KalVista Pharmaceuticals Corporate Overview January 2026 .2

Forward-looking statements This presentation and the accompanying oral commentary contain forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. For this purpose, any statements that are not statements of historical fact may be deemed forward-looking statements. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expect,” “plan,” anticipate,” “believe,” “estimate,” “predict,” “intend,” “potential,” “would,” “continue,” “ongoing”, "seek", "future", "likely", "goal", "strategy", "project", or the negative of these terms or other comparable terminology. These forward-looking statements include statements contained in this presentation, including, among others, those relating to: information regarding the potential commercial success and growth of EKTERLY, including market size, acceptance, demand, adoption rate for EKTERLY (sebetralstat), our plan to report on patient start forms, and, generally, our expected potential revenues from the sale of EKTERLY, our ability to successfully implement our patient and provider outreach campaign, whether EKTERLY will receive foreign approval when expected or at all, information relating to our general business plans and objectives, the timing and success of our planned nonclinical and clinical development activities, including our KONFIDENT-S and KONFIDENT-KID trials, and the future progress and potential success of our oral Factor XIIa program, the timing and results of nonclinical studies and clinical trials, the efficacy and safety profiles of our product candidates, any expectations about safety, the efficacy of EKTERLY, the ability of EKTERLY to treat hereditary angioedema (HAE), the potential therapeutic benefits and economic value of our product candidates, statements regarding potential market and growth opportunities, our competitive position, the industry environment as a whole, our ability to protect intellectual property and the impact of global business or macroeconomic conditions, including as a result of inflation, rising interest rates, instability in the global banking system, and geopolitical conflicts, including the conflicts in Ukraine and the Middle East, on our business and operations. Forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. These factors, together with those that are described under the heading “Risk Factors” contained in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on July 10, 2025, as updated by our subsequent filings with the SEC, including our Quarterly Reports on Form 10-Q, as well as other documents we file from time to time with the SEC, may cause our actual results, performance or achievements to differ materially and adversely from those anticipated or implied by our forward-looking statements. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this presentation, and although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

We deliver novel therapies that empower people to live better lives We aim to develop therapies that change the treatment landscape for rare diseases with high unmet needs—beginning with hereditary angioedema (HAE).

KalVista: A patient-focused rare disease company We are a global pharmaceutical company that developed and is commercializing EKTERLY as the first and only oral on-demand therapy for HAE in the U.S. and other key global markets. Our strategy is to leverage the global capabilities and infrastructure that supported the development and commercialization of EKTERLY, and develop, acquire or in-license additional innovative therapies targeting rare diseases with significant unmet needs. Overview Strategy

Our flagship product: EKTERLY Please see Prescribing Information at KalVista.com Poised to become the foundational therapy for hereditary angioedema (HAE) Approved in seven key global markets: US, EU, UK, Switzerland, Australia, Japan and Singapore Indicated for the treatment of acute attacks of HAE in adult and pediatric patients aged 12 years and older; planned expansion to ages 2-11 in 2027 Proven rapid and sustained relief of HAE attacks of all types and severity; pristine safety

