NASDAQ: CPRX Improving the Lives of Patients Living with Rare Diseases January 2026

Safe Harbor This presentation contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are outside our control. All statements regarding our strategy, future operations, financial position, estimated revenues or losses, projected costs, prospects, plans, and objectives, other than statements of historical fact included in our filings with the U.S. Securities and Exchange Commission (“SEC”), are forward-looking statements. The language reflected in these statements only speaks as of the date that appears on the front cover of the presentation; the words “may,” “will,” “could,” “would,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “potential,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. You should not place undue reliance on forward-looking statements. While we believe that we have a reasonable basis for each forward-looking statement that we make, we caution you that these statements are based on a combination of facts and factors currently known by us and projections of future events or conditions about which we cannot be certain. Forward-looking statements in this presentation should be evaluated together with the many uncertainties that affect our business, particularly those mentioned in the “Risk Factors” section of our Annual Report on Form 10-K filed with the SEC, reporting our financial position and results of operations as of and for the year ended December 31, 2024, as well as our subsequent reports filed with the SEC. In addition, market and industry statistics contained in this presentation are based on information available to us that we believe is accurate. This information is generally based on publications that are not produced for purposes of securities offerings or economic analysis. All forward-looking statements speak only as of the date that appears on the front cover of the presentation or the date of this presentation. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the factors that could cause actual results to differ materially, even if new information becomes available in the future.

Catalyst Pharmaceuticals is a commercial-stage biopharmaceutical company focused on acquiring, in-licensing, developing, and commercializing novel medicines for patients living with rare diseases Patients are at the center of every decision we make

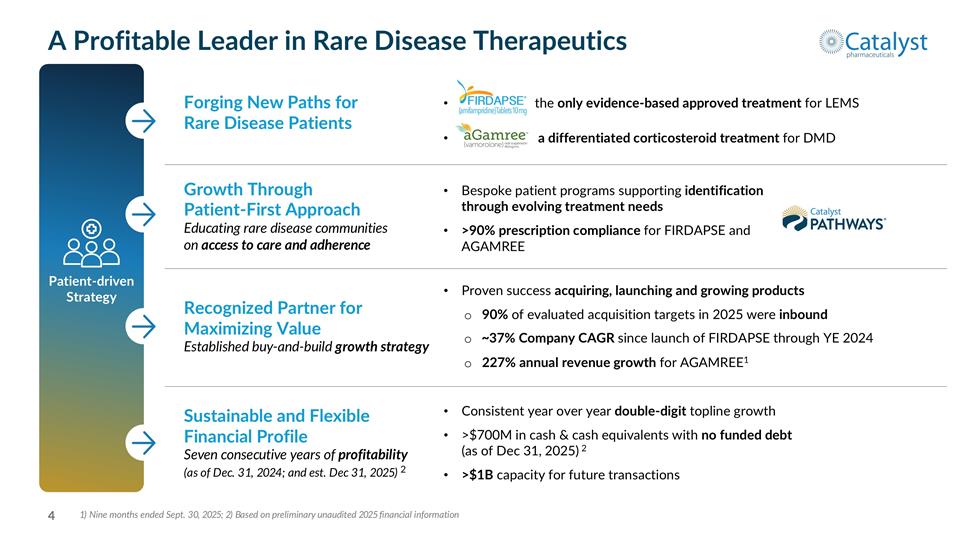

Growth Through Patient-First Approach Educating rare disease communities on access to care and adherence A Profitable Leader in Rare Disease Therapeutics Forging New Paths for Rare Disease Patients Patient-driven Strategy 1) Nine months ended Sept. 30, 2025; 2) Based on preliminary unaudited 2025 financial information the only evidence-based approved treatment for LEMS a differentiated corticosteroid treatment for DMD Bespoke patient programs supporting identification through evolving treatment needs >90% prescription compliance for FIRDAPSE and AGAMREE Recognized Partner for Maximizing Value Established buy-and-build growth strategy Proven success acquiring, launching and growing products 90% of evaluated acquisition targets in 2025 were inbound ~37% Company CAGR since launch of FIRDAPSE through YE 2024 227% annual revenue growth for AGAMREE1 Sustainable and Flexible Financial Profile Seven consecutive years of profitability (as of Dec. 31, 2024; and est. Dec 31, 2025) 2 Consistent year over year double-digit topline growth >$700M in cash & cash equivalents with no funded debt (as of Dec 31, 2025) 2 >$1B capacity for future transactions

