David flynn CEO All hands meeting June 26, 2019 .2

Important Additional Information and Where to Find It In connection with the proposed acquisition of Aerohive Networks, Inc. (“Aerohive Networks”) by Extreme Networks, Inc. (“Extreme Networks”), Clover Merger Sub, Inc., a wholly-owned subsidiary of Extreme Networks (“Purchaser”) will commence a tender offer for all of the outstanding shares of Aerohive Networks. The tender offer has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Aerohive Networks, nor is it a substitute for the tender offer materials that Extreme Networks and Purchaser will file with the SEC upon commencement of the tender offer. At the time that the tender offer is commenced, Extreme Networks and Purchaser will file tender offer materials on Schedule TO with the SEC, and Aerohive Networks will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BY AEROHIVE NETWORKS’ STOCKHOLDERS BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Both the tender offer statement and the solicitation/recommendation statement will be made available to Aerohive Networks’ stockholders free of charge. A free copy of the tender offer statement and the solicitation/recommendation statement will also be made available to all stockholders of Aerohive Networks by contacting Aerohive Networks at ir@aerohive.com or by phone at 1-408-769-6720, or by visiting Aerohive Networks’ website (https://ir.aerohive.com/inforequest). In addition, the tender offer statement and the solicitation/recommendation statement (and all other documents filed with the SEC) will be available at no charge on the SEC’s website (www.sec.gov) upon filing with the SEC. AEROHIVE NETWORKS’ STOCKHOLDERS ARE ADVISED TO READ THE TENDER OFFER STATEMENT AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE TRANSACTION.

Forward-Looking Statements This communication may contain forward-looking statements made in reliance upon the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, but not limited to any statements regarding or relating to the transaction between Aerohive Networks, Extreme Networks, and Purchaser; any statements of expectation or belief; any statement regarding the future financial performance of Aerohive Networks; and any statements of assumptions underlying any of the foregoing. When used in this communication, the words “anticipate”, “believe”, “estimate”, “expect”, “expectation”, “goal”, “should”, “would”, “project”, “plan”, “predict”, “intend”, “target” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to Aerohive Networks and are subject to a number of risks, uncertainties and other factors that could cause results to differ from expectations include, but are not limited to: (i) uncertainties as to the timing of the tender offer and the merger; (ii) uncertainties as to how many of the holders of shares will tender their shares into the tender offer; (iii) the possibility that various closing conditions for the tender offer or the merger may not be satisfied or waived; (iv) legal proceedings that may be instituted against Aerohive Networks and others following announcement of the definitive agreement entered into with Extreme Networks and Purchaser; (v) other business effects, including the effects of industrial, economic or political conditions outside of Aerohive Networks’ control; (vi) transaction costs and/or actual or contingent liabilities; and (vii) other risks and uncertainties. Although Aerohive Networks believes that the expectations reflected in the forward-looking statements are reasonable, Aerohive Networks cannot guarantee future results, performance or achievements and no assurance can be given that the actual results will be consistent with these forward-looking statements. Aerohive Networks does not intend to update any of the forward-looking statements after the date of this communication to conform these statements to actual results, to changes in management's expectations or otherwise, except as may be required by law.

The News Ed Meyercord, CEO Extreme Networks Timeline, transitions and implications Nabil Bukhari (Products), Erik Broockman (CTO), and Dean Chabrier (People) Next steps Agenda

Today Extreme Networks and Aerohive Networks announced that they have signed a definitive agreement for Extreme to acquire Aerohive Adds critical Cloud-Management and edge capabilities to Extreme’s portfolio of end-to-end, edge to cloud networking solutions Provides a strong subscription revenue stream Strengthens the company’s position in wireless LAN at a critical technology transition to Wi-Fi 6 Consideration: $4.45 per share, $272M purchase price Acquisition targeted to Close in August The news

