Please wait

Exhibit (c)(iii)

| |

|

|

| |

STRICTLY

PRIVATE & CONFIDENTIAL |

DRAFT

- CONFIDENTIAL |

| |

|

|

| |

|

|

|

[***]

indicates information has been omitted on the basis of a confidential treatment request pursuant

to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been

filed separately with the Securities and Exchange Commission. |

INVESTMENT

BANKING

|

| |

|

|

Project

Elk

Board

Discussion Materials

Goldman

Sachs & Co. LLC

April

4, 2024

Goldman

Sachs does not provide accounting, tax, or legal advice. Notwithstanding anything in this document to the contrary, and except as required

to enable compliance with applicable securities law, you (and each of your employees, representatives, and other agents) may disclose

to any and all persons the US federal income and state tax treatment and tax structure of the transaction and all materials of any kind

(including tax opinions and other tax analyses) that are provided to you relating to such tax treatment and tax structure, without Goldman

Sachs imposing any limitation of any kind.

| | | |

| Disclaimer

| INVESTMENT

BANKING

|

These materials have

been prepared and are provided by Goldman Sachs on a confidential basis solely for the information and assistance of the Board of Directors

and senior management of Elk (the "Company") in connection with their consideration of the matters referred to herein. These

materials and Goldman Sachs’ presentation relating to these materials (the “Confidential Information”) may not be disclosed

to any third party or circulated or referred to publicly or used for or relied upon for any other purpose without the prior written consent

of Goldman Sachs. The Confidential Information was not prepared with a view to public disclosure or to conform to any disclosure standards

under any state, federal or international securities laws or other laws, rules or regulations, and Goldman Sachs does not take any responsibility

for the use of the Confidential Information by persons other than those set forth above. Notwithstanding anything in this Confidential

Information to the contrary, the Company may disclose to any person the US federal income and state income tax treatment and tax structure

of any transaction described herein and all materials of any kind (including tax opinions and other tax analyses) that are provided to

the Company relating to such tax treatment and tax structure, without Goldman Sachs imposing any

limitation of any kind. The Confidential Information has been prepared by the Investment Banking Division of Goldman Sachs and is not

a product of its research department.

Goldman Sachs and its affiliates are engaged in

advisory, underwriting and financing, principal investing, sales and trading, research, investment management and other financial and

non-financial activities and services for various persons and entities. Goldman Sachs and its affiliates and employees, and funds or other

entities they manage or in which they invest or have other economic interests or with which they co-invest, may at any time purchase,

sell, hold or vote long or short positions and investments in securities, derivatives, loans, commodities, currencies, credit default

swaps and other financial instruments of the Company, any other party to any transaction and any of their respective affiliates or any

currency or commodity that may be involved in any transaction. Goldman Sachs’ investment banking division maintains regular, ordinary

course client service dialogues with clients and potential clients to review events, opportunities, and conditions in particular sectors

and industries and, in that connection, Goldman Sachs may make reference to the Company, but Goldman Sachs will not disclose any confidential

information received from the Company.

The Confidential Information has been prepared based

on historical financial information, forecasts and other information obtained by Goldman Sachs from publicly available sources, the management

of the Company or other sources (approved for our use by the Company in the case of information from management and non-public information).

In preparing the Confidential Information, Goldman Sachs has relied upon and assumed, without assuming any responsibility for independent

verification, the accuracy and completeness of all of the financial, legal, regulatory, tax, accounting and other information provided

to, discussed with or reviewed by us, and Goldman Sachs does not assume any liability for any such information. Goldman Sachs does not

provide accounting, tax, legal or regulatory advice.

Goldman Sachs has

not made an independent evaluation or appraisal of the assets and liabilities (including any contingent, derivative or other off-balance

sheet assets and liabilities) of the Company or any other party to any transaction or any of their respective affiliates and has no obligation

to evaluate the solvency of the Company or any other party to any transaction under any state or federal laws relating to bankruptcy,

insolvency or similar matters. The analyses contained in the Confidential Information do not purport to be appraisals nor do they necessarily

reflect the prices at which businesses or securities actually may be sold or purchased. Goldman Sachs’ role in any due diligence

review is limited solely to performing such a review as it shall deem necessary to support its own advice and analysis and shall not be

on behalf of the Company. Analyses based upon forecasts of future results are not necessarily indicative of actual future results, which

may be significantly more or less favorable than suggested by these analyses, and Goldman Sachs does not assume responsibility

if future results are materially different from those forecast.

The Confidential Information

does not address the underlying business decision of the Company to engage in any transaction, or the relative merits of any transaction

or strategic alternative referred to herein as compared to any other transaction or alternative that may be available to the Company.

The Confidential Information is necessarily based on economic, monetary, market and other conditions as in effect on, and the information

made available to Goldman Sachs as of, the date of such Confidential Information and Goldman Sachs assumes no responsibility for updating

or revising the Confidential Information based on circumstances, developments or events occurring after such date. The Confidential Information

does not constitute any opinion, nor does the Confidential Information constitute a recommendation to the Board, any security holder

of the Company or any other person as to how to vote or act with respect to any transaction or any other matter. The Confidential Information,

including this disclaimer, is subject to, and governed by, any written agreement between the Company, the Board and/or any committee

thereof, on the one hand, and Goldman Sachs, on the other hand. The Confidential Information does not address, nor does Goldman Sachs

express any view as to, the potential effects of volatility in the credit, financial and stock markets on the Company, any other party

to any transaction or any transaction.

| | | |

|

| INVESTMENT

BANKING

|

I. Process

Overview

| | | |

| Overview

of Stork Proposal

Summary of Key Terms

| INVESTMENT

BANKING

|

| | |

| Headline

Offer Value / Consideration |

■ Aggregate

consideration of $4.948bn, comprised of $4.198bn fully diluted equity value

and $750mm pre-closing dividend to acquire all outstanding ordinary shares of Elk1

■ Stork

stated per share offer price of $3272

■ Assumes

Elk pays pre-closing dividend(s) of $750mm ahead of transaction closing, less any share repurchases that have been completed since

the last public reported balance sheet (31-Dec-2023)

—

Offer price reduced dollar for dollar for the pre-closing dividend amount

—

Assumes all equity awards issued by Elk will become vested and cashed

out based on the stated offer price

—

Assumes all preferred shares in the Company remain outstanding

—

Dividend to be paid pro-rata to current shareholders, inclusive of Stork

|

| | |

| | |

| Acquiring

Entity / Source of Financing | ■ Contemplating

a newly formed entity directly or indirectly controlled by one or more private investment

funds affiliated with Stork

■ Expect

to finance transaction via combination of cash from one or more of Stork’s investment vehicles or affiliated funds, as well as

potentially bringing in certain co-investors

—

Will also consider raising bank financing to finance a portion of the

transaction |

| | |

| | |

| Areas

of Focus in Due Diligence | ■ Confirmatory

in nature only given significant due diligence completed when making initial investment in Elk

■ Key

areas include refresh of reserve adequacy analysis, review of latest asset tape, marks of illiquid and semi-liquid assets, reinsurance

trust investment guidelines, quality of earnings review, and customary financial / operational / accounting / tax / legal / regulatory

due diligence

■ Expect

to be able to complete outstanding diligence by the end of April 2024, assuming appropriate access to Elk management and information |

| | |

| | |

| Anticipated

Approvals Required | ■ Approval

from Stork Investment Committee before entering into binding proposal (initial non-binding proposal has been reviewed by relevant Investment

Committee based on feedback conveyed by Stork)

■ Applicable

anti-trust, foreign direct investment and regulatory approvals |

| | |

| | |

| Transaction

Advisors | ■ Hired

Simpson Thatcher (M&A), Willkie Farr & Gallagher (regulatory), Cleary Gottlieb Steen & Hamilton (funds) as legal advisors,

Oliver Wyman as actuarial advisor, and EY and KPMG as accounting / tax advisors

■ Yet

to finalize financial advisor(s) |

| | |

Source:

Stork IOI submitted on 24-Mar-2023. 1 Based on Elk computed diluted shares outstanding inclusive of ordinary shares, non-voting

ordinary shares, RSUs, PSUs and JSOP shares as of 31-Dec-2023. Elk has not repurchased any shares since the last reported balance sheet

date (31-Dec-2023). 2 $327 per share value based on Stork written proposal, inclusive of $750mm dividend. See page 6 for computed

per share calculation based on Elk diluted shares outstanding inclusive of ordinary shares, non-voting ordinary shares, RSUs, PSUs and

JSOP shares as of 31-Dec-2023.

| | | |

|

| INVESTMENT

BANKING

|

II. Elk

Summary Preliminary Valuation Assessment

|

Summary

of Key Economic Terms

Stork

Mar-2024 Proposal | ($ in millions)

|

INVESTMENT

BANKING

|

| |

|

|

| |

|

|

| Analysis

at Various Prices |

|

|

| Consideration

Paid by Stork |

|

|

|

|

$

4,198 |

|

$

4,219 |

$

4,296 |

$

4,373 |

$

4,450 |

$

4,527 |

|

Elk

Standalone

< Preliminary

Q1 2024E BVPS (incl. AOCI): $340

< Preliminary

Q1 2024E BVPS (excl. AOCI): $364 |

| |

| Pre-Closing

Dividend |

|

|

|

|

750 |

|

750 |

750 |

750 |

750 |

750 |

|

| |

|

|

|

|

|

| Total

Equity Purchase Price |

|

|

|

|

$

4,948 |

|

$

4,969 |

$

5,046 |

$

5,123 |

$

5,200 |

$

5,277 |

|

| |

|

|

|

|

|

| Implied

Purchase Price Per Share¹ |

|

|

|

|

$

328.67 |

|

$

330.00 |

$

335.00 |

$

340.00 |

$

345.00 |

$

350.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Reference

Valuation |

| |

|

|

|

|

|

|

|

Multiple |

|

|

|

|

Peer

Trading Comparables |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Traditional |

Other |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Bermuda |

Bermuda |

Precedent |

| Metric |

|

Value |

Current |

|

Bid

Price |

|

Illustrative Bid Price Sensitivity |

|

Reinsurers² |

Reinsurers³ |

Transactions |

| Implied Purchase Premiums |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Day Before

Stork Letter (22-Mar-2024) |

|

$

292.50 |

- |

|

12.4

% |

|

12.8

% |

14.5

% |

16.2

% |

17.9

% |

19.7

% |

|

|

|

|

| Current

Share Price |

|

310.76 |

- |

|

5.8 |

|

6.2 |

7.8 |

9.4 |

11.0 |

12.6 |

|

|

|

|

| All-Time-High

(28-Mar-2024) |

|

310.76 |

|

|

5.8 |

|

6.2 |

7.8 |

9.4 |

11.0 |

12.6 |

|

|

|

|

| 52-Week-High

(28-Mar-2024) |

|

310.76 |

- |

|

5.8 |

|

6.2 |

7.8 |

9.4 |

11.0 |

12.6 |

|

|

|

|

| 52-Week-Low

(29-Mar-2023) |

|

229.09 |

- |

|

43.5 |

|

44.0 |

46.2 |

48.4 |

50.6 |

52.8 |

|

|

|

|

| 30-Day

VWAP |

|

299.51 |

- |

|

9.7 |

|

10.2 |

11.8 |

13.5 |

15.2 |

16.9 |

|

|

|

|

| 60-Day

VWAP |

|

290.24 |

- |

|

13.2 |

|

13.7 |

15.4 |

17.1 |

18.9 |

20.6 |

|

|

|

|

| 90-Day

VWAP |

|

285.50 |

- |

|

15.1 |

|

15.6 |

17.3 |

19.1 |

20.8 |

22.6 |

|

|

|

|

| VWAP

Since Stork Investment (08-Nov-2023) |

|

283.42 |

- |

|

16.0 |

|

16.4 |

18.2 |

20.0 |

21.7 |

23.5 |

|

|

|

|

| |

Standalone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Implied

Price / Book Value Multiples |

Per

Share 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| YE 2023

Book Value (incl. AOCI) |

$ 337 |

$

5,025 |

0.92

x |

|

0.98

x |

|

0.99

x |

1.00

x |

1.02

x |

1.03

x |

1.05

x |

|

1.25

x |

0.79

x |

1.09

x |

| YE 2023

Book Value (excl. AOCI) |

359 |

5,361 |

0.86 |

|

0.92 |

|

0.93 |

0.94 |

0.96 |

0.97 |

0.98 |

|

1.17 |

0.79 |

1.18

x |

| YE 2023

Book Value (Management Adjusted)5 |

361 |

5,391 |

0.86 |

|

0.92 |

|

0.92 |

0.94 |

0.95 |

0.96 |

0.98 |

|

|

|

- |

| Implied

Price / Tangible Book Value Multiples |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| YE 2023

