.2

ADMA Biologics Realizing the Potential of Specialty Biologicswith Groundbreaking

Immunotechnology January 2026 NASDAQ: ADMA

Forward-Looking Statements This presentation contains "forward-looking

statements" pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, about ADMA Biologics, Inc. and its subsidiaries (collectively, “we,” “our” or the “Company”), including, without limitation, statements

that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words “estimate,” “project,” “potential,” “possible,” “forecast,” “intend,” “target,” “anticipate,” “plan,” “expect,” “believe,”

“will,” “is likely,” “will likely,” “should,” “could,” “would,” “may” or, in each case, their negative, or words or expressions of similar meaning. These forward-looking statements also include, without limitation, our ability to manufacture

ASCENIV and BIVIGAM on a commercial scale and further commercialize these products as a result of their approval by the U.S. Food and Drug Administration (the “FDA”) in 2019; our plans to develop, manufacture, market, launch and expand our own

commercial infrastructure and commercialize our current products and future products; our plans to expand our pipeline with differentiated immune globulin product candidates in development (including SG-001) and estimated revenue potential and

capital requirements for such product candidates; potential near and mid-term value creation through certain milestones; the possibility of expanding our product portfolio with additional specialty immune globulin products; product expansions

into new fields of use, indications, target populations and product candidates, and the labeling or nature of any such approvals; our dependence upon our third-party and related party customers, suppliers and vendors and their compliance with

applicable regulatory requirements; our ability to obtain adequate quantities of FDA-approved plasma with proper specifications; the likelihood and timing of FDA action with respect to any further filings by the Company; the expected financial,

strategic and commercial benefits of our FDA-approved yield enhancement production process; results of clinical development; the potential of specialty plasma-derived biologics to provide meaningful clinical improvement for patients living with

Primary Immune Deficiency Disease (“PI”); expected market size growth in the U.S. immune globulin market; our ability to market and promote our products in the competitive environment and to generate meaningful revenues; our estimated revenue

potential and related timing; certain revenue opportunities; future financial guidance; our estimated revenue growth relative to our competitors; our production capacity and yield and ability to increase such capacity and yield; our ability to

increase market share and grow revenue through anticipated product launches as well as expected peak market share; estimated global supply and demand for plasma; our ability to ensure continuity of product supply; the estimated value of our

Boca Raton manufacturing facility; potential clinical trial initiations; potential investigational new product applications, Biologics License Applications, and expansion plans; our intellectual property position and the defense thereof,

including our expectations regarding the scope of patent protection with respect to our products or other future pipeline product candidates; the achievement of or expected timing of clinical and regulatory milestones; our manufacturing

capabilities; third-party contractor capabilities and strategy; our manufacturing, supply and other collaborative agreements; potential contract manufacturing opportunities and sales of our immune globulin products; our estimates regarding

expenses, capital requirements and needs for additional financing; possible or likely reimbursement levels for our currently marketed products and estimates regarding market size; projected growth and sales of our existing products as well as

our expectations of market acceptance of BIVIGAM® and ASCENIV™; our strategic plasma network repositioning and related timing; and future domestic and global economic conditions and performance. The forward-looking statements contained herein

represent the Company’s estimates and assumptions only as of the date of this presentation, and the Company undertakes no duty or obligation to update or revise publicly any forward-looking statements contained in this presentation, except as

otherwise required by the federal securities laws. Forward-looking statements are subject to many risks, uncertainties and other factors that could cause our actual results, and the timing of certain events, to differ materially from any future

results expressed or implied by these forward-looking statements, including, but not limited to, the continued safety and efficacy of, and our ability to obtain and maintain regulatory approvals of, our current products, and the labeling or

nature of any such approval, as well as our third-party Respiratory Syncytial Virus plasma agreements and their potential impact on our financial performance; regulatory processes and interpretations of final data of our products and product

candidates; acceptability of any of our products for any purpose, by physicians, patients or payers; concurrence by the FDA with our conclusions and the satisfaction by us of its guidance relating to risks; and uncertainties described in our

filings with the U.S. Securities and Exchange Commission, including our most recent reports on Form 10-K, 10-Q and 8-K, and any amendments thereto.

Who We Are NASDAQ: ADMA

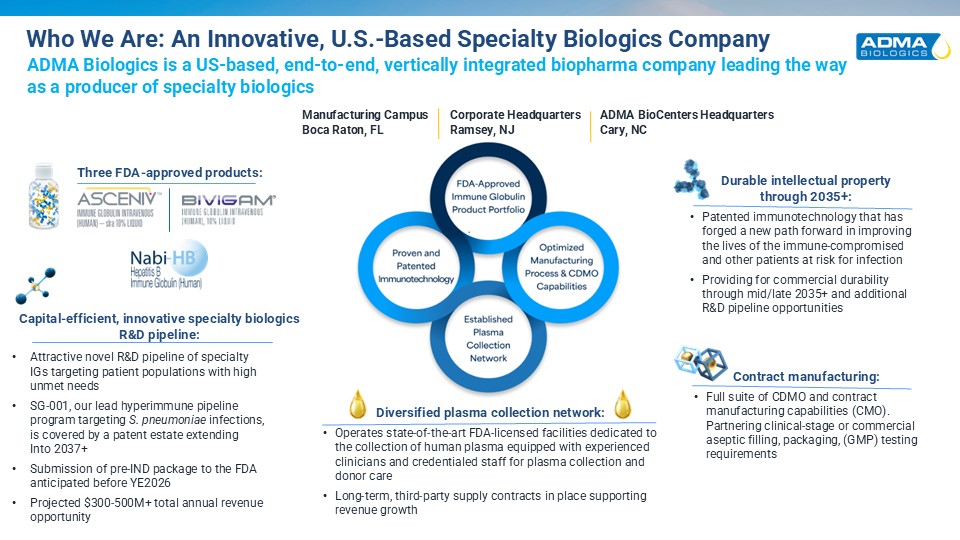

Who We Are: An Innovative, U.S.-Based Specialty Biologics Company ADMA Biologics

ian end-to-end commercial biopharmaceutical company committed to manufacturing, marketing and developing specialty biologics for the prevention and treatment of infectious diseases in the immune compromised and other patients at risk for

infection ADMA Biologics is a US-based, end-to-end, vertically integrated biopharma company leading the wayas a producer of specialty biologics Three FDA-approved products: Durable intellectual propertythrough 2035+: Patented

immunotechnology that has forged a new path forward in improving the lives of the immune-compromised and other patients at risk for infection Providing for commercial durability through mid/late 2035+ and additional R&D pipeline

opportunities Contract manufacturing: Full suite of CDMO and contract manufacturing capabilities (CMO). Partnering clinical-stage or commercial aseptic filling, packaging, (GMP) testing requirements Capital-efficient, innovative specialty

biologics R&D pipeline: Attractive novel R&D pipeline of specialtyIGs targeting patient populations with highunmet needs SG-001, our lead hyperimmune pipelineprogram targeting S. pneumoniae infections,is covered by a patent estate

extending Into 2037+ Submission of pre-IND package to the FDA anticipated before YE2026 Projected $300-500M+ total annual revenue opportunity Diversified plasma collection network: Operates state-of-the-art FDA-licensed facilities

dedicated to the collection of human plasma equipped with experienced clinicians and credentialed staff for plasma collection and donor care Long-term, third-party supply contracts in place supportingrevenue growth Corporate

