Investor Presentation January 2026

Forward-Looking Statements This presentation contains forward-looking statements (“FLS”) which are protected as FLS under the PSLRA, and which are based on management’s current expectations and beliefs, as well as a number of assumptions concerning future events. The assumptions and estimates underlying FLS are inherently uncertain and are subject to a wide variety of significant business and economic uncertainties and competitive risks that could cause actual results to differ materially from those contained in the prospective information. Accordingly, there can be no assurance CVR Energy, Inc. (together with its subsidiaries, “CVI”, “CVR Energy”, “we”, “us” or the Company”) will achieve the future results we expect or that actual results will not differ materially from expectations. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are FLS and include, but are not limited to, statements regarding future: safe and reliable operations; compliance with regulations; ability to minimize environmental impacts and create value; economic and social impacts of donations and contributions; financial performance and forecasts; strategic value of our locations and ability to capitalize thereon; strategic priorities including identification of commercial optimization opportunities and ability to improve refining margin capture or pursue asset footprint expansion opportunities; ability to maintain a disciplined approach to capital allocation; plant capacity and reliability; access to crude oil and condensate fields with price advantages or at all; exposure to Brent-WTI; percentage ownership of CVR Partners common units and its general partner; our controlling shareholder’s intention regarding ownership of our common stock and CVR Partners common units and potential strategic transactions involving us or CVR Partners; fertilizer segment service areas; fertilizer segment feedstock diversity and optionality, products produced, costs, and utilization rates; ; investment profile; generation and return of cash; divestitures; optionality of our crude oil sourcing and/or marketing network; storage capacity; liquid volume yields and production mix, including jet fuel; use of, access to (on a contracted basis or otherwise), space on and direction of pipelines we utilize; utilization rates and turnaround and other impacts thereon; crude oil slates, capacities, optimization, and throughputs and factors impacting same; benefits of our margin capture investments; opportunities created as a result of the conversion of the RDU back to hydrocarbon processing; ability to return the RDU to renewable diesel service; ability to repurpose assets, including rail, and the benefits thereof; impact of RFS on our business including but not limited to renewable volume obligations and potential reallocation thereof; RIN pricing and availability; small refinery exemptions (SREs) or other hardship relief to WRC or others; WRC’s full or partial grant or denial of hardship relief including the impact of EPA rulings and past, current or potential challenges thereto and the impact thereof on our financial position, operations and cash flow; opportunities and conditions that could impact any decision to rail products to the West; capital allocation strategies; efforts to preserve and strengthen our balance sheet and liquidity, reduce debt, return to targeted leverage levels and preserve cash; pursuit of acquisition and investment opportunities and the benefits thereof; timing and amount of our dividends/distributions, if any; capital, maintenance, growth and turnaround spending, timing, targets and benefits; power supply outages; unplanned downtime; adverse weather events; blending and participation in renewable fuel blending economics; RIN and LCFS generation, capture, pricing, purchasing and availability; rack access; product sales outlets; quality of our refining assets; the macro environment; U.S. refining capacity; gasoline and distillate supply and demand; product inventories; crack spreads; crude oil differentials (including our exposure thereto); availability, sufficiency or impact of government credit programs, including the BTC and PTC; renewables projects; our and third party nitrogen fertilizer plant capacity, production, yields, pricing, feedstocks (including types and costs thereof), inventories, utilization rates, sales, distribution methods (including rail) and revenue; imports and exports including restrictions and actual and potential tariffs thereupon; corn and grain demand, planted acres, inventories and stocks, pricing, uses, cost, consumption, production, planting and yield, including the drivers thereof; ethanol demand; global and domestic nitrogen fertilizer market conditions, production, curtailments, supply, capacity, demand and consumption; farmer economics and cost structure; trade disputes, geopolitical impacts and global fertilizer plant disruptions on fertilizer supply and pricing; fertilizer segment service areas; ability to minimize distribution costs and maximize fertilizer net back pricing; fertilizer logistics optionality and storage; sustainability of production; feedstock diversification and optimization at our Coffeyville fertilizer facility, including the economics thereof; natural gas pricing, including impacts thereof on fertilizer production; nitrogen fertilizer application rates; harvest timing; weather and soil conditions and impacts thereof on fertilizer application and pricing; fertilizer sale prepay levels; reserve levels; distributions (if any) from our 45Q JV; EBITDA and adjusted EBITDA; forecasts including projected maintenance and growth expenditures in our segments; and other matters. Please do not put undue reliance on FLS (including forecasts and projections regarding our future performance) because actual results may vary materially from those expressed or implied as a result of various factors, including, but not limited to those set forth under “Risk Factors” in the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and any other filings with the Securities and Exchange Commission (“SEC”) by CVR Energy, Inc. (“CVI”) or CVR Partners, LP (“UAN”). These FLS are made only as of the date hereof. Neither CVI nor UAN assume any obligation to, and they expressly disclaim any obligation to, update or revise any FLS, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Financial Measures Certain financial information in this presentation (including EBITDA and Adjusted EBITDA) are not presentations made in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and use of such terms varies from others in the same industry. Non-GAAP financial measures should not be considered as alternatives to income from continuing operations, income from operations or any other performance measures derived in accordance with GAAP. Non-GAAP financial measures have important limitations as analytical tools, and you should not consider them in isolation or as substitutes for results as reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with GAAP. Market and Industry Data The market and industry data included in this presentation is based on a variety of sources, including industry publications, government publications and other published sources, information from customers, distributors, suppliers, trade and business organizations and publicly available information (including reports and other information others file with the SEC, which we did not participate in preparing and as to which we make no representation), as well as our good faith estimates, which have been derived from management’s knowledge and experience. Estimates of market size and relative positions in a market are difficult to develop and inherently uncertain. Accordingly, investors should not place undue weight on the industry and market share data presented in or discussed during this presentation. 1

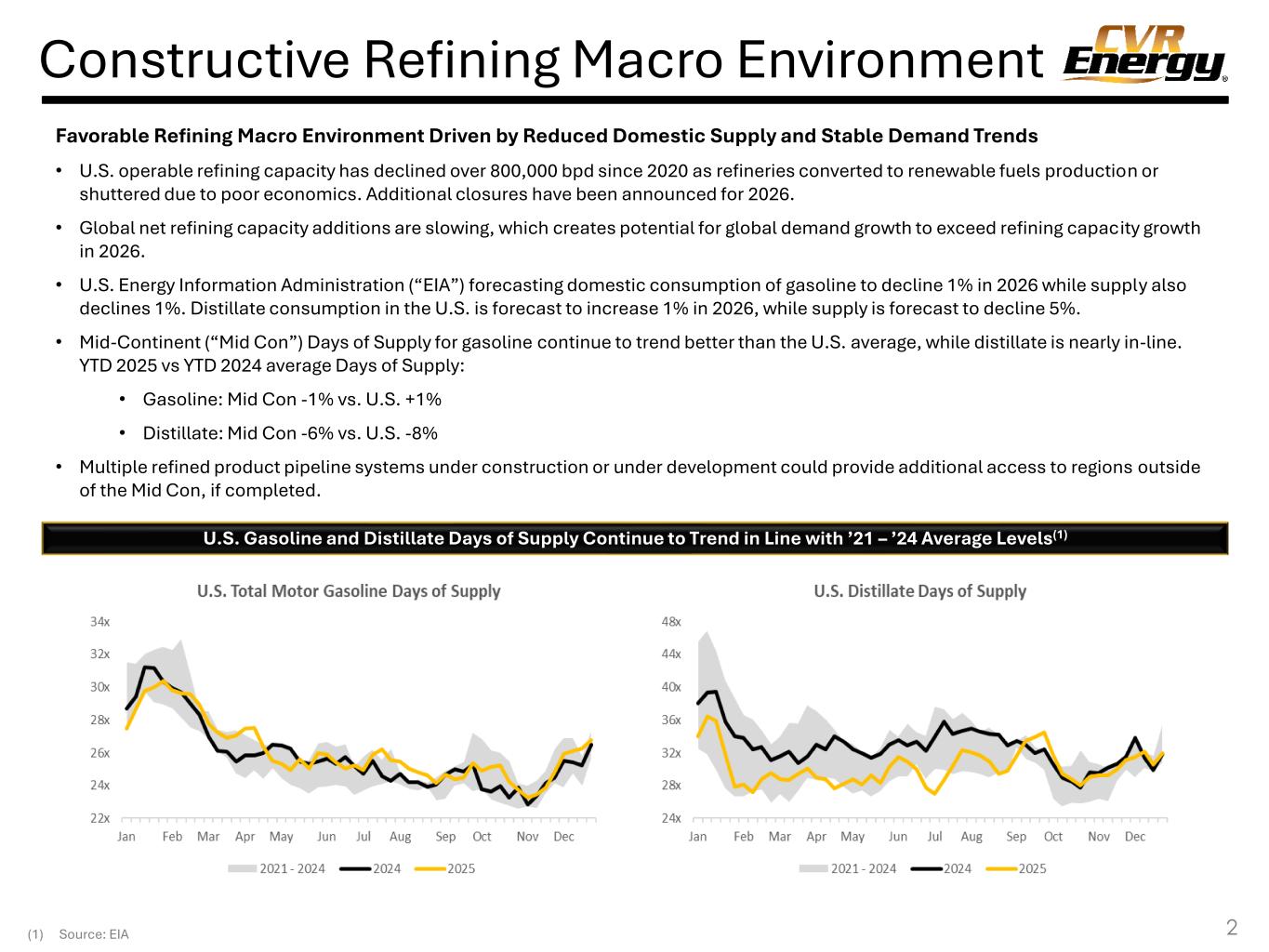

Constructive Refining Macro Environment 2 U.S. Gasoline and Distillate Days of Supply Continue to Trend in Line with ’21 – ’24 Average Levels(1) Favorable Refining Macro Environment Driven by Reduced Domestic Supply and Stable Demand Trends • U.S. operable refining capacity has declined over 800,000 bpd since 2020 as refineries converted to renewable fuels production or shuttered due to poor economics. Additional closures have been announced for 2026. • Global net refining capacity additions are slowing, which creates potential for global demand growth to exceed refining capacity growth in 2026. • U.S. Energy Information Administration (“EIA”) forecasting domestic consumption of gasoline to decline 1% in 2026 while supply also declines 1%. Distillate consumption in the U.S. is forecast to increase 1% in 2026, while supply is forecast to decline 5%. • Mid-Continent (“Mid Con”) Days of Supply for gasoline continue to trend better than the U.S. average, while distillate is nearly in-line. YTD 2025 vs YTD 2024 average Days of Supply: • Gasoline: Mid Con -1% vs. U.S. +1% • Distillate: Mid Con -6% vs. U.S. -8% • Multiple refined product pipeline systems under construction or under development could provide additional access to regions outside of the Mid Con, if completed. (1) Source: EIA

