Please wait

Exhibit (c)(vi)

STRICTLY

PRIVATE & CONFIDENTIAL

|

[***]

indicates information has been omitted on the basis of a confidential treatment request pursuant

to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been

filed separately with the Securities and Exchange Commission. | INVESTMENT

BANKING

|

Project Elk

Presentation to the Board of Directors

Goldman Sachs & Co. LLC

July 28, 2024

Goldman Sachs does not provide accounting, tax, or

legal advice. Notwithstanding anything in this document to the contrary, and except as required to enable compliance with applicable securities

law, you (and each of your employees, representatives, and other agents) may disclose to any and all persons the US federal income and

state tax treatment and tax structure of the transaction and all materials of any kind (including tax opinions and other tax analyses)

that are provided to you relating to such tax treatment and tax structure, without Goldman Sachs imposing any limitation of any kind.

STRICTLY PRIVATE & CONFIDENTIAL

|

Disclaimer

| INVESTMENT

BANKING

|

These materials have been

prepared and are provided by Goldman Sachs on a confidential basis solely for the information and assistance of the Board of Directors

and senior management of Elk (the "Company") in connection with their consideration of the matters referred to herein. These

materials and Goldman Sachs’ presentation relating to these materials (the “Confidential Information”) may not be disclosed

to any third party or circulated or referred to publicly or used for or relied upon for any other purpose without the prior written consent

of Goldman Sachs. The Confidential Information was not prepared with a view to public disclosure or to conform to any disclosure standards

under any state, federal or international securities laws or other laws, rules or regulations, and Goldman Sachs does not take any responsibility

for the use of the Confidential Information by persons other than those set forth above. Notwithstanding anything in this Confidential

Information to the contrary, the Company may disclose to any person the US federal income and state income tax treatment and tax structure

of any transaction described herein and all materials of any kind (including tax opinions and other tax analyses) that are provided to

the Company relating to such tax treatment and tax structure, without Goldman Sachs imposing any limitation of any kind. The Confidential

Information has been prepared by the Investment Banking Division of Goldman Sachs and is not a product of its research department.

Goldman Sachs and its affiliates

are engaged in advisory, underwriting and financing, principal investing, sales and trading, research, investment management and other

financial and non-financial activities and services for various persons and entities. Goldman Sachs and its affiliates and employees,

and funds or other entities they manage or in which they invest or have other economic interests or with which they co-invest, may at

any time purchase, sell, hold or vote long or short positions and investments in securities, derivatives, loans, commodities, currencies,

credit default swaps and other financial instruments of the Company, any other party to any transaction and any of their respective affiliates

or any currency or commodity that may be involved in any transaction. Goldman Sachs’ investment banking division maintains regular,

ordinary course client service dialogues with clients and potential clients to review events, opportunities, and conditions in particular

sectors and industries and, in that connection, Goldman Sachs may make reference to the Company, but Goldman Sachs will not disclose any

confidential information received from the Company.

The Confidential Information

has been prepared based on historical financial information, forecasts and other information obtained by Goldman Sachs from publicly available

sources, the management of the Company or other sources (approved for our use by the Company in the case of information from management

and non-public information). In preparing the Confidential Information, Goldman Sachs has relied upon and assumed, without assuming any

responsibility for independent verification, the accuracy and completeness of all of the financial, legal, regulatory, tax, accounting

and other information provided to, discussed with or reviewed by us, and Goldman Sachs does not assume any liability for any such information.

Goldman Sachs does not provide accounting, tax, legal or regulatory advice.

Goldman Sachs has not made

an independent evaluation or appraisal of the assets and liabilities (including any contingent, derivative or other off-balance sheet

assets and liabilities) of the Company or any other party to any transaction or any of their respective affiliates and has no obligation

to evaluate the solvency of the Company or any other party to any transaction under any state or federal laws relating to bankruptcy,

insolvency or similar matters. The analyses contained in the Confidential Information do not purport to be appraisals nor do they necessarily

reflect the prices at which businesses or securities actually may be sold or purchased. Goldman Sachs’ role in any due diligence

review is limited solely to performing such a review as it shall deem necessary to support its own advice and analysis and shall not be

on behalf of the Company. Analyses based upon forecasts of future results are not necessarily indicative of actual future results, which

may be significantly more or less favorable than suggested by these analyses, and Goldman Sachs does not assume responsibility if future

results are materially different from those forecast.

The Confidential Information

does not address the underlying business decision of the Company to engage in any transaction, or the relative merits of any transaction

or strategic alternative referred to herein as compared to any other transaction or alternative that may be available to the Company.

The Confidential Information is necessarily based on economic, monetary, market and other conditions as in effect on, and the information

made available to Goldman Sachs as of, the date of such Confidential Information and Goldman Sachs assumes no responsibility for updating

or revising the Confidential Information based on circumstances, developments or events occurring after such date. The Confidential Information

does not constitute any opinion, nor does the Confidential Information constitute a recommendation to the Board, any security holder

of the Company or any other person as to how to vote or act with respect to any transaction or any other matter. The Confidential Information,

including this disclaimer, is subject to, and governed by, any written agreement between the Company, the Board and/or any committee

thereof, on the one hand, and Goldman Sachs, on the other hand. The Confidential Information does not address, nor does Goldman Sachs

express any view as to, the potential effects of volatility in the credit, financial and stock markets on the Company, any other party

to any transaction or any transaction.

STRICTLY

PRIVATE & CONFIDENTIAL

|

Table

of Contents

| INVESTMENT

BANKING

|

| |

I. |

Transaction Overview and Recent Trading |

| |

|

| |

|

| |

|

| |

II. |

Financial Projections |

| |

|

| |

|

| |

|

| |

III. |

Elk Financial Analysis |

| |

Appendix A: Additional Materials |

STRICTLY

PRIVATE & CONFIDENTIAL

|

| INVESTMENT

BANKING

|

| |

I. |

Transaction Overview and Recent Trading |

STRICTLY

PRIVATE & CONFIDENTIAL

|

Elk

Transaction Multiples

($

in millions) | INVESTMENT

BANKING

|

| Aggregate

Total Cash Consideration¹ |

|

|

$

5,137 |

|

|

|

|

|

| Total

Cash Consideration |

|

|

$

338.00 |

|

Reference

Valuation |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

Peer

Trading Comparables |

|

|

| |

|

|

|

|

Traditional |

|

|

|

| |

|

|

Total Cash |

|

Bermuda |

Other

Bermuda |

Precedent |

|

| Metric |

|

Value |

Consideration |

|

Reinsurers² |

Reinsurers³ |

Transactions |

|

| Implied

Purchase Premiums |

|

|

|

|

|

|

|

|

| Day

Before Stork Letter (22-Mar-2024) |

|

$

292.50 |

15.6

% |

|

|

|

|

|

| Day

Before Revised Elk Offer (08-Apr-2024) |

|

292.80 |

15.4 |

|

|

|

|

|

| Current

Stock Price (26-Jul-2024) |

|

348.31 |

(3.0) |

|

|

|

|

|

| Undisturbed

Share Price (28-Jun-2024) |

|

305.70 |

10.6 |

|

|

|

|

|

| All-Time-High

(30-May-2024)4 |

|

314.83 |

7.4 |

|

|

|

|

|

| 52-Week-High

(30-May-2024)4 |

|

314.83 |

7.4 |

|

|

|

|

|

| 52-Week-Low

(20-Oct-2023)4 |

|

232.05 |

45.7 |

|

|

|

|

|

| 30-Day

VWAP4 |

|

307.32 |

10.0 |

|

|

|

|

|

| 60-Day

VWAP4 |

|

302.24 |

11.8 |

|

|

|

|

|

| 90-Day

VWAP4 |

|

301.26 |

12.2 |

|

|

|

|

|

| |

Standalone |

|

|

|

|

|

|

|

| Implied

Price / Book Value Multiples |

Per

Share6 |

|

|

|

|

|

|

|

| Q2

2024 Book Value (incl. AOCI) |

$

351 |

$

5,261 |

0.98

x |

|

|

1.09

x |

|

| Q2

2024 Book Value (excl. AOCI) |

375 |

5,618 |

0.91 |

|

|

|

1.18 |

|

| Q2

2024 Book Value (Management Adjusted)5 |

381 |

5,713 |

0.90 |

|

|

|

- |

|

| Q1

2024 Book Value (incl. AOCI) |

342 |

5,122 |

1.00 |

|

1.25

x |

0.90

x |

|

|

| Q1

2024 Book Value (excl. AOCI) |

366 |

5,486 |

0.94 |

|

1.17 |

0.90 |

|

|

| Q1

2024 Book Value (Management Adjusted)5 |

370 |

5,551 |

0.93 |

|

- |

- |

|

|

| Implied

Price / Mangement Projected Earnings Multiples |

|

|

|

|

|

|

|

|

| 2024E

Earnings - Per Management |

|

$

659 |

7.8

x |

6.2

x |

7.1

x |

- |

|

| 2025E

Earnings - Per Management |

|

572 |

9.0 |

|

6.1 |

8.0 |

- |

|

Source: Elk Management projections, FactSet, Company filings. Market

data as of 26-Jul-2024 unless otherwise stated. Q2 2024 Elk figures as provided by Elk Management. ¹ Based on Elk computed diluted

shares outstanding inclusive of ordinary shares, non-voting ordinary shares, RSUs, PSUs and JSOP shares as of 25-Jul-2024 as provided

by Elk Management. 2 Traditional Bermuda Reinsurers include Everest Re, RenaissanceRe, Axis Capital, and Fidelis. 3

Other Bermuda Reinsurers include Hamilton, Greenlight Re and SiriusPoint. 4 Relative to Elk’s undisturbed date (28-Jun-2024).

