.2

[This document is an English translation provided for informational purposes only. In event of any discrepancy between this translated document and the Spanish original, the original should prevail.]

INFORMATION STATEMENT ON CORPORATE RESTRUCTURING

November 14, 2025

GRUPO AEROPORTUARIO DEL PACÍFICO, S.A.B. DE C.V.

Av. Mariano Otero 1249-B, Torre Pacífico, 6th Floor

Colonia Rinconada del Bosque, C.P. 44530, Guadalajara Jalisco, Mexico

Listed on: Bolsa Mexicana de Valores, S.A.B. de C.V. and the New York Stock Exchange

Ticker symbol on the BMV: “GAP B”

NYSE ticker symbol: “PAC”

Submitted in accordance with Article 104, Section IV of the Mexican Securities Market Law and Article 35 of the General Provisions Applicable to Securities Issuers and other Securities Market participants issued by the Mexican National Banking and Securities Commission. GAP is a foreign private issuer under the rules of the U.S. Securities and Exchange Commission and is therefore exempt from compliance with the proxy rules set forth in the U.S. Securities Exchange Act of 1934. This English version is provided for informational purposes only and has been prepared to comply with the disclosure obligations set forth in the U.S. Securities Exchange Act of 1934.

Summary of the Transaction

GAP has called an Ordinary and Extraordinary General Shareholders’ Meeting for December 11, 2025, to consider and approve the proposals described in this Information Statement, which are summarized below:

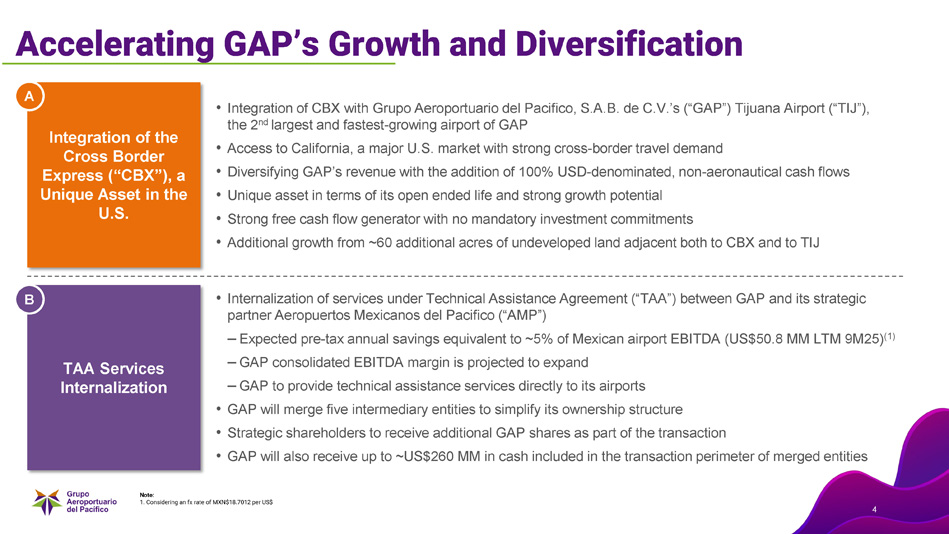

Business Combination

GAP’s management continuously evaluates strategic business and growth opportunities. For several years, management has explored various initiatives to advance GAP to the next level. GAP is now proposing to shareholders a comprehensive development, growth, and diversification plan called GAP 2.0. This plan seeks to benefit all of our shareholders and stakeholders by combining: (i) the technical assistance services and technology transfer that have been outsourced to our strategic partner Aeropuertos Mexicanos del Pacífico, S.A.P.I. de C.V. (AMP) since GAP’s inception; and (ii) the Cross Border Xpress (CBX) project, which is a “landside” terminal located in San Diego, United States connected to a pedestrian bridge that adjoins the border with Mexico, which in turn connects to the section in Mexico leading to the Tijuana International Airport. The latter, through the merger of various entities within GAP, as described in this Information Statement.

Internalization of technical assistance services and technology transfer: Under the current Technical Assistance Agreement with AMP, GAP’s airports receive management and consulting services, as well as technology transfer from AMP. GAP’s subsidiary, SIAP, pays AMP an annual fee for these services. The Technical Assistance Agreement grants GAP an exclusive license in Mexico to use all technical assistance and industry knowledge transferred by AMP during the term of the agreement. AMP provides assistance in various areas, including but not limited to development of commercial activities, preparation of master development plans for each airport, market studies, and implementation of initiatives to increase passenger traffic and improve airport operations. GAP considers these technical assistance services to be high-value specialized services that have provided fundamental benefits since GAP began operations as a private airport group. These services are essential for airport operations. GAP believes it is convenient to ensure their continuity through internalization, as GAP has now reached sufficient maturity for this transition. If the Merger is approved, GAP would provide these services directly to its airports, which would continue to benefit the airports’ operations.

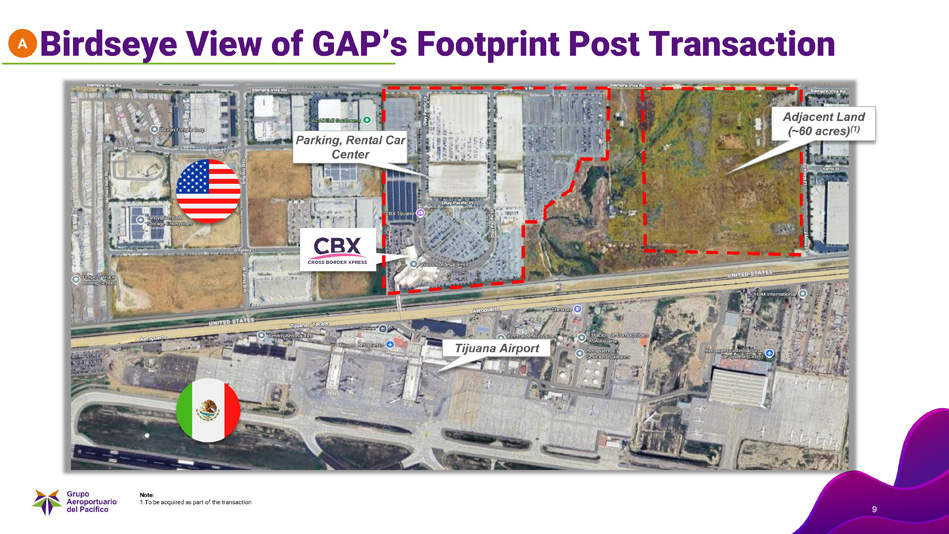

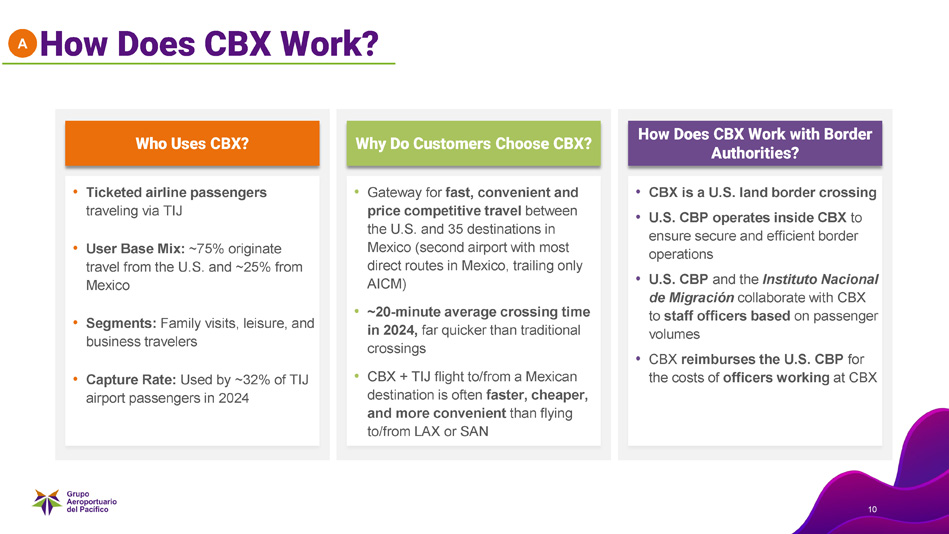

Integration of the CBX: The CBX is a “landside” terminal located in San Diego, United States, connected to a pedestrian bridge that crosses the Mexican border to Tijuana International Airport. The pedestrian bridge, including all sections, is 120 meters long and is exclusively for passengers of the Tijuana International Airport. It provides a fast, comfortable, and secure border crossing without requiring passengers to leave Tijuana International Airport. The CBX currently serves as the main point of entry for Mexicans traveling by air from locations in Mexico to California, United States. The CBX has been designated part of the San Ysidro Port of Entry under U.S. law. The immigration process into the United States is carried out by Customs and Border Protection (“CBP”) officers, and CBX reimburses the United States government for the cost of those officers. CBX began operations in 2015 and served during the years ended December 31, 2022, 2023, 2024, respectively, and during the first nine months of 2025, 4.1, 4.3, 4.0 and 3.0 million passengers, respectively. In the same period, it generated EBITDA of US$87 million, US$102 million, US$94 million, and US$75 million, respectively. The growth of CBX has driven a significant increase in passenger traffic at Tijuana airport. GAP believes that the CBX represents an opportunity for consolidation and growth. GAP has identified the CBX as a complement to its business model, directly related to its operations and aligned with GAP’s growth objectives. This asset represents a strategic platform that facilitates connectivity between Mexico and the United States, a key area where GAP has identified significant growth potential. GAP believes that integrating CBX will not only strengthen its operational infrastructure but also provide a strategic position in the international logistics and passenger transport sector. As a result of the Merger, GAP would acquire a 75% ownership interest in CBX, and through the ancillary transaction described below, GAP intends to acquire the remaining 25% ownership interest in the CBX project through a cash payment of approximately US$487.5 million dollars.

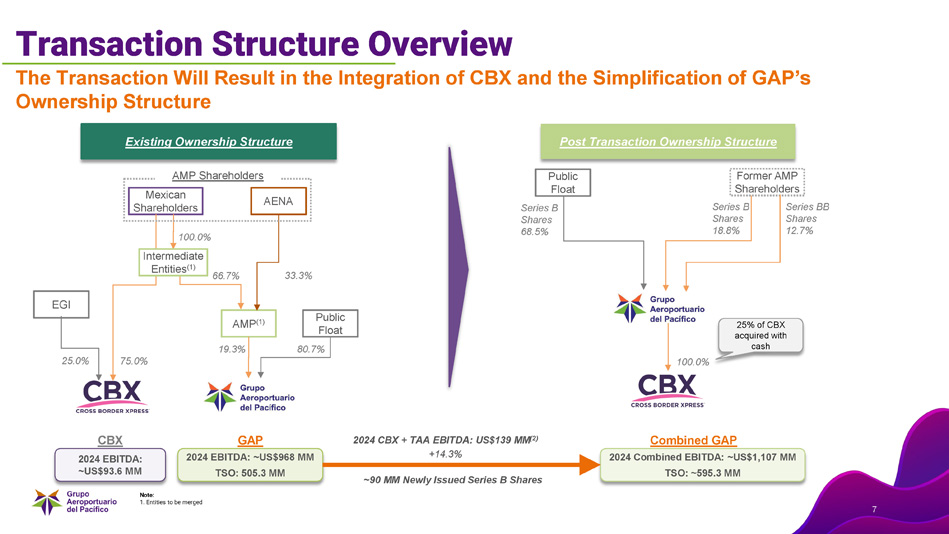

Capital Stock Increase

As a result of the Merger, if approved by our shareholders, it is estimated that GAP would issue and put into circulation approximately 90 million new net shares representing its capital stock, subject to adjustments. These newly issued shares would be delivered to the direct or indirect shareholders of the Merged Companies. As of the date hereof, GAP’s capital stock is represented by approximately 505 million shares currently in circulation. If the Merger is approved, as consequence thereof and once the Merger is effective, GAP’s capital stock would be represented by approximately 595 million shares, as described in this Information Statement.

Ancillary Transaction

In connection with the Merger, we intend to acquire the remaining 25% interest in the CBX project that would not be integrated by virtue of the Merger, as well as certain assets adjacent to the CBX project. By virtue of both the Merger and the ancillary transaction, GAP would acquire 100% ownership of the CBX project. This ancillary transaction is contingent upon effectiveness of the Merger.

Required Voting. The resolutions of the Extraordinary General Shareholders’ Meeting referred to in this Information Statement will require the favorable vote of more than 50% of GAP’s outstanding capital stock, considering that the Merger involves entities directly related to the main line of business of GAP and its subsidiaries.

Characteristics of the Share Certificates

If completed on its terms, the Merger would involve a capital increase. The share certificates will be adjusted to reflect the proposals contained in this Information Statement, if approved.

THIS INFORMATION STATEMENT IS NOT AN OFFER TO SELL SECURITIES IN MEXICO OR THE UNITED STATES, OR IN ANY OTHER JURISDICTION, BUT HAS BEEN PREPARED AND IS MADE AVAILABLE TO THE SHAREHOLDERS OF THE ISSUER AND THE GENERAL PUBLIC SOLELY FOR THE PURPOSE OF PROVIDING INFORMATION TO SHAREHOLDERS, IN ACCORDANCE WITH THE MEXICAN SECURITIES MARKET LAW, THE MEXICAN GENERAL PROVISIONS APPLICABLE TO SECURITIES ISSUERS AND OTHER SECURITIES MARKET PARTICIPANTS, AND ANY OTHER APPLICABLE LEGISLATION.

The shares representing the capital stock of Grupo Aeroportuario del Pacífico, S.A.B. de C.V. are registered in the Mexican National Securities Registry maintained by the Mexican National Banking and Securities Commission and are traded on the Mexican Stock Exchange, S.A.B. de C.V. under the ticker symbol “GAP B”. Registration in the Mexican National Securities Registry does not imply certification of the quality of the securities, the solvency of the Issuer, or the accuracy or veracity of the information contained in this Information Statement, nor does it validate any acts that may have been carried out in violation of the law.

