Investor Outreach May 22, 2025 Annual Meeting

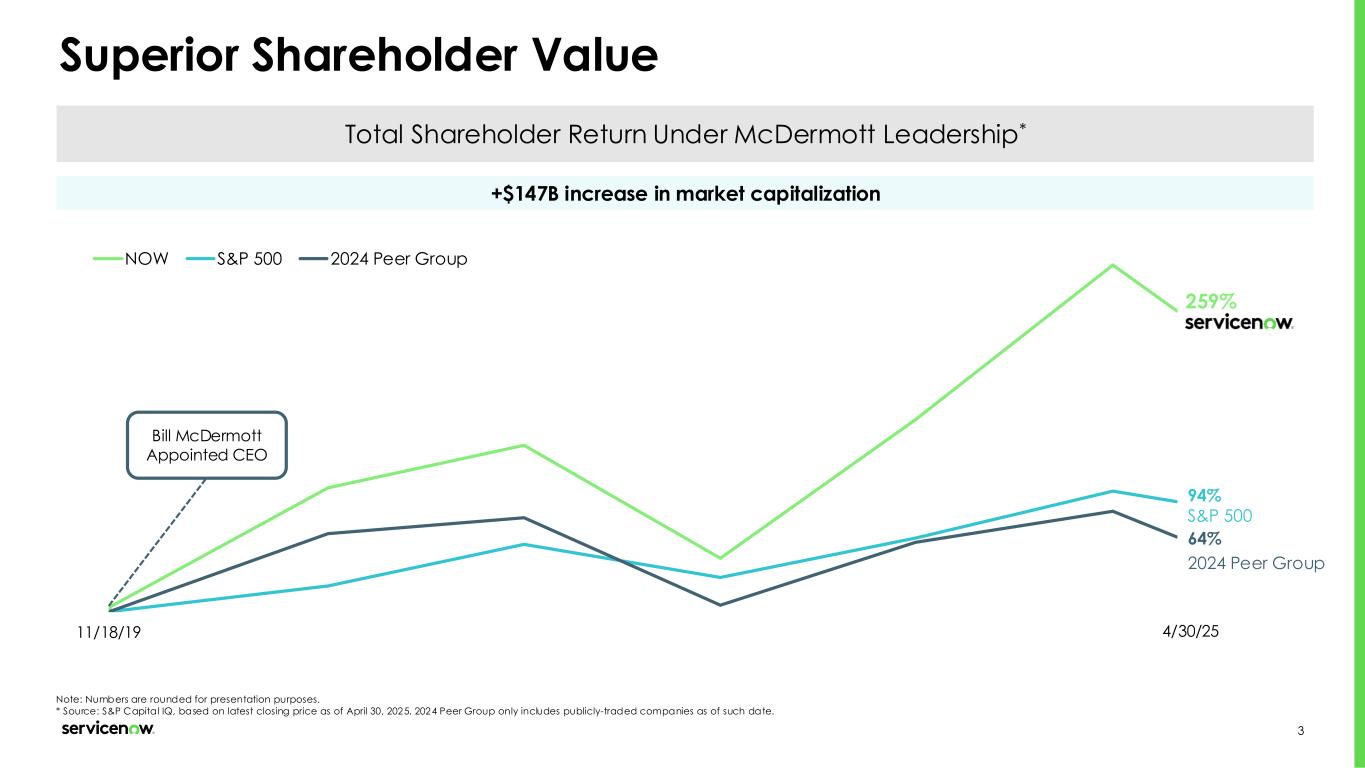

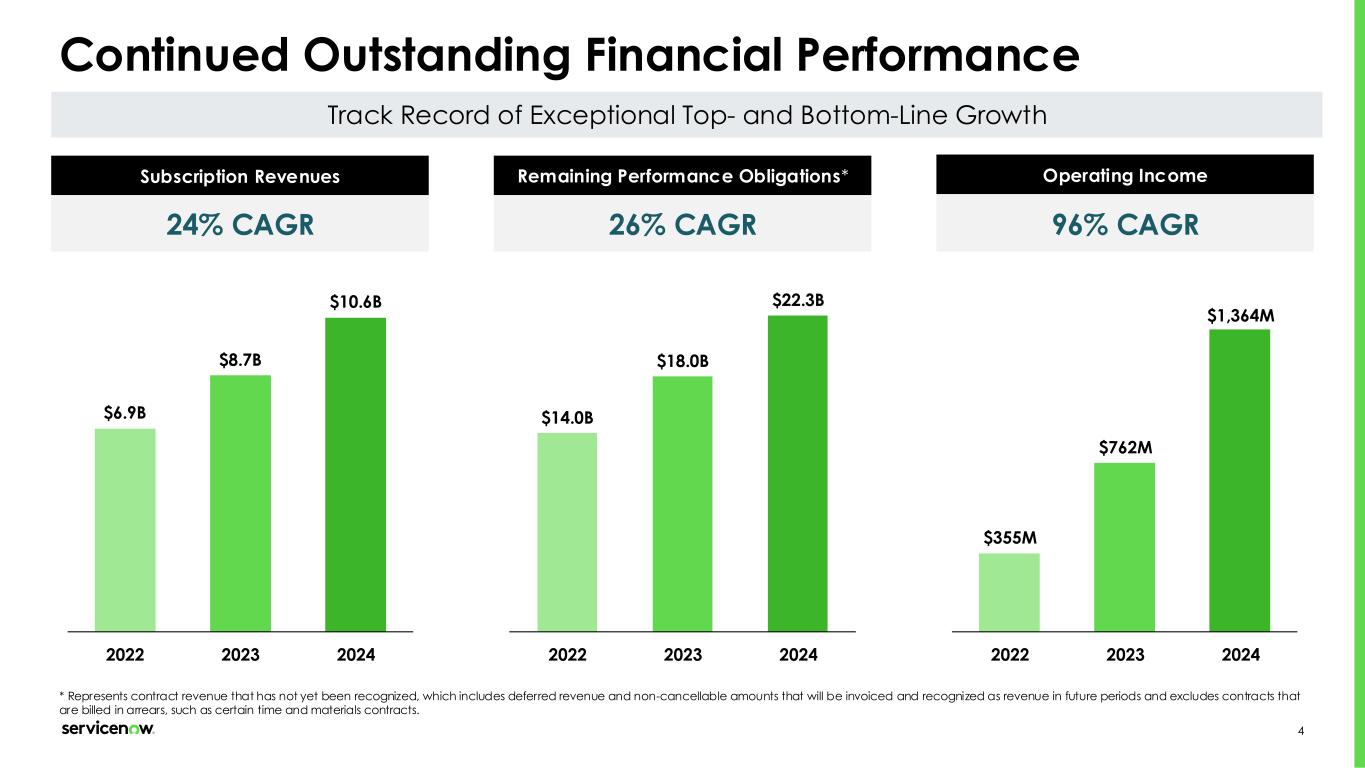

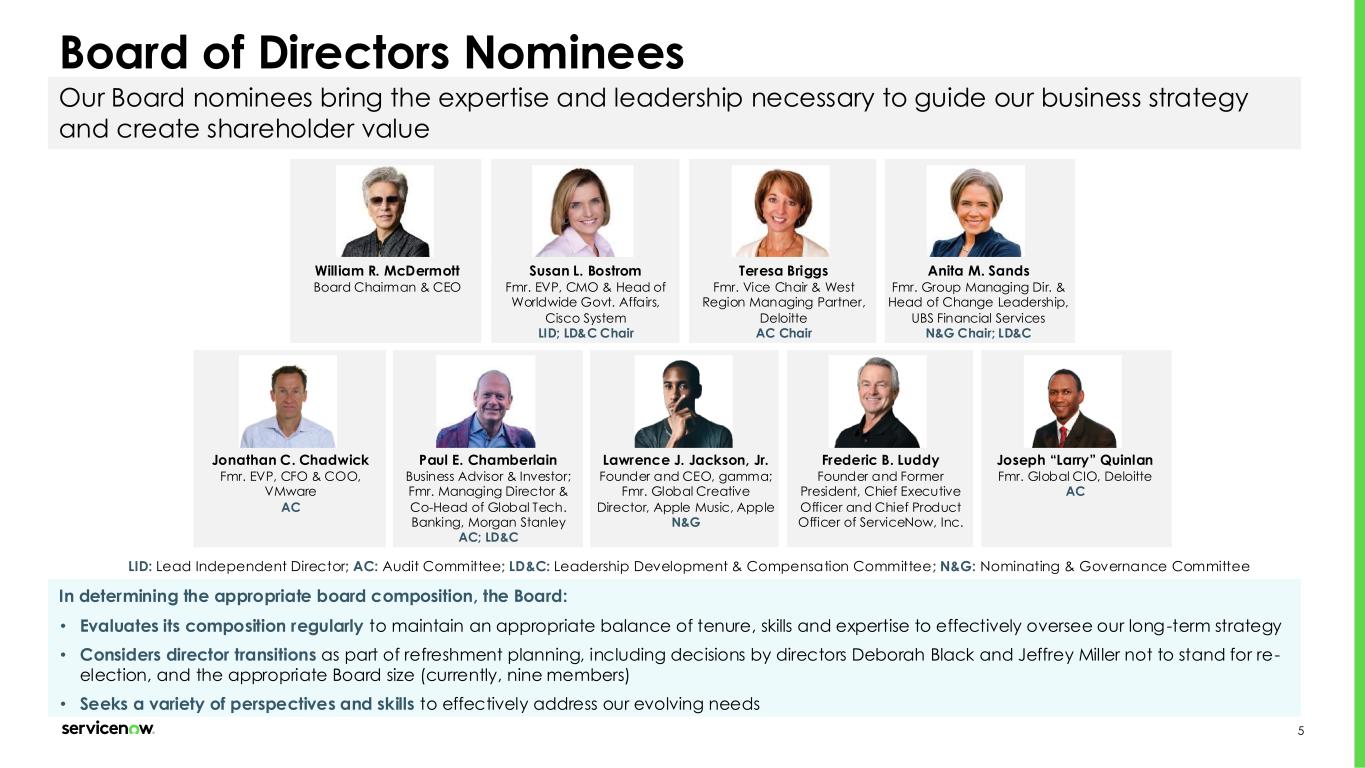

2 Executive Summary Superior Shareholder Value • Shareholder returns have been meaningfully above peers and the broader market, and we have continued to grow across the top and bottom line (slides 3-4) Board of Directors Nominees • Our Nominees have the depth of experience necessary to guide our business strategy and create shareholder value (slide 5) Executive Compensation Program • We implemented enhancements in our executive compensation program to strengthen the link between pay and performance and align with shareholder