Q4 and Full Year 2025 Letter to Shareholders February 12, 2026 yelp-ir.com Q4 and Full Year 2024 Letter to Shareholder s .2

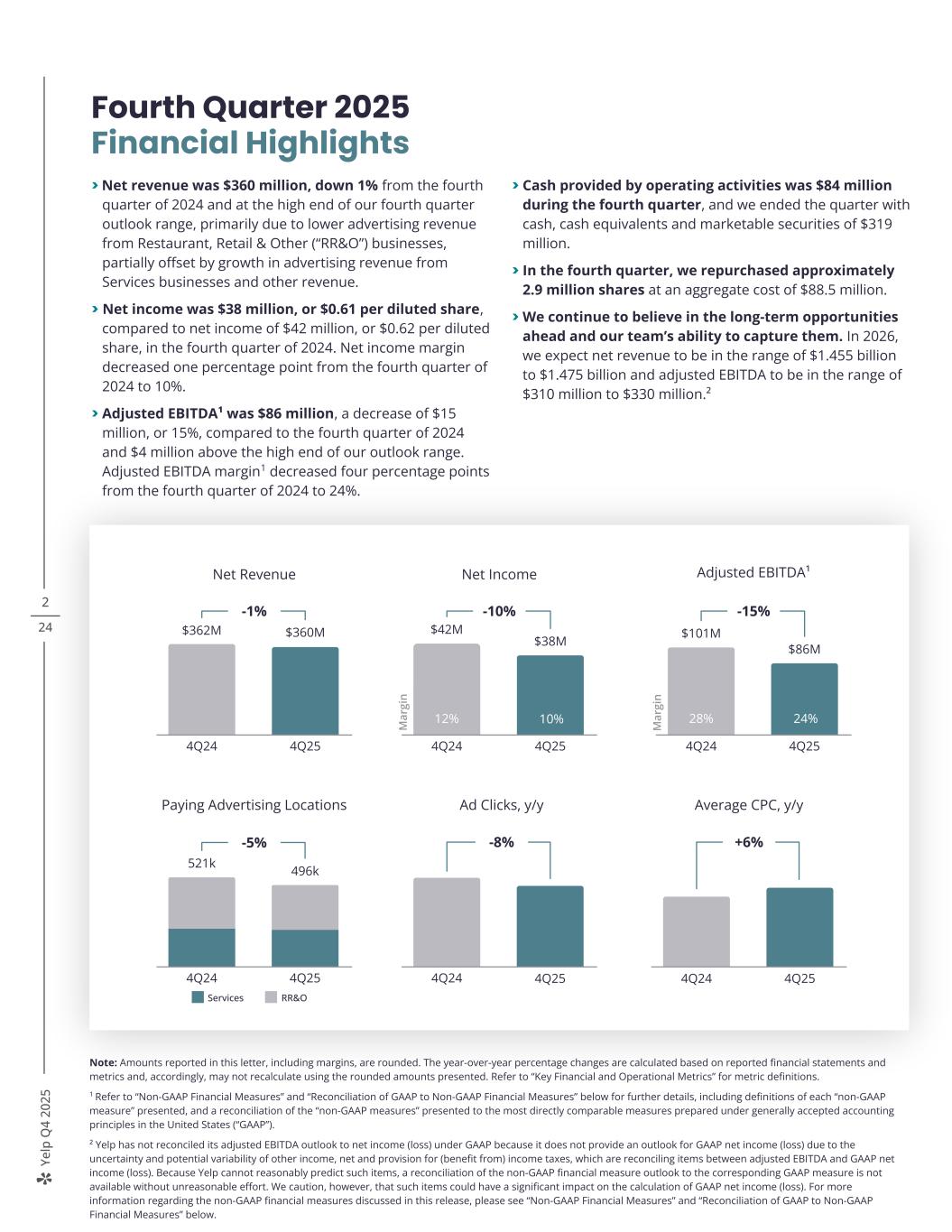

Ye lp Q 4 20 25 2 24 Note: Amounts reported in this letter, including margins, are rounded. The year-over-year percentage changes are calculated based on reported financial statements and metrics and, accordingly, may not recalculate using the rounded amounts presented. Refer to “Key Financial and Operational Metrics” for metric definitions. 1 Refer to “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below for further details, including definitions of each “non-GAAP measure” presented, and a reconciliation of the “non-GAAP measures” presented to the most directly comparable measures prepared under generally accepted accounting principles in the United States (“GAAP”). ² Yelp has not reconciled its adjusted EBITDA outlook to net income (loss) under GAAP because it does not provide an outlook for GAAP net income (loss) due to the uncertainty and potential variability of other income, net and provision for (benefit from) income taxes, which are reconciling items between adjusted EBITDA and GAAP net income (loss). Because Yelp cannot reasonably predict such items, a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure is not available without unreasonable effort. We caution, however, that such items could have a significant impact on the calculation of GAAP net income (loss). For more information regarding the non-GAAP financial measures discussed in this release, please see “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below. Fourth Quarter 2025 Financial Highlights > Net revenue was $360 million, down 1% from the fourth quarter of 2024 and at the high end of our fourth quarter outlook range, primarily due to lower advertising revenue from Restaurant, Retail & Other (“RR&O”) businesses, partially offset by growth in advertising revenue from Services businesses and other revenue. > Net income was $38 million, or $0.61 per diluted share, compared to net income of $42 million, or $0.62 per diluted share, in the fourth quarter of 2024. Net income margin decreased one percentage point from the fourth quarter of 2024 to 10%. > Adjusted EBITDA¹ was $86 million, a decrease of $15 million, or 15%, compared to the fourth quarter of 2024 and $4 million above the high end of our outlook range. Adjusted EBITDA margin1 decreased four percentage points from the fourth quarter of 2024 to 24%. > Cash provided by operating activities was $84 million during the fourth quarter, and we ended the quarter with cash, cash equivalents and marketable securities of $319 million. > In the fourth quarter, we repurchased approximately 2.9 million shares at an aggregate cost of $88.5 million. > We continue to believe in the long-term opportunities ahead and our team’s ability to capture them. In 2026, we expect net revenue to be in the range of $1.455 billion to $1.475 billion and adjusted EBITDA to be in the range of $310 million to $330 million.² 19% 17% Net Revenue -1% $362M $360M 4Q24 4Q25 Average CPC, y/y +6% 4Q24 4Q25 Paying Advertising Locations -5% 521k 496k 4Q24 4Q25 Services RR&O Adjusted EBITDA¹ -15% $101M $86M 4Q24 4Q25 M ar gi n 28% 24%8% 7% M ar gi n Net Income -10% $42M $38M 4Q24 4Q25 10%12% Ad Clicks, y/y -8% 4Q24 4Q25

Ye lp Q 4 20 25 3 24 Dear fellow shareholders, In 2025, Yelp delivered record net revenue and strong profitability, with Services continuing to drive our business performance amid a challenging environment for local businesses, particularly in RR&O categories. We introduced more than 55 new products and features, many powered by artificial intelligence (“AI”). Highlights include our expansion of Yelp Assistant’s capabilities across all categories and the introduction of new AI-powered voice experiences. As we look to 2026, we are accelerating Yelp’s AI transformation. We plan to expand our AI chatbot, Yelp Assistant, to make local discovery and task completion more seamless, deliver AI tools to help businesses grow and operate, and extend the reach of our trusted content to new data licensing partners. To accelerate this strategy, we recently signed an agreement with OpenAI and acquired Hatchify Inc. (“Hatch”), an AI lead management platform. We believe these investments in our strategy will position us to drive long-term sustainable growth and we remain committed to delivering value to our shareholders. +2 ppt 3% 4% 2Q22 2Q23 Net Income Margin

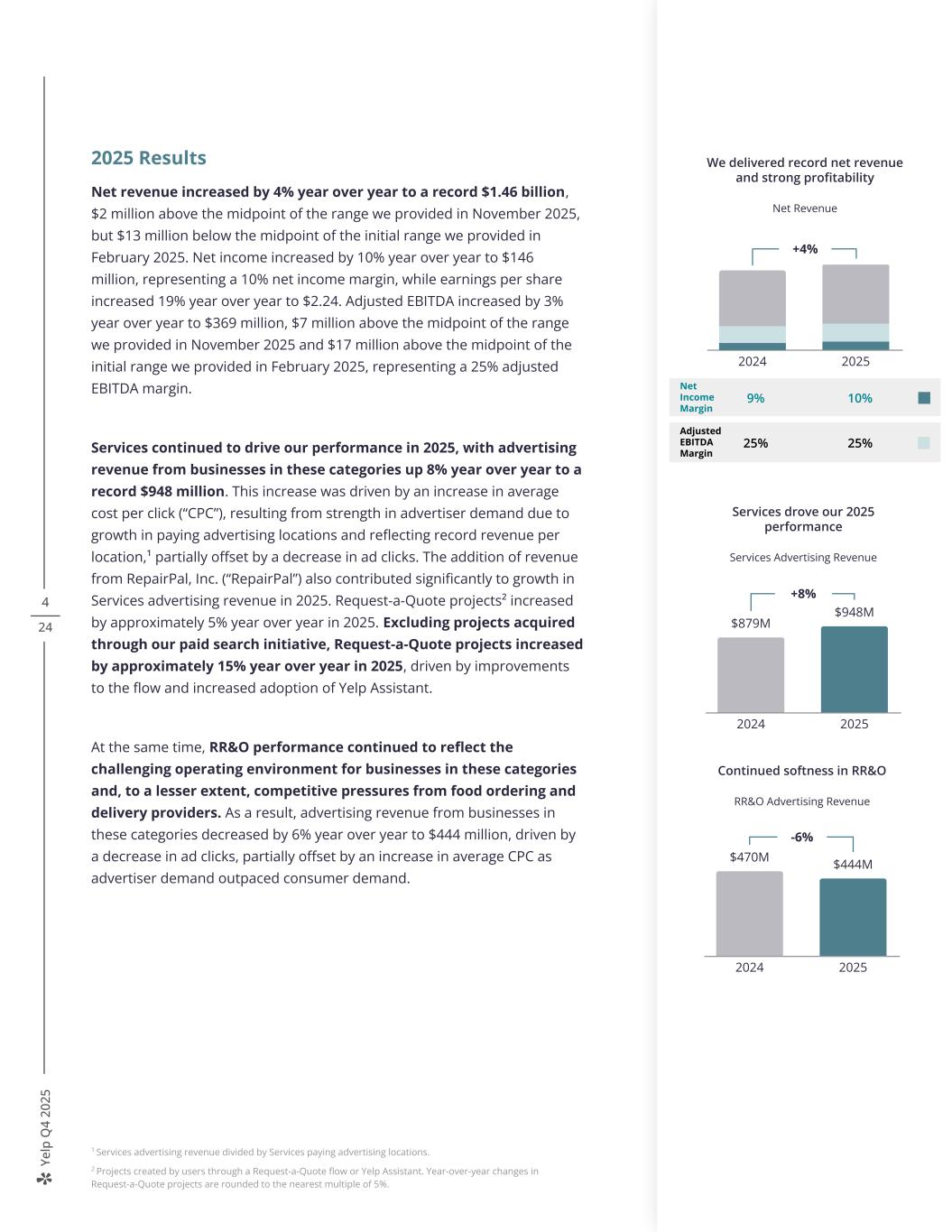

Ye lp Q 4 20 25 4 24 2025 Results Net revenue increased by 4% year over year to a record $1.46 billion, $2 million above the midpoint of the range we provided in November 2025, but $13 million below the midpoint of the initial range we provided in February 2025. Net income increased by 10% year over year to $146 million, representing a 10% net income margin, while earnings per share increased 19% year over year to $2.24. Adjusted EBITDA increased by 3% year over year to $369 million, $7 million above the midpoint of the range we provided in November 2025 and $17 million above the midpoint of the initial range we provided in February 2025, representing a 25% adjusted EBITDA margin. Services continued to drive our performance in 2025, with advertising revenue from businesses in these categories up 8% year over year to a record $948 million. This increase was driven by an increase in average cost per click (“CPC”), resulting from strength in advertiser demand due to growth in paying advertising locations and reflecting record revenue per location,¹ partially offset by a decrease in ad clicks. The addition of revenue from RepairPal, Inc. (“RepairPal”) also contributed significantly to growth in Services advertising revenue in 2025. Request-a-Quote projects² increased by approximately 5% year over year in 2025. Excluding projects acquired through our paid search initiative, Request-a-Quote projects increased by approximately 15% year over year in 2025, driven by improvements to the flow and increased adoption of Yelp Assistant. At the same time, RR&O performance continued to reflect the challenging operating environment for businesses in these categories and, to a lesser extent, competitive pressures from food ordering and delivery providers. As a result, advertising revenue from businesses in these categories decreased by 6% year over year to $444 million, driven by a decrease in ad clicks, partially offset by an increase in average CPC as advertiser demand outpaced consumer demand. 1 Services advertising revenue divided by Services paying advertising locations. 2 Projects created by users through a Request-a-Quote flow or Yelp Assistant. Year-over-year changes in Request-a-Quote projects are rounded to the nearest multiple of 5%. +8% $879M $948M 2024 2025 Services drove our 2025 performance Services Advertising Revenue -6% $470M $444M 2024 2025 Continued softness in RR&O RR&O Advertising Revenue 2024 2025 Net Income Margin 10%9% Adjusted EBITDA Margin 25%25% +4% We delivered record net revenue and strong profitability Net Revenue