GAP makes this document available to the financial community and other interested parties through its own website (www.aeropuertosgap.com.mx) in the “investors” section, or through the BMV website (www.bmv.com.mx) or the U.S. Securities and Exchange Commission website (www.sec.gov). In any case, copies of this documentation may be requested by any investor by submitting a request to GAP at its offices located at Avenida Mariano Otero No. 1249 – B, 6th floor, Torre Pacífico, Col. Rinconada del Bosque, C.P. 44530, Guadalajara, Jalisco, Mexico, or by calling 01(33) 38 80 11 00 ext. 20294, attention Ms. Gisela Mariazel Murillo Herrera in the Investor Relations Department or at the following email address: gmurillo@aeropuertosgap.com.mx. The electronic version of this Information Statement may be consulted on the Issuer’s website at the following address: www.aeropuertosgap.com.mx and on the website of the Mexican Stock Exchange, S.A.B. de C.V. at the following address: www.bmv.com.mx.

Capitalized words and terms not defined in this Information Statement shall have the meanings attributed to them in the Issuer’s annual report for the year ended December 31, 2024, which can be consulted by visiting the Issuer’s website at: https://www.aeropuertosgap.com.mx/es/ and on the Stock Exchange’s website at: www.bmv.com.mx

GAP IS NOT REQUESTING PROXY LETTERS TO EXERCISE VOTING RIGHTS

[Space intentionally left blank.]

| 2 |

TABLE OF CONTENTS

Page

| LETTER FROM THE CHIEF EXECUTIVE OFFICER | 5 |

| FUTURE EVENTS | 7 |

| INCORPORATION BY REFERENCE | 8 |

| GLOSSARY OF TERMS AND DEFINITIONS | 9 |

| EXECUTIVE SUMMARY | 12 |

| Considerations of the Board of Directors | 14 |

| STRATEGIC REASONS | 16 |

| DETAILED INFORMATION ON THE TRANSACTION | 31 |

| Cross Border Xpress Project | 38 |

| Technical Assistance Services and Technology Transfer | 43 |

| GOVERNMENT AUTHORIZATIONS | 46 |

| BACKGROUND AND PREVIOUS CORPORATE ACTIONS | 47 |

| PARTIES TO THE TRANSACTION | 52 |

| QUESTIONS AND ANSWERS | 56 |

| RISK FACTORS | 60 |

| MATTERS TO BE RESOLVED | 69 |

| Shares to be issued by GAP | 71 |

| SELECTED FINANCIAL INFORMATION | 72 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF OPERATING RESULTS AND FINANCIAL CONDITION | 82 |

| RELEVANT CONTRACTS | 84 |

| Opinion and Analysis of the Financial Advisors | 86 |

| RESPONSIBLE PERSONS | 94 |

| ANNEX | 97 |

| Annex 1. Assurance report of the independent accountants on the compilation of the pro forma financial information. | 98 |

| Annex 2. Presentation with summary information on the transaction. | 114 |

| Annex 3. Form of Merger Agreement. | 142 |

| Annex 4. Draft Resolutions. | 200 |

| 3 |

| Annex 5. Fairness opinion. | 204 |

| Annex 6. ADSs Voting Procedures | 208 |

The annexes attached to this Information Statement form an integral part thereof.

| 4 |

LETTER FROM THE CHIEF EXECUTIVE OFFICER

Dear Shareholder:

It is an honor to address you on this occasion to share a strategic initiative that we believe is fundamental to our Company’s future and the continued sustainable growth of our operations.

The aviation and airport services environment is constantly evolving. Competitiveness, innovation, and operational efficiency are key factors that define long-term success in this sector. We continually evaluate strategic business opportunities and growth alternatives. Today, we believe that GAP must look to the future and embark on a phase of innovation, expansion, and diversification that will consolidate our position as a major global player. Although our business has proven successful for years and we have built trust among our investors through hard work and carefully analyzed decisions, the current environment demands that we seek further expansion. We aim to achieve new goals and overcome new challenges, propelling our company to the next level.

We have been analyzing the possibility of internalizing the technical assistance services that we currently receive on an outsourced basis and integrating the project known as “Cross Border Xpress” into our business, and we believe that now, as part of a comprehensive strategy, the time is right to materialize these opportunities. We believe that the internalization of technical advisory and technology transfer services and the integration of the Cross Border Xpress project would represent an attractive opportunity for long-term value maximization.

Since our inception as a private airport group in 1999, we have received technical assistance and technology transfer services from our strategic partner, AMP, pursuant to an agreement reached with the various stakeholders in our Company at that time. These services are fundamental and indispensable for airport operations, and it is important to ensure their continuity, through its integration into GAP. We pay compensation for these services through our subsidiary SIAP. These services include, among others, advisory services for our airports on strategies to increase aeronautical and non-aeronautical revenues, continuous engagement with regulators and various stakeholders in our sector, support for the preparation of master development plans for each airport, development of commercial activities, and preparation of market studies and implementation of initiatives focused on increasing passenger traffic and improving airport operations. These services are fundamental tools for our growth and value maximization. If the Merger described in this document is approved, these services would continue to benefit the operation of our airports but would be provided internally. GAP would provide these services directly to its airports, as we consider them indispensable for their operation.

We believe we have reached sufficient maturity to internalize the technical assistance and technology transfer services currently provided under our Technical Assistance Agreement. We consider it essential to ensure continuity of these services for our airports’ benefit. From our perspective, discontinuing these services would be risky, so internalization serves our best interests. Additionally, this change would enhance operational efficiency, provide greater flexibility to adapt to our airports’ specific needs, and deliver a superior customer experience. Internal management of these services would also enable us to innovate in processes and technologies, allowing us to maintain market leadership more effectively. If the Merger is approved, GAP would provide these services directly to its airports.

Furthermore, although our strategic partner’s provision of technical assistance and technology transfer services has been key to our development, we believe that internalizing them, taking advantage of GAP’s current maturity and the prevailing circumstances, reinforces the alignment of interests and the economic balance between our various shareholders and stakeholders.

| 5 |

Regarding CBX, it is a project that would be ideal for consolidation into GAP and would serve as a key driver in our new phase of growth. We have identified CBX as an ideal complement to our business model, directly related to it and with attributes for our new phase that we wish to initiate. This asset represents a strategic platform facilitating connectivity between Mexico and the United States, a key area in which we have identified great growth potential. We believe that the integration of CBX will not only strengthen our operational infrastructure, but also give us a privileged position in the international logistics and passenger transport sector.

Opened in December 2015, CBX links Tijuana Airport with the United States border, allowing passengers to cross directly into the United States from the Tijuana Airport, reducing connection and waiting times at both the San Ysidro and Mesa de Otay border crossings and facilitating transfers between both countries for travelers with boarding passes for all flights departing from or arriving in Tijuana. As a result, CBX has been a significant factor in boosting passenger traffic at Tijuana Airport. In 2024, 4 million passengers used the CBX facilities from the United States to Mexico and vice versa (on average, 32.5% of total passenger traffic at Tijuana Airport). We estimate that approximately 45% of Tijuana passengers have the United States as their origin or final destination. Therefore, a significant portion of passengers at the airport are CBX users, due to its convenience and accessibility for residents of the United States.

Initially, the Board of Directors chose to refrain from participating in the CBX project. While CBX is now a proven project, at that time the Board of Directors deemed it a high-risk project with several uncertainties. Noting that various individuals that participated in its management and development during its early stages, some of whom are now members of our Board of Directors and indirect shareholders of GAP, were, at that time, minority shareholders in our strategic partner AMP.

The internalization of technical assistance services and the integration of CBX align with our vision of taking GAP to the next level of development as part of our GAP 2.0 initiative. We believe that these actions would allow us, among other things, to improve our profitability by reducing operating costs and maximizing the value of our assets, strengthen our competitiveness in the sector in which we operate, diversify risks and opportunities, and expand our international presence through closer integration of our services in cross-border operations. We therefore believe that your support for these decisions would strengthen our position in the medium and long term, generating sustainable value for all our shareholders.

With these considerations in mind, we, as management, submitted to our Audit and Corporate Practices Committee, and in turn to our Board of Directors, the possibility of initiating processes to internalize technical assistance and technology transfer services and integrate the CBX project. After careful analysis and with due process and consideration, our governing bodies decided to submit the aforementioned proposals, described in this document, to you, our shareholders. It is you, our shareholders, who will decide and approve the projects proposed herein. Both management and our corporate bodies have worked on the initiative we are presenting to you here. Our Audit and Corporate Practices Committee has led vigorous negotiations with the owners of the businesses to be internalized and integrated to reach an understanding that we consider viable. However, it is essential for us that our shareholders, through their free and informed vote, make the final and only decision.

We reiterate that we consider communication with our shareholders to be essential and kindly ask you to contact us through the institutional channels available to you to address any questions or comments. Thank you for your continued support and confidence in our vision and strategy. Together, we will continue to build the future of GAP.

Sincerely,

Raúl Revuelta Musalem

CEO

| 6 |

FUTURE EVENTS

This Information Statement contains forward-looking statements. Words such as “we intend,” “attempt,” “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “advise,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “would,” as well as similar expressions, are intended to identify forward-looking projections and statements, but are not the only means of identifying such projections and statements. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and there are risks that predictions, forecasts, projections, and other forward-looking statements may not be achieved. We caution investors that a number of important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates, and intentions expressed or implied in such statements. If one or more of these factors or uncertainties materialize, or if underlying assumptions prove incorrect, actual results may vary significantly from those described herein as anticipated, considered, estimated, expected, forecasted, or intended.

These forward-looking statements are made only as of the date of this Information Statement. We do not undertake any obligation to update or revise any forward-looking projections or statements due to new information, future events, or other developments. Additional factors may emerge at any time that could affect our business. We cannot predict all such factors or assess their impact on our business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statement. We cannot assure you that our plans, intentions, or expectations will be achieved. Furthermore, statements regarding past trends or activities should not be interpreted as assertions that those trends or activities will continue in the future. All forward-looking statements, whether written, oral, or electronic, that can be attributed to us or to persons acting on our behalf are expressly subject in their entirety to this Information Statement.

[Space intentionally left blank.]

| 7 |

INCORPORATION BY REFERENCE

We incorporate by reference certain documents filed with the Mexican National Banking and Securities Commission. This means we disclose important information by referring to those documents. The incorporated information is considered part of this Information Statement. We may amend or supplement this Information Statement by filing additional materials with the Mexican National Banking and Securities Commission and the Mexican Stock Exchange, S.A.B. de C.V. We incorporate by reference the following documents:

| · | our annual report for the fiscal year ended December 31, 2024, filed on April 23, 2025. |

| · | our relevant events, submitted from April 24, 2025, to the date of this document. |

| · | our latest quarterly report for the fiscal year ended September 30, 2025, filed on October 20, 2025. |

These documents can be consulted on the website of the Mexican Stock Exchange, S.A.B. de C.V. at www.bmv.com.mx and on the Issuer’s website at www.aeropuertosgap.com.mx.

We also incorporate by reference certain documents filed with the U.S. Securities and Exchange Commission. This means we disclose important information by referring to those documents. The incorporated information is considered part of this Information Statement. We may amend or supplement this Information Statement by filing additional materials with the U.S. Securities and Exchange Commission. We incorporate by reference the following documents:

| · | our annual report on Form 20-F for the fiscal year ended December 31, 2024, filed on April 24, 2025. |

| · | our material events on Form 6-K, filed from April 24, 2025, to the date of this document. |

| · | our latest quarterly report for the fiscal year ended September 30, 2025, filed on October 21, 2025. |

These documents can be found on the website of the U.S. Securities and Exchange Commission at www.sec.gov and on the Issuer’s website at www.aeropuertosgap.com.mx.

[Space intentionally left blank.]

| 8 |

GLOSSARY OF TERMS AND DEFINITIONS

Unless otherwise defined herein, capitalized terms used in this Information Statement and listed below shall have the following meanings, which shall also apply to the singular or plural forms of such terms:

| Term | Definition |

| “AMP” | Refers to Aeropuertos Mexicanos del Pacífico, S.A.P.I. de C.V. |

| “Annual Report” | Refers to GAP’s annual report for the fiscal year ended December 31, 2024. You can access this report at www.aeropuertosgap.com.mx and at the website of the Mexican Stock Exchange, S.A.B. de C.V. at www.bmv.com.mx. |

| “CBX” | Refers to Cross Border Xpress, a “landside” terminal in San Diego, California connected to a pedestrian bridge that crosses the Mexican border to Tijuana International Airport in Mexico, which currently serves as the main entry point for Mexicans traveling by air from locations in Mexico to California. |

| “Dollars” or “USD” or “US$” | Refers to dollars, the legal tender of the United States. |

| “Extraordinary General Shareholders’ Meeting” | Refers to the GAP’s ordinary and extraordinary shareholders’ meeting to be held on December 11, 2025. |

| “EBITDA” | Refers to earnings before interests, taxes, depreciation, and amortization. |

| “IFRS” | Refers to the International Financial Reporting Standards, as defined by the International Accounting Standards Board (IASB), also known as Normas Internacionales de Información Financiera (NIIFs). |

| “Information Statement” | Refers to this corporate restructuring information statement. Prepared in accordance with Mexican Securities Market Law and the Mexican General Provisions Applicable to Securities Issuers and Other Securities Market Participants in connection with the Merger. |

| “Issuer,” “Company,” or “GAP” | Refers to Grupo Aeroportuario del Pacífico, S.A.B. de C.V. |

| “Merged Companies” | Refers to each and all of the following five companies: Aeropuertos Mexicanos del Pacífico, S.A.P.I. de C.V., Controladora Mexicana de Aeropuertos, S.A. de C.V., Promotora Aeronáutica del Pacífico, S.A. de C.V., PAL Aeropuertos, S. de R.L. de C.V., and Proyectos de Infraestructura Charter, S. de R.L. de C.V. |