HeadquartersRamsey, NJ Manufacturing CampusBoca Raton, FL ADMA BioCenters Headquarters Cary, NC

Vertically Integrated U.S.-Based Manufacturing Supply Chain with Innovative

Technology ADMA’s end-to-end manufacturing capabilities enable efficiency, visibility and a competitive advantage Among an elite group of US-based biologic drug manufacturers World-class, cGMP facility for fractionation & purification

of specialty biologics Viral Inactivation Ultra-Filtration FINAL FORMULATION Cryoprecipitate II+III PASTE / IG / IVIG Diversified Long Term Plasma Supply Supports Forecasts ADMA’s 10 Internal BioCenters & Long-term 3rd party plasma

supply support the achievement of all financial targets Donors Plasmapheresis FDA REGS -60 day-hold Filling intoVials Final Packaging & Labeling Lot #Serialization Comprehensive Control of Critical Manufacturing Functions In-House

filling, packaging, release & in-process testing Established infrastructure supports near and long-term revenue growth and ensures continuityof product supply into the growing U.S. immunoglobulin (IG) market VERTICALLY INTEGRATED US-BASED

SUPPLY CHAIN End-to-end control of cGMP-compliant supply chain from plasma supply, through fractionation and distribution Among an elite group of US-based biologic drug manufacturers with comprehensive in-house control of critical

manufacturing and testing functions First-of its-kind US FDA approval of innovative yield enhancement production process provides for 20%+ greater finished IG from same starting plasma Unique visibility due to 6-9-month manufacturing lead

time Sufficient plasma supply to achieve financial targets Among the fastest growing, profitable BioPharma Companies in the US 90- day hold period for certain 3rd testinglab releases FDA-Reviewof Each Lot ~645 FULL TIME EMPLOYEES, FULLY

US-BASED PROPRIETARY SCREENING ASSAY

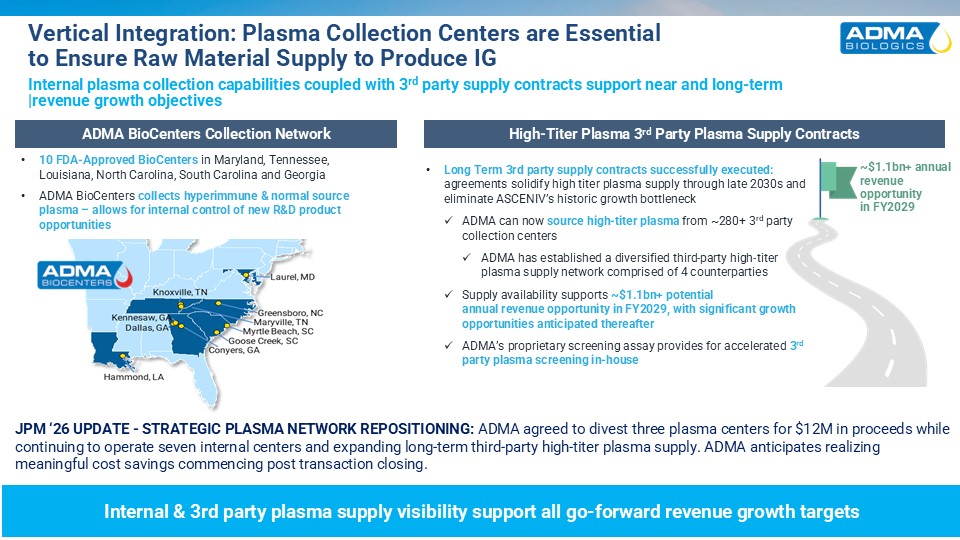

Vertical Integration: Plasma Collection Centers are Essentialto Ensure Raw

Material Supply to Produce IG 10 FDA-Approved BioCenters in Maryland, Tennessee, Louisiana, North Carolina, South Carolina and Georgia ADMA BioCenters collects hyperimmune & normal source plasma – allows for internal control of new

R&D product opportunities ADMA BioCenters Collection Network High-Titer Plasma 3rd Party Plasma Supply Contracts Internal plasma collection capabilities coupled with 3rd party supply contracts support near and long-term|revenue growth

objectives Internal & 3rd party plasma supply visibility support all go-forward revenue growth targets Long Term 3rd party supply contracts successfully executed:agreements solidify high titer plasma supply through late 2030s and

eliminate ASCENIV’s historic growth bottleneck ADMA can now source high-titer plasma from ~280+ 3rd party collection centers ADMA has established a diversified third-party high-titer plasma supply network comprised of 4 counterparties Supply

availability supports ~$1.1bn+ potentialannual revenue opportunity in FY2029, with significant growth opportunities anticipated thereafter ADMA’s proprietary screening assay provides for accelerated 3rd party plasma screening

in-house ~$1.1bn+ annual revenue opportunityin FY2029 JPM ‘26 UPDATE - STRATEGIC PLASMA NETWORK REPOSITIONING: ADMA agreed to divest three plasma centers for $12M in proceeds while continuing to operate seven internal centers and expanding

long-term third-party high-titer plasma supply. ADMA anticipates realizing meaningful cost savings commencing post transaction closing.

