Where Intelligence Meets Infrastructure® Investor Presentation November 11, 2025

2 Non-GAAP Measures In an effort to provide investors with additional information regarding the Company’s results as determined by accounting principles generally accepted in the United States (“GAAP”), the Company also provides non-GAAP information that management believes is useful to investors. These non-GAAP measures have limitations as analytical tools, and securities analysts, investors and other interested parties should not consider any of these non-GAAP measures in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. These non-GAAP measures may not be comparable to similarly titled measures used by other companies. Adjusted net income, adjusted net income per diluted share, adjusted operating income, adjusted operating margin, adjusted EBITDA and adjusted EBITDA margin are non- GAAP measures that the Company presents as performance measures because management uses these measures to evaluate the Company’s underlying performance on a consistent basis across periods and to make decisions about operational strategies. Management also believes these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of the Company’s recurring performance. Net debt and net debt leverage are non-GAAP measures that the Company presents as liquidity measures because management uses them to evaluate its capital management and financial position, and the investment community commonly uses them as measures of indebtedness. Free cash flow is a non-GAAP liquidity measure used to assist management and investors in analyzing the Company’s ability to generate liquidity from its operating activities. The calculations of these non-GAAP measures and reconciliations to GAAP results are included as an attachment to this presentation, which has been posted online at www.muellerwaterproducts.com. The Company does not reconcile forward-looking non-GAAP measures to the comparable GAAP measures, as permitted by Regulation S-K, as certain items, e.g., expenses related to corporate development activities, transactions, pension expenses/(benefits), corporate restructuring and non-cash asset impairment, may have not yet occurred, are out of the Company’s control or cannot be reasonably predicted without unreasonable efforts. Additionally, such reconciliation would imply a degree of precision and certainty regarding relevant items that may be confusing to investors. Such items could have a substantial impact on GAAP measures of the Company's financial performance.

3 Forward-Looking Statements This presentation contains certain statements that may be deemed “forward-looking statements” within the meaning of the federal securities laws. All statements that address activities, events or developments that the Company intends, expects, plans, projects, believes or anticipates will or may occur in the future are forward-looking statements, including, without limitation, statements regarding outlooks, projections, forecasts, expectations, commitments, trend descriptions and the ability to capitalize on trends, value creation, long-term strategies and the execution or acceleration thereof, operational improvements, inventory positions, the benefits of capital investments, financial or operating performance, including driving increased margins, operational and commercial initiatives, capital allocation and growth strategy plans, and the demand for the Company’s products. Forward-looking statements are based on certain assumptions and assessments made by the Company in light of the Company’s experience and perception of historical trends, current conditions and expected future developments. Actual results and the timing of events may differ materially from those contemplated by the forward-looking statements due to a number of factors, including, without limitation, changing regulatory, trade and tariff conditions; logistical challenges and supply chain disruptions, geopolitical conditions, including the Israel-Hamas war, public health crises, or other events; inventory and in-stock positions of our distributors and end customers; an inability to realize the anticipated benefits from our operational initiatives, including our large capital investments in Decatur, Illinois, plant closures, and reorganization and related strategic realignment activities; an inability to attract or retain a skilled and diverse workforce, increased competition related to the workforce and labor markets; an inability to protect the Company’s information systems against service interruption, risks resulting from possible future cybersecurity incidents, misappropriation of data or breaches of security; failure to comply with personal data protection and privacy laws; cyclical and changing demand in core markets such as municipal spending, residential construction and natural gas distribution; government monetary or fiscal policies; the impact of adverse weather conditions; the impact of manufacturing and product performance; the impact of wage, commodity and materials price inflation; foreign exchange rate fluctuations; the impact of higher interest rates; the impact of warranty charges and claims, and related accommodations; the strength of our brands and reputation; an inability to successfully resolve significant legal proceedings or government investigations; compliance with environmental, trade and anti- corruption laws and regulations; climate change and legal or regulatory responses thereto; the failure to integrate and/or realize any of the anticipated benefits of acquisitions or divestitures; an inability to achieve our goals and commitments in environmental and sustainability programs; and other factors that are described in the section entitled “RISK FACTORS” in Item 1A. of the Company’s most recent Annual Report on Form 10-K and later filings on Form 10-Q, as applicable. Forward-looking statements do not guarantee future performance and are only as of the date they are made. The Company undertakes no duty to update its forward- looking statements except as required by law. Undue reliance should not be placed on any forward-looking statements. You are advised to review any further disclosures the Company makes on related subjects in subsequent Forms 10-K, 10-Q, 8-K and other reports filed with the United States Securities and Exchange Commission.

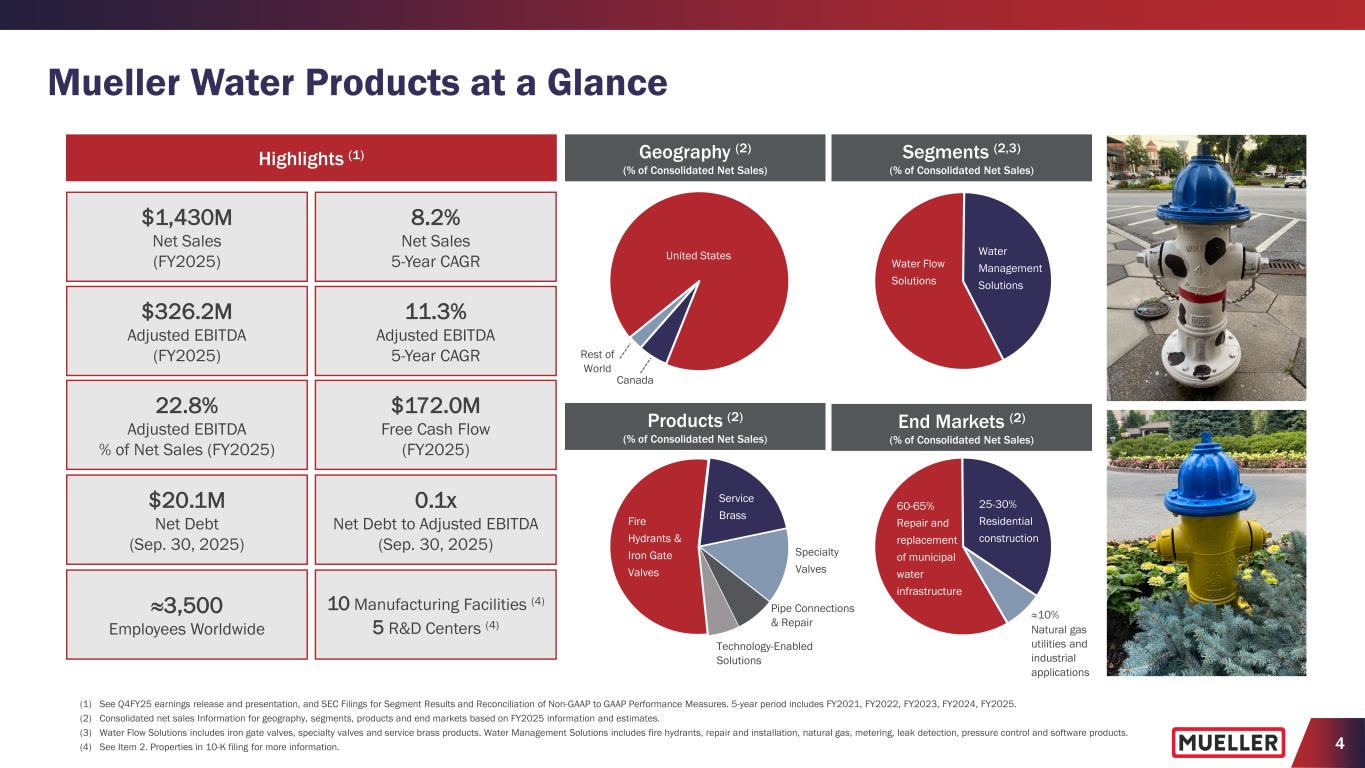

4 (1) See Q4FY25 earnings release and presentation, and SEC Filings for Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures. 5-year period includes FY2021, FY2022, FY2023, FY2024, FY2025. (2) Consolidated net sales Information for geography, segments, products and end markets based on FY2025 information and estimates. (3) Water Flow Solutions includes iron gate valves, specialty valves and service brass products. Water Management Solutions includes fire hydrants, repair and installation, natural gas, metering, leak detection, pressure control and software products. (4) See Item 2. Properties in 10-K filing for more information. Water Flow Solutions Water Management Solutions United States Rest of World Geography (2) (% of Consolidated Net Sales) Segments (2,3) (% of Consolidated Net Sales) ≈10% Natural gas utilities and industrial applications 60-65% Repair and replacement of municipal water infrastructure 25-30% Residential construction Service BrassFire Hydrants & Iron Gate Valves Specialty Valves Technology-Enabled Solutions Products (2) (% of Consolidated Net Sales) End Markets (2) (% of Consolidated Net Sales) Canada Highlights (1) $1,430M Net Sales (FY2025) 8.2% Net Sales 5-Year CAGR $326.2M Adjusted EBITDA (FY2025) 11.3% Adjusted EBITDA 5-Year CAGR 22.8% Adjusted EBITDA % of Net Sales (FY2025) $172.0M Free Cash Flow (FY2025) $20.1M Net Debt (Sep. 30, 2025) 0.1x Net Debt to Adjusted EBITDA (Sep. 30, 2025) ≈3,500 Employees Worldwide 10 Manufacturing Facilities (4) 5 R&D Centers (4) Mueller Water Products at a Glance Pipe Connections & Repair

5 Why Invest in Mueller LEADING BRANDS WITH LARGE INSTALLED BASE OF INNOVATIVE INFRASTRUCTURE PRODUCTS AND SOLUTIONS BENEFITING FROM LONG-TERM END MARKET DYNAMICS SUPPORTED BY AGING WATER INFRASTRUCTURE DRIVING OPERATIONAL EXCELLENCE AND EXPANDING CAPABILITIES TO FURTHER EXPAND GROSS MARGINS ENHANCING CUSTOMER EXPERIENCE TO DRIVE GROWTH THROUGH COMPREHENSIVE DISTRIBUTION NETWORK INCREASING MARGINS AND FREE CASH FLOW SUPPORT FUTURE INVESTMENTS AND GROWTH Continued investments in customer experience, product innovation and operational excellence support further net sales growth and margin improvements SUPPORTING STRATEGIC PRIORITIES THROUGH BALANCE SHEET WITH AMPLE CAPACITY, LIQUIDITY AND FLEXIBILITY

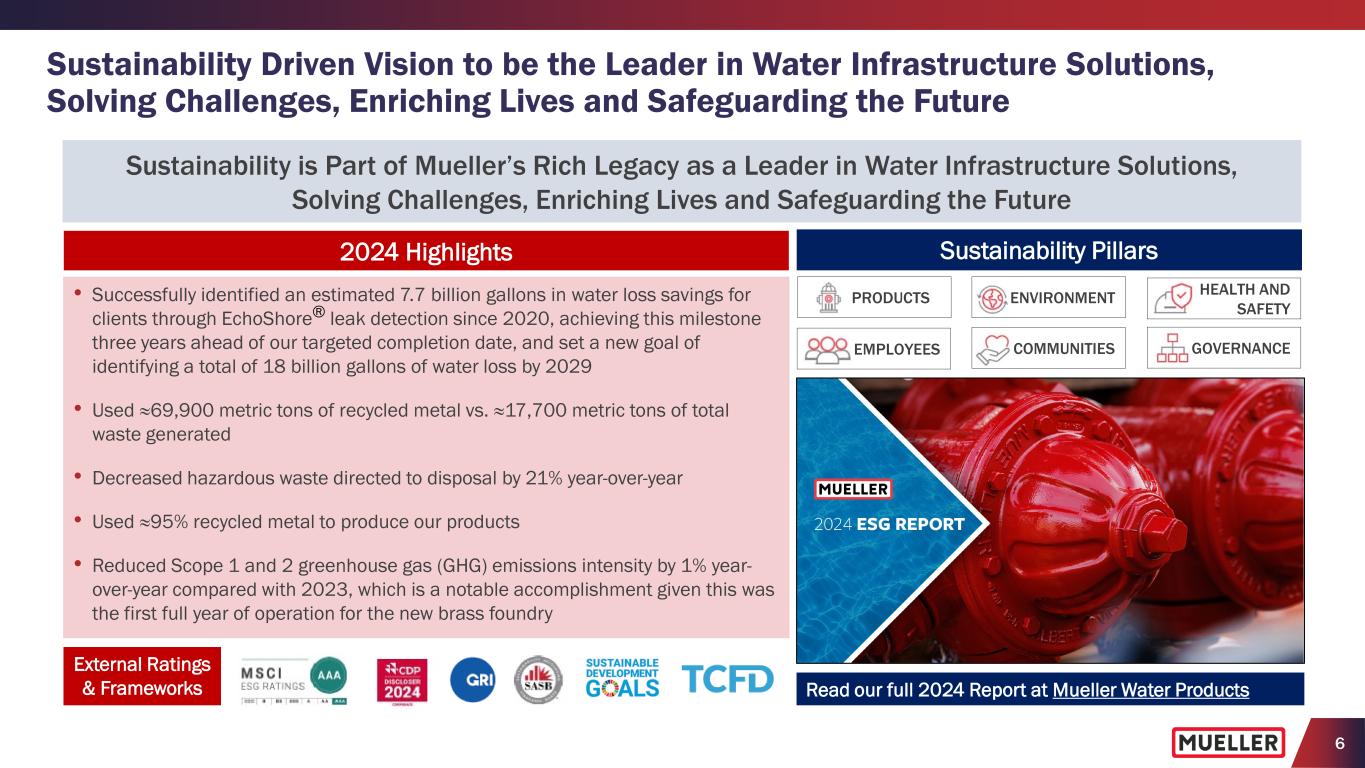

6 Sustainability Driven Vision to be the Leader in Water Infrastructure Solutions, Solving Challenges, Enriching Lives and Safeguarding the Future Sustainability is Part of Mueller’s Rich Legacy as a Leader in Water Infrastructure Solutions, Solving Challenges, Enriching Lives and Safeguarding the Future 2024 Highlights • Successfully identified an estimated 7.7 billion gallons in water loss savings for clients through EchoShore® leak detection since 2020, achieving this milestone three years ahead of our targeted completion date, and set a new goal of identifying a total of 18 billion gallons of water loss by 2029 • Used ≈69,900 metric tons of recycled metal vs. ≈17,700 metric tons of total waste generated • Decreased hazardous waste directed to disposal by 21% year-over-year • Used ≈95% recycled metal to produce our products • Reduced Scope 1 and 2 greenhouse gas (GHG) emissions intensity by 1% year- over-year compared with 2023, which is a notable accomplishment given this was the first full year of operation for the new brass foundry EMPLOYEES ENVIRONMENTPRODUCTS COMMUNITIES GOVERNANCE HEALTH AND SAFETY Sustainability Pillars Read our full 2024 Report at Mueller Water Products External Ratings & Frameworks

7 Strategic Priorities to Drive Growth and Margin Improvement Supported by Purpose-driven Organization STRATEGIC PRIORITIES CONNECTING COMMUNITIES TO WATER, LIFE’S MOST ESSENTIAL RESOURCE, WITH EXCEPTIONAL PEOPLE, SOLUTIONS AND PRODUCTS IMPROVE OPERATIONAL EXCELLENCE AND EXPAND CAPABILITIES ACCELERATE SALES GROWTH THROUGH CUSTOMER EXPERIENCE AND INNOVATION FOSTER CULTURE THROUGH PURPOSE, COLLABORATION, INCLUSION AND EFFECTIVENESS INCREASE MARGINS AND FREE CASH FLOW TO SUPPORT FUTURE INVESTMENTS AND GROWTH PURPOSE CORE VALUES EXECUTE DIGITAL TRANSFORMATION TO DRIVE RESULTS RESPECTSAFETY TRUST INCLUSIONINTEGRITY

