Scaling for Sustainable Growth Q4 AND FULL YEAR 2025 EARNINGS CONFERENCE CALL February 17, 2026

Q4 2025Herc Holdings Inc. NYSE: HRI 2 Herc Rentals Team and Agenda Agenda Safe Harbor FY 2025 Overview Q4 Operations Review Q4 Financial Review 2026 Outlook Q&ALarry Silber Chief Executive Officer Aaron Birnbaum President Mark Humphrey Senior Vice President & Chief Financial Officer Leslie Hunziker Senior Vice President Investor Relations, Communications & Sustainability

Q4 2025Herc Holdings Inc. NYSE: HRI 3 Safe Harbor Statements and Non-GAAP Financial Measures Forward-Looking Statements This presentation includes forward-looking statements within the meaning of Section 21E of the Securities Exchange Act, as amended, and the Private Securities Litigation Reform Act of 1995. Forward looking statements are generally identified by the words "estimates," "expects," "anticipates," "projects," "plans," "intends," "believes," "forecasts," "looks," and future or conditional verbs, such as "will," "should," "could" or "may," as well as variations of such words or similar expressions. All forward-looking statements are based upon our current expectations and various assumptions and there can be no assurance that our current expectations will be achieved. You should not place undue reliance on the forward-looking statements. They are subject to future events, risks and uncertainties - many of which are beyond our control - as well as potentially inaccurate assumptions, that could cause actual results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those projected include, but are not limited to, the following: (1) the cyclical nature of our industry and our dependence on the levels of capital investment and maintenance expenditures by our customers; (2) the competitiveness of our industry, including the potential downward pricing pressures or the inability to increase prices; (3) our dependence on relationships with key suppliers; (4) our heavy reliance on communication networks, centralized information technology systems and third party technology and services and our ability to maintain, upgrade or replace our information technology systems; (5) our ability to respond adequately to changes in technology and customer demands; (6) our ability to attract and retain key management, sales and trades talent; (7) our rental fleet is subject to residual value risk upon disposition; (8) the impact of climate change and the legal and regulatory responses to such change; (9) our ability to execute our strategy to grow through strategic transactions;(10) our significant indebtedness; and (11) our ability to integrate the acquisition of H&E Equipment Services, Inc. into our business and our ability to realize all the anticipated benefits of the transaction. Further information on the risks that may affect our business is included in filings we make with the Securities and Exchange Commission from time to time, including our most recent annual report on Form 10-K, subsequent quarterly reports on Form 10-Q, and in our other SEC filings. We undertake no obligation to update or revise forward- looking statements that have been made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Information Regarding Non-GAAP Financial Measures In addition to results calculated according to accounting principles generally accepted in the United States (“GAAP”), the Company has provided certain information in this presentation that is not calculated according to GAAP (“non-GAAP”), such as adjusted net income, adjusted earnings per diluted share, EBITDA, adjusted EBITDA, adjusted EBITDA margin, REBITDA, REBITDA margin, REBITDA flow-through, free cash flow and adjusted free cash flow. Management uses these non-GAAP measures to evaluate operating performance and period-over-period performance of our core business without regard to potential distortions, and believes that investors will likewise find these non-GAAP measures useful in evaluating the Company’s performance. These measures are frequently used by security analysts, institutional investors and other interested parties in the evaluation of companies in our industry. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to similarly titled measures of other companies. For the definitions of these terms, further information about management’s use of these measures as well as a reconciliation of these non-GAAP measures to the most comparable GAAP financial measures, please see the appendix that accompanies this presentation.

Q4 2025Herc Holdings Inc. NYSE: HRI 4 2025 Overview Larry Silber Chief Executive Officer

Q4 2025Herc Holdings Inc. NYSE: HRI 5 Integration Progress Ramps Up 4 Key Focus Areas for Seasonal Shoulder Periods: 1. Branch Network Optimization– Increasing specialty footprint by 25% • Q4:25 80% complete; synergy contribution ramps through '26 2. Fleet Optimization–Age, category classes, brands • Complete: Rightsized fleet and re-aligned mix by market 3. Salesforce Assimilation–Product portfolio & technology tools • Scaling sales team for larger market opportunity; contribution ramps through '26 • Proficiency improving on Herc go-to-market strategy & pricing systems 4. Productivity improvement–Scale benefits and cost efficiencies • Pro forma employee productivity up YoY • Proficiency improving on Herc logistics and operating systems • Reduced re-rent to Herc historical level • YE'25: cost synergies tracking ahead of plan

Q4 2025Herc Holdings Inc. NYSE: HRI 6 Focusing on Safety Onboarded over 2,500 new team members into Herc Health & Safety programs Full Year 2025: Continuing focus on Perfect Days • All branches reported > 97% Perfect Days • Perfect Days are those with no: • OSHA reportable incidents • At-fault moving vehicle accidents • DOT violations Total TTM Recordable Incident Rate is 0.93 — favorable to industry standard of 1.0 Proven safety record is a must-have for customers

Q4 2025Herc Holdings Inc. NYSE: HRI 7 FY 2025: Delivering on Growth Strategies Optimize branch network for fleet / operating efficiencies at scale • Completed largest acquisition in industry, integration on track with strong execution • ~30% increase YoY in branch locations, adding density in the key Gulf Coast, Mountain, West, Midwest, and Southeast regions • Opened 26 previously planned greenfield locations • Completed the sale of Cinelease studio entertainment business July 31, 2025 Enhance fleet mix • Added specialty fleet for mega projects, cross-selling and end-market expansion Support customers’ efficiency goals through data and telematics • Advanced our industry leading digital capabilities: ProControl by Herc Rentals™ Prioritize Capital and Invest Responsibly • Continued disciplined investments in fleet • Declared regular dividend Lead through continuous improvement with E3OS • Standardized processes • Committed to superior customer experiences Strategies to Accelerate ROIC and Increase Shareholder Returns: Grow the Core Expand Specialty Elevate Technology Allocate Capital Execute at Highest Level

Financial Review Mark Humphrey Senior Vice President and Chief Financial Officer

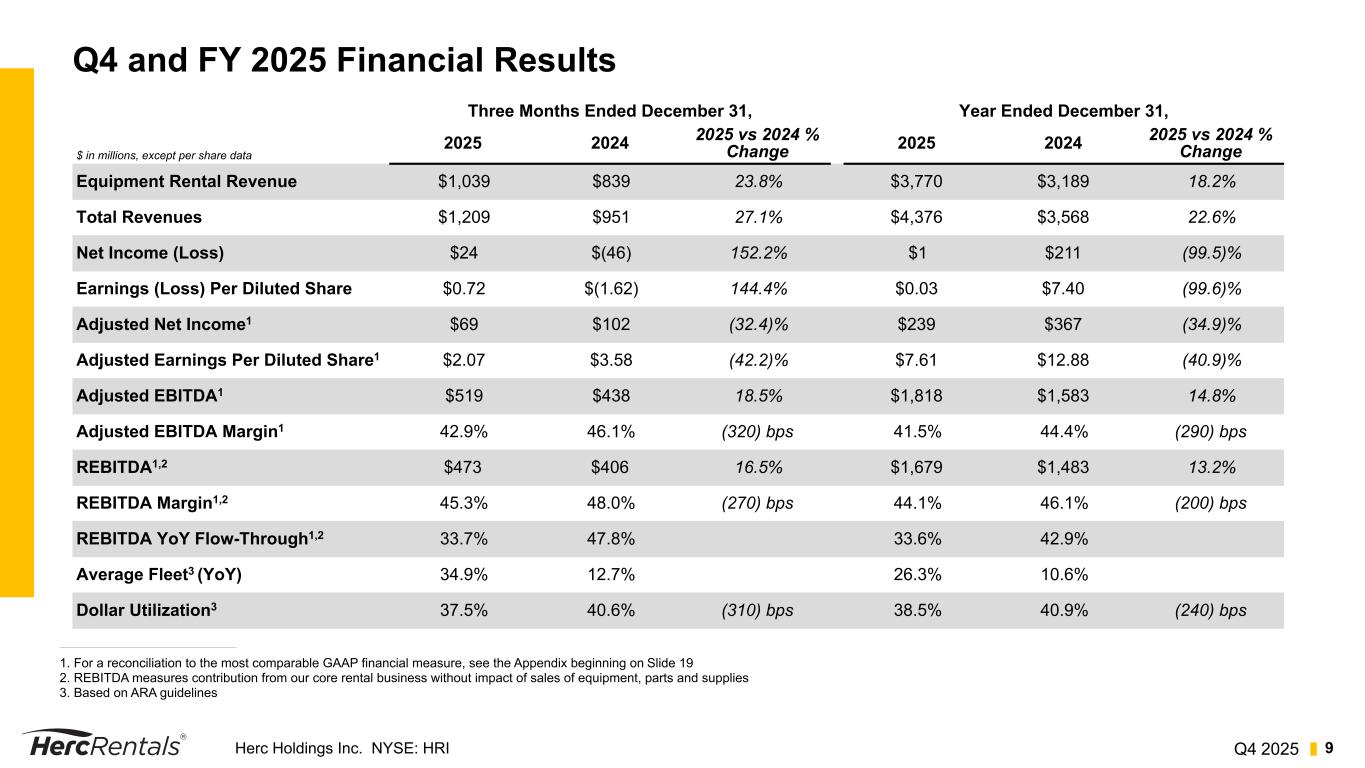

Q4 2025Herc Holdings Inc. NYSE: HRI 9 Q4 and FY 2025 Financial Results 1. For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 19 2. REBITDA measures contribution from our core rental business without impact of sales of equipment, parts and supplies 3. Based on ARA guidelines Three Months Ended December 31, Year Ended December 31, $ in millions, except per share data 2025 2024 2025 vs 2024 % Change 2025 2024 2025 vs 2024 % Change Equipment Rental Revenue $1,039 $839 23.8% $3,770 $3,189 18.2% Total Revenues $1,209 $951 27.1% $4,376 $3,568 22.6% Net Income (Loss) $24 $(46) 152.2% $1 $211 (99.5)% Earnings (Loss) Per Diluted Share $0.72 $(1.62) 144.4% $0.03 $7.40 (99.6)% Adjusted Net Income1 $69 $102 (32.4)% $239 $367 (34.9)% Adjusted Earnings Per Diluted Share1 $2.07 $3.58 (42.2)% $7.61 $12.88 (40.9)% Adjusted EBITDA1 $519 $438 18.5% $1,818 $1,583 14.8% Adjusted EBITDA Margin1 42.9% 46.1% (320) bps 41.5% 44.4% (290) bps REBITDA1,2 $473 $406 16.5% $1,679 $1,483 13.2% REBITDA Margin1,2 45.3% 48.0% (270) bps 44.1% 46.1% (200) bps REBITDA YoY Flow-Through1,2 33.7% 47.8% 33.6% 42.9% Average Fleet3 (YoY) 34.9% 12.7% 26.3% 10.6% Dollar Utilization3 37.5% 40.6% (310) bps 38.5% 40.9% (240) bps

