Investor Presentation January 2026

Disclaimer & Cautionary Statements This presentation and our earnings call includes forward-looking statements. Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Such forward-looking statements include statements regarding: • Growing expansion outside of the U.S.; • Our growth expectations in 2026 and beyond, including our growth in surgery, increased funding in targeted research and expanded product portfolio; • Expected results of research and development, including that our efforts will innovate and diversify our product portfolio; • Placental-derived products and their potential clinical benefits; • EPIEFFECT® randomized controlled trial enrollment; • Expectations regarding the reimbursement environment for the Company’s products, including Medicare Spending; • Expectations regarding HELIOGEN®, AMNIOFIX® and AMNIOEFFECT® driving Surgical growth; • Our expectations that we will continue to advocate for Medicare spending reform; • Exposure to tariffs and the anticipation that they will not impact the Company’s results; • 2026 full-year revenue growth and Adjusted EBITDA margin, our Long-term non-GAAP effective tax rates and top-line growth post reform in Medicare spending; • Our ability to manage Private Office dynamics, including adjusting our strategy to remain competitive; and • The Company’s long-term strategy and goals for value creation, the status of its pipeline products, expectations for future products, and expectations for future growth and profitability Additional forward-looking statements may be identified by words such as "believe," "expect," "may," "plan," "potential," "will," "preliminary," and similar expressions, and are based on management's current beliefs and expectations. Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ from expectations include: • Future sales are uncertain and are affected by competition, access to customers, patient access to hospitals and healthcare providers, the reimbursement environment and many other factors; • The future market for the Company’s products can depend on regulatory approval of such products, which might not occur at all or when expected, and is based in part on assumptions regarding the number of patients who elect less acute and more acute treatment than the Company’s products, market acceptance of the Company’s products, and adequate reimbursement for such therapies; • The process of obtaining regulatory clearances or approvals to market a biological product or medical device from the FDA or similar regulatory authorities outside of the U.S. is costly and time consuming, and such clearances or approvals may not be granted on a timely basis, or at all, and the ability to obtain the rights to market additional, suitable products depends on negotiations with third parties which may not be forthcoming; and • The Company describes additional risks and uncertainties in the Risk Factors section of its most recent annual report and quarterly reports filed with the Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this presentation and the Company assumes no obligation to update any forward-looking statement. | 2 |

Reconciliation of Non-GAAP Measures | 3 | In addition to our GAAP results, we provide certain non-GAAP measures including Adjusted EBITDA, related margins, Free Cash Flow, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Net Income and Adjusted EPS. • Adjusted EBITDA consists of GAAP net income excluding: (i) depreciation, (ii) amortization of intangibles, (iii) interest (income) expense, net, (iv) income tax provision, (v) share-based compensation, (vi) investigation, restatement and related expenses, (vii) expenses related to disbanding of the Regenerative Medicine business unit, (viii) strategic legal and regulatory expenses, (ix) transaction- related expenses, (x) impairment of intangible assets, and (xi) reorganization expenses. • Adjusted Net Income provides a view of our operating performance, exclusive of certain items which are non-recurring or not reflective of our core operations. Adjusted Net Income is defined as GAAP net income plus (i) loss on extinguishment of debt, (ii) investigation restatement and related expenses, (iii) impairment of intangible assets, (iv) amortization of acquired intangible assets, (v) transaction related expenses, (vi) strategic legal and regulatory expenses, and (vii) expenses related to disbanding of our Regenerative Medicine business unit, and (viii) the long-term effective income tax rate adjustment.

Investment Rationale | 4 | Addressing large & expanding markets in Wound and Surgical Attractive opportunities to expand growth through M&A Key competitive advantages with innovative products, extensive IP, proprietary technologies and expansive sales infrastructure Strong balance sheet and cash flow generation Experienced leadership team driving company strategy

MIMEDX – A Pioneer & Leader Delivering Healing Solutions in Healthcare | 5 | At MIMEDX, our vision is to be the leading global provider of healing solutions through relentless innovation to restore quality of life. AN INDUSTRY PIONEER in Advanced Wound Care with a product offering backed by a compendium of scientific and clinical evidence EXPANDING SURGICAL APPLICATIONS beginning to multiply as we demonstrate positive clinical and economic outcomes using our Surgical products STRONG FINANCIAL DISCIPLINE as focused capital deployment and expense management supports continued growth, profitability & cash flow HELPING HUMANS HEAL