interests (slide 6) Certificate of Incorporation Amendments • We are proposing to add officer exculpation and eliminate supermajority voting provisions (slide 7) Shareholder Proposals • We received two shareholder proposals, which the Board is recommending AGAINST, as their adoption is unnecessary and not in the best interests of ServiceNow or our shareholders (slide 8)

3 11/18/19 NOW S&P 500 2024 Peer Group Superior Shareholder Value Note: Numbers are rounded for presentation purposes. * Source: S&P Capital IQ, based on latest closing price as of April 30, 2025. 2024 Peer Group only includes publicly-traded companies as of such date. 94% S&P 500 64% 2024 Peer Group 259% +$147B increase in market capitalization Total Shareholder Return Under McDermott Leadership* Bill McDermott Appointed CEO 4/30/25

4 Continued Outstanding Financial Performance Subscription Revenues Track Record of Exceptional Top- and Bottom-Line Growth 26% CAGR Remaining Performance Obligations* Operating Income 24% CAGR 96% CAGR $6.9B $8.7B $10.6B 2022 2023 2024 $14.0B $18.0B $22.3B 2022 2023 2024 $355M $762M $1,364M 2022 2023 2024 * Represents contract revenue that has not yet been recognized, which includes deferred revenue and non-cancellable amounts that will be invoiced and recognized as revenue in future periods and excludes contracts that are billed in arrears, such as certain time and materials contracts.

