/(LOSS)

6.3

9.7

3.4

FD

Shares

Out

65.1

65.2

Stock

Option Expense (Tax

Adjusted)

7.5

(7.5)

Diluted

EPS

0.17

0.15

(0.02)

Diluted

EPS (with stock

options expense)

0.05

0.15

0.10

FC

EPS

(10/24/06)

0.07

0.08

Cialis

Additional Clinical Trial Programs

Hypertension

–

Positive Phase II data released on Q3 2006 earnings call – Market is

in

excess of $15B according to ICOS

Benign

Prostatic

Hyperplasia – Phase IIb program initiated in Q3 2006 – GSK’s

Avodart is

expected to generate ~ $300M in revenue in 2006

Pulmonary

Arterial

Hypertension – patient enrollment progressing on schedule –

Revatio (Viagra)

already approved - $250M+ opportunity

400

patient phase

III study

Once

a day treatment

for ED – expects to file an expanded indication – regulatory

filings

occurred in the US and Canada in mid-2006

8

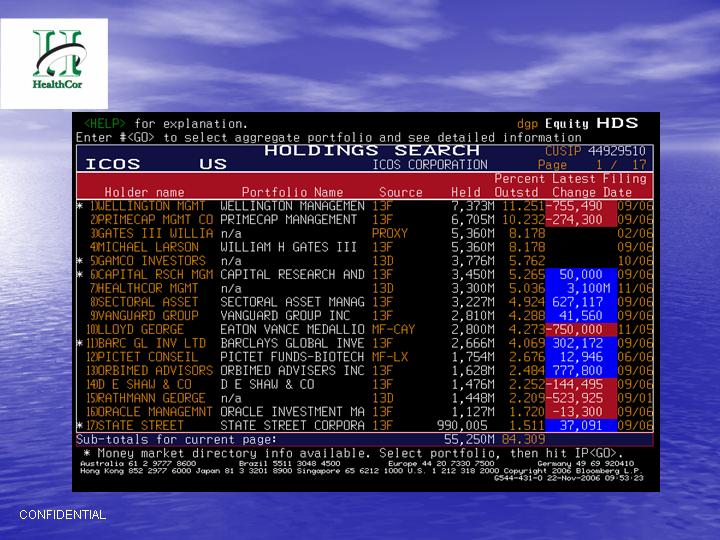

ICOS

Shareholders – As Reported by Bloomberg

9

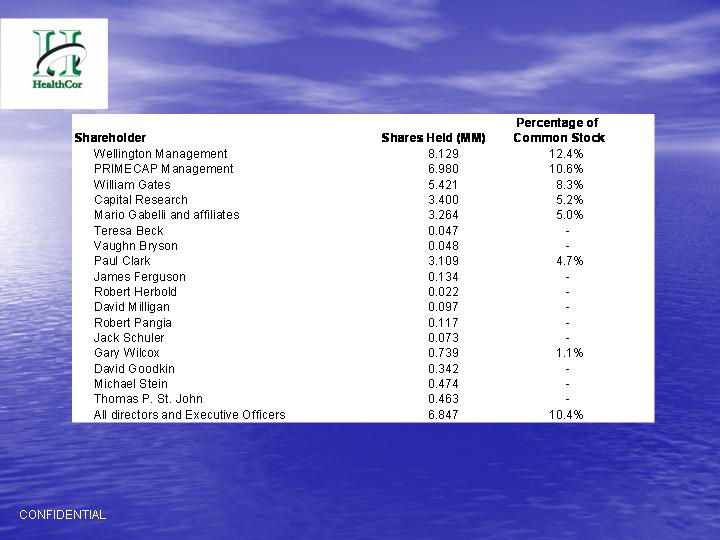

ICOS

Shareholders - According to Proxy - As of October 30

10

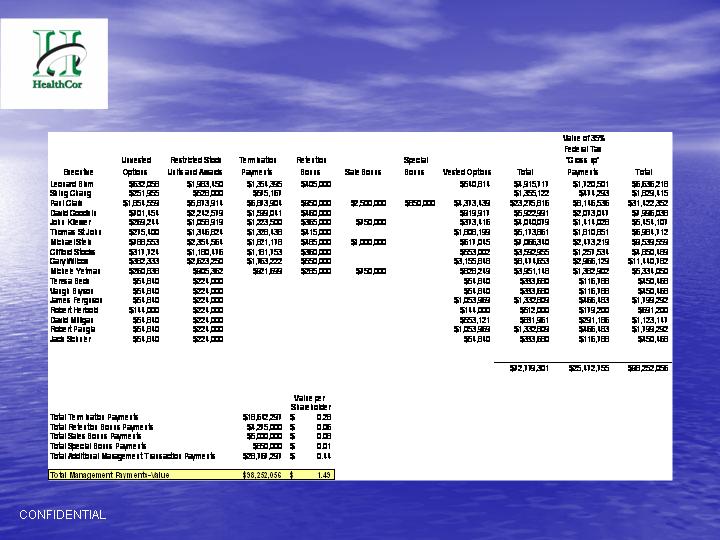

Excessive

ICOS Executive Compensation from Transaction

11

Table

of

Contents

Executive

Summary

ICOS

Corporation

Erectile

Dysfunction

Market

Valuation

Considerations

Dissenters’

