.2 Earnings Release Supplement Third Quarter 2025

Citizens Community Bancorp, Inc. Table of Contents Cautionary Notes and Additional Disclosures Deposit Composition Commercial Deposit Concentrations Top 100 Depositors Liquidity Non-Owner Occupied CRE Owner Occupied CRE Multi-family Commercial & Industrial Loans Construction & Development Loans Agricultural Real Estate & Operating Loans (The following four slides are loans included in previous commercial loan slides above, excluding Multi-family loans) Hotel Loans Restaurant Loans Campground Loans Office Loans Credit Quality/Risk Rating Descriptions Loans by Risk Rating as of September 30, 2025 Loans by Risk Rating as of June 30, 2025 Loans by Risk Rating as of December 31, 2024 Loans by Risk Rating as of September 30, 2024 Allowance for Credit Losses – Loans Allowance for Credit Losses – Unfunded Commitments Delinquency as of September 30, 2025 and June 30, 2025 Delinquency as of December 31, 2024 and September 30, 2024 Page(s) 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 18 19 19 20 20 21 22 Nonaccrual Loans Roll Forward Other Real Estate Owned Roll Forward Investments – Amortized Cost and Fair Value Investments – Credit Ratings Earnings Per Share Economic Value of Equity Net Interest Income Over One Year Horizon Selected Capital Composition Highlights – Bank and Company Fair Value Accounting and Fair Value Table Page(s) 23 23 24 24 25 26 26 27 28 1

Cautionary Notes and Additional Disclosures SOURCE, DATES AND PERIODS PRESENTED In this earnings release financial supplement, unless otherwise noted, data from internal documents was used as the source for this document. Unless otherwise noted, “20YY” refers to either the corresponding fiscal year-end date or the corresponding 12-months (i.e. fiscal year) then ended. “MMM-YY” refers to either the corresponding quarter-end date, or the corresponding three-month period then ended. CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS This earnings release financial supplement may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, descriptions of the financial condition, results of operations, asset and credit quality trends, profitability, projected earnings, future plans, strategies and expectations of Citizens Community Bancorp, Inc. (“CZWI” or the “Company”) and its subsidiary, Citizens Community Federal, National Association (“CCFBank”). The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and is including this statement for purposes of complying with those safe harbor provisions. Forward-looking statements, which are based on certain assumptions of the Company, are generally identifiable by use of the words “believe,” “expect,” “estimates,” “intend,” “anticipate,” “estimate,” “project,” “on pace,” “seek,” “target,” “potential,” “focus,” “may,” “preliminary,” “could,” “should” or similar expressions. These forward-looking statements express management’s current expectations or forecasts of future events, and by their nature, are subject to risks and uncertainties. Therefore, there are a number of factors that might cause actual results to differ materially from those in such statements. These uncertainties include: conditions in the financial markets and economic conditions generally; the impact of inflation on our business and our customers; geopolitical tensions, including current or anticipated impact of military conflicts; higher lending risks associated with our commercial and agricultural banking activities; future pandemics (including new variants of COVID-19); cybersecurity risks; adverse impacts on the regional banking industry and the business environment in which it operates; interest rate risk; lending risk; changes in the fair value or ratings downgrades of our securities; the sufficiency of allowance for credit losses; competitive pressures among depository and other financial institutions; disintermediation risk; our ability to maintain our reputation; our ability to maintain or increase our market share; our ability to realize the benefits of net deferred tax assets; our ability to obtain needed liquidity; our ability to raise capital needed to fund growth or meet regulatory requirements; our ability to attract and retain key personnel; our ability to keep pace with technological change; prevalence of fraud and other financial crimes; the possibility that our internal controls and procedures could fail or be circumvented; our ability to successfully execute our acquisition growth strategy; risks posed by acquisitions and other expansion opportunities, including difficulties and delays in integrating the acquired business operations or fully realizing the cost savings and other benefits; restrictions on our ability to pay dividends; the potential volatility of our stock price; accounting standards for credit losses; legislative or regulatory changes or actions, or significant litigation, adversely affecting the Company or Bank; public company reporting obligations; changes in federal or state tax laws; and changes in accounting principles, policies or guidelines and their impact on financial performance. Stockholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. Such uncertainties and other risks that may affect the Company's performance are discussed further in Part I, Item 1A, “Risk Factors,” in the Company’s Form 10-K, for the year ended December 31, 2024, filed with the Securities and Exchange Commission (“SEC”) on March 13, 2025, and the Company's subsequent filings with the SEC. The Company undertakes no obligation to make any revisions to the forward- looking statements contained herein or to update them to reflect events or circumstances occurring after the date hereof. NON-GAAP FINANCIAL MEASURES This earnings release financial supplement contains non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Non-GAAP financial measures referred to herein include net income as adjusted, return on average equity as adjusted, and return on average assets as adjusted. Reconciliations of all non-GAAP financial measures used herein to the comparable GAAP financial measures appear in the appendix at the end of this presentation. 2

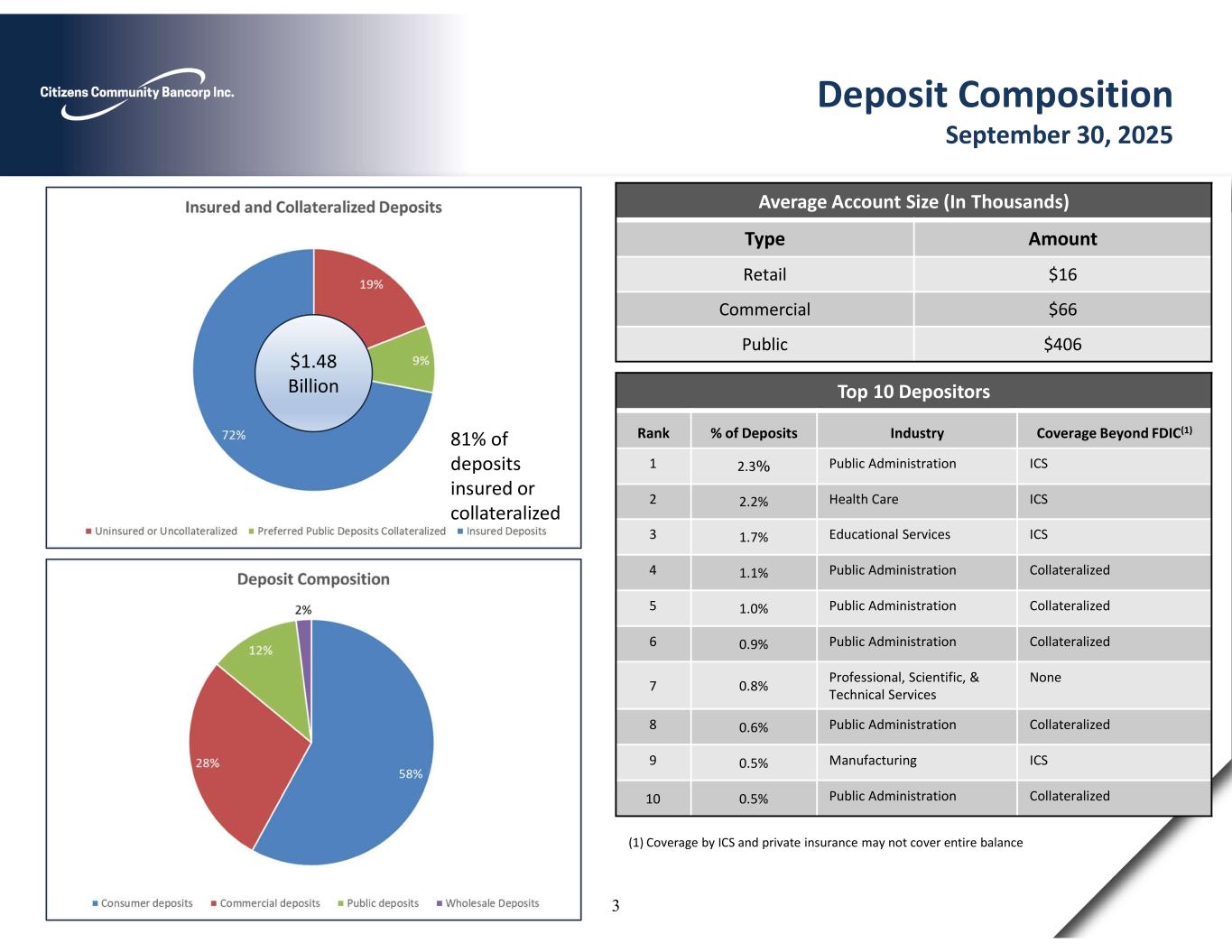

Deposit Composition September 30, 2025 Average Account Size (In Thousands) AmountType $16Retail $66Commercial $406Public $1.48 Billion 81% of deposits insured or collateralized Top 10 Depositors Coverage Beyond FDIC(1)Industry% of DepositsRank ICSPublic Administration2.3%1 ICSHealth Care2.2%2 ICSEducational Services1.7%3 CollateralizedPublic Administration1.1%4 CollateralizedPublic Administration1.0%5 CollateralizedPublic Administration0.9%6 NoneProfessional, Scientific, & Technical Services0.8%7 CollateralizedPublic Administration0.6%8 ICSManufacturing0.5%9 CollateralizedPublic Administration0.5%10 (1) Coverage by ICS and private insurance may not cover entire balance 3

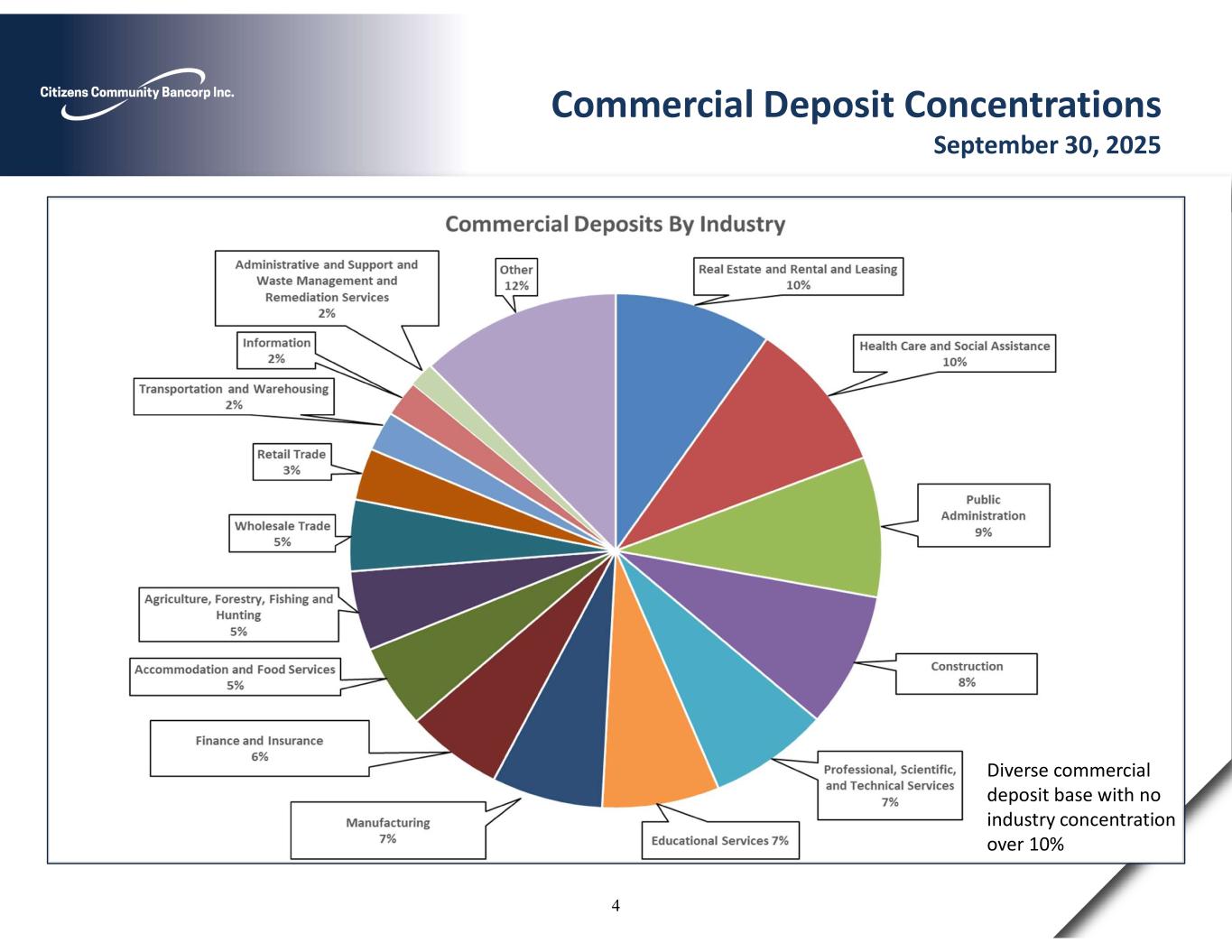

Commercial Deposit Concentrations September 30, 2025 Diverse commercial deposit base with no industry concentration over 10% 4