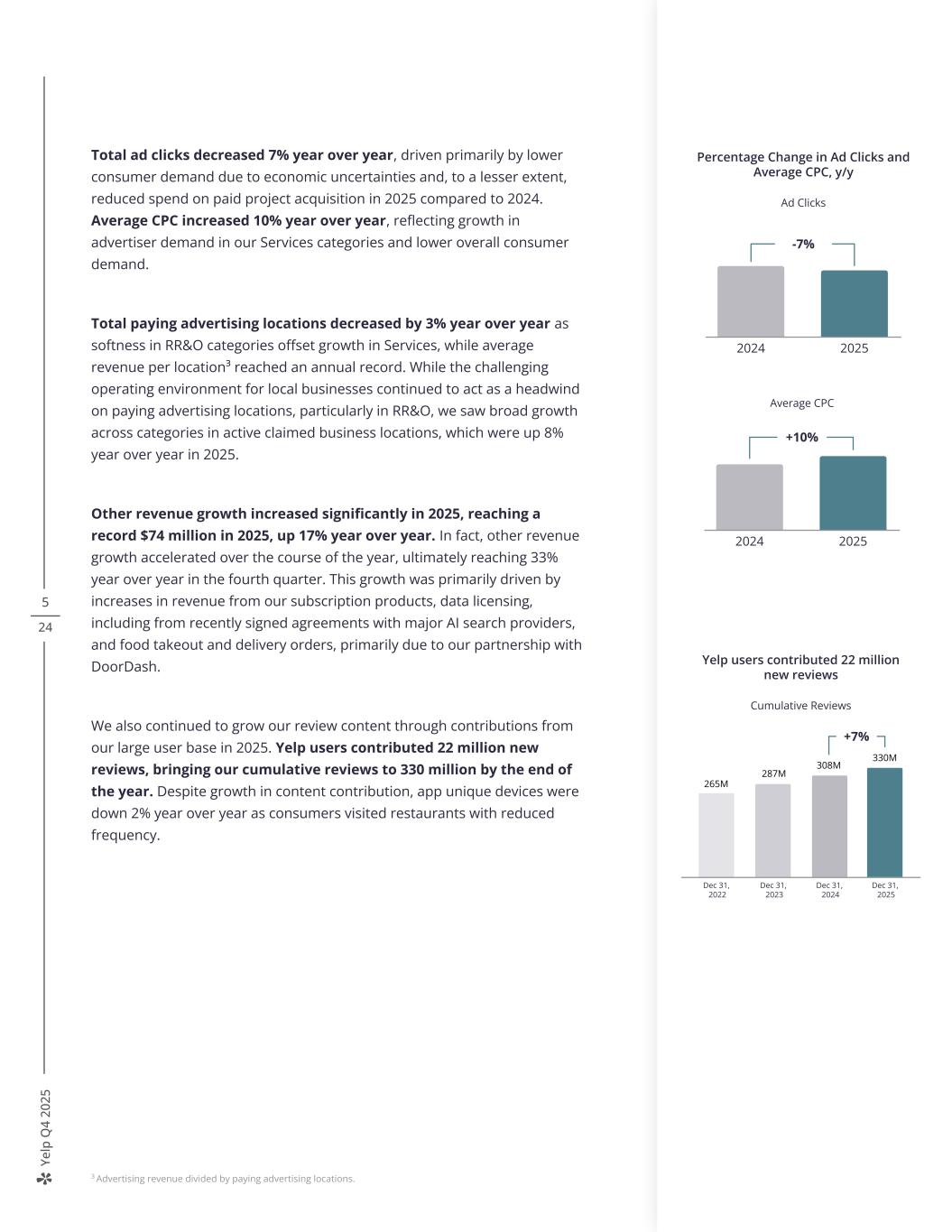

Ye lp Q 4 20 25 5 24 Total ad clicks decreased 7% year over year, driven primarily by lower consumer demand due to economic uncertainties and, to a lesser extent, reduced spend on paid project acquisition in 2025 compared to 2024. Average CPC increased 10% year over year, reflecting growth in advertiser demand in our Services categories and lower overall consumer demand. Total paying advertising locations decreased by 3% year over year as softness in RR&O categories offset growth in Services, while average revenue per location³ reached an annual record. While the challenging operating environment for local businesses continued to act as a headwind on paying advertising locations, particularly in RR&O, we saw broad growth across categories in active claimed business locations, which were up 8% year over year in 2025. Other revenue growth increased significantly in 2025, reaching a record $74 million in 2025, up 17% year over year. In fact, other revenue growth accelerated over the course of the year, ultimately reaching 33% year over year in the fourth quarter. This growth was primarily driven by increases in revenue from our subscription products, data licensing, including from recently signed agreements with major AI search providers, and food takeout and delivery orders, primarily due to our partnership with DoorDash. We also continued to grow our review content through contributions from our large user base in 2025. Yelp users contributed 22 million new reviews, bringing our cumulative reviews to 330 million by the end of the year. Despite growth in content contribution, app unique devices were down 2% year over year as consumers visited restaurants with reduced frequency. 3 Advertising revenue divided by paying advertising locations. $94 $112 330M Yelp users contributed 22 million new reviews Cumulative Reviews Dec 31, 2022 Dec 31, 2023 Dec 31, 2024 Dec 31, 2025 287M 308M 265M +7% Percentage Change in Ad Clicks and Average CPC, y/y Ad Clicks 5% 4Q24 1Q25 3Q25 4Q25 -8% -11% 2Q25 -7% 0% Average CPC 4Q24 1Q25 2Q25 3Q25 4Q25 6% 14% 11% -3% 9% -7% 2024 2025 Percentage Change in Ad Clicks and Average CPC, y/y Ad Clicks +10% 2024 2025 Average CPC

Ye lp Q 4 20 25 6 24 Initiatives to drive long-term, durable growth Our focus on Services and product innovation, with more than 200 new features and updates launched over the last five years, continued to drive our results in 2025. Looking ahead, we will continue to invest in delivering greater value to our advertisers. For example, we plan to drive incremental, high-quality leads to multi-location Services businesses through increased investment in paid search, leveraging insights gained from past initiatives. We are confident that Yelp’s advertising business is well positioned to deliver durable revenue over the long term. In 2026, we are also investing in our AI transformation across three strategic initiatives designed to drive long-term growth: > Reconceive Yelp around answers and actions > Deliver AI tools that help service pros and other local businesses grow, operate and succeed > Extend our reach to power local discovery across the AI ecosystem Through these strategic initiatives, we are transforming key parts of Yelp: the experience, the technology, and the value we provide to consumers and businesses. Our updated review submission flow enables users to post high-resolution videos AI-powered review topics suggest helpful items for contributors to cover when writing a review Depictions of Yelp's features are provided for illustrative purposes only, and may differ from the actual product. I was just blown away by people having these conversations with the AI. It's the voice, the inflection, the way Yelp Host can build on the information and extrapolate and can speak words you never typed into the backend. We've had guests walk up to us in the restaurant and compliment us on it. - John Garbiel, Owner, Metropolitan Diner