Rights

Broker

Models

HealthCor

13D

Filings

12

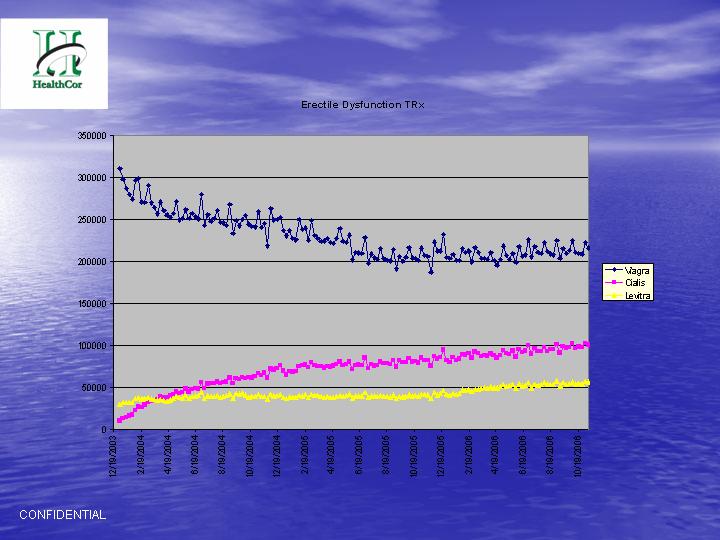

Erectile

Dysfunction Market Overview

In

November of 2003,

FDA approved LLY-ICOS’ PDE-5 inhibitor Cialis for

erectile dysfunction

Since

then

prescriptions have steadily grown and the drug continues to take

market

share from Viagra

Cialis

is

differentiated from its competing PDE-5 inhibitors, Viagra and

Levitra, by

its extended 36-hour duration of action and lack of food effects

Both

are mentioned

in its label

Viagra,

the current

market leader, recorded over $1.6BN in revenue in

2005

13

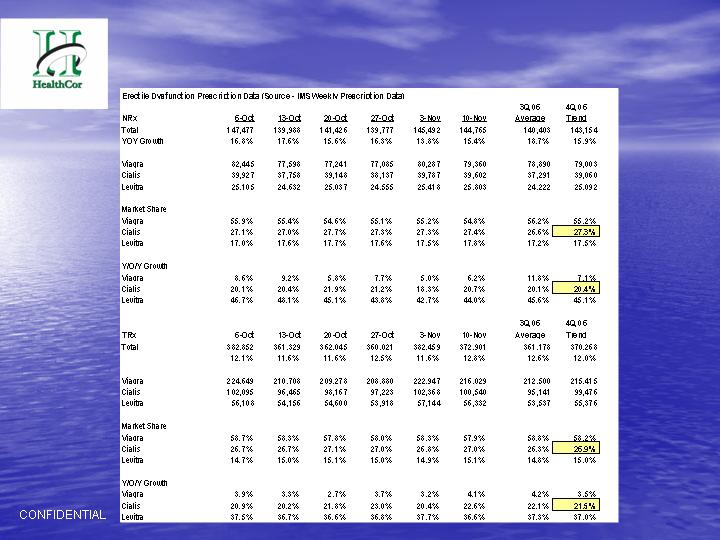

Erectile

Dysfunction Prescriptions Continue to Grow AND Cialis

continues to Gain

market share

14

Erectile

Dysfunction Prescriptions Continue to Grow AND Cialis

continues to Gain

market share

Source:

IMS

15

Table

of

Contents

Executive

Summary

ICOS

Corporation

Erectile

Dysfunction

Market

Valuation

Considerations

Dissenters’

Rights

Broker

Models

HealthCor

13D

Filings

16

Large

Cap

Biotech Trading Comps

17

Biotech

Comps - Source -

Factset

11/21/06

2006E

EV

/

EV

/

2006

2007

2008

Company

Ticker

Price

Mkt

Cap

EV

LTM

Sales

EBITDA

LTM

Sales

2006