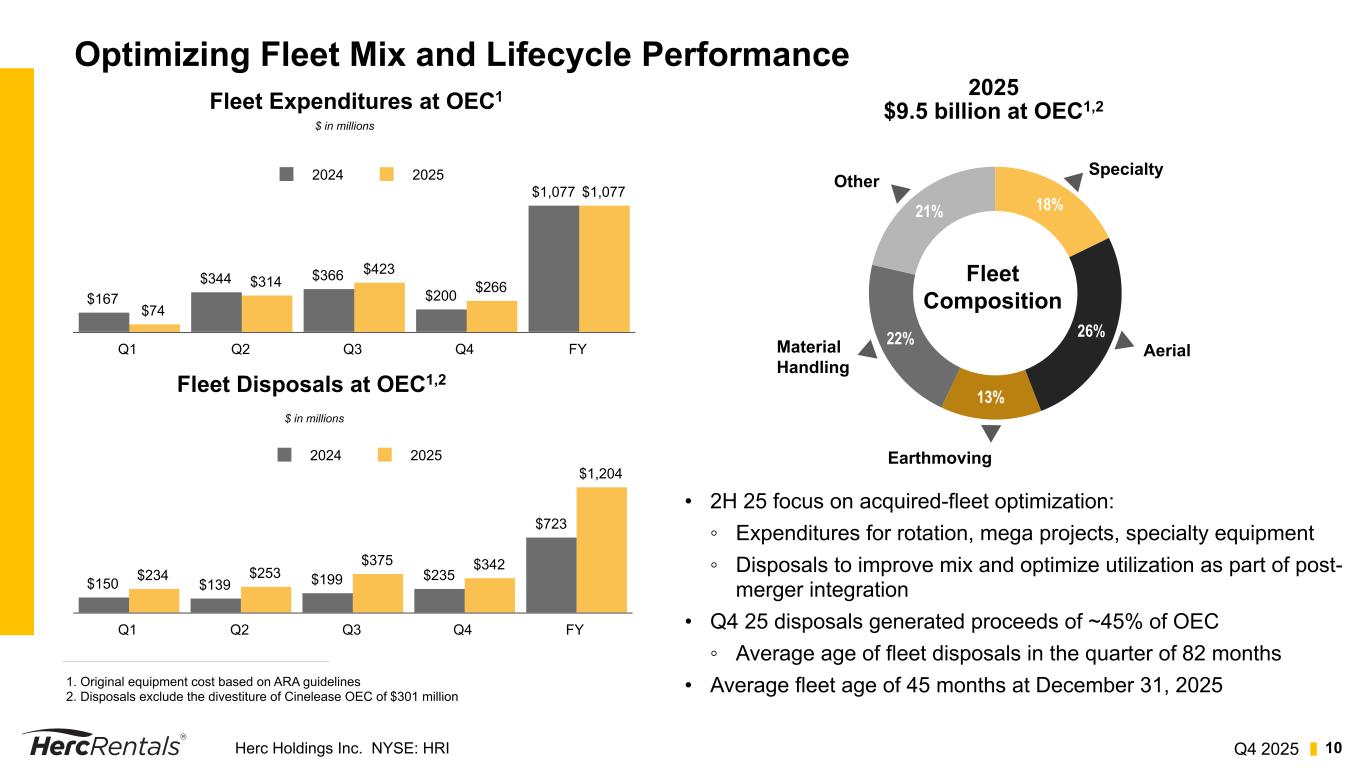

Q4 2025Herc Holdings Inc. NYSE: HRI 10 Optimizing Fleet Mix and Lifecycle Performance 1. Original equipment cost based on ARA guidelines 2. Disposals exclude the divestiture of Cinelease OEC of $301 million $167 $344 $366 $200 $1,077 $74 $314 $423 $266 $1,077 2024 2025 Q1 Q2 Q3 Q4 FY Fleet Expenditures at OEC1 $ in millions $150 $139 $199 $235 $723 $234 $253 $375 $342 $1,204 2024 2025 Q1 Q2 Q3 Q4 FY Fleet Disposals at OEC1,2 $ in millions • 2H 25 focus on acquired-fleet optimization: ◦ Expenditures for rotation, mega projects, specialty equipment ◦ Disposals to improve mix and optimize utilization as part of post- merger integration • Q4 25 disposals generated proceeds of ~45% of OEC ◦ Average age of fleet disposals in the quarter of 82 months • Average fleet age of 45 months at December 31, 2025 18% 26% 13% 22% 21% 2025 $9.5 billion at OEC1,2 Material Handling Other Specialty Aerial Earthmoving Fleet Composition

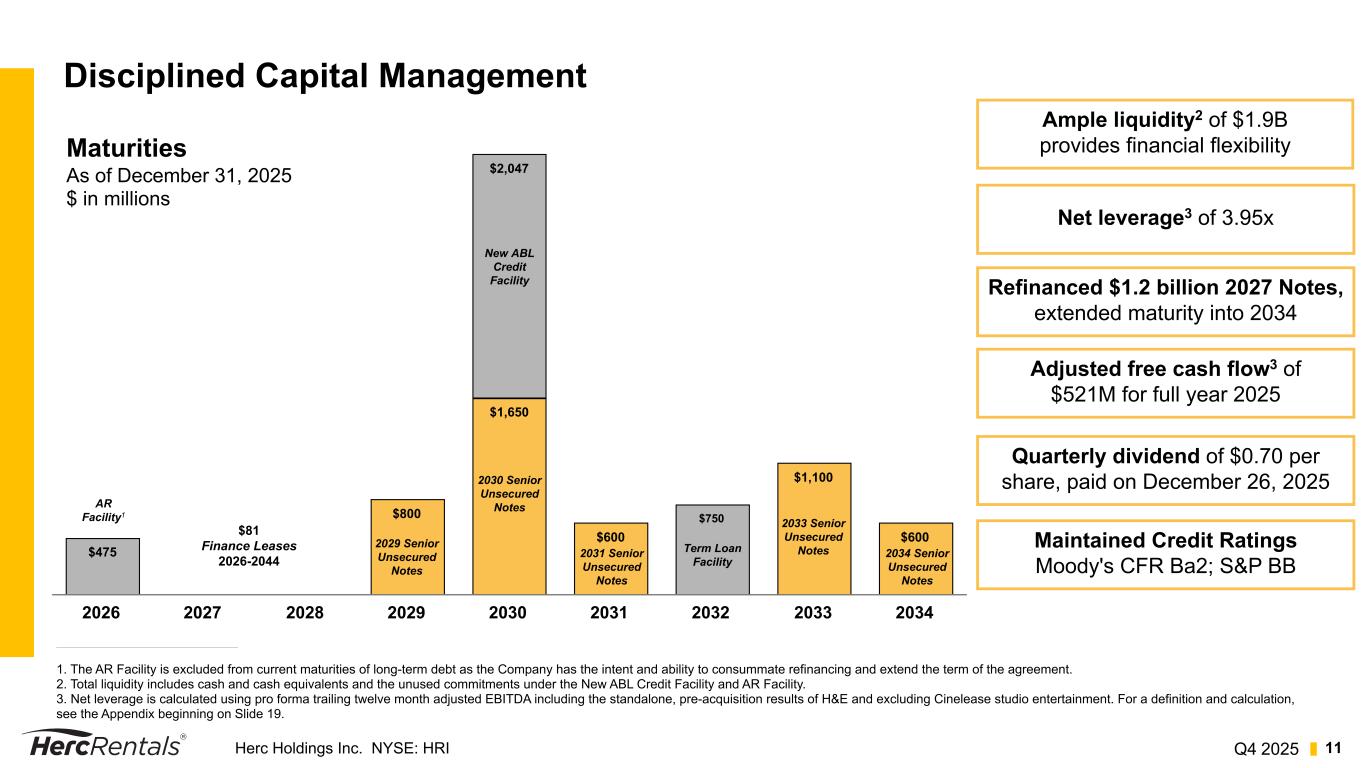

Q4 2025Herc Holdings Inc. NYSE: HRI 11 Disciplined Capital Management 1. The AR Facility is excluded from current maturities of long-term debt as the Company has the intent and ability to consummate refinancing and extend the term of the agreement. 2. Total liquidity includes cash and cash equivalents and the unused commitments under the New ABL Credit Facility and AR Facility. 3. Net leverage is calculated using pro forma trailing twelve month adjusted EBITDA including the standalone, pre-acquisition results of H&E and excluding Cinelease studio entertainment. For a definition and calculation, see the Appendix beginning on Slide 19. Maturities As of December 31, 2025 $ in millions $800 $1,650 $600 $1,100 $600 $2,047 $750 $475 2026 2027 2028 2029 2030 2031 2032 2033 2034 $81 Finance Leases 2026-2044 2031 Senior Unsecured Notes AR Facility1 2029 Senior Unsecured Notes New ABL Credit Facility Ample liquidity2 of $1.9B provides financial flexibility Net leverage3 of 3.95x Adjusted free cash flow3 of $521M for full year 2025 Quarterly dividend of $0.70 per share, paid on December 26, 2025 Maintained Credit Ratings Moody's CFR Ba2; S&P BB 2033 Senior Unsecured Notes 2030 Senior Unsecured Notes Term Loan Facility 2034 Senior Unsecured Notes Refinanced $1.2 billion 2027 Notes, extended maturity into 2034

