Financial Results Conference Call October 29, 2025 Q3:2025

Disclaimer & Cautionary Statements This presentation and our earnings call includes forward-looking statements. Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Such forward-looking statements include statements regarding: • Our growth expectations in 2025 and beyond, including our growth in surgery, increased funding in targeted research and expanded product portfolio; • Expected results of research and development, including that our efforts will innovate and diversify our product portfolio; • Placental-derived products and their potential clinical benefits; • EPIEFFECT enrollment; • Expectations regarding the reimbursement environment for the Company’s products, including Medicare Spending and changes to CMS rules in 2026; • Expectations regarding HELIOGEN, AMNIOFIX and AMNIOEFFECT driving Surgical growth; • the future of CELERA and EMERGE’s and their impact on our financial results; • 2025 guidance, including revenue growth, adjusted EBITDA margin, gross margin, sales and marketing expenses, G&A expenses, R&D expenses and year end cash balance; • Longer term guidance, including net sales growth and adjusted EBITDA margins; • Our ability to manage Private Office dynamics, including adjusting our strategy to remain competitive; and • The Company’s long-term strategy and goals for value creation, the status of its pipeline products, expectations for future products, and expectations for future growth and profitability. Additional forward-looking statements may be identified by words such as "believe," "expect," "may," "plan," "potential," "will," "preliminary," and similar expressions, and are based on management's current beliefs and expectations. Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ from expectations include: • Future sales are uncertain and are affected by competition, access to customers, patient access to hospitals and healthcare providers, the reimbursement environment and many other factors; • The future market for the Company’s products can depend on regulatory approval of such products, which might not occur at all or when expected, and is based in part on assumptions regarding the number of patients who elect less acute and more acute treatment than the Company’s products, market acceptance of the Company’s products, and adequate reimbursement for such therapies; • The process of obtaining regulatory clearances or approvals to market a biological product or medical device from the FDA or similar regulatory authorities outside of the U.S. is costly and time consuming, and such clearances or approvals may not be granted on a timely basis, or at all, and the ability to obtain the rights to market additional, suitable products depends on negotiations with third parties which may not be forthcoming; and • The Company describes additional risks and uncertainties in the Risk Factors section of its most recent annual report and quarterly reports filed with the Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this presentation and the Company assumes no obligation to update any forward-looking statement. Q3:25 Financial Results Conference Call 2

Opening Remarks Joseph H. Capper, Chief Executive Officer 3Q3:25 Financial Results Conference Call

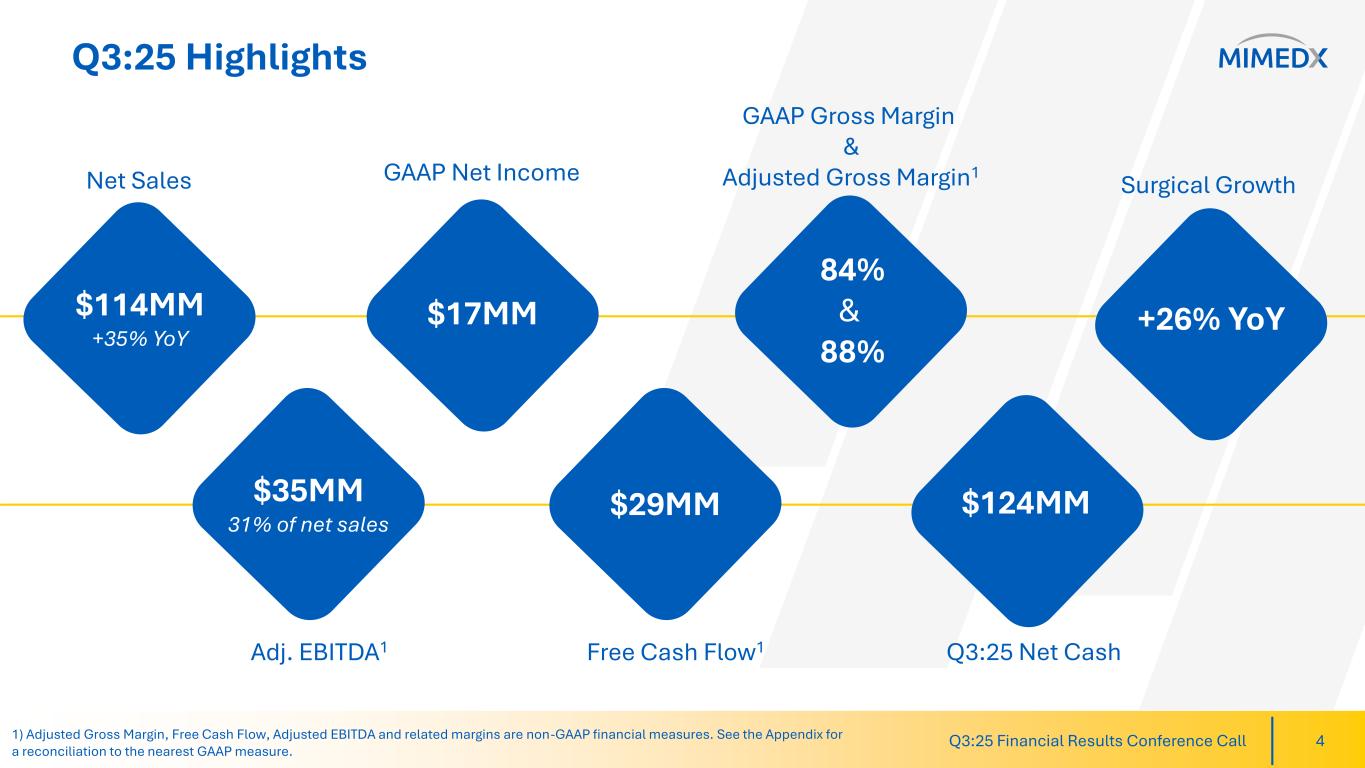

Q3:25 Highlights Q3:25 Financial Results Conference Call 4 Net Sales $114MM +35% YoY GAAP Gross Margin & Adjusted Gross Margin1 84% & 88% GAAP Net Income $17MM Adj. EBITDA1 $35MM 31% of net sales Free Cash Flow1 $29MM 1) Adjusted Gross Margin, Free Cash Flow, Adjusted EBITDA and related margins are non-GAAP financial measures. See the Appendix for a reconciliation to the nearest GAAP measure. Surgical Growth +26% YoY Q3:25 Net Cash $124MM

