SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Soliciting Material Under Rule |

| ¨ | Confidential, For Use of the 14a-12 Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

Dialogic Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1) | Amount previously paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

DIALOGIC INC.

1504 McCarthy Boulevard

Milpitas, California 95035

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held On September 14, 2012

Notice is hereby given that a special meeting of the stockholders of Dialogic Inc., a Delaware corporation, will be held on September 14, 2012 at 10:00 a.m. local time at our corporate headquarters located at 1504 McCarthy Boulevard, Milpitas, California 95035, for the following purposes:

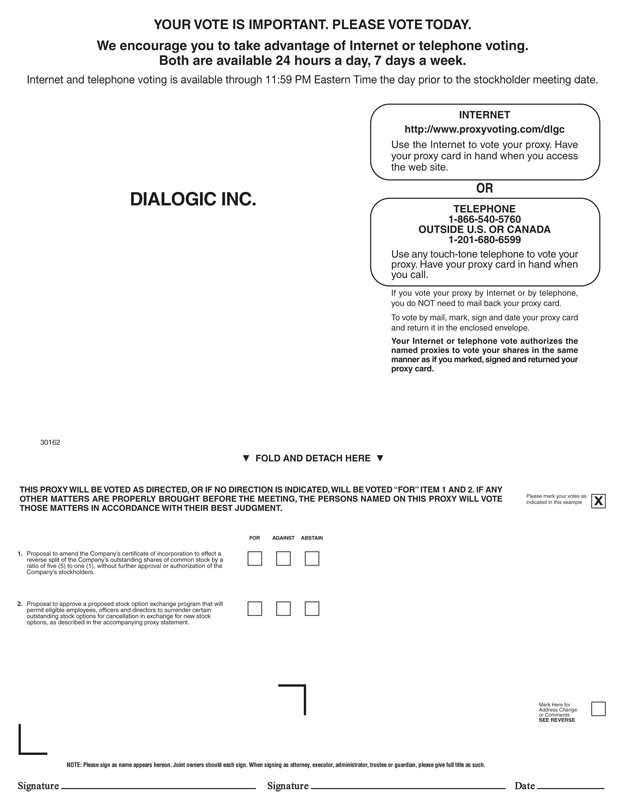

1. To approve a proposed amendment to the Company’s certificate of incorporation to effect a reverse split of the Company’s outstanding shares of common stock by a ratio of five (5) to one (1), without further approval or authorization of the Company’s stockholders, as described in the accompanying proxy statement;

2. To approve a proposed stock option exchange program that will permit eligible employees, officers and directors to surrender certain outstanding stock options for cancellation in exchange for new stock options, as described in the accompanying proxy statement; and

3. To consider any and all other matters that may properly come before the special meeting or any adjournments thereof.

The enclosed proxy statement is being issued in connection with the solicitation of a proxy by the Board of Directors for use at the special meeting. Please read the attached proxy statement carefully.

You are entitled to notice of, and to vote at, the special meeting, or any adjournments or postponements thereof, only if you were a stockholder of record at the close of business on August 9, 2012. A complete list of stockholders entitled to vote at the special meeting will be open for examination by our stockholders for any purpose germane to the special meeting, during regular business hours, for a period of ten days prior to the special meeting, at the meeting place.

Your vote is important. Whether or not you expect to attend the special meeting in person, please complete, date, sign and return the enclosed proxy, using the enclosed prepaid envelope or vote over the telephone or the Internet in accordance with the instructions set forth on the proxy card, as promptly as possible in order to ensure your representation at the special meeting. If you vote by telephone or Internet, you do not need to return the proxy card. Even if you have voted by proxy, if you attend the special meeting in person, you may revoke your proxy and vote in person. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the special meeting, you must obtain a proxy issued in your name from that record holder.

By Order of the Board of Directors

/s/ Anthony Housefather

Anthony Housefather

Secretary

Milpitas, California

August 24, 2012

Important Notice Regarding the Availability of Proxy Materials for the special meeting

to Be Held on September 14, 2012 at 1504 McCarthy Boulevard, Milpitas, CA 95035.

The proxy statement to stockholders is available at

http://shareowner.mobular.net/shareowner/dlgc

You are cordially invited to attend the special meeting in person. Whether or not you expect to attend the special meeting, please complete, date, sign and return the enclosed proxy, or vote over the telephone or the Internet as instructed in these materials, as promptly as possible in order to ensure your representation at the special meeting. A return envelope (which is postage prepaid if mailed in the United States) has been provided for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the special meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the special meeting, you must obtain a proxy issued in your name from that record holder.

This proxy statement and the accompanying form of proxy are being sent to our stockholders in connection with our solicitation of proxies for use at the special meeting of our stockholders to be held on September 14, 2012 or at any adjournments or postponements of the special meeting.

DIALOGIC INC.

1504 McCarthy Boulevard

Milpitas, California 95035

PROXY STATEMENT FOR THE DIALOGIC INC.

SPECIAL MEETING OF STOCKHOLDERS

To Be Held On September 14, 2012

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We sent you this proxy statement and the enclosed proxy card because the Board of Directors of Dialogic Inc. (referred to as “Dialogic” or “we” or “us” or the “Company”) is soliciting your proxy to vote at a special meeting of our stockholders, which will take place on September 14, 2012. You are invited to attend the special meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the special meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or on the Internet.

We intend to mail this proxy statement and accompanying proxy card on or about August 24, 2012 to all stockholders of record entitled to vote at the special meeting.

Who can vote at the special meeting of stockholders?

Only stockholders of record at the close of business on August 9, 2012 will be entitled to vote at the special meeting. On this record date, there were 31,895,955 shares of common stock outstanding and entitled to vote. Information about the stockholdings of our directors and executive officers is contained in the section of this proxy statement entitled “Security Ownership of Certain Beneficial Owners and Management” on pages 17-18 of this proxy statement.

Stockholder of Record: Shares Registered in Your Name

If on August 9, 2012 your shares were registered directly in your name with our transfer agent, Computershare Limited, then you are a stockholder of record. As a stockholder of record, you may vote in person at the special meeting or vote by proxy. Whether or not you plan to attend the special meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on August 9, 2012 your shares were held, not in your name but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the special meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the special meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the special meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

You are being asked to consider and approve (i) a proposed amendment to the Company’s certificate of incorporation to effect a reverse stock split of the Company’s outstanding shares of common stock by a ratio of five (5) to one (1), without further approval or authorization of the Company’s stockholders and (ii) a proposed stock option exchange program that will permit eligible employees, officers and directors to surrender certain outstanding stock options for cancellation in exchange for new stock options. The Company’s Board of Directors has approved and adopted resolutions proposing, declaring advisable and in the best interests and recommending

1

to the stockholders of the Company for approval, an amendment to the Company’s certificate of incorporation to effect the reverse split of the Company’s outstanding shares of common stock by a ratio of five (5) to one (1) and a stock option exchange program that will permit eligible employees, officers and directors to surrender certain outstanding stock options for cancellation in exchange for new stock options.