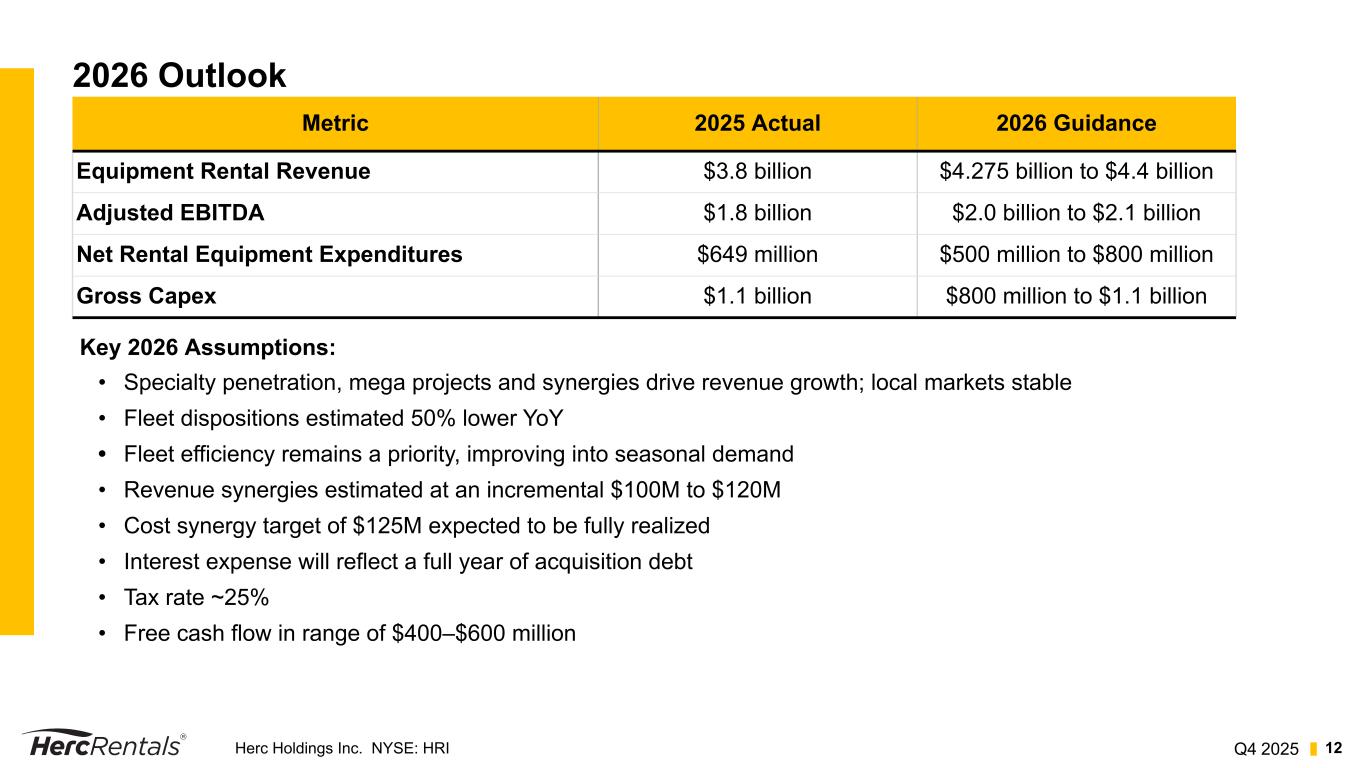

Q4 2025Herc Holdings Inc. NYSE: HRI 12 2026 Outlook Key 2026 Assumptions: • Specialty penetration, mega projects and synergies drive revenue growth; local markets stable • Fleet dispositions estimated 50% lower YoY • Fleet efficiency remains a priority, improving into seasonal demand • Revenue synergies estimated at an incremental $100M to $120M • Cost synergy target of $125M expected to be fully realized • Interest expense will reflect a full year of acquisition debt • Tax rate ~25% • Free cash flow in range of $400–$600 million Metric 2025 Actual 2026 Guidance Equipment Rental Revenue $3.8 billion $4.275 billion to $4.4 billion Adjusted EBITDA $1.8 billion $2.0 billion to $2.1 billion Net Rental Equipment Expenditures $649 million $500 million to $800 million Gross Capex $1.1 billion $800 million to $1.1 billion

Q4 2025Herc Holdings Inc. NYSE: HRI 13 Operations Review Aaron Birnbaum President

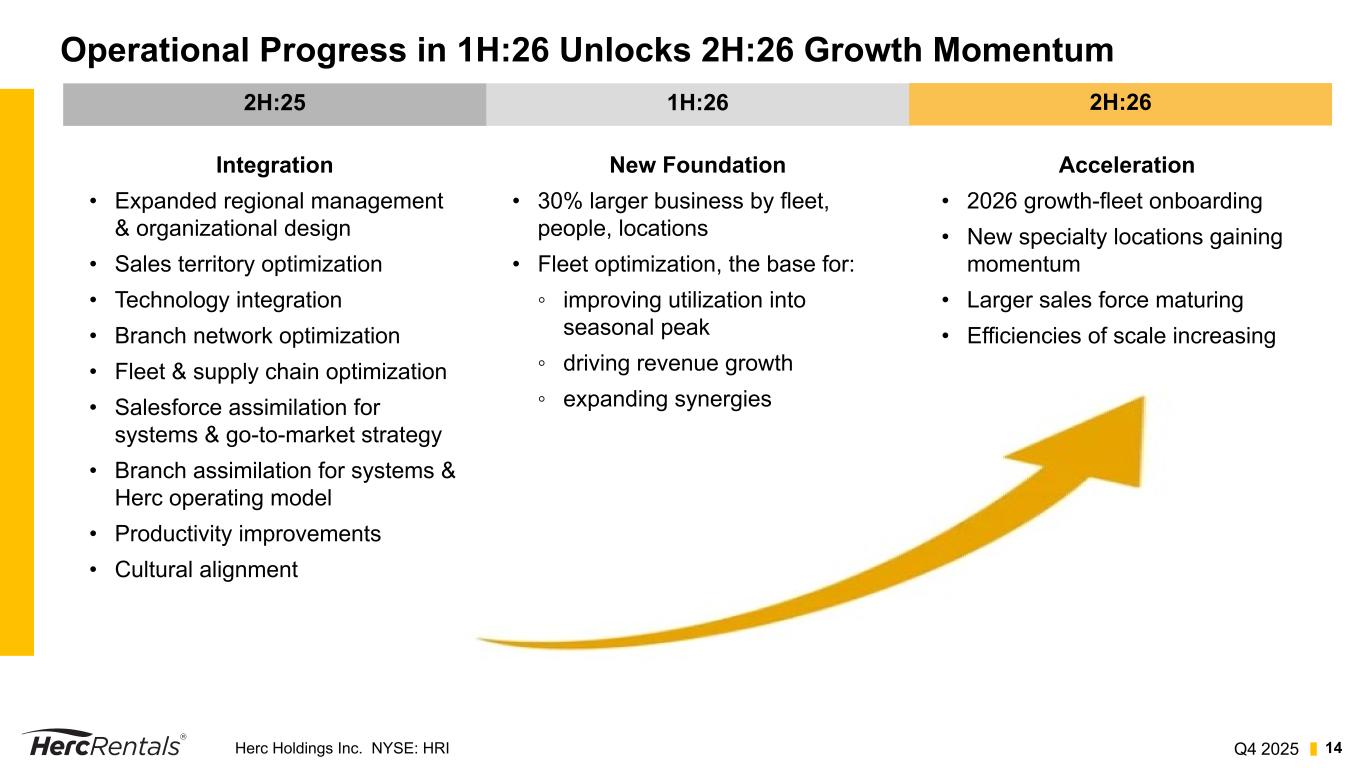

Q4 2025Herc Holdings Inc. NYSE: HRI 14 Operational Progress in 1H:26 Unlocks 2H:26 Growth Momentum Integration • Expanded regional management & organizational design • Sales territory optimization • Technology integration • Branch network optimization • Fleet & supply chain optimization • Salesforce assimilation for systems & go-to-market strategy • Branch assimilation for systems & Herc operating model • Productivity improvements • Cultural alignment New Foundation • 30% larger business by fleet, people, locations • Fleet optimization, the base for: ◦ improving utilization into seasonal peak ◦ driving revenue growth ◦ expanding synergies Acceleration • 2026 growth-fleet onboarding • New specialty locations gaining momentum • Larger sales force maturing • Efficiencies of scale increasing 2H:25 1H:26 2H:26