5 Jonathan C. Chadwick Fmr. EVP, CFO & COO, VMware AC Paul E. Chamberlain Business Advisor & Investor; Fmr. Managing Director & Co-Head of Global Tech. Banking, Morgan Stanley AC; LD&C Lawrence J. Jackson, Jr. Founder and CEO, gamma; Fmr. Global Creative Director, Apple Music, Apple N&G Frederic B. Luddy Founder and Former President, Chief Executive Officer and Chief Product Officer of ServiceNow, Inc. Joseph “Larry” Quinlan Fmr. Global CIO, Deloitte AC Board of Directors Nominees • Evaluates its composition regularly to maintain an appropriate balance of tenure, skills and expertise to effectively oversee our long-term strategy • Considers director transitions as part of refreshment planning, including decisions by directors Deborah Black and Jeffrey Miller not to stand for re- election, and the appropriate Board size (currently, nine members) • Seeks a variety of perspectives and skills to effectively address our evolving needs LID: Lead Independent Director; AC: Audit Committee; LD&C: Leadership Development & Compensation Committee; N&G: Nominating & Governance Committee William R. McDermott Board Chairman & CEO Susan L. Bostrom Fmr. EVP, CMO & Head of Worldwide Govt. Affairs, Cisco System LID; LD&C Chair Teresa Briggs Fmr. Vice Chair & West Region Managing Partner, Deloitte AC Chair Anita M. Sands Fmr. Group Managing Dir. & Head of Change Leadership, UBS Financial Services N&G Chair; LD&C In determining the appropriate board composition, the Board: Our Board nominees bring the expertise and leadership necessary to guide our business strategy and create shareholder value