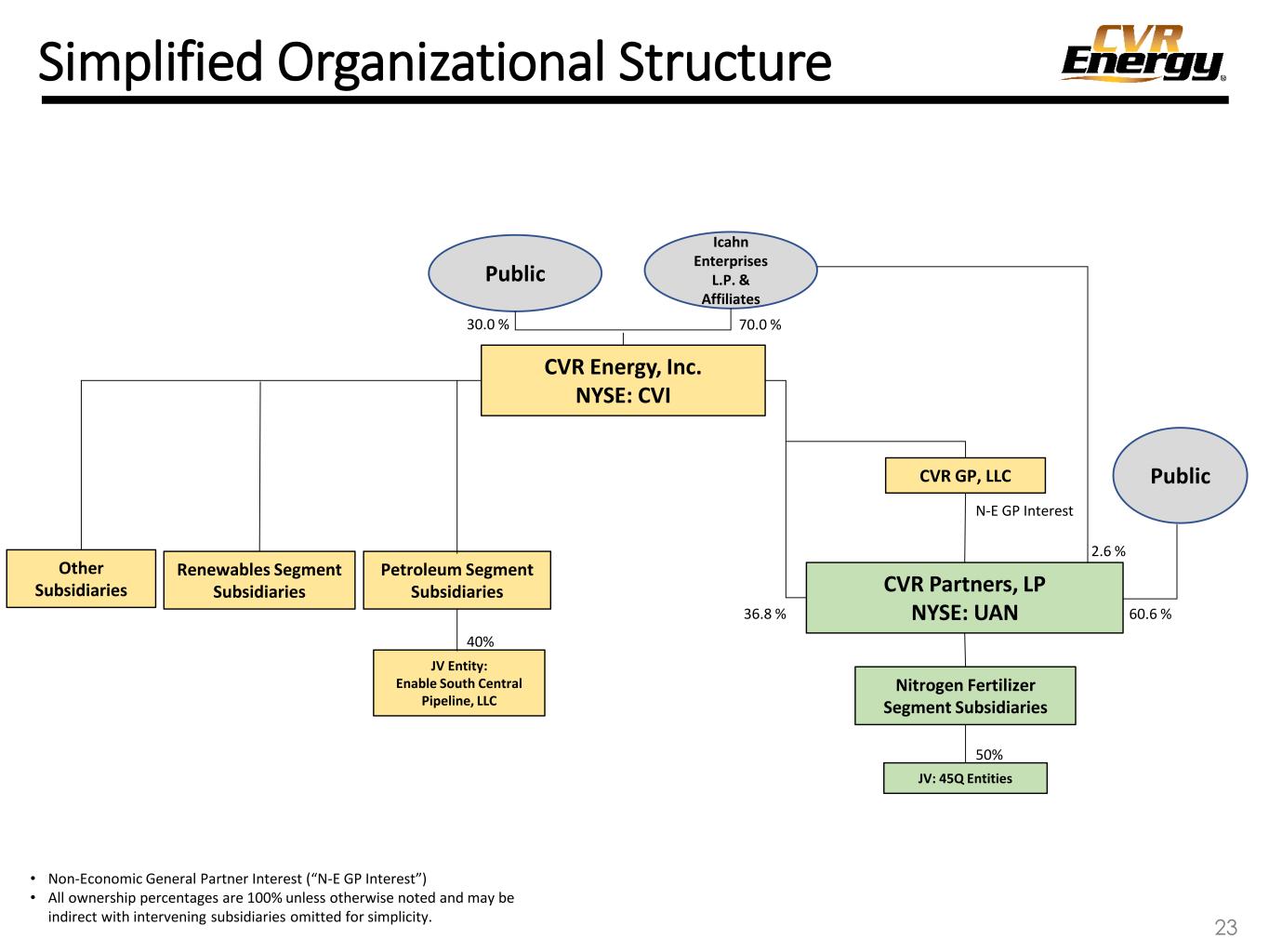

Company Overview 3 Petroleum Refining ▪ Two strategically located Mid-Continent refineries close to Cushing, Oklahoma. ▪ Total nameplate crude oil capacity of 206,500; average complexity rating of 10.8. ▪ Complementary logistics assets and access to key pipelines provide a variety of advantaged crude oil supply options: 100% exposure to Brent – WTI crude differential. ▪ Historically high product yield vs. peers: 97% liquid volume yield and 91% yield of gasoline and distillate.(1) (1) Based on total throughputs; for the twelve months ended September 30, 2025. Nitrogen Fertilizer ▪ CVR Energy owns the general partner and 37% of the common units of CVR Partners, LP. ▪ Two strategically located nitrogen fertilizer facilities serving the Southern Plains and Corn Belt. ▪ Primarily engaged in the production of nitrogen fertilizers - ammonia and urea ammonium nitrate (UAN). ▪ Diverse feedstock exposure through petroleum coke (“pet coke”) and natural gas. CVR Energy (NYSE: CVI) is a diversified holding company, formed in 2006, primarily engaged in the petroleum refining and marketing industry and the fertilizer manufacturing industry through its interest in CVR Partners, LP (NYSE: UAN), a publicly traded limited partnership (“CVR Partners”). Strategic Priorities: ➢ Constant focus on the safe, reliable operations of our facilities ➢ Evaluate commercial optimization opportunities to improve margin capture in the Petroleum Segment ➢ Aggressively pursue opportunities to expand our asset footprint ➢ Maintain a disciplined approach to capital allocation

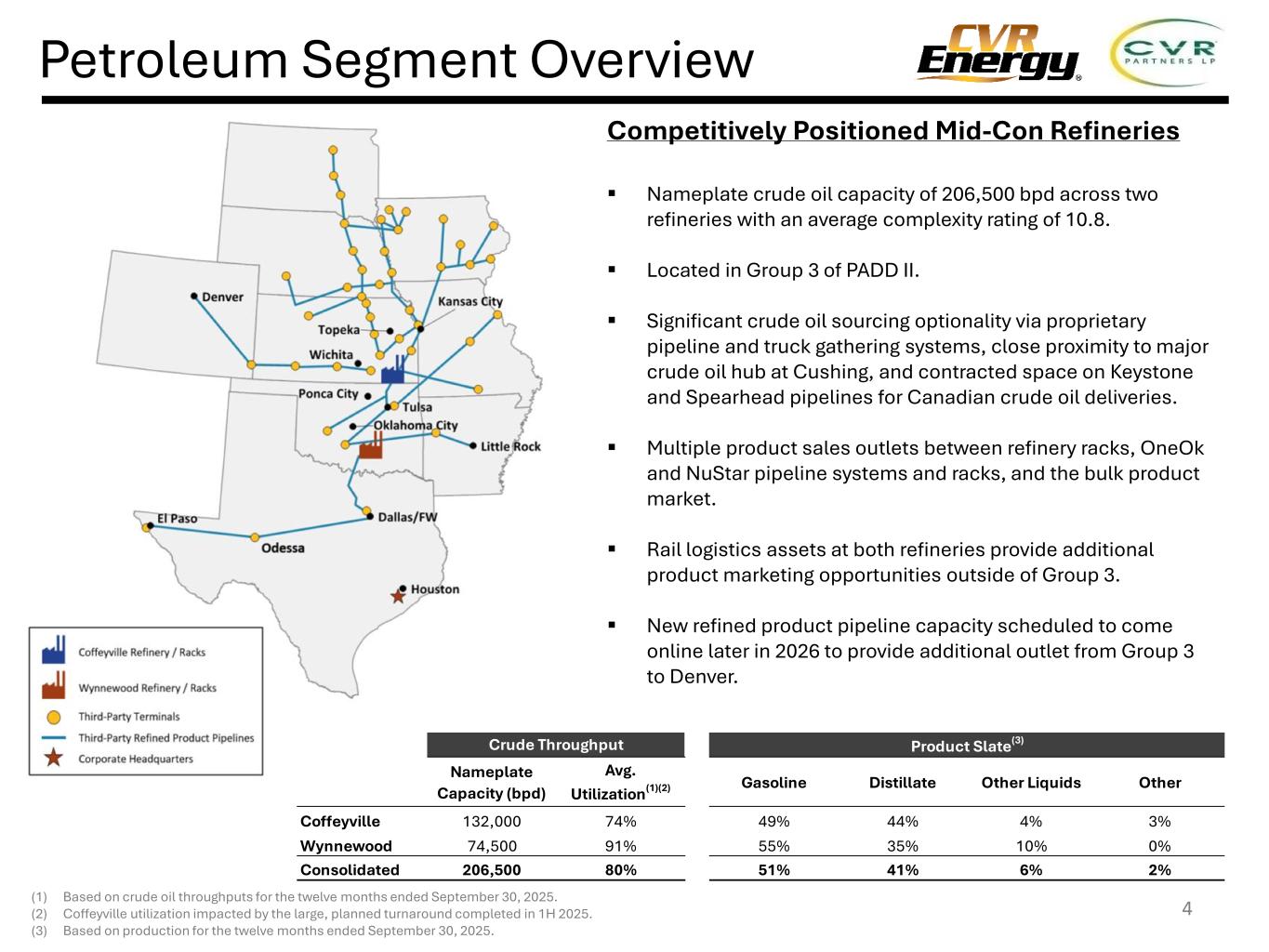

Petroleum Segment Overview 4 Competitively Positioned Mid-Con Refineries ▪ Nameplate crude oil capacity of 206,500 bpd across two refineries with an average complexity rating of 10.8. ▪ Located in Group 3 of PADD II. ▪ Significant crude oil sourcing optionality via proprietary pipeline and truck gathering systems, close proximity to major crude oil hub at Cushing, and contracted space on Keystone and Spearhead pipelines for Canadian crude oil deliveries. ▪ Multiple product sales outlets between refinery racks, OneOk and NuStar pipeline systems and racks, and the bulk product market. ▪ Rail logistics assets at both refineries provide additional product marketing opportunities outside of Group 3. ▪ New refined product pipeline capacity scheduled to come online later in 2026 to provide additional outlet from Group 3 to Denver. (1) Based on crude oil throughputs for the twelve months ended September 30, 2025. (2) Coffeyville utilization impacted by the large, planned turnaround completed in 1H 2025. (3) Based on production for the twelve months ended September 30, 2025. Nameplate Capacity (bpd) Avg. Utilization(1)(2) Gasoline Distillate Other Liquids Other Coffeyville 132,000 74% 49% 44% 4% 3% Wynnewood 74,500 91% 55% 35% 10% 0% Consolidated 206,500 80% 51% 41% 6% 2% Crude Throughput Product Slate(3)