US IG Landscape NASDAQ: ADMA

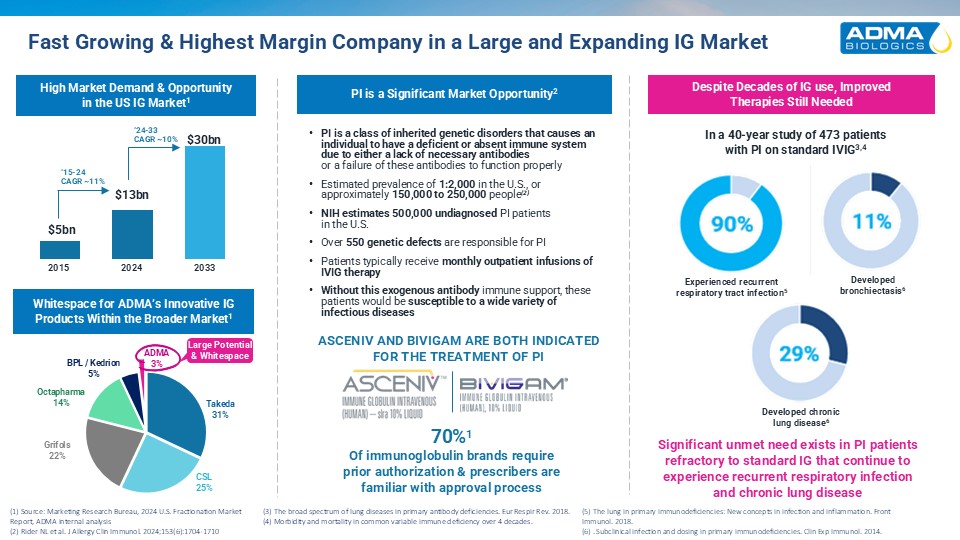

Fast Growing & Highest Margin Company in a Large and Expanding IG Market (1)

Source: Marketing Research Bureau, 2024 U.S. Fractionation Market Report, ADMA internal analysis (2) Rider NL et al. J Allergy Clin Immunol. 2024;153(6):1704-1710 In a 40-year study of 473 patients with PI on standard IVIG3,4 Despite Decades

of IG use, ImprovedTherapies Still Needed High Market Demand & Opportunity in the US IG Market1 Whitespace for ADMA’s Innovative IG Products Within the Broader Market1 PI is a Significant Market Opportunity2 PI is a class of inherited

genetic disorders that causes an individual to have a deficient or absent immune system due to either a lack of necessary antibodiesor a failure of these antibodies to function properly Estimated prevalence of 1:2,000 in the U.S., or

approximately 150,000 to 250,000 people(2) NIH estimates 500,000 undiagnosed PI patientsin the U.S. Over 550 genetic defects are responsible for PI Patients typically receive monthly outpatient infusions of IVIG therapy Without this

exogenous antibody immune support, these patients would be susceptible to a wide variety of infectious diseases 70%1Of immunoglobulin brands requireprior authorization & prescribers arefamiliar with approval process (3) The broad spectrum

of lung diseases in primary antibody deficiencies. Eur Respir Rev. 2018. (4) Morbidity and mortality in common variable immune deficiency over 4 decades. ‘15-24CAGR ~11% ‘24-33CAGR ~10% 2015 2024 2033 ADMA3% Large Potential &

Whitespace BPL / Kedrion5% Octapharma14% Grifols22% CSL25% Takeda31% ASCENIV AND BIVIGAM ARE BOTH INDICATED FOR THE TREATMENT OF PI Developedbronchiectasis6 Experienced recurrentrespiratory tract infection5 Developed chroniclung

disease6 Significant unmet need exists in PI patientsrefractory to standard IG that continue toexperience recurrent respiratory infectionand chronic lung disease (5) The lung in primary immunodeficiencies: New concepts in infection and

inflammation. Front Immunol. 2018. (6) . Subclinical infection and dosing in primary immunodeficiencies. Clin Exp Immunol. 2014.

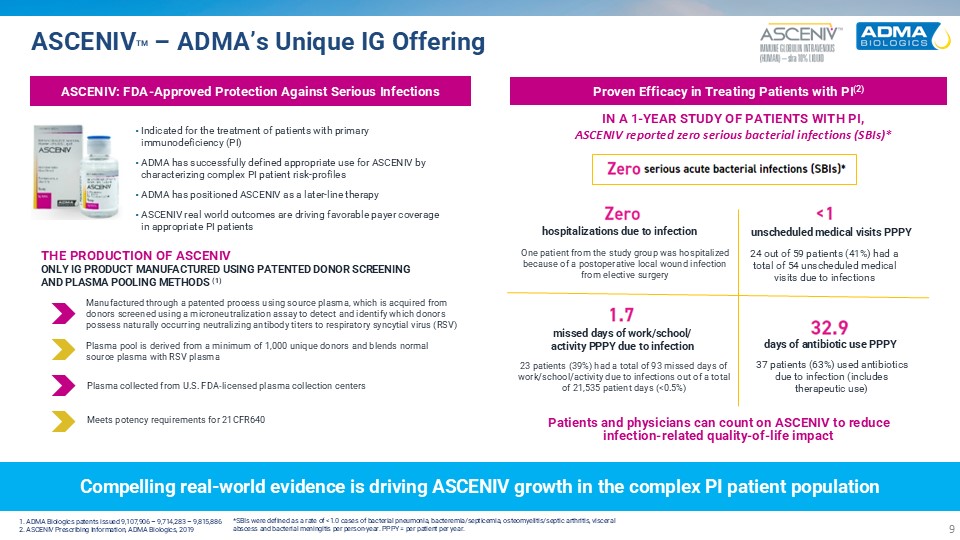

ASCENIVTM – ADMA’s Unique IG Offering THE PRODUCTION OF ASCENIV ONLY IG PRODUCT

MANUFACTURED USING PATENTED DONOR SCREENINGAND PLASMA POOLING METHODS (1) IN A 1-YEAR STUDY OF PATIENTS WITH PI, ASCENIV reported zero serious bacterial infections (SBIs)* *SBIs were defined as a rate of <1.0 cases of bacterial

pneumonia, bacteremia/septicemia, osteomyelitis/septic arthritis, visceral abscess and bacterial meningitis per person-year. PPPY = per patient per year. Compelling real-world evidence is driving ASCENIV growth in the complex PI patient

population Indicated for the treatment of patients with primary immunodeficiency (PI) ADMA has successfully defined appropriate use for ASCENIV by characterizing complex PI patient risk-profiles ADMA has positioned ASCENIV as a later-line

therapy ASCENIV real world outcomes are driving favorable payer coverage in appropriate PI patients 1. ADMA Biologics patents issued 9,107,906 – 9,714,283 – 9,815,886 2. ASCENIV Prescribing Information, ADMA Biologics, 2019 Plasma pool is

derived from a minimum of 1,000 unique donors and blends normal source plasma with RSV plasma Manufactured through a patented process using source plasma, which is acquired from donors screened using a microneutralization assay to detect and

identify which donors possess naturally occurring neutralizing antibody titers to respiratory syncytial virus (RSV) Plasma collected from U.S. FDA-licensed plasma collection centers Meets potency requirements for 21CFR640 ASCENIV:

FDA-Approved Protection Against Serious Infections Proven Efficacy in Treating Patients with PI(2) One patient from the study group was hospitalized because of a postoperative local wound infection from elective surgery 24 out of 59

patients (41%) had a total of 54 unscheduled medical visits due to infections 23 patients (39%) had a total of 93 missed days of work/school/activity due to infections out of a total of 21,535 patient days (<0.5%) 37 patients (63%) used

antibiotics due to infection (includes therapeutic use) hospitalizations due to infection missed days of work/school/activity PPPY due to infection unscheduled medical visits PPPY days of antibiotic use PPPY Patients and physicians can

count on ASCENIV to reduce infection-related quality-of-life impact

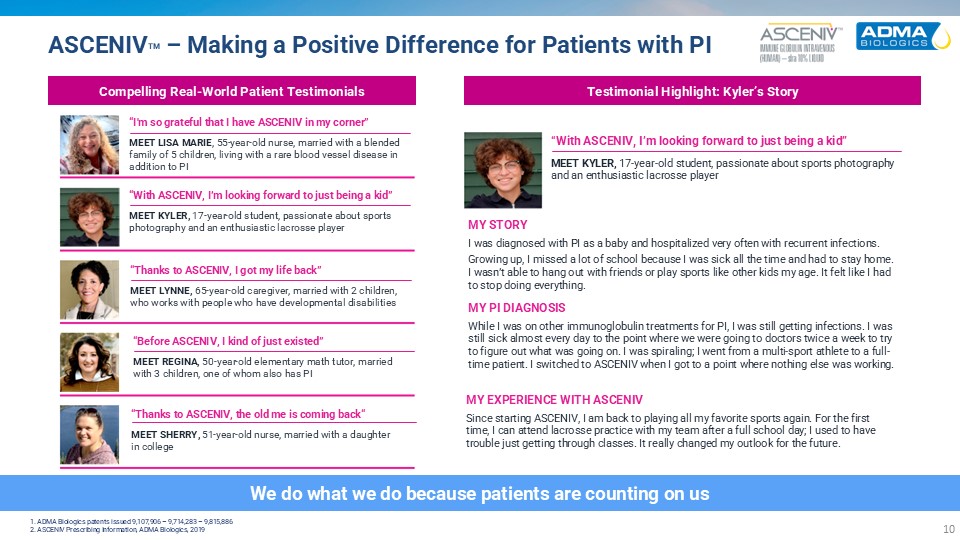

ASCENIVTM – Making a Positive Difference for Patients with PI We do what we do

because patients are counting on us 1. ADMA Biologics patents issued 9,107,906 – 9,714,283 – 9,815,886 2. ASCENIV Prescribing Information, ADMA Biologics, 2019 Compelling Real-World Patient Testimonials Testimonial Highlight: Kyler’s

Story “I'm so grateful that I have ASCENIV in my corner” MEET LISA MARIE, 55-year-old nurse, married with a blended family of 5 children, living with a rare blood vessel disease in addition to PI “Before ASCENIV, I kind of just

existed” MEET REGINA, 50-year-old elementary math tutor, married with 3 children, one of whom also has PI “With ASCENIV, I’m looking forward to just being a kid” MEET KYLER, 17-year-old student, passionate about sports photography and an

enthusiastic lacrosse player “Thanks to ASCENIV, I got my life back” MEET LYNNE, 65-year-old caregiver, married with 2 children, who works with people who have developmental disabilities “Thanks to ASCENIV, the old me is coming back“ MEET

SHERRY, 51-year-old nurse, married with a daughterin college “With ASCENIV, I’m looking forward to just being a kid” MEET KYLER, 17-year-old student, passionate about sports photography and an enthusiastic lacrosse player MY STORY I was

diagnosed with PI as a baby and hospitalized very often with recurrent infections. Growing up, I missed a lot of school because I was sick all the time and had to stay home. I wasn’t able to hang out with friends or play sports like other kids

my age. It felt like I had to stop doing everything. MY PI DIAGNOSIS While I was on other immunoglobulin treatments for PI, I was still getting infections. I was still sick almost every day to the point where we were going to doctors twice a

week to try to figure out what was going on. I was spiraling; I went from a multi-sport athlete to a full-time patient. I switched to ASCENIV when I got to a point where nothing else was working. MY EXPERIENCE WITH ASCENIV Since starting

ASCENIV, I am back to playing all my favorite sports again. For the first time, I can attend lacrosse practice with my team after a full school day; I used to have trouble just getting through classes. It really changed my outlook for the

future.

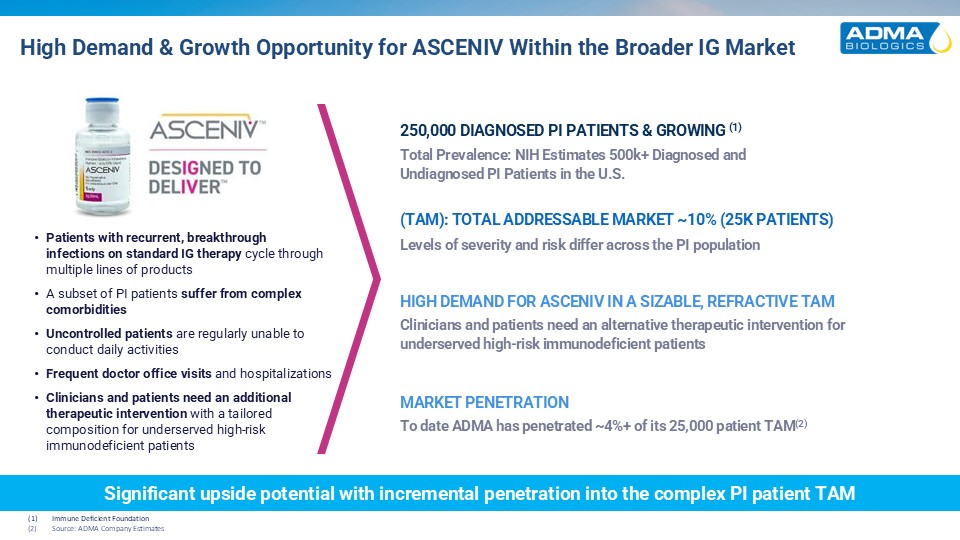

High Demand & Growth Opportunity for ASCENIV Within the Broader IG

Market Significant upside potential with incremental penetration into the complex PI patient TAM Immune Deficient Foundation Source: ADMA Company Estimates (TAM): TOTAL ADDRESSABLE MARKET ~10% (25K PATIENTS) 250,000 DIAGNOSED PI PATIENTS