| 9 |

| Term | Definition |

| “Merger” | Refers to the merger of five entities into GAP in one single act: Aeropuertos Mexicanos del Pacífico, S.A.P.I. de C.V., Controladora Mexicana de Aeropuertos, S.A. de C.V., Promotora Aeronáutica del Pacífico, S.A. de C.V., PAL Aeropuertos, S. de R.L. de C.V., and Proyectos de Infraestructura Charter, S. de R.L. de C.V. Through this merger, GAP will acquire ownership of: (i) the technical assistance and technology transfer services business, which AMP has provided to us on an outsourced basis since our inception as a private airport group; and (ii) the Cross Border Xpress project, which is a “landside” terminal located in San Diego, United States, connected by pedestrian bridge to Tijuana International Airport in Mexico, as described in this Information Statement. |

| “Mexican Shareholders” | Refers to PAL Shareholders and PAP Shareholders, collectively. |

| “OTV” | Refers to Otay-Tijuana Venture, LLC, a private company incorporated in the United States that owns the CBX project and its subsidiaries. |

| “PAL Shareholders” | Refers to the shareholders of PAL Aeropuertos, S. de R.L. de C.V., a trust controlled by Eduardo Sánchez Navarro Redo and certain members of his immediate family, and Juan Gallardo Thurlow. PAL Aeropuertos, S. de R.L. de C.V. is a special purpose entity, currently an indirect shareholder of AMP. |

| “PAP shareholders” | Refers to the shareholders of Promotora Aeronáutica del Pacífico, S.A. de C.V., Laura Diez-Barroso Azcárraga, Carlos Laviada Ocejo. Promotora Aeronáutica del Pacífico, S.A. de C.V. is a special purpose entity and current indirect shareholder of AMP. |

| “Pesos” or “$” or “Ps.” | Refers to pesos, the legal tender of the United Mexican States. |

| “Pro Forma Condensed Consolidated Financial Information” | Refers to GAP’s unaudited pro forma condensed consolidated statements of financial position as of December 31, 2024 and September 30, 2025, and the unaudited pro forma condensed consolidated statements of income and other comprehensive income for the year ended December 31, 2024 and September 30, 2025, including the corresponding notes. |

| “Pro Forma Condensed Consolidated Financial Statements” | Refers to GAP’s unaudited pro forma consolidated financial statements for the year ended December 31, 2024, including the unaudited pro forma consolidated income statements for the same period. These statements reflect the impact of the Merger. |

| “Quarterly Report” | Refers to GAP’s quarterly report for the quarter ended September 30, 2025. You can access this report at www.aeropuertosgap.com.mx and at the website of the Mexican Stock Exchange, S.A.B. de C.V. at www.bmv.com.mx. |

| “SIAP” | Refers to Servicios a la Infraestructura Aeroportuaria del Pacífico, S.A. de C.V., a GAP subsidiary and AMP’s counterparty under the Technical Assistance Agreement. |

| 10 |

| Term | Definition |

| “Technical Assistance Agreement” or “TAA” | Refers to the Technical Assistance and Technology Transfer Agreement dated August 25, 1999, between SIAP, GAP, each of GAP’s airport concessionaire subsidiaries, and AMP. Under this agreement, AMP provides GAP technical assistance and technology transfer services necessary for GAP’s airport operations. GAP pays compensation for these services. |

| “US GAAP” | Refers to Generally Accepted Accounting Principles in the United States. |

[Space intentionally left blank.]

| 11 |

EXECUTIVE SUMMARY

The following is a summary that provides a brief description of the most relevant aspects of the transaction described in this document, which is not intended to be exhaustive and contain all information that may be relevant to it, and is therefore supplemented by the detailed information and financial information included in other sections of this Information Statement.

This Information Statement should be read carefully in its entirety. Pay particular attention to the “Risk Factors,” “Detailed Information On The Transaction,” and “Management’s Discussion And Analysis Of Operating Results And Financial Condition” sections. Also review our Pro Forma Financial Statements and related notes included in this Information Statement. Additional information is available in our Annual Report and Quarterly Report, which are incorporated by reference. These documents can be consulted on the website of the Mexican Stock Exchange, S.A.B. de C.V. at www.bmv.com.mx and on the Issuer’s website at www.aeropuertosgap.com.mx.

Business Combination

GAP’s management continuously evaluates strategic business and growth opportunities. For several years, our management has explored various initiatives with the purpose of leading GAP towards an evolution in its business. On this occasion we are proposing to our shareholders, within the context of a comprehensive plan for development, growth, and diversification, GAP 2.0, which seeks to drive the Company to the next level for the benefit of all our shareholders and stakeholders, the combination of the following businesses through the Merger: (i) the provision technical assistance and technology transfer services, which since our inception has been done by our strategic partner AMP; and (ii) the Cross Border Express project, which is a “landside” terminal located in San Diego, United States connected to a pedestrian bridge that adjoins the border with Mexico, which in turn connects to the section in Mexico leading to the Tijuana International Airport.

Internalizing technical assistance and technology transfer services: Under our Technical Assistance Agreement with AMP, our airports receive management and consulting services plus technology transfer. Our subsidiary SIAP pays AMP an annual fee for these services. The Technical Assistance Agreement grants us an exclusive license in Mexico to use technical assistance and industry knowledge transferred by AMP during the term of the agreement. AMP provides assistance in several areas including among others, commercial activities development, master development plans preparation, market studies, and initiatives to increase passenger traffic and improve airport operations.

We consider AMP’s technical assistance a high-value specialized service that has provided fundamental benefits to GAP since inception. These services are necessary for airport operations and should continue internally. GAP has reached sufficient maturity for internalization. If the Merger is approved, GAP would provide these services directly to its airports, which would continue to benefit the airports’ operations. For more information regarding technical assistance services and technology transfer, see the “Technical Assistance Services and Technology Transfer” section in this document.

Integrating CBX: CBX is a “landside” terminal located in San Diego, United States, connected to a pedestrian bridge that crosses the Mexican border to Tijuana International Airport in Mexico. The pedestrian bridge spans 120 meters and is exclusively for passengers traveling through Tijuana International Airport. It provides fast, comfortable, and secure border crossing without leaving Tijuana International Airport. CBX currently serves as the main point of entry for Mexicans traveling by air from Mexico to California. CBX is designated as part of the San Ysidro Port of Entry under U.S. law. CBX began operations in 2015 and served, during the years ended December 31,2022, 2023, 2024, respectively, and during the first nine months of 2025, 4.1, 4.3, 4.0 and 3.0 million passengers, respectively. In the same period, it generated EBITDA of US$87 million, US$102 million, US$94 million, and US$75 million, respectively.

We believe CBX is ideal for integration into GAP and will drive our next growth phase. We have identified CBX as a complement to our business model. This asset represents a strategic platform facilitating connectivity between Mexico and the United States, where we see significant growth potential. We believe CBX integration will strengthen our operational infrastructure and provide a strategic position in international logistics and passenger transport. Through the Merger, 75% of CBX would be integrated. Through the ancillary transaction described in this Information Statement, we intend to acquire the remaining 25%. For more information regarding CBX, see the “Cross Border Xpress Project” section in this document.

| 12 |

Capital Stock Increase

As a result of the Merger described in this Information Statement, if approved by our shareholders, it is estimated that GAP would issue approximately 90 million new shares representing its capital stock, subject to adjustments. These newly issued shares would be delivered to the direct or indirect shareholders of the Merged Companies in exchange for their ownership interests in the Merged Companies. As of the date hereof, GAP’s capital stock is represented by approximately 505 million shares currently in circulation. If the Merger is approved, as consequence thereof and once the Merger is effective, GAP’s capital stock would be represented by approximately 595 million shares, as described in this Information Statement.

The net number of shares represents the total number of shares to be issued by GAP as a result of the Merger, minus the shares representing GAP’s capital stock owned by the Merging Entities prior to the Merger (which would be received by GAP as a result of the Merger and subsequently canceled).

Attached as Annex 3 “Form of Merger Agreement” to this Information Statement is a copy of the form of merger agreement between GAP, the Merged Companies, and the owners of the companies, which contains the material terms of the Merger and is subject to approval by the Extraordinary General Shareholders’ Meeting of GAP.

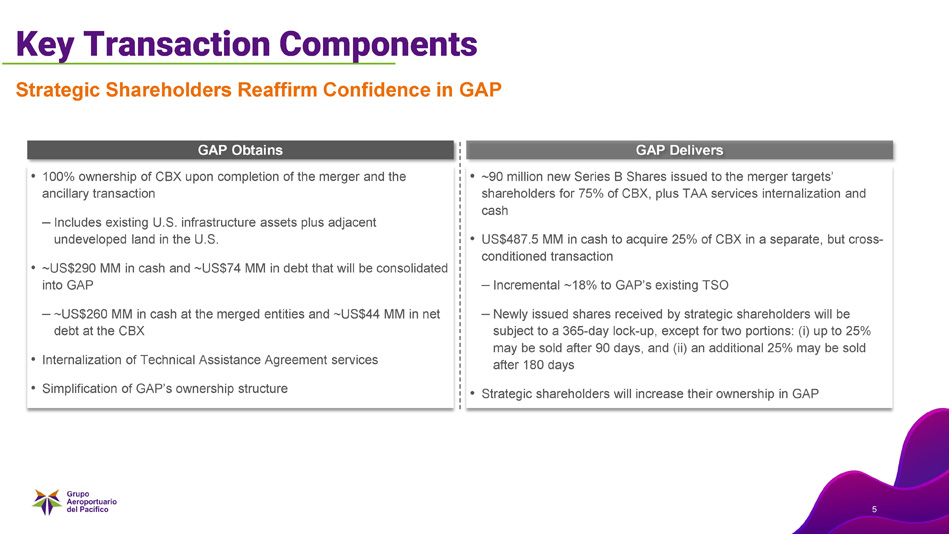

Ancillary Transaction

In connection with the Merger, we intend to acquire the remaining 25% interest in the CBX project that would not be integrated by virtue of the Merger, as well as certain assets adjacent to the CBX project. Through the Merger and the ancillary transaction, GAP would acquire 100% ownership of the CBX project. This ancillary transaction is contingent upon effectiveness of the Merger and will be carried out through a cash payment of approximately US$487.5 million dollars.

Additionally, as part of the Merger and the ancillary transaction, GAP is expected to assume, on the effective date of the Merger, cash and cash equivalents amounting up to US$290 million dollars, and a financial debt of US$74 million dollars, approximately. The latter includes an estimate of up to US$260 million in the treasury of the merged entities and their non-operative subsidiaries and US$44 million in net debt from the integration of CBX.

Required Voting

The Extraordinary General Shareholders’ Meeting resolutions described in this Information Statement require favorable votes from more than 50% of GAP’s outstanding capital stock, considering that the merger described herein involves entities directly related to GAP’s and its subsidiaries’ main line of business.

AMP, our strategic partner, has informed us that at the upcoming Extraordinary General Shareholders’ Meeting, it will vote its shares in accordance with the majority of the votes cast at such meeting.

Brief simplified summary of the transaction

In short, the Merger and the ancillary transaction will result in GAP (i) integrating 75% of CBX, the provision of technical assistance services, and assuming cash and cash equivalents of approximately USD $260 million through the Merger, in exchange for which it will issue approximately 90 million net new shares; and (ii) acquiring the remaining 25% of CBX in a transaction related to the Merger through a cash payment of USD $487.5 million.

| 13 |

We propose the delegation of broad authority to GAP's Board of Directors to determine the final terms of the Merger prior to, or on its effective date.

The Issuer

Information about this section is available in the Issuer’s Annual Report and Quarterly Report, which are incorporated by reference into this Information Statement. These documents are available at www.bmv.com.mx and www.aeropuertosgap.com.mx.

| 14 |

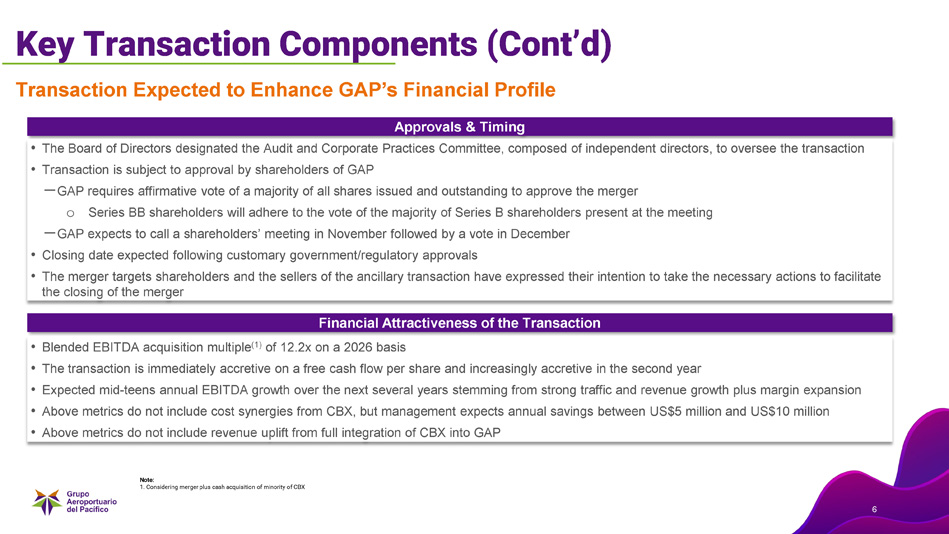

Considerations of the Board of Directors

Our Board of Directors, based on the opinion of our Audit and Corporate Practices Committee, composed exclusively of independent directors and strengthened by the participation of two additional independent members, Ms. Alejandra Palacios Prieto and Mr. Luis Tellez Kuenzler, taking into account various factors, including analysis supported by external legal, financial, and accounting advisors, determined that the Merger initiative should be presented for shareholders' consideration and, if applicable, approval of our general shareholders’ meeting. On November 3, 2025, Morgan Stanley & Co. LLC issued a fairness opinion issued by, which is included as Annex 5 “Fairness opinion” to this Information Statement.