We will also transact any other business that properly comes before the special meeting.

What are the recommendations of Dialogic’s Board of Directors on the matters scheduled for a vote?

The Board of Directors unanimously recommends that the stockholders vote FOR the approval of the proposed amendment to the Company’s certificate of incorporation to effect a reverse split of the Company’s outstanding shares of common stock by a ratio of five (5) to one (1), without further approval or authorization of the Company’s stockholders and FOR the approval of the proposed stock option exchange program that will permit eligible employees, officers and directors to surrender certain outstanding stock options for cancellation in exchange for new stock options.

With respect to any other matter that properly comes before the special meeting, the proxy holders will vote in accordance with their judgment on such matter.

How do I vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the special meeting, vote by proxy using the enclosed proxy card, vote by proxy over the telephone, or vote by proxy on the Internet. Whether or not you plan to attend the special meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the special meeting and vote in person if you have already voted by proxy.

| • | To vote in person, come to the special meeting and we will give you a ballot when you arrive. |

| • | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the special meeting, we will vote your shares as you direct. |

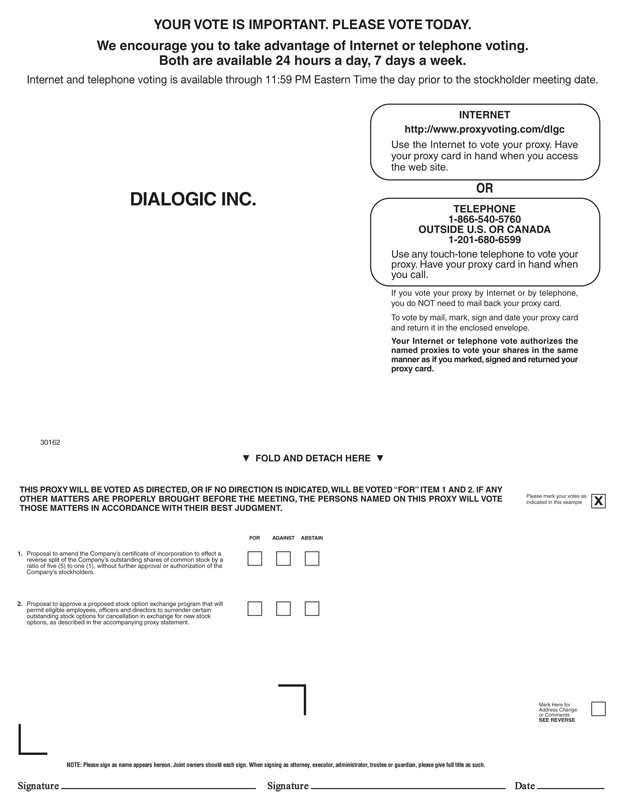

| • | To vote over the telephone, please dial toll-free 1-866-540-5760, or 1-201-680-6599 from outside the United States and Canada, using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:59 P.M. Eastern Time on September 13, 2012 to be counted. |

| • | To vote on the Internet, go to http://www.proxyvoting.com/dlgc to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:59 P.M. Eastern Time on September 13, 2012 to be counted. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the special meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

2

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of August 9, 2012.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the Internet or in person at the special meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the New York Stock Exchange (the NYSE”) deems the particular proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholder, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory shareholder votes on executive compensation and on the frequency of shareholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Accordingly, your broker or nominee may not vote your shares on the proposal to approve a proposed amendment to the Company’s certificate of incorporation to effect a reverse split of the Company’s outstanding shares of common stock by a ratio of five (5) to one (1), without further approval or authorization of the Company’s stockholders or on the proposal to approve a proposed stock option exchange program that will permit eligible employees, officers and directors to surrender certain outstanding stock options for cancellation in exchange for new stock options.

If you do not vote and the proposal to amend the Company’s certificate of incorporation to effect the reverse split of the Company’s outstanding shares of common stock by a ratio of five (5) to one (1) is not approved by the stockholders, then the Company’s common stock will be subject to delisting from The NASDAQ Global Market.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the proposal to approve a proposed amendment to the Company’s certificate of incorporation to effect a reverse split of the Company’s outstanding shares of common stock by a ratio of five (5) to one (1), without further approval or authorization of the Company’s stockholders and “For” the proposal to approve a proposed stock option exchange program that will permit eligible employees, officers and directors to surrender certain outstanding stock options for cancellation in exchange for new stock options. If any other matter is properly presented at the special meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the special meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| • | You may submit another properly completed proxy card with a later date. |

| • | You may grant a subsequent proxy by telephone or through the Internet. |

3

| • | You may send a timely written notice that you are revoking your proxy to our Corporate Secretary at 1504 McCarthy Boulevard, Milpitas, California 95035. |

| • | You may attend the special meeting and vote in person. Simply attending the special meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

How are votes counted?

Votes will be counted by the inspector of election appointed for the special meeting, who will separately count “For” and “Against” and “Abstain” votes, abstentions and broker non-votes. Abstentions will be counted towards the vote total for each proposal, and will have the same effect as “Against” votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the NYSE on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes. The proposal to amend the Company’s certificate of incorporation to effect a reverse split of the Company’s outstanding shares of common stock by a ratio of five (5) to one (1) and the proposed stock option exchange program that will permit eligible employees, officers and directors to surrender certain outstanding stock options for cancellation in exchange for new stock options are considered non-discretionary items.

How many votes are needed to approve the proposal?

Approval and adoption of the proposed amendment to our certificate of incorporation to effect a reverse split of the Company’s outstanding shares of common stock by a ratio of five (5) to one (1) requires the affirmative vote of at least a majority of our issued and outstanding shares of common stock. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

Approval and adoption of the proposed stock option exchange program that will permit eligible employees, officers and directors to surrender certain outstanding stock options for cancellation in exchange for new stock options requires the affirmative vote of at least a majority of shares present in person or by proxy and entitled to vote. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes will have no effect.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares entitled to vote are represented by stockholders present at the special meeting or by proxy. On the record date, there were 31,895,955 shares outstanding and entitled to vote. Thus, 15,947,978 shares must be represented by stockholders present at the special meeting or by proxy to have a quorum.

4

Your shares will be counted towards the quorum only if you submit a valid proxy vote (or one is submitted on your behalf by your broker bank or other nominee) or vote in person at the special meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the special meeting may adjourn the special meeting to another date.

How can I find out the results of the voting at the special meeting?

Preliminary voting results will be announced at the special meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the special meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the special meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

Who will pay for the cost of this proxy solicitation?

