COMPANY OVERVIEW Dinesh V. Patel, Ph.D. President & CEO January 12, 2026 1

Legal Disclaimer This presentation and any accompanying oral presentation contain forward - looking statements within the meaning of the Private Se curities Litigation Reform Act. All statements other than statements of historical facts contained in this presentation are forward - looking statements, including st atements regarding: our future results of operations and financial position; business strategy; our capital resources; pre - clinical and clinical product candidates (inclu ding PN - 881, PN - 477; PN - 458 and PN - 8047) and discovery programs; our icotrokinra collaboration with Johnson & Johnson Innovation, Inc. (”JNJ”) and our rusfertid e c ollaboration with Takeda, including our expectations related to the achievement and timing of milestone and royalty payments from JNJ and Takeda; the potential m ark et opportunities for icotrokinra and rusfertide and other product candidates; the impact on our business or product candidates of actions of the U.S. Food and Dru g A dministration (“FDA”) and foreign regulatory agencies, including expectations regarding timing of FDA approval of NDAs for icotrokinra and rusfertide; expectat ion s regarding timing and announcements related to pre - clinical and clinical programs; and the scope of protection we are able to establish and maintain f or intellectual property rights covering our product candidates. In some cases, you can identify forward - looking statements by terminology such as “anticipate,” “believe ,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potentially,” “predict,” “should,” “will,” or the negative of these terms or other simila r e xpressions. Forward - looking statements are subject to risks and uncertainties, including those discussed in our filings with the Securities and Exchange Commission, including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of ou r m ost recently filed periodic reports on Form 10 - K and Form 10 - Q and subsequent filings and in the documents incorporated by reference therein. Because forward - lookin g statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, yo u should not rely on these forward - looking statements as predictions of future events. The events and circumstances reflected in our forward - looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward - looking statements. The information included in these materials is provided as of the date specified on the cover page of this presentation, unless specified elsewhere herein, and is qualified as such. Except as requ ire d by applicable law, we undertake no obligation to update any forward - looking statements or other information contained herein, whether as a result of any new inform ation, future events, changed circumstances or otherwise. This presentation concerns products under clinical investigation which have not yet been approved for marketing by the FDA. T hey are currently limited by Federal law to investigational use. No representation is made as to their safety or effectiveness for the purposes for which they are be ing investigated. All copyrights and trademarks included herein are the property of their respective owners. 2

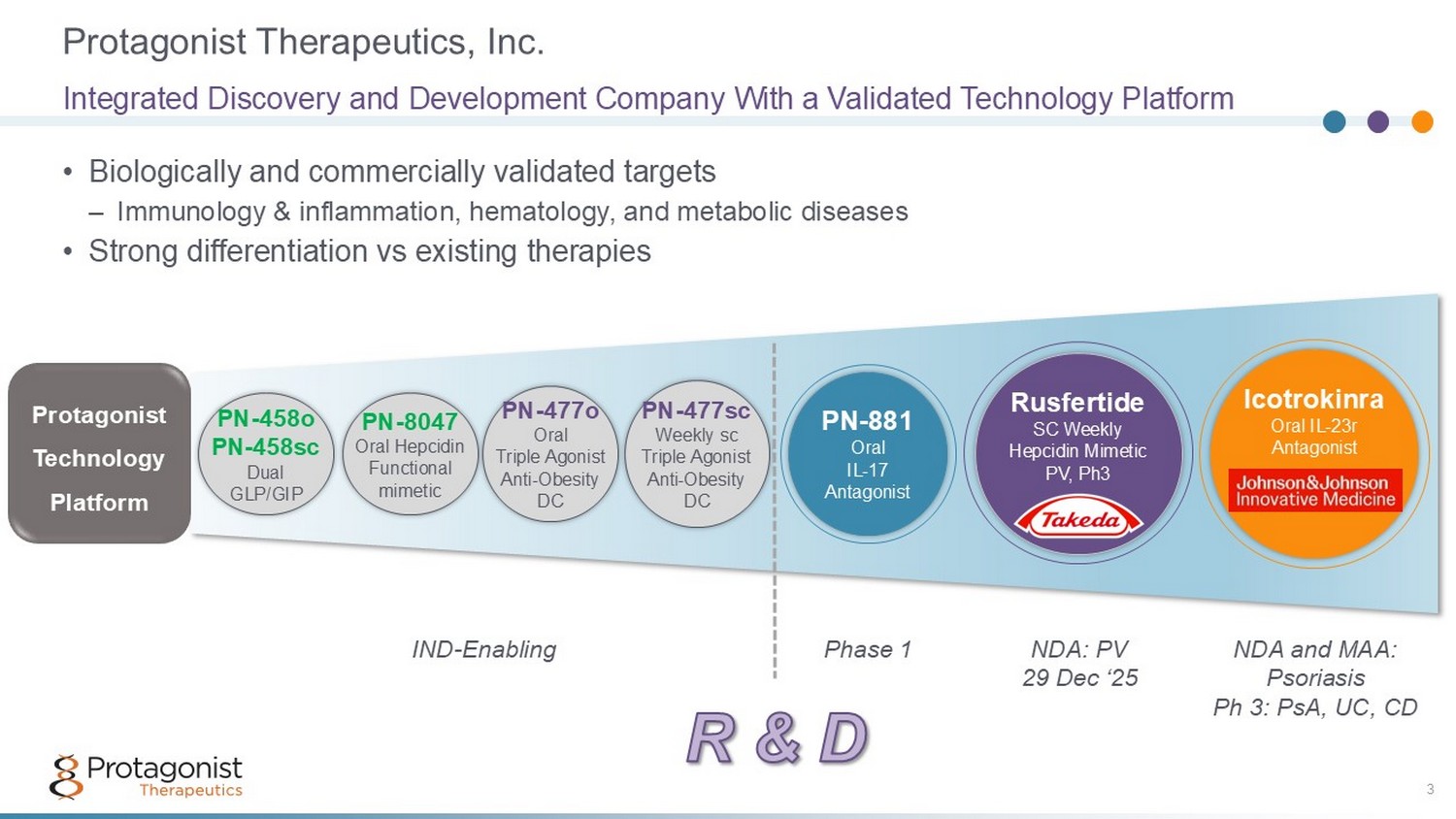

Protagonist Therapeutics, Inc. 3 • Biologically and commercially validated targets – Immunology & inflammation, hematology, and metabolic diseases • Strong differentiation vs existing therapies Integrated Discovery and Development Company With a Validated Technology Platform PN - 881 Oral IL - 17 Antagonist IND - Enabling NDA: PV 29 Dec ‘25 Icotrokinra Oral IL - 23r Antagonist Rusfertide SC Weekly Hepcidin Mimetic PV, Ph3 Phase 1 NDA and MAA: Psoriasis Ph 3: PsA, UC, CD Protagonist Technology Platform PN - 477sc Weekly sc Triple Agonist Anti - Obesity DC PN - 477o Oral Triple Agonist Anti - Obesity DC PN - 8047 Oral Hepcidin Functional mimetic PN - 458o PN - 458sc Dual GLP/GIP