GAP and its Board of Directors believe that our shareholders should make informed decisions freely and without coercion. Consistent with our historical practice, we respect and will respect the will of our shareholders as expressed in accordance with applicable law and our bylaws.

The development of this initiative presented to our shareholders involved in-depth analysis and vigorous negotiations led by our Audit and Corporate Practices Committee, supported by management and independent external legal, financial, and accounting advisors hired for this purpose. For more information on the background and work of our corporate bodies regarding the transaction described in this Information Statement, see the “Background And Previous Corporate Actions” section of this Information Statement.

Our management and Audit and Corporate Practices Committee, with support from independent external legal, accounting and financial advisors, considered numerous quantitative and qualitative factors before presenting this initiative to the Board of Directors. The Board subsequently presented these to the Extraordinary General Shareholders’ Meeting. These factors include (without establishing priority or assigning specific weight):

| · | It was estimated that the transaction described in this Information Statement would create value for GAP and all its shareholders in the long term, without benefiting a particular shareholder or group of shareholders to the detriment of the rest of the shareholders. |

| · | The proposals were considered consistent with a comprehensive strategic plan for expansion, evolution, and risk diversification. |

| · | Comparable transactions with sufficient public financial information were considered. Although no perfect comparable exists, other internalizations were determined to have a degree of similarity. |

| · | Technical assistance and technology transfer services have been fundamental to the development, operation, and sustained growth of our airports. GAP has reached sufficient maturity to directly assume these functions. This will enable us to, among other things: ensure continuity of key capabilities for airport operations, incorporate internally the technical knowledge accumulated since GAP’s founding, and adapt support services more quickly to the specific needs of each airport under direct management. |

| · | Regarding CBX, it was considered that this would increase GAP’s risk diversification through: |

| o | Exposure to other markets, as CBX is not subject to regulated tariffs and has a different functional currency from GAP’s. |

| o | The presidential permit for CBX operation has no defined term (although it may be terminated at the discretion of the U.S. Secretary of State), unlike our airport concessions. |

| 15 |

| o | The real estate on which the CBX business is located is privately owned and therefore has freedom of ownership, while our airports operate on public property subject to concessions granted by the Mexican federal government. |

| o | CBX has no minimum regulatory investment commitments, which provides greater flexibility in financial planning, unlike GAP, which has minimum investment commitments in its five-year master development plan. |

| o | CBX has strong strategic alignment and efficiencies with our Tijuana Airport and represents a project that is not capital intensive while presenting solid profit margins. |

| · | The Merger would allow the elimination of intermediate structures that are no longer necessary for future operations, the integration of technical, commercial, and strategic activities under a single corporate framework, and the reduction of costs and administrative burdens associated with separate operation of various entities. |

| · | Directly assuming the services currently provided by AMP and consolidating CBX within our corporate structure would strengthen our planning, execution, and oversight capabilities. This is expected to improve strategic alignment across airport and logistics operations and provide greater visibility and control to GAP’s corporate bodies over key functions for future growth, among other things. |

In analyzing and considering the transaction, GAP’s management and our Audit and Corporate Practices Committee received advice from its financial advisor Morgan Stanley & Co. LLC. For more information regarding the financial analysis performed by Morgan Stanley & Co. LLC, see the section “Opinion And Analysis Of The Financial Advisors”.

[Space intentionally left blank.]

| 16 |

STRATEGIC REASONS

The Merger supports GAP’s comprehensive corporate evolution and long-term competitive positioning strategy under our GAP 2.0 plan. We expect the transaction to strengthen our operational capabilities and expand our market reach through two key components: internalizing technical assistance and technology transfer services and integrating CBX. These actions are designed to consolidate critical capabilities, generate efficiencies, enhance strategic oversight, and diversify GAP’s geographic footprint.

The following describes strategic reasons and considerations that our management considered, with support from independent external financial advisors, in analyzing this initiative. These reasons are neither exclusive nor exhaustive, and no specific weight was assigned to any particular factor. This summary contains forward-looking estimates whose results we cannot guarantee.

A. CBX

1. CBX: A Unique Infrastructure Asset Driving TIJ’s Sustainable Growth

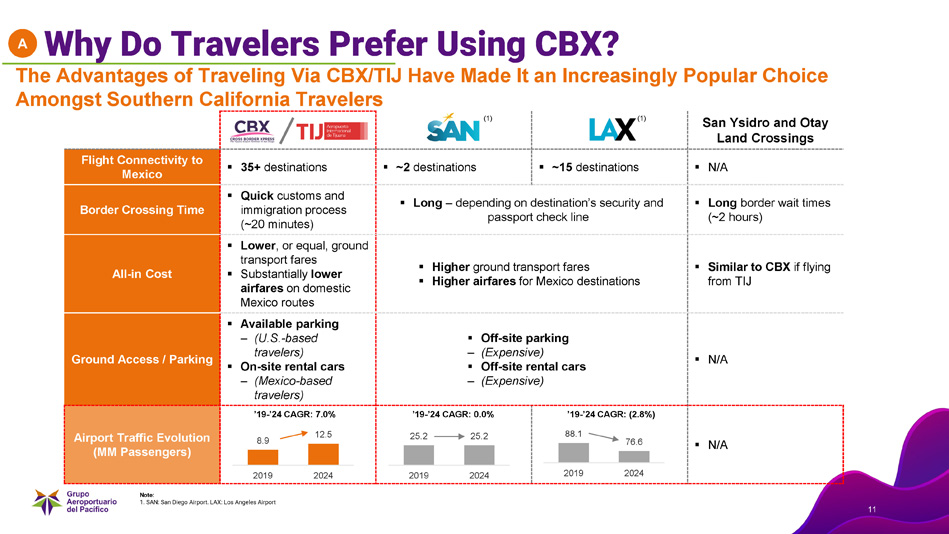

CBX is a U.S.-based, one-of-a-kind cross-border binational terminal and the only facility globally that directly links an international airport—Tijuana International Airport (TIJ)—to the United States via a secure, fast, land crossing of the Mexico – US border via a private pedestrian bridge into San Diego, California. This seamless connection positions CBX as a strategic and indispensable gateway at the world’s busiest land border crossing, offering unmatched convenience and efficiency for travelers. Its unique infrastructure and location underpin its role as a high-growth, high-margin asset with long-term sustainability.

CBX serves a rapidly expanding and underserved segment of cross-border travelers from both the U.S. and Mexico, who benefit from TIJ’s extensive and competitively priced domestic and international flight network. On the other hand, TIJ gains from CBX’s streamlined passenger crossings into San Diego, enhancing its accessibility and appeal. Its strategic location allows CBX to capitalize on growing binational mobility, delivering unmatched convenience, time savings, and cost advantages across the region. This unique positioning reinforces CBX’s role as a preferred gateway for US-based passengers to fly to destinations in Mexico and for Mexico-originating passengers to travel to the United States, and a driver of long-term growth for TIJ.

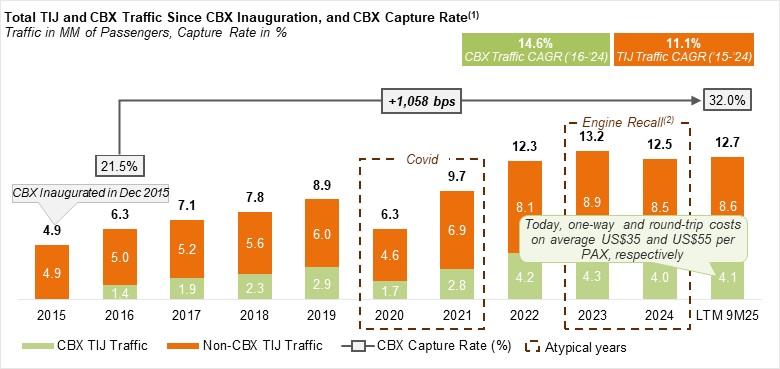

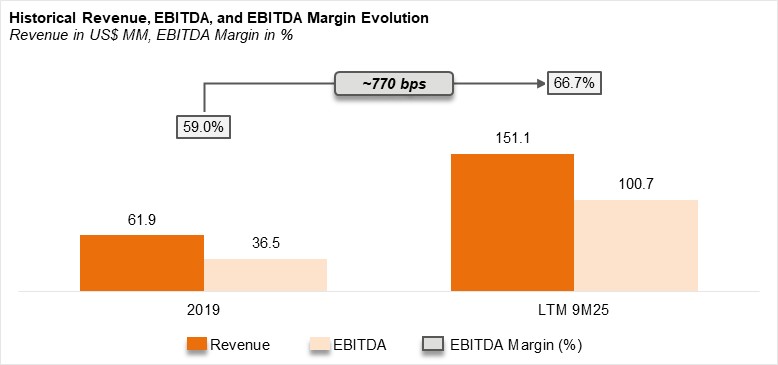

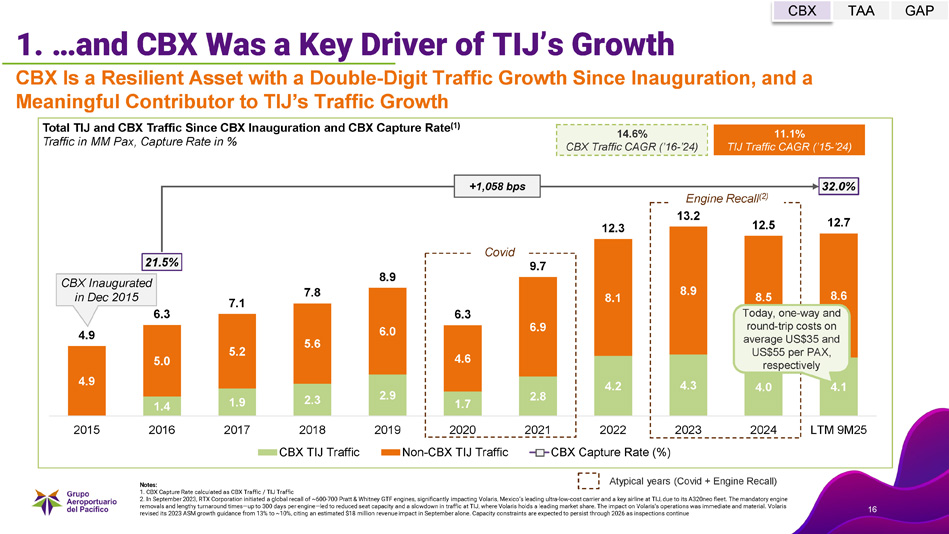

Since it opened for passenger traffic in December 2015, CBX has consistently demonstrated robust operating performance, with cross-border passenger traffic growing at a compound annual rate of 14.6% during the period 2016-2024. This sustained growth reflects rising demand for air travel between the US and destinations across Mexico and the growing appeal of CBX’s unique combination of convenience and value. The asset has maintained stable performance and operational continuity, even during periods of macroeconomic uncertainty, underscoring its reliability and importance in an ever-evolving mobility landscape.

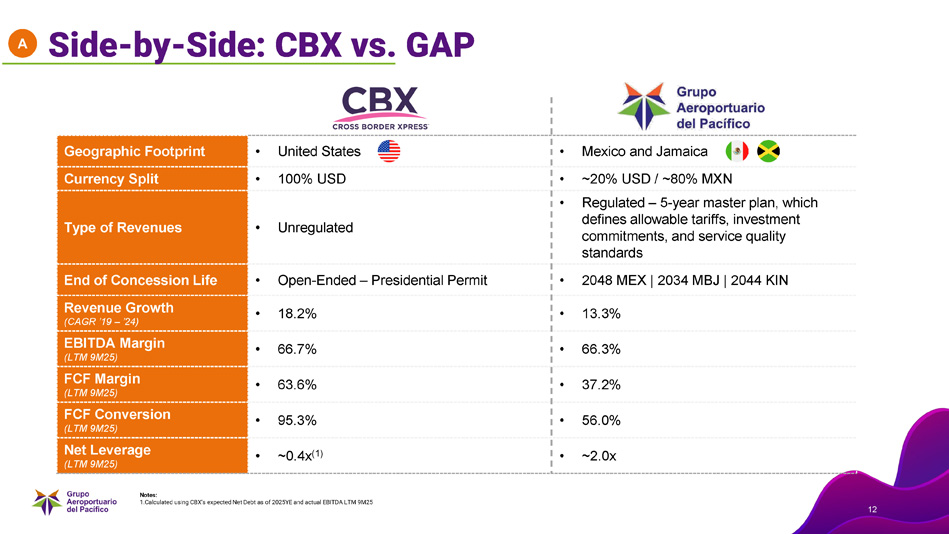

CBX’s strong profitability further reinforces its value, with attractive EBITDA margins, driven by efficient operations and a resilient revenue model. As an asset-light business with no mandatory capex commitments and high cash conversion, CBX generates attractive free cash flow and supports disciplined, scalable growth.