Products and Markets

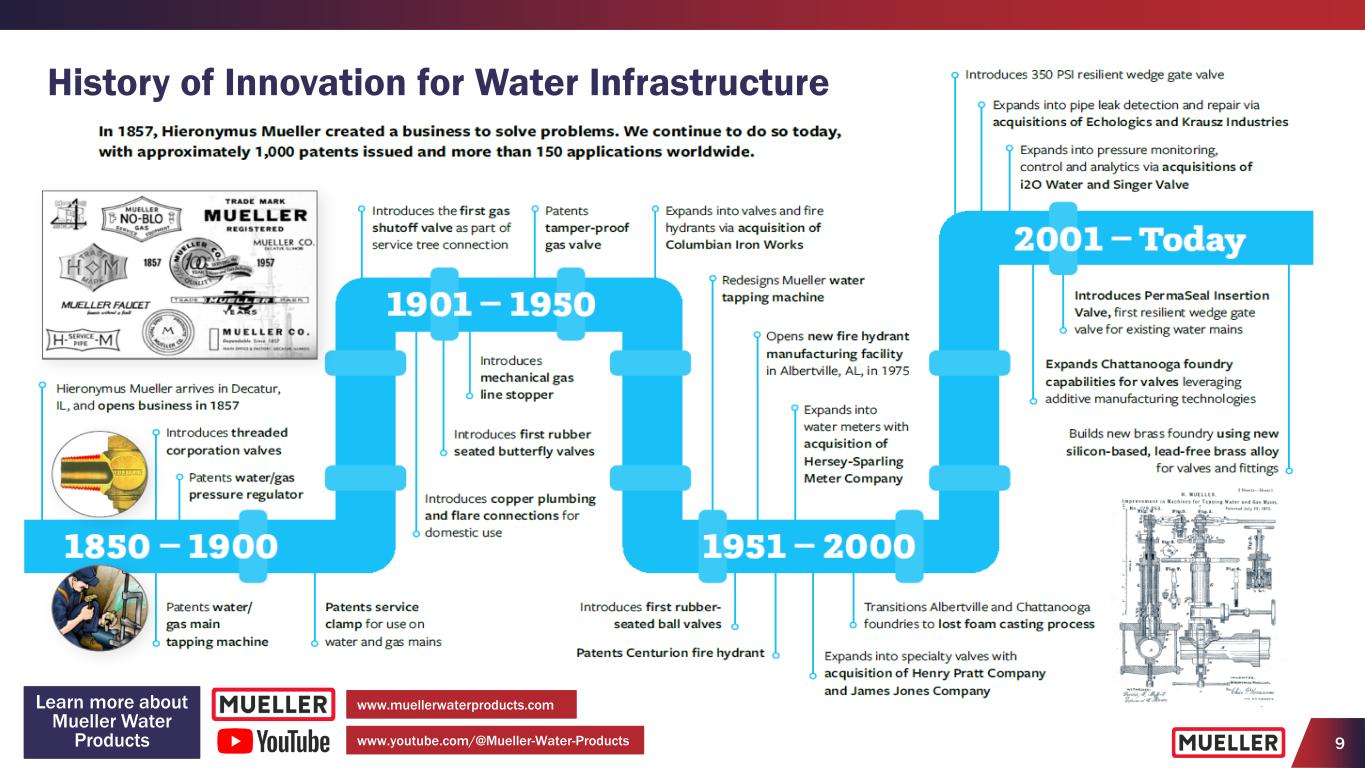

9 History of Innovation for Water Infrastructure www.youtube.com/@Mueller-Water-Products www.muellerwaterproducts.comLearn more about Mueller Water Products

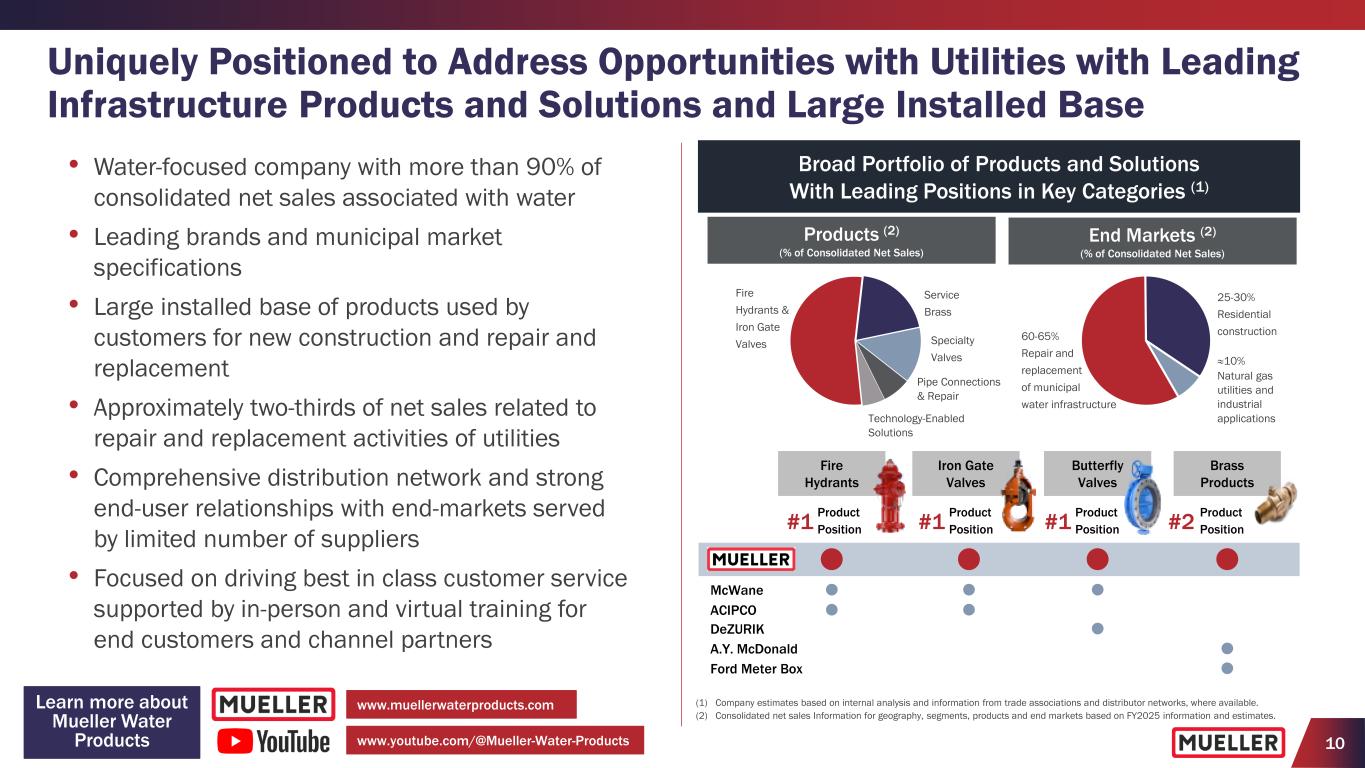

10 Leading Product Positions in Key Product Categories (1) (1) Company estimates based on internal analysis and information from trade associations and distributor networks, where available. (2) Consolidated net sales Information for geography, segments, products and end markets based on FY2025 information and estimates. Fire Hydrants Iron Gate Valves Butterfly Valves Brass Products #1 Product Position A.Y. McDonald ACIPCO DeZURIK Ford Meter Box McWane #1 Product Position #1 Product Position #2 Product Position Broad Portfolio of Products and Solutions With Leading Positions in Key Categories (1) Uniquely Positioned to Address Opportunities with Utilities with Leading Infrastructure Products and Solutions and Large Installed Base • Water-focused compa y with more than 90% of consolidated net sales associated with water • Leading brands and municipal market specifications • Large installed base of products used by customers for new construction and repair and replacement • Approximately two-thirds of net sales related to repair and replacement activities of utilities • Comprehensive distribution network and strong end-user relationships with end-markets served by limited number of suppliers • Focused on driving best in class customer service supported by in-person and virtual training for end customers and channel partners www.youtube.com/@Mueller-Water-Products www.muellerwaterproducts.comLearn more about Mueller Water Products ≈10% Natural gas utilities and industrial applications 60-65% Repair and replacement of municipal water infrastructure 25-30% Residential construction Service Brass Fire Hydrants & Iron Gate Valves Specialty Valves Technology-Enabled Solutions Products (2) (% of Consolidated Net Sales) End Markets (2) (% of Consolidated Net Sales) Pipe Connections & Repair

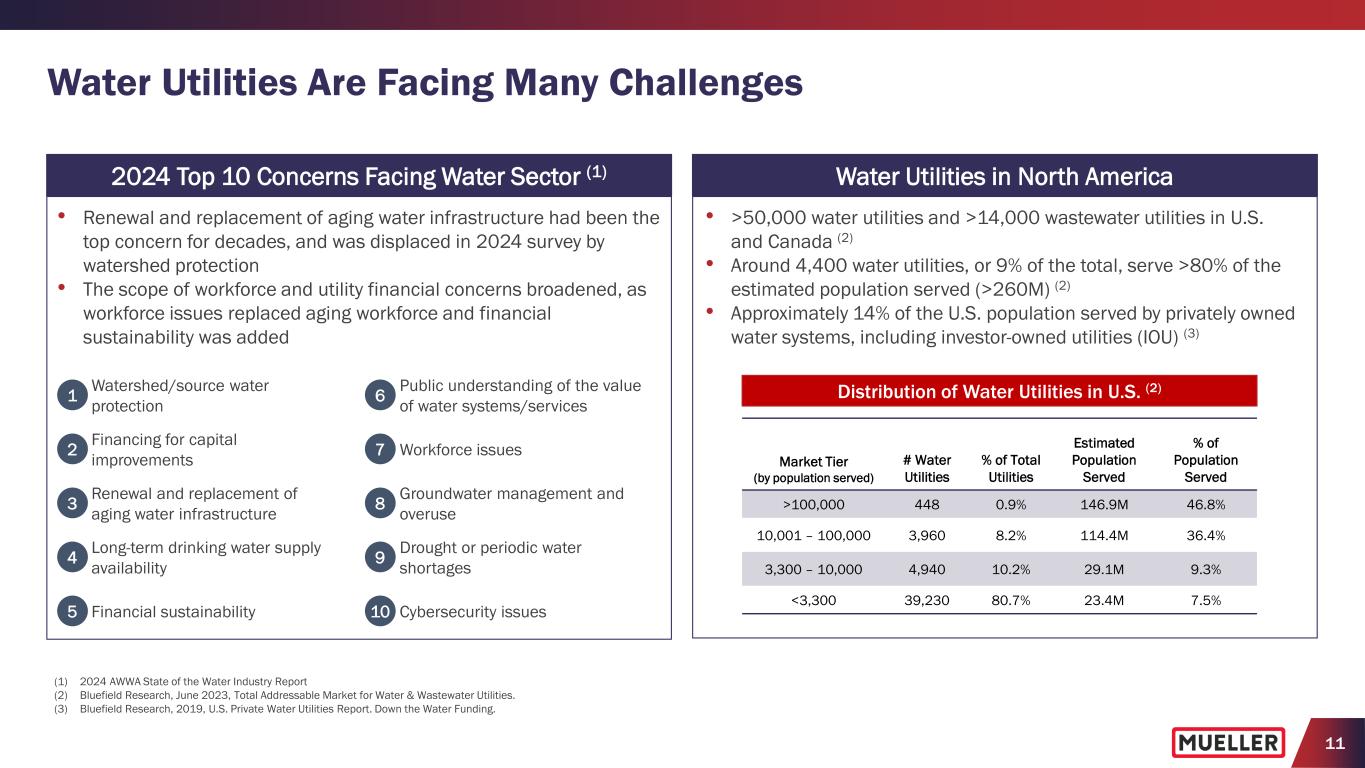

11 1 Watershed/source water protection 2 Financing for capital improvements 3 Renewal and replacement of aging water infrastructure 4 Long-term drinking water supply availability 5 Financial sustainability • Renewal and replacement of aging water infrastructure had been the top concern for decades, and was displaced in 2024 survey by watershed protection • The scope of workforce and utility financial concerns broadened, as workforce issues replaced aging workforce and financial sustainability was added 2024 Top 10 Concerns Facing Water Sector (1) 6 Public understanding of the value of water systems/services 7 Workforce issues 8 Groundwater management and overuse 9 Drought or periodic water shortages 10 Cybersecurity issues • >50,000 water utilities and >14,000 wastewater utilities in U.S. and Canada (2) • Around 4,400 water utilities, or 9% of the total, serve >80% of the estimated population served (>260M) (2) • Approximately 14% of the U.S. population served by privately owned water systems, including investor-owned utilities (IOU) (3) Water Utilities in North America Market Tier (by population served) # Water Utilities % of Total Utilities Estimated Population Served % of Population Served >100,000 448 0.9% 146.9M 46.8% 10,001 – 100,000 3,960 8.2% 114.4M 36.4% 3,300 – 10,000 4,940 10.2% 29.1M 9.3% <3,300 39,230 80.7% 23.4M 7.5% Distribution of Water Utilities in U.S. (2) (1) 2024 AWWA State of the Water Industry Report (2) Bluefield Research, June 2023, Total Addressable Market for Water & Wastewater Utilities. (3) Bluefield Research, 2019, U.S. Private Water Utilities Report. Down the Water Funding. Water Utilities Are Facing Many Challenges

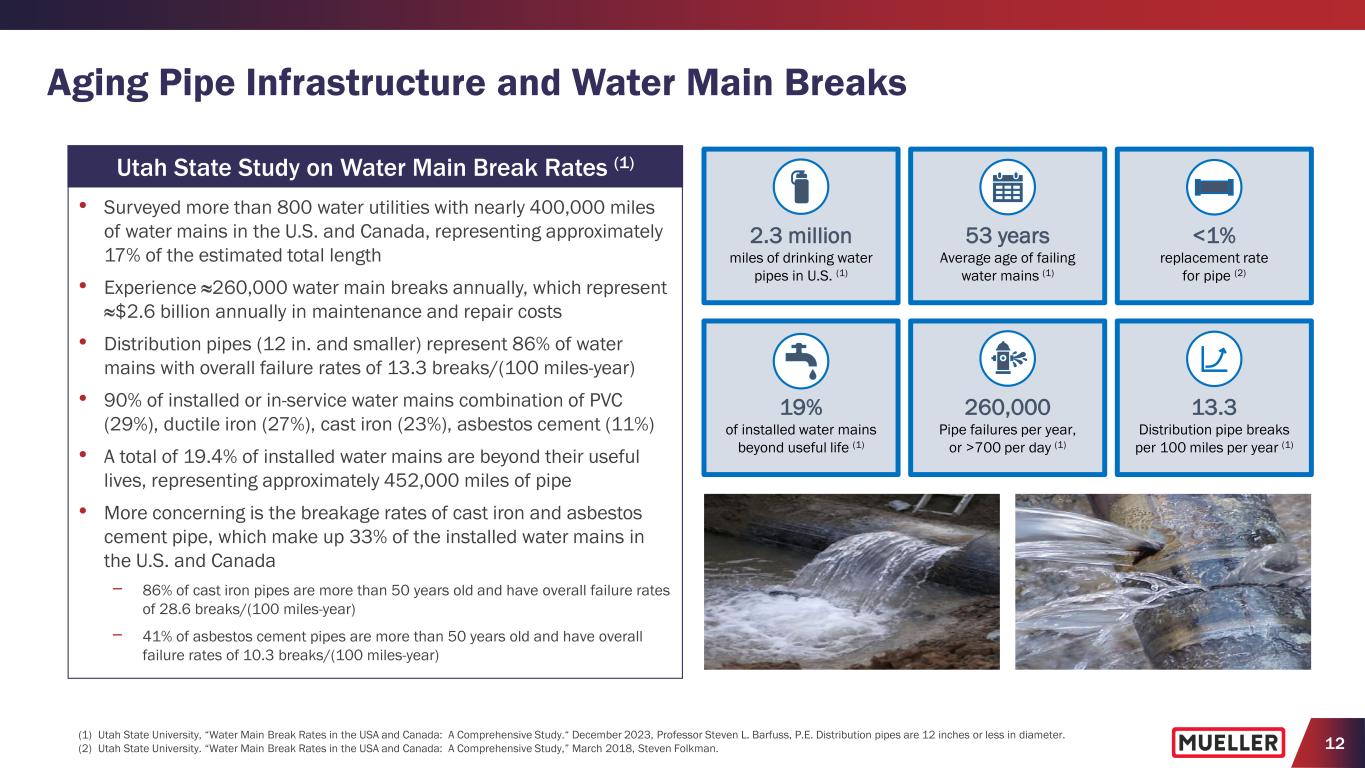

12 Aging Pipe Infrastructure and Water Main Breaks Utah State Study on Water Main Break Rates (1) • Surveyed more than 800 water utilities with nearly 400,000 miles of water mains in the U.S. and Canada, representing approximately 17% of the estimated total length • Experience ≈260,000 water main breaks annually, which represent ≈$2.6 billion annually in maintenance and repair costs • Distribution pipes (12 in. and smaller) represent 86% of water mains with overall failure rates of 13.3 breaks/(100 miles-year) • 90% of installed or in-service water mains combination of PVC (29%), ductile iron (27%), cast iron (23%), asbestos cement (11%) • A total of 19.4% of installed water mains are beyond their useful lives, representing approximately 452,000 miles of pipe • More concerning is the breakage rates of cast iron and asbestos cement pipe, which make up 33% of the installed water mains in the U.S. and Canada − 86% of cast iron pipes are more than 50 years old and have overall failure rates of 28.6 breaks/(100 miles-year) − 41% of asbestos cement pipes are more than 50 years old and have overall failure rates of 10.3 breaks/(100 miles-year) (1) Utah State University, “Water Main Break Rates in the USA and Canada: A Comprehensive Study.“ December 2023, Professor Steven L. Barfuss, P.E. Distribution pipes are 12 inches or less in diameter. (2) Utah State University. “Water Main Break Rates in the USA and Canada: A Comprehensive Study,” March 2018, Steven Folkman. 13.3 Distribution pipe breaks per 100 miles per year (1) <1% replacement rate for pipe (2) 2.3 million miles of drinking water pipes in U.S. (1) 19% of installed water mains beyond useful life (1) 53 years Average age of failing water mains (1) 260,000 Pipe failures per year, or >700 per day (1)