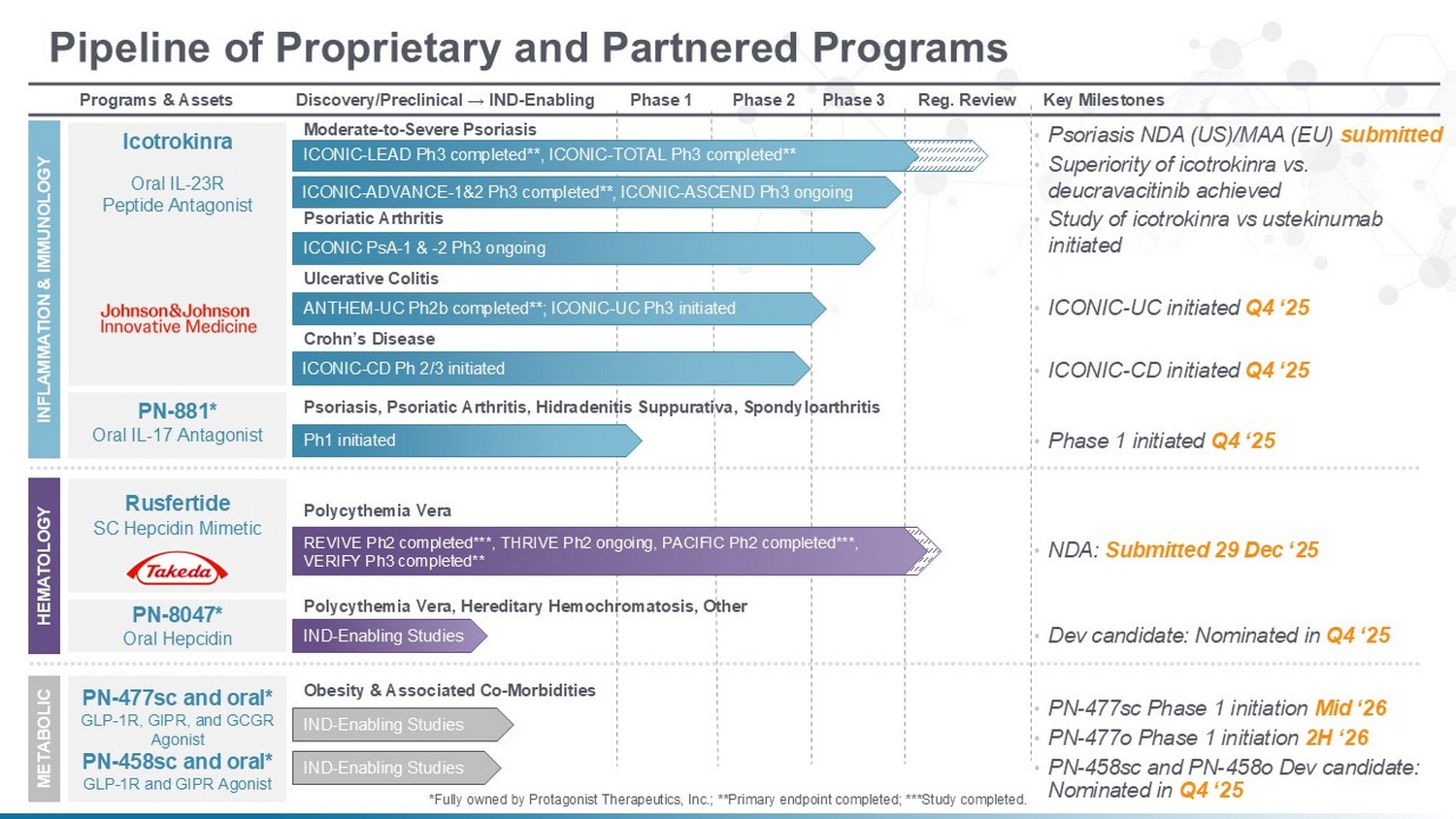

Key Milestones Reg. Review Phase 3 Phase 2 Phase 1 Discovery/Preclinical → IND - Enabling Programs & Assets Pipeline of Proprietary and Partnered Programs INFLAMMATION & IMMUNOLOGY Icotrokinra Oral IL - 23R Peptide Antagonist Ulcerative Colitis Moderate - to - Severe Psoriasis ICONIC PsA - 1 & - 2 Ph3 ongoing Psoriatic Arthritis ANTHEM - UC Ph2b completed**; ICONIC - UC Ph3 initiated Crohn’s Disease ICONIC - CD Ph 2/3 initiated HEMATOLOGY METABOLIC PN - 477sc and oral* GLP - 1R, GIPR, and GCGR Agonist PN - 458sc and oral* GLP - 1R and GIPR Agonist IND - Enabling Studies Polycythemia Vera REVIVE Ph2 completed***, THRIVE Ph2 ongoing, PACIFIC Ph2 completed***, VERIFY Ph3 completed** Rusfertide SC Hepcidin Mimetic • NDA: Submitted 29 Dec ‘25 • PN - 477sc Phase 1 initiation Mid ‘26 Obesity & Associated Co - Morbidities PN - 881* Oral IL - 17 Antagonist Ph1 initiated Psoriasis, Psoriatic Arthritis, Hidradenitis Suppurativa, Spondyloarthritis • Phase 1 initiated Q4 ‘25 PN - 8047* Oral Hepcidin IND - Enabling Studies Polycythemia Vera, Hereditary Hemochromatosis, Other • Dev candidate: Nominated in Q4 ‘25 • ICONIC - UC initiated Q4 ‘25 • ICONIC - CD initiated Q4 ‘25 • Psoriasis NDA (US)/MAA (EU) submitted • PN - 477o Phase 1 initiation 2H ‘26 IND - Enabling Studies ICONIC - ADVANCE - 1&2 Ph3 completed**, ICONIC - ASCEND Ph3 ongoing • Superiority of icotrokinra vs. deucravacitinib achieved *Fully owned by Protagonist Therapeutics, Inc.; **Primary endpoint completed; ***Study completed. ICONIC - LEAD Ph3 completed**, ICONIC - TOTAL Ph3 completed** 4 • Study of icotrokinra vs ustekinumab initiated • PN - 458sc and PN - 458o Dev candidate: Nominated in Q4 ‘25

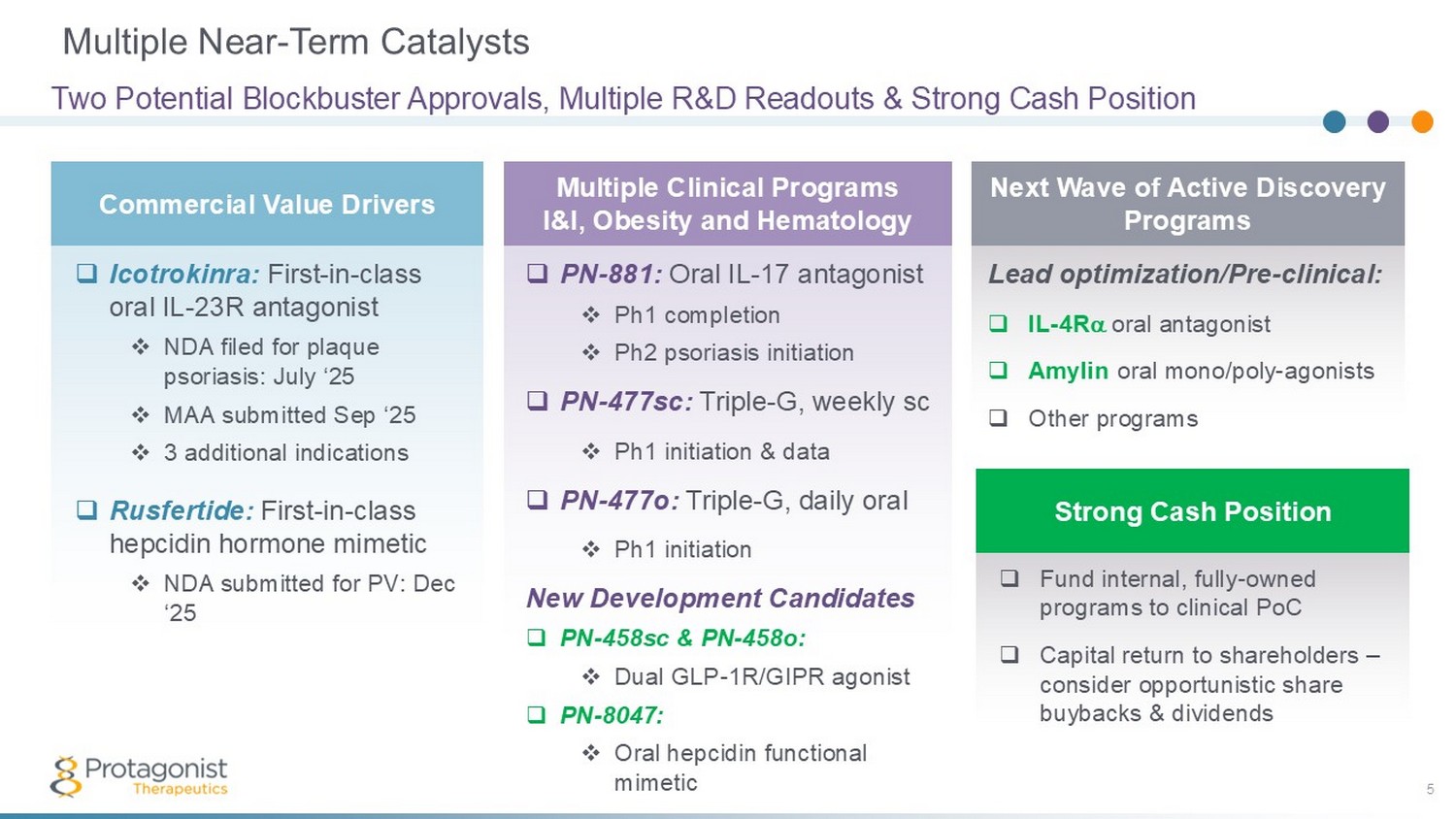

Lead optimization/Pre - clinical: □ IL - 4R oral antagonist □ Amylin oral mono/poly - agonists □ Other programs Multiple Near - Term Catalysts 5 Two Potential Blockbuster Approvals, Multiple R&D Readouts & Strong Cash Position Commercial Value Drivers Multiple Clinical Programs I&I, Obesity and Hematology Next Wave of Active Discovery Programs Strong Cash Position □ Icotrokinra: First - in - class oral IL - 23R antagonist □ NDA filed for plaque psoriasis: July ‘25 □ MAA submitted Sep ‘25 □ 3 additional indications □ Rusfertide: First - in - class hepcidin hormone mimetic □ NDA submitted for PV: Dec ‘25 □ PN - 881: Oral IL - 17 antagonist □ Ph1 completion □ Ph2 psoriasis initiation □ PN - 477sc: Triple - G, weekly sc □ Ph1 initiation & data □ PN - 477o: Triple - G, daily oral □ Ph1 initiation New Development Candidates □ PN - 458sc & PN - 458o: □ Dual GLP - 1R/GIPR agonist □ PN - 8047: □ Oral hepcidin functional mimetic □ Fund internal, fully - owned programs to clinical PoC □ Capital return to shareholders – consider opportunistic share buybacks & dividends

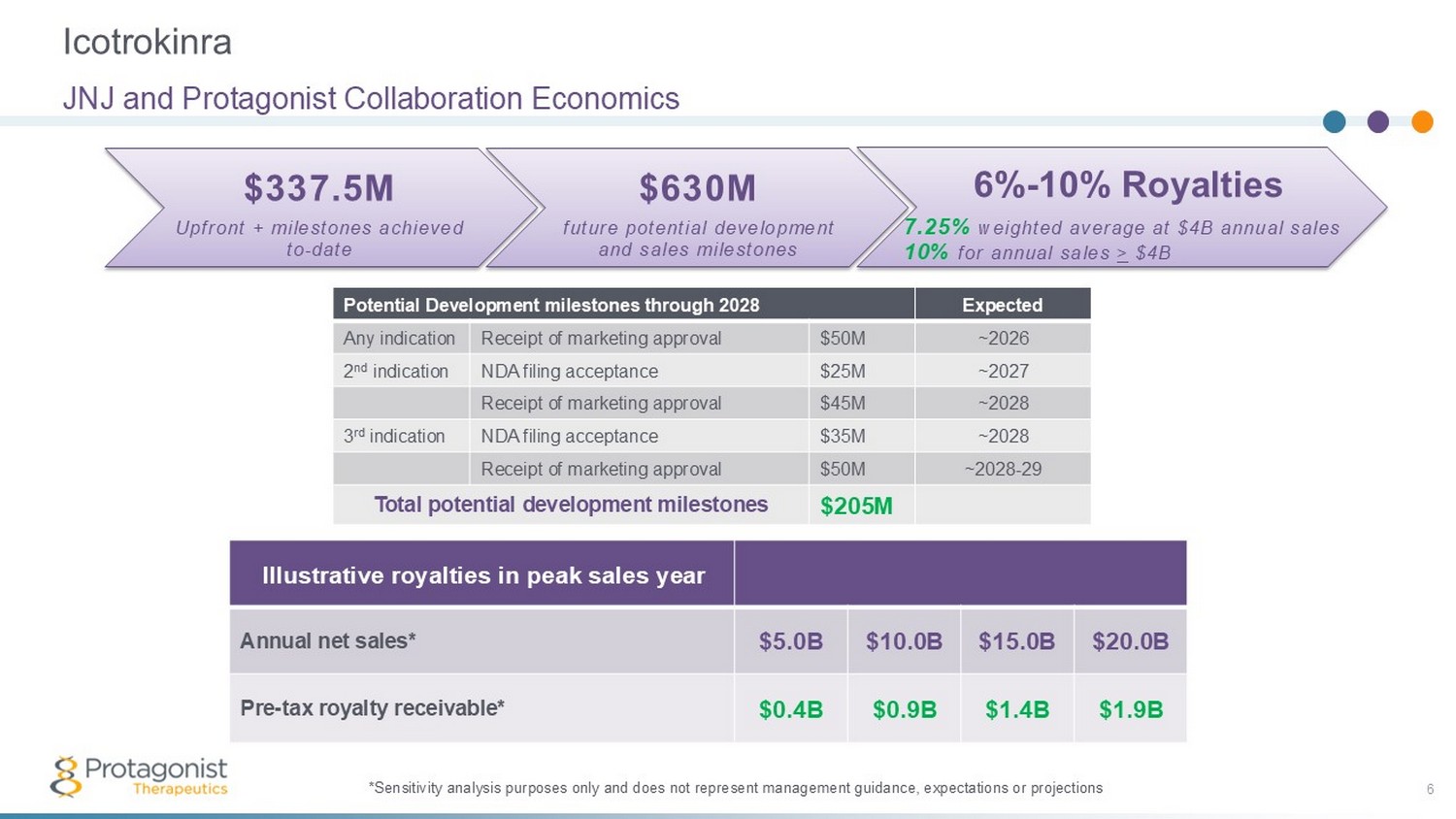

Icotrokinra 6 JNJ and Protagonist Collaboration Economics *Sensitivity analysis purposes only and does not represent management guidance, expectations or projections Expected Potential Development milestones through 2028 ~2026 $50M Receipt of marketing approval Any indication ~2027 $25M NDA filing acceptance 2 nd indication ~2028 $45M Receipt of marketing approval ~2028 $35M NDA filing acceptance 3 rd indication ~2028 - 29 $50M Receipt of marketing approval $205M Total potential development milestones $630M future potential development and sales milestones $337.5M Upfront + milestones achieved to - date 6% - 10% Royalties 7.25% weighted average at $4B annual sales 10% for annual sales > $4B Illustrative royalties in peak sales year $20.0B $15.0B $10.0B $5.0B Annual net sales* $1.9B $1.4B $0.9B $0.4B Pre - tax royalty receivable*