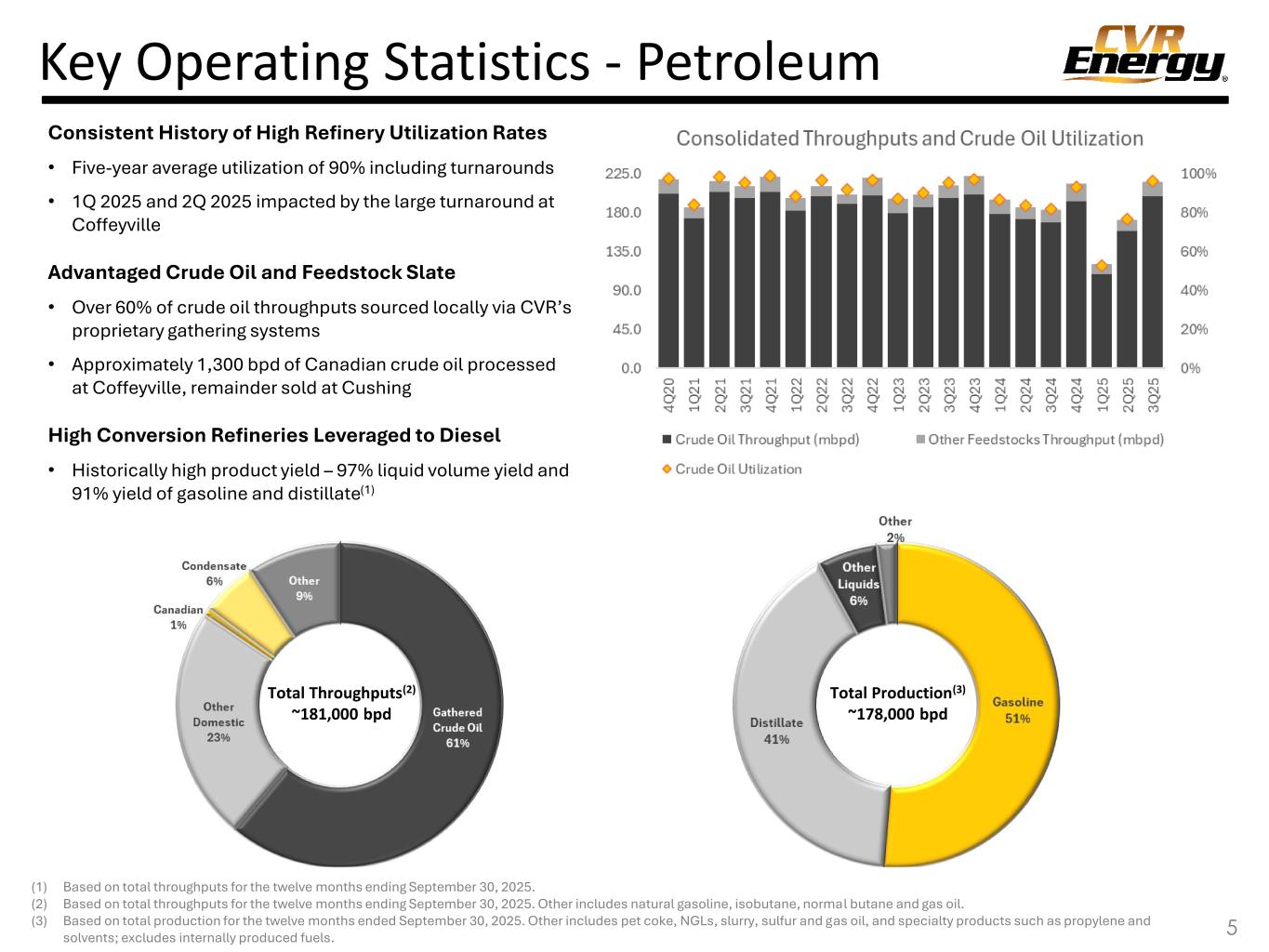

Key Operating Statistics - Petroleum 5 (1) Based on total throughputs for the twelve months ending September 30, 2025. (2) Based on total throughputs for the twelve months ending September 30, 2025. Other includes natural gasoline, isobutane, normal butane and gas oil. (3) Based on total production for the twelve months ended September 30, 2025. Other includes pet coke, NGLs, slurry, sulfur and gas oil, and specialty products such as propylene and solvents; excludes internally produced fuels. Total Throughputs(2) ~181,000 bpd Total Production(3) ~178,000 bpd Consistent History of High Refinery Utilization Rates • Five-year average utilization of 90% including turnarounds • 1Q 2025 and 2Q 2025 impacted by the large turnaround at Coffeyville Advantaged Crude Oil and Feedstock Slate • Over 60% of crude oil throughputs sourced locally via CVR’s proprietary gathering systems • Approximately 1,300 bpd of Canadian crude oil processed at Coffeyville, remainder sold at Cushing High Conversion Refineries Leveraged to Diesel • Historically high product yield – 97% liquid volume yield and 91% yield of gasoline and distillate(1)

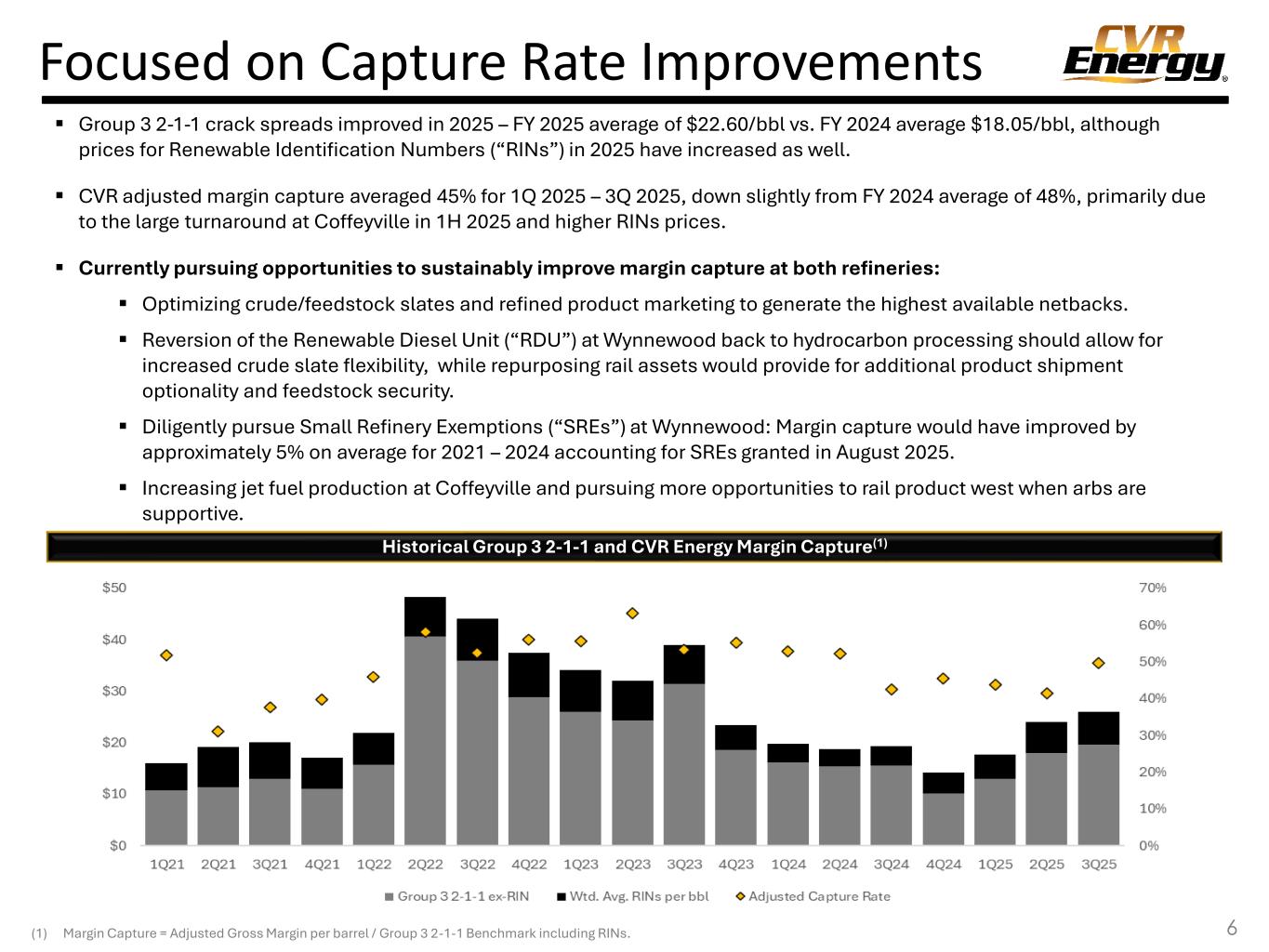

Focused on Capture Rate Improvements 6(1) Margin Capture = Adjusted Gross Margin per barrel / Group 3 2-1-1 Benchmark including RINs. Historical Group 3 2-1-1 and CVR Energy Margin Capture(1) ▪ Group 3 2-1-1 crack spreads improved in 2025 – FY 2025 average of $22.60/bbl vs. FY 2024 average $18.05/bbl, although prices for Renewable Identification Numbers (“RINs”) in 2025 have increased as well. ▪ CVR adjusted margin capture averaged 45% for 1Q 2025 – 3Q 2025, down slightly from FY 2024 average of 48%, primarily due to the large turnaround at Coffeyville in 1H 2025 and higher RINs prices. ▪ Currently pursuing opportunities to sustainably improve margin capture at both refineries: ▪ Optimizing crude/feedstock slates and refined product marketing to generate the highest available netbacks. ▪ Reversion of the Renewable Diesel Unit (“RDU”) at Wynnewood back to hydrocarbon processing should allow for increased crude slate flexibility, while repurposing rail assets would provide for additional product shipment optionality and feedstock security. ▪ Diligently pursue Small Refinery Exemptions (“SREs”) at Wynnewood: Margin capture would have improved by approximately 5% on average for 2021 – 2024 accounting for SREs granted in August 2025. ▪ Increasing jet fuel production at Coffeyville and pursuing more opportunities to rail product west when arbs are supportive.

Capital Allocation Strategy Prioritize Sustaining Capital Investments Return Cash to Investors When Appropriate Pursue Accretive Acquisition and Investment Opportunities Maintain Strong Balance Sheet and Liquidity Disciplined Approach to Capital Allocation Maintaining safe, reliable operations is priority #1. Focusing on debt reduction in the near-term to return to targeted leverage levels while maintaining sufficient cash balances. Aggressively pursue opportunities to profitably grow our asset footprint and improve margin capture. Dividends and distributions are quarterly determination by the Boards - debt repayment progress, cash balances and free cash flow generation are among the key criteria evaluated. 7