Ed meyercord CEO, Extreme networks

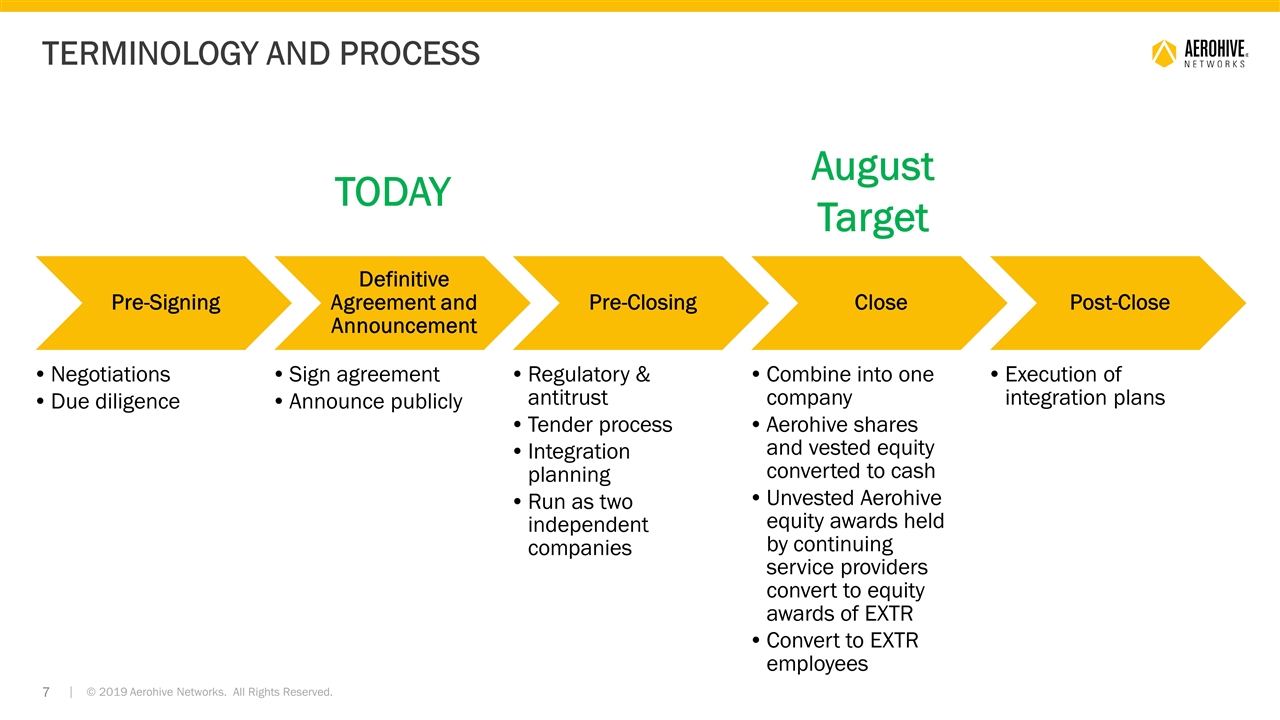

Terminology and process TODAY August Target Pre-Signing Definitive Agreement and Announcement Pre-Closing Close Post-Close Negotiations Due diligence Sign agreement Announce publicly Regulatory & antitrust Tender process Integration planning Combine into one company Run as two independent companies Execution of integration plans Aerohive shares and vested equity converted to cash Unvested Aerohive equity awards held by continuing service providers convert to equity awards of EXTR Convert to EXTR employees