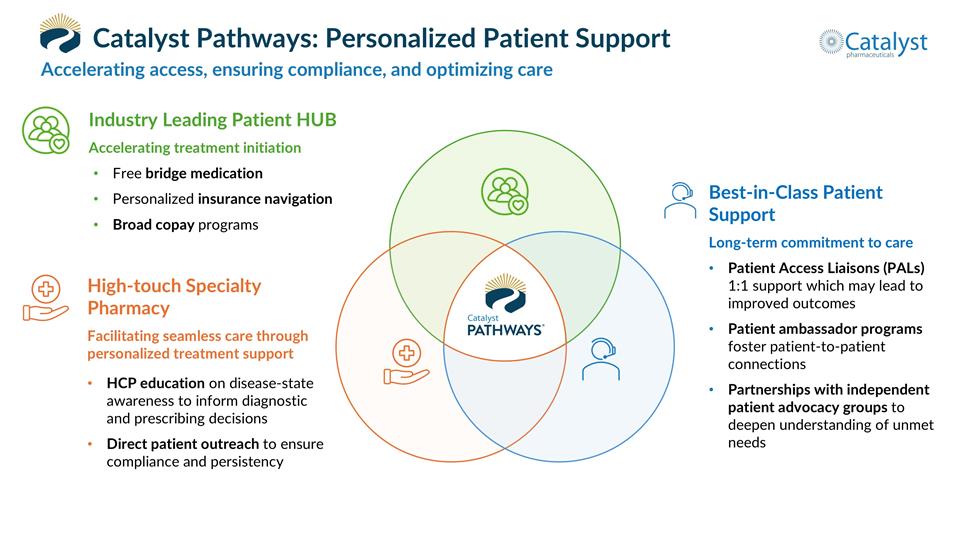

Catalyst Pathways: Personalized Patient Support Accelerating access, ensuring compliance, and optimizing care Industry Leading Patient HUB Accelerating treatment initiation Free bridge medication Personalized insurance navigation Broad copay programs Best-in-Class Patient Support Long-term commitment to care Patient Access Liaisons (PALs) 1:1 support which may lead to improved outcomes Patient ambassador programs foster patient-to-patient connections Partnerships with independent patient advocacy groups to deepen understanding of unmet needs High-touch Specialty Pharmacy Facilitating seamless care through personalized treatment support HCP education on disease-state awareness to inform diagnostic and prescribing decisions Direct patient outreach to ensure compliance and persistency

Clear and Focused Acquisition Strategy to Supplement Organic Growth Financial flexibility to deploy >$1B toward: Rare disease products across diverse therapeutic areas, agnostic to treatment modality Opportunities with up to ~$500M in peak sales Immediate / near-term accretive acquisitions Clinical-stage opportunities (Ph 3) with robust and established proof of concept U.S. and ex-U.S. opportunities with worldwide rights

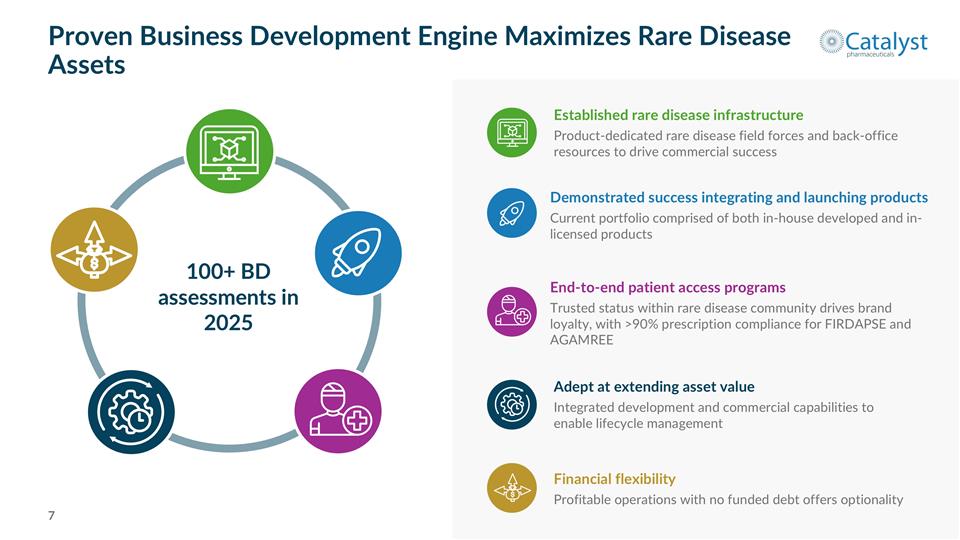

Proven Business Development Engine Maximizes Rare Disease Assets 100+ BD assessments in 2025 Adept at extending asset value Integrated development and commercial capabilities to enable lifecycle management Established rare disease infrastructure Product-dedicated rare disease field forces and back-office resources to drive commercial success End-to-end patient access programs Trusted status within rare disease community drives brand loyalty, with >90% prescription compliance for FIRDAPSE and AGAMREE Financial flexibility Profitable operations with no funded debt offers optionality Demonstrated success integrating and launching products Current portfolio comprised of both in-house developed and in-licensed products