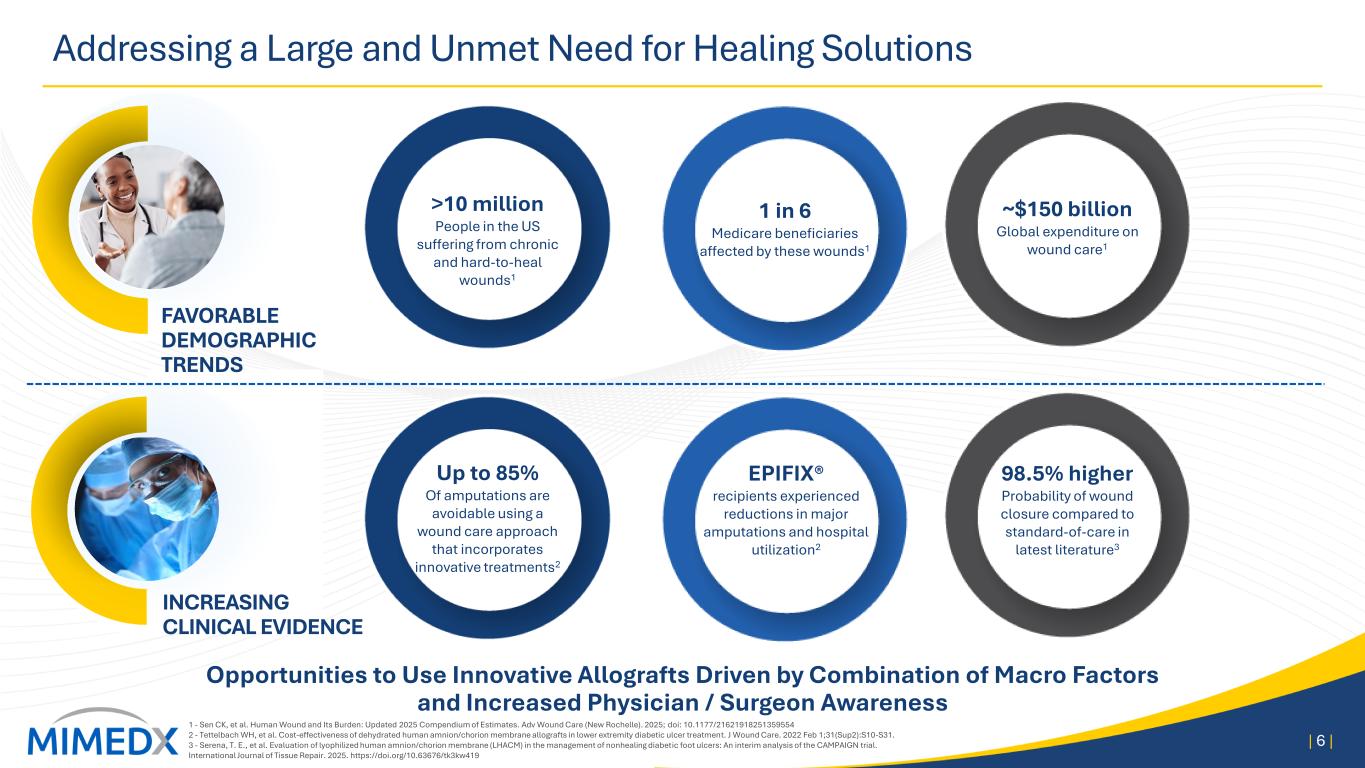

Addressing a Large and Unmet Need for Healing Solutions 1 - Sen CK, et al. Human Wound and Its Burden: Updated 2025 Compendium of Estimates. Adv Wound Care (New Rochelle). 2025; doi: 10.1177/21621918251359554 2 - Tettelbach WH, et al. Cost-effectiveness of dehydrated human amnion/chorion membrane allografts in lower extremity diabetic ulcer treatment. J Wound Care. 2022 Feb 1;31(Sup2):S10-S31. 3 - Serena, T. E., et al. Evaluation of lyophilized human amnion/chorion membrane (LHACM) in the management of nonhealing diabetic foot ulcers: An interim analysis of the CAMPAIGN trial. International Journal of Tissue Repair. 2025. https://doi.org/10.63676/tk3kw419 | 6 | Opportunities to Use Innovative Allografts Driven by Combination of Macro Factors and Increased Physician / Surgeon Awareness INCREASING CLINICAL EVIDENCE FAVORABLE DEMOGRAPHIC TRENDS >10 million People in the US suffering from chronic and hard-to-heal wounds1 1 in 6 Medicare beneficiaries affected by these wounds1 Up to 85% Of amputations are avoidable using a wound care approach that incorporates innovative treatments2 EPIFIX® recipients experienced reductions in major amputations and hospital utilization2 98.5% higher Probability of wound closure compared to standard-of-care in latest literature3 ~$150 billion Global expenditure on wound care1

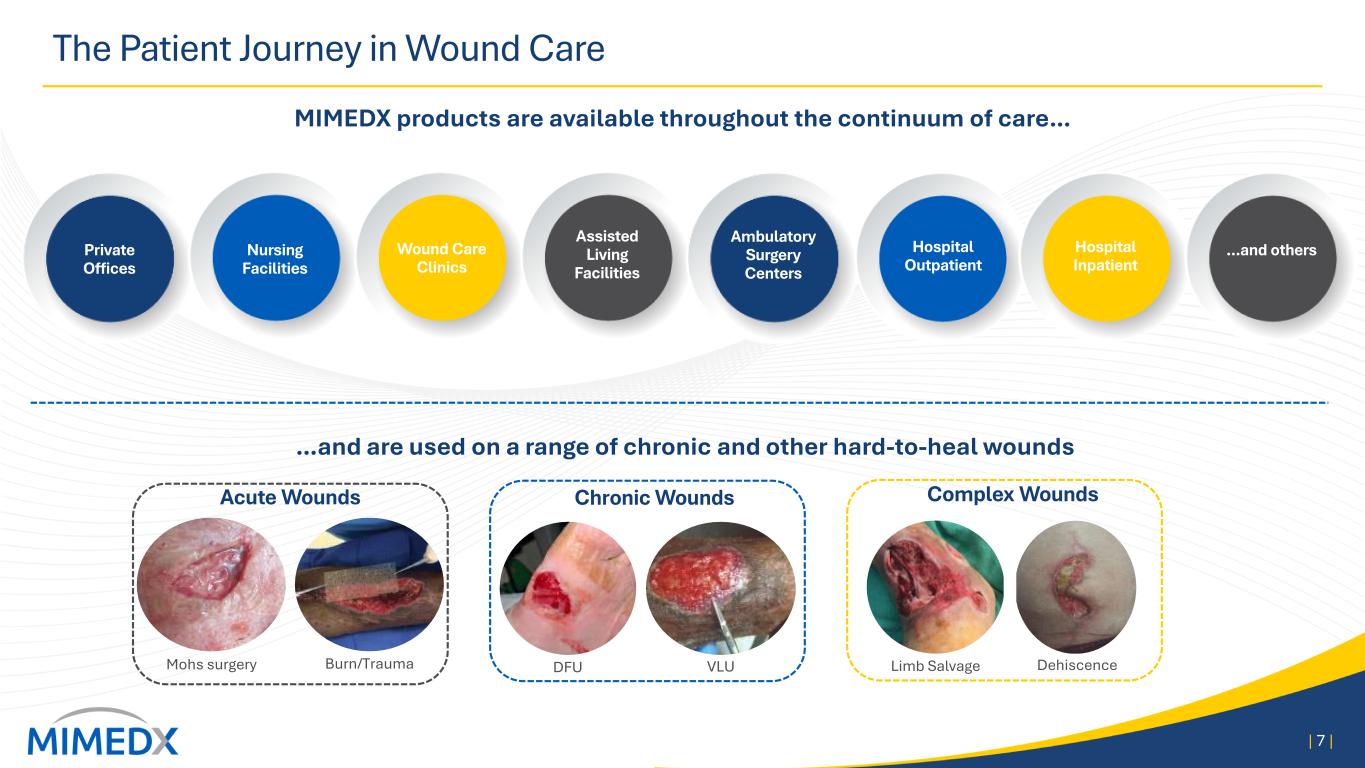

The Patient Journey in Wound Care MIMEDX products are available throughout the continuum of care… | 7 | Mohs surgery Burn/Trauma DFU VLU Limb Salvage Dehiscence Acute Wounds Chronic Wounds Complex Wounds Private Offices Nursing Facilities Wound Care Clinics Assisted Living Facilities Ambulatory Surgery Centers Hospital Outpatient Hospital Inpatient …and others …and are used on a range of chronic and other hard-to-heal wounds