5 Adjusted for net realized and unrealized gains / (losses) on fixed maturities available for sale, fixed maturities trading,

and funds held, change in fair value of insurance contracts, and amortization of fair value adjustments. 6 BVPS metrics when

applying fully diluted shares outstanding per total cash consideration inclusive of ordinary shares, non-voting ordinary shares, RSUs,

PSUs and JSOP shares as of 25-Jul-2024 as provided by Elk Management result in Q2 BVPS incl. AOCI of $346, Q2 BVPS excl. AOCI of $370,

and Q2 Management Adjusted BVPS of $376.

| Transaction Overview and Recent Trading | 5 | | |

STRICTLY

PRIVATE & CONFIDENTIAL

|

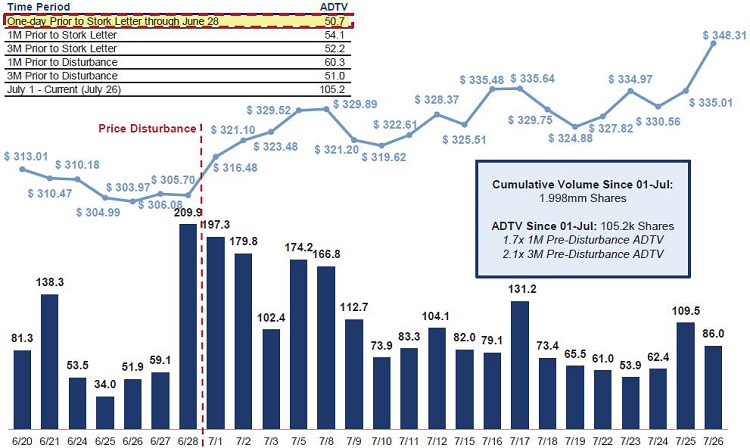

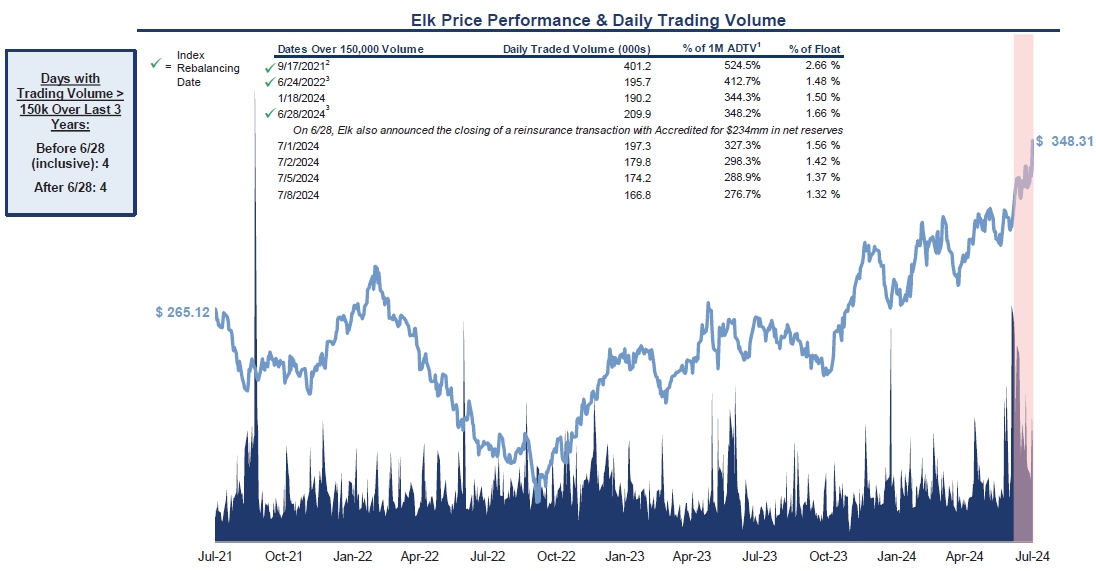

Recent

Elk Trading Activity

| INVESTMENT

BANKING

|

| |

Elk

Daily Trading Volume (Thousands of Shares) |

| |

|

| |

|

| |

Source:

Bloomberg; market data as of 26-Jul-2024

Note: Stork Letter received on 23-Mar-2024.

|

| Transaction Overview and Recent Trading | 6 | | |

STRICTLY

PRIVATE & CONFIDENTIAL

|

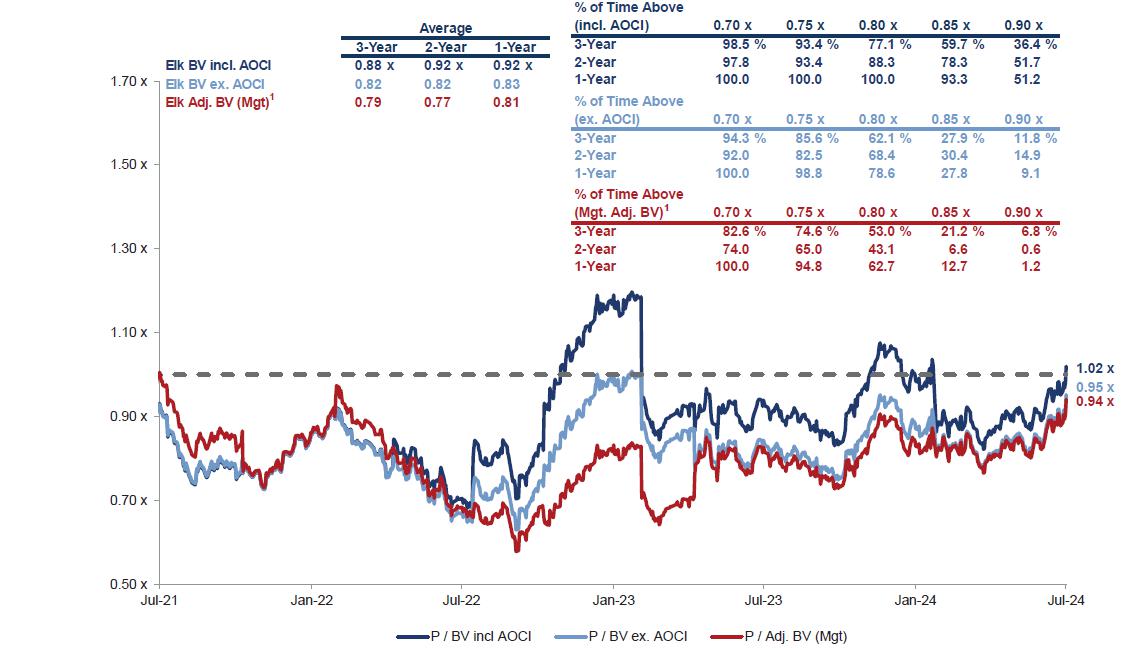

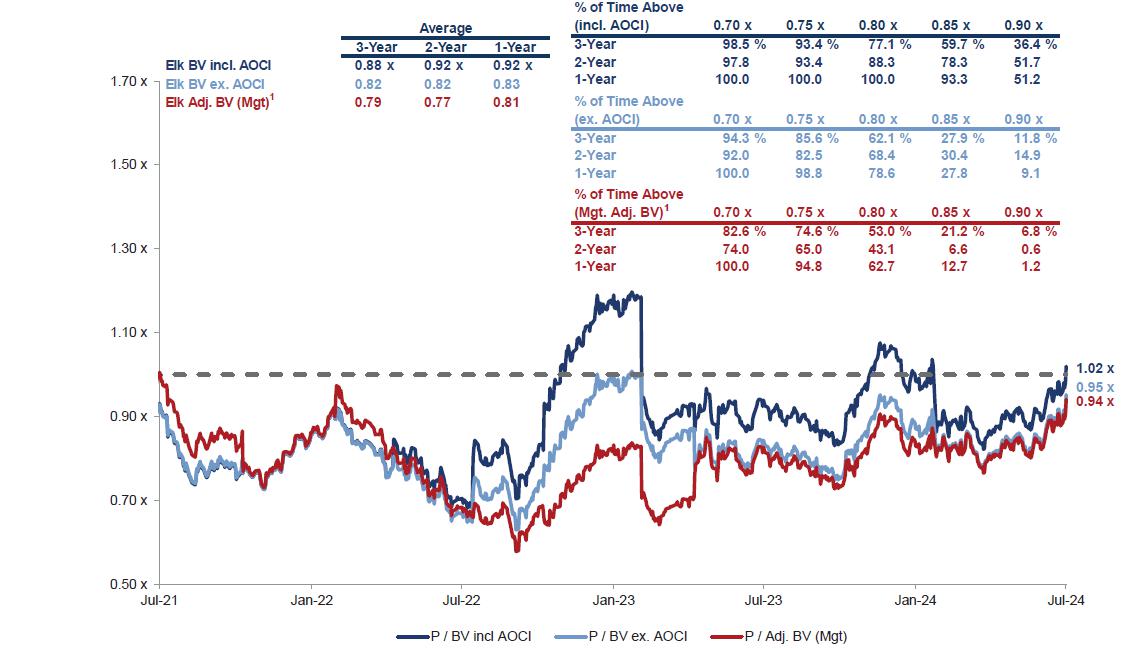

Elk’s

Price to Book Value Multiple Over Time

|

INVESTMENT

BANKING

|

| |

|

|

| |

|

|

Source:

Company filings, FactSet. Note: Multiples chart as of 26-Jul-2024 for reference. Tables depicted as of Elk undisturbed date (28-Jun-2024).

1 Adjusted for net realized and unrealized gains / (losses) on fixed maturities available for sale, fixed maturities trading,

and funds held, change in fair value of insurance contracts, and amortization of fair value adjustments.