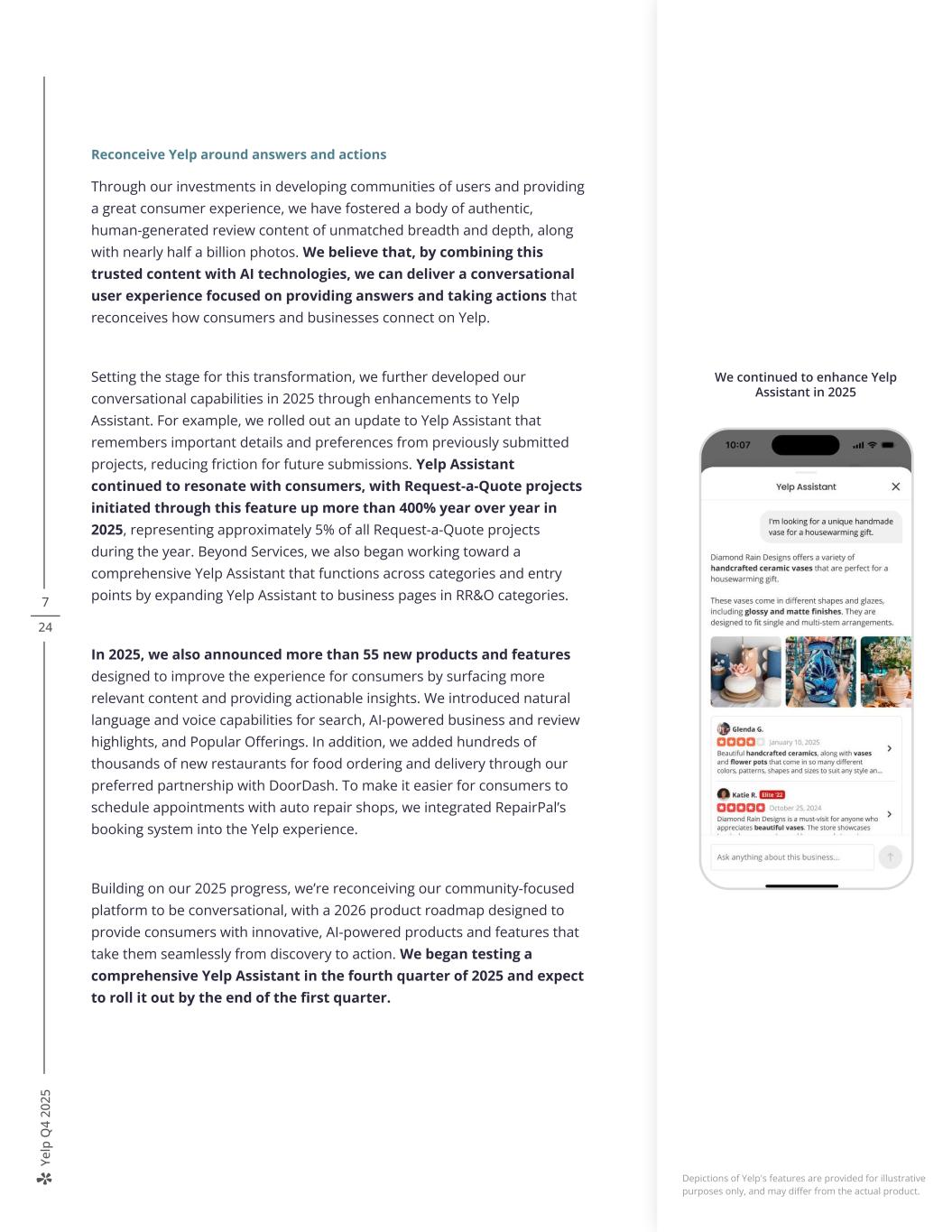

Ye lp Q 4 20 25 7 24 Reconceive Yelp around answers and actions Through our investments in developing communities of users and providing a great consumer experience, we have fostered a body of authentic, human-generated review content of unmatched breadth and depth, along with nearly half a billion photos. We believe that, by combining this trusted content with AI technologies, we can deliver a conversational user experience focused on providing answers and taking actions that reconceives how consumers and businesses connect on Yelp. Setting the stage for this transformation, we further developed our conversational capabilities in 2025 through enhancements to Yelp Assistant. For example, we rolled out an update to Yelp Assistant that remembers important details and preferences from previously submitted projects, reducing friction for future submissions. Yelp Assistant continued to resonate with consumers, with Request-a-Quote projects initiated through this feature up more than 400% year over year in 2025, representing approximately 5% of all Request-a-Quote projects during the year. Beyond Services, we also began working toward a comprehensive Yelp Assistant that functions across categories and entry points by expanding Yelp Assistant to business pages in RR&O categories. In 2025, we also announced more than 55 new products and features designed to improve the experience for consumers by surfacing more relevant content and providing actionable insights. We introduced natural language and voice capabilities for search, AI-powered business and review highlights, and Popular Offerings. In addition, we added hundreds of thousands of new restaurants for food ordering and delivery through our preferred partnership with DoorDash. To make it easier for consumers to schedule appointments with auto repair shops, we integrated RepairPal’s booking system into the Yelp experience. Building on our 2025 progress, we’re reconceiving our community-focused platform to be conversational, with a 2026 product roadmap designed to provide consumers with innovative, AI-powered products and features that take them seamlessly from discovery to action. We began testing a comprehensive Yelp Assistant in the fourth quarter of 2025 and expect to roll it out by the end of the first quarter. Depictions of Yelp's features are provided for illustrative purposes only, and may differ from the actual product. We continued to enhance Yelp Assistant in 2025

Ye lp Q 4 20 25 8 24 Deliver AI tools that help service pros and other local businesses grow, operate & succeed Our investments in business-focused products and advertising technology have helped us to attract and retain new customers. In 2025, we continued to make progress on delivering value to businesses, whether or not they are advertisers on Yelp. We plan to continue these efforts in 2026 with a focus on delivering AI-powered tools that help businesses operate more efficiently, particularly in Services categories. Since its roll out in the third quarter of 2025, our teams have continued to scale Yelp Host, our AI-powered call answering service offering for restaurants. Since launch, Yelp Host has answered more than 190,000 calls, handling thousands of reservations for restaurant customers per month. To build on this momentum, we expect to continue to roll out improvements and upgrades to Yelp Host in 2026, including functionality that will enable food orders over the phone. We see a significant market opportunity for Yelp Host. In 2025, we extended our Review Insights feature, which utilizes large language models to surface relevant topics and sentiment scores from reviews, to Services categories. We also began providing real-time AI-powered guidance to help service pros improve their replies to project requests, providing a pathway to improve their response quality badge. I was just blown away by people having these conversations with the AI. It's the voice, the inflection, the way Yelp Host can build on the information and extrapolate and can speak words you never typed into the backend. We've had guests walk up to us in the restaurant and compliment us on it. - John Gabriel, Owner, Metropolitan Diner

Ye lp Q 4 20 25 9 24 Looking ahead, we aim to build and acquire technology to manage the full customer lifecycle. We plan to offer a new generation of AI tools that go beyond advertising to help businesses capture demand, manage leads, support their customers, and operate with increased efficiency. In early February, we completed our acquisition of Hatch, a leading AI-powered lead management platform focused on Services businesses. The acquisition brings together Yelp’s scale and trusted brand with Hatch’s innovative lead management solutions for service pros, allowing them to drive bookings, qualify leads and better serve their customers, whether or not they advertise on Yelp. Hatch is a first mover with highly customizable and flexible AI agents that engage with customers across SMS, email and live calls to help increase efficiency and conversion rates. With Yelp’s go-to-market reach, we believe we can scale Hatch’s solutions more efficiently, increasing both upsell opportunities and cross-sell potential within high-value Services categories. With this acquisition, we have now shifted our focus in Services lead management from Yelp Receptionist to supporting Hatch. As of November 2025, Hatch had achieved approximately $25 million in annual recurring revenue (“ARR”),4 representing a year-over-year ARR growth rate of 70% at a modestly negative cash flow. We expect our acquisition of Hatch will deliver meaningful incremental growth in other revenue in 2026. Our efforts to provide AI tools that benefit businesses operationally represent an opportunity to diversify our business with new revenue streams. These new subscription tools create value beyond advertising, building a more diverse and resilient business while strengthening our relationships with service pros. We expect that, in addition to allocating internal resources toward these efforts, we will continue to pursue acquisition opportunities that accelerate this initiative to deliver more value to local businesses. 4 Calculated as recurring subscription amounts billed to customers in November 2025, less refunds and uncollectable amounts, multiplied by 12.

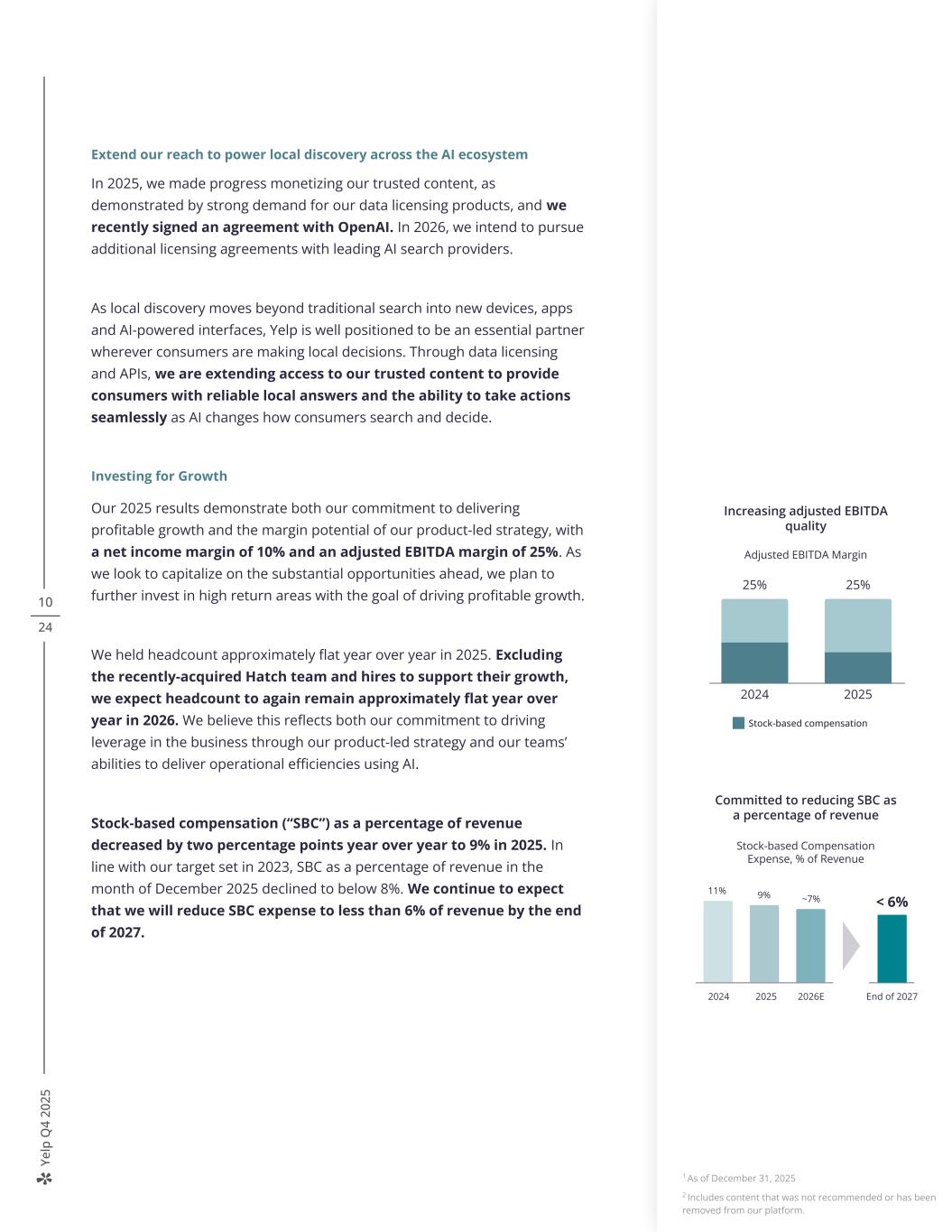

Ye lp Q 4 20 25 10 24 Extend our reach to power local discovery across the AI ecosystem In 2025, we made progress monetizing our trusted content, as demonstrated by strong demand for our data licensing products, and we recently signed an agreement with OpenAI. In 2026, we intend to pursue additional licensing agreements with leading AI search providers. As local discovery moves beyond traditional search into new devices, apps and AI-powered interfaces, Yelp is well positioned to be an essential partner wherever consumers are making local decisions. Through data licensing and APIs, we are extending access to our trusted content to provide consumers with reliable local answers and the ability to take actions seamlessly as AI changes how consumers search and decide. Investing for Growth Our 2025 results demonstrate both our commitment to delivering profitable growth and the margin potential of our product-led strategy, with a net income margin of 10% and an adjusted EBITDA margin of 25%. As we look to capitalize on the substantial opportunities ahead, we plan to further invest in high return areas with the goal of driving profitable growth. We held headcount approximately flat year over year in 2025. Excluding the recently-acquired Hatch team and hires to support their growth, we expect headcount to again remain approximately flat year over year in 2026. We believe this reflects both our commitment to driving leverage in the business through our product-led strategy and our teams’ abilities to deliver operational efficiencies using AI. Stock-based compensation (“SBC”) as a percentage of revenue decreased by two percentage points year over year to 9% in 2025. In line with our target set in 2023, SBC as a percentage of revenue in the month of December 2025 declined to below 8%. We continue to expect that we will reduce SBC expense to less than 6% of revenue by the end of 2027. LLM-powered Review Insights Enhanced user-generated videos in the home feed 2024 2025 Stock-based compensation 25% 25% Increasing adjusted EBITDA quality Adjusted EBITDA Margin 2026E End of 2027 Committed to reducing SBC as a percentage of revenue Stock-based Compensation Expense, % of Revenue 11% 9% 2024 2025 < 6%~7% 1 As of December 31, 2025 2 Includes content that was not recommended or has been removed from our platform.