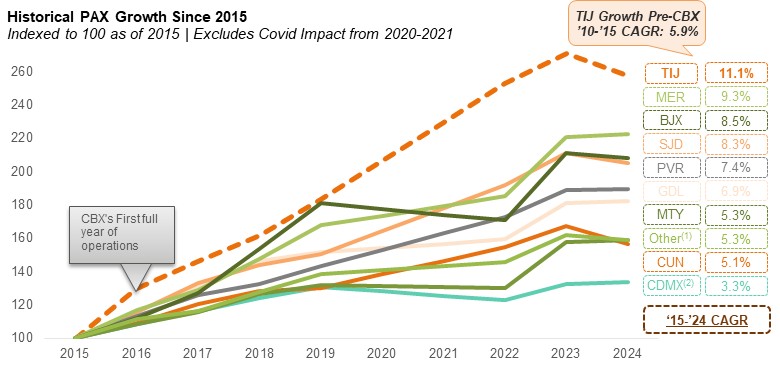

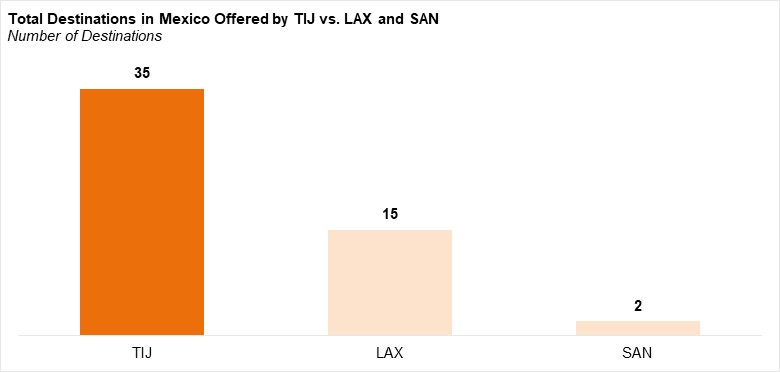

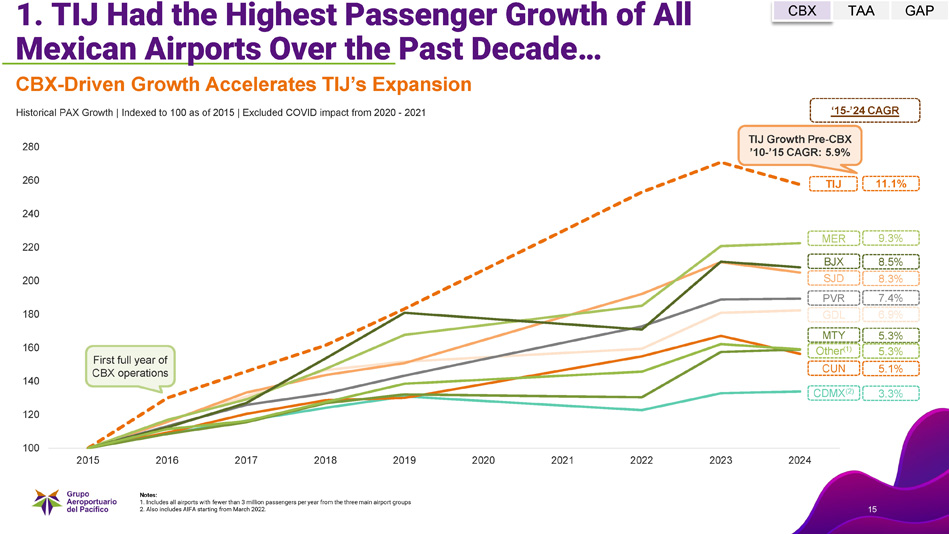

CBX enables direct connectivity between the U.S. and multiple destinations in Mexico by leveraging TIJ’s robust domestic flight network (which is the second airport in Mexico with the most domestic flight destinations, trailing only Mexico City’s International Airport). Since opening in late 2015, CBX has contributed meaningfully to TIJ’s airport traffic expansion. TIJ led Mexico in passenger growth over the last decade, posting an ~11.1% CAGR from 2015–2024, ahead of major peers. A big part of this success has been CBX, which has structurally strengthened TIJ’s ability to attract airline routes, capture passengers and expand its overall share of US-Mexico travel. To put this in perspective, before CBX, passenger traffic at TIJ grew at a CAGR below 6% from 2010 to 2015, well below the ~11.1% CAGR of the last decade. Even during atypical periods like Covid and the global engine recall by Pratt & Whitney in 2023 and 2024 that heavily impacted airlines’ number of available seats, CBX has proved resilient and continued to support TIJ’s trajectory.

| 17 |

Additionally, CBX supports regional economic development by facilitating tourism, family connectivity, and business travel between the U.S. and Mexico. Its operations generate local employment and contribute to the broader commercial ecosystem in both Tijuana and Southern California.

Notes: 1. Participation Rate is defined as the number of passengers that use CBX divided by the total passengers in TIJ

2. In September 2023, RTX Corporation initiated a global recall of between 600 and 700 Pratt & Whitney GTF engines, significantly impacting Volaris, Mexico’s leading ultra-low-cost carrier and a key airline at TIJ, due to its A320neo fleet. The mandatory engine removals and lengthy turnaround times—up to 300 days per engine—led to reduced seat capacity and a slowdown in traffic at TIJ, where Volaris holds a leading market share. The impact on Volaris's operations was immediate and material. Volaris revised its 2023 ASM growth guidance from 13% to ~10%, citing an estimated $18 million revenue impact in September alone. Capacity constraints are expected to persist through 2026 as inspections continue.

Notes: 1. Includes all airports with fewer than 3 million passengers per year from the three main airport groups.

2. Also includes AIFA starting from March 2022.

| 18 |

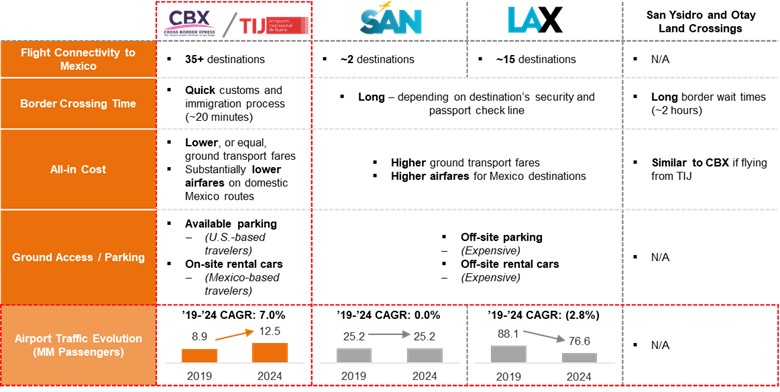

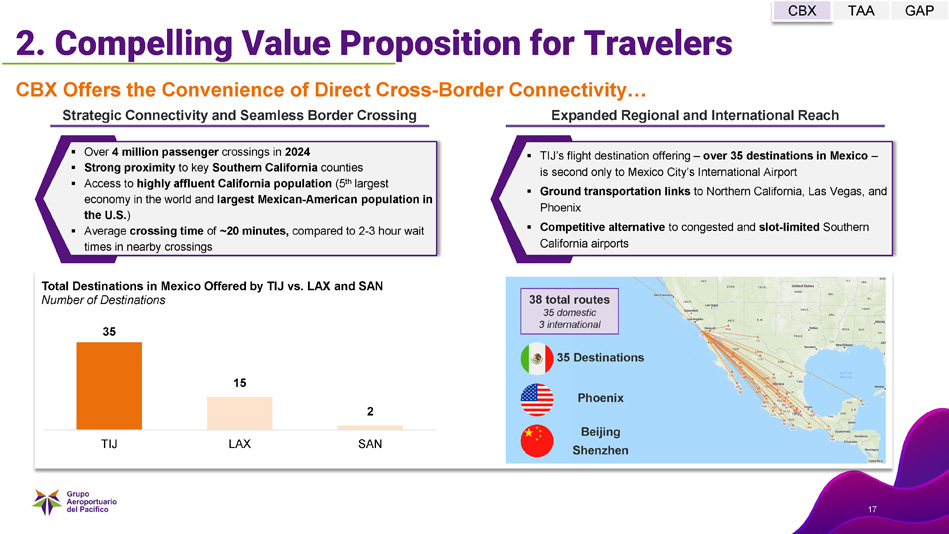

2. CBX: Compelling Value Proposition for Travelers

CBX offers a highly attractive and differentiated value proposition, anchored in the convenience of seamless cross-border connectivity and the often-lower cost provided by using the CBX and connecting to a domestic Mexican airline flight. When planning travel between the US and destinations throughout Mexico, many travelers to and from California compare the cost of flying from US airports that offer flights to destinations in Mexico with the cost of traveling to San Diego and using the CBX to access Mexican domestic flights from TIJ. With three different Mexican airlines offering flights to 35 different destinations in Mexico, pricing for round trips within Mexico is highly competitive. In most cases, the cost of traveling between California and Mexican destinations via the CBX and TIJ is lower than flying from a US airport.

The appeal of CBX is based on its combination of strategic location, passenger convenience, and economic advantages:

Unique Border Crossing Alternative

The Tijuana – San Diego cross is one of the world’s busiest land border crossings. CBX delivers unmatched speed and ease of access, with an average crossing time of ~20 minutes, well below the long and unpredictable crossing times (2-3 hours, excluding additional travel time to and from TIJ airport to nearby crossings) at nearby traditional border crossings such as San Ysidro and Otay Mesa. This efficiency makes CBX a significantly more convenient alternative for crossing the border for people traveling between destinations in Mexico and the US using flights originating or terminating in TIJ.

Expanded Regional and International Reach

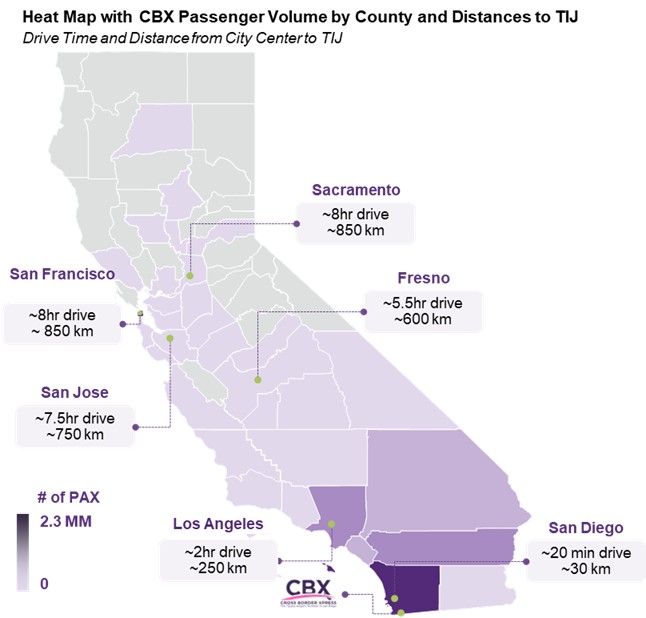

Together, CBX and TIJ form a strategic gateway connecting the U.S. with Mexico and Asia, offering access to 35 destinations in Mexico via TIJ (second only to Mexico City’s International Airport, showcasing TIJ’s vast connectivity). This connectivity serves both U.S.-based travelers seeking affordable international routes and California’s large Mexican population traveling to visit family, as well as business travelers accessing key regional markets. Ground transportation links to Northern California, Las Vegas, and Phoenix further position CBX as a competitive alternative to the congested Southern California airport system.

| 19 |

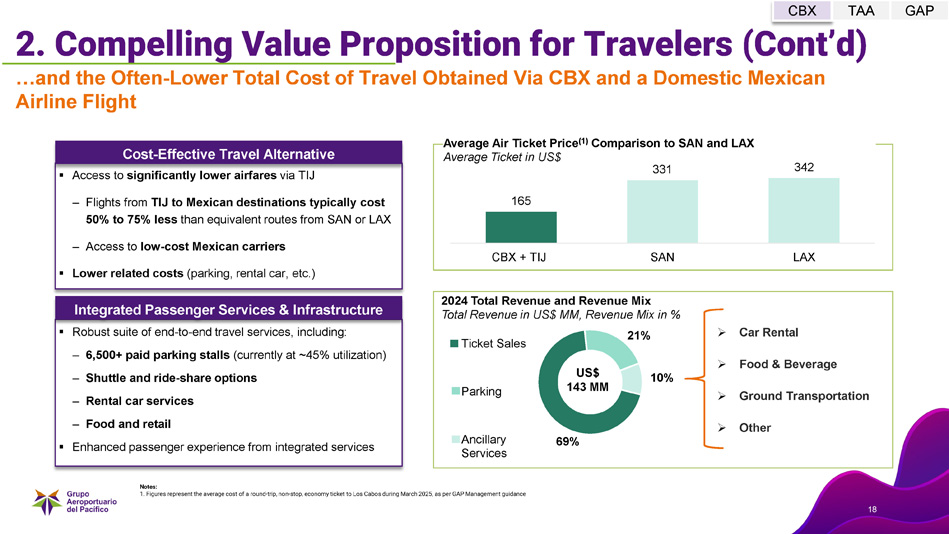

Cost-Effective Travel Alternative

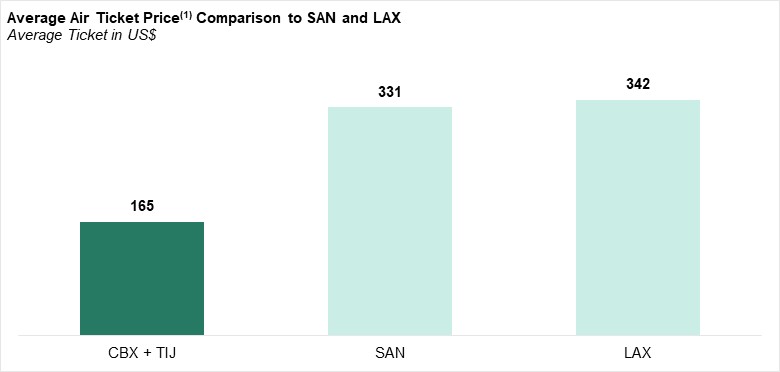

CBX enables access to significantly lower airfares via TIJ, particularly for price-sensitive travelers and families. Flights from TIJ to Mexican destinations typically cost 50% to 75% less than equivalent routes from San Diego (SAN) or Los Angeles (LAX), driven by lower airport fees.

| 20 |

Note: 1. Figures represent the cost of a round-trip, non-stop, economy ticket to Los Cabos during March 2025