| Transaction Overview and Recent Trading | 7 | | |

STRICTLY

PRIVATE & CONFIDENTIAL

|

|

INVESTMENT

BANKING

|

| |

|

|

| |

|

|

II. Financial Projections

STRICTLY

PRIVATE & CONFIDENTIAL

|

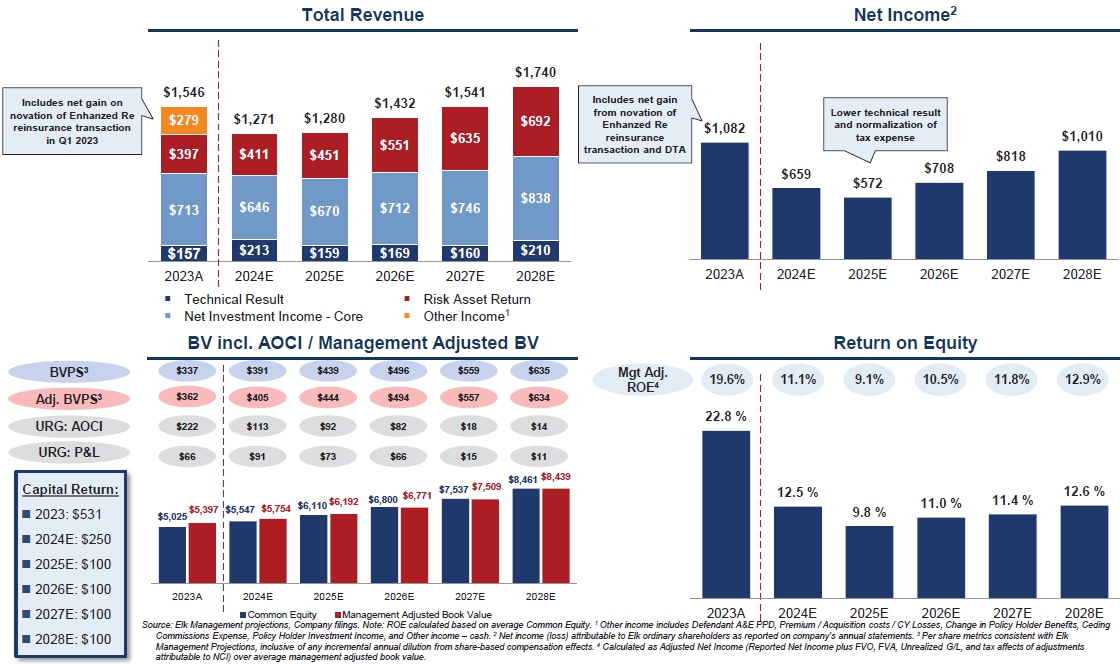

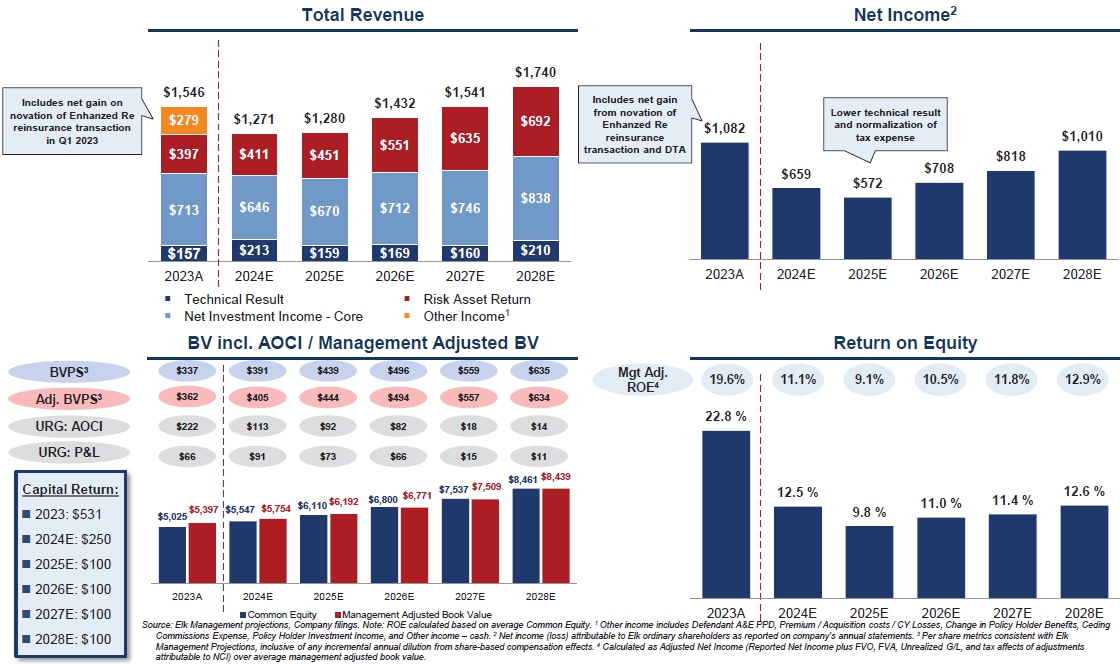

Overview

of Elk Management Projections

($

in millions, except per share data)

|

INVESTMENT

BANKING

|

| |

|

|

| |

|

|

STRICTLY

PRIVATE & CONFIDENTIAL

|

|

INVESTMENT

BANKING

|

| |

|

|

| |

|

|

III.

Elk Financial Analysis

STRICTLY

PRIVATE & CONFIDENTIAL

|

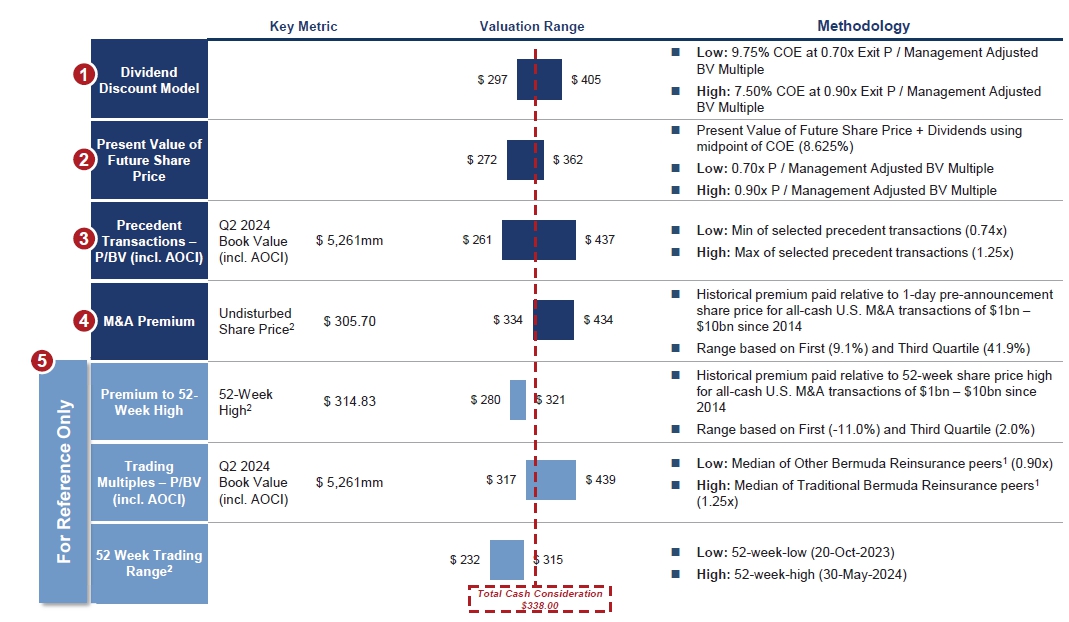

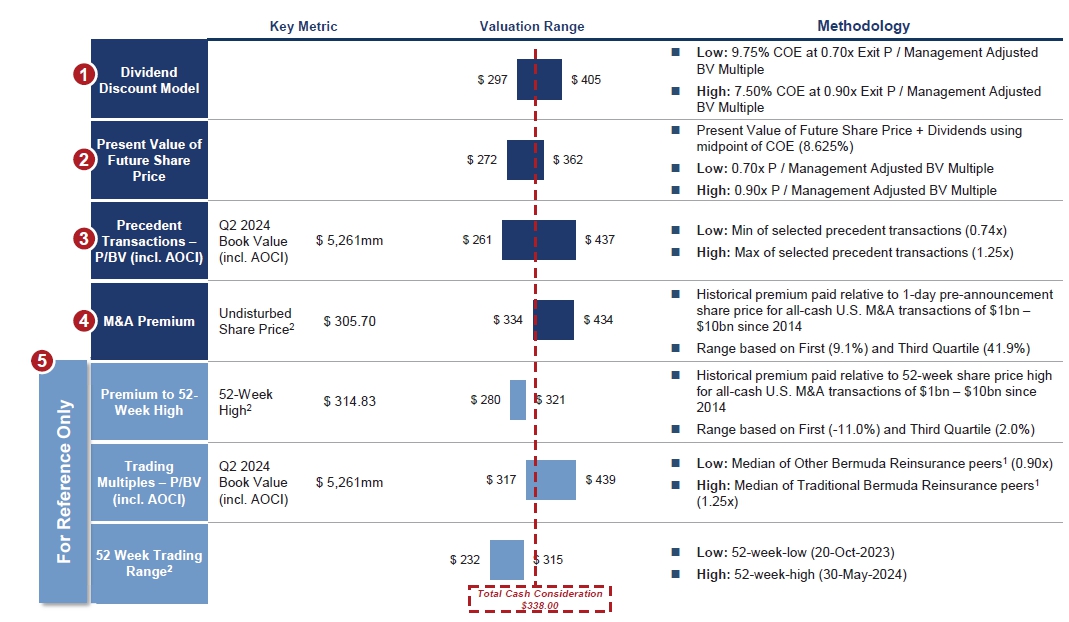

Summary

of Financial Analyses

($

per share, unless otherwise indicated)

|

INVESTMENT

BANKING

|

| |

|

|

| |

|

|

Source:

Elk Management projections, Company filings, FactSet. Market data as of 26-Jul-2024 unless otherwise stated. Note: Per share metrics

based on Elk computed diluted shares outstanding inclusive of ordinary shares, non-voting ordinary shares, RSUs, PSUs and JSOP shares

as of 25-Jul-2024 as provided by Elk Management; Q2 2024 Elk figures as provided by Elk Management. 1 Traditional Bermuda

Reinsurers include RenaissanceRe, Everest Re, Axis Capital and Fidelis; Other Bermuda Reinsurers include Hamilton, Greenlight Re and

SiriusPoint; RenaissanceRe data as of Q2 2024, all other peers as of Q1 2024 based on latest public filings. 2 As of Elk undisturbed

date (28-Jun-2024).

| Elk Financial Analysis | 11 | | |

| |

STRICTLY

PRIVATE & CONFIDENTIAL |

|

|

|

Summary

Dividend Discount Model

($

in millions, unless otherwise noted)

|

INVESTMENT

BANKING

|

Summary

of Book Value Generation and Cash Flow Distributions

| |

H1'24A |

H2'24E |

2025E |

2026E |

2027E |

2028E |

| BoP

Book Value |

|

$

5,261 |

$

5,547 |

$

6,110 |

$

6,800 |

$

7,537 |

| (+)

Earnings |

|

414 |

572 |

708 |

818 |

1,010 |

| (-)

Share Repurchases |

|

(250) |

(100) |

(100) |

(100) |

(100) |

| (+)

OCI Change |

|

122 |

92 |

82 |

18 |

14 |

| EoP

Book Value (incl. AOCI) |

$

5,261 |

$

5,547 |

$

6,110 |

$

6,800 |

$

7,537 |

$

8,461 |

| +

/ (-) AOCI |

357 |

$

223 |

$

131 |

$

49 |

$

31 |

$

17 |

| EoP

Book Value (excl. AOCI) |

$

5,618 |

$

5,769 |

$

6,241 |

$

6,849 |

$

7,568 |

$

8,478 |

| EoP

Book Value (incl. AOCI) |

$

5,261 |

$

5,547 |

$

6,110 |

$

6,800 |

$

7,537 |

$

8,461 |

| (+)

Net URL / (G) on AFS/HFT/Funds Held Securities |

803 |

517 |

352 |

204 |

172 |

146 |

| (-) Fair Value of Insurance Contracts |

(253) |

(211) |

(180) |

(152) |

(126) |

(102) |

| (-)

Fair Value Adjustment |

(98) |

(99) |

(89) |

(81) |

(73) |

(66) |

| Management

Adj. Book Value |

$

5,713 |

$

5,754 |

$

6,192 |

$

6,771 |

$

7,509 |

$

8,439 |

| |

|

|

|

|

|

|

| Distributable

Cash Flows |

|

$

250 |

$

100 |

$

100 |

$

100 |

$

100 |

| |

Sensitivity

Analysis |

|

|

|

|

| |

|

|

Elk

Implied Share Price |

| |

|

|

|

| |

|

|

Discount

Rate |

| |

|

|

7.50

% |

8.06

% |

8.63

% |

9.19

% |

9.75

% |

| |

|

0.70

x |

$

323 |

$

316 |

$

310 |

$

303 |

$

297 |

| |

0.75

x |

344 |

336 |

329 |

322 |

315 |

| |

0.80

x |

364 |

356 |

349 |

341 |

334 |

| |

0.85

x |

384 |

376 |

368 |

360 |

352 |

| |

0.90

x |

405 |

396 |

387 |

379 |

371 |

Source: Elk Management

projections, FactSet, Company filings. Note: Market Data as of 26-Jul-2024; Q2 2024 Elk figures as provided by Elk Management; Per share

metrics based on Elk reported diluted shares outstanding inclusive of ordinary shares, non-voting ordinary shares, RSUs, PSUs and JSOP

shares as of 30-Jun-2024 as provided by Elk Management. Adjusted Book Value adjusts for net realized and unrealized gains / (losses)

on fixed maturities available for sale, fixed maturities trading, and funds held, change in fair value of insurance contracts, and amortization

of fair value adjustments.