HAE Unmet Need & EKTERLY Clinical Data

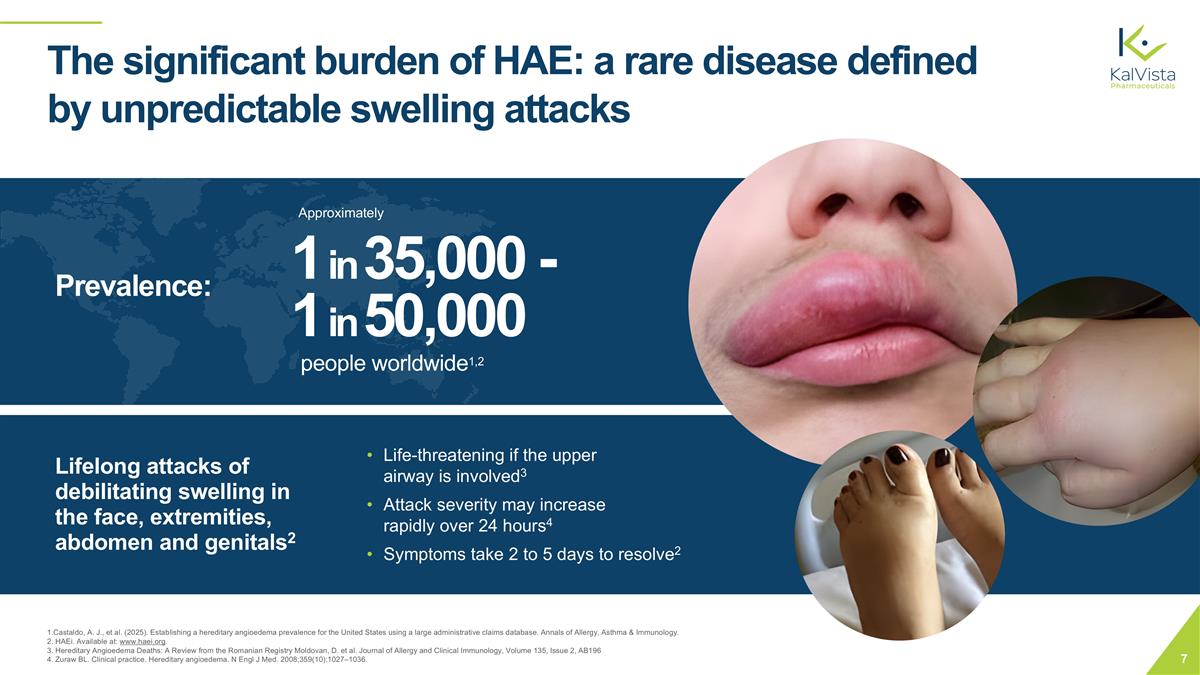

The significant burden of HAE: a rare disease defined by unpredictable swelling attacks 1 in 35,000 - 1 in 50,000 people worldwide1,2 Lifelong attacks of debilitating swelling in the face, extremities, abdomen and genitals2 Life-threatening if the upper airway is involved3 Attack severity may increase rapidly over 24 hours4 Symptoms take 2 to 5 days to resolve2 1.Castaldo, A. J., et al. (2025). Establishing a hereditary angioedema prevalence for the United States using a large administrative claims database. Annals of Allergy, Asthma & Immunology. 2. HAEi. Available at: www.haei.org. 3. Hereditary Angioedema Deaths: A Review from the Romanian Registry Moldovan, D. et al. Journal of Allergy and Clinical Immunology, Volume 135, Issue 2, AB196 4. Zuraw BL. Clinical practice. Hereditary angioedema. N Engl J Med. 2008;359(10):1027–1036. Prevalence: Approximately