Integrated Passenger Services and Infrastructure

CBX enhances its value proposition through a robust suite of end-to-end travel services, including:

| • | Over 6,500 paid parking stalls (currently at ~45% utilization) |

| • | Shuttle and ride-share options |

| • | Rental car services |

| • | Food, retail, and other passenger amenities |

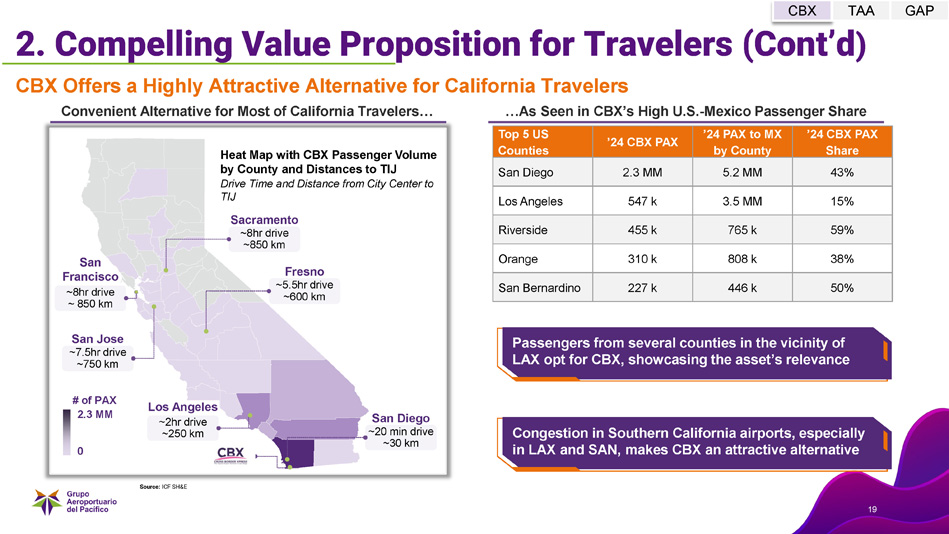

High Passenger Volume and Strategic Connectivity

In 2024, CBX facilitated over 4.0 million passenger crossings, providing travelers with direct and convenient access between TIJ and San Diego. Its location offers proximity not only to San Diego and Los Angeles, but also to key Southern California counties—Orange, Riverside, and San Bernardino—with comparable or shorter drive times than LAX.

| 21 |

Volume of Passengers by County Traveling to Mexico

| Top 5 US Counties | ’24 CBX Pax | ’24 PAX to MX by County | ’24 CBX Share |

| San Diego | 2.3 MM | 5.2 MM | 43% |

| Los Angeles | 547 k | 3.5 MM | 15% |

| Riverside | 455 k | 765 k | 59% |

| Orange | 310 k | 808 k | 38% |

| San Bernardino | 227 k | 446 k | 50% |

| Note: Top 5 counties represent 95% of total CBX pax | |||

| 22 |

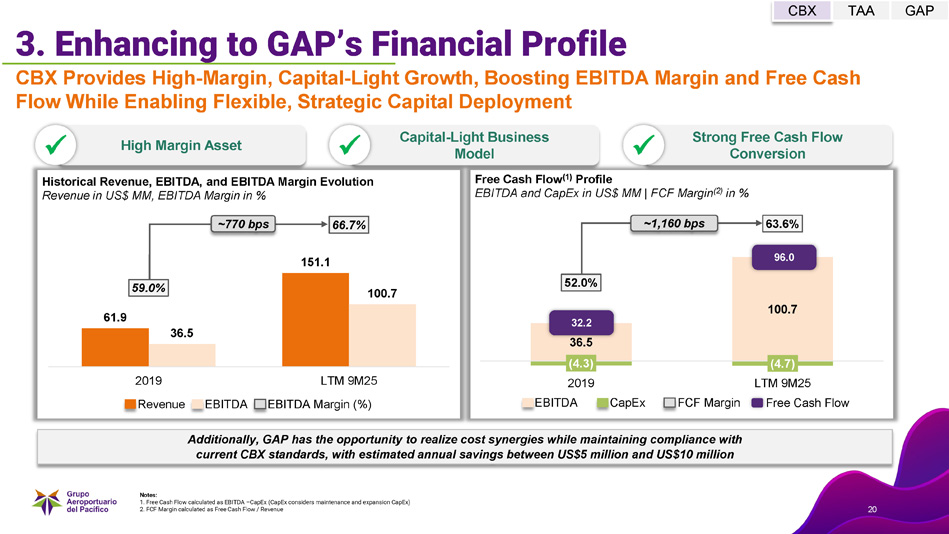

3. Enhancing to GAP’s Financial Profile

The integration of CBX significantly enhances GAP’s financial profile by adding a high-margin, cash-generative asset with consistent growth and low capex requirements, without compromising balance sheet integrity.

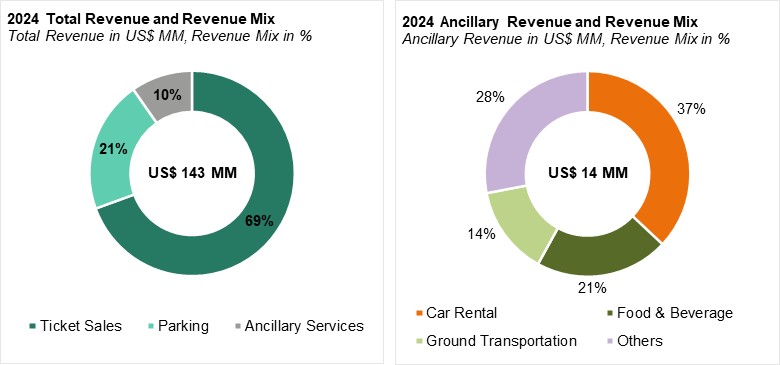

Historically, CBX has delivered robust revenue performance, supported by growing TIJ passenger volumes, passenger capture rates above 32% between 2022 and 2024, and strong ancillary revenue streams.

Unlike GAP’s regulated Mexican airport concessions, which are subject to periodic investment obligations under the Master Development Plan, CBX operates free from such regulatory constraints, except for those required by the CBP, which are not representative. This flexibility enables more strategic capital deployment in high-impact areas such as human capital, IT infrastructure (e.g., facial recognition technology), and customer experience enhancements, ensuring long-term competitiveness without substantial fixed capital commitments.

As an asset-light business with low capex requirements and an efficient working capital cycle, CBX supports strong free cash flow generation, enhancing GAP’s cash flow profile and reinforcing its commitment to disciplined capital allocation and long-term shareholder value creation.

| 23 |

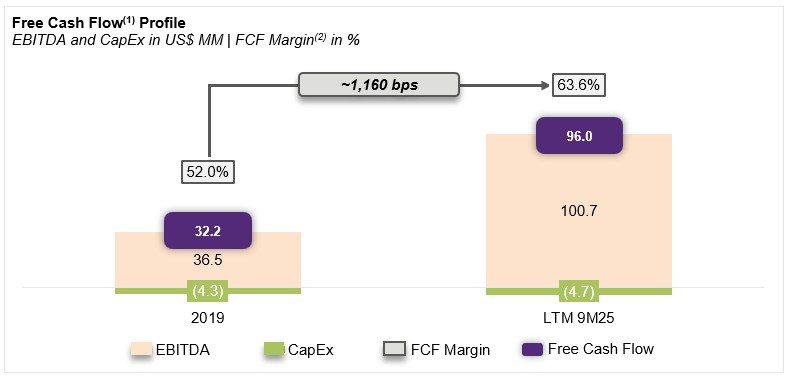

Notes:

1. Calculated as EBITDA - CapEx

2. Calculated as Free Cash Flow / Revenue

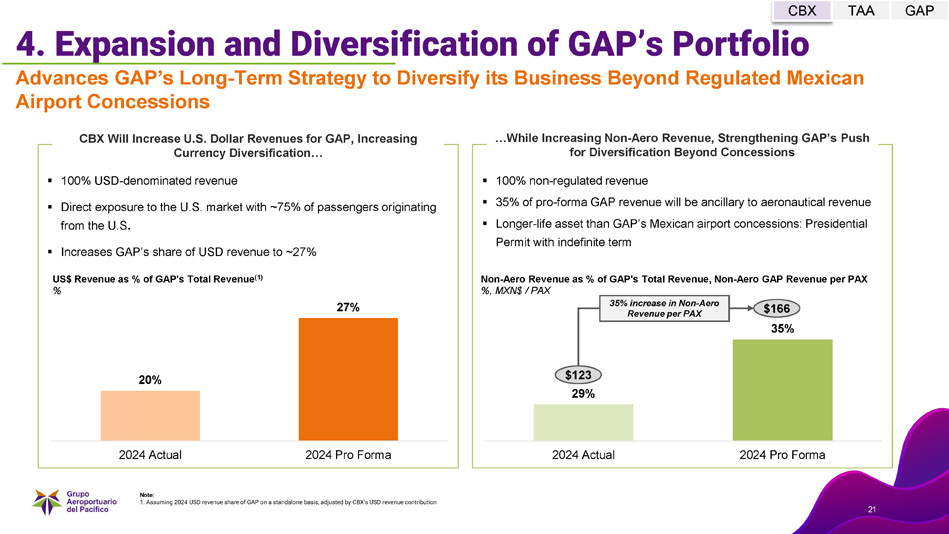

4. Expansion and Diversification of GAP’s Portfolio

The acquisition of CBX marks a pivotal milestone in the execution of GAP’s long-term strategy to diversify its portfolio and evolve beyond regulated Mexican airport concessions. CBX introduces a differentiated, high-performing infrastructure asset that strengthens GAP’s operational platform and unlocks new avenues for sustainable value creation.

Note: 1. Calculated using CBX’s expected Net Debt as of 2025YE and actual EBITDA LTM 9M25.

CBX enhances GAP’s strategic positioning across multiple dimensions:

| 24 |

Geographic and Currency Diversification

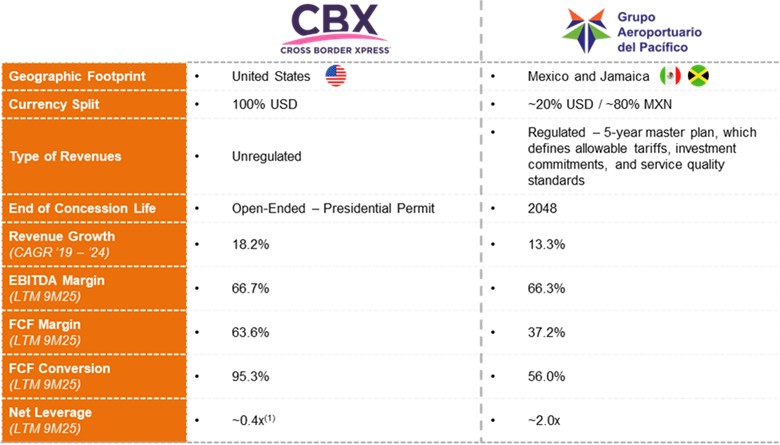

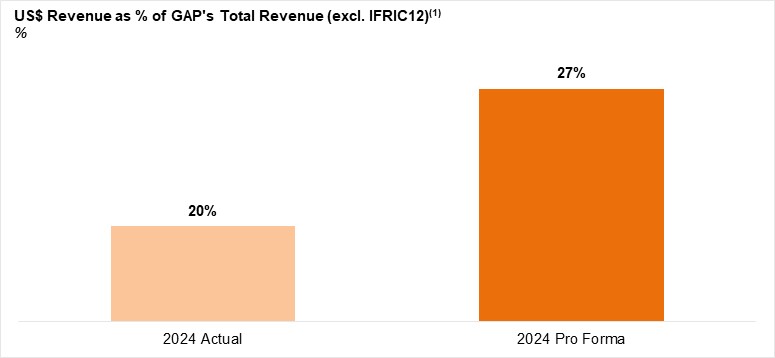

CBX is a fully dollarized asset which generates 100% of its revenue in U.S. dollars and will provide a significant component of currency diversification to GAP, considering that around 80% of GAP’s revenue is currently in Mexican pesos. CBX provides a natural hedge against currency volatility and reinforces GAP’s financial resilience. Additionally, with approximately 75% of CBX passengers originating from the United States, CBX provides direct exposure to the U.S. market and is therefore more resilient to economic downturns.

Note: 1. Assuming 2024 US$ revenue share of GAP on a standalone basis disclosed in GAP’s 2024 20-F, adjusted by CBX’s US$ revenue contribution

Regulatory Risk Diversification

CBX operates under a Presidential Permit with indefinite term (granted in 2010) and an operating agreement with U.S. Customs and Border Protection, which regulates the costs and the recovery of operating expenses, for a 50-year term. This long-term permit may provide regulatory certainty and institutional stability, extending well beyond the duration of GAP’s Mexican airport concessions. Moreover, CBX owns both the land on which the facility stands and the adjacent ~60 acres, further reducing risk related to property lease recontracting.