| Elk Financial Analysis | 12 | | |

| |

STRICTLY

PRIVATE & CONFIDENTIAL |

|

|

|

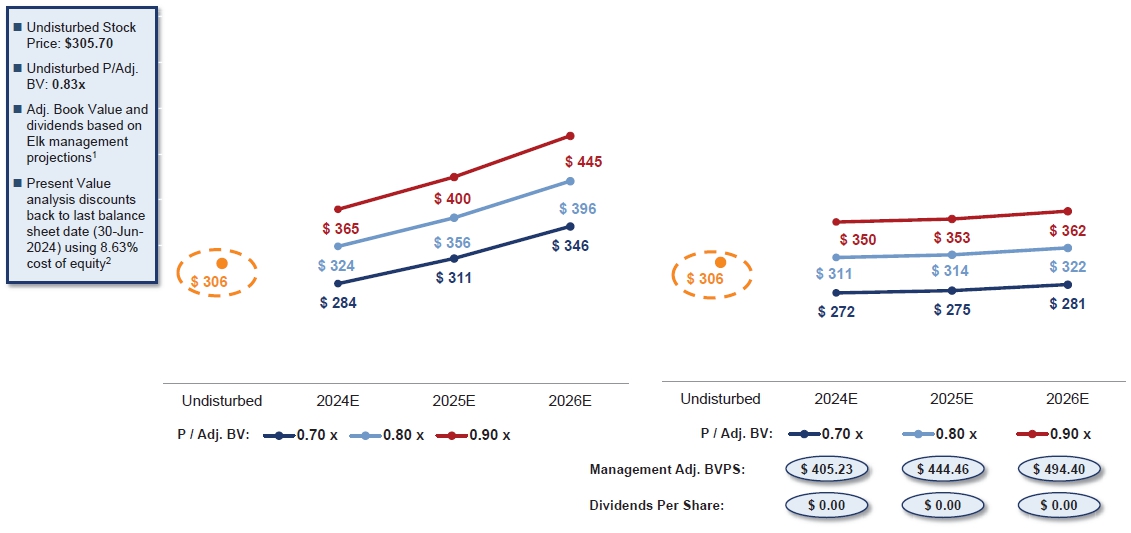

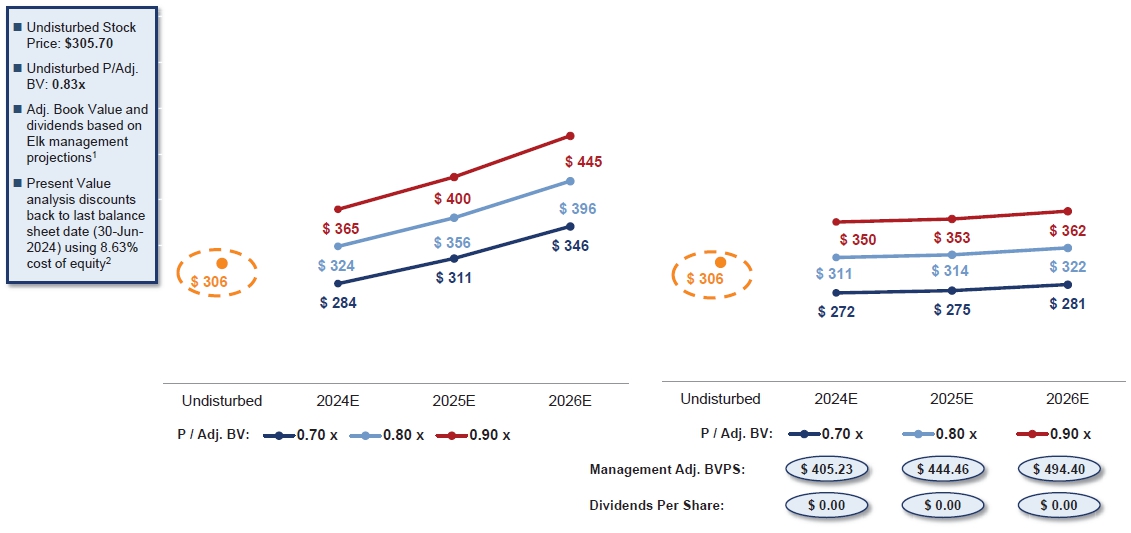

Present

Value of Future Share Price Analysis

|

INVESTMENT

BANKING

|

| |

Future

Share Price (at Respective Year-Ends) |

|

Present

Value of Future Share Price + Dividends (at

Respective Year-Ends) Discounted at 8.63%2 |

Source:

Elk Management projections, Company filings, FactSet. Note: Market data as of Elk undisturbed date (28-Jun-2024); per share metrics consistent

with Elk Management projections, inclusive of any incremental annual dilution from share-based compensation effects 1 Adjusted

for net realized and unrealized gains / (losses) on fixed maturities available for sale, fixed maturities trading, and funds held, change

in fair value of insurance contracts, and amortization of fair value adjustments. 2 Represents midpoint of discount rate as

shown on page 12.

| Elk Financial Analysis | 13 | | |

| |

STRICTLY

PRIVATE & CONFIDENTIAL |

|

|

|

Selected

Precedent P&C Reinsurance M&A Transactions

($

in millions)

|

INVESTMENT

BANKING

|

| Ann.

Date |

Acquiror |

Target |

Equity

Value |

%

Cash |

P/BV

incl. AOCI1 |

| Oct-21 |

Covea |

PartnerRe |

9,000 |

100 |

1.25

x |

| Oct-18 |

RenaissanceRe |

Tokio

Millenium Re |

1,469 |

83 |

1.01 |

| Aug-15 |

Exor |

PartnerRe |

6,875 |

100 |

1.10 |

| Mar-15 |

Endurance |

Montpelier

Re |

1,831 |

25 |

1.22 |

| Nov-14 |

RenaissanceRe |

Platinum |

1,925 |

60 |

1.13 |

| Dec-12 |

Markel |

Alterra |

3,130 |

32 |

1.07 |

| Aug-12 |

Validus |

Flagstone |

623 |

24 |

0.74 |

| Nov-11 |

Alleghany |

Transatlantic |

3,431 |

24 |

0.80 |

| |

|

|

|

|

|

| Low |

|

|

|

|

0.74

x |

| |

|

|

|

|

|

| 25th

Percentile |

|

|

|

0.96 |

| |

|

|

|

|

|

| Median |

|

|

|

|

1.09 |

| |

|

|

|

|

|

| 75th

Percentile |

|

|

|

1.16 |

| |

|

|

|

|

|

| High |

|

|

|

|

1.25 |

| |

|

|

|

|

|

Source: Public

filings and press releases, CapIQ, SNL, Thomson Reuters.

1

Based on reported aggregate purchase price and book value multiples (including AOCI) where available.

| Elk Financial Analysis | 14 | | |

| |

STRICTLY

PRIVATE & CONFIDENTIAL |

|

|

|

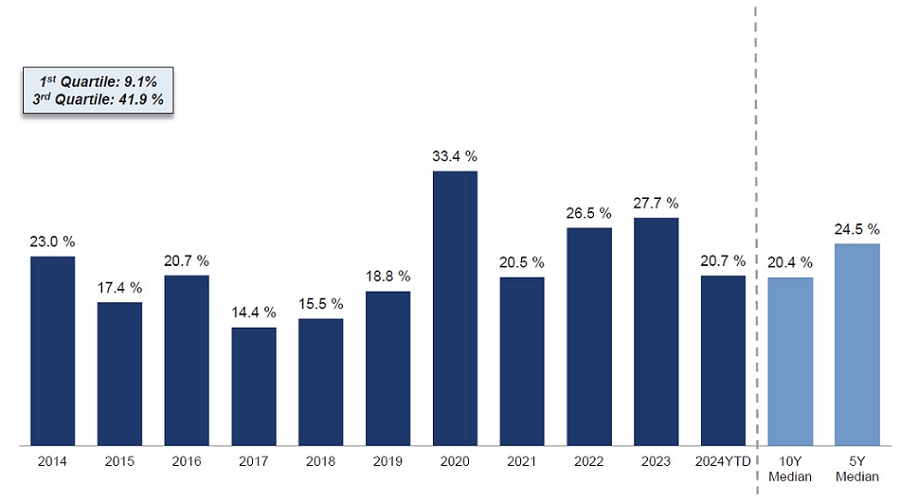

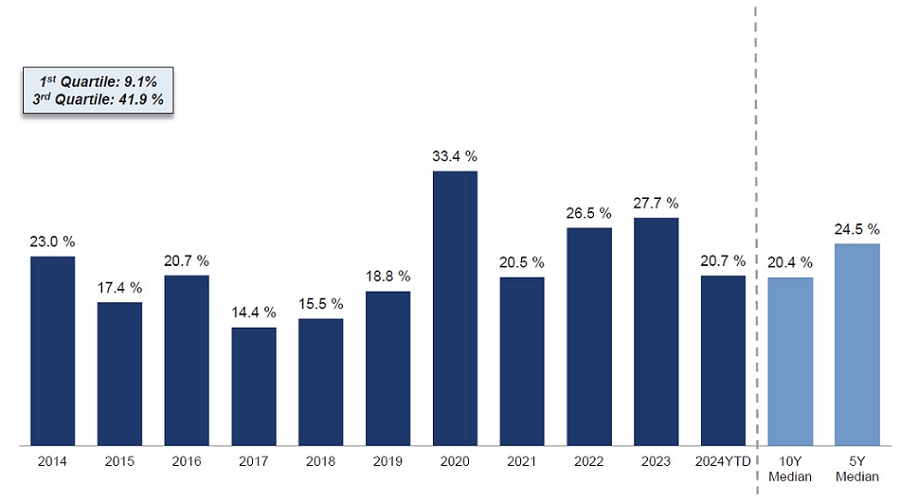

Premia

Paid in Precedent U.S. Public M&A

All-Cash

Acquisitions | Since 01-Jan-2014 between $1.0bn and $10.0bn

% Premia

to 1-day Prior to Announcement (Median)

|

INVESTMENT

BANKING

|

| 1-Week

Prior |

30.1

% |

24.4

% |

22.7

% |

18.6

% |

17.8

% |

20.5

% |

34.0

% |

21.3

% |

33.0

% |

30.5

% |

23.1

% |

23.8

% |

27.0

% |

| Number

of Transactions |

43 |

60 |

70 |

57 |

69 |

53 |

40 |

75 |

58 |

49 |

55 |

607

(10Y Total) |

303

(5Y Total) |

Source:

Dealogic, FactSet as of 26-Jul-2024.

