Please wait

DEF 14A0001350593FALSEiso4217:USD00013505932023-10-012024-09-300001350593mwa:ZakasMember2023-10-012024-09-300001350593mwa:HallMember2022-10-012023-09-300001350593mwa:ZakasMember2022-10-012023-09-3000013505932022-10-012023-09-300001350593mwa:HallMember2021-10-012022-09-3000013505932021-10-012022-09-300001350593mwa:HallMember2020-10-012021-09-3000013505932020-10-012021-09-300001350593mwa:HallMember2023-10-012024-09-300001350593ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembermwa:HallMember2023-10-012024-09-300001350593ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembermwa:ZakasMember2023-10-012024-09-300001350593ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMembermwa:HallMember2023-10-012024-09-300001350593ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMembermwa:ZakasMember2023-10-012024-09-300001350593ecd:PnsnAdjsSvcCstMemberecd:PeoMembermwa:HallMember2023-10-012024-09-300001350593ecd:PnsnAdjsSvcCstMemberecd:PeoMembermwa:ZakasMember2023-10-012024-09-300001350593ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembermwa:HallMember2023-10-012024-09-300001350593ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembermwa:ZakasMember2023-10-012024-09-300001350593ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembermwa:HallMember2023-10-012024-09-300001350593ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembermwa:ZakasMember2023-10-012024-09-300001350593ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMembermwa:HallMember2023-10-012024-09-300001350593ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMembermwa:ZakasMember2023-10-012024-09-300001350593ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembermwa:HallMember2023-10-012024-09-300001350593ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembermwa:ZakasMember2023-10-012024-09-300001350593ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembermwa:HallMember2023-10-012024-09-300001350593ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembermwa:ZakasMember2023-10-012024-09-300001350593ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMembermwa:HallMember2023-10-012024-09-300001350593ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMembermwa:ZakasMember2023-10-012024-09-300001350593ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-10-012024-09-300001350593ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-10-012024-09-300001350593ecd:PnsnAdjsSvcCstMemberecd:NonPeoNeoMember2023-10-012024-09-300001350593ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-10-012024-09-300001350593ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-10-012024-09-300001350593ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-10-012024-09-300001350593ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-10-012024-09-300001350593ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-10-012024-09-300001350593ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-10-012024-09-30000135059312023-10-012024-09-30000135059322023-10-012024-09-30000135059332023-10-012024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | | | | | | | | | | | | | |

| ☒ | Filed by the Registrant | | ☐ | Filed by a Party other than the Registrant |

| | | | |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| | |

| Mueller Water Products, Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | | | | |

| | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | |

NOTICE OF ANNUAL MEETING

| | | | | | | | | | | | | | |

| | | | |

| WHEN |

| WHERE |

| RECORD DATE |

Thursday, February 6, 2025; 10:00 A.M., Eastern Time | | The Annual Meeting will be held virtually via live webcast at: meetnow.global/MHMJVY5 | | Only our stockholders at the close of business on December 9, 2024, the record date for voting at the Annual Meeting, are entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof. |

ITEMS OF BUSINESS | | | | | | | | |

|

| Board Recommendation |

Proposal 1 | To elect nine directors | FOR each director nominee |

Proposal 2 | To approve, on an advisory basis, the compensation of our named executive officers | FOR |

Proposal 3 | To approve the amendment and restatement of the 2006 Employee Stock Purchase Plan | FOR |

Proposal 4 | To approve the amendment and restatement of the 2006 Stock Incentive Plan | FOR |

Proposal 5 | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2025 | FOR |

Stockholders will also transact any other business properly brought before the Annual Meeting and any reconvened or rescheduled meeting following any adjournments or postponements thereof.

We use United States Securities and Exchange Commission (“SEC”) rules allowing issuers to furnish proxy materials to their stockholders over the Internet. A Notice of Internet Availability of Proxy Materials or this Proxy Statement will first be mailed to our stockholders on or about December 18, 2024. Please refer to the Notice of Internet Availability of Proxy Materials, proxy materials email or proxy card you received for information on how to vote your shares and to ensure your shares will be represented and voted at the Annual Meeting.

By Order of the Board of Directors.

CHASON A. CARROLL

Corporate Secretary

Atlanta, Georgia

December 18, 2024

| | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON February 6, 2025 This Proxy Statement and our 2024 Annual Report are available at www.proxyvote.com (for beneficial stockholders) and www.edocumentview.com/mwa (for registered stockholders). |

PROXY STATEMENT FOR 2025 ANNUAL MEETING 1

LETTER TO STOCKHOLDERS

DEAR FELLOW STOCKHOLDERS,

Fiscal year 2024 was a record year for Mueller Water Products (“Mueller”). With Mueller’s outstanding financial, operational and strategic performance, as well as the reaffirmation of Marietta Edmunds Zakas as our Chief Executive Officer and appointment of Paul McAndrew as our President and Chief Operating Officer, the Board of Directors and I are enthusiastic about Mueller’s future. Together with the management team, we are focused on executing our strategic priorities to benefit our customers, people, communities and stockholders.

As previously reported, Mueller achieved record annual net sales, margins and cash generation in fiscal 2024. We also returned approximately $50 million to shareholders through share repurchases and increased quarterly dividends for the ninth time through the end of fiscal 2024. We are confident in our future, knowing that the significant investments we have made in our facilities and our ongoing strategies position us well to be a major contributor to enhancing the aging North American water infrastructure as the expected incremental spending associated with the federal infrastructure bill is realized. We remain committed to developing the products and solutions our communities need as we help our cities and water utilities deliver clean, safe drinking water.

Our commitment extends to our Environmental, Social and Governance (“ESG”) initiatives. In September, we released our fourth ESG Report, highlighting our progress toward becoming a more sustainable, innovative and impactful organization. Notably, in March 2024, MSCI ESG Research LLC upgraded Mueller’s ESG practices to its highest level of AAA. We also enhanced our global disclosure alignment with the United Nations Sustainable Development Goals and provided initial climate-related information to CDP Worldwide.

This year, we continued to advance our board refreshment plans by adding two highly accomplished directors. Christian A. Garcia brings operational and financial expertise in the industrial and manufacturing sectors across global organizations, while Brian Healy offers extensive executive leadership experience, strategic planning skills, and financial acumen. Additionally, we are nominating two senior executives, each of whom joined us as Board Observers in December 2024, as new directors for election at the 2025 Annual Meeting of Stockholders. Ms. Bentina Chisolm Terry brings us over 25 years of senior leadership in the utility industry, and Mr. Leland G. Weaver brings over 20 years of broad experience in operations and manufacturing. We are confident that each will bring fresh perspectives and significant value to our diverse Board.

With a continued eye to the future, we adopted tenure/age-based guidelines for continuing membership on our Board – carefully balancing our desire to benefit from the experience and historical knowledge of our members as well as from the infusion of fresh perspectives to assure the ongoing vitality of our Board.

Lastly, at the 2025 Annual Meeting of Stockholders, both Dr. Lydia Waters Thomas and Ms. Shirley C. Franklin will retire from the Board. I want to recognize and deeply thank Dr. Thomas and Ms. Franklin for their combined 31 years of instrumental and respected service on the Board. Through their leadership, they have provided thoughtful and judicious guidance. They will both be missed.

My fellow directors and I encourage you to review the accompanying Proxy Statement and associated materials prior to the Annual Meeting on February 6, 2025.

On behalf of the Board, our management, and all of our people, I thank you for being a Mueller Water Products stockholder and for your continued support of our superb organization.

STEPHEN C. VAN ARSDELL

Non-Executive Chair of the Board

2 MUELLER WATER PRODUCTS, INC.

PROXY SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider, and you should read the entire Proxy Statement carefully before voting.