We are making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. If you choose to access the proxy materials and/or vote over the Internet, however, you are responsible for Internet access charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. We will request banks, brokers, nominees, custodians and other fiduciaries, who hold shares of Dialogic stock in street name, to forward these proxy solicitation materials to the beneficial owners of those shares and we will reimburse them the reasonable out-of-pocket expenses they incur in doing so.

Will other matters be voted on at the special meeting?

We are not aware of any other matters to be presented at the special meeting other than those described in this proxy statement. If any other matters not described in the proxy statement are properly presented at the special meeting, proxies will be voted in accordance with the best judgment of the proxy holders.

What proxy materials are available on the internet?

The proxy statement is available at http://shareowner.mobular.net/shareowner/dlgc.

NO PERSON IS AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION OTHER THAN THOSE CONTAINED IN THIS PROXY STATEMENT, AND, IF GIVEN OR MADE, SUCH INFORMATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED AND THE DELIVERY OF THIS PROXY STATEMENT SHALL, UNDER NO CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY SINCE THE DATE OF THIS PROXY STATEMENT.

5

PROPOSAL NO. 1

APPROVAL OF A REVERSE STOCK SPLIT

UNLESS OTHERWISE INDICATED OR THE CONTEXT REQUIRES, ALL SHARE NUMBERS,

SHARE PRICES AND PER SHARE AMOUNTS IN THIS PROXY STATEMENT DO NOT GIVE

EFFECT TO THE REVERSE SPLIT

General

The Company’s Board of Directors has approved and adopted resolutions proposing, declaring advisable and in the best interests and recommending to the stockholders of the Company for approval, a proposed amendment to the Company’s Certificate of Incorporation, the form of amendment which is attached to this proxy statement as Appendix A (the “Proposed Amendment”), to effect a reverse split of our common stock, or Reverse Split. Pursuant to the Proposed Amendment, each outstanding five (5) shares of common stock would be combined into and become one (1) share of common stock. To avoid the existence of fractional shares of our common stock, stockholders who would otherwise be entitled to receive fractional shares of our common stock as a result of the Reverse Split will receive a cash payment in lieu thereof. As of August 9, 2012, we had 31,895,955 shares of common stock issued and outstanding. Based on the number of shares of our common stock currently issued and outstanding, immediately following the completion of the Reverse Split, we would have approximately 6 million shares of our common stock issued and outstanding (without giving effect to the cash payment in lieu of fractional shares). The number of authorized shares of the Company will not be changed.

The Board of Directors will determine the actual timing for the filing of the Proposed Amendment to effect the Reverse Split with the Secretary of State of the State of Delaware after the special meeting. We currently anticipate that if the Proposed Amendment is approved by stockholders at the special meeting, we will file the Proposed Amendment as soon as reasonably practicable. The Board of Directors reserves the right, notwithstanding stockholder approval and without further action by stockholders, to not proceed with the filing of the Proposed Amendment to effect the Reverse Split with the Secretary of State of the State of Delaware if the Board of Directors determines that the Reverse Split is no longer in the best interests of the Company and its stockholders. If the Reverse Split is approved by the stockholders but is subsequently not implemented by the Board of Directors by December 31, 2012, then the Proposed Amendment shall be deemed abandoned, without any further effect.

Background

On February 28, 2012, the Company received a deficiency letter from the Listing Qualifications Department of The NASDAQ Stock Market (the “Staff”), notifying it that, for the last 30 consecutive business days, the bid price for the Company’s common stock had closed below the minimum $1.00 per share requirement for continued listing on The NASDAQ Global Market pursuant to NASDAQ Listing Rule 5450(a)(1) (the “Bid Price Rule”).

In accordance with Listing Rule 5810(c)(3)(A), the Company has been given 180 calendar days, or until August 27, 2012, to regain compliance with the Bid Price Rule. If at any time before August 27, 2012 the bid price for the Company’s common stock closes at $1.00 or more for a minimum of 10 consecutive business days as required under Listing Rule 5810(c)(3)(A), the Staff will provide written notification to the Company that it complies with the Bid Price Rule. If the Company does not regain compliance with the Bid Price Rule by August 27, 2012, but applies for listing on The NASDAQ Capital Market by such date, provided it meets the initial inclusion and continued listing requirements of that market as set forth in Listing Rule 5505 other than the $1.00 per share bid price requirement, and provides the Staff with written notice of its intention to cure the deficiency, the Company will be granted an additional 180 calendar day compliance period. At the present time, the Company currently is not eligible to list its shares on The NASDAQ Capital Market.

If the Company does not regain compliance with the Bid Price Rule by August 27, 2012 and is not eligible for an additional compliance period at that time, the Staff will provide written notification to the Company that

6

its common stock is subject to delisting. At that time, the Company may appeal the Staff’s delisting determination to a Hearings Panel, or the Panel. The Company would remain listed pending the Panel’s decision. There can be no assurance that, if the Company does appeal the delisting determination by the Staff to the Panel, that such appeal would be successful. The Company hopes to effect the Reverse Split before its appeal proceeding, so that it will become compliant with Listing Rule 5450(a)(1) at the time of the Panel’s decision on our planned appeal.

Approval of the Proposed Amendment requires the affirmative vote of at least a majority of our outstanding shares of common stock.

Purpose of the Proposed Amendment

The Board of Directors believes that the delisting of our common stock from The NASDAQ Global Market would likely result in decreased liquidity, especially since the Company is not eligible to be listed on The NASDAQ Capital Market. Such decreased liquidity would result in the increase in the volatility of the trading price of our common stock, a loss of current or future coverage by certain analysts and a diminution of institutional investor interest. The Board of Directors also believes that such delisting could also cause a loss of confidence of corporate partners, customers and our employees, which could harm our business and future prospects.

If our common stock were delisted from The NASDAQ Global Market and we are unable to obtain or maintain listing on The NASDAQ Capital Market, our common stock would likely still qualify to trade on the OTC Bulletin Board (the “OTCBB”) or in the “pink sheets” maintained by the National Quotation Bureau, Inc. The Board of Directors believes that in this event, stockholders would likely find it more difficult to obtain accurate quotations as to the price of our common stock, the liquidity of our stock would likely be further reduced, making it difficult for stockholders to buy or sell our stock at competitive market prices or at all, and support from institutional investors and/or market makers that currently buy and sell our stock would likely decline further, possibly resulting in a further decrease in the trading price of our common stock. Furthermore, companies trading on the OTCBB or in the pink sheets are not be able to avail themselves of federal preemption of state securities laws, also called “blue sky” laws, and the sale of such companies’ securities must generally be registered or exempt in each applicable state.