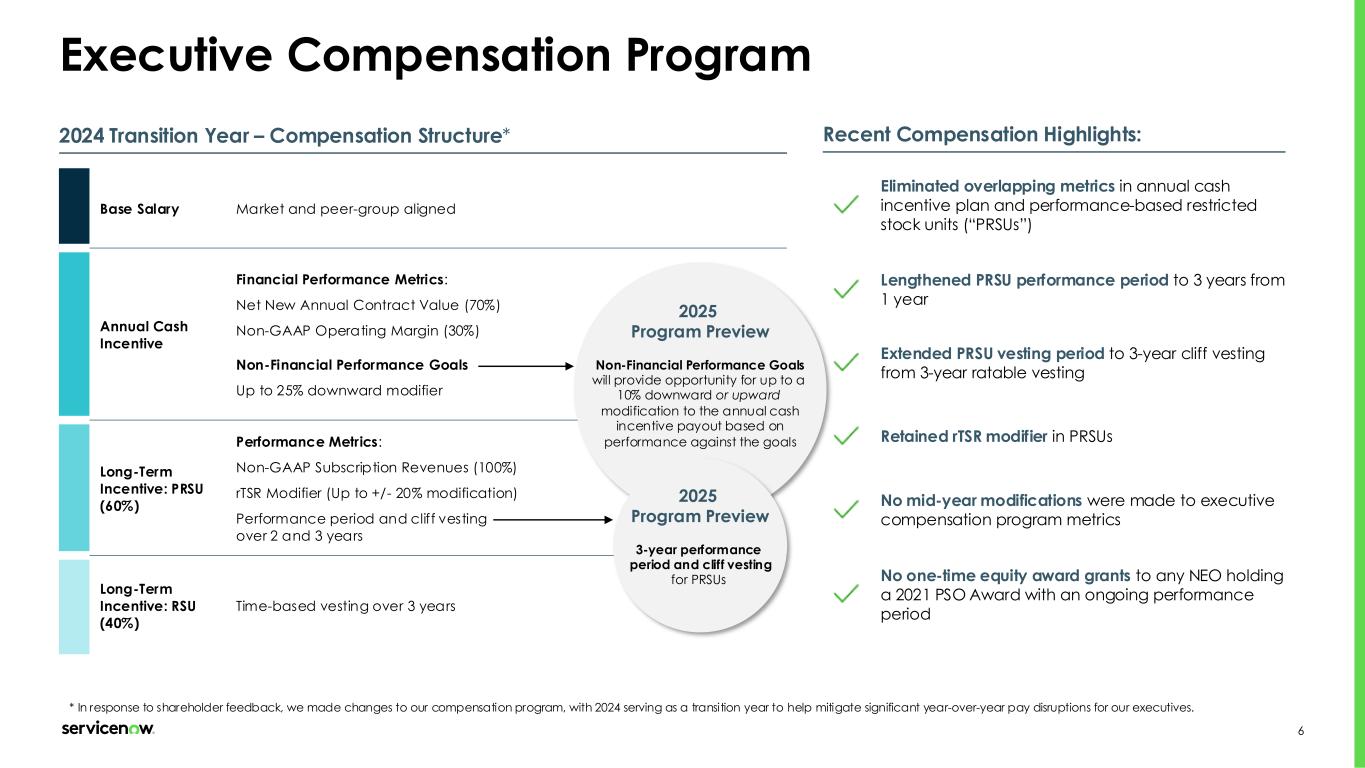

6 Recent Compensation Highlights: Eliminated overlapping metrics in annual cash incentive plan and performance-based restricted stock units (“PRSUs”) Lengthened PRSU performance period to 3 years from 1 year Extended PRSU vesting period to 3-year cliff vesting from 3-year ratable vesting Retained rTSR modifier in PRSUs No mid-year modifications were made to executive compensation program metrics No one-time equity award grants to any NEO holding a 2021 PSO Award with an ongoing performance period 2024 Transition Year – Compensation Structure* Base Salary Market and peer-group aligned Annual Cash Incentive Financial Performance Metrics: Net New Annual Contract Value (70%) Non-GAAP Operating Margin (30%) Non-Financial Performance Goals Up to 25% downward modifier Long-Term Incentive: PRSU (60%) Performance Metrics: Non-GAAP Subscription Revenues (100%) rTSR Modifier (Up to +/- 20% modification) Performance period and cliff vesting over 2 and 3 years Long-Term Incentive: RSU (40%) Time-based vesting over 3 years * In response to shareholder feedback, we made changes to our compensation program, with 2024 serving as a transition year to help mitigate significant year-over-year pay disruptions for our executives. 2025 Program Preview Non-Financial Performance Goals will provide opportunity for up to a 10% downward or upward modification to the annual cash incentive payout based on performance against the goals 2025 Program Preview 3-year performance period and cliff vesting for PRSUs Executive Compensation Program

