Please wait

December 11, 2024

via EDGAR

Division of Corporation Finance

Office of Finance

SECURITIES AND EXCHANGE COMMISSION

100 F Street, NE

Washington, D.C. 20549

Attention: Cara Lubit

Robert Klein

Re: Trupanion, Inc.

Form 10-K for Fiscal Year Ended December 31, 2023

File No. 001-36537

Ladies and Gentlemen:

By letter dated October 28, 2024 (the “Comment Letter”), you provided comments on behalf of the staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) with respect to the Form 10-K for Fiscal Year Ended December 31, 2023 (the “Form 10-K”) of Trupanion, Inc. (the “Company”, “Trupanion”, “we”, “us” and “our”). Set forth below are Trupanion’s responses to the Staff’s comments in the Comment Letter. The Staff’s comments are retyped below in bold-face type for your ease of reference and are followed by Trupanion’s responses.

Form 10-K for the Fiscal Year Ended December 31, 2023

Revenue, page 46

1.We note your disclosure on page 45 describing your revenue streams, including subscription fees, writing policies on behalf of third parties, and insurance software solutions. We also note your disclosures elsewhere in the filing that reference revenues, such as but not limited to commissions (page 40), gross underwriting premiums (page 40), and sign-up fees (page 45). To help investors better understand your results of operation and the underlying reasons for material changes in quantitative and qualitative terms, please revise your future filings to address the items below. See Item 303 of Regulation S-K.

•Enhance your discussion of revenues to better define your different revenue streams. For example, define “subscription fees” and “premiums,” distinguishing between the two, if applicable, and explain all key revenue streams for each segments’ business.

•Where applicable, provide additional details regarding material revenue drivers for the periods presented and the business(es) to which these apply. For example, if

TRUPANION.COM | 855.372.6704

Trupanion is a registered trademark owned by Trupanion, Inc. Underwritten in Canada by Accelerant Insurance Company of Canada, and in the United States by American Pet Insurance Company or ZPIC Insurance Company, 6100 4th Ave S, Seattle, WA 98108.

commissions and premiums are material contributors to subscription and / or other business revenues, separately quantify and discuss trends for these items.

Company Response:

The Company respectfully acknowledges the Staff’s comments. Trupanion generates revenue in its Subscription Business segment through the following means:

•Subscription fees from direct-to-consumer medical insurance products for cats and dogs, typically paid monthly. The Company has historically used the terms “subscription fees” and “insurance premiums” interchangeably for insurance policies administered and underwritten by the Company in this segment. Revenue is recognized pro-rata over the insurance policy term in accordance with Accounting Standards Codification (“ASC”) 944. For the year ended December 31, 2023, total subscription fees were $705.6 million, or 63.6% of total consolidated revenue.

•Sign-up fees, a one-time charge to new members collected at the time of enrollment to partially offset initial setup costs. As explained in in our response to Comment 4 in the separate letter from the Staff dated May 2, 2019, the Company has concluded that the sign-up fees included within the insurance contract are related to the fulfillment of Trupanion’s obligation to provide insurance coverage and are recognized over the policy term consistent with ASC 944-605. As disclosed on page 45 of the Form 10-K, for the year ended December 31, 2023, sign-up fee revenue was $4.5 million, or 0.4% of total consolidated revenue.

•Commissions earned through insurance policies underwritten by third parties, for which the Company currently serves as an agent to sell and service these policies. Commission revenue is recognized in accordance with ASC 606. For the year ended December 31, 2023, commission revenue was $2.7 million, or 0.2% of total consolidated revenue.

Our Other Business segment generates revenue from other product offerings with third parties with whom we generally have a business-to-business relationship. This business segment has a different margin profile than our Subscription segment and includes revenues from:

•Insurance premiums from underwriting policies on behalf of an unaffiliated general agent, as well as other miscellaneous pet medical insurance policies. Revenue is recognized pro-rata over the insurance policy term in accordance with ASC 944. For the year ended December 31, 2023, revenue from underwriting these policies was $393.2 million, or 35.5% of total consolidated revenue.

•Sales of insurance software solutions, which are recognized in accordance with ASC 606. For the year ended December 31, 2023, revenue from these sales was $2.5 million, or 0.2% of total consolidated revenue.