In evaluating whether or not to authorize the Reverse Split, in addition to the considerations described above, the Board of Directors also took into account various negative factors associated with a reverse stock split. These factors include: the negative perception of reverse stock splits held by some investors, analysts and other stock market participants; the fact that the stock price of some companies that have effected reverse stock splits has subsequently declined back to pre-reverse stock split levels; the adverse effect on liquidity that might be caused by a reduced number of shares outstanding; and the costs associated with implementing a reverse stock split.

The Board of Directors considered these factors, and the potential harm of being delisted from The NASDAQ Global Market. The Board of Directors determined that continued listing on The NASDAQ Global Market is in the best interest of the Company and its stockholders, and that the Reverse Split is necessary to attempt to maintain the listing of our common stock on The NASDAQ Global Market. As noted above, even if stockholders approve the Reverse Split, we reserve the right not to effect the Reverse Split if our Board of Directors does not deem it to be in the best interests of Dialogic and its stockholders.

In addition, in determining to authorize the Reverse Split, the Board of Directors considered that a sustained higher per share price of our common stock, which may result from the Reverse Split, might heighten the interest of the financial community in us and potentially broaden the pool of investors that may consider investing in us, possibly increasing the trading volume and liquidity of our common stock or helping to mitigate any decrease in such trading volume and liquidity which might result from the Reverse Split. As a matter of policy, many institutional investors are prohibited from purchasing stocks below certain minimum price levels. For the same

7

reason, brokers often discourage their customers from purchasing such stocks. The Board of Directors believes that, to the extent that the price per share of our common stock remains at a higher per share price as a result of the Reverse Split, some of these concerns may be ameliorated. However, as noted above, there can be no assurance that the price of our common stock would remain above $1.00 per share following the Reverse Split.

The Board of Directors also believes that a higher per share market price for our common stock may help us attract and retain employees. Our Board of Directors believes that some potential employees are less likely to work for a company with a low stock price, especially below $1.00 per share, regardless of the company’s market capitalization. However, again, there can be no assurance as to the market prices for our common stock following the Reverse Split or that increased market prices for our common stock will in fact enhance our ability to attract and retain employees.

There also can be no assurance that, after the Reverse Split, we would be able to maintain the listing of our common stock on The NASDAQ Global Market. The NASDAQ Global Market maintains several other continued listing requirements currently applicable to the listing of our common stock, including a market value of listed securities of $50 million, a minimum of 1.1 million publicly held shares, a minimum market value of publicly held shares of $15 million, a minimum of 400 stockholders, a minimum of two market makers and compliance with The NASDAQ’s corporate governance rules. While the Company plans to regain compliance with the minimum market value requirement and has until December 24, 2012 to regain such compliance and would be in compliance with other requirements of The NASDAQ Global Market after and as a result of the Reverse Split, we cannot assure you that we will be able to maintain compliance with all of these requirements or the minimum bid price requirement.

Stockholders should recognize that if the Reverse Split is effected, they will own a smaller number of shares than they currently own (approximately equal to the number of shares owned immediately prior to the Reverse Split divided by five, after giving effect to the cash payments in lieu of fractional shares described above). While we expect that the Reverse Split will result in an increase in the market price of our common stock, the Reverse Split may not increase the market price of our common stock in proportion to the reduction in the number of shares of our common stock outstanding or result in a permanent increase in the market price (which depends on many factors, including our performance, prospects and other factors that may be unrelated to the number of shares outstanding).

If the Reverse Split is effected and the market price of our common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Split. Furthermore, the liquidity of our common stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Split. In addition, the Reverse Split will likely increase the number of our stockholders who own odd lots (less than 100 shares). Stockholders who hold odd lots typically will experience an increase in the cost of selling their shares, as well as potentially greater difficulty in effecting such sales. Accordingly, the Reverse Split may not achieve the desired results that have been outlined above.

Principal Effects of the Proposed Amendment

General

Our common stock is currently registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and we are subject to the periodic reporting and other requirements of the Exchange Act. The Reverse Split, if effected, will not affect the registration of our common stock under the Exchange Act. Our common stock is currently traded, and following the Reverse Split will continue to be traded, on The NASDAQ Global Market under the symbol “DLGC”, subject to our continued satisfaction of the NASDAQ listing requirements.

8

Number of Shares of Common Stock and Corporate Matters

If approved and implemented, the Proposed Amendment would have the following effects on the number of shares of common stock:

| • | each five (5) shares of our common stock owned by a stockholder immediately prior to the Reverse Split would become one (1) share of common stock after the Reverse Split; |

| • | all outstanding but unexercised options entitling the holders thereof to purchase shares of our common stock will enable such holders to purchase, upon exercise of their options, one fifth (1/5th) of the number of shares of our common stock that such holders would have been able to purchase upon exercise of their options immediately preceding the Reverse Split, at an exercise price equal to five (5) times the exercise price specified before the Reverse Split, resulting in approximately the same aggregate exercise price being required to be paid upon exercise thereof immediately preceding the Reverse Split; and |

| • | the number of shares of our common stock reserved for issuance (including the maximum number of shares that may be subject to options) under our stock option plans will be reduced to one fifth (1/5th) of the number of shares currently included in such plans. |

The number of authorized shares of the Company will not be changed. Our Board of Directors believes that maintaining the same number of authorized shares of common and preferred stock, and thereby increasing the number of shares of common stock available for future issuance, will provide us with the certainty and flexibility to undertake various types of transactions, including financings, acquisitions of companies or assets, strategic transactions including a sale of all or a portion of the Company, increases in the shares reserved for issuance pursuant to stock incentive plans, sales of stock or securities convertible into common stock, or other corporate transactions not yet determined. Certain kinds of these transactions may have anti-takeover affects, and certain kinds of these transactions may require stockholder approval under Delaware law or applicable NASDAQ rules, but the Board of Directors believes that this certainty and flexibility is helpful to the Company and in the stockholders’ interests. We currently have no plan, arrangement or agreement to issue shares of our common stock for any purpose, except for the issuance of shares of common stock pursuant to our stock option and employee stock purchase plans or upon exercise of our outstanding warrants. If we issue additional shares, the ownership interests of holders of our common stock may be diluted.

The Reverse Split will affect all of our stockholders uniformly and will not change the proportionate equity interests of our stockholders, nor will the respective voting rights and other rights of stockholders be altered, except for possible changes due to the treatment of fractional shares resulting from the Reverse Split. As described below, stockholders holding fractional shares will be entitled to cash payments in lieu of such fractional shares. Common stock issued and outstanding pursuant to the Reverse Split will remain fully paid and non-assessable.