EBITDA

CY

06

EPS

CY

07

EPS

CY

08

EPS

PE

PE

PE

GENENTECH

INC

DNA

80.36

$

84,699.5

89,030.2

6,972.1

3,327.6

12.8x

26.8x

2.16

2.66

3.28

37.2x

30.2x

24.5x

AMGEN

INC

AMGN

72.98

$

85,132.5

88,357.5

13,704.0

6,170.5

6.4x

14.3x

3.93

4.41

4.99

18.6x

16.5x

14.6x

CELGENE

CORP

CELG

56.07

$

20,882.8

19,288.9

773.3

223.8

24.9x

86.2x

0.53

1.07

1.62

105.8x

52.4x

34.6x

GENZYME

CORP

GENZ

66.05

$

17,361.6

17,229.9

3,045.3

808.0

5.7x

21.3x

2.74

3.14

3.64

24.1x

21.0x

18.1x

BIOGEN

IDEC INC

BIIB

51.00

$

17,193.5

16,577.5

2,607.6

1,339.4

6.4x

12.4x

2.22

2.54

2.89

23.0x

20.1x

17.6x

SEPRACOR

INC

SEPR

55.28

$

6,056.1

6,393.6

1,150.5

169.4

5.6x

37.7x

1.31

2.18

3.10

42.2x

25.4x

17.8x

GILEAD

SCIENCES INC

GILD

67.51

$

31,042.9

29,549.1

2,736.2

1,584.7

10.8x

18.6x

2.38

2.55

2.90

28.4x

26.5x

23.3x

MEDIMMUNE

INC

MEDI

33.11

$

7,920.1

8,362.2

1,240.1

125.7

6.7x

66.5x

0.19

0.85

1.22

174.3x

39.0x

27.1x

MILLENNIUM

PHARMACEUTICALS

MLNM

11.26

$

3,558.5

3,098.9

383.1

80.0

8.1x

38.7x

0.11

0.13

0.24

102.4x

86.6x

46.9x

OSI

PHARMACEUTICALS INC

OSIP

37.74

$

2,161.1

2,225.5

366.1

(3.7)

6.1x

-596.6x

(0.51)