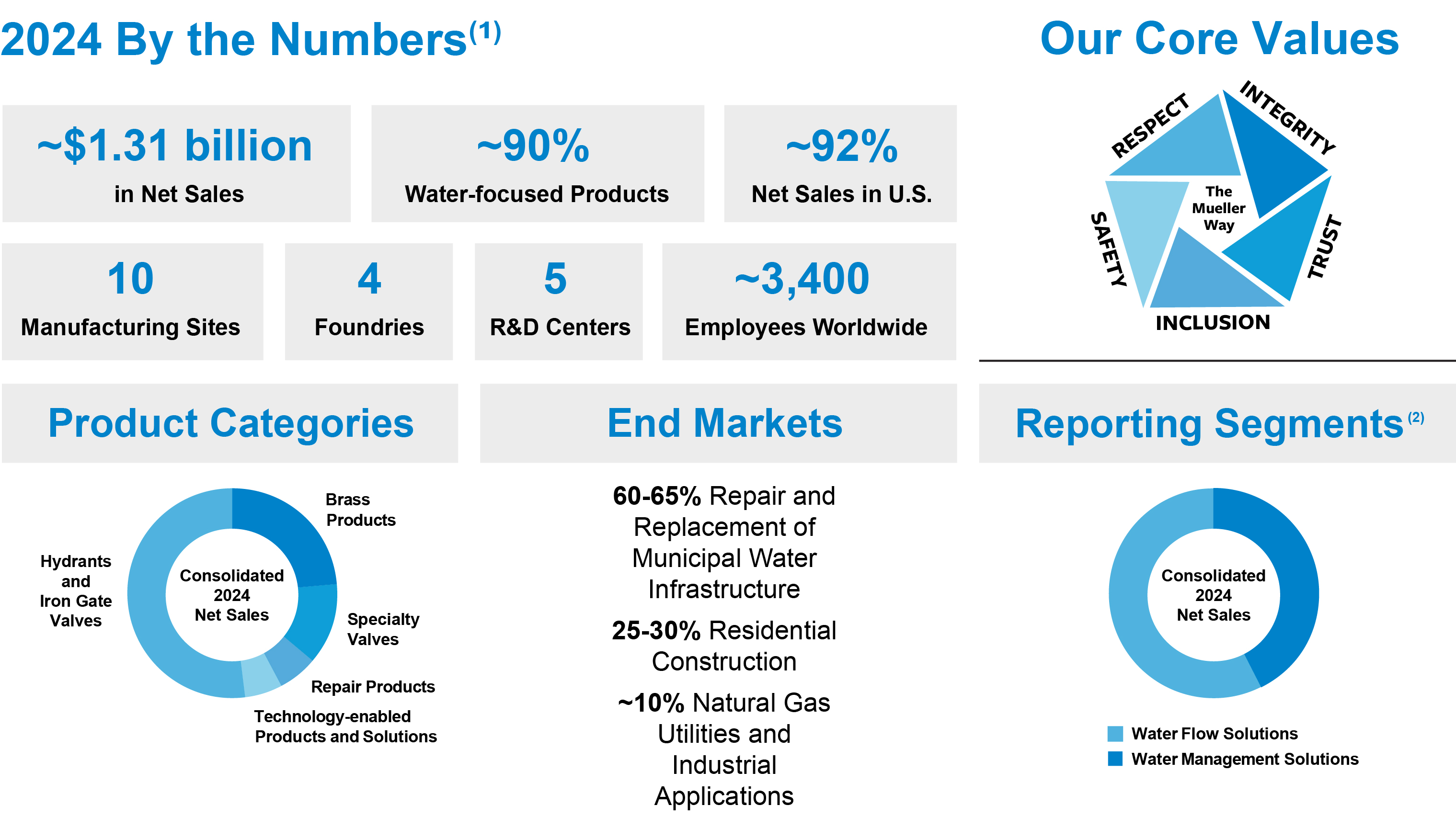

Company Overview

The Mueller Water Products story began in 1857 when a young machine shop apprentice immigrated to America to establish his first business in Decatur, Illinois. Since then, the Mueller name has become known for innovative water distribution products of superior quality, many of which have become industry standards.

Although the business has undergone many changes throughout the years, our commitment to innovation has never wavered. We are proud of our position as a leading manufacturer and marketer of products and services used in the transmission, distribution and measurement of water in North America. We continue to invest, invent and lead in our worldwide broad product and service portfolios, which includes engineered valves, fire hydrants, pipe connection and repair products, metering products, leak detection, pipe condition assessment, pressure management products and software that provides critical water system data.

This breadth of products and services enables us to deliver sustainable and efficient solutions that bridge the gap between intelligence and infrastructure, helping our customers deliver important water resources to their communities and empowering the smart cities of the future. We are one of the few companies that can fulfill the needs of water utilities from end to end – at the source, at the plant, below the ground, on the street and in the cloud. Built on a solid legacy of innovation, we have the expertise and vision to provide advanced infrastructure and technology solutions for transmitting, distributing, measuring and monitoring water more safely and effectively than ever before, demonstrating why Mueller Water Products is Where Intelligence Meets Infrastructure®. To learn more visit www.muellerwaterproducts.com.

(1) As of September 30, 2024.

(2) Water Flow Solutions includes iron gate valves, specialty valves and service brass products. Water Management Solutions includes fire hydrants, repair and installation, natural gas, metering, leak detection, pressure control and software products.

PROXY STATEMENT FOR 2025 ANNUAL MEETING 3

Notable Achievements in Fiscal 2024

| | | | | |

| |

| ESG Achievements | •We published our fourth annual ESG Report, disclosing an approximate 3% reduction in Scope 1 and Scope 2 emissions intensity between 2022 and 2023 and a +15% decrease in waste directed to disposal compared to 2022. •We received a AAA ESG Rating from MSCI, the firm’s highest rating. |

| |

| Leadership and Culture | •We launched a frontline leadership training program to enhance leadership capabilities across the organization, including a new organization-wide video communication strategy to increase leadership visibility and foster our values and shared culture. |

| |

| Inclusion and Development | •We continued to drive a culture of inclusion through employee-led councils and involvement with Women in Manufacturing. •We awarded the first annual Mueller HBCU Scholarship. |

| |

| Employee Engagement | •We conducted a robust employee engagement survey process with year-over-year increases in both participation and engagement. |

| |

| Operational Improvements | •Our new brass foundry in Decatur, Illinois is operational, and we are in the process of closing our legacy Decatur foundry in fiscal 2025 as we continue to modernize our facilities and expand our capabilities. |

Highlights of Fiscal 2024 Performance

| | | | | | | | | | | |

| |

| Focused on Operational Investment and Efficiencies to Increase Long-Term Stockholder Value |

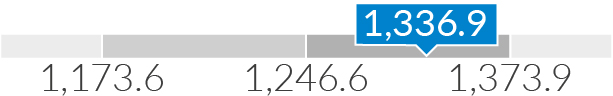

We generated net sales of $1,314.7 million, operating income of $181.7 million, adjusted earnings before interest tax depreciation and amortization (“EBITDA”) of $284.7 million, net income per diluted share of $0.74 (with adjusted net income per diluted share of $0.96) and $238.8 million net cash provided by operating activities (an increase in free cash flow of $130.0 million to $191.4 million). Adjusted EBITDA, adjusted net income per diluted share and free cash flow are financial measures not calculated in accordance with generally accepted accounting principles in the U.S. (“GAAP”) and are therefore considered non-GAAP measures. See Exhibit A for a reconciliation of non-GAAP performance measures to GAAP performance measures. |

| | | |

| | | |

| Dividend Benefits | | Stockholder Value |

•We paid stockholders a quarterly $0.064 per share dividend during fiscal 2024, an increase of 4.9% from fiscal 2023. •We returned $39.9 million to our stockholders through dividends in fiscal 2024. | We repurchased $10 million of our outstanding Common Stock during fiscal 2024.

|

4 MUELLER WATER PRODUCTS, INC.

Stockholder Engagement

We believe that strong corporate governance should include regular engagement with our stockholders to discuss various topics, including corporate governance, compensation, performance, strategy and other matters. With regular engagement with our stockholders, we are able to strengthen our relationships with stockholders and better understand stockholders’ views on our policies and practices and other matters of importance to our business. In 2024, management and the Board continued to reinforce our commitment to building long-term relationships with our stockholders. During the year, we utilized a variety of avenues for engagement including our Annual Meeting of Stockholders, in-person and virtual meetings, quarterly earnings calls and other investor events and conferences.

| | | | | | | | |

Fiscal 2024 engagement included: •Ten investor events, including investor and industry conferences and road shows, and regular meetings and calls with investors and research analysts •Topics of discussion included: •Drivers of sales growth, including pricing initiatives, end markets, backlog, orders and volumes •Trends in key end markets, including municipal repair and replacement and new residential construction, and anticipated benefits from the federal Infrastructure Investment and Jobs Act •Discussion of strategic initiatives •Impacts of inflationary pressures, supply chain disruptions, manufacturing inefficiencies, backlog levels and labor availability •Environmental, Social and Governance topics, including strategies to achieve targets and goals •Leadership Team and Board Refreshment Update and Chief Financial Officer Succession Plan •Capital spending plans, including large capital projects, especially the new brass foundry •Cash flow expectations, including liquidity and working capital, including inventory levels •Capital allocation strategy, including future capital spending and acquisitions, dividends and share repurchases •Our 2024 Annual Meeting of Stockholders | | We value the stockholder feedback that we receive through our engagement activities. |

Sustainability

PRIORITY AND REPORTING

We view sustainability, including environmental, social and governance (“ESG”) practices, as essential to our long-term viability. As an industry leader for more than 165 years, we embrace our responsibilities for sustainability stewardship. We recognize that these responsibilities not only address our commitment to our employees and our facilities, but also extend to our other stakeholders, including our investors, customers, suppliers and communities.

Access to clean, safe water is essential. With the depletion of freshwater sources, the impacts of climate change and aging water infrastructure, we understand the importance of managing resources from start to finish. As a good steward and leader in water infrastructure, we embrace the opportunity and responsibility to make the world a better place for the benefit of future generations.

In September 2024, the Company published its annual ESG Report, which includes the principal sustainability metrics the Company tracks: water withdrawal/energy usage, greenhouse gas emissions and solid waste management. The ESG Report may be found at https://www.muellerwaterproducts.com/environmental-social-and-governance. Our ESG Report is not a part of, or incorporated by reference in, this Proxy Statement.

PROXY STATEMENT FOR 2025 ANNUAL MEETING 5

Throughout 2024, we remained focused on our ESG commitments, which are intended to create value for our stakeholders. We are excited about the progress we are making through our ESG initiatives, which is further described in our ESG Report.

SUSTAINABILITY APPROACH

•Our approach to sustainability programs and initiatives is rooted in and guided by the sustainability reporting standards set forth by the Global Reporting Initiative, the Sustainability Accounting Standards Board, the United Nations Sustainable Development Goals and the Task Force on Climate-related Financial Disclosures.

•When we first became a publicly traded company in 2006, our Board formed the Environment, Health and Safety Committee to oversee and guide our progress toward smart sustainability, making sustainability a key consideration in our directors’ deliberations and informing their overall approach to risk oversight.

•Management formed the ESG Management Committee in 2020 to further enhance our focus on developing, monitoring, implementing, measuring and reporting on ESG-related matters.

•Our executive compensation programs include ESG metrics, which highlights our focus on the importance of sustainability.

SOCIAL STEWARDSHIP

•We provide access to benefits and offer programs that are designed to support work-life balance, including physical, financial and mental health resources for employees and their families.

•We promote and facilitate a high-performance, inclusive workplace, including by embracing diverse experiences and perspectives.

•We utilize a new associate development program to introduce and train new generations of employees entering the Mueller family.

•We partner each year with the American Water Works Association and local organizations providing scholarships, charitable donations and employee volunteers.

•We drive best practices development and benchmarking through lean principles and our safety excellence and leadership program.

•We focus on the prevention of all injuries with an emphasis on the prevention of serious injuries and fatalities.

•We seek to utilize new technologies and data analytics to drive safety performance improvement.

ENVIRONMENTAL STEWARDSHIP

•We strive to reduce our energy, water and material usage and to maintain a close watch on key performance indicators.

•We engage our supply chain to improve packaging and freight efficiencies.

•We strive to integrate sustainability key performance indicators into our facilities.

•We invest in the modernization of our facilities.

•We develop and implement programs to upgrade to more energy efficient equipment, utilize reusable material and implement cutting-edge technology.