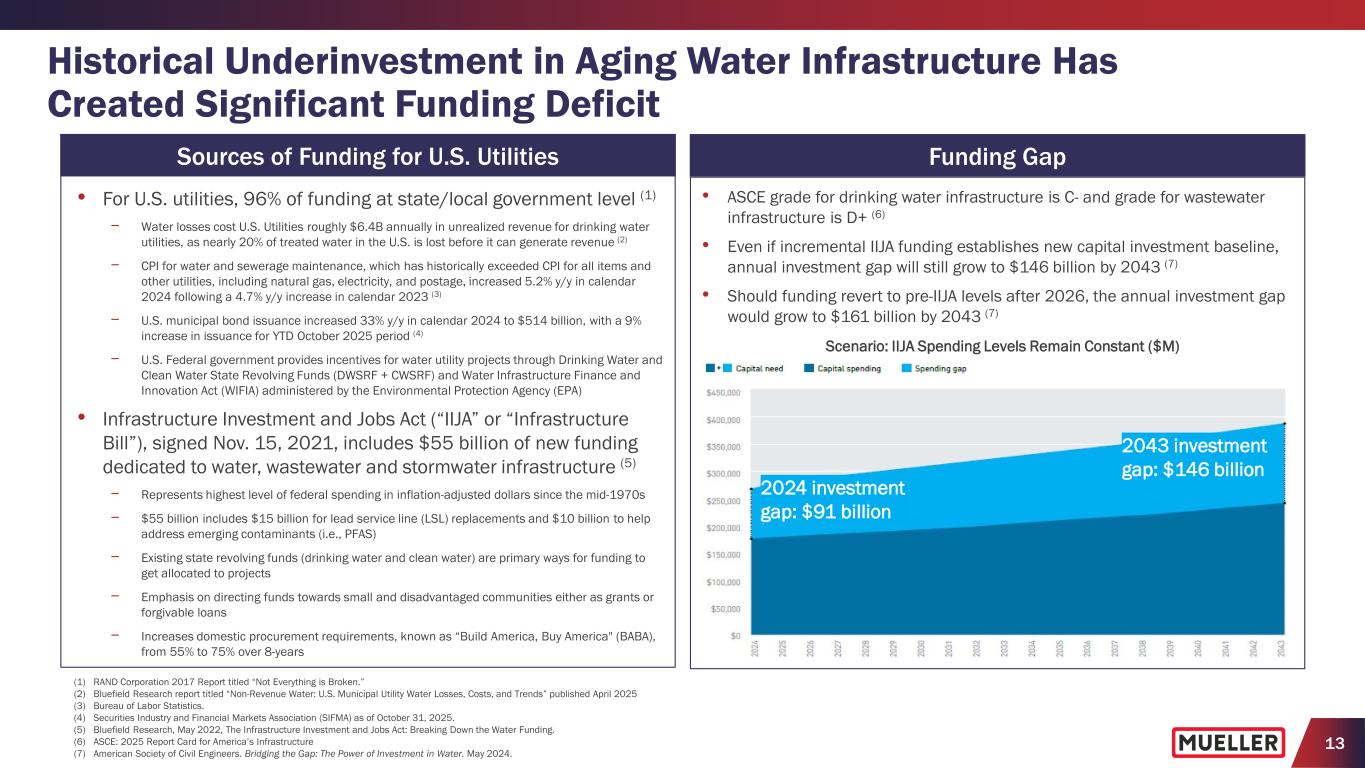

13 Historical Underinvestment in Aging Water Infrastructure Has Created Significant Funding Deficit (1) RAND Corporation 2017 Report titled “Not Everything is Broken.” (2) Bluefield Research report titled “Non-Revenue Water: U.S. Municipal Utility Water Losses, Costs, and Trends” published April 2025 (3) Bureau of Labor Statistics. (4) Securities Industry and Financial Markets Association (SIFMA) as of October 31, 2025. (5) Bluefield Research, May 2022, The Infrastructure Investment and Jobs Act: Breaking Down the Water Funding. (6) ASCE: 2025 Report Card for America’s Infrastructure (7) American Society of Civil Engineers. Bridging the Gap: The Power of Investment in Water. May 2024. Sources of Funding for U.S. Utilities • For U.S. utilities, 96% of funding at state/local government level (1) − Water losses cost U.S. Utilities roughly $6.4B annually in unrealized revenue for drinking water utilities, as nearly 20% of treated water in the U.S. is lost before it can generate revenue (2) − CPI for water and sewerage maintenance, which has historically exceeded CPI for all items and other utilities, including natural gas, electricity, and postage, increased 5.2% y/y in calendar 2024 following a 4.7% y/y increase in calendar 2023 (3) − U.S. municipal bond issuance increased 33% y/y in calendar 2024 to $514 billion, with a 9% increase in issuance for YTD October 2025 period (4) − U.S. Federal government provides incentives for water utility projects through Drinking Water and Clean Water State Revolving Funds (DWSRF + CWSRF) and Water Infrastructure Finance and Innovation Act (WIFIA) administered by the Environmental Protection Agency (EPA) • Infrastructure Investment and Jobs Act (“IIJA” or “Infrastructure Bill”), signed Nov. 15, 2021, includes $55 billion of new funding dedicated to water, wastewater and stormwater infrastructure (5) − Represents highest level of federal spending in inflation-adjusted dollars since the mid-1970s − $55 billion includes $15 billion for lead service line (LSL) replacements and $10 billion to help address emerging contaminants (i.e., PFAS) − Existing state revolving funds (drinking water and clean water) are primary ways for funding to get allocated to projects − Emphasis on directing funds towards small and disadvantaged communities either as grants or forgivable loans − Increases domestic procurement requirements, known as “Build America, Buy America" (BABA), from 55% to 75% over 8-years • ASCE grade for drinking water infrastructure is C- and grade for wastewater infrastructure is D+ (6) • Even if incremental IIJA funding establishes new capital investment baseline, annual investment gap will still grow to $146 billion by 2043 (7) • Should funding revert to pre-IIJA levels after 2026, the annual investment gap would grow to $161 billion by 2043 (7) Funding Gap Scenario: IIJA Spending Levels Remain Constant ($M) 2024 investment gap: $91 billion 2043 investment gap: $146 billion

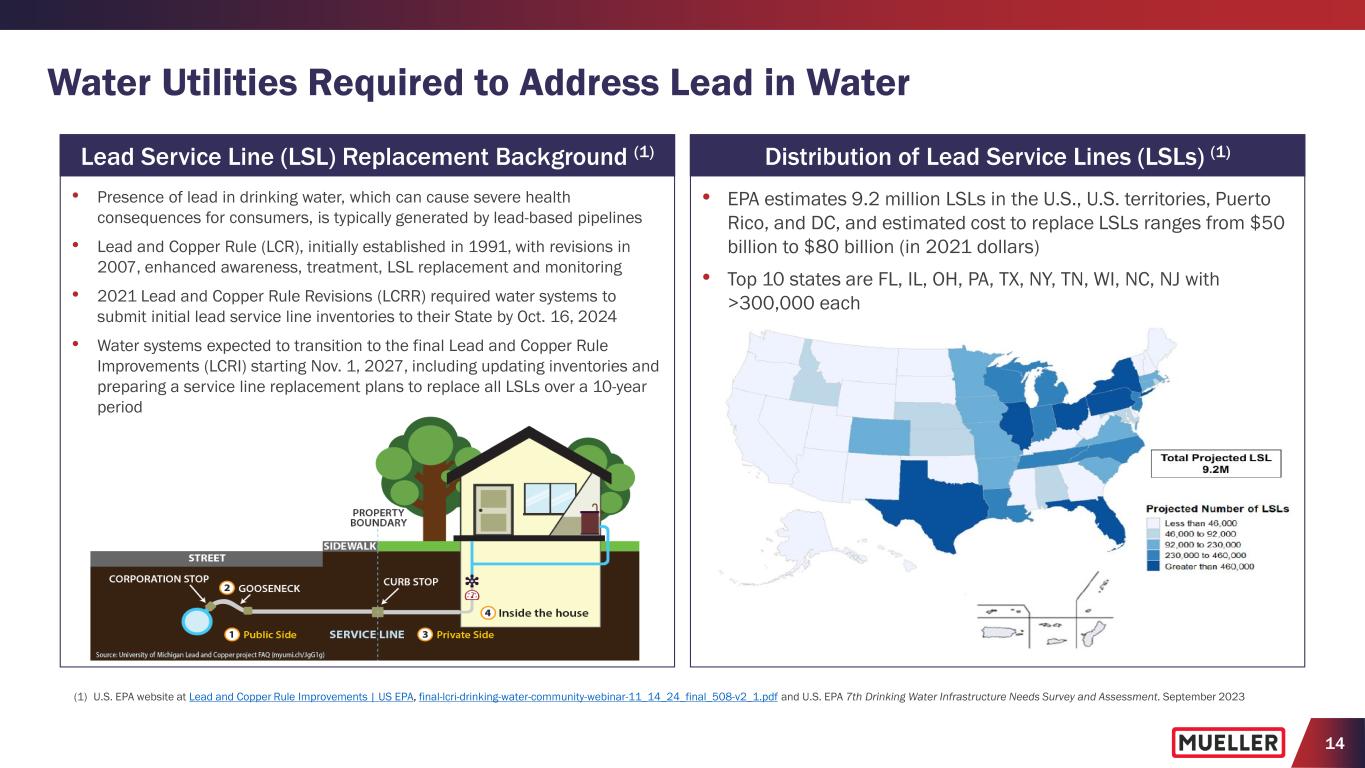

14 Water Utilities Required to Address Lead in Water • EPA estimates 9.2 million LSLs in the U.S., U.S. territories, Puerto Rico, and DC, and estimated cost to replace LSLs ranges from $50 billion to $80 billion (in 2021 dollars) • Top 10 states are FL, IL, OH, PA, TX, NY, TN, WI, NC, NJ with >300,000 each Distribution of Lead Service Lines (LSLs) (1) • Presence of lead in drinking water, which can cause severe health consequences for consumers, is typically generated by lead-based pipelines • Lead and Copper Rule (LCR), initially established in 1991, with revisions in 2007, enhanced awareness, treatment, LSL replacement and monitoring • 2021 Lead and Copper Rule Revisions (LCRR) required water systems to submit initial lead service line inventories to their State by Oct. 16, 2024 • Water systems expected to transition to the final Lead and Copper Rule Improvements (LCRI) starting Nov. 1, 2027, including updating inventories and preparing a service line replacement plans to replace all LSLs over a 10-year period Lead Service Line (LSL) Replacement Background (1) (1) U.S. EPA website at Lead and Copper Rule Improvements | US EPA, final-lcri-drinking-water-community-webinar-11_14_24_final_508-v2_1.pdf and U.S. EPA 7th Drinking Water Infrastructure Needs Survey and Assessment. September 2023

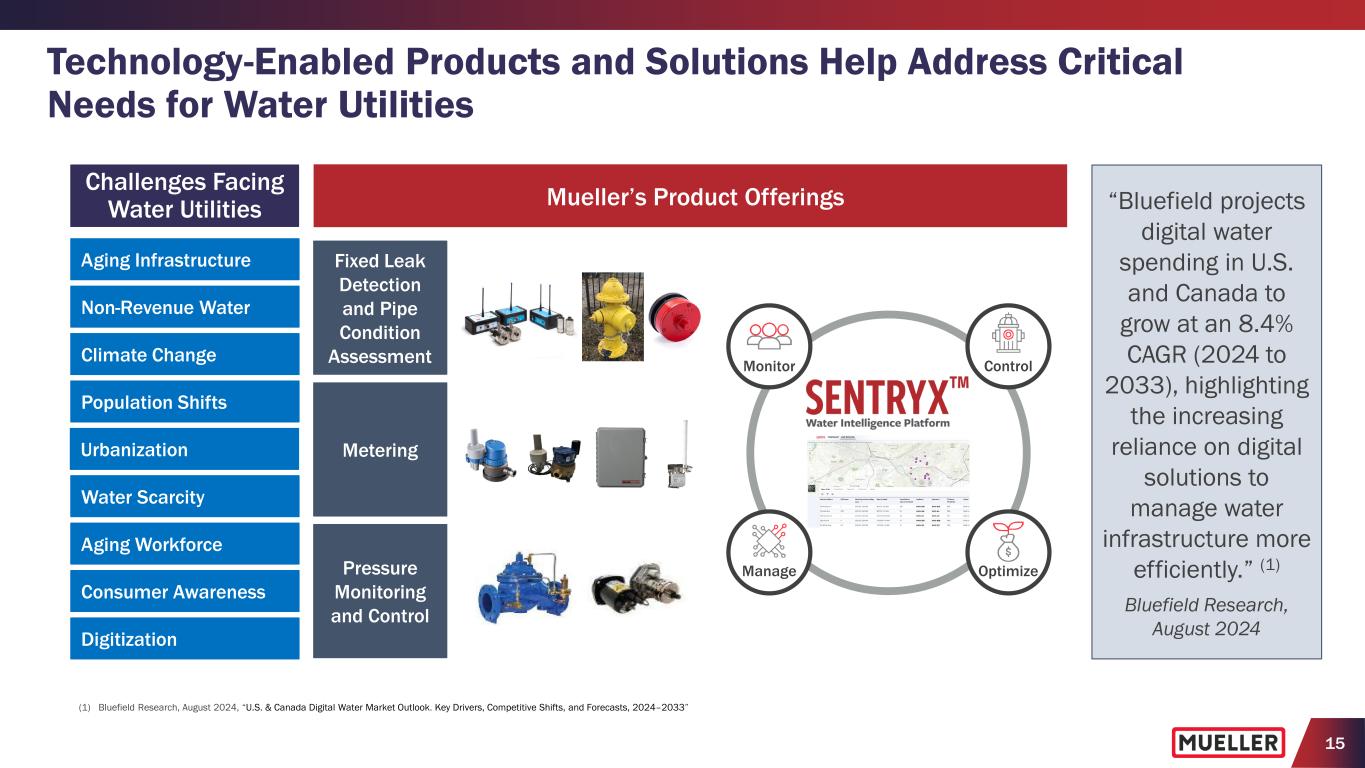

15 Technology-Enabled Products and Solutions Help Address Critical Needs for Water Utilities ControlMonitor Manage Optimize Mueller’s Product Offerings Aging Infrastructure Non-Revenue Water Climate Change Population Shifts Water Scarcity Aging Workforce Consumer Awareness Digitization Challenges Facing Water Utilities Urbanization Fixed Leak Detection and Pipe Condition Assessment Metering Pressure Monitoring and Control “Bluefield projects digital water spending in U.S. and Canada to grow at an 8.4% CAGR (2024 to 2033), highlighting the increasing reliance on digital solutions to manage water infrastructure more efficiently.” (1) Bluefield Research, August 2024 (1) Bluefield Research, August 2024, “U.S. & Canada Digital Water Market Outlook. Key Drivers, Competitive Shifts, and Forecasts, 2024–2033”