0.32

1.04

-74.0x

117.9x

36.3x

IMCLONE

SYSTEMS INC

IMCL

31.66

$

2,681.8

2,280.6

644.7

309.1

3.5x

7.4x

2.94

1.48

1.43

10.8x

21.4x

22.1x

Mean

8.8x

-24.2x

44.8x

41.5x

25.7x

Median

6.4x

21.3x

28.4x

26.5x

23.3x

Max

24.9x

86.2x

174.3x

117.9x

46.9x

Min

3.5x

-596.6x

-74.0x

16.5x

14.6x

ICOS

CORP

ICOS

32.46

$

2,127.7

2,299.5

76.7

NA

30.0x

NA

0.29

0.65

1.25

111.9x

49.9x

26.0x

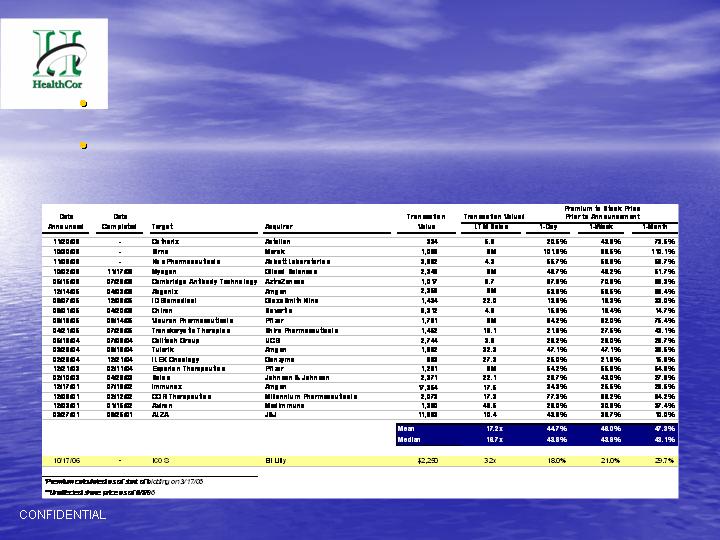

Selected

Merger Transaction Analysis

The

premium being

offered to ICOS shareholders is significantly below

that offered in

comparable transactions

Since

the LLY / ICOS

transaction was announced – a number of

acquisitions have been announced all

w / takeover premiums far higher

than that offered to ICOS shareholders

18

Table

of

Contents

Executive

Summary

ICOS

Corporation

Erectile

Dysfunction

Market

Valuation

Consideration

Dissenters’

Rights

Broker

Models

HealthCor

13D

Filings

19

Dissenters’

Rights

20

The

following is a summary of the

process

shareholders

will

need to follow if

they

wish

to

assert its rights under Washington

State’s dissenters’ rights statute:

1.

Notice

of intent to demand

payment

:

Anytime before the special

shareholder meeting on

December

19,

2006, we must deliver a notice

stating we intend to demand payment of

what

we believe to be the fair market

value of our shares if the merger is approved.

2.

Shareholder

vote

:

We must not vote in favor of the

merger in order to assert our

dissenters’

righ

ts.

3.

Notice

from company

:

If the merger is approved at the

special meeting (approval requires

the

affirmative vote of the majority

of the outstanding shares entitled to vote), within 10

days

afterwards, the company must

send dissenters a notice stating wher

e

a payment

demand

must be

submitted.

4.

Payment

demand

:

After receiving the company’s

notice, we must submit a payment

demand

to the

company. The payment demand must be received by the company not

fewer

than 30 nor more than 60 days

after company’s notice

to

us is delivered.

5.

Payment

by company

:

Within 30 days of the later of the

effective date of the merger, or

the

date our payment demand is

received by the company, the company must pay us

what

it estimates the fair value of

the shares to be plus accrued

interest. The

payment

needs

to be accompanied by certain

company financial statements and an explanation of

how

the shares’ fair value was

determined.

6.

Shareholder

dissatisfaction with

payment

:

If we believe the company’s payment

is

inadequate,

within 30 d

ays

of the payment, we must deliver a

notice to the company

setting

forth our estimate of fair

value and demand payment of that estimate less

whatever

has been paid.

7.