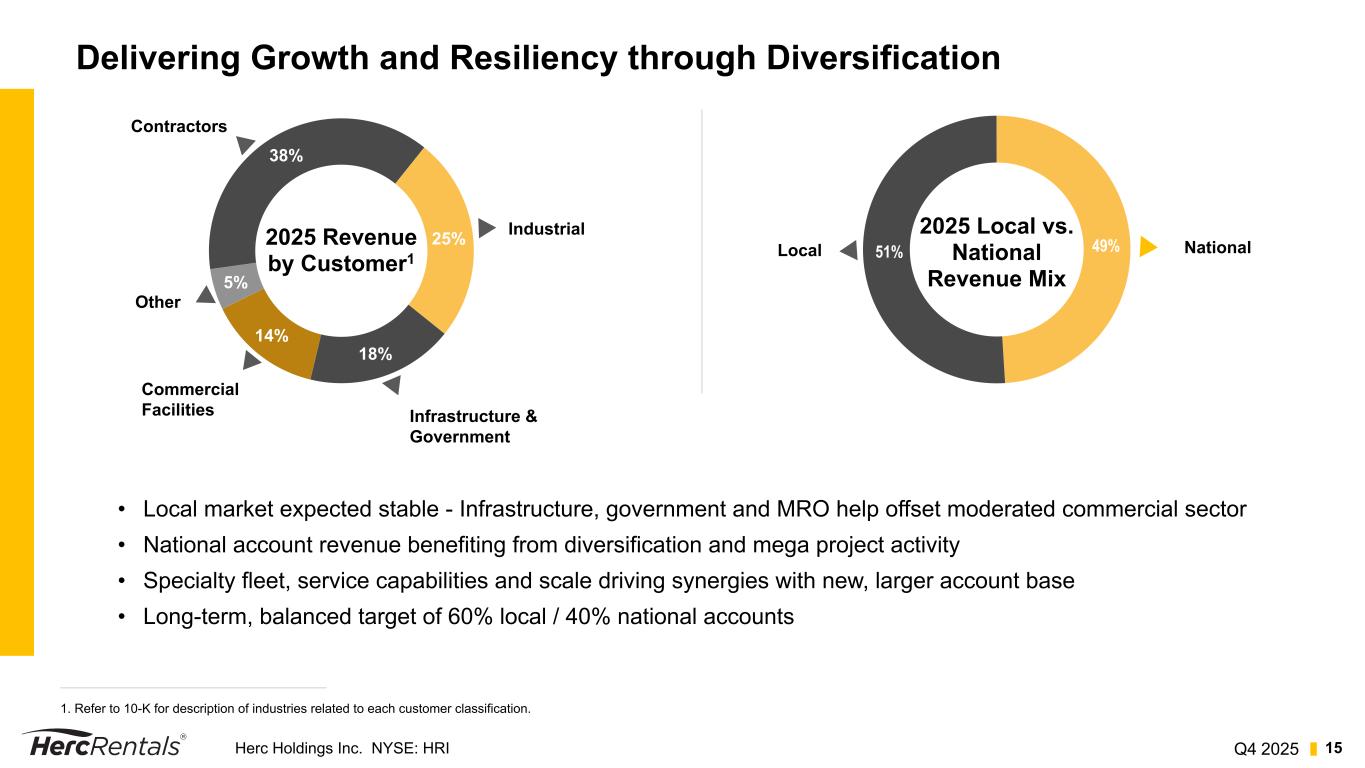

Q4 2025Herc Holdings Inc. NYSE: HRI 15 Delivering Growth and Resiliency through Diversification 2025 Local vs. National Revenue Mix 49%51% National2025 Revenue by Customer1 38% 25% 18% 14% 5% Local Commercial Facilities Contractors Infrastructure & Government Other Industrial • Local market expected stable - Infrastructure, government and MRO help offset moderated commercial sector • National account revenue benefiting from diversification and mega project activity • Specialty fleet, service capabilities and scale driving synergies with new, larger account base • Long-term, balanced target of 60% local / 40% national accounts 1. Refer to 10-K for description of industries related to each customer classification.

Q4 2025Herc Holdings Inc. NYSE: HRI 16 Capitalizing on Growth Trends Across Diverse Customer and Project Base Pipeline of new construction and maintenance projects offers wide spectrum of growth opportunities • Banks • Casinos • Hospitality (hotel & motel) • Parking Garages • Religious Building • Retail Facilities • Commercial Warehousing • Education • Facility Maintenance • Healthcare • Data Centers • Sporting Events • TV, Film & Radio • Live Events Contractors (38%) Industrial (25%) Commercial Facilities (14%) Other (5%) • Aerospace • Alternative • Automotive • Energy/ Renewables • Food & Beverage • Agriculture • Chemical Processing • Industrial Manufacturing • Metals & Minerals • Oil & Gas Production • Oil & Gas Pipeline • Oil & Gas Refineries • Pharmaceutical • Power • Pulp. Paper & Wood • Shipbuilding/Yards • Electrical • General Contractors • Mechanical • Remediation & Environmental • Residential • Restoration • Specialty Contractors • Airports • Bridge • Federal Government • Local & State Government • Military Base • Prisons • Railroad & Mass Transportation • Streets, Road & Highway • Sewer & Waste Disposal • Water Supply & Distribution • Utilities Infrastructure & Gov. Direct (18%) Herc Rentals is Well Positioned with Current Trending Opportunities HybridChip Plants Data Centers LNG PlantRenewables Utilities Healthcare Infrastructure New verticals since 2016 in bold.

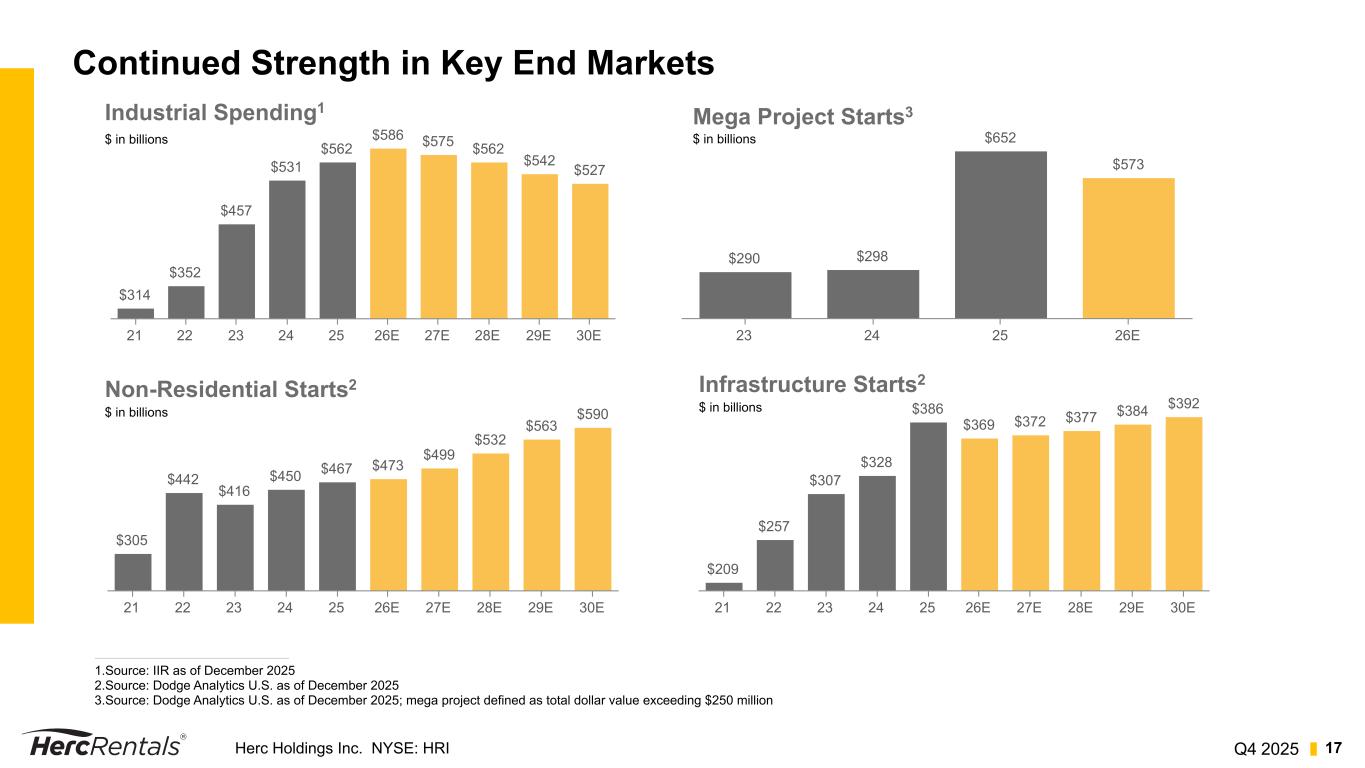

Q4 2025Herc Holdings Inc. NYSE: HRI 17 Continued Strength in Key End Markets 1.Source: IIR as of December 2025 2.Source: Dodge Analytics U.S. as of December 2025 3.Source: Dodge Analytics U.S. as of December 2025; mega project defined as total dollar value exceeding $250 million Industrial Spending1 $314 $352 $457 $531 $562 $586 $575 $562 $542 $527 21 22 23 24 25 26E 27E 28E 29E 30E $ in billions Non-Residential Starts2 $305 $442 $416 $450 $467 $473 $499 $532 $563 $590 21 22 23 24 25 26E 27E 28E 29E 30E $ in billions Infrastructure Starts2 $209 $257 $307 $328 $386 $369 $372 $377 $384 $392 21 22 23 24 25 26E 27E 28E 29E 30E $ in billions Mega Project Starts3 $290 $298 $652 $573 23 24 25 26E $ in billions

Q4 2025Herc Holdings Inc. NYSE: HRI 18 Purpose, Vision, Mission and Values Purpose: We equip our customers and communities to build a brighter future

Appendix

Q4 2025Herc Holdings Inc. NYSE: HRI 20 Glossary of Terms Commonly Use in the Industry OEC: Original Equipment Cost which is an operating measure based on the guidelines of the American Rental Association (ARA), which is calculated as the cost of the asset at the time it was first purchased plus additional capitalized refurbishment costs (with the basis of refurbished assets reset at the refurbishment date). Fleet Age: The OEC weighted age of the entire fleet, based on ARA guidelines. Net Fleet Capital Expenditures: Capital expenditures of rental equipment minus the proceeds from disposal of rental equipment. Dollar Utilization ($ UT): Dollar utilization is an operating measure calculated by dividing equipment rental revenue (excluding re-rent, delivery, pick-up and other ancillary revenue) by the average OEC of the equipment fleet for the relevant time period, based on ARA guidelines.

