UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of November, 2025

Commission File Number: 001-15102

__________________________________

Embraer S.A.

__________________________________

Avenida Dra. Ruth Cardoso, 8501,

30th floor (part), Pinheiros, São Paulo, SP, 05425-070, Brazil

(Address of principal executive offices)

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

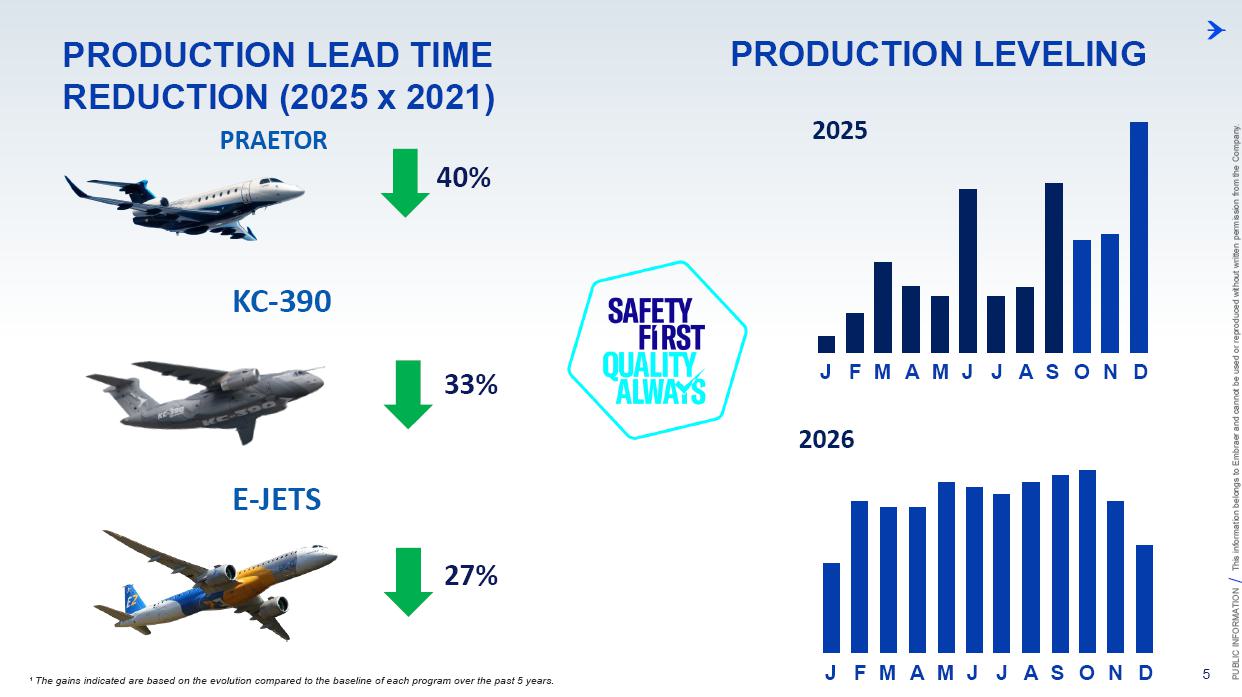

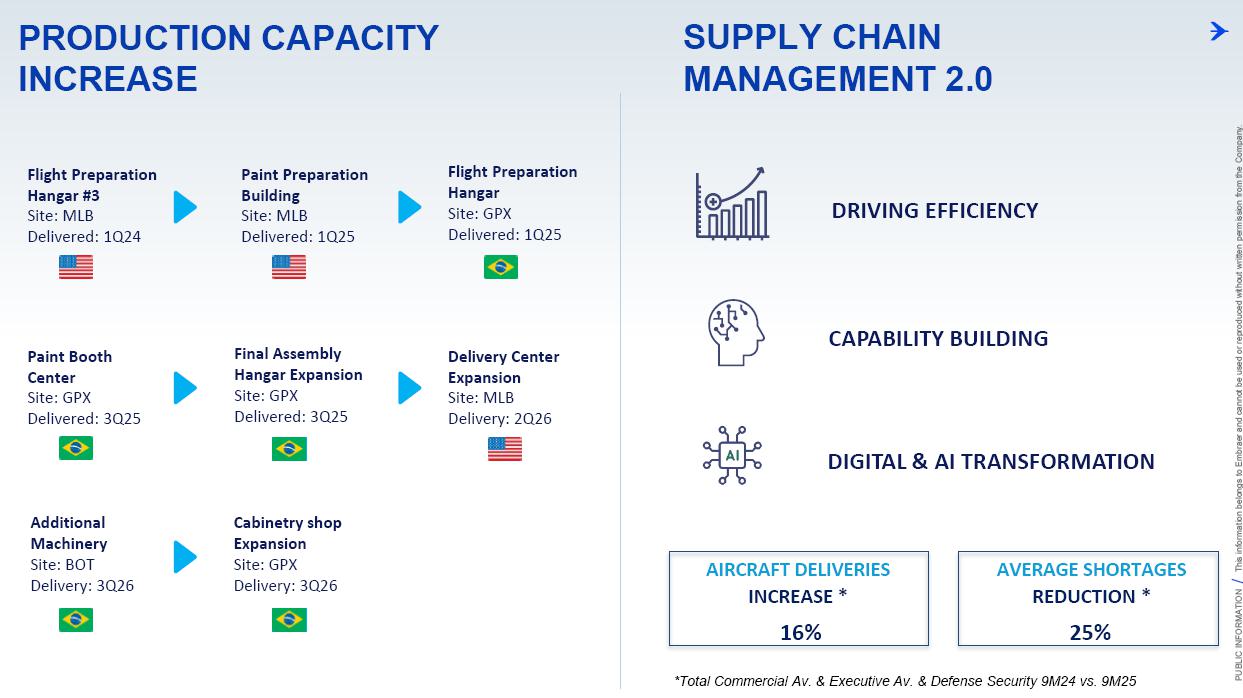

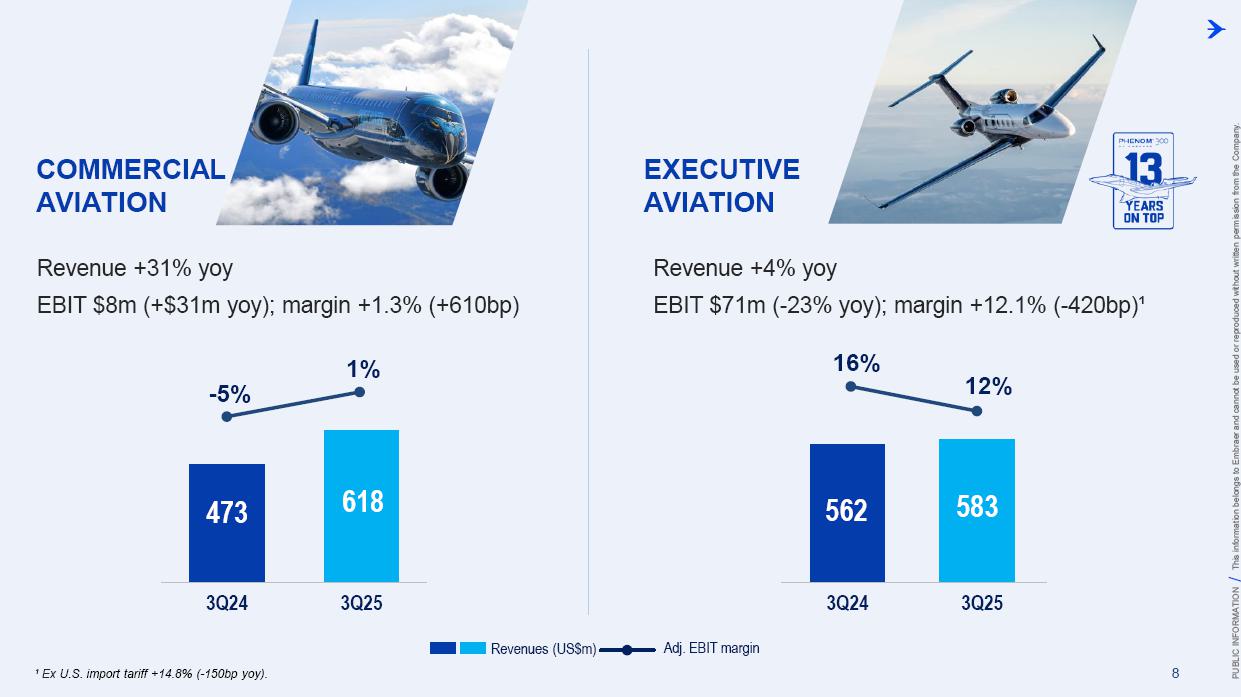

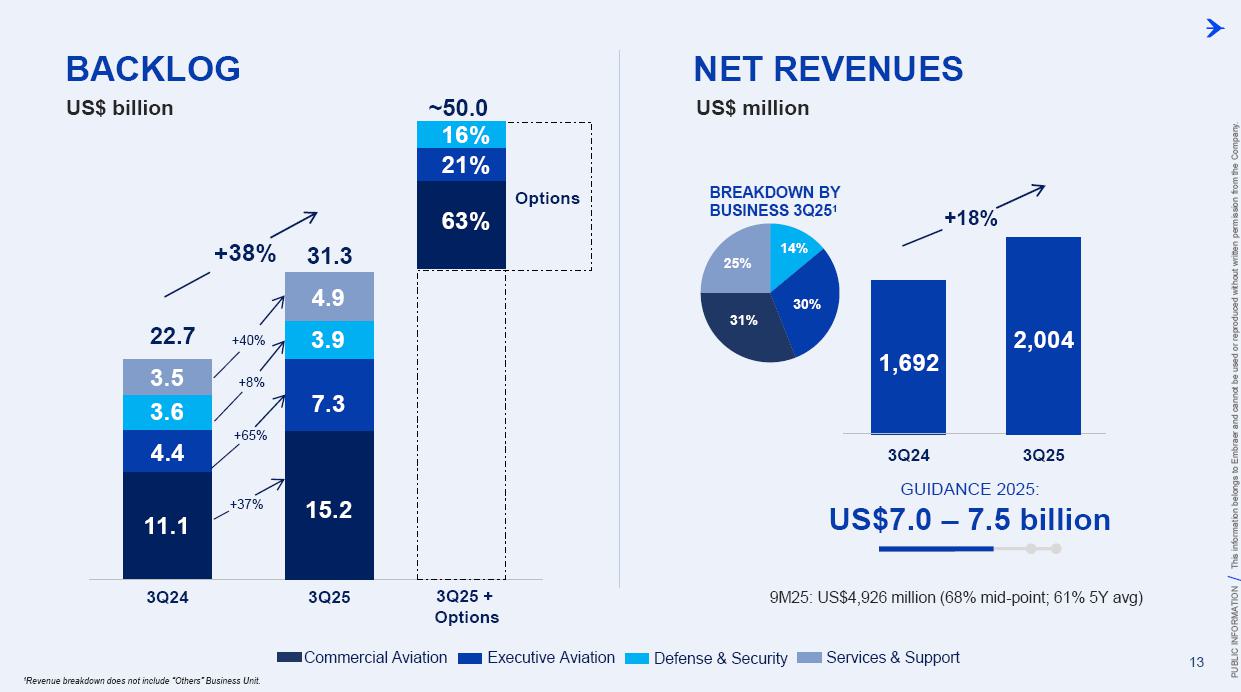

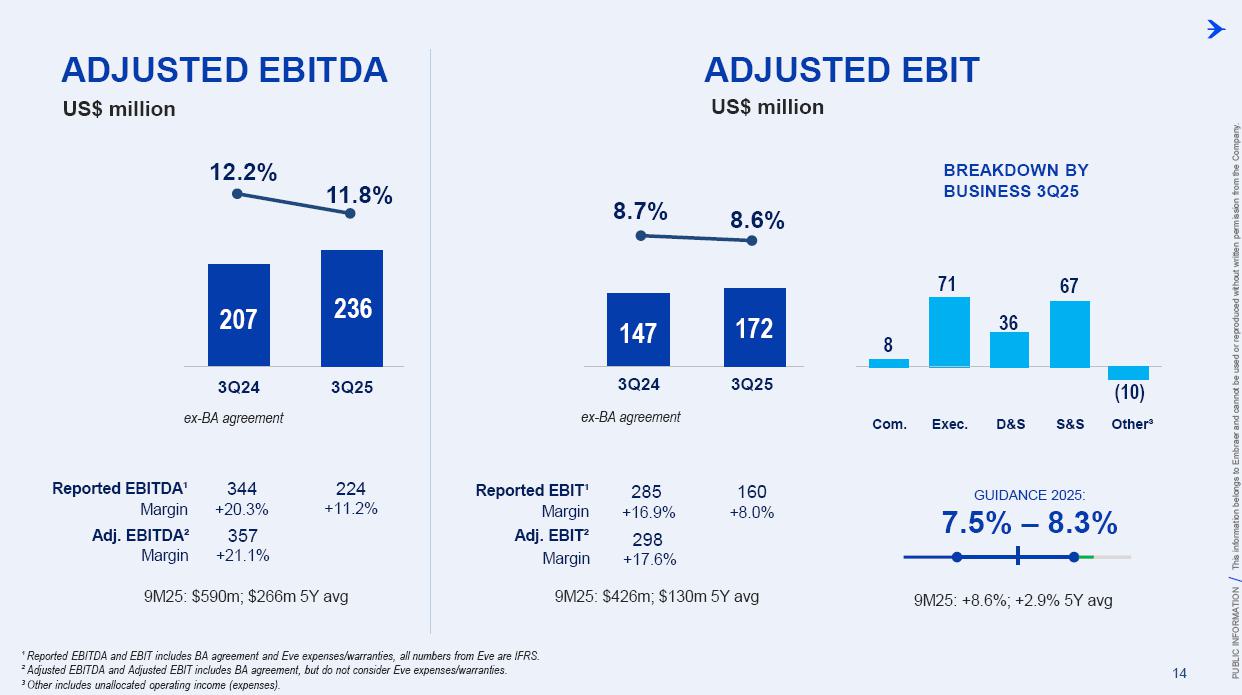

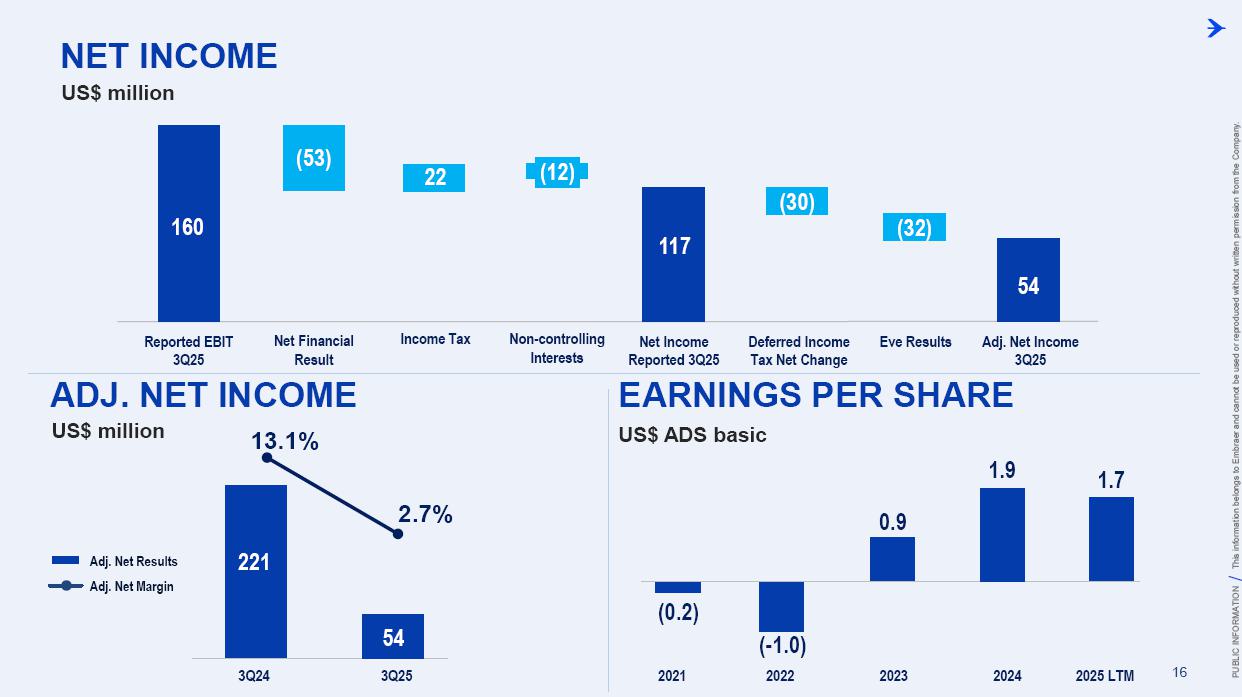

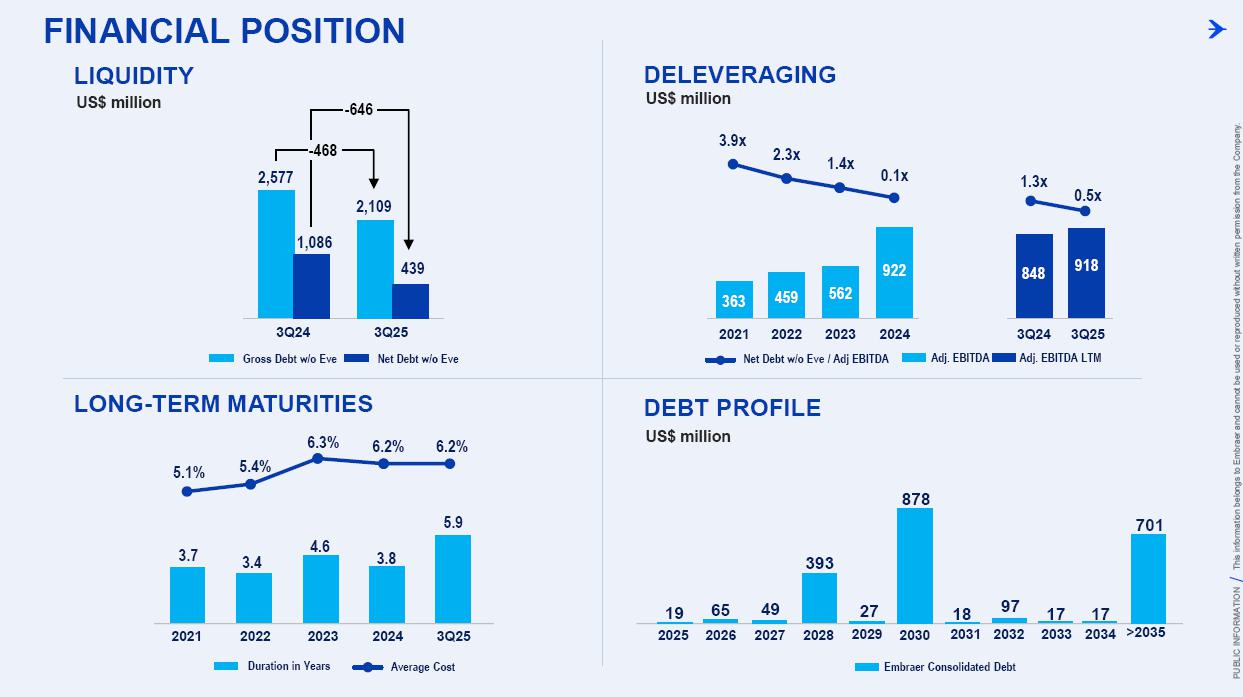

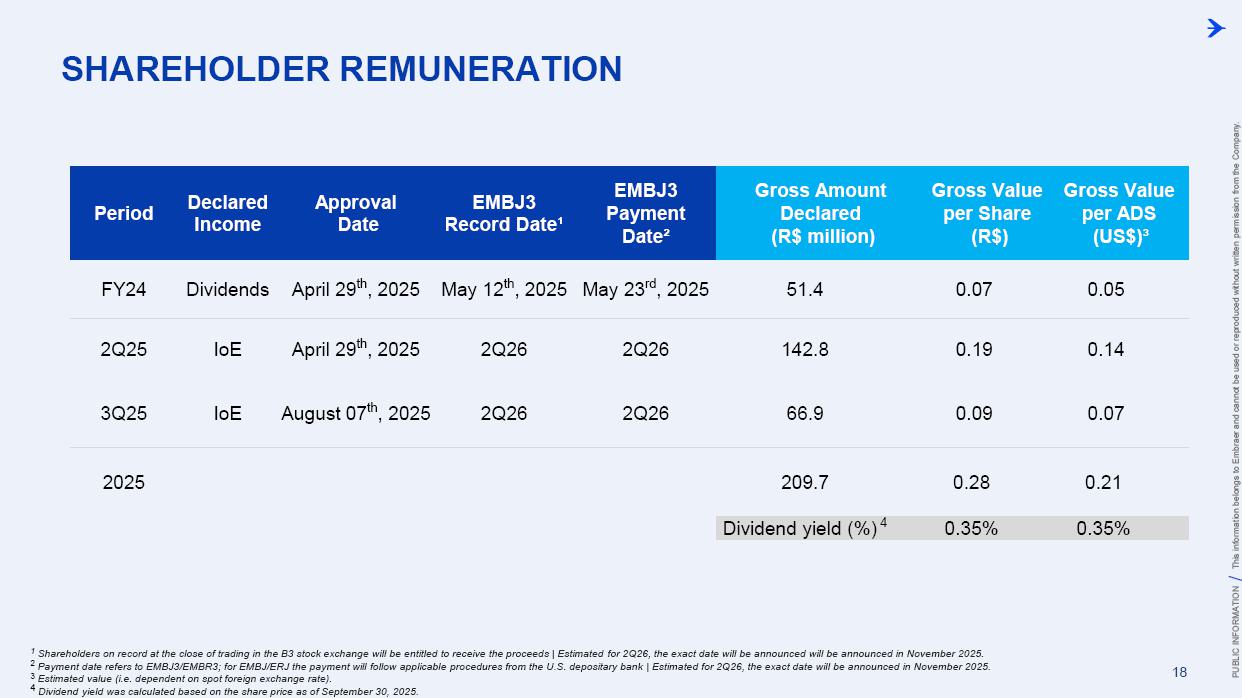

This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. RESULTS3Q25 +2,000 Executive Jets delivered This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. 2 DISCLAIMER This conference call may include statements about future events, based on Embraer's expectations and market financial trends. Such statements are subject to uncertainties that may cause actual results to differ from those expressed or implied in this conference call. Except in accordance with the applicable