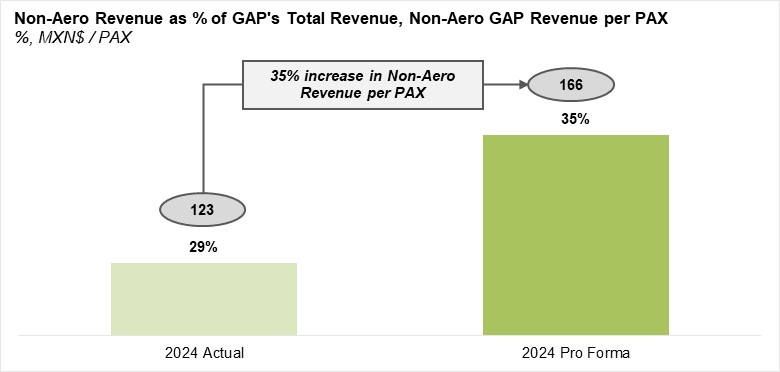

Business Model Diversification

CBX’s revenue is 100% non-aeronautical, further enhancing GAP’s business model diversification. In addition to its primary source of revenue, which is the sale of passenger tickets to cross between the US and TIJ (which are only available to passengers holding air tickets for flights originating or terminating at TIJ), CBX generates other non-aeronautical revenues through a mix of services including parking, car rental companies operating on CBX’s property, retail and food service, and other passenger-focused amenities. This diversified and resilient revenue profile enhances CBX’s profitability and supports GAP’s broader objective of building a balanced infrastructure platform beyond conventional airport assets.

| 25 |

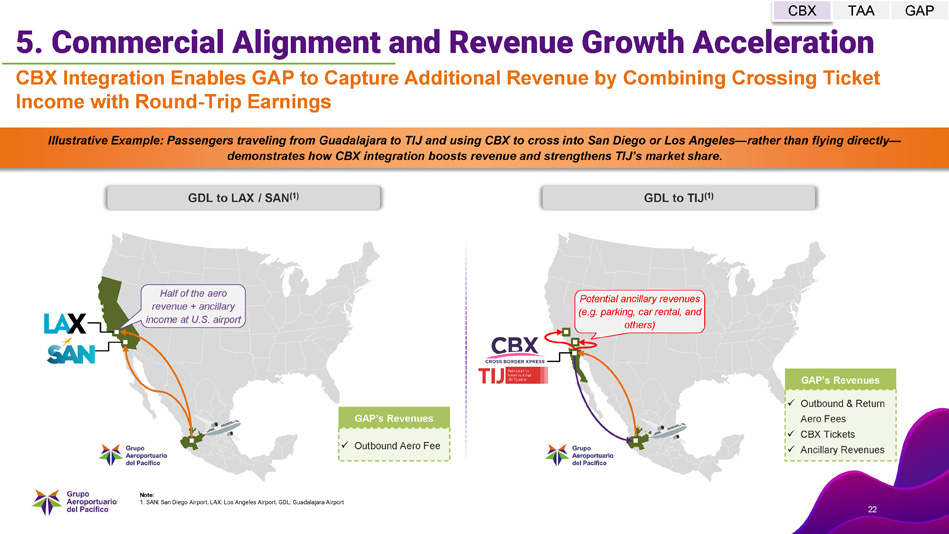

5. Commercial Alignment and Revenue Growth Acceleration

Together, CBX and TIJ will form a tightly integrated cross-border platform that strengthens GAP’s infrastructure footprint, enhances operating efficiency, and supports long-term value creation through strategic asset alignment.

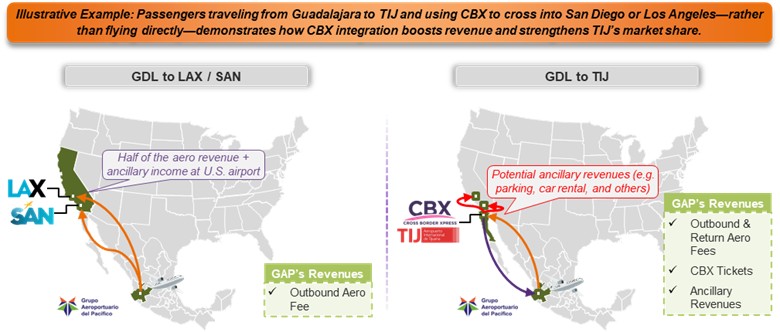

The integration will facilitate a coordinated commercial strategy across CBX and TIJ, unlocking high-impact revenue opportunities. For example, in a scenario where a passenger flies from Guadalajara to San Diego or Los Angeles, half of the aeronautical revenue from the trip stays at the U.S. airport, limiting GAP’s ability to capture incremental revenues. With CBX incorporated, GAP will now capture revenue from passengers flying from Guadalajara to Tijuana – and then using CBX to cross to California – in both legs of the trip via airport fees, CBX crossing tickets, and ancillary revenues. This model not only strengthens GAP’s revenue streams but also boosts TIJ’s market share by positioning it as a preferred gateway for cross-border travel. It’s a clear example of how commercial alignment with CBX drives incremental revenues and enhances GAP’s competitive advantage.

With GAP, CBX is expected to achieve substantial administrative efficiency and reduce operating expenses, which would contribute to a significant expansion of margins and an improvement in operating leverage.

Beyond cost synergies, the integration would enable a coordinated commercial strategy between CBX and the Tijuana International Airport, allowing them to capture high-impact revenue opportunities and generate efficiencies for our customers. GAP is well positioned to drive incremental growth through combined travel offerings, joint marketing initiatives, and harmonized passenger services, enhancing the monetization of both assets.

From an operational standpoint, CBX and the Tijuana International Airport would benefit from complementary capabilities, allowing for a more agile deployment of resources, improved service delivery, and scalable growth. This alignment would support a more efficient operating model and strengthen GAP’s ability to respond dynamically to market demand.

| 26 |

6. Actionable Growth Opportunities to Drive Incremental Value

GAP is uniquely positioned to unlock CBX’s next phase of growth through a targeted set of strategic initiatives designed to enhance revenues, operational efficiency, and long-term asset value. These initiatives span market expansion, commercial optimization, and infrastructure development:

Market Expansion and Demand Consolidation

CBX is strategically positioned to capture traffic from travelers currently using alternate border crossings to access TIJ. By improving convenience and increasing visibility, GAP aims to consolidate demand and reinforce CBX’s role as the preferred gateway for binational travel. Additionally, targeted efforts to attract new airline partnerships and international routes, particularly from underserved regions such as Central America and Asia, will expand CBX’s reach and strengthen its connectivity profile. Moreover, GAP expects to expand CBX’s footprint and model through new projects, including a rental car center, hotel, food and beverage commerce, among others.

Customer Acquisition and Revenue Optimization

GAP is deploying advanced revenue management strategies to maximize yield across both core and ancillary revenue streams. These include bundled service offerings, tactical pricing adjustments, and dynamic pricing techniques tailored to traveler behavior. Strategic partnerships and digital campaigns will further expand CBX’s customer base, positioning it as a viable alternative for passengers searching flights to/from SAN and LAX.

Expansion of Ancillary Services

GAP believes that CBX has significant runway to grow its ancillary revenue base through targeted enhancements:

| • | Parking Optimization: New offerings such as long-term stay discounts, local resident promotions, and bundled packages to drive utilization. |

| • | Rental Car Expansion: Addition of new providers and partnerships with U.S.-based corporate RACs to extend CBX’s reach into Southern California. |

| • | Ground Transportation: Strengthening shuttle and land transport connectivity to improve access and expand CBX’s catchment area. |

| 27 |

| • | Increase Destination Options and Hospitality Services |

Technology-Driven Efficiencies

Continued investment in passenger-facing technologies, such as automated migration forms and self-service immigration e-gates, is streamlining the travel experience, reducing waiting times, and lowering operating costs. These enhancements reinforce CBX’s positioning as a modern, efficient, and customer-centric gateway, while also reducing the reimbursement per passenger to U.S. Customs and Border Protection as automation scales.

Long-Term Projects

CBX is a fully integrated border-crossing complex in a highly strategic location. It includes parking facilities, a car rental center, food and beverage options, and approximately 60 acres of adjacent land available for future development.

The transaction includes almost all the 60 acres of land adjacent to the CBX facilities, offering a compelling opportunity to develop complementary infrastructure. Potential projects include expanded parking, hospitality services, rental car operations, and convention facilities, each designed to enhance the traveler experience, diversify revenue streams, and unlock long-term value. Additionally, CBX opens an opportunity to participate in upcoming border and infrastructure projects.

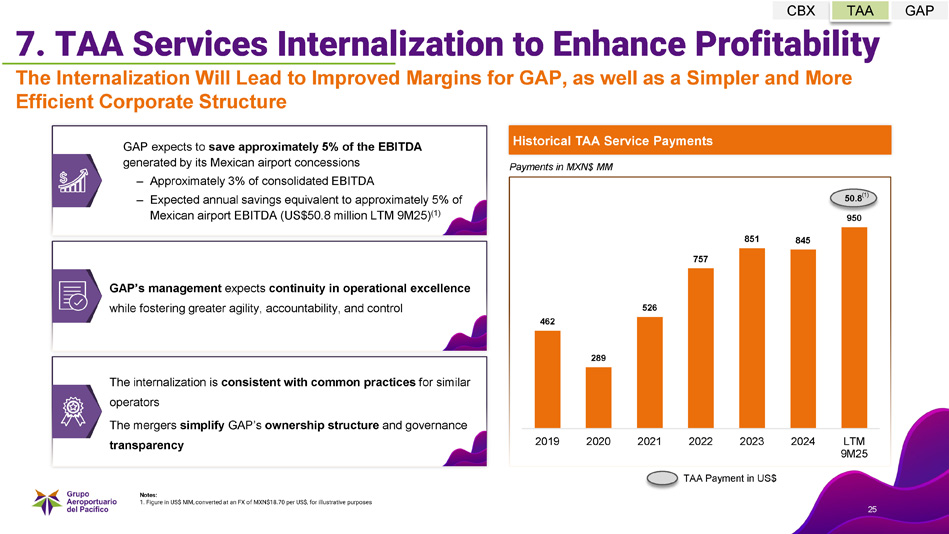

B. Technical Assistance Services and Technology Transfer

Strategic Internalization of TAA Services to Enhance Profitability, Operational Control, and Corporate Governance

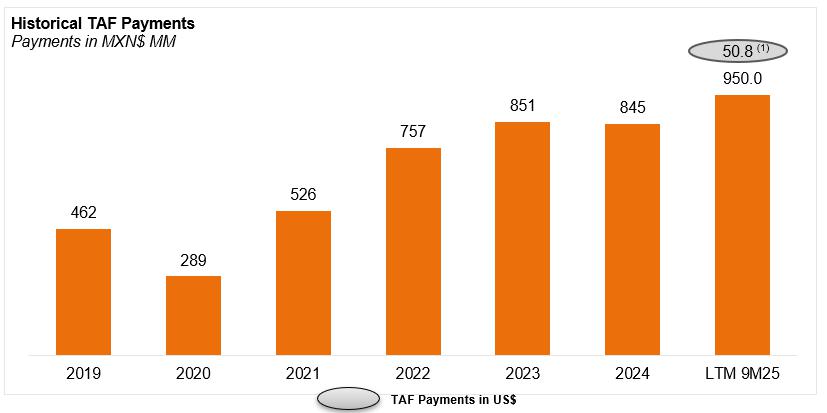

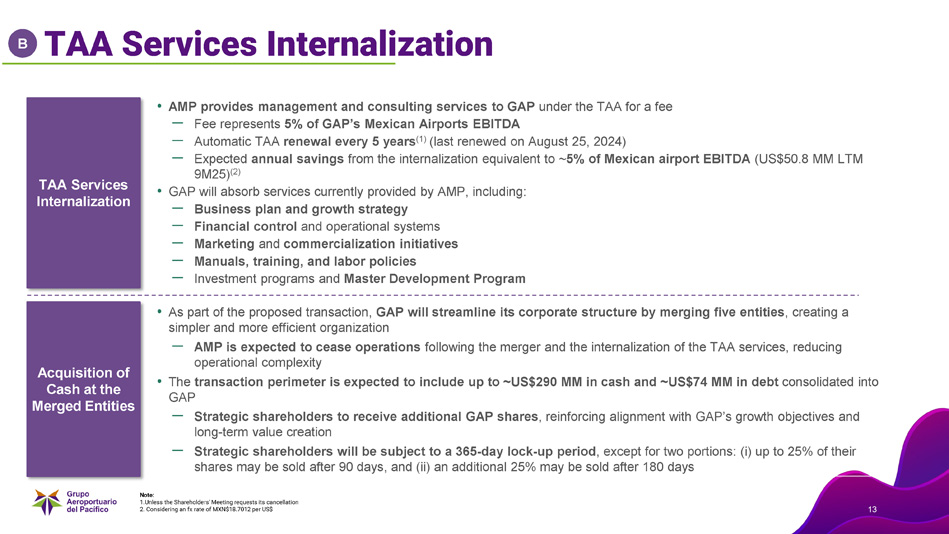

The internalization of the services under the Technical Assistance Agreement (TAA) represents a significant step forward in GAP’s strategy to enhance profitability, operational autonomy, and governance standards. By eliminating, at a consolidated level, the recurring Technical Assistance Fee (TAF) payments to a third-party provider under an agreement renovated automatically every 5 years unless our shareholder meeting requests its termination, GAP expects to generate annual savings equivalent to approximately 5% of EBITDA from its Mexican airport operations, or around MXN$845 million in 2024. These savings directly strengthen GAP’s bottom line and unlock additional capital for reinvestment in strategic priorities on capital allocation.

Under the new structure, GAP’s management will assume full responsibility for the technical assistance and technology transfer functions previously outsourced. This transition ensures continuity in operational excellence for GAP’s airports while fostering greater agility, accountability, and institutional knowledge retention. Over time, GAP expects to create a self-reinforcing cycle of internal knowledge, reducing reliance on external entities and incorporating critical capabilities within the organization. However, given the importance of this service, a transition period of approximately 6 to 12 months is anticipated, during which the services, processes, and systems for the management and operation of the airports in Mexico will be transferred.

The internalization also aligns with global best practices and investor expectations, reinforcing GAP’s commitment to transparency, efficiency, and long-term value creation. By consolidating control over key operational functions, GAP will enhance its ability to respond to evolving market dynamics, implement innovation more rapidly, and maintain consistent service standards across its airport network.

