325722163 v9 Chegg, Inc. Employment Agreement October 27, 2025 Daniel Rosensweig Sent via email Dear Dan: On behalf of Chegg, Inc. (the “Company”), this Employment Agreement (this “Agreement”) sets forth the terms and conditions of your continued employment with the Company. This Agreement replaces and supersedes in its entirety the April 24, 2024 Executive Chair Agreement between you and the Company. 1. Position. Effective as of October 27, 2025 (the “Effective Date”) you will be appointed as Chief Executive Officer (“CEO”) of the Company and will hold the title of CEO, President and Executive Chairman. You will continue to serve as a member of the Company’s Board of Directors (the “Board”), and in your capacity as CEO and President will report to the Board. You will have all of the duties, responsibilities and authority commensurate with the position of CEO and President. You will be expected to devote your full working time and attention to the business of the Company, and you will not render services to any other business without the prior approval of the Board. Notwithstanding the foregoing, you may manage personal investments, participate in civic, charitable, professional and academic activities (including serving on boards and committees), provided that such activities do not at the time the activity or activities commence or thereafter create an actual or potential business or fiduciary conflict of interest. 2. Term. Subject to the terms of this Agreement, this Agreement will remain in effect from the Effective Date and until terminated by you or the Company. 3. Base Salary. The Company will continue to pay you a base salary (the “Base Salary”) at the annualized rate of eight hundred and fifty thousand dollars ($850,000) per year, subject to annual review. Payment of your salary shall be less applicable withholding taxes and payable in accordance with the Company’s standard payroll schedule. At this time, you are not eligible for an annual bonus. 4. Benefits. You will continue to be eligible to participate in all employee retirement, welfare, insurance, benefit and vacation programs of the Company as are in effect from time to time and in which other senior executives of the Company are eligible to participate, on the same terms as such other senior executives. 5. Equity Awards. (a) RSUs. Subject to the approval of the Board or the Compensation Committee of the Board (the “Compensation Committee”), you will be granted an award of restricted stock units (“RSUs”) representing the right to acquire 1,650,000 shares of the Company’s common stock (“Common Stock”). As more fully described in the form of RSU award agreement that will be provided by the Company (the

325722163 v9 “RSU Agreement”), the RSUs will vest over three (3) years, with 1/3 vesting on the one-year anniversary of the first regularly occurring quarterly vesting date that occurs on or following the Transition Date and the remainder vesting in eight (8) equal quarterly installments thereafter, subject to your continued service on such vesting dates. (b) PSUs. Subject to the approval of the Board or the Compensation Committee, you will be granted an award of performance-based restricted stock units (“PSUs”) representing the right to acquire a maximum of 3,850,000 shares of Company Common Stock. As more fully described in the form of PSU award agreement that will be provided by the Company (the “PSU Agreement”), the PSUs will vest based upon the Compensation Committee’s certification of achievement of certain stock price thresholds (as set forth on Exhibit A hereto), as measured at 18 months and 36 months following the date of grant of the PSUs, subject to your continued service on such vesting dates, and subject to potential earlier vesting upon a Change in Control (as defined in the Chegg, Inc. Severance Plan, as it may be amended from time to time (the “Severance Plan”)) if the per-share price with respect to such Change in Control meets or exceeds one or more previously-uncertified stock price thresholds. The RSUs and the PSUs will be subject to the terms and conditions of the Company’s 2023 Equity Incentive Plan (as amended from time to time, the “2023 Plan”) and the RSU Agreement and PSU Agreement, respectively, and vested RSUs and PSUs will be settled as provided thereunder. Except as set forth in the award agreements and the Severance Plan, in the event that you cease service for any reason, you will immediately forfeit any then-unvested RSUs and PSUs without any further action by the Company. (c) Other Outstanding Company Equity Awards. Your other outstanding Company Equity Awards will continue to vest according to the existing vesting schedules applicable to such awards as of the Transition Date, subject to your continued service to the Company on each applicable vesting date, and shall be governed by the applicable Company Equity Plan and the written award agreements governing their grant. 6. Expenses and Reimbursement under Company Policies. The Company will continue to, in accordance with applicable Company policies and guidelines, reimburse you for all reasonable and necessary expenses incurred by you in connection with your performance of services on behalf of the Company. 7. No Other Board Compensation. You acknowledge that for so long as you are employed as CEO (or in any other employment position), you shall not receive any cash or equity compensation for your service on the Board. 8. Severance Plan Eligibility. You will be eligible to participate in the Chegg, Inc. Severance Plan, as it may be amended from time to time (the “Severance Plan”), pursuant to the terms and conditions of the Severance Plan and your Participation Agreement under the Severance Plan, provided that you and the Company have timely executed such Participation Agreement. 