rules, the company assumes no obligation to publicly update any forward-looking statements. For detailed financial information, the company encourages reviewing publications filed by the company with the CVM. This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. SUSTAINABLE GROWTH Driven by Efficiency and Innovation 3 Strong sales momentum with higher backlog across all BUs S&P rating upgrade to BBB High(er) margin across all BUs Substantial midterm growth and long-term focus on innovation Capacity increase and supply chain management Zero import tariffs push CULTURE FOUNDATION: SAFETY FIRST, QUALITY ALWAYS IN EVERYTHING WE DO! This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. EXECUTIVE JETS EXPANSION: All time high 3Q revenues (c.$580 million) +2,000 business jets delivery, record 3Q deliveries 4 3Q25 HIGHLIGHTS Backlog$15.2 bn 2.7 btb* Backlog$4.9 bn 1.8 btb* Backlog$3.9 bn 1.3 btb* Backlog$7.3 bn 2.4 btb* GLOBAL DEFENSE SALES: Portugal 6th KC-390 purchase, along with 10 new options Panama (4) and SNC (1) sign A-29 acquisition agreements NEW ORDERS IN COMMERCIAL AVIATION: Avelo 50 E195-E2 plus 50 purchase rights LATAM 24 E195-E2 plus 50 options SERVICES SUSTAINABLE GROWTH: CommuteAir new maintenance agreement Starlink connectivity solution for Praetor and Legacy operators *btb= book-to-bill LTM This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. 