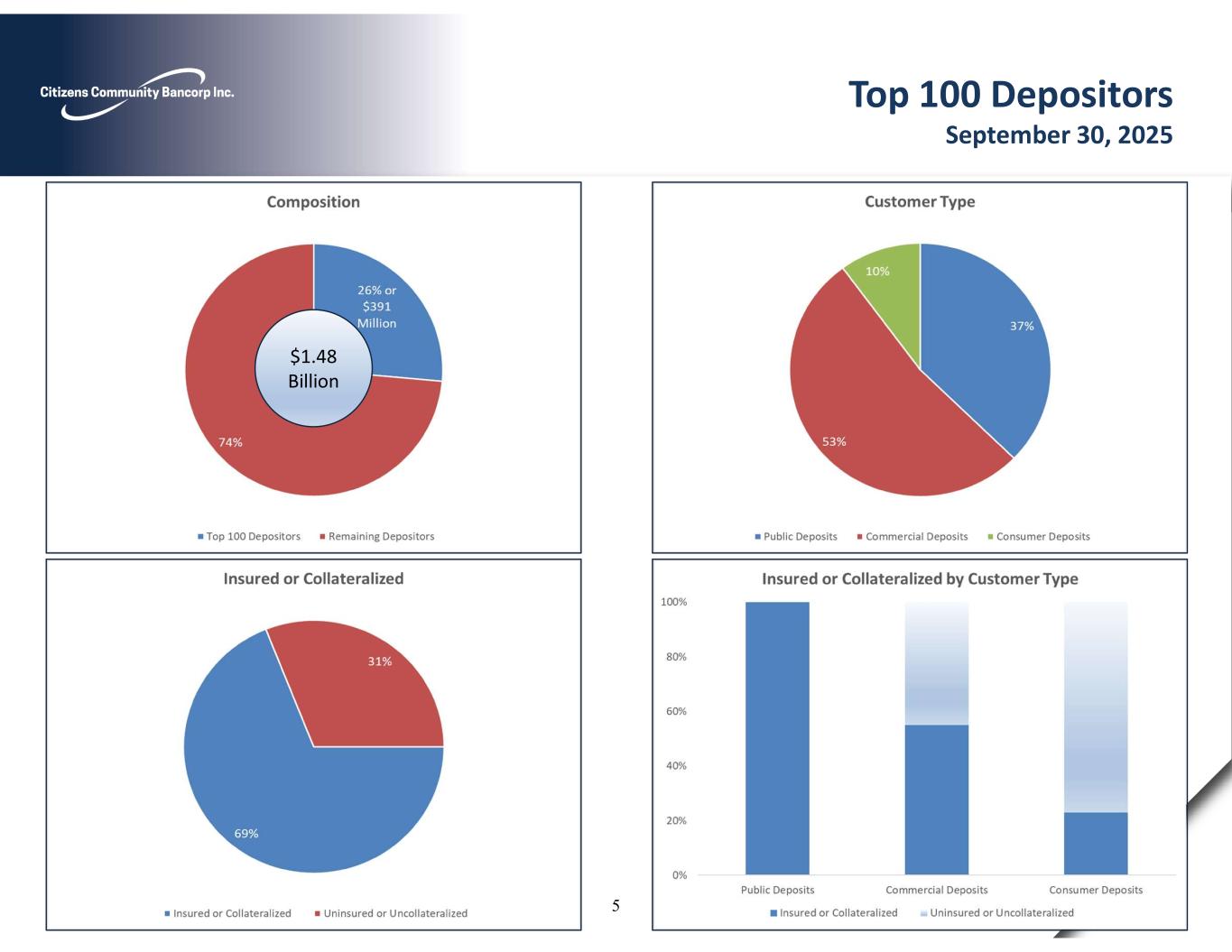

Top 100 Depositors September 30, 2025 $1.48 Billion 5

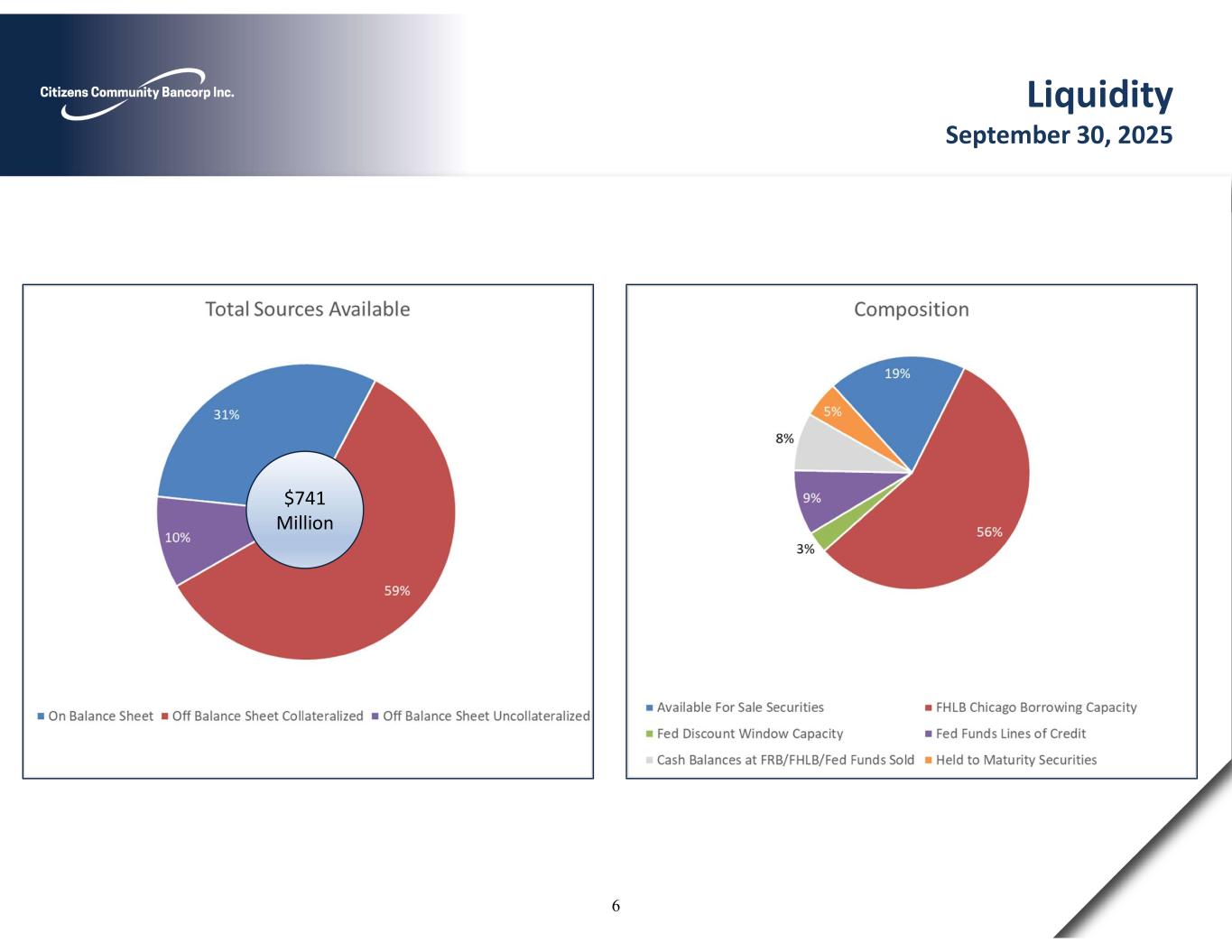

Liquidity September 30, 2025 $741 Million 6

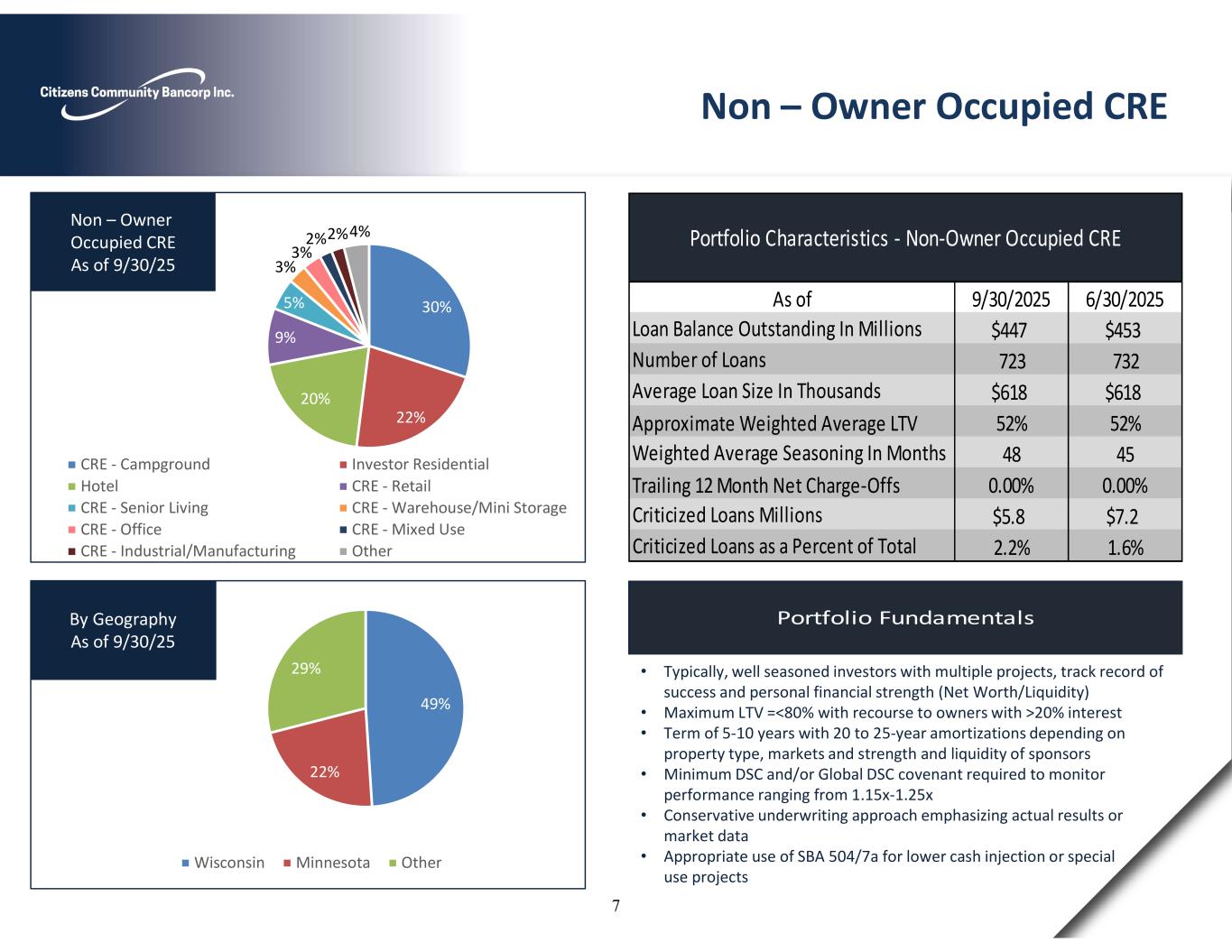

Portfolio Fundamentals 49% 22% 29% Wisconsin Minnesota Other By Geography As of 9/30/25 • Typically, well seasoned investors with multiple projects, track record of success and personal financial strength (Net Worth/Liquidity) • Maximum LTV =<80% with recourse to owners with >20% interest • Term of 5-10 years with 20 to 25-year amortizations depending on property type, markets and strength and liquidity of sponsors • Minimum DSC and/or Global DSC covenant required to monitor performance ranging from 1.15x-1.25x • Conservative underwriting approach emphasizing actual results or market data • Appropriate use of SBA 504/7a for lower cash injection or special use projects Non – Owner Occupied CRE 9/30/2025 6/30/2025 $447 $453 723 732 $618 $618 Approximate Weighted Average LTV 52% 52% 48 45 Trailing 12 Month Net Charge-Offs 0.00% 0.00% $5.8 $7.2 2.2% 1.6% Weighted Average Seasoning In Months Loan Balance Outstanding In Millions Number of Loans Average Loan Size In Thousands Portfolio Characteristics - Non-Owner Occupied CRE As of Criticized Loans Millions Criticized Loans as a Percent of Total 30% 22% 20% 9% 5% 3% 3% 2%2%4% CRE - Campground Investor Residential Hotel CRE - Retail CRE - Senior Living CRE - Warehouse/Mini Storage CRE - Office CRE - Mixed Use CRE - Industrial/Manufacturing Other Non – Owner Occupied CRE As of 9/30/25 7

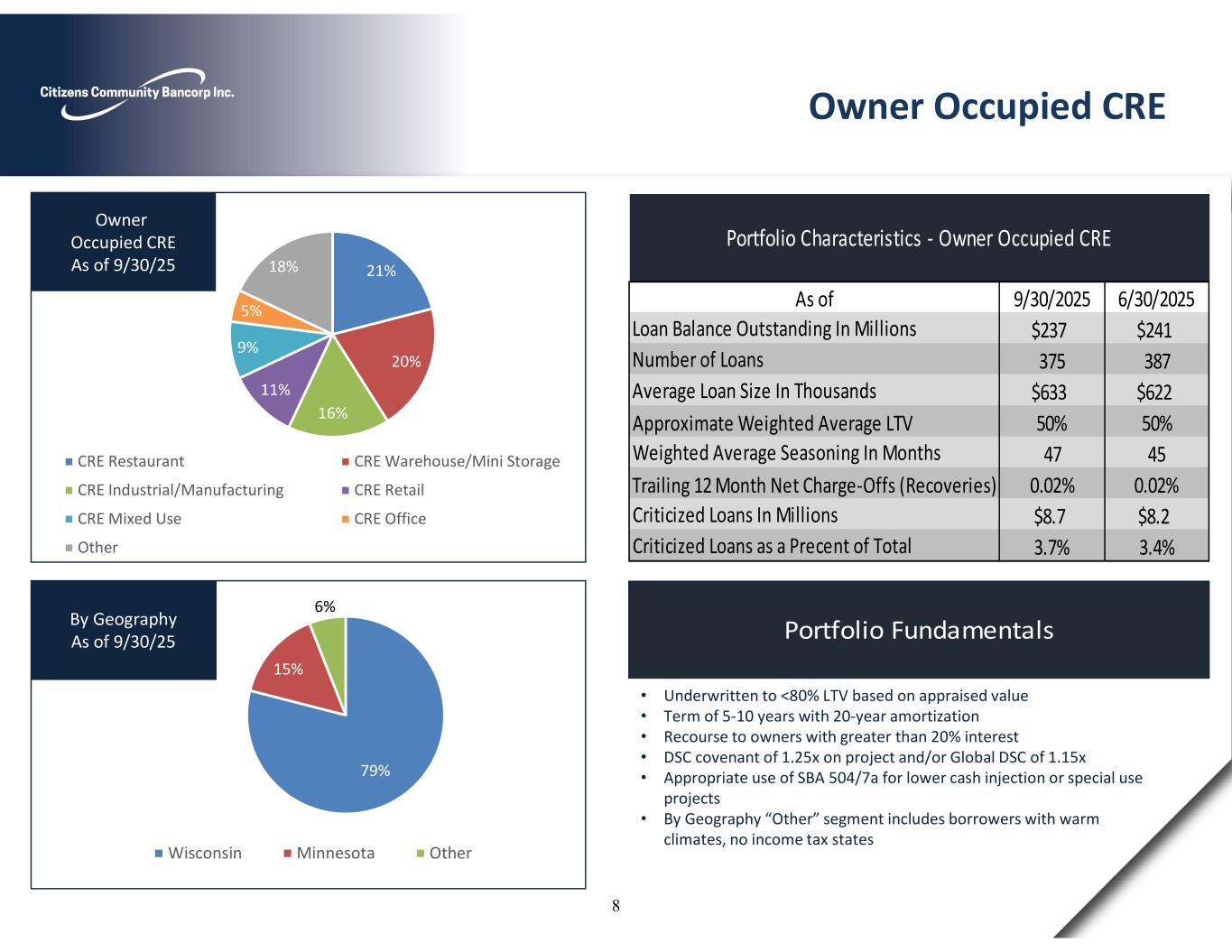

21% 20% 16% 11% 9% 5% 18% CRE Restaurant CRE Warehouse/Mini Storage CRE Industrial/Manufacturing CRE Retail CRE Mixed Use CRE Office Other Owner Occupied CRE As of 9/30/25 Portfolio Fundamentals 79% 15% 6% Wisconsin Minnesota Other By Geography As of 9/30/25 • Underwritten to <80% LTV based on appraised value • Term of 5-10 years with 20-year amortization • Recourse to owners with greater than 20% interest • DSC covenant of 1.25x on project and/or Global DSC of 1.15x • Appropriate use of SBA 504/7a for lower cash injection or special use projects • By Geography “Other” segment includes borrowers with warm climates, no income tax states Owner Occupied CRE 9/30/2025 6/30/2025 $237 $241 375 387 $633 $622 Approximate Weighted Average LTV 50% 50% 47 45 Trailing 12 Month Net Charge-Offs (Recoveries) 0.02% 0.02% $8.7 $8.2 3.7% 3.4%Criticized Loans as a Precent of Total Weighted Average Seasoning In Months Criticized Loans In Millions Portfolio Characteristics - Owner Occupied CRE Loan Balance Outstanding In Millions Number of Loans Average Loan Size In Thousands As of 8