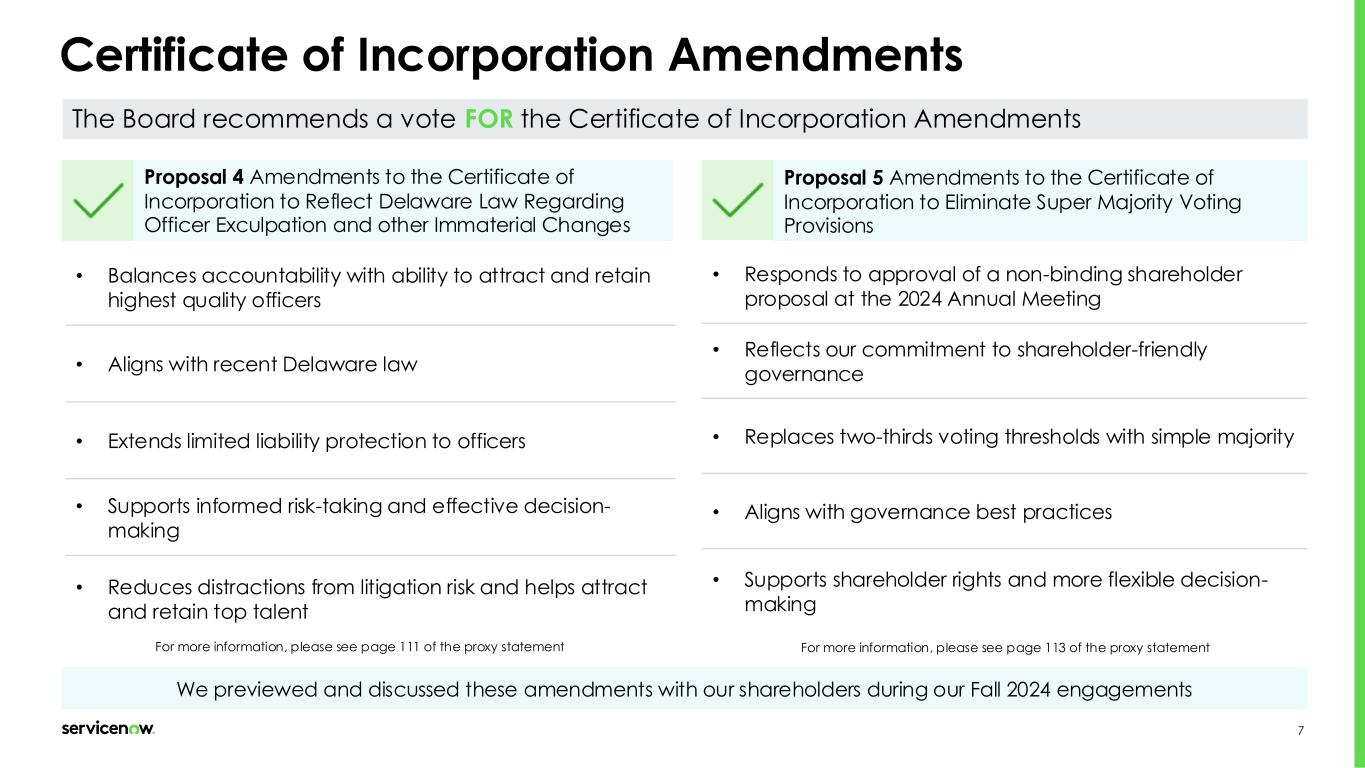

7 Proposal 4 Amendments to the Certificate of Incorporation to Reflect Delaware Law Regarding Officer Exculpation and other Immaterial Changes • Balances accountability with ability to attract and retain highest quality officers • Aligns with recent Delaware law • Extends limited liability protection to officers • Supports informed risk-taking and effective decision- making • Reduces distractions from litigation risk and helps attract and retain top talent • Responds to approval of a non-binding shareholder proposal at the 2024 Annual Meeting • Reflects our commitment to shareholder-friendly governance • Replaces two-thirds voting thresholds with simple majority • Aligns with governance best practices • Supports shareholder rights and more flexible decision- making For more information, please see page 111 of the proxy statement For more information, please see page 113 of the proxy statement The Board recommends a vote FOR the Certificate of Incorporation Amendments Proposal 5 Amendments to the Certificate of Incorporation to Eliminate Super Majority Voting Provisions Certificate of Incorporation Amendments We previewed and discussed these amendments with our shareholders during our Fall 2024 engagements