•We work to standardize equipment and procedures across all our facilities to promote consistent, efficient manufacturing processes.

GOVERNANCE STEWARDSHIP

•We are committed to maintaining a strong governance structure built on a comprehensive set of corporate governance guidelines that promote the interests of our stakeholders.

•Our Board is led by an independent Chair and supported by fully independent standing committees of the Board.

•We promote director effectiveness through director orientation and mentoring, continuing education and regular Board, committee and director self and peer evaluations.

•We foster board and committee independence by conducting frequent executive sessions without the CEO or other members of management present.

•For our executive officers and directors, we maintain significant Common Stock ownership guidelines, prohibit hedging and pledging of our securities and have adopted enhanced clawback policies for executive compensation in the event of financial restatements or misconduct.

6 MUELLER WATER PRODUCTS, INC.

•We maintain a robust stakeholder engagement program.

See “Proposal One - Election of Nine Directors — The Board’s Role and Responsibilities — Board Oversight — Environmental, Social and Governance” for information regarding the Company's governance practices.

| | | | | |

| Proposal One |

Election of Nine Directors |

| The Board recommends a vote FOR each nominee for director. |

Director Nominees

Our directors are elected annually by the affirmative vote of a majority of the votes cast. All nominees are independent, except Ms. Zakas, our Chief Executive Officer (“CEO”). As part of the Company's Board refreshment plans, Ms. Shirley Franklin and Dr. Lydia Thomas are not renominated for reelection at the Annual Meeting. Messrs. Brian Slobodow and Niclas Ytterdahl are not renominated for reelection at the Annual Meeting. Additionally, Bentina Chisolm Terry and Leland G. Weaver were appointed to the Board as Board Observers, effective December 4, 2024, and are nominated for election at the Annual Meeting.

The following table provides summary information about each director nominee. See “The Board of Directors” for more information about each nominee.

| | | | | | | | | | | | | | | | | |

| Name and Experience | Age | Director Since | Independent | Board Committees(1) |

| Christian A. Garcia(2) Former Executive Vice President and Chief Financial Officer of BrandSafway | 61 | 2024 | | |

| Thomas J. Hansen Former Vice Chairman of Illinois Tool Works Inc. | 75 | 2011 | | |

| Brian C. Healy(3) Lecturer in Finance at University of Virginia; Former Managing Director and Co-Head of Mergers and Acquisitions – Americas of Morgan Stanley | 54 | 2024 | | |

| Christine Ortiz Morris Cohen Professor of Materials Science and Engineering at Massachusetts Institute of Technology | 54 | 2019 | | |

| Jeffery S. Sharritts(3) Former Executive Vice President and Chief Customer and Partner Officer of Cisco | 56 | 2021 | | |

| Bentina Chisolm Terry(4) President and Chief Executive Officer, Southern Linc and Southern Telecom, Inc. at Southern Company | 54 | New Director Nominee | | |

| Stephen C. Van Arsdell(5) Former Senior Partner of Deloitte LLP Chair and Chief Executive Officer of Deloitte & Touche LLP | 74 | 2019 | | |

| Leland G. Weaver(6) President, Water and Protection of DuPont de Nemours, Inc. | 44 | New Director Nominee | | |

| Marietta Edmunds Zakas Chief Executive Officer of Mueller Water Products, Inc. | 65 | 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chair | | Member | A = Audit | C = Compensation | E = EHS | G = Governance | O = Capital Allocation | X = Executive |

(1)Anticipated committee assignments upon election at the Annual Meeting.

PROXY STATEMENT FOR 2025 ANNUAL MEETING 7

(2)Upon the recommendation of the Nominating and Corporate Governance Committee, in connection with the Board’s refreshment activities, the Board appointed Mr. Garcia to the Board and Audit Committee effective August 1, 2024. If elected at the Annual Meeting, Mr. Garcia will join the Environment, Health and Safety Committee and continue on the Audit Committee.

(3)Mr. Sharritts and Mr. Healy will be appointed to chair the Compensation and Human Resources Committee and the Nominating and Corporate Governance Committee, respectively, upon Ms. Franklin’s and Dr. Thomas’ retirement.

(4)Upon the recommendation of the Nominating and Corporate Governance Committee, in connection with the Board’s refreshment activities, the Board appointed Ms. Bentina Chisolm Terry as Board Observer effective December 4, 2024. If elected at the Annual Meeting, Ms. Terry will join the Compensation and Human Resources Committee and the Environment, Health and Safety Committee.

(5)Mr. Van Arsdell serves as our Non-Executive Chair. See "Proposal One - Election of Nine Directors — Board Structure — Board Leadership Structure” for more information.

(6)Upon the recommendation of the Nominating and Corporate Governance Committee in connection with the Board’s refreshment activities, the Board appointed Mr. Leland G. Weaver as Board Observer effective December 4, 2024. If elected at the Annual Meeting, Mr. Weaver will join the Audit Committee and the Capital Allocation and Operations Committee.

Board Nominee Snapshot

| | | | | | | | | | | | | | | | | | | | |

| INDEPENDENCE | | AGE | | TENURE | | DIVERSITY |

8 Independent | | 5 59 and Younger | | 8 0 to 10 Years | | 4 Underrepresented Minorities |

| | | | | | |

1 Not Independent | | 2 60 to 70 | | 1 Over 10 Years | | 3 Women |

| | | | | | |

| | 2 Over 70 | | | | |

| | | | | | |

8 MUELLER WATER PRODUCTS, INC.

| | | | | |

Proposal Two |

Advisory Vote to Approve Executive Compensation |

| The Board recommends a vote FOR this proposal. |

Framework of 2024 Compensation

The following table lists the primary elements of our compensation structure. This overview should be read in conjunction with the more detailed information set forth under “Compensation Discussion and Analysis” below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pay Element | Salary | Bonus | | | Options | RSUs | PRSUs |

| Recipients |

| | | | | |

| | | All Named Executive Officers ("NEOs") | |

|

|

|

|

|

|

| | | |

| Period of Grant | Generally reviewed every 12 months | Annually | | | Annually | Annually | Annually |

| Form of Delivery | | Cash | | | | | Equity | | |

| | | | | |

|

| Type of Performance |

| Short-term emphasis |

| | | | Long-term emphasis | |

|

| | | | |

Performance

Measures | — | Mix of financial results and ESG-related operational goals | | | Value of delivered shares based on stock price on date of exercise | Value of delivered shares based on stock price on vesting dates | Return on Invested Capital ("ROIC") achievement | Relative total shareholder return ("rTSR") |

| Performance Period/Vesting | Ongoing | 1 year | | | Generally vest annually over 3 years | Generally vest annually over 3 years | Vest at the end of the 3-year award cycle | Vest at the end of the 3-year award cycle |

How Payout

Determined | Predominantly tied to Peer Group data, with an element of Compensation Committee discretion | Predominantly formulaic (based on performance against goals), with an element of Compensation Committee discretion | | | Completion of required service period through each vesting date | Completion of required service period through each vesting date | Formulaic (based on performance against goals) for specific performance periods | Formulaic (based on performance against peers) for specific performance periods |