9. Section 280G. In the event that the severance and other benefits provided for in this Agreement or otherwise payable to you (a) constitute “parachute payments” within the meaning of Section 280G of the Internal Revenue Code of 1986, as amended (the “Code”), and (b) but for this Section, would be subject to the excise tax imposed by Section 4999 of the Code, then, your severance and other benefits under this Agreement shall be payable either (i) in full, or (ii) as to such lesser amount which would result in no portion of such severance and other benefits being subject to the excise tax under Section 4999 of the Code, whichever of the foregoing amounts, taking into account the applicable federal, state and local income taxes and the excise tax imposed by Section 4999, results in the receipt by you on an after-tax basis,

325722163 v9 of the greatest amount of severance benefits under this Agreement, notwithstanding that all or some portion of such severance benefits may be taxable under Section 4999 of the Code. 10. Section 409A. To the extent (a) any payments to which you become entitled under this Agreement, or any agreement or plan referenced herein, in connection with your termination of employment with the Company constitute deferred compensation subject to Section 409A of the Code and (b) you are deemed at the time of such termination of employment to be a “specified” employee under Section 409A of the Code, then such payment or payments shall not be made or commence until the earlier of (i) the expiration of the six (6)-month period measured from the date of your “separation from service” (as such term is at the time defined in regulations under Section 409A of the Code) with the Company; or (ii) the date of your death following such separation from service; provided, however, that such deferral shall only be effected to the extent required to avoid adverse tax treatment to you, including (without limitation) the additional twenty percent (20%) tax for which you would otherwise be liable under Section 409A(a)(1)(B) of the Code in the absence of such deferral. Upon the expiration of the applicable deferral period, any payments which would have otherwise been made during that period (whether in a single sum or in installments) in the absence of this paragraph shall be paid to you or your beneficiary in one lump sum (without interest). Except as otherwise expressly provided herein, to the extent any expense reimbursement or the provision of any in-kind benefit under this Agreement (or otherwise referenced herein) is determined to be subject to (and not exempt from) Section 409A of the Code, the amount of any such expenses eligible for reimbursement, or the provision of any in-kind benefit, in one calendar year shall not affect the expenses eligible for reimbursement or in kind benefits to be provided in any other calendar year, in no event shall any expenses be reimbursed after the last day of the calendar year following the calendar year in which you incurred such expenses, and in no event shall any right to reimbursement or the provision of any in-kind benefit be subject to liquidation or exchange for another benefit. To the extent that any provision of this Agreement is ambiguous as to its exemption or compliance with Section 409A, the provision will be read in such a manner so that all payments hereunder are exempt from Section 409A to the maximum permissible extent, and for any payments where such construction is not tenable, that those payments comply with Section 409A to the maximum permissible extent. To the extent any payment under this Agreement may be classified as a “short-term deferral” within the meaning of Section 409A, such payment shall be deemed a short-term deferral, even if it may also qualify for an exemption from Section 409A under another provision of Section 409A. Payments pursuant to this Agreement (or referenced in this Agreement), and each installment thereof, are intended to constitute separate payments for purposes of Section 1.409A-2(b)(2) of the regulations under Section 409A of the Code. Notwithstanding anything to the contrary in this Agreement, any reference herein to a termination of your employment is intended to constitute a “separation from service” within the meaning of Section 409A of the Code, and Section 1.409A-1(h) of the regulations promulgated thereunder, and shall be so construed. If the period during which you may sign the Release begins in one calendar year and ends in the following calendar year, then no severance payments or benefits that that would constitute deferred compensation within the meaning of Section 409A will be paid or provided until the later calendar year. 11. At Will Employment. Your service with the Company is for no specific period of time. Your employment with the Company continues to be “at will,” meaning that either you or the Company may terminate your service at any time and for any reason, with or without cause, subject to your rights under the Severance Plan. Any contrary representations that may have been made to you are superseded by this Agreement. This is the full and complete agreement between you and the Company on this term. Although your compensation and benefits, as well as the Company’s personnel policies and procedures, may change from time to time, the “at will” nature of your service may only be changed in an express written agreement signed by you and a member of the Board (other than you).