Q4 2025Herc Holdings Inc. NYSE: HRI 21 Reconciliation of Net Income to Adj. EBITDA and Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through EBITDA, Adjusted EBITDA, and REBITDA—EBITDA represents the sum of net income (loss), provision (benefit) for income taxes, interest expense, net, depreciation of rental equipment and non-rental depreciation and amortization. Adjusted EBITDA represents EBITDA plus the sum of transaction expenses, restructuring and restructuring related charges, spin-off costs, non-cash stock based compensation charges, loss on extinguishment of debt (which is included in interest expense, net), impairment charges, gain (loss) on disposal of a business, impact of the fair value mark-up of acquired fleet, impact of the studio entertainment business and certain other items. REBITDA represents Adjusted EBITDA excluding the gain (loss) on sales of rental equipment and new equipment, parts and supplies. EBITDA, Adjusted EBITDA and REBITDA do not purport to be alternatives to net income as an indicator of operating performance. Additionally, none of these measures purports to be an alternative to cash flows from operating activities as a measure of liquidity, as they do not consider certain cash requirements such as interest payments and tax payments. Adjusted EBITDA Margin, REBITDA Margin and REBITDA Flow-Through—Adjusted EBITDA Margin (Adjusted EBITDA / Total Revenues) is a commonly used profitability ratio. REBITDA Margin (REBITDA / Equipment rental, service and other revenues) and REBITDA Flow- Through (the year-over-year change in REBITDA/the year-over-year change in Equipment rental, service, and other revenues) are useful operating profitability ratios to management and investors.

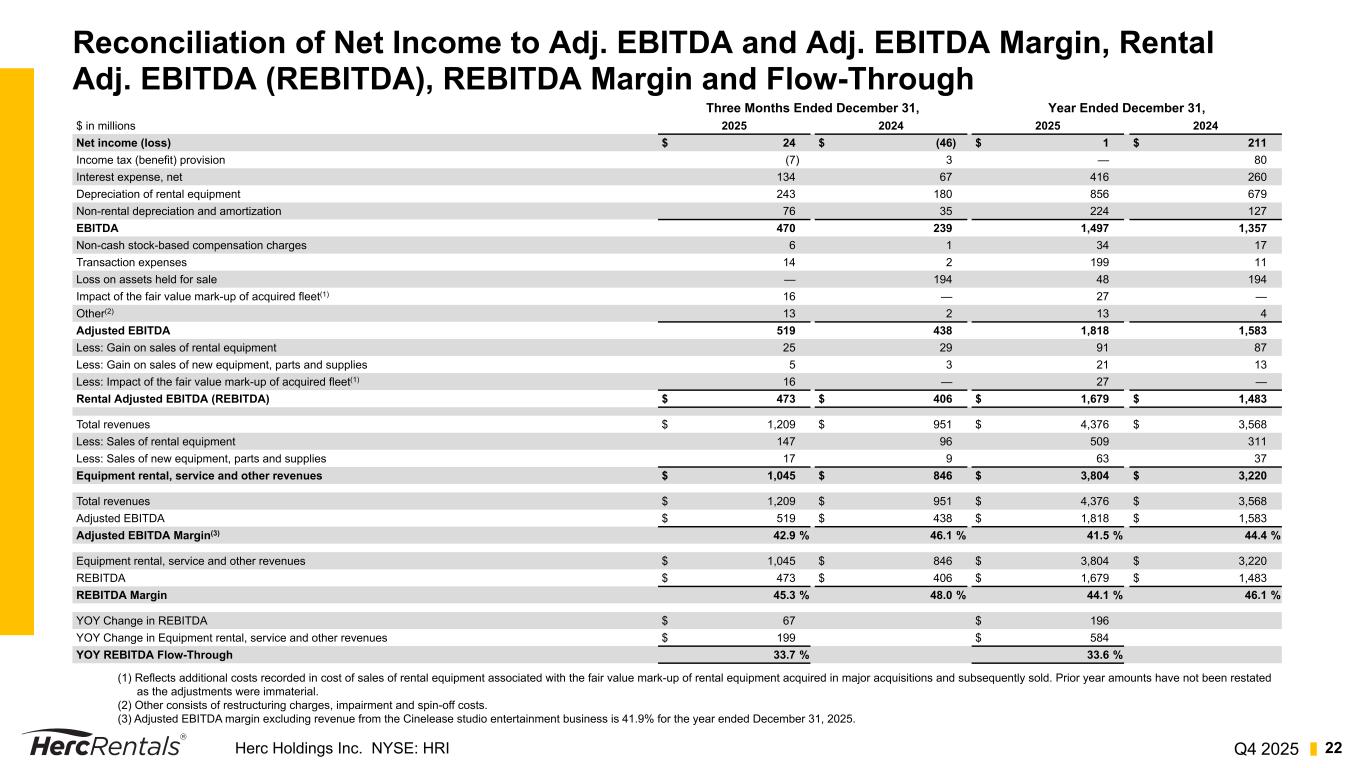

Q4 2025Herc Holdings Inc. NYSE: HRI 22 Reconciliation of Net Income to Adj. EBITDA and Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through Three Months Ended December 31, Year Ended December 31, $ in millions 2025 2024 2025 2024 Net income (loss) $ 24 $ (46) $ 1 $ 211 Income tax (benefit) provision (7) 3 — 80 Interest expense, net 134 67 416 260 Depreciation of rental equipment 243 180 856 679 Non-rental depreciation and amortization 76 35 224 127 EBITDA 470 239 1,497 1,357 Non-cash stock-based compensation charges 6 1 34 17 Transaction expenses 14 2 199 11 Loss on assets held for sale — 194 48 194 Impact of the fair value mark-up of acquired fleet(1) 16 — 27 — Other(2) 13 2 13 4 Adjusted EBITDA 519 438 1,818 1,583 Less: Gain on sales of rental equipment 25 29 91 87 Less: Gain on sales of new equipment, parts and supplies 5 3 21 13 Less: Impact of the fair value mark-up of acquired fleet(1) 16 — 27 — Rental Adjusted EBITDA (REBITDA) $ 473 $ 406 $ 1,679 $ 1,483 Total revenues $ 1,209 $ 951 $ 4,376 $ 3,568 Less: Sales of rental equipment 147 96 509 311 Less: Sales of new equipment, parts and supplies 17 9 63 37 Equipment rental, service and other revenues $ 1,045 $ 846 $ 3,804 $ 3,220 Total revenues $ 1,209 $ 951 $ 4,376 $ 3,568 Adjusted EBITDA $ 519 $ 438 $ 1,818 $ 1,583 Adjusted EBITDA Margin(3) 42.9 % 46.1 % 41.5 % 44.4 % Equipment rental, service and other revenues $ 1,045 $ 846 $ 3,804 $ 3,220 REBITDA $ 473 $ 406 $ 1,679 $ 1,483 REBITDA Margin 45.3 % 48.0 % 44.1 % 46.1 % YOY Change in REBITDA $ 67 $ 196 YOY Change in Equipment rental, service and other revenues $ 199 $ 584 YOY REBITDA Flow-Through 33.7 % 33.6 % (1) Reflects additional costs recorded in cost of sales of rental equipment associated with the fair value mark-up of rental equipment acquired in major acquisitions and subsequently sold. Prior year amounts have not been restated as the adjustments were immaterial. (2) Other consists of restructuring charges, impairment and spin-off costs. (3) Adjusted EBITDA margin excluding revenue from the Cinelease studio entertainment business is 41.9% for the year ended December 31, 2025.