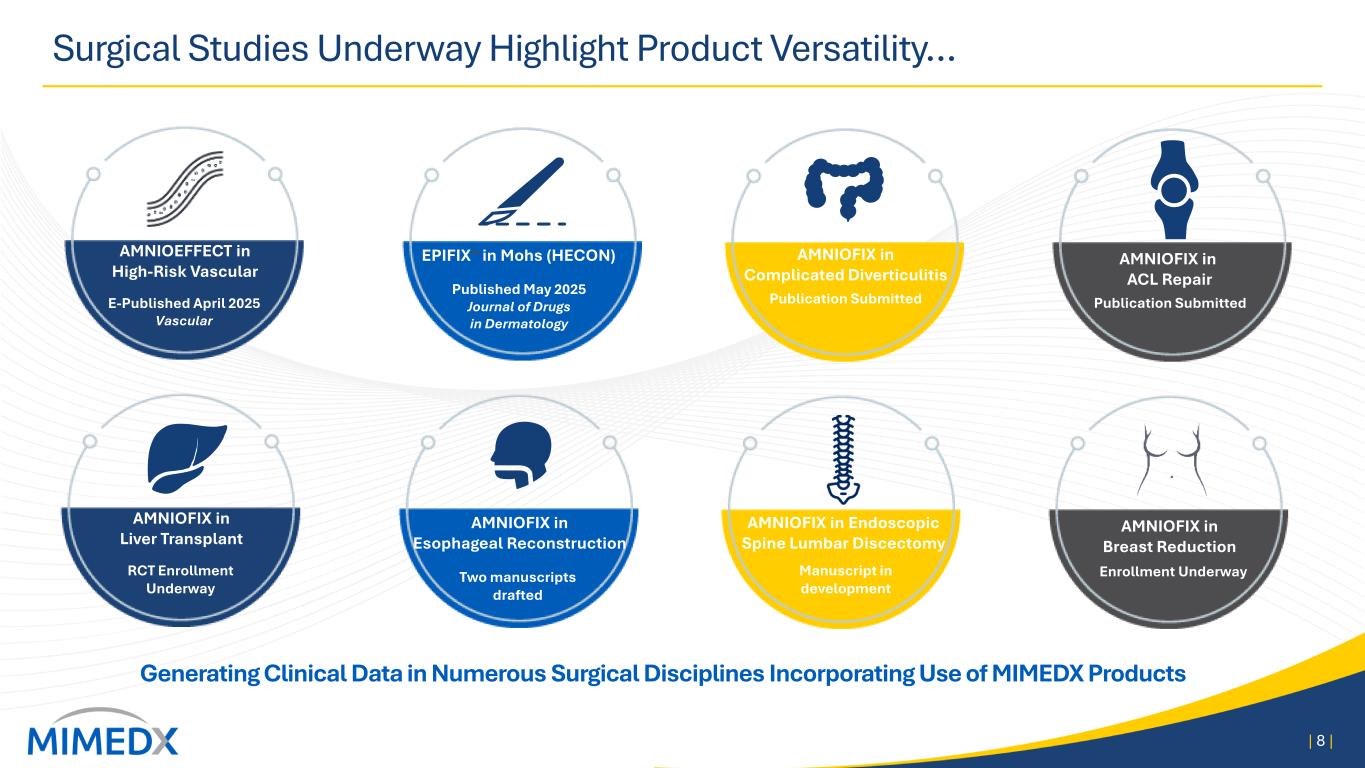

Surgical Studies Underway Highlight Product Versatility… | 8 | Generating Clinical Data in Numerous Surgical Disciplines Incorporating Use of MIMEDX Products AMNIOEFFECT in High-Risk Vascular E-Published April 2025 Vascular Published May 2025 Journal of Drugs in Dermatology EPIFIX® in Mohs (HECON) Publication Submitted AMNIOFIX in Complicated Diverticulitis AMNIOFIX in ACL Repair Publication Submitted AMNIOFIX in Liver Transplant RCT Enrollment Underway Manuscript in development Enrollment Underway AMNIOFIX in Breast Reduction Two manuscripts drafted AMNIOFIX in Esophageal Reconstruction AMNIOFIX in Endoscopic Spine Lumbar Discectomy

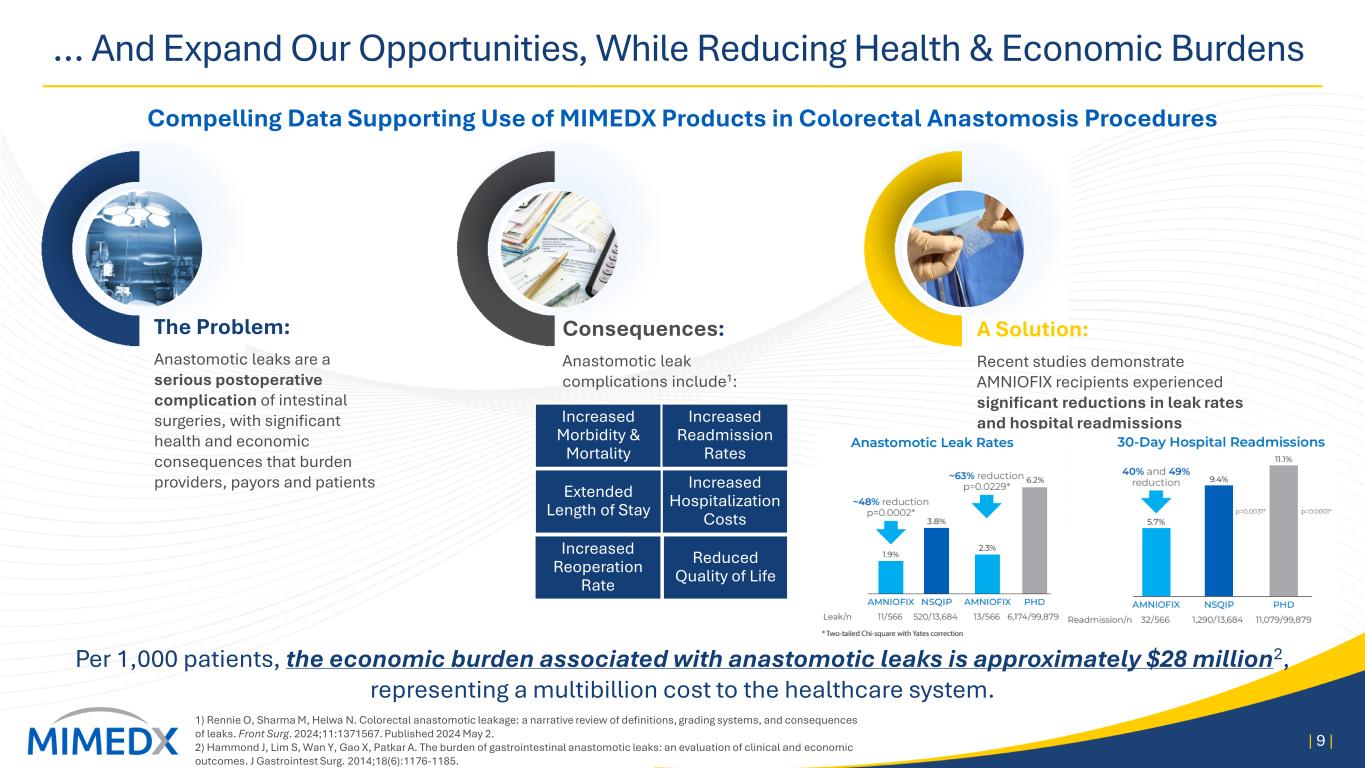

… And Expand Our Opportunities, While Reducing Health & Economic Burdens Compelling Data Supporting Use of MIMEDX Products in Colorectal Anastomosis Procedures 1) Rennie O, Sharma M, Helwa N. Colorectal anastomotic leakage: a narrative review of definitions, grading systems, and consequences of leaks. Front Surg. 2024;11:1371567. Published 2024 May 2. 2) Hammond J, Lim S, Wan Y, Gao X, Patkar A. The burden of gastrointestinal anastomotic leaks: an evaluation of clinical and economic outcomes. J Gastrointest Surg. 2014;18(6):1176-1185. | 9 | Per 1,000 patients, the economic burden associated with anastomotic leaks is approximately $28 million2, representing a multibillion cost to the healthcare system. Increased Morbidity & Mortality Increased Hospitalization Costs Increased Reoperation Rate Reduced Quality of Life Extended Length of Stay Increased Readmission Rates The Problem: Anastomotic leaks are a serious postoperative complication of intestinal surgeries, with significant health and economic consequences that burden providers, payors and patients Consequences: Anastomotic leak complications include1: A Solution: Recent studies demonstrate AMNIOFIX recipients experienced significant reductions in leak rates and hospital readmissions

The Most Comprehensive End-To-End Product Ecosystem Leading the field with science, clinical efficacy and a customer and patient-centric go-to-market mindset | 10 | The most studied portfolio of placental products with a growing compendium of published scientific, clinical and health outcome data Large, national placental donation network and proprietary tissue processing. New product innovations leading to untapped opportunities for growth, including an increasing footprint in the Surgical market. A key partner to healthcare professionals with industry leading support services and customer-focused approach.