325722163 v9 12. Confidential Information and Other Company Policies. You will continue to be bound by and comply fully with your agreement regarding proprietary information, invention assignment and confidentiality with the Company (the “Confidentiality Agreement”), insider trading policy, code of conduct, and any other policies and programs adopted by the Company regulating the behavior of its employees, as such policies and programs may be amended from time to time to the extent the same are not inconsistent with this Agreement, unless you consent to the same at the time of such amendment. 13. Indemnification. You will continue to be named as an insured on the director and officer liability insurance policy currently maintained by the Company, or as may be maintained by the Company from time to time, and will continue to be subject to indemnification as required by the Company’s Bylaws and the Indemnification Agreement previously entered into between you and the Company. 14. Arbitration. To aid the rapid and economical resolution of disputes that may arise in connection with your employment with the Company, and in exchange for the mutual promises contained in this offer letter, you and the Company agree that any and all disputes, claims, or causes of action, in law or equity, including but not limited to statutory claims arising from or relating to the enforcement, breach, performance, or interpretation of this letter agreement, your employment with the Company, or the termination of your employment, shall be resolved, to the fullest extent permitted by law, by final, binding and confidential arbitration conducted by JAMS, Inc. (“JAMS”) or its successor, under JAMS’ then applicable rules and procedures appropriate to the relief being sought (available upon request and also currently available at the following web address: (i) https://www.jamsadr.com/rules-employment- arbitration/ and (ii) https://www.jamsadr.com/rules-comprehensive-arbitration/) in Santa Clara County, California. Notwithstanding the foregoing, if JAMS is unavailable due to location or otherwise, or if the parties mutually agree, then the arbitration shall be conducted by the American Arbitration Association (“AAA”) or its successor, under AAA’s then applicable rules and procedures appropriate to the relief being sought (available upon request and also currently available at the following web address: https://www.adr.org/sites/default/files/EmploymentRules-Web.pdf), at a location closest to where you last worked for the Company or another mutually agreeable location. Any demand for arbitration must be made within the statute of limitations applicable to the claim asserted as if such claim were asserted in court. Failure to demand arbitration (or, where applicable, file a counterclaim, crossclaim, or third-party claim) within such time limitation shall serve as a waiver and release with respect to all such claims. You acknowledge that by agreeing to this arbitration procedure, both you and the Company waive the right to resolve any such dispute through a trial by jury or