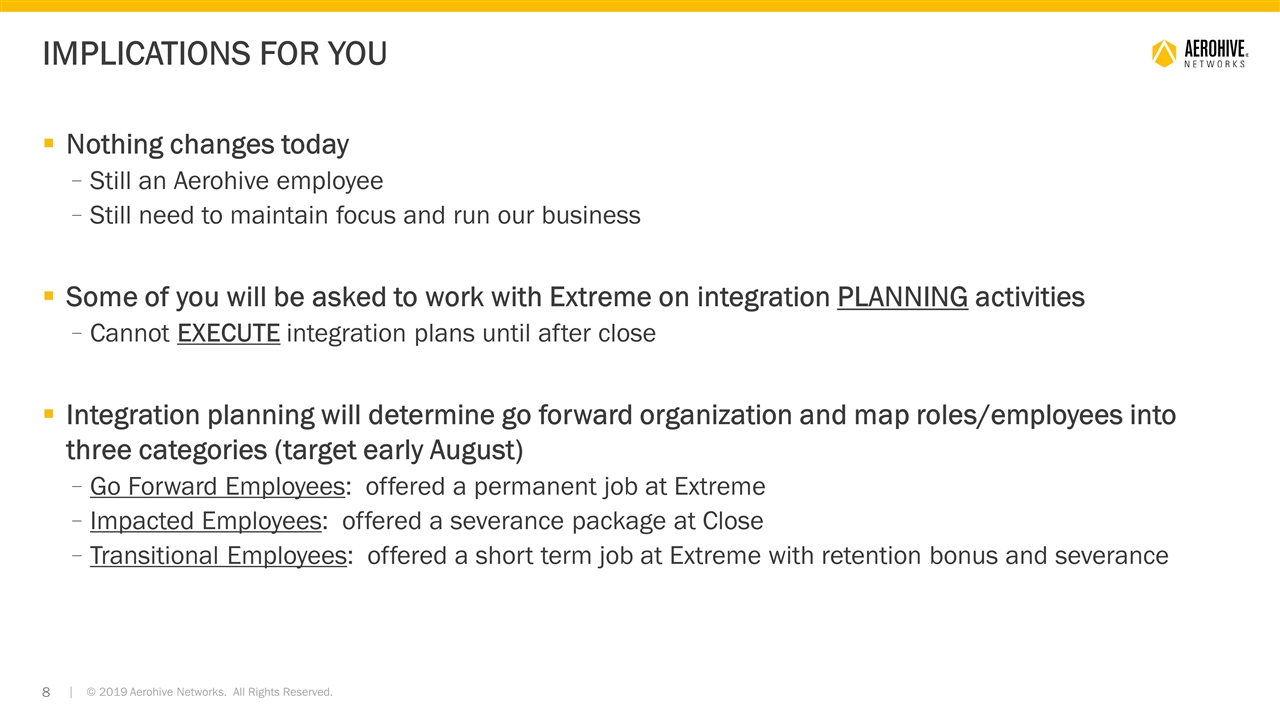

Nothing changes today Still an Aerohive employee Still need to maintain focus and run our business Some of you will be asked to work with Extreme on integration PLANNING activities Cannot EXECUTE integration plans until after close Integration planning will determine go forward organization and map roles/employees into three categories (target early August) Go Forward Employees: offered a permanent job at Extreme Impacted Employees: offered a severance package at Close Transitional Employees: offered a short term job at Extreme with retention bonus and severance Implications for you