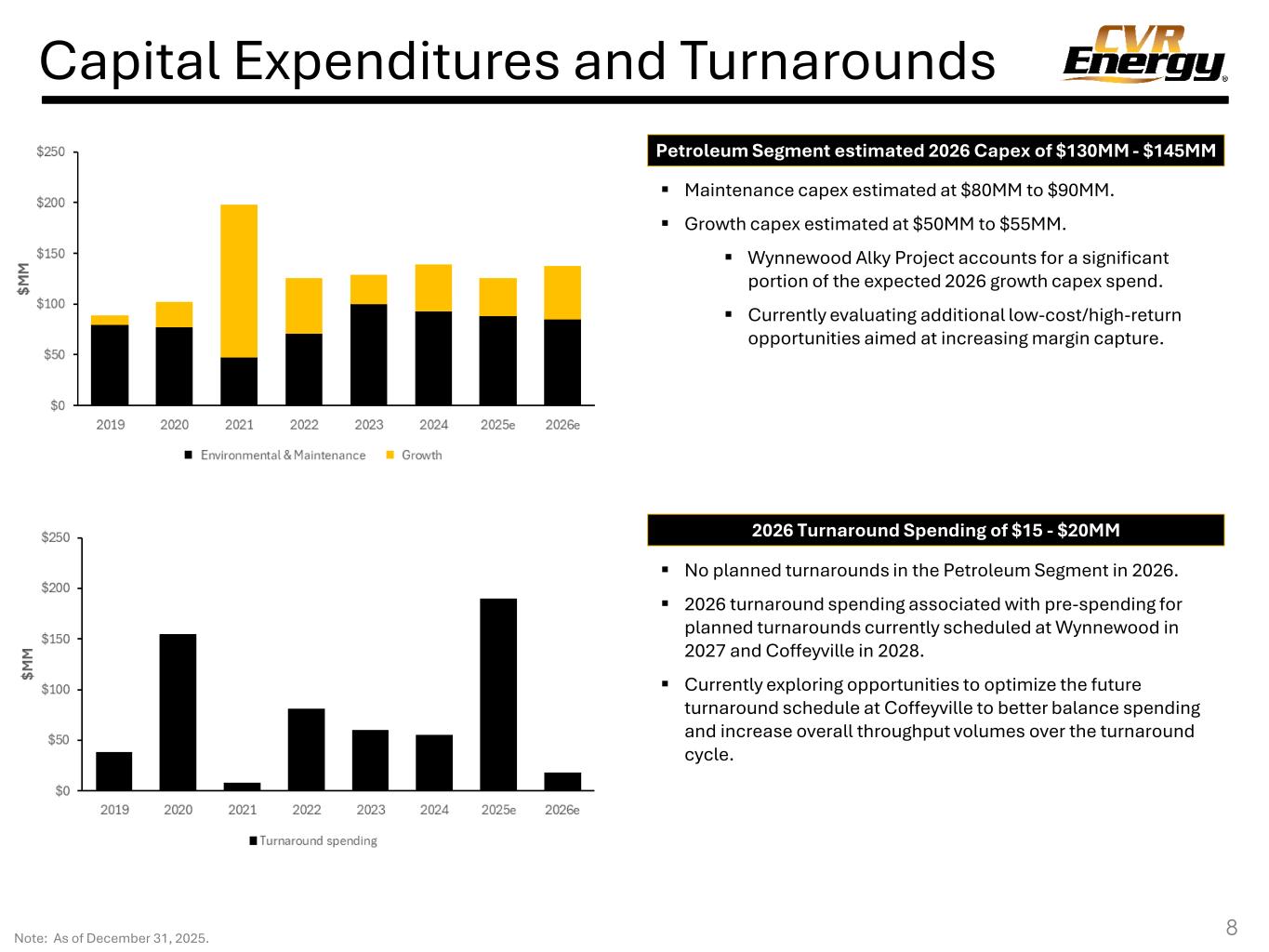

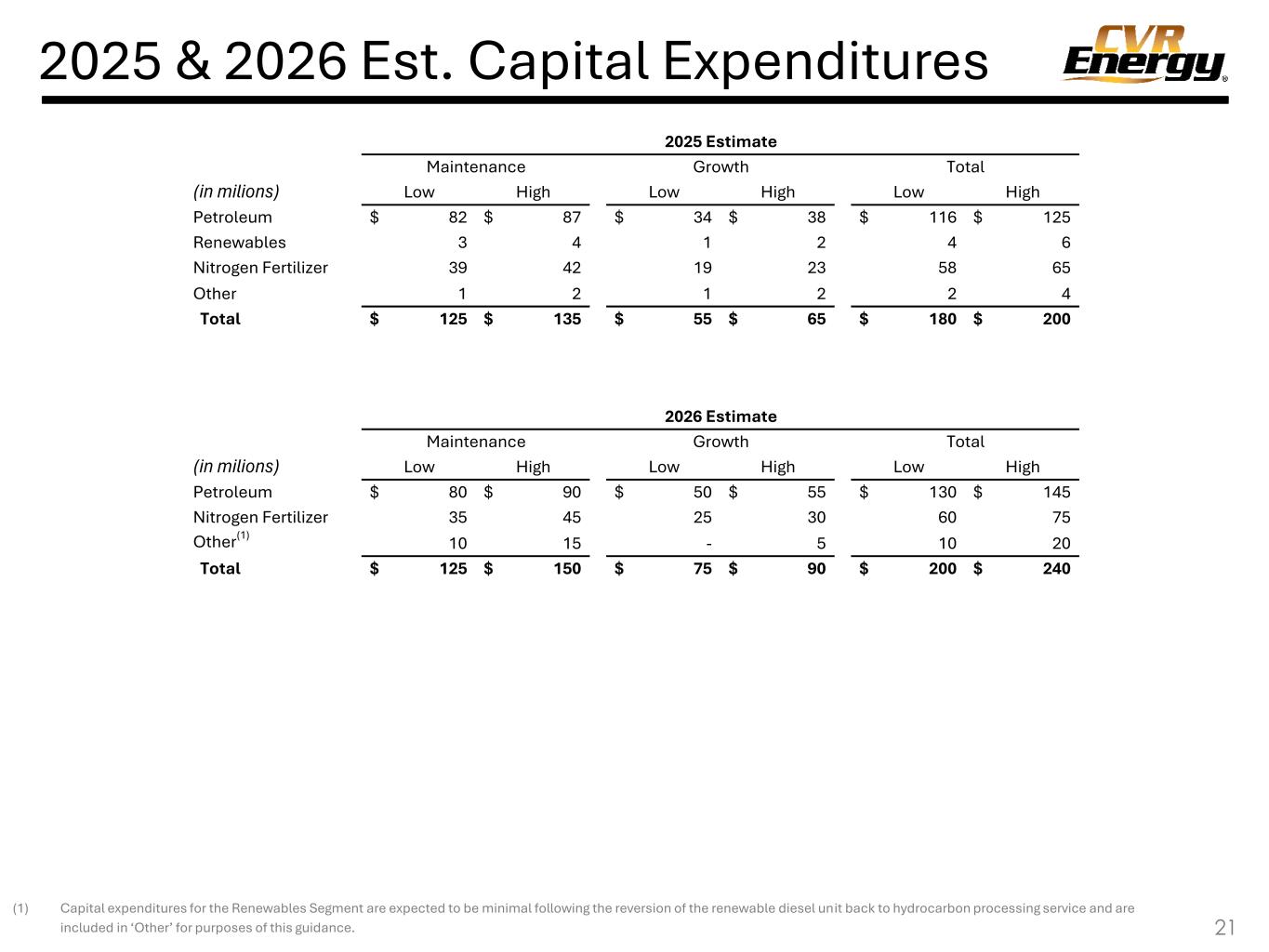

Capital Expenditures and Turnarounds 8Note: As of December 31, 2025. ▪ Maintenance capex estimated at $80MM to $90MM. ▪ Growth capex estimated at $50MM to $55MM. ▪ Wynnewood Alky Project accounts for a significant portion of the expected 2026 growth capex spend. ▪ Currently evaluating additional low-cost/high-return opportunities aimed at increasing margin capture. ▪ No planned turnarounds in the Petroleum Segment in 2026. ▪ 2026 turnaround spending associated with pre-spending for planned turnarounds currently scheduled at Wynnewood in 2027 and Coffeyville in 2028. ▪ Currently exploring opportunities to optimize the future turnaround schedule at Coffeyville to better balance spending and increase overall throughput volumes over the turnaround cycle. Petroleum Segment estimated 2026 Capex of $130MM - $145MM 2026 Turnaround Spending of $15 - $20MM

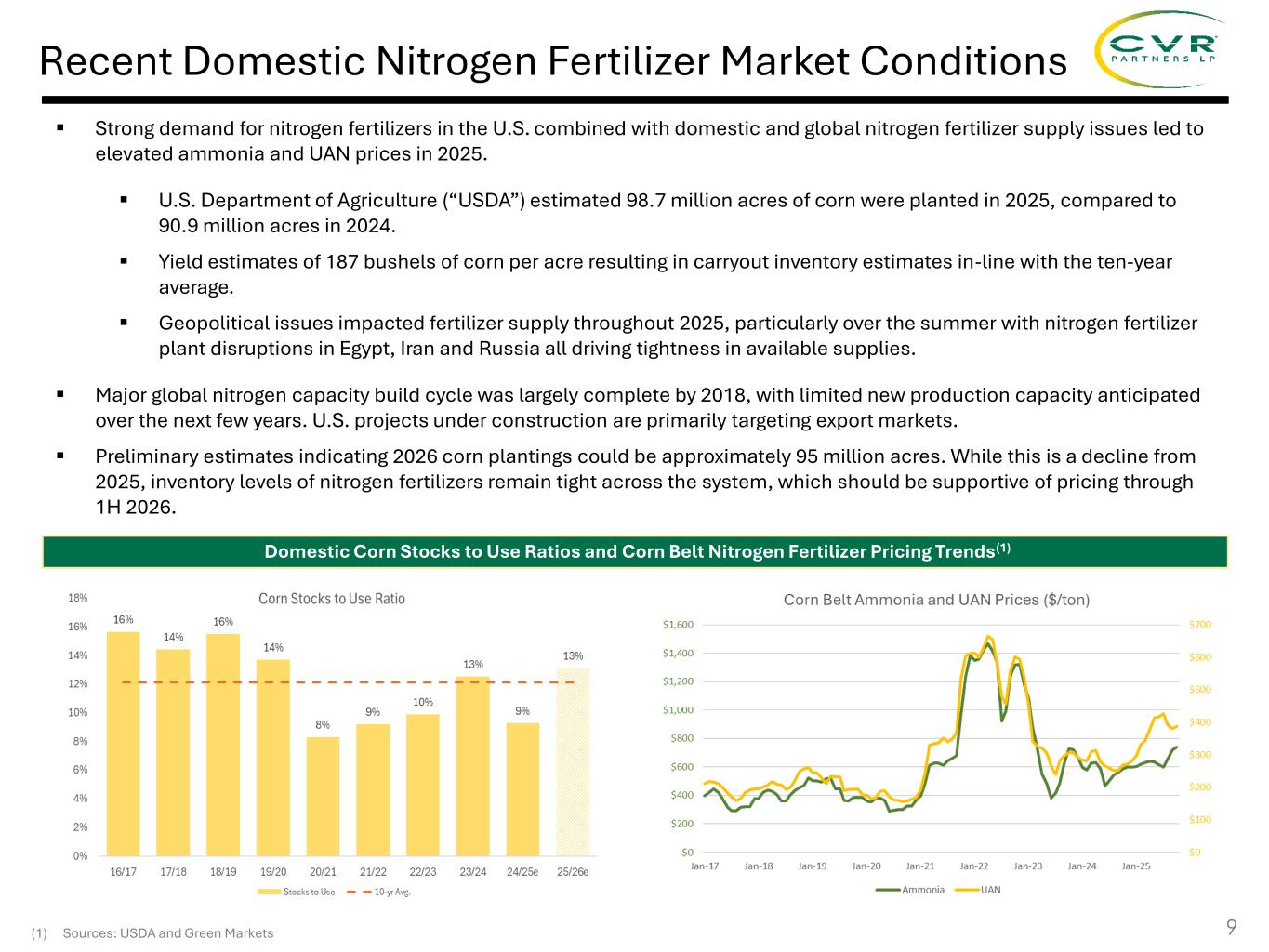

Recent Domestic Nitrogen Fertilizer Market Conditions 9 Domestic Corn Stocks to Use Ratios and Corn Belt Nitrogen Fertilizer Pricing Trends(1) ▪ Strong demand for nitrogen fertilizers in the U.S. combined with domestic and global nitrogen fertilizer supply issues led to elevated ammonia and UAN prices in 2025. ▪ U.S. Department of Agriculture (“USDA”) estimated 98.7 million acres of corn were planted in 2025, compared to 90.9 million acres in 2024. ▪ Yield estimates of 187 bushels of corn per acre resulting in carryout inventory estimates in-line with the ten-year average. ▪ Geopolitical issues impacted fertilizer supply throughout 2025, particularly over the summer with nitrogen fertilizer plant disruptions in Egypt, Iran and Russia all driving tightness in available supplies. ▪ Major global nitrogen capacity build cycle was largely complete by 2018, with limited new production capacity anticipated over the next few years. U.S. projects under construction are primarily targeting export markets. ▪ Preliminary estimates indicating 2026 corn plantings could be approximately 95 million acres. While this is a decline from 2025, inventory levels of nitrogen fertilizers remain tight across the system, which should be supportive of pricing through 1H 2026. (1) Sources: USDA and Green Markets