Tangible Book Value (incl. AOCI) |

$ 333 |

$

4,962 |

0.93

x |

|

1.00

x |

|

1.00

x |

1.02

x |

1.03

x |

1.05

x |

1.06

x |

|

1.29

x |

0.83

x |

1.11

x |

| YE 2023

Tangible Book Value (excl. AOCI) |

355 |

5,298 |

0.87 |

|

0.93 |

|

0.94 |

0.95 |

0.97 |

0.98 |

1.00 |

|

1.20 |

0.83 |

- |

| YE 2023

Tangible Book Value (Management Adjusted)5 |

357 |

5,328 |

0.87 |

|

0.93 |

|

0.93 |

0.95 |

0.96 |

0.98 |

0.99 |

|

|

|

- |

| Implied

Price / Mangement Projected Earnings Multiples |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024E

Earnings - Per Management |

|

$

659 |

7.0

x |

|

7.5 x |

|

7.5

x |

7.7 x |

7.8

x |

7.9

x |

8.0 x |

|

6.4

x |

7.8 x |

- |

| 2025E

Earnings - Per Management |

|

572 |

8.1 |

|

8.7 |

|

8.7 |

8.8 |

9.0 |

9.1 |

9.2 |

|

6.0 |

7.1 |

- |

Source:

Elk Management preliminary projections, FactSet as of 28-Mar-2024, Company filings. ¹ Based on Elk computed diluted shares outstanding

inclusive of ordinary shares, non-voting ordinary shares, RSUs, PSUs and JSOP shares as of 31-Dec-2023. Analysis accounts for share count

dilution applied to valuation range. 2 Traditional Bermuda Reinsurers include Everest Re, RenaissanceRe, Axis Capital, and

Fidelis. 3 Other Bermuda Reinsurers include Hamilton, Greenlight Re and SiriusPoint. 4 Based on Elk management

standalone fully diluted shares outstanding as of 31-Dec-2023. 5 Adjusted for net realized and unrealized gains / (losses)

on fixed maturities available for sale, fixed maturities trading, and funds held, change in fair value of insurance contracts, and amortization

of fair value adjustments.

| Elk Summary Preliminary Valuation Assessment | 6 | | |

|

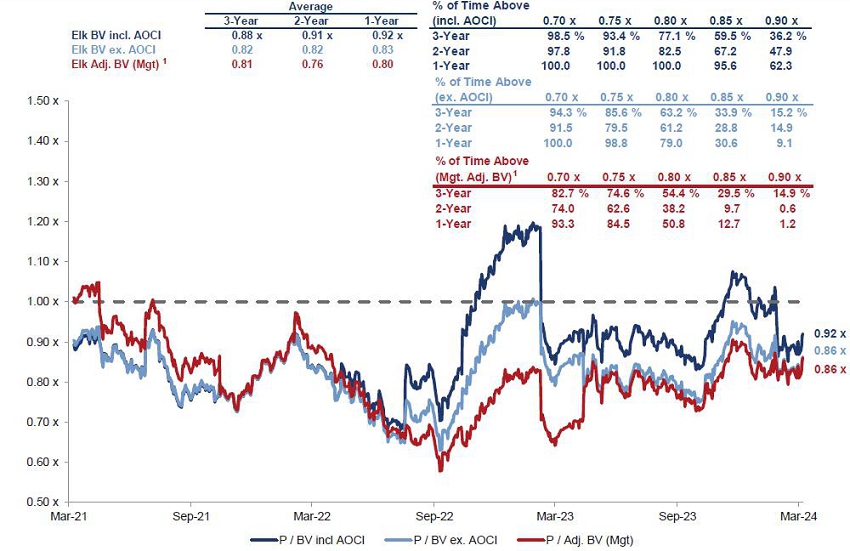

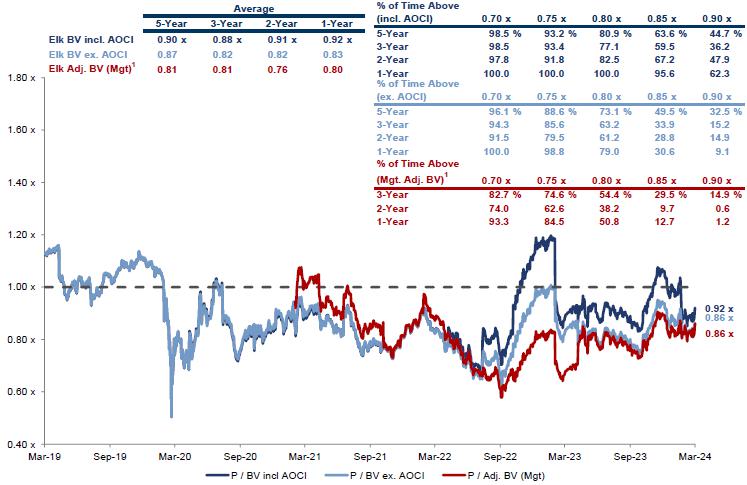

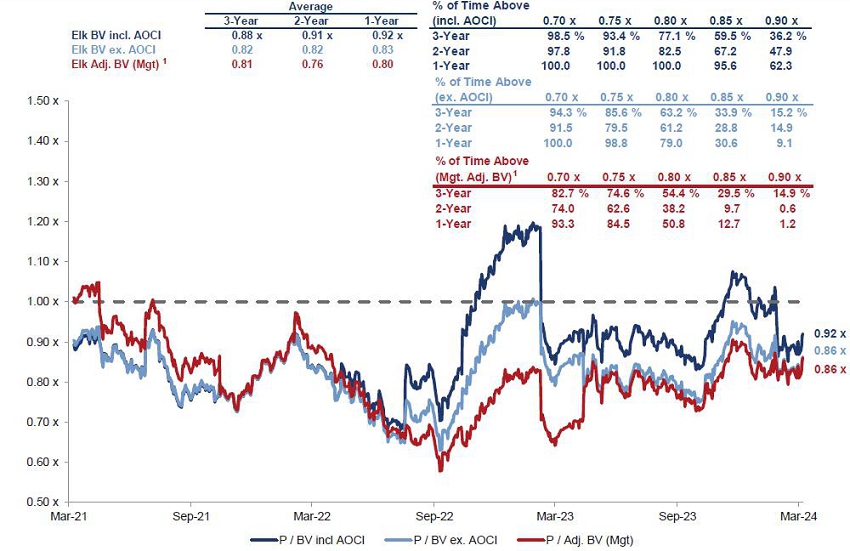

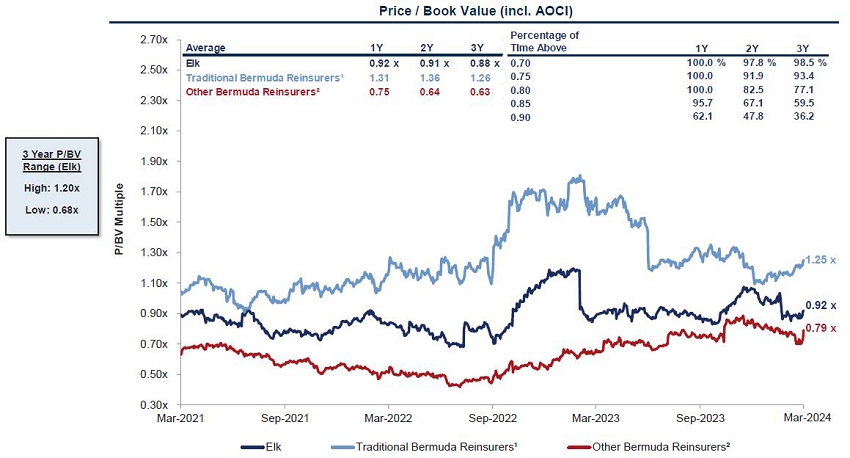

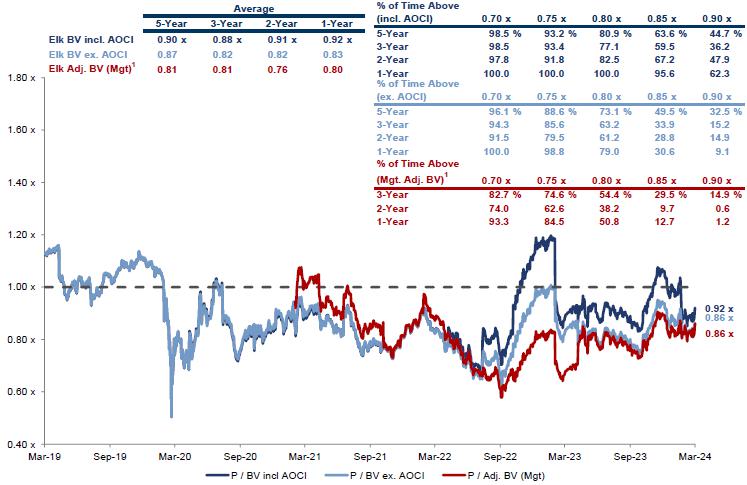

Elk’s

Price to Book Value Multiple Over Time

|

INVESTMENT

BANKING

|

| |

|

|

| |

|

|

Source:

Company filings, FactSet as of 28-Mar-2024. 1 Adjusted for net realized and unrealized gains / (losses) on fixed maturities

available for sale, fixed maturities trading, and funds held, change in fair value of insurance contracts, and amortization of fair value

adjustments.

| Elk Summary Preliminary Valuation Assessment | 7 | | |

|

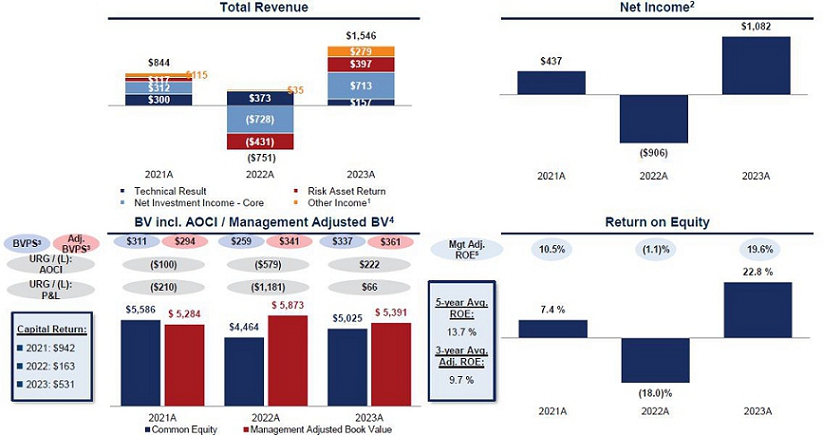

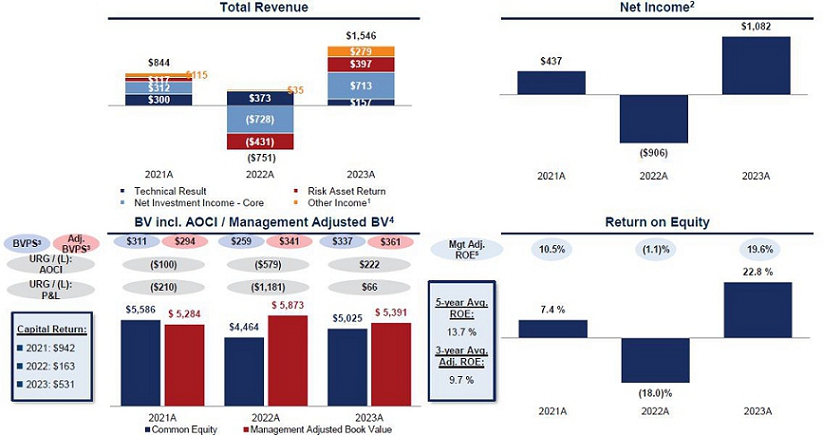

Overview of Elk Historical Financials

($

in millions, except per share data)

|

INVESTMENT

BANKING

|

| |

|

|

| |

|

|

Source:

Elk Management and public company reported financials. Note: ROE calculated based on average Common Equity. 1 Other income

includes Defendant A&E PPD, Premium / Acquisition costs / CY Losses, Change in Policy Holder Benefits, Ceding Commissions Expense,

Policy Holder Investment Income, and Other income – cash. 2 Net income (loss) attributable to Elk ordinary shareholders

as reported on company’s annual statements. 3 Based on Elk computed diluted shares outstanding inclusive of ordinary

shares, non-voting ordinary shares, RSUs, PSUs and JSOP shares as of respective year ends. 4YE 2021 book value presented at

time of public reporting (31-Dec-2021), without adjusting for retrospective ASU 2018-12 accounting adjustments. 5 Calculation

refers to page 30, Elk Historical Management Adjusted Book Value Reconciliation.

| Elk Summary Preliminary Valuation Assessment | 8 | | |

|

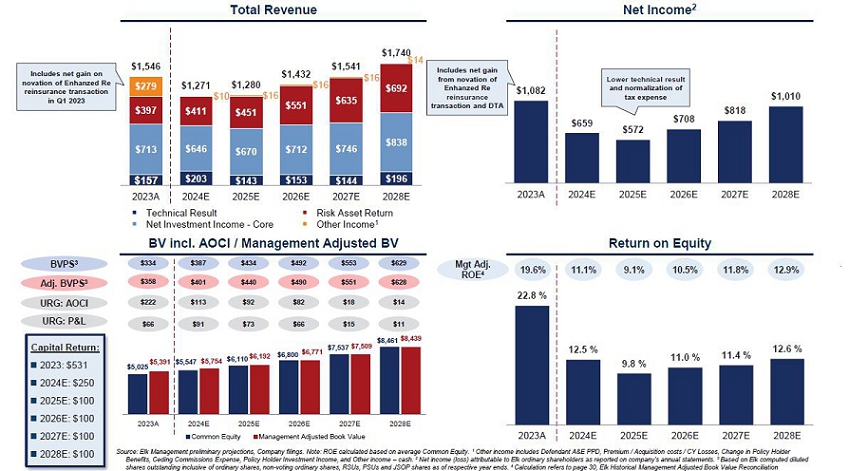

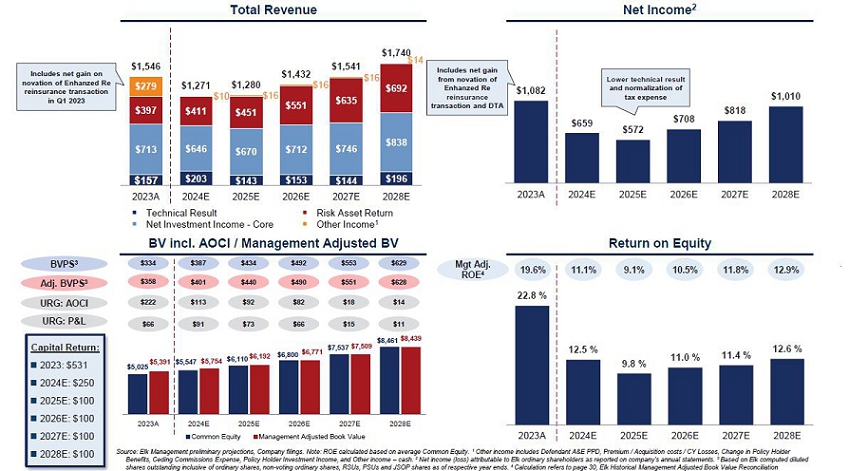

Overview

of Elk Management Preliminary Projections

($

in millions, except per share data)

|

INVESTMENT

BANKING

|

| |

|

|

| |

|

|

| Elk Summary Preliminary Valuation Assessment | 9 | | |

|

Elk

Investment Portfolio Evolution

($ in billions, unless stated otherwise)

|

INVESTMENT

BANKING

|

| |

|

|

| |

|

|

| |

YE

2020 |

|

YE

2022 |

|

YE

2023 |

|

YE

2028 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Management

Projected

Annual

Risk

Asset

Return:

2024:

9.2 %

2025:

9.8 %

2026:

10.9 %

2027:

11.4 %

2028:

11.4 %

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Risk

Assets as %

of Book Value1 |

83% |

|

100% |

|

90% |

|

75% |

| |

|

|

|

|

|

|

|

Total

Investable

Assets2 |

$15.8 |

|

$15.1 |

|

$14.9 |

|

$23.7 |

| |

|

|

|

|

|

|

|

Source:

Company filings, investor presentations and Elk Management preliminary projections.

1

Risk assets defined as private credit funds, fixed income funds, public equities, privately held equities, private equity funds,

hedge funds, equity funds, CLO equities, CLO equity funds and real estate.

2 Excludes management and custody fees.

| Elk Summary Preliminary Valuation Assessment | 10 | | |

|

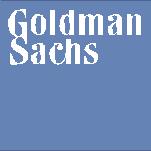

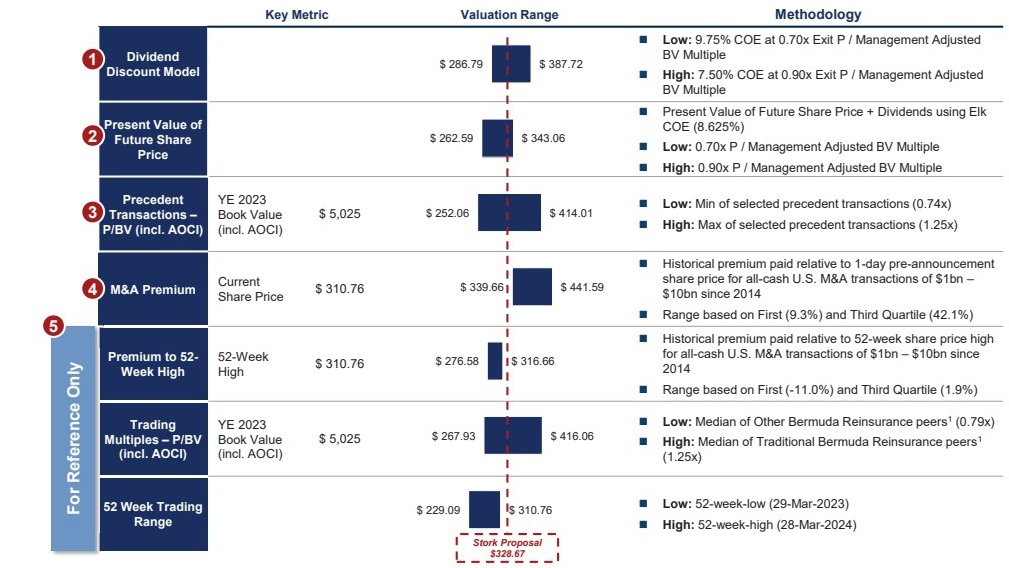

Summary of Preliminary Financial Analyses

($

in millions, except per share data) |

INVESTMENT

BANKING

|

| |

|

|

| |

|

Source:

Elk Management projections, Company filings, FactSet. Market data as of 28-Mar-2024. Note: Per share metrics based on Elk computed diluted

shares outstanding inclusive of ordinary shares, non-voting ordinary shares, RSUs, PSUs and JSOP shares as of 31-Dec-2023. Analysis accounts

for share count dilution applied to valuation range. 1 Traditional Bermuda Reinsurers include RenaissanceRe, Everest Re, Axis

Capital and Fidelis; Other Bermuda Reinsurers include Hamilton, Greenlight Re and SiriusPoint.

| Elk Summary Preliminary Valuation Assessment | 11 | | |

|

|

Elk Summary Dividend Discount Model

($

in millions, unless otherwise noted) |

INVESTMENT

BANKING

|

| |

|

|

| |

|

| |

Summary of Book Value Generation and Cash Flow Distributions |

| |

2023A |

2024E |

2025E |

2026E |

2027E |

2028E |

| BoP Book Value |

|

$ 5,025 |

$ 5,547 |

$ 6,110 |

$ 6,800 |

$ 7,537 |

| (+) Earnings |

|

659 |

572 |

708 |

818 |

1,010 |

| (-) Share Repurchases |

|

(250) |

(100) |

(100) |

(100) |

(100) |

| (+) OCI Change |

|

113 |

92 |

82 |

18 |

14 |

| EoP Book Value (incl. AOCI) |

$ 5,025 |

$ 5,547 |

$ 6,110 |

$ 6,800 |

$ 7,537 |

$ 8,461 |

| + / (-) AOCI |

336 |

$ 223 |

$ 131 |

$ 49 |

$ 31 |

$ 17 |

| EoP Book Value (excl. AOCI) |

$ 5,361 |

$ 5,769 |

$ 6,241 |

$ 6,849 |

$ 7,568 |

$ 8,478 |

| EoP Book Value (incl. AOCI) |

$ 5,025 |

$ 5,547 |

$ 6,110 |

$ 6,800 |

$ 7,537 |

$ 8,461 |

| (+) Net URL / (G) on AFS/HFT/Funds Held Securities |

721 |

517 |

352 |

204 |

172 |

146 |

| (-) Change in Fair Value of Insurance Contracts |

(246) |

(211) |

(180) |

(152) |

(126) |

(102) |

| (-) Fair Value Adjustment |

(108) |

(99) |

(89) |

(81) |

(73) |

(66) |

| Management Adj. Book Value |

$ 5,391 |

$ 5,754 |

$ 6,192 |

$ 6,771 |

$ 7,509 |

$ 8,439 |

| |

|

|

|

|

|

|

| Distributable Cash Flows |

|

$ 250 |

$ 100 |

$ 100 |

$ 100 |

$ 100 |

Sensitivity

Analysis

| |

|

|

|

| |

|

|

Elk

Implied Share Price |

| |

|

|

|

| |

|

|

Discount

Rate |

| |

|

|

7.50

% |

7.95

% |

8.40

% |

8.85

% |

9.30

% |

9.75

% |

| |

|

0.70

x |

$

315 |

$

309 |

$

304 |

$

298 |

$

292 |

$

287 |

| |

0.75

x |

330 |

324 |

318 |

316 |

310 |

305 |

| |

0.80

x |

350 |

343 |

337 |

330 |

324 |

318 |

| |

0.85

x |

369 |

362 |

355 |

348 |

342 |

335 |

| |

0.90

x |

388 |

380 |

373 |

366 |

359 |

353 |

Source: Elk Management preliminary projections,

FactSet, Company filings. Note: Market Data as of 28-Mar-2024; Per share metrics based on Elk computed diluted shares outstanding inclusive

of ordinary shares, non-voting ordinary shares, RSUs, PSUs and JSOP shares as of 31-Dec -2023. Analysis accounts for share count dilution

applied to valuation range. Adjusted Book Value adjusts for net realized and unrealized gains / (losses) on fixed maturities available

for sale, fixed maturities trading, and funds held, change in fair value of insurance contracts, and amortization of fair value

adjustments.