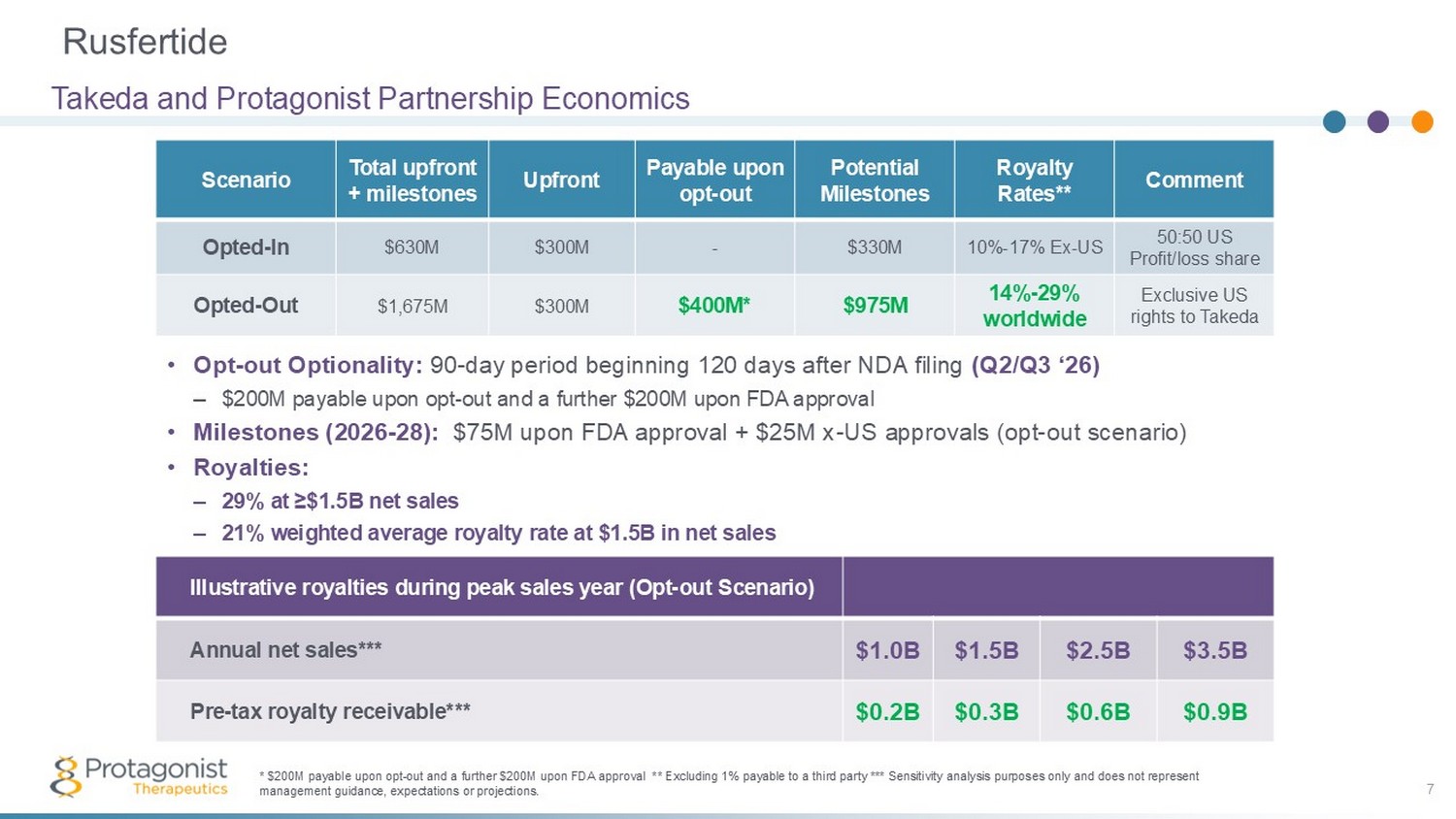

Rusfertide 7 Takeda and Protagonist Partnership Economics Illustrative royalties during peak sales year (Opt - out Scenario) $3.5B $2.5B $1.5B $1.0B Annual net sales*** $0.9B $0.6B $0.3B $0.2B Pre - tax royalty receivable*** * $200M payable upon opt - out and a further $200M upon FDA approval **excluding 1% payable to a third party *** Sensitivity anal ysis purposes only and does not represent management guidance, expectations or projections Comment Royalty Rates** Potential Milestones Payable upon opt - out Upfront Total upfront + milestones Scenario 50:50 US Profit/loss share 10% - 17% Ex - US $330M - $300M $630M Opted - In Exclusive US rights to Takeda 14% - 29% worldwide 4 $975M 3 $400M 2 $300M $1,675M Opted - Out 1 • Opt - out Optionality: 90 - day period beginning 120 days after NDA filing (Q2/Q3 ‘26) – $200M payable upon opt - out and a further $200M upon FDA approval • Milestones (2026 - 28): $75M upon FDA approval + $25M x - US approvals (opt - out scenario) • Royalties: – 29% at ≥$1.5B net sales – 21% weighted average royalty rate at $1.5B in net sales

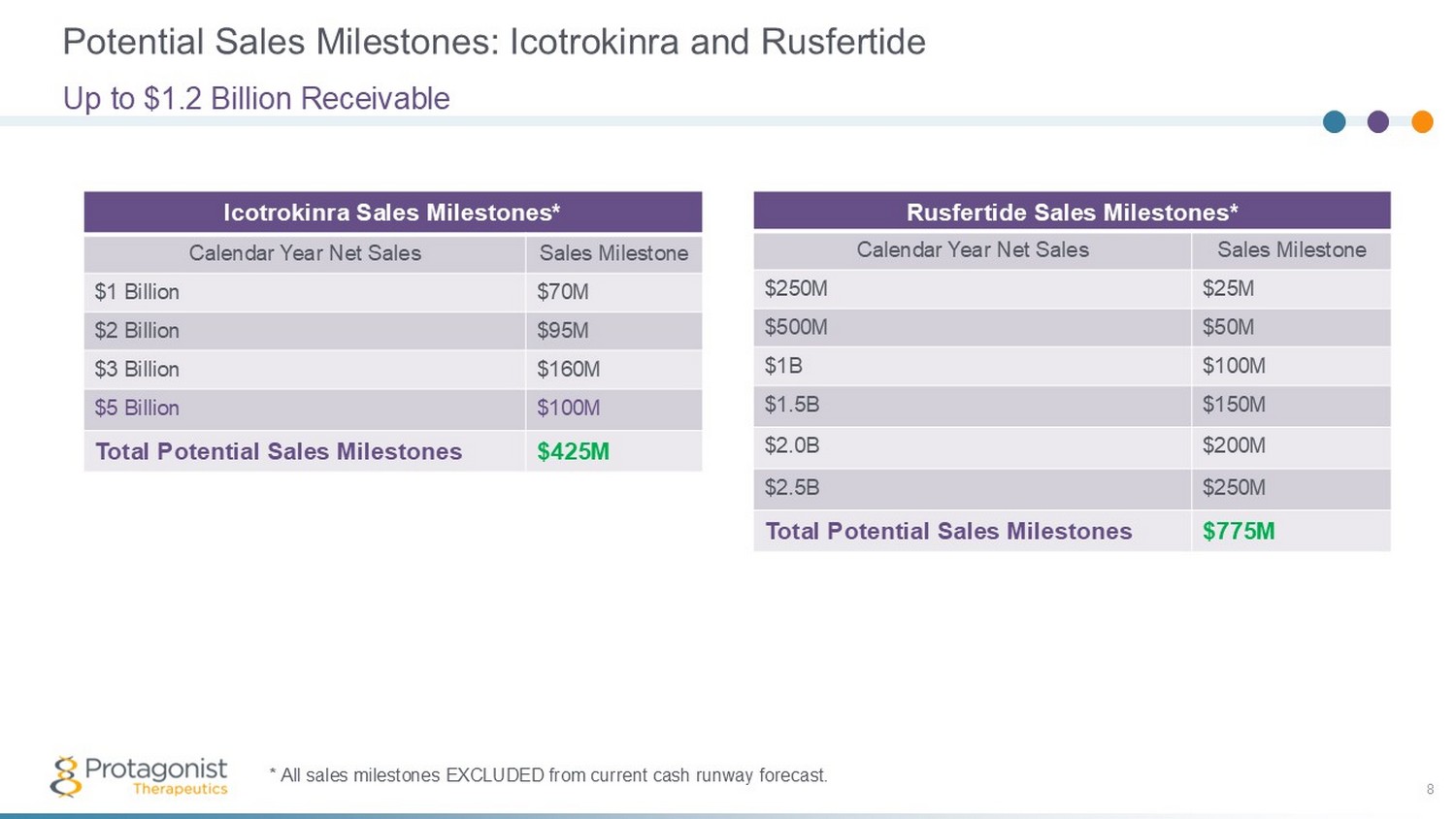

Potential Sales Milestones: Icotrokinra and Rusfertide 8 Up to $1.2 Billion Receivable Icotrokinra Sales Milestones* Sales Milestone Calendar Year Net Sales $70M $1 Billion $95M $2 Billion $160M $3 Billion $100M $5 Billion $425M Total Potential Sales Milestones * All sales milestones EXCLUDED from current cash runway forecast. Rusfertide Sales Milestones* Sales Milestone Calendar Year Net Sales $25M $250M $50M $500M $100M $1B $150M $1.5B $200M $2.0B $250M $2.5B $775M Total Potential Sales Milestones

Icotrokinra (JNJ - 2113, formerly PN - 235): Oral IL - 23 Receptor Antagonist Peptide Setting a new standard of treatment in plaque psoriasis & other IL - 23 mediated diseases J&J Partnership: 2017 to Present 9