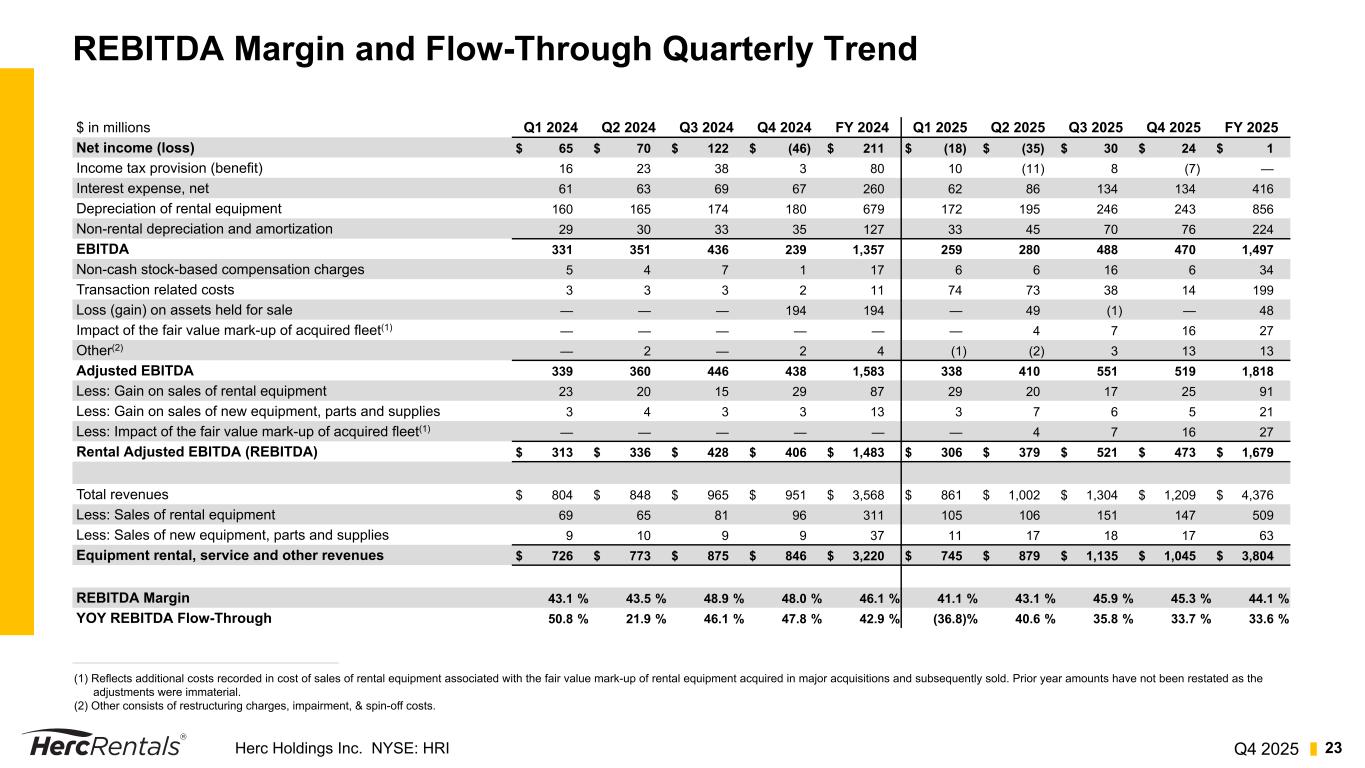

Q4 2025Herc Holdings Inc. NYSE: HRI 23 REBITDA Margin and Flow-Through Quarterly Trend $ in millions Q1 2024 Q2 2024 Q3 2024 Q4 2024 FY 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 FY 2025 Net income (loss) $ 65 $ 70 $ 122 $ (46) $ 211 $ (18) $ (35) $ 30 $ 24 $ 1 Income tax provision (benefit) 16 23 38 3 80 10 (11) 8 (7) — Interest expense, net 61 63 69 67 260 62 86 134 134 416 Depreciation of rental equipment 160 165 174 180 679 172 195 246 243 856 Non-rental depreciation and amortization 29 30 33 35 127 33 45 70 76 224 EBITDA 331 351 436 239 1,357 259 280 488 470 1,497 Non-cash stock-based compensation charges 5 4 7 1 17 6 6 16 6 34 Transaction related costs 3 3 3 2 11 74 73 38 14 199 Loss (gain) on assets held for sale — — — 194 194 — 49 (1) — 48 Impact of the fair value mark-up of acquired fleet(1) — — — — — — 4 7 16 27 Other(2) — 2 — 2 4 (1) (2) 3 13 13 Adjusted EBITDA 339 360 446 438 1,583 338 410 551 519 1,818 Less: Gain on sales of rental equipment 23 20 15 29 87 29 20 17 25 91 Less: Gain on sales of new equipment, parts and supplies 3 4 3 3 13 3 7 6 5 21 Less: Impact of the fair value mark-up of acquired fleet(1) — — — — — — 4 7 16 27 Rental Adjusted EBITDA (REBITDA) $ 313 $ 336 $ 428 $ 406 $ 1,483 $ 306 $ 379 $ 521 $ 473 $ 1,679 Total revenues $ 804 $ 848 $ 965 $ 951 $ 3,568 $ 861 $ 1,002 $ 1,304 $ 1,209 $ 4,376 Less: Sales of rental equipment 69 65 81 96 311 105 106 151 147 509 Less: Sales of new equipment, parts and supplies 9 10 9 9 37 11 17 18 17 63 Equipment rental, service and other revenues $ 726 $ 773 $ 875 $ 846 $ 3,220 $ 745 $ 879 $ 1,135 $ 1,045 $ 3,804 REBITDA Margin 43.1 % 43.5 % 48.9 % 48.0 % 46.1 % 41.1 % 43.1 % 45.9 % 45.3 % 44.1 % YOY REBITDA Flow-Through 50.8 % 21.9 % 46.1 % 47.8 % 42.9 % (36.8) % 40.6 % 35.8 % 33.7 % 33.6 % (1) Reflects additional costs recorded in cost of sales of rental equipment associated with the fair value mark-up of rental equipment acquired in major acquisitions and subsequently sold. Prior year amounts have not been restated as the adjustments were immaterial. (2) Other consists of restructuring charges, impairment, & spin-off costs.

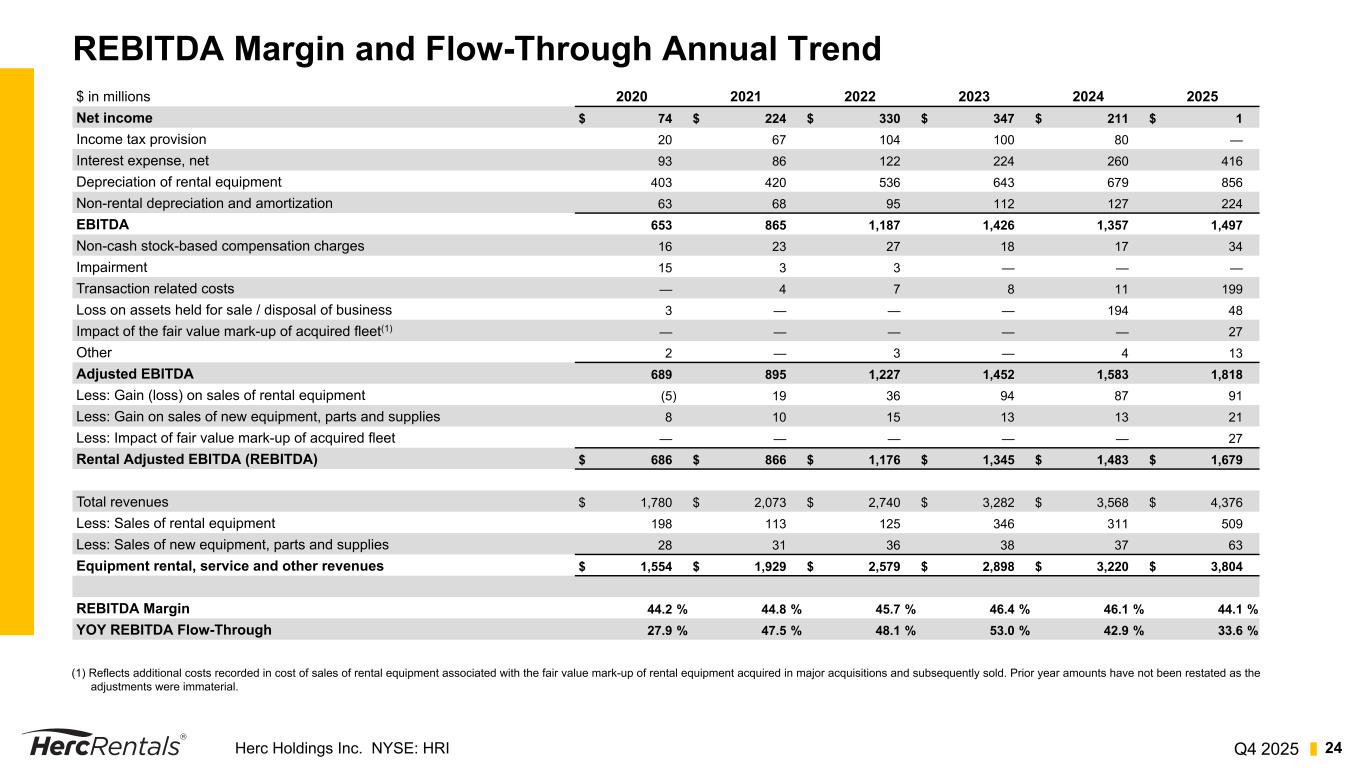

Q4 2025Herc Holdings Inc. NYSE: HRI 24 REBITDA Margin and Flow-Through Annual Trend $ in millions 2020 2021 2022 2023 2024 2025 Net income $ 74 $ 224 $ 330 $ 347 $ 211 $ 1 Income tax provision 20 67 104 100 80 — Interest expense, net 93 86 122 224 260 416 Depreciation of rental equipment 403 420 536 643 679 856 Non-rental depreciation and amortization 63 68 95 112 127 224 EBITDA 653 865 1,187 1,426 1,357 1,497 Non-cash stock-based compensation charges 16 23 27 18 17 34 Impairment 15 3 3 — — — Transaction related costs — 4 7 8 11 199 Loss on assets held for sale / disposal of business 3 — — — 194 48 Impact of the fair value mark-up of acquired fleet(1) — — — — — 27 Other 2 — 3 — 4 13 Adjusted EBITDA 689 895 1,227 1,452 1,583 1,818 Less: Gain (loss) on sales of rental equipment (5) 19 36 94 87 91 Less: Gain on sales of new equipment, parts and supplies 8 10 15 13 13 21 Less: Impact of fair value mark-up of acquired fleet — — — — — 27 Rental Adjusted EBITDA (REBITDA) $ 686 $ 866 $ 1,176 $ 1,345 $ 1,483 $ 1,679 Total revenues $ 1,780 $ 2,073 $ 2,740 $ 3,282 $ 3,568 $ 4,376 Less: Sales of rental equipment 198 113 125 346 311 509 Less: Sales of new equipment, parts and supplies 28 31 36 38 37 63 Equipment rental, service and other revenues $ 1,554 $ 1,929 $ 2,579 $ 2,898 $ 3,220 $ 3,804 REBITDA Margin 44.2 % 44.8 % 45.7 % 46.4 % 46.1 % 44.1 % YOY REBITDA Flow-Through 27.9 % 47.5 % 48.1 % 53.0 % 42.9 % 33.6 % (1) Reflects additional costs recorded in cost of sales of rental equipment associated with the fair value mark-up of rental equipment acquired in major acquisitions and subsequently sold. Prior year amounts have not been restated as the adjustments were immaterial.