| Elk Summary Preliminary Valuation Assessment | 12 | | |

|

|

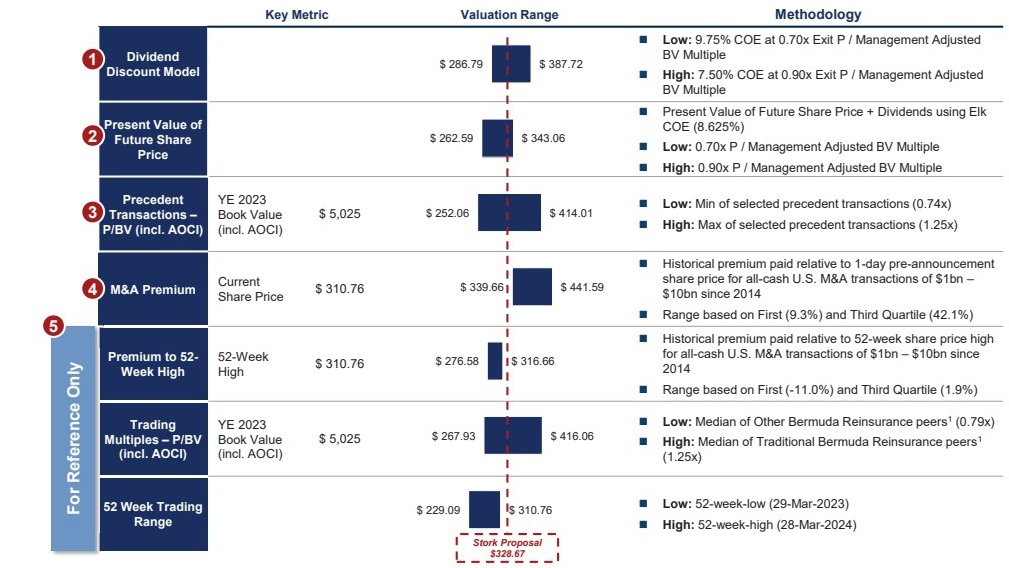

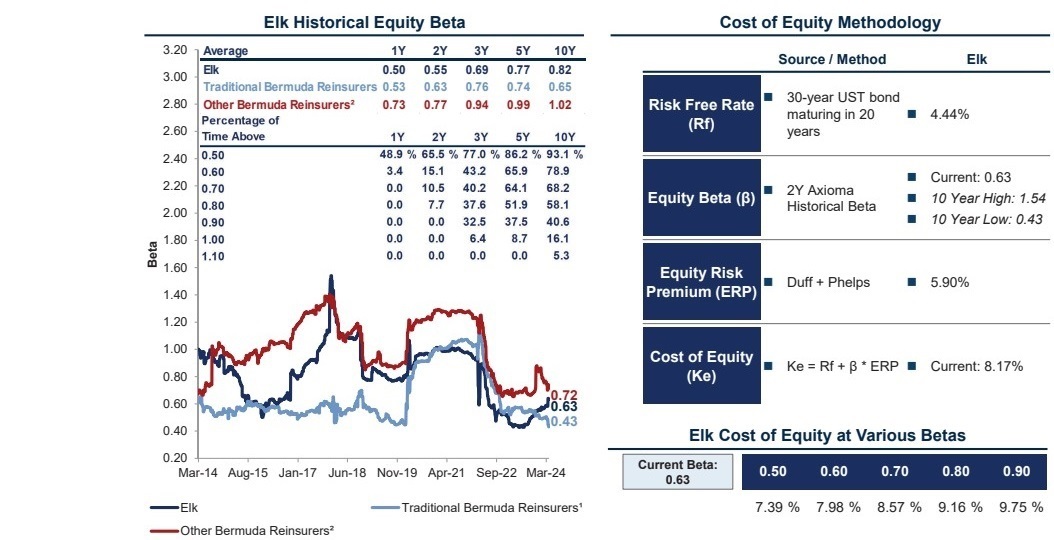

Elk Beta and Cost of Equity Analysis

Comparison of Historical Peer Equity Betas | Last 10 Years |

INVESTMENT

BANKING

|

| |

|

|

| |

|

Source: Axioma, Duff and Phelps; market data as of 28-Mar-2024

¹ Traditional Bermuda Reinsurers

include RenaissanceRe, Everest Re, Axis Capital, and Fidelis (Since 03-Jul-2023 IPO, the earliest date for available data). ² Other

Bermuda Reinsurers include Hamilton (Since 13-Nov-2023 IPO, the earliest date for available data), Greenlight Re and SiriusPoint (Since

19-Aug-2014, the earliest date for available data).

| Elk Summary Preliminary Valuation Assessment | 13 | | |

|

|

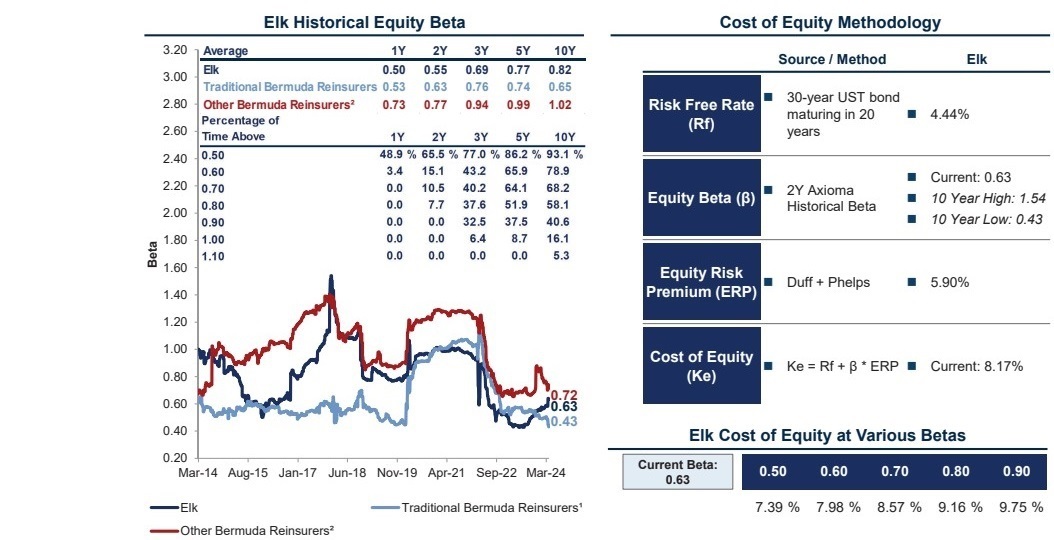

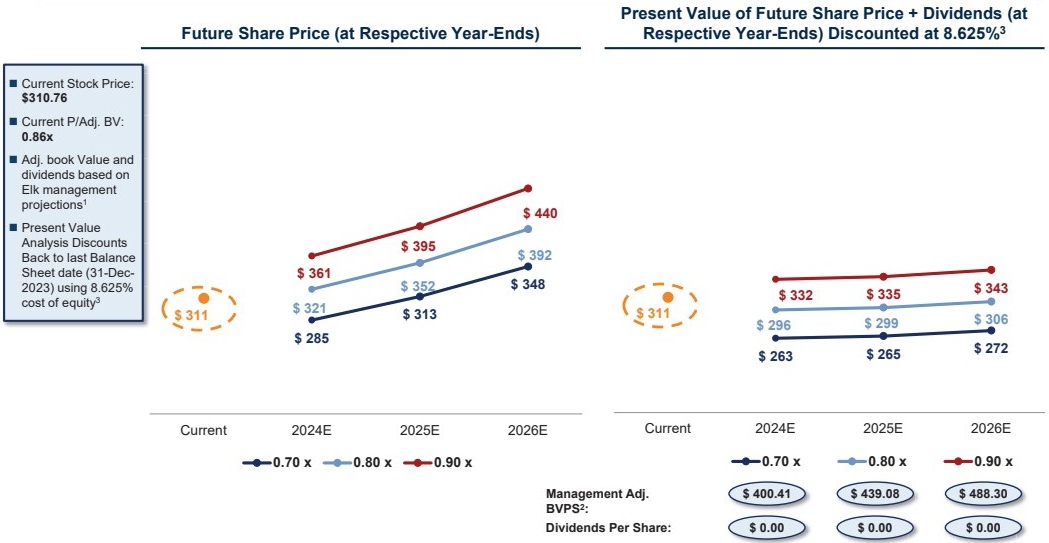

Present

Value of Future Share Price Analysis |

INVESTMENT

BANKING

|

| |

|

|

| |

|

Source:

Elk Management preliminary projections, Company filings, FactSet. Note: Market data as of 28-Mar-2024; Per share metrics based on

Elk computed diluted shares outstanding inclusive of ordinary shares, non-voting ordinary shares, RSUs, PSUs and JSOP shares as of

respective year ends. Analysis accounts for share count dilution applied to valuation range. Assumes number of shares repurchased in

each year consistent with Elk Management Projections. 1 Adjusted for net realized and unrealized gains / (losses) on

fixed maturities available for sale, fixed maturities trading, and funds held, change in fair value of insurance contracts, and

amortization of fair value adjustments. 2 Based on computed diluted shares outstanding at current P / Management Adjusted

BV range (0.86x). 3 Represents median of range used for Dividend Discount Model.

| Elk Summary Preliminary Valuation Assessment | 14 | | |

|

|

Selected Precedent P&C (Re)insurance M&A

Transactions

($

in millions) |

INVESTMENT

BANKING

|

| |

|

| Ann.

Date |

Acquiror |

Target |

Equity

Value |

%

Cash |

P/BV

incl. AOCI1 |

P/TBV

incl. AOCI1 |

P/BV

excl. AOCI1 |

| Oct-21 |

Covea |

PartnerRe

2 |

9,000 |

100 |

1.25 |

1.35 |

1.24 |

| Oct-18 |

RenaissanceRe |

Tokio

Millenium Re |

1,469 |

83 |

1.01 |

1.02 |

NA |

| Aug-15 |

Exor |

PartnerRe |

6,875 |

100 |

1.10 |

1.21 |

1.10 |

| Mar-15 |

Endurance |

Montpelier

Re |

1,831 |

25 |

1.22 |

1.22 |

1.22 |

| Nov-14 |

RenaissanceRe |

Platinum |

1,925 |

60 |

1.13 |

1.13 |

1.20 |

| Dec-12 |

Markel |

Alterra |

3,130 |

32 |

1.07 |

1.09 |

1.18 |

| Aug-12 |

Validus |

Flagstone |

623 |

24 |

0.74 |

0.74 |

0.73 |

| Nov-11 |

Alleghany |

Transatlantic |

3,431 |

24 |

0.80 |

0.80 |

0.85 |

| Low |

|

|

|

|

0.74

x |

0.74

x |

0.73

x |

| 25th

Percentile |

|

|

|

0.96 |

0.96 |

0.98 |

| Median |

|

|

|

|

1.09 |

1.11 |

1.18 |

| 75th

Percentile |

|

|

|

1.16 |

1.21 |

1.21 |

| High |

|

|

|

|

1.25 |

1.35 |

1.24 |

Source:

Public filings and press releases, CapIQ, SNL, Thomson Reuters.

| 1 | Based

on reported aggregate purchase price and book value multiples (including AOCI) where available.

|

| 2 | Excludes

future capital synergies and prospective future cash dividends from excess capital, as well

as any value attributed to strategic partnership between AIG and RNR Capital Partners

|

| Elk Summary Preliminary Valuation Assessment | 15 | | |

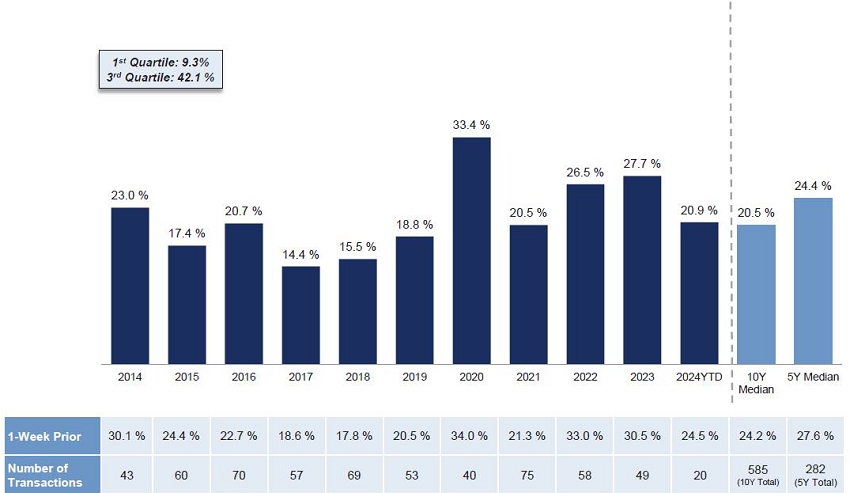

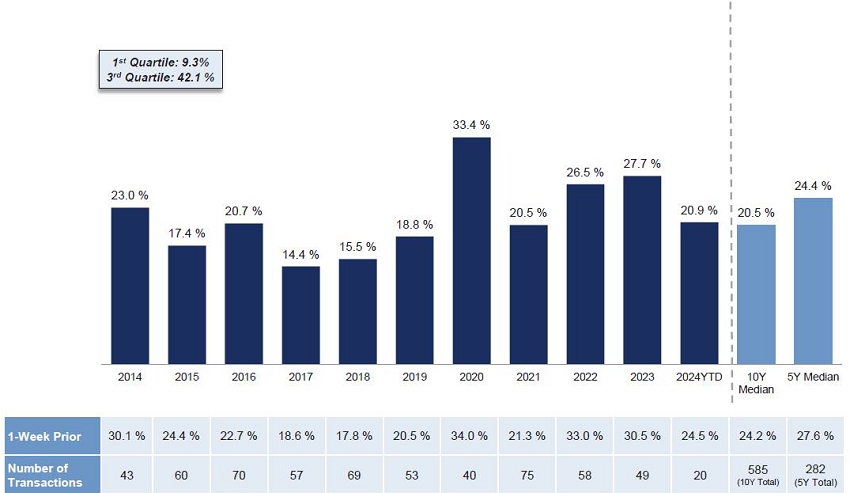

| Premia

Paid in Precedent U.S. Public M&A

All-Cash

Acquisitions | Since 01-Jan-2014 between $1.0bn and $10.0bn

% Premia to 1-day Prior to Announcement (Median)

| INVESTMENT

BANKING

|

Source:

Dealogic, CapIQ as of 28-Mar-2024.

| Elk Summary Preliminary Valuation Assessment | 16 | | |

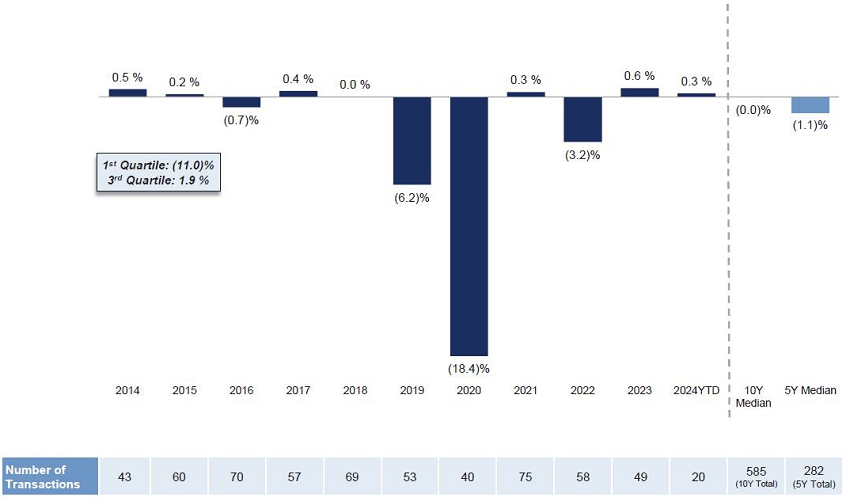

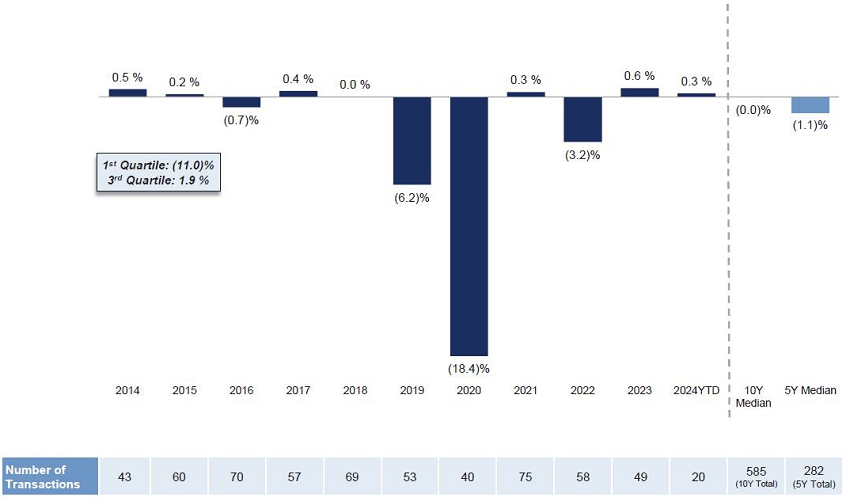

| Premia

Paid in Precedent U.S. Public M&A

All-Cash

Acquisitions | Since 01-Jan-2014 between $1.0bn and $10.0bn

% Premia to 52 Week High (Median)

| INVESTMENT

BANKING

|

Source:

Dealogic, CapIQ as of 28-Mar-2024.

| Elk Summary Preliminary Valuation Assessment | 17 | | |

| Selected

Peer Common Stock Comparison

($

in millions, except per share amounts)

| INVESTMENT

BANKING

|

| |

Closing |

Equity |

|

|

Calendarized |

|

|

|

|

|

|

LTM |

| Price |

Market |

%

of 52 |

|

P/E |

P/B |

P/B |

P

/ TBV |

P

/ TBV |

ROE |

|

Dividend |

| Company |

28-Mar-24 |

Cap |

Wk.

High |

|

2024E

|

2025E |

(in.

AOCI) |

(ex.

AOCI) |

(in.

AOCI) |

(ex.

AOCI) |

2024E

|

2025E |

|

Yield |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Elk |

$

310.76 |

$

4,613 |

100.0

% |

|

8.4

x |

7.8

x |

0.92

x |

0.86

x |

0.93

x |

0.87

x |

NA |

NA |

|

0.0

% |

| Traditional

Bermuda Reinsurers |

| Everest

Re |

$

397.50 |

$

17,303 |

95.9

% |

|

6.4

x |

5.8

x |

1.31

x |

1.22

x |

1.31

x |

1.22

x |

17.1

% |

16.2

% |

|

1.7 % |

| RenaissanceRe |

235.03 |

12,644 |

98.8 |

|

6.7 |

6.7 |

1.45 |

1.45 |

1.59 |

1.59 |

20.5 |

18.8 |

|

0.7 |

| Axis

|

65.02 |

5,621 |

100.0 |

|

6.4 |

6.3 |

1.19 |

1.11 |

1.27 |

1.17 |

17.4 |

15.4 |

|

2.7 |

| Fidelis

|

19.48 |

2,317 |

100.0 |

|

6.1 |

5.4 |

0.95 |

0.94 |

0.95 |

0.94 |

13.3 |

12.9 |

|

0.5 |

| Median

- Traditional Bermuda Reinsurers |

99.4

% |

|

6.4

x |

6.0

x |

1.25

x |

1.17

x |

1.29

x |

1.20

x |

17.3

% |

15.8

% |

|

1.2

% |

| Other

Bermuda Reinsurers |

|

|

|

|

|

|

|

|

|

|

|

|

|

| SiriusPoint

|

$

12.71 |

$

2,234 |

100.0

% |

|

7.9

x |

7.1

x |

0.97

x |

0.97

x |

1.03

x |

1.04

x |

NA |

NA |

|

0.0

% |

| Hamilton

|

13.93 |

1,621 |

88.4 |

|

5.1 |

4.0 |

0.79 |

0.79 |

0.83 |

0.83 |

12.7 |

13.7 |

|

0.0 |

| Greenlight

Re |

12.47 |

462 |

98.7 |

|

7.8 |

7.8 |

0.78 |

0.78 |

0.78 |

0.78 |

NA |

NA |

|

0.0 |

| Median

- Other Bermuda Reinsurers |

98.7

% |

|

7.8

x |

7.1

x |

0.79

x |

0.79

x |

0.83

x |

0.83

x |

12.7

% |

13.7

% |

|

0.0

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Overall

Low |

|

88.4

% |

|

5.1

x |

4.0

x |

0.78

x |

0.78

x |

0.78

x |

0.78

x |

12.7

% |

12.9

% |

|

0.0

% |

| Overall

Median |

|

98.8 |

|

6.4 |

6.3 |

0.97 |

0.97 |

1.03 |

1.04 |

17.1 |

15.4 |

|

0.5 |

| Overall

Mean |

|

97.4 |

|

6.6 |

6.2 |

1.06 |

1.04 |

1.11 |

1.08 |

16.2 |

15.4 |

|

0.8 |

| Overall

High |

|

100.0 |

|

7.9 |

7.8 |

1.45 |

1.45 |

1.59 |

1.59 |

20.5 |

18.8 |

|

2.7 |

Source:

Company filings, FactSet; market data as of 28-Mar-2024. Note: Earnings projections used for computation of P/E multiples based on median

of equity research analyst projections.

| Elk Summary Preliminary Valuation Assessment | 18 | | |

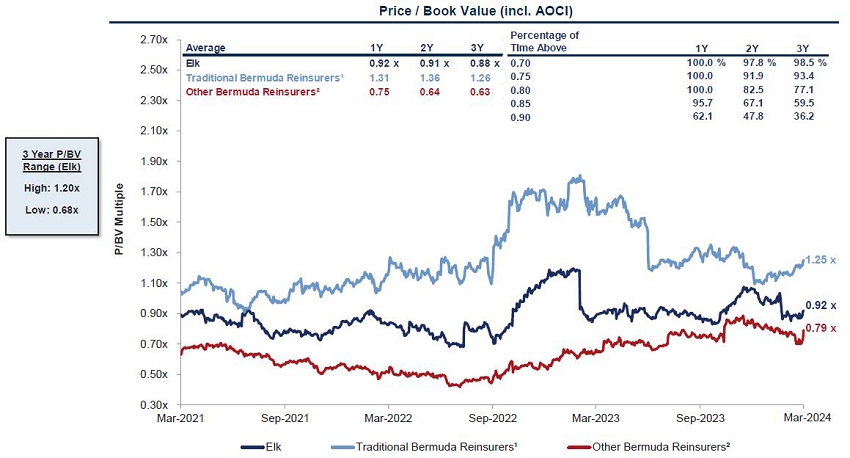

| Elk

Historical Valuation Compared to Peers

P/BV

Multiples | Last 3 Years

|

INVESTMENT

BANKING

|

Source:

Elk Management, public company filings, FactSet as of 28-Mar-2024

¹

Traditional Bermuda Reinsurers include Renaissance Re, Everest Re, Axis Capital, and Fidelis (Since 03-Jul-2023 IPO, the earliest date

for available data). ² Other Bermuda Reinsurers include Hamilton (Since 13-Nov-2023 IPO, the earliest date for available data),

Greenlight Re and SiriusPoint.

| Elk Summary Preliminary Valuation Assessment | 19 | | |

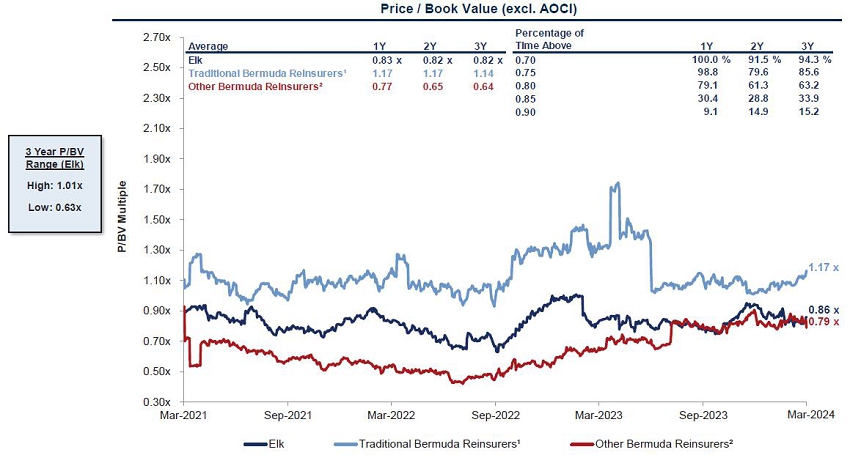

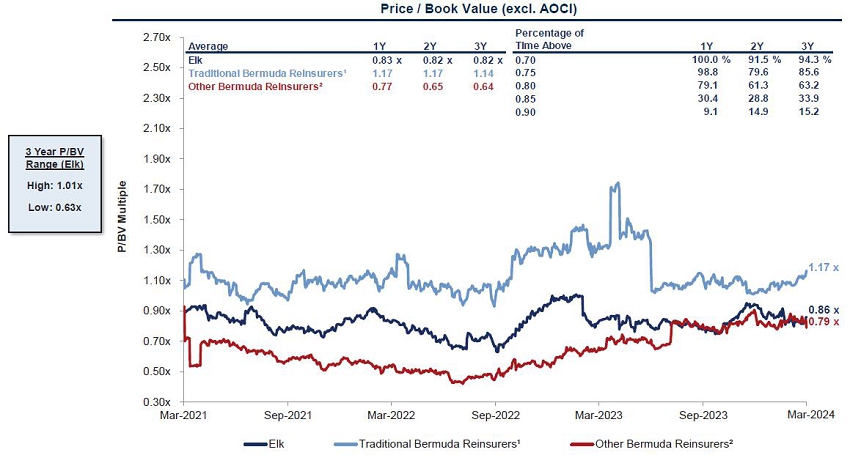

| Elk

Historical Valuation Compared to Peers

P/BV

Multiples | Last 3 Years

|

INVESTMENT

BANKING

|

Source:

FactSet as of 28-Mar-2024

¹

Traditional Bermuda Reinsurers include Renaissance Re, Everest Re, Axis Capital, and Fidelis (Since 03-Jul-2023 IPO, the earliest date

for available data). ² Other Bermuda Reinsurers include Hamilton (Since 13-Nov-2023 IPO, the earliest date for available data),

Greenlight Re and SiriusPoint.

| Elk Summary Preliminary Valuation Assessment | 20 | | |

| |

|

|

| |

|

DRAFT

- CONFIDENTIAL |

| |

|

|

| |

|

|

|

Detailed

Equity Capitalization and Share Count Table |

INVESTMENT

BANKING

|

| |

|

|

| |

Security

Type |

As

of Latest Public Filings

(YE 2023) |

As

Computed Per Stork

Proposal (YE 2023) |

|

| |

Voting

Ordinary Shares

|

14.631 |

14.631 |

|

| |

Restricted

Stock Units

|

0.131 |

|

|

| |

Performance

Stock Units

|

0.083 |

0.292 |

|

| |

Joint

Share Ownership Plan (Treasury Stock Method)

|

0.211 |

0.209 |

|

| |

|

|

|

|

| |

Fully

Diluted Shares Outstanding

|

15.056 |

15.133 |

|

| |

|

|

|

|

| |

(-)

Current Stork Ownership Shares

|

(0.714) |

- |

|

| |

Fully

Diluted Shares Outstanding (excl. Current Stork Ownership)

|

14.342 |

- |

|

Source:

Elk management, company filings as of YE 2023, Refinitiv, Stork IOI submitted on 24-Mar-2023

Note:

Based on Stork’s stated offer price of $4.948bn. Assumes PSUs granted Mar 1st in each respective year for purposes of change of

control pro-rata vesting.

| Elk Summary Preliminary Valuation Assessment | 21 | | |

| |

|

|

| |

|

DRAFT

- CONFIDENTIAL |

| |

|

|

| |

|

|

|

|

INVESTMENT

BANKING

|

| |

|

|

III.

Potential Next Steps

| |

|

|

| |

|

DRAFT

- CONFIDENTIAL |

| |

|

|

| |

|

|

|

Potential

Next Steps |

INVESTMENT

BANKING

|

| |

|

|

| ■ | Discussion

on how to engage with Stork |

| ■ | If

willing to engage, discuss potential responses to seek to optimize valuation outcome / other

key commercial terms |

| ■ | If

ultimately reach an agreement on valuation / other key commercial terms: |

—

Due diligence

—

Contracts

—

Financing syndication

| ■ | Agree

on plan to engage with other potential interested parties (process, market check, go shop,

fiduciary out, etc.) |

| |

|

|

| |

|

DRAFT

- CONFIDENTIAL |

| |

|

|

| |

|

|

|

|

INVESTMENT

BANKING

|

| |

|

|

Appendix

A: Additional Financial Materials

| |

|

|

| |

|

DRAFT

- CONFIDENTIAL |

| |

|

|

| |

|

|

|

Overview

of Elk Management Preliminary Projections

(1/2)

Income

Statement | ($ in millions)

|

INVESTMENT

BANKING

|

| |

|

|

| |

2022A |

2023A |

2024E |

2025E |

2026E |

2027E |

2028E |

2022A

- 2028E

CAGR |

| Technical

Result |

$

373 |

$

157 |

$

203 |

$

143 |

$

153 |

$

144 |

$

196 |

(10.1)% |

| Net

Investment Income (Core Fixed Income Return) |

(728) |

713 |

646 |

670 |

712 |

746 |

838 |

NM |

| Risk

Asset Return |

(431) |

397 |

411 |

451 |

551 |

635 |

692 |

NM |

| Other

Income |

35 |

279 |

10 |

16 |

16 |

16 |

14 |

(14.4) |

| Total

Revenue |

$(751) |

$

1,546 |

$

1,271 |

$

1,280 |

$

1,432 |

$

1,541 |

$

1,740 |

NM |

| G&A

Expenses |

(331) |

(369) |

(395) |

(405) |

(405) |

(395) |

(384) |

2.5

% |

| FVO

/ FVA / ULAE |

353 |

(26) |

39 |

34 |

44 |

58 |

74 |

(22.8) |

| Deferred

Charge Amortization |

(80) |

(106) |

(133) |

(137) |

(136) |

(138) |

(137) |

9.3 |

| Interest,

Pref Dividends & FX |

(110) |

(126) |

(131) |

(134) |

(137) |

(140) |

(143) |

4.4 |

| Income

Tax Benefit / (Expense) |

12 |

250 |

(4) |

(92) |

(115) |

(133) |

(166) |

NM |

| Net

Income Before Strategic Investments |

$(907) |

$

1,169 |

$

648 |

$

547 |

$

683 |

$

793 |

$

985 |

NM |

| Earnings

from Disc. Ops and NCI |

75 |

(100) |

(0) |

0 |

0 |

0 |

0 |

NM |

| Earnings

from Strategic Investments |

(74) |

13 |

12 |

25 |

25 |

25 |

25 |

NM |

| Net

Income |

$(906) |

$

1,082 |

$

659 |

$

572 |

$

708 |

$

818 |

$

1,010 |

NM |

Source:

Elk Management preliminary projections

Note:

Deferred Charge Amortization reflects amount by which estimated ultimate losses payable exceed consideration received at the inception

of a retroactive reinsurance agreement.

| Additional Financial Materials | 25 | | |

| | | |

| Overview

of Elk Management Preliminary Projections (2/2)

Balance Sheet | ($ in millions) | INVESTMENT

BANKING

|

|

2022A |

2023A |

2024E |

2025E |

2026E |

2027E |

2028E |

2022A - 2028E

CAGR |

| Cash and Investments |

$ 15,053 |

$ 14,893 |

$ 15,656 |

$ 17,181 |

$ 19,365 |

$ 21,512 |

$ 23,658 |

7.8 % |

| Restricted Cash |

508 |

266 |

266 |

266 |

266 |

266 |

266 |

(10.2) |

| Equity Method Investments |

397 |

334 |

346 |

371 |

396 |

421 |

446 |

1.9 |

| Funds Held by Reinsured Companies |

3,582 |

2,750 |

2,750 |

2,750 |

2,750 |

2,750 |

2,750 |

(4.3) |

| Other Assets |

1,483 |

1,712 |

1,760 |

1,734 |

1,728 |

1,716 |

1,708 |

2.4 |

| Total Assets |

$ 21,023 |

$ 19,955 |

$ 20,777 |

$ 22,302 |

$ 24,504 |

$ 26,665 |

$ 28,828 |

5.4 % |

|

Loss and LAE Reserves, Net |

$ 11,876 |

$ 11,402 |

$ 11,786 |

$ 12,821 |

$ 14,414 |

$ 15,932 |

$ 17,277 |

6.4 % |

| Life Insurance Reserves |

821 |

- |

- |

- |

- |

- |

- |

NM |

| Defendant A&E Liabilities, Net |

607 |

567 |

522 |

482 |

445 |

411 |

378 |

(7.6) |

| Debt |

1,829 |

1,831 |

1,831 |

1,831 |

1,831 |

1,831 |

1,831 |

0.0 |

| Other Liabilities |

562 |

508 |

469 |

435 |

390 |

332 |

258 |

(12.2) |

| Total Liabilities |

$ 15,695 |

$ 14,308 |

$ 14,607 |

$ 15,568 |

$ 17,081 |

$ 18,506 |

$ 19,744 |

3.9 % |

|

Preferred Equity |

$ 510 |

$ 510 |

$ 510 |

$ 510 |

$ 510 |

$ 510 |

$ 510 |

0.0 % |

| Common Equity |

4,464 |

5,025 |

5,547 |

6,110 |

6,800 |

7,537 |

8,461 |

11.2 |

| Total Shareholders Equity (excl. NCI) |

$ 4,974 |

$ 5,535 |

$ 6,057 |

$ 6,620 |

$ 7,310 |

$ 8,047 |

$ 8,971 |

10.3 % |

| Memo: Management Adjusted Common Equity |

$ 5,873 |

$ 5,391 |

$ 5,754 |

$ 6,192 |

$ 6,771 |

$ 7,509 |

$ 8,439 |

6.2 % |

| Memo: (Redeemable) Non-Controlling Interest |

$ 354 |

$ 113 |

$ 113 |

$ 113 |

$ 113 |

$ 113 |

$ 113 |

(17.3)% |

| Memo: URG / (L) from AFS Securities in AOCI |

$(579) |

$ 222 |

$ 113 |

$ 92 |

$ 82 |

$ 18 |

$ 14 |

NM |

| Memo: URG / (L) from HFT Securities in P&L |

$(1,181) |

$ 66 |

$ 91 |

$ 73 |

$ 66 |

$ 15 |

$ 11 |

NM |

Source:

Elk Management preliminary projections

Note: Other Assets composed of Deferred Charge Assets, Insurance Recoverables and Other Assets.

| Additional Financial Materials | 26 | | |

| | | |

| Elk

Historical Management Adjusted Book Value Reconciliation | INVESTMENT

BANKING

|

| |

YE 2021 |

YE 2022 |

|

YE 2023 |

| Total Equity |

$ 6,096 |

$ 5,160 |

|

$ 5,648 |

| (Non-Controlling Interest) |

- |

(186) |

|

(113) |

| (Preferred Shares) |

(510) |

(510) |

|

(510) |

| AOCI |

16 |

302 |

|

336 |

| Common Equity excl. AOCI |

$ 5,602 |

$ 4,766 |

|

$ 5,361 |

| Common Equity incl. AOCI |

5,586 |

4,464 |

|

5,025 |

| |

|

|

|

|

| Net URL / (G) on AFS Securities |

(89) |

647 |

|

|

| Net URL / (G) on HFT Securities |

(107) |

400 |

721 |

| Net URL / (G) on Funds Held - Directly Managed Securities |

(106) |

780 |

|

| Change in Fair Value of Insurance Contracts |

- |

(294) |

|

(246) |

| Fair Value Adjustments (Amortization) |

- |

(124) |

|

(108) |

| Adjusted Common Equity- Management View |

$ 5,284 |

$ 5,873 |

|

$ 5,391 |

| Memo: Reported ROE |

7.4 % |

(18.0)% |

|

22.8 % |

| Memo: Management Adjusted ROE |

10.5 % |

(1.1)% |

|

19.6 % |

Source: Company public filings

Note: Reported ROE and Management Adjusted ROE computed based on average

equity. Management publicly reports ROE and Adjusted ROE based off opening equity and opening adjusted equity. Figures depicted at time

of public filing.