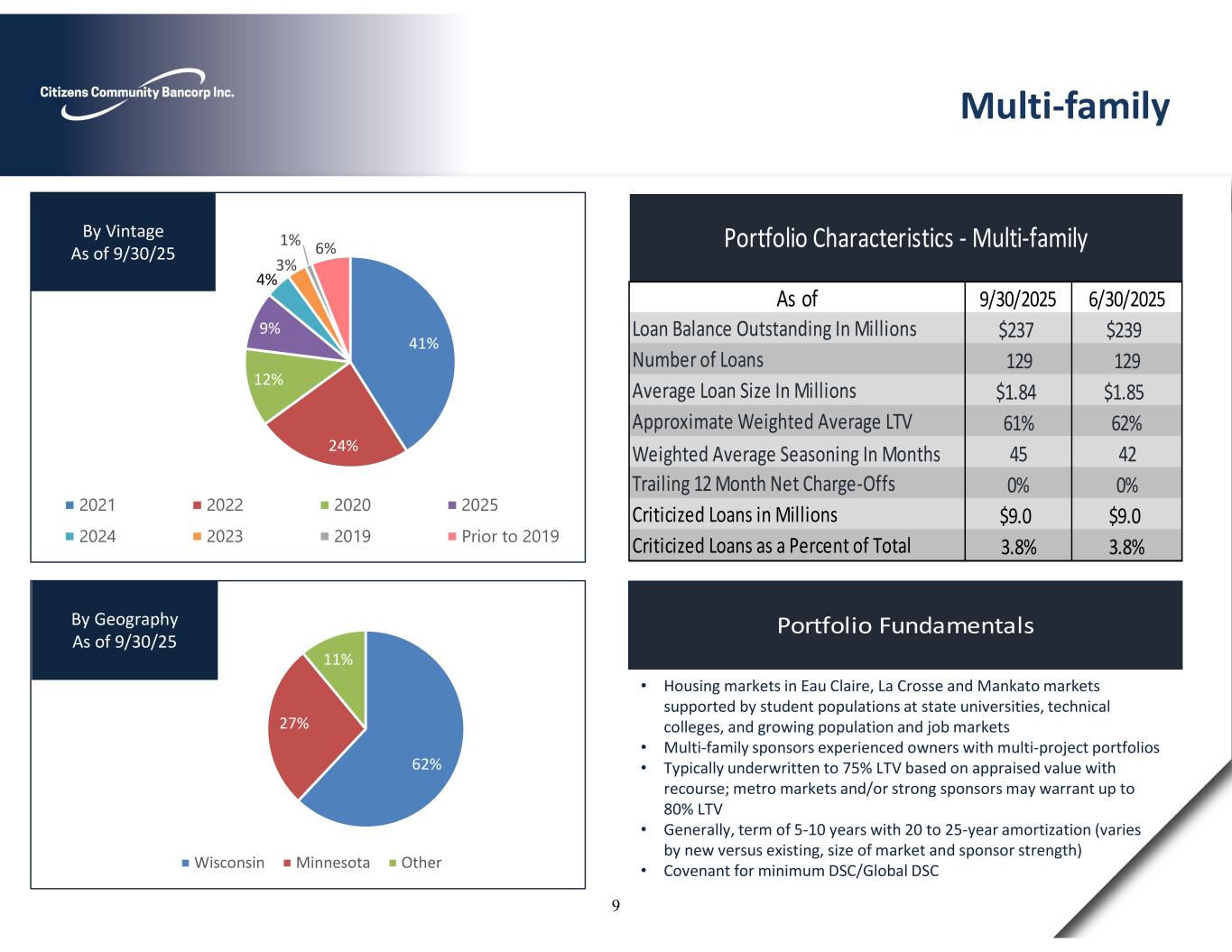

Portfolio Fundamentals 62% 27% 11% Wisconsin Minnesota Other By Geography As of 9/30/25 41% 24% 12% 9% 4% 3% 1% 6% 2021 2022 2020 2025 2024 2023 2019 Prior to 2019 By Vintage As of 9/30/25 • Housing markets in Eau Claire, La Crosse and Mankato markets supported by student populations at state universities, technical colleges, and growing population and job markets • Multi-family sponsors experienced owners with multi-project portfolios • Typically underwritten to 75% LTV based on appraised value with recourse; metro markets and/or strong sponsors may warrant up to 80% LTV • Generally, term of 5-10 years with 20 to 25-year amortization (varies by new versus existing, size of market and sponsor strength) • Covenant for minimum DSC/Global DSC Multi-family 9/30/2025 6/30/2025 $237 $239 129 129 $1.84 $1.85 61% 62% Weighted Average Seasoning In Months 45 42 0% 0% $9.0 $9.0 3.8% 3.8%Criticized Loans as a Percent of Total Approximate Weighted Average LTV Trailing 12 Month Net Charge-Offs Criticized Loans in Millions Portfolio Characteristics - Multi-family Loan Balance Outstanding In Millions Number of Loans Average Loan Size In Millions As of 9

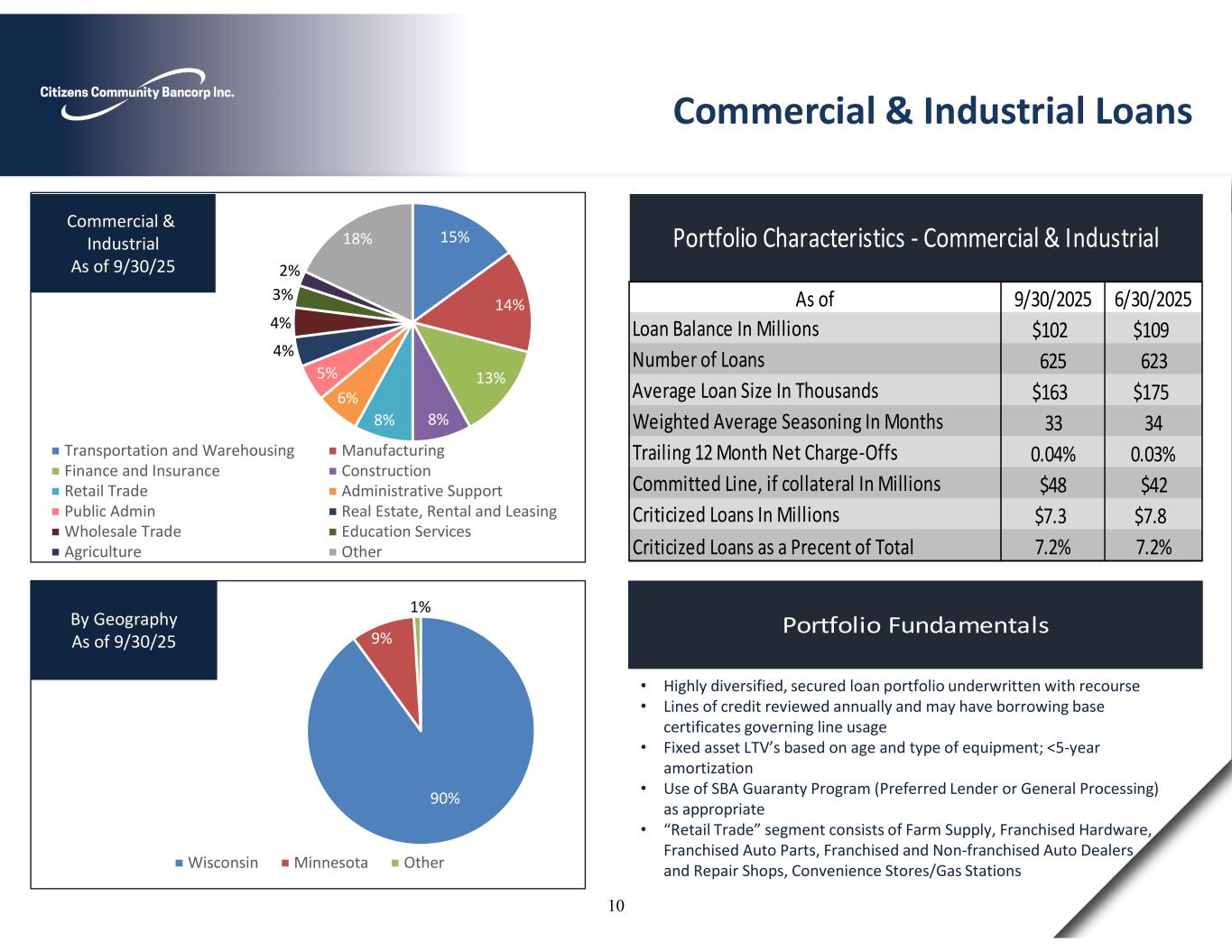

90% 9% 1% Wisconsin Minnesota Other By Geography As of 9/30/25 15% 14% 13% 8%8% 6% 5% 4% 4% 3% 2% 18% Transportation and Warehousing Manufacturing Finance and Insurance Construction Retail Trade Administrative Support Public Admin Real Estate, Rental and Leasing Wholesale Trade Education Services Agriculture Other Commercial & Industrial As of 9/30/25 • Highly diversified, secured loan portfolio underwritten with recourse • Lines of credit reviewed annually and may have borrowing base certificates governing line usage • Fixed asset LTV’s based on age and type of equipment; <5-year amortization • Use of SBA Guaranty Program (Preferred Lender or General Processing) as appropriate • “Retail Trade” segment consists of Farm Supply, Franchised Hardware, Franchised Auto Parts, Franchised and Non-franchised Auto Dealers and Repair Shops, Convenience Stores/Gas Stations Commercial & Industrial Loans 9/30/2025 6/30/2025 $102 $109 625 623 $163 $175 33 34 0.04% 0.03% $48 $42 $7.3 $7.8 Criticized Loans as a Precent of Total 7.2% 7.2% Criticized Loans In Millions Weighted Average Seasoning In Months Trailing 12 Month Net Charge-Offs Committed Line, if collateral In Millions Portfolio Characteristics - Commercial & Industrial Loan Balance In Millions Number of Loans Average Loan Size In Thousands As of Portfolio Fundamentals 10

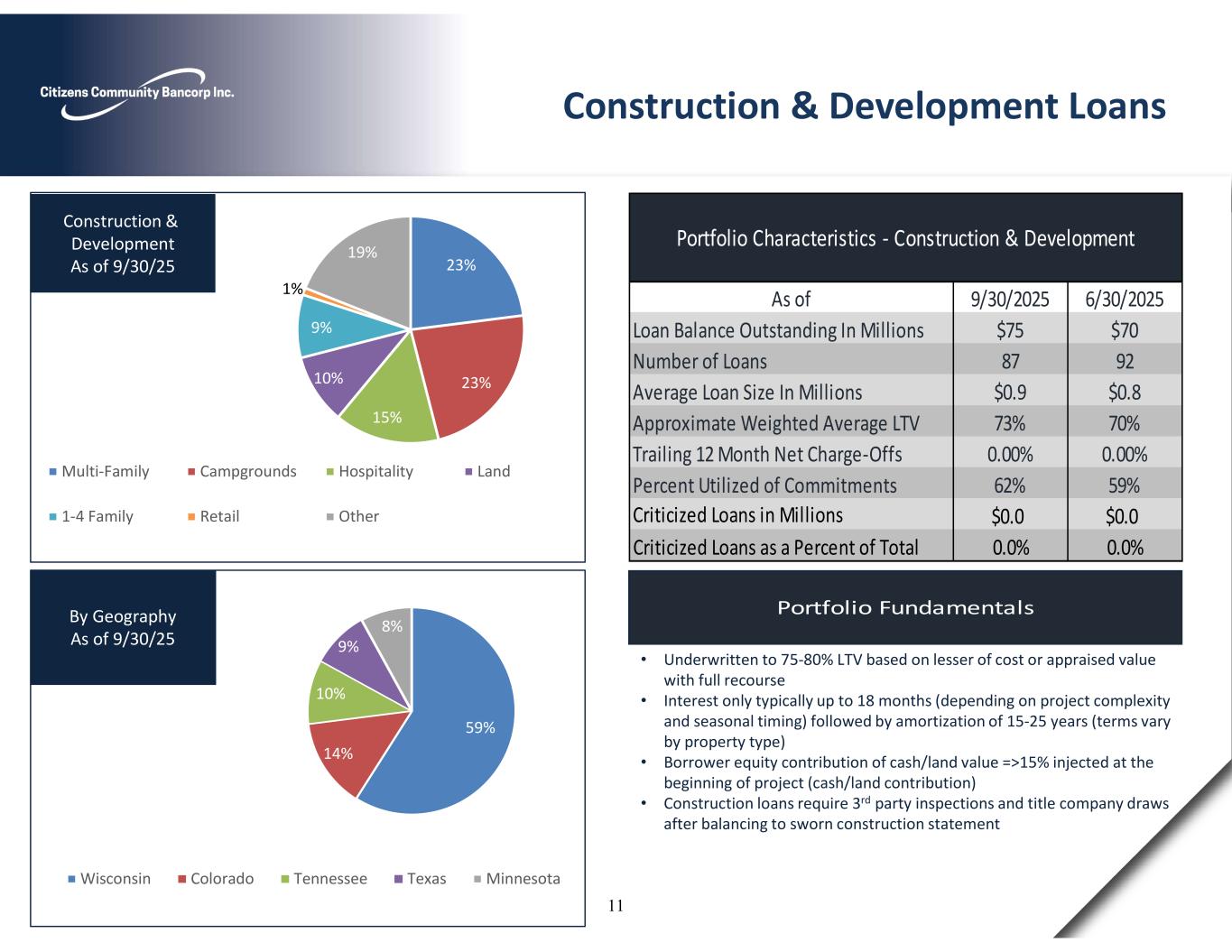

Portfolio Fundamentals 23% 23% 15% 10% 9% 1% 19% Multi-Family Campgrounds Hospitality Land 1-4 Family Retail Other Construction & Development As of 9/30/25 59% 14% 10% 9% 8% Wisconsin Colorado Tennessee Texas Minnesota By Geography As of 9/30/25 • Underwritten to 75-80% LTV based on lesser of cost or appraised value with full recourse • Interest only typically up to 18 months (depending on project complexity and seasonal timing) followed by amortization of 15-25 years (terms vary by property type) • Borrower equity contribution of cash/land value =>15% injected at the beginning of project (cash/land contribution) • Construction loans require 3rd party inspections and title company draws after balancing to sworn construction statement Construction & Development Loans 9/30/2025 6/30/2025 Loan Balance Outstanding In Millions $75 $70 Number of Loans 87 92 Average Loan Size In Millions $0.9 $0.8 Approximate Weighted Average LTV 73% 70% Trailing 12 Month Net Charge-Offs 0.00% 0.00% Percent Utilized of Commitments 62% 59% $0.0 $0.0 Criticized Loans as a Percent of Total 0.0% 0.0% Portfolio Characteristics - Construction & Development As of Criticized Loans in Millions 11