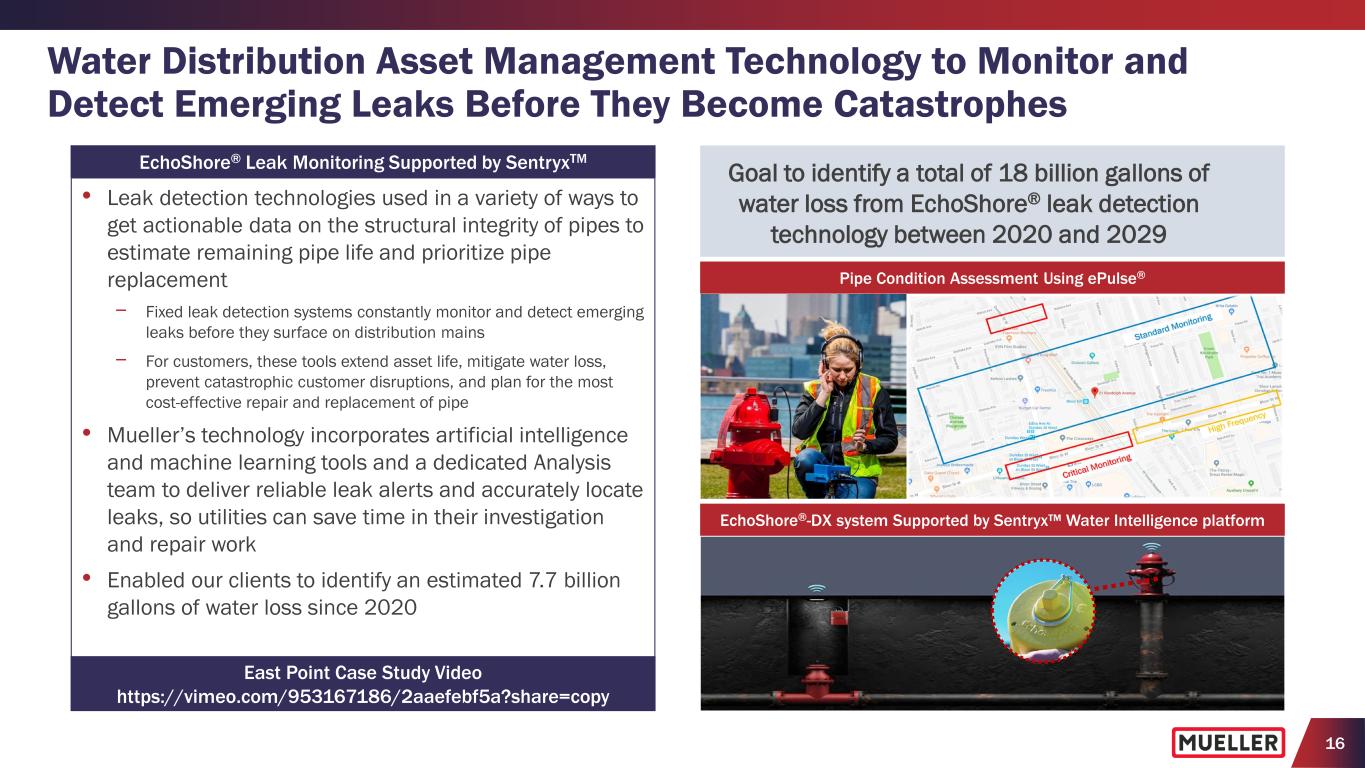

16 Water Distribution Asset Management Technology to Monitor and Detect Emerging Leaks Before They Become Catastrophes Goal to identify a total of 18 billion gallons of water loss from EchoShore® leak detection technology between 2020 and 2029 EchoShore®-DX system Supported by Sentryx Water Intelligence platform Pipe Condition Assessment Using ePulse® • Leak detection technologies used in a variety of ways to get actionable data on the structural integrity of pipes to estimate remaining pipe life and prioritize pipe replacement − Fixed leak detection systems constantly monitor and detect emerging leaks before they surface on distribution mains − For customers, these tools extend asset life, mitigate water loss, prevent catastrophic customer disruptions, and plan for the most cost-effective repair and replacement of pipe • Mueller’s technology incorporates artificial intelligence and machine learning tools and a dedicated Analysis team to deliver reliable leak alerts and accurately locate leaks, so utilities can save time in their investigation and repair work • Enabled our clients to identify an estimated 7.7 billion gallons of water loss since 2020 East Point Case Study Video https://vimeo.com/953167186/2aaefebf5a?share=copy EchoShore® Leak Monitoring Supported by SentryxTM

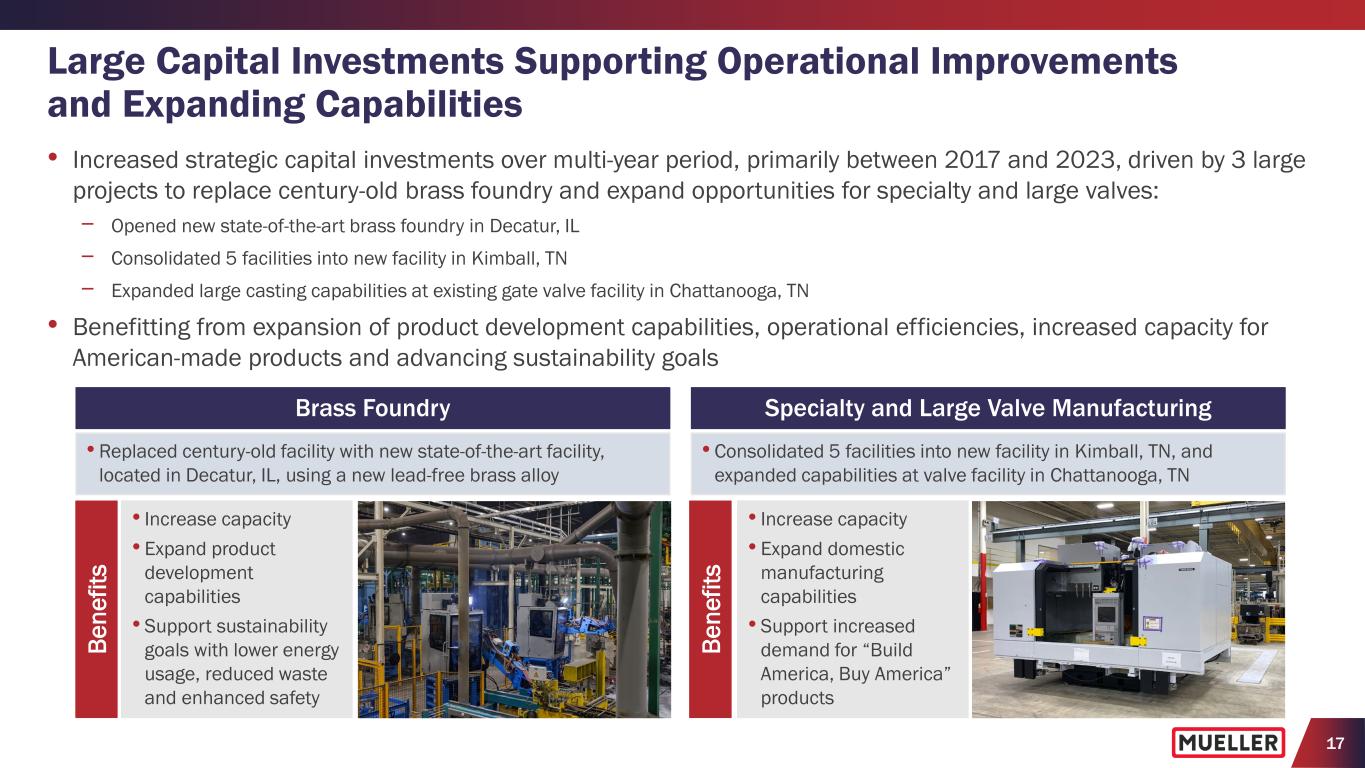

17 Large Capital Investments Supporting Operational Improvements and Expanding Capabilities • Increased strategic capital investments over multi-year period, primarily between 2017 and 2023, driven by 3 large projects to replace century-old brass foundry and expand opportunities for specialty and large valves: − Opened new state-of-the-art brass foundry in Decatur, IL − Consolidated 5 facilities into new facility in Kimball, TN − Expanded large casting capabilities at existing gate valve facility in Chattanooga, TN • Benefitting from expansion of product development capabilities, operational efficiencies, increased capacity for American-made products and advancing sustainability goals Brass Foundry • Replaced century-old facility with new state-of-the-art facility, located in Decatur, IL, using a new lead-free brass alloy Specialty and Large Valve Manufacturing • Consolidated 5 facilities into new facility in Kimball, TN, and expanded capabilities at valve facility in Chattanooga, TN • Increase capacity • Expand product development capabilities • Support sustainability goals with lower energy usage, reduced waste and enhanced safety • Increase capacity • Expand domestic manufacturing capabilities • Support increased demand for “Build America, Buy America” products Be ne fit s Be ne fit s

Financial Performance

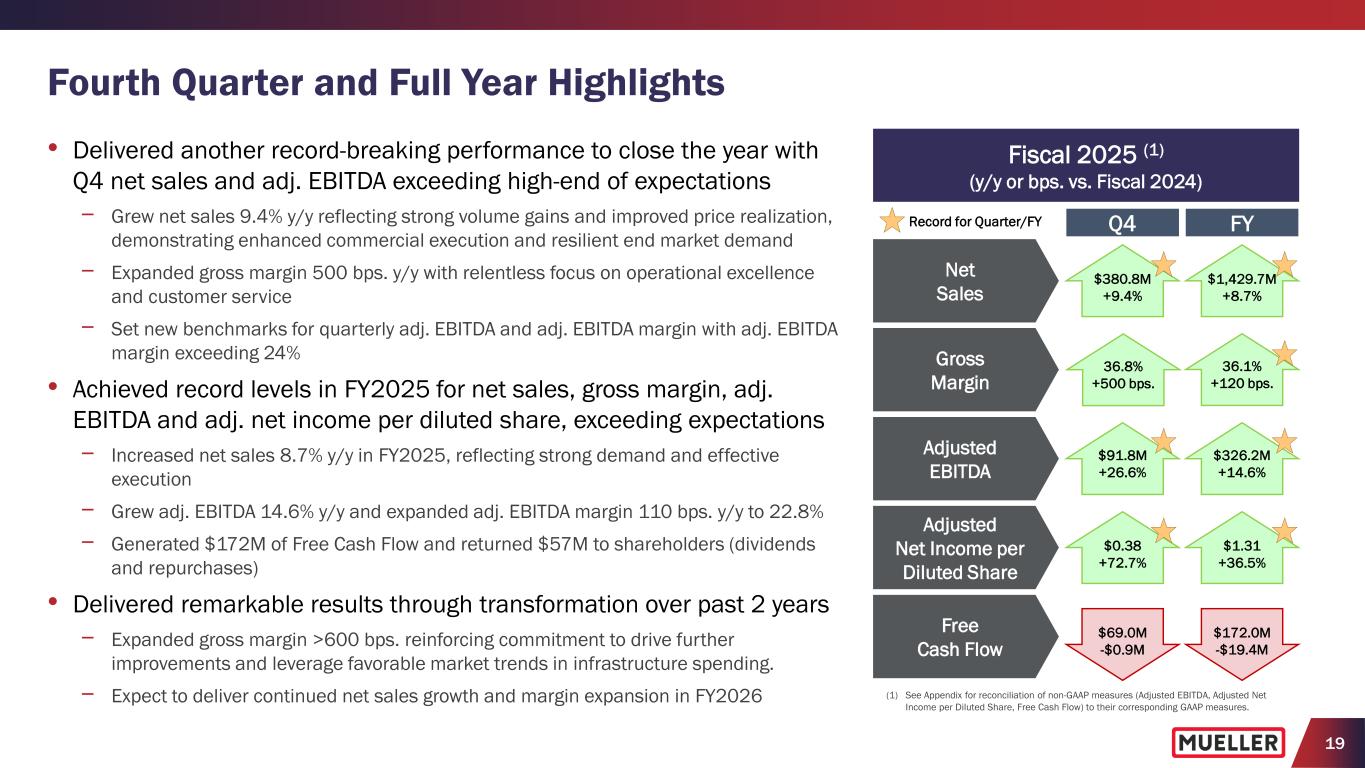

19 • Delivered another record-breaking performance to close the year with Q4 net sales and adj. EBITDA exceeding high-end of expectations − Grew net sales 9.4% y/y reflecting strong volume gains and improved price realization, demonstrating enhanced commercial execution and resilient end market demand − Expanded gross margin 500 bps. y/y with relentless focus on operational excellence and customer service − Set new benchmarks for quarterly adj. EBITDA and adj. EBITDA margin with adj. EBITDA margin exceeding 24% • Achieved record levels in FY2025 for net sales, gross margin, adj. EBITDA and adj. net income per diluted share, exceeding expectations − Increased net sales 8.7% y/y in FY2025, reflecting strong demand and effective execution − Grew adj. EBITDA 14.6% y/y and expanded adj. EBITDA margin 110 bps. y/y to 22.8% − Generated $172M of Free Cash Flow and returned $57M to shareholders (dividends and repurchases) • Delivered remarkable results through transformation over past 2 years − Expanded gross margin >600 bps. reinforcing commitment to drive further improvements and leverage favorable market trends in infrastructure spending. − Expect to deliver continued net sales growth and margin expansion in FY2026 Fourth Quarter and Full Year Highlights (1) See Appendix for reconciliation of non-GAAP measures (Adjusted EBITDA, Adjusted Net Income per Diluted Share, Free Cash Flow) to their corresponding GAAP measures. Q4 Fiscal 2025 (1) (y/y or bps. vs. Fiscal 2024) Net Sales $380.8M +9.4% Gross Margin Adjusted EBITDA $91.8M +26.6% Free Cash Flow $69.0M -$0.9M Adjusted Net Income per Diluted Share $0.38 +72.7% FY $1,429.7M +8.7% $326.2M +14.6% $1.31 +36.5% $172.0M -$19.4M 36.8% +500 bps. 36.1% +120 bps. Record for Quarter/FY

20 • Delivered another year of gross margin improvement and double-digit net sales growth for iron gate and specialty valves, hydrants and repair products − Exceptional execution, despite challenging external environment, through discipline, dedication and teamwork − Commercial investments, which enhanced customer service and expanded market penetration, contributed to mid-single-digit volume growth this year • Completed transition to state-of-the-art brass foundry − Expect to continue to achieve remaining y/y gross margin benefit from the closure of legacy foundry in first half of 2026, while unlocking significant multi-year opportunities for volume and margin expansion as we scale production and drive efficiencies at the new foundry • Strengthened foundation to achieve greater productivity across our facilities and lowest TRIR (Total Recordable Injury Rate) in history − Elevating operational standards, delivering outstanding customer service, optimizing supply chain processes and advancing manufacturing capabilities • Continue to make disciplined investments in commercial and operational capabilities to deliver sustained margin expansion and long-term value creation − Accelerating capital investments to expand capacity and drive efficiencies, including increasing our domestic capabilities, and increasing capital expenditures to 4% to 5% of net sales over next 3 years Commercial and Operational Highlights