Cash Payment in Lieu of Fractional Shares

The Company will not issue fractional certificates for post-Reverse Split shares in connection with the Reverse Split. Instead, our transfer agent will aggregate all fractional shares and sell them as soon as practicable after the effective time of the Reverse Split at the then prevailing prices on the open market, on behalf of those holders who would otherwise be entitled to receive a fractional share. We expect that it may take several days for our transfer agent to sell all of the aggregated fractional shares of common stock. After completing such sale, stockholders otherwise entitled to receive a fractional share will receive a cash payment from our transfer agent in an amount equal to their pro rata share of the total net proceeds of that sale. The proceeds of such sale will be subject to federal income tax, as described further below in “Certain United States Federal Income Tax Consequences”. In addition, such stockholders will not be entitled to receive interest for the period of time between the effective time of the Reverse Split and the date they receive payment for the cashed-out shares.

9

The ownership of a fractional interest will not give the holder thereof any voting, dividend or other rights except to receive payment therefor as described herein.

Stockholders should be aware that, under the escheat laws of the various jurisdictions where stockholders reside, sums due for fractional interests that are not timely claimed after the effective time may be required to be paid to the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to seek to obtain them directly from the state to which they were paid.

Accounting Matters

The Reverse Split will not affect total stockholders’ equity on our balance sheet. However, because the par value of our common stock will remain unchanged, the components that make up total stockholders’ equity will change by offsetting amounts. As a result of the Reverse Split, the stated capital component attributable to our common stock will be reduced to an amount equal to one fifth (1/5th) of its present amount, and the additional paid-in capital component will be increased by the amount by which the stated capital is reduced. The per share net loss and net book value per share of our common stock will be increased as a result of the Reverse Split because there will be fewer shares of our common stock outstanding. Prior periods’ per share amounts will be restated to reflect the Reverse Split.

Procedure for Effecting Proposed Amendment and Exchange of Stock Certificates

If our stockholders approve the Proposed Amendment and the Board of Directors determines that the Reverse Split, at a ratio of five (5) to one (1), continues to be in the best interests of the Company and its stockholders in order for our common stock to remain listed on The NASDAQ Global Market, our Board of Directors will file the Proposed Amendment effecting the Reverse Split with the Secretary of State of the State of Delaware. The Reverse Split will become effective as of 5:00 p.m. eastern time on the date of filing, which time on such date will be referred to as the “effective time.” Except as described above on page 11 under “Cash Payment in Lieu of Fractional Shares,” at the effective time, each five (5) shares of common stock issued and outstanding immediately prior to the effective time will, automatically and without any further action on the part of our stockholders, be combined into and become one (1) share of common stock, subject to the treatment for fractional shares described above, each certificate which, immediately prior to the effective time represented pre-Reverse Split shares, will be deemed for all corporate purposes to evidence ownership of post-Reverse Split shares.

The Company’s transfer agent, Computershare Limited, will act as exchange agent for purposes of implementing the exchange of stock certificates, and is referred to as the “exchange agent.” As soon as practicable after the effective time, a letter of transmittal will be sent to stockholders of record as of the effective time for purposes of surrendering to the exchange agent certificates representing pre-Reverse Split shares in exchange for certificates representing post-Reverse Split shares in accordance with the procedures set forth in the letter of transmittal. No new certificates will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s), together with the properly completed and executed letter of transmittal, to the exchange agent. From and after the effective time, any certificates formerly representing pre-Reverse Split shares which are submitted for transfer, whether pursuant to a sale, other disposition or otherwise, will be exchanged for certificates representing post-Reverse Split shares. STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

No Appraisal Rights

Under the Delaware General Corporation Law, stockholders will not be entitled to exercise appraisal rights in connection with the Reverse Split, and the Company will not independently provide stockholders with any such right.

10

Certain United States Federal Income Tax Consequences

The following is a summary of certain United States federal income tax consequences of the Reverse Split generally applicable to beneficial holders of shares of our common stock. This summary addresses only such stockholders who hold their pre-Reverse Split shares as capital assets and will hold the post-Reverse Split shares as capital assets. This discussion does not address all United States federal income tax considerations that may be relevant to particular stockholders in light of their individual circumstances or to stockholders that are subject to special rules, such as financial institutions, tax-exempt organizations, insurance companies, dealers in securities, and foreign stockholders. The following summary is based upon the provisions of the Internal Revenue Code of 1986, as amended, applicable Treasury Regulations thereunder, judicial decisions and current administrative rulings, as of the date hereof, all of which are subject to change, possibly on a retroactive basis. Tax consequences under state, local, foreign, and other laws are not addressed herein. Each stockholder should consult its tax advisor as to the particular facts and circumstances which may be unique to such stockholder and also as to any estate, gift, state, local or foreign tax considerations arising out of the Reverse Split.

Exchange Pursuant to Reverse Split

No gain or loss will be recognized by a stockholder upon such stockholder’s exchange of pre-Reverse Split shares for post-Reverse Split shares pursuant to the Reverse Split, except to the extent of cash, if any, received in lieu of fractional shares. See “Cash in Lieu of Fractional Shares” below. The aggregate tax basis of the post-Reverse Split shares received in the Reverse Split, including any fractional share deemed to have been received, will be equal to the aggregate tax basis of the pre-Reverse Split shares exchanged therefor, and the holding period of the post-Reverse Split shares will include the holding period of the pre-Reverse Split shares.

Cash in Lieu of Fractional Shares

A holder of pre-Reverse Split shares that receives cash in lieu of a fractional share of post-Reverse Split shares should generally be treated as having received such fractional share pursuant to the Reverse Split and then as having exchanged such fractional share for cash in a redemption by the Company. The amount of any gain or loss should be equal to the difference between the ratable portion of the tax basis of the pre-Reverse Split shares exchanged in the Reverse Split that is allocated to such fractional share and the cash received in lieu thereof. In general, any such gain or loss will constitute long-term capital gain or loss if the holder’s holding period for such pre-Reverse Split shares exceeds one year at the time of the Reverse Split. Deductibility of capital losses by holders is subject to limitations.

Vote Required and Board Recommendation

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the special meeting will be required to approve the Reverse Split. Abstentions will be counted toward the tabulation of votes cast on this proposal and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL NO. 1.

11

PROPOSAL NO. 2

APPROVAL OF AN OPTION EXCHANGE PROGRAM

We are asking our stockholders to approve a one-time stock option exchange program to be conducted in the first 12 months following the date of this special meeting. The proposed exchange program would allow eligible employees, officers and directors of the Company and its affiliates, or, collectively, service providers, to surrender “underwater” stock options that were granted under our 2001 Equity Incentive Plan, or the 2001 Plan, or our 2006 Equity Incentive Plan, or the 2006 Plan, and together with the 2001 Plan, the Plans, with an exercise price above the closing price of our common stock on the closing date of the tender offer, in exchange for new stock options to purchase a number of shares not in excess of the number of shares subject to the options surrendered, with the actual number to be determined by the Board of Directors at the time the tender offer is approved by the Board of Directors. The new options would be granted under our 2006 Plan with an exercise price equal to not less than the closing price of our common stock on the closing date of the tender offer exchange and the surrendered options would be cancelled.