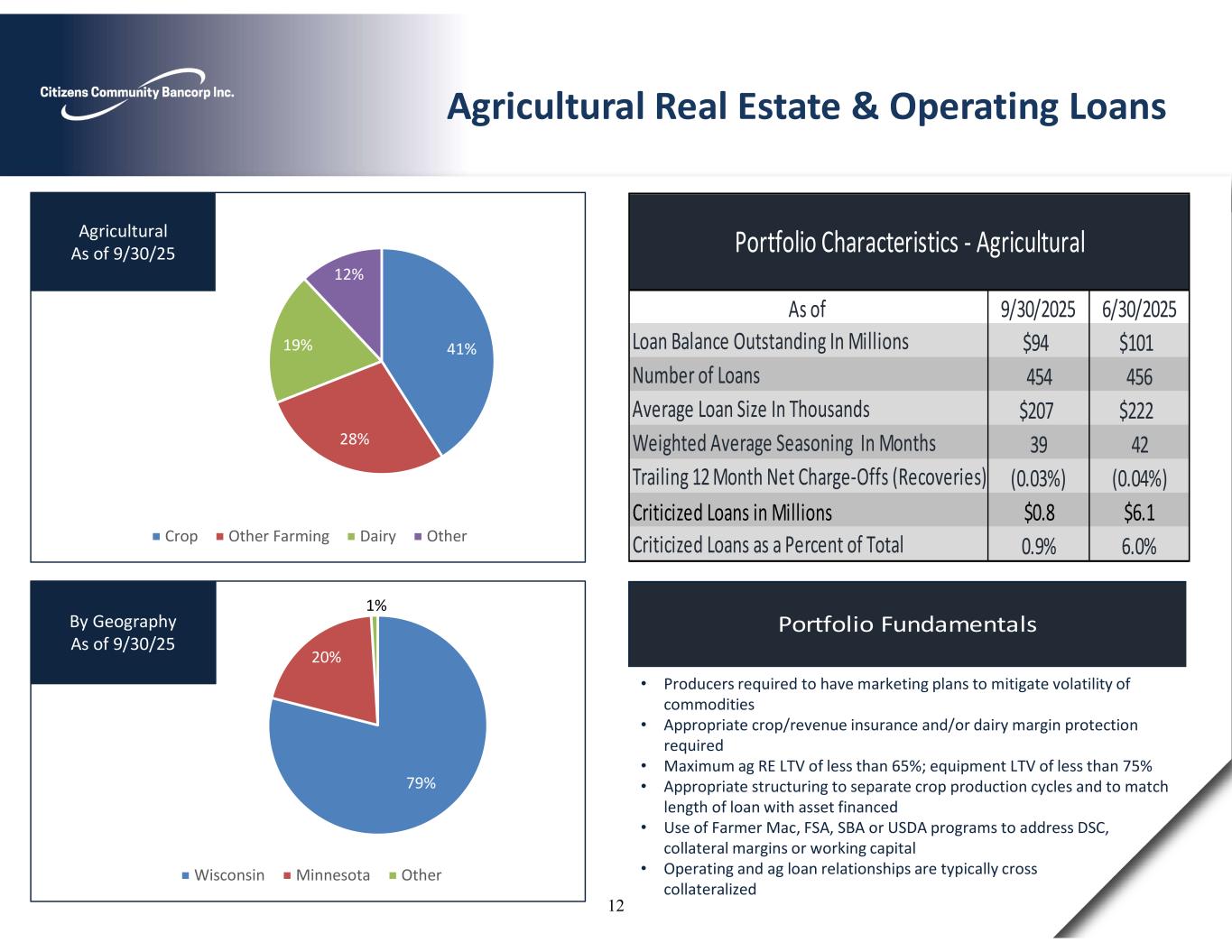

41% 28% 19% 12% Crop Other Farming Dairy Other Agricultural As of 9/30/25 Portfolio Fundamentals 79% 20% 1% Wisconsin Minnesota Other By Geography As of 9/30/25 • Producers required to have marketing plans to mitigate volatility of commodities • Appropriate crop/revenue insurance and/or dairy margin protection required • Maximum ag RE LTV of less than 65%; equipment LTV of less than 75% • Appropriate structuring to separate crop production cycles and to match length of loan with asset financed • Use of Farmer Mac, FSA, SBA or USDA programs to address DSC, collateral margins or working capital • Operating and ag loan relationships are typically cross collateralized Agricultural Real Estate & Operating Loans 9/30/2025 6/30/2025 $94 $101 454 456 $207 $222 39 42 (0.03%) (0.04%) Criticized Loans in Millions $0.8 $6.1 0.9% 6.0%Criticized Loans as a Percent of Total Weighted Average Seasoning In Months Trailing 12 Month Net Charge-Offs (Recoveries) Portfolio Characteristics - Agricultural Loan Balance Outstanding In Millions Number of Loans Average Loan Size In Thousands As of 12

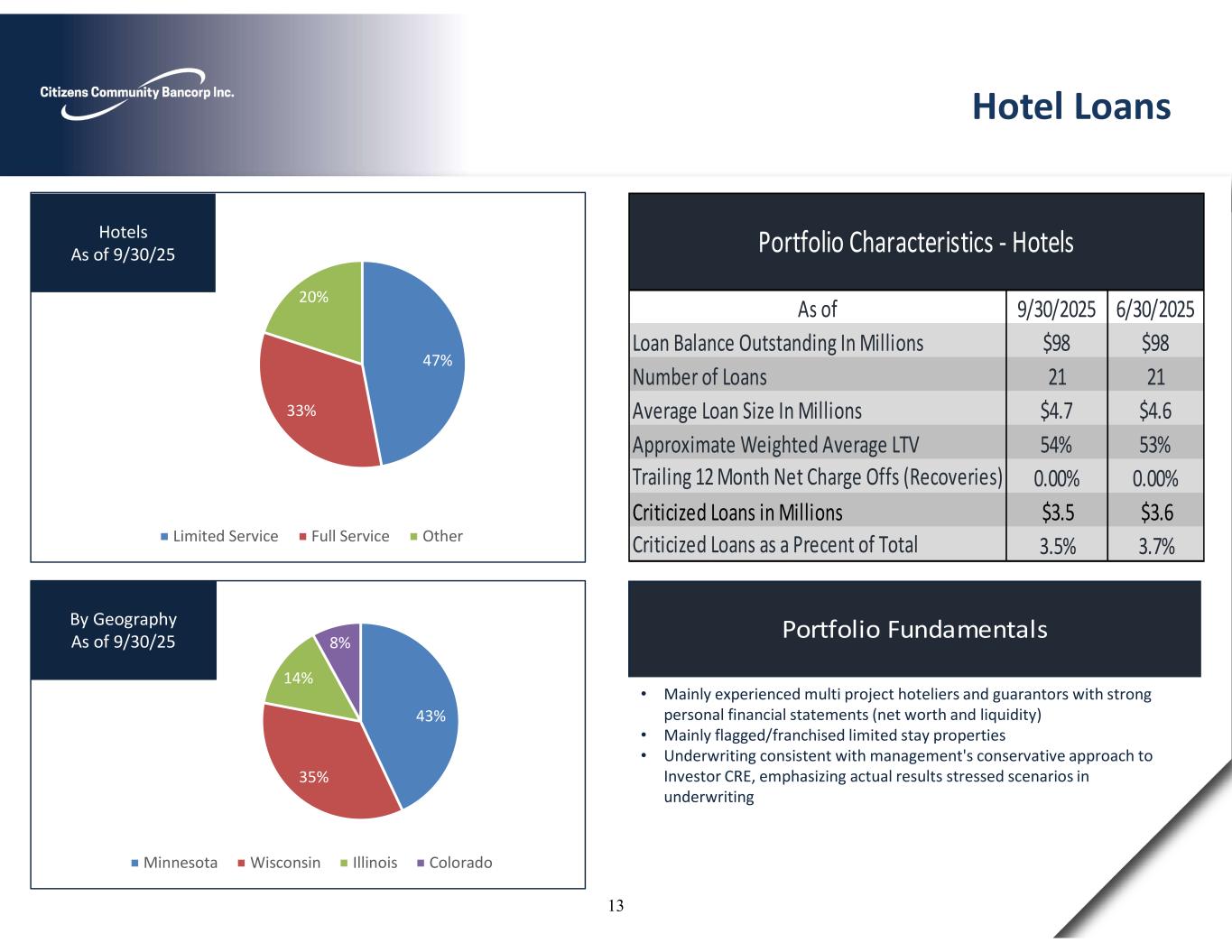

47% 33% 20% Limited Service Full Service Other Hotels As of 9/30/25 Portfolio Fundamentals 43% 35% 14% 8% Minnesota Wisconsin Illinois Colorado By Geography As of 9/30/25 • Mainly experienced multi project hoteliers and guarantors with strong personal financial statements (net worth and liquidity) • Mainly flagged/franchised limited stay properties • Underwriting consistent with management's conservative approach to Investor CRE, emphasizing actual results stressed scenarios in underwriting Hotel Loans 9/30/2025 6/30/2025 $98 $98 21 21 $4.7 $4.6 54% 53% 0.00% 0.00% Criticized Loans in Millions $3.5 $3.6 3.5% 3.7%Criticized Loans as a Precent of Total As of Number of Loans Trailing 12 Month Net Charge Offs (Recoveries) Portfolio Characteristics - Hotels Loan Balance Outstanding In Millions Average Loan Size In Millions Approximate Weighted Average LTV 13

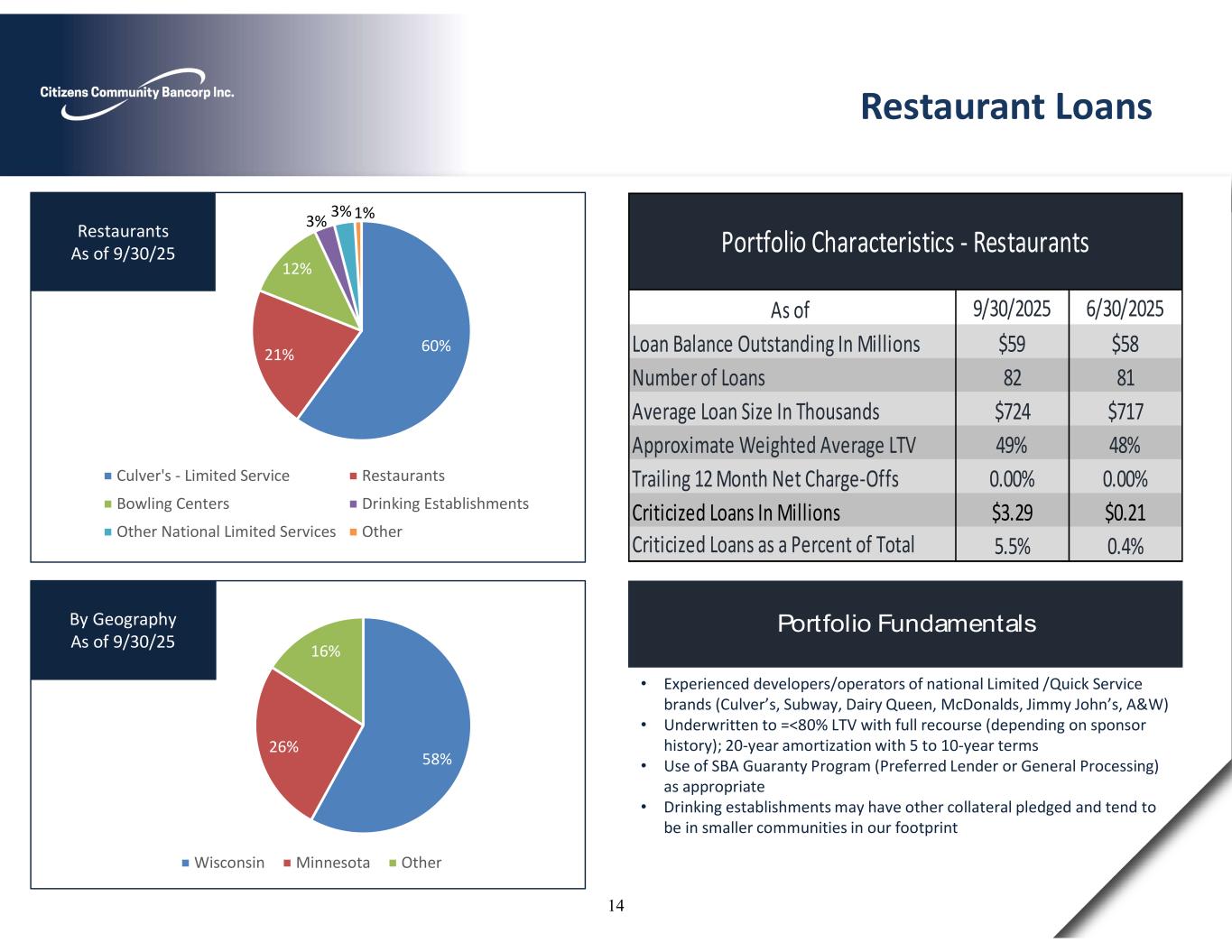

60%21% 12% 3% 3% 1% Culver's - Limited Service Restaurants Bowling Centers Drinking Establishments Other National Limited Services Other Restaurants As of 9/30/25 Portfolio Fundamentals 58% 26% 16% Wisconsin Minnesota Other By Geography As of 9/30/25 • Experienced developers/operators of national Limited /Quick Service brands (Culver’s, Subway, Dairy Queen, McDonalds, Jimmy John’s, A&W) • Underwritten to =<80% LTV with full recourse (depending on sponsor history); 20-year amortization with 5 to 10-year terms • Use of SBA Guaranty Program (Preferred Lender or General Processing) as appropriate • Drinking establishments may have other collateral pledged and tend to be in smaller communities in our footprint Restaurant Loans 9/30/2025 6/30/2025 $59 $58 82 81 $724 $717 49% 48% 0.00% 0.00% Criticized Loans In Millions $3.29 $0.21 5.5% 0.4%Criticized Loans as a Percent of Total Portfolio Characteristics - Restaurants As of Trailing 12 Month Net Charge-Offs Loan Balance Outstanding In Millions Number of Loans Average Loan Size In Thousands Approximate Weighted Average LTV 14