In addition to the financial and operational benefits, the move strengthens GAP’s governance framework, improving oversight and aligning decision-making more closely with shareholder interests. The internalization is a step in the evolution of GAP into a more autonomous and strategically agile infrastructure operator.

| 28 |

Note: 1. Converted at a fixed FX of MXN$18.70 per US$, for illustrative purposes

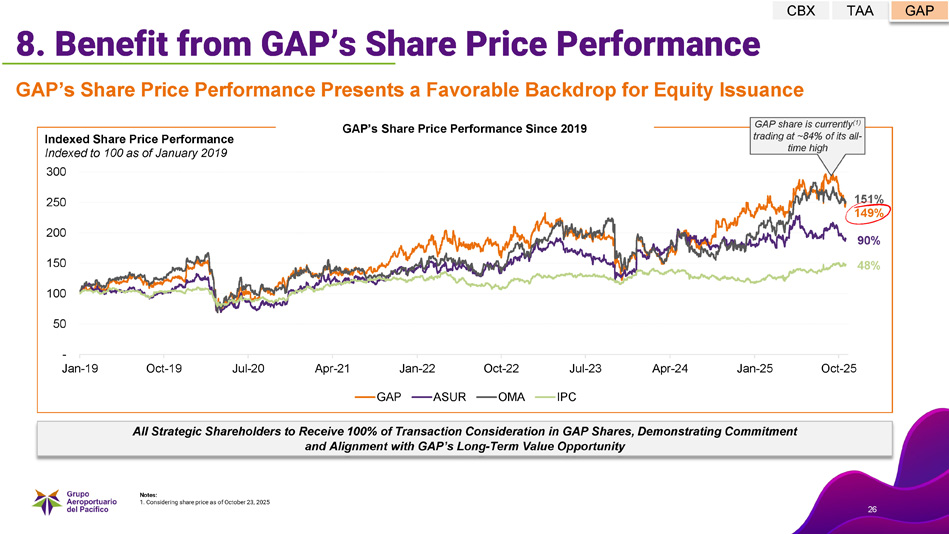

C. GAP

Benefit from GAP’s Share Price Performance

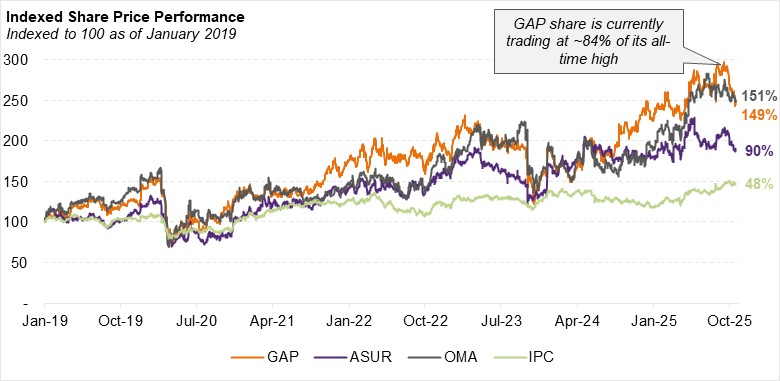

GAP’s sustained share price outperformance and current valuation premium provide a strategically advantageous backdrop for executing the proposed Transaction. Since 2019, GAP has delivered exceptional equity returns, boasting a 149% indexed growth, well above the Mexican Stock Exchange index (IPC). As of October 23, 2025, GAP shares were trading at ~84% of their all-time high, which provides an attractive environment for equity issuance.

The transaction involves GAP issuing approximately 90 million new net shares, as well as the acquisition, through a cash payment, of the 25 percent minority interest in CBX in a separate transaction with cross-conditions. All strategic shareholders will receive only GAP-issued shares as a result of the Merger, which will strengthen alignment and long-term value creation.

The transaction is expected to be accretive on a free cash flow per share basis from the first full year post-integration, driven by CBX’s high-margin profile, strong cash conversion, revenue growth, and synergies from internalizing technical assistance. These factors will enhance key metrics such as operating cash flow per share and dividends per share, underscoring GAP’s commitment to disciplined growth and long-term shareholder value. We expect for the integration as a whole to have a positive impact on our EBITDA of approximately $US180 million.

| 29 |

| 30 |

DETAILED INFORMATION ON THE TRANSACTION

Detailed Description

Business Combination

We propose combining two businesses through the Merger: (i) technical assistance and technology transfer services currently outsourced to our strategic partner AMP since our inception as a private airport group; and (ii) the CBX project, which is a “landside” terminal in San Diego, United States, connected by pedestrian bridge to Tijuana International Airport in Mexico.

Internalization of Technical Assistance and Technology Transfer Services

Under our Technical Assistance Agreement with AMP, our airports receive management and consulting services plus technology transfer. Our subsidiary SIAP pays AMP an annual fee for these services. The Technical Assistance Agreement grants us an exclusive license in Mexico to use all technical assistance, transfer services, and industry knowledge transferred by AMP during the agreement term. AMP provides assistance in several areas including commercial activities development, master development plans preparation, market studies, and initiatives to increase passenger traffic and improve airport operations.

We consider AMP’s technical assistance and transfer services a high-value specialized service that has provided fundamental benefits since our inception as a private airport group. These services are necessary for airport operations and ensuring their continuity through internalization is strategically advantageous. GAP has reached sufficient maturity for internalization. If the Merger is approved, GAP would provide these services directly to its airports while maintaining current operational benefits.

For more information on technical assistance and technology transfer services, see “Technical Assistance Services and Technology Transfer” in this document.

CBX Integration

The CBX is a “landside” terminal located in San Diego, United States connected to a pedestrian bridge that borders the Mexican border, where it connects to the section in Mexico that leads to Tijuana International Airport. The pedestrian bridge, including all its sections, is 120 meters long and is exclusively for passengers from Tijuana International Airport. It is a fast, comfortable, and secure border crossing, without leaving the Tijuana International Airport. CBX currently serves as the main entry point for Mexicans traveling by air from Mexico to California. CBX is designated as part of the San Ysidro Port of Entry under U.S. law. CBX began operations in 2015 and served during the years ended December 31, 2022, 2023, 2024, respectively, and during the first nine months of 2025, 4.1, 4.3, 4.0 and 3.0 million passengers, respectively. In the same period, it generated EBITDA of US$87 million, US$102 million, US$94 million, and US$75 million, respectively, and in the last twelve months ended September 2025, totaled USD $101 million. The Tijuana Airport has a commercial agreement with OTV (which would become part of GAP through the Merger) for CBX construction, operation, maintenance, and use, which is further described in the “Cross Border Xpress Project” section of this Information Statement. OTV also owns approximately 60 acres adjacent to the border crossing that could represent multiple growth opportunities.

We believe CBX is ideal for integration into GAP and will drive our next growth phase. We have long identified CBX as an ideal complement to our business model, directly related to it and with attributes for the new phase we wish to initiate. This asset represents a strategic platform facilitating connectivity between Mexico and the United States, a key area where we see significant growth potential. We believe CBX integration will strengthen our operational infrastructure and provide a strategic position in international logistics and passenger transport.

For more information about CBX, see “Cross Border Xpress Project” in this document.

| 31 |

Ancillary Transaction

The entities to be merged into GAP through the Merger hold a 75% stake in the CBX project. The Merger will transfer this 75% interest to GAP without additional cash consideration. The remaining 25% stake belongs to a private U.S. entity and is not part of the Merger. As a separate ancillary transaction, we intend to acquire that remaining 25% interest and certain adjacent assets for a cash price of approximately US$487.5 million. This ancillary acquisition is subject to effectiveness of the Merger.

Integration Process

If approved by our shareholders, GAP would absorb the assets, rights, and liabilities necessary for internalizing technical assistance and technology transfer services and integrating the operation, maintenance, development and commercial exploitation of the CBX project through the Merger.

Once the Merger is completed, GAP will continue as a publicly traded corporation. Its shares will remain listed on the Mexican Stock Exchange and its ADRs on the New York Stock Exchange. The merged companies will be dissolved.

Through the Merger, GAP would acquire all assets, property, and rights of the Merged Companies, as well as all their liabilities, obligations, and responsibilities on a universal basis, except for assets that are extinguished at the time of the Merger.

Additionally, as part of the Merger and the ancillary transaction, GAP is expected to assume, as of the effective date of the Merger, cash and cash equivalents of up to US$290 million, and financial debt of approximately US$74 million. This includes an estimate of up to US$260 million in the treasury of the merged entities and their non-operative subsidiaries and US$44 million in net debt from the integration of CBX.

GAP Capital Stock

If the Merger is approved by our shareholders, it is estimated that GAP would issue and put into circulation approximately 90 million new net shares representing its capital stock, subject to adjustments.

As a consequence of the Merger, if approved, GAP would issue approximately 187 million new shares. However, before the Merger, the Merged Companies own approximately, 97 million shares representing the capital stock of GAP. Thus, once the Merger is effective, GAP would receive such shares as part of the Merged Companies’ assets. The shares so received by GAP as a result of the Merger would be cancelled.

This number of net shares represents the total number of shares to be issued to direct or indirect shareholders by GAP as a result of the Merger, minus the shares representing GAP’s capital stock that are owned by the Merging Entities prior to the Merger (which will be received by GAP as a result of the Merger and subsequently cancelled).

The final amount of capital increase, the final number of shares to be issued, and their proportion among the different series that make up our capital stock will be reported in due course. Additionally, we propose delegating broad powers to GAP’s Board of Directors to determine the terms of the Merger, including the number of shares to be issued on its effective date.

Merger Agreement

The merger agreement between GAP and the Merged Companies, subject to approval by GAP’s Extraordinary General Shareholders’ Meeting, will include, among other things: (i) the Merger terms; (ii) certain representations by the Merged Companies and GAP regarding incorporation, existence, capacity, powers and validity, compliance with applicable laws, asset ownership, absence of legal proceedings and material disputes, related party transactions, financial information, government authorizations, taxes, intellectual property, insurance, and capital stock; (iii) obligations for shareholders receiving shares resulting from the Merger and GAP to be liable for undisclosed contingencies from the Merged Companies, subject to certain limits and conditions; and (iv) an agreement by shareholders receiving GAP shares not to dispose of them without GAP’s consent for 365 days following the date on which the Merger is approved by GAP’s Extraordinary General Shareholders’ Meeting, subject to exceptions. Two 25% portions will not be subject to sale restrictions. The first 25% may be sold after 90 days, and the second 25% after 180 days following the date on which the Merger is approved by GAP’s Extraordinary General Shareholders’ meeting. All sales must be through registered public offerings or block sales in Mexico or the United States that comply with securities regulations in coordination with GAP.

| 32 |

A copy of the form of merger agreement is attached as Annex 3 “Form of Merger Agreement” to this Information Statement.

[Space intentionally left blank.]

| 33 |

GAP’s Corporate Structure Before and After the Merger

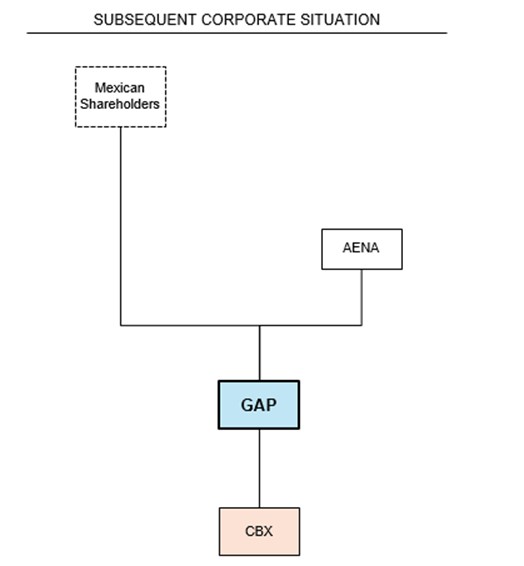

The following organizational charts show GAP’s corporate structure before and after the Merger in simplified form:

Before the Merger:

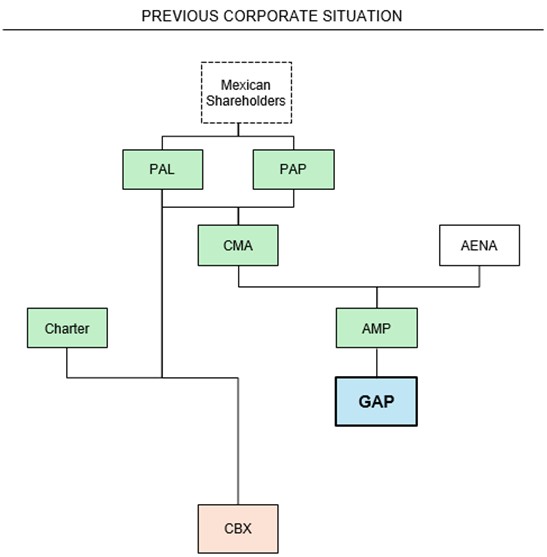

Before the Merger, the Mexican Shareholders wholly own PAP (Promotora Aeronáutica del Pacifico, S.A. de C.V.) and PAL (PAL Aeropuertos, S. de R.L. de C.V.). PAP and PAL own all of CMA (Controladora Mexicana de Aeropuertos, S.A. de C.V.), which holds 66.6% of AMP’s capital stock. Aena Desarrollo Internacional S.M.E., S.A., Sociedad Unipersonal holds the remaining 33.3% of AMP. AMP owns 19.3% of GAP shares (Series B and Series BB shares), with the remainder, approximately 80.7% held by the investing public. CBX is held through OTV (Otay-Tijuana Venture, LLC.), which is owned by Otay-TJ Holdings LLC. The latter is 37.5% owned by PAP shareholders, through Proyectos de Infraestructura Charter, S. de R.L. de C.V.; 37.5% by PAL shareholders, and 25% by EGI-Otay Investors, LLC.

| 34 |

After the Merger:

After the Merger, including the ancillary transaction, the Mexican shareholders and Aena Desarrollo Internacional S.M.E., S.A., Sociedad Unipersonal will own GAP capital stock. The investing public will continue to own the capital stock in GAP and GAP will own the entire CBX project.

Transaction Objective

The Merger will enable integration of the technical assistance and technology transfer services business and the CBX project into GAP. We believe the Merger represents a significant step in our corporate history and expect it to create substantial long-term value for our shareholders.

Sources of Financing for the Transaction

Except for inherent expenses related to the Merger and the ancillary transaction to consolidate the minority interest in CBX, including certain adjacent assets, there will not be any cash outlay by GAP.

We expect to cover inherent Merger expenses with our own resources. In the event we acquire the minority interest in CBX and certain adjacent assets, as an ancillary transaction to the Merger, we expect to cover the price of such transaction and the related expenses with access to credit lines, and we could use our own resources.

Merger Expenses

Each party will bear its own legal and corporate expenses for the Merger, except those that by their nature must be borne by third parties. These expenses include, among others, payment of duties, taxes, registration fees, notary fees, and fees for external legal, accounting, and external financial advisors common in a transaction of this nature.

| 35 |

GAP expenses arising from the Merger and the ancillary transaction are expected to be approximately $200 million pesos. This excludes expenses related to the payment of duties, taxes, and registration fees.

Impact on Share Rights and Obligations