judge. The Federal Arbitration Act, 9 U.S.C. § 1 et seq., will, to the fullest extent permitted by law, govern the interpretation and enforcement of this arbitration agreement and any arbitration proceedings. This provision shall not be mandatory for any claim or cause of action to the extent applicable law prohibits subjecting such claim or cause of action to mandatory arbitration and such applicable law is not preempted by the Federal Arbitration Act or otherwise invalid (collectively, the “Excluded Claims”), such as non-individual claims that cannot be waived under applicable law, claims or causes of action alleging sexual harassment or a nonconsensual sexual act or sexual contact, or unemployment or workers’ compensation claims brought before the applicable state governmental agency. In the event you or the Company intend to bring multiple claims, including one of the Excluded Claims listed above, the Excluded Claims may be filed with a court, while any other claims will remain subject to mandatory arbitration. You acknowledge and agree that proceedings of any non- individual claim(s) under the California Private Attorneys General Act (“PAGA”) that may be brought in court shall be stayed for the duration and pending a final resolution of the arbitration of any individual or individual PAGA claim. Nothing herein prevents you from filing and pursuing proceedings before a federal or state governmental agency, although if you choose to pursue a claim following the exhaustion of any applicable administrative remedies, that claim would be subject to this provision. In addition, with the exception of Excluded Claims arising out of 9 U.S.C. § 401 et seq., all claims, disputes, or causes of action under this section, whether by you or the Company, must be brought in an individual capacity, and shall not be brought as a plaintiff (or claimant) or class member in any purported class, representative, or

325722163 v9 collective proceeding, nor joined or consolidated with the claims of any other person or entity. You acknowledge that by agreeing to this arbitration procedure, both you and the Company waive all rights to have any dispute be brought, heard, administered, resolved, or arbitrated on a class, representative, or collective action basis. The arbitrator may not consolidate the claims of more than one person or entity, and may not preside over any form of representative or class proceeding. If a court finds, by means of a final decision, not subject to any further appeal or recourse, that the preceding sentences regarding class, representative, or collective claims or proceedings violate applicable law or are otherwise found unenforceable as to a particular claim or request for relief, the parties agree that any such claim(s) or request(s) for relief be severed from the arbitration and may proceed in a court of law rather than by arbitration. All other claims or requests for relief shall be arbitrated. You will have the right to be represented by legal counsel at any arbitration proceeding. Questions of whether a claim is subject to arbitration