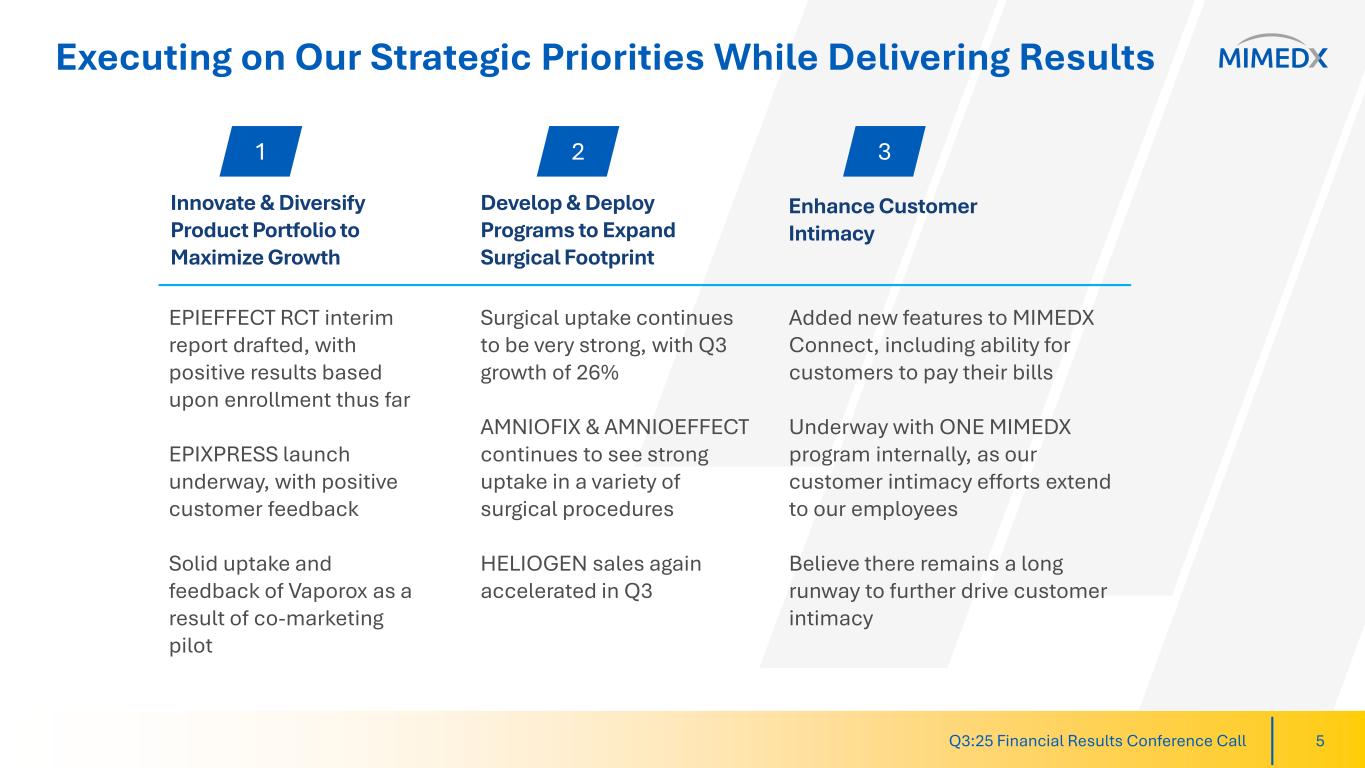

Executing on Our Strategic Priorities While Delivering Results Q3:25 Financial Results Conference Call 5 Innovate & Diversify Product Portfolio to Maximize Growth Develop & Deploy Programs to Expand Surgical Footprint Enhance Customer Intimacy EPIEFFECT RCT interim report drafted, with positive results based upon enrollment thus far EPIXPRESS launch underway, with positive customer feedback Solid uptake and feedback of Vaporox as a result of co-marketing pilot Surgical uptake continues to be very strong, with Q3 growth of 26% AMNIOFIX & AMNIOEFFECT continues to see strong uptake in a variety of surgical procedures HELIOGEN sales again accelerated in Q3 Added new features to MIMEDX Connect, including ability for customers to pay their bills Underway with ONE MIMEDX program internally, as our customer intimacy efforts extend to our employees Believe there remains a long runway to further drive customer intimacy 1 2 3