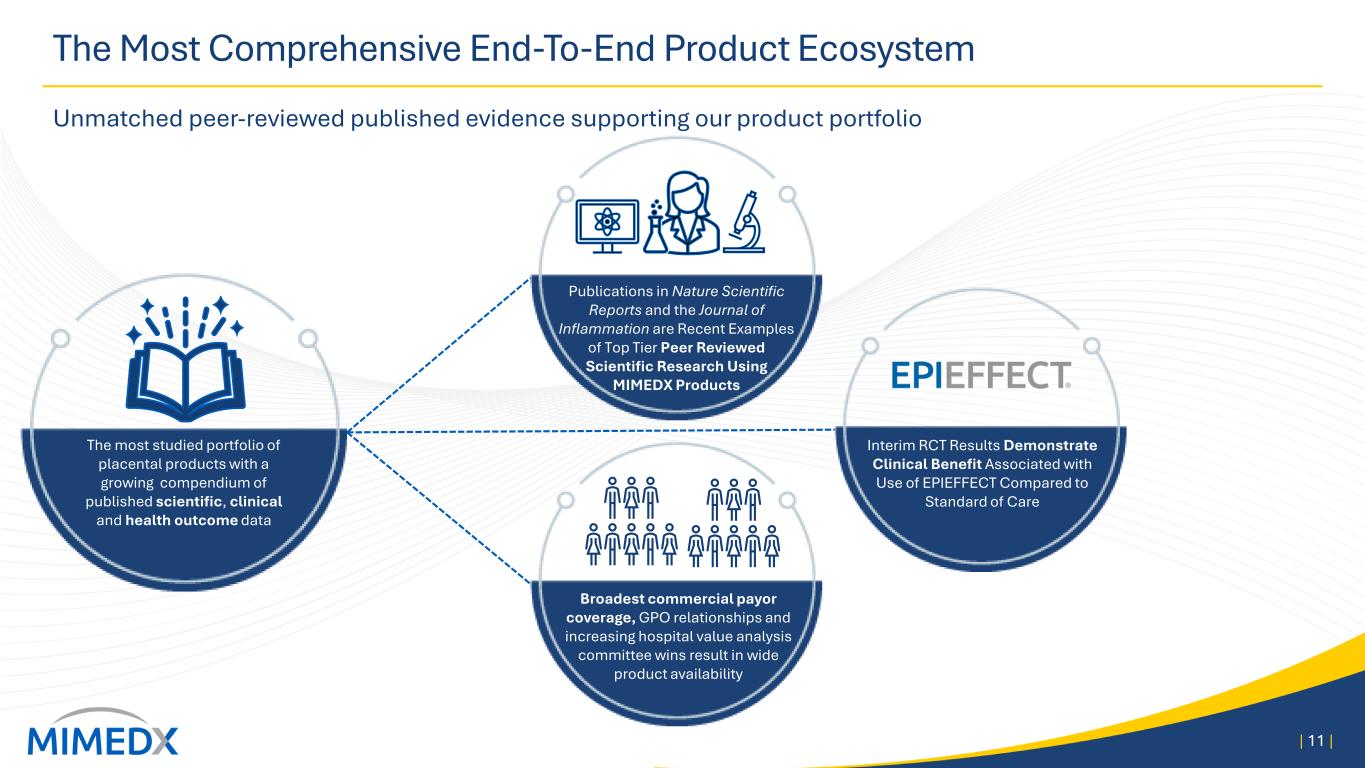

The Most Comprehensive End-To-End Product Ecosystem Unmatched peer-reviewed published evidence supporting our product portfolio | 11 | The most studied portfolio of placental products with a growing compendium of published scientific, clinical and health outcome data Broadest commercial payor coverage, GPO relationships and increasing hospital value analysis committee wins result in wide product availability Interim RCT Results Demonstrate Clinical Benefit Associated with Use of EPIEFFECT Compared to Standard of Care Publications in Nature Scientific Reports and the Journal of Inflammation are Recent Examples of Top Tier Peer Reviewed Scientific Research Using MIMEDX Products

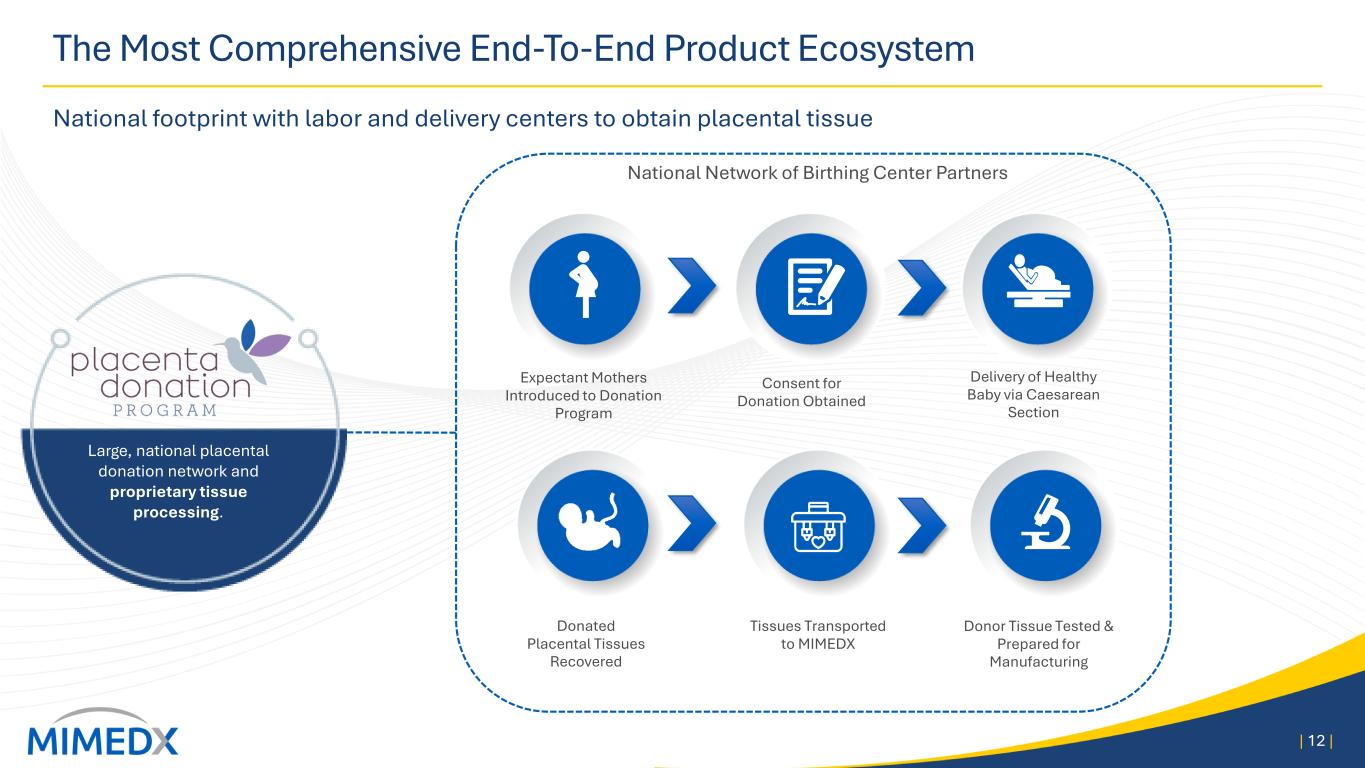

The Most Comprehensive End-To-End Product Ecosystem National footprint with labor and delivery centers to obtain placental tissue | 12 | Consent for Donation Obtained Delivery of Healthy Baby via Caesarean Section Donated Placental Tissues Recovered Tissues Transported to MIMEDX National Network of Birthing Center Partners Expectant Mothers Introduced to Donation Program Donor Tissue Tested & Prepared for Manufacturing Large, national placental donation network and proprietary tissue processing.