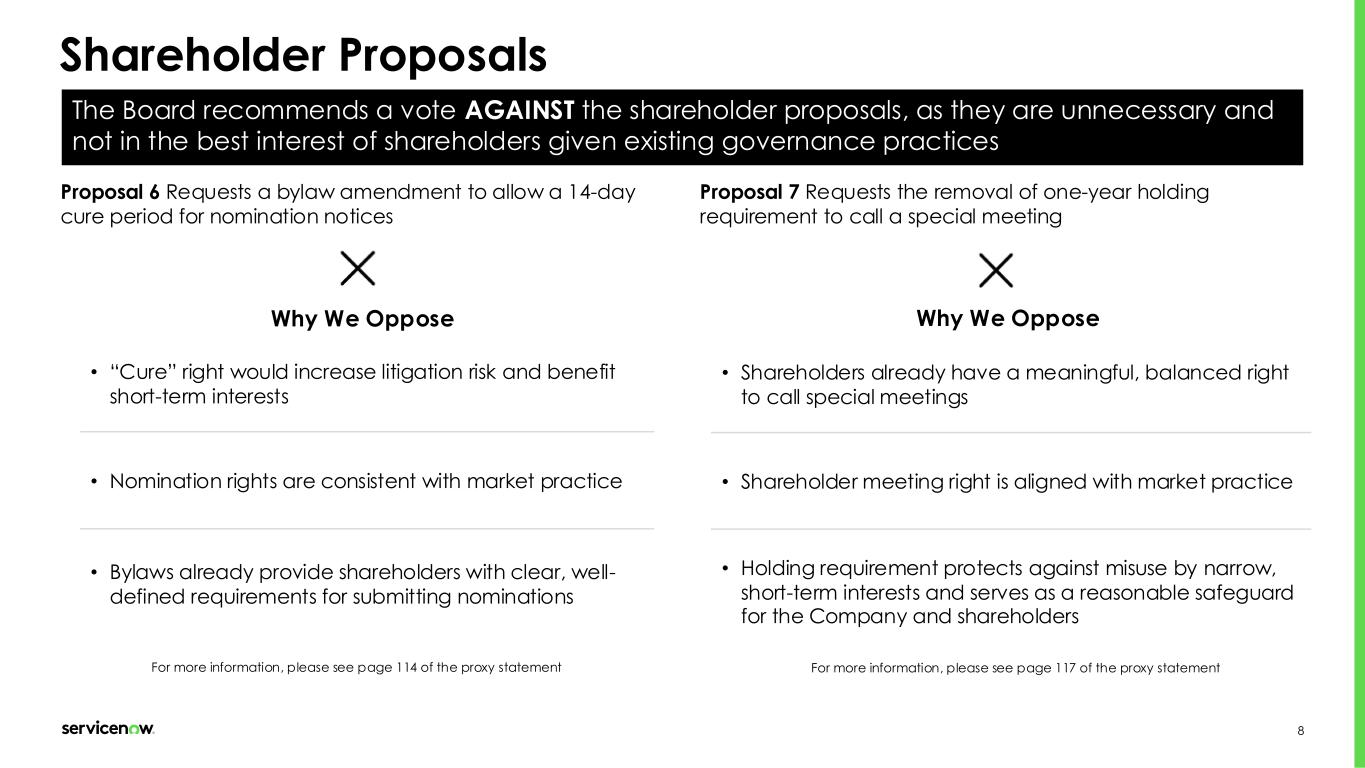

8 Shareholder Proposals Proposal 6 Requests a bylaw amendment to allow a 14-day cure period for nomination notices Proposal 7 Requests the removal of one-year holding requirement to call a special meeting The Board recommends a vote AGAINST the shareholder proposals, as they are unnecessary and not in the best interest of shareholders given existing governance practices Why We Oppose • “Cure” right would increase litigation risk and benefit short-term interests • Nomination rights are consistent with market practice • Bylaws already provide shareholders with clear, well- defined requirements for submitting nominations Why We Oppose • Shareholders already have a meaningful, balanced right to call special meetings • Shareholder meeting right is aligned with market practice • Holding requirement protects against misuse by narrow, short-term interests and serves as a reasonable safeguard for the Company and shareholders For more information, please see page 114 of the proxy statement For more information, please see page 117 of the proxy statement