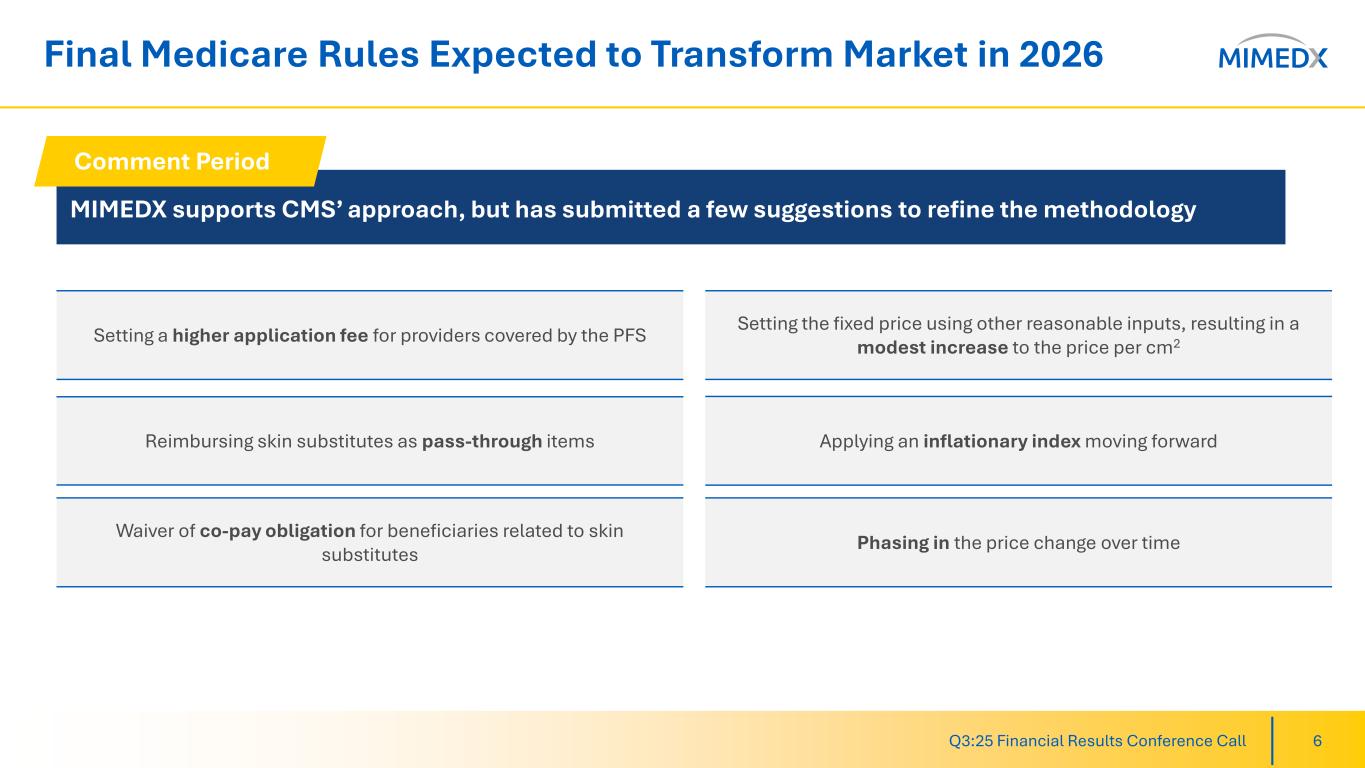

Final Medicare Rules Expected to Transform Market in 2026 Q3:25 Financial Results Conference Call 6 Setting the fixed price using other reasonable inputs, resulting in a modest increase to the price per cm2Setting a higher application fee for providers covered by the PFS Reimbursing skin substitutes as pass-through items MIMEDX supports CMS’ approach, but has submitted a few suggestions to refine the methodology Comment Period Applying an inflationary index moving forward Phasing in the price change over timeWaiver of co-pay obligation for beneficiaries related to skin substitutes

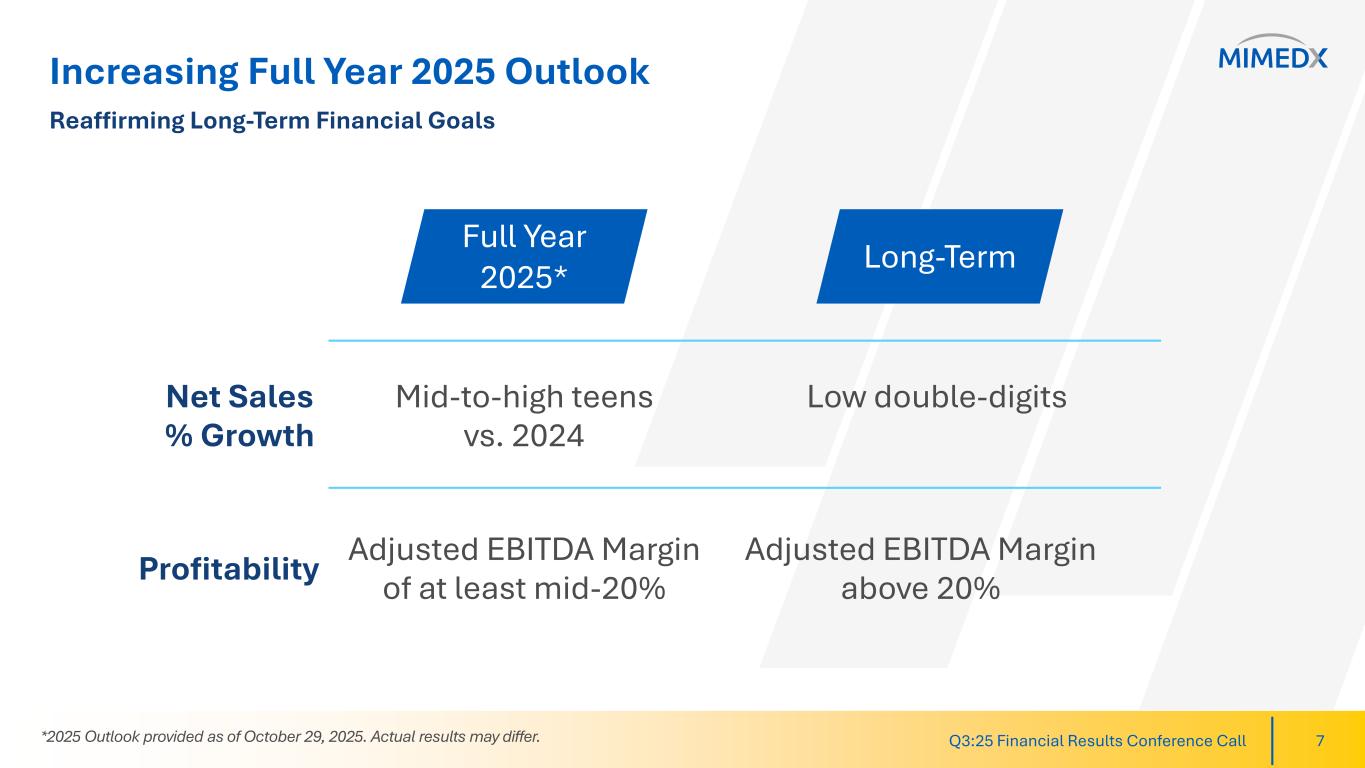

Increasing Full Year 2025 Outlook Q3:25 Financial Results Conference Call 7 Full Year 2025* Long-Term Net Sales % Growth Adjusted EBITDA Margin above 20%Profitability Mid-to-high teens vs. 2024 Low double-digits Reaffirming Long-Term Financial Goals *2025 Outlook provided as of October 29, 2025. Actual results may differ. Adjusted EBITDA Margin of at least mid-20%

Financial Results Doug Rice, Chief Financial Officer 8Q3:25 Financial Results Conference Call