| | | | | | | | |

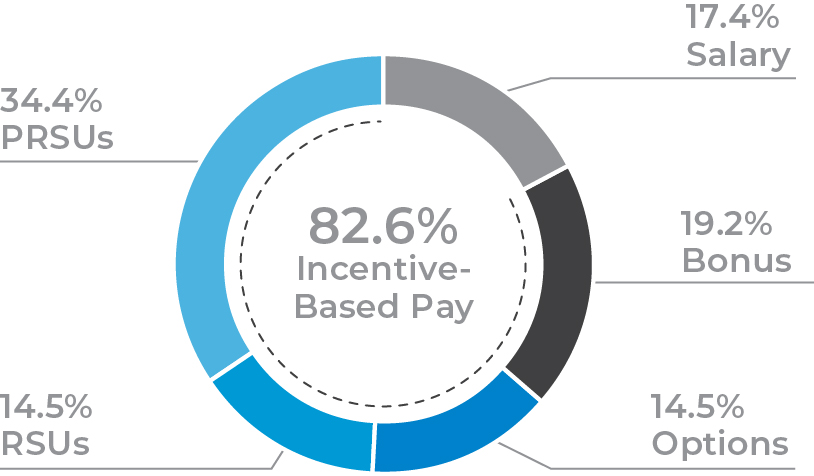

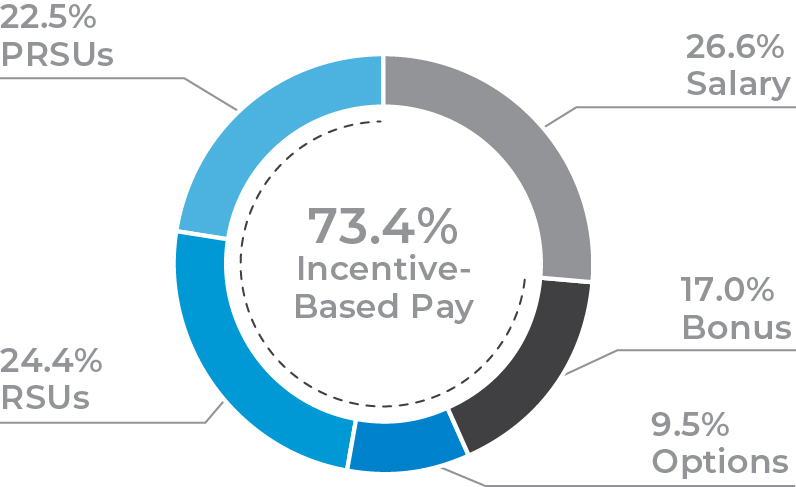

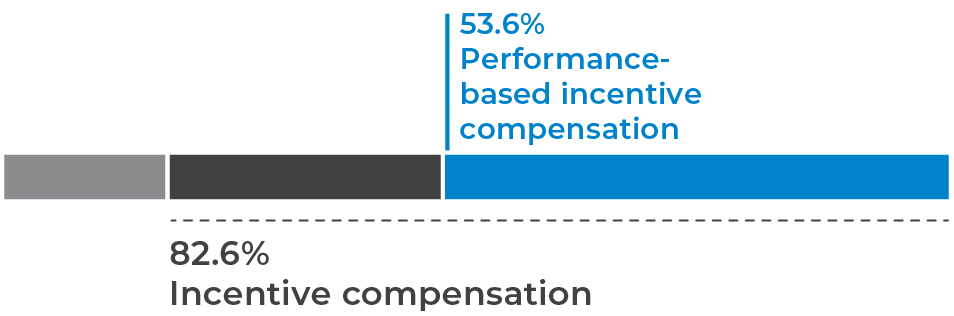

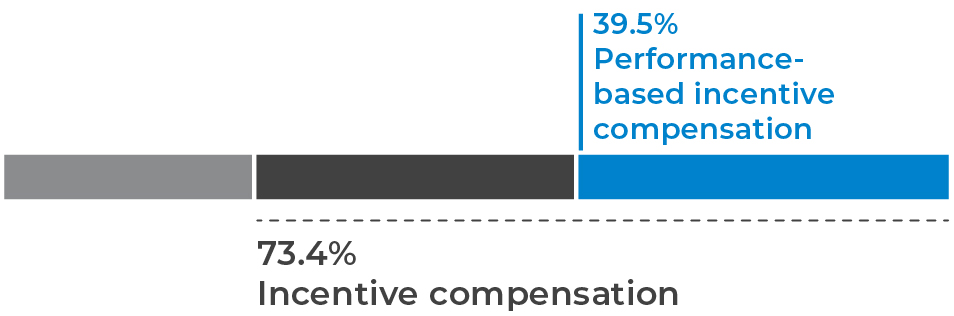

CEO TARGET COMPENSATION MIX(1) |

| OTHER NEOs TARGET COMPENSATION MIX(1) |

| | |

(1)Excludes Other Compensation. See "Proposal Two - Advisory Vote to Approve Executive Compensation — Executive Compensation Tables — Summary Compensation Table" for total compensation earned.

PROXY STATEMENT FOR 2025 ANNUAL MEETING 9

| | | | | | | | |

| ANNUAL CASH INCENTIVE |

| Relative Weighting |

Performance Metric | Zakas McAndrew Heinrichs Helms | Floyd |

| Adjusted EBITDA | 50% | 55% |

Adjusted Net Sales | 25% | 30% |

| Adjusted Working Capital as a % of Net Sales | 15% | 15% |

ESG-Related Operational Goals(1) | 10% | — |

(1)Applicable to only Ms. Zakas and Messrs. McAndrew, Heinrichs and Helms.

| | | | | | | | | | | |

LONG-TERM INCENTIVE |

| |

| 50% Time Based | 50% Performance Based |

| | | |

| 25% | 25% | 25% | 25% |

| Restricted Stock Units | Stock Options | Relative Total Shareholder Return | Return on Invested Capital |

2024 Performance Highlights Related to Executive Compensation

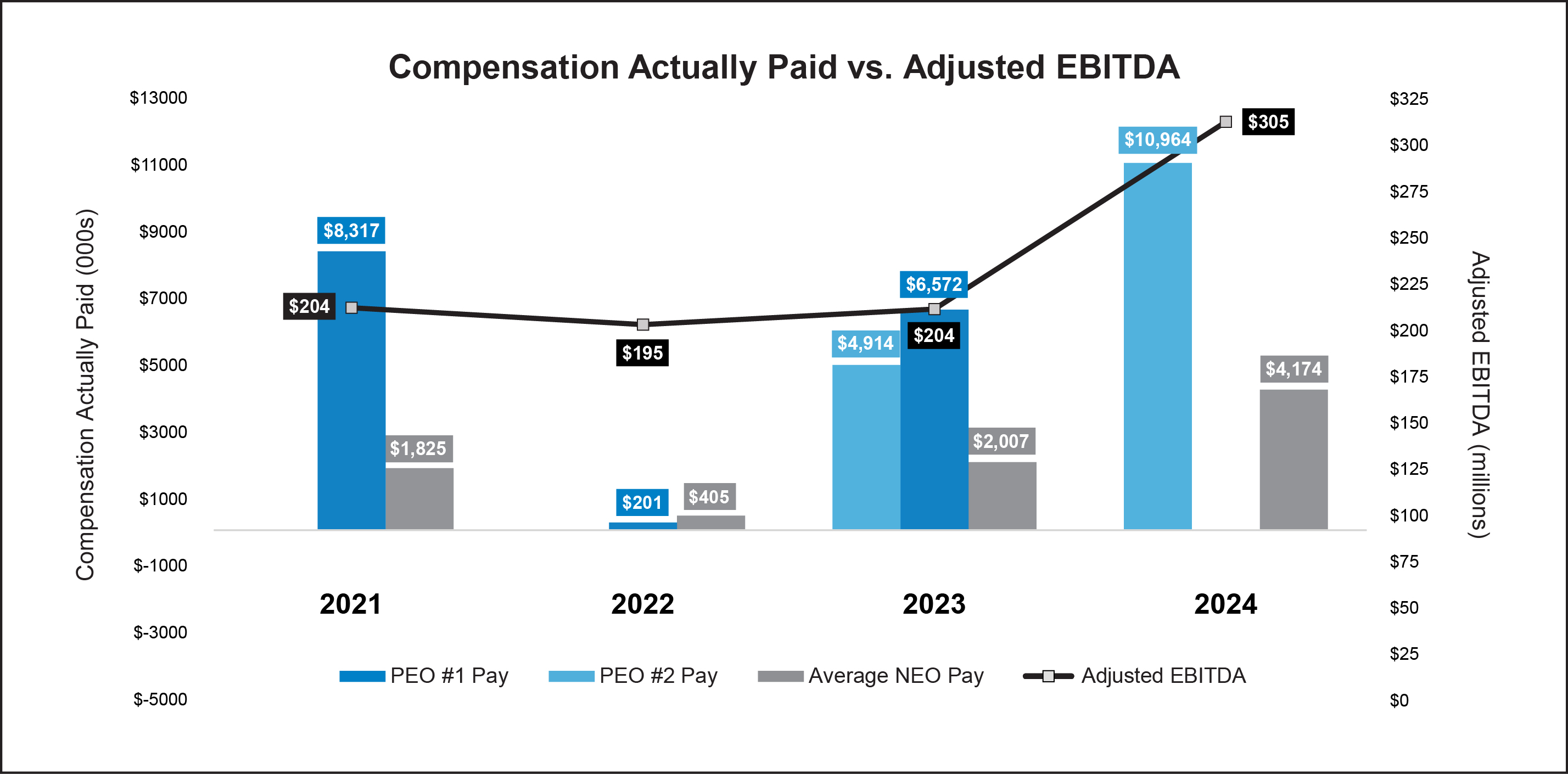

The Compensation and Human Resources Committee (the “Compensation Committee”) established several performance metrics, including those set forth below, to assess and determine incentive plan compensation earned during fiscal 2024.

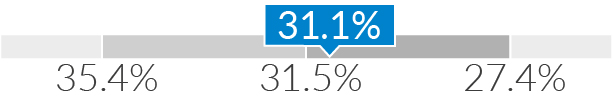

| | | | | | | | | | | | | | | | | | | | |

| Company Results for Performance Evaluation Basis |

| Adjusted Net Sales | Adjusted

EBITDA | | Adjusted Working Capital (as a % of Net Sales) | | Relative Total Shareholder

Return |

| ($ in millions) | | % | | Percentile |

| 2024 | 1,336.9 | 304.8 | | 31.1 | | 61st |

See “Proposal Two - Advisory Vote to Approve Executive Compensation — Compensation Discussion and Analysis — Highlights of 2024 Performance Related to Executive Compensation” for more information and Exhibit A for a reconciliation of the non-GAAP financial measures used in determining executive compensation to GAAP financial results.

Highlights of 2024 Executive Compensation

We design our executive compensation programs to target total compensation (and each principal element of compensation) for our NEOs at or about the 50th percentile of our customized peer group and size-adjusted survey sources. The principal elements of these compensation programs are base salary, annual performance-based cash bonus and long-term incentive compensation, including performance-based equity compensation. Additionally, our NEOs are covered under our broad-based employee benefit plans and executive severance plan(1).

We structure a significant portion of executives’ total compensation as incentive/performance-based compensation.

•We set clear and measurable financial goals for Company performance.

•We assess progress toward strategic priorities when evaluating individual performance.

•We align executive compensation with shareholder value with performance metrics, including relative total shareholder return (“rTSR”) and return on invested capital (“ROIC”).

10 MUELLER WATER PRODUCTS, INC.

| | | | | | | | |

CEO TOTAL TARGET COMPENSATION(2) |

| OTHER NEOs TOTAL TARGET COMPENSATION(2) |

| | |

Compensation for fiscal 2024 reflects Company performance.

•Our NEOs’ compensation was positively affected by performance in relation to targets set for fiscal 2024.

•Annual cash bonuses earned by Ms. Zakas and Messrs. McAndrew, Heinrichs and Helms were 168.1% of target. The annual cash bonus earned by Mr. Floyd was 177.7% of target.

| | | | | | | | | | | | | | |

| | | | |

(1) Ms. Zakas and Messrs. McAndrew and Heinrichs are subject to specific employment agreements and change in control severance agreements and do not receive benefits under the executive severance plan. |

(2) Excludes Other Compensation. See "Proposal Two - Advisory Vote to Approve Executive Compensation — Executive Compensation Tables — Summary Compensation Table" for total compensation as earned. |

•Long-term compensation based on ROIC is earned and vests as of the end of the applicable three-year cumulative performance period based on the three-year average ROIC performance of each year within the performance period. By way of example, the fiscal 2024 ROIC performance will be calculated by measuring the individual annual ROIC performance of fiscal 2024, fiscal 2025 and fiscal 2026 and dividing by three. Long-term compensation based on ROIC was first granted for fiscal 2023 (with a performance period from fiscal 2023 to fiscal 2025).