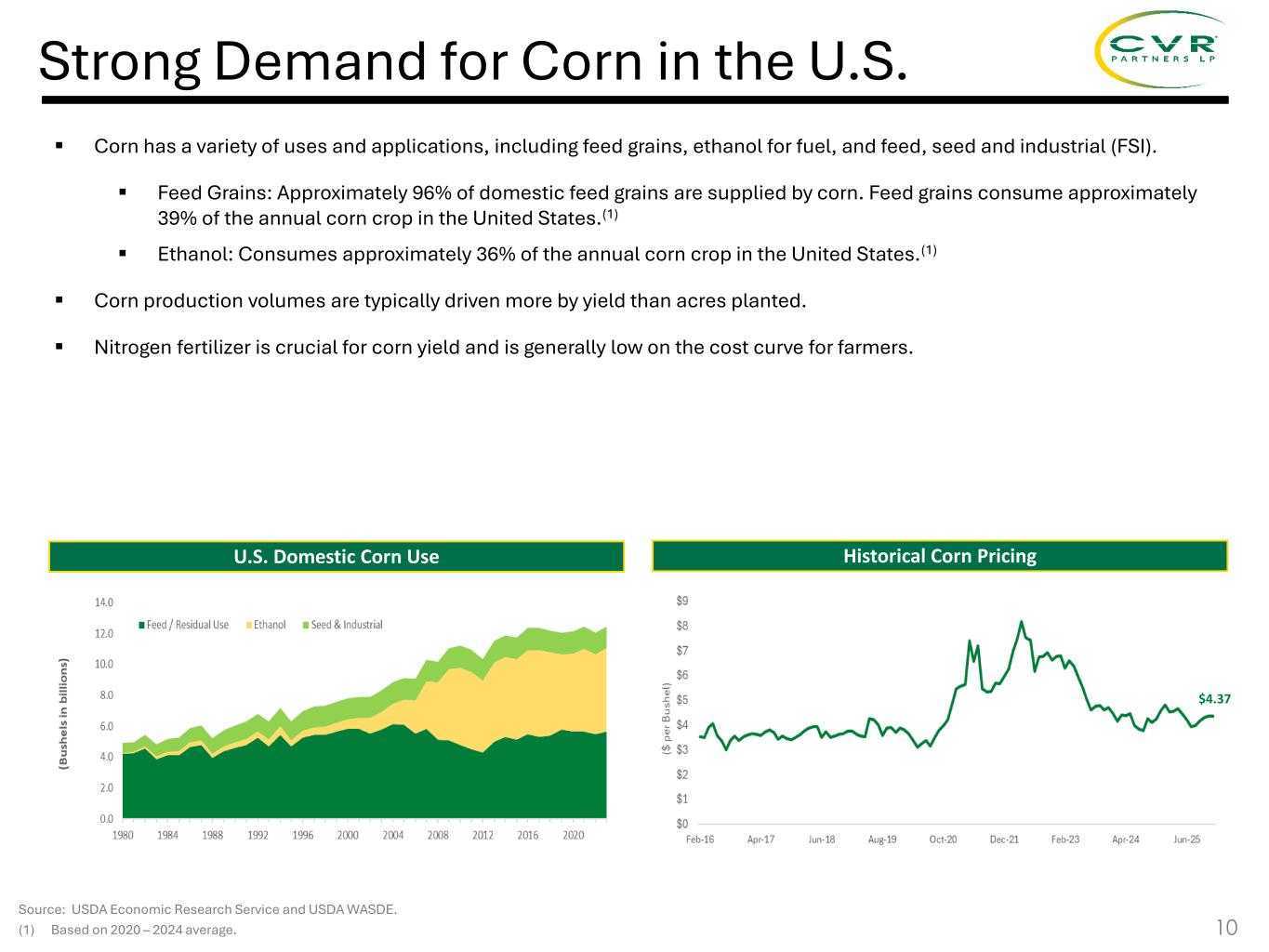

Strong Demand for Corn in the U.S. Source: USDA Economic Research Service and USDA WASDE. (1) Based on 2020 – 2024 average. 10 U.S. Domestic Corn Use Historical Corn Pricing $4.37 ▪ Corn has a variety of uses and applications, including feed grains, ethanol for fuel, and feed, seed and industrial (FSI). ▪ Feed Grains: Approximately 96% of domestic feed grains are supplied by corn. Feed grains consume approximately 39% of the annual corn crop in the United States.(1) ▪ Ethanol: Consumes approximately 36% of the annual corn crop in the United States.(1) ▪ Corn production volumes are typically driven more by yield than acres planted. ▪ Nitrogen fertilizer is crucial for corn yield and is generally low on the cost curve for farmers.

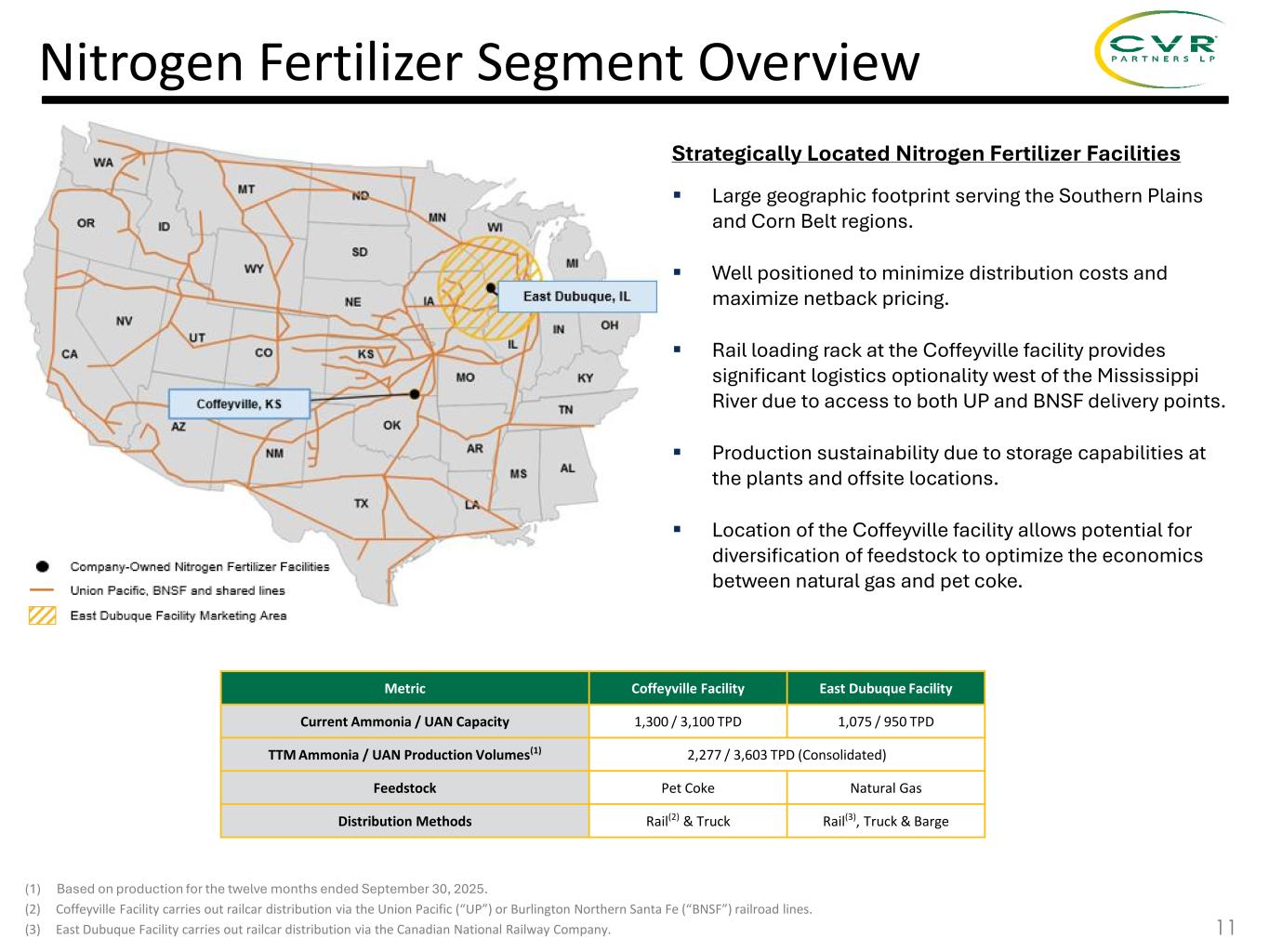

(1) Based on production for the twelve months ended September 30, 2025. (2) Coffeyville Facility carries out railcar distribution via the Union Pacific (“UP”) or Burlington Northern Santa Fe (“BNSF”) railroad lines. (3) East Dubuque Facility carries out railcar distribution via the Canadian National Railway Company. Nitrogen Fertilizer Segment Overview 11 Strategically Located Nitrogen Fertilizer Facilities ▪ Large geographic footprint serving the Southern Plains and Corn Belt regions. ▪ Well positioned to minimize distribution costs and maximize netback pricing. ▪ Rail loading rack at the Coffeyville facility provides significant logistics optionality west of the Mississippi River due to access to both UP and BNSF delivery points. ▪ Production sustainability due to storage capabilities at the plants and offsite locations. ▪ Location of the Coffeyville facility allows potential for diversification of feedstock to optimize the economics between natural gas and pet coke. Metric Coffeyville Facility East Dubuque Facility Current Ammonia / UAN Capacity 1,300 / 3,100 TPD 1,075 / 950 TPD TTM Ammonia / UAN Production Volumes(1) 2,277 / 3,603 TPD (Consolidated) Feedstock Pet Coke Natural Gas Distribution Methods Rail(2) & Truck Rail(3), Truck & Barge

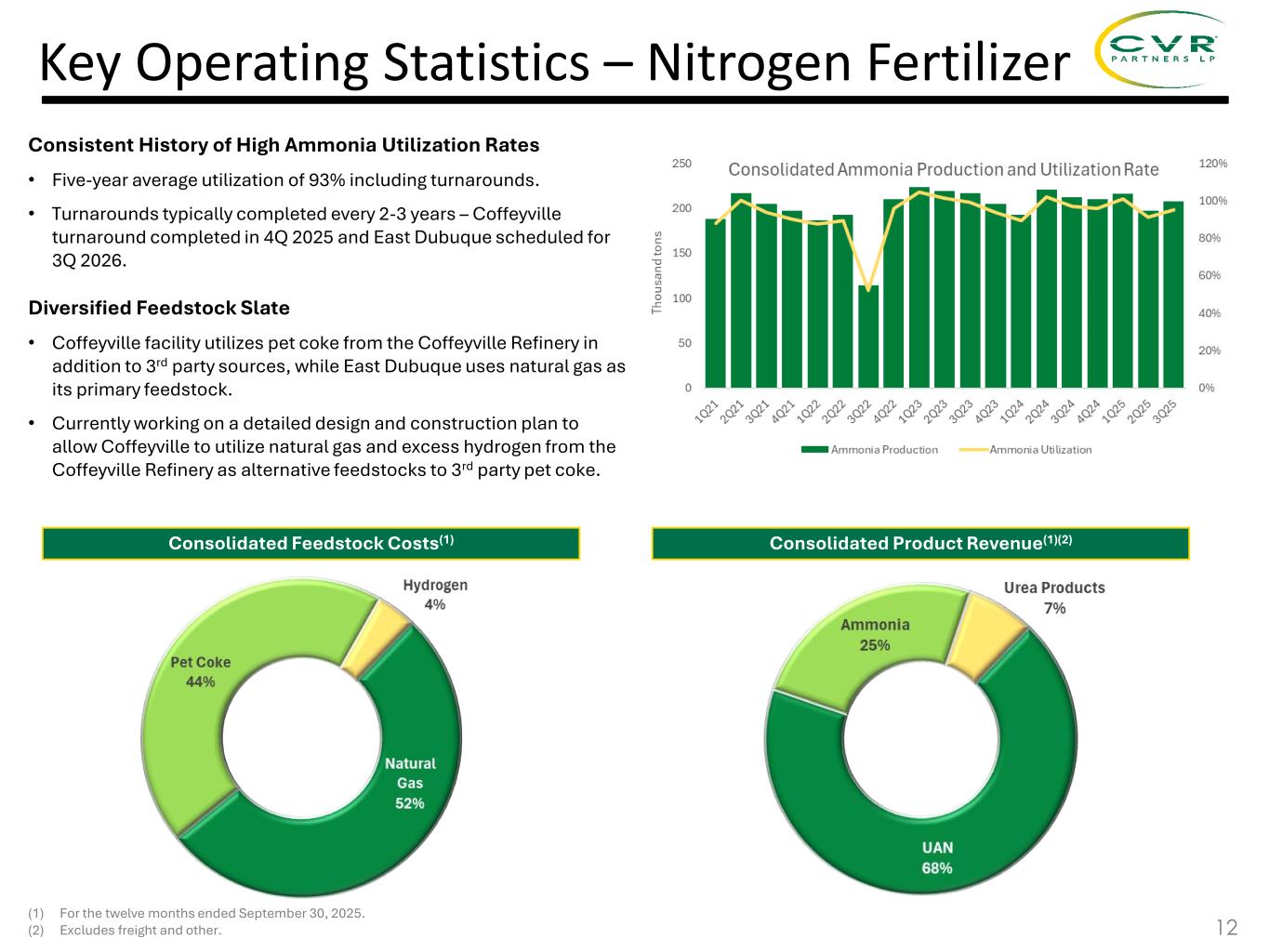

Consolidated Feedstock Costs(1) (1) For the twelve months ended September 30, 2025. (2) Excludes freight and other. Key Operating Statistics – Nitrogen Fertilizer Consolidated Product Revenue(1)(2) 12 Consistent History of High Ammonia Utilization Rates • Five-year average utilization of 93% including turnarounds. • Turnarounds typically completed every 2-3 years – Coffeyville turnaround completed in 4Q 2025 and East Dubuque scheduled for 3Q 2026. Diversified Feedstock Slate • Coffeyville facility utilizes pet coke from the Coffeyville Refinery in addition to 3rd party sources, while East Dubuque uses natural gas as its primary feedstock. • Currently working on a detailed design and construction plan to allow Coffeyville to utilize natural gas and excess hydrogen from the Coffeyville Refinery as alternative feedstocks to 3rd party pet coke.

