Sept. 29, 2025 Strategic Separation to Maximize Shareholder Value

This presentation and any accompanying oral presentation contains forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to: the timing of the release of data from the Company’s clinical trials, including initial data for rosnilimab’s Phase 2 clinical trial in ulcerative colitis; expectations regarding the structure, infrastructure, timing and taxation of the proposed separation of companies; timing of paydown of financial obligations to Sagard; timing of initiation of Phase 1b clinical trial in second indication with ANB033; timing of initiation of potential Phase 2 clinical trials with rosnilimab in additional indications; whether any partnership with rosnilimab will take place; the potential to receive any royalties or milestone payments from the Vanda Pharmaceuticals license agreement; whether any of the Company’s product candidates will be best in class or optimized; the potential to receive any additional milestones or royalties from the GSK collaboration and timing therefor; and the Company’s projected cash runway. Statements including words such as “plan,” “continue,” “expect,” or “ongoing” and statements in the future tense are forward-looking statements. These forward-looking statements involve risks and uncertainties, as well as assumptions, which, if they do not fully materialize or prove incorrect, could cause its results to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements are subject to risks and uncertainties that may cause the company’s actual activities or results to differ significantly from those expressed in any forward-looking statement, including risks and uncertainties related to the company’s ability to advance its product candidates, obtain regulatory approval of and ultimately commercialize its product candidates, the timing and results of preclinical and clinical trials, the company’s ability to fund development activities and achieve development goals, the company’s ability to protect intellectual property and other risks and uncertainties described under the heading “Risk Factors” in documents the company files from time to time with the Securities and Exchange Commission. These forward-looking statements speak only as of the date of this presentation, and the company undertakes no obligation to revise or update any forward-looking statements to reflect events or circumstances after the date hereof. Certain information contained in this presentation may be derived from information provided by industry sources. The Company believes such information is accurate and that the sources from which it has been obtained are reliable. However, the Company cannot guarantee the accuracy of, and has not independently verified, such information. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of such products. 2 Safe harbor statement

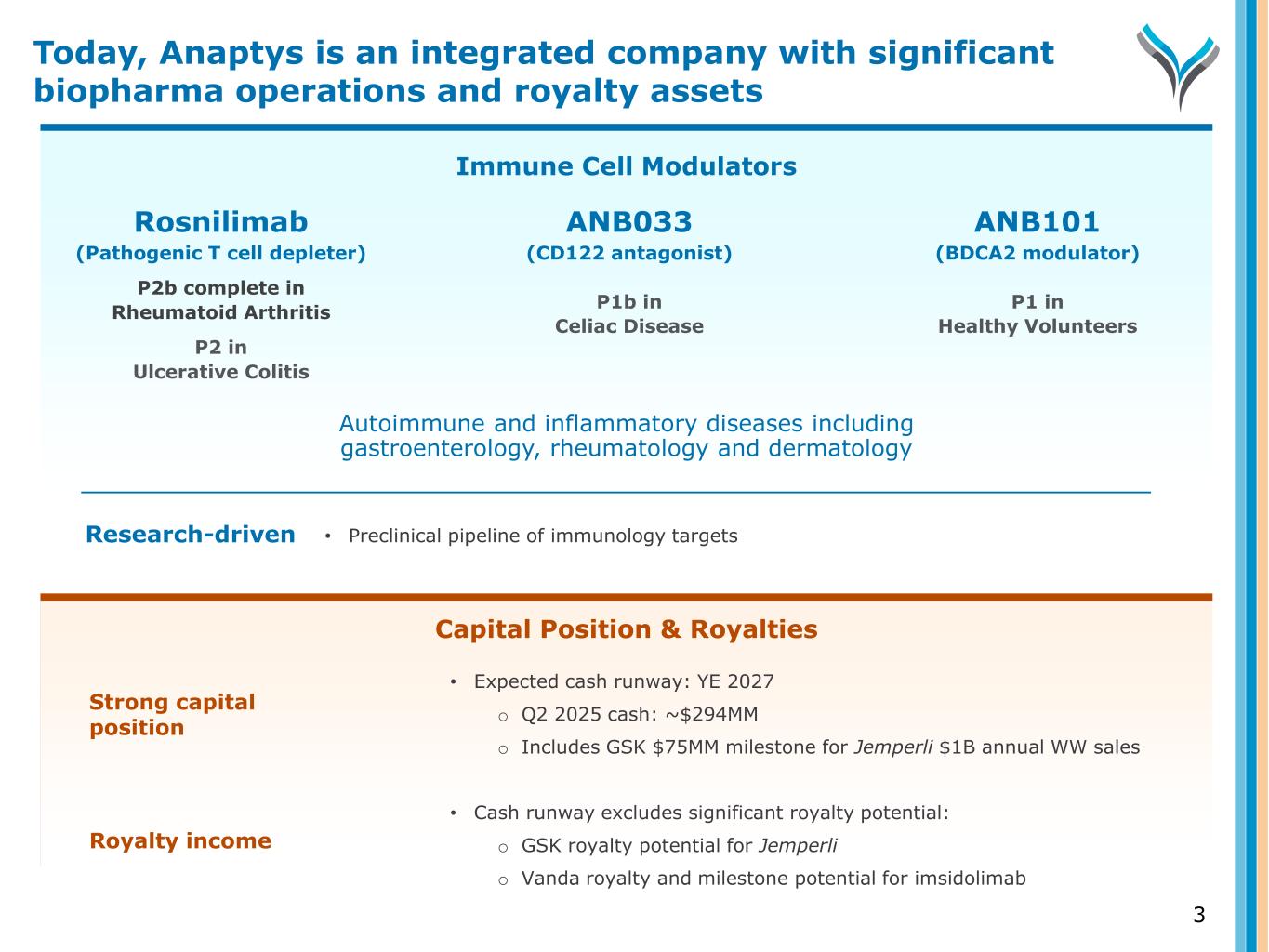

Immune Cell Modulators ANB033 (CD122 antagonist) P1b in Celiac Disease Rosnilimab (Pathogenic T cell depleter) P2b complete in Rheumatoid Arthritis P2 in Ulcerative Colitis Autoimmune and inflammatory diseases including gastroenterology, rheumatology and dermatology ANB101 (BDCA2 modulator) P1 in Healthy Volunteers Capital Position & Royalties Strong capital position • Expected cash runway: YE 2027 o Q2 2025 cash: ~$294MM o Includes GSK $75MM milestone for Jemperli $1B annual WW sales • Cash runway excludes significant royalty potential: o GSK royalty potential for Jemperli o Vanda royalty and milestone potential for imsidolimab Royalty income Today, Anaptys is an integrated company with significant biopharma operations and royalty assets 3 Research-driven • Preclinical pipeline of immunology targets

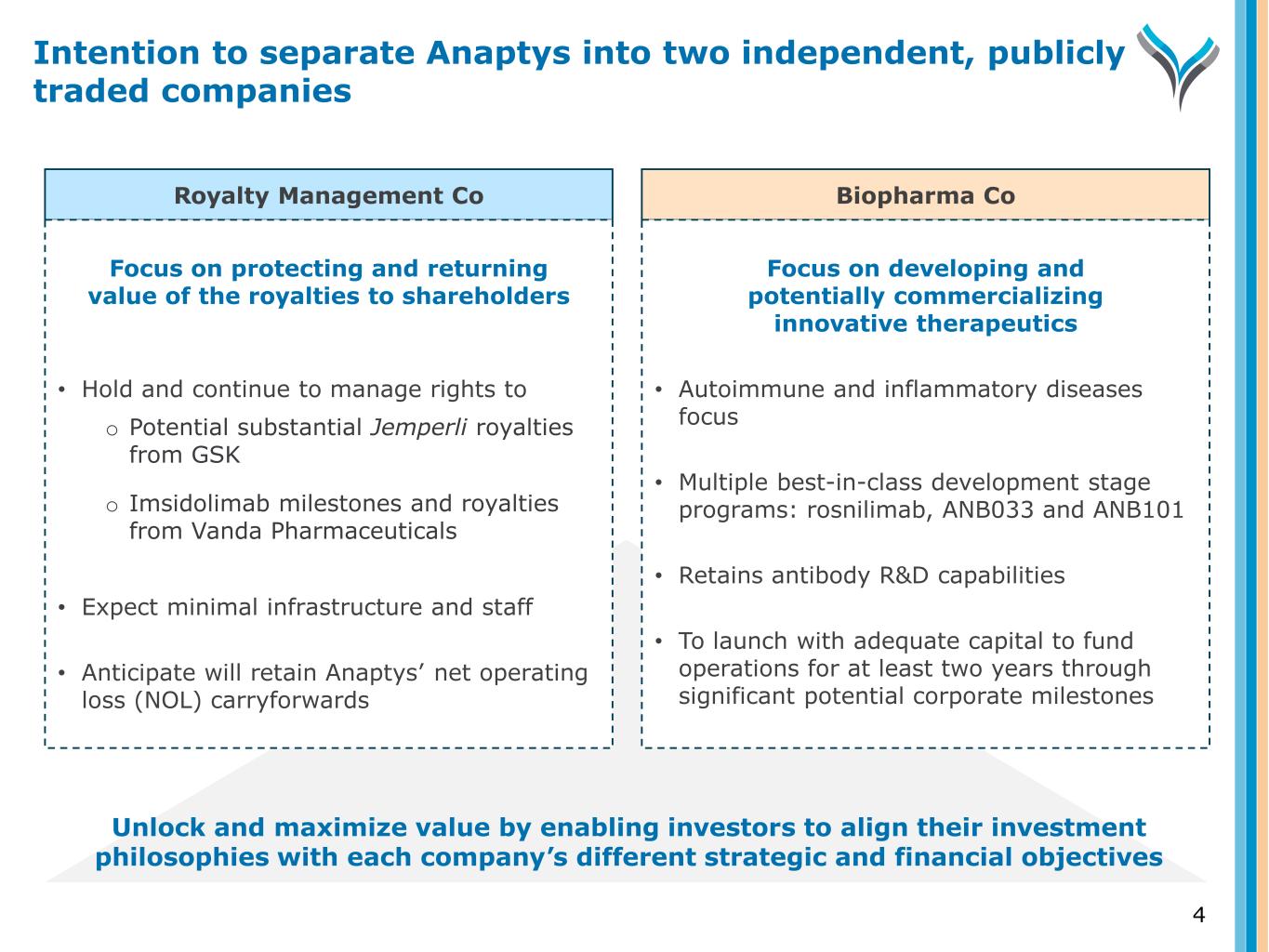

4 Royalty Management Co Biopharma Co Focus on protecting and returning value of the royalties to shareholders • Hold and continue to manage rights to o Potential substantial Jemperli royalties from GSK o Imsidolimab milestones and royalties from Vanda Pharmaceuticals • Expect minimal infrastructure and staff • Anticipate will retain Anaptys’ net operating loss (NOL) carryforwards Focus on developing and potentially commercializing innovative therapeutics • Autoimmune and inflammatory diseases focus • Multiple best-in-class development stage programs: rosnilimab, ANB033 and ANB101 • Retains antibody R&D capabilities • To launch with adequate capital to fund operations for at least two years through significant potential corporate milestones Unlock and maximize value by enabling investors to align their investment philosophies with each company’s different strategic and financial objectives Intention to separate Anaptys into two independent, publicly traded companies

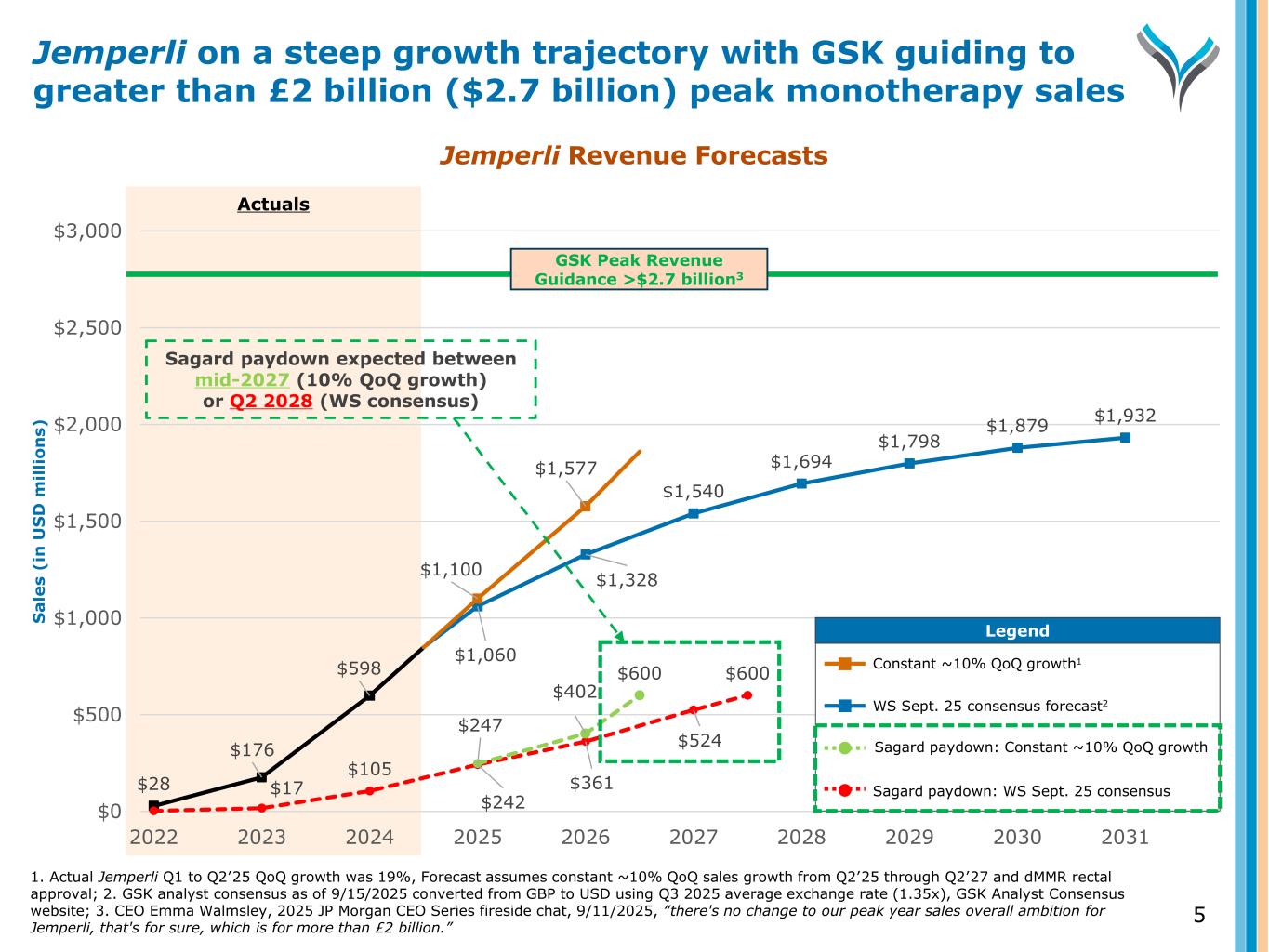

Actuals 1. Actual Jemperli Q1 to Q2’25 QoQ growth was 19%, Forecast assumes constant ~10% QoQ sales growth from Q2’25 through Q2’27 and dMMR rectal approval; 2. GSK analyst consensus as of 9/15/2025 converted from GBP to USD using Q3 2025 average exchange rate (1.35x), GSK Analyst Consensus website; 3. CEO Emma Walmsley, 2025 JP Morgan CEO Series fireside chat, 9/11/2025, “there's no change to our peak year sales overall ambition for Jemperli, that's for sure, which is for more than £2 billion.” Jemperli on a steep growth trajectory with GSK guiding to greater than £2 billion ($2.7 billion) peak monotherapy sales 5 Jemperli Revenue Forecasts $28 $176 $598 $1,060 $1,328 $1,540 $1,694 $1,798 $1,879 $1,932 $17 $105 $242 $361 $524 $600 $1,100 $1,577 $247 $402 $600 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 S a le s (i n U S D m il li o n s) Legend Legend Constant ~10% QoQ growth1 WS Sept. 25 consensus forecast2 Sagard paydown: Constant ~10% QoQ growth Sagard paydown: WS Sept. 25 consensus Sagard paydown expected between mid-2027 (10% QoQ growth) or Q2 2028 (WS consensus) GSK Peak Revenue Guidance >$2.7 billion3

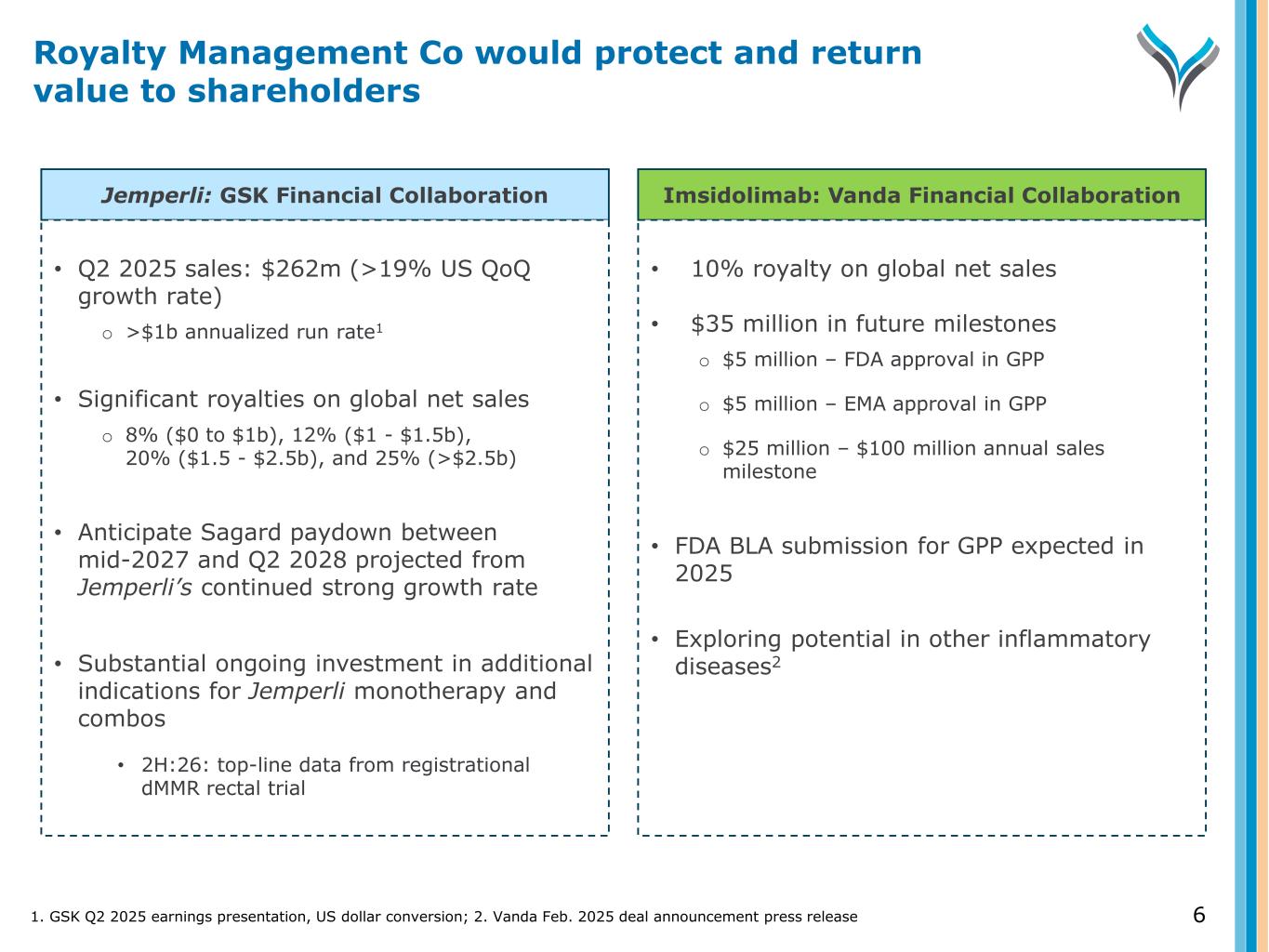

6 Jemperli: GSK Financial Collaboration Imsidolimab: Vanda Financial Collaboration • Q2 2025 sales: $262m (>19% US QoQ growth rate) o >$1b annualized run rate1 • Significant royalties on global net sales o 8% ($0 to $1b), 12% ($1 - $1.5b), 20% ($1.5 - $2.5b), and 25% (>$2.5b) • Anticipate Sagard paydown between mid-2027 and Q2 2028 projected from Jemperli’s continued strong growth rate • Substantial ongoing investment in additional indications for Jemperli monotherapy and combos • 2H:26: top-line data from registrational dMMR rectal trial • 10% royalty on global net sales • $35 million in future milestones o $5 million – FDA approval in GPP o $5 million – EMA approval in GPP o $25 million – $100 million annual sales milestone • FDA BLA submission for GPP expected in 2025 • Exploring potential in other inflammatory diseases2 1. GSK Q2 2025 earnings presentation, US dollar conversion; 2. Vanda Feb. 2025 deal announcement press release Royalty Management Co would protect and return value to shareholders

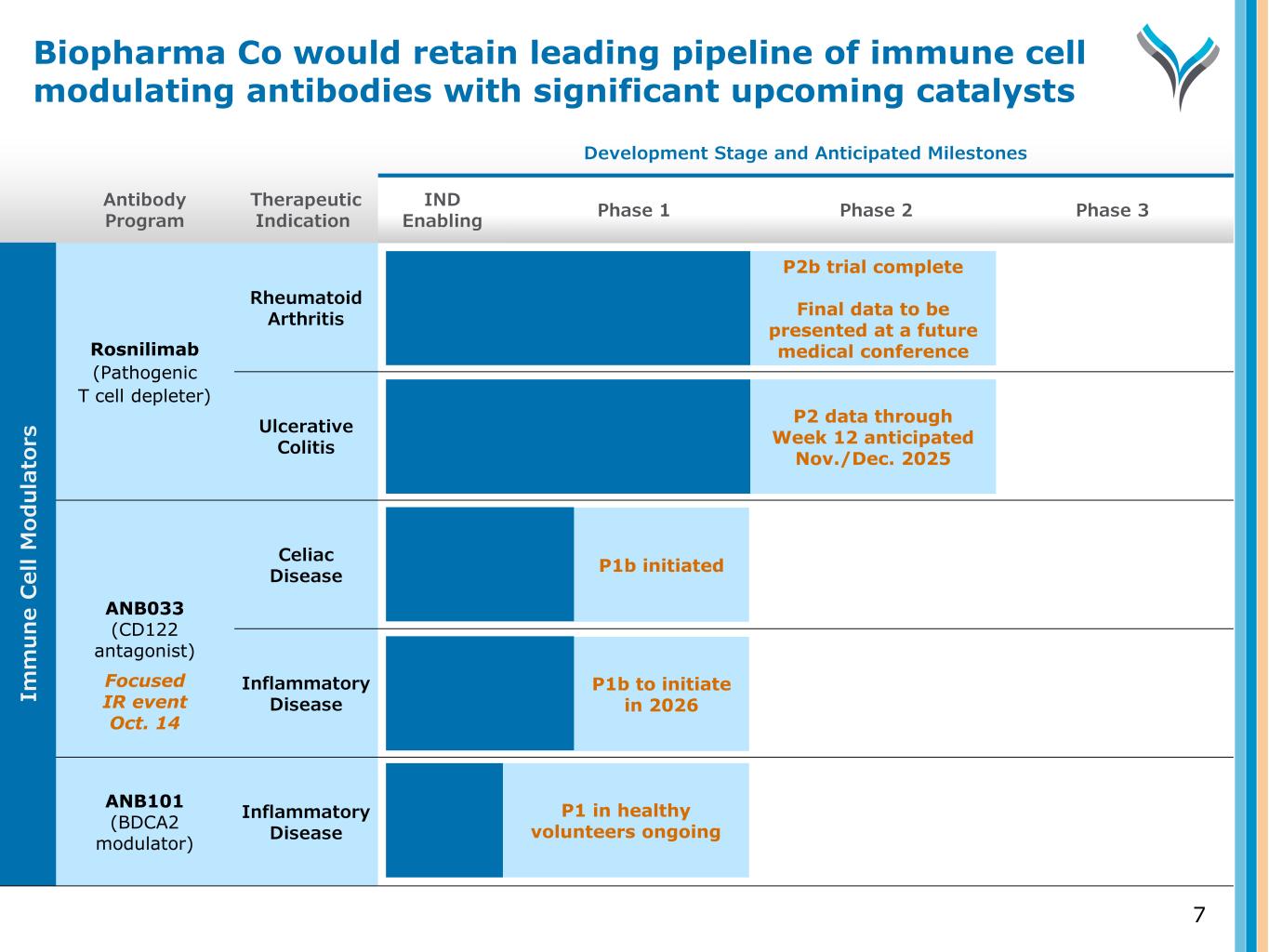

Antibody Program Therapeutic Indication Development Stage and Anticipated Milestones IND Enabling Phase 1 Phase 2 Phase 3 Rosnilimab (Pathogenic T cell depleter) Rheumatoid Arthritis Ulcerative Colitis ANB033 (CD122 antagonist) Celiac Disease Inflammatory Disease ANB101 (BDCA2 modulator) Inflammatory Disease 7 P2b trial complete Final data to be presented at a future medical conference P2 data through Week 12 anticipated Nov./Dec. 2025 P1b initiated Im m u n e C el l M od u la to rs P1 in healthy volunteers ongoing P1b to initiate in 2026 Focused IR event Oct. 14 Biopharma Co would retain leading pipeline of immune cell modulating antibodies with significant upcoming catalysts

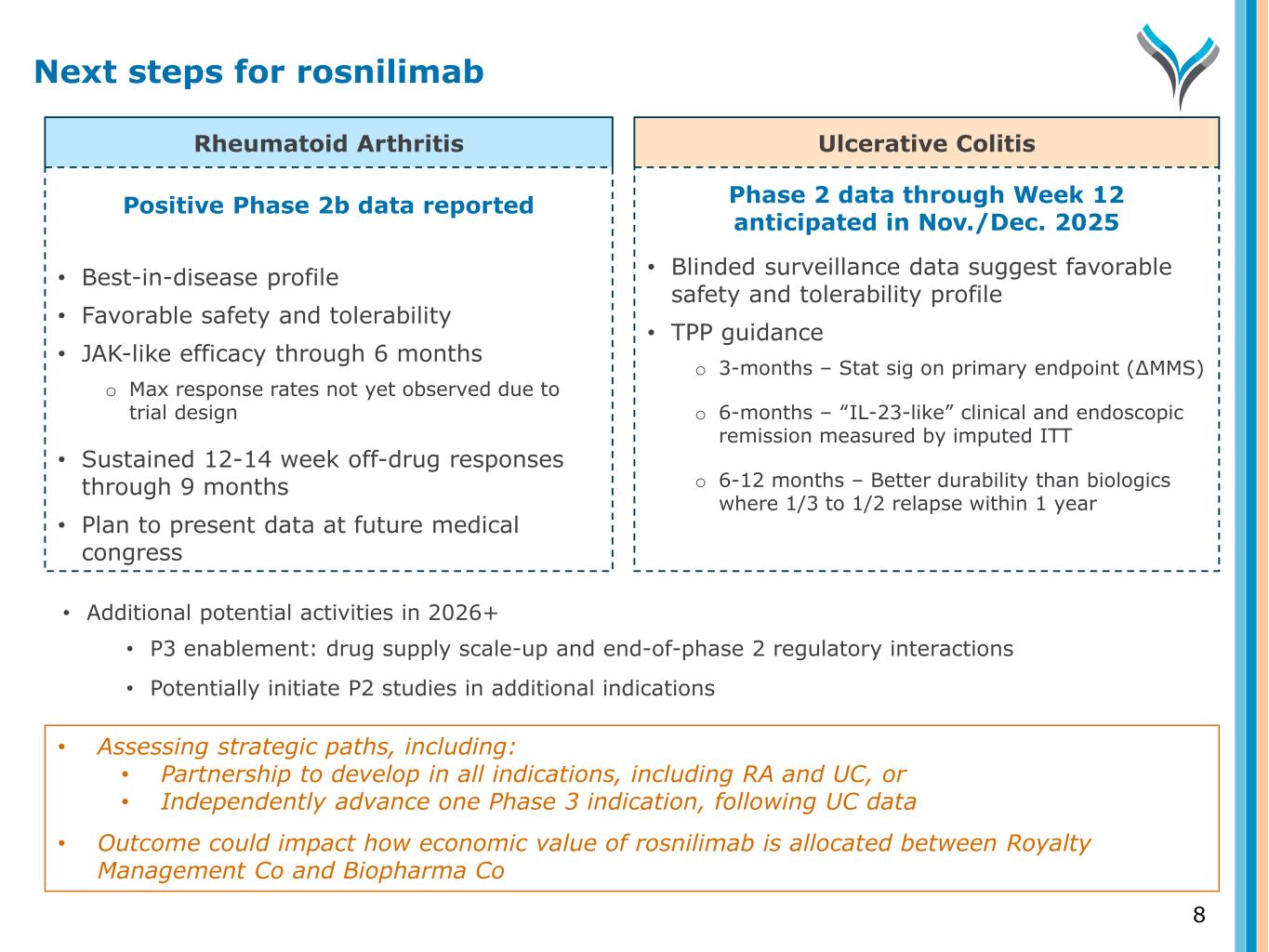

Rheumatoid Arthritis Ulcerative Colitis Positive Phase 2b data reported • Best-in-disease profile • Favorable safety and tolerability • JAK-like efficacy through 6 months o Max response rates not yet observed due to trial design • Sustained 12-14 week off-drug responses through 9 months • Plan to present data at future medical congress Phase 2 data through Week 12 anticipated in Nov./Dec. 2025 • Blinded surveillance data suggest favorable safety and tolerability profile • TPP guidance o 3-months – Stat sig on primary endpoint (∆MMS) o 6-months – “IL-23-like” clinical and endoscopic remission measured by imputed ITT o 6-12 months – Better durability than biologics where 1/3 to 1/2 relapse within 1 year • Additional potential activities in 2026+ • P3 enablement: drug supply scale-up and end-of-phase 2 regulatory interactions • Potentially initiate P2 studies in additional indications Next steps for rosnilimab 8 • Assessing strategic paths, including: • Partnership to develop in all indications, including RA and UC, or • Independently advance one Phase 3 indication, following UC data • Outcome could impact how economic value of rosnilimab is allocated between Royalty Management Co and Biopharma Co

9 • Anticipate separation of Biopharma Co will be completed by YE 2026 o Focused on minimizing overall corporate- and shareholder-level taxation across the entire transaction • Specific decisions regarding the structure, Board of Directors, leadership and financial operations of the two companies will be disclosed at a later time o Daniel Faga, president and CEO of Anaptys, is anticipated to be CEO of Biopharma Co • Completion subject to final approval by Anaptys’ Board of Directors and other customary conditions Additional information on the intended separation Potential transformative strategic advancement to unlock strong, sustainable growth and maximize the value recognized across these two sets of assets: the royalties and the biopharma development portfolio

Appendix 10

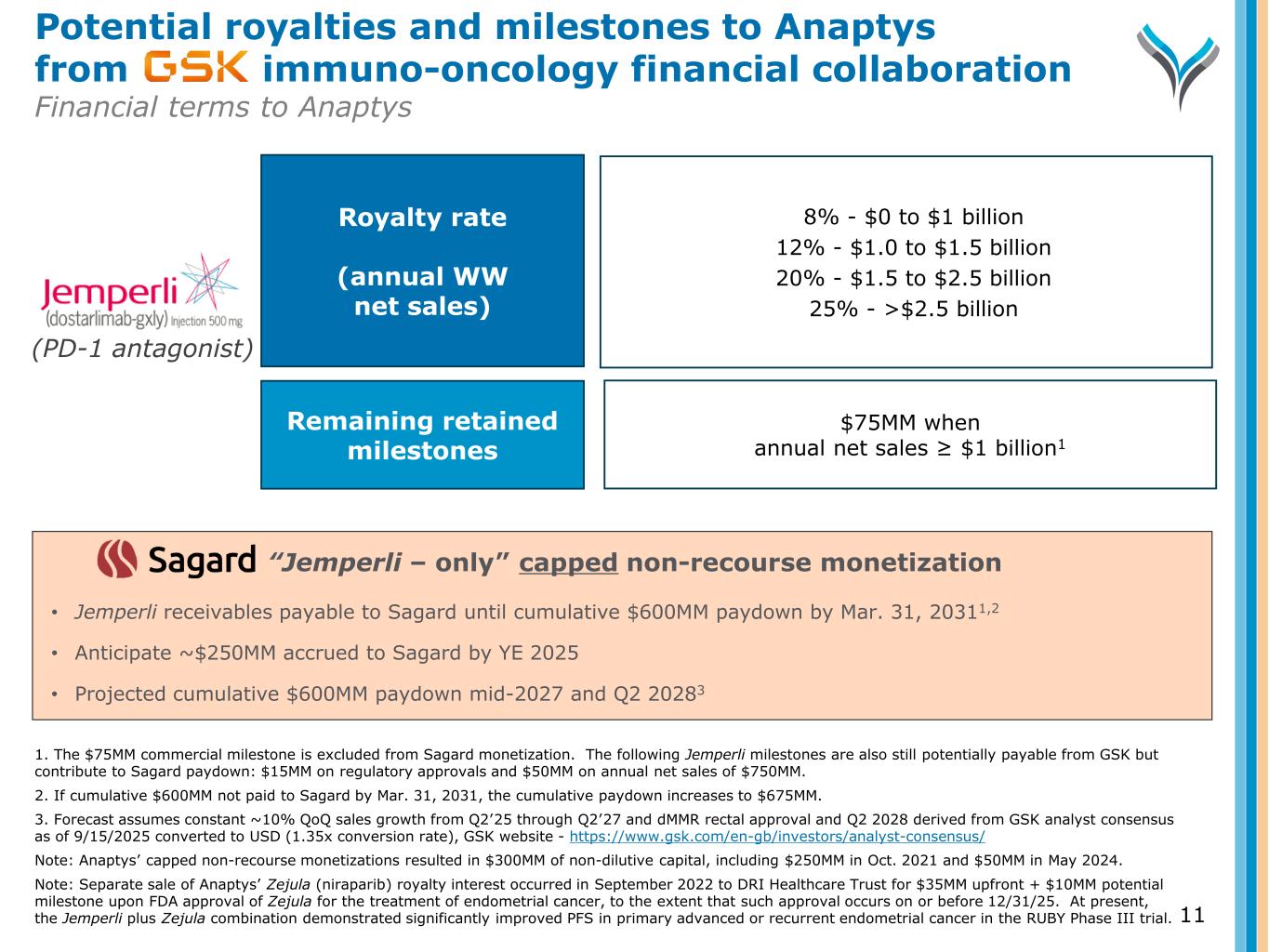

“Jemperli – only” capped non-recourse monetization • Jemperli receivables payable to Sagard until cumulative $600MM paydown by Mar. 31, 20311,2 • Anticipate ~$250MM accrued to Sagard by YE 2025 • Projected cumulative $600MM paydown mid-2027 and Q2 20283 Potential royalties and milestones to Anaptys from immuno-oncology financial collaboration Financial terms to Anaptys 11 1. The $75MM commercial milestone is excluded from Sagard monetization. The following Jemperli milestones are also still potentially payable from GSK but contribute to Sagard paydown: $15MM on regulatory approvals and $50MM on annual net sales of $750MM. 2. If cumulative $600MM not paid to Sagard by Mar. 31, 2031, the cumulative paydown increases to $675MM. 3. Forecast assumes constant ~10% QoQ sales growth from Q2’25 through Q2’27 and dMMR rectal approval and Q2 2028 derived from GSK analyst consensus as of 9/15/2025 converted to USD (1.35x conversion rate), GSK website - https://www.gsk.com/en-gb/investors/analyst-consensus/ Note: Anaptys’ capped non-recourse monetizations resulted in $300MM of non-dilutive capital, including $250MM in Oct. 2021 and $50MM in May 2024. Note: Separate sale of Anaptys’ Zejula (niraparib) royalty interest occurred in September 2022 to DRI Healthcare Trust for $35MM upfront + $10MM potential milestone upon FDA approval of Zejula for the treatment of endometrial cancer, to the extent that such approval occurs on or before 12/31/25. At present, the Jemperli plus Zejula combination demonstrated significantly improved PFS in primary advanced or recurrent endometrial cancer in the RUBY Phase III trial. (PD-1 antagonist) Royalty rate (annual WW net sales) Remaining retained milestones 8% - $0 to $1 billion 12% - $1.0 to $1.5 billion 20% - $1.5 to $2.5 billion 25% - >$2.5 billion $75MM when annual net sales ≥ $1 billion1

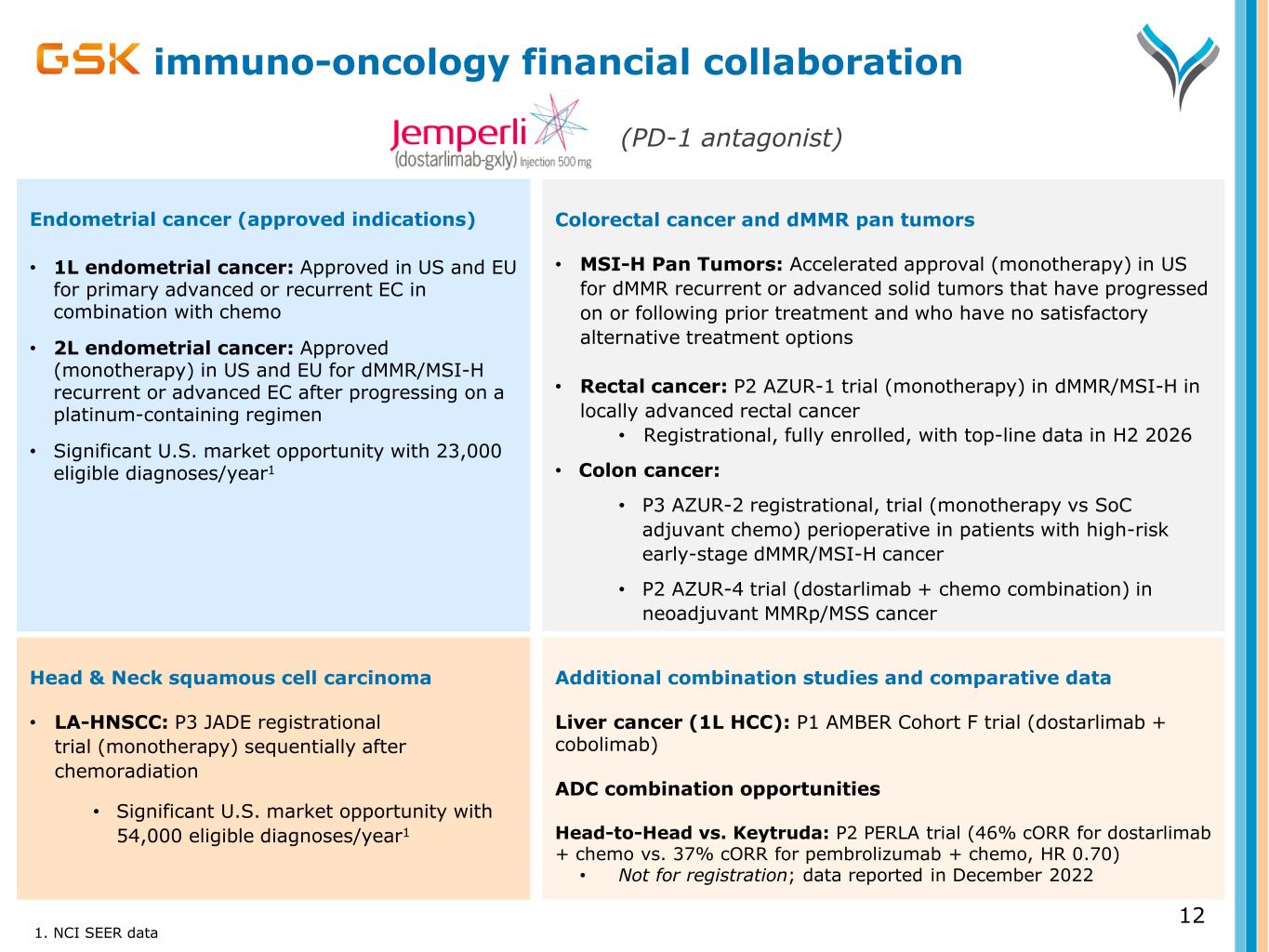

Head & Neck squamous cell carcinoma • LA-HNSCC: P3 JADE registrational trial (monotherapy) sequentially after chemoradiation • Significant U.S. market opportunity with 54,000 eligible diagnoses/year1 immuno-oncology financial collaboration Colorectal cancer and dMMR pan tumors • MSI-H Pan Tumors: Accelerated approval (monotherapy) in US for dMMR recurrent or advanced solid tumors that have progressed on or following prior treatment and who have no satisfactory alternative treatment options • Rectal cancer: P2 AZUR-1 trial (monotherapy) in dMMR/MSI-H in locally advanced rectal cancer • Registrational, fully enrolled, with top-line data in H2 2026 • Colon cancer: • P3 AZUR-2 registrational, trial (monotherapy vs SoC adjuvant chemo) perioperative in patients with high-risk early-stage dMMR/MSI-H cancer • P2 AZUR-4 trial (dostarlimab + chemo combination) in neoadjuvant MMRp/MSS cancer 1. NCI SEER data 12 Endometrial cancer (approved indications) • 1L endometrial cancer: Approved in US and EU for primary advanced or recurrent EC in combination with chemo • 2L endometrial cancer: Approved (monotherapy) in US and EU for dMMR/MSI-H recurrent or advanced EC after progressing on a platinum-containing regimen • Significant U.S. market opportunity with 23,000 eligible diagnoses/year1 (PD-1 antagonist) Additional combination studies and comparative data Liver cancer (1L HCC): P1 AMBER Cohort F trial (dostarlimab + cobolimab) ADC combination opportunities Head-to-Head vs. Keytruda: P2 PERLA trial (46% cORR for dostarlimab + chemo vs. 37% cORR for pembrolizumab + chemo, HR 0.70) • Not for registration; data reported in December 2022

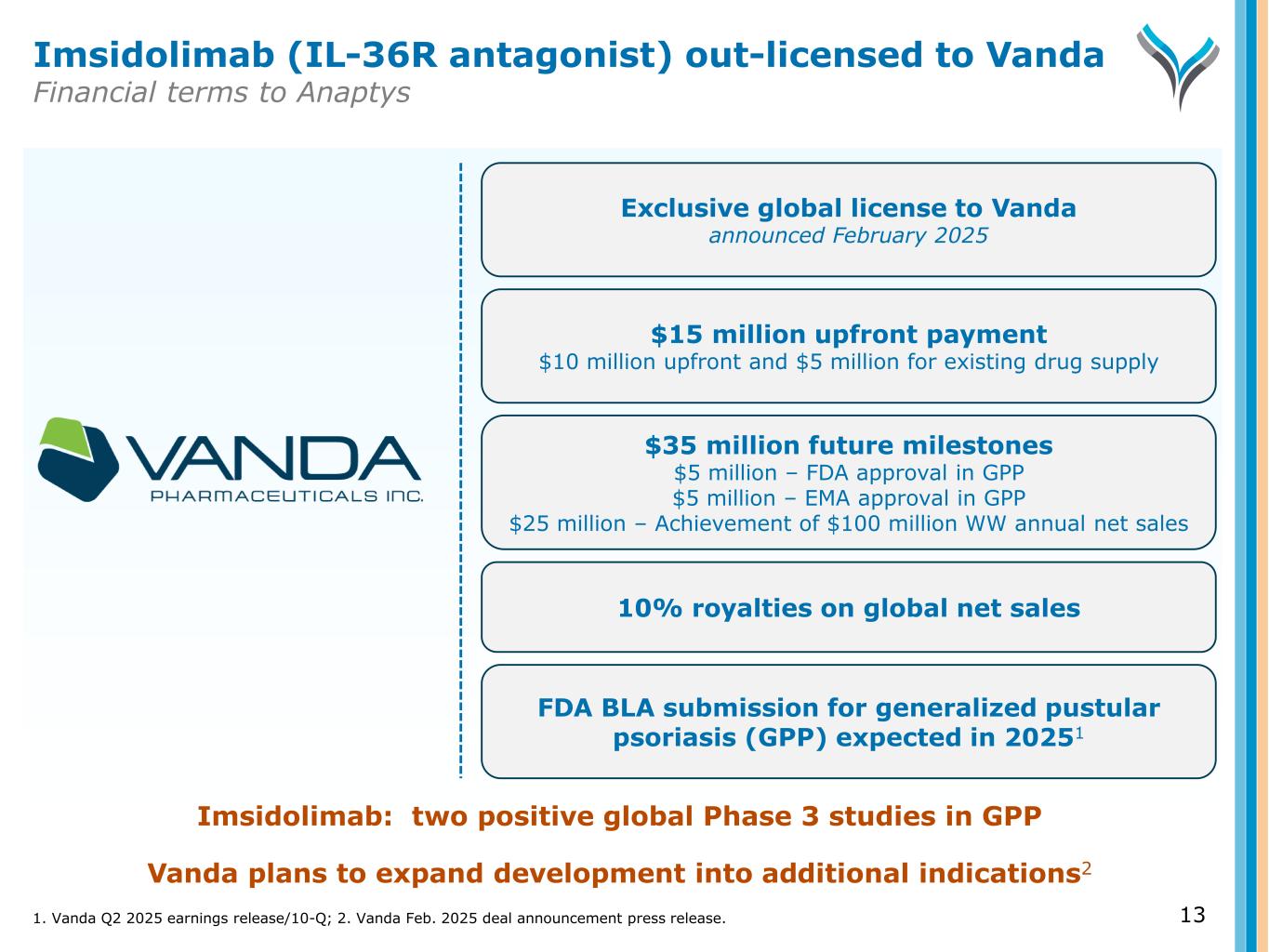

13 Exclusive global license to Vanda announced February 2025 $15 million upfront payment $10 million upfront and $5 million for existing drug supply 10% royalties on global net sales FDA BLA submission for generalized pustular psoriasis (GPP) expected in 20251 Imsidolimab: two positive global Phase 3 studies in GPP Vanda plans to expand development into additional indications2 Imsidolimab (IL-36R antagonist) out-licensed to Vanda Financial terms to Anaptys $35 million future milestones $5 million – FDA approval in GPP $5 million – EMA approval in GPP $25 million – Achievement of $100 million WW annual net sales 1. Vanda Q2 2025 earnings release/10-Q; 2. Vanda Feb. 2025 deal announcement press release.