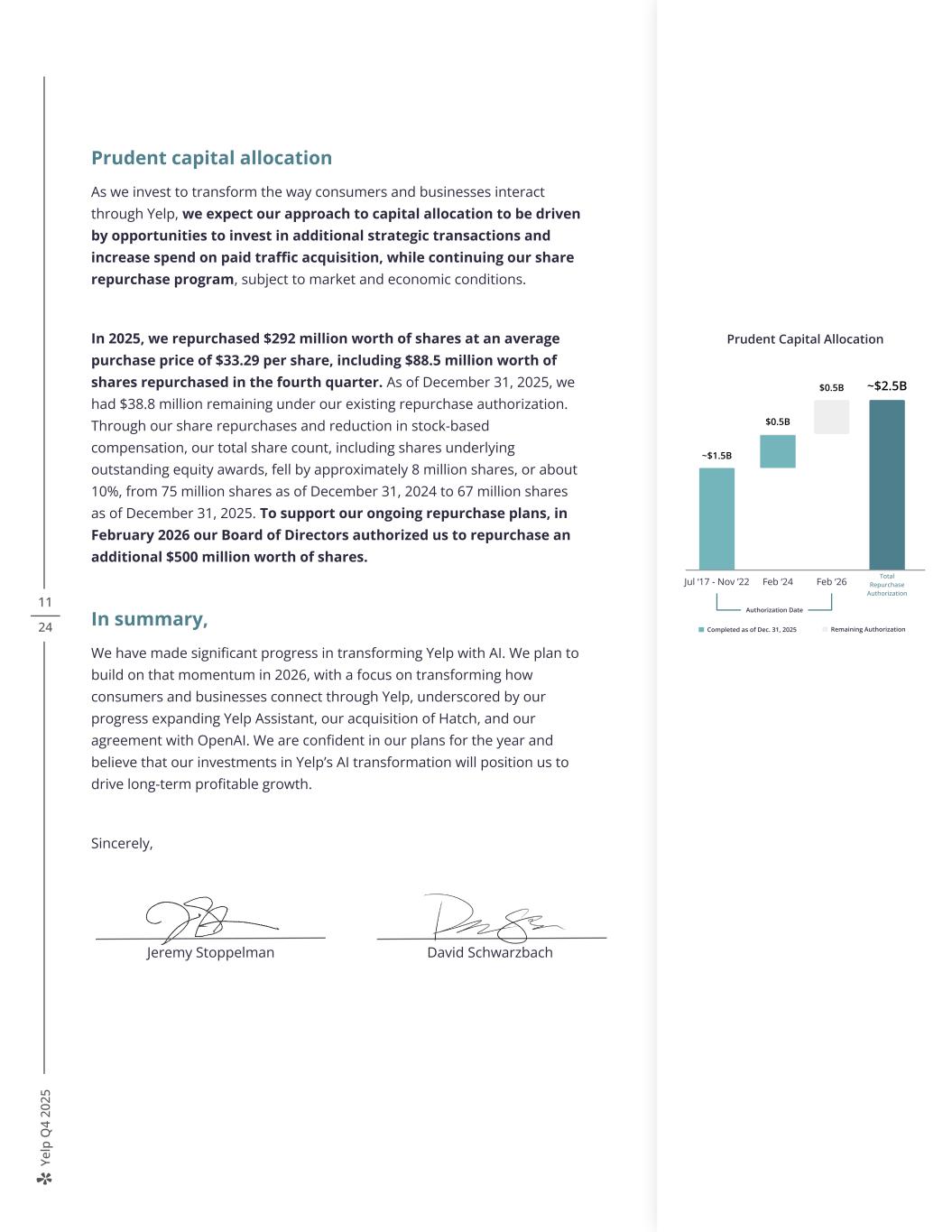

Ye lp Q 4 20 25 11 24 Prudent capital allocation As we invest to transform the way consumers and businesses interact through Yelp, we expect our approach to capital allocation to be driven by opportunities to invest in additional strategic transactions and increase spend on paid traffic acquisition, while continuing our share repurchase program, subject to market and economic conditions. In 2025, we repurchased $292 million worth of shares at an average purchase price of $33.29 per share, including $88.5 million worth of shares repurchased in the fourth quarter. As of December 31, 2025, we had $38.8 million remaining under our existing repurchase authorization. Through our share repurchases and reduction in stock-based compensation, our total share count, including shares underlying outstanding equity awards, fell by approximately 8 million shares, or about 10%, from 75 million shares as of December 31, 2024 to 67 million shares as of December 31, 2025. To support our ongoing repurchase plans, in February 2026 our Board of Directors authorized us to repurchase an additional $500 million worth of shares. In summary, We have made significant progress in transforming Yelp with AI. We plan to build on that momentum in 2026, with a focus on transforming how consumers and businesses connect through Yelp, underscored by our progress expanding Yelp Assistant, our acquisition of Hatch, and our agreement with OpenAI. We are confident in our plans for the year and believe that our investments in Yelp’s AI transformation will position us to drive long-term profitable growth. Sincerely, Total Repurchase Authorization Authorization Date Prudent Capital Allocation $2.0B Completed as of June 30, 2024 Remaining Authorization $200M $250M $250M $250M $250M $250M Nov ‘22Jul ‘17 Nov ‘18 Feb ‘19 Jan ‘20 Aug ‘21 Feb ‘24 $500M Jeremy Stoppelman David Schwarzbach Total Repurchase Authorization Jul ‘17 - Nov ’22 Feb ‘24 Feb ‘26 ~$2.5B$0.5B $0.5B ~$1.5B Prudent Capital Allocation Authorization Date Completed as of Dec. 31, 2025 Remaining Authorization

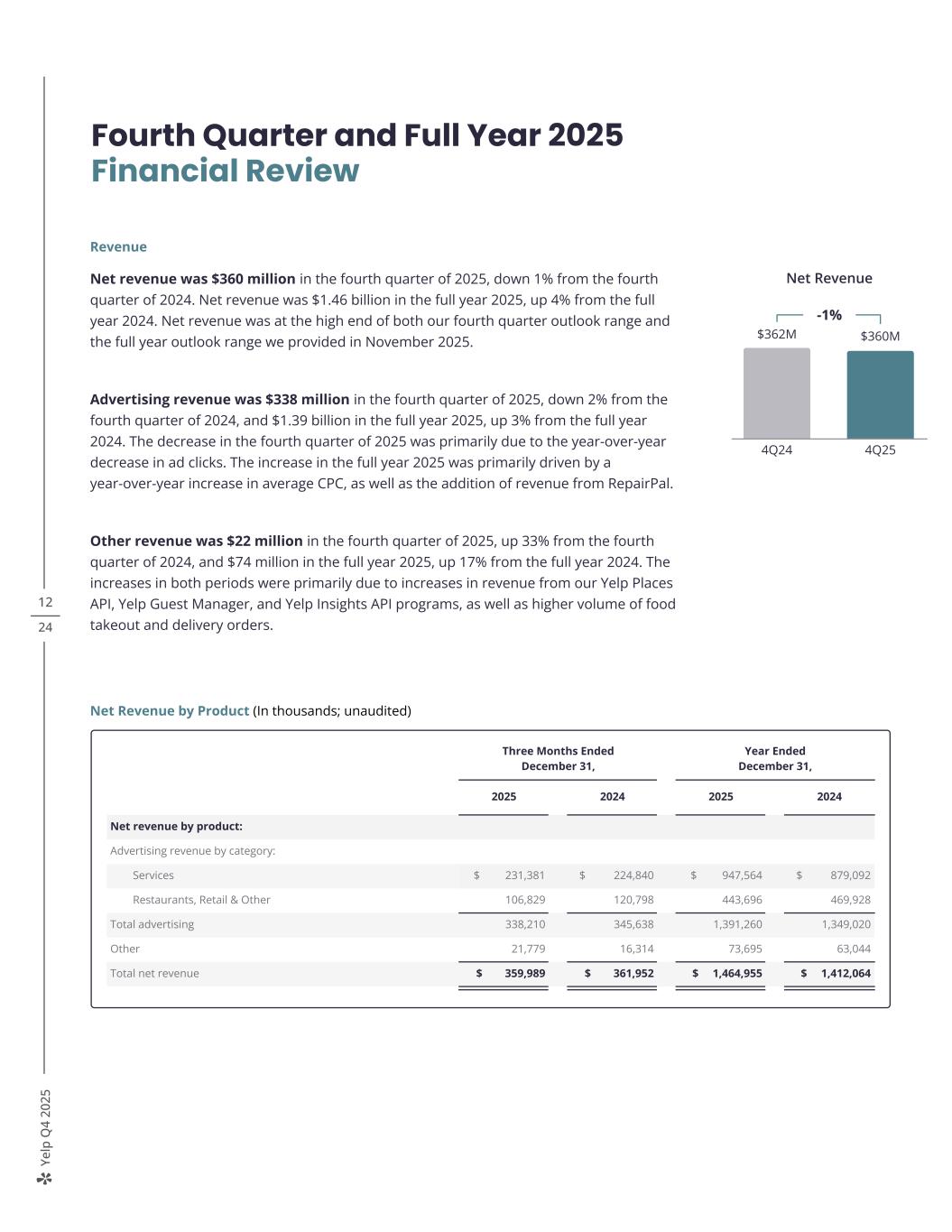

Ye lp Q 4 20 25 12 24 Revenue Net revenue was $360 million in the fourth quarter of 2025, down 1% from the fourth quarter of 2024. Net revenue was $1.46 billion in the full year 2025, up 4% from the full year 2024. Net revenue was at the high end of both our fourth quarter outlook range and the full year outlook range we provided in November 2025. Advertising revenue was $338 million in the fourth quarter of 2025, down 2% from the fourth quarter of 2024, and $1.39 billion in the full year 2025, up 3% from the full year 2024. The decrease in the fourth quarter of 2025 was primarily due to the year-over-year decrease in ad clicks. The increase in the full year 2025 was primarily driven by a year-over-year increase in average CPC, as well as the addition of revenue from RepairPal. Other revenue was $22 million in the fourth quarter of 2025, up 33% from the fourth quarter of 2024, and $74 million in the full year 2025, up 17% from the full year 2024. The increases in both periods were primarily due to increases in revenue from our Yelp Places API, Yelp Guest Manager, and Yelp Insights API programs, as well as higher volume of food takeout and delivery orders. Net Revenue by Product (In thousands; unaudited) Fourth Quarter and Full Year 2025 Financial Review Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Net revenue by product: Advertising revenue by category: Services $ 231,381 $ 224,840 $ 947,564 $ 879,092 Restaurants, Retail & Other 106,829 120,798 443,696 469,928 Total advertising 338,210 345,638 1,391,260 1,349,020 Other 21,779 16,314 73,695 63,044 Total net revenue $ 359,989 $ 361,952 $ 1,464,955 $ 1,412,064 Net Revenue -1% $362M $360M 4Q24 4Q25