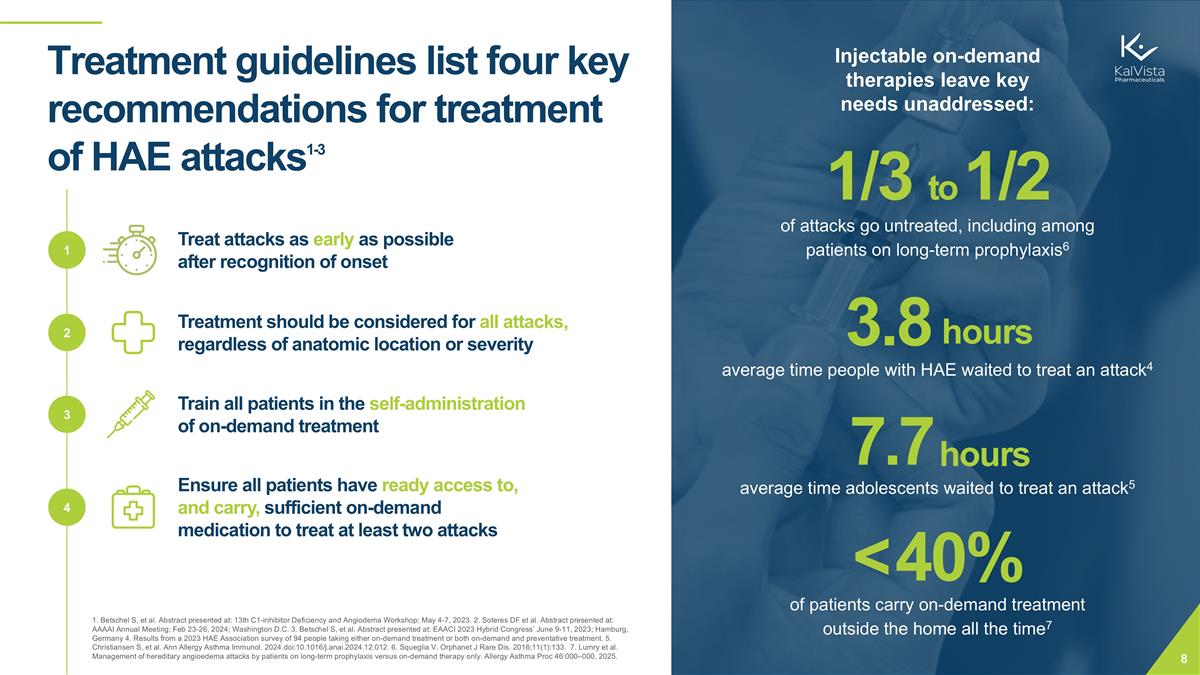

Treatment guidelines list four key recommendations for treatment of HAE attacks1-3 Treat attacks as early as possible after recognition of onset Treatment should be considered for all attacks, regardless of anatomic location or severity Train all patients in the self-administration of on-demand treatment Ensure all patients have ready access to, and carry, sufficient on-demand medication to treat at least two attacks 1 2 3 4 Injectable on-demand therapies leave key needs unaddressed: 3.8 hours average time people with HAE waited to treat an attack4 of patients carry on-demand treatment outside the home all the time7 1/3 to 1/2 <40% 1. Betschel S, et al. Abstract presented at: 13th C1-inhibitor Deficiency and Angiodema Workshop; May 4-7, 2023. 2. Soteres DF et al. Abstract presented at: AAAAI Annual Meeting; Feb 23-26, 2024; Washington D.C. 3. Betschel S, et al. Abstract presented at: EAACI 2023 Hybrid Congress’ June 9-11, 2023; Hamburg, Germany 4. Results from a 2023 HAE Association survey of 94 people taking either on-demand treatment or both on-demand and preventative treatment. 5. Christiansen S, et al. Ann Allergy Asthma Immunol. 2024.doi:10.1016/j.anai.2024.12.012. 6. Squeglia V. Orphanet J Rare Dis. 2016;11(1):133. 7. Lumry et al. Management of hereditary angioedema attacks by patients on long-term prophylaxis versus on-demand therapy only. Allergy Asthma Proc 46:000–000, 2025. 7.7 hours average time adolescents waited to treat an attack5 of attacks go untreated, including among patients on long-term prophylaxis6

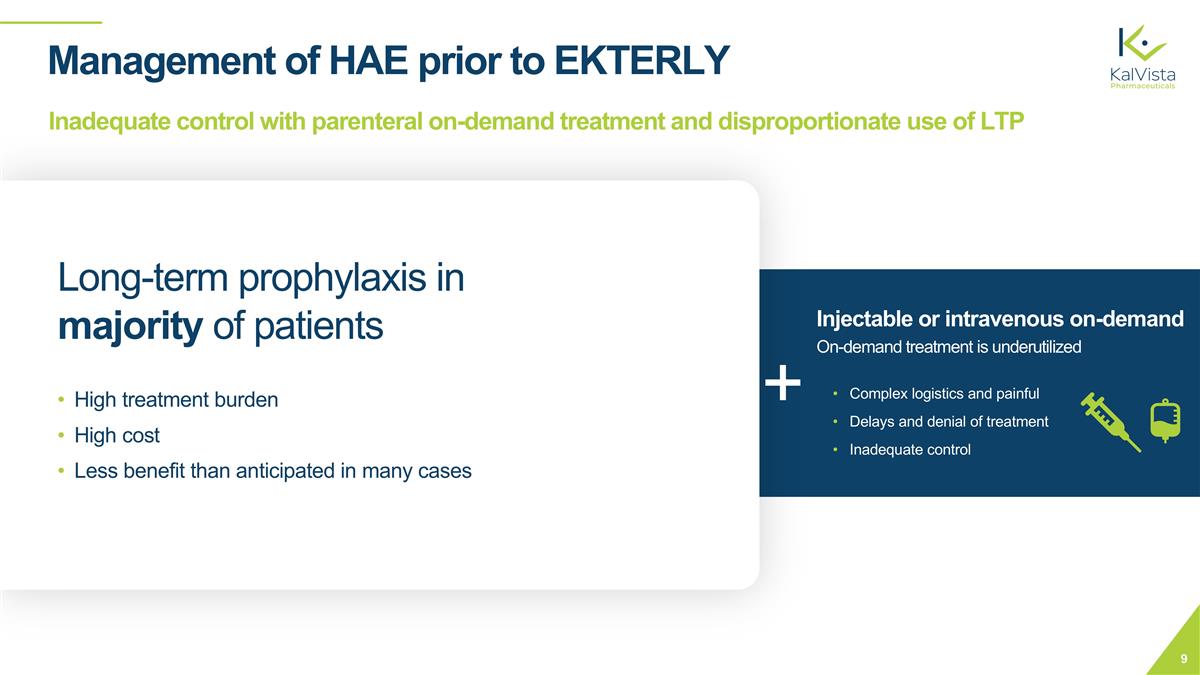

Management of HAE prior to EKTERLY Long-term prophylaxis in majority of patients Injectable or intravenous on-demand On-demand treatment is underutilized Complex logistics and painful Delays and denial of treatment Inadequate control High treatment burden High cost Less benefit than anticipated in many cases Inadequate control with parenteral on-demand treatment and disproportionate use of LTP

Management of HAE with EKTERLY 1. Busse PJ, et al. J Allergy Clin Immunol Pract. 2021;9(1):132-150.e3. 2. Maurer M, et al. Allergy. 2022;77(7):1961-1990. Long-term prophylaxis in appropriate patients1,2 EKTERLY On-Demand Treatment First and only oral on-demand HAE treatment Poised to Become the Foundational HAE Treatment