The proposed exchange offer would not necessarily be limited in the way that was proposed to, and approved by, our stockholders under Proposal No. 4 at our Annual General Meeting held on August 8, 2012. The exchange offer Proposal No. 4 was created prior to the determination of the desire to consider and potentially act upon a proposed amendment to the Company’s certificate of incorporation to cause a reverse split of our outstanding shares of common stock by a ratio of five (5) to one (1). While Proposal No. 4 was approved by our stockholders at the meeting on August 8, 2012, we are concerned that the formula for determining the number of shares subject to new options, and the formula for determining the exercise price, could be unnecessarily confusing for employees, and that confusion may result in decreased participation in the proposed exchange program. Therefore, we are asking our stockholders to approve the authority for our Board of Directors to approve an option exchange program on terms that can better promote the goals of the exchange offer.

As described in more detail below, we believe that the exchange program is in the best interest of the Company and our stockholders.

Reasons for Implementing the Exchange Program

The primary purpose of the proposed exchange program is to restore the intended retention and incentive value of stock options granted to our service providers, which we believe will promote long-term stockholder value. All of the currently outstanding stock options granted under our stock plans are now underwater, and a large portion of our service providers holds these underwater options. The market price of our common stock declined significantly throughout the past 18 months, despite our success in restructuring our debt obligations, reducing expenses and adapting to changes in our business and industry. As of July 31, 2012, all outstanding stock options, including all unvested stock options, were underwater – that is, all service providers were holding stock options with an exercise price greater than $0.62 (which was our closing stock price as of July 31, 2012). At the same time, the market for our key service providers remains extremely competitive.

The exchange program would align the interests of our service providers with the interests of our stockholders because it will allow us to:

| • | Renew Retention and Motivation Incentives. Many companies, especially those in our industry, have long used equity awards to attract, motivate and retain their service providers, while aligning those individuals’ interests with those of the stockholders. Compensatory stock options are an important component of our approach to retaining and motivating our service providers. If we do not address the underwater stock option issue in the near to medium term, we believe it will be more difficult for us to retain key service providers. If we cannot retain these individuals, our ability to compete with other companies in our industry could be jeopardized, which could adversely affect our business, operating results and future stock price. We believe that granting new stock options in exchange for underwater stock options will aid in both motivating and retaining our participating service providers because the new stock option will have the potential for appreciation in line with the appreciation of our stock price. |

12

| • | Align Compensation Costs with the Value of Stock Options. Our underwater stock options were granted with exercise prices equal to the fair market value of our common stock at the time of grant. Under applicable accounting rules, we are required to continue to recognize compensation expense related to these stock options while they remain outstanding, even if they are never exercised because they remain underwater and do not fully provide the intended incentive and retention benefits. We believe it is an inefficient use of corporate resources to recognize compensation expense on stock options that our service providers do not value. By replacing stock options that have little or no retention or incentive value with new stock options that will provide both retention and incentive value, we will more efficiently use our resources. |

| • | Reduce Overhang and Potential Dilution. Presently, the underwater stock options will not be removed from our equity award overhang until they are exercised or are cancelled due to expiration or the service provider’s termination. The exchange program may assist in reducing our overhang and eliminating many of the ineffective underwater stock options that are currently outstanding. The Board of Directors may consider structuring the new exchange offering so that service providers receive new stock options covering a lesser number of shares than the number of shares covered by the surrendered stock options. This could result in a net reduction in the number of shares associated with outstanding stock options. |

Although our Plans permit us to conduct an option exchange without prior stockholder approval, the Board of Directors has decided it is in the best interests of the Company and our stockholders to seek such approval.

SUMMARY OF THE EXCHANGE PROGRAM

Mechanics of the Exchange Program

Our Board of Directors has not yet approved specific terms for an option exchange that would be conducted if this Proposal No. 2 is approved by our stockholder. However, if approved, we expect to start any such option exchange within 12 months following the date of stockholder approval. Within this time frame, we will determine the actual start date. However, even if our stockholders approve the exchange program, we may later decide not to implement it.

At the start of the exchange program, eligible optionholders will receive a written offer that describes the precise terms and timing of the exchange program. We will file with the Securities and Exchange Commission, or the SEC, the written offer to exchange as part of a tender offer statement on Schedule TO. Eligible optionholders, as well as stockholders and members of the public, will be able to obtain the offer to exchange and other documents filed by us with the SEC free of charge from the SEC’s website at www.sec.gov. We will give eligible optionholders at least 20 business days to elect to surrender their eligible stock options in exchange for new stock options covering a lesser number of shares. At the completion of the exchange offer, we will cancel the surrendered stock options and grant new stock options in exchange.

Eligible Stock Options

Generally, stock options will be eligible for exchange in the exchange program if the exercise price of the stock option is above the closing price of a share of our common stock on the closing date of the exchange program. We may consider adding an additional eligibility threshold of having an existing exercise price greater than the closing price on the closing date of the exchange program.

As of July 31, 2012, stock options to purchase 3,864,301 shares of our common stock were outstanding under our 2006 Plan and stock options to purchase 76,508 shares of our common stock were outstanding under our 2001 Plan. Because the eligibility of stock options will be determined only after our Board of Directors approves specific terms for the exchange offer, and will be dependent on the closing date of the exchange program, we are unable to determine at this time the exact number of shares underlying eligible stock options.

13

Eligible Optionholders

Our Board of Directors may hold open the exchange program to holders of eligible stock options who are, throughout the exchange offer, service providers to the Company or our eligible affiliates. We may, however, exclude otherwise eligible optionholders in non-U.S. jurisdictions if local tax or securities laws or other considerations would make their participation illegal or impractical. In addition, any eligible optionholder who elects to participate in the exchange program but whose service terminates for any reason prior to the grant date of the new stock option will retain his or her eligible stock options subject to their existing terms and will not receive a new option grant under the exchange program.

Exchange Ratios

Our Board of Directors has not yet approved specific terms for an option exchange that would be conducted if this Proposal No. 2 is approved by our stockholder. However, if approved, our Board of Directors may require that for each option award that an eligible optionholder tenders in the exchange program, he or she will receive a new stock option for a lesser number of shares. In no event will the new option granted in exchange for the tendered option cover more shares than the tendered option.

Participation in the Exchange Program

Participation in the exchange program is voluntary. Eligible optionholders will not be required to participate in the exchange program. Eligible optionholders will have at least 20 business days from the start of the exchange program to decide whether they wish to participate. Because the decision to participate in the exchange program is voluntary, we are not able to predict which or how many optionholders will elect to participate, how many eligible stock options will be surrendered for exchange, and therefore how many shares may be issued under new stock option grants under the exchange program. The exchange program will not be conditioned on a minimum level of participation.