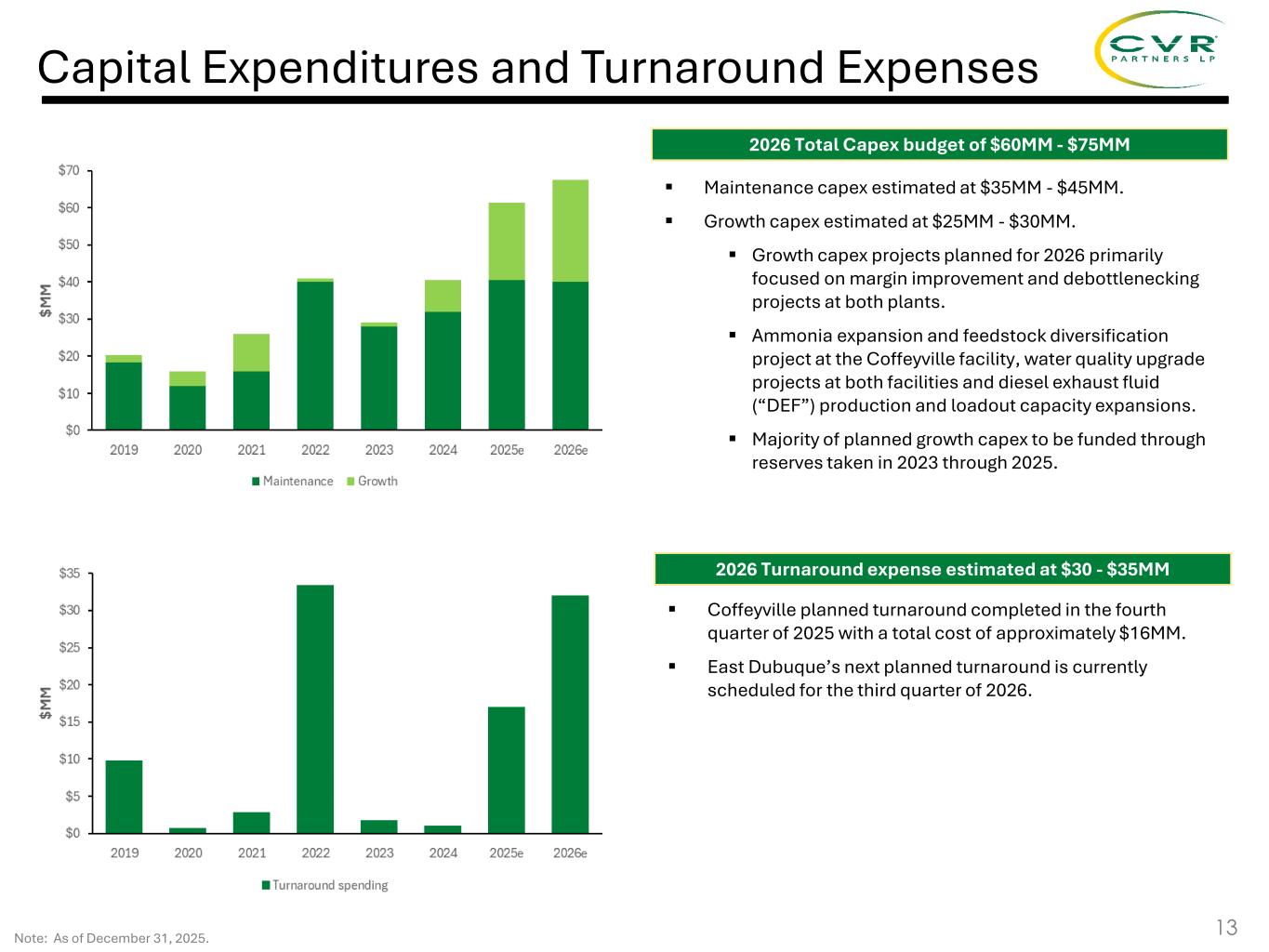

Capital Expenditures and Turnaround Expenses 13 ▪ Maintenance capex estimated at $35MM - $45MM. ▪ Growth capex estimated at $25MM - $30MM. ▪ Growth capex projects planned for 2026 primarily focused on margin improvement and debottlenecking projects at both plants. ▪ Ammonia expansion and feedstock diversification project at the Coffeyville facility, water quality upgrade projects at both facilities and diesel exhaust fluid (“DEF”) production and loadout capacity expansions. ▪ Majority of planned growth capex to be funded through reserves taken in 2023 through 2025. ▪ Coffeyville planned turnaround completed in the fourth quarter of 2025 with a total cost of approximately $16MM. ▪ East Dubuque’s next planned turnaround is currently scheduled for the third quarter of 2026. 2026 Total Capex budget of $60MM - $75MM 2026 Turnaround expense estimated at $30 - $35MM Note: As of December 31, 2025.

APPENDIX

Mission and Values Safety - We always put safety first. The protection of our employees, contractors and communities is paramount. We have an unwavering commitment to safety above all else. If it’s not safe, then we don’t do it. Environment - We care for our environment. Complying with all regulations and minimizing any environmental impact from our operations is essential. We understand our obligation to the environment and that it’s our duty to protect it. Integrity - We require high business ethics. We comply with the law and practice sound corporate governance. We only conduct business one way – the right way with integrity. Corporate Citizenship - We are proud members of the communities where we operate. We are good neighbors and know that it’s a privilege we can’t take for granted. We seek to make a positive economic and social impact through our financial donations and contributions of time, knowledge and talent of our employees to the places where we live and work. Continuous Improvement - We foster accountability under a performance-driven culture. We believe in both individual and team success. We foster accountability under a performance-driven culture that supports creative thinking, teamwork, diversity and personal development so that employees can realize their maximum potential. We use defined work practices for consistency, efficiency and to create value across the organization. Our core values are driven by our people, inform the way we do business each and every day and enhance our ability to accomplish our mission and related strategic objectives. Our mission is to be a top tier North American renewable fuels, petroleum refining, and nitrogen-based fertilizer company as measured by safe and reliable operations, superior financial performance and profitable growth. 15

16 Adjusted EBITDA represents EBITDA adjusted for certain significant noncash items and items that management believes are not attributable to or indicative of our on-going operations or that may obscure our underlying results and trends. Adjusted Refining Margin and Adjusted Renewables Margin represents Refining Margin and Renewables Margin adjusted for certain significant non- cash items and items that management believes are not attributable to or indicative of our underlying operational results of the period or that may obscure results and trends we deem useful. Direct Operating Expenses per Throughput Barrel represents direct operating expenses for the Company’s Petroleum segment divided by total throughput barrels for the period, which is calculated as total throughput barrels per day times the number of days in the period. Direct Operating Expenses per Vegetable Oil Throughput Gallon represents direct operating expenses for the Company’s Renewables segment divided by total vegetable oil throughput gallons for the period, which is calculated as total vegetable oil throughput gallons per day times the number of days in the period. EBITDA represents net income (loss) before (i) interest expense, net, (ii) income tax expense (benefit) and (iii) depreciation and amortization expense. Refining Margin represents the difference between the Company’s Petroleum segment net sales and cost of materials and other. Refining Margin and Adjusted Refining Margin per Throughput Barrel represents Refining Margin and Adjusted Refining Margin divided by the total throughput barrels for the period, which is calculated as total throughput barrels per day times the number of days in the period. Renewables Margin represents the difference between the Company’s Renewables segment net sales and cost of materials and other. Renewables Margin and Adjusted Renewables Margin per Vegetable Oil Throughput Gallon represents Renewables Margin and Adjusted Renewables Margin divided by the total vegetable oil throughput gallons for the period, which is calculated as total vegetable oil throughput gallons per day times the number of days in the period. Note: Due to rounding, numbers presented within this section may not add or equal to numbers or totals presented elsewhere within this document. Non-GAAP Financial Measures