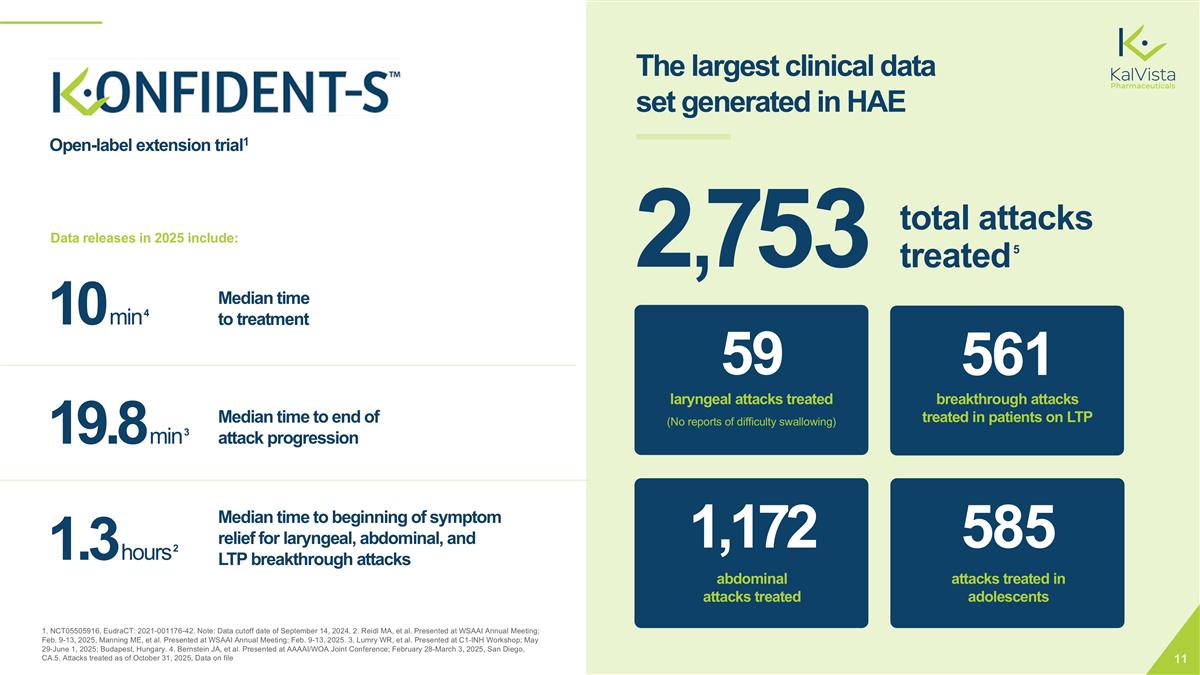

1. NCT05505916, EudraCT: 2021-001176-42. Note: Data cutoff date of September 14, 2024. 2. Reidl MA, et al. Presented at WSAAI Annual Meeting; Feb. 9-13, 2025, Manning ME, et al. Presented at WSAAI Annual Meeting; Feb. 9-13, 2025. 3. Lumry WR, et al. Presented at C1-INH Workshop; May 29-June 1, 2025; Budapest, Hungary. 4. Bernstein JA, et al. Presented at AAAAI/WOA Joint Conference; February 28-March 3, 2025, San Diego, CA.5. Attacks treated as of October 31, 2025, Data on file 59 (No reports of difficulty swallowing) laryngeal attacks treated 1,172 abdominal attacks treated 2,753 total attacks treated5 585 attacks treated in adolescents 561 breakthrough attacks treated in patients on LTP The largest clinical data set generated in HAE Open-label extension trial1 1.3 hours 2 Median time to beginning of symptom relief for laryngeal, abdominal, and LTP breakthrough attacks 19.8 min 3 Median time to end of attack progression 10 min 4 Median time to treatment Data releases in 2025 include:

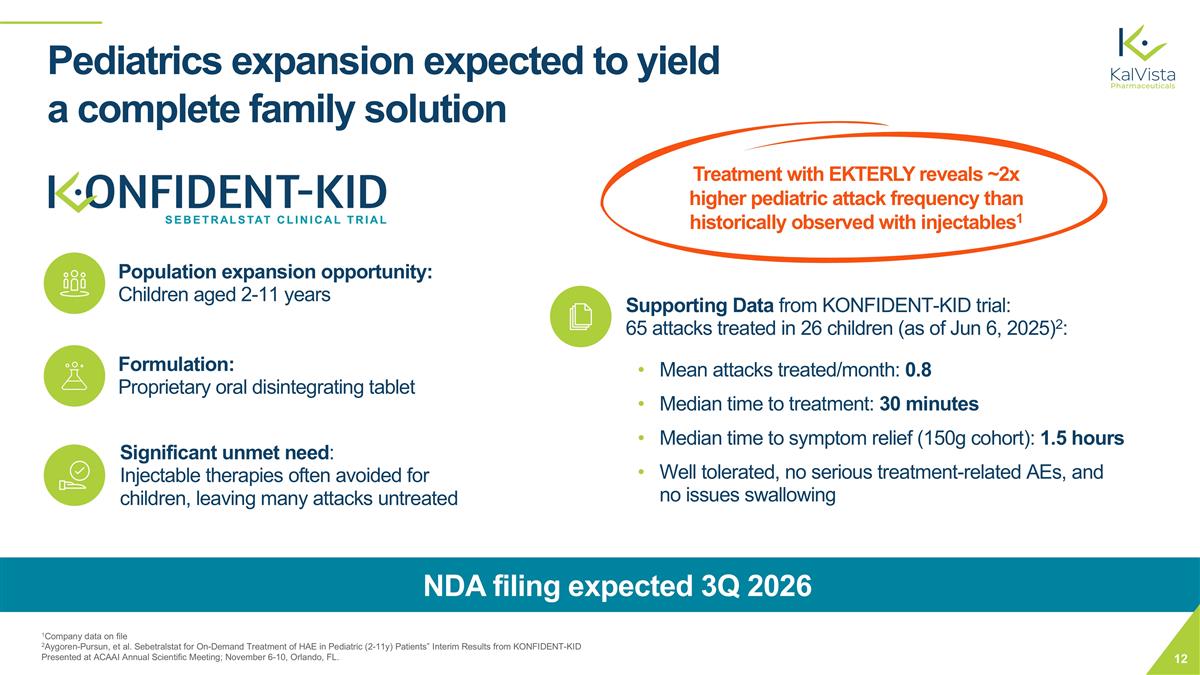

Pediatrics expansion expected to yield a complete family solution 1Company data on file 2Aygoren-Pursun, et al. Sebetralstat for On-Demand Treatment of HAE in Pediatric (2-11y) Patients” Interim Results from KONFIDENT-KID Presented at ACAAI Annual Scientific Meeting; November 6-10, Orlando, FL. Population expansion opportunity: Children aged 2-11 years Formulation: Proprietary oral disintegrating tablet Significant unmet need: Injectable therapies often avoided for children, leaving many attacks untreated Supporting Data from KONFIDENT-KID trial: 65 attacks treated in 26 children (as of Jun 6, 2025)2: Mean attacks treated/month: 0.8 Median time to treatment: 30 minutes Median time to symptom relief (150g cohort): 1.5 hours Well tolerated, no serious treatment-related AEs, and no issues swallowing NDA filing expected 3Q 2026 Treatment with EKTERLY reveals ~2x higher pediatric attack frequency than historically observed with injectables1