and procedural questions which grow out of the dispute and bear on the final disposition are matters for the arbitrator to decide, provided however, that if required by applicable law, a court and not the arbitrator may determine the enforceability of this paragraph with respect to Excluded Claims. The arbitrator shall: (a) have the authority to compel adequate discovery for the resolution of the dispute and to award such relief as would otherwise be permitted by law; and (b) issue a written statement signed by the arbitrator regarding the disposition of each claim and the relief, if any, awarded as to each claim, the reasons for the award, and the arbitrator’s essential findings and conclusions on which the award is based. The arbitrator shall be authorized to award all relief that you or the Company would be entitled to seek in a court of law. The Company shall pay all arbitration administrative fees in excess of the administrative fees that you would be required to pay if the dispute were decided in a court of law. Each party is responsible for its own attorneys’ fees, except as may be expressly set forth in your Employee Confidential Information and Inventions Assignment Agreement or as otherwise provided under applicable law. Nothing in this letter agreement is intended to prevent either you or the Company from obtaining injunctive relief in court to prevent irreparable harm pending the conclusion of any such arbitration. Any awards or orders in such arbitrations may be entered and enforced as judgments in the federal and state courts of any competent jurisdiction. 15. Compensation Recoupment. All amounts payable to you hereunder shall be subject to recoupment pursuant to the Company’s current compensation recoupment and forfeiture policy and any additional compensation recoupment policy or amendments to the then-current policy adopted by the Board or any committee thereof as required by law during the term of your service with the Company that is applicable generally to executive officers of the Company. 16. Miscellaneous. (a) Successors. The Company will require any successor (whether direct or indirect and whether by purchase, merger, consolidation, liquidation or otherwise) to all or substantially all of the Company’s business and/or assets to assume this Agreement and to agree expressly to perform this Agreement in the same manner and to the same extent as the Company would be required to perform it in the absence of a succession. For all purposes under this Agreement, the term “Company” will include any successor to the Company’s business and/or assets, or which becomes bound by this Agreement by operation of law. This Agreement and all of your rights hereunder will inure to the benefit of, and be enforceable by, your personal or legal representatives, executors, administrators, successors, heirs, distributes, devisees and legatees. (b) Notices. Notices under this Agreement must be in writing and will be deemed to have been given when personally delivered or two days after mailed by U.S. registered or certified mail, return receipt requested and postage prepaid or deposited with an overnight courier, with shipping charges prepaid. Mailed notices to you will be addressed to you at the home address which you have most recently