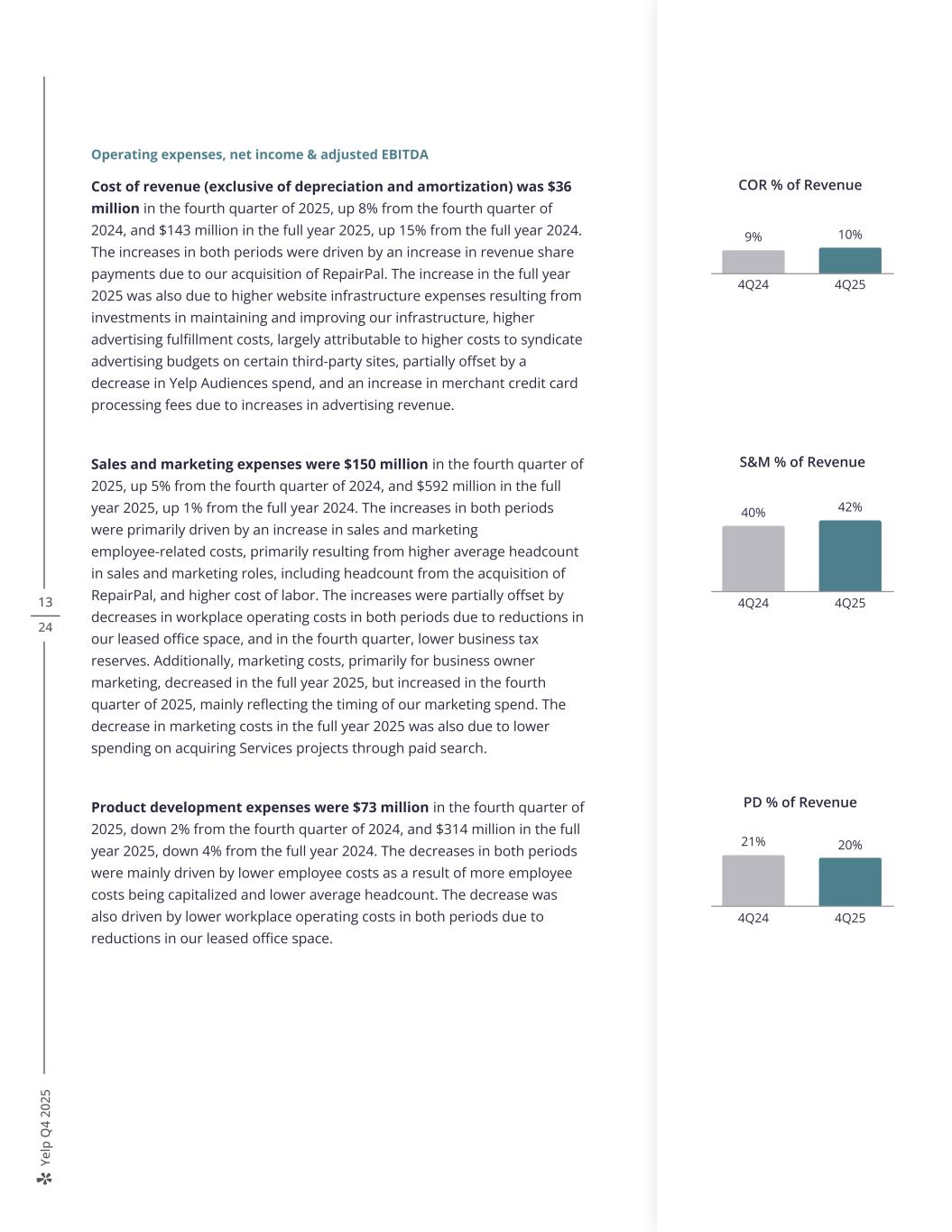

Ye lp Q 4 20 25 13 24 Operating expenses, net income & adjusted EBITDA Cost of revenue (exclusive of depreciation and amortization) was $36 million in the fourth quarter of 2025, up 8% from the fourth quarter of 2024, and $143 million in the full year 2025, up 15% from the full year 2024. The increases in both periods were driven by an increase in revenue share payments due to our acquisition of RepairPal. The increase in the full year 2025 was also due to higher website infrastructure expenses resulting from investments in maintaining and improving our infrastructure, higher advertising fulfillment costs, largely attributable to higher costs to syndicate advertising budgets on certain third-party sites, partially offset by a decrease in Yelp Audiences spend, and an increase in merchant credit card processing fees due to increases in advertising revenue. Sales and marketing expenses were $150 million in the fourth quarter of 2025, up 5% from the fourth quarter of 2024, and $592 million in the full year 2025, up 1% from the full year 2024. The increases in both periods were primarily driven by an increase in sales and marketing employee-related costs, primarily resulting from higher average headcount in sales and marketing roles, including headcount from the acquisition of RepairPal, and higher cost of labor. The increases were partially offset by decreases in workplace operating costs in both periods due to reductions in our leased office space, and in the fourth quarter, lower business tax reserves. Additionally, marketing costs, primarily for business owner marketing, decreased in the full year 2025, but increased in the fourth quarter of 2025, mainly reflecting the timing of our marketing spend. The decrease in marketing costs in the full year 2025 was also due to lower spending on acquiring Services projects through paid search. Product development expenses were $73 million in the fourth quarter of 2025, down 2% from the fourth quarter of 2024, and $314 million in the full year 2025, down 4% from the full year 2024. The decreases in both periods were mainly driven by lower employee costs as a result of more employee costs being capitalized and lower average headcount. The decrease was also driven by lower workplace operating costs in both periods due to reductions in our leased office space. COR % of Revenue 9% 10% 4Q24 4Q25 S&M % of Revenue 40% 42% 4Q24 4Q25 PD % of Revenue 21% 20% 4Q24 4Q25

Ye lp Q 4 20 25 14 24 General and administrative expenses were $38 million in the fourth quarter of 2025, down 15% from the fourth quarter of 2024, and $182 million in the full year 2025, down 2% from the full year 2024. The decreases in both periods were primarily driven by decreases in our provision for credit losses primarily due to lower customer delinquencies. The decrease in the fourth quarter of 2025 was also due to the release of a portion of the RepairPal holdback to indemnify us for certain expenses in prior periods; for the full year, the released holdback amount offset the associated expenses. The decrease in the full year 2025 was also due to impairment charges incurred in the prior-year period related to the right-of-use assets and leasehold improvements for office space that was subleased, partially offset by increases in employee-related costs primarily driven by higher cost of labor. Total costs and expenses were $311 million in the fourth quarter of 2025, up 1% from the fourth quarter of 2024, and $1.28 billion in the full year 2025, up 2% from the full year 2024. Other income, net was $3 million in the fourth quarter of 2025, down 59% from the fourth quarter of 2024, and $20 million in the full year 2025, down 39% from the full year 2024. The decreases in both periods were driven by lower tax incentives related to research and development (“R&D”) activity in the United Kingdom. The decrease in the full year 2025 was also due to lower interest income due to lower average cash, cash equivalents and marketable securities balances and lower federal interest rates, as well as the release of a reserve related to a one-time payroll tax credit. Provision for income taxes was $14 million in the fourth quarter of 2025, down 23% from the fourth quarter of 2024, and $58 million in the full year 2025, up 17% from the full year 2024. The decrease in the fourth quarter was primarily driven by lower profit before tax and a refundable California R&D credit election; the increase in the full year was primarily due to higher profit, greater tax impacts related to SBC vesting and exercises, and R&D credit changes from the One Big Beautiful Bill Act, partly offset by the California credit election. Net income was $38 million in the fourth quarter of 2025, down 10% from the fourth quarter of 2024, and $146 million in the full year 2025, up 10% from the full year 2024. Net income margin decreased one percentage point from the fourth quarter of 2024 to 10% in the fourth quarter of 2025, and increased one percentage point from the full year 2024 to 10% in the full year 2025. 19% 17% 19% 17% 8% 7% M ar gi n Net Income -10% $42M $38M 4Q24 4Q25 10%12% G&A % of Revenue 13% 11% 4Q24 4Q25

Ye lp Q 4 20 25 15 24 Diluted net income per share was $0.61 in the fourth quarter of 2025, down from $0.62 in the fourth quarter of 2024, reflecting the decrease in net income. Diluted net income per share was $2.24 in the full year 2025, up from $1.88 in the full year 2024, reflecting the decrease in weighted-average diluted shares outstanding and the increase in net income. Adjusted EBITDA was $86 million in the fourth quarter of 2025, a 15% decrease from the fourth quarter of 2024. Adjusted EBITDA margin decreased four percentage points from the fourth quarter of 2024 to 24%. Adjusted EBITDA was $369 million in the full year 2025, up 3% from the full year 2024. Adjusted EBITDA margin remained flat at 25% compared to the full year 2024. Balance sheet At the end of December 2025, we held $319 million in cash, cash equivalents and marketable securities on our condensed consolidated balance sheets, with no debt. 19% 17% 19% 17% Adjusted EBITDA -15% $101M $86M 4Q24 4Q25 M ar gi n 28% 24%

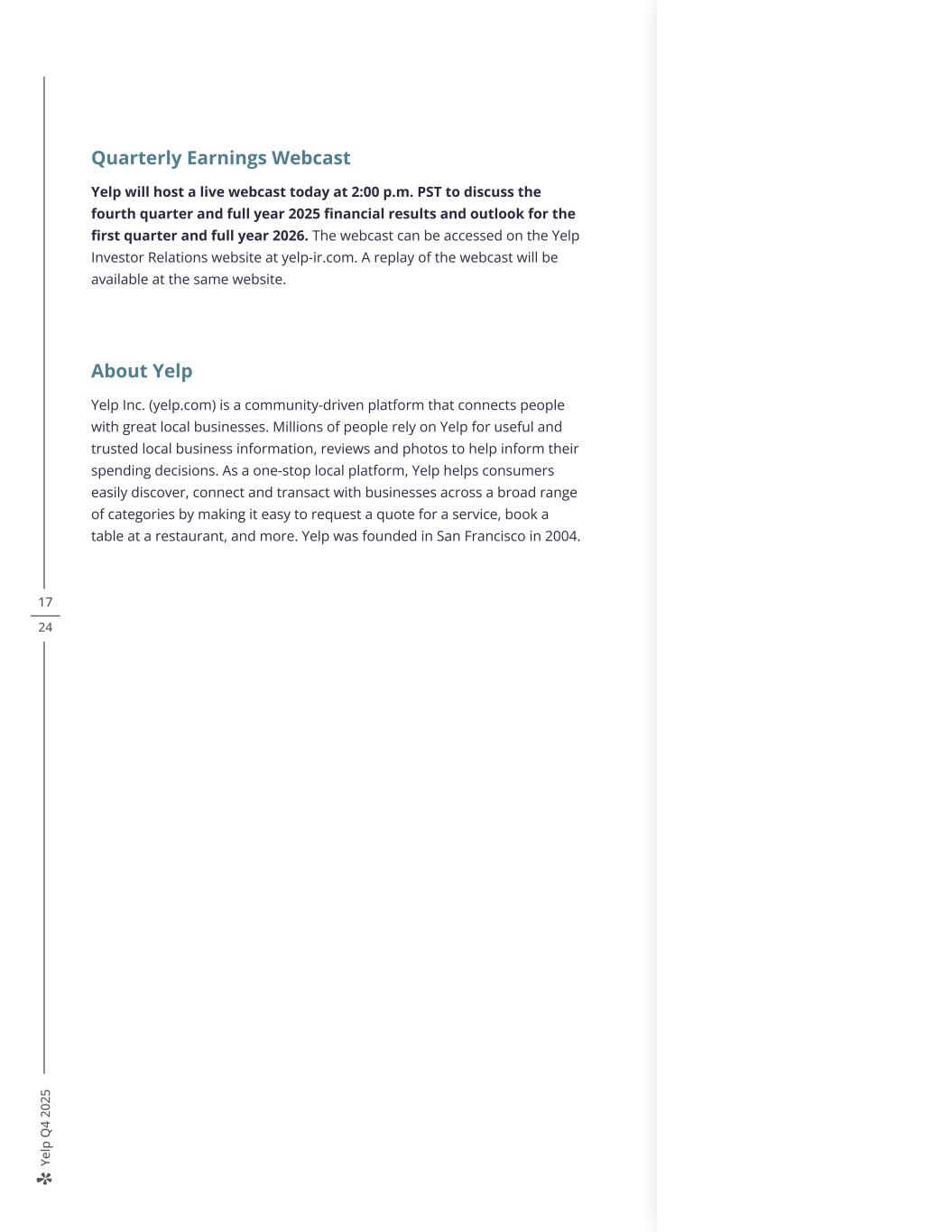

Ye lp Q 4 20 25 16 24 Business Outlook As we enter 2026, we see a significant opportunity to drive growth in other revenue through our AI transformation. We believe that Yelp is well positioned to deliver long-term durable growth by executing consistently against our strategic initiatives, and we plan to increase our investments in 2026 to capitalize on this opportunity. We expect many of the same trends that characterized 2025 to persist into 2026 and to continue negatively impacting advertising revenue. We anticipate that other revenue and Services advertising revenue will continue to drive our business performance, while RR&O advertising revenue will remain pressured. As a result, for the first quarter of 2026, we expect net revenue will be in the range of $350 million to $355 million. For the full year, we expect net revenue will be in the range of $1.455 billion to $1.475 billion. We anticipate expenses will increase seasonally from the fourth quarter of 2025 to the first quarter of 2026, primarily driven by payroll taxes and benefits. As a result, we expect first quarter adjusted EBITDA will be in the range of $58 million to $63 million. For the full year, we expect expenses to increase, driven primarily by investments in our AI transformation and the integration of Hatch. As a result, we expect adjusted EBITDA for the full year to be in the range of $310 million to $330 million. For both the first quarter and full year, our expected adjusted EBITDA ranges exclude accrued acquisition and integration-related payments for continuing Hatch employees of approximately $2 million and $13 million, respectively, which we do not believe are indicative of our ongoing operating performance. We estimate that our effective GAAP tax rate (before discrete items) for 2026 will be in the range of 22% to 26%. However, our GAAP tax rate is impacted by a number of factors that are not in our direct control and that are subject to quarterly variability, which limits our visibility into the applicable rate for future fiscal periods. $369M Adjusted EBITDA Outlook 2025 2026E $310M-$330M * Yelp has not reconciled its adjusted EBITDA outlook to Net income (loss) under GAAP because it does not provide an outlook for GAAP Net income (loss) due to the uncertainty and potential variability of Other income, net and Provision for (benefit from) income taxes, which are reconciling items between adjusted EBITDA and GAAP Net income (loss). Because Yelp cannot reasonably predict such items, a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure is not available without unreasonable effort. We caution, however, that such items could have a significant impact on the calculation of GAAP Net income (loss). For more information regarding the non-GAAP financial measures discussed in this release, please see “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below. 2025 2026E $1.465B $1.455B-$1.475B Net Revenue Outlook First Quarter 2026 Full Year 2026 Net revenue $350M to $355M $1.455B to $1.475B Adjusted EBITDA* $58M to $63M $310M to $330M Stock-based compensation expense as a % of Net revenue ~8% ~7% Depreciation and amortization as a % of Net revenue ~4% ~4%

Ye lp Q 4 20 25 17 24 Quarterly Earnings Webcast Yelp will host a live webcast today at 2:00 p.m. PST to discuss the fourth quarter and full year 2025 financial results and outlook for the first quarter and full year 2026. The webcast can be accessed on the Yelp Investor Relations website at yelp-ir.com. A replay of the webcast will be available at the same website. About Yelp Yelp Inc. (yelp.com) is a community-driven platform that connects people with great local businesses. Millions of people rely on Yelp for useful and trusted local business information, reviews and photos to help inform their spending decisions. As a one-stop local platform, Yelp helps consumers easily discover, connect and transact with businesses across a broad range of categories by making it easy to request a quote for a service, book a table at a restaurant, and more. Yelp was founded in San Francisco in 2004.