5 PRODUCTION LEAD TIME REDUCTION (2025 x 2021) PRAETOR KC-390 E-JETS 40% 33% 27% ¹ The gains indicated are based on the evolution compared to the baseline of each program over the past 5 years. 2025 2026 J F M A M J J A S O N D J F M A M J J A S O N D PRODUCTION LEVELING This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. PRODUCTION CAPACITY INCREASE Flight Preparation Hangar #3Site: MLB Delivered: 1Q24 Paint PreparationBuildingSite: MLB Delivered: 1Q25 Flight PreparationHangarSite: GPX Delivered: 1Q25 Paint BoothCenterSite: GPX Delivered: 3Q25 Final AssemblyHangar ExpansionSite: GPX Delivered: 3Q25 Delivery CenterExpansionSite: MLB Delivery: 2Q26 AdditionalMachinerySite: BOT Delivery: 3Q26 Cabinetry shopExpansionSite: GPX Delivery: 3Q26 DRIVING EFFICIENCY CAPABILITY BUILDING DIGITAL & AI TRANSFORMATION AIRCRAFT DELIVERIES INCREASE * 16% AVERAGE SHORTAGES REDUCTION * 25% *Total Commercial Av. & Executive Av. & Defense Security 9M24 vs. 9M25 SUPPLY CHAIN MANAGEMENT 2.0 OPERATIONAL RESULTS 3Q25 This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. 