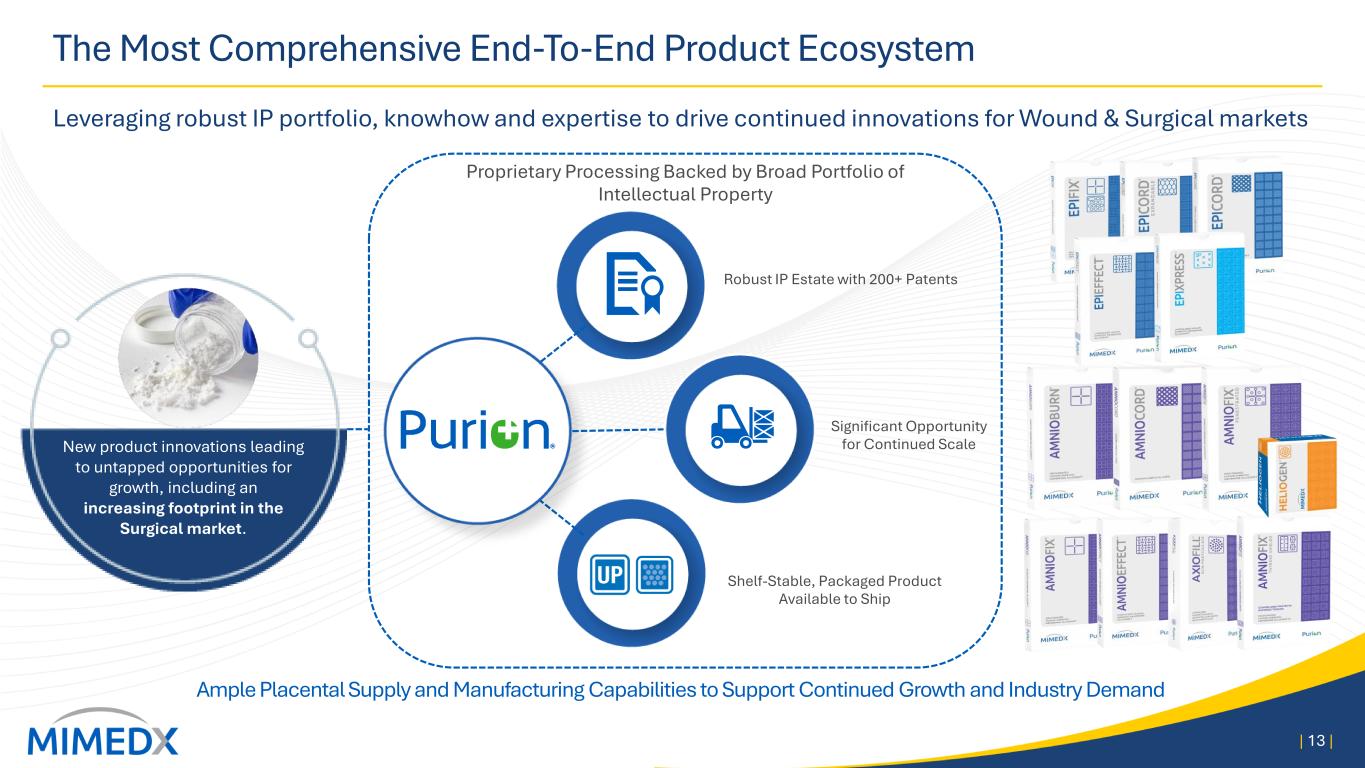

The Most Comprehensive End-To-End Product Ecosystem Leveraging robust IP portfolio, knowhow and expertise to drive continued innovations for Wound & Surgical markets | 13 | New product innovations leading to untapped opportunities for growth, including an increasing footprint in the Surgical market. Ample Placental Supply and Manufacturing Capabilities to Support Continued Growth and Industry Demand Proprietary Processing Backed by Broad Portfolio of Intellectual Property Shelf-Stable, Packaged Product Available to Ship Robust IP Estate with 200+ Patents Significant Opportunity for Continued Scale

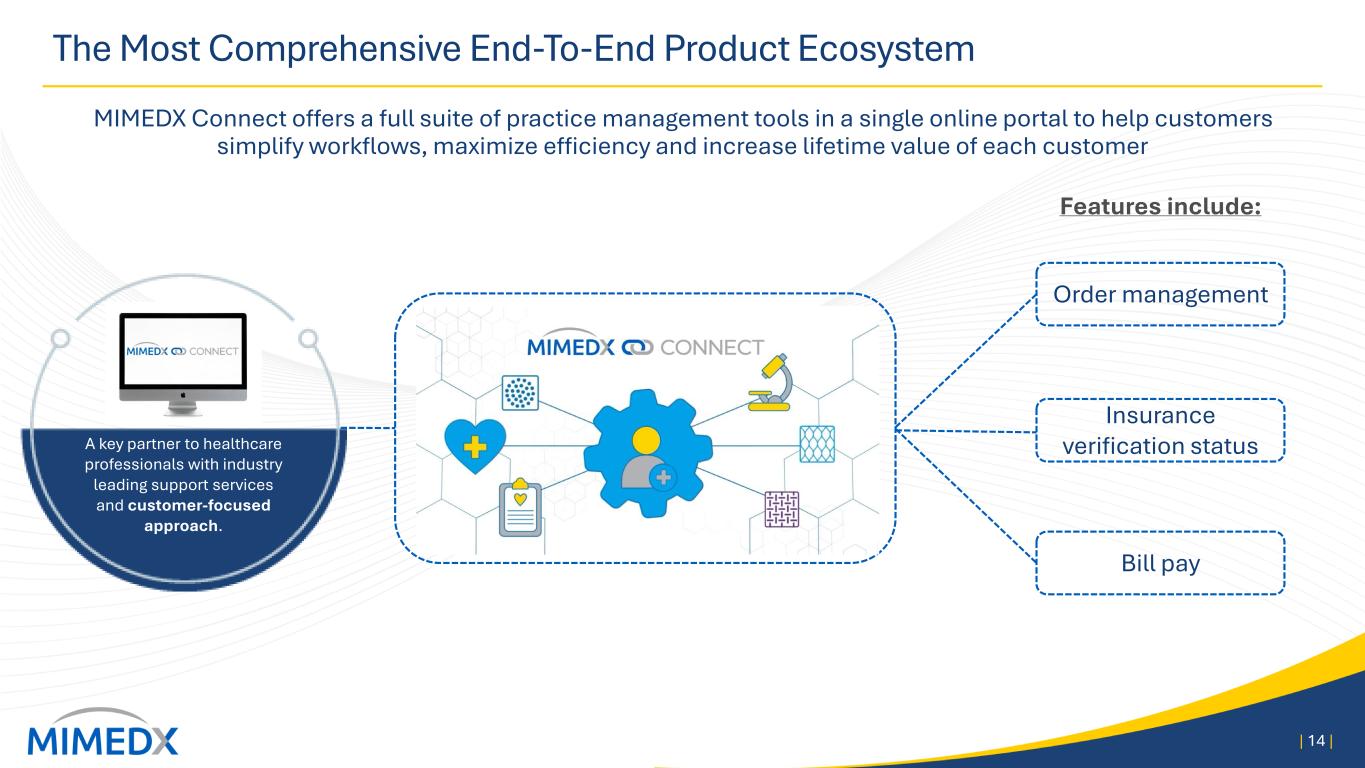

The Most Comprehensive End-To-End Product Ecosystem MIMEDX Connect offers a full suite of practice management tools in a single online portal to help customers simplify workflows, maximize efficiency and increase lifetime value of each customer | 14 | A key partner to healthcare professionals with industry leading support services and customer-focused approach. Order management Insurance verification status Bill pay Features include:

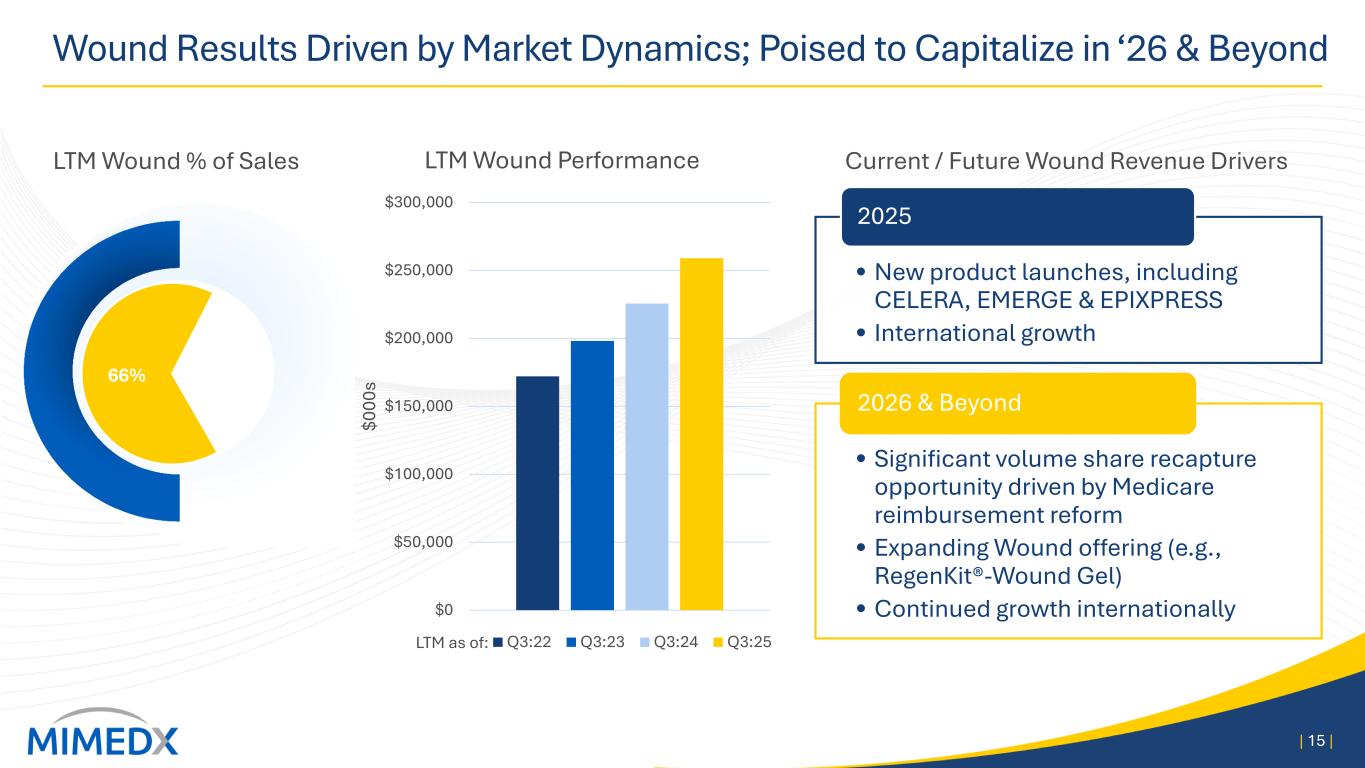

Wound Results Driven by Market Dynamics; Poised to Capitalize in ‘26 & Beyond | 15 | $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $0 00 s LTM Wound Performance Q3:22 Q3:23 Q3:24 Q3:25 LTM Wound % of Sales Current / Future Wound Revenue Drivers • New product launches, including CELERA, EMERGE & EPIXPRESS • International growth 2025 • Significant volume share recapture opportunity driven by Medicare reimbursement reform • Expanding Wound offering (e.g., RegenKit®-Wound Gel) • Continued growth internationally 2026 & Beyond LTM as of: 66%