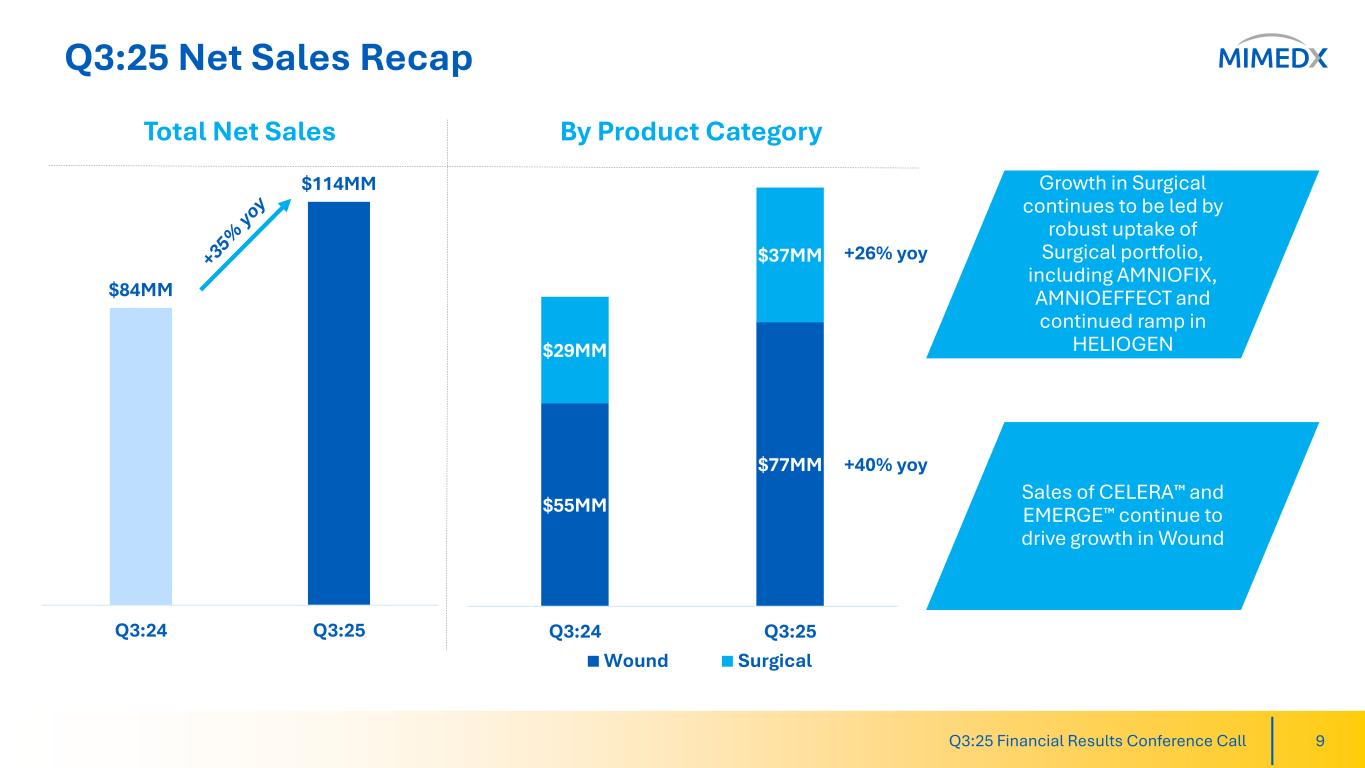

Q3:25 Net Sales Recap Q3:25 Financial Results Conference Call 9 By Product CategoryTotal Net Sales $84MM $114MM Q3:24 Q3:25 $55MM $77MM $29MM $37MM Q3:24 Q3:25 Wound Surgical +40% yoy +26% yoy Growth in Surgical continues to be led by robust uptake of Surgical portfolio, including AMNIOFIX, AMNIOEFFECT and continued ramp in HELIOGEN Sales of CELERA and EMERGE continue to drive growth in Wound