3Q24 3Q25 8 -5% 3Q24 1% 3Q25 16% 12% 583 562 618 473 Adj. EBIT margin Revenues (US$m) COMMERCIAL AVIATION EXECUTIVE AVIATION Revenue +4% yoy EBIT $71m (-23% yoy); margin +12.1% (-420bp)¹ Revenue +31% yoy EBIT $8m (+$31m yoy); margin +1.3% (+610bp) ¹ Ex U.S. import tariff +14.8% (-150bp yoy). This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. 9 Revenue +16% yoy EBIT $68m (-15% yoy); margin +13.7% (-500bp)¹ Revenue +27% yoy EBIT $36m (+127% yoy); margin +12.9% (+570bp) DEFENSE & SECURITY SERVICES & SUPPORT Adj. EBIT margin Revenues (US$m) 3Q24 3Q25 7% 3Q24 13% 3Q25 19% 14% 493 426 278 220 ¹ Ex U.S. import tariff +14.0% (-460bp yoy). This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. 10 FIRST FULL SCALE ENGINEERING PROTOTYPE TEST ENVELOPE FLIGHT SCHEDULED FOR LATE 2025 EARLY 2026 FINANCIAL RESULTS 3Q25 This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. EXECUTIVE AVIATION Light Jets Midsize Jets COMMERCIAL AVIATION 3Q24 3Q25 41 41 3Q24 3Q25 7 GUIDANCE 2025: 77 to 85 9M25: 46 (57% mid-point; 55% 5Y avg) E1 E2 12 DELIVERIES GUIDANCE 2025: 145 to 155 9M25: 102 (68% mid-point; 57% 5Y avg) 23 22 19 18 12 4 13 7 16 20 +25% 