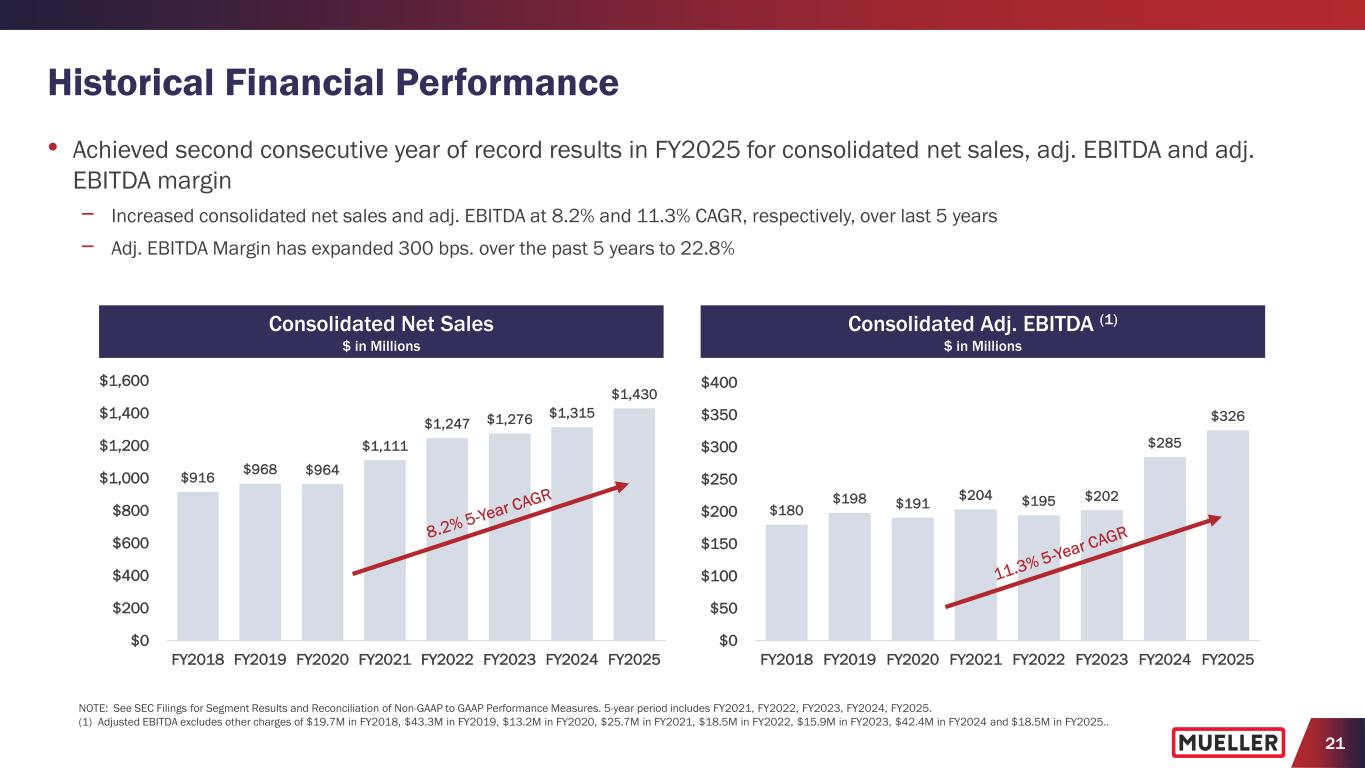

21 Historical Financial Performance • Achieved second consecutive year of record results in FY2025 for consolidated net sales, adj. EBITDA and adj. EBITDA margin − Increased consolidated net sales and adj. EBITDA at 8.2% and 11.3% CAGR, respectively, over last 5 years − Adj. EBITDA Margin has expanded 300 bps. over the past 5 years to 22.8% $916 $968 $964 $1,111 $1,247 $1,276 $1,315 $1,430 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 FY2018 FY2019 FY2020 FY2021 FY2022 FY2023 FY2024 FY2025 $180 $198 $191 $204 $195 $202 $285 $326 $0 $50 $100 $150 $200 $250 $300 $350 $400 FY2018 FY2019 FY2020 FY2021 FY2022 FY2023 FY2024 FY2025 NOTE: See SEC Filings for Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures. 5-year period includes FY2021, FY2022, FY2023, FY2024, FY2025. (1) Adjusted EBITDA excludes other charges of $19.7M in FY2018, $43.3M in FY2019, $13.2M in FY2020, $25.7M in FY2021, $18.5M in FY2022, $15.9M in FY2023, $42.4M in FY2024 and $18.5M in FY2025.. Consolidated Net Sales $ in Millions Consolidated Adj. EBITDA (1) $ in Millions

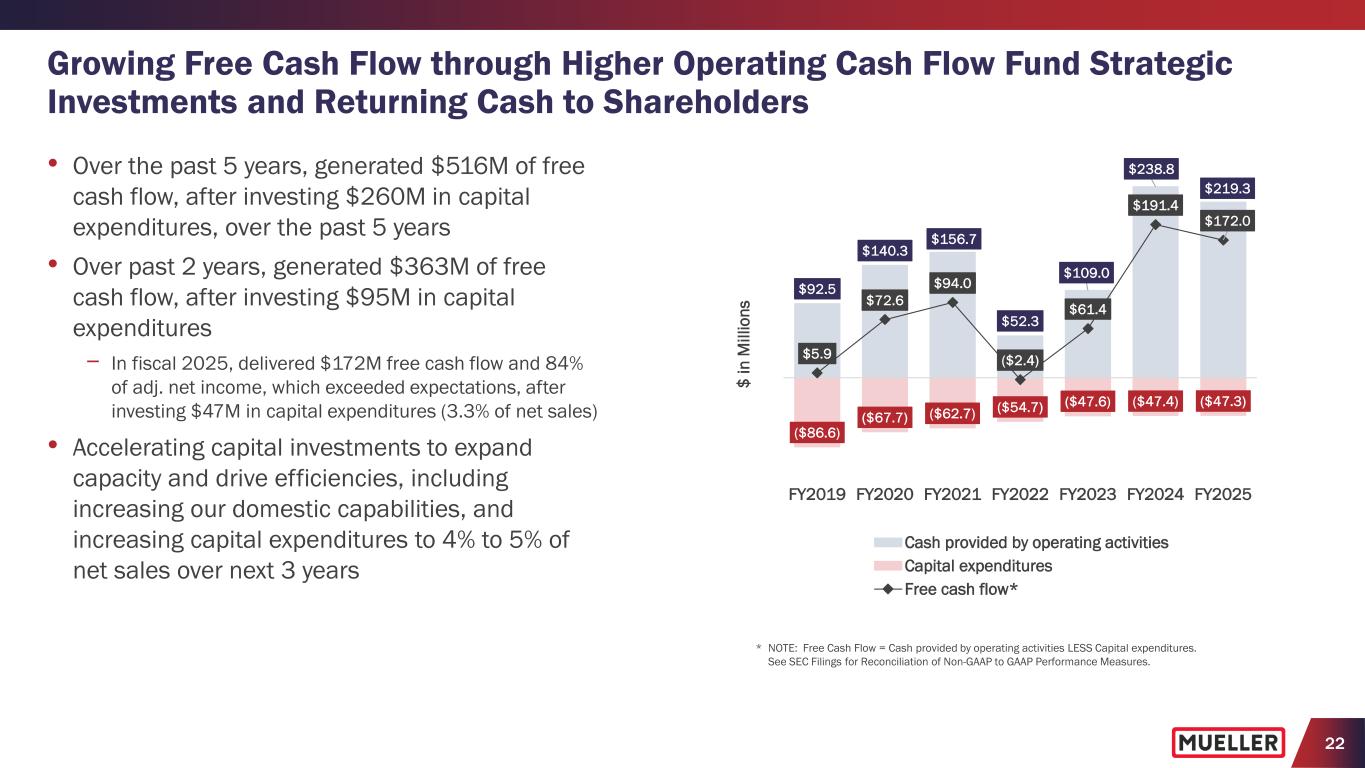

22 Growing Free Cash Flow through Higher Operating Cash Flow Fund Strategic Investments and Returning Cash to Shareholders • Over the past 5 years, generated $516M of free cash flow, after investing $260M in capital expenditures, over the past 5 years • Over past 2 years, generated $363M of free cash flow, after investing $95M in capital expenditures − In fiscal 2025, delivered $172M free cash flow and 84% of adj. net income, which exceeded expectations, after investing $47M in capital expenditures (3.3% of net sales) • Accelerating capital investments to expand capacity and drive efficiencies, including increasing our domestic capabilities, and increasing capital expenditures to 4% to 5% of net sales over next 3 years ($86.6) ($67.7) ($62.7) ($54.7) ($47.6) ($47.4) ($47.3) $92.5 $140.3 $156.7 $52.3 $109.0 $238.8 $219.3 $5.9 $72.6 $94.0 ($2.4) $61.4 $191.4 $172.0 FY2019 FY2020 FY2021 FY2022 FY2023 FY2024 FY2025 $ in M ill io ns Cash provided by operating activities Capital expenditures Free cash flow* * NOTE: Free Cash Flow = Cash provided by operating activities LESS Capital expenditures. See SEC Filings for Reconciliation of Non-GAAP to GAAP Performance Measures.

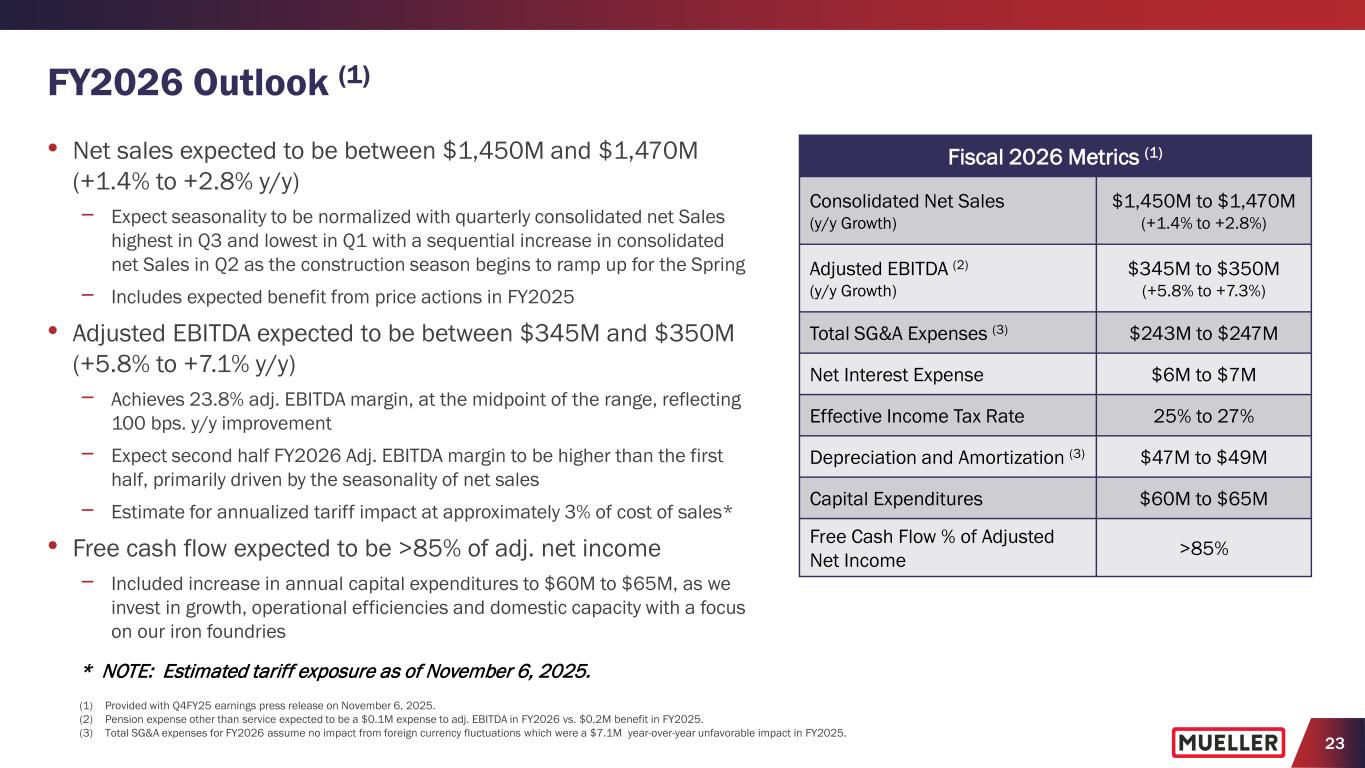

23 FY2026 Outlook (1) • Net sales expected to be between $1,450M and $1,470M (+1.4% to +2.8% y/y) − Expect seasonality to be normalized with quarterly consolidated net Sales highest in Q3 and lowest in Q1 with a sequential increase in consolidated net Sales in Q2 as the construction season begins to ramp up for the Spring − Includes expected benefit from price actions in FY2025 • Adjusted EBITDA expected to be between $345M and $350M (+5.8% to +7.1% y/y) − Achieves 23.8% adj. EBITDA margin, at the midpoint of the range, reflecting 100 bps. y/y improvement − Expect second half FY2026 Adj. EBITDA margin to be higher than the first half, primarily driven by the seasonality of net sales − Estimate for annualized tariff impact at approximately 3% of cost of sales* • Free cash flow expected to be >85% of adj. net income − Included increase in annual capital expenditures to $60M to $65M, as we invest in growth, operational efficiencies and domestic capacity with a focus on our iron foundries (1) Provided with Q4FY25 earnings press release on November 6, 2025. (2) Pension expense other than service expected to be a $0.1M expense to adj. EBITDA in FY2026 vs. $0.2M benefit in FY2025. (3) Total SG&A expenses for FY2026 assume no impact from foreign currency fluctuations which were a $7.1M year-over-year unfavorable impact in FY2025. Fiscal 2026 Metrics (1) Consolidated Net Sales (y/y Growth) $1,450M to $1,470M (+1.4% to +2.8%) Adjusted EBITDA (2) (y/y Growth) $345M to $350M (+5.8% to +7.3%) Total SG&A Expenses (3) $243M to $247M Net Interest Expense $6M to $7M Effective Income Tax Rate 25% to 27% Depreciation and Amortization (3) $47M to $49M Capital Expenditures $60M to $65M Free Cash Flow % of Adjusted Net Income >85% * NOTE: Estimated tariff exposure as of November 6, 2025.

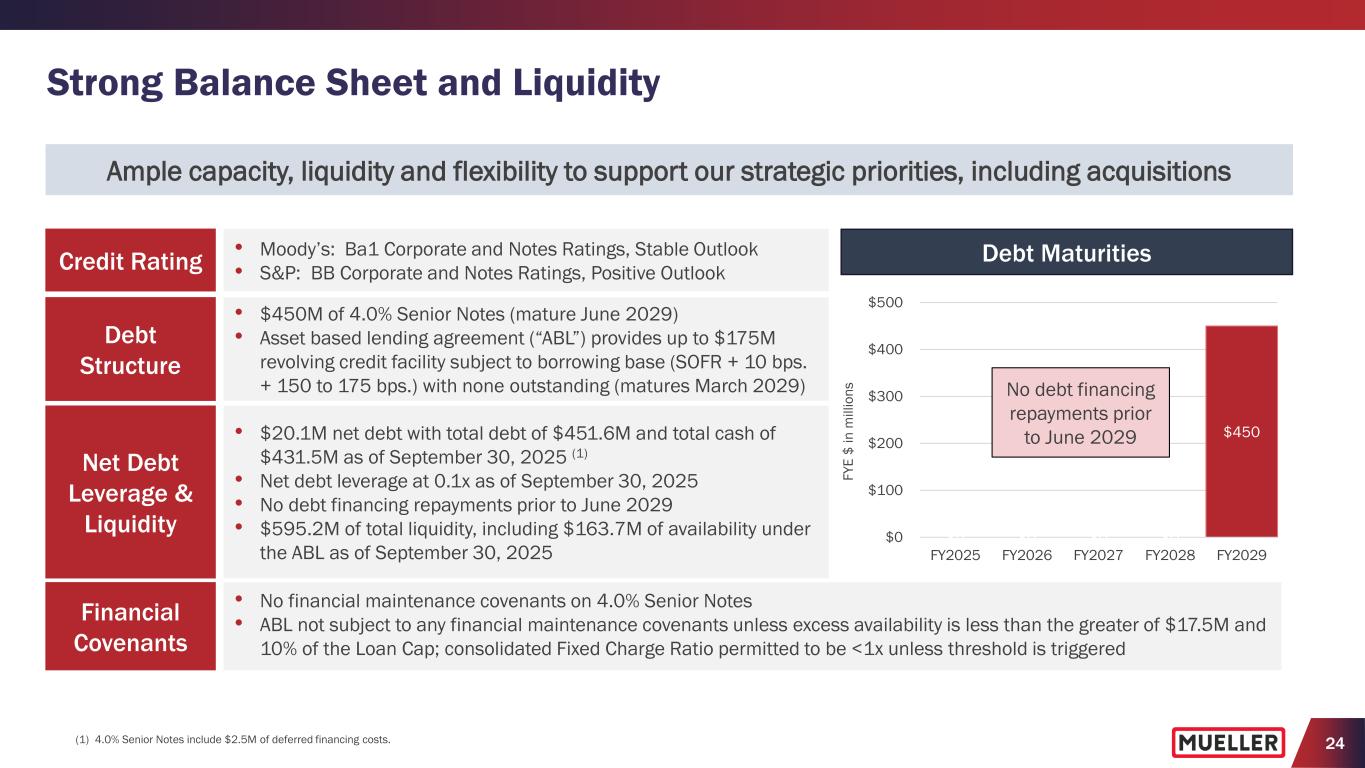

24 Credit Rating Debt Structure Debt Maturities Financial Covenants • $450M of 4.0% Senior Notes (mature June 2029) • Asset based lending agreement (“ABL”) provides up to $175M revolving credit facility subject to borrowing base (SOFR + 10 bps. + 150 to 175 bps.) with none outstanding (matures March 2029) • No financial maintenance covenants on 4.0% Senior Notes • ABL not subject to any financial maintenance covenants unless excess availability is less than the greater of $17.5M and 10% of the Loan Cap; consolidated Fixed Charge Ratio permitted to be <1x unless threshold is triggered Net Debt Leverage & Liquidity • $20.1M net debt with total debt of $451.6M and total cash of $431.5M as of September 30, 2025 (1) • Net debt leverage at 0.1x as of September 30, 2025 • No debt financing repayments prior to June 2029 • $595.2M of total liquidity, including $163.7M of availability under the ABL as of September 30, 2025 (1) 4.0% Senior Notes include $2.5M of deferred financing costs. $0 $0 $0 $0 $450 $0 $100 $200 $300 $400 $500 FY2025 FY2026 FY2027 FY2028 FY2029 FY E $ in m ill io ns No debt financing repayments prior to June 2029 Ample capacity, liquidity and flexibility to support our strategic priorities, including acquisitions • Moody’s: Ba1 Corporate and Notes Ratings, Stable Outlook • S&P: BB Corporate and Notes Ratings, Positive Outlook Strong Balance Sheet and Liquidity