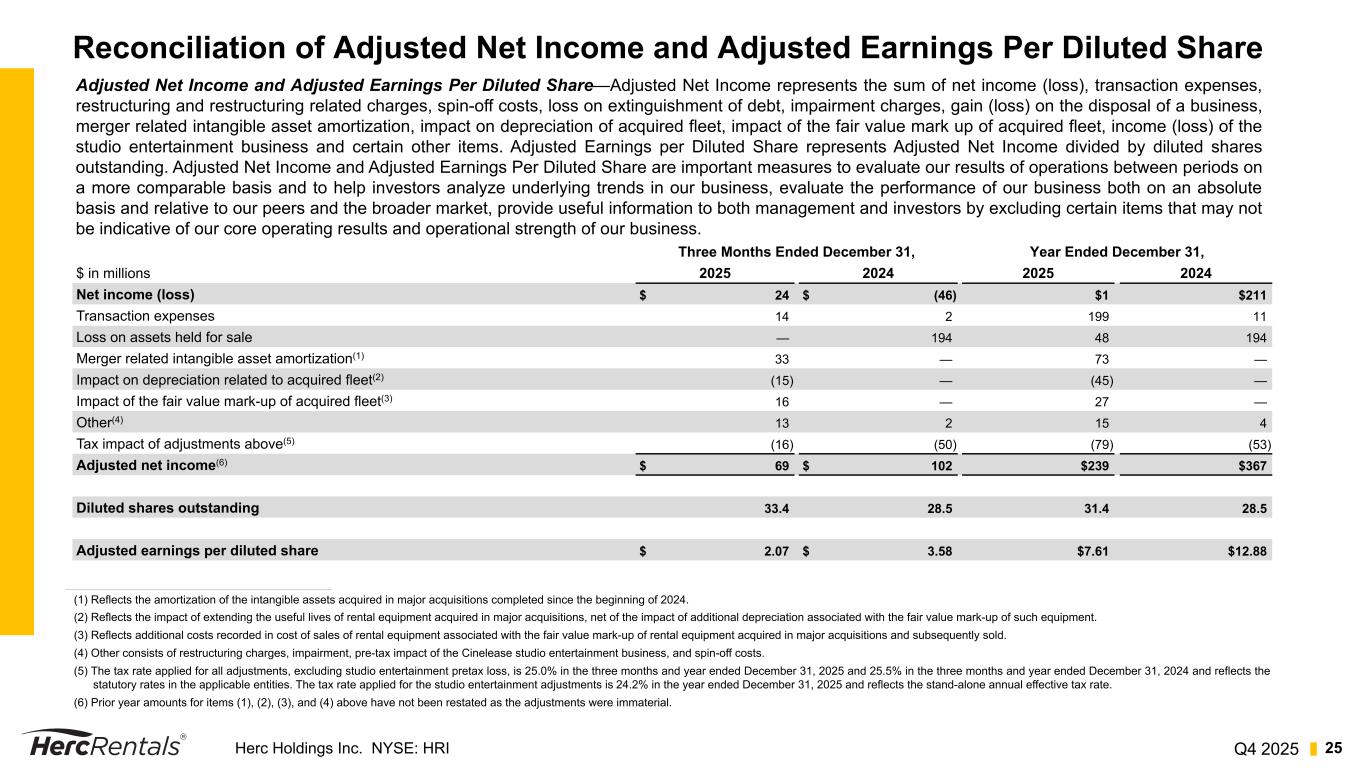

Q4 2025Herc Holdings Inc. NYSE: HRI 25 Reconciliation of Adjusted Net Income and Adjusted Earnings Per Diluted Share Three Months Ended December 31, Year Ended December 31, $ in millions 2025 2024 2025 2024 Net income (loss) $ 24 $ (46) $1 $211 Transaction expenses 14 2 199 11 Loss on assets held for sale — 194 48 194 Merger related intangible asset amortization(1) 33 — 73 — Impact on depreciation related to acquired fleet(2) (15) — (45) — Impact of the fair value mark-up of acquired fleet(3) 16 — 27 — Other(4) 13 2 15 4 Tax impact of adjustments above(5) (16) (50) (79) (53) Adjusted net income(6) $ 69 $ 102 $239 $367 Diluted shares outstanding 33.4 28.5 31.4 28.5 Adjusted earnings per diluted share $ 2.07 $ 3.58 $7.61 $12.88 Adjusted Net Income and Adjusted Earnings Per Diluted Share—Adjusted Net Income represents the sum of net income (loss), transaction expenses, restructuring and restructuring related charges, spin-off costs, loss on extinguishment of debt, impairment charges, gain (loss) on the disposal of a business, merger related intangible asset amortization, impact on depreciation of acquired fleet, impact of the fair value mark up of acquired fleet, income (loss) of the studio entertainment business and certain other items. Adjusted Earnings per Diluted Share represents Adjusted Net Income divided by diluted shares outstanding. Adjusted Net Income and Adjusted Earnings Per Diluted Share are important measures to evaluate our results of operations between periods on a more comparable basis and to help investors analyze underlying trends in our business, evaluate the performance of our business both on an absolute basis and relative to our peers and the broader market, provide useful information to both management and investors by excluding certain items that may not be indicative of our core operating results and operational strength of our business. (1) Reflects the amortization of the intangible assets acquired in major acquisitions completed since the beginning of 2024. (2) Reflects the impact of extending the useful lives of rental equipment acquired in major acquisitions, net of the impact of additional depreciation associated with the fair value mark-up of such equipment. (3) Reflects additional costs recorded in cost of sales of rental equipment associated with the fair value mark-up of rental equipment acquired in major acquisitions and subsequently sold. (4) Other consists of restructuring charges, impairment, pre-tax impact of the Cinelease studio entertainment business, and spin-off costs. (5) The tax rate applied for all adjustments, excluding studio entertainment pretax loss, is 25.0% in the three months and year ended December 31, 2025 and 25.5% in the three months and year ended December 31, 2024 and reflects the statutory rates in the applicable entities. The tax rate applied for the studio entertainment adjustments is 24.2% in the year ended December 31, 2025 and reflects the stand-alone annual effective tax rate. (6) Prior year amounts for items (1), (2), (3), and (4) above have not been restated as the adjustments were immaterial.

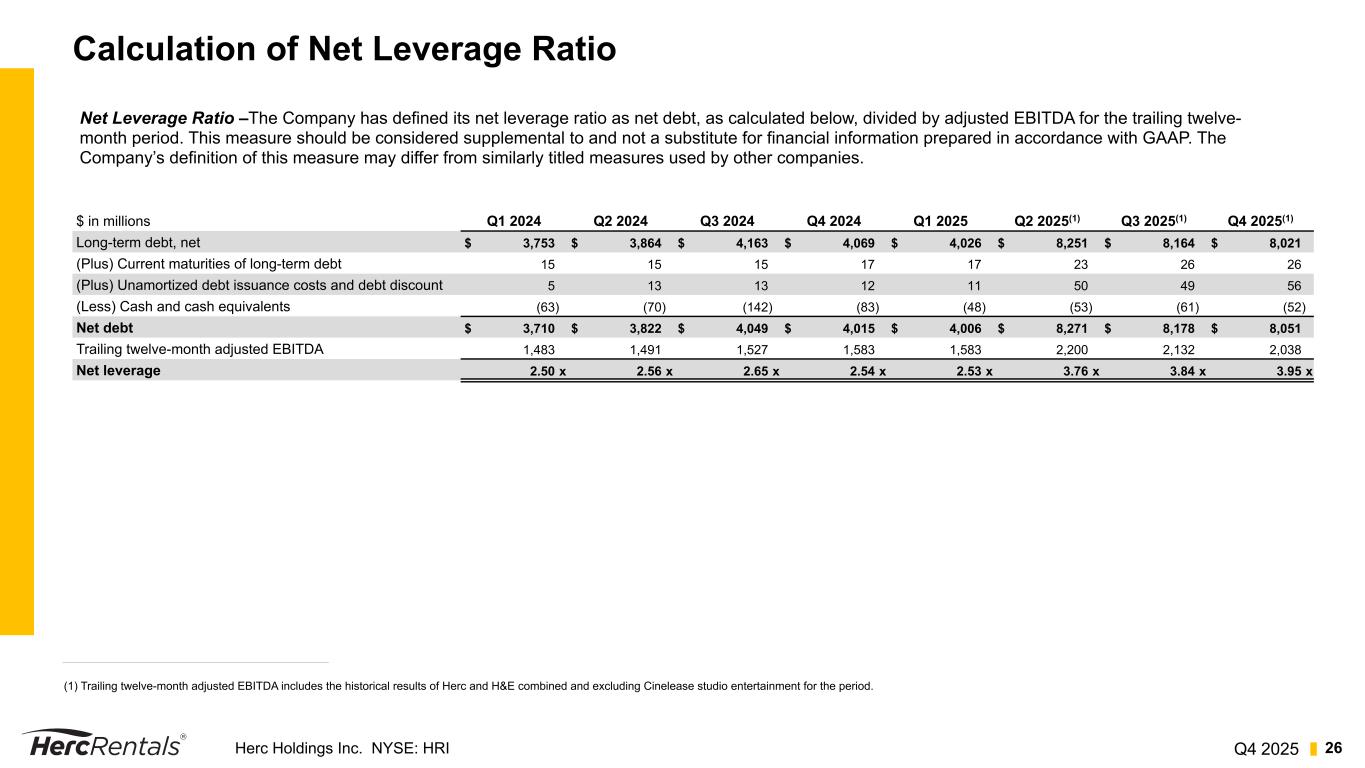

Q4 2025Herc Holdings Inc. NYSE: HRI 26 Calculation of Net Leverage Ratio $ in millions Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025(1) Q3 2025(1) Q4 2025(1) Long-term debt, net $ 3,753 $ 3,864 $ 4,163 $ 4,069 $ 4,026 $ 8,251 $ 8,164 $ 8,021 (Plus) Current maturities of long-term debt 15 15 15 17 17 23 26 26 (Plus) Unamortized debt issuance costs and debt discount 5 13 13 12 11 50 49 56 (Less) Cash and cash equivalents (63) (70) (142) (83) (48) (53) (61) (52) Net debt $ 3,710 $ 3,822 $ 4,049 $ 4,015 $ 4,006 $ 8,271 $ 8,178 $ 8,051 Trailing twelve-month adjusted EBITDA 1,483 1,491 1,527 1,583 1,583 2,200 2,132 2,038 Net leverage 2.50 x 2.56 x 2.65 x 2.54 x 2.53 x 3.76 x 3.84 x 3.95 x Net Leverage Ratio –The Company has defined its net leverage ratio as net debt, as calculated below, divided by adjusted EBITDA for the trailing twelve- month period. This measure should be considered supplemental to and not a substitute for financial information prepared in accordance with GAAP. The Company’s definition of this measure may differ from similarly titled measures used by other companies. (1) Trailing twelve-month adjusted EBITDA includes the historical results of Herc and H&E combined and excluding Cinelease studio entertainment for the period.