0% This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. US$ billion US$ million 14% 30% 31% 25% BREAKDOWN BY BUSINESS 3Q251 Services & Support Defense & Security Executive Aviation Commercial Aviation 1,692 3Q24 2,004 3Q25 +18% GUIDANCE 2025: US$7.0 – 7.5 billion 9M25: US$4,926 million (68% mid-point; 61% 5Y avg) 13 BACKLOG NET REVENUES ¹Revenue breakdown does not include “Others” Business Unit. +65% +8% +40% +37% 3.5 3.6 4.4 11.1 3Q24 4.9 3.9 7.3 15.2 3Q25 22.7 31.3 +38% 3Q25 + Options ~50.0 63% 21% 16% Options This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. Reported EBITDA¹ 224 +11.2% 344 +20.3% 3Q24 3Q25 14 ADJUSTED EBITDA US$ million 160 +8.0% BREAKDOWN BY BUSINESS 3Q25 Reported EBIT¹ 3Q24 3Q25 Exec. D&S Com. S&S Other³ US$ million ADJUSTED EBIT 285 +16.9% Margin Margin 236 207 12.2% 11.8% 172 147 8.7% 8.6% 71 36 8 67 (10) ¹ Reported EBITDA and EBIT includes BA agreement and Eve expenses/warranties, all numbers from Eve are IFRS. ² Adjusted EBITDA and Adjusted EBIT includes BA agreement, but do not consider Eve expenses/warranties. ³ Other includes unallocated operating income (expenses). 