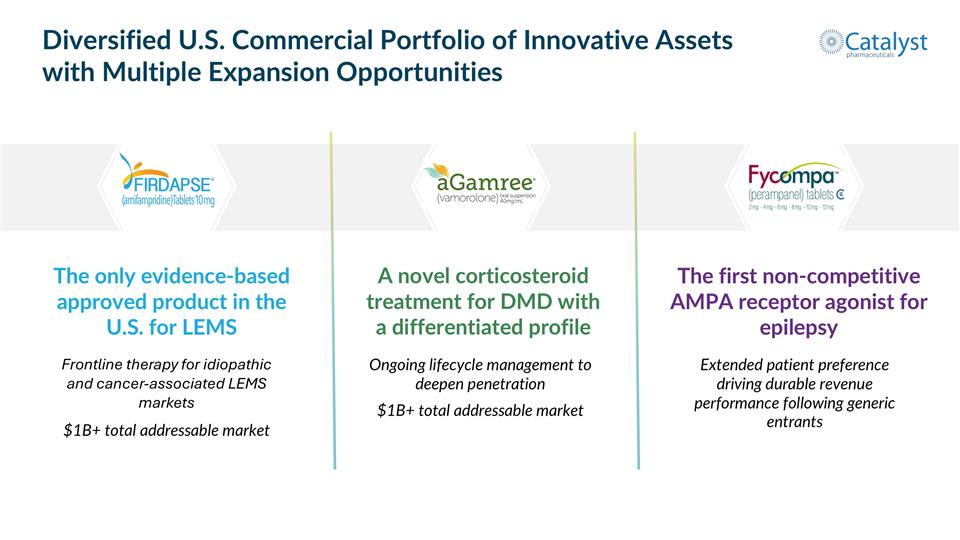

The only evidence-based approved product in the U.S. for LEMS Diversified U.S. Commercial Portfolio of Innovative Assets with Multiple Expansion Opportunities Frontline therapy for idiopathic and cancer-associated LEMS markets $1B+ total addressable market A novel corticosteroid treatment for DMD with a differentiated profile Ongoing lifecycle management to deepen penetration $1B+ total addressable market The first non-competitive AMPA receptor agonist for epilepsy Extended patient preference driving durable revenue performance following generic entrants

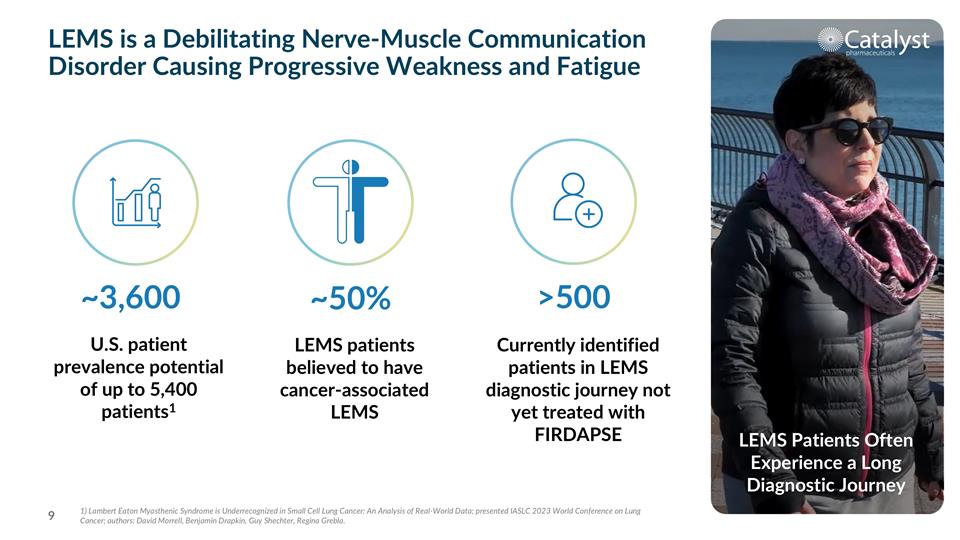

LEMS is a Debilitating Nerve-Muscle Communication Disorder Causing Progressive Weakness and Fatigue LEMS Patients Often Experience a Long Diagnostic Journey ~3,600 >500 ~50% U.S. patient prevalence potential of up to 5,400 patients1 Currently identified patients in LEMS diagnostic journey not yet treated with FIRDAPSE LEMS patients believed to have cancer-associated LEMS 1) Lambert Eaton Myasthenic Syndrome is Underrecognized in Small Cell Lung Cancer: An Analysis of Real-World Data; presented IASLC 2023 World Conference on Lung Cancer; authors: David Morrell, Benjamin Drapkin, Guy Shechter, Regina Grebla.