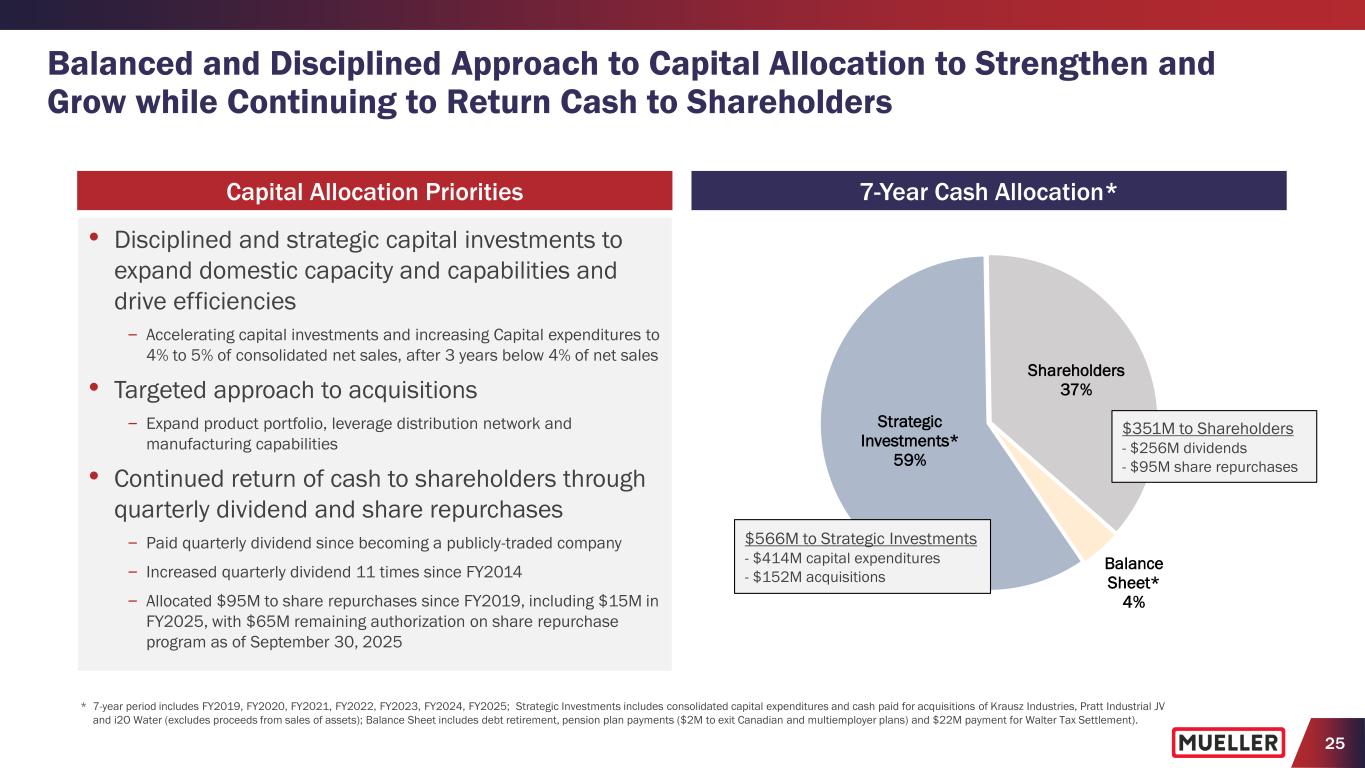

25 Balanced and Disciplined Approach to Capital Allocation to Strengthen and Grow while Continuing to Return Cash to Shareholders • Disciplined and strategic capital investments to expand domestic capacity and capabilities and drive efficiencies – Accelerating capital investments and increasing Capital expenditures to 4% to 5% of consolidated net sales, after 3 years below 4% of net sales • Targeted approach to acquisitions – Expand product portfolio, leverage distribution network and manufacturing capabilities • Continued return of cash to shareholders through quarterly dividend and share repurchases – Paid quarterly dividend since becoming a publicly-traded company – Increased quarterly dividend 11 times since FY2014 – Allocated $95M to share repurchases since FY2019, including $15M in FY2025, with $65M remaining authorization on share repurchase program as of September 30, 2025 Shareholders 37% Balance Sheet* 4% Strategic Investments* 59% $351M to Shareholders - $256M dividends - $95M share repurchases 7-Year Cash Allocation* $566M to Strategic Investments - $414M capital expenditures - $152M acquisitions * 7-year period includes FY2019, FY2020, FY2021, FY2022, FY2023, FY2024, FY2025; Strategic Investments includes consolidated capital expenditures and cash paid for acquisitions of Krausz Industries, Pratt Industrial JV and i2O Water (excludes proceeds from sales of assets); Balance Sheet includes debt retirement, pension plan payments ($2M to exit Canadian and multiemployer plans) and $22M payment for Walter Tax Settlement). Capital Allocation Priorities

26 Investment Highlights LEADING BRANDS WITH LARGE INSTALLED BASE OF INNOVATIVE INFRASTRUCTURE PRODUCTS AND SOLUTIONS BENEFITING FROM LONG-TERM END MARKET DYNAMICS SUPPORTED BY AGING WATER INFRASTRUCTURE DRIVING OPERATIONAL EXCELLENCE AND EXPANDING CAPABILITIES TO FURTHER EXPAND GROSS MARGINS ENHANCING CUSTOMER EXPERIENCE TO DRIVE GROWTH THROUGH COMPREHENSIVE DISTRIBUTION NETWORK INCREASING MARGINS AND FREE CASH FLOW SUPPORT FUTURE INVESTMENTS AND GROWTH Continued investments in customer experience, product innovation and operational excellence support further net sales growth and margin improvements SUPPORTING STRATEGIC PRIORITIES THROUGH BALANCE SHEET WITH AMPLE CAPACITY, LIQUIDITY AND FLEXIBILITY

Supplemental Data

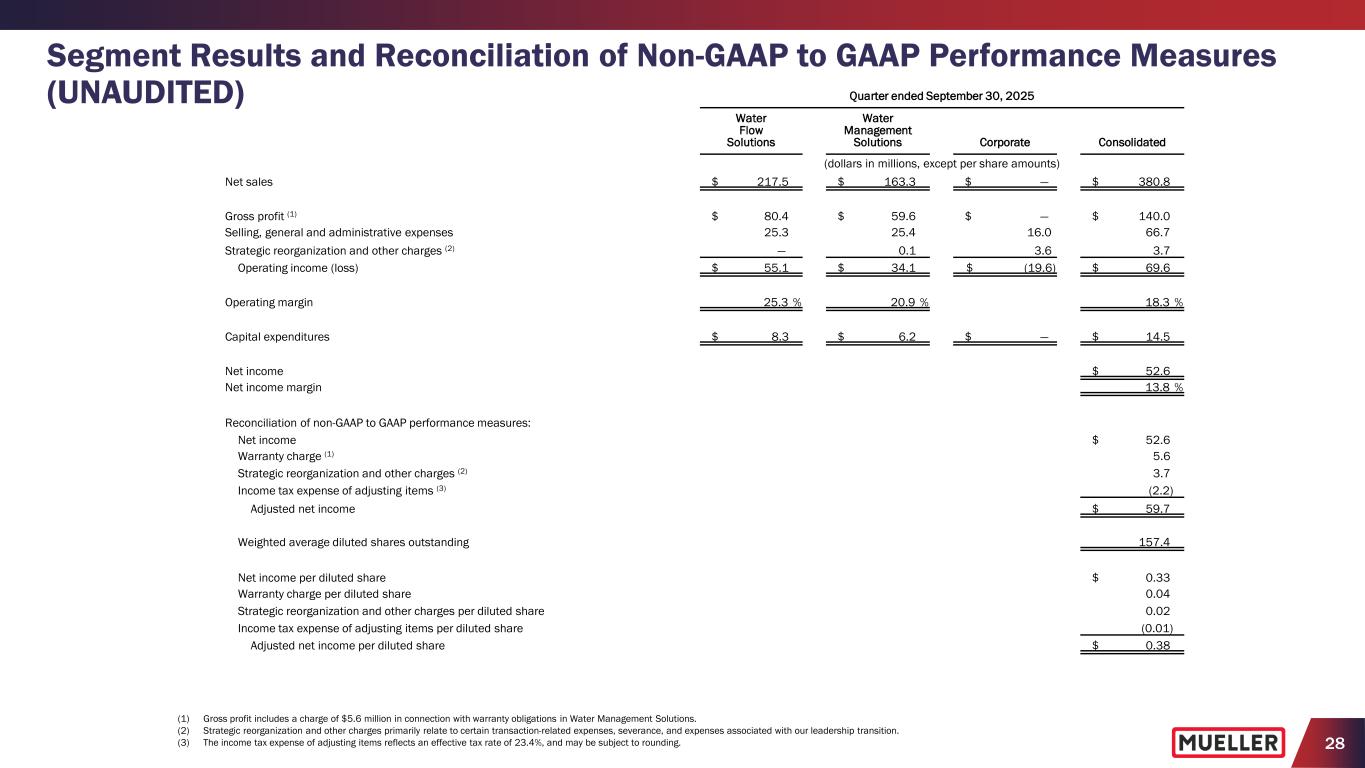

28 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) (1) Gross profit includes a charge of $5.6 million in connection with warranty obligations in Water Management Solutions. (2) Strategic reorganization and other charges primarily relate to certain transaction-related expenses, severance, and expenses associated with our leadership transition. (3) The income tax expense of adjusting items reflects an effective tax rate of 23.4%, and may be subject to rounding. Quarter ended September 30, 2025 Water Flow Solutions Water Management Solutions Corporate Consolidated (dollars in millions, except per share amounts) Net sales $ 217.5 $ 163.3 $ — $ 380.8 Gross profit (1) $ 80.4 $ 59.6 $ — $ 140.0 Selling, general and administrative expenses 25.3 25.4 16.0 66.7 Strategic reorganization and other charges (2) — 0.1 3.6 3.7 Operating income (loss) $ 55.1 $ 34.1 $ (19.6) $ 69.6 Operating margin 25.3 % 20.9 % 18.3 % Capital expenditures $ 8.3 $ 6.2 $ — $ 14.5 Net income $ 52.6 Net income margin 13.8 % Reconciliation of non-GAAP to GAAP performance measures: Net income $ 52.6 Warranty charge (1) 5.6 Strategic reorganization and other charges (2) 3.7 Income tax expense of adjusting items (3) (2.2) Adjusted net income $ 59.7 Weighted average diluted shares outstanding 157.4 Net income per diluted share $ 0.33 Warranty charge per diluted share 0.04 Strategic reorganization and other charges per diluted share 0.02 Income tax expense of adjusting items per diluted share (0.01) Adjusted net income per diluted share $ 0.38

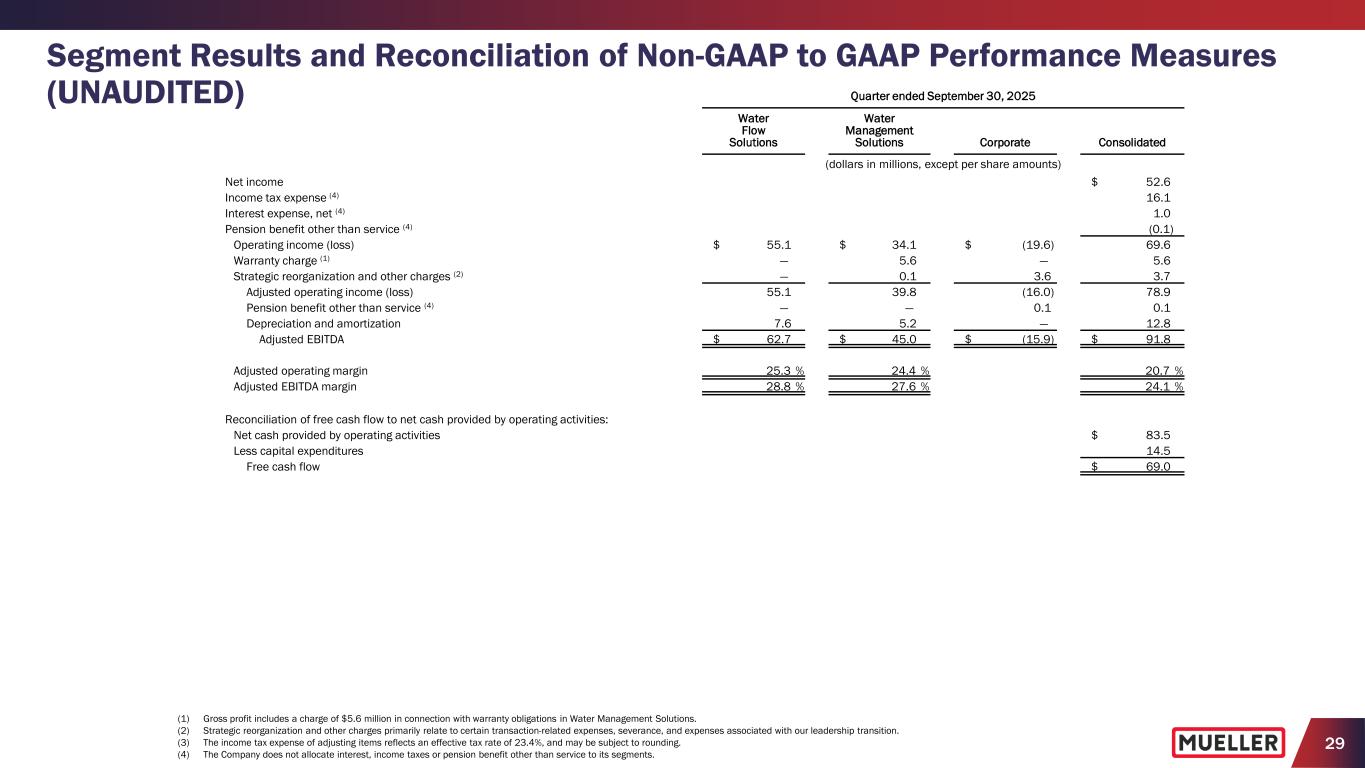

29 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) (1) Gross profit includes a charge of $5.6 million in connection with warranty obligations in Water Management Solutions. (2) Strategic reorganization and other charges primarily relate to certain transaction-related expenses, severance, and expenses associated with our leadership transition. (3) The income tax expense of adjusting items reflects an effective tax rate of 23.4%, and may be subject to rounding. (4) The Company does not allocate interest, income taxes or pension benefit other than service to its segments. Quarter ended September 30, 2025 Water Flow Solutions Water Management Solutions Corporate Consolidated (dollars in millions, except per share amounts) Net income $ 52.6 Income tax expense (4) 16.1 Interest expense, net (4) 1.0 Pension benefit other than service (4) (0.1) Operating income (loss) $ 55.1 $ 34.1 $ (19.6) 69.6 Warranty charge (1) — 5.6 — 5.6 Strategic reorganization and other charges (2) — 0.1 3.6 3.7 Adjusted operating income (loss) 55.1 39.8 (16.0) 78.9 Pension benefit other than service (4) — — 0.1 0.1 Depreciation and amortization 7.6 5.2 — 12.8 Adjusted EBITDA $ 62.7 $ 45.0 $ (15.9) $ 91.8 Adjusted operating margin 25.3 % 24.4 % 20.7 % Adjusted EBITDA margin 28.8 % 27.6 % 24.1 % Reconciliation of free cash flow to net cash provided by operating activities: Net cash provided by operating activities $ 83.5 Less capital expenditures 14.5 Free cash flow $ 69.0