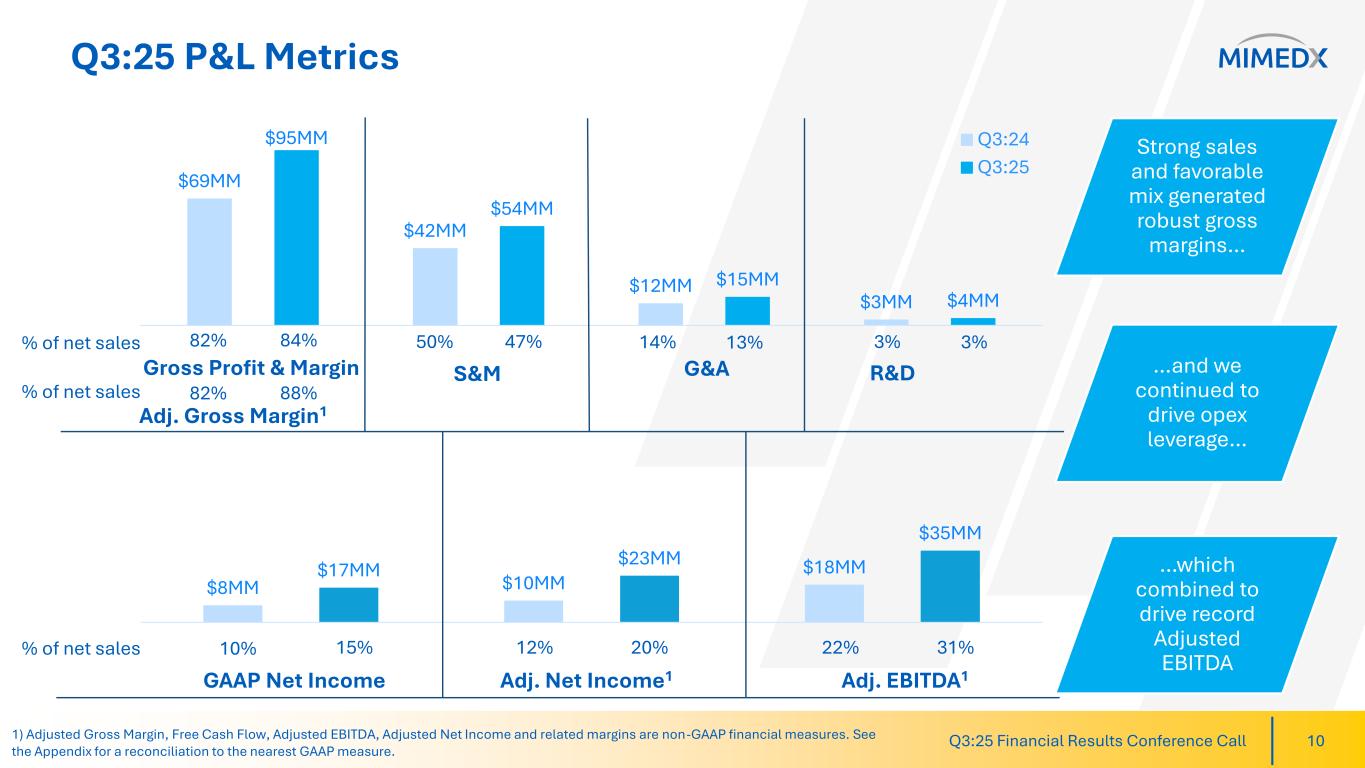

$8MM $10MM $18MM$17MM $23MM $35MM Q3:25 P&L Metrics Q3:25 Financial Results Conference Call 10 $69MM $42MM $12MM $3MM $95MM $54MM $15MM $4MM Q3:24 Q3:25 S&M Adj. EBITDA1GAAP Net Income R&D % of net sales 50% 47% 3% 3% % of net sales 10% 15% 22% 31% Adj. Net Income1 12% 20% Gross Profit & Margin 82% 84% 1) Adjusted Gross Margin, Free Cash Flow, Adjusted EBITDA, Adjusted Net Income and related margins are non-GAAP financial measures. See the Appendix for a reconciliation to the nearest GAAP measure. G&A 14% 13% Strong sales and favorable mix generated robust gross margins… …and we continued to drive opex leverage… …which combined to drive record Adjusted EBITDA % of net sales Adj. Gross Margin1 82% 88%

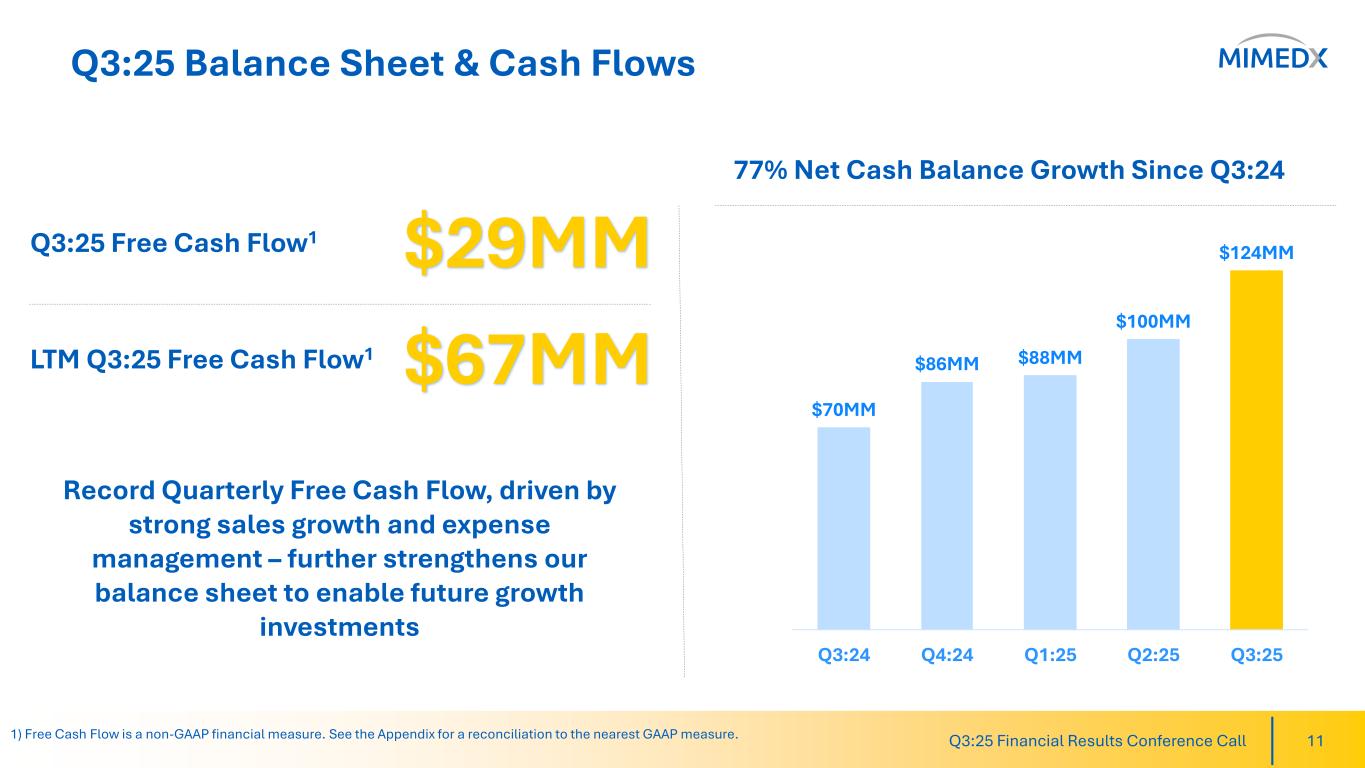

77% Net Cash Balance Growth Since Q3:24 $70MM $86MM $88MM $100MM $124MM Q3:24 Q4:24 Q1:25 Q2:25 Q3:25 Q3:25 Balance Sheet & Cash Flows Q3:25 Financial Results Conference Call 111) Free Cash Flow is a non-GAAP financial measure. See the Appendix for a reconciliation to the nearest GAAP measure. $29MMQ3:25 Free Cash Flow1 Record Quarterly Free Cash Flow, driven by strong sales growth and expense management – further strengthens our balance sheet to enable future growth investments $67MMLTM Q3:25 Free Cash Flow1

Joseph H. Capper, Chief Executive Officer 12Q3:25 Financial Results Conference Call Closing Remarks

Summary Q3:25 Financial Results Conference Call 131) Adjusted Gross Margin, Free Cash Flow, EBITDA, Adjusted EBITDA and related margins are non-GAAP financial measures. See Appendix for a reconciliation to the nearest GAAP measure. *2025 Outlook provided as of October 29, 2025. Actual results may differ. Net Sales $114MM +35% YoY GAAP Net Income $17MM Adj. EBITDA1 $35MM 31% of Net Sales Free Cash Flow1 $29MM Recently Launched Pilot Programs Progressing, Including: FY2025 Guidance* Revenue Outlook Mid-to-High Teens percentage basis FY2025 Guidance* Adj. EBITDA Mid-to-High 20s percentage basis