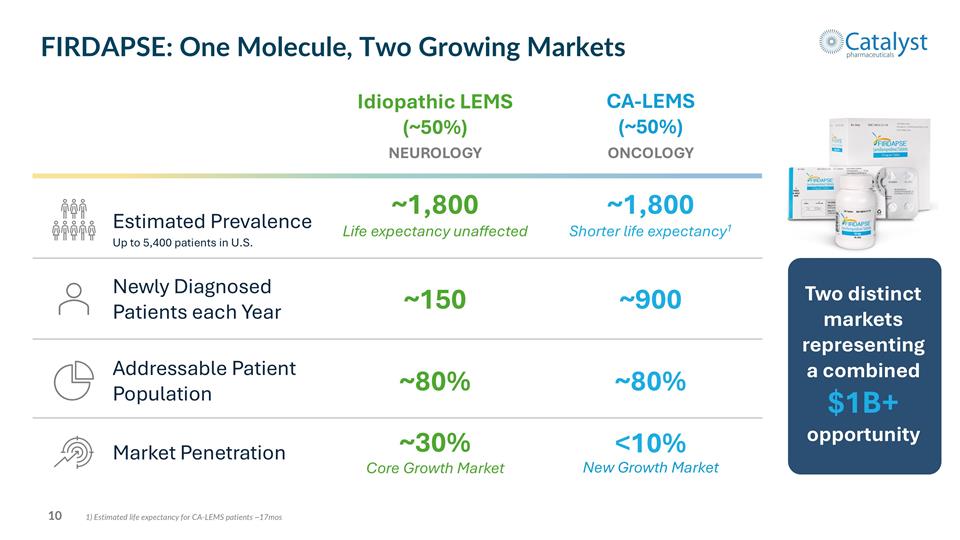

Two distinct markets representing a combined $1B+ opportunity Up to 5,400 patients in U.S. 1) Estimated life expectancy for CA-LEMS patients ~17mos FIRDAPSE: One Molecule, Two Growing Markets Estimated Prevalence Addressable Patient Population NEUROLOGY Idiopathic LEMS (~50%) ONCOLOGY CA-LEMS (~50%) ~1,800 Life expectancy unaffected ~1,800 Shorter life expectancy1 ~80% ~80% Market Penetration Core Growth Market ~30% New Growth Market <10% Newly Diagnosed Patients each Year ~150 ~900