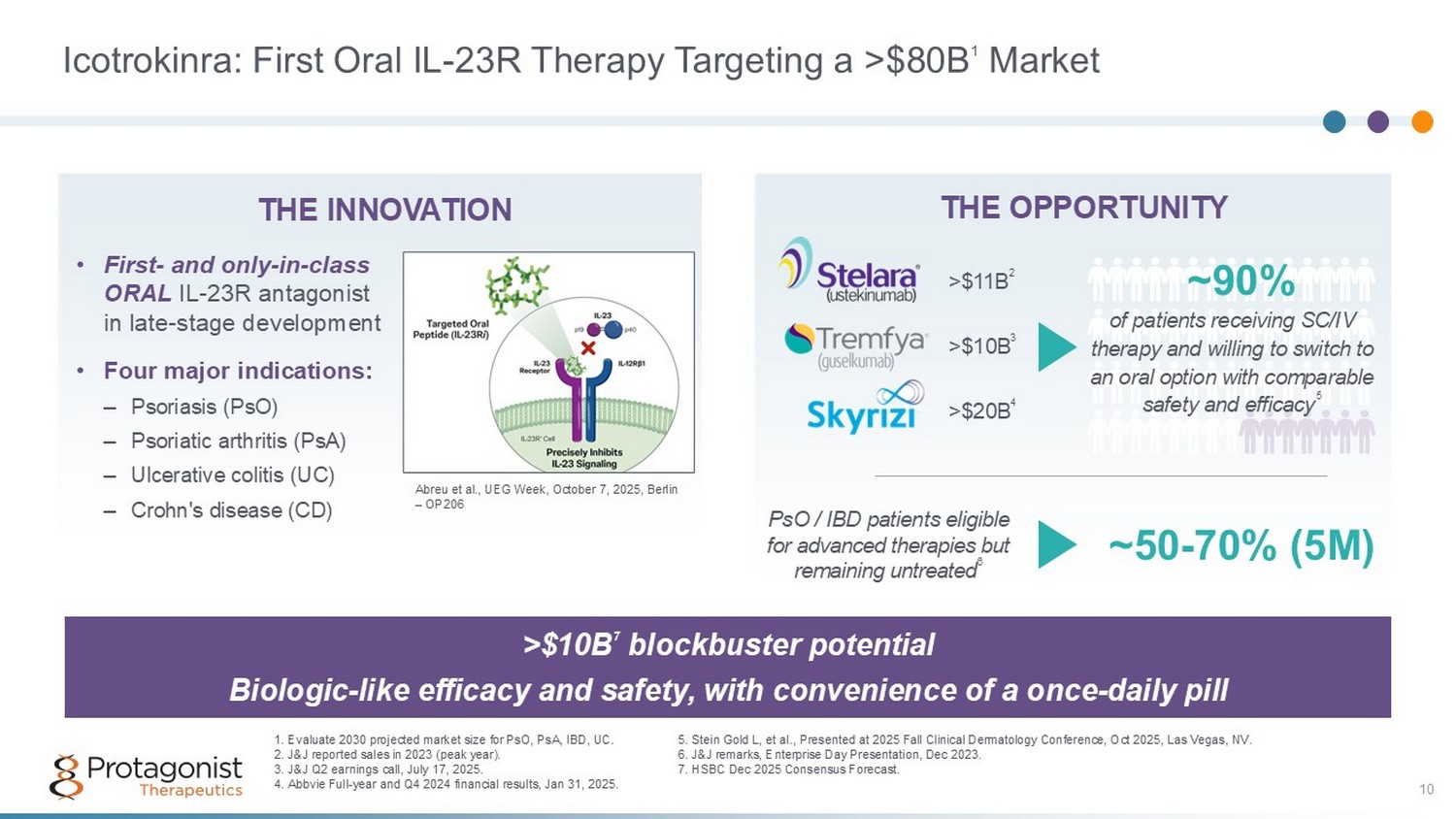

Icotrokinra: First Oral IL - 23R Therapy Targeting a >$80B 1 Market 10 >$10B 7 blockbuster potential Biologic - like efficacy and safety, with convenience of a once - daily pill WW market Size 2030 est. (7 - yr CAGR) 1 THE OPPORTUNITY of patients receiving SC/IV therapy and willing to switch to an oral option with comparable safety and efficacy 5 ~90% WW market Size 2030 est. (7 - yr CAGR) 1 THE INNOVATION >$20B 4 1. Evaluate 2030 projected market size for PsO, PsA, IBD, UC. 2. J&J reported sales in 2023 (peak year). 3. J&J Q2 earnings call, July 17, 2025. 4. Abbvie Full - year and Q4 2024 financial results, Jan 31, 2025. >$11B 2 PsO / IBD patients eligible for advanced therapies but remaining untreated 6 ~50 - 70% (5M) >$10B 3 • First - and only - in - class ORAL IL - 23R antagonist in late - stage development • Four major indications: – Psoriasis (PsO) – Psoriatic arthritis (PsA) – Ulcerative colitis (UC) – Crohn's disease (CD) 5 . Stein Gold L, et al., Presented at 2025 Fall Clinical Dermatology Conference, Oct 2025, Las Vegas, NV. 6. J&J remarks, Enterprise Day Presentation, Dec 2023. 7. HSBC Dec 2025 Consensus Forecast. Abreu et al., UEG Week, October 7, 2025, Berlin – OP206

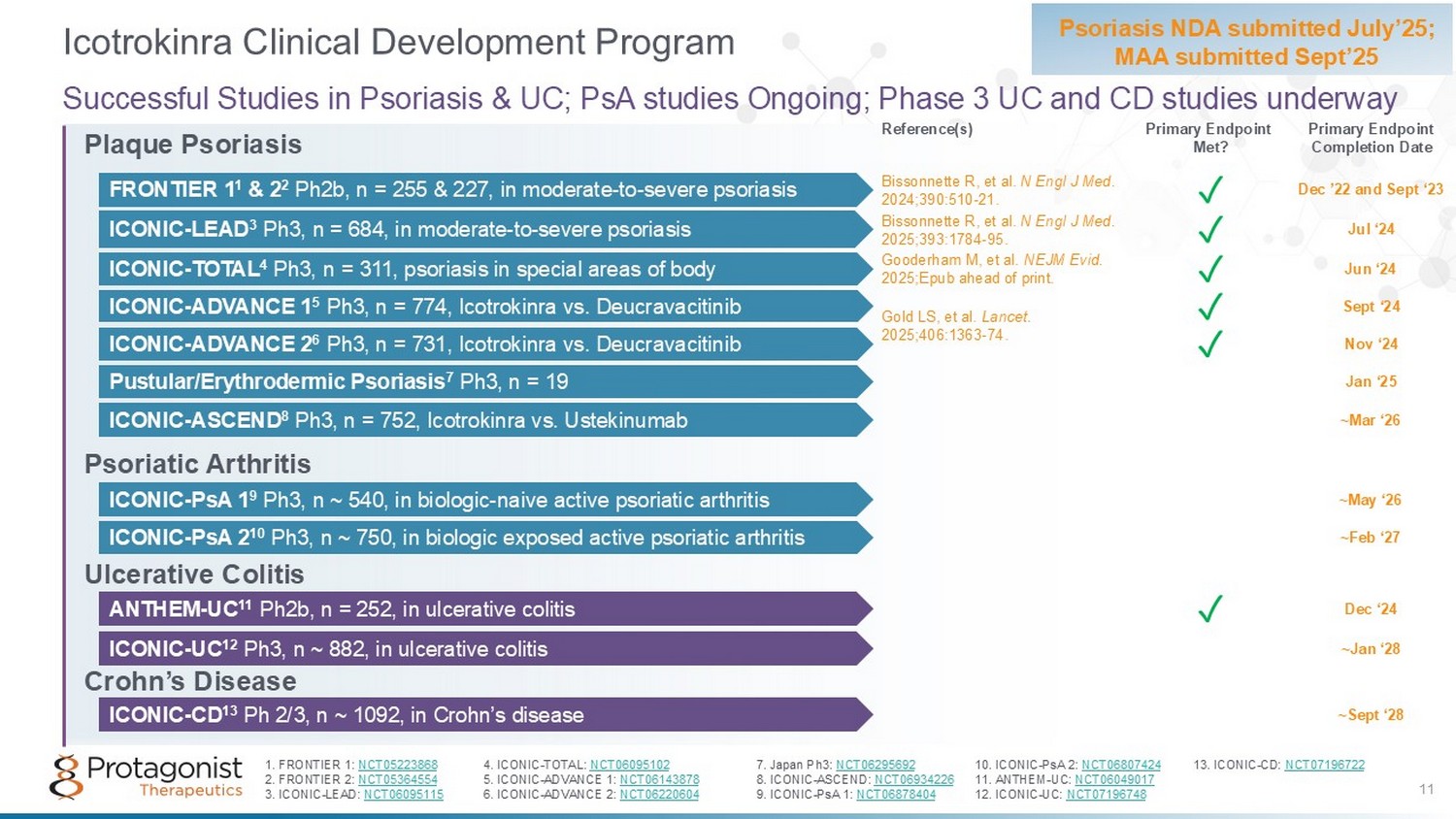

Plaque Psoriasis Psoriatic Arthritis Ulcerative Colitis Crohn’s Disease Icotrokinra Clinical Development Program Psoriasis NDA submitted July’25; MAA submitted Sept’25 Successful Studies in Psoriasis & UC; PsA studies Ongoing; Phase 3 UC and CD studies underway ~Feb ‘27 ICONIC - PsA 2 10 Ph3, n ~ 750, in biologic exposed active psoriatic arthritis ICONIC - PsA 1 9 Ph3, n ~ 540, in biologic - naive active psoriatic arthritis ~May ‘26 ICONIC - ASCEND 8 Ph3 , n = 752, Icotrokinra vs. Ustekinumab ~Mar ‘26 ICONIC - UC 12 Ph3, n ~ 882, in ulcerative colitis ~Jan ‘28 ICONIC - CD 13 Ph 2/3, n ~ 1092, in Crohn’s disease ~Sept ‘28 11 Gold LS, et al. Lancet. 2025;406:1363 - 74. Reference(s) Primary Endpoint Completion Date Primary Endpoint Met? 1. FRONTIER 1: NCT05223868 4. ICONIC - TOTAL: NCT06095102 7. Japan Ph3: NCT06295692 10. ICONIC - PsA 2: NCT06807424 13. ICONIC - CD: NCT07196722 2. FRONTIER 2: NCT05364554 5. ICONIC - ADVANCE 1: NCT06143878 8. ICONIC - ASCEND: NCT06934226 11. ANTHEM - UC: NCT06049017 3. ICONIC - LEAD: NCT06095115 6. ICONIC - ADVANCE 2: NCT06220604 9. ICONIC - PsA 1: NCT06878404 12. ICONIC - UC: NCT07196748 FRONTIER 1 1 & 2 2 Ph2b, n = 255 & 227, in moderate - to - severe psoriasis ✓ Bissonnette R, et al. N Engl J Med . 2024;390:510 - 21. Dec ’22 and Sept ‘23 ICONIC - LEAD 3 Ph3, n = 684, in moderate - to - severe psoriasis ✓ Bissonnette R, et al. N Engl J Med. 2025;393:1784 - 95. Jul ‘24 Gooderham M, et al. NEJM Evid. 2025;Epub ahead of print. ICONIC - TOTAL 4 Ph3, n = 311, psoriasis in special areas of body ✓ Jun ‘24 ICONIC - ADVANCE 1 5 Ph3, n = 774, Icotrokinra vs. Deucravacitinib ✓ Sept ‘24 ICONIC - ADVANCE 2 6 Ph3, n = 731, Icotrokinra vs. Deucravacitinib ✓ Nov ‘24 Pustular/Erythrodermic Psoriasis 7 Ph3, n = 19 Jan ‘25 ANTHEM - UC 11 Ph2b, n = 252, in ulcerative colitis ✓ Dec ‘24