9M25: $426m; $130m 5Y avg 9M25: $590m; $266m 5Y avg Adj. EBITDA² 357 +21.1% Adj. EBIT² 298 +17.6% Margin Margin GUIDANCE 2025: 7.5% – 8.3% 9M25: +8.6%; +2.9% 5Y avg ex-BA agreement ex-BA agreement This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. 9 13 37 39 59 33 1 Research is expensed (i.e. not capitalized) 15 Capex Net add Pool Program Additions to intangible Research ¹ ADJUSTED FCF US$ million US$ million INVESTMENTS 3Q24 3Q25 3Q24 3Q25 111 99 241 300 GUIDANCE 2025: US$200 million or higher 9M25: ($247m); ($522m) 5Y avg 10 Excludes Eve 10 This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. 16 Adj. Net Results Adj. Net Margin US$ million ADJ. NET INCOME 13.1% 3Q24 2.7% 3Q25 221 54 160 22 (53) Reported EBIT 3Q25 US$ million NET INCOME EARNINGS PER SHARE (0.2) (-1.0) 0.9 1.9 1.7 US$ ADS basic (12) 117 (30) (32) 54 2021 2022 2023 2024 2025 LTM Net Income Reported 3Q25 Adj. Net Income 3Q25 Deferred Income Tax Net Change Eve Results Net Financial Result Income Tax Non-controlling Interests This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. DELEVERAGING 3.9x 2021 2.3x 2022 1.4x 2023 0.1x 2024 US$ million Gross Debt w/o Eve Net Debt w/o Eve 562 459 363 Net Debt w/o Eve / Adj EBITDA Adj. EBITDA FINANCIAL POSITION 3Q24 3Q25 2,577 1,086 2,109 -468 -646 922 1.3x 3Q24 0.5x 3Q25 848 918 439 