| Elk Financial Analysis | 15 | | |

| |

STRICTLY

PRIVATE & CONFIDENTIAL |

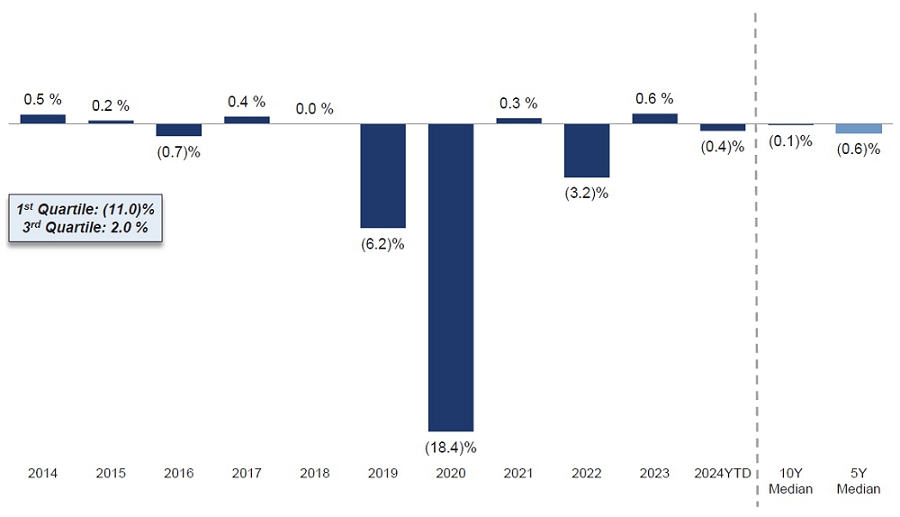

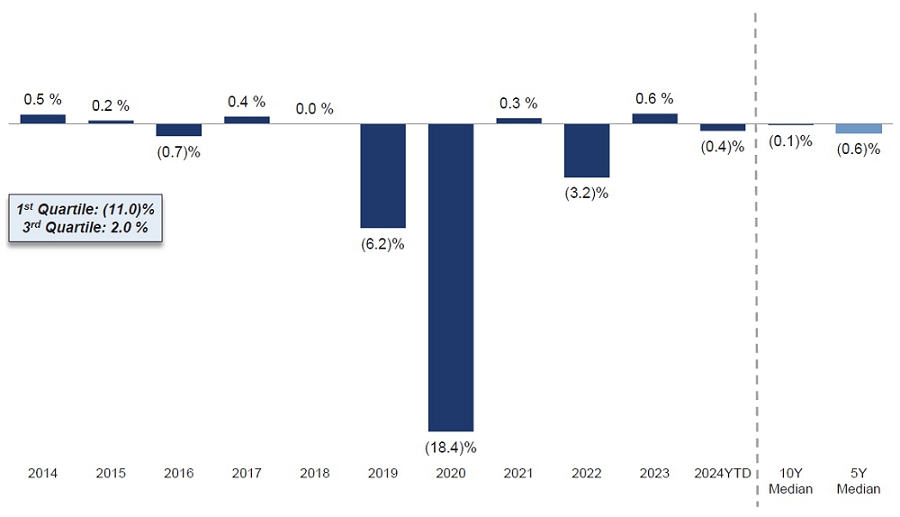

For

Reference Only |

|

|

Premia

Paid in Precedent U.S. Public M&A

All-Cash

Acquisitions | Since 01-Jan-2014 between $1.0bn and $10.0bn

% Premia

to 52 Week High (Median)

|

INVESTMENT

BANKING

|

Number

of

Transactions |

43 |

60 |

70 |

57 |

69 |

53 |

40 |

75 |

58 |

49 |

55 |

607

(10Y Total) |

303

(5Y Total) |

Source:

Dealogic, FactSet as of 26-Jul-2024.

| Elk Financial Analysis | 16 | | |

| |

STRICTLY PRIVATE & CONFIDENTIAL |

For

Reference Only |

| Selected Peer Common Stock Comparison

($

in millions, except per share amounts)

| INVESTMENT

BANKING

|

| | | |

| | | |

| |

Closing |

Equity |

|

Calendarized |

|

|

|

|

|

|

LTM |

| |

Price |

Market |

%

of 52 |

P/E |

P/B |

P/B |

P

/ TBV |

P

/ TBV |

ROE |

Dividend |

| Company |

26-Jul-24 |

Cap |

Wk.

High |

2024E |

2025E |

(in.

AOCI) |

(ex.

AOCI) |

(in.

AOCI) |

(ex.

AOCI) |

2024E |

2025E |

Yield |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Elk |

$

348.31 |

$

5,224 |

100.0

% |

9.4

x |

8.7

x |

1.02

x |

0.95

x |

1.03

x |

0.96

x |

NA |

NA |

0.0

% |

| Memo:

Elk Undisturbed (28-Jun-2024) |

305.70 |

4,585 |

97.1 |

8.3 |

7.6 |

0.90 |

0.84 |

0.91 |

0.85 |

NA |

NA |

0.0 |

| Traditional

Bermuda Reinsurers |

|

|

|

|

|

|

|

|

|

|

|

|

| Everest

Re |

$

382.93 |

$

16,838 |

92.4

% |

6.3

x |

5.7

x |

1.24

x |

1.14

x |

1.24

x |

1.14

x |

17.2

% |

16.4

% |

1.9

% |

| RenaissanceRe |

224.50 |

11,956 |

94.4 |

6.0 |

6.4 |

1.27 |

1.27 |

1.38 |

1.37 |

21.1 |

17.0 |

0.7 |

| Axis |

73.66 |

6,386 |

99.7 |

7.3 |

6.9 |

1.29 |

1.19 |

1.37 |

1.26 |

15.9 |

14.8 |

2.4 |

| Fidelis |

17.48 |

2,073 |

87.3 |

5.6 |

4.9 |

0.82 |

0.81 |

0.82 |

0.81 |

13.2 |

13.1 |

1.1 |

| Median

- Traditional Bermuda Reinsurers |

|

|

93.4

% |

6.2

x |

6.1

x |

1.25

x |

1.17

x |

1.30

x |

1.20

x |

16.5

% |

15.6

% |

1.5

% |

| Other

Bermuda Reinsurers |

|

|

|

|

|

|

|

|

|

|

|

|

| SiriusPoint |

$

14.38 |

$

2,547 |

100.0

% |

9.0

x |

8.0

x |

1.06

x |

1.05

x |

1.13

x |

1.12

x |

NA |

NA |

0.0

% |

| Hamilton |

17.13 |

1,998 |

97.0 |

5.0 |

4.8 |

0.90 |

0.90 |

0.94 |

0.94 |

14.7 |

13.2 |

0.0 |

| Greenlight

Re |

13.52 |

501 |

100.0 |

7.1 |

8.4 |

0.80 |

0.80 |

0.80 |

0.80 |

NA |

NA |

0.0 |

| Median

- Other Bermuda Reinsurers |

|

|

100.0

% |

7.1

x |

8.0

x |

0.90

x |

0.90

x |

0.94

x |

0.94

x |

14.7

% |

13.2

% |

0.0

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Overall

Low |

|

|

87.3

% |

5.0

x |

4.8

x |

0.80

x |

0.80

x |

0.80

x |

0.80

x |

13.2

% |

13.1

% |

0.0

% |

| Overall

Median |

|

|

97.0 |

6.3 |

6.4 |

1.06 |

1.05 |

1.13 |

1.12 |

15.9 |

14.8 |

0.7 |

| Overall

Mean |

|

|

95.8 |

6.6 |

6.5 |

1.05 |

1.02 |

1.10 |

1.06 |

16.4 |

14.9 |

0.9 |

| Overall

High |

|

|

100.0 |

9.0 |

8.4 |

1.29 |

1.27 |

1.38 |

1.37 |

21.1 |

17.0 |

2.4 |

Source:

Company filings, FactSet; market data as of 26-Jul-2024, excluding the Elk Undisturbed row (as of 28-Jun-2024). Note: Earnings projections

used for computation of P/E multiples based on median of equity research analyst projections. RenaissanceRe data as of Q2 2024, all other

peers as of Q1 2024 based on latest public filings.

| Elk Financial Analysis | 17 | | |

| |

STRICTLY PRIVATE & CONFIDENTIAL |

For

Reference Only |

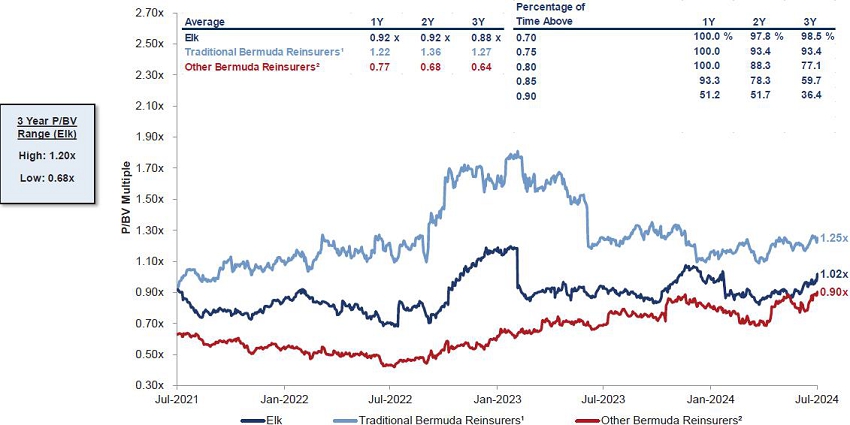

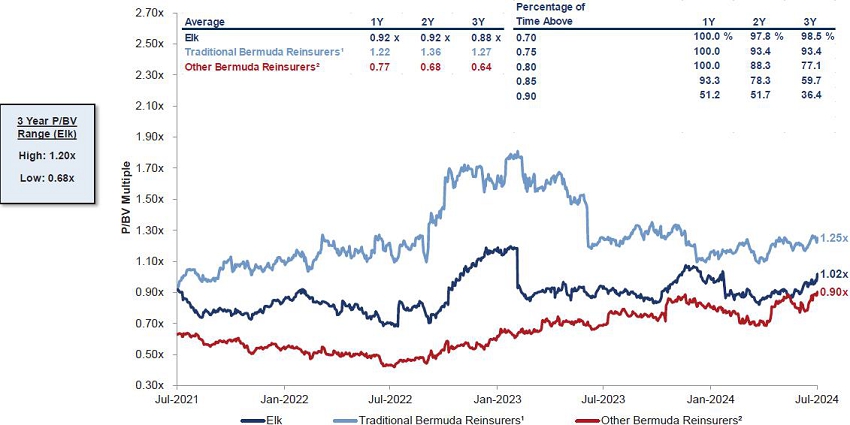

| Elk

Historical Valuation Compared to Peers

P/BV

(incl. AOCI) Multiples | Last 3 Years

| INVESTMENT

BANKING

|

| | | |

| | | |

| Price

/ Book Value (incl. AOCI) |

Source:

Public company filings, FactSet. Note: Multiples chart as of 26-Jul-2024 for reference. Tables depicted as of Elk undisturbed date (28-Jun-2024).

Note: RenaissanceRe data as of Q2 2024, all other peers as of Q1 2024 based on latest public filings.

¹

Traditional Bermuda Reinsurers include Renaissance Re, Everest Re, Axis Capital, and Fidelis (Since 03-Jul-2023 IPO, the earliest date

for available data). ² Other Bermuda Reinsurers include Hamilton (Since 13-Nov-2023 IPO, the earliest date for available data),

Greenlight Re and SiriusPoint.

| Elk Financial Analysis | 18 | | |

| |

STRICTLY PRIVATE & CONFIDENTIAL |

For

Reference Only |

| Elk Historical Valuation Compared to Peers

P/BV (excl. AOCI) Multiples | Last 3 Years

| INVESTMENT

BANKING

|

| | | |

| | | |

| Price

/ Book Value (excl. AOCI) |

Source:

Public company filings, FactSet. Note: Multiples chart as of 26-Jul-2024 for reference. Tables depicted as of Elk undisturbed date (28-Jun-2024).