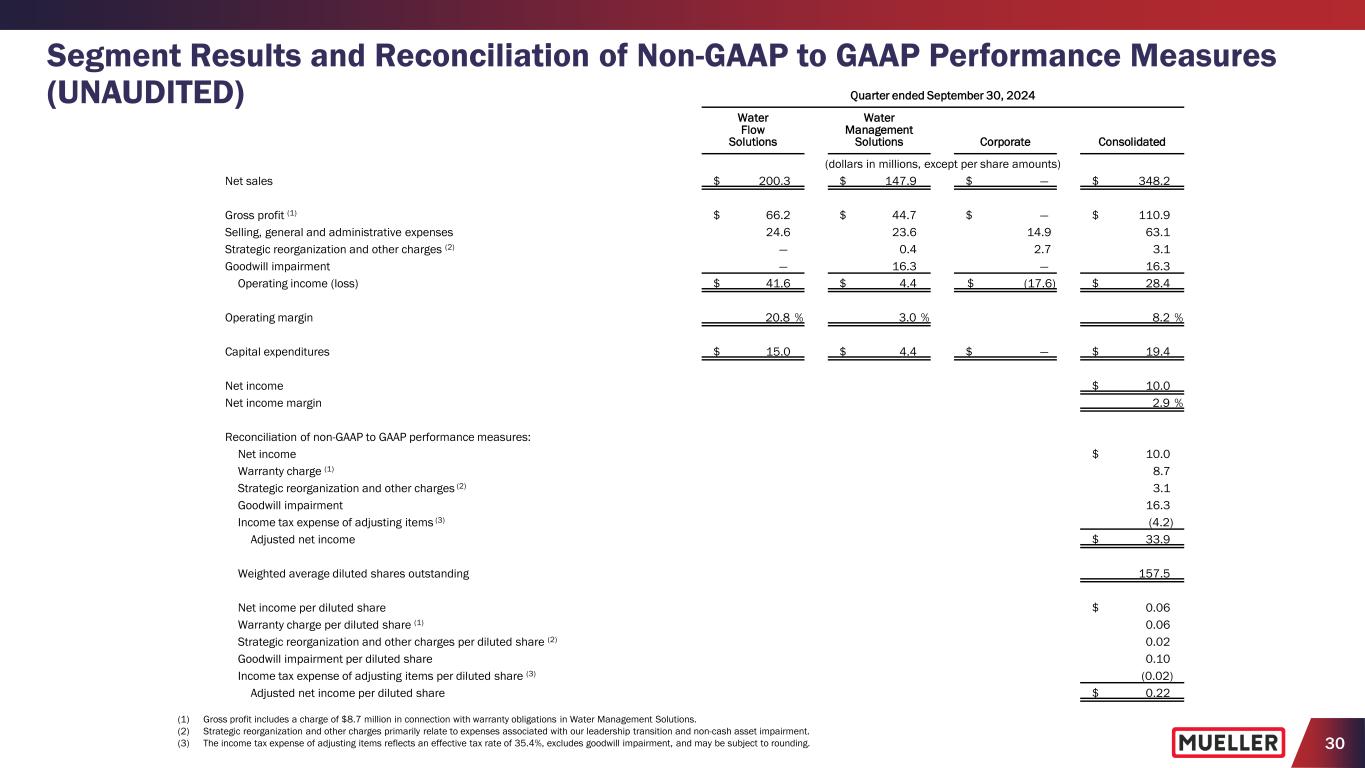

30 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) (1) Gross profit includes a charge of $8.7 million in connection with warranty obligations in Water Management Solutions. (2) Strategic reorganization and other charges primarily relate to expenses associated with our leadership transition and non-cash asset impairment. (3) The income tax expense of adjusting items reflects an effective tax rate of 35.4%, excludes goodwill impairment, and may be subject to rounding. Quarter ended September 30, 2024 Water Flow Solutions Water Management Solutions Corporate Consolidated (dollars in millions, except per share amounts) Net sales $ 200.3 $ 147.9 $ — $ 348.2 Gross profit (1) $ 66.2 $ 44.7 $ — $ 110.9 Selling, general and administrative expenses 24.6 23.6 14.9 63.1 Strategic reorganization and other charges (2) — 0.4 2.7 3.1 Goodwill impairment — 16.3 — 16.3 Operating income (loss) $ 41.6 $ 4.4 $ (17.6) $ 28.4 Operating margin 20.8 % 3.0 % 8.2 % Capital expenditures $ 15.0 $ 4.4 $ — $ 19.4 Net income $ 10.0 Net income margin 2.9 % Reconciliation of non-GAAP to GAAP performance measures: Net income $ 10.0 Warranty charge (1) 8.7 Strategic reorganization and other charges (2) 3.1 Goodwill impairment 16.3 Income tax expense of adjusting items (3) (4.2) Adjusted net income $ 33.9 Weighted average diluted shares outstanding 157.5 Net income per diluted share $ 0.06 Warranty charge per diluted share (1) 0.06 Strategic reorganization and other charges per diluted share (2) 0.02 Goodwill impairment per diluted share 0.10 Income tax expense of adjusting items per diluted share (3) (0.02) Adjusted net income per diluted share $ 0.22

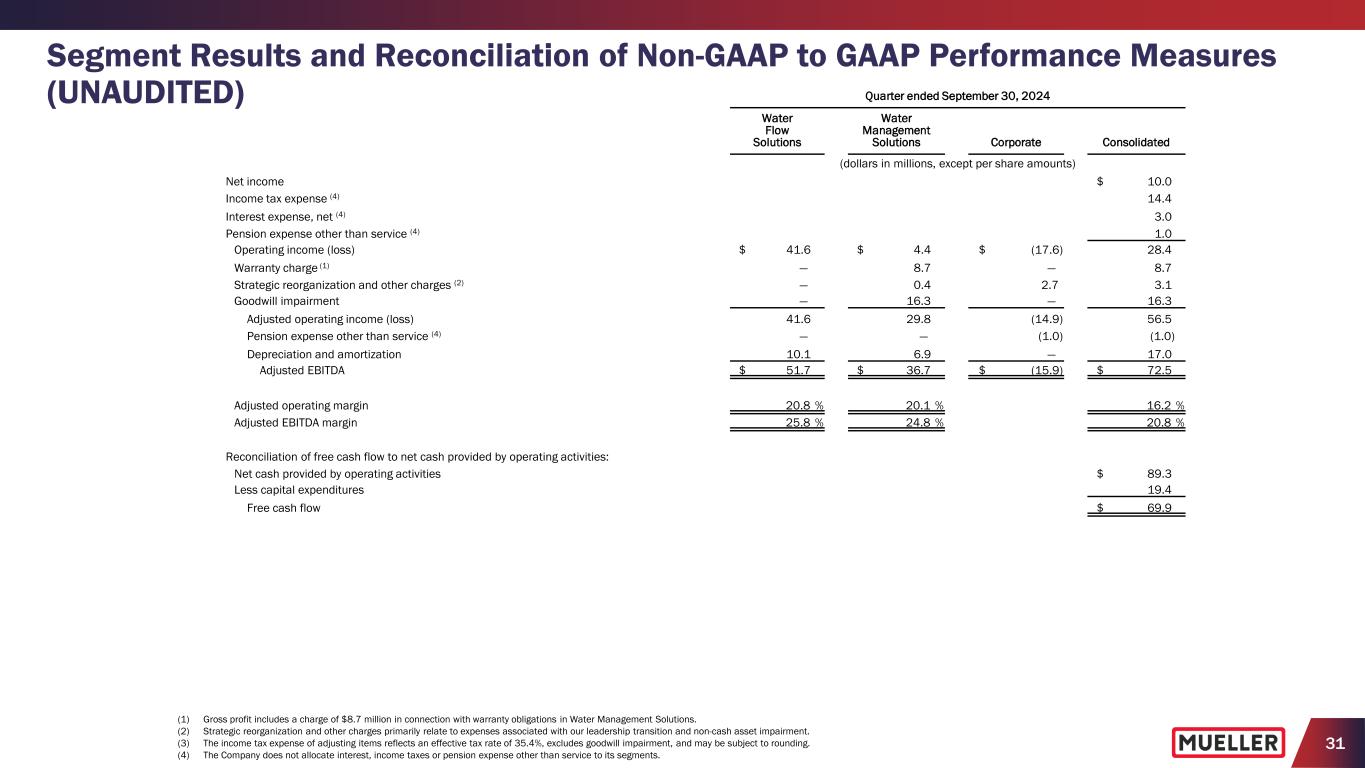

31 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) (1) Gross profit includes a charge of $8.7 million in connection with warranty obligations in Water Management Solutions. (2) Strategic reorganization and other charges primarily relate to expenses associated with our leadership transition and non-cash asset impairment. (3) The income tax expense of adjusting items reflects an effective tax rate of 35.4%, excludes goodwill impairment, and may be subject to rounding. (4) The Company does not allocate interest, income taxes or pension expense other than service to its segments. Quarter ended September 30, 2024 Water Flow Solutions Water Management Solutions Corporate Consolidated (dollars in millions, except per share amounts) Net income $ 10.0 Income tax expense (4) 14.4 Interest expense, net (4) 3.0 Pension expense other than service (4) 1.0 Operating income (loss) $ 41.6 $ 4.4 $ (17.6) 28.4 Warranty charge (1) — 8.7 — 8.7 Strategic reorganization and other charges (2) — 0.4 2.7 3.1 Goodwill impairment — 16.3 — 16.3 Adjusted operating income (loss) 41.6 29.8 (14.9) 56.5 Pension expense other than service (4) — — (1.0) (1.0) Depreciation and amortization 10.1 6.9 — 17.0 Adjusted EBITDA $ 51.7 $ 36.7 $ (15.9) $ 72.5 Adjusted operating margin 20.8 % 20.1 % 16.2 % Adjusted EBITDA margin 25.8 % 24.8 % 20.8 % Reconciliation of free cash flow to net cash provided by operating activities: Net cash provided by operating activities $ 89.3 Less capital expenditures 19.4 Free cash flow $ 69.9

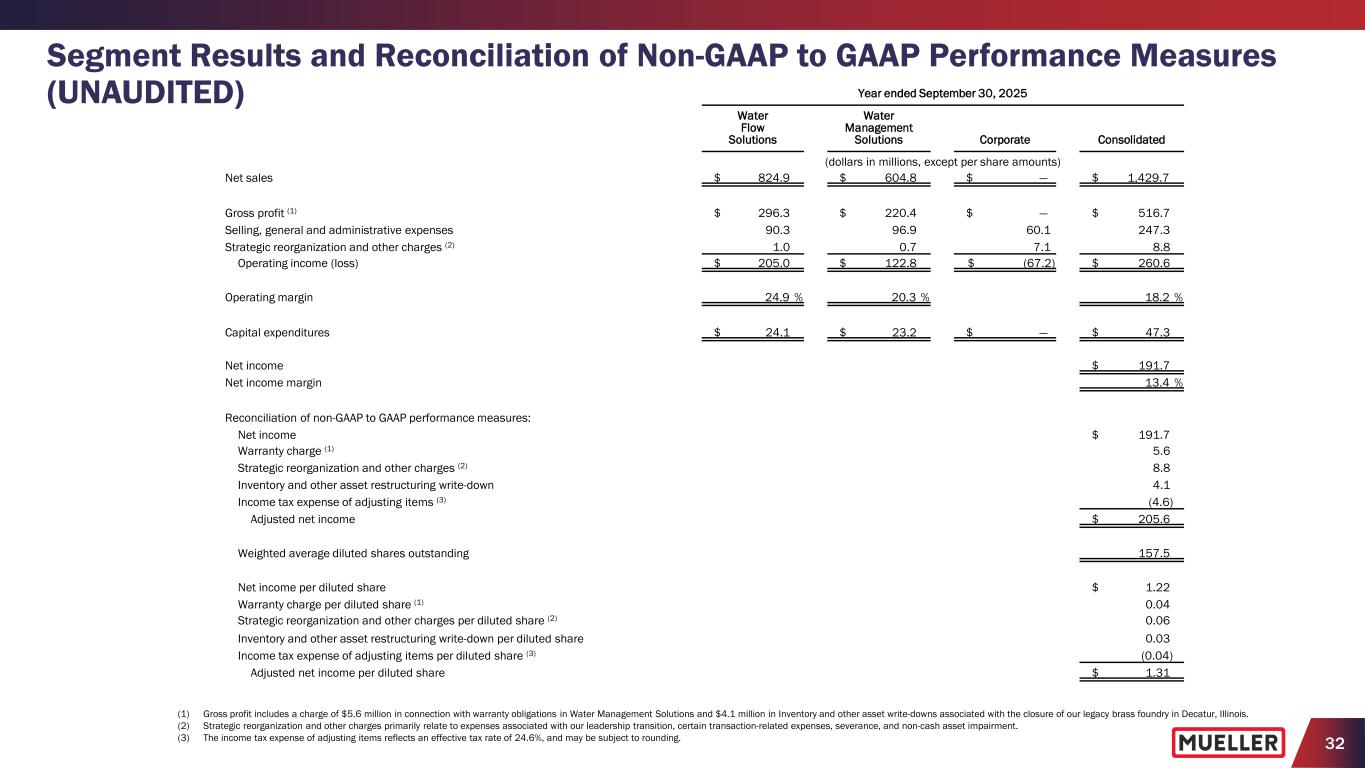

32 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) (1) Gross profit includes a charge of $5.6 million in connection with warranty obligations in Water Management Solutions and $4.1 million in Inventory and other asset write-downs associated with the closure of our legacy brass foundry in Decatur, Illinois. (2) Strategic reorganization and other charges primarily relate to expenses associated with our leadership transition, certain transaction-related expenses, severance, and non-cash asset impairment. (3) The income tax expense of adjusting items reflects an effective tax rate of 24.6%, and may be subject to rounding. Year ended September 30, 2025 Water Flow Solutions Water Management Solutions Corporate Consolidated (dollars in millions, except per share amounts) Net sales $ 824.9 $ 604.8 $ — $ 1,429.7 Gross profit (1) $ 296.3 $ 220.4 $ — $ 516.7 Selling, general and administrative expenses 90.3 96.9 60.1 247.3 Strategic reorganization and other charges (2) 1.0 0.7 7.1 8.8 Operating income (loss) $ 205.0 $ 122.8 $ (67.2) $ 260.6 Operating margin 24.9 % 20.3 % 18.2 % Capital expenditures $ 24.1 $ 23.2 $ — $ 47.3 Net income $ 191.7 Net income margin 13.4 % Reconciliation of non-GAAP to GAAP performance measures: Net income $ 191.7 Warranty charge (1) 5.6 Strategic reorganization and other charges (2) 8.8 Inventory and other asset restructuring write-down 4.1 Income tax expense of adjusting items (3) (4.6) Adjusted net income $ 205.6 Weighted average diluted shares outstanding 157.5 Net income per diluted share $ 1.22 Warranty charge per diluted share (1) 0.04 Strategic reorganization and other charges per diluted share (2) 0.06 Inventory and other asset restructuring write-down per diluted share 0.03 Income tax expense of adjusting items per diluted share (3) (0.04) Adjusted net income per diluted share $ 1.31