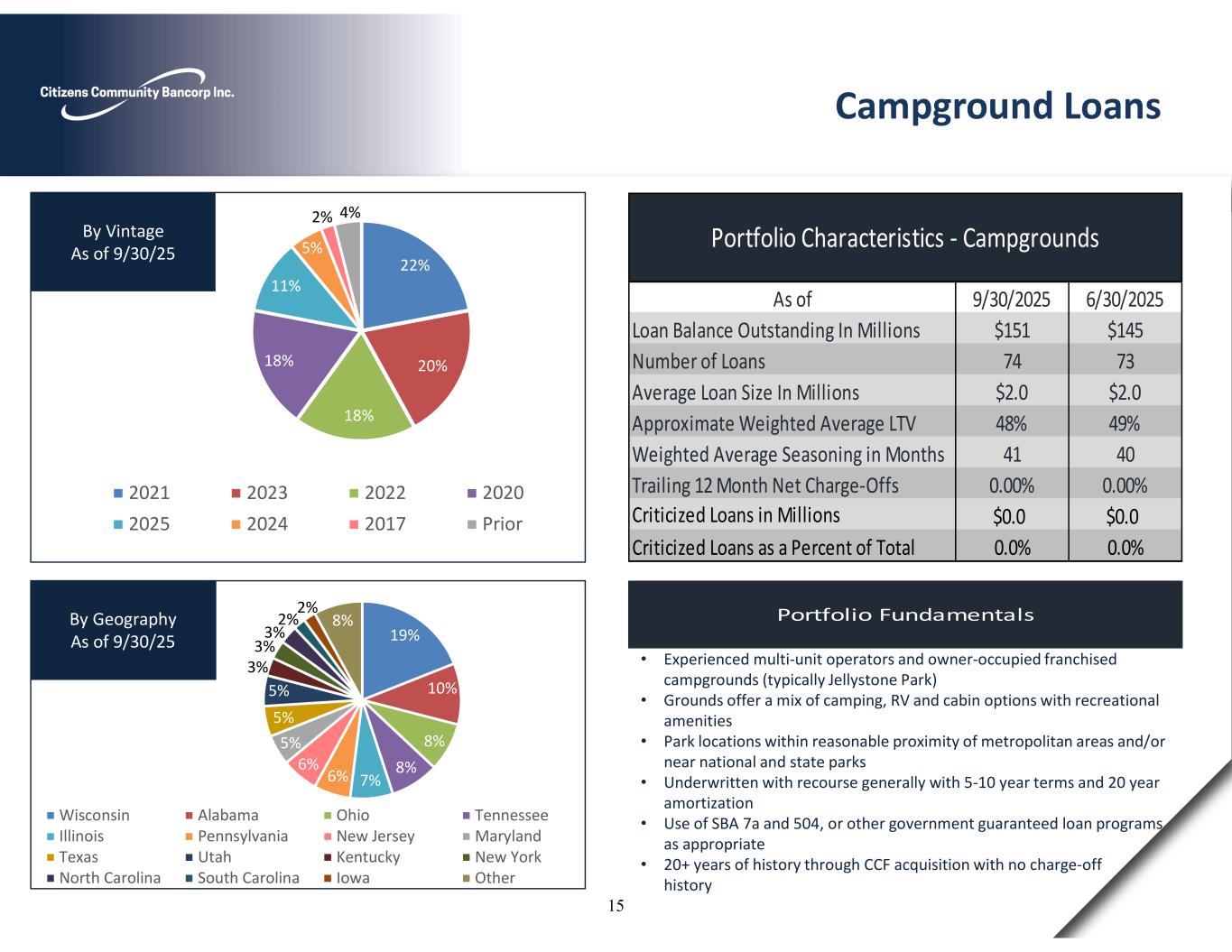

22% 20% 18% 18% 11% 5% 2% 4% 2021 2023 2022 2020 2025 2024 2017 Prior By Vintage As of 9/30/25 Portfolio Fundamentals 19% 10% 8% 8% 7%6% 6% 5% 5% 5% 3% 3% 3% 2% 2% 8% Wisconsin Alabama Ohio Tennessee Illinois Pennsylvania New Jersey Maryland Texas Utah Kentucky New York North Carolina South Carolina Iowa Other By Geography As of 9/30/25 • Experienced multi-unit operators and owner-occupied franchised campgrounds (typically Jellystone Park) • Grounds offer a mix of camping, RV and cabin options with recreational amenities • Park locations within reasonable proximity of metropolitan areas and/or near national and state parks • Underwritten with recourse generally with 5-10 year terms and 20 year amortization • Use of SBA 7a and 504, or other government guaranteed loan programs as appropriate • 20+ years of history through CCF acquisition with no charge-off history Campground Loans 9/30/2025 6/30/2025 $151 $145 74 73 $2.0 $2.0 48% 49% 41 40 0.00% 0.00% $0.0 $0.0 Criticized Loans as a Percent of Total 0.0% 0.0% Portfolio Characteristics - Campgrounds As of Weighted Average Seasoning in Months Criticized Loans in Millions Loan Balance Outstanding In Millions Number of Loans Average Loan Size In Millions Approximate Weighted Average LTV Trailing 12 Month Net Charge-Offs 15

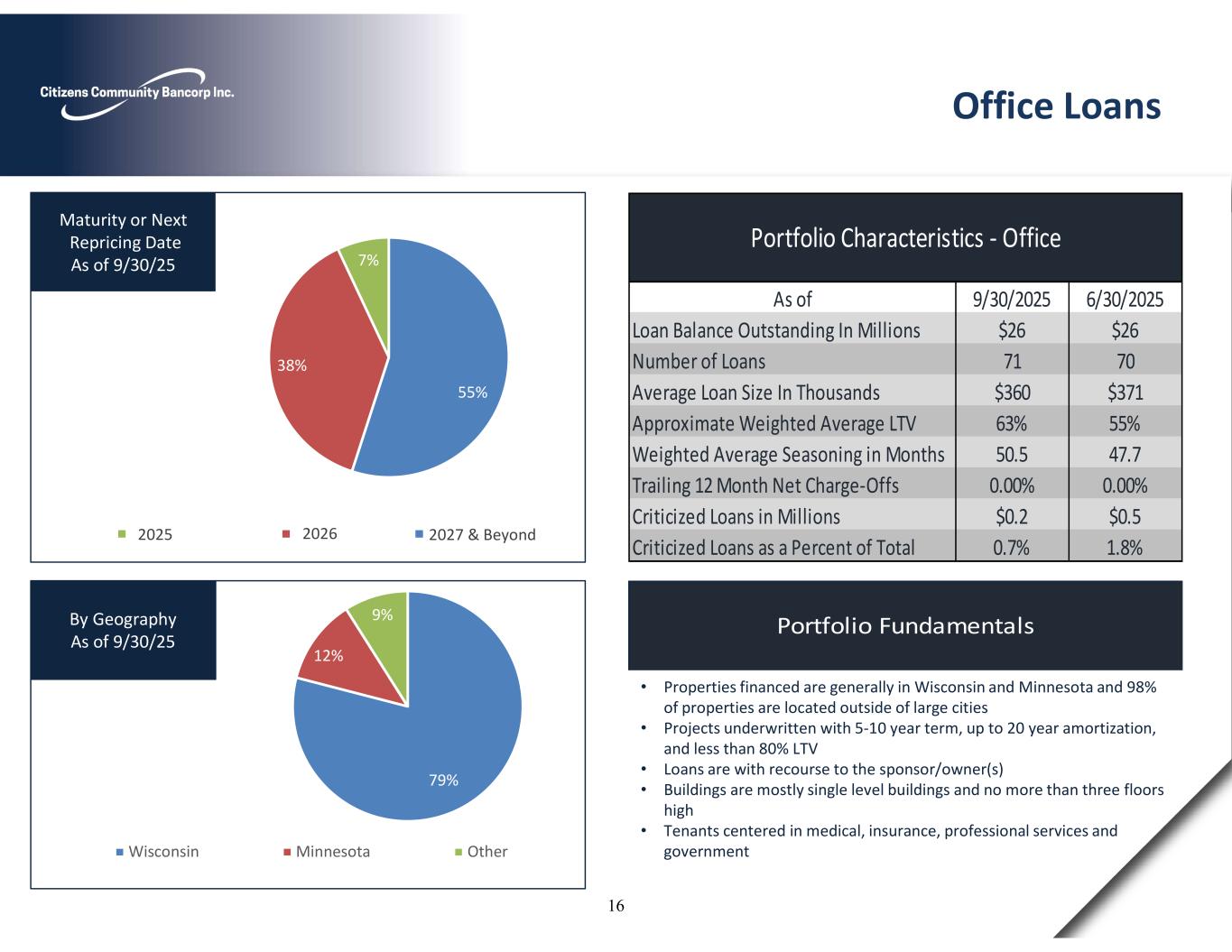

55% 38% 7% Maturity or Next Repricing Date As of 9/30/25 2025 2026 2027 & Beyond Portfolio Fundamentals 79% 12% 9% Wisconsin Minnesota Other By Geography As of 9/30/25 • Properties financed are generally in Wisconsin and Minnesota and 98% of properties are located outside of large cities • Projects underwritten with 5-10 year term, up to 20 year amortization, and less than 80% LTV • Loans are with recourse to the sponsor/owner(s) • Buildings are mostly single level buildings and no more than three floors high • Tenants centered in medical, insurance, professional services and government Office Loans 9/30/2025 6/30/2025 $26 $26 71 70 $360 $371 63% 55% 50.5 47.7 0.00% 0.00% $0.2 $0.5 0.7% 1.8%Criticized Loans as a Percent of Total Portfolio Characteristics - Office As of Weighted Average Seasoning in Months Criticized Loans in Millions Loan Balance Outstanding In Millions Number of Loans Average Loan Size In Thousands Approximate Weighted Average LTV Trailing 12 Month Net Charge-Offs 16

Credit Quality/Risk Ratings: Management utilizes a numeric risk rating system to identify and quantify the Bank’s risk of loss within its loan portfolio. Ratings are initially assigned prior to funding the loan, and may be changed at any time as circumstances warrant. Ratings range from the highest to lowest quality based on factors that include measurements of ability to pay, collateral type and value, borrower stability and management experience. The Bank’s loan portfolio is presented below in accordance with the risk rating framework that has been commonly adopted by the federal banking agencies. The definitions of the various risk rating categories are as follows: 1 through 4 - Pass. A “Pass” loan means that the condition of the borrower and the performance of the loan is satisfactory or better. 5 - Watch. A “Watch” loan has clearly identifiable developing weaknesses that deserve additional attention from management. Weaknesses that are not corrected or mitigated, may jeopardize the ability of the borrower to repay the loan in the future. 6 - Special Mention. A “Special Mention” loan has one or more potential weakness that deserve management’s close attention. If left uncorrected, these potential weaknesses may result in deterioration of the repayment prospects for the loan or in the institution’s credit position in the future. 7 - Substandard. A “Substandard” loan is inadequately protected by the current net worth and paying capacity of the obligor or the collateral pledged, if any. Assets classified as substandard must have a well-defined weakness, or weaknesses, that jeopardize the liquidation of the debt. They are characterized by the distinct possibility that the Bank will sustain some loss if the deficiencies are not corrected. 8 - Doubtful. A “Doubtful” loan has all the weaknesses inherent in a Substandard loan with the added characteristic that the weaknesses make collection or liquidation in full, on the basis of currently existing facts, conditions and values, highly questionable and improbable. 9 - Loss. Loans classified as “Loss” are considered uncollectible, and their continuance as bankable assets is not warranted. This classification does not mean that the loan has absolutely no recovery or salvage value, and a partial recovery may occur in the future. As of September 30, 2025, June 30, 2025, December 31, 2024, and September 30, 2024, there were no loans classified as doubtful with a risk rating of 8 and no loans classified as loss with a risk rating of 9. Residential and consumer loans are typically not rated until they are past due 90 days at month-end which is why they are classified as pass graded 1-5 and once past due or have a history of delinquencies, get assigned a grade 7. 17

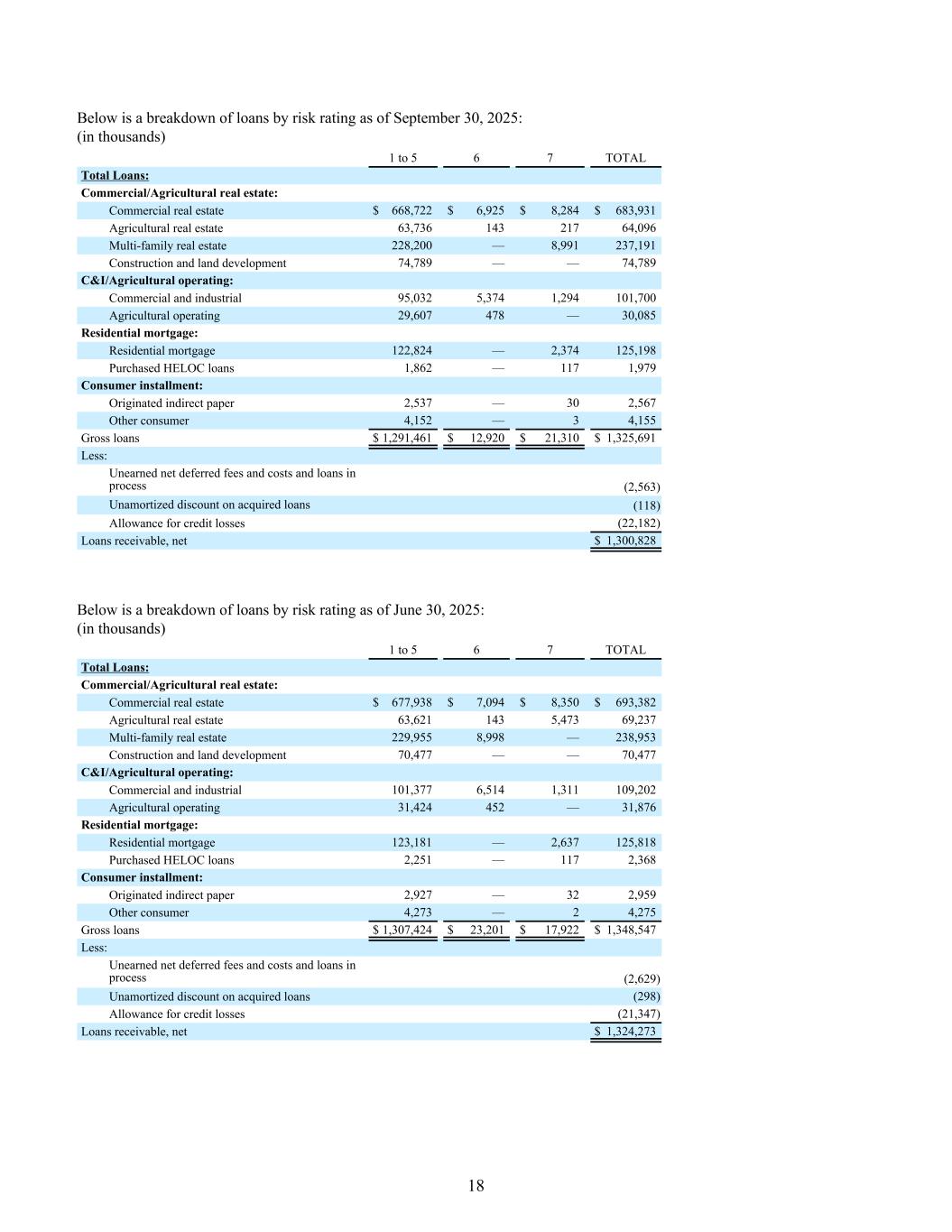

Below is a breakdown of loans by risk rating as of September 30, 2025: (in thousands) 1 to 5 6 7 TOTAL Total Loans: Commercial/Agricultural real estate: Commercial real estate $ 668,722 $ 6,925 $ 8,284 $ 683,931 Agricultural real estate 63,736 143 217 64,096 Multi-family real estate 228,200 — 8,991 237,191 Construction and land development 74,789 — — 74,789 C&I/Agricultural operating: Commercial and industrial 95,032 5,374 1,294 101,700 Agricultural operating 29,607 478 — 30,085 Residential mortgage: Residential mortgage 122,824 — 2,374 125,198 Purchased HELOC loans 1,862 — 117 1,979 Consumer installment: Originated indirect paper 2,537 — 30 2,567 Other consumer 4,152 — 3 4,155 Gross loans $ 1,291,461 $ 12,920 $ 21,310 $ 1,325,691 Less: Unearned net deferred fees and costs and loans in process (2,563) Unamortized discount on acquired loans (118) Allowance for credit losses (22,182) Loans receivable, net $ 1,300,828 Below is a breakdown of loans by risk rating as of June 30, 2025: (in thousands) 1 to 5 6 7 TOTAL Total Loans: Commercial/Agricultural real estate: Commercial real estate $ 677,938 $ 7,094 $ 8,350 $ 693,382 Agricultural real estate 63,621 143 5,473 69,237 Multi-family real estate 229,955 8,998 — 238,953 Construction and land development 70,477 — — 70,477 C&I/Agricultural operating: Commercial and industrial 101,377 6,514 1,311 109,202 Agricultural operating 31,424 452 — 31,876 Residential mortgage: Residential mortgage 123,181 — 2,637 125,818 Purchased HELOC loans 2,251 — 117 2,368 Consumer installment: Originated indirect paper 2,927 — 32 2,959 Other consumer 4,273 — 2 4,275 Gross loans $ 1,307,424 $ 23,201 $ 17,922 $ 1,348,547 Less: Unearned net deferred fees and costs and loans in process (2,629) Unamortized discount on acquired loans (298) Allowance for credit losses (21,347) Loans receivable, net $ 1,324,273 18