Note:

RenaissanceRe data as of Q2 2024, all other peers as of Q1 2024 based on latest public filings.

¹

Traditional Bermuda Reinsurers include Renaissance Re, Everest Re, Axis Capital, and Fidelis (Since 03-Jul-2023 IPO, the earliest date

for available data). ² Other Bermuda Reinsurers include Hamilton (Since 13-Nov-2023 IPO, the earliest date for available data),

Greenlight Re and SiriusPoint.

| Elk Financial Analysis | 19 | | |

| STRICTLY PRIVATE & CONFIDENTIAL |

|

| INVESTMENT

BANKING

|

| | | |

| | | |

Appendix A:

Additional Materials

| |

STRICTLY PRIVATE & CONFIDENTIAL |

|

| Overview

of Elk Management Projections (1/2)

Income Statement | ($ in millions)

| INVESTMENT

BANKING

|

| | | |

| | | |

| |

|

|

|

|

|

|

|

2022A

- 2028E |

| |

2022A |

2023A |

2024E |

2025E |

2026E |

2027E |

2028E |

CAGR |

| Technical

Result |

$

373 |

$

157 |

$

213 |

$

159 |

$

169 |

$

160 |

$

210 |

(9.1)% |

| Net

Investment Income (Core Fixed Income Return) |

(728) |

713 |

646 |

670 |

712 |

746 |

838 |

NM |

| Risk

Asset Return |

(431) |

397 |

411 |

451 |

551 |

635 |

692 |

NM |

| Other

Income |

35 |

279 |

0 |

0 |

0 |

0 |

0 |

NM |

| Total

Revenue |

$(751) |

$

1,546 |

$

1,271 |

$

1,280 |

$

1,432 |

$

1,541 |

$

1,740 |

NM |

| G&A

Expenses |

(331) |

(369) |

(395) |

(405) |

(405) |

(395) |

(384) |

2.5

% |

| FVO

/ FVA / ULAE |

353 |

(26) |

39 |

34 |

44 |

58 |

74 |

(22.8) |

| Deferred

Charge Amortization |

(80) |

(106) |

(133) |

(137) |

(136) |

(138) |

(137) |

9.3 |

| Interest,

Pref Dividends & FX |

(110) |

(126) |

(131) |

(134) |

(137) |

(140) |

(143) |

4.4 |

| Income

Tax Benefit / (Expense) |

12 |

250 |

(4) |

(92) |

(115) |

(133) |

(166) |

NM |

| Net

Income Before Strategic Investments |

$(907) |

$

1,169 |

$

648 |

$

547 |

$

683 |

$

793 |

$

985 |

NM |

| Earnings

from Disc. Ops and NCI |

75 |

(100) |

(0) |

0 |

0 |

0 |

0 |

NM |

| Earnings

from Strategic Investments |

(74) |

13 |

12 |

25 |

25 |

25 |

25 |

NM |

| Net

Income |

$(906) |

$

1,082 |

$

659 |

$

572 |

$

708 |

$

818 |

$

1,010 |

NM |

Source:

Elk Management projections

Note:

Deferred Charge Amortization reflects amount by which estimated ultimate losses payable exceed consideration received at the inception

of a retroactive reinsurance agreement.

STRICTLY

PRIVATE & CONFIDENTIAL

| Overview

of Elk Management Projections (2/2)

Balance Sheet

| ($ in millions) | INVESTMENT

BANKING

|

| | | |

| |

|

|

|

|

|

|

|

|

|

|

|

2022A

- 2028E |

| |

2022A |

2023A |

|

|

2024E |

2025E |

2026E |

2027E |

2028E |

|

|

CAGR |

| Cash

and Investments |

$

15,053 |

$

14,893 |

|

|

$

15,656 |

$

17,181 |

$

19,365 |

$

21,512 |

$

23,658 |

|

|

7.8

% |

| Restricted

Cash |

508 |

266 |

|

|

266 |

266 |

266 |

266 |

266 |

|

|

(10.2) |

| Equity

Method Investments |

397 |

334 |

|

|

346 |

371 |

396 |

421 |

446 |

|

|

1.9 |

| Funds

Held by Reinsured Companies |

3,582 |

2,750 |

|

|

2,750 |

2,750 |

2,750 |

2,750 |

2,750 |

|

|

(4.3) |

| Other

Assets |

1,483 |

1,712 |

|

|

1,760 |

1,734 |

1,728 |

1,716 |

1,708 |

|

|

2.4 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

Assets |

$

21,023 |

$

19,956 |

|

|

$

20,777 |

$

22,302 |

$

24,504 |

$

26,665 |

$

28,828 |

|

|

5.4

% |

| Loss

and LAE Reserves, Net |

$

11,876 |

$

11,402 |

|

|

$

11,786 |

$

12,821 |

$

14,414 |

$

15,932 |

$

17,277 |

|

|

6.4

% |

| Life

Insurance Reserves |

821 |

- |

|

|

- |

- |

- |

- |

- |

|

|

NM |

| Defendant

A&E Liabilities, Net |

607 |

567 |

|

|

522 |

482 |

445 |

411 |

378 |

|

|

(7.6) |

| Debt |

1,829 |

1,831 |

|

|

1,831 |

1,831 |

1,831 |

1,831 |

1,831 |

|

|

0.0 |

| Other

Liabilities |

562 |

508 |

|

|

469 |

435 |

390 |

332 |

258 |

|

|

(12.2) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

Liabilities |

$

15,695 |

$

14,308 |

|

|

$

14,607 |

$

15,568 |

$

17,081 |

$

18,506 |

$

19,744 |

|

|

3.9

% |

| Preferred

Equity |

$

510 |

$

510 |

|

|

$

510 |

$

510 |

$

510 |

$

510 |

$

510 |

|

|

0.0

% |

| Common

Equity |

4,464 |

5,025 |

|

|

5,547 |

6,110 |

6,800 |

7,537 |

8,461 |

|

|

11.2 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

Shareholders Equity (excl. NCI) |

$

4,974 |

$

5,535 |

|

|

$

6,057 |

$

6,620 |

$

7,310 |

$

8,047 |

$

8,971 |

|

|

10.3

% |

| Memo:

Management Adjusted Common Equity |

$

5,873 |

$

5,397 |

|

|

$

5,754 |

$

6,192 |

$

6,771 |

$

7,509 |

$

8,439 |

|

|

6.2

% |

| Memo:

(Redeemable) Non-Controlling Interest |

$

354 |

$

113 |

|

|

$

113 |

$

113 |

$

113 |

$

113 |

$

113 |

|

|

(17.3)% |

| Memo:

URG / (L) from AFS Securities in AOCI |

$(579) |

$

222 |

|

|

$

113 |

$

92 |

$

82 |

$

18 |

$

14 |

|

|

NM |

| Memo:

URG / (L) from HFT Securities in P&L |

$(1,181) |

$

66 |

|

|

$

91 |

$

73 |

$

66 |

$

15 |

$

11 |

|

|

NM |

| Source:

Elk Management projections |

|

|

|

|

|

|

|

|

|

|

|

|

| Note:

Other Assets composed of Deferred Charge Assets, Insurance Recoverables and Other Assets. |

|

STRICTLY

PRIVATE & CONFIDENTIAL

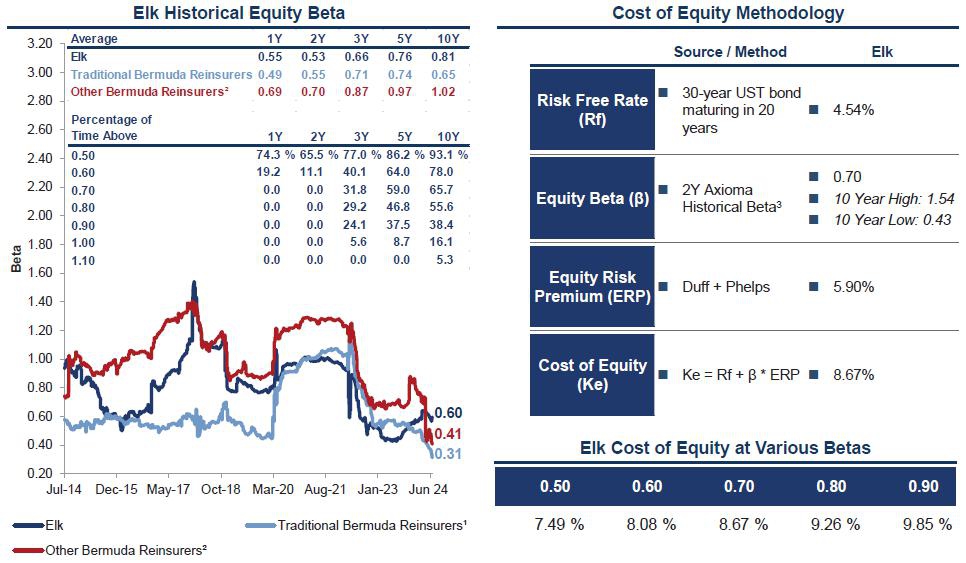

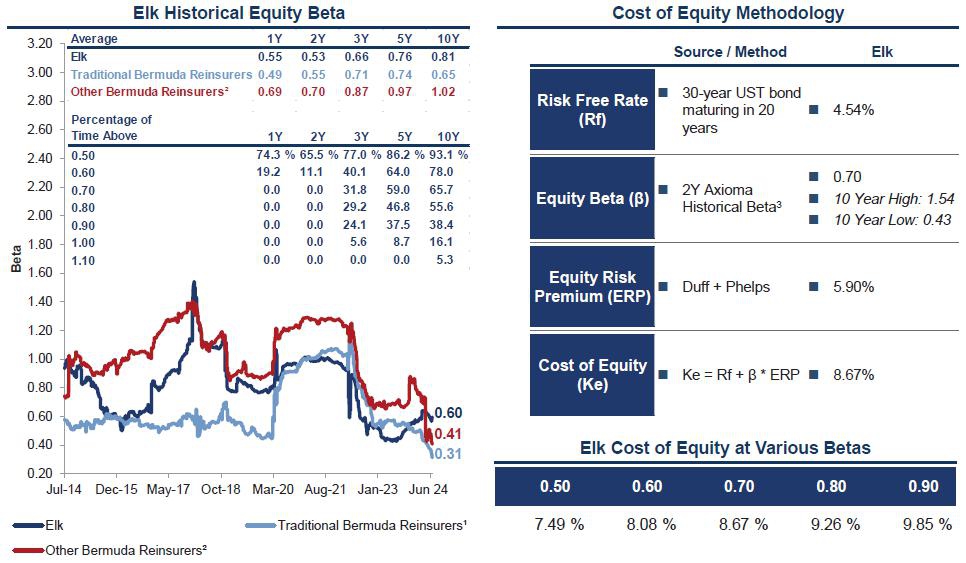

| Elk

Beta and Cost of Equity Analysis

Comparison of

Historical Peer Equity Betas | Last 10 Years | INVESTMENT

BANKING

|

| | | |

Source:

Axioma, Duff and Phelps; Beta data for Elk and peers as of Elk undisturbed date (28-Jun-2024); Risk Free Rate and Equity Risk Premium

as of 26-Jul-2024.