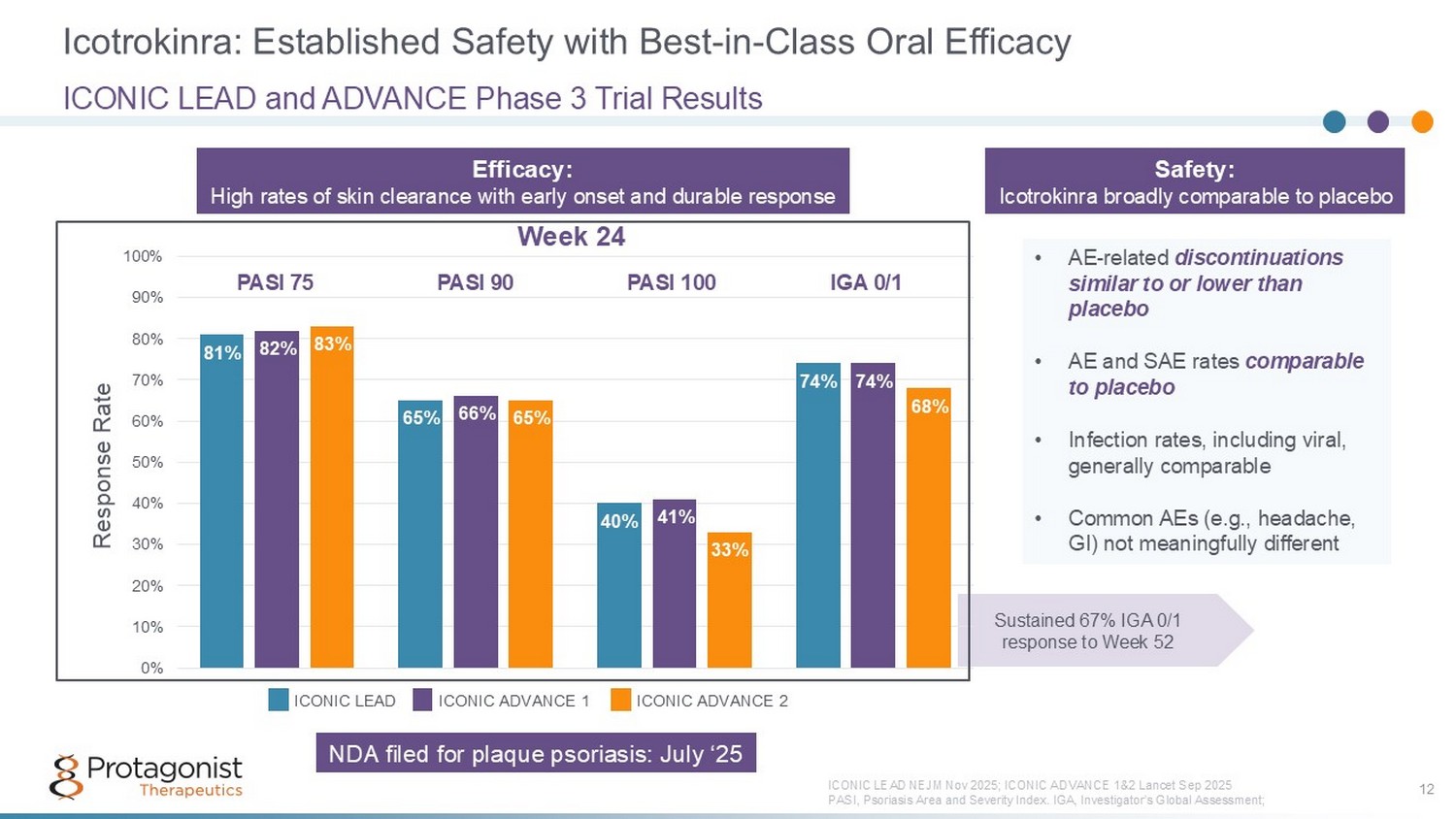

Icotrokinra: Established Safety with Best - in - Class Oral Efficacy 12 ICONIC LEAD and ADVANCE Phase 3 Trial Results ICONIC LEAD NEJM Nov 2025; ICONIC AD VANCE 1&2 Lancet Sep 2025 PASI, Psoriasis Area and Severity Index. IGA, Investigator’s Global Assessment; • AE - related discontinuations similar to or lower than placebo • AE and SAE rates comparable to placebo • Infection rates, including viral, generally comparable • Common AEs (e.g., headache, GI) not meaningfully different Sustained 67% IGA 0/1 response to Week 52 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Response Rate 81% 82% 83% 65% 66% 65% 40% 41% 33% 74% 74% 68% PASI 75 IGA 0/1 PASI 90 PASI 100 ICONIC LEAD ICONIC ADVANCE 1 ICONIC ADVANCE 2 Week 24 Efficacy: High rates of skin clearance with early onset and durable response Safety: Icotrokinra broadly comparable to placebo NDA filed for plaque psoriasis: July ‘25

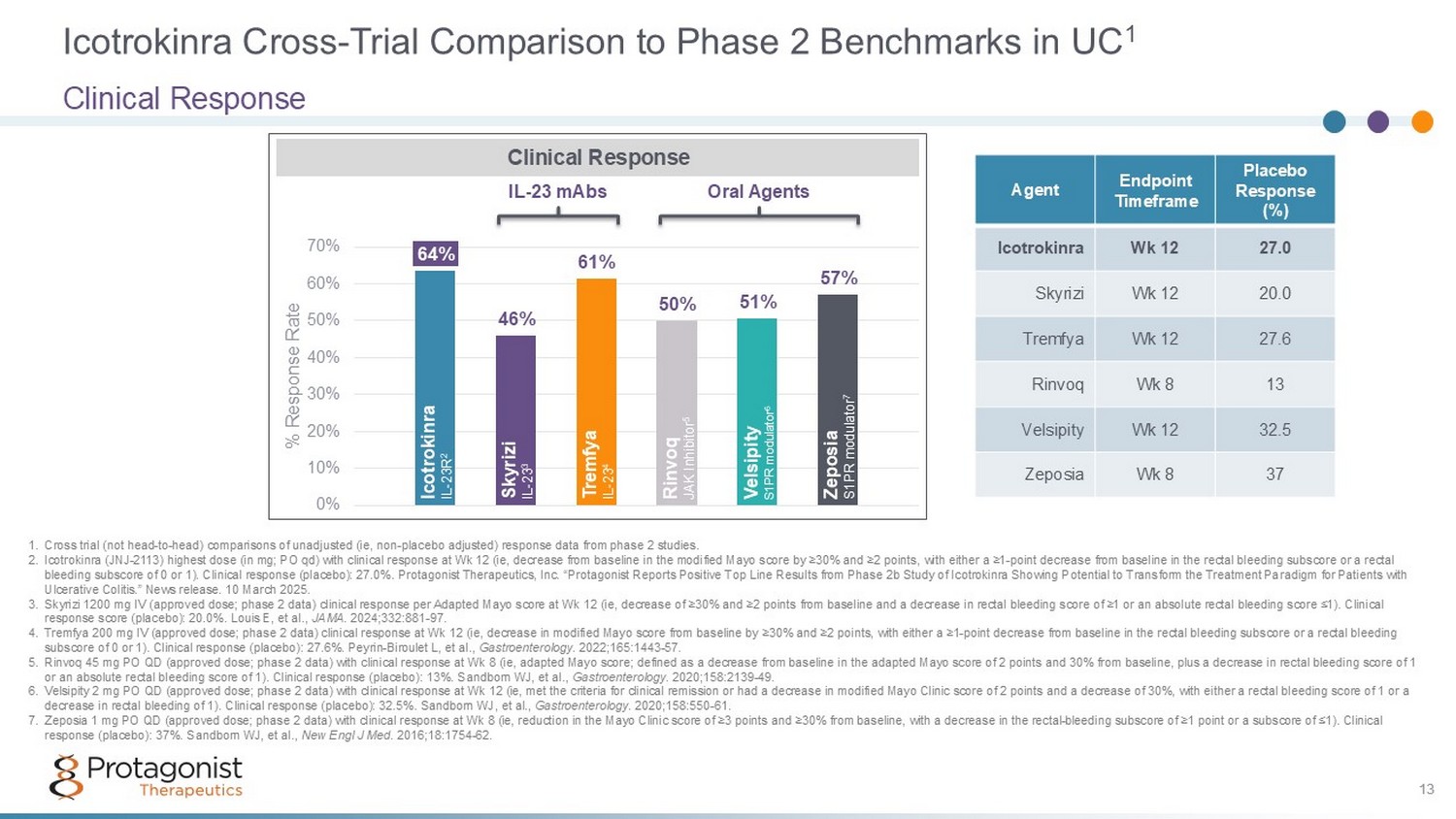

Icotrokinra Cross - Trial Comparison to Phase 2 Benchmarks in UC 1 Clinical Response 13 64% 46% 61% 50% 51% 57% 0% 10% 20% 30% 40% 50% 60% 70% % Response Rate 1. Cross trial (not head - to - head) comparisons of unadjusted (ie, non - placebo adjusted) response data from phase 2 studies. 2. Icotrokinra (JNJ - 2113) highest dose (in mg; PO qd) with clinical response at Wk 12 (ie, decrease from baseline in the modified M ayo score by ≥30% and ≥2 points, with either a ≥1 - point decrease from baseline in the rectal bleeding subscore or a rectal bleeding subscore of 0 or 1). Clinical response (placebo): 27.0%. Protagonist Therapeutics, Inc. “ Protagonist Reports Positive Top Line Results from Phase 2b Study of Icotrokinra Showing Potential to Transform the Treatment Pa radigm for Patients with Ulcerative Colitis .” News release. 10 March 2025. 3. Skyrizi 1200 mg IV (approved dose; phase 2 data) clinical response per Adapted Mayo score at Wk 12 (ie, decrease of ≥30% and ≥2 points from baseline and a decrease in rectal bleeding score of ≥1 or an absolute rectal bleeding score ≤1). Clinical response score (placebo): 20.0%. Louis E, et al., JAMA . 2024;332:881 - 97. 4. Tremfya 200 mg IV (approved dose; phase 2 data) clinical response at Wk 12 (ie, decrease in modified Mayo score from baseline by ≥30% and ≥2 points, with either a ≥1 - point decrease from baseline in the rectal bleeding subscore or a rectal bleeding subscore of 0 or 1). Clinical response (placebo): 27.6%. Peyrin - Biroulet L, et al., Gastroenterology . 2022;165:1443 - 57. 5. Rinvoq 45 mg PO QD (approved dose; phase 2 data) with clinical response at Wk 8 (ie, adapted Mayo score; defined as a decreas e f rom baseline in the adapted Mayo score of 2 points and 30% from baseline, plus a decrease in rectal bleeding score of 1 or an absolute rectal bleeding score of 1). Clinical response (placebo): 13%. Sandborn WJ, et al., Gastroenterology . 2020;158:2139 - 49. 6. Velsipity 2 mg PO QD (approved dose; phase 2 data) with clinical response at Wk 12 (ie, met the criteria for clinical remissi on or had a decrease in modified Mayo Clinic score of 2 points and a decrease of 30%, with either a rectal bleeding score of 1 o r a decrease in rectal bleeding of 1). Clinical response (placebo): 32.5%. Sandborn WJ, et al., Gastroenterology . 2020;158:550 - 61. 7. Zeposia 1 mg PO QD (approved dose; phase 2 data) with clinical response at Wk 8 (ie, reduction in the Mayo Clinic score of ≥3 po ints and ≥30% from baseline, with a decrease in the rectal - bleeding subscore of ≥1 point or a subscore of ≤1). Clinical response (placebo): 37%. Sandborn WJ, et al., New Engl J Med . 2016;18:1754 - 62. Clinical Response Icotrokinra IL - 23R 2 Rinvoq JAK Inhibitor 5 Velsipity S1P R modulator 6 Zeposia S1PR modulator 7 Skyrizi IL - 23 3 Tremfya IL - 23 4 Oral Agents IL - 23 mAbs Placebo Response (%) Endpoint Timeframe Agent 27.0 Wk 12 Icotrokinra 20.0 Wk 12 Skyrizi 27.6 Wk 12 Tremfya 13 Wk 8 Rinvoq 32.5 Wk 12 Velsipity 37 Wk 8 Zeposia 13