Election to Exchange Underwater Stock Options

Eligible optionholders may decide to participate in the exchange program on a grant-by-grant basis. This means that eligible optionholders may elect to tender any or all of their eligible stock option grants, or only one of their eligible stock option grants. However, an eligible optionholder must tender the entire outstanding option grant — he or she may not tender only part of an outstanding, unexercised option grant.

Vesting and Expiration Date of New Stock Options

Our outstanding stock options generally vest over four years following the date of grant. Our Board of Directors has not yet approved specific terms for an option exchange that would be conducted if this Proposal No. 2 is approved by our stockholder. However, if approved, our Board of Directors may impose a new vesting schedule on the new stock options granted in the exchange for the surrendered stock options. Each new stock option may have a new 10 year term, or may have a term not longer than the original term associated with the tendered option. In all cases, the new options will be subject to earlier termination in the event of the optionholder’s termination of continuous service.

Other Terms and Conditions of the New Stock Options

New stock options granted in the exchange program will be subject to the terms and conditions of our 2006 Plan, our standard form of stock option agreement under our 2006 Plan and, to the extent applicable any foreign country appendix or sub-plan provisions. All new stock options granted in the exchange program will be nonstatutory stock options — that is, stock options that are not intended to be incentive stock options within the meaning of Section 422 of the Code.

14

Potential Modification to the Exchange Program

In determining the terms of any exchange offer, our Board of Directors will consider our administrative needs, legal requirements, accounting rules, Company policy decisions and or other considerations. The final terms of the exchange program will be described in a written offer to exchange that we will file with the SEC. After the written offer to exchange is filed, it is possible that we will need to alter the terms of the exchange program to comply with comments from the SEC staff. The Board of Directors will retain the discretion to make any necessary or desirable changes to the terms of the exchange program. In addition, the Board of Directors reserves the right to amend, postpone, or cancel the exchange program once it has started. As noted above, we may decide not to implement the exchange program even if our stockholders approve the exchange program.

Potential Modifications to the Exchange Program in Non-U.S. Jurisdictions

We intend to make the exchange program available to employees and other service providers who are located outside of the United States, where permitted by local law and to the extent reasonably practicable and cost-efficient. We may exclude employees and other service providers in non-U.S. jurisdictions from the exchange program if local tax or other laws would make their participation impractical or cost-prohibitive. In addition, we may need to modify the terms offered to employees in countries outside the United States to comply with local laws or regulations, or for tax or accounting reasons.

U.S. Federal Income Tax Consequences of Participation

The following is a summary of the anticipated material U.S. federal income tax consequences of participating in the exchange program. We will provide a more detailed summary of the applicable tax considerations to participants in the exchange program documents. However, the tax consequences of the exchange program are not entirely certain. The applicable U.S. federal income tax law and regulations may change, and the Internal Revenue Service may adopt a position contrary to the summary below.

We believe that the exchange of eligible stock options for new stock options under the exchange program should be treated as a non-taxable exchange, and so our optionholders should not recognize income for U.S. federal income tax purposes upon the surrender of eligible stock options and the grant of new stock options. If the exchange program is open for 30 days or more, eligible stock options that were intended to be incentive stock options will be considered “modified,” which will result in a deemed re-grant of the eligible stock option for purposes of qualification as incentive stock options, whether or not the option is ever exchanged. This would mean that, for purposes of the tax rules on incentive stock options, the holding period measured from the grant date would restart and the optionholder would not receive any credit for the time from the original grant date of the stock option. In addition, for purposes of the tax rules on incentive stock options, if the fair market value of our common stock on the date of the deemed re-grant is greater than the exercise price of the stock option, the stock option will no longer qualify as an incentive stock option. The tax consequences for participating non-U.S. employees may differ from the U.S. federal tax consequences described in this paragraph.

Accounting Treatment of New Equity Awards

We account for stock-based compensation in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, or FASB ASC 718. Under FASB ASC 718, we will recognize incremental compensation expense resulting from the new stock options granted in the exchange program. The incremental compensation cost will be measured as the excess, if any, of the fair value of new stock options granted in exchange for surrendered stock options, measured as of the date the new stock options are granted, over the fair value of the surrendered eligible stock options, measured immediately prior to the exchange.

We will recognize any incremental compensation expense related to the new stock options issued in the exchange program ratably over the vesting period of the new stock options. If any of the new stock options are forfeited prior to their vesting due to termination of an employee’s or other service provider’s service, we will not recognize the incremental compensation expense for the forfeited stock options.

15

We currently recognize and will continue to recognize compensation expense relating to the eligible stock options, even though they are underwater and do not fully provide the intended incentive and retention benefits.

Impact of the Exchange Program on Our Stockholders

We are unable to predict the precise impact of the exchange program on our stockholders because we do not know how many or which service providers will exchange their eligible stock options. The exchange program is intended to better align compensation expense with the retention and motivation value that we are trying to capture with our outstanding equity grants, to restore competitive and appropriate equity incentives for our service providers, and to reduce our existing overhang and potential dilution.

Vote Required and Board Recommendation

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the special meeting will be required to approve the exchange program. Abstentions will be counted toward the tabulation of votes cast on this Proposal and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL NO. 2.

16

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of our common stock as of August 15, 2012 by: (i) each director; (ii) each of the named executive officers; and (iii) all of our executive officers and directors as a group. In addition, the table sets forth certain information regarding the ownership of our common stock by all those known by us to be beneficial owners of more than five percent of our common stock as of the dates noted below.

| Beneficial Ownership (1) | ||||||||

| Beneficial Owner |

Number of Shares | Percent of Total | ||||||

| 5% Stockholders |

||||||||

| Entities Affiliated with Tennenbaum Capital Partners, LLC (2) |

55,499,950 | 61.7 | % | |||||

| 2951 28th Street, Suite 1000 Santa Monica, CA 90405 |

||||||||

| Eicon Dialogic Investment SRL (3) |

7,019,069 | 9.75 | ||||||

| c/o Cidel Bank and Trust Inc. 1 Financial Plaza, Lower Collymore Rock St. Michael, NN11000 Barbados, West Indies |

||||||||

| ApS Kbus 17 nr. 2101 (4) |

5,010,845 | 6.96 | ||||||

| Vedbaek Strandvej 321 DK-2950, Vedbaek Denmark |

||||||||

| GW Invest ApS (5) |

5,010,845 | 6.96 | ||||||

| Mosehoejvej 3B DK-2920, Charlotenlund Denmark |

||||||||

| Executive Officers and Directors |

||||||||

| Nick Jensen (4) |

5,010,845 | 6.96 | ||||||

| Nick DeRoma |

19,417 | * | ||||||

| Dion Joannou (6) |

146,798 | * | ||||||

| Patrick Jones |

12,285 | * | ||||||

| Richard Piasentin |

6,944 | * | ||||||

| Rajneesh Vig (2) |

55,499,950 | 61.7 | ||||||

| W. Michael West (7) |

38,231 | * | ||||||

| Kevin Cook (8) |

123,312 | * | ||||||

| John Hanson (8) |

87,500 | * | ||||||

| All executive officers and directors as a group (10 persons) (9) |

61,033,714 | 67.48 | % | |||||

| * | Less than one percent. |

| (1) | This table is based upon information supplied by officers, directors and principal stockholders and Schedules 13D and 13G filed with the SEC. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, we believe that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 72,008,579 shares outstanding on August 15, 2012, adjusted as required by rules promulgated by the SEC. |