& GROWING (1) HIGH DEMAND FOR ASCENIV IN A SIZABLE, REFRACTIVE TAM Patients with recurrent, breakthroughinfections on standard IG therapy cycle through multiple lines of products A subset of PI patients suffer from complex

comorbidities Uncontrolled patients are regularly unable to conduct daily activities Frequent doctor office visits and hospitalizations Clinicians and patients need an additional therapeutic intervention with a tailored composition for

underserved high-risk immunodeficient patients Total Prevalence: NIH Estimates 500k+ Diagnosed andUndiagnosed PI Patients in the U.S. Levels of severity and risk differ across the PI population Clinicians and patients need an alternative

therapeutic intervention for underserved high-risk immunodeficient patients MARKET PENETRATION To date ADMA has penetrated ~4%+ of its 25,000 patient TAM(2)

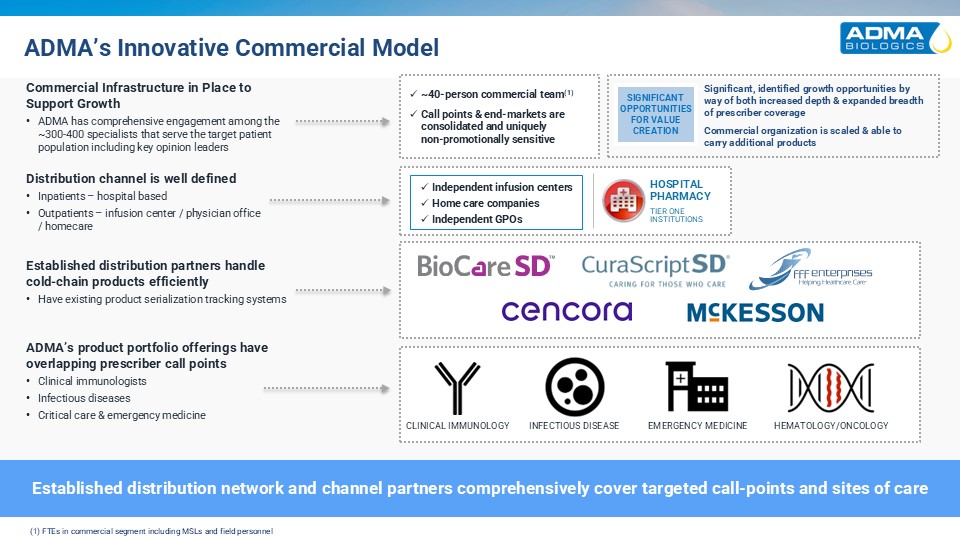

Established distribution network and channel partners comprehensively cover

targeted call-points and sites of care Distribution channel is well defined Inpatients – hospital based Outpatients – infusion center / physician office / homecare Established distribution partners handle cold-chain products efficiently

Have existing product serialization tracking systems ADMA’s product portfolio offerings have overlapping prescriber call points Clinical immunologists Infectious diseases Critical care & emergency medicine HOSPITALPHARMACY TIER

ONEINSTITUTIONS Independent infusion centers Home care companies Independent GPOs EMERGENCY MEDICINE INFECTIOUS DISEASE CLINICAL IMMUNOLOGY HEMATOLOGY/ONCOLOGY ADMA’s Innovative Commercial Model Commercial Infrastructure in Place to

Support Growth ADMA has comprehensive engagement among the ~300-400 specialists that serve the target patient population including key opinion leaders ~40-person commercial team(1) Call points & end-markets are consolidated and

uniquelynon-promotionally sensitive SIGNIFICANT OPPORTUNITIES FOR VALUE CREATION Significant, identified growth opportunities by way of both increased depth & expanded breadth of prescriber coverage Commercial organization is scaled

& able to carry additional products (1) FTEs in commercial segment including MSLs and field personnel

Upside & Growth Opportunities NASDAQ: ADMA

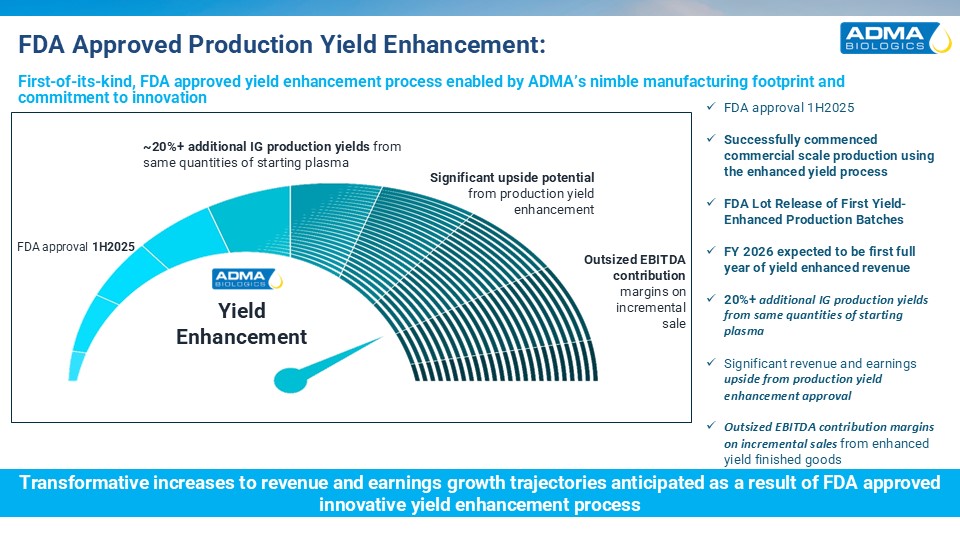

FDA approval 1H2025 Successfully commenced commercial scale production using the

enhanced yield process FDA Lot Release of First Yield-Enhanced Production Batches FY 2026 expected to be first full year of yield enhanced revenue 20%+ additional IG production yields from same quantities of starting plasma Significant