The Company has added certain clarifications of its various revenue streams in its latest Form 10-Q for the quarterly period ended September 30, 2024. In future filings with the Commission, the Company will, for each of its segments, (i) enhance its disclosures to better define and explain its revenue streams as discussed above, and (ii) where applicable, provide additional details regarding material revenue drivers.

Note 10. Reserve for Veterinary Invoices, page 80

2.We note your disclosures on page 81 that period-over-period favorable and unfavorable development for the subscription and other business segments is attributable to ongoing

TRUPANION.COM | 855.372.6704

Trupanion is a registered trademark owned by Trupanion, Inc. Underwritten in Canada by Accelerant Insurance Company of Canada, and in the United States by American Pet Insurance Company or ZPIC Insurance Company, 6100 4th Ave S, Seattle, WA 98108.

analysis of recent payment trends. In future filings, please enhance your disclosures to include more detail on recent payment trends, and to provide more detailed discussion, with quantification, of period-over-period changes and trends in claim severity, frequency, average settlement time or other underlying drivers.

Company Response:

The Company respectfully acknowledges the Staff’s comment. The Company uses generally accepted actuarial methodologies, such as paid loss development methods, in estimating the amount of the reserve for veterinary invoices. The reserve is made for each of the Company's segments (the Subscription Business segment and the Other Business segment), and it is continually refined as the Company receives and pays veterinary invoices.

In future filings with the Commission, the Company will enhance its disclosure to include more detail on recent payment trends, including discussion and quantification of period-over-period changes and trends in underlying drivers, to the extent material. An example of such disclosure using the year ended December 31, 2023 is as follows:

"The Company had unfavorable development on veterinary invoice reserves for the Subscription Business segment of $2.8 million for the year ended December 31, 2023, including $1.3 million attributable to accident year 2022 and $1.5 million attributable to accident year 2021 and prior. The unfavorable development for accident year 2022 was primarily driven by slower reporting of claims than anticipated, in addition to severity trending higher than initially expected. The unfavorable development for accident year 2021 and prior was primarily driven by higher than anticipated frequency of claims."

3.We note your inclusion of “Non-cash expenses” in your reserve roll-forwards on page 81. In future filings, please provide a definition and explanation of what these amounts represent.

Company Response:

The Company respectfully acknowledges the Staff’s comment. The referenced non-cash expenses are primarily comprised of stock-based compensation expense for employees performing claims processing related duties. The Company has included the explanation of these non-cash expenses in its latest Form 10-Q for the quarterly period ended September 30, 2024, and will continue to disclose the nature of these expenses in future filings with the Commission.

Note 15. Segments, page 88

4.We note your disclosure that the Company has two aggregated reporting segments and, further, that the subscription business segment consists of products that have similar target margin profiles. Please clarify for us if the Company has multiple operating segments that aggregate into the two reportable segments and, if so, provide us with a summary of the Company's identified operating segments. To the extent that the Company is aggregating or combining multiple operating segments in determining your reportable segments pursuant to ASC 280-10-50-10 through 50-13, provide us with your aggregation analysis. In your

TRUPANION.COM | 855.372.6704

Trupanion is a registered trademark owned by Trupanion, Inc. Underwritten in Canada by Accelerant Insurance Company of Canada, and in the United States by American Pet Insurance Company or ZPIC Insurance Company, 6100 4th Ave S, Seattle, WA 98108.

analysis, please compare and contrast the similarity of the economic characteristics between the aggregated operating segments, and address each of the areas listed in ASC 280-10-50-11a to 11e.

Company Response:

The Company respectfully acknowledges the Staff’s comment. The Company’s segment analysis begins with the identification of our chief operating decision maker (“CODM”). Decisions surrounding the allocation of resources and the assessment of operating results of the Company’s operating segments for the year ended December 31, 2023 were made by our Chief Executive Officer and our President. As such, the Company determined these members of leadership collectively were the CODM during 2023.

The Company then analyzes our lines of business and products to determine operating segments utilizing the guidance provided by ASC 280-10-50-1, which states that “an operating segment is a component of a public entity that has all of the following characteristics:

a.It engages in business activities from which it may recognize revenues and incur expenses (including revenues and expenses relating to transactions with other components of the same public entity).

b.Its operating results are regularly reviewed by the public entity’s chief operating decision maker to make decisions about resources to be allocated to the segment and assess its performance.

c.Its discrete financial information is available.”