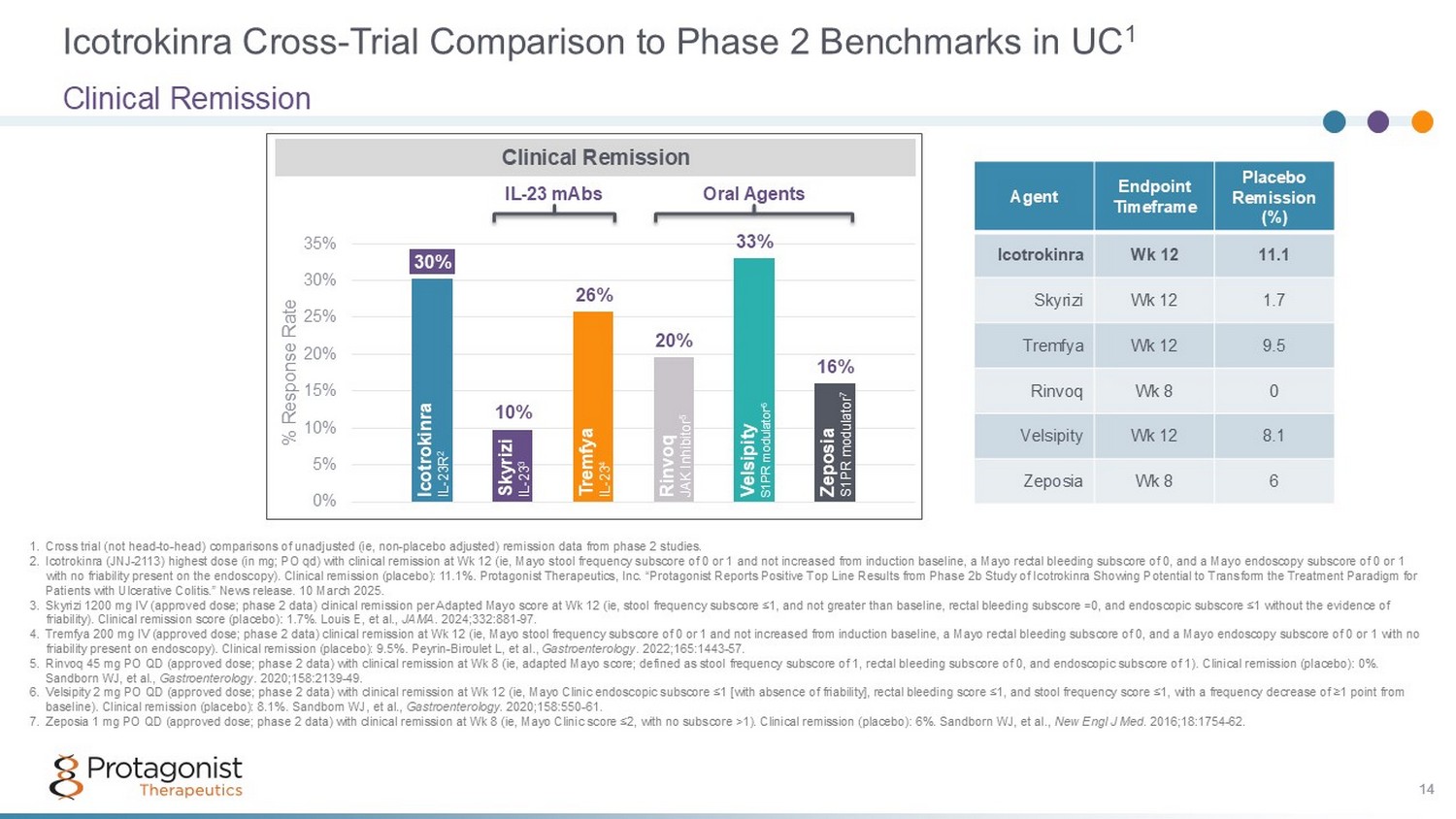

Icotrokinra Cross - Trial Comparison to Phase 2 Benchmarks in UC 1 Clinical Remission 14 30% 10% 26% 20% 33% 16% 0% 5% 10% 15% 20% 25% 30% 35% % Response Rate 1. Cross trial (not head - to - head) comparisons of unadjusted (ie, non - placebo adjusted) remission data from phase 2 studies. 2. Icotrokinra (JNJ - 2113) highest dose (in mg; PO qd) with clinical remission at Wk 12 (ie, Mayo stool frequency subscore of 0 or 1 and not increased from induction baseline, a Mayo rectal bleeding subscore of 0, and a Mayo endoscopy subscore of 0 or 1 with no friability present on the endoscopy). Clinical remission (placebo): 11.1 %. Protagonist Therapeutics, Inc. “ Protagonist Reports Positive Top Line Results from Phase 2b Study of Icotrokinra Showing Potential to Transform the Treatment Pa radigm for Patients with Ulcerative Colitis .” News release. 10 March 2025. 3. Skyrizi 1200 mg IV (approved dose; phase 2 data) clinical remission per Adapted Mayo score at Wk 12 (ie, stool frequency subs cor e ≤1, and not greater than baseline, rectal bleeding subscore =0, and endoscopic subscore ≤1 without the evidence of friability). Clinical remission score (placebo): 1.7%. Louis E, et al., JAMA . 2024;332:881 - 97. 4. Tremfya 200 mg IV (approved dose; phase 2 data) clinical remission at Wk 12 (ie, Mayo stool frequency subscore of 0 or 1 and not increased from induction baseline, a Mayo rectal bleeding subscore of 0, and a Mayo endoscopy subscore of 0 or 1 with no friability present on endoscopy). Clinical remission (placebo): 9.5%. Peyrin - Biroulet L, et al., Gastroenterology . 2022;165:1443 - 57. 5. Rinvoq 45 mg PO QD (approved dose; phase 2 data) with clinical remission at Wk 8 (ie, adapted Mayo score; defined as stool fr equ ency subscore of 1, rectal bleeding subscore of 0, and endoscopic subscore of 1). Clinical remission (placebo): 0%. Sandborn WJ, et al., Gastroenterology . 2020;158:2139 - 49. 6. Velsipity 2 mg PO QD (approved dose; phase 2 data) with clinical remission at Wk 12 (ie, Mayo Clinic endoscopic subscore ≤1 [ wit h absence of friability], rectal bleeding score ≤1, and stool frequency score ≤1, with a frequency decrease of ≥1 point from baseline). Clinical remission (placebo): 8.1%. Sandborn WJ, et al., Gastroenterology . 2020;158:550 - 61. 7. Zeposia 1 mg PO QD (approved dose; phase 2 data) with clinical remission at Wk 8 (ie, Mayo Clinic score ≤2, with no subscore >1) . Clinical remission (placebo): 6%. Sandborn WJ, et al., New Engl J Med . 2016;18:1754 - 62. Clinical Remission Icotrokinra IL - 23R 2 Rinvoq JAK Inhibitor 5 Velsipity S1PR modulator 6 Zeposia S1PR modulator 7 Skyrizi IL - 23 3 Tremfya IL - 23 4 Oral Agents IL - 23 mAbs Placebo Remission (%) Endpoint Timeframe Agent 11.1 Wk 12 Icotrokinra 1.7 Wk 12 Skyrizi 9.5 Wk 12 Tremfya 0 Wk 8 Rinvoq 8.1 Wk 12 Velsipity 6 Wk 8 Zeposia 14