Court

action

:

If our demand remains unsettled,

the company must initiate a proceeding

wit

hin

60 days after receipt of our

notice stating the company’s payment was inadequate

by

petitioning the superior court of

the county in which the company’s principal office is

located,

to determine the fair value

of the shares. If the company does not do

so,

it must

pay

each dissenter whose demand is

unsettled the amount demanded. The court shall

have

the power to appoint one or more

appraisers to receive evidence and recommend a

decision

as to fair

value.

8.

Withdrawal

of demand

: Under

the terms of the

mer

ger

agreement, at any point prior to

the

closing of the merger, we may

withdraw our payment demand and instead receive the

merger

consideration to which we

would otherwise be entitled.

Table

of

Contents

Executive

Summary

ICOS

Corporation

Erectile

Dysfunction

Market

Valuation

Consideration

Dissenters’

Rights

Broker

Models

HealthCor

13D

Filings

21

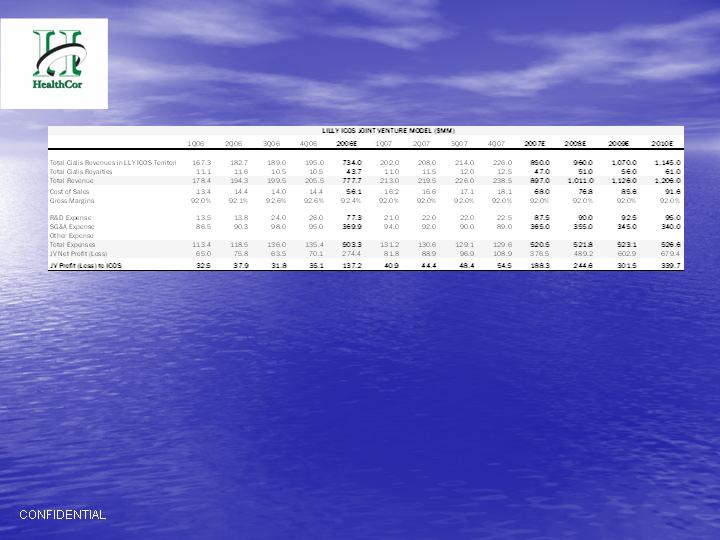

Broker

JV

Model 1 – Cowen

22

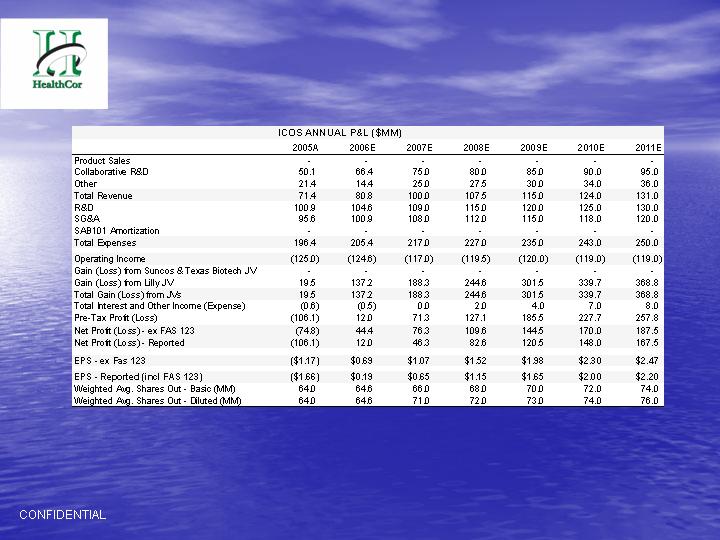

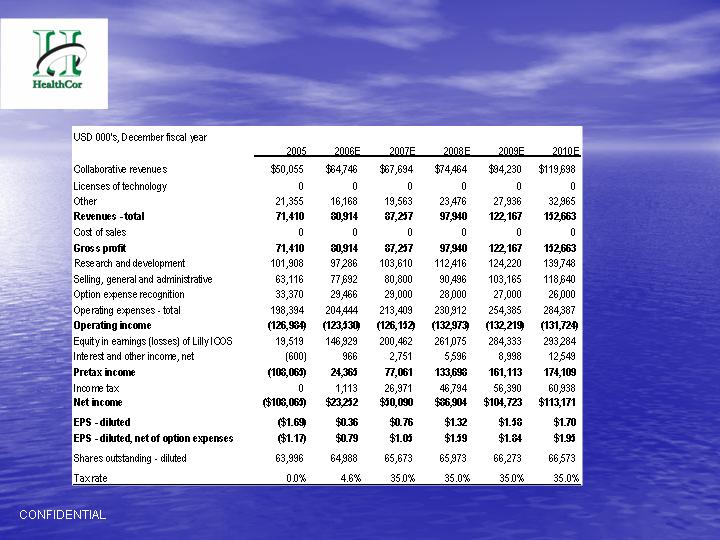

Broker

Full P&L Model 1 – Cowen

23

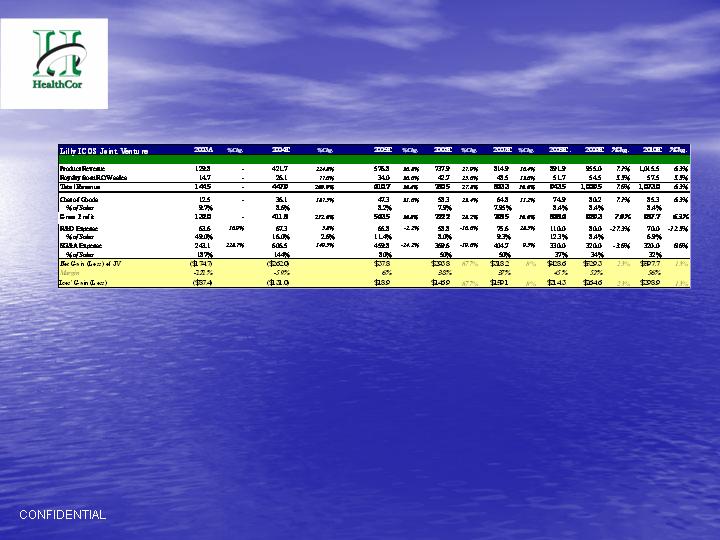

Broker

JV

Model 2 – UBS

24

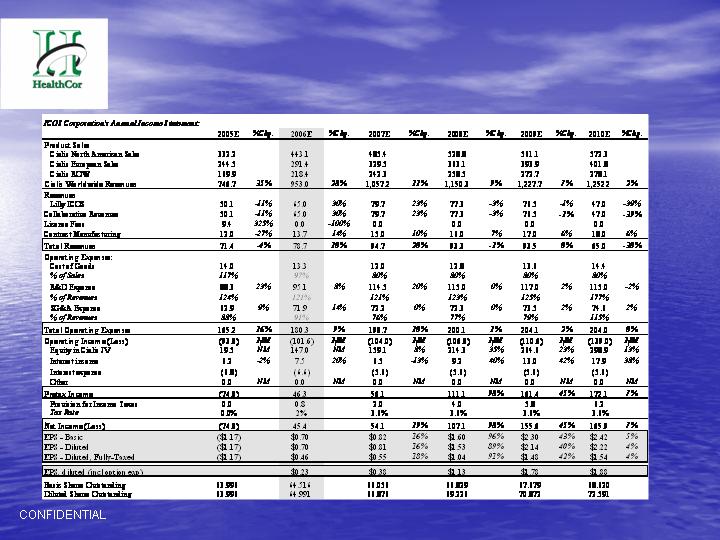

Broker

Full P&L Model 2 – UBS

25

Broker

JV

Model 3 – Morgan Stanley

26

Broker

Full P&L Model 3 – Morgan Stanley

27

Table

of

Contents

Executive

Summary

ICOS

Corporation

Erectile

Dysfunction

Market

Valuation

Consideration

Dissenters’

Rights

Broker

Models

HealthCor

13D

Filings

28