revenue and earnings upside from production yield enhancement approval Outsized EBITDA contribution margins on incremental sales from enhanced yield finished goods FDA Approved Production Yield Enhancement: Transformative increases to

revenue and earnings growth trajectories anticipated as a result of FDA approved innovative yield enhancement process Yield Enhancement FDA approval 1H2025 ~20%+ additional IG production yields from same quantities of starting

plasma Significant upside potential from production yield enhancement Outsized EBITDAcontributionmargins on incrementalsale First-of-its-kind, FDA approved yield enhancement process enabled by ADMA’s nimble manufacturing footprint and

commitment to innovation

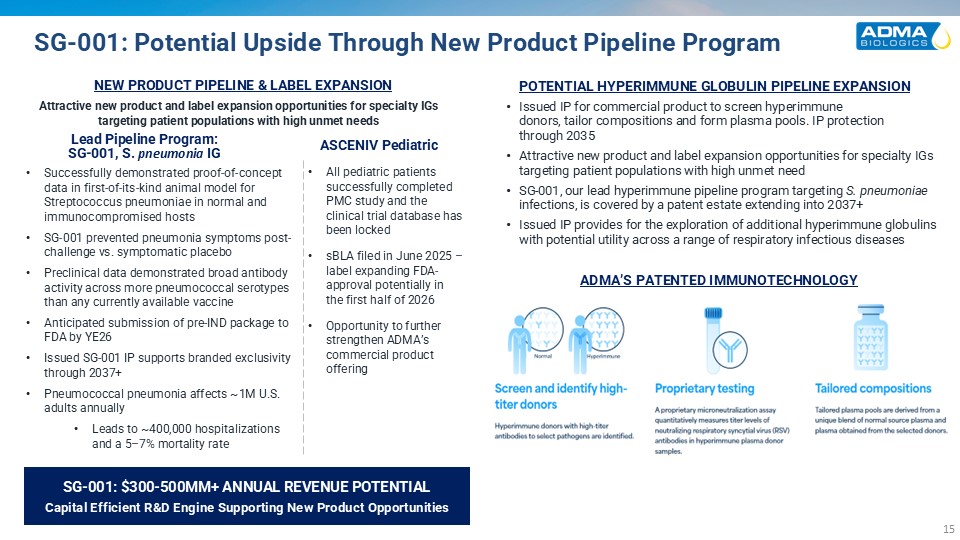

SG-001: Potential Upside Through New Product Pipeline Program Issued IP for

commercial product to screen hyperimmunedonors, tailor compositions and form plasma pools. IP protectionthrough 2035 Attractive new product and label expansion opportunities for specialty IGs targeting patient populations with high unmet need

SG-001, our lead hyperimmune pipeline program targeting S. pneumoniae infections, is covered by a patent estate extending into 2037+ Issued IP provides for the exploration of additional hyperimmune globulins with potential utility across a

range of respiratory infectious diseases POTENTIAL HYPERIMMUNE GLOBULIN PIPELINE EXPANSION ADMA’S PATENTED IMMUNOTECHNOLOGY Screen and identify high-titer RSV plasma donors Hyperimmune donors with sufficient antibodies to select pathogens

are identified Tailoredcompositions Tailored plasma poolsare derived from a unique blend of normal source plasma and plasma obtained from the selected donors Proprietarytesting A proprietary microneutralization assay quantitatively

measures titer levels of neutralizing RSV antibodies in plasma donor samples NEW PRODUCT PIPELINE & LABEL EXPANSION Lead Pipeline Program: SG-001, S. pneumonia IG ASCENIV Pediatric SG-001: $300-500MM+ ANNUAL REVENUE POTENTIALCapital

Efficient R&D Engine Supporting New Product Opportunities Attractive new product and label expansion opportunities for specialty IGs targeting patient populations with high unmet needs Successfully demonstrated proof-of-concept data in

first-of-its-kind animal model for Streptococcus pneumoniae in normal and immunocompromised hosts SG-001 prevented pneumonia symptoms post-challenge vs. symptomatic placebo Preclinical data demonstrated broad antibody activity across more

pneumococcal serotypes than any currently available vaccine Anticipated submission of pre-IND package to FDA by YE26 Issued SG-001 IP supports branded exclusivity through 2037+ Pneumococcal pneumonia affects ~1M U.S. adults annually Leads

to ~400,000 hospitalizations and a 5–7% mortality rate All pediatric patients successfully completed PMC study and the clinical trial database has been locked sBLA filed in June 2025 – label expanding FDA-approval potentially in the first

half of 2026 Opportunity to further strengthen ADMA’s commercial product offering

Senior Leadership NASDAQ: ADMA

Experienced Management Team and Board of Directors NAME SELECTED CURRENT OR PAST

AFFILIATIONS Dr. Jerrold GrossmanFounder & Vice Chairman Lawrence GuiheenDirector Steven ElmsChairman Young Kwon, Ph.D.Director Alison FingerDirector Kaitlin KestenbergCOO & SVP Compliance Brad TadeCFO & Treasurer Adam

GrossmanFounder, President, CEO & Director Eduardo Rene SalasDirector

Financials NASDAQ: ADMA

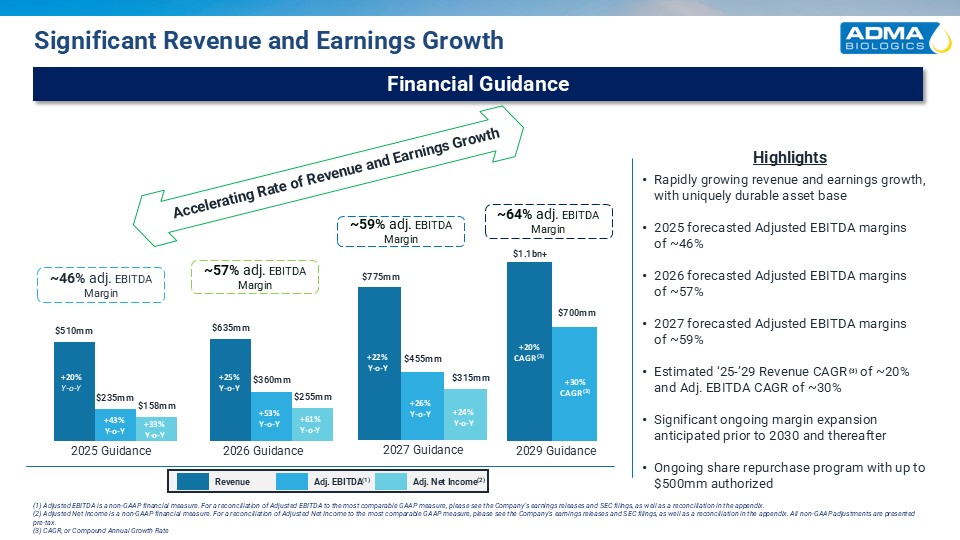

Rapidly growing revenue and earnings growth, with uniquely durable asset base

2025 forecasted Adjusted EBITDA marginsof ~46% 2026 forecasted Adjusted EBITDA marginsof ~57% 2027 forecasted Adjusted EBITDA marginsof ~59% Estimated ‘25-’29 Revenue CAGR (3) of ~20% and Adj. EBITDA CAGR of ~30% Significant ongoing