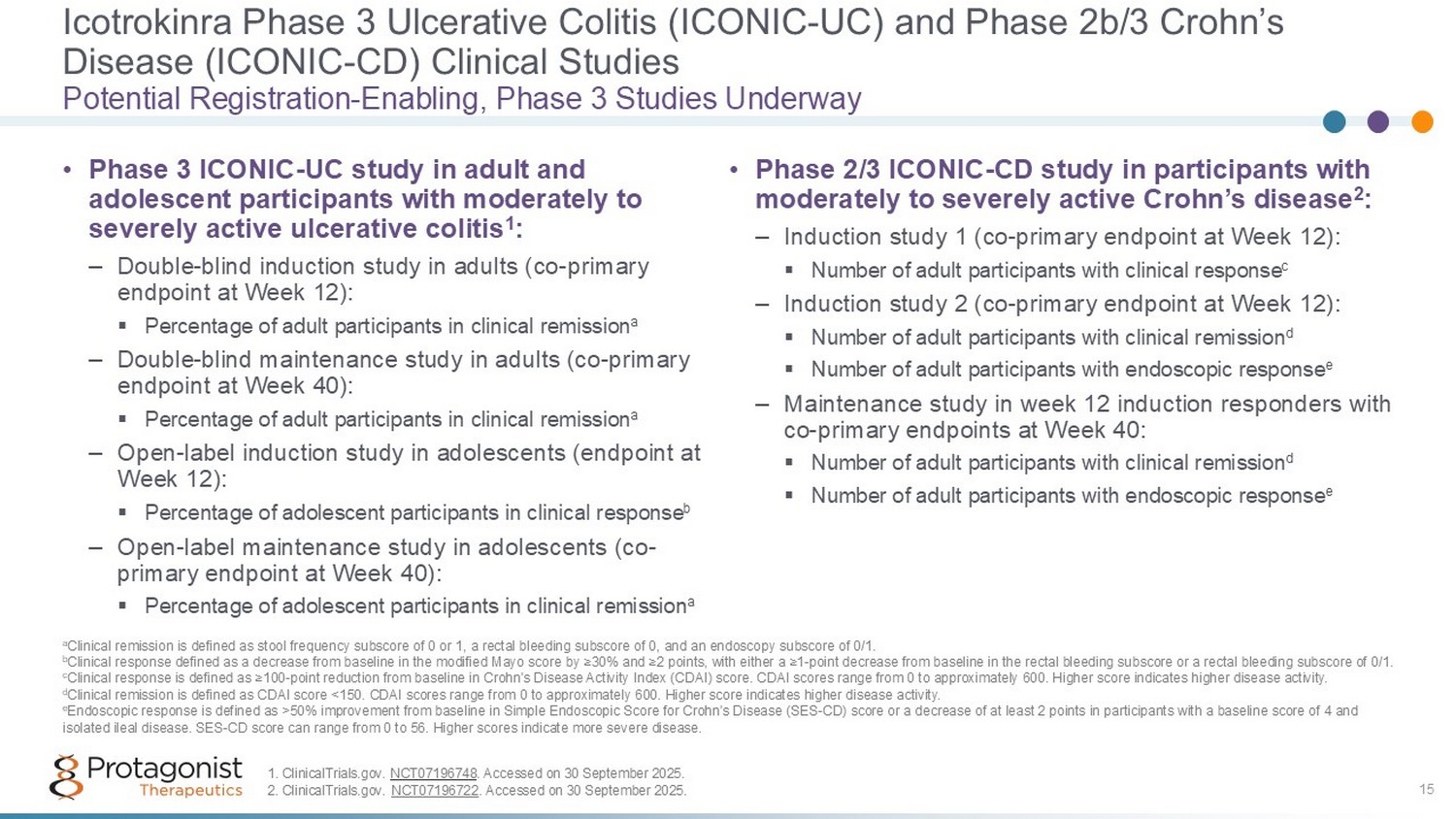

Icotrokinra Phase 3 Ulcerative Colitis (ICONIC - UC) and Phase 2b/3 Crohn’s Disease (ICONIC - CD) Clinical Studies 15 • Phase 3 ICONIC - UC study in adult and adolescent participants with moderately to severely active ulcerative colitis 1 : – Double - blind induction study in adults (co - primary endpoint at Week 12): ▪ Percentage of adult participants in clinical remission a – Double - blind maintenance study in adults (co - primary endpoint at Week 40): ▪ Percentage of adult participants in clinical remission a – Open - label induction study in adolescents (endpoint at Week 12): ▪ Percentage of adolescent participants in clinical response b – Open - label maintenance study in adolescents (co - primary endpoint at Week 40): ▪ Percentage of adolescent participants in clinical remission a • Phase 2/3 ICONIC - CD study in participants with moderately to severely active Crohn’s disease 2 : – Induction study 1 (co - primary endpoint at Week 12): ▪ Number of adult participants with clinical response c – Induction study 2 (co - primary endpoint at Week 12): ▪ Number of adult participants with clinical remission d ▪ Number of adult participants with endoscopic response e – Maintenance study in week 12 induction responders with co - primary endpoints at Week 40: ▪ Number of adult participants with clinical remission d ▪ Number of adult participants with endoscopic response e Potential Registration - Enabling, Phase 3 Studies Underway a Clinical remission is defined as stool frequency subscore of 0 or 1, a rectal bleeding subscore of 0, and an endoscopy subsco re of 0/1. b Clinical response defined as a decrease from baseline in the modified Mayo score by ≥30% and ≥2 points, with either a ≥1 - point d ecrease from baseline in the rectal bleeding subscore or a rectal bleeding subscore of 0/1. c Clinical response is defined as ≥100 - point reduction from baseline in Crohn's Disease Activity Index (CDAI) score. CDAI scores r ange from 0 to approximately 600. Higher score indicates higher disease activity. d Clinical remission is defined as CDAI score <150. CDAI scores range from 0 to approximately 600. Higher score indicates highe r d isease activity. e Endoscopic response is defined as >50% improvement from baseline in Simple Endoscopic Score for Crohn's Disease (SES - CD) score o r a decrease of at least 2 points in participants with a baseline score of 4 and isolated ileal disease. SES - CD score can range from 0 to 56. Higher scores indicate more severe disease. 1. ClinicalTrials.gov. NCT07196748 . Accessed on 30 September 2025. 2. ClinicalTrials.gov. NCT07196722 . Accessed on 30 September 2025.

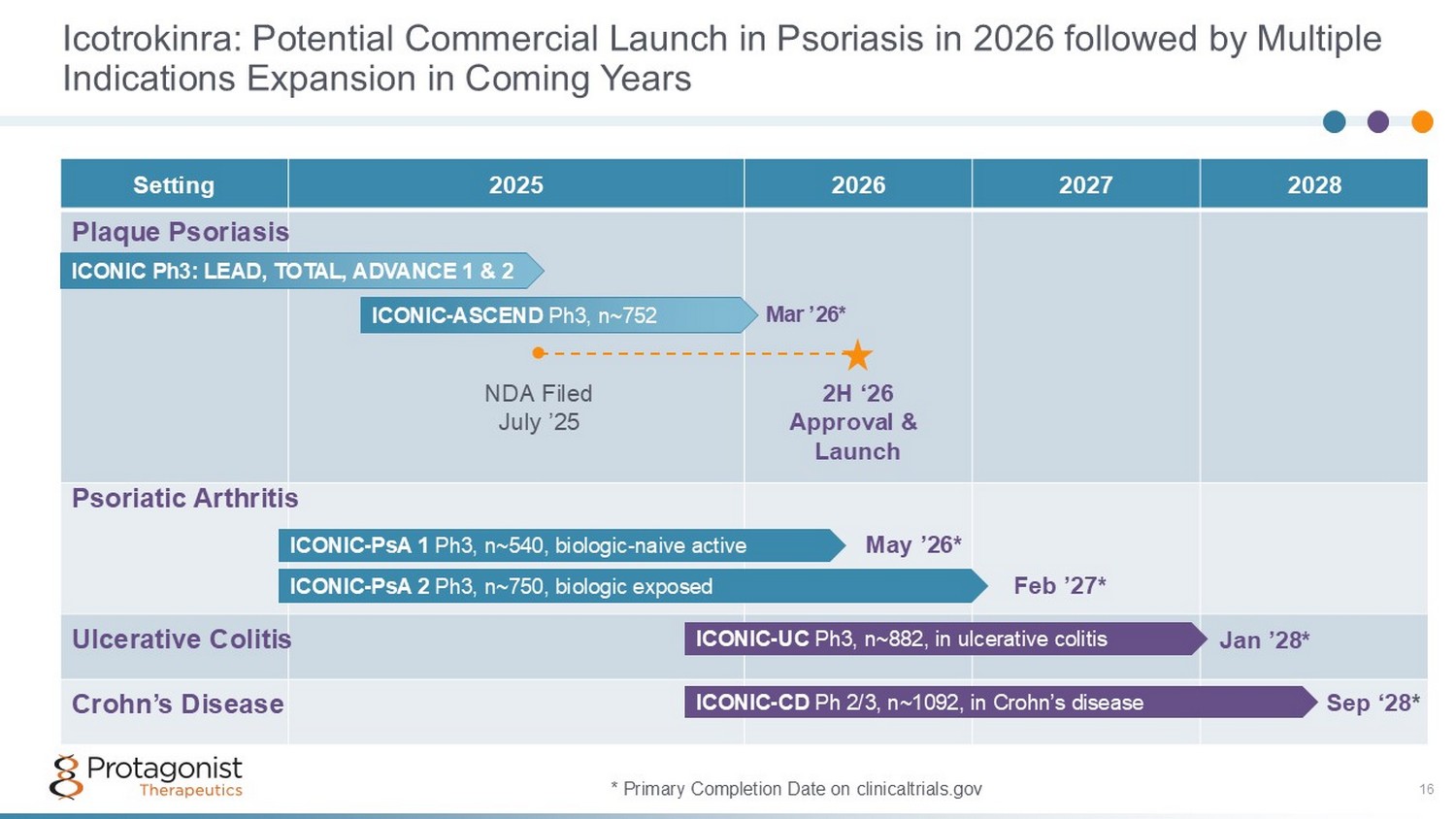

Icotrokinra: Potential Commercial Launch in Psoriasis in 2026 followed by Multiple Indications Expansion in Coming Years 16 2028 2027 2026 2025 Setting ICONIC - PsA 1 Ph3, n~540, biologic - naive active ICONIC - PsA 2 Ph3, n~750, biologic exposed ICONIC - UC Ph3, n~882, in ulcerative colitis ICONIC - CD Ph 2/3, n~1092, in Crohn’s disease ICONIC Ph3: LEAD, TOTAL, ADVANCE 1 & 2 Sep ‘28 * Jan ’28* Feb ’27* May ’26* ● * Primary Completion Date on clinicaltrials.gov ICONIC - ASCEND Ph3, n~752 Mar ’26* NDA Filed July ’25 2H ‘26 Approval & Launch Plaque Psoriasis Psoriatic Arthritis Ulcerative Colitis Crohn’s Disease

17 Rusfertide: Hepcidin Mimetic Potential as a new practice changing standard of care in Polycythemia Vera (PV) PV: A rare myeloproliferative neoplasm characterized by excessive production of red blood cells 1 - Primary treatment goal is to maintain Hct <45% 2,3,4 , Polycythemia Vera. https://rarediseases.org/rare - diseases/polycythemia - vera/ . 2. Spivak JL. Ann Hematol 2018; 19(2):1 - 14 3. Marchioli R, et al. N Engl J Med 2013; 368:22 - 33. 4. Barbui, T, et al. Leukemia 2018;32;1057 - 69

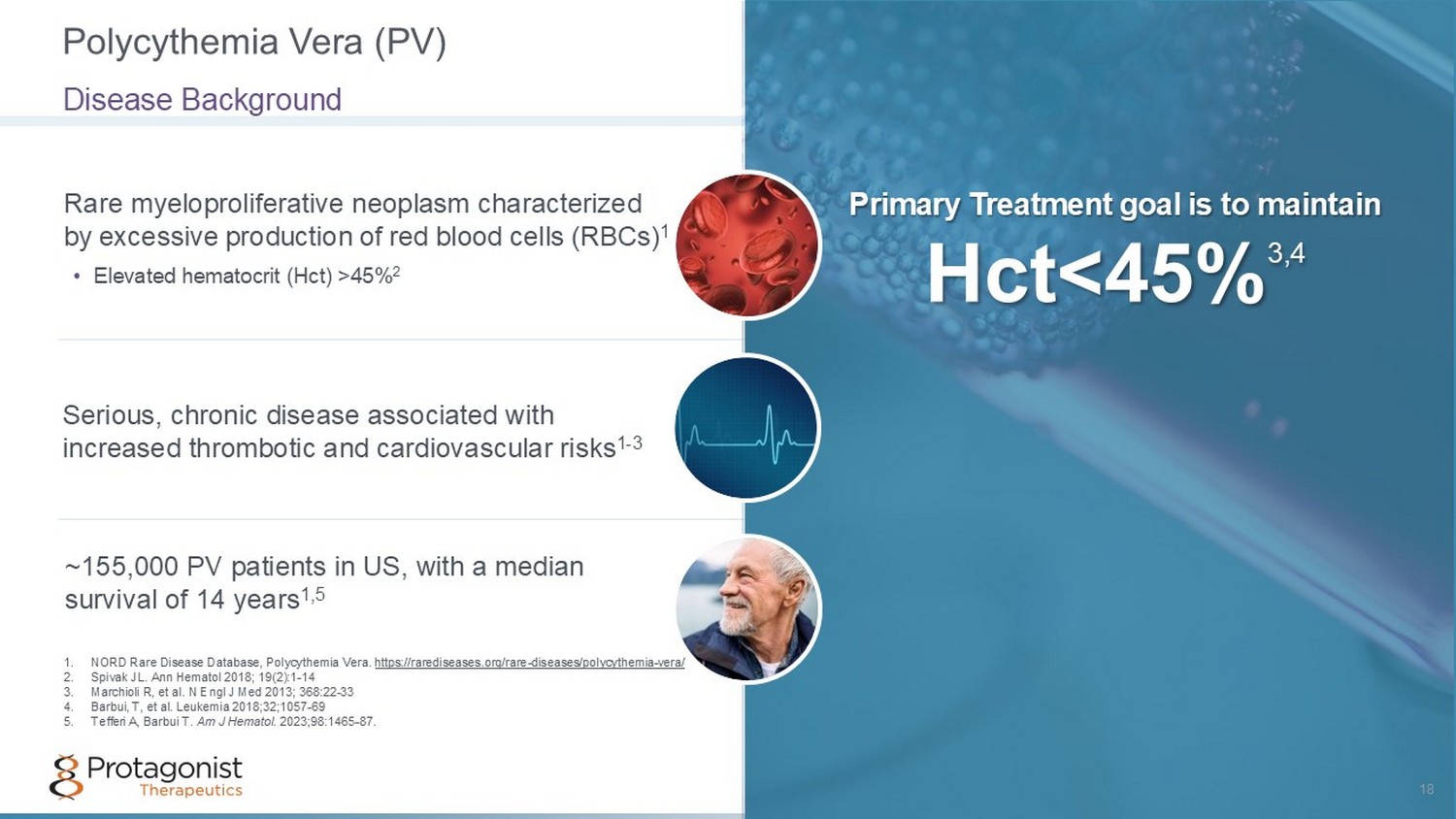

Rare myeloproliferative neoplasm characterized by excessive production of red blood cells (RBCs) 1 Primary Treatment goal is to maintain Hct <45% 3,4 • Elevated hematocrit (Hct) >45% 2 Serious, chronic disease associated with increased thrombotic and cardiovascular risks 1 - 3 ~155,000 PV patients in US, with a median survival of 14 years 1,5 Polycythemia Vera (PV) 18 Disease Background 1. NORD Rare Disease Database, Polycythemia Vera. https://rarediseases.org/rare - diseases/polycythemia - vera/ 2. Spivak JL. Ann Hematol 2018; 19(2):1 - 14 3. Marchioli R, et al. N Engl J Med 2013; 368:22 - 33 4. Barbui, T, et al. Leukemia 2018;32;1057 - 69 5. Tefferi A, Barbui T. Am J Hematol . 2023;98:1465 - 87.