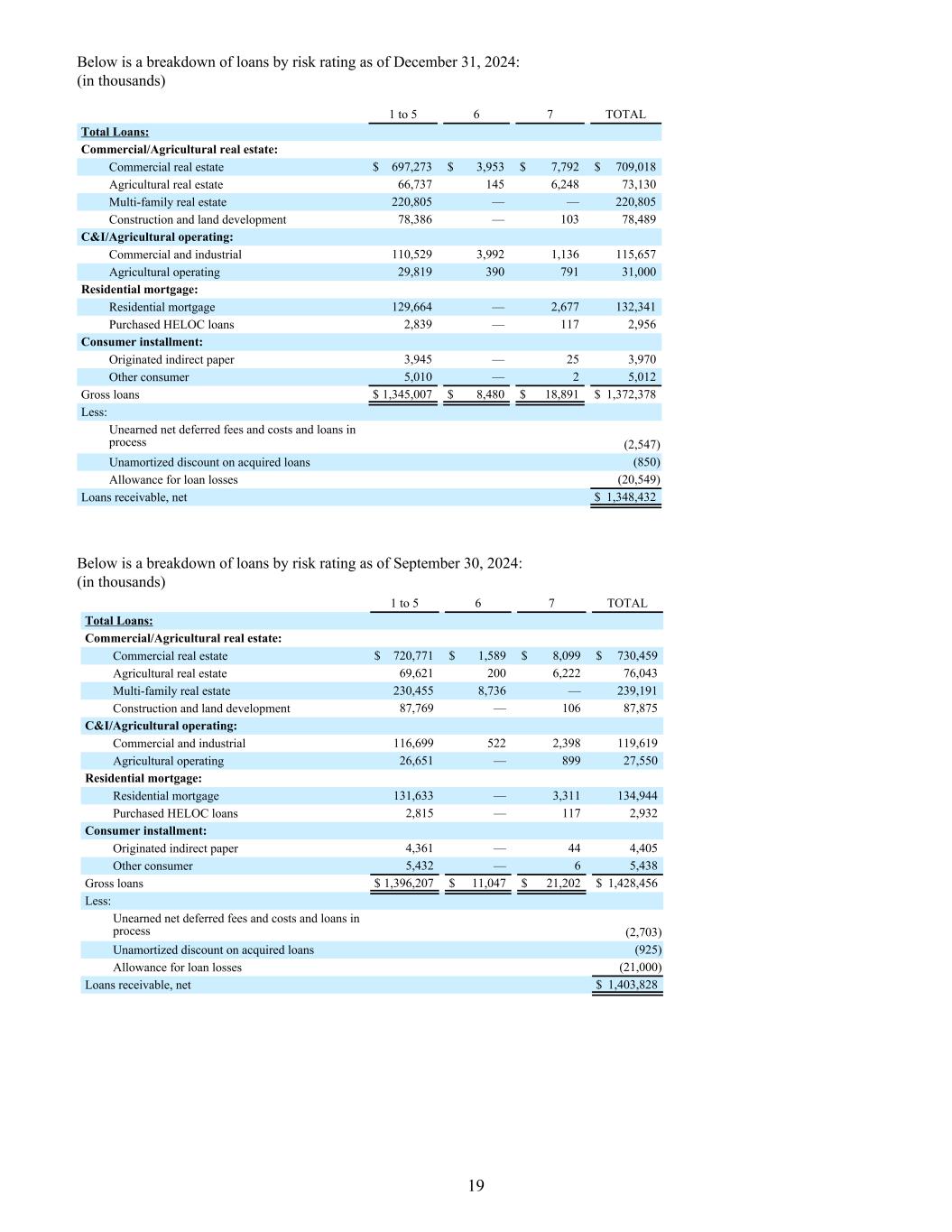

Below is a breakdown of loans by risk rating as of December 31, 2024: (in thousands) 1 to 5 6 7 TOTAL Total Loans: Commercial/Agricultural real estate: Commercial real estate $ 697,273 $ 3,953 $ 7,792 $ 709,018 Agricultural real estate 66,737 145 6,248 73,130 Multi-family real estate 220,805 — — 220,805 Construction and land development 78,386 — 103 78,489 C&I/Agricultural operating: Commercial and industrial 110,529 3,992 1,136 115,657 Agricultural operating 29,819 390 791 31,000 Residential mortgage: Residential mortgage 129,664 — 2,677 132,341 Purchased HELOC loans 2,839 — 117 2,956 Consumer installment: Originated indirect paper 3,945 — 25 3,970 Other consumer 5,010 — 2 5,012 Gross loans $ 1,345,007 $ 8,480 $ 18,891 $ 1,372,378 Less: Unearned net deferred fees and costs and loans in process (2,547) Unamortized discount on acquired loans (850) Allowance for loan losses (20,549) Loans receivable, net $ 1,348,432 Below is a breakdown of loans by risk rating as of September 30, 2024: (in thousands) Below is a breakdown of loans by risk rating as of December 31, 2023: 1 to 5 6 7 TOTAL Total Loans: Commercial/Agricultural real estate: Commercial real estate $ 720,771 $ 1,589 $ 8,099 $ 730,459 Agricultural real estate 69,621 200 6,222 76,043 Multi-family real estate 230,455 8,736 — 239,191 Construction and land development 87,769 — 106 87,875 C&I/Agricultural operating: Commercial and industrial 116,699 522 2,398 119,619 Agricultural operating 26,651 — 899 27,550 Residential mortgage: Residential mortgage 131,633 — 3,311 134,944 Purchased HELOC loans 2,815 — 117 2,932 Consumer installment: Originated indirect paper 4,361 — 44 4,405 Other consumer 5,432 — 6 5,438 Gross loans $ 1,396,207 $ 11,047 $ 21,202 $ 1,428,456 Less: Unearned net deferred fees and costs and loans in process (2,703) Unamortized discount on acquired loans (925) Allowance for loan losses (21,000) Loans receivable, net $ 1,403,828 19

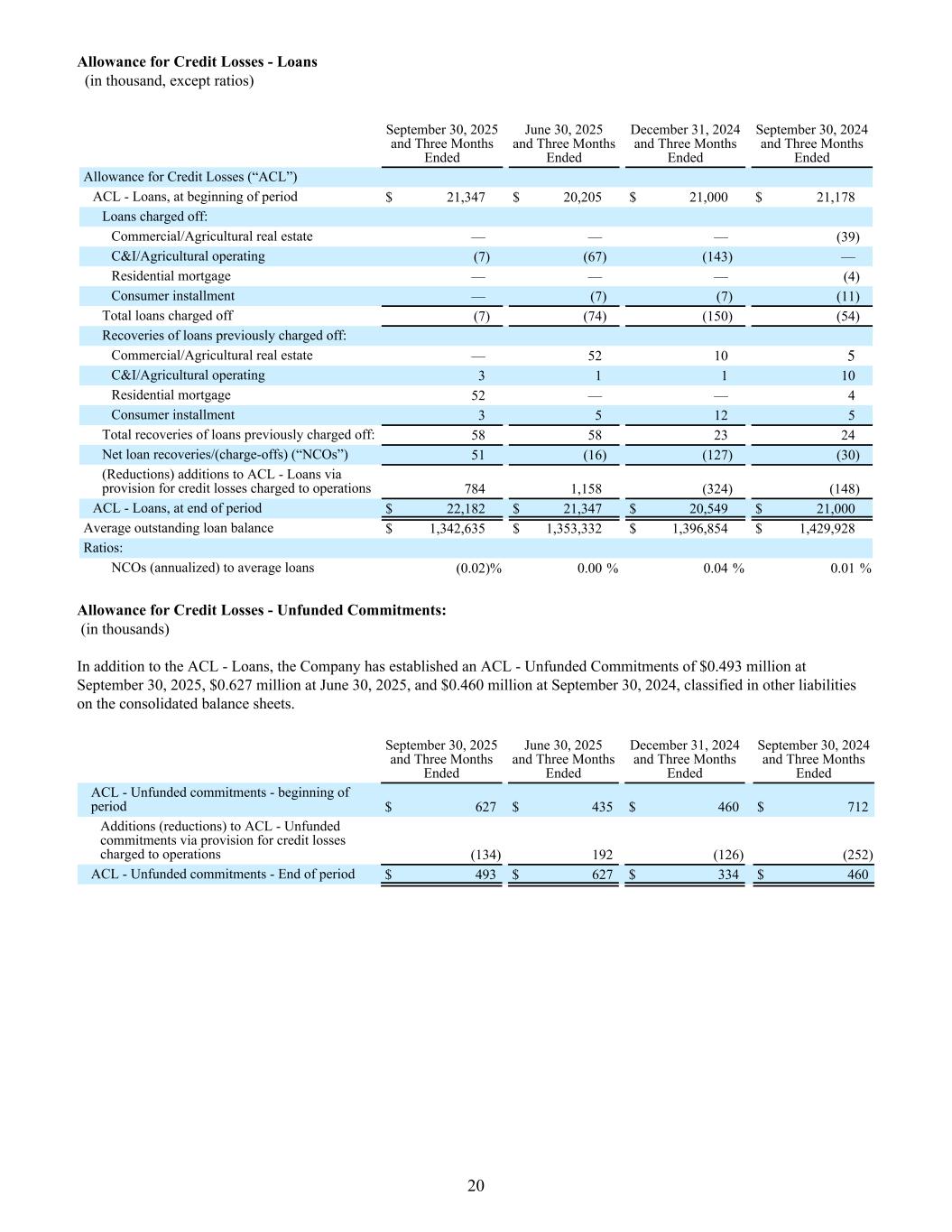

Allowance for Credit Losses - Loans (in thousand, except ratios) September 30, 2025 and Three Months Ended June 30, 2025 and Three Months Ended December 31, 2024 and Three Months Ended September 30, 2024 and Three Months Ended Allowance for Credit Losses (“ACL”) ACL - Loans, at beginning of period $ 21,347 $ 20,205 $ 21,000 $ 21,178 Loans charged off: Commercial/Agricultural real estate — — — (39) C&I/Agricultural operating (7) (67) (143) — Residential mortgage — — — (4) Consumer installment — (7) (7) (11) Total loans charged off (7) (74) (150) (54) Recoveries of loans previously charged off: Commercial/Agricultural real estate — 52 10 5 C&I/Agricultural operating 3 1 1 10 Residential mortgage 52 — — 4 Consumer installment 3 5 12 5 Total recoveries of loans previously charged off: 58 58 23 24 Net loan recoveries/(charge-offs) (“NCOs”) 51 (16) (127) (30) (Reductions) additions to ACL - Loans via provision for credit losses charged to operations 784 1,158 (324) (148) ACL - Loans, at end of period $ 22,182 $ 21,347 $ 20,549 $ 21,000 Average outstanding loan balance $ 1,342,635 $ 1,353,332 $ 1,396,854 $ 1,429,928 Ratios: NCOs (annualized) to average loans (0.02) % 0.00 % 0.04 % 0.01 % Allowance for Credit Losses - Unfunded Commitments: (in thousands) In addition to the ACL - Loans, the Company has established an ACL - Unfunded Commitments of $0.493 million at September 30, 2025, $0.627 million at June 30, 2025, and $0.460 million at September 30, 2024, classified in other liabilities on the consolidated balance sheets. September 30, 2025 and Three Months Ended June 30, 2025 and Three Months Ended December 31, 2024 and Three Months Ended September 30, 2024 and Three Months Ended ACL - Unfunded commitments - beginning of period $ 627 $ 435 $ 460 $ 712 Additions (reductions) to ACL - Unfunded commitments via provision for credit losses charged to operations (134) 192 (126) (252) ACL - Unfunded commitments - End of period $ 493 $ 627 $ 334 $ 460 20

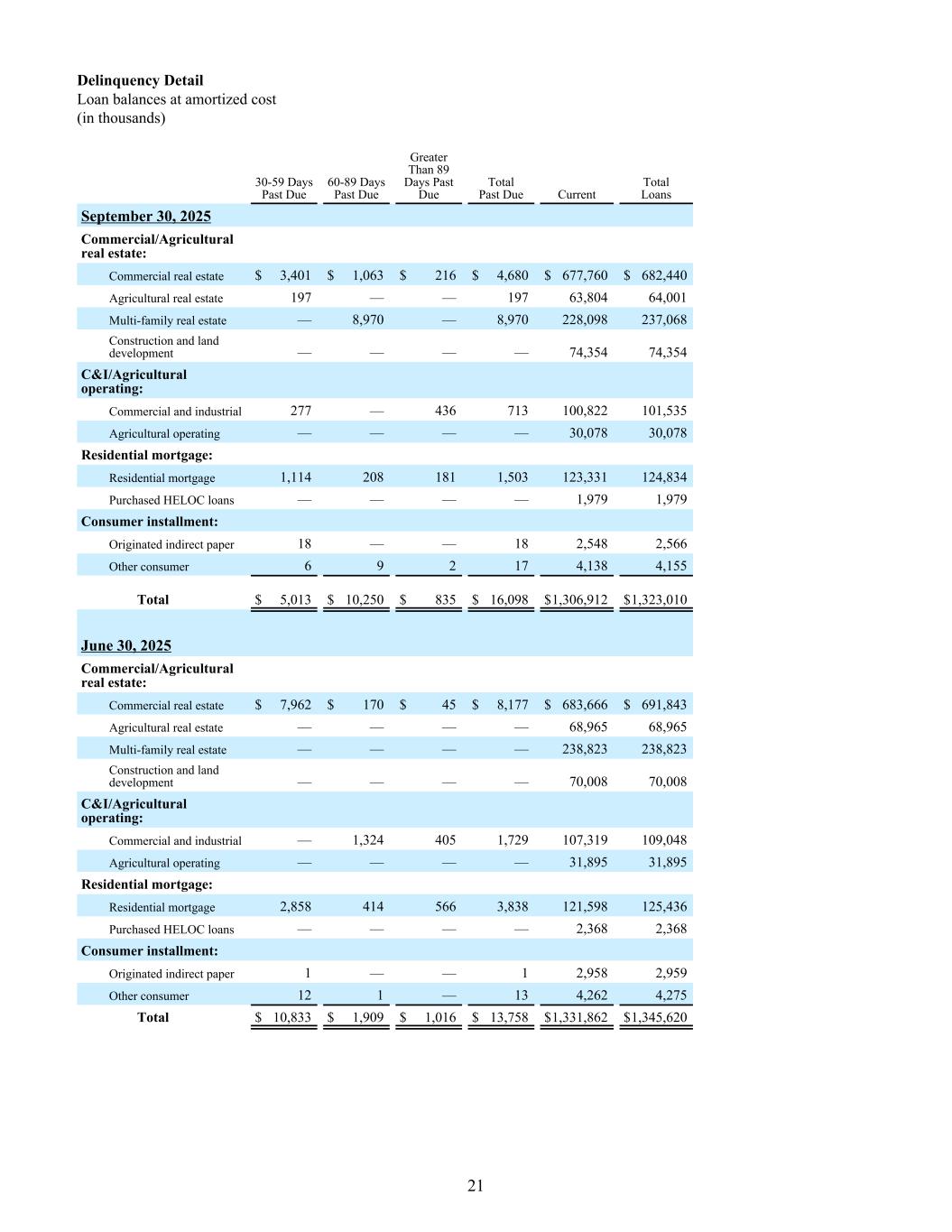

Delinquency Detail Loan balances at amortized cost (in thousands) 30-59 Days Past Due 60-89 Days Past Due Greater Than 89 Days Past Due Total Past Due Current Total Loans September 30, 2025 Commercial/Agricultural real estate: Commercial real estate $ 3,401 $ 1,063 $ 216 $ 4,680 $ 677,760 $ 682,440 Agricultural real estate 197 — — 197 63,804 64,001 Multi-family real estate — 8,970 — 8,970 228,098 237,068 Construction and land development — — — — 74,354 74,354 C&I/Agricultural operating: Commercial and industrial 277 — 436 713 100,822 101,535 Agricultural operating — — — — 30,078 30,078 Residential mortgage: Residential mortgage 1,114 208 181 1,503 123,331 124,834 Purchased HELOC loans — — — — 1,979 1,979 Consumer installment: Originated indirect paper 18 — — 18 2,548 2,566 Other consumer 6 9 2 17 4,138 4,155 Total $ 5,013 $ 10,250 $ 835 $ 16,098 $ 1,306,912 $ 1,323,010 June 30, 2025 Commercial/Agricultural real estate: Commercial real estate $ 7,962 $ 170 $ 45 $ 8,177 $ 683,666 $ 691,843 Agricultural real estate — — — — 68,965 68,965 Multi-family real estate — — — — 238,823 238,823 Construction and land development — — — — 70,008 70,008 C&I/Agricultural operating: Commercial and industrial — 1,324 405 1,729 107,319 109,048 Agricultural operating — — — — 31,895 31,895 Residential mortgage: Residential mortgage 2,858 414 566 3,838 121,598 125,436 Purchased HELOC loans — — — — 2,368 2,368 Consumer installment: Originated indirect paper 1 — — 1 2,958 2,959 Other consumer 12 1 — 13 4,262 4,275 Total $ 10,833 $ 1,909 $ 1,016 $ 13,758 $ 1,331,862 $ 1,345,620 21