Q&A 14Q3:25 Financial Results Conference Call

Appendix 15Q3:25 Financial Results Conference Call

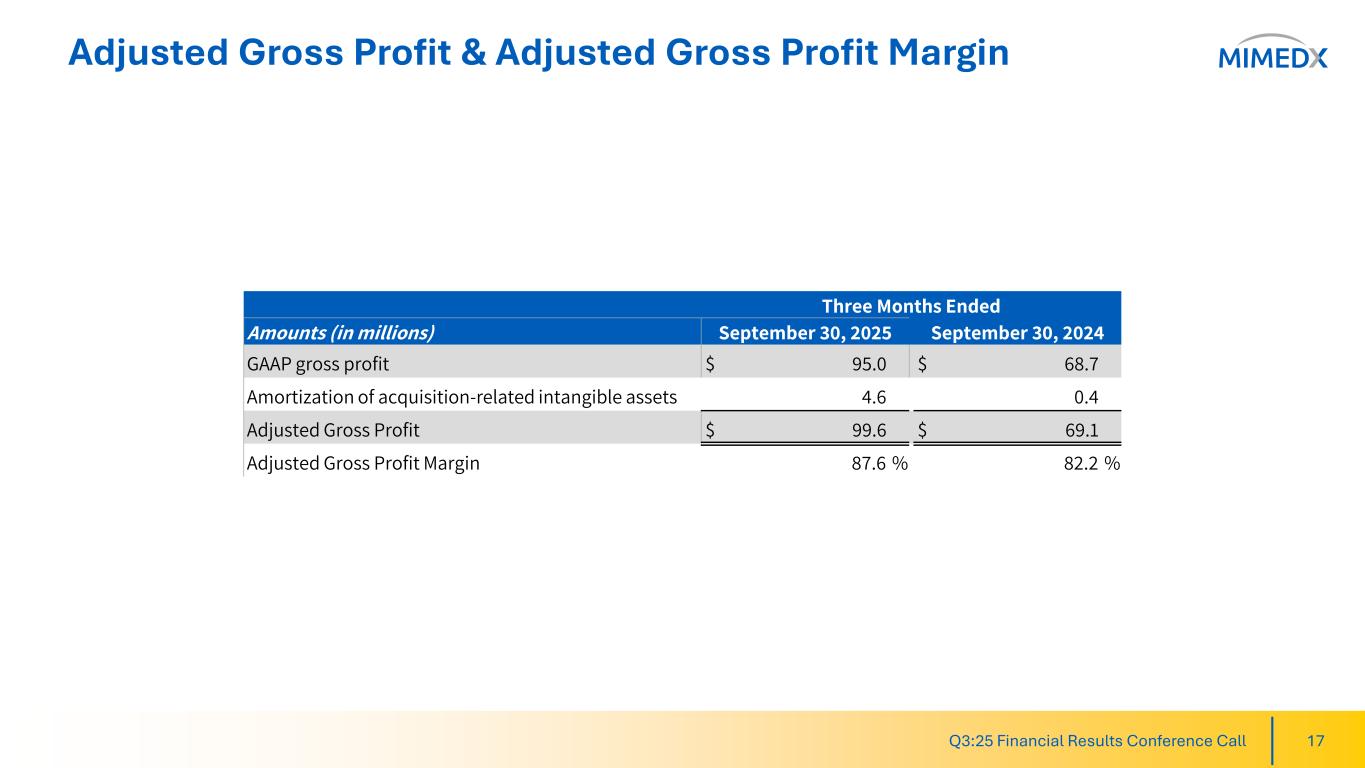

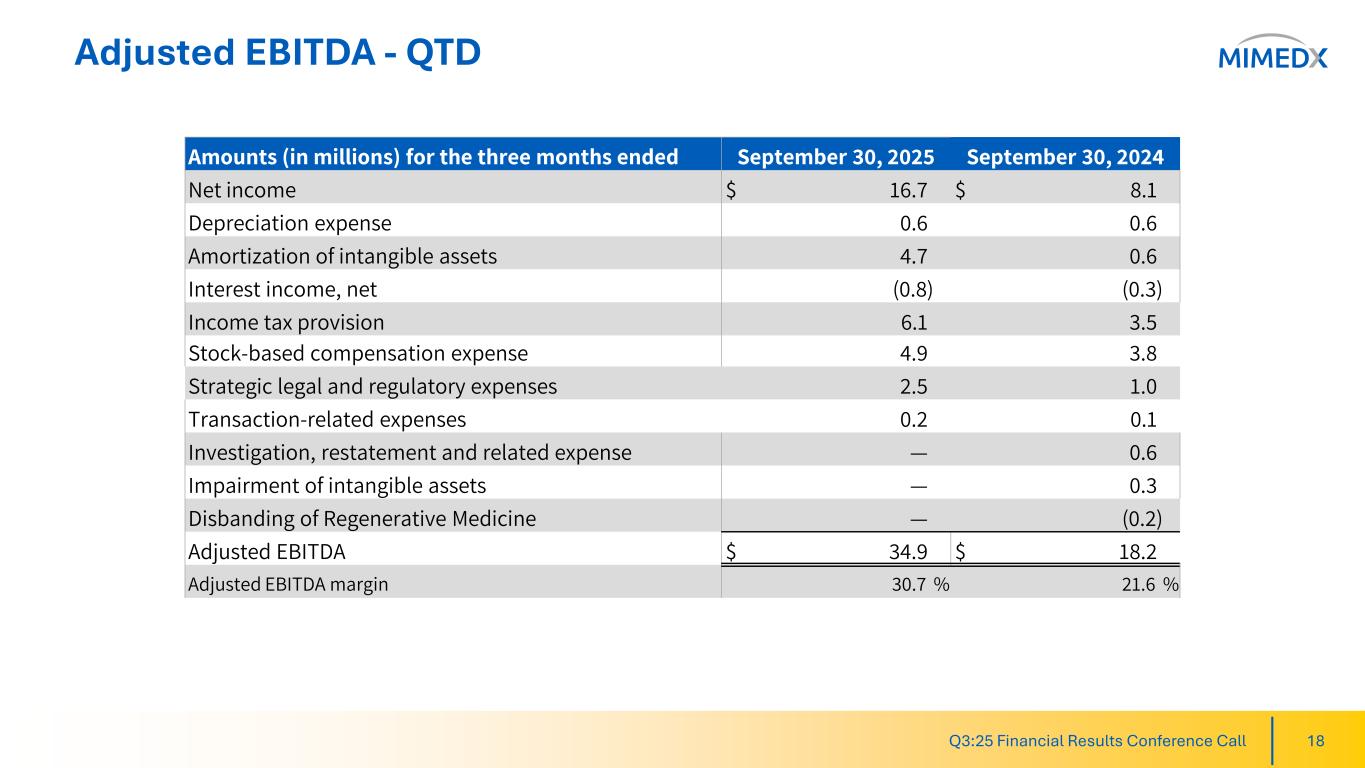

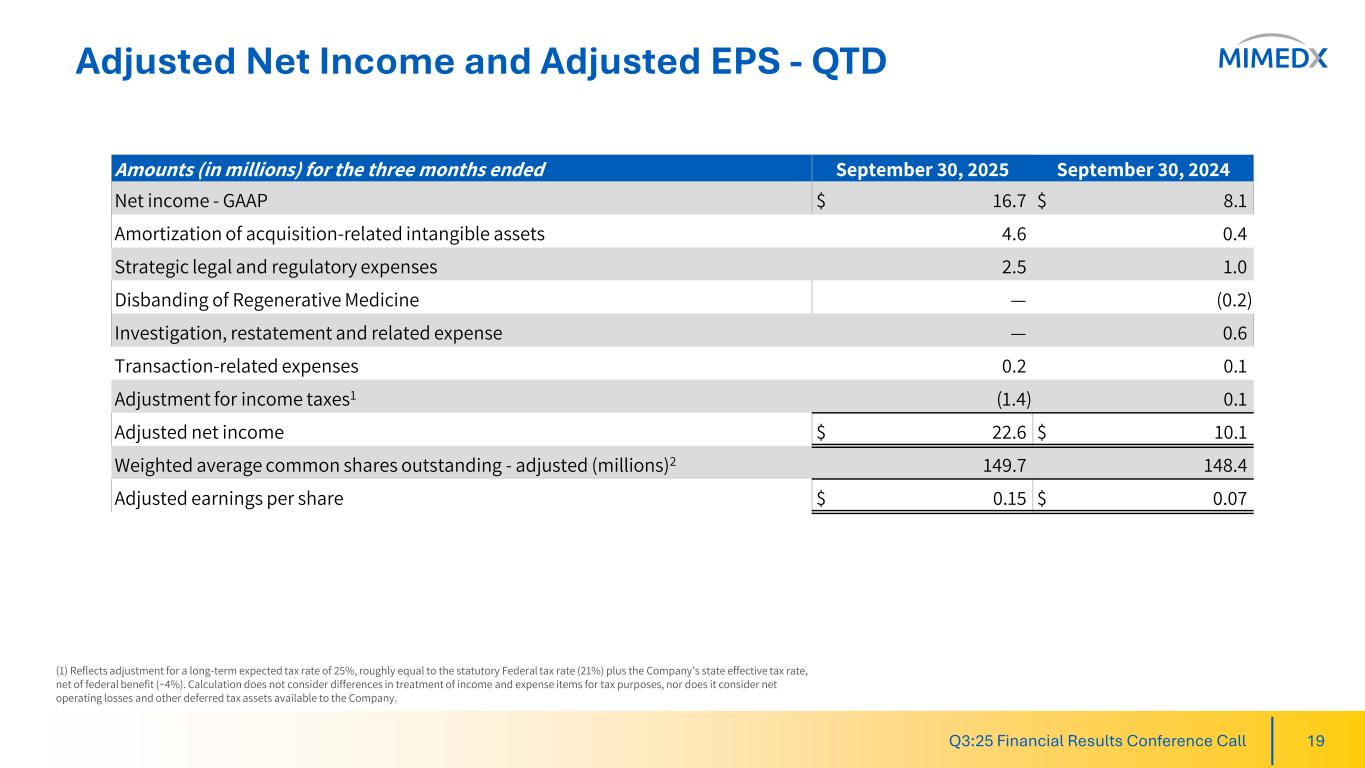

Reconciliation of Non-GAAP Measures In addition to our GAAP results, we provide certain non-GAAP measures including Adjusted EBITDA, related margins, Free Cash Flow, Adjusted Gross Profit, Adjusted Gross Margin and Adjusted Net Income. • Adjusted EBITDA consists of GAAP net income excluding: (i) depreciation, (ii) amortization of intangibles, (iii) interest (income) expense, net, (iv) income tax provision, (v) share-based compensation, (vi) investigation, restatement and related expenses, (vii) expenses related to disbanding of the Regenerative Medicine business unit, (viii) strategic legal and regulatory expenses, (ix) transaction-related expenses, (x) impairment of intangible assets, and (xi) reorganization expenses. • Adjusted Net Income provides a view of our operating performance, exclusive of certain items which are non-recurring or not reflective of our core operations. Adjusted Net Income is defined as GAAP net income plus (i) loss on extinguishment of debt, (ii) investigation restatement and related expenses, (iii) impairment of intangible assets, (iv) amortization of acquired intangible assets, (v) transaction related expenses, (vi) strategic legal and regulatory expenses, and (vii) expenses related to disbanding of our Regenerative Medicine business unit, and (viii) the long-term effective income tax rate adjustment. • Each of the adjustments to reconcile Adjusted Net Income to GAAP net income affect individual financial statement captions which are reflected in our consolidated statements of operations, including gross profit. Adjusted Gross Profit is therefore defined as GAAP gross profit plus (i) loss on extinguishment of debt, (ii) investigation restatement and related expenses, (iii) impairment of intangible assets, (iv) amortization of acquired intangible assets, (v) transaction related expenses, (vi) strategic legal and regulatory expenses, and (vii) expenses related to disbanding of our Regenerative Medicine business unit, and (viii) the long-term effective income tax rate adjustment., to the extent that these adjustments impact GAAP gross profit. Adjusted Gross Margin is calculated as Adjusted Gross Profit divided by GAAP net sales. • Free Cash Flow is intended to provide a measure of our ability to generate cash in excess of capital investments. It provides management with a view of cash flows which can be used to finance operational and strategic investments. Free Cash Flow is defined as net cash provided by operating activities less capital expenditures, including purchases of equipment. 16Q3:25 Financial Results Conference Call