| Additional Financial Materials | 27 | | |

| | | |

| Comparison

of Elk Management Preliminary Projections

Key

Value Drivers | ($ in millions, except for per share metrics) | INVESTMENT

BANKING

|

| |

January 2024 Preliminary Projections |

April 2024 Preliminary Projections |

Value ∆ (April vs. January) |

| |

2024E |

2025E |

2026E |

2027E |

2028E |

2024E-2028E

CAGR% |

2024E |

2025E |

2026E |

2027E |

2028E |

2024E-2028E

CAGR% |

2024E |

2025E |

2026E |

2027E |

2028E |

| Common

BV incl. AOCI |

$

5,555 |

$

5,979 |

$

6,561 |

$

7,296 |

$

8,236 |

10.3

% |

$

5,547 |

$

6,110 |

$

6,800 |

$

7,537 |

$

8,461 |

11.1

% |

$(8) |

$

131 |

$

239 |

$

241 |

$

225 |

| BVPS

incl. AOCI |

$

412 |

$

462 |

$

526 |

$

605 |

$

704 |

14.3

% |

$

391 |

$

439 |

$

496 |

$

559 |

$

635 |

12.9

% |

$(22) |

$(23) |

$(30) |

$(46) |

$(68) |

| Management

Adj. BV |

$

5,519 |

$

5,918 |

$

6,483 |

$

7,209 |

$

8,143 |

10.2

% |

$

5,754 |

$

6,192 |

$

6,771 |

$

7,509 |

$

8,439 |

10.0

% |

$

235 |

$

274 |

$

289 |

$

300 |

$

296 |

| Net

Income |

$

783 |

$

588 |

$

753 |

$

911 |

$

1,120 |

9.4

% |

$

659 |

$

572 |

$

708 |

$

818 |

$

1,010 |

11.2

% |

$(123) |

$(16) |

$(44) |

$(92) |

$(110) |

| Annual

New M&A |

$

3,500 |

$

3,500 |

$

4,000 |

$

4,000 |

$

4,000 |

3.4

% |

$

3,000 |

$

3,000 |

$

3,500 |

$

3,500 |

$

3,500 |

3.9

% |

$(500) |

$(500) |

$(500) |

$(500) |

$(500) |

| Annual

Repurchases |

$

500 |

$

200 |

$

200 |

$

200 |

$

200 |

(20.5)% |

$

250 |

$

100 |

$

100 |

$

100 |

$

100 |

(20.5)% |

$(250) |

$(100) |

$(100) |

$(100) |

$(100) |

| URG

- P&L |

$

199 |

$

29 |

$

24 |

$

19 |

$

17 |

(46.3)% |

$

91 |

$

73 |

$

66 |

$

15 |

$

11 |

(40.5)% |

$(108) |

$

44 |

$

42 |

$(4) |

$(5) |

| URG

- AOCI |

$

248 |

$

36 |

$

30 |

$

23 |

$

21 |

(46.3)% |

$

113 |

$

92 |

$

82 |

$

18 |

$

14 |

(40.5)% |

$(135) |

$

55 |

$

52 |

$(5) |

$(6) |

| ROE

incl. AOCI |

14.8

% |

10.2

% |

12.0

% |

13.1

% |

14.4

% |

(37)bps |

12.5

% |

9.8

% |

11.0

% |

11.4

% |

12.6

% |

15bps |

(232)bps |

(39)bps |

(103)bps |

(173)bps |

(179)bps |

| Management

Adj. ROE |

11.5

% |

10.5

% |

12.4

% |

13.5

% |

14.8

% |

327bps |

11.1

% |

9.1

% |

10.5

% |

11.8

% |

12.9

% |

184bps |

(42)bps |

(138)bps |

(186)bps |

(175)bps |

(186)bps |

Source: Elk Management preliminary projections

Note: Per share figures based on Elk management preliminary forecasted

standalone fully diluted shares outstanding as of respective year ends.

| Additional Financial Materials | 28 | | |

|

| INVESTMENT

BANKING

|

Appendix

B: Additional Stork Materials

| | | |

| Stork

Company Overview | INVESTMENT

BANKING

|

| | Stork Company Overview |

| ■ | Founded

in 2009, Stork is a global investment firm with over $75bn in assets under management and committed capital |

| — | Created

originally as TPG’s dedicated global credit and credit-related investing platform |

| — | Became

an independent business in May-2020 and announced the acquisition of Tiger in Jan-2021 |

| — | Stork

has over 200 investment professionals globally |

| ■ | Stork

has built an internal team dedicated to its insurance capabilities and, in addition to Tiger, has existing insurance investments in Europe

and Bermuda |

| — | $130bn

insurance assets under management, 600+ insurance portfolio company employees, and 25+ dedicated insurance professionals |

| — | Stork

pursues investments in the insurance sector primarily through the Stork TAO platform |

| — | Solutions

include block reinsurance, flow reinsurance, legal entity acquisitions and portfolio transfers |

| — | Additional

capabilities in Europe via pension risk transfer platforms in the Netherlands and UK |

| |

Key

Stork Insurance Solutions Personnel |

| |

|

|

| |

Michael Muscolino |

Rohan Singhal |

| |

Partner

Stork |

Partner

Stork |

Source:

Stork Website, Stork Financials, SNL Financial

Key

Metrics

| Stork |

| |

$75bn+

AUM and Committed Capital |

| |

600+

Insurance Portfolio Company Team Members |

| |

25+

Stork Dedicated Insurance Professionals |

Recent

Developments and Relevant Transactions

| ■ | Oct-2023:

Announced the appointment of Imran Siddiqui as the Chief Executive Officer of Tiger |

| ■ | Jul-2023:

Announced the appointment of Michael Smith as Executive Chairman of Tiger |

| ■ | Oct-2022:

Reinsurance from Guardian Life of $7bn VA reserves |

| ■ | Jan-2022:

Reinsurance from Principal Financial of $25bn in FA / ULSG reserves |

| ■ | Dec-2021:

Partner with Resolution Life to reinsure of $35bn of FA reserves from Allianz |

| ■ | Jan-2021:

Acquisition by Stork of Tiger platform from consortium led by Cornell Capital, Atlas Merchant Capital and TRB Advisors |

| ■ | Jan-2021:

$500mm preferred equity capital commitment to specialty insurance / reinsurance platform, Convex |

| Additional Stork Materials | 30 | | |

|

Summary of Stork

Due Diligence Areas of Focus

| INVESTMENT

BANKING

|

| Actuarial |

|

■ Refresh

of reserve adequacy analysis, with a focus on the recent large portfolios (QBE 2, Aspen, AXA ADC) as well as the general casualty

portfolios where Elk undertook reserve strengthening during its annual reserve deep dive process in Q4 2023 |

| |

|

|

| |

|

|

| Asset

/ ALM |

|

■ Review

CUSIP tape and validation of management investment income projections on the inforce asset

portfolio

■ Review

of marks of illiquid and semi-liquid asset classes (ABS, CLOs, below IG corporates, alternatives)

■ Review

of existing reinsurance trust investment guidelines, including opportunities to optimize strategic asset allocation further |

| |

|

|

| |

|

|

Financial

/

Accounting / Tax /

HR/ IT |

|

■ Customary

confirmatory due diligence, including quality of earnings review

■ Detailed

review of operating expense base of Elk, as well as better understanding Elk’s strategic forward plan on expense management |

| |

|

|

| |

|

|

| Legal

/ Regulatory |

|

■ Together

with the Elk, seek to determine required antitrust, FDI and regulatory approvals / regulatory compliance

■ Review

of reinsurance agreements, strategic partnership agreements and other key contracts for any implications or required consents upon

a change of control

■ Compliance matters, including insurance regulatory compliance, and understanding of any material litigation |

| |

|

|

Source: Stork IOI submitted

on 24-Mar-2023

| Additional Stork Materials | 31 | | |

| | INVESTMENT

BANKING

|

Appendix

C: Additional Process Materials

| Additional Process Materials | 33 | | |

|

Overview of Elk

Historical Counterparty Interactions

| INVESTMENT

BANKING

|

| Counterparties |

Discussion

Summaries |

| |

|

| |

|

| Stork |

■ Discussions

historically have included introductions to Elk's business model and management team, prospective

capital diversification benefits / accessibility, dividend capacity, historical financial

performance, new business returns and investment portfolio allocation and repositioning opportunities

■ In

November 2023, Stork agreed to purchase a minority common equity interest in Elk from CPPIB, who had been evaluating opportunities

to monetize a portion of their stake in Elk, for an aggregate price of $182.5mm |

| |

|

| |

|

|

■ Discussions

have included introductions to Elk's business model and management team, prospective capital

diversification benefits / accessibility, dividend capacity, investment portfolio allocation

and repositioning opportunities and joint business planning

■ Initially

attracted to potential capital diversification benefits from a combination, Elk's sourcing capabilities and asset portfolio

deployment opportunities

■ After

submitting an initial, non-binding proposal to acquire the Company, elected not to submit a binding proposal and halted pursuit of

a transaction given liquidity concerns, impact of inflation and ability to reposition the investment portfolio into desired strategies

at scale |

| |

|

| |

|

|

■ Discussions

included introductions to Elk's business model and management team, understanding current

investment portfolio al locations / investment guidelines and Elk liability characteristics

■ Elected

not to pursue a transaction; conveyed interest in potentially pursuing either a minority investment in Elk or investment management opportunities

—

Preferred structure was for Elk to acquire [***] ,

alongside minority investment into Elk, providing immediately liquidity for [***]

shareholders |

| |

|

|

■ Discussions

included introductions to Elk's business model and management team, understanding Elk's approach

to transaction pricing, understanding current investment portfolio allocations / investment

guidelines

■ Elected

not to pursue a transaction given overall size of the transaction (interested in pursuing

smaller joint venture opportunities) |

| |

|

| |

|

|

■ Discussions

included introductions to Elk's business model, understanding Elk's addressable market opportunity,

M&A pipeline, dividend capacity and overview of recent financial / investment portfolio

performance |

| |

|

| |

|

|

■ Discussions

included introductions to Elk's business model, understanding Elk's addressable market opportunity,

M&A pipeline, dividend capacity and overview of recent financial / investment portfolio

performance |

| Additional Process Materials | 34 | | |

|

Sale Process Alternative

Approaches

| INVESTMENT

BANKING

|

| |

|

|

| |

Full

Auction Process |

“Market

Check” Pre-Signing |

“Go-Shop”

Provision |

Fiduciary

Out |

|

■ Contact

broad list of credible potential buyers prior to signing of transaction |

■ Contact

a focused number of potential buyers prior to signing of a definitive agreement

■ Contact

typically made in the 2-4 week period prior to targeted signing

■ Process

may be extended if any buyers express legitimate interest |

■ Will

allow Elk to actively solicit other buyers for a period of time after signing definitive

merger agreement

■ During

the go-shop period, the level of deal protection may be reduced

■ Typically

includes a reduced termination fee during the go-shop period |

■ Standard

in M&A purchase agreements for public company targets

■ Allows

Board to terminate the deal to accept a superior offer from another company - typically subject to termination fee |

| |

|

|

|

|

|

ü Increases

probability of maximizing valuation / terms

ü Provides

greatest protection to Board

ü Buyers

more likely to engage in full auction process relative to post-announcement alternatives |

ü Provides opportunity for Board to check other buyers’ potential interest prior to signing

ü Potential

buyers may be more willing to engage pre-signing vs. post-announcement

— No break fee, private vs. public forum, not “breaking-up”

signed deal, etc.