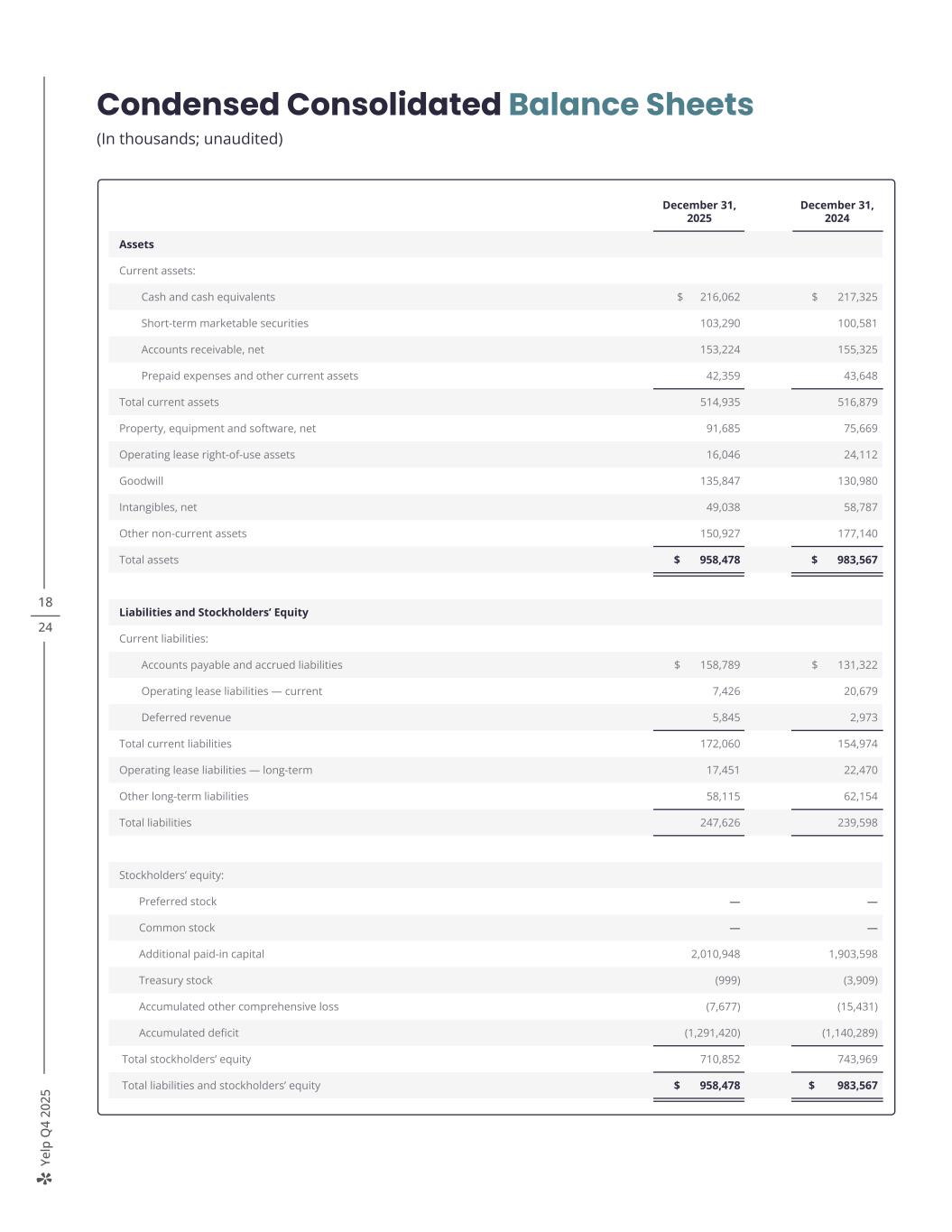

Ye lp Q 4 20 25 18 24 Condensed Consolidated Balance Sheets (In thousands; unaudited) December 31, 2025 December 31, 2024 Assets Current assets: Cash and cash equivalents $ 216,062 $ 217,325 Short-term marketable securities 103,290 100,581 Accounts receivable, net 153,224 155,325 Prepaid expenses and other current assets 42,359 43,648 Total current assets 514,935 516,879 Property, equipment and software, net 91,685 75,669 Operating lease right-of-use assets 16,046 24,112 Goodwill 135,847 130,980 Intangibles, net 49,038 58,787 Other non-current assets 150,927 177,140 Total assets $ 958,478 $ 983,567 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable and accrued liabilities $ 158,789 $ 131,322 Operating lease liabilities — current 7,426 20,679 Deferred revenue 5,845 2,973 Total current liabilities 172,060 154,974 Operating lease liabilities — long-term 17,451 22,470 Other long-term liabilities 58,115 62,154 Total liabilities 247,626 239,598 Stockholders’ equity: Preferred stock — — Common stock — — Additional paid-in capital 2,010,948 1,903,598 Treasury stock (999) (3,909) Accumulated other comprehensive loss (7,677) (15,431) Accumulated deficit (1,291,420) (1,140,289) Total stockholders’ equity 710,852 743,969 Total liabilities and stockholders’ equity $ 958,478 $ 983,567

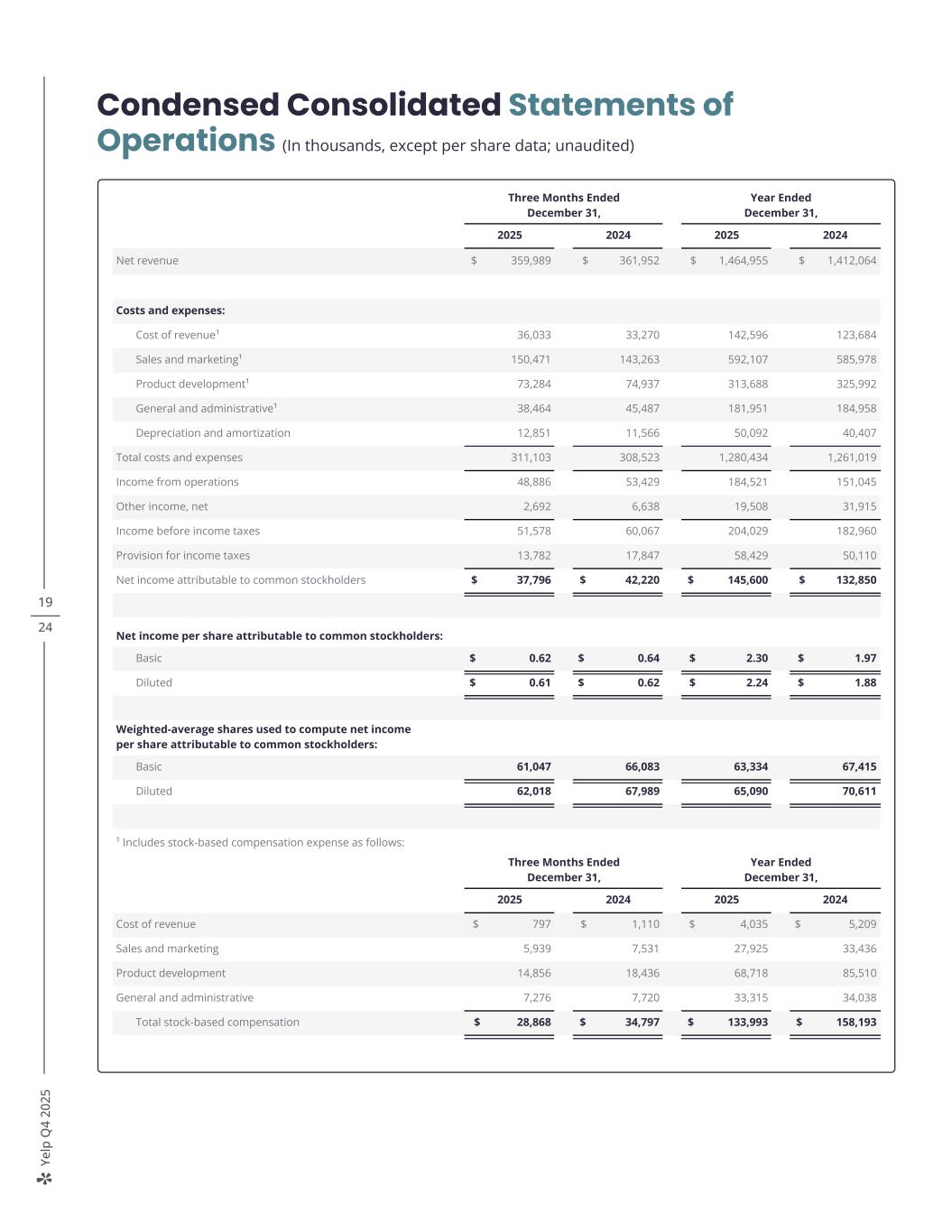

Ye lp Q 4 20 25 19 24 Condensed Consolidated Statements of Operations (In thousands, except per share data; unaudited) Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Net revenue $ 359,989 $ 361,952 $ 1,464,955 $ 1,412,064 Costs and expenses: Cost of revenue¹ 36,033 33,270 142,596 123,684 Sales and marketing¹ 150,471 143,263 592,107 585,978 Product development¹ 73,284 74,937 313,688 325,992 General and administrative¹ 38,464 45,487 181,951 184,958 Depreciation and amortization 12,851 11,566 50,092 40,407 Total costs and expenses 311,103 308,523 1,280,434 1,261,019 Income from operations 48,886 53,429 184,521 151,045 Other income, net 2,692 6,638 19,508 31,915 Income before income taxes 51,578 60,067 204,029 182,960 Provision for income taxes 13,782 17,847 58,429 50,110 Net income attributable to common stockholders $ 37,796 $ 42,220 $ 145,600 $ 132,850 Net income per share attributable to common stockholders: Basic $ 0.62 $ 0.64 $ 2.30 $ 1.97 Diluted $ 0.61 $ 0.62 $ 2.24 $ 1.88 Weighted-average shares used to compute net income per share attributable to common stockholders: Basic 61,047 66,083 63,334 67,415 Diluted 62,018 67,989 65,090 70,611 ¹ Includes stock-based compensation expense as follows: Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Cost of revenue $ 797 $ 1,110 $ 4,035 $ 5,209 Sales and marketing 5,939 7,531 27,925 33,436 Product development 14,856 18,436 68,718 85,510 General and administrative 7,276 7,720 33,315 34,038 Total stock-based compensation $ 28,868 $ 34,797 $ 133,993 $ 158,193