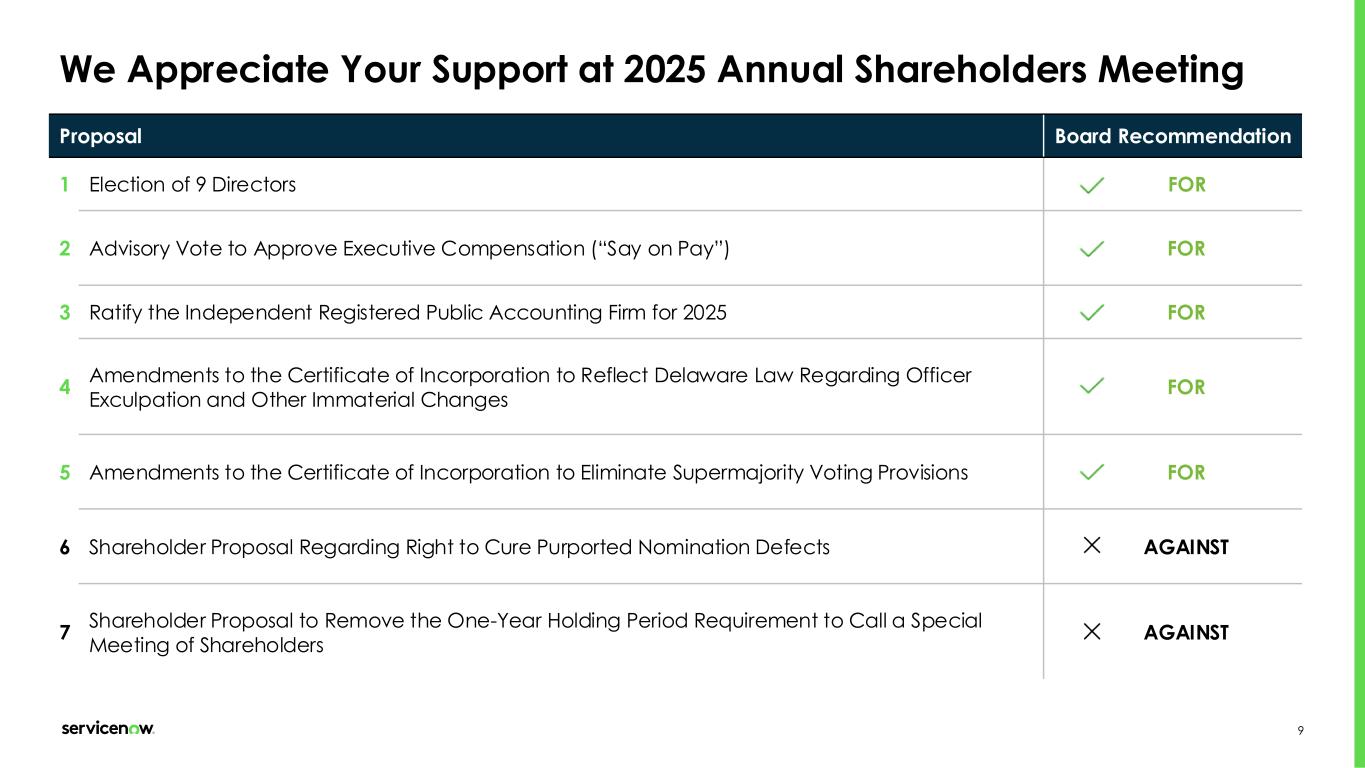

9 We Appreciate Your Support at 2025 Annual Shareholders Meeting Proposal Board Recommendation 1 Election of 9 Directors FOR 2 Advisory Vote to Approve Executive Compensation (“Say on Pay”) FOR 3 Ratify the Independent Registered Public Accounting Firm for 2025 FOR 4 Amendments to the Certificate of Incorporation to Reflect Delaware Law Regarding Officer Exculpation and Other Immaterial Changes FOR 5 Amendments to the Certificate of Incorporation to Eliminate Supermajority Voting Provisions FOR 6 Shareholder Proposal Regarding Right to Cure Purported Nomination Defects AGAINST 7 Shareholder Proposal to Remove the One-Year Holding Period Requirement to Call a Special Meeting of Shareholders AGAINST

10 Safe Harbor and Other Information This presentation contains “forward‐looking” statements that are based on our management’s beliefs and assumptions and on information currently available to management. Forward‐looking statements include information concerning our possible or assumed strategy, future operations, financing plans, operating model, financial position, future revenues, projected costs, competitive position, industry environment, potential growth opportunities, potential market opportunities, plans and objectives of management, the effects of competition on our business and customer trends. Forward‐looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “seeks,” “estimates,” “targets,” “guidance,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “prospects,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms, although not all forward‐looking statements contain these identifying words. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Additionally, these forward-looking statements, involve risks, uncertainties and assumptions based on information available to us as of May 8, 2025, including those related to our future financial performance, global economic conditions and demand for digital transformation. Many of these assumptions relate to matters that are beyond our control and changing rapidly, including, but not limited to, fluctuations in the value of foreign currencies relative to the U.S. Dollar; fluctuations in interest rates; the impact of tariffs and conflicts on macroeconomic conditions; inflation; and fluctuations and volatility in our stock price. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our results could differ materially from the results expressed or implied by the forward-looking statements we make. Further information on these and other factors that could cause or contribute to such differences include, but are not limited to, those discussed in the “Risk Factors” section in our Annual Report on Form 10-K filed for the year ended December 31, 2024 and in our other Securities and Exchange Commission (“SEC”) filings. We cannot guarantee that we will achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Forward-looking statements represent our management’s beliefs and assumptions only as of the date of this presentation. We undertake no obligation, and do not intend, to update these forward-looking statements, to review or confirm analysts’ expectations, or to provide interim reports or updates on the progress of the current financial quarter.