EKTERLY Commercial Strategy & Launch

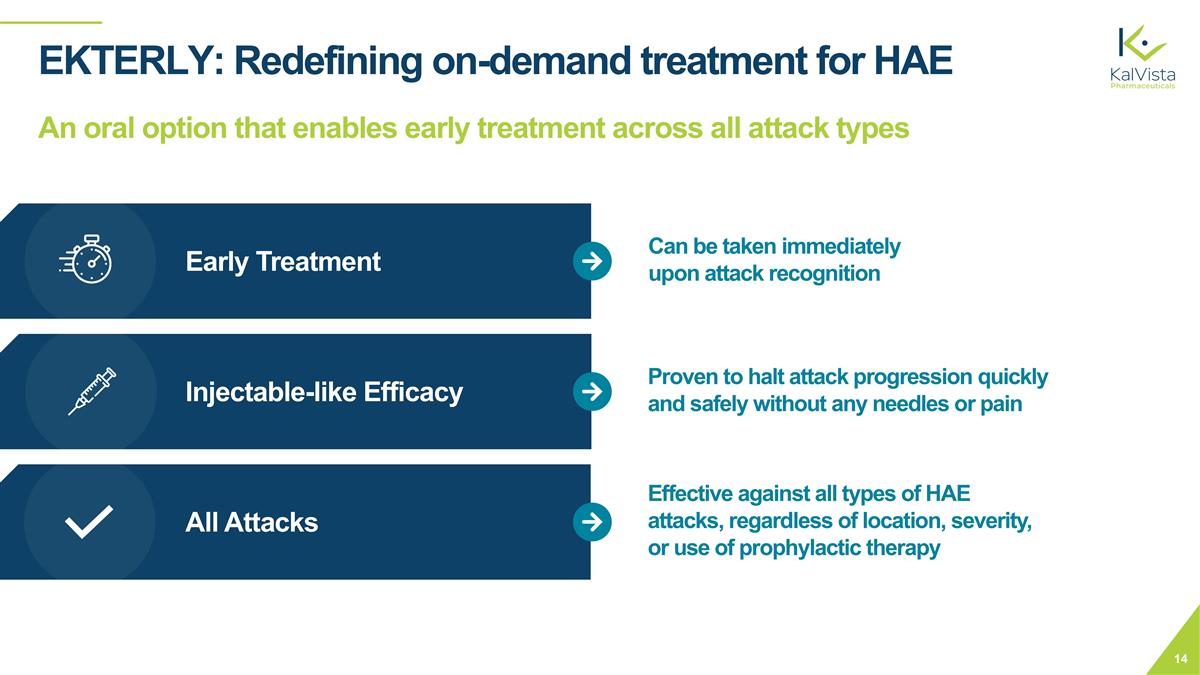

EKTERLY: Redefining on-demand treatment for HAE An oral option that enables early treatment across all attack types Early Treatment Injectable-like Efficacy All Attacks Effective against all types of HAE attacks, regardless of location, severity, or use of prophylactic therapy Proven to halt attack progression quickly and safely without any needles or pain Can be taken immediately upon attack recognition

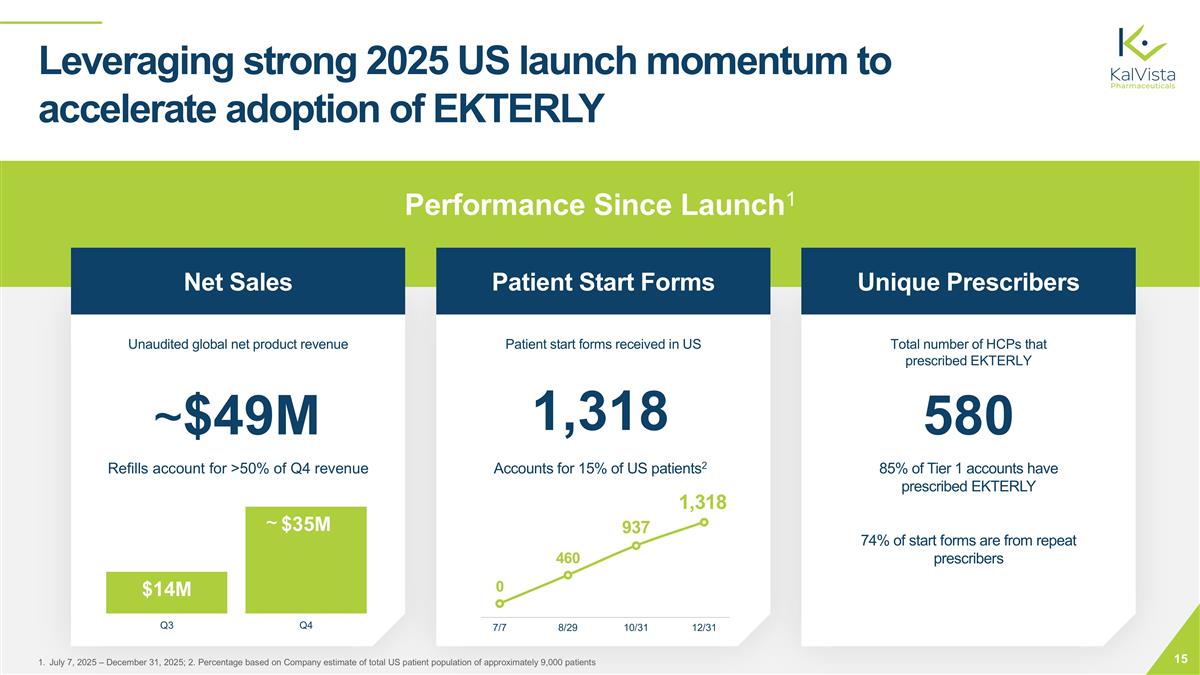

Performance Since Launch1 ~$49M 1,318 580 Leveraging strong 2025 US launch momentum to accelerate adoption of EKTERLY Refills account for >50% of Q4 revenue 85% of Tier 1 accounts have prescribed EKTERLY 74% of start forms are from repeat prescribers July 7, 2025 – December 31, 2025; 2. Percentage based on Company estimate of total US patient population of approximately 9,000 patients Net Sales Patient Start Forms Unique Prescribers Unaudited global net product revenue Patient start forms received in US Total number of HCPs that prescribed EKTERLY Accounts for 15% of US patients2 ~