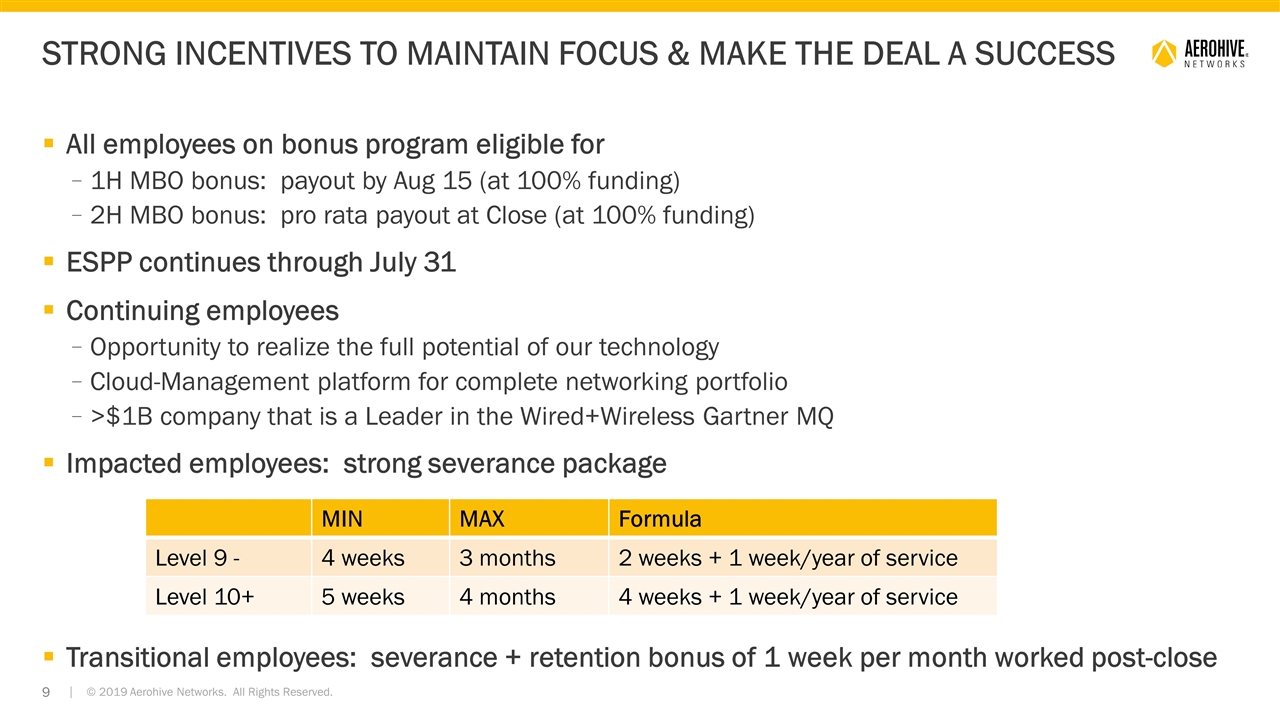

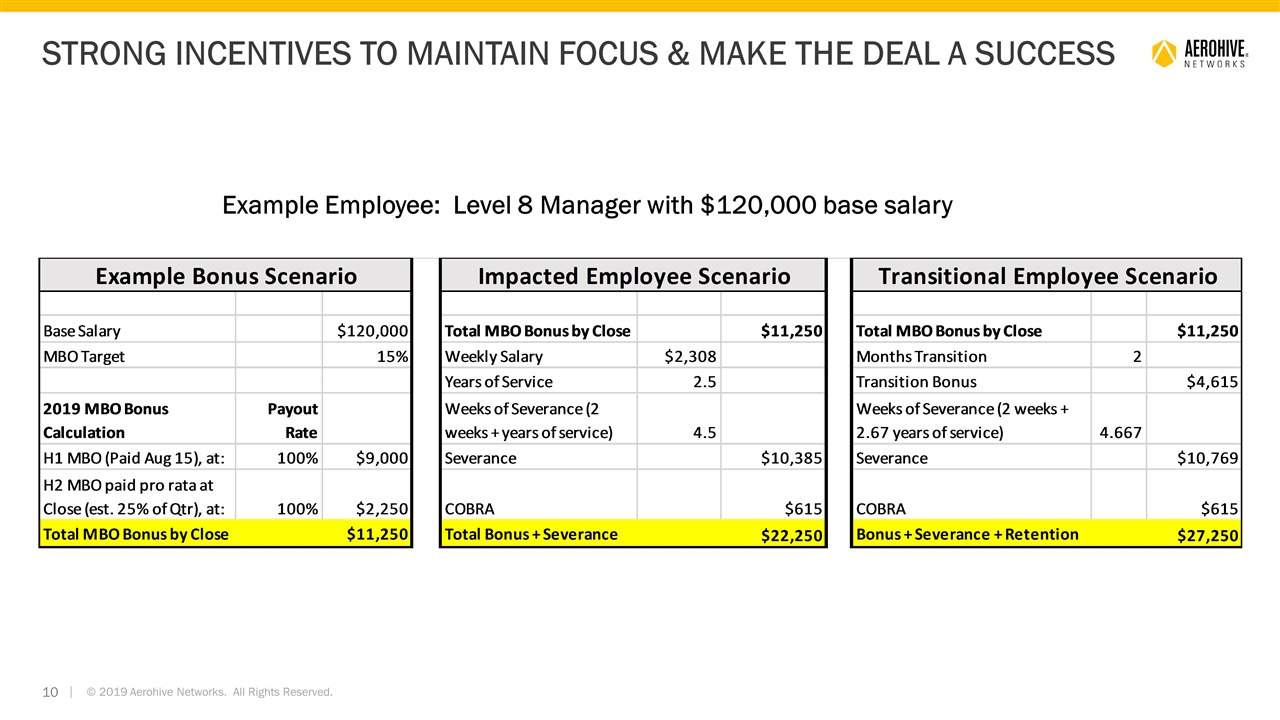

All employees on bonus program eligible for 1H MBO bonus: payout by Aug 15 (at 100% funding) 2H MBO bonus: pro rata payout at Close (at 100% funding) ESPP continues through July 31 Continuing employees Opportunity to realize the full potential of our technology Cloud-Management platform for complete networking portfolio >$1B company that is a Leader in the Wired+Wireless Gartner MQ Impacted employees: strong severance package Transitional employees: severance + retention bonus of 1 week per month worked post-close Strong incentives to maintain focus & make the deal a success MIN MAX Formula Level 9 - 4 weeks 3 months 2 weeks + 1 week/year of service Level 10+ 5 weeks 4 months 4 weeks + 1 week/year of service

Strong incentives to maintain focus & make the deal a success Example Employee: Level 8 Manager with $120,000 base salary

Nabil Bukhari (Products) Eric Broockman (CTO) Dean chabrier (People) Extreme networks

Strong finish to Q2. Let’s make it a great quarter! Keep running the business – we are still Aerohive until the Close Reach out to customers, partners and suppliers to update them on the exciting news Reassure them as to Extreme’s commitment to our product offering and the potential for the combined company Join us for a live All Hands and Q&A with Ed Meyercord at Aerohive on July 8 Submit any questions to Valerie and we will answer what we can either there or via email Going forward