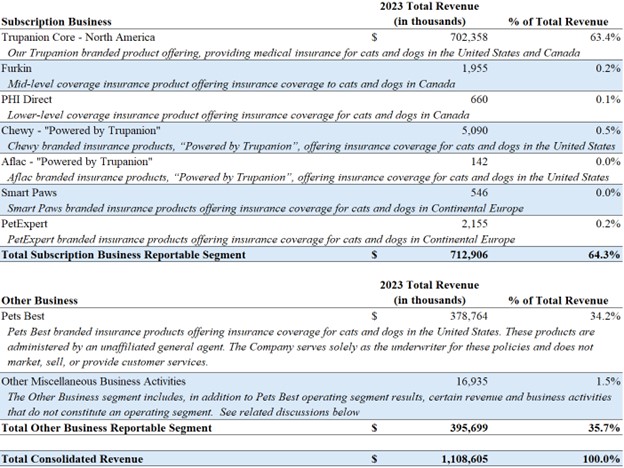

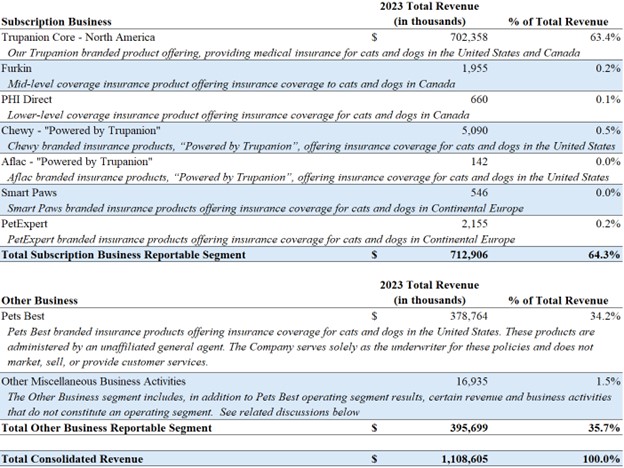

For the year ended December 31, 2023, the Company determined that it had eight individual operating segments, aggregated into two reportable segments identified as the Subscription Business segment and the Other Business segment, as discussed further below and illustrated as follows:

TRUPANION.COM | 855.372.6704

Trupanion is a registered trademark owned by Trupanion, Inc. Underwritten in Canada by Accelerant Insurance Company of Canada, and in the United States by American Pet Insurance Company or ZPIC Insurance Company, 6100 4th Ave S, Seattle, WA 98108.

For the year ended December 31, 2023, “Trupanion Core – North America” accounted for 98.5% of total revenue and 97.5% of total operating costs in the Subscription Business segment. The other six subscription product lines listed above were either organically developed (Furkin, PHI Direct, Chewy – Powered by Trupanion, and Aflac – Powered by Trupanion), or acquired (Smart Paws, and PetExpert) by the Company within the past four years. Although none of them were yet operating at scale in 2023, each engaged in business activities from which we recognized revenues and incurred expenses. Their discrete financial information was tracked and reported to our CODM, and our CODM regularly reviewed their performance to monitor their development and growth. The Company determined that each of them constituted a separate operating segment in 2023, in application of ASC 280-10-50-1 and in recognition of the points described above.

The Other Business segment has a different margin profile, and is operationally and financially different for the Company, as compared to the Company’s Subscription Business segment. The Other Business segment generates revenue and incurs operating expenses primarily from underwriting policies on behalf of Pets Best, a third-party general insurance agent. The Company does not undertake marketing efforts for these policies and has a business-to-business relationship with Pets Best. The Other Business segment also includes other pet health insurance products and miscellaneous insurance software solutions. They have notably different operating features and margins. Our CODM does not review their performance on a regular basis. The Company determines that they do not meet the criteria to be identified as operating segments. Collectively, the total revenue from these business activities accounted for 1.5% of the

TRUPANION.COM | 855.372.6704

Trupanion is a registered trademark owned by Trupanion, Inc. Underwritten in Canada by Accelerant Insurance Company of Canada, and in the United States by American Pet Insurance Company or ZPIC Insurance Company, 6100 4th Ave S, Seattle, WA 98108.