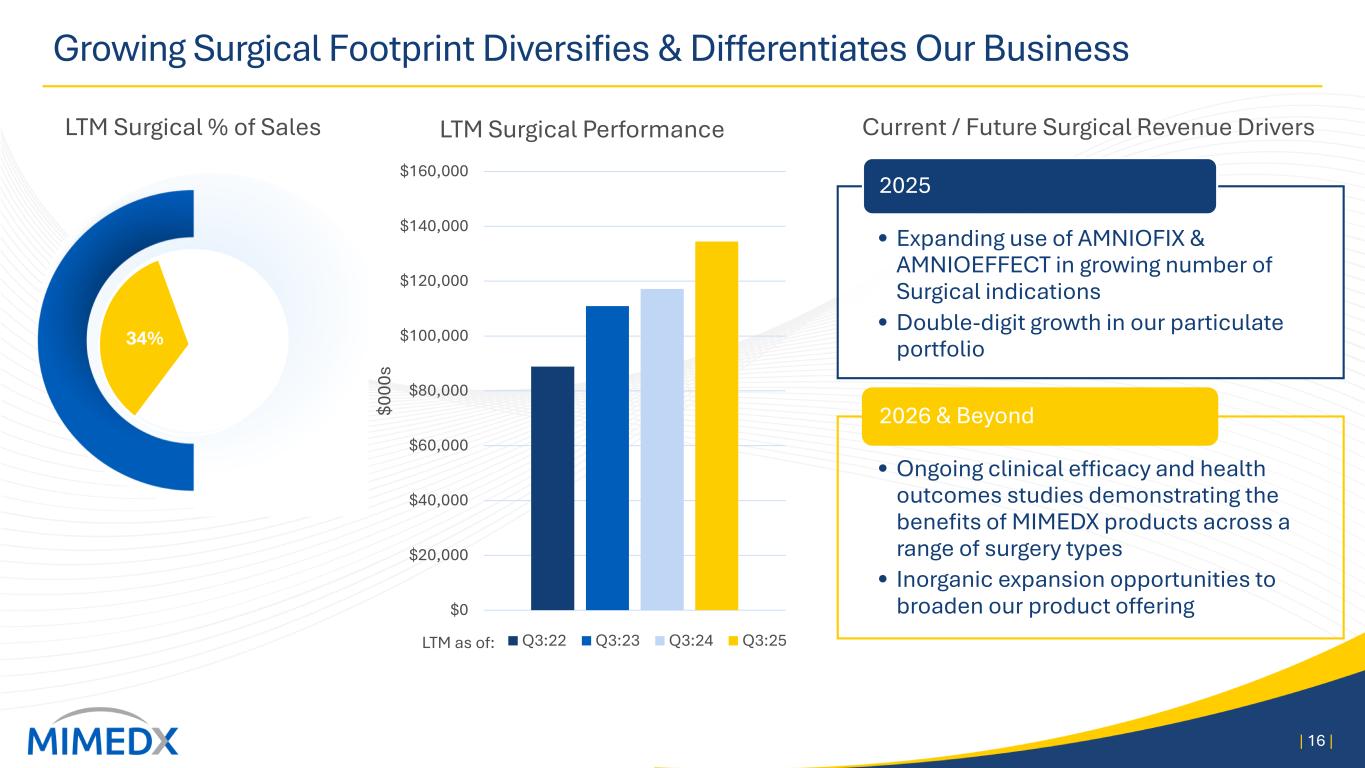

Growing Surgical Footprint Diversifies & Differentiates Our Business | 16 | Current / Future Surgical Revenue Drivers • Expanding use of AMNIOFIX & AMNIOEFFECT in growing number of Surgical indications • Double-digit growth in our particulate portfolio 2025 • Ongoing clinical efficacy and health outcomes studies demonstrating the benefits of MIMEDX products across a range of surgery types • Inorganic expansion opportunities to broaden our product offering 2026 & Beyond $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $0 00 s LTM Surgical Performance Q3:22 Q3:23 Q3:24 Q3:25LTM as of: 34% LTM Surgical % of Sales

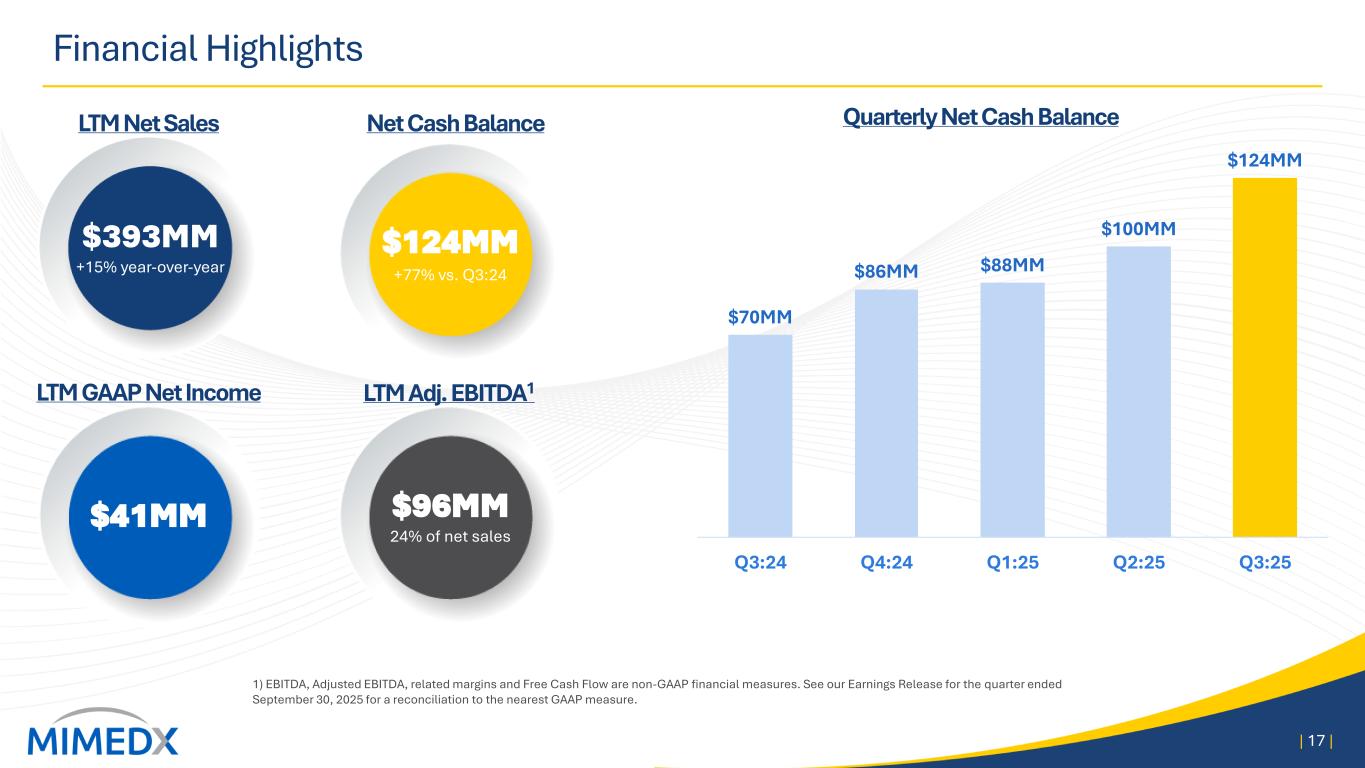

Financial Highlights 1) EBITDA, Adjusted EBITDA, related margins and Free Cash Flow are non-GAAP financial measures. See our Earnings Release for the quarter ended September 30, 2025 for a reconciliation to the nearest GAAP measure. | 17 | Quarterly Net Cash Balance $393MM +15% year-over-year $124MM +77% vs. Q3:24 $96MM 24% of net sales LTM Net Sales Net Cash Balance LTM Adj. EBITDA1LTM GAAP Net Income $70MM $86MM $88MM $100MM $124MM Q3:24 Q4:24 Q1:25 Q2:25 Q3:25 $41MM