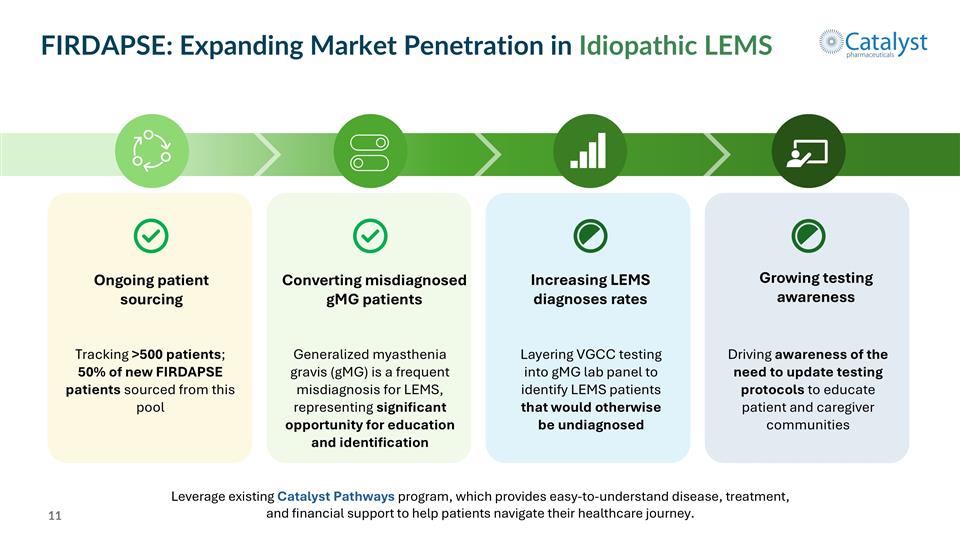

FIRDAPSE: Expanding Market Penetration in Idiopathic LEMS Leverage existing Catalyst Pathways program, which provides easy-to-understand disease, treatment, and financial support to help patients navigate their healthcare journey. Ongoing patient sourcing Converting misdiagnosed gMG patients Growing testing awareness Increasing LEMS diagnoses rates Tracking >500 patients; 50% of new FIRDAPSE patients sourced from this pool Generalized myasthenia gravis (gMG) is a frequent misdiagnosis for LEMS, representing significant opportunity for education and identification Layering VGCC testing into gMG lab panel to identify LEMS patients that would otherwise be undiagnosed Driving awareness of the need to update testing protocols to educate patient and caregiver communities

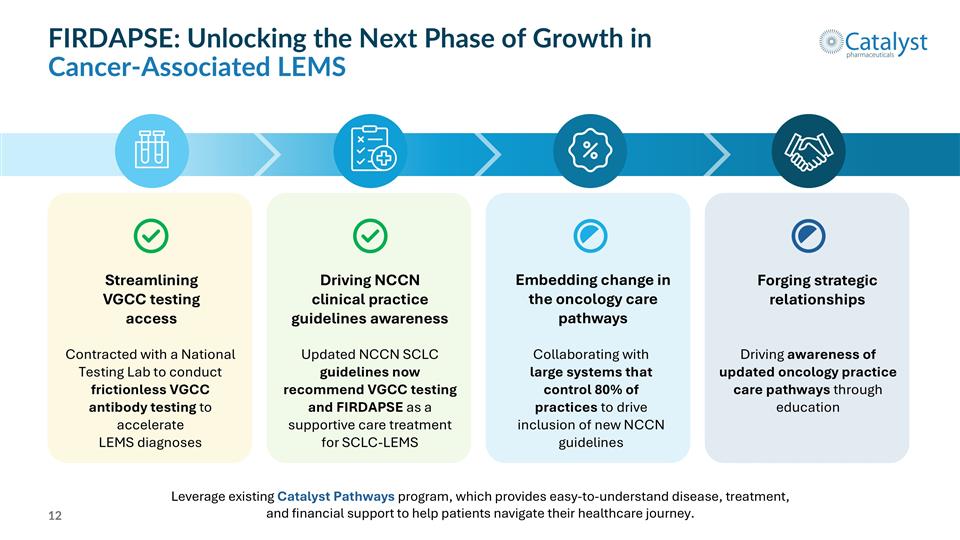

FIRDAPSE: Unlocking the Next Phase of Growth in Cancer-Associated LEMS Streamlining VGCC testing access Driving NCCN clinical practice guidelines awareness Forging strategic relationships Embedding change in the oncology care pathways Contracted with a National Testing Lab to conduct frictionless VGCC antibody testing to accelerate LEMS diagnoses Updated NCCN SCLC guidelines now recommend VGCC testing and FIRDAPSE as a supportive care treatment for SCLC-LEMS Collaborating with large systems that control 80% of practices to drive inclusion of new NCCN guidelines Driving awareness of updated oncology practice care pathways through education Leverage existing Catalyst Pathways program, which provides easy-to-understand disease, treatment, and financial support to help patients navigate their healthcare journey.

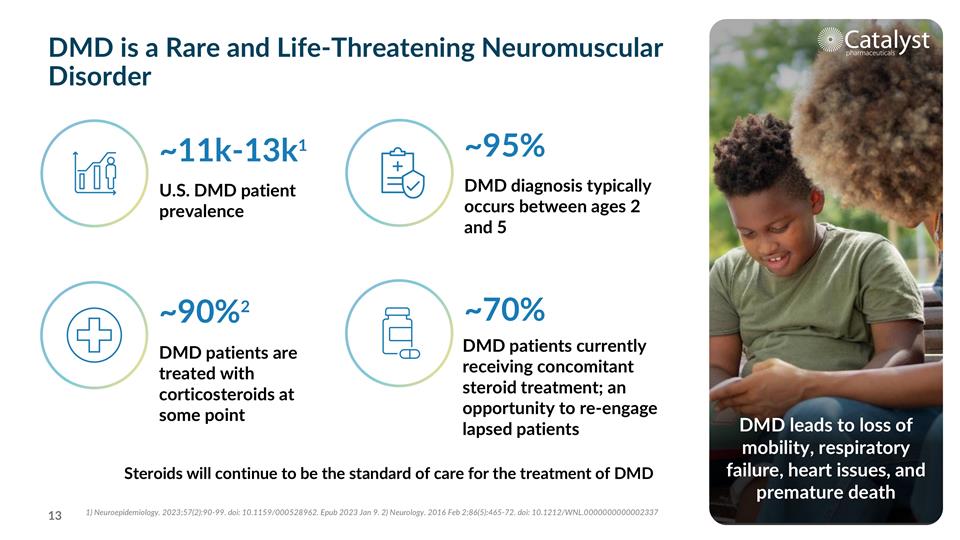

~11k-13k1 ~95% ~70% U.S. DMD patient prevalence DMD diagnosis typically occurs between ages 2 and 5 DMD is a Rare and Life-Threatening Neuromuscular Disorder DMD leads to loss of mobility, respiratory failure, heart issues, and premature death DMD patients currently receiving concomitant steroid treatment; an opportunity to re-engage lapsed patients DMD patients are treated with corticosteroids at some point ~90%2 1) Neuroepidemiology. 2023;57(2):90-99. doi: 10.1159/000528962. Epub 2023 Jan 9. 2) Neurology. 2016 Feb 2;86(5):465-72. doi: 10.1212/WNL.0000000000002337 Steroids will continue to be the standard of care for the treatment of DMD

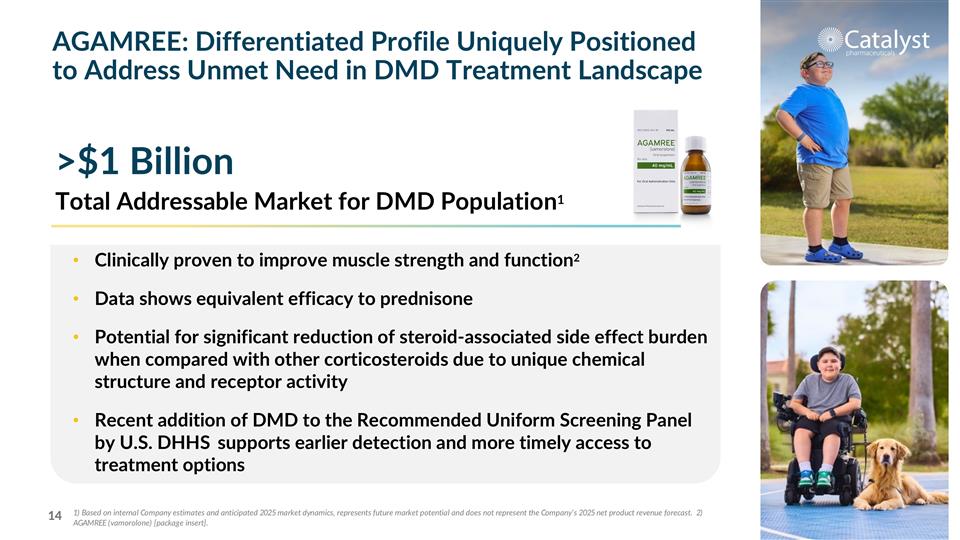

AGAMREE: Differentiated Profile Uniquely Positioned to Address Unmet Need in DMD Treatment Landscape Total Addressable Market for DMD Population1 >$1 Billion Clinically proven to improve muscle strength and function2 Data shows equivalent efficacy to prednisone Potential for significant reduction of steroid-associated side effect burden when compared with other corticosteroids due to unique chemical structure and receptor activity Recent addition of DMD to the Recommended Uniform Screening Panel by U.S. DHHS supports earlier detection and more timely access to treatment options 1) Based on internal Company estimates and anticipated 2025 market dynamics, represents future market potential and does not represent the Company’s 2025 net product revenue forecast. 2) AGAMREE (vamorolone) [package insert].

AGAMREE: Strategy to Achieve Full Potential A multi-faceted approach to lifecycle management Strong Profile and Outstanding Acceptance ~90% patient retention rate ~90% penetration across all DMD Centers of Excellence >85% patients are reimbursed 85% patient conversion from branded / generic agents Commercial team driving targeted provider education Strengthening Differentiation SUMMIT: generating real-world evidence on potential long-term safety benefits over standard of care Leveraging data to further drive HCP awareness and inform prescribing practices Realizing Full Potential Conducting Phase 1 study with two key objectives: Preliminary evaluation of dose equivalence between AGAMREE and other steroids Evaluation of potential immunosuppressive activity of AGAMREE Exploring opportunities to expand beyond DMD Expanding Market Share

AGAMREE: SUMMIT Study Evaluating Potential Long-term Safety Benefits Real-world data to assess potential long-term benefits of AGAMREE over standard of care Behavioral improvements (e.g., reduced aggression) Stature/growth parameters Bone health Open label, five-year follow up on ~250 DMD patients across ~25 Centers of Excellence1 SUMMIT [SUpplemental assessMents of dMd patients Investigating ouTcomes] Cardiovascular health Ophthalmological status (cataracts/glaucoma) . 1) https://clinicaltrials.gov/study/NCT06564974

Market Dynamics Strong product profile: Well-tolerated with minimal drug-drug interactions and no contraindications2 Seizure freedom rate of ~72% when used adjunctively3 Generic entry (Q2 ’25, tablets; Q4’25 oral solution) less significant in the epilepsy space FYCOMPA: The First Non-Competitive AMPA Receptor Antagonist for Epilepsy Epilepsy is 4th most common neurological disorder1 1) England MJ, Liverman CT, Schultz AM, Strawbridge LM, eds. Epilepsy Across the Spectrum: Promoting Health and Understanding. Washington, DC: National Academies Press (U.S.); 2012; 2) CDC Epilepsy Data and Statistics; Epilepsy Prevalence in the U.S. (data as of 2015); 3) Examining the Economic Impact and Implications of Epilepsy, AJMC (US); 2020.

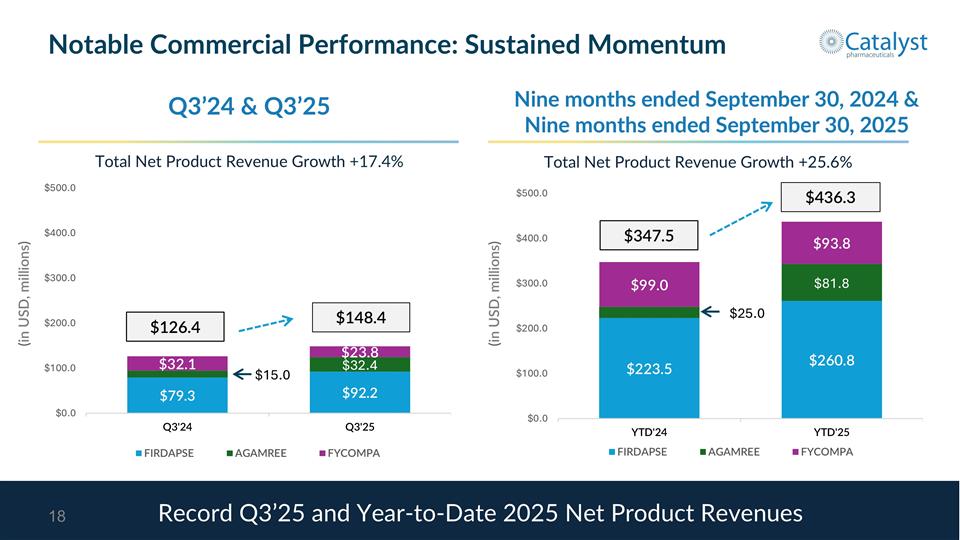

$148.4 $126.4 (in USD, millions) Notable Commercial Performance: Sustained Momentum Q3’24 & Q3’25 Record Q3’25 and Year-to-Date 2025 Net Product Revenues $436.3 $347.5 (in USD, millions) Nine months ended September 30, 2024 & Nine months ended September 30, 2025 Total Net Product Revenue Growth +17.4% Total Net Product Revenue Growth +25.6%

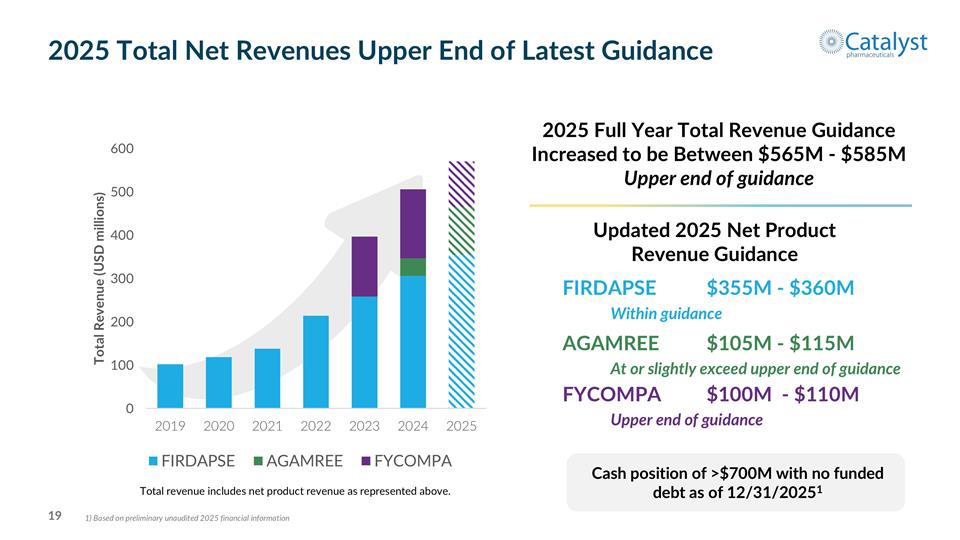

Updated 2025 Net Product Revenue Guidance FIRDAPSE$355M - $360M Within guidance AGAMREE$105M - $115M At or slightly exceed upper end of guidance FYCOMPA$100M - $110M Upper end of guidance 2025 Full Year Total Revenue Guidance Increased to be Between $565M - $585M Upper end of guidance Total revenue includes net product revenue as represented above. 2025 Total Net Revenues Upper End of Latest Guidance Cash position of >$700M with no funded debt as of 12/31/20251 1) Based on preliminary unaudited 2025 financial information

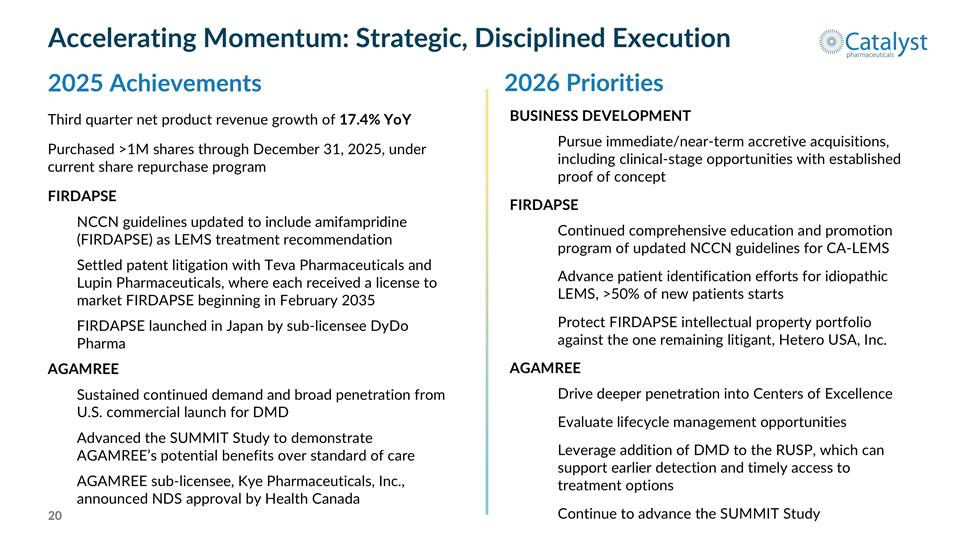

Third quarter net product revenue growth of 17.4% YoY Purchased >1M shares through December 31, 2025, under current share repurchase program FIRDAPSE NCCN guidelines updated to include amifampridine (FIRDAPSE) as LEMS treatment recommendation Settled patent litigation with Teva Pharmaceuticals and Lupin Pharmaceuticals, where each received a license to market FIRDAPSE beginning in February 2035 FIRDAPSE launched in Japan by sub-licensee DyDo Pharma AGAMREE Sustained continued demand and broad penetration from U.S. commercial launch for DMD Advanced the SUMMIT Study to demonstrate AGAMREE’s potential benefits over standard of care AGAMREE sub-licensee, Kye Pharmaceuticals, Inc., announced NDS approval by Health Canada 2025 Achievements Accelerating Momentum: Strategic, Disciplined Execution 2026 Priorities BUSINESS DEVELOPMENT Pursue immediate/near-term accretive acquisitions, including clinical-stage opportunities with established proof of concept FIRDAPSE Continued comprehensive education and promotion program of updated NCCN guidelines for CA-LEMS Advance patient identification efforts for idiopathic LEMS, >50% of new patients starts Protect FIRDAPSE intellectual property portfolio against the one remaining litigant, Hetero USA, Inc. AGAMREE Drive deeper penetration into Centers of Excellence Evaluate lifecycle management opportunities Leverage addition of DMD to the RUSP, which can support earlier detection and timely access to treatment options Continue to advance the SUMMIT Study

NASDAQ: CPRX