325722163 v9 communicated to the Company in writing. Notices to the Company will be addressed to the Board at the Company’s corporate headquarters. (c) Waiver. No provision of this Agreement will be modified or waived except in writing signed by you and a member of the Board (other than you). No waiver by either party of any breach of this Agreement by the other party will be considered a waiver of any other breach of this Agreement. (d) Severability. In the event that any provision hereof becomes or is declared by a court of competent jurisdiction to be illegal, unenforceable or void, this Agreement shall continue in full force and effect without said provision. (e) Withholding. All sums payable to you hereunder shall be reduced by all federal, state, local and other withholding and similar taxes and payments required by applicable law. (f) Entire Agreement. This Agreement, the Confidentiality Agreement, the Company Equity Plans and the equity award agreements representing your Company Equity Awards represent the entire agreement between the parties concerning the subject matter herein (and expressly supersede any prior agreements that you may have entered into regarding your employment with the Company, including but not limited to, the Executive Chair Agreement). This Agreement may be amended, or any of its provisions waived, only by a written document executed by you and a member of the Board (other than you) in the case of an amendment, or by the party against whom the waiver is asserted. (g) Governing Law. This Agreement will be governed by the laws of the State of California (other than its choice-of-law provisions). (h) Survival. The provisions of this Agreement shall survive the termination of your service for any reason to the extent necessary to enable the parties to enforce their respective rights under this Agreement.

325722163 v9 Please sign and date this Agreement and return it to me if you wish to accept service as Chief Executive Officer at the Company under the terms described above. Best regards, Chegg, Inc. /S/ RENEE BUDIG Renee Budig Chair of the Compensation Committee, Board of Directors I, the undersigned, hereby accept and agree to the terms and conditions of my service as Chief Executive Officer with the Company as set forth in this Agreement. /S/ DAN ROSENSWEIG Daniel Rosensweig 10/27/25 Date [Signature Page to Employment Agreement]

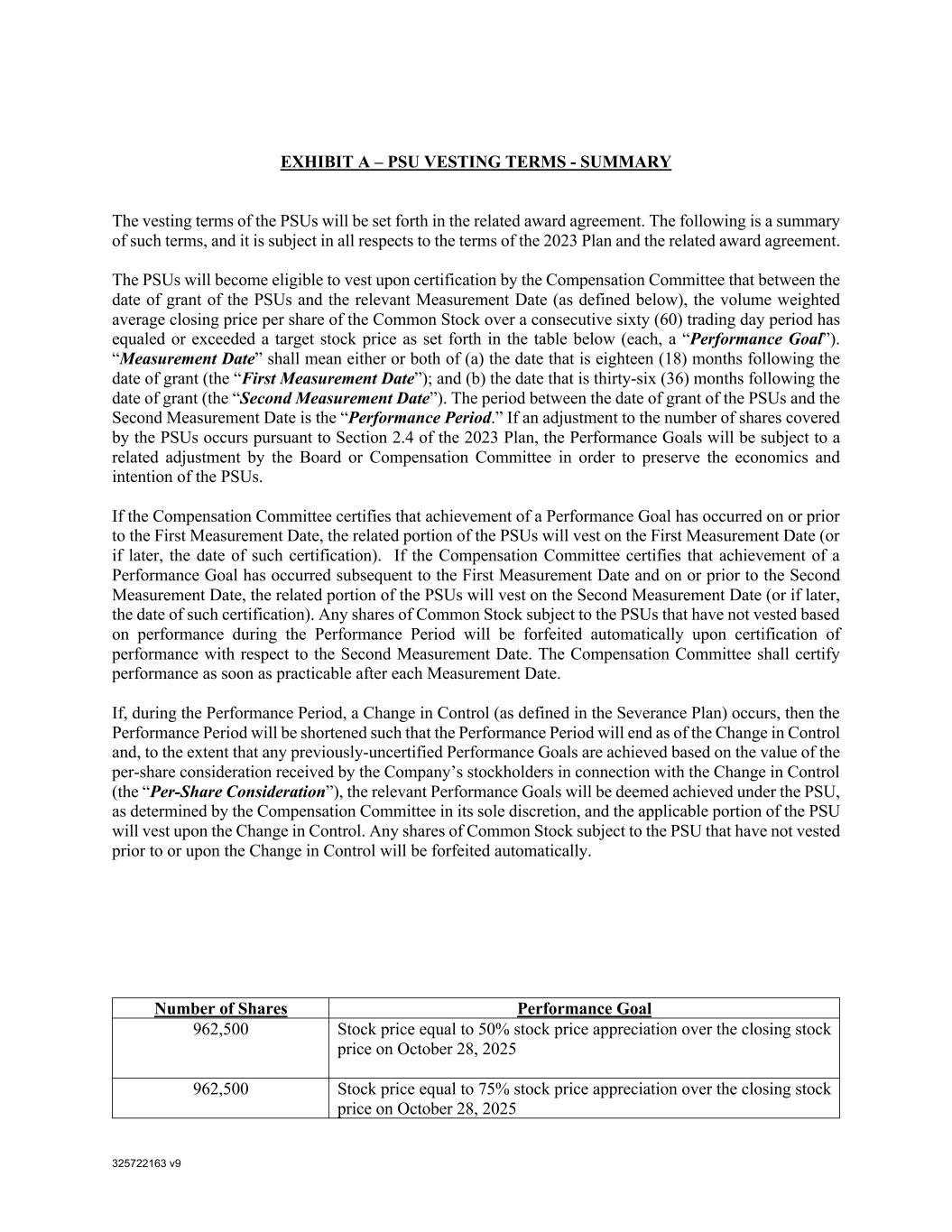

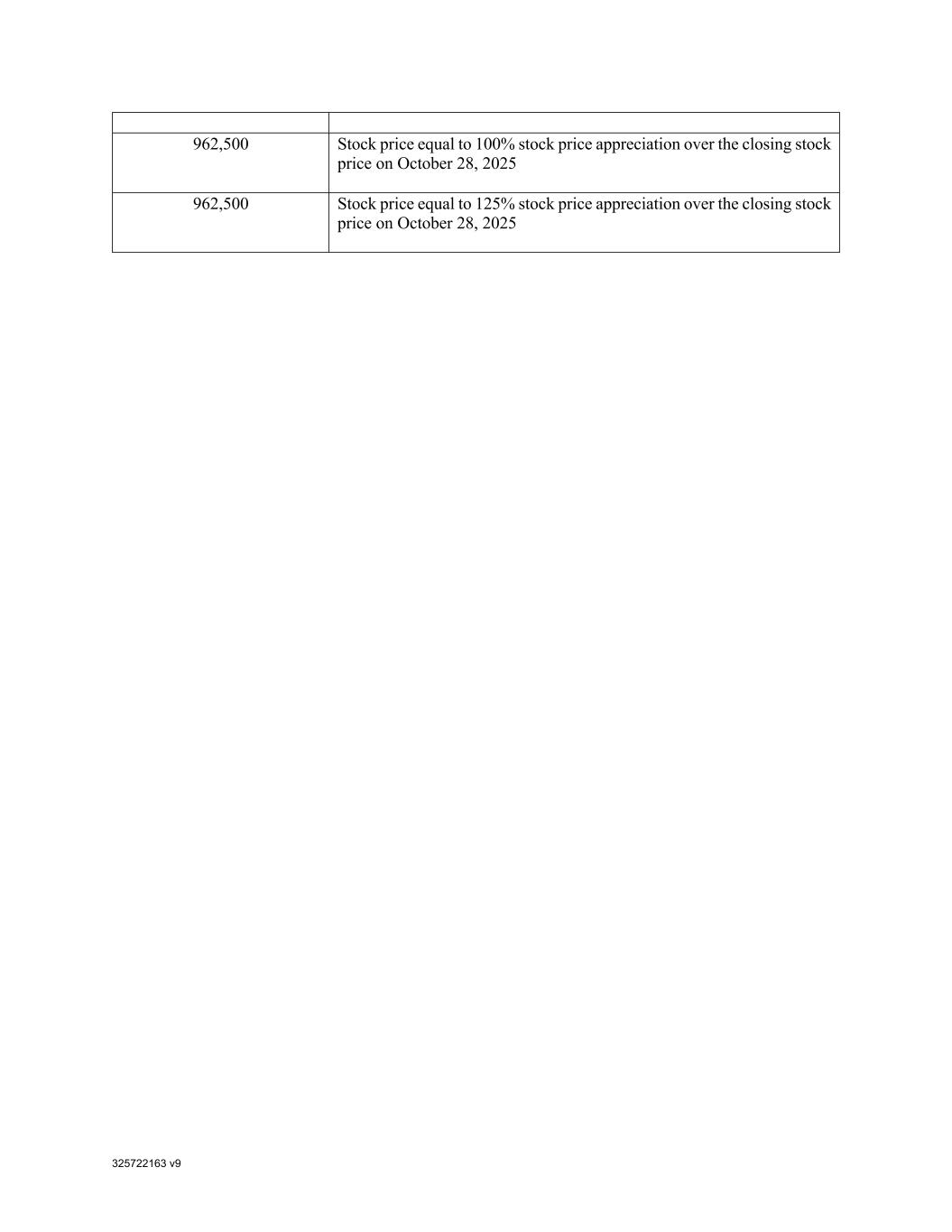