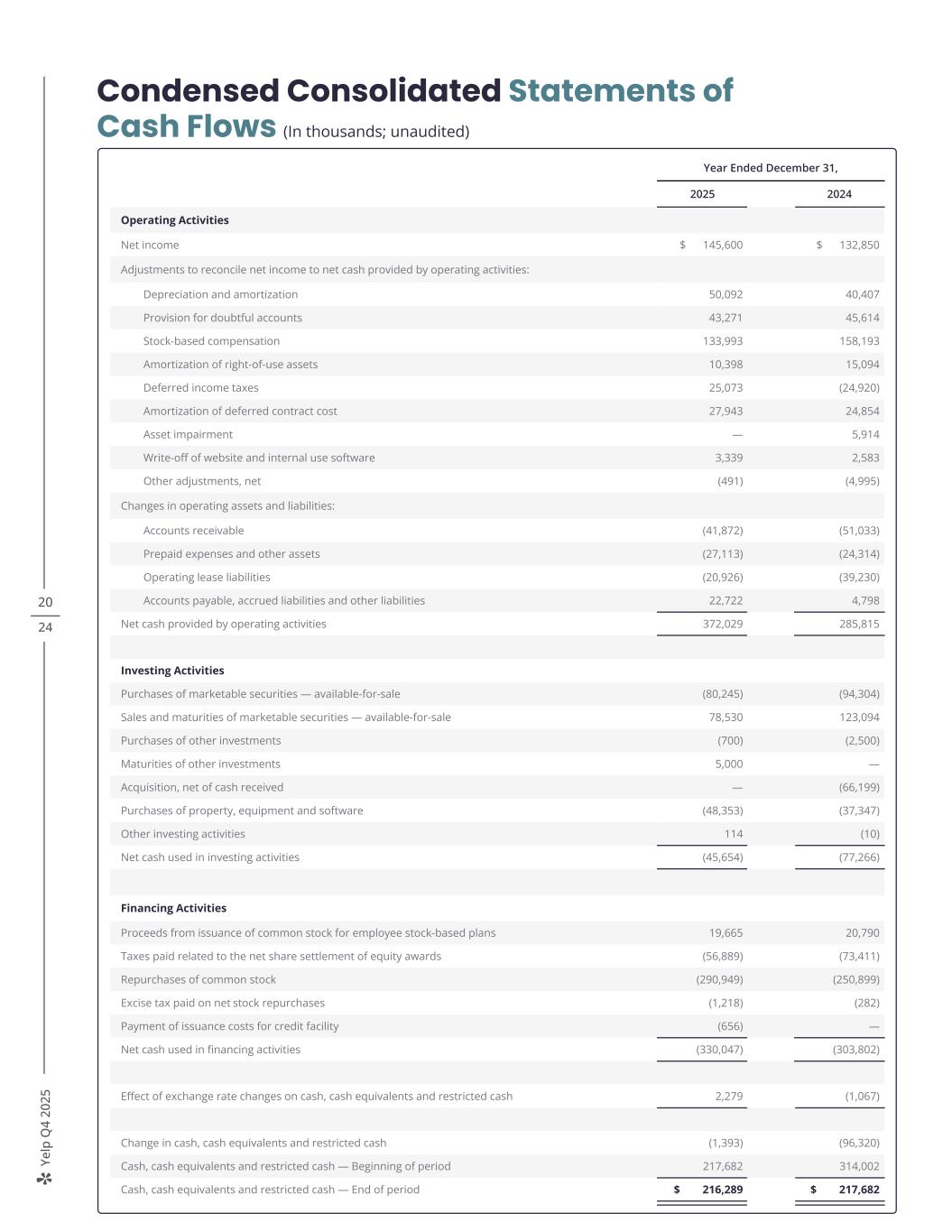

Ye lp Q 4 20 25 20 24 Condensed Consolidated Statements of Cash Flows (In thousands; unaudited) Year Ended December 31, 2025 2024 Operating Activities Net income $ 145,600 $ 132,850 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 50,092 40,407 Provision for doubtful accounts 43,271 45,614 Stock-based compensation 133,993 158,193 Amortization of right-of-use assets 10,398 15,094 Deferred income taxes 25,073 (24,920) Amortization of deferred contract cost 27,943 24,854 Asset impairment — 5,914 Write-off of website and internal use software 3,339 2,583 Other adjustments, net (491) (4,995) Changes in operating assets and liabilities: Accounts receivable (41,872) (51,033) Prepaid expenses and other assets (27,113) (24,314) Operating lease liabilities (20,926) (39,230) Accounts payable, accrued liabilities and other liabilities 22,722 4,798 Net cash provided by operating activities 372,029 285,815 Investing Activities Purchases of marketable securities — available-for-sale (80,245) (94,304) Sales and maturities of marketable securities — available-for-sale 78,530 123,094 Purchases of other investments (700) (2,500) Maturities of other investments 5,000 — Acquisition, net of cash received — (66,199) Purchases of property, equipment and software (48,353) (37,347) Other investing activities 114 (10) Net cash used in investing activities (45,654) (77,266) Financing Activities Proceeds from issuance of common stock for employee stock-based plans 19,665 20,790 Taxes paid related to the net share settlement of equity awards (56,889) (73,411) Repurchases of common stock (290,949) (250,899) Excise tax paid on net stock repurchases (1,218) (282) Payment of issuance costs for credit facility (656) — Net cash used in financing activities (330,047) (303,802) Effect of exchange rate changes on cash, cash equivalents and restricted cash 2,279 (1,067) Change in cash, cash equivalents and restricted cash (1,393) (96,320) Cash, cash equivalents and restricted cash — Beginning of period 217,682 314,002 Cash, cash equivalents and restricted cash — End of period $ 216,289 $ 217,682

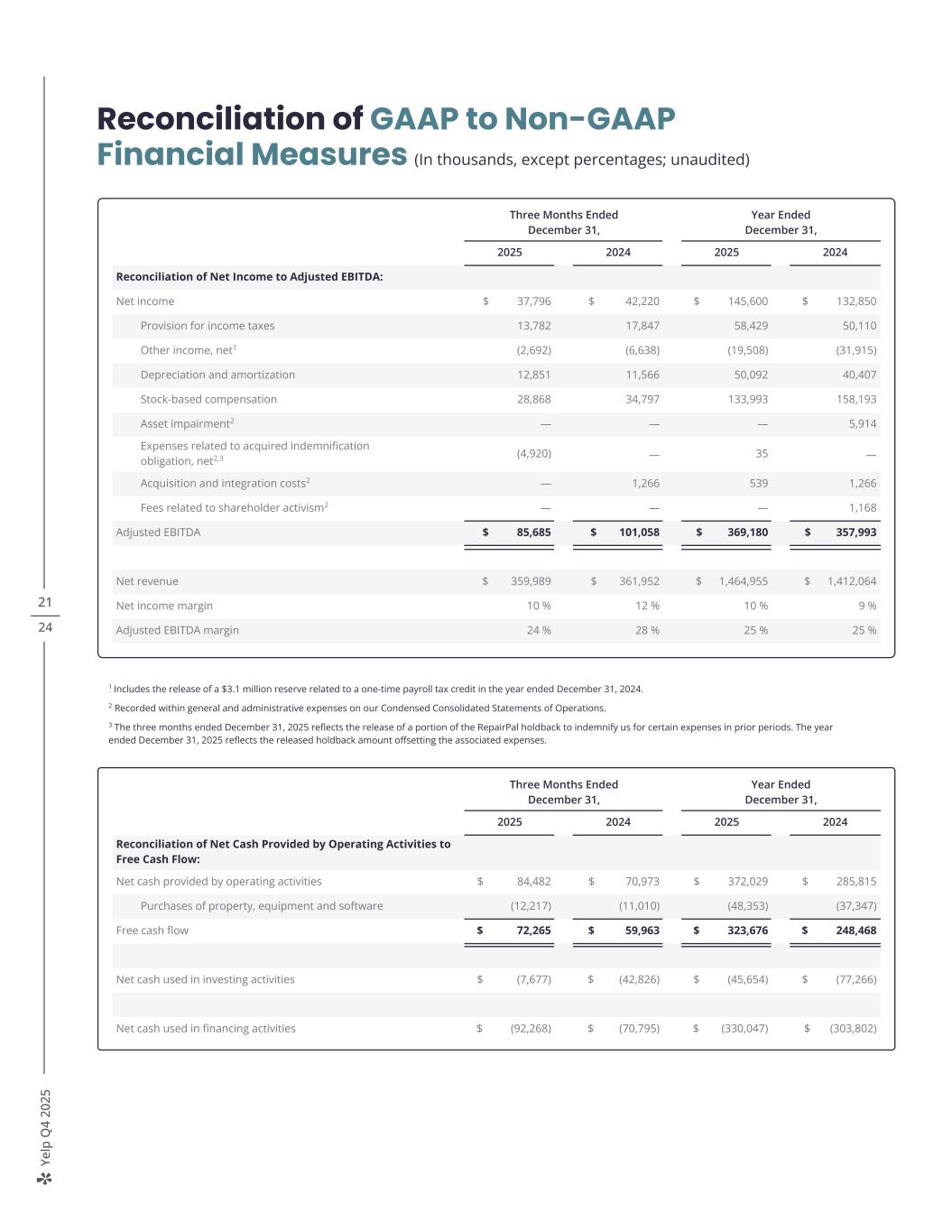

Ye lp Q 4 20 25 21 24 Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, except percentages; unaudited) 1 Includes the release of a $3.1 million reserve related to a one-time payroll tax credit in the year ended December 31, 2024. 2 Recorded within general and administrative expenses on our Condensed Consolidated Statements of Operations. 3 The three months ended December 31, 2025 reflects the release of a portion of the RepairPal holdback to indemnify us for certain expenses in prior periods. The year ended December 31, 2025 reflects the released holdback amount offsetting the associated expenses. Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Reconciliation of Net Income to Adjusted EBITDA: Net income $ 37,796 $ 42,220 $ 145,600 $ 132,850 Provision for income taxes 13,782 17,847 58,429 50,110 Other income, net1 (2,692) (6,638) (19,508) (31,915) Depreciation and amortization 12,851 11,566 50,092 40,407 Stock-based compensation 28,868 34,797 133,993 158,193 Asset impairment2 — — — 5,914 Expenses related to acquired indemnification obligation, net2,3 (4,920) — 35 — Acquisition and integration costs2 — 1,266 539 1,266 Fees related to shareholder activism2 — — — 1,168 Adjusted EBITDA $ 85,685 $ 101,058 $ 369,180 $ 357,993 Net revenue $ 359,989 $ 361,952 $ 1,464,955 $ 1,412,064 Net income margin 10 % 12 % 10 % 9 % Adjusted EBITDA margin 24 % 28 % 25 % 25 % Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Net cash provided by operating activities $ 84,482 $ 70,973 $ 372,029 $ 285,815 Purchases of property, equipment and software (12,217) (11,010) (48,353) (37,347) Free cash flow $ 72,265 $ 59,963 $ 323,676 $ 248,468 Net cash used in investing activities $ (7,677) $ (42,826) $ (45,654) $ (77,266) Net cash used in financing activities $ (92,268) $ (70,795) $ (330,047) $ (303,802)