Adj. EBITDA LTM LIQUIDITY US$ million LONG-TERM MATURITIES Duration in Years Average Cost 3.7 3.4 4.6 3.8 5.9 2021 2022 2023 2024 3Q25 5.1% 5.4% 6.3% 6.2% 6.2% 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 >2035 19 65 49 393 27 878 18 97 17 17 701 DEBT PROFILE US$ million Embraer Consolidated Debt This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. 18 SHAREHOLDER REMUNERATION Period Declared Income Approval Date EMBJ3 Record Date¹ EMBJ3 Payment Date² Gross Amount Declared (R$ million) Gross Value per Share (R$) Gross Value per ADS (US$)³ FY24 Dividends April 29th, 2025 May 12th, 2025 May 23rd, 2025 51.4 0.07 0.05 2Q25 IoE April 29th, 2025 2Q26 2Q26 142.8 0.19 0.14 3Q25 IoE August 07th, 2025 2Q26 2Q26 66.9 0.09 0.07 2025 209.7 0.28 0.21 Dividend yield (%) 4 0.35% 0.35% 1Shareholders on record at the close of trading in the B3 stock exchange will be entitled to receive the proceeds | Estimated for 2Q26, the exact date will be announced will be announced in November 2025. 2 Payment date refers to EMBJ3/EMBR3; for EMBJ/ERJ the payment will follow applicable procedures from the U.S. depositary bank | Estimated for 2Q26, the exact date will be announced in November 2025. 3 Estimated value (i.e. dependent on spot foreign exchange rate). 4 Dividend yield was calculated based on the share price as of September 30, 2025. This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. Francisco Gomes Neto - CEO CLOSING REMARKS This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. Strong E1 sales combined with the consolidation of the E2 platform marked our best sales year Executive Aviation experiencing strong Retail & Fleet demand across its product portfolio KC-390 progress in global campaigns, including India and NATO, with Sweden’s recent order Services & Support expansion with the groundbreaking of the new MRO facility in the U.S. 20 Continuous focus on sales and efficiency to maximize midterm results while investing in new technologies to prepare the company for a more ambitious long-term expansion This information belongs to Embraer and cannot be used or reproduced without written permission PUBLIC INFORMATION from the Company. THANK YOU!

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 4, 2025

| Embraer S.A. | ||||

| By: |

/s/ Antonio Carlos Garcia | |||

|

Name: |

Antonio Carlos Garcia | |||

| Title: | Executive Vice President of Finance and Investor Relations | |||