margin expansion anticipated prior to 2030 and thereafter Ongoing share repurchase program with up to $500mm authorized ~57% adj. EBITDA Margin Revenue Adj. EBITDA(1) Adj. Net Income(2) Financial Guidance Significant Revenue and Earnings

Growth ~46% adj. EBITDA Margin 2025 Guidance 2026 Guidance 2029 Guidance Highlights Accelerating Rate of Revenue and Earnings Growth +20% Y-o-Y +53% Y-o-Y +43% Y-o-Y +33% Y-o-Y (1) Adjusted EBITDA is a non-GAAP financial

measure. For a reconciliation of Adjusted EBITDA to the most comparable GAAP measure, please see the Company’s earnings releases and SEC filings, as well as a reconciliation in the appendix. (2) Adjusted Net Income is a non-GAAP financial

measure. For a reconciliation of Adjusted Net Income to the most comparable GAAP measure, please see the Company’s earnings releases and SEC filings, as well as a reconciliation in the appendix. All non-GAAP adjustments are presented pre-tax.

(3) CAGR, or Compound Annual Growth Rate +25% Y-o-Y +61% Y-o-Y ~64% adj. EBITDA Margin +20% CAGR (3) +30% CAGR (3) ~59% adj. EBITDA Margin 2027 Guidance +22% Y-o-Y +26% Y-o-Y +24% Y-o-Y

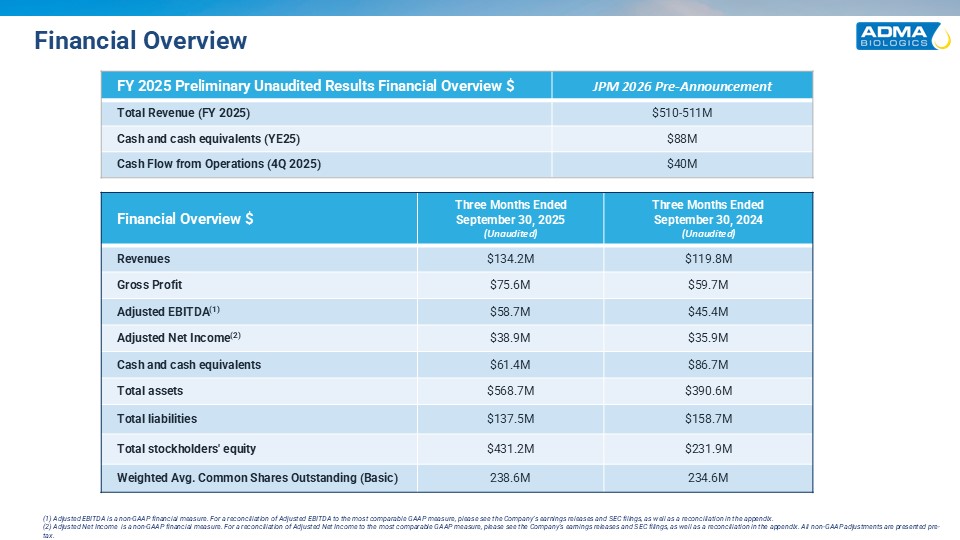

Financial Overview Financial Overview $ Three Months Ended September 30,

2025 (Unaudited) Three Months Ended September 30, 2024 (Unaudited) Revenues $134.2M $119.8M Gross Profit $75.6M $59.7M Adjusted EBITDA(1) $58.7M $45.4M Adjusted Net Income(2) $38.9M $35.9M Cash and cash

equivalents $61.4M $86.7M Total assets $568.7M $390.6M Total liabilities $137.5M $158.7M Total stockholders' equity $431.2M $231.9M Weighted Avg. Common Shares Outstanding (Basic) 238.6M 234.6M (1) Adjusted EBITDA is a non-GAAP

financial measure. For a reconciliation of Adjusted EBITDA to the most comparable GAAP measure, please see the Company’s earnings releases and SEC filings, as well as a reconciliation in the appendix. (2) Adjusted Net Income is a non-GAAP

financial measure. For a reconciliation of Adjusted Net Income to the most comparable GAAP measure, please see the Company’s earnings releases and SEC filings, as well as a reconciliation in the appendix. All non-GAAP adjustments are presented

pre-tax. FY 2025 Preliminary Unaudited Results Financial Overview $ JPM 2026 Pre-Announcement Total Revenue (FY 2025) $510-511M Cash and cash equivalents (YE25) $88M Cash Flow from Operations (4Q 2025) $40M

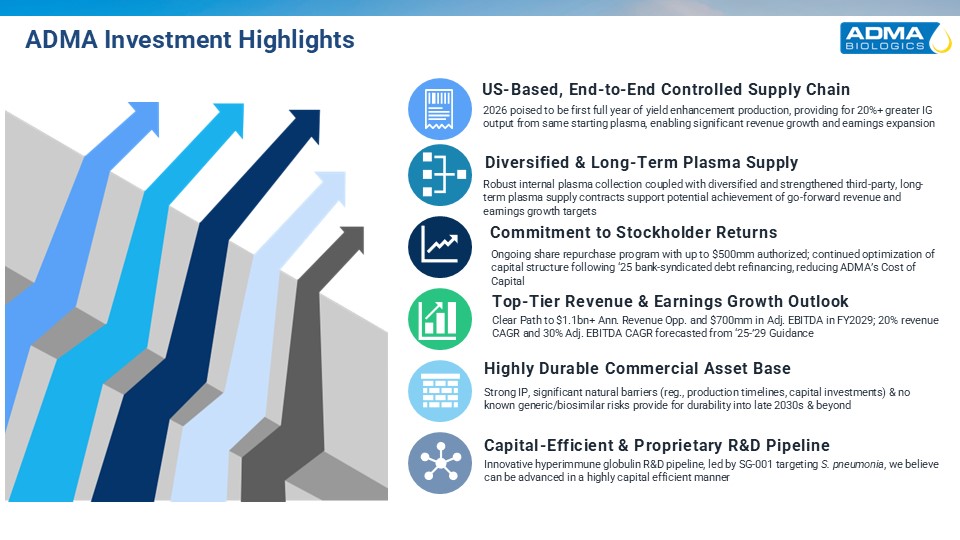

Commitment to Stockholder Returns Ongoing share repurchase program with up to

$500mm authorized; continued optimization of capital structure following ‘25 bank-syndicated debt refinancing, reducing ADMA’s Cost of Capital US-Based, End-to-End Controlled Supply Chain 2026 poised to be first full year of yield