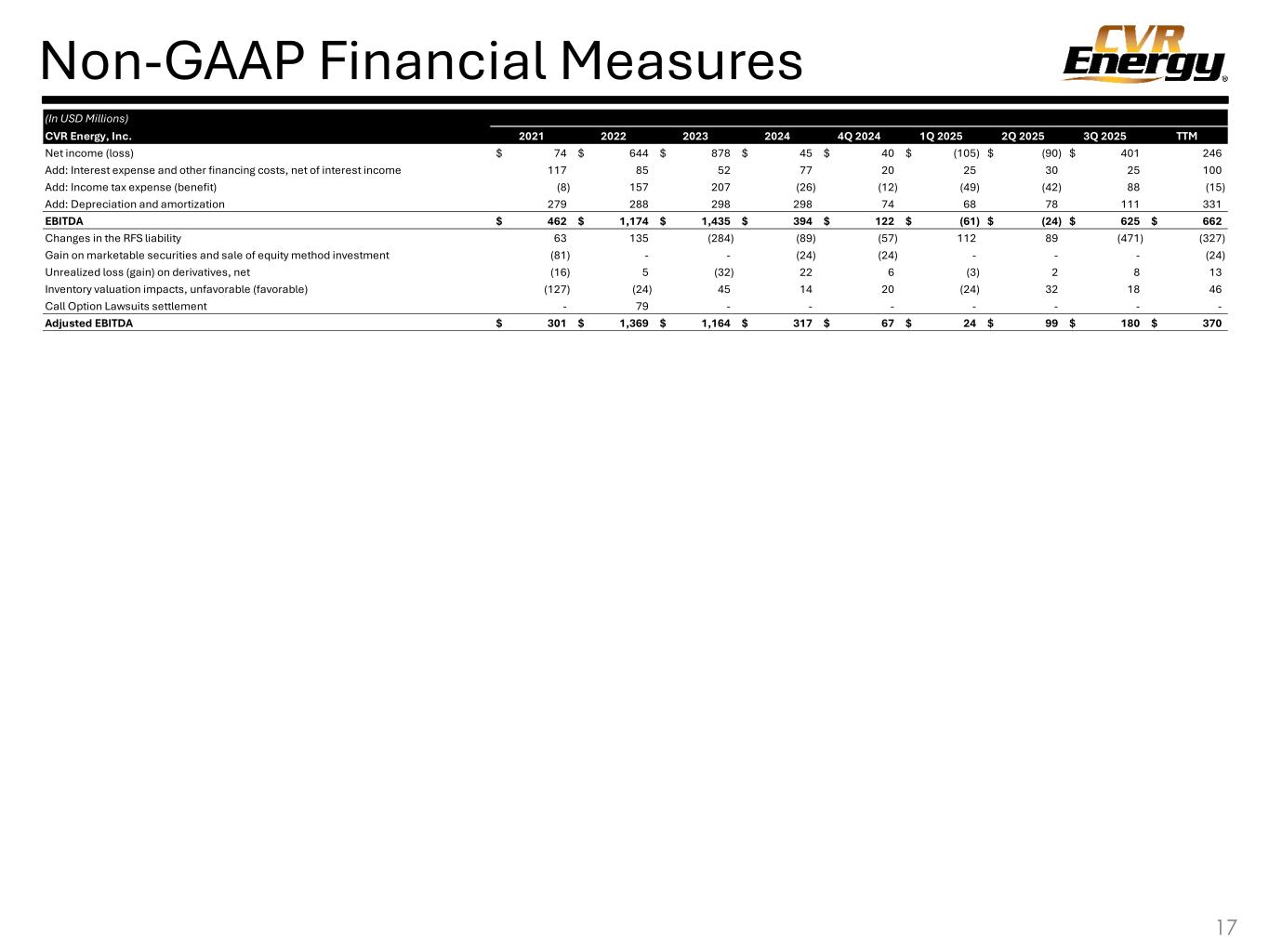

Non-GAAP Financial Measures 17 (In USD Millions) CVR Energy, Inc. 2021 2022 2023 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 TTM Net income (loss) 74$ 644$ 878$ 45$ 40$ (105)$ (90)$ 401$ 246 Add: Interest expense and other financing costs, net of interest income 117 85 52 77 20 25 30 25 100 Add: Income tax expense (benefit) (8) 157 207 (26) (12) (49) (42) 88 (15) Add: Depreciation and amortization 279 288 298 298 74 68 78 111 331 EBITDA 462$ 1,174$ 1,435$ 394$ 122$ (61)$ (24)$ 625$ 662$ Changes in the RFS liability 63 135 (284) (89) (57) 112 89 (471) (327) Gain on marketable securities and sale of equity method investment (81) - - (24) (24) - - - (24) Unrealized loss (gain) on derivatives, net (16) 5 (32) 22 6 (3) 2 8 13 Inventory valuation impacts, unfavorable (favorable) (127) (24) 45 14 20 (24) 32 18 46 Call Option Lawsuits settlement - 79 - - - - - - - Adjusted EBITDA 301$ 1,369$ 1,164$ 317$ 67$ 24$ 99$ 180$ 370$

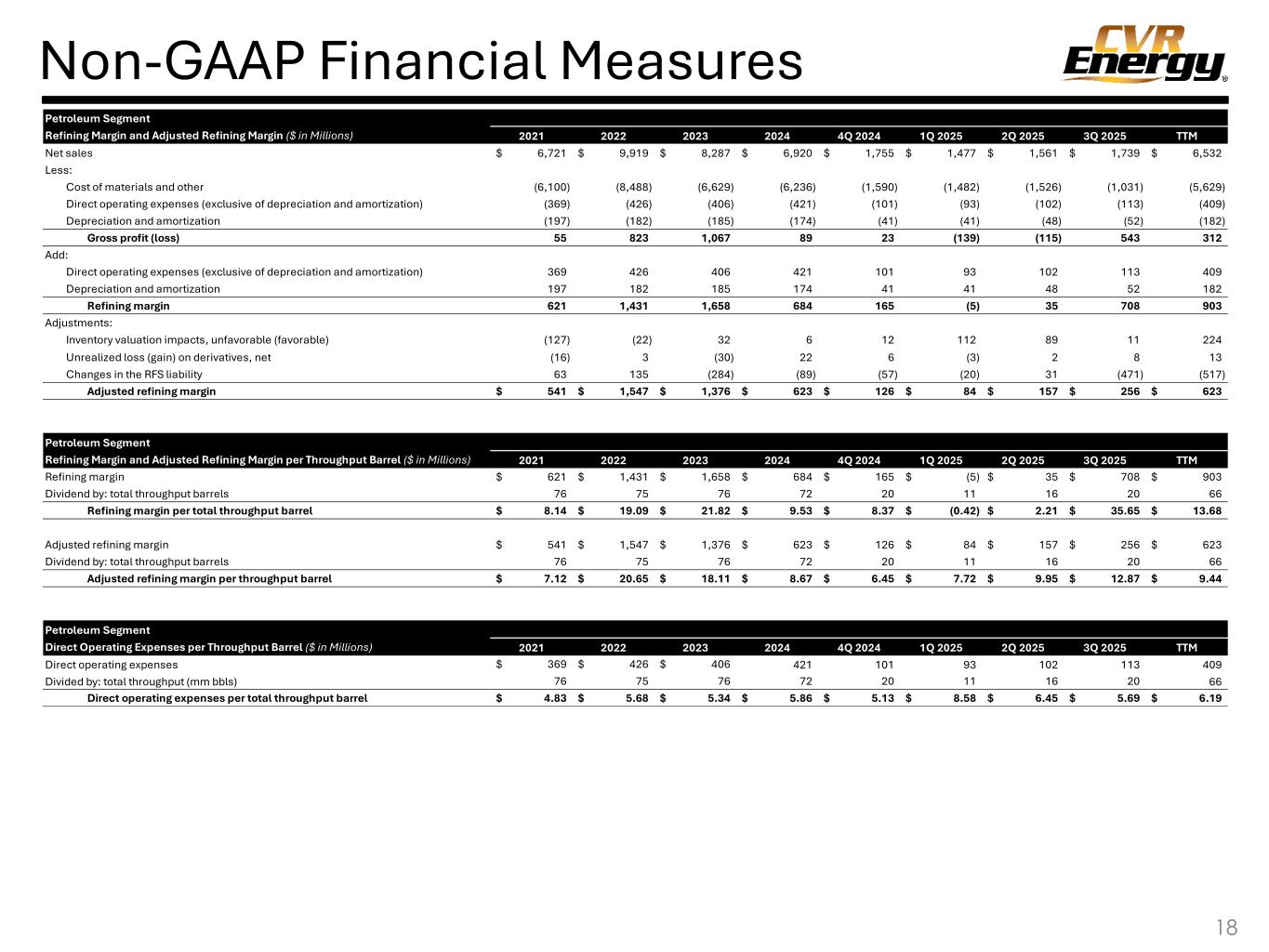

Non-GAAP Financial Measures 18 Petroleum Segment Refining Margin and Adjusted Refining Margin ($ in Millions) 2021 2022 2023 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 TTM Net sales 6,721$ 9,919$ 8,287$ 6,920$ 1,755$ 1,477$ 1,561$ 1,739$ 6,532$ Less: Cost of materials and other (6,100) (8,488) (6,629) (6,236) (1,590) (1,482) (1,526) (1,031) (5,629) Direct operating expenses (exclusive of depreciation and amortization) (369) (426) (406) (421) (101) (93) (102) (113) (409) Depreciation and amortization (197) (182) (185) (174) (41) (41) (48) (52) (182) Gross profit (loss) 55 823 1,067 89 23 (139) (115) 543 312 Add: Direct operating expenses (exclusive of depreciation and amortization) 369 426 406 421 101 93 102 113 409 Depreciation and amortization 197 182 185 174 41 41 48 52 182 Refining margin 621 1,431 1,658 684 165 (5) 35 708 903 Adjustments: Inventory valuation impacts, unfavorable (favorable) (127) (22) 32 6 12 112 89 11 224 Unrealized loss (gain) on derivatives, net (16) 3 (30) 22 6 (3) 2 8 13 Changes in the RFS liability 63 135 (284) (89) (57) (20) 31 (471) (517) Adjusted refining margin 541$ 1,547$ 1,376$ 623$ 126$ 84$ 157$ 256$ 623$ Petroleum Segment Refining Margin and Adjusted Refining Margin per Throughput Barrel ($ in Millions) 2021 2022 2023 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 TTM Refining margin 621$ 1,431$ 1,658$ 684$ 165$ (5)$ 35$ 708$ 903$ Dividend by: total throughput barrels 76 75 76 72 20 11 16 20 66 Refining margin per total throughput barrel 8.14$ 19.09$ 21.82$ 9.53$ 8.37$ (0.42)$ 2.21$ 35.65$ 13.68$ Adjusted refining margin 541$ 1,547$ 1,376$ 623$ 126$ 84$ 157$ 256$ 623$ Dividend by: total throughput barrels 76 75 76 72 20 11 16 20 66 Adjusted refining margin per throughput barrel 7.12$ 20.65$ 18.11$ 8.67$ 6.45$ 7.72$ 9.95$ 12.87$ 9.44$ Petroleum Segment Direct Operating Expenses per Throughput Barrel ($ in Millions) 2021 2022 2023 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 TTM Direct operating expenses 369$ 426$ 406$ 421 101 93 102 113 409 Divided by: total throughput (mm bbls) 76 75 76 72 20 11 16 20 66 Direct operating expenses per total throughput barrel 4.83$ 5.68$ 5.34$ 5.86$ 5.13$ 8.58$ 6.45$ 5.69$ 6.19$