Delinquency Detail (Continued) Loan balances at amortized cost (in thousands) 30-59 Days Past Due 60-89 Days Past Due Greater Than 89 Days Past Due Total Past Due Current Total Loans December 31, 2024 Commercial/Agricultural real estate: Commercial real estate $ 857 $ 322 $ 367 $ 1,546 $ 705,463 $ 707,009 Agricultural real estate 26 — 556 582 72,156 72,738 Multi-family real estate — — — — 220,706 220,706 Construction and land development — — — — 78,146 78,146 C&I/Agricultural operating: Commercial and industrial 566 50 564 1,180 114,355 115,535 Agricultural operating — — 793 793 30,224 31,017 Residential mortgage: Residential mortgage 1,873 796 500 3,169 128,723 131,892 Purchased HELOC loans — — 117 117 2,839 2,956 Consumer installment: Originated indirect paper 25 — — 25 3,945 3,970 Other consumer 27 — — 27 4,985 5,012 Total $ 3,374 $ 1,168 $ 2,897 $ 7,439 $ 1,361,542 $ 1,368,981 September 30, 2024 Commercial/Agricultural real estate: Commercial real estate $ 125 $ — $ 232 $ 357 $ 728,090 $ 728,447 Agricultural real estate 229 — 354 583 75,030 75,613 Multi-family real estate — — — — 239,065 239,065 Construction and land development 413 — — 413 86,968 87,381 C&I/Agricultural operating: Commercial and industrial 48 253 421 722 118,792 119,514 Agricultural operating — — 901 901 26,666 27,567 Residential mortgage: Residential mortgage 1,534 770 1,070 3,374 131,093 134,467 Purchased HELOC loans — — 117 117 2,815 2,932 Consumer installment: Originated indirect paper 9 — 12 21 4,384 4,405 Other consumer 21 29 2 52 5,385 5,437 Total $ 2,379 $ 1,052 $ 3,109 $ 6,540 $ 1,418,288 $ 1,424,828 22

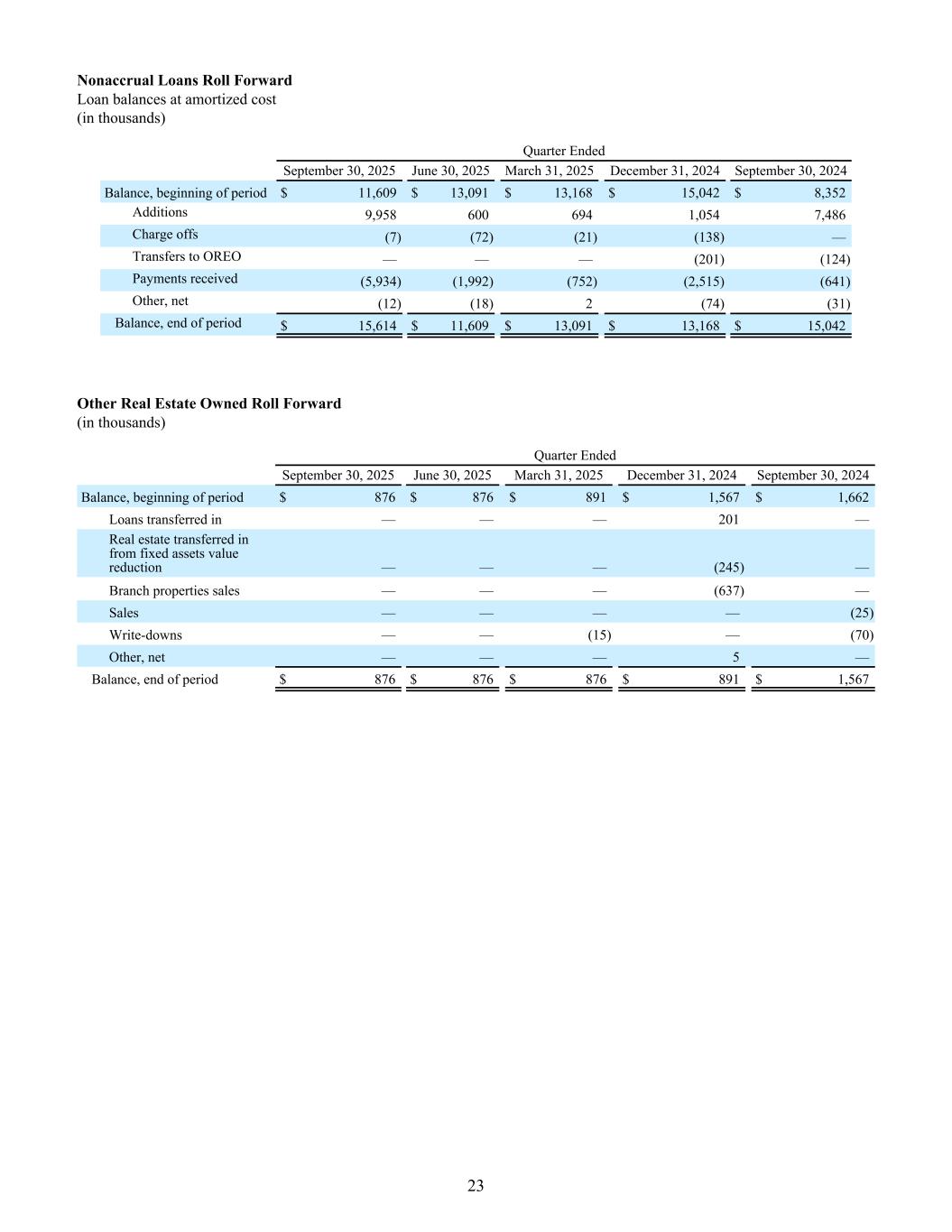

Nonaccrual Loans Roll Forward Loan balances at amortized cost (in thousands) Quarter Ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Balance, beginning of period $ 11,609 $ 13,091 $ 13,168 $ 15,042 $ 8,352 Additions 9,958 600 694 1,054 7,486 Charge offs (7) (72) (21) (138) — Transfers to OREO — — — (201) (124) Payments received (5,934) (1,992) (752) (2,515) (641) Other, net (12) (18) 2 (74) (31) Balance, end of period $ 15,614 $ 11,609 $ 13,091 $ 13,168 $ 15,042 Other Real Estate Owned Roll Forward (in thousands) Quarter Ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Balance, beginning of period $ 876 $ 876 $ 891 $ 1,567 $ 1,662 Loans transferred in — — — 201 — Real estate transferred in from fixed assets value reduction — — — (245) — Branch properties sales — — — (637) — Sales — — — — (25) Write-downs — — (15) — (70) Other, net — — — 5 — Balance, end of period $ 876 $ 876 $ 876 $ 891 $ 1,567 23

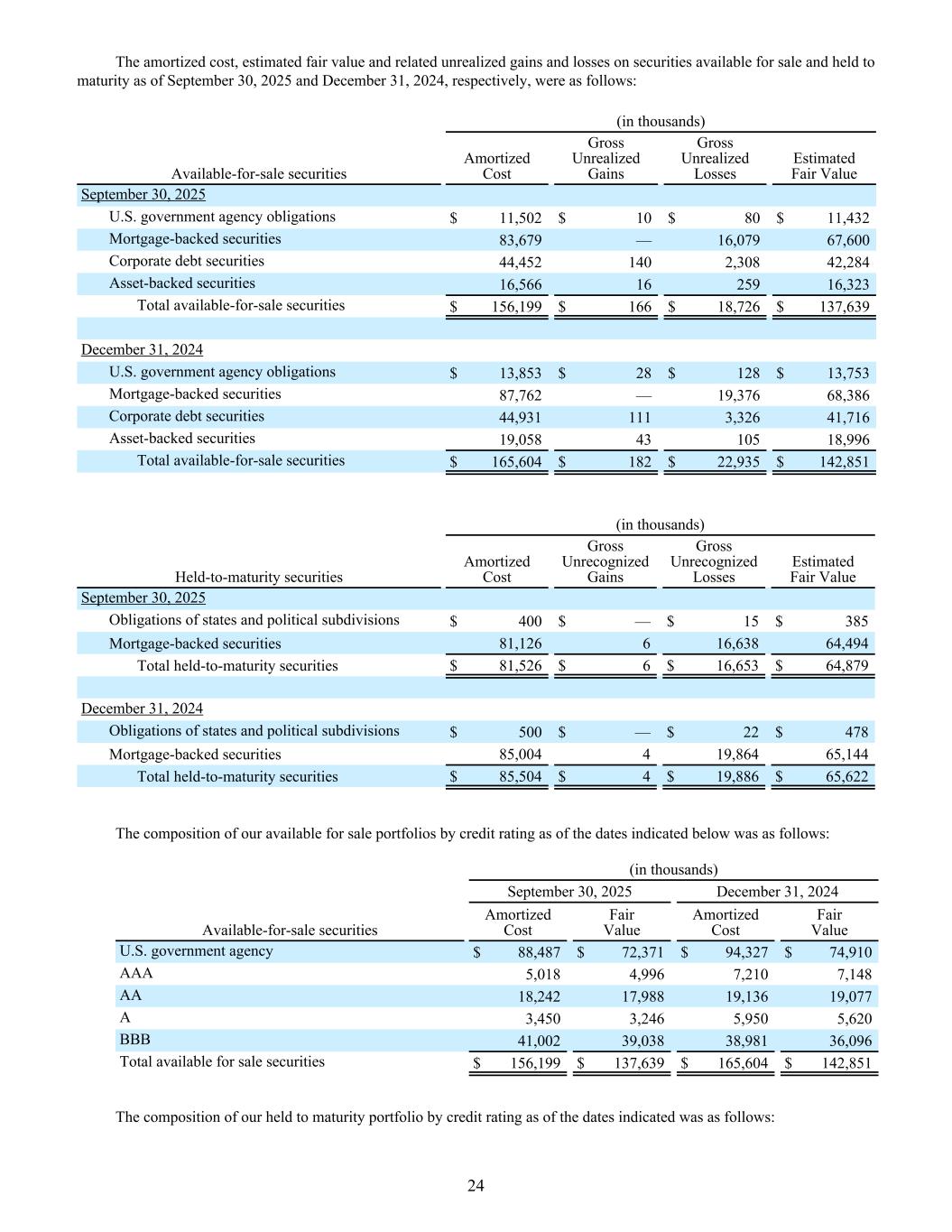

The amortized cost, estimated fair value and related unrealized gains and losses on securities available for sale and held to maturity as of September 30, 2025 and December 31, 2024, respectively, were as follows: (in thousands) Available-for-sale securities Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Estimated Fair Value September 30, 2025 U.S. government agency obligations $ 11,502 $ 10 $ 80 $ 11,432 Mortgage-backed securities 83,679 — 16,079 67,600 Corporate debt securities 44,452 140 2,308 42,284 Asset-backed securities 16,566 16 259 16,323 Total available-for-sale securities $ 156,199 $ 166 $ 18,726 $ 137,639 December 31, 2024 U.S. government agency obligations $ 13,853 $ 28 $ 128 $ 13,753 Mortgage-backed securities 87,762 — 19,376 68,386 Corporate debt securities 44,931 111 3,326 41,716 Asset-backed securities 19,058 43 105 18,996 Total available-for-sale securities $ 165,604 $ 182 $ 22,935 $ 142,851 (in thousands) Held-to-maturity securities Amortized Cost Gross Unrecognized Gains Gross Unrecognized Losses Estimated Fair Value September 30, 2025 Obligations of states and political subdivisions $ 400 $ — $ 15 $ 385 Mortgage-backed securities 81,126 6 16,638 64,494 Total held-to-maturity securities $ 81,526 $ 6 $ 16,653 $ 64,879 December 31, 2024 Obligations of states and political subdivisions $ 500 $ — $ 22 $ 478 Mortgage-backed securities 85,004 4 19,864 65,144 Total held-to-maturity securities $ 85,504 $ 4 $ 19,886 $ 65,622 The composition of our available for sale portfolios by credit rating as of the dates indicated below was as follows: (in thousands) September 30, 2025 December 31, 2024 Available-for-sale securities Amortized Cost Fair Value Amortized Cost Fair Value U.S. government agency $ 88,487 $ 72,371 $ 94,327 $ 74,910 AAA 5,018 4,996 7,210 7,148 AA 18,242 17,988 19,136 19,077 A 3,450 3,246 5,950 5,620 BBB 41,002 39,038 38,981 36,096 Total available for sale securities $ 156,199 $ 137,639 $ 165,604 $ 142,851 The composition of our held to maturity portfolio by credit rating as of the dates indicated was as follows: 24