Company’s total consolidated revenue for the year ended December 31, 2023. Overall, the Other Business segment plays a secondary role in the Company's operations, as the primary focus remains on the Subscription Business. The Company concluded that combining the operating results of these business activities with the results of the Pets Best operating segment in the Other Business reporting segment would not have a material impact on its segment reporting conclusions or related disclosures.

Following the identification of our operating segments, the Company assesses each operating segment for aggregation into reportable segments utilizing the guidance provided by ASC 280-10-50-11. All seven operating segments within the Subscription Business reportable segment offer insurance products for cats and dogs that are designed to provide the Company with a 15% adjusted operating margin (a non-GAAP metric used by our CODM to assess performance) when operating at scale. Reaching what we consider operating scale can take time in the underpenetrated pet health insurance market as we work to enroll a sufficient base of insured pets. However, with our cost-plus pricing model (wherein we price each of these products based on estimated operating costs and expenses, including veterinary invoice expenses), we developed and ultimately expect the six newer operating segments to achieve a similar long-term target margin (15% of adjusted operating income) to our “Trupanion Core – North America” operating segment.

In addition to economic similarities, the Company evaluated the five qualitative characteristics outlined in ASC 280-10-50-11, as follows:

a.The nature of the products and services

All seven operating segments within our Subscription Business reportable segment offer short-duration insurance policies for cats and dogs.

b.The nature of the production process for all segments

Except for the recently acquired Smart Paws and PetExpert, all of our operating segments are underwritten, or reinsured, by insurance entities wholly owned by the Company. The Company maintains all insurance risk with these policies and directly administers insurance premiums and claims.

We acquired the Smart Paws and PetExpert operating segments in 2022. These segments operate in Europe and currently generate revenue from commissions earned on policies underwritten by third parties. For the year ended December 31, 2023, commission revenue was $2.7 million, or 0.2% of total consolidated revenue. The Company plans to underwrite these products similar to other Trupanion subscription products in future years, at which time they are expected to perform in-line with “Trupanion Core – North America”, as noted above.

c.The type or class of customer for their products and services

The type of customer for all seven of these operating segments is individual cat and dog owners seeking insurance coverage to assist with their pet’s medical bills.

d.The methods used to distribute their products or provide their services

All seven of these operating segments market and distribute their products directly to consumers or maintain a direct-to-consumer connection. We may use various channels to generate leads, but

TRUPANION.COM | 855.372.6704

Trupanion is a registered trademark owned by Trupanion, Inc. Underwritten in Canada by Accelerant Insurance Company of Canada, and in the United States by American Pet Insurance Company or ZPIC Insurance Company, 6100 4th Ave S, Seattle, WA 98108.

the Company is ultimately responsible for providing direct support for these products, including claims administration and customer services.

e.If applicable, the nature of regulatory environment, for example, banking, insurance, or public utilities

All of our operating segments are subject to pet health insurance regulations and comply with local insurance laws, regulations and guidelines.

In summary, the Company concluded the following for the year ended December 31, 2023:

•The Company had eight operating segments.

•The Company aggregated seven operating segments into one reporting segment (Subscription Business) according to ASC 280-10-50-11.

•The Pets Best operating segment was combined with other miscellaneous business activities into a second reporting segment (Other Business).

We acknowledge the judgment involved in considering the Company’s evolving business lines and products in light of the ASC guidance. In this context, the Company separately assessed and concluded that the operating results of the six newer operating segments were not material—collectively less than 1% of total consolidated revenue and less than 2% of total consolidated operating expenses.

The Company acknowledges its responsibility to continuously monitor its segment conclusions for future filings. We will continue to monitor the operations and performance of our business lines and products, and our CODM’s process for review of the financial results of our business, including the assessment of performance and process for allocating resources, and we will adjust our segment disclosures as appropriate.

Please let us know if you would like any additional information about this comment. Please do not hesitate to contact Chris Kearns at +1 (855) 727-9079 or chris.kearns@trupanion.com.

Very truly yours,

/s/ Chris Kearns

Chris Kearns, General Counsel

cc: Margaret Tooth, Chief Executive Officer

Fawwad Qureshi, Chief Financial Officer

TRUPANION.COM | 855.372.6704

Trupanion is a registered trademark owned by Trupanion, Inc. Underwritten in Canada by Accelerant Insurance Company of Canada, and in the United States by American Pet Insurance Company or ZPIC Insurance Company, 6100 4th Ave S, Seattle, WA 98108.