| (2) | Consists of 5,586,121 shares held by Special Value Expansion Fund, LLC (“SVEF”), (ii) 13,239,108 shares held by Special Value Opportunity Fund, LLC (“SVOF”), (iii) 18,674,721 shares held by Tennenbaum Opportunities Partners V, LP (“TOP V”) and (iv) an aggregate of 18,000,000 shares issuable upon the exercise of warrants exercisable within 60 days after August 15, 2012 held by SVEF, SVOF and TOP V. |

17

| SVEF holds warrants to purchase 2,492,582 shares, SVOF holds warrants to purchase 5,907,418 shares and TOP V holds warrants to purchase 9,600,000 shares. Tennenbaum Capital Partners, LLC (“TCP”) serves as investment advisor to SVEF, SVOF and TOP V. Mr. Vig, currently a member of our Board, is a partner at TCP. Mr. Chan, a former member of our Board, is a Principal at TCP. Messrs. Vig and Chan disclaims beneficial ownership of these shares, except to the extent of their pecuniary interest therein. |

| (3) | Messrs. Ben-Gacem and Guira, former members of the Board, and former Co-Heads of Investcorp Bank B.S.C.’s Technology Investment Group for Investcorp Bank B.S.C.. Sipco Holdings Limited is the ultimate parent of the entities that manage the Investcorp Technology Investment Group partnerships that indirectly own Eicon Dialogic Investment SRL. Messrs. Ben-Gacem and Guira disclaim beneficial ownership of these shares, except to the extent of his pecuniary interest therein. |

| (4) | Mr. Jensen, formerly the Chairman of the Board and formerly Chief Executive Officer, owns and controls ApS Kbus 17 nr. 2101 and may be deemed to beneficially own these shares. |

| (5) | Mr. Konnerup, a former member of the Board, owns and controls GW Invest ApS and may be deemed to beneficially own these shares. |

| (6) | Includes 127,233 shares issuable upon the exercise of options exercisable within 60 days after August 15, 2012. |

| (7) | Includes 12,666 shares issuable upon the exercise of options exercisable within 60 days after August 15, 2012. |

| (8) | Consists of shares issuable upon the exercise of options exercisable within 60 days after August 15, 2012. |

| (9) | Includes the shares issuable upon the exercise of warrants within 60 days of August 15, 2012 as described in footnote 2 above and an aggregate of 432,441 shares issuable to our directors and executive officers upon the exercise of options exercisable within 60 days after August 15, 2012. |

We know of no arrangements, the operation of which may at a subsequent date result in the change of control of Dialogic.

18

DELIVERY OF THIS PROXY STATEMENT

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

This year, a number of brokers with account holders who are our stockholders will be “householding” our proxy materials. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement, please notify your broker or Dialogic by written request to Dialogic’s Corporate Secretary at 1504 McCarthy Boulevard, Milpitas, California 95035 or by telephone at (408) 750-9400. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request “householding” of their communications should contact their broker.

FORWARD LOOKING STATEMENTS

This document includes certain estimates and other forward-looking statements, including statements relating to the consummation of the proposed transaction described above. These statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. Actual results may differ materially from these expectations due to changes in global economic conditions and competition. Important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements include but are not limited to and other factors which may be identified from time to time in our SEC filings and other public announcements, including Dialogic’s Form 10-K for the fiscal year ended December 31, 2011 and Form 10-Q for the quarterly period ended March 31, 2012. We assume no obligation to update these forward-looking statements to reflect actual results, changes in risks, uncertainties or assumptions underlying or affecting such statements or for prospective events that may have a retroactive effect.

OTHER BUSINESS

We know of no other matters to be submitted at the special meeting. Inasmuch as matters not known at this time may arise at the special meeting, the submission of the proxy by the stockholder authorizes the persons named on the proxy to use their discretion in voting on any matter brought before the special meeting.

We are a reporting company and file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission. You may read and copy these reports, proxy statements and other information at the Securities and Exchange Commission public reference rooms. A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2011is available without charge upon written request to: Corporate Secretary, Dialogic Inc., 1504 McCarthy Boulevard, Milpitas, California 95035.

By Order of the Board of Directors,

/s/ Anthony Housefather

Anthony Housefather

Corporate Secretary

August 24, 2012

19

APPENDIX A

CERTIFICATE OF AMENDMENT

TO THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

DIALOGIC INC.

Pursuant to Section 242 of the

General Corporation Law of the State of Delaware (“DGCL”)

Dialogic Inc., a Delaware corporation (hereinafter called the “Corporation”), does hereby certify as follows:

FIRST: Effective at 5:00 p.m. (Eastern Time) on the date of filing with the Secretary of State of the State of Delaware (such time, on such date, the “Effective Time”) of this Certificate of Amendment pursuant to the DGCL, each five (5) shares of the Corporation’s common stock, $0.0001 par value per share, issued and outstanding immediately prior to the Effective Time (the “Old Common Stock”) shall automatically without further action on the part of the Corporation or any holder of Old Common Stock, be reclassified, combined, converted and changed into one (1) fully paid and nonassessable share of common stock, $0.0001 par value per share (the “New Common Stock”), subject to the treatment of fractional share interests as described below. The conversion of the Old Common Stock into New Common Stock will be deemed to occur at the Effective Time. From and after the Effective Time, certificates representing the Old Common Stock shall represent the number of shares of New Common Stock into which such Old Common Stock shall have been converted pursuant to this Certificate of Amendment. There shall be no fractional shares issued. In lieu thereof, the aggregate of all fractional shares otherwise issuable to the holders of record of Old Common Stock shall be issued to Computershare Limited (the “Transfer Agent”), as agent, for the accounts of all holders of record of Old Common Stock otherwise entitled to have a fraction of a share issued to them. The sale of all fractional interests will be effected by the Transfer Agent as soon as practicable after the Effective Time on the basis of prevailing market prices of the New Common Stock at the time of sale. After such sale and upon the surrender of the stockholders’ stock certificates, the Transfer Agent will pay to such holders of record their pro rata share of the net proceeds derived from the sale of the fractional interests.

SECOND: The foregoing amendment was duly adopted in accordance with Section 242 of the DGCL.