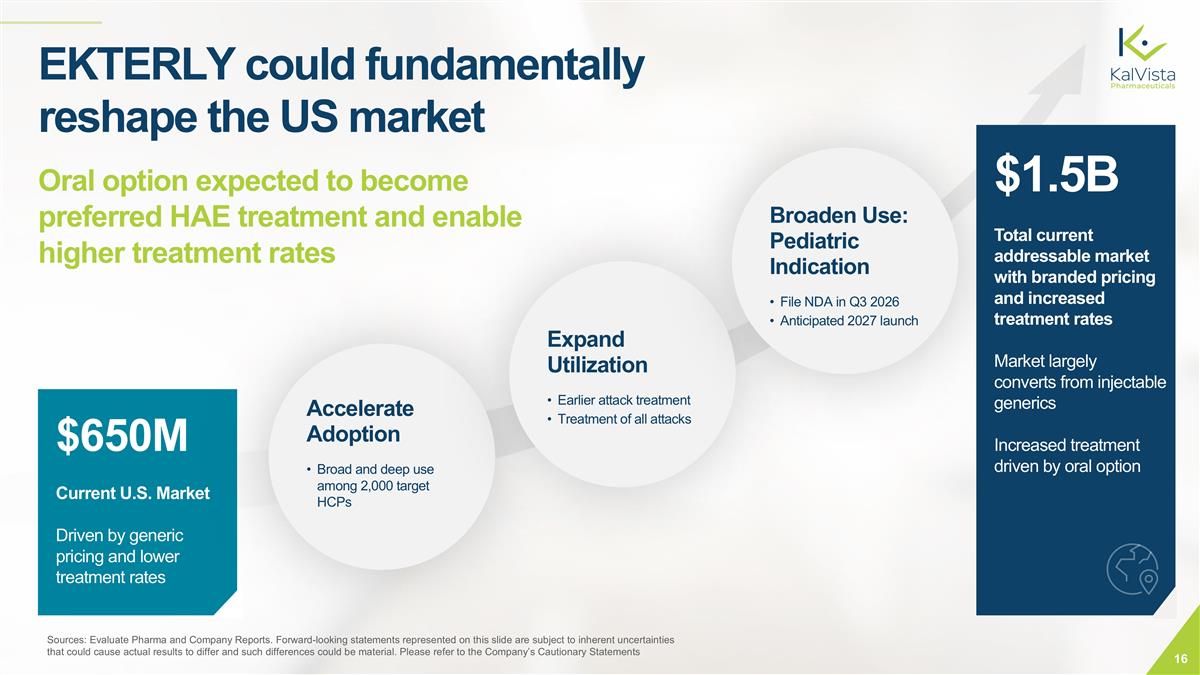

Sources: Evaluate Pharma and Company Reports. Forward-looking statements represented on this slide are subject to inherent uncertainties that could cause actual results to differ and such differences could be material. Please refer to the Company’s Cautionary Statements $650M Current U.S. Market Driven by generic pricing and lower treatment rates Accelerate Adoption Broad and deep use among 2,000 target HCPs Expand Utilization Earlier attack treatment Treatment of all attacks Broaden Use: Pediatric Indication File NDA in Q3 2026 Anticipated 2027 launch $1.5B Total current addressable market with branded pricing and increased treatment rates Market largely converts from injectable generics Increased treatment driven by oral option EKTERLY could fundamentally reshape the US market Oral option expected to become preferred HAE treatment and enable higher treatment rates