¹

Traditional Bermuda Reinsurers include RenaissanceRe, Everest Re, Axis Capital, and Fidelis (Since 03-Jul-2023 IPO, the earliest date

for available data). ² Other Bermuda Reinsurers include Hamilton (Since 13-Nov-2023 IPO, the earliest date for available data),

Greenlight Re and SiriusPoint (Since 19-Aug-2014, the earliest date for available data). 3 As of Elk undisturbed date (28-Jun-2024).

STRICTLY

PRIVATE & CONFIDENTIAL

| Detailed

Equity Capitalization and Share Count Table

| INVESTMENT

BANKING

|

| | | |

| |

Per

Elk Management |

As

Computed Based on |

| Security

Type |

(Q2

2024) |

Total

Cash Consideration |

| Voting

Ordinary Shares1 |

14.665 |

14.664 |

| Restricted

Stock Units1 |

0.169 |

0.171 |

| Performance

Stock Units |

0.166 |

0.142 |

| Joint

Share Ownership Plan (Treasury Stock Method) |

|

0.221 |

| |

|

|

|

|

|

Fully

Diluted Shares Outstanding |

15.000 |

15.198 |

|

| |

|

|

|

|

Source:

Elk management as of 30-Jun-2024; Total cash consideration share count as of 25-Jul-2024.

Note:

Total cash consideration figures based on Stork’s stated offer price of $338 per share. Total cash consideration assumes

30-Jun-2025 closing.

1 Delta in Voting Ordinary Shares between two columns based on presentation of Director Restricted

Shares.

STRICTLY

PRIVATE & CONFIDENTIAL

| Elk

Shareholder Registry

| INVESTMENT

BANKING

|

| | | |

| |

|

|

|

Cost

Basis & Returns |

Most

Recent |

| |

Refinitiv |

AUM |

|

|

|

|

|

| Institution |

Style |

($bn) |

Last

Report Date |

Cost

Basis¹ |

Unrealized

Gain² |

%

OS |

Shares

(mm) |

| Stone

Point Capital LLC |

Strategic |

$

1.0 |

31-Mar-2024 |

$

157.42 |

121.3

% |

9.5

% |

1.5 |

| Vanguard |

Index |

6,040.8 |

31-Mar-2024 |

155.25 |

124.4 |

8.1 |

1.2 |

| BlackRock

Institutional Trust Co. |

Index |

3,555.3 |

31-Mar-2024 |

139.58 |

149.5 |

5.4 |

0.8 |

| Dimensional

Fund Advisors |

Quantitative |

540.9 |

31-Mar-2024 |

169.30 |

105.7 |

5.0 |

0.8 |

| Sixth

Street Partners, LLC |

Other |

0.9 |

31-Mar-2024 |

265.42 |

31.2 |

4.7 |

0.7 |

| Beck,

Mack & Oliver |

GARP |

4.9 |

31-Mar-2024 |

101.32 |

243.8 |

4.6 |

0.7 |

| Silvester

(Dominic Francis Michael) |

Strategic |

0.2 |

08-Apr-2024 |

137.09 |

154.1 |

4.3 |

0.7 |

| CPP

Investment Board |

Pension |

109.3 |

31-Mar-2024 |

151.16 |

130.4 |

4.3 |

0.6 |

| Fidelity

Management & Research Company LLC |

GARP |

1,633.4 |

31-Mar-2024 |

181.73 |

91.7 |

3.7 |

0.6 |

| Fuller

& Thaler Asset Management Inc. |

GARP |

22.0 |

31-Mar-2024 |

198.48 |

75.5 |

2.8 |

0.4 |

| Allspring

Global Investments, LLC |

Value |

72.0 |

31-Mar-2024 |

185.34 |

87.9 |

2.7 |

0.4 |

| Wellington |

Value |

643.5 |

31-Mar-2024 |

156.94 |

121.9 |

2.4 |

0.4 |

| Hotchkis

and Wiley Capital Management, LLC |

Value |

29.5 |

31-Mar-2024 |

187.20 |

86.1 |

2.3 |

0.3 |

| State

Street Global Advisors (US) |

Index |

2,353.9 |

31-Mar-2024 |

153.91 |

126.3 |

2.2 |

0.3 |

| Geode

Capital Management, L.L.C. |

Index |

1,286.2 |

31-Mar-2024 |

187.39 |

85.9 |

1.9 |

0.3 |

| O'Shea

(Paul James) |

Strategic |

0.1 |

08-Apr-2024 |

122.18 |

185.1 |

1.6 |

0.2 |

| Harspring

Capital Management, LLC |

Hedge

Fund |

0.4 |

31-Mar-2024 |

242.56 |

43.6 |

1.2 |

0.2 |

| Crow's

Nest Holdings LP |

Hedge

Fund |

0.6 |

31-Mar-2024 |

269.50 |

29.2 |

1.1 |

0.2 |

| Campbell

(Robert Johnson) |

Strategic |

0.0 |

08-Apr-2024 |

100.10 |

248.0 |

1.1 |

0.2 |

| American

Century IM |

Growth |

189.1 |

31-Mar-2024 |

263.55 |

32.2 |

1.0 |

0.1 |

| Charles

Schwab Investment Management, Inc. |

Index |

527.3 |

31-Mar-2024 |

177.60 |

96.1 |

0.9 |

0.1 |

| Norges

Bank Investment Management (NBIM) |

Pension |

1,204.4 |

31-Dec-2023 |

169.16 |

105.9 |

0.9 |

0.1 |

| Barrow

Hanley Global Investors |

Income |

32.6 |

31-May-2024 |

240.09 |

45.1 |

0.9 |

0.1 |

| WCM

Investment Management |

Growth |

61.3 |

31-Mar-2024 |

189.22 |

84.1 |

0.8 |

0.1 |

| Diamond

Hill Capital Management Inc. |

Value |

23.8 |

31-Mar-2024 |

128.93 |

170.1 |

0.8 |

0.1 |

| Total |

|

|

|

|

|

74.1

% |

11.3 |

| Median |

|

|

|

$

169.30 |

105.7

% |

|

|

| Weighted

Average³ |

|

|

|

$

168.20 |

118.7

% |

|

|

Source:

Public Investor Filings. 1 Calculated as the weighted average cost of current shares held based on quarterly VWAPs and all

share purchases from Q1 '05 - Q3 ‘24. 2 Based on share price at market close on 26-Jul-2024 ($348.31). 3

Weighted by number of shares held in Q3 '24.

STRICTLY

PRIVATE & CONFIDENTIAL

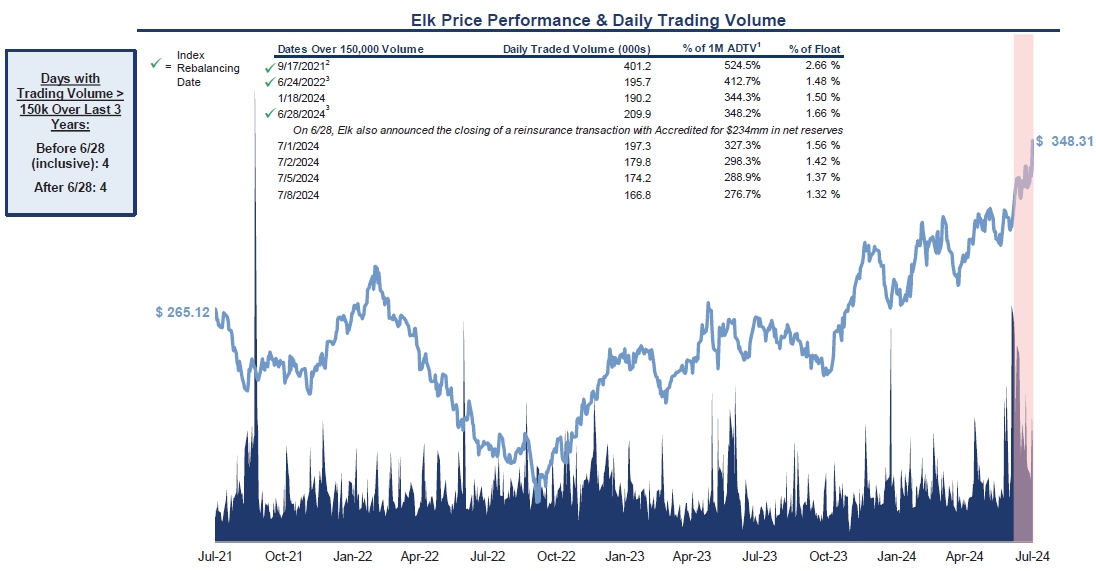

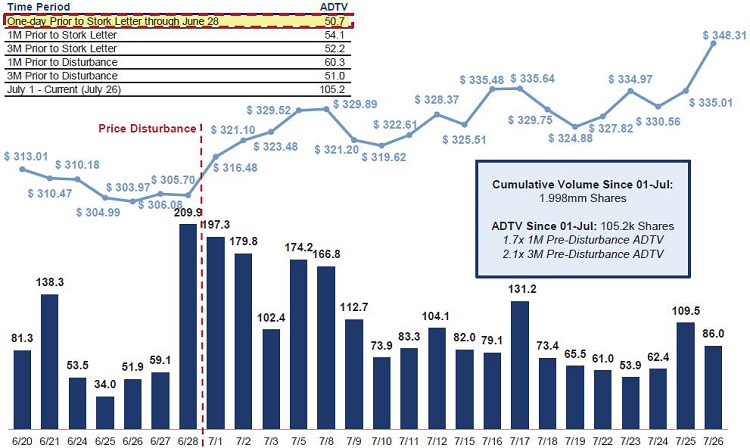

| Elk

Trading Activity Over The Last 3 Years

| INVESTMENT

BANKING

|

| |

|

|

Period

Post-Elk Disturbance Date (6/28) |

|

Source:

Bloomberg; market data as of 26-Jul-2024. 1 1M average daily trading volume shown as of 28-Jun-2024 (undisturbed date) for

dates post-28-Jun-2024. 2 Reflects an S&P index rebalancing date. 3 Reflects a Russell Reconstitution date.