325722163 v9 EXHIBIT A – PSU VESTING TERMS - SUMMARY The vesting terms of the PSUs will be set forth in the related award agreement. The following is a summary of such terms, and it is subject in all respects to the terms of the 2023 Plan and the related award agreement. The PSUs will become eligible to vest upon certification by the Compensation Committee that between the date of grant of the PSUs and the relevant Measurement Date (as defined below), the volume weighted average closing price per share of the Common Stock over a consecutive sixty (60) trading day period has equaled or exceeded a target stock price as set forth in the table below (each, a “Performance Goal”). “Measurement Date” shall mean either or both of (a) the date that is eighteen (18) months following the date of grant (the “First Measurement Date”); and (b) the date that is thirty-six (36) months following the date of grant (the “Second Measurement Date”). The period between the date of grant of the PSUs and the Second Measurement Date is the “Performance Period.” If an adjustment to the number of shares covered by the PSUs occurs pursuant to Section 2.4 of the 2023 Plan, the Performance Goals will be subject to a related adjustment by the Board or Compensation Committee in order to preserve the economics and intention of the PSUs. If the Compensation Committee certifies that achievement of a Performance Goal has occurred on or prior to the First Measurement Date, the related portion of the PSUs will vest on the First Measurement Date (or if later, the date of such certification). If the Compensation Committee certifies that achievement of a Performance Goal has occurred subsequent to the First Measurement Date and on or prior to the Second Measurement Date, the related portion of the PSUs will vest on the Second Measurement Date (or if later, the date of such certification). Any shares of Common Stock subject to the PSUs that have not vested based on performance during the Performance Period will be forfeited automatically upon certification of performance with respect to the Second Measurement Date. The Compensation Committee shall certify performance as soon as practicable after each Measurement Date. If, during the Performance Period, a Change in Control (as defined in the Severance Plan) occurs, then the Performance Period will be shortened such that the Performance Period will end as of the Change in Control and, to the extent that any previously-uncertified Performance Goals are achieved based on the value of the per-share consideration received by the Company’s stockholders in connection with the Change in Control (the “Per-Share Consideration”), the relevant Performance Goals will be deemed achieved under the PSU, as determined by the Compensation Committee in its sole discretion, and the applicable portion of the PSU will vest upon the Change in Control. Any shares of Common Stock subject to the PSU that have not vested prior to or upon the Change in Control will be forfeited automatically. Number of Shares Performance Goal 962,500 Stock price equal to 50% stock price appreciation over the closing stock price on October 28, 2025 962,500 Stock price equal to 75% stock price appreciation over the closing stock price on October 28, 2025

325722163 v9 962,500 Stock price equal to 100% stock price appreciation over the closing stock price on October 28, 2025 962,500 Stock price equal to 125% stock price appreciation over the closing stock price on October 28, 2025