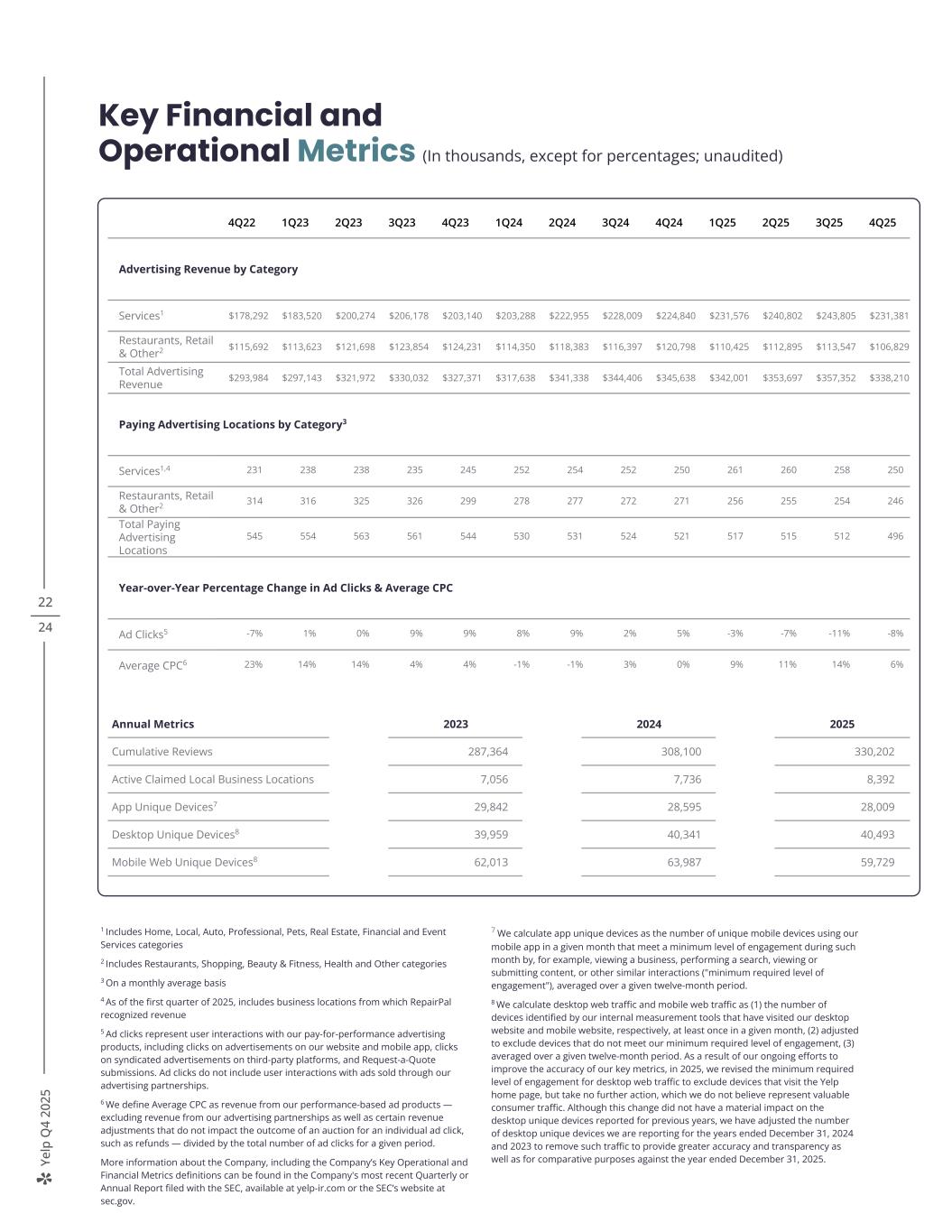

Ye lp Q 4 20 25 22 24 Key Financial and Operational Metrics (In thousands, except for percentages; unaudited) 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Advertising Revenue by Category Services1 $178,292 $183,520 $200,274 $206,178 $203,140 $203,288 $222,955 $228,009 $224,840 $231,576 $240,802 $243,805 $231,381 Restaurants, Retail & Other2 $115,692 $113,623 $121,698 $123,854 $124,231 $114,350 $118,383 $116,397 $120,798 $110,425 $112,895 $113,547 $106,829 Total Advertising Revenue $293,984 $297,143 $321,972 $330,032 $327,371 $317,638 $341,338 $344,406 $345,638 $342,001 $353,697 $357,352 $338,210 Paying Advertising Locations by Category3 Services1,4 231 238 238 235 245 252 254 252 250 261 260 258 250 Restaurants, Retail & Other2 314 316 325 326 299 278 277 272 271 256 255 254 246 Total Paying Advertising Locations 545 554 563 561 544 530 531 524 521 517 515 512 496 Year-over-Year Percentage Change in Ad Clicks & Average CPC Ad Clicks5 -7% 1% 0% 9% 9% 8% 9% 2% 5% -3% -7% -11% -8% Average CPC6 23% 14% 14% 4% 4% -1% -1% 3% 0% 9% 11% 14% 6% 1 Includes Home, Local, Auto, Professional, Pets, Real Estate, Financial and Event Services categories 2 Includes Restaurants, Shopping, Beauty & Fitness, Health and Other categories 3 On a monthly average basis 4 As of the first quarter of 2025, includes business locations from which RepairPal recognized revenue 5 Ad clicks represent user interactions with our pay-for-performance advertising products, including clicks on advertisements on our website and mobile app, clicks on syndicated advertisements on third-party platforms, and Request-a-Quote submissions. Ad clicks do not include user interactions with ads sold through our advertising partnerships. 6 We define Average CPC as revenue from our performance-based ad products — excluding revenue from our advertising partnerships as well as certain revenue adjustments that do not impact the outcome of an auction for an individual ad click, such as refunds — divided by the total number of ad clicks for a given period. More information about the Company, including the Company’s Key Operational and Financial Metrics definitions can be found in the Company's most recent Quarterly or Annual Report filed with the SEC, available at yelp-ir.com or the SEC’s website at sec.gov. 7 We calculate app unique devices as the number of unique mobile devices using our mobile app in a given month that meet a minimum level of engagement during such month by, for example, viewing a business, performing a search, viewing or submitting content, or other similar interactions ("minimum required level of engagement"), averaged over a given twelve-month period. 8 We calculate desktop web traffic and mobile web traffic as (1) the number of devices identified by our internal measurement tools that have visited our desktop website and mobile website, respectively, at least once in a given month, (2) adjusted to exclude devices that do not meet our minimum required level of engagement, (3) averaged over a given twelve-month period. As a result of our ongoing efforts to improve the accuracy of our key metrics, in 2025, we revised the minimum required level of engagement for desktop web traffic to exclude devices that visit the Yelp home page, but take no further action, which we do not believe represent valuable consumer traffic. Although this change did not have a material impact on the desktop unique devices reported for previous years, we have adjusted the number of desktop unique devices we are reporting for the years ended December 31, 2024 and 2023 to remove such traffic to provide greater accuracy and transparency as well as for comparative purposes against the year ended December 31, 2025. Annual Metrics 2023 2024 2025 Cumulative Reviews 287,364 308,100 330,202 Active Claimed Local Business Locations 7,056 7,736 8,392 App Unique Devices7 29,842 28,595 28,009 Desktop Unique Devices8 39,959 40,341 40,493 Mobile Web Unique Devices8 62,013 63,987 59,729

Ye lp Q 4 20 25 Non-GAAP Financial Measures This letter and statements made during the above referenced webcast may include information relating to Adjusted EBITDA, Adjusted EBITDA margin and Free cash flow, each of which is a “non-GAAP financial measure.” We define Adjusted EBITDA as net income (loss), adjusted to exclude: provision for (benefit from) income taxes; other income, net; depreciation and amortization; stock-based compensation expense; and, in certain periods, certain other income and expense items, such as asset impairment charges, expenses related to acquired indemnification obligation, acquisition and integration costs, fees related to shareholder activism and other items that we deem not to be indicative of our ongoing operating performance. We define Adjusted EBITDA margin as Adjusted EBITDA divided by net revenue. We define Free cash flow as cash flow from operating activities, less cash used for purchases of property, equipment and software. Adjusted EBITDA and Free cash flow, which are not prepared under any comprehensive set of accounting rules or principles, have limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of Yelp’s financial results as reported in accordance with GAAP. In particular, Adjusted EBITDA and Free cash flow should not be viewed as substitutes for, or superior to, net income (loss) or net cash provided by (used in) operating activities prepared in accordance with GAAP as measures of profitability or liquidity. Some of these limitations are: > although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect all cash capital expenditure requirements for such replacements or for new capital expenditure requirements; > Adjusted EBITDA does not reflect changes in, or cash requirements for, Yelp’s working capital needs; > Adjusted EBITDA does not reflect the impact of the recording or release of valuation allowances or tax payments that may represent a reduction in cash available to Yelp; > Adjusted EBITDA does not consider the potentially dilutive impact of equity-based compensation; > Adjusted EBITDA does not take into account certain income and expense items, such as asset impairment charges, expenses related to acquired indemnification obligation, acquisition and integration costs and fees related to shareholder activism, or other costs that management determines are not indicative of our ongoing operating performance; > Free cash flow does not represent the total residual cash flow available for discretionary purposes because it does not reflect our contractual commitments or obligations; and > other companies, including those in Yelp’s industry, may calculate Adjusted EBITDA and Free cash flow differently, which reduces their usefulness as comparative measures. Because of these limitations, you should consider Adjusted EBITDA, Adjusted EBITDA margin and Free cash flow alongside other financial performance measures, including net income (loss), net cash provided by (used in) operating activities and Yelp’s other GAAP results. Forward-Looking Statements This letter contains, and statements made during the above-referenced webcast will contain, forward-looking statements relating to, among other things, the future performance of Yelp and its consolidated subsidiaries, that are based on Yelp’s current expectations, forecasts and assumptions and involve risks and uncertainties. These statements include, but are not limited to, statements regarding: Yelp’s expected financial results; Yelp’s plans and ability to drive profitable growth in 2026 and the long term as well as to accelerate its AI transformation; Yelp’s expectations regarding the drivers of its business performance and the timing of expenses; Yelp’s plans for and ability to execute on its strategic initiatives, particularly its AI transformation, as well as the expected results thereof; Yelp’s product roadmap and planned investments therein, as well as its opportunities to drive profitable growth through such product roadmap; Yelp’s integration of Hatch and its plans for strategic acquisitions, the impact of such acquisitions and their expected benefits; Yelp’s expectations regarding headcount; Yelp’s plans to reduce SBC expense as a percentage of revenue and the expected benefits therefrom; Yelp’s expectations regarding its share repurchase program; and Yelp’s expectations with respect to trends that will continue to impact its results of operations. 23 24

Ye lp Q 4 20 25 Yelp’s actual results could differ materially from those predicted or implied by such forward-looking statements and reported results should not be considered as an indication of future performance. Factors that could cause or contribute to such differences include, but are not limited to > macroeconomic uncertainty — including related to labor and supply chain issues, inflation and recessionary concerns, interest rates and tariffs — and its effect on consumer behavior, user activity and advertiser spending; > Yelp’s ability to maintain and expand its base of advertisers, particularly if advertiser turnover substantially worsens and/or consumer demand significantly degrades; > Yelp’s ability to drive continued growth through its strategic initiatives, including its AI transformation; > Yelp’s ability to successfully manage acquisitions of new businesses, solutions or technologies, such as Hatch, to successfully integrate those businesses, solutions or technologies, and to monetize such acquired products, solutions or technologies; > Yelp’s ability to continue to effectively operate with a primarily remote work force and attract and retain key talent; > Yelp’s limited operating history in an evolving industry; > Yelp’s ability to generate and maintain sufficient high-quality content from its users; > Yelp’s reliance on traffic to its website from search engines like Google and Bing and the quality and reliability of such traffic; > maintaining a strong brand and managing negative publicity that may arise; and > Yelp’s ability to timely upgrade and develop its systems, infrastructure and customer service capabilities. Factors that could cause or contribute to such differences also include, but are not limited to, those factors that could affect Yelp’s business, operating results and stock price included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Yelp’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q at yelp-ir.com or the SEC’s website at sec.gov. Undue reliance should not be placed on the forward-looking statements in this letter or the above-referenced webcast, which are based on information available to Yelp on the date hereof. Such forward-looking statements do not include the potential impact of any acquisitions or divestitures that may be announced and/or completed after the date hereof. Yelp assumes no obligation to update such statements. 24 24