STRICTLY

PRIVATE & CONFIDENTIAL

|

Elk Daily Trading Volume Relative to Peers (1/2)

(Shares in 000s) | INVESTMENT

BANKING

|

| |

ADTV |

|

|

%

of Float |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

01-Jul

to |

|

|

|

|

|

01-Jul

to |

| |

1M |

3M |

6M |

26-Jul |

|

Free

Float1 |

1M |

3M |

6M |

26-Jul |

| Elk |

60.3 |

51.0 |

51.8 |

105.2 |

|

12,670.7 |

0.48

% |

0.40

% |

0.41

% |

0.83

% |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Traditional

Bermuda Reinsurers |

|

|

|

|

|

|

|

|

|

|

| Everest

Re |

226.2 |

270.6 |

327.1 |

318.8 |

|

42,798.6 |

0.53

% |

0.63

% |

0.76

% |

0.74

% |

| |

|

|

|

|

|

|

|

|

|

|

| RenaissanceRe |

287.0 |

303.9 |

338.5 |

363.5 |

|

50,314.5 |

0.57

% |

0.60

% |

0.67

% |

0.72

% |

| |

|

|

|

|

|

|

|

|

|

|

| Axis |

497.2 |

599.7 |

611.9 |

549.2 |

|

77,477.0 |

0.64

% |

0.77

% |

0.79

% |

0.71

% |

| |

|

|

|

|

|

|

|

|

|

|

| Fidelis |

653.6 |

682.0 |

643.9 |

465.0 |

|

37,358.7 |

1.75

% |

1.83

% |

1.72

% |

1.24

% |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Other

Bermuda Reinsurers |

|

|

|

|

|

|

|

|

|

|

| Hamilton

Re |

388.8 |

341.5 |

297.7 |

404.6 |

|

47,047.7 |

0.83

% |

0.73

% |

0.63

% |

0.86

% |

| |

|

|

|

|

|

|

|

|

|

|

| SiriusPoint |

848.0 |

672.3 |

648.8 |

457.1 |

|

93,079.1 |

0.91

% |

0.72

% |

0.70

% |

0.49

% |

| |

|

|

|

|

|

|

|

|

|

|

| Greenlight

Capital Re |

72.7 |

67.6 |

74.1 |

79.9 |

|

25,851.2 |

0.28

% |

0.26

% |

0.29

% |

0.31

% |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Median

- Traditional Bermuda Reinsurers |

392.1 |

451.8 |

475.2 |

414.3 |

|

46,556.6 |

0.61

% |

0.70

% |

0.78

% |

0.73

% |

| Median

- Other Bermuda Reinsurers |

388.8 |

341.5 |

297.7 |

404.6 |

|

47,047.7 |

0.83

% |

0.72

% |

0.63

% |

0.49

% |

| |

|

|

|

|

|

|

|

|

|

|

Source: Bloomberg, FactSet

1 Free float as of 26-Jul-2024,

defined as shares of Elk that can be publicly traded and are not restricted.

STRICTLY

PRIVATE & CONFIDENTIAL

|

Elk Daily Trading Volume Relative to Peers (2/2)

(Shares in 000s) | INVESTMENT

BANKING

|

| |

|

|

|

|

|

Daily

Trading Volume |

|

|

|

|

|

|

|

|

|

|

%

of Float |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

15-Jul - |

|

|

|

|

|

|

|

|

|

|

|

|

15-Jul

- |

|

| |

1M |

|

|

|

|

|

|

|

|

|

|

|

26-Jul |

|

1M |

|

|

|

|

|

|

|

|

|

|

26-Jul |

|

| |

ADTV |

|

28-Jun |

01-Jul |

02-Jul |

03-Jul |

05-Jul |

08-Jul |

09-Jul |

10-Jul |

11-Jul |

12-Jul |

ADTV |

|

ADTV |

28-Jun |

01-Jul |

02-Jul |

03-Jul |

05-Jul |

|

08-Jul |

|

09-Jul |

10-Jul |

11-Jul |

12-Jul |

ADTV |

|

| Elk |

60.3 |

|

209.9 |

197.3 |

179.8 |

102.4 |

174.2 |

166.8 |

112.7 |

73.9 |

83.3 |

104.1 |

80.4 |

|

0.48

% |

1.66

% |

1.56

% |

1.42

% |

0.81

% |

1.37

% |

1.32

% |

0.89

% |

0.58

% |

0.66

% |

0.82

% |

0.63

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Memo:

% of 1M ADTV |

|

|

348.2

% |

327.3

% |

298.3

% |

169.8

% |

288.9

% |

276.7

% |

187.0

% |

122.7

% |

138.1

% |

172.7

% |

133.4

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Traditional

Bermuda Reinsurers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Everest

Re |

226.2 |

|

511.2 |

250.0 |

318.0 |

262.6 |

495.2 |

274.7 |

268.9 |

231.7 |

185.0 |

176.1 |

359.6 |

|

0.53

% |

1.19

% |

0.58 % |

0.74 % |

0.61 % |

1.16 % |

0.64 % |

0.63 % |

0.54 % |

0.43 % |

0.41

% |

0.84

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| RenaissanceRe |

287.0 |

|

819.9 |

252.1 |

540.6 |

309.5 |

731.5 |

386.6 |

241.2 |

223.5 |

320.5 |

241.3 |

366.0 |

|

0.57

% |

1.63

% |

0.50 % |

1.07 % |

0.62 % |

1.45 % |

0.77 % |

0.48 % |

0.44 % |

0.64 % |

0.48

% |

0.73

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Axis |

497.2 |

|

796.1 |

526.8 |

947.2 |

255.4 |

746.3 |

584.1 |

438.8 |

310.6 |

323.3 |

303.4 |

599.9 |

|

0.64

% |

1.03

% |

0.68 % |

1.22 % |

0.33 % |

0.96 % |

0.75 % |

0.57 % |

0.40 % |

0.42 % |

0.39

% |

0.77

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fidelis |

653.6 |

|

1,911.7 |

377.1 |

786.3 |

407.3 |

491.3 |

550.1 |

528.8 |

563.3 |

569.1 |

411.2 |

415.1 |

|

1.75

% |

5.12

% |

1.01

% |

2.10

% |

1.09

% |

1.32

% |

1.47

% |

1.42

% |

1.51

% |

1.52

% |

1.10

% |

1.11

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

Bermuda Reinsurers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Hamilton

Re |

388.8 |

|

2,114.6 |

343.4 |

302.2 |

71.0 |

278.1 |

201.5 |

346.6 |

477.4 |

273.8 |

197.2 |

519.6 |

|

0.83

% |

4.49

% |

0.73 % |

0.64 % |

0.15 % |

0.59 % |

0.43 % |

0.74 % |

1.01 % |

0.58 % |

0.42

% |

1.10

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SiriusPoint |

848.0 |

|

5,850.1 |

559.3 |

347.0 |

214.2 |

339.4 |

396.2 |

287.6 |

246.9 |

386.8 |

378.8 |

552.9 |

|

0.91

% |

6.29

% |

0.60 % |

0.37 % |

0.23 % |

0.36 % |

0.43 % |

0.31 % |

0.27 % |

0.42 % |

0.41

% |

0.59

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Greenlight

Capital Re |

72.7 |

|

582.5 |

89.6 |

30.1 |

45.9 |

9.0 |

83.5 |

47.5 |

52.8 |

148.6 |

88.4 |

84.0 |

|

0.28

% |

2.25

% |

0.35 % |

0.12 % |

0.18 % |

0.03 % |

0.32 % |

0.18 % |

0.20 % |

0.57 % |

0.34

% |

0.32

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Median

- Traditional Bermuda Reinsurers |

392.1 |

|

808.0 |

314.6 |

663.4 |

286.1 |

613.4 |

468.4 |

353.8 |

271.2 |

321.9 |

272.3 |

390.5 |

|

0.61

% |

1.41

% |

0.63

% |

1.15

% |

0.61

% |

1.24

% |

0.76

% |

0.60

% |

0.49

% |

0.53

% |

0.45

% |

0.81

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Memo:

% of 1M ADTV |

|

|

255.9

% |

96.9

% |

164.5

% |

85.1

% |

184.5

% |

119.5

% |

86.2

% |

82.0

% |

84.4

% |

70.4

% |

124.1

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Median

- Other Bermuda Reinsurers |

388.8 |

|

2,114.6 |

343.4 |

302.2 |

71.0 |

278.1 |

201.5 |

287.6 |

246.9 |

273.8 |

197.2 |

519.6 |

|

0.83

% |

4.49

% |

0.60

% |

0.37

% |

0.18

% |

0.36

% |

0.43

% |

0.31

% |

0.27

% |

0.57

% |

0.41

% |

0.59

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Memo:

% of 1M ADTV |

|

|

689.8

% |

88.3

% |

41.4

% |

25.3

% |

40.0

% |

51.8

% |

65.4

% |

72.7

% |

70.4

% |

50.7

% |

115.5

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: Bloomberg, FactSet

Note: 1M ADTV relative to undisturbed pricing date (28-Jun-2024).

1 Free float as of 26-Jul-2024, defined as shares

of Elk that can be publicly traded and are not restricted.

STRICTLY

PRIVATE & CONFIDENTIAL

|

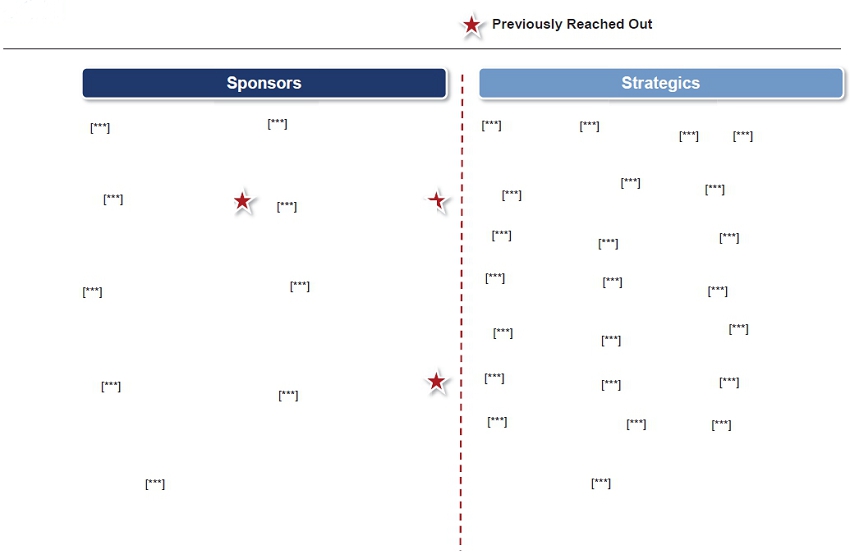

Potential Go-Shop Outreach Candidates | INVESTMENT

BANKING

|

STRICTLY

PRIVATE & CONFIDENTIAL

|

Glossary of Key Terms | INVESTMENT

BANKING

|

| Key

Terms |

|

Definitions |

| Adjusted Book Value |

|

■ Elk

ordinary shareholders' equity, less fair value changes on fixed maturities and funds held-directly managed, fair value of insurance

contracts for which Elk has elected the fair value option, fair value adjustments, and net assets of held for sale or disposed subsidiaries

classified as discontinued operations (if any) |

| |

|

|

| Adjusted Operating Income |

|

■ Net

income (loss) attributable to Elk ordinary shareholders, adjusted for fair value changes and net realized (gains) losses on fixed

maturities and funds held directly managed, change in fair value of insurance contracts for which Elk has elected the fair value

option, amortization of fair value adjustments, net gain / loss on purchase and sales of subsidiaries (if any), net income from discontinued

operations (if any), tax effects of adjustments and adjustments attributable to noncontrolling interests |

| |

|

|

| Adjusted Return on Equity |

|

■ Adjusted

Operating Income attributable to Elk ordinary shareholders divided by Elk Adjusted Book Value |

| |

|

|

| Undisturbed Date |

|

■ Defined

as 28-June-2024, based on observed disturbances in daily trading volume of Elk’s stock relative to historical activity and

peer activity |

Source:

Elk Management |

|

|