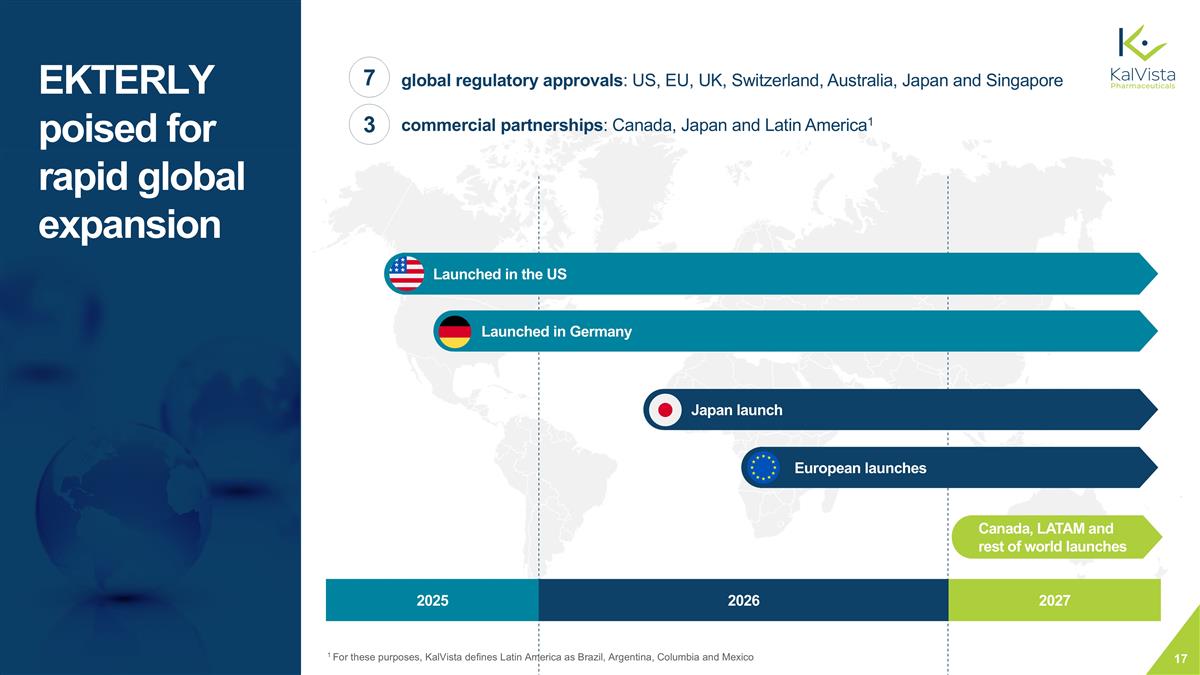

2025 2026 Launched in the US Launched in Germany European launches Japan launch Canada, LATAM and rest of world launches EKTERLY poised for rapid global expansion global regulatory approvals: US, EU, UK, Switzerland, Australia, Japan and Singapore commercial partnerships: Canada, Japan and Latin America1 7 3 2027 1 For these purposes, KalVista defines Latin America as Brazil, Argentina, Columbia and Mexico

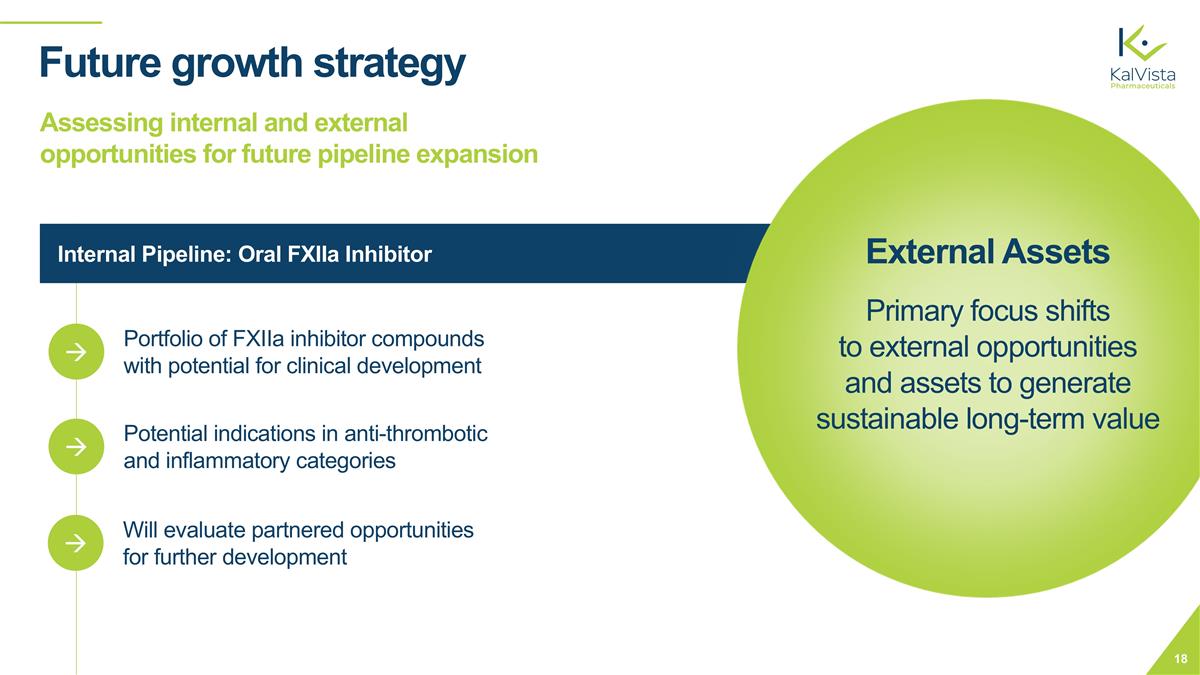

Internal Pipeline: Oral FXIIa Inhibitor Future growth strategy Assessing internal and external opportunities for future pipeline expansion Portfolio of FXIIa inhibitor compounds with potential for clinical development à Potential indications in anti-thrombotic and inflammatory categories à Will evaluate partnered opportunities for further development à External Assets Primary focus shifts to external opportunities and assets to generate sustainable long-term value

Strong Position, Clear Growth Trajectory Built on five differentiated value drivers Global Opportunity Rare Disease Expertise Financial Foundation Protected Value Growth Strategy EKTERLY approved in 7 key markets; launched in the US & Germany; commercial partners in place in Canada, Japan & Latin America Built world-class global development and commercial teams with deep rare disease and HAE experience Financed through profitability Secured IP into 2040s Leverage capabilities by developing a portfolio of therapies addressing rare diseases with high unmet need

Nasdaq: KALV