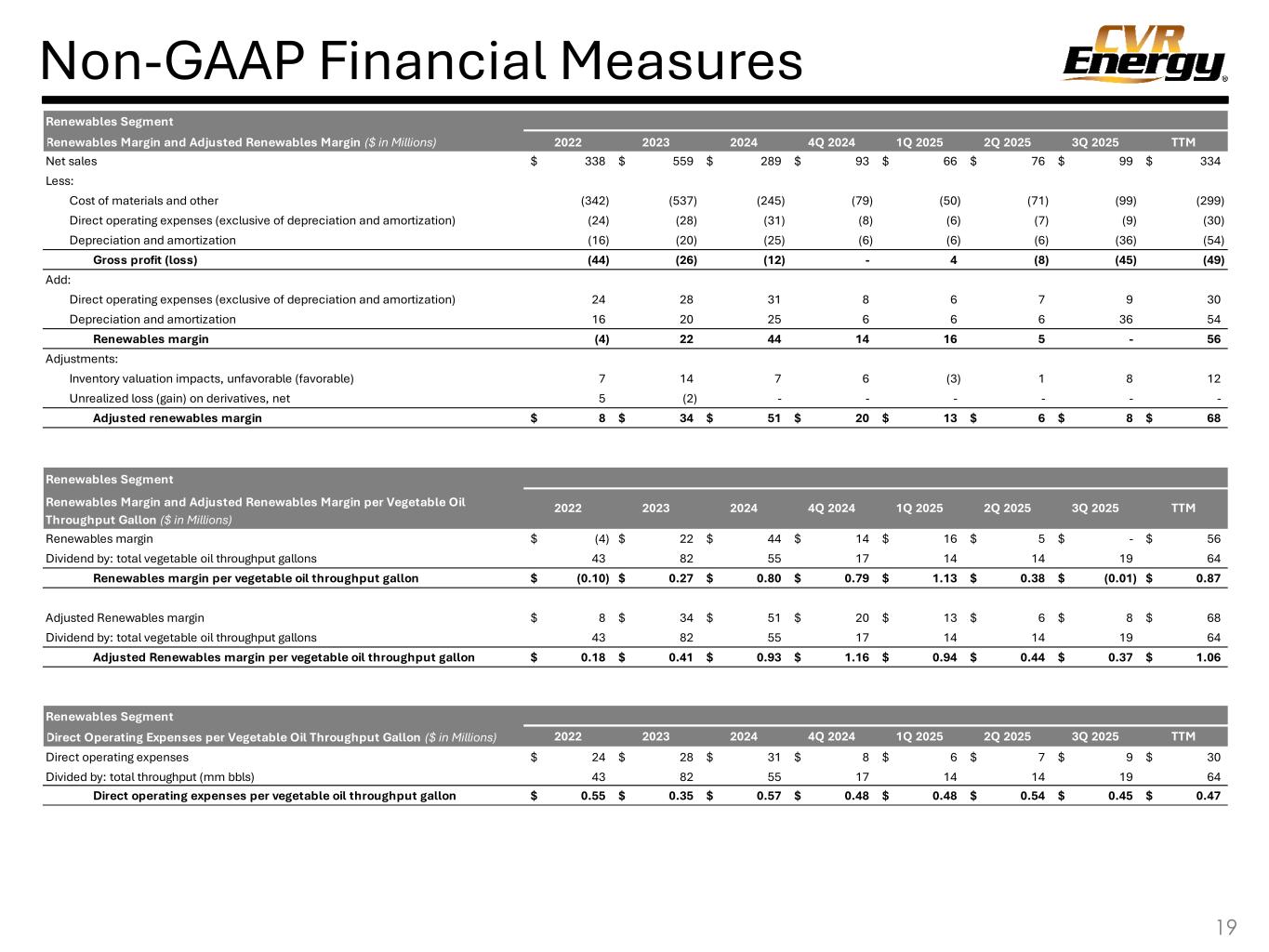

Non-GAAP Financial Measures 19 Renewables Segment Renewables Margin and Adjusted Renewables Margin ($ in Millions) 2022 2023 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 TTM Net sales 338$ 559$ 289$ 93$ 66$ 76$ 99$ 334$ Less: Cost of materials and other (342) (537) (245) (79) (50) (71) (99) (299) Direct operating expenses (exclusive of depreciation and amortization) (24) (28) (31) (8) (6) (7) (9) (30) Depreciation and amortization (16) (20) (25) (6) (6) (6) (36) (54) Gross profit (loss) (44) (26) (12) - 4 (8) (45) (49) Add: Direct operating expenses (exclusive of depreciation and amortization) 24 28 31 8 6 7 9 30 Depreciation and amortization 16 20 25 6 6 6 36 54 Renewables margin (4) 22 44 14 16 5 - 56 Adjustments: Inventory valuation impacts, unfavorable (favorable) 7 14 7 6 (3) 1 8 12 Unrealized loss (gain) on derivatives, net 5 (2) - - - - - - Adjusted renewables margin 8$ 34$ 51$ 20$ 13$ 6$ 8$ 68$ Renewables Segment Renewables margin (4)$ 22$ 44$ 14$ 16$ 5$ -$ 56$ Dividend by: total vegetable oil throughput gallons 43 82 55 17 14 14 19 64 Renewables margin per vegetable oil throughput gallon (0.10)$ 0.27$ 0.80$ 0.79$ 1.13$ 0.38$ (0.01)$ 0.87$ Adjusted Renewables margin 8$ 34$ 51$ 20$ 13$ 6$ 8$ 68$ Dividend by: total vegetable oil throughput gallons 43 82 55 17 14 14 19 64 Adjusted Renewables margin per vegetable oil throughput gallon 0.18$ 0.41$ 0.93$ 1.16$ 0.94$ 0.44$ 0.37$ 1.06$ Renewables Segment Direct Operating Expenses per Vegetable Oil Throughput Gallon ($ in Millions) 2022 2023 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 TTM Direct operating expenses 24$ 28$ 31$ 8$ 6$ 7$ 9$ 30$ Divided by: total throughput (mm bbls) 43 82 55 17 14 14 19 64 Direct operating expenses per vegetable oil throughput gallon 0.55$ 0.35$ 0.57$ 0.48$ 0.48$ 0.54$ 0.45$ 0.47$ TTM3Q 20252024Renewables Margin and Adjusted Renewables Margin per Vegetable Oil Throughput Gallon ($ in Millions) 2022 2023 4Q 2024 1Q 2025 2Q 2025

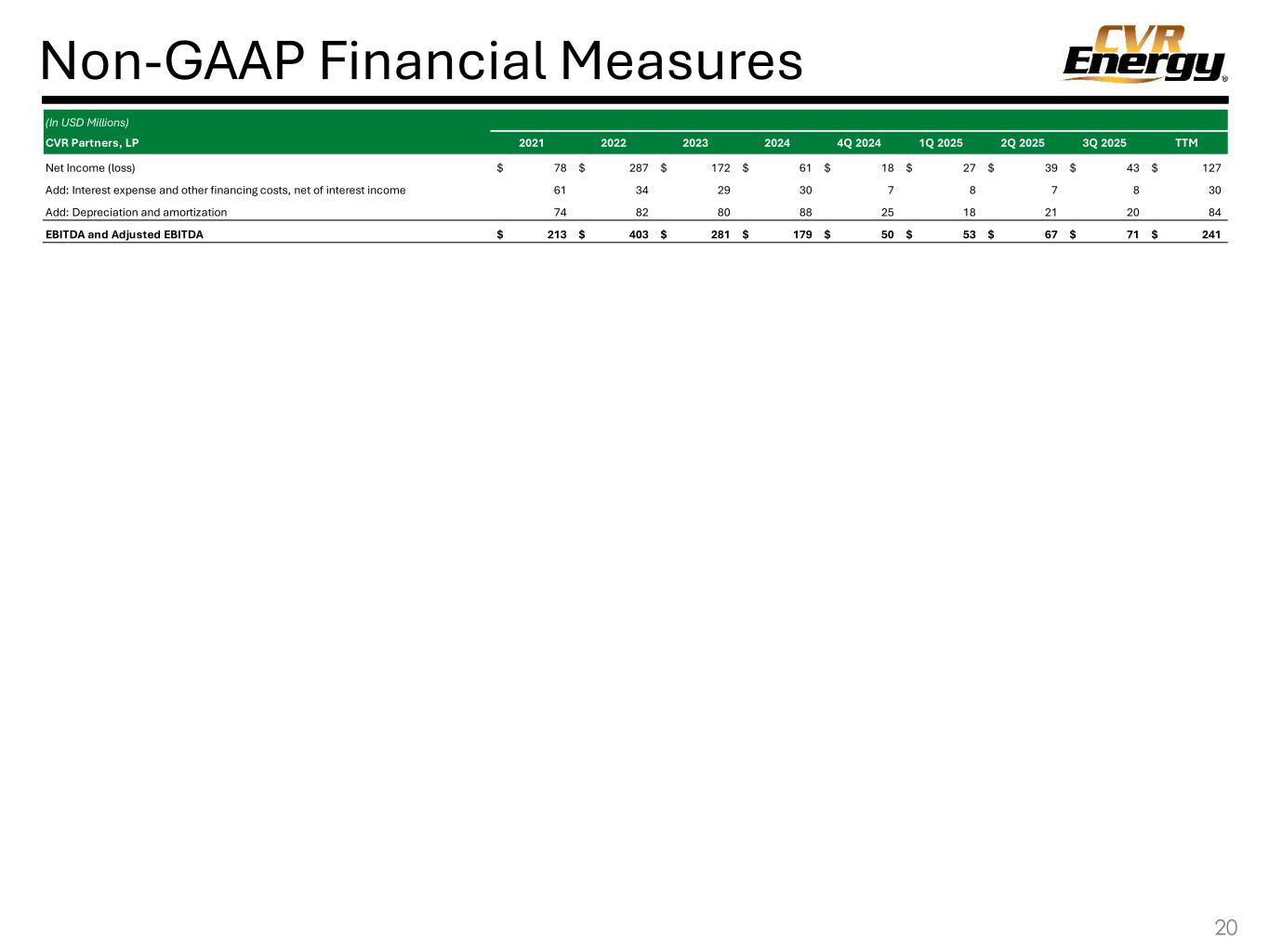

Non-GAAP Financial Measures 20 (In USD Millions) CVR Partners, LP 2021 2022 2023 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 TTM Net Income (loss) 78$ 287$ 172$ 61$ 18$ 27$ 39$ 43$ 127$ Add: Interest expense and other financing costs, net of interest income 61 34 29 30 7 8 7 8 30 Add: Depreciation and amortization 74 82 80 88 25 18 21 20 84 EBITDA and Adjusted EBITDA 213$ 403$ 281$ 179$ 50$ 53$ 67$ 71$ 241$

2025 & 2026 Est. Capital Expenditures 21 (in milions) Low High Low High Low High Petroleum 82$ 87$ 34$ 38$ 116$ 125$ Renewables 3 4 1 2 4 6 Nitrogen Fertilizer 39 42 19 23 58 65 Other 1 2 1 2 2 4 Total 125$ 135$ 55$ 65$ 180$ 200$ 2025 Estimate Maintenance Growth Total (in milions) Low High Low High Low High Petroleum 80$ 90$ 50$ 55$ 130$ 145$ Nitrogen Fertilizer 35 45 25 30 60 75 Other(1) 10 15 - 5 10 20 Total 125$ 150$ 75$ 90$ 200$ 240$ 2026 Estimate Maintenance Growth Total (1) Capital expenditures for the Renewables Segment are expected to be minimal following the reversion of the renewable diesel unit back to hydrocarbon processing service and are included in ‘Other’ for purposes of this guidance.

RINs Summary 22 • CVR’s Coffeyville and Wynnewood refineries are subject to the Renewable Fuel Standards (“RFS”) implemented by the U.S. Environmental Protection Agency (the “EPA”), which requires refineries to either blend renewable fuels into their transportation fuels or purchase renewable fuel credits, knows as RINs, in lieu of blending. • Historically, Wynnewood has qualified for and received Small Refinery Exemptions (“SREs”) from the EPA, exempting it from compliance with the RFS. Refineries with capacity less than 75,000 barrels per day that would face Disproportionate Economic Harm (“DEH”) through complying with the RFS can apply for SREs, as prescribed by the RFS regulation. • CVR Energy’s obligated party subsidiary, Wynnewood Refining Company, LLC (“WRC”), has suffered DEH due to the RFS and has petitioned for SREs which would relieve it from RFS obligations. • On August 22, 2025, the EPA issued a decision document affirming the validity of its previous grants of WRC’s SREs for 2017 and 2018, granting 100% waivers for WRC’s 2019 and 2021 compliance periods, and 50% waivers for its 2020, 2022, 2023 and 2024 compliance periods. • Based on this decision, WRC reduced its balance sheet obligation related to the 2020 – 2025 compliance periods by over 420 million RINs, resulting in an obligation of 90 million RINs as of September 30, 2025. • Assuming another 50% SRE is granted for WRC’s 2025 obligation, as of September 30, 2025, approximately $100 million worth of RINs would need to be purchased by March 31, 2026, in order to satisfy both of CVR’s obligated subsidiaries’ 2024 and 2025 obligations.

CVR Energy, Inc. NYSE: CVI Icahn Enterprises L.P. & Affiliates Public CVR GP, LLC CVR Partners, LP NYSE: UAN Nitrogen Fertilizer Segment Subsidiaries Petroleum Segment Subsidiaries Public 60.6 % N-E GP Interest • Non-Economic General Partner Interest (“N-E GP Interest”) • All ownership percentages are 100% unless otherwise noted and may be indirect with intervening subsidiaries omitted for simplicity. 30.0 % 70.0 % 36.8 % JV: 45Q Entities Other Subsidiaries JV Entity: Enable South Central Pipeline, LLC 40% 50% 2.6 % Renewables Segment Subsidiaries Simplified Organizational Structure 23