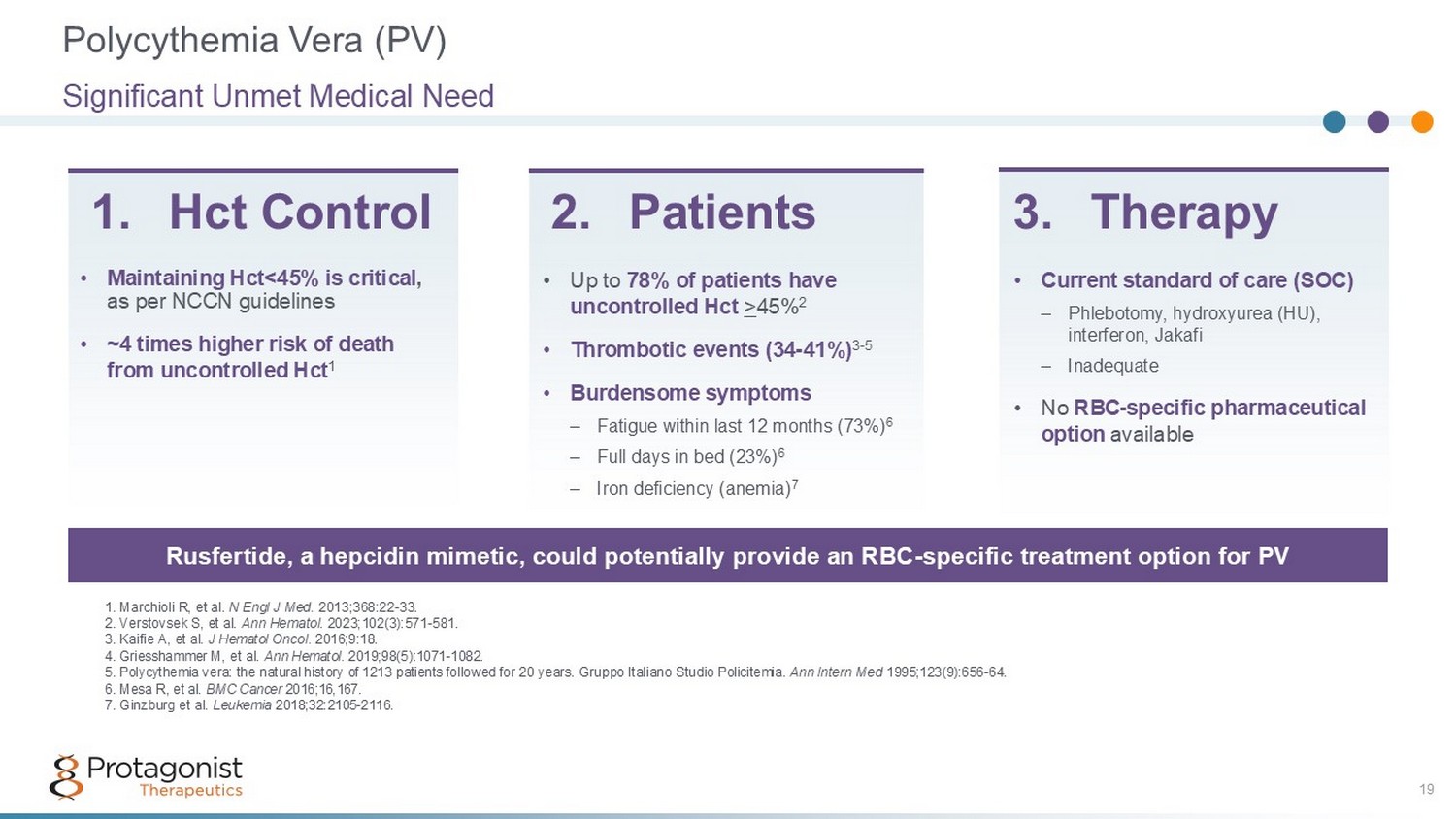

• Up to 78% of patients have uncontrolled Hct > 45% 2 • Thrombotic events (34 - 41%) 3 - 5 • Burdensome symptoms – Fatigue within last 12 months (73%) 6 – Full days in bed (23%) 6 – Iron deficiency (anemia) 7 1. Marchioli R, et al. N Engl J Med. 2013;368:22 - 33. 2. Verstovsek S, et al. Ann Hematol . 2023;102(3):571 - 581. 3. Kaifie A, et al. J Hematol Oncol . 2016;9:18. 4. Griesshammer M, et al. Ann Hematol . 2019;98(5):1071 - 1082. 5. Polycythemia vera: the natural history of 1213 patients followed for 20 years. Gruppo Italiano Studio Policitemia. Ann Intern Med 1995;123(9):656 - 64. 6. Mesa R, et al. BMC Cancer 2016;16,167. 7. Ginzburg et al. Leukemia 2018;32:2105 - 2116. 1. Hct Control Rusfertide, a hepcidin mimetic, could potentially provide an RBC - specific treatment option for PV • Current standard of care (SOC) – Phlebotomy, hydroxyurea (HU), interferon, Jakafi – Inadequate • No RBC - specific pharmaceutical option available 2. Patients 3. Therapy • Maintaining Hct<45% is critical , as per NCCN guidelines • ~4 times higher risk of death from uncontrolled Hct 1 Polycythemia Vera (PV) Significant Unmet Medical Need 19

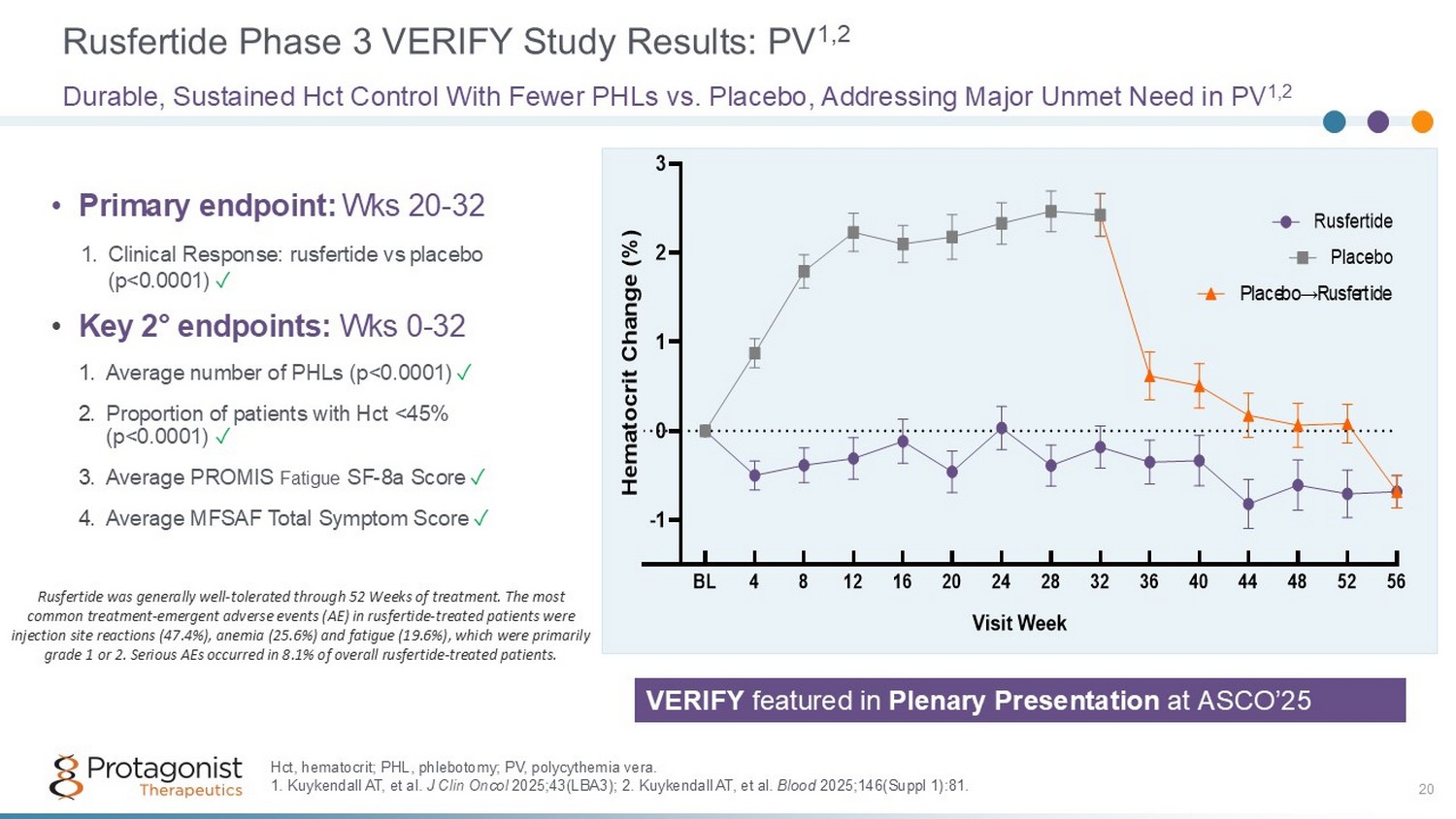

Rusfertide Phase 3 VERIFY Study Results: PV 1,2 20 Durable, Sustained Hct Control With Fewer PHLs vs. Placebo, Addressing Major Unmet Need in PV 1,2 -1 0 1 2 3 Visit Week H e m a t o c r i t C h a n g e ( % ) BL 4 8 12 16 20 24 28 32 36 40 44 48 52 56 Rusfertide Placebo Placebo→Rusfertide Hct, hematocrit; PHL, phlebotomy; PV, polycythemia vera. 1. Kuykendall AT, et al. J Clin Oncol 2025;43(LBA3); 2. Kuykendall AT, et al. Blood 2025;146(Suppl 1):81. • Primary endpoint: Wks 20 - 32 1. Clinical Response: rusfertide vs placebo (p<0.0001) ✓ • Key 2 ƒ endpoints: Wks 0 - 32 1. Average number of PHLs (p<0.0001) ✓ 2. Proportion of patients with Hct <45% (p<0.0001) ✓ 3. Average PROMIS Fatigue SF - 8a Score ✓ 4. Average MFSAF Total Symptom Score ✓ Rusfertide was generally well - tolerated through 52 Weeks of treatment. The most common treatment - emergent adverse events (AE) in rusfertide - treated patients were injection site reactions (47.4%), anemia (25.6%) and fatigue (19.6%), which were primarily grade 1 or 2. Serious AEs occurred in 8.1% of overall rusfertide - treated patients. VERIFY featured in Plenary Presentation at ASCO’25

Identifying PV Patients Who Will Benefit From Rusfertide Defining patient population characteristics using current market treatments and trends is the key to understanding rusfertide's market opportