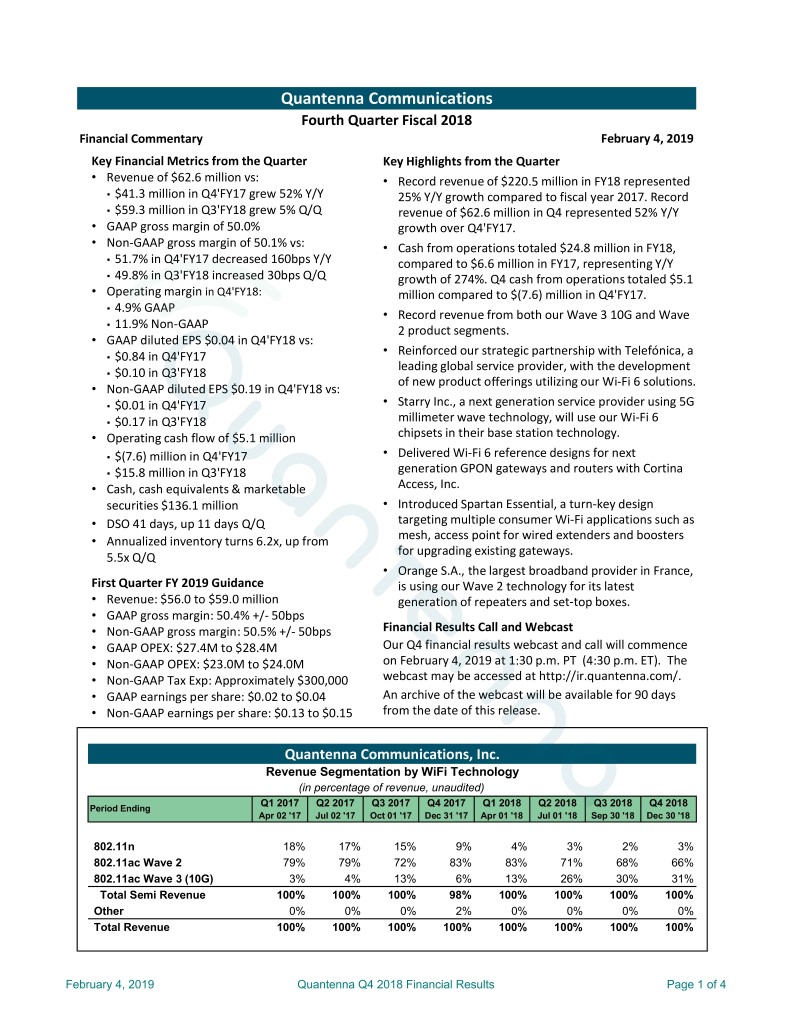

Quantenna Communications Fourth Quarter Fiscal 2018 Financial Commentary February 4, 2019 Key Financial Metrics from the Quarter Key Highlights from the Quarter • Revenue of $62.6 million vs: • Record revenue of $220.5 million in FY18 represented ▪ $41.3 million in Q4'FY17 grew 52% Y/Y 25% Y/Y growth compared to fiscal year 2017. Record ▪ $59.3 million in Q3'FY18 grew 5% Q/Q revenue of $62.6 million in Q4 represented 52% Y/Y • GAAP gross margin of 50.0% growth over Q4'FY17. • Non-GAAP gross margin of 50.1% vs: • Cash from operations totaled $24.8 million in FY18, ▪ 51.7% in Q4'FY17 decreased 160bps Y/Y compared to $6.6 million in FY17, representing Y/Y ▪ 49.8% in Q3'FY18 increased 30bps Q/Q growth of 274%. Q4 cash from operations totaled $5.1 • Operating margin in Q4'FY18: million compared to $(7.6) million in Q4'FY17. ▪ 4.9% GAAP • Record revenue from both our Wave 3 10G and Wave ▪ 11.9% Non-GAAP 2 product segments. • GAAP diluted EPS $0.04 in Q4'FY18 vs: • Reinforced our strategic partnership with Telefónica, a ▪ $0.84 in Q4'FY17 leading global service provider, with the development ▪ $0.10 in Q3'FY18 of new product offerings utilizing our Wi-Fi 6 solutions. • Non-GAAP diluted EPS $0.19 in Q4'FY18 vs: ▪ $0.01 in Q4'FY17 • Starry Inc., a next generation service provider using 5G ▪ $0.17 in Q3'FY18 millimeter wave technology, will use our Wi-Fi 6 • Operating cash flow of $5.1 million chipsets in their base station technology. ▪ $(7.6) million in Q4'FY17 • Delivered Wi-Fi 6 reference designs for next ▪ $15.8 million in Q3'FY18 generation GPON gateways and routers with Cortina • Cash, cash equivalents & marketable Access, Inc. securities $136.1 million • Introduced Spartan Essential, a turn-key design • DSO 41 days, up 11 days Q/Q targeting multiple consumer Wi-Fi applications such as • Annualized inventory turns 6.2x, up from mesh, access point for wired extenders and boosters for upgrading existing gateways. 5.5x Q/Q • Orange S.A., the largest broadband provider in France, First Quarter FY 2019 Guidance is using our Wave 2 technology for its latest • Revenue: $56.0 to $59.0 million generation of repeaters and set-top boxes. • GAAP gross margin: 50.4% +/- 50bps • Non-GAAP gross margin: 50.5% +/- 50bps Financial Results Call and Webcast • GAAP OPEX: $27.4M to $28.4M Our Q4 financial results webcast and call will commence • Non-GAAP OPEX: $23.0M to $24.0M on February 4, 2019 at 1:30 p.m. PT (4:30 p.m. ET). The • Non-GAAP Tax Exp: Approximately $300,000 webcast may be accessed at http://ir.quantenna.com/. • GAAP earnings per share: $0.02 to $0.04 An archive of the webcast will be available for 90 days • Non-GAAP earnings per share: $0.13 to $0.15 from the date of this release. Quantenna Communications, Inc. Revenue Segmentation by WiFi Technology (in percentage of revenue, unaudited) Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Period Ending Apr 02 '17 Jul 02 '17 Oct 01 '17 Dec 31 '17 Apr 01 '18 Jul 01 '18 Sep 30 '18 Dec 30 '18 802.11n 18% 17% 15% 9% 4% 3% 2% 3% 802.11ac Wave 2 79% 79% 72% 83% 83% 71% 68% 66% 802.11ac Wave 3 (10G) 3% 4% 13% 6% 13% 26% 30% 31% Total Semi Revenue 100% 100% 100% 98% 100% 100% 100% 100% Other 0% 0% 0% 2% 0% 0% 0% 0% Total Revenue 100% 100% 100% 100% 100% 100% 100% 100% February 4, 2019 Quantenna Q4 2018 Financial Results Page 1 of 4

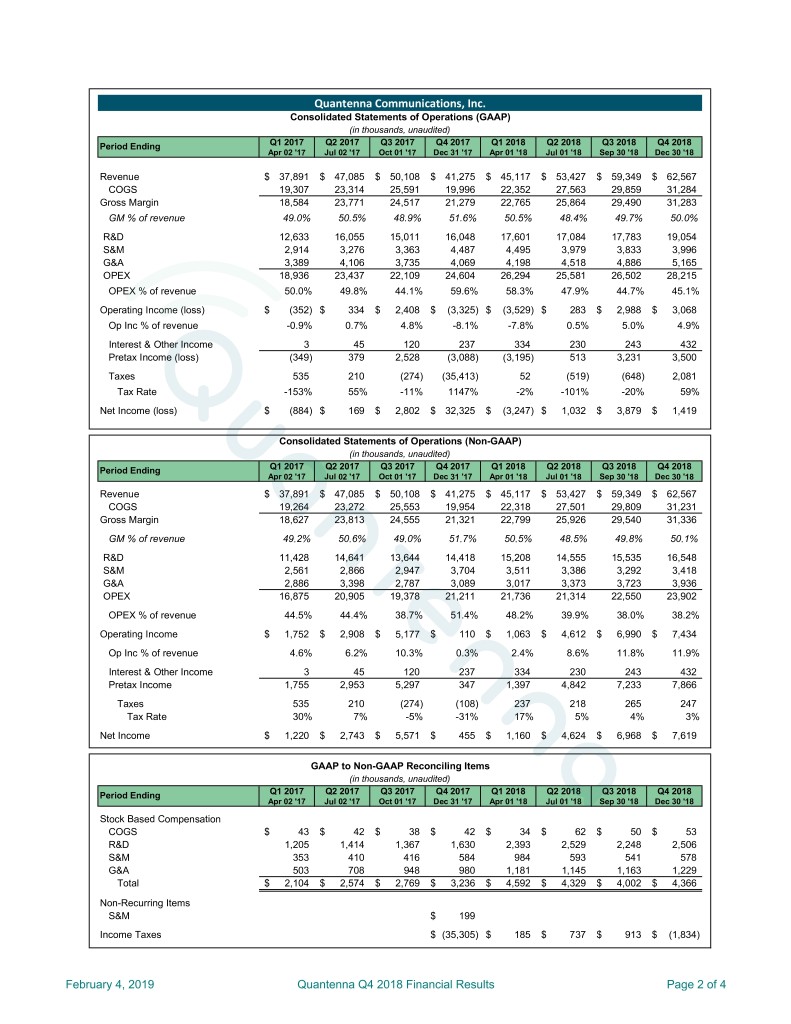

Quantenna Communications, Inc. Consolidated Statements of Operations (GAAP) (in thousands, unaudited) Period Ending Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Apr 02 '17 Jul 02 '17 Oct 01 '17 Dec 31 '17 Apr 01 '18 Jul 01 '18 Sep 30 '18 Dec 30 '18 Revenue 37,891$ 47,085$ 50,108$ 41,275$ 45,117$ 53,427$ 59,349$ 62,567$ COGS 19,307 23,314 25,591 19,996 22,352 27,563 29,859 31,284 Gross Margin 18,584 23,771 24,517 21,279 22,765 25,864 29,490 31,283 GM % of revenue 49.0% 50.5% 48.9% 51.6% 50.5% 48.4% 49.7% 50.0% R&D 12,633 16,055 15,011 16,048 17,601 17,084 17,783 19,054 S&M 2,914 3,276 3,363 4,487 4,495 3,979 3,833 3,996 G&A 3,389 4,106 3,735 4,069 4,198 4,518 4,886 5,165 OPEX 18,936 23,437 22,109 24,604 26,294 25,581 26,502 28,215 OPEX % of revenue 50.0% 49.8% 44.1% 59.6% 58.3% 47.9% 44.7% 45.1% Operating Income (loss) (352)$ 334$ 2,408$ (3,325)$ (3,529)$ 283$ 2,988$ 3,068$ Op Inc % of revenue -0.9% 0.7% 4.8% -8.1% -7.8% 0.5% 5.0% 4.9% Interest & Other Income 3 45 120 237 334 230 243 432 Pretax Income (loss) (349) 379 2,528 (3,088) (3,195) 513 3,231 3,500 Taxes 535 210 (274) (35,413) 52 (519) (648) 2,081 Tax Rate -153% 55% -11% 1147% -2% -101% -20% 59% Net Income (loss) (884)$ 169$ 2,802$ 32,325$ (3,247)$ 1,032$ 3,879$ 1,419$ Consolidated Statements of Operations (Non-GAAP) (in thousands, unaudited) Period Ending Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Apr 02 '17 Jul 02 '17 Oct 01 '17 Dec 31 '17 Apr 01 '18 Jul 01 '18 Sep 30 '18 Dec 30 '18 Revenue 37,891$ 47,085$ 50,108$ 41,275$ 45,117$ 53,427$ 59,349$ 62,567$ COGS 19,264 23,272 25,553 19,954 22,318 27,501 29,809 31,231 Gross Margin 18,627 23,813 24,555 21,321 22,799 25,926 29,540 31,336 GM % of revenue 49.2% 50.6% 49.0% 51.7% 50.5% 48.5% 49.8% 50.1% R&D 11,428 14,641 13,644 14,418 15,208 14,555 15,535 16,548 S&M 2,561 2,866 2,947 3,704 3,511 3,386 3,292 3,418 G&A 2,886 3,398 2,787 3,089 3,017 3,373 3,723 3,936 OPEX 16,875 20,905 19,378 21,211 21,736 21,314 22,550 23,902 OPEX % of revenue 44.5% 44.4% 38.7% 51.4% 48.2% 39.9% 38.0% 38.2% Operating Income 1,752$ 2,908$ 5,177$ 110$ 1,063$ 4,612$ 6,990$ 7,434$ Op Inc % of revenue 4.6% 6.2% 10.3% 0.3% 2.4% 8.6% 11.8% 11.9% Interest & Other Income 3 45 120 237 334 230 243 432 Pretax Income 1,755 2,953 5,297 347 1,397 4,842 7,233 7,866 Taxes 535 210 (274) (108) 237 218 265 247 Tax Rate 30% 7% -5% -31% 17% 5% 4% 3% Net Income 1,220$ 2,743$ 5,571$ 455$ 1,160$ 4,624$ 6,968$ 7,619$ GAAP to Non-GAAP Reconciling Items (in thousands, unaudited) Period Ending Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Apr 02 '17 Jul 02 '17 Oct 01 '17 Dec 31 '17 Apr 01 '18 Jul 01 '18 Sep 30 '18 Dec 30 '18 Stock Based Compensation COGS 43$ 42$ 38$ 42$ 34$ 62$ 50$ 53$ R&D 1,205 1,414 1,367 1,630 2,393 2,529 2,248 2,506 S&M 353 410 416 584 984 593 541 578 G&A 503 708 948 980 1,181 1,145 1,163 1,229 Total 2,104$ 2,574$ 2,769$ 3,236$ 4,592$ 4,329$ 4,002$ 4,366$ Non-Recurring Items S&M 199$ Income Taxes (35,305)$ 185$ 737$ 913$ (1,834)$ February 4, 2019 Quantenna Q4 2018 Financial Results Page 2 of 4

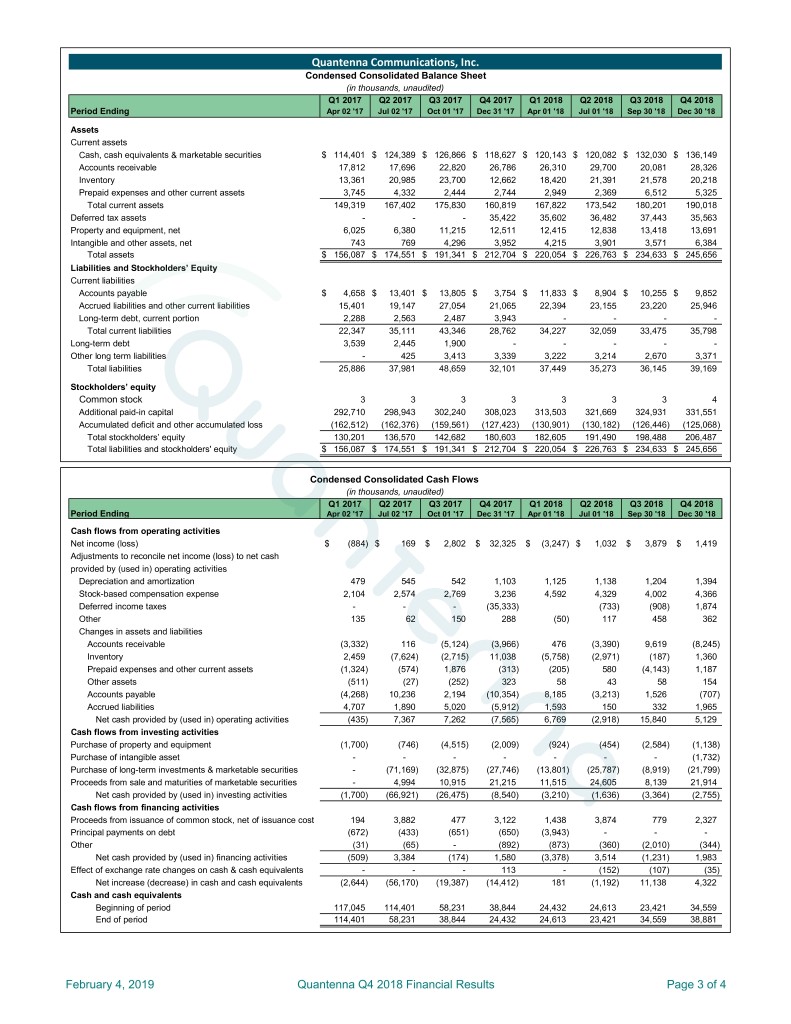

Quantenna Communications, Inc. Condensed Consolidated Balance Sheet (in thousands, unaudited) Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Period Ending Apr 02 '17 Jul 02 '17 Oct 01 '17 Dec 31 '17 Apr 01 '18 Jul 01 '18 Sep 30 '18 Dec 30 '18 Assets Current assets Cash, cash equivalents & marketable securities $ 114,401 $ 124,389 $ 126,866 $ 118,627 $ 120,143 $ 120,082 $ 132,030 $ 136,149 Accounts receivable 17,812 17,696 22,820 26,786 26,310 29,700 20,081 28,326 Inventory 13,361 20,985 23,700 12,662 18,420 21,391 21,578 20,218 Prepaid expenses and other current assets 3,745 4,332 2,444 2,744 2,949 2,369 6,512 5,325 Total current assets 149,319 167,402 175,830 160,819 167,822 173,542 180,201 190,018 Deferred tax assets - - - 35,422 35,602 36,482 37,443 35,563 Property and equipment, net 6,025 6,380 11,215 12,511 12,415 12,838 13,418 13,691 Intangible and other assets, net 743 769 4,296 3,952 4,215 3,901 3,571 6,384 Total assets $ 156,087 $ 174,551 $ 191,341 $ 212,704 $ 220,054 $ 226,763 $ 234,633 $ 245,656 Liabilities and Stockholders’ Equity Current liabilities Accounts payable $ 4,658 $ 13,401 $ 13,805 $ 3,754 $ 11,833 $ 8,904 $ 10,255 $ 9,852 Accrued liabilities and other current liabilities 15,401 19,147 27,054 21,065 22,394 23,155 23,220 25,946 Long-term debt, current portion 2,288 2,563 2,487 3,943 - - - - Total current liabilities 22,347 35,111 43,346 28,762 34,227 32,059 33,475 35,798 Long-term debt 3,539 2,445 1,900 - - - - - Other long term liabilities - 425 3,413 3,339 3,222 3,214 2,670 3,371 Total liabilities 25,886 37,981 48,659 32,101 37,449 35,273 36,145 39,169 Stockholders’ equity Common stock 3 3 3 3 3 3 3 4 Additional paid-in capital 292,710 298,943 302,240 308,023 313,503 321,669 324,931 331,551 Accumulated deficit and other accumulated loss (162,512) (162,376) (159,561) (127,423) (130,901) (130,182) (126,446) (125,068) Total stockholders’ equity 130,201 136,570 142,682 180,603 182,605 191,490 198,488 206,487 Total liabilities and stockholders' equity $ 156,087 $ 174,551 $ 191,341 $ 212,704 $ 220,054 $ 226,763 $ 234,633 $ 245,656 Condensed Consolidated Cash Flows (in thousands, unaudited) Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Period Ending Apr 02 '17 Jul 02 '17 Oct 01 '17 Dec 31 '17 Apr 01 '18 Jul 01 '18 Sep 30 '18 Dec 30 '18 Cash flows from operating activities Net income (loss) $ (884) 169$ 2,802$ 32,325$ $ (3,247) 1,032$ 3,879$ 1,419$ Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities Depreciation and amortization 479 545 542 1,103 1,125 1,138 1,204 1,394 Stock-based compensation expense 2,104 2,574 2,769 3,236 4,592 4,329 4,002 4,366 Deferred income taxes - - - (35,333) (733) (908) 1,874 Other 135 62 150 288 (50) 117 458 362 Changes in assets and liabilities Accounts receivable (3,332) 116 (5,124) (3,966) 476 (3,390) 9,619 (8,245) Inventory 2,459 (7,624) (2,715) 11,038 (5,758) (2,971) (187) 1,360 Prepaid expenses and other current assets (1,324) (574) 1,876 (313) (205) 580 (4,143) 1,187 Other assets (511) (27) (252) 323 58 43 58 154 Accounts payable (4,268) 10,236 2,194 (10,354) 8,185 (3,213) 1,526 (707) Accrued liabilities 4,707 1,890 5,020 (5,912) 1,593 150 332 1,965 Net cash provided by (used in) operating activities (435) 7,367 7,262 (7,565) 6,769 (2,918) 15,840 5,129 Cash flows from investing activities Purchase of property and equipment (1,700) (746) (4,515) (2,009) (924) (454) (2,584) (1,138) Purchase of intangible asset - - - - - - - (1,732) Purchase of long-term investments & marketable securities - (71,169) (32,875) (27,746) (13,801) (25,787) (8,919) (21,799) Proceeds from sale and maturities of marketable securities - 4,994 10,915 21,215 11,515 24,605 8,139 21,914 Net cash provided by (used in) investing activities (1,700) (66,921) (26,475) (8,540) (3,210) (1,636) (3,364) (2,755) Cash flows from financing activities Proceeds from issuance of common stock, net of issuance cost 194 3,882 477 3,122 1,438 3,874 779 2,327 Principal payments on debt (672) (433) (651) (650) (3,943) - - - Other (31) (65) - (892) (873) (360) (2,010) (344) Net cash provided by (used in) financing activities (509) 3,384 (174) 1,580 (3,378) 3,514 (1,231) 1,983 Effect of exchange rate changes on cash & cash equivalents - - - 113 - (152) (107) (35) Net increase (decrease) in cash and cash equivalents (2,644) (56,170) (19,387) (14,412) 181 (1,192) 11,138 4,322 Cash and cash equivalents Beginning of period 117,045 114,401 58,231 38,844 24,432 24,613 23,421 34,559 End of period 114,401 58,231 38,844 24,432 24,613 23,421 34,559 38,881 February 4, 2019 Quantenna Q4 2018 Financial Results Page 3 of 4

Quantenna Communications, Inc. Non-GAAP Financial Measures In addition to GAAP reporting, Quantenna provides information regarding net income, gross profit, gross margin, and operating expenses on a non-GAAP basis. This non-GAAP information excludes stock-based compensation expense and changes to deferred tax balances. These non-GAAP measures are used by the Company’s management for the purposes of evaluating the underlying operating performance of the Company, establishing internal budgets, comparing performance with internal forecasts and goals, strategic planning, benchmarking against other companies, to provide a more consistent basis of comparison and to enable more meaningful period to period comparisons. These non-GAAP measures are provided in addition to, and not as a substitute for, measures of financial performance prepared in accordance with GAAP. A reconciliation between GAAP and non-GAAP financial data is included in the supplemental financial tables included in this financial commentary. Forward-Looking Statements This financial commentary contains forward-looking statements based on Quantenna’s current expectations, including statements regarding Quantenna’s preliminary financial results for the fourth quarter and fiscal year 2018 ended December 30, 2018, forecasted financial results for the first quarter of fiscal 2019, expected future business and financial performance, growth opportunities, product technologies and customer relationships. The words "believe," "estimate," "expect," "intend," "anticipate," "plan," "project," "will" and similar phrases as they relate to Quantenna are intended to identify such forward-looking statements. These forward- looking statements reflect the current views and assumptions of Quantenna and are subject to various risks and uncertainties that could cause actual results to differ materially from expectations. Among the factors that could cause actual results to differ materially from those in the forward-looking statements are the following: challenges developing new and leading edge products on a timely basis that achieve market acceptance; quarterly fluctuations in revenues and operating results; risks and uncertainties related to international operations, including the impact of increased tariffs and escalating trade tensions with China directly and indirectly impacting Quantenna and its customers, end customers, vendors and partners; potential cancellation, delay or volatility of customer orders; intense market competition, including competition from other companies that are larger and have greater resources and broader product ecosystem offerings; ability to accurately predict future revenue and expenses; risks that Quantenna may not be able to maintain its historical growth or achieve similar levels of success with respect to new products; ability to attract and retain customers and service providers; dependence on a limited number of products and customers; the complexity of the products, including integration requirements with components from other third parties that are outside of Quantenna's control; intellectual property litigation risks; industry consolidation and risks associated with acquisitions, divestitures and strategic partnerships with respect to Quantenna as well as third parties; product liability risks; dependence of Quantenna's customers on components from other third parties; risks that Quantenna may not be able to manage strains associated with its growth; dependence on key personnel; stock price volatility; the cyclical nature of the semiconductor industry; changes in tax and other laws affecting Quantenna’s business and operations; cyberattacks; adjustments to the preliminary financial results reported in this financial commentary and related earnings call announcement and materials for the fourth quarter of 2018 in connection with completion of the final closing process and procedures and preparation of our preparation of our Annual Report on Form 10-K; and other factors that are detailed in the Securities and Exchange (“SEC”) filings of Quantenna, which you may obtain for free at the SEC’s website at http://www.sec.gov. Quantenna disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. About Quantenna Communications Quantenna (Nasdaq:QTNA) is the global leader and innovator of high performance Wi-Fi solutions. Founded in 2006, Quantenna has demonstrated its leadership in Wi-Fi technologies with many industry firsts. Quantenna continues to innovate with the mission to perfect Wi-Fi by establishing benchmarks for speed, range, efficiency and reliability. Quantenna takes a multidimensional approach, from silicon and system to software, and provides total Wi-Fi solutions. For more information, visit www.quantenna.com. February 4, 2019 Quantenna Q4 2018 Financial Results Page 4 of 4