enhancement production, providing for 20%+ greater IG output from same starting plasma, enabling significant revenue growth and earnings expansion Diversified & Long-Term Plasma Supply Robust internal plasma collection coupled with

diversified and strengthened third-party, long-term plasma supply contracts support potential achievement of go-forward revenue and earnings growth targets Top-Tier Revenue & Earnings Growth Outlook Clear Path to $1.1bn+ Ann. Revenue Opp.

and $700mm in Adj. EBITDA in FY2029; 20% revenue CAGR and 30% Adj. EBITDA CAGR forecasted from ‘25-’29 Guidance Highly Durable Commercial Asset Base Strong IP, significant natural barriers (reg., production timelines, capital investments)

& no known generic/biosimilar risks provide for durability into late 2030s & beyond Capital-Efficient & Proprietary R&D Pipeline Innovative hyperimmune globulin R&D pipeline, led by SG-001 targeting S. pneumonia, we

believe can be advanced in a highly capital efficient manner ADMA Investment Highlights

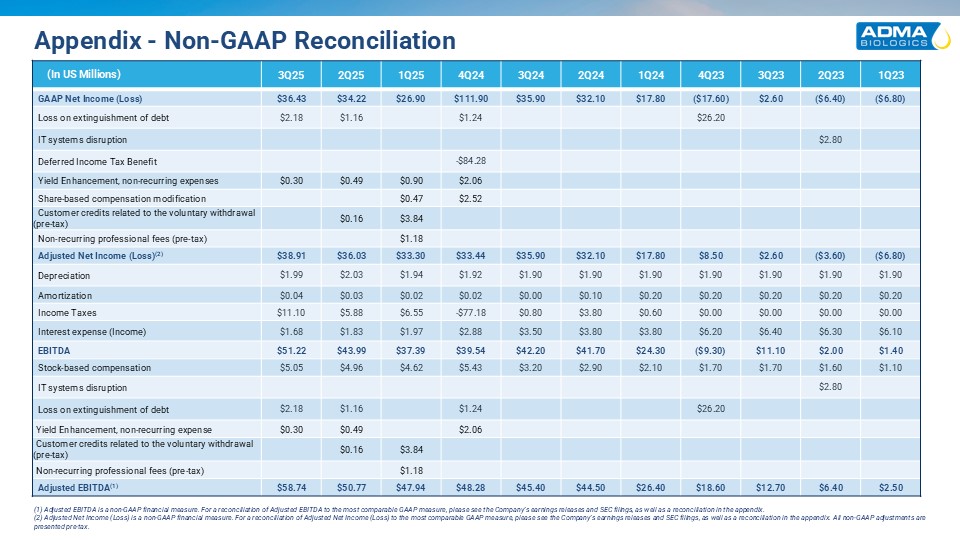

Appendix - Non-GAAP Reconciliation (In US

Millions) 3Q25 2Q25 1Q25 4Q24 3Q24 2Q24 1Q24 4Q23 3Q23 2Q23 1Q23 GAAP Net Income (Loss) $36.43 $34.22 $26.90 $111.90 $35.90 $32.10 $17.80 ($17.60) $2.60 ($6.40) ($6.80) Loss on extinguishment of

debt $2.18 $1.16 $1.24 $26.20 IT systems disruption $2.80 Deferred Income Tax Benefit -$84.28 Yield Enhancement, non-recurring expenses $0.30 $0.49 $0.90 $2.06 Share-based compensation modification $0.47 $2.52 Customer

credits related to the voluntary withdrawal (pre-tax) $0.16 $3.84 Non-recurring professional fees (pre-tax) $1.18 Adjusted Net Income (Loss)(2) $38.91 $36.03 $33.30 $33.44 $35.90 $32.10 $17.80 $8.50 $2.60

($3.60) ($6.80) Depreciation $1.99 $2.03 $1.94 $1.92 $1.90 $1.90 $1.90 $1.90 $1.90 $1.90 $1.90 Amortization $0.04 $0.03 $0.02 $0.02 $0.00 $0.10 $0.20 $0.20 $0.20 $0.20 $0.20 Income

Taxes $11.10 $5.88 $6.55 -$77.18 $0.80 $3.80 $0.60 $0.00 $0.00 $0.00 $0.00 Interest expense (Income) $1.68 $1.83 $1.97 $2.88 $3.50 $3.80 $3.80 $6.20 $6.40 $6.30 $6.10

EBITDA $51.22 $43.99 $37.39 $39.54 $42.20 $41.70 $24.30 ($9.30) $11.10 $2.00 $1.40 Stock-based compensation $5.05 $4.96 $4.62 $5.43 $3.20 $2.90 $2.10 $1.70 $1.70 $1.60 $1.10 IT systems disruption $2.80

Loss on extinguishment of debt $2.18 $1.16 $1.24 $26.20 Yield Enhancement, non-recurring expense $0.30 $0.49 $2.06 Customer credits related to the voluntary withdrawal (pre-tax) $0.16 $3.84 Non-recurring professional fees

(pre-tax) $1.18 Adjusted EBITDA(1) $58.74 $50.77 $47.94 $48.28 $45.40 $44.50 $26.40 $18.60 $12.70 $6.40 $2.50 (1) Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation of Adjusted EBITDA to the most

comparable GAAP measure, please see the Company’s earnings releases and SEC filings, as well as a reconciliation in the appendix. (2) Adjusted Net Income (Loss) is a non-GAAP financial measure. For a reconciliation of Adjusted Net Income

(Loss) to the most comparable GAAP measure, please see the Company’s earnings releases and SEC filings, as well as a reconciliation in the appendix. All non-GAAP adjustments are presented pre-tax.