Adjusted Gross Profit & Adjusted Gross Profit Margin 17Q3:25 Financial Results Conference Call Three Months Ended Amounts (in millions) September 30, 2025 September 30, 2024 GAAP gross profit $ 95.0 $ 68.7 Amortization of acquisition-related intangible assets 4.6 0.4 Adjusted Gross Profit $ 99.6 $ 69.1 Adjusted Gross Profit Margin 87.6 % 82.2 %

Adjusted EBITDA - QTD 18Q3:25 Financial Results Conference Call Amounts (in millions) for the three months ended September 30, 2025 September 30, 2024 Net income $ 16.7 $ 8.1 Depreciation expense 0.6 0.6 Amortization of intangible assets 4.7 0.6 Interest income, net (0.8) (0.3) Income tax provision 6.1 3.5 Stock-based compensation expense 4.9 3.8 Strategic legal and regulatory expenses 2.5 1.0 Transaction-related expenses 0.2 0.1 Investigation, restatement and related expense — 0.6 Impairment of intangible assets — 0.3 Disbanding of Regenerative Medicine — (0.2) Adjusted EBITDA $ 34.9 $ 18.2 Adjusted EBITDA margin 30.7 % 21.6 %

Adjusted Net Income and Adjusted EPS - QTD 19 (1) Reflects adjustment for a long-term expected tax rate of 25%, roughly equal to the statutory Federal tax rate (21%) plus the Company’s state effective tax rate, net of federal benefit (~4%). Calculation does not consider differences in treatment of income and expense items for tax purposes, nor does it consider net operating losses and other deferred tax assets available to the Company. Q3:25 Financial Results Conference Call Amounts (in millions) for the three months ended September 30, 2025 September 30, 2024 Net income - GAAP $ 16.7 $ 8.1 Amortization of acquisition-related intangible assets 4.6 0.4 Strategic legal and regulatory expenses 2.5 1.0 Disbanding of Regenerative Medicine — (0.2) Investigation, restatement and related expense — 0.6 Transaction-related expenses 0.2 0.1 Adjustment for income taxes1 (1.4) 0.1 Adjusted net income $ 22.6 $ 10.1 Weighted average common shares outstanding - adjusted (millions)2 149.7 148.4 Adjusted earnings per share $ 0.15 $ 0.07

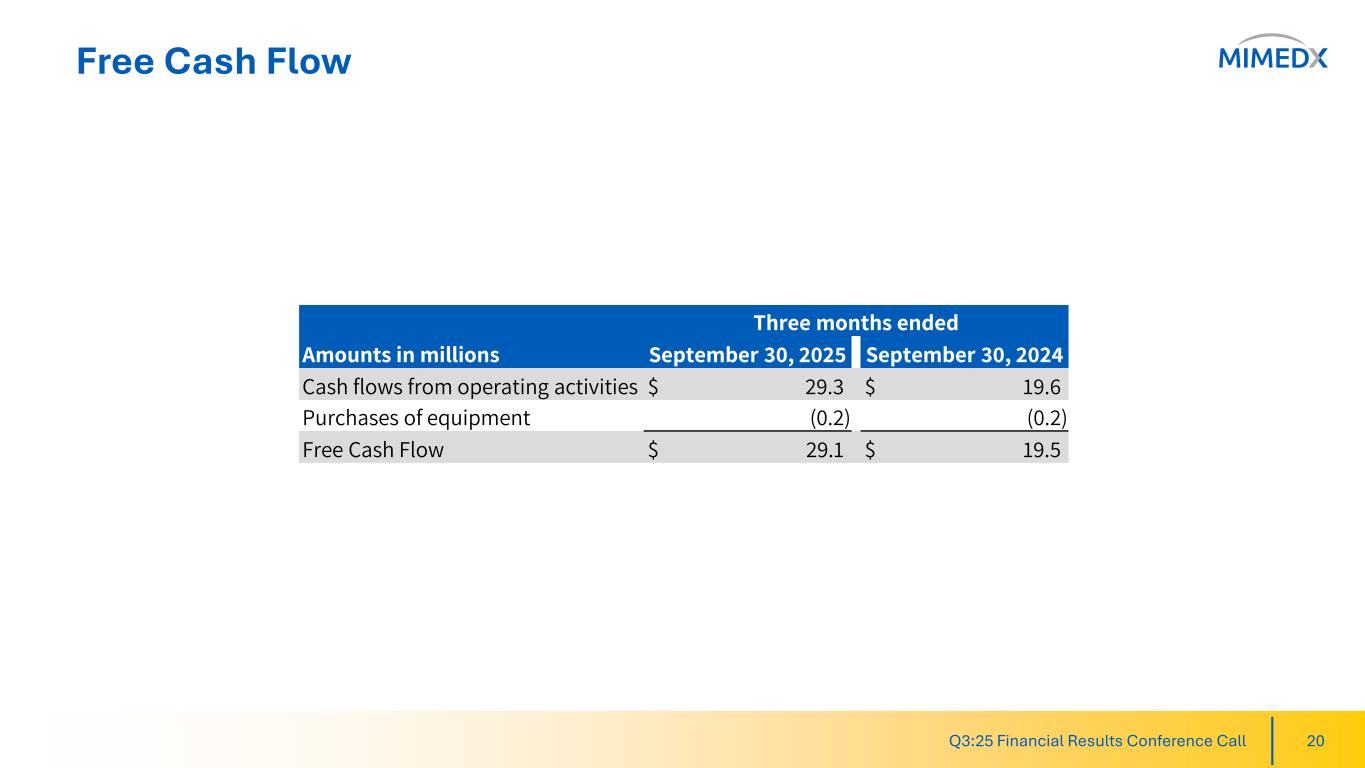

Free Cash Flow 20Q3:25 Financial Results Conference Call Three months ended Amounts in millions September 30, 2025 September 30, 2024 Cash flows from operating activities $ 29.3 $ 19.6 Purchases of equipment (0.2) (0.2) Free Cash Flow $ 29.1 $ 19.5