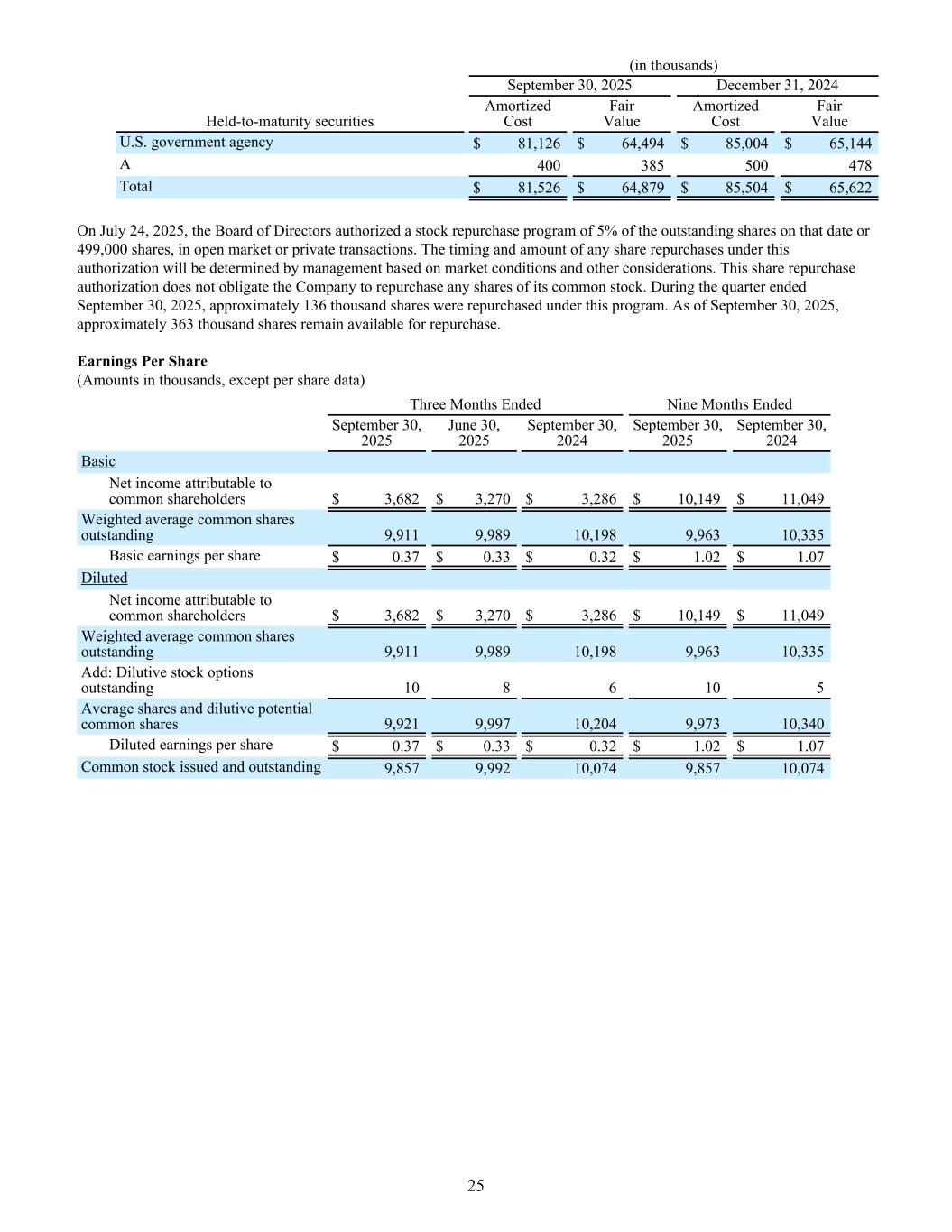

(in thousands) September 30, 2025 December 31, 2024 Held-to-maturity securities Amortized Cost Fair Value Amortized Cost Fair Value U.S. government agency $ 81,126 $ 64,494 $ 85,004 $ 65,144 A 400 385 500 478 Total $ 81,526 $ 64,879 $ 85,504 $ 65,622 On July 24, 2025, the Board of Directors authorized a stock repurchase program of 5% of the outstanding shares on that date or 499,000 shares, in open market or private transactions. The timing and amount of any share repurchases under this authorization will be determined by management based on market conditions and other considerations. This share repurchase authorization does not obligate the Company to repurchase any shares of its common stock. During the quarter ended September 30, 2025, approximately 136 thousand shares were repurchased under this program. As of September 30, 2025, approximately 363 thousand shares remain available for repurchase. Earnings Per Share (Amounts in thousands, except per share data) Three Months Ended Nine Months Ended September 30, 2025 June 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Basic Net income attributable to common shareholders $ 3,682 $ 3,270 $ 3,286 $ 10,149 $ 11,049 Weighted average common shares outstanding 9,911 9,989 10,198 9,963 10,335 Basic earnings per share $ 0.37 $ 0.33 $ 0.32 $ 1.02 $ 1.07 Diluted Net income attributable to common shareholders $ 3,682 $ 3,270 $ 3,286 $ 10,149 $ 11,049 Weighted average common shares outstanding 9,911 9,989 10,198 9,963 10,335 Add: Dilutive stock options outstanding 10 8 6 10 5 Average shares and dilutive potential common shares 9,921 9,997 10,204 9,973 10,340 Diluted earnings per share $ 0.37 $ 0.33 $ 0.32 $ 1.02 $ 1.07 Common stock issued and outstanding 9,857 9,992 10,074 9,857 10,074 25

Economic Value of Equity Percent Change in Economic Value of Equity (EVE) Change in Interest Rates in Basis Points (“bp”) Rate Shock in Rates (1) At September 30, 2025 At December 31, 2024 +300 bp 6 % 2 % +200 bp 4 % 2 % +100 bp 2 % 1 % -100 bp (4) % (1) % -200 bp (8) % (4) % Net Interest Income Over One Year Horizon Percent Change in Net Interest Income Over One Year Horizon Change in Interest Rates in Basis Points (“bp”) Rate Shock in Rates (1) At September 30, 2025 At December 31, 2024 +300 bp (4) % (8) % +200 bp (2) % (5) % +100 bp (1) % (3) % -100 bp 0 % 2 % -200 bp (1) % 3 % 26

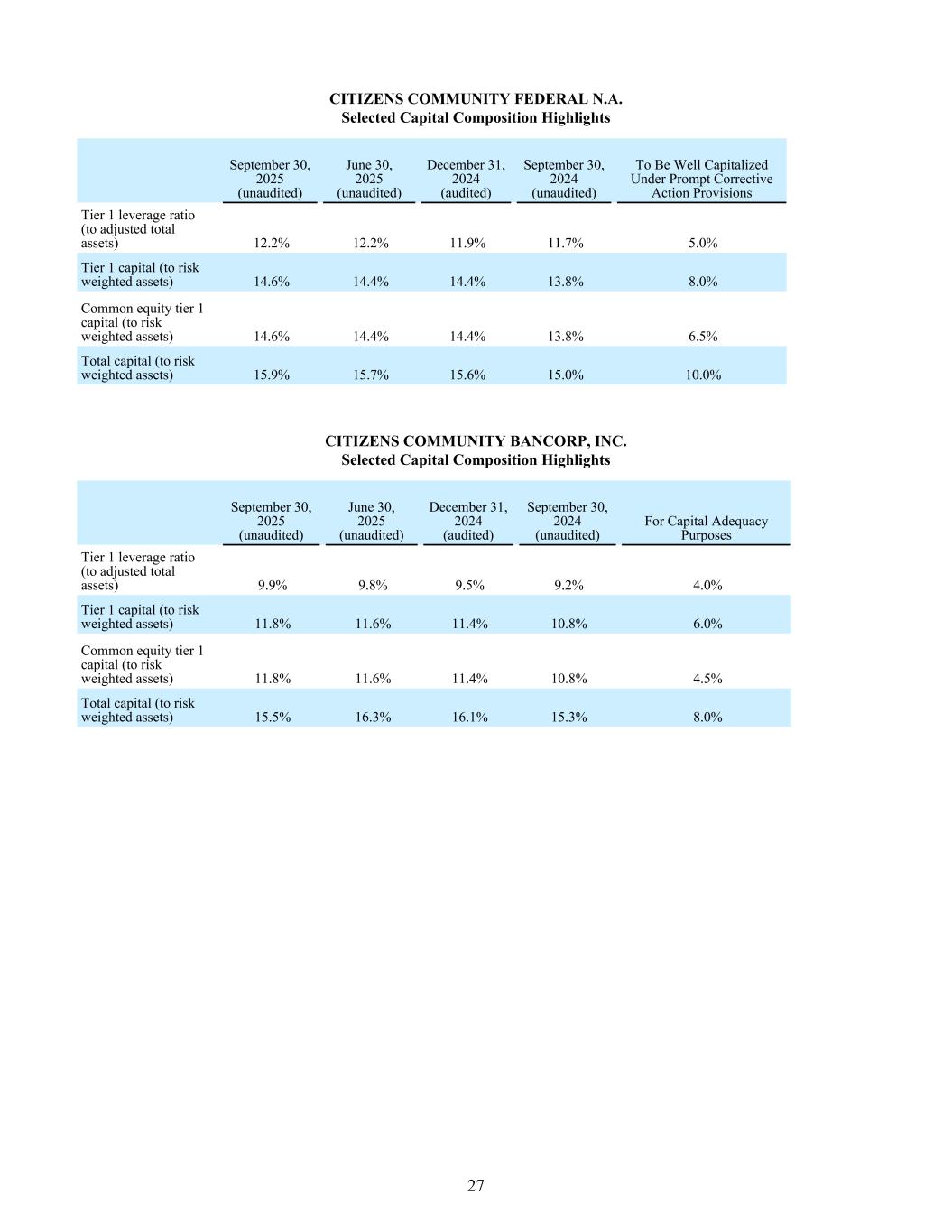

CITIZENS COMMUNITY FEDERAL N.A. Selected Capital Composition Highlights September 30, 2025 (unaudited) June 30, 2025 (unaudited) December 31, 2024 (audited) September 30, 2024 (unaudited) To Be Well Capitalized Under Prompt Corrective Action Provisions Tier 1 leverage ratio (to adjusted total assets) 12.2% 12.2% 11.9% 11.7% 5.0% Tier 1 capital (to risk weighted assets) 14.6% 14.4% 14.4% 13.8% 8.0% Common equity tier 1 capital (to risk weighted assets) 14.6% 14.4% 14.4% 13.8% 6.5% Total capital (to risk weighted assets) 15.9% 15.7% 15.6% 15.0% 10.0% CITIZENS COMMUNITY BANCORP, INC. Selected Capital Composition Highlights September 30, 2025 (unaudited) June 30, 2025 (unaudited) December 31, 2024 (audited) September 30, 2024 (unaudited) For Capital Adequacy Purposes Tier 1 leverage ratio (to adjusted total assets) 9.9% 9.8% 9.5% 9.2% 4.0% Tier 1 capital (to risk weighted assets) 11.8% 11.6% 11.4% 10.8% 6.0% Common equity tier 1 capital (to risk weighted assets) 11.8% 11.6% 11.4% 10.8% 4.5% Total capital (to risk weighted assets) 15.5% 16.3% 16.1% 15.3% 8.0% 27

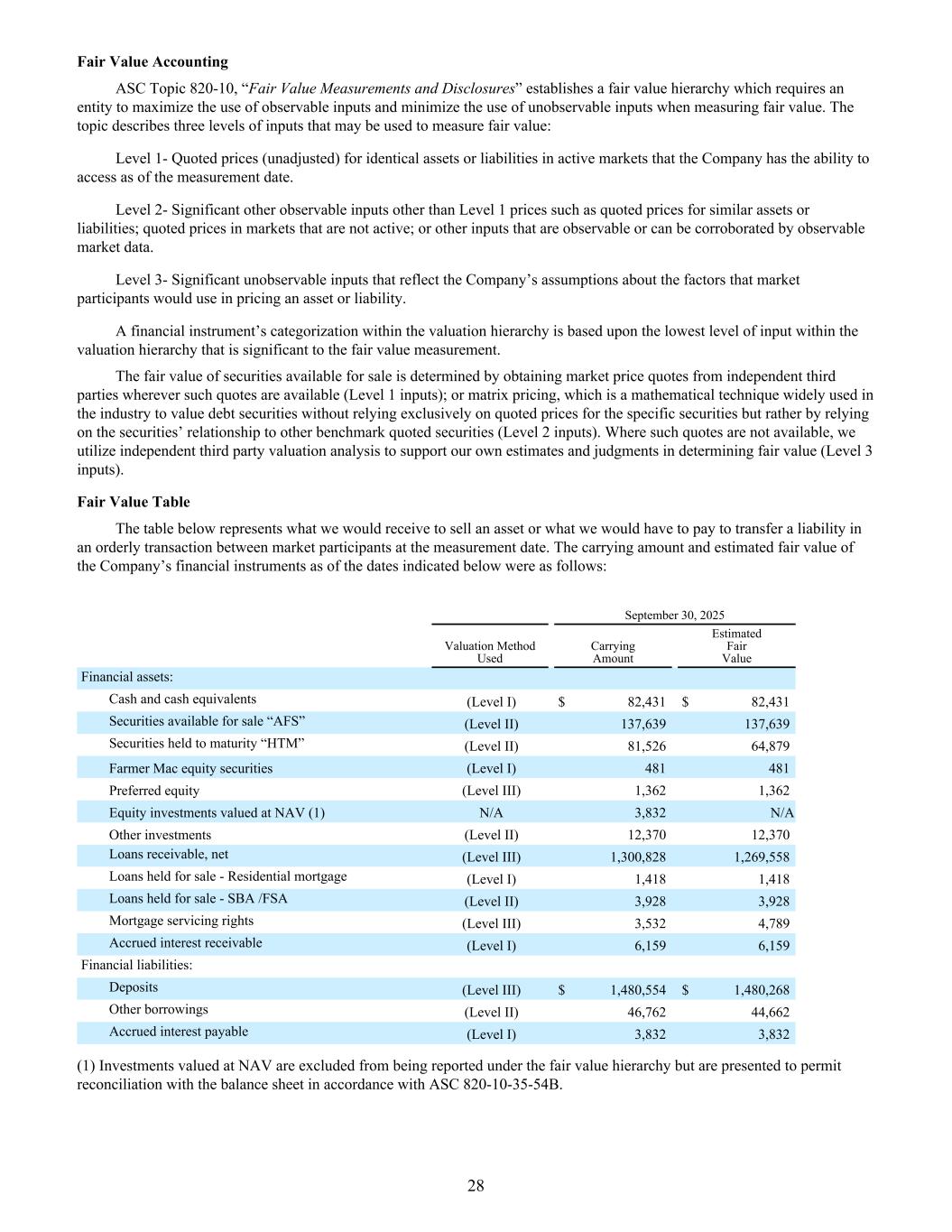

Fair Value Accounting ASC Topic 820-10, “Fair Value Measurements and Disclosures” establishes a fair value hierarchy which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The topic describes three levels of inputs that may be used to measure fair value: Level 1- Quoted prices (unadjusted) for identical assets or liabilities in active markets that the Company has the ability to access as of the measurement date. Level 2- Significant other observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data. Level 3- Significant unobservable inputs that reflect the Company’s assumptions about the factors that market participants would use in pricing an asset or liability. A financial instrument’s categorization within the valuation hierarchy is based upon the lowest level of input within the valuation hierarchy that is significant to the fair value measurement. The fair value of securities available for sale is determined by obtaining market price quotes from independent third parties wherever such quotes are available (Level 1 inputs); or matrix pricing, which is a mathematical technique widely used in the industry to value debt securities without relying exclusively on quoted prices for the specific securities but rather by relying on the securities’ relationship to other benchmark quoted securities (Level 2 inputs). Where such quotes are not available, we utilize independent third party valuation analysis to support our own estimates and judgments in determining fair value (Level 3 inputs). Fair Value Table The table below represents what we would receive to sell an asset or what we would have to pay to transfer a liability in an orderly transaction between market participants at the measurement date. The carrying amount and estimated fair value of the Company’s financial instruments as of the dates indicated below were as follows: September 30, 2025 Valuation Method Used Carrying Amount Estimated Fair Value Financial assets: Cash and cash equivalents (Level I) $ 82,431 $ 82,431 Securities available for sale “AFS” (Level II) 137,639 137,639 Securities held to maturity “HTM” (Level II) 81,526 64,879 Farmer Mac equity securities (Level I) 481 481 Preferred equity (Level III) 1,362 1,362 Equity investments valued at NAV (1) N/A 3,832 N/A Other investments (Level II) 12,370 12,370 Loans receivable, net (Level III) 1,300,828 1,269,558 Loans held for sale - Residential mortgage (Level I) 1,418 1,418 Loans held for sale - SBA /FSA (Level II) 3,928 3,928 Mortgage servicing rights (Level III) 3,532 4,789 Accrued interest receivable (Level I) 6,159 6,159 Financial liabilities: Deposits (Level III) $ 1,480,554 $ 1,480,268 Other borrowings (Level II) 46,762 44,662 Accrued interest payable (Level I) 3,832 3,832 (1) Investments valued at NAV are excluded from being reported under the fair value hierarchy but are presented to permit reconciliation with the balance sheet in accordance with ASC 820-10-35-54B. 28