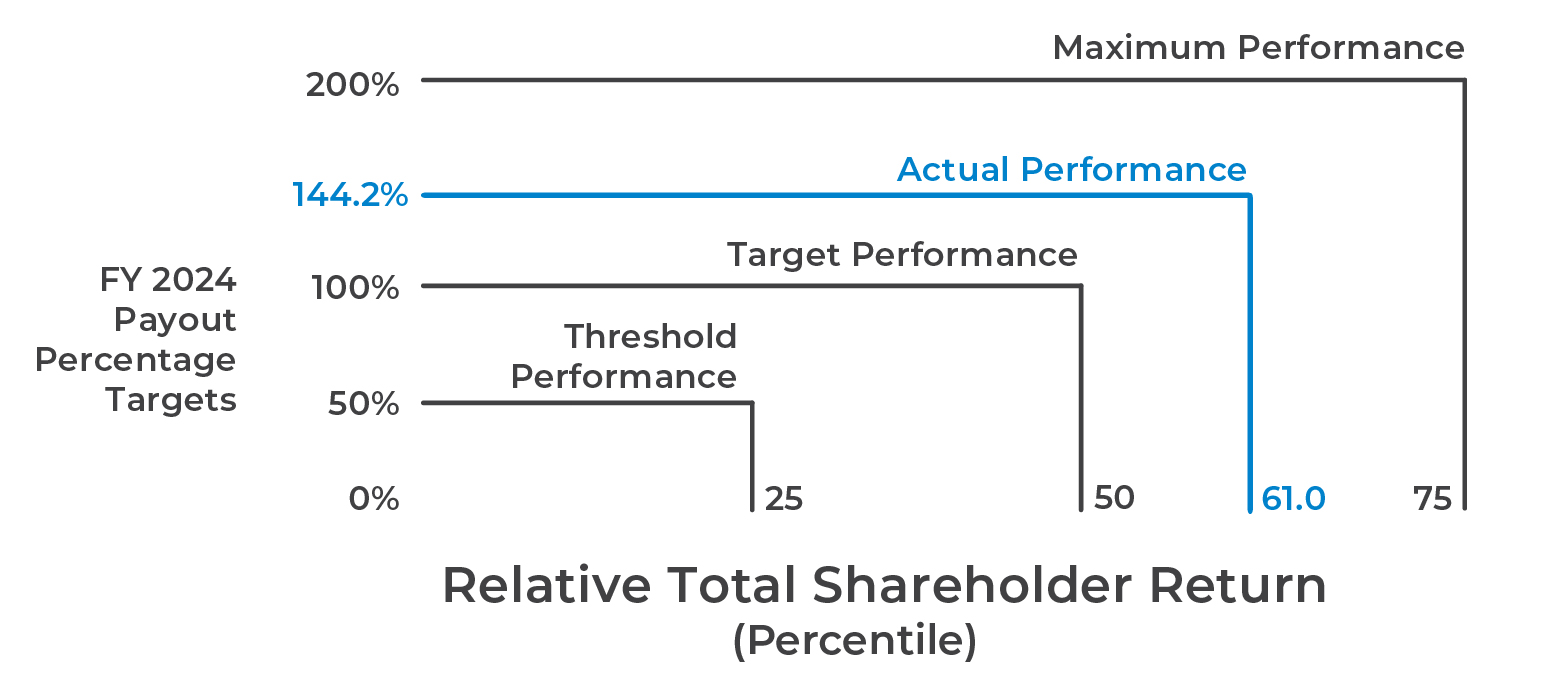

•Long-term compensation based on rTSR is earned and vests as of the end of the applicable three-year cumulative performance period. Long-term compensation based on rTSR granted for the fiscal 2022 to fiscal 2024 performance period was earned at 144.2% of target.

•Long-term compensation in the form of time-based restricted stock units and stock options awarded in fiscal 2024 vests annually over a three-year period.

We continue to maintain best practices for executive compensation.

•Our equity incentive plan prohibits the repricing or exchange of equity-based awards without stockholder approval.

•We prohibit hedging and pledging of our Common Stock by executives or directors.

•Our executives and directors are subject to stock ownership guidelines.

•We can “clawback” cash- or equity-based compensation paid to executives under certain circumstances.

•We do not provide excise tax gross-up benefits.

•We design our compensation programs to mitigate risk.

•We require a “double trigger” with respect to vesting of executive officers’ equity awards upon a change-in-control.

See “Proposal Two - Advisory Vote to Approve Executive Compensation — Compensation Discussion and Analysis — Executive Compensation Program Overview”, “— Other Factors Considered by the Compensation Committee” and “— Other Compensation Practices and Policies” for more information regarding our compensation philosophy, structure and developments.

PROXY STATEMENT FOR 2025 ANNUAL MEETING 11

| | | | | |

Proposal Three |

Amendment and Restatement of 2006 Employee Stock Purchase Plan |

| The Board recommends a vote FOR this proposal. |

We are asking our stockholders to approve the Mueller Water Products, Inc. Second Amended and Restated Employee Stock Purchase Plan (the “Amended ESPP”), which will amend and restate and replace the Mueller Water Products, Inc. Amended and Restated 2006 Employee Stock Purchase Plan (as amended, the “ESPP”). The primary purpose of the Amended ESPP is to increase the total number of shares of Common Stock reserved for issuance (the “shares”) under the ESPP by 1,800,000 shares from 5,800,000 shares to 7,600,000 shares. The Amended ESPP will also extend the term of the Amended ESPP to the tenth anniversary of the Annual Meeting.

The ESPP was originally adopted in 2006 and amended in 2015. On December 4, 2024, the Board approved the Amended ESPP, subject to approval by our stockholders at the Annual Meeting. We are asking our stockholders to approve the Amended ESPP so that we may continue to provide eligible employees with the opportunity to acquire Common Stock in a manner consistent with the best interest of our stockholders.

The ESPP is currently scheduled to terminate on May 24, 2026. If the Amended ESPP is approved by our stockholders at the Annual Meeting, it will become effective as of the date of the Annual Meeting and will supersede and replace the ESPP. All reserved shares that have not been issued pursuant to the ESPP will become available for issuance under the Amended ESPP. If the Amended ESPP is not approved by our stockholders, the ESPP will remain in effect until it terminates in accordance with its terms on May 24, 2026.

The Board believes extending the term of the ESPP is in the best interests of our stockholders, as it encourages broad-based employee stock ownership, enables us to attract, motivate and retain the best employees with a market-competitive benefit and does so at a reasonable cost to stockholders.

Summary of the Amendments to the ESPP in the Amended ESPP

The terms of the Amended ESPP are substantially the same as those of the ESPP. If approved by our stockholders, the Amended ESPP would:

•Extend the term of the ESPP by 10 years from May 24, 2026 to the 10-year anniversary of the Annual Meeting; and

•Increase the number of shares of Common Stock available for purchase under the ESPP by 1,800,000 shares from 5,800,000 to 7,600,000.

See “Proposal Three - Amendment and Restatement of 2006 Employee Stock Purchase Plan — Summary of the Amended ESPP” for more information regarding the key terms of the Amended ESPP, as proposed.

| | | | | |

Proposal Four |

Amendment and Restatement of Second Amended and Restated 2006 Stock Incentive Plan |

| The Board recommends a vote FOR this proposal. |

We are asking our stockholders to approve the Mueller Water Products, Inc. Third Amended and Restated 2006 Stock Incentive Plan (the “Amended Plan”), which will amend and restate and replace the Second Amended and Restated 2006 Stock Incentive Plan (the “Current Plan”), if approved by our stockholders. The primary purpose of the Amended Plan is to increase the shares under the Current Plan by 3,300,000 shares from 20,500,000 shares to 23,800,000 shares. Certain other changes to the Current Plan have been made as described below.

The Mueller Water Products, Inc. Amended and Restated 2006 Stock Incentive Plan was originally adopted by the Board on May 24, 2006. On December 2, 2015, the Board approved the Current Plan, which was approved by our stockholders on January 26, 2016 and became effective on May 24, 2016, immediately following the expiration of the Amended and Restated 2006 Stock Plan on May 23, 2016. On December 4, 2024, the Board approved the Amended Plan, subject to approval by our stockholders at the Annual Meeting.

12 MUELLER WATER PRODUCTS, INC.

If the Amended Plan is approved by our stockholders at the Annual Meeting, it will become effective as of the date of the Annual Meeting and will supersede and replace the Current Plan. All reserved shares that have not been issued pursuant to awards under the Current Plan will become available for issuance under the Amended Plan. If the Amended Plan is not approved by our stockholders, the Current Plan will remain in effect until it terminates in accordance with its terms on May 24, 2026.

The Board believes the Amended Plan is in the best interests of our stockholders, as it is integral to the Company’s compensation strategies and programs. The Board believes the Amended Plan provides the flexibility the Company needs to keep pace with its competitors and effectively recruit, motivate and retain the caliber of employees and directors essential for meeting our business objectives.

Summary of the Amendments to the Current Plan in the Amended Plan

The terms of the Amended Plan are substantially the same as those of the Current Plan. Changes were made to the Amended Plan which, if approved by our stockholders, would:

•Extend the term of the Current Plan from May 24, 2026 to the 10-year anniversary of the Annual Meeting.

•Increase the number of shares available for issuance under the Current Plan by 3,300,000 shares from 20,500,000 shares to 23,800,000 shares.

•Expressly subject all awards, including time-based awards, under the Amended Plan to the Company’s Incentive Clawback Policy and Supplemental Clawback Policy. See “Proposal Two - Advisory Vote to Approve Executive Compensation — Compensation Discussion and Analysis — Other Compensation Practices and Policies — Compensation Recovery (Clawback) Policies” for more information.

•Clarify that the more restrictive annual limitation on stock awards for directors only applies to non-employee directors and the limit is applied without regard to any stock awards received by a non-employee director during any period in which the individual served as an employee or consultant to the Company and its affiliates.