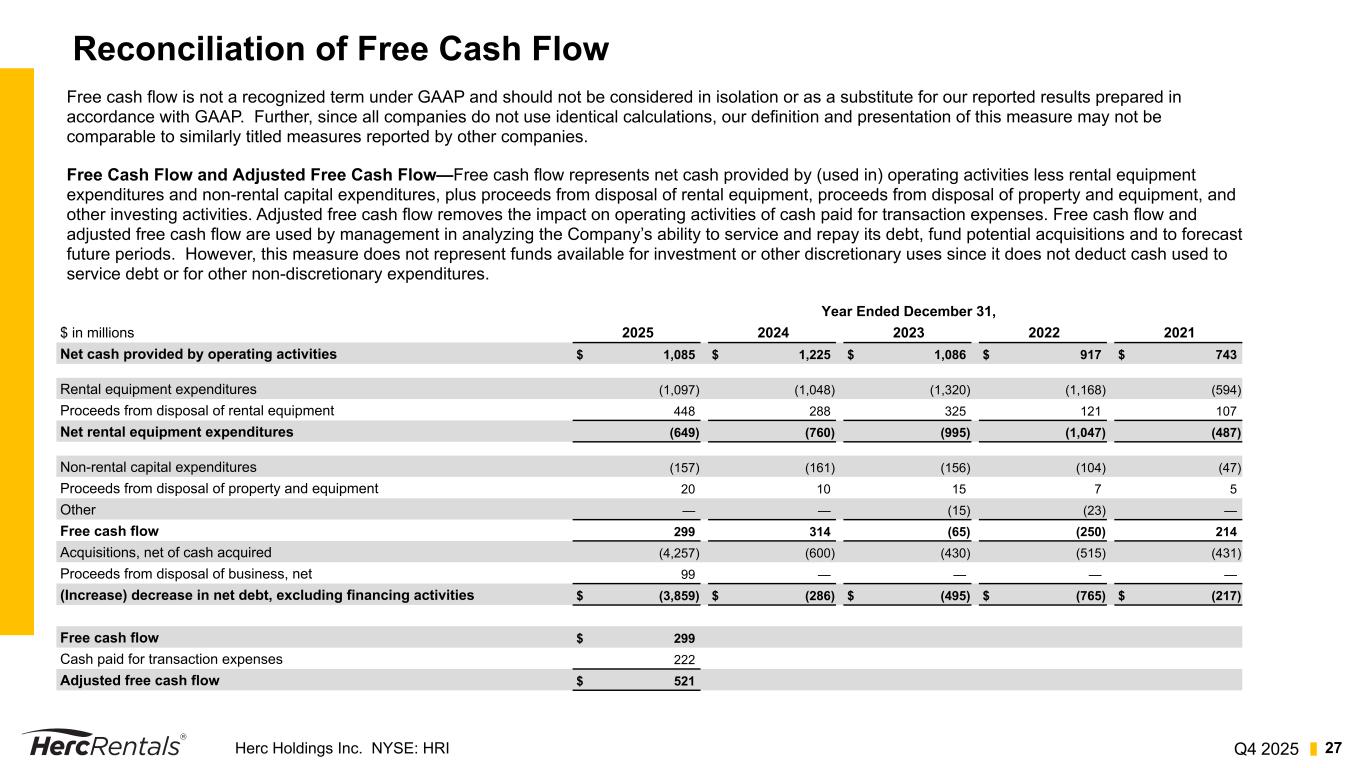

Q4 2025Herc Holdings Inc. NYSE: HRI 27 Reconciliation of Free Cash Flow Year Ended December 31, $ in millions 2025 2024 2023 2022 2021 Net cash provided by operating activities $ 1,085 $ 1,225 $ 1,086 $ 917 $ 743 Rental equipment expenditures (1,097) (1,048) (1,320) (1,168) (594) Proceeds from disposal of rental equipment 448 288 325 121 107 Net rental equipment expenditures (649) (760) (995) (1,047) (487) Non-rental capital expenditures (157) (161) (156) (104) (47) Proceeds from disposal of property and equipment 20 10 15 7 5 Other — — (15) (23) — Free cash flow 299 314 (65) (250) 214 Acquisitions, net of cash acquired (4,257) (600) (430) (515) (431) Proceeds from disposal of business, net 99 — — — — (Increase) decrease in net debt, excluding financing activities $ (3,859) $ (286) $ (495) $ (765) $ (217) Free cash flow $ 299 Cash paid for transaction expenses 222 Adjusted free cash flow $ 521 Free cash flow is not a recognized term under GAAP and should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP. Further, since all companies do not use identical calculations, our definition and presentation of this measure may not be comparable to similarly titled measures reported by other companies. Free Cash Flow and Adjusted Free Cash Flow—Free cash flow represents net cash provided by (used in) operating activities less rental equipment expenditures and non-rental capital expenditures, plus proceeds from disposal of rental equipment, proceeds from disposal of property and equipment, and other investing activities. Adjusted free cash flow removes the impact on operating activities of cash paid for transaction expenses. Free cash flow and adjusted free cash flow are used by management in analyzing the Company’s ability to service and repay its debt, fund potential acquisitions and to forecast future periods. However, this measure does not represent funds available for investment or other discretionary uses since it does not deduct cash used to service debt or for other non-discretionary expenditures.

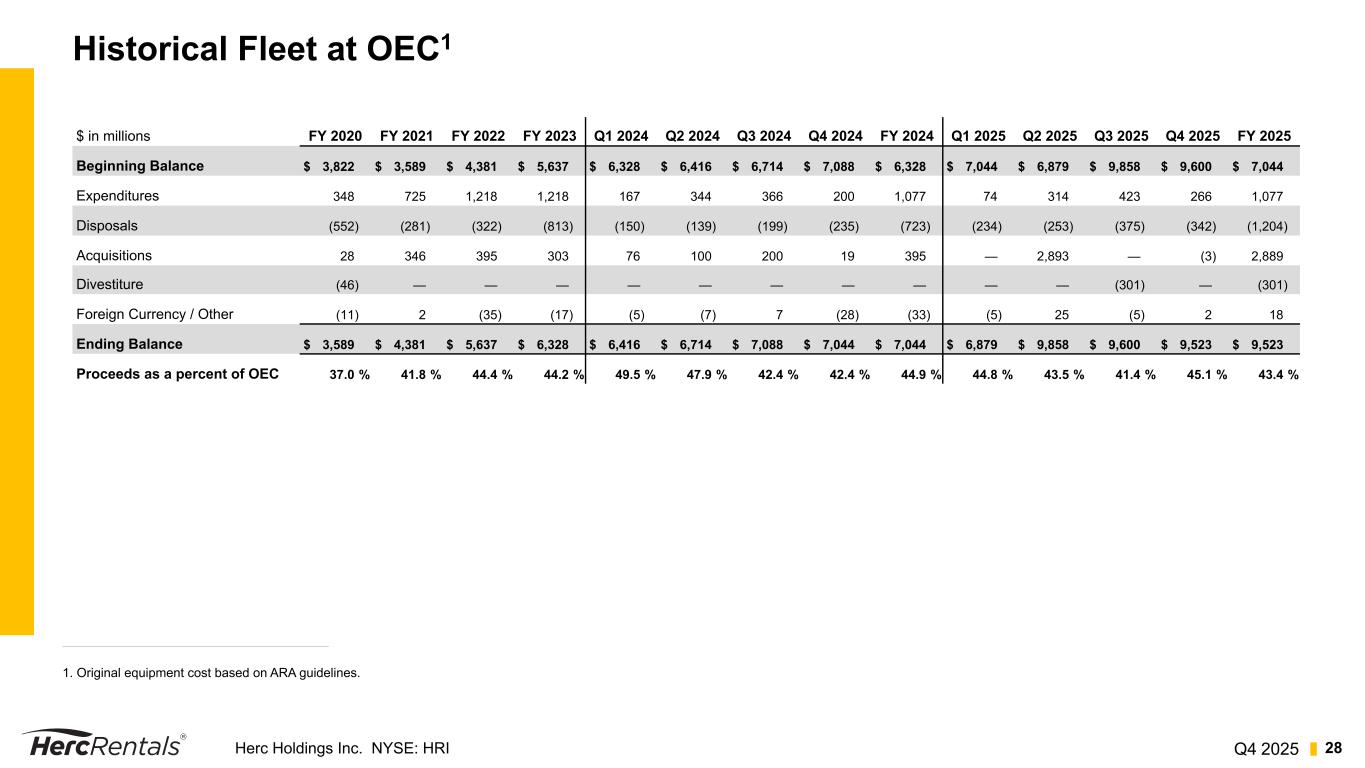

Q4 2025Herc Holdings Inc. NYSE: HRI 28 Historical Fleet at OEC1 $ in millions FY 2020 FY 2021 FY 2022 FY 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 FY 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 FY 2025 Beginning Balance $ 3,822 $ 3,589 $ 4,381 $ 5,637 $ 6,328 $ 6,416 $ 6,714 $ 7,088 $ 6,328 $ 7,044 $ 6,879 $ 9,858 $ 9,600 $ 7,044 Expenditures 348 725 1,218 1,218 167 344 366 200 1,077 74 314 423 266 1,077 Disposals (552) (281) (322) (813) (150) (139) (199) (235) (723) (234) (253) (375) (342) (1,204) Acquisitions 28 346 395 303 76 100 200 19 395 — 2,893 — (3) 2,889 Divestiture (46) — — — — — — — — — — (301) — (301) Foreign Currency / Other (11) 2 (35) (17) (5) (7) 7 (28) (33) (5) 25 (5) 2 18 Ending Balance $ 3,589 $ 4,381 $ 5,637 $ 6,328 $ 6,416 $ 6,714 $ 7,088 $ 7,044 $ 7,044 $ 6,879 $ 9,858 $ 9,600 $ 9,523 $ 9,523 Proceeds as a percent of OEC 37.0 % 41.8 % 44.4 % 44.2 % 49.5 % 47.9 % 42.4 % 42.4 % 44.9 % 44.8 % 43.5 % 41.4 % 45.1 % 43.4 % 1. Original equipment cost based on ARA guidelines.

Q4 2025Herc Holdings Inc. NYSE: HRI 29 For additional information, please contact: Leslie Hunziker SVP Investor Relations, Communications & Sustainability leslie.hunziker@hercrentals.com 239-301-1675