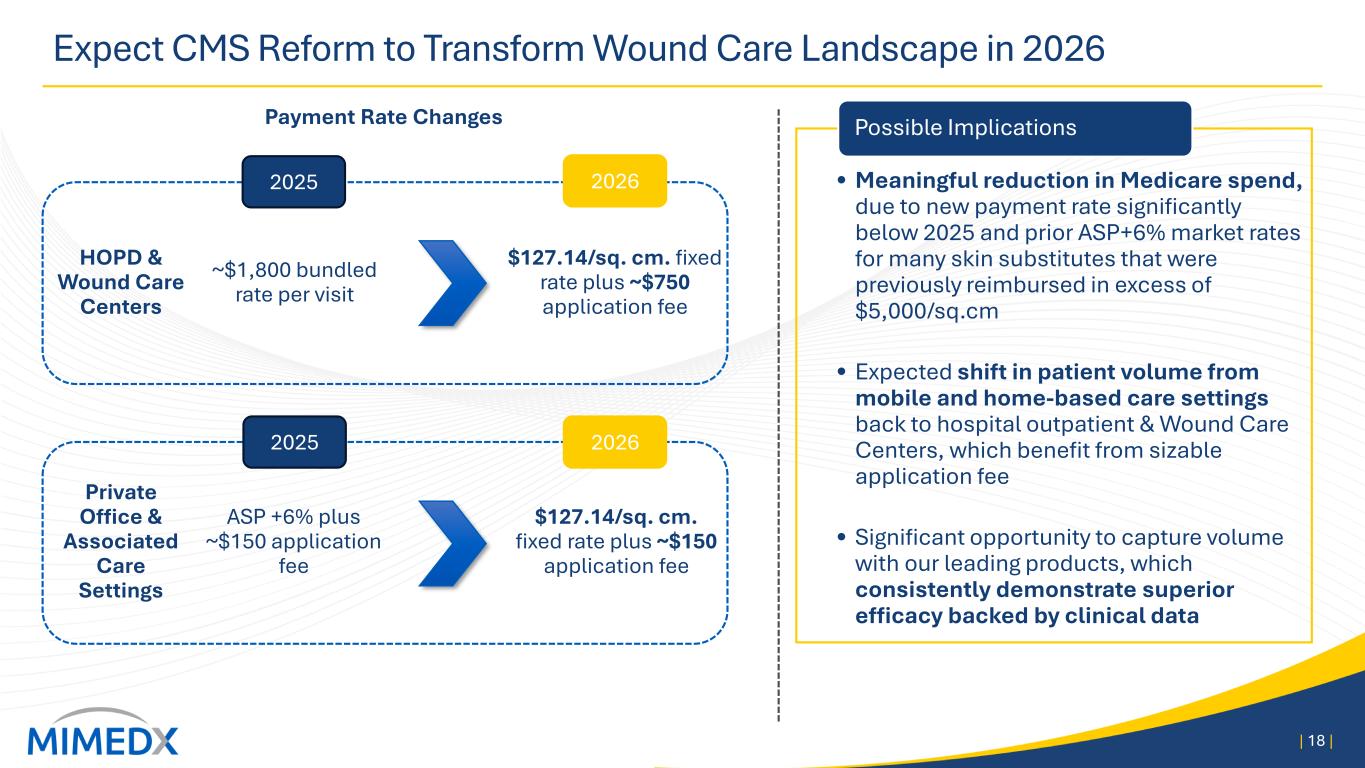

• Meaningful reduction in Medicare spend, due to new payment rate significantly below 2025 and prior ASP+6% market rates for many skin substitutes that were previously reimbursed in excess of $5,000/sq.cm • Expected shift in patient volume from mobile and home-based care settings back to hospital outpatient & Wound Care Centers, which benefit from sizable application fee • Significant opportunity to capture volume with our leading products, which consistently demonstrate superior efficacy backed by clinical data Expect CMS Reform to Transform Wound Care Landscape in 2026 | 18 | Payment Rate Changes HOPD & Wound Care Centers Private Office & Associated Care Settings ~$1,800 bundled rate per visit ASP +6% plus ~$150 application fee $127.14/sq. cm. fixed rate plus ~$750 application fee $127.14/sq. cm. fixed rate plus ~$150 application fee 2025 2026 2025 2026 Possible Implications

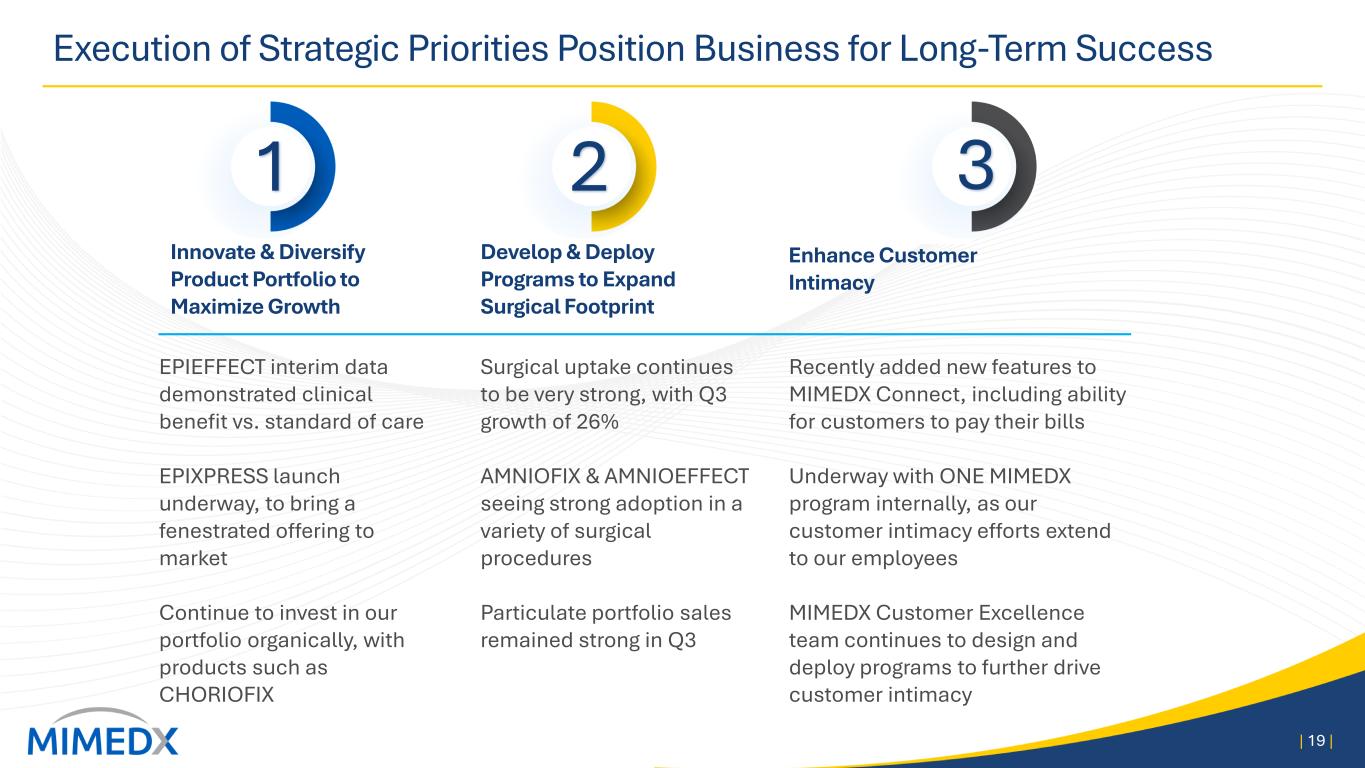

Execution of Strategic Priorities Position Business for Long-Term Success | 19 | Innovate & Diversify Product Portfolio to Maximize Growth Develop & Deploy Programs to Expand Surgical Footprint Enhance Customer Intimacy Surgical uptake continues to be very strong, with Q3 growth of 26% AMNIOFIX & AMNIOEFFECT seeing strong adoption in a variety of surgical procedures Particulate portfolio sales remained strong in Q3 Recently added new features to MIMEDX Connect, including ability for customers to pay their bills Underway with ONE MIMEDX program internally, as our customer intimacy efforts extend to our employees MIMEDX Customer Excellence team continues to design and deploy programs to further drive customer intimacy 1 2 3 EPIEFFECT interim data demonstrated clinical benefit vs. standard of care EPIXPRESS launch underway, to bring a fenestrated offering to market Continue to invest in our portfolio organically, with products such as CHORIOFIX

Experienced, Skillful Leadership Team Executing Strategy Prior Roles Include: Management Team with Track Record of Success in MedTech Joe Capper Chief Executive Officer Doug Rice Chief Financial Officer Butch Hulse Chief Administrative Officer & General Counsel Kim Moller Chief Commercial Officer Ricci Whitlow Chief Operating Officer John Harper, Ph.D. Chief Scientific Officer & SVP, R&D Matt Notarianni Head of IR 20| | Tracy Chastain Chief Human Resources Officer Eric Smith SVP, Marketing & International

Summary | 21 | Addressing large & expanding markets Attractive opportunities to expand growth Key competitive advantages Strong balance sheet and cash flow generation Experienced leadership team

THANK YOU MIMEDX 1775 West Oak Commons Ct. Marietta, GA 30062 888.543.1917 | 770.651.9100 | 22 |