See “Proposal Four - Amendment and Restatement of Second Amended and Restated 2006 Stock Incentive Plan — Summary of the Amended Plan” for more information regarding the key terms of the Amended Stock Plan, as proposed.

| | | | | |

Proposal Five |

Ratification of the Appointment of our Independent Registered Public Accounting Firm for Fiscal 2025 |

| The Board recommends a vote FOR this proposal. |

The Audit Committee has appointed Ernst & Young LLP as the independent registered public accounting firm to audit our consolidated financial statements and internal control over financial reporting for the fiscal year ending September 30, 2025, subject to negotiation of definitive fee arrangements.

PROXY STATEMENT FOR 2025 ANNUAL MEETING 13

14 MUELLER WATER PRODUCTS, INC.

| | | | | |

| Page |

| |

| |

| |

| |

| |

| |

| |

Leadership Transition Compensation Matters | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Summary Compensation Table | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Proposal Three - Ratification of the Appointment of Our Independent Registered Public Accounting Firm for Fiscal 2025 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PROXY STATEMENT FOR 2025 ANNUAL MEETING 15

16 MUELLER WATER PRODUCTS, INC.

ELECTION OF DIRECTORS

| | | | | |

| Proposal One |

Election of Nine Directors |

| The Board recommends a vote FOR each nominee for director. |

The Board of Directors

The Nominating and Corporate Governance Committee (the “Governance Committee”) is responsible for identifying qualified candidates to serve on the Board and recommending nominees to be submitted to our stockholders for election at each annual meeting. After the Governance Committee completes its evaluation of candidates, it presents its recommendation to the Board for consideration and approval.

We strive to maintain a diverse Board whose collective body of skills and experience supports achievement of the Company’s strategy. We work to balance industry expertise with independence and the institutional knowledge of longer-tenured directors with the fresh perspectives brought by new directors. The Governance Committee uses a matrix of key skills and experiences to evaluate candidates. The Governance Committee carefully reviews all directors and director candidates in light of these factors based on the context of the current and anticipated composition of the Board and our current and anticipated strategic and operating requirements. In reviewing a director candidate, the Governance Committee considers the following elements as qualifications required of all directors:

| | | | | | | | |

•Personal ethics and integrity •Independence | •Collaborative skills •Interpersonal skills | •Commitment •Business acumen |

The Governance Committee expects and intends the Board to be comprised of directors with diverse backgrounds, skills and experiences. Although the Board does not have a formal policy regarding diversity, diversity is among the criteria considered by the Board when evaluating candidates. Diversity may include gender, race, ethnicity, geographic origin or personal, educational and professional experience. The Governance Committee further believes the backgrounds and qualifications of the directors, considered as a group, should provide an appropriate mix of experience, knowledge and abilities that will enhance the Board’s oversight role.

After almost 17 years of distinguished service as a director on our Board, Dr. Lydia Thomas will retire at the 2025 Annual Meeting. Dr. Thomas has more than 30 years of experience in senior executive positions with multiple companies, including service as a Chair, President and CEO. Dr. Thomas’ executive experience, combined with her willingness to listen and advise, has been vital to the Company’s success. Her judicious guidance has been a true North Star for helping the Company thrive in the water infrastructure and technology space. As a Board member, Dr. Thomas has served on multiple Board committees, including as Chair of the Environment, Health and Safety Committee from January 2014 to October 2022 and as Chair of the Nominating and Governance Committee since October 2022. Throughout her tenure, she has contributed a broad perspective on business strategy, capital allocation and sustainability. We take this opportunity to thank Dr. Thomas for her many years of service, advice, wisdom and dedication.

After 14 years of distinguished service as a director on our Board, Shirley Franklin will retire at the 2025 Annual Meeting. With decades of experience in senior positions, including serving as Mayor of Atlanta, Georgia from 2002 to 2009, Ms. Franklin has provided invaluable leadership, particularly in matters related to the municipal arena. Her expertise in capital management and utility operations has helped the Company excel in key areas. Ms. Franklin has served on multiple Board committees, including as Chair of the Compensation Committee since February 2024. Her acumen in matters of strategy, operations, customer relationships and executive compensation has been key in helping the Company achieve a diverse products and solutions portfolio. We take this opportunity to thank Ms. Franklin for her many years of service, guidance, commitment and insight.

PROXY STATEMENT FOR 2025 ANNUAL MEETING 17

As previously disclosed, in accordance with the Cooperation Agreement entered into between the Company and Ancora Catalyst Institutional, LP and certain of its affiliates in October 2022, Brian Slobodow and Niclas Ytterdahl joined the Board. With the expiration of the Cooperation Agreement in August 2024, Messrs. Slobodow and Ytterdahl are not renominated for re-election at the 2025 Annual Meeting. We thank them for their service.

In connection with the above and based on the recommendation of the Governance Committee, the Board plans to reduce the size of the Board from eleven to nine directors effective as of the 2025 Annual Meeting.

Set forth below is a summary of the key skills and experience reflected in our director nominees.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SKILLS & EXPERIENCE AND LINK TO STRATEGY |

|

| Garcia | Hansen | Healy | Ortiz | Sharritts | Terry | Van Arsdell | Weaver | Zakas |

| Executive Leadership/CEO | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Corporate Governance | ü | ü | ü |

| | ü | ü | ü | ü |

| Financial/Capital Allocation | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Government and Regulatory Affairs | |

| ü | ü | ü | ü | ü |

| |

| International Business | ü | ü | ü | ü | ü | | ü | ü | ü |

| Mergers and Acquisitions | ü | ü | ü |

|

| | ü | ü | ü |

| Multiple-Part Manufacturing | ü | ü | | ü | | |

| ü | |

| Strategic Planning | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Enterprise Risk Management | ü | ü | ü | ü | | | ü |

| ü |

| Human Capital Management | | ü | ü | ü | ü | | ü | ü | ü |

| Environment, Health and Safety | | ü | | ü | | |

| ü | |

| Technology |

|

|

| ü | ü | ü |

| ü | ü |

| Materials Science and Engineering |

|

|

| ü | | |

| ü | |

| Environmental, Social and Governance | | | | ü | | ü | | | ü |

| Branding | | ü | | ü | ü | ü |

| | ü |

After evaluating each director and the composition of the full Board, the Governance Committee has recommended each nominee identified above for election. If elected, each of the nine individuals nominated for election to the Board will hold office until the 2026 Annual Meeting of Stockholders and until his or her successor is elected and qualified. Each nominee has agreed to serve as a director if elected. However, if for some unforeseen reason a nominee becomes unwilling or unable to serve, proxies will be voted for a substitute nominee selected by the Board. In lieu of designating a substitute nominee, the Board, in its discretion, may reduce the number of directors.

18 MUELLER WATER PRODUCTS, INC.

Information about the nominees, including information concerning their qualifications for office, is set forth below:

| | | | | | | | |

Christian A. Garcia Age: 61 Independent Director since 2024

Committees: | | Key Board Contributions |

| Mr. Garcia has more than 30 years of financial leadership experience in the industrial services, automotive electronics, energy, software and business equipment industries. He has served as Chief Financial Officer to three public companies, overseeing all aspects of finance, including accounting, financial planning, investor relations, treasury and operational finance. Through his executive positions, Mr. Garcia brings strategic planning and corporate growth insights to the Board, gained from his involvement in strategic acquisitions, cost optimization, and business model transformation. Mr. Garcia has broad experience in multiple-part manufacturing from his financial leadership of large global companies, oversight of supply chain operations, and track record of value creation across a number of industrial manufacturing industries. |

| |

| Professional Experience |

| BrandSafway, an industrial services company •Executive Vice President and Chief Financial Officer (2020–2023) Weatherford International (NASDAQ: WFRD), a multinational oilfield services company •Executive Vice President and Chief Financial Officer (2020) Visteon Corporation (NASDAQ: VC), a global automotive electronics manufacturer •Executive Vice President and Chief Financial Officer (2016–2019) Halliburton Company (NYSE: HAL), a global energy company •Senior Vice President and Acting Chief Financial Officer (2015–2016) •Senior Vice President and Chief Accounting Officer (2014–2015) •Senior Vice President and Treasurer (2011–2014) •Senior Vice President, Investor Relations (2008–2011) •Vice President, Operations Finance (2006–2007) •Various Roles (1995–2006) |

| |

Skills and Qualifications •Corporate Governance •Enterprise Risk Management •Executive Leadership/CEO •Financial/Capital Allocation •International Business •Mergers and Acquisitions •Multiple-Part Manufacturing •Strategic Planning | |

|

| |

| Public Company Boards |

| | •Bausch Health Companies (NYSE: BHC) (since 2024) •TETRA Technologies (NYSE: TTI) (since 2023) •Keane Group, Inc. (formerly NYSE: FRAC) (2017–2019) |

| | |

| | Education |

| | •BS, Business Economics, University of the Philippines •MS, Management, Purdue University |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chair | | Member | A = Audit | C = Compensation | E = EHS | G = Governance | O = Capital Allocation | X = Executive |

PROXY STATEMENT FOR 2025 ANNUAL MEETING 19

| | | | | | | | |

Thomas J. Hansen Age: 75 Independent Director since 2011

Committees: | | Key Board Contributions |

| With over three-decades of leadership career at a global manufacturing company, Mr. Hansen has a proven track record of corporate value creation and business development. He provides the Board with valuable insights on strategic capital allocation and international business operations. While serving as EVP and Vice Chairman of Illinois Tool Works, Mr. Hansen also oversaw several successful business divestitures and acquisitions, driving significant shareholder value creation opportunities for the company. He brings a particular expertise with multi-part manufacturing processes developed through his oversight responsibilities displayed throughout his career at Illinois Tool Works, a diversified manufacturer of fasteners and components, consumable systems and a variety of specialty products and equipment, and contributes vital perspectives developed through his extensive experience in operations and environmental, health and safety oversight. |

| |

| Professional Experience |

| Illinois Tool Works, Inc. (NYSE: ITW), a global manufacturer of engineered components, consumable systems and a variety of specialty products and equipment •Vice Chairman (2006–2012) •Executive Vice President, Worldwide Metal, Plastic Fastener and Components; Fluids and Polymers; Construction (1998–2006) •President, Worldwide Metal Fastener and Components (1993–1998) •President, North American Industrial and Automotive Fastener (1990–1993) •Vice President and General Manager, North American Industrial Metal Fastener and Buckle Divisions (1986–1990) •General Manager, Shakeproof Industrial Products (1983–1986) •Manager, Sales and Marketing (1980–1983) |

| |

Skills and Qualifications •Branding •Corporate Governance •Enterprise Risk Management •Environment, Health and Safety •Executive Leadership/CEO •Financial/Capital Allocation •Human Capital Management •International Business •Mergers and Acquisitions •Multiple-Part Manufacturing •Strategic Planning | |

| |

| Public Company Boards |

| •Standex International Corporation (NYSE: SXI) (2013–present) •Terex Corporation (NYSE: TEX) (2008–2024) •CDW Corp. (NASDAQ: CDW) (2005–2008) |

| |

| Other Affiliations |

| •Gill Industries Inc., Director (2014–2018) |

| | |

| | Education |

| | •BS, Marketing, Northern Illinois University •MBA, Governors State University |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chair | | Member | A = Audit | C = Compensation | E = EHS | G = Governance | O = Capital Allocation | X = Executive |