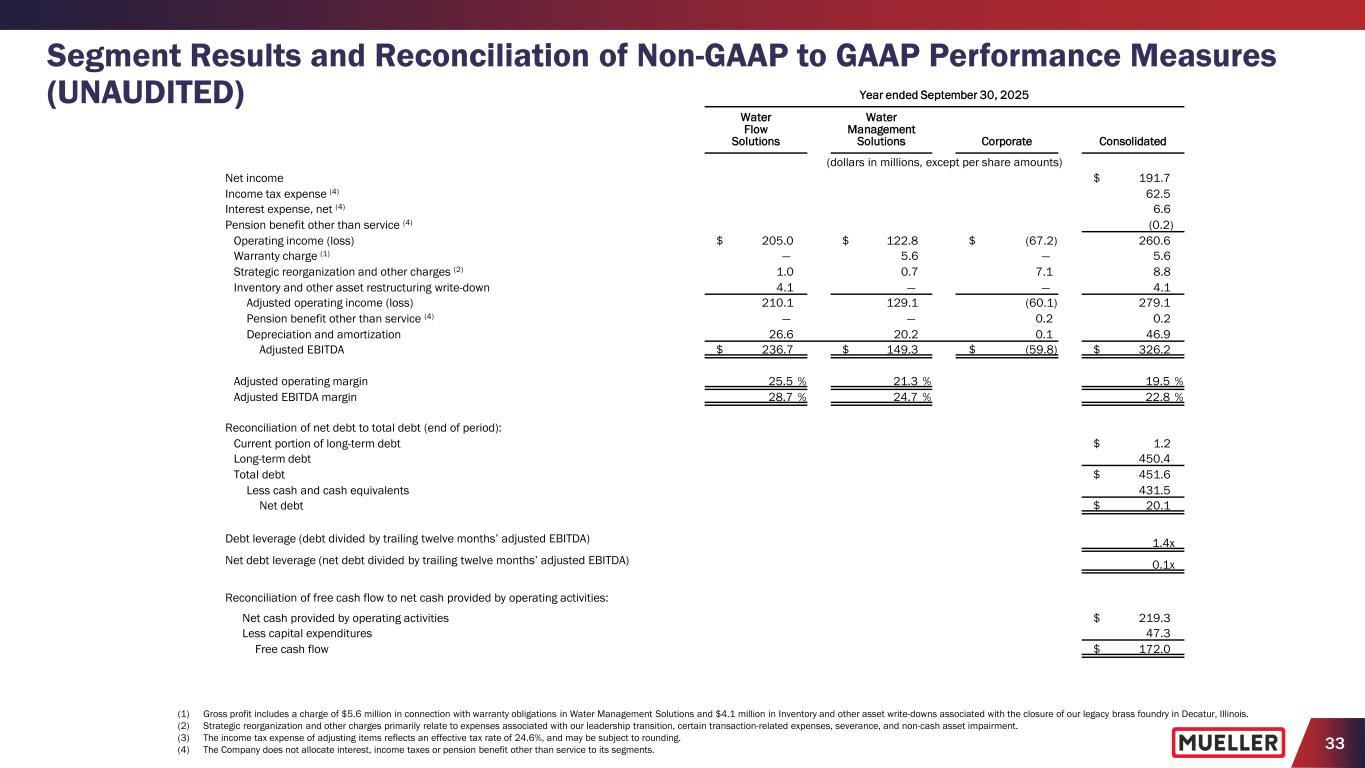

33 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) (1) Gross profit includes a charge of $5.6 million in connection with warranty obligations in Water Management Solutions and $4.1 million in Inventory and other asset write-downs associated with the closure of our legacy brass foundry in Decatur, Illinois. (2) Strategic reorganization and other charges primarily relate to expenses associated with our leadership transition, certain transaction-related expenses, severance, and non-cash asset impairment. (3) The income tax expense of adjusting items reflects an effective tax rate of 24.6%, and may be subject to rounding. (4) The Company does not allocate interest, income taxes or pension benefit other than service to its segments. Year ended September 30, 2025 Water Flow Solutions Water Management Solutions Corporate Consolidated (dollars in millions, except per share amounts) Net income $ 191.7 Income tax expense (4) 62.5 Interest expense, net (4) 6.6 Pension benefit other than service (4) (0.2) Operating income (loss) $ 205.0 $ 122.8 $ (67.2) 260.6 Warranty charge (1) — 5.6 — 5.6 Strategic reorganization and other charges (2) 1.0 0.7 7.1 8.8 Inventory and other asset restructuring write-down 4.1 — — 4.1 Adjusted operating income (loss) 210.1 129.1 (60.1) 279.1 Pension benefit other than service (4) — — 0.2 0.2 Depreciation and amortization 26.6 20.2 0.1 46.9 Adjusted EBITDA $ 236.7 $ 149.3 $ (59.8) $ 326.2 Adjusted operating margin 25.5 % 21.3 % 19.5 % Adjusted EBITDA margin 28.7 % 24.7 % 22.8 % Reconciliation of net debt to total debt (end of period): Current portion of long-term debt $ 1.2 Long-term debt 450.4 Total debt $ 451.6 Less cash and cash equivalents 431.5 Net debt $ 20.1 Debt leverage (debt divided by trailing twelve months’ adjusted EBITDA) 1.4x Net debt leverage (net debt divided by trailing twelve months’ adjusted EBITDA) 0.1x Reconciliation of free cash flow to net cash provided by operating activities: Net cash provided by operating activities $ 219.3 Less capital expenditures 47.3 Free cash flow $ 172.0

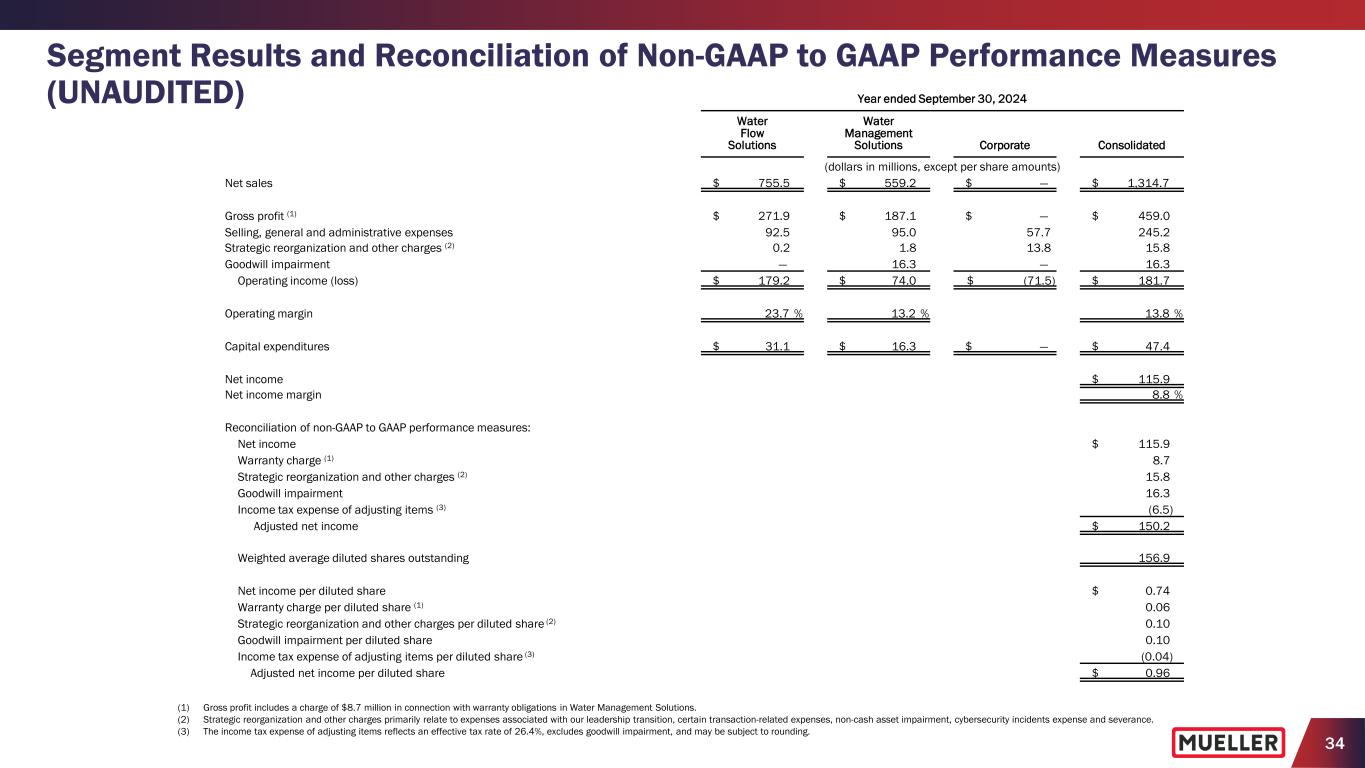

34 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) (1) Gross profit includes a charge of $8.7 million in connection with warranty obligations in Water Management Solutions. (2) Strategic reorganization and other charges primarily relate to expenses associated with our leadership transition, certain transaction-related expenses, non-cash asset impairment, cybersecurity incidents expense and severance. (3) The income tax expense of adjusting items reflects an effective tax rate of 26.4%, excludes goodwill impairment, and may be subject to rounding. Year ended September 30, 2024 Water Flow Solutions Water Management Solutions Corporate Consolidated (dollars in millions, except per share amounts) Net sales $ 755.5 $ 559.2 $ — $ 1,314.7 Gross profit (1) $ 271.9 $ 187.1 $ — $ 459.0 Selling, general and administrative expenses 92.5 95.0 57.7 245.2 Strategic reorganization and other charges (2) 0.2 1.8 13.8 15.8 Goodwill impairment — 16.3 — 16.3 Operating income (loss) $ 179.2 $ 74.0 $ (71.5) $ 181.7 Operating margin 23.7 % 13.2 % 13.8 % Capital expenditures $ 31.1 $ 16.3 $ — $ 47.4 Net income $ 115.9 Net income margin 8.8 % Reconciliation of non-GAAP to GAAP performance measures: Net income $ 115.9 Warranty charge (1) 8.7 Strategic reorganization and other charges (2) 15.8 Goodwill impairment 16.3 Income tax expense of adjusting items (3) (6.5) Adjusted net income $ 150.2 Weighted average diluted shares outstanding 156.9 Net income per diluted share $ 0.74 Warranty charge per diluted share (1) 0.06 Strategic reorganization and other charges per diluted share (2) 0.10 Goodwill impairment per diluted share 0.10 Income tax expense of adjusting items per diluted share (3) (0.04) Adjusted net income per diluted share $ 0.96

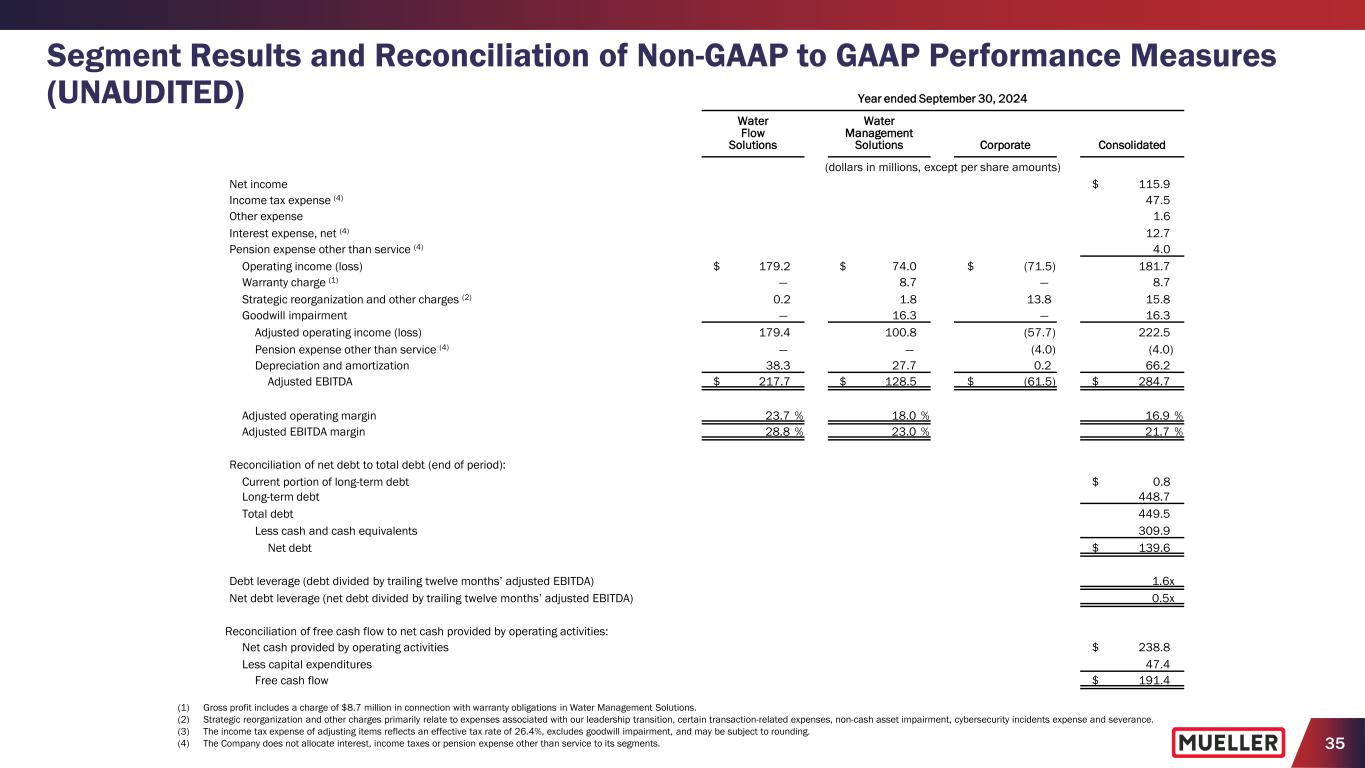

35 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) (1) Gross profit includes a charge of $8.7 million in connection with warranty obligations in Water Management Solutions. (2) Strategic reorganization and other charges primarily relate to expenses associated with our leadership transition, certain transaction-related expenses, non-cash asset impairment, cybersecurity incidents expense and severance. (3) The income tax expense of adjusting items reflects an effective tax rate of 26.4%, excludes goodwill impairment, and may be subject to rounding. (4) The Company does not allocate interest, income taxes or pension expense other than service to its segments. Year ended September 30, 2024 Water Flow Solutions Water Management Solutions Corporate Consolidated (dollars in millions, except per share amounts) Net income $ 115.9 Income tax expense (4) 47.5 Other expense 1.6 Interest expense, net (4) 12.7 Pension expense other than service (4) 4.0 Operating income (loss) $ 179.2 $ 74.0 $ (71.5) 181.7 Warranty charge (1) — 8.7 — 8.7 Strategic reorganization and other charges (2) 0.2 1.8 13.8 15.8 Goodwill impairment — 16.3 — 16.3 Adjusted operating income (loss) 179.4 100.8 (57.7) 222.5 Pension expense other than service (4) — — (4.0) (4.0) Depreciation and amortization 38.3 27.7 0.2 66.2 Adjusted EBITDA $ 217.7 $ 128.5 $ (61.5) $ 284.7 Adjusted operating margin 23.7 % 18.0 % 16.9 % Adjusted EBITDA margin 28.8 % 23.0 % 21.7 % Reconciliation of net debt to total debt (end of period): Current portion of long-term debt $ 0.8 Long-term debt 448.7 Total debt 449.5 Less cash and cash equivalents 309.9 Net debt $ 139.6 Debt leverage (debt divided by trailing twelve months’ adjusted EBITDA) 1.6x Net debt leverage (net debt divided by trailing twelve months’ adjusted EBITDA) 0.5x Reconciliation of free cash flow to net cash provided by operating activities: Net cash provided by operating activities $ 238.8 Less capital expenditures 47.4 Free cash flow $ 191.4