ü As a public company, Elk is well known to most potential buyers, allowing them to move quickly if interested

ü May be undertaken as long as not limited by an exclusivity agreement with the bidder |

ü Provides structured opportunity to proactively / openly pursue other potential buyers

ü Easier for buyer to engage under “go-shop” provision

relative to only including fiduciary out provision |

ü Common

/ routine provision

ü Likely

no objection from the bidder |

| |

|

|

|

|

|

û Limited

number of motivated, credible buyers at high premium levels

û Requires

longer time period to execute

û Higher

degree of leak risk; difficult for a public company to manage

û Some

bidders may not participate in auction process |

û Depending

on timing, may have shorter period for parties to complete due diligence, which may modestly discourage some potential buyers from participation

û Significant leak risk

û Typically

contact “focused” list of potential buyers rather than exhaustive list

û Reaction

from the initial bidder? Potential to lose interest |

û Rare

feature, particularly in non-private equity transactions

— However, have seen feature in several insurance M&A deals over number of years

û Some

potential buyers may still be reluctant to engage / “break-up” public deal

û Other

buyers may be reluctant to pay break-up fee, even if at a lower level |

û Some

buyers may be reluctant to “break-up” a publicly announced deal

û

Requires payment of termination / break-up fee |

| Additional Process Materials | 35 | | |

| | INVESTMENT

BANKING

|

Appendix

D: Elk Additional Reference Materials

|

Evolution

of Elk’s Shareholder Base

Top

20 Institutional & Individual Holders

|

INVESTMENT

BANKING

|

| |

|

|

|

Q1 '24 |

|

Historical

Positions (% OS) |

| |

|

|

Position |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Refinitiv |

AUM |

Entry |

Cost |

|

Unrealized |

|

Shares |

|

|

|

|

|

|

|

|

| Institution |

Style |

($bn) |

Date1 |

Basis2 |

|

Gain3 |

%

OS |

(mm) |

|

Q4

'23 |

Q3

'23 |

Q2

'23 |

Q1

'23 |

Q4

'22 |

Q3

'22 |

Q2

'22 |

| Stone Point Capital LLC |

Strategic |

$ 1.1 |

Q4 '15 |

$ 157.42 |

97.4

% |

9.5 % |

1.5 |

9.5

% |

9.6

% |

9.6

% |

9.7

% |

9.7

% |

8.8

% |

8.8 % |

| Vanguard |

Index |

5,414.5 |

Q4 '04 |

158.94 |

95.5 |

8.4 |

1.3 |

8.4 |

8.0 |

8.1 |

6.9 |

6.9 |

6.2 |

6.1 |

| BlackRock Institutional Trust

Co. |

Index |

3,215.7 |

Q2 '07 |

142.29 |

118.4 |

5.6 |

0.9 |

5.6 |

4.9 |

4.9 |

4.7 |

4.6 |

4.1 |

4.2 |

| Dimensional Fund Advisors |

Quantitative |

513.8 |

Q1 '09 |

163.51 |

90.1 |

4.8 |

0.7 |

4.8 |

4.3 |

4.1 |

4.1 |

4.2 |

3.8 |

3.8 |

| Stork |

Other |

1.3 |

Q4 '23 |

265.42 |

17.1 |

4.7 |

0.7 |

4.7 |

|

|

|

|

|

|

| Beck, Mack & Oliver |

GARP |

4.3 |

Q2 '05 |

94.04 |

230.5 |

4.4 |

0.7 |

4.4 |

4.2 |

4.3 |

4.3 |

4.3 |

3.8 |

3.9 |

| CPP Investment Board |

Pension |

140.1 |

Q2 '15 |

151.16 |

105.6 |

4.3 |

0.6 |

4.3 |

9.4 |

9.4 |

9.4 |

9.4 |

8.5 |

8.5 |

| Silvester (Dominic Francis

Michael) |

Strategic |

0.2 |

Q2 '07 |

124.30 |

150.0 |

4.0 |

0.6 |

4.0 |

3.8 |

3.8 |

3.7 |

3.7 |

3.3 |

3.3 |

| Fidelity Management & Research

Company LLC |

GARP |

1,367.0 |

Q2 '13 |

181.72 |

71.0 |

3.7 |

0.6 |

3.7 |

4.6 |

4.7 |

4.7 |

4.6 |

4.2 |

4.5 |

| Fuller & Thaler Asset Management

Inc. |

GARP |

19.8 |

Q1 '19 |

202.98 |

53.1 |

3.2 |

0.5 |

3.2 |

3.2 |

3.3 |

3.3 |

3.3 |

2.7 |

1.9 |

| Wellington |

Value |

607.1 |

Q3 '15 |

171.29 |

81.4 |

3.1 |

0.5 |

3.1 |

3.5 |

4.7 |

6.5 |

6.3 |

5.1 |

5.9 |

| Allspring Global Investments,

LLC |

Value |

69.7 |

Q4 '18 |

184.06 |

68.8 |

2.6 |

0.4 |

2.6 |

2.5 |

2.5 |

2.5 |

2.5 |

2.2 |

2.1 |

| Hotchkis and Wiley Capital

Management, LLC |

Value |

28.2 |

Q4 '13 |

186.95 |

66.2 |

2.2 |

0.3 |

2.2 |

2.1 |

1.6 |

2.0 |

2.1 |

1.8 |

1.5 |

| State Street Global Advisors

(US) |

Index |

2,113.4 |

Q2 '03 |

141.19 |

120.1 |

2.0 |

0.3 |

2.0 |

1.8 |

1.7 |

1.8 |

1.7 |

1.5 |

1.5 |

| Geode Capital Management, L.L.C. |

Index |

1,113.9 |

Q1 '06 |

182.80 |

70.0 |

1.9 |

0.3 |

1.9 |

1.7 |

1.6 |

1.6 |

1.5 |

1.3 |

1.3 |

| O'Shea (Paul James) |

Strategic |

0.1 |

Q2 '07 |

121.88 |

155.0 |

1.6 |

0.2 |

1.6 |

1.5 |

1.5 |

1.5 |

1.5 |

1.4 |

1.4 |

| Campbell (Robert Johnson) |

Strategic |

0.1 |

Q2 '08 |

119.37 |

160.3 |

1.2 |

0.2 |

1.2 |

1.2 |

1.2 |

1.0 |

1.0 |

0.9 |

0.9 |

| Harspring Capital Management,

LLC |

Hedge Fund |

0.4 |

Q4 '22 |

238.93 |

30.1 |

1.1 |

0.2 |

1.1 |

1.1 |

0.8 |

0.6 |

0.1 |

|

|

| Capital Research |

Growth |

774.1 |

Q1 '22 |

244.00 |

27.4 |

1.1 |

0.2 |

1.1 |

1.0 |

1.0 |

1.0 |

1.0 |

0.8 |

0.6 |

| Charles Schwab Investment Management,

Inc. |

Index |

473.6 |

Q3 '07 |

177.62 |

75.0 |

0.9 |

0.1 |

0.9 |

0.9 |

0.9 |

0.9 |

0.9 |

0.8 |

0.7 |

| Total |

|

|

|

|

|

70.5 % |

10.7 |

70.5

% |

69.3

% |

69.7

% |

70.2

% |

69.2

% |

61.4

% |

60.9 % |

| Median |

|

|

|

$

167.40 |

85.7

% |

|

|

|

|

|

|

|

|

|

|

Source:

Refinitiv

1

Quarter of the investors most recent position initiation in the security. Resets whenever the investor sells out completely. ²

Calculated as the weighted average cost of current shares held based on quarterly VWAPs and all share purchases from Q1 '05 – Q1

‘24. ³ Based on share price at market close on 28-Mar-2024.

| Elk Additional Reference Materials | 37 | | |

|

Elk

is Thinly Covered by Analysts, Making the Business Difficult to Model Externally

Selected

Peer Research Coverage

|

INVESTMENT

BANKING

|

| Company |

Number

of Analysts Covering |

Earnings

Calls |

Research

Coverage |

| Elk |

1 |

|

|

|

1 |

|

|

|

1 |

|

|

|

13 |

|

|

|

14 |

|

|

|

8 |

|

|

|

8 |

|

|

|

7 |

|

|

Source:

FactSet, Company websites

| Elk Additional Reference Materials | 38 | | |

|

Elk

ADTV Relative to Peers

|

INVESTMENT

BANKING

|

| |

ADTV |

|

%

of Float |

| |

|

|

|

|

|

|

|

| |

1M |

3M |

6M |

Free

Float |

1M |

3M |

6M |

| Elk |

54,210 |

52,775 |

44,143 |

12,670,707 |

0.43

% |

0.42

% |

0.35

% |

| Traditional

Bermuda Reinsurers |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| EG |

359,214 |

383,083 |

392,296 |

33,075,574 |

1.09

% |

1.16

% |

1.19

% |

| RNR |

288,498 |

371,537 |

434,937 |

51,676,368 |

0.56

% |

0.72

% |

0.84

% |

| AXS |

542,492 |

627,523 |

571,207 |

77,477,043 |

0.70

% |

0.81

% |

0.74

% |

| FIHL |

963,950 |

613,087 |

440,700 |

37,358,696 |

2.58

% |

1.64

% |

1.18

% |

| Other

Bermuda Reinsurers |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| HG |

489,431 |

256,849 |

309,058 |

47,047,714 |

1.04

% |

0.55

% |

0.66

% |

| SPNT |

623,606 |

624,437 |

596,704 |

93,079,146 |

0.67

% |

0.67

% |

0.64

% |

| GLRE |

87,898 |

82,511 |

86,035 |

25,851,187 |

0.34

% |

0.32

% |

0.33

% |

| |

|

|

|

|

|

|

|

| Median

- Traditional Bermuda Reinsurers |

450,853 |

498,085 |

437,819 |

44,517,532 |

0.89

% |

0.98

% |

1.01

% |

| |

|

|

|

|

|

|

|

| Median

- Other Bermuda Reinsurers |

489,431 |

256,849 |

309,058 |

47,047,714 |

0.67

% |

0.55

% |

0.64

% |

Source:

Bloomberg, CapIQ, Market data as of 28-Mar-2024

| Elk Additional Reference Materials | 39 | | |

| |

STRICTLY PRIVATE & CONFIDENTIAL |

DRAFT - CONFIDENTIAL |

| | INVESTMENT

BANKING

|

Project Elk

Board Follow Up

Goldman Sachs & Co. LLC

April 4, 2024

Goldman Sachs does not provide accounting, tax, or legal

advice. Notwithstanding anything in this document to the contrary, and except as required to enable compliance with applicable securities

law, you (and each of your employees, representatives, and other agents) may disclose to any and all persons the US federal income and

state tax treatment and tax structure of the transaction and all materials of any kind (including tax opinions and other tax analyses)

that are provided to you relating to such tax treatment and tax structure, without Goldman Sachs imposing any limitation of any kind.

|

Elk’s Price to Book Value Multiple Over Time

Last 5 Years

| INVESTMENT

BANKING

|

Source:

Company filings, FactSet as of 28-Mar-2024. 1Adjusted

for net realized and unrealized gains / (losses) on fixed maturities available for sale, fixed maturities trading, and funds held, change

in fair value of insurance contracts, and amortization of fair value adjustments.

| Elk Summary Preliminary Valuation Assessment | 2 | | |

|

Elk Summary Dividend Discount Model (1/2)

Base Case | ($ in millions, unless otherwise noted)

| INVESTMENT

BANKING |

Summary of Book Value Generation and Cash

Flow Distributions

| |

2023A |

2024E |

2025E |

2026E |

2027E |

2028E |

| BoP Book Value |

|

$ 5,025 |

$ 5,547 |

$ 6,110 |

$ 6,800 |

$ 7,537 |

| (+) Earnings |

|

659 |

572 |

708 |

818 |

1,010 |

| (-) Share Repurchases |

|

(250) |

(100) |

(100) |

(100) |

(100) |

| (+) OCI Change |

|

113 |

92 |

82 |

18 |

14 |

| EoP Book Value (incl. AOCI) |

$ 5,025 |

$ 5,547 |

$ 6,110 |

$ 6,800 |

$ 7,537 |

$ 8,461 |

| + / (-) AOCI |

336 |

$ 223 |

$ 131 |

$ 49 |

$ 31 |

$ 17 |

| EoP Book Value (excl. AOCI) |

$ 5,361 |

$ 5,769 |

$ 6,241 |

$ 6,849 |

$ 7,568 |

$ 8,478 |

| EoP Book Value (incl. AOCI) |

$ 5,025 |

$ 5,547 |

$ 6,110 |

$ 6,800 |

$ 7,537 |

$ 8,461 |

| (+) Net URL / (G) on AFS/HFT/Funds Held Securities |

721 |

517 |

352 |

204 |

172 |

146 |

| (-) Change in Fair Value of Insurance Contracts |

(246) |

(211) |