20 MUELLER WATER PRODUCTS, INC.

| | | | | | | | |

Brian C. Healy Age: 54 Independent Director since 2024

Committees: | | Key Board Contributions |

| Mr. Healy is a financial expert with over 25 years of experience in the investment banking industry, advising public and private companies on a wide range of strategic transactions including acquisitions, divestitures, spin-offs and corporate carve-outs, as well as cross-border transactions. His expertise includes advising boards and senior management on all aspects of M&A, including strategic rationale, valuation and financial impact, and negotiation tactics. During his senior leadership roles at Morgan Stanley, he oversaw business development strategies, financial planning, regulatory compliance and risk mitigation, including evaluating the impacts of regulatory changes and developing response and mitigation strategies. Mr. Healy also provides perspectives on human capital management, having led and overseen global teams through complex transactions and projects. |

| |

| Professional Experience |

| McIntire School of Commerce, University of Virginia •Lecturer of Commerce, Associate Director of the Center for Investments & Financial Markets (2024–present) Morgan Stanley (NYSE: MS), a financial holding company that provides various financial products and services •Managing Director and Co-Head of Mergers and Acquisitions – Americas (2019–2023) •Managing Director and Global Chief Operating Officer – Investment Banking (2014–2019) •Managing Director and Head of Firm Strategy and Execution (2012–2014) •Managing Director - Mergers and Acquisitions (2008–2012) •Various roles (2000–2008) Lehman Brothers, a global financial services firm •Associate, Mergers and Acquisitions (1998–2000) Raymond James Financial, a financial services firm •Analyst, Investment Banking (1993–1996) |

| |

Skills and Qualifications •Corporate Governance •Enterprise Risk Management •Executive Leadership/CEO •Financial/Capital Allocation •Government and Regulatory Affairs •Human Capital Management •International Business •Mergers and Acquisitions •Strategic Planning | |

| |

| Public Company Boards |

| •None |

| |

| Other Affiliations |

| •Children’s Aid and Family Services of New Jersey, Board Member (2017–present) |

| | |

| | Education |

| | •BS, Commerce – Finance and Accounting, University of Virginia •MBA, Chicago Graduate School of Business |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chair | | Member | A = Audit | C = Compensation | E = EHS | G = Governance | O = Capital Allocation | X = Executive |

PROXY STATEMENT FOR 2025 ANNUAL MEETING 21

| | | | | | | | |

Christine Ortiz Age: 54 Independent Director since 2019

Committees: | | Key Board Contributions |

| Dr. Ortiz is a distinguished scientist and engineer in the areas of materials technologies, advanced manufacturing and sustainable design. She has served as a professor at MIT for over 25 years, focusing her research on multi-scale mechanics of structural materials, materials design, nanotechnology, additive manufacturing and computational materials science. During her tenure as the institution’s Dean for Graduate Education, she supported over 7,000 graduate students in 45 graduate degree programs across 5 academic schools. Over her career, Dr. Ortiz has authored over 200 scholarly publications and received more than 30 national and international honors, including the Presidential Early Career Award in Science and Engineering. Dr. Ortiz also gained significant business innovation and strategic planning experience through founding Station1, an innovative higher education educational institution, and has partnered with over 90 technology-focused startup companies, social enterprises, and nonprofit organizations on innovation-focused research and development projects. |

| |

| Professional Experience |

| | Massachusetts Institute of Technology (MIT) •Director, MIT Technology and Policy Program, Institute for Data, Systems, and Society (2024–present) •Dean for Graduate Education (2010–2016) •Morris Cohen Professor of Materials Science and Engineering (since 1999) Station1, an innovation-focused nonprofit higher education educational institution •Founder (since 2016) |

Skills and Qualifications •Branding •Enterprise Risk Management •Environment, Health and Safety •Environmental, Social and Governance •Executive Leadership/CEO •Financial/Capital Allocation •Government and Regulatory Affairs •Human Capital Management •International Business •Materials Science and Engineering •Multiple-Part Manufacturing •Strategic Planning •Technology | |

| |

| Public Company Boards |

| •Enovis Corporation (NYSE: ENOV) (2022–present) |

| |

| Other Affiliations |

| •Massachusetts State Apprenticeship Council (2023–present) |

| |

| Education |

| •BS, Materials Science and Engineering, Rensselaer Polytechnic Institute •MS, Materials Science and Engineering, Cornell University •PhD, Materials Science and Engineering, Cornell University |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chair | | Member | A = Audit | C = Compensation | E = EHS | G = Governance | O = Capital Allocation | X = Executive |

22 MUELLER WATER PRODUCTS, INC.

| | | | | | | | |

Jeffery S. Sharritts Age: 56 Independent Director since 2021

Committees: | | Key Board Contributions |

| With over two decades in sales leadership roles with a multinational public company, Mr. Sharritts has deep experience in strategy development, market positioning, branding, and customer engagement with particular expertise in sales and marketing of technology-driven products and services. Mr. Sharritts provides the Board with unique insights on international business operations and strategic planning. As SVP of the Americas for Cisco, he managed a business unit with more than $29 billion of annual sales in 49 countries, overseeing products in both the commercial and public sector verticals. He also played a central role in expanding Cisco’s commercial sales model to Canada and Latin America. Additionally, Mr. Sharritts was responsible for overseeing global talent teams, developing effective human capital management programs to attract and retain top technical talent, with a focus on fostering a culture of innovation and transformation to build value. |

| |

| Professional Experience |

| Cisco Systems, Inc. (NYSE: CSCO), a multinational technology company that develops, sells, and manufactures networking equipment, software, and services •Executive Vice President, Chief Customer and Partner Officer (2022–2024) •Senior Vice President, America Sales (2018–2022) •Senior Vice President, U.S. Commercial Sales (2014–2018) •Various sales leadership roles (2000–2018) |

| |

Skills and Qualifications •Branding •Executive Leadership/CEO •Financial/Capital Allocation •Government and Regulatory Affairs •Human Capital Management •International Business •Strategic Planning •Technology | |

|

| |

| Public Company Boards |

| •None |

| |

| Other Affiliations |

| •Georgia Chamber of Commerce, Advisory Board Member (2011–present) •Metro Atlanta Chamber of Commerce, Advisory Board Member (2011–present) |

| |

| Education |

| •BS, Business Administration, The Ohio State University |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chair | | Member | A = Audit | C = Compensation | E = EHS | G = Governance | O = Capital Allocation | X = Executive |

PROXY STATEMENT FOR 2025 ANNUAL MEETING 23

| | | | | | | | |

Bentina Chisolm Terry Age: 54 New Director Nominee

Committees: | | Key Board Contributions |

| Ms. Terry is an accomplished senior executive with over 25 years of experience across a range of functions in the utility industry and a strong track record of driving growth and innovation. She brings valuable perspectives on technology, through her current role leading The Southern Company’s fiber-optic and wireless communications businesses and as the chief architect for Georgia Power’s digital transformation of its Direct-to-Consumer platforms. Through various executive leadership roles with The Southern Company, Ms. Terry led multiple environmental initiatives and had responsibility for health and safety, providing her with a strong understanding of environmental and sustainability issues. She also contributes to the Board a strong understanding of regulatory matters and government affairs, demonstrated through her service as General Counsel for Southern Nuclear Operating Company and overseeing the government and regulatory teams for Gulf Power Company, where her efforts led to the company receiving the largest rate increase in its history to ensure continued service reliability and infrastructure upgrades. |

| |

| Professional Experience |

| The Southern Company (NYSE: SO), an energy company •President and CEO, Southern Linc and Southern Telecom (2024-present) •Senior Vice President, Customer Strategy and Solutions, Georgia Power Company (2021–2024) •Senior Vice President, Region External Affairs & Community Engagement, Georgia Power Company (2017–2021) •Vice President, Customer Service and Sales; President, Gulf Power Foundation (2014–2017) •Vice President, External Affairs & Administrative Services, Compliance Officer, Gulf Power Company (2007–2014) •General Counsel, Vice President, External Affairs, Compliance Officer and Corporate Secretary, Southern Nuclear Operating Company (2005–2007) •Other leadership roles with Georgia Power Company (2001–2004) Progress Energy (formerly NYSE: PGN), a vertically integrated electric and gas utility •Associate General Counsel (1998–2001) Troutman Sanders, a national law firm •Associate, Labor and Employment (1996–1998) |

| |

Skills and Qualifications •Branding •Corporate Governance •Environmental, Social and Governance •Executive Leadership/CEO •Financial/Capital Allocation •Government and Regulatory Affairs •Strategic Planning •Technology

| |

| | |

| | Public Company Boards |

| | •None |

| | |

| | Other Affiliations |

| | •Competitive Carriers Association, Board Member (2024–present) •CTIA, Board Member (since 2024) •International Women’s Forum – Georgia, Board Secretary (2022–present) •North Carolina State University Foundation, Chair of the Board of Trustees (2020–present) |

| | |

| | Education |

| | •BA, English, North Carolina State University •JD, University of Michigan |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chair | | Member | A = Audit | C = Compensation | E = EHS | G = Governance | O = Capital Allocation | X = Executive |

24 MUELLER WATER PRODUCTS, INC.

| | | | | | | | |

Stephen C. Van Arsdell Age: 74 Independent Director since 2019

Committees: | | Key Board Contributions |

| Mr. Van Arsdell has developed extensive leadership, finance, and risk management expertise throughout his nearly four decades at Deloitte and Deloitte & Touche, where he oversaw a national organization of 15,000 professionals providing audit, assurance, risk and capital markets advisory services. He has significant experience in mergers and acquisitions acquired through advising numerous clients on their M&A activities and overseeing the successful merger of First Midwest Bancorp and Old National Bancorp in his capacity as a corporate director, creating the sixth largest bank in the Midwest. He also brings deep knowledge in international business and strategic planning, gained through his roles serving Deloitte’s multinational clients and in Deloitte’s international operations as a key member of the Global Audit Leadership Team, where he helped develop the firm’s strategic plans for the global audit practice. |

| |

| Professional Experience |

| Deloitte & Touche LLP, a global provider of audit, assurance, risk and capital markets advisory services •Chair, Chief Executive Officer, and Chief Quality Officer (2010–2012) •Deputy Chief Executive Officer (2009–2010) •Various roles of increasing responsibility (1975–2003) Deloitte LLP, a global provider of audit, consulting, tax, and advisory services •Senior Partner, Member and Vice Chair of the Board (2003–2009) |

| |

Skills and Qualifications •Corporate Governance •Enterprise Risk Management •Executive Leadership/CEO •Financial/Capital Allocation •Government and Regulatory Affairs •Human Capital Management •International Business •Mergers and Acquisitions •Strategic Planning | |

| |

| Public Company Boards |

| •Old National Bancorp (NASDAQ: ONB) (2022–present) •First Midwest Bancorp (formerly NASDAQ: FMBI) (2017–2022) |

| |

| Other Affiliations |

| •Brown Brothers Harriman, Audit Committee Member (2015–present) •The Morton Arboretum, Board of Trustees, (2015–2024, Chair 2020–2024) |

| |

| Education |

| | •BS, Accounting, University of Illinois •MAS, University of Illinois •Certified Public Accountant (CPA) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chair | | Member | A = Audit | C = Compensation | E = EHS | G = Governance | O = Capital Allocation | X = Executive |

PROXY STATEMENT FOR 2025 ANNUAL MEETING 25

| | | | | | | | |

Leland G. Weaver Age: 44 New Director Nominee

Committees: | | Key Board Contributions |

| Mr. Weaver is an accomplished senior executive with extensive experience across various industries and global markets. His career highlights include building high-performance teams, managing large-scale operations, and driving significant financial growth. He has acquired deep knowledge of the water business through his current role as President of the DuPont Water & Protection business, a global business with $6 billion revenue, where he oversees 34 manufacturing sites and 7,000 employees as well as the strategy to deliver sustainable, technology-based products and solutions for water, shelter and safety. Mr. Weaver brings to the board both operational and manufacturing experience as well as growth strategy and transformation having held leadership roles within Dupont’s investor relations and business strategy arm, managing relationships with institutional investors and playing a pivotal role in significant corporate transformation initiatives, including the spin-off of DuPont’s Nutrition & Biosciences business and its merger with International Flavors and Fragrances. |

| |

| Professional Experience |

| |

Skills and Qualifications •Corporate Governance •Environment, Health and Safety •Executive Leadership/CEO •Financial/Capital Allocation •Human Capital Management •International Business •Materials Science and Engineering •Mergers and Acquisitions •Multiple-Part Manufacturing •Strategic Planning •Technology | | DuPont (NYSE: DD), a global chemicals company •President, Water & Protection (2021–Present) •Vice President, Investor Relations (2019–2021) •Director, Investor Relations (2019) •Vice President, Americas Commercial, Mobility & Materials (2016–2019) •Global Business Director, Kalrez (2014–2015) •Manager, Global Strategic Planning, Performance Polymers (2014) •Manager, Finance and Marketing, Corporate Executive Office (2013–2014) •Manager, Sales Accounts, Titanium Technologies (2011–2013) •Manager, Market Development (2010–2011) •Various Roles (2003–2008) |

|

|

| |

| Public Company Boards |

| •None |

| |

| Other Affiliations |

| | •National Action Council for Minorities in Engineering (NACME), Board Member (since 2023) |

| | |

| | Education |

| | •BS, Chemical Engineering, University of Alabama •MBA, Wharton School at the University of Pennsylvania |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chair | | Member | A = Audit | C = Compensation | E = EHS | G = Governance | O = Capital Allocation | X = Executive |

26 MUELLER WATER PRODUCTS, INC.

| | | | | | | | |

Marietta Edmunds Zakas Age: 65 Director since 2023

Committees: | | Key Board Contributions |

| Ms. Zakas is a proven executive leader with deep experience in finance and business development. In her current and former roles, she has directed the Company’s strategic planning, investor relations and corporate development activities and previously held responsibility as Chief Financial Officer, overseeing all financial functions, developing a deep understanding of capital allocation strategies and financial risk management with a focus on long-term sustainable growth. Ms. Zakas has in-depth knowledge and experience with corporate growth strategy and mergers and acquisitions through her roles at both Mueller Water Products and at Russell Corporation, where she played a key role in the firm’s 2006 acquisition by Berkshire Hathaway. She brings human capital management expertise developed in her leadership roles at Russell Corporation and further enhanced while serving for two years as Interim Head of Human Resources at the Company. |

| |

| Professional Experience |

| Mueller Water Products (NYSE: MWA) •Chief Executive Officer (2024–present) •President and Chief Executive Officer (2023–2024) •Executive Vice President and Chief Financial Officer (2018–2023) •Interim Head of HR (2016–2017) •Senior Vice President, Strategy, Corporate Development and Communications (2006–2017) Russell Corporation, an athletic apparel, footwear and equipment company •Corporate Vice President, Chief of Staff, Business Development and Treasurer (2005–2006) •Vice President and Treasurer (2002–2005) Equifax, Inc. (NYSE: EFX), a global data, analytics and technology company •Corporate Vice President, Director of Investor Relations and Corporate Secretary (1996–2000) •Various Senior Leadership Roles including Treasurer and Director of Investor Relations (1993–1996) Morgan Stanley (NYSE: MS), a global financial services firm •Vice President, Investment Banking Division (1988–1991) |

| |

Skills and Qualifications •Branding •Corporate Governance •Enterprise Risk Management •Environmental, Social and Governance •Executive Leadership/CEO •Financial/Capital Allocation •Human Capital Management •International Business •Mergers and Acquisitions •Strategic Planning •Technology | |

| |

| Public Company Boards |

| •BlueLinx Holdings, Inc. (NYSE: BXC) (2022–present) •Atlantic Capital Bancshares, Inc. (NASDAQ: ACBI) (2011– until acquisition by SouthState Corporation (NASDAQ: SSB) in 2022) |

| | |

| | Other Affiliations |

| | •National Alliance of Manufacturers (NAM), Board Member (beginning 2025) •Manufacturers Alliance, Board Member (2023–present) •University of Virginia Darden School Foundation, Trustee (2023–present) |

| | |

| | Education |

| | •BA, Mathematics and Economics, Randolph-Macon Woman’s College •MBA, General Management, University of Virginia Darden School of Business •JD, University of Virginia School of Law |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chair | | Member | A = Audit | C = Compensation | E = EHS | G = Governance | O = Capital Allocation | X = Executive |

PROXY STATEMENT FOR 2025 ANNUAL MEETING 27

Board Refreshment/Board Succession Planning

We continued our refreshment program that has introduced six new directors to the Board since 2019 and has seen the retirement of six, including Ms. Franklin and Dr. Thomas this year, of our longer tenured members beginning in 2021. As part of this program, each member of the Board who has served for more than 10 years will have retired by the 2026 Annual Meeting. Board refreshment has been undertaken with attentiveness to continually enhancing the Board’s set of relevant skills and diversity of experience and successively strengthening the Board’s oversight capabilities.

The Board believes that thoughtful refreshment is necessary to ensure that the Board remains aligned with the needs of the Company as it evolves. To that end, the Governance Committee regularly assesses director succession and board refreshment, with a focus on maintaining an optimal mix of institutional knowledge, industry expertise and fresh insight among its directors.

Board Tenure Policy

The Board believes that an appropriate mix of tenured directors and newer directors with fresh perspectives is necessary to ensure a vital and effective Board. Complementing this strategy of refreshment and enhancement is a commitment to making the most of our longer tenured directors’ experience and knowledge of the Company’s operations. While the Board believes the best interests of the Company are served by taking advantage of all available talent and that a significant degree of continuity year-over-year is beneficial to stockholders, it also believes that age and tenure are important considerations in assessing Board composition. Accordingly, in January 2024, the Board prospectively implemented tenure and age limits of 10 years and 75 years, respectively, and provided discretion to the Board to allow exceptions to these limits.

Board Composition

The Board continues to identify and incorporate directors with diverse experiences and perspectives to provide the Company with thoughtful and engaged board oversight. In fiscal 2024, with the retirement of Messrs. O’Brien and Tokarz, the election of Mr. Healy and the appointment of Mr. Garcia, the number of Board members was eleven. In fiscal 2025, with the departures of Dr. Thomas, Ms. Franklin, and Messrs. Slobodow and Ytterdahl, and the additions of Ms. Terry and Mr. Weaver, if elected, the number of our Board members will be nine. Each of our director nominees is independent, except Ms. Zakas, our CEO. As demonstrated by the following key metrics, the Board actively seeks highly qualified women, individuals from underrepresented minorities and those with a wealth of diverse skills and talents to join the Board.

28 MUELLER WATER PRODUCTS, INC.

| | | | | | | | | | | | | | |

At September 30, 2024 | | As Nominated |

| | | | |

| 10 of our 11 directors are independent, including the Chair | | | 8 of our 9 director nominees are independent, including the Chair |

| 4 of our 11 directors are women | | | 3 of our 9 director nominees are women |

| 9 of our 11 directors have Corporate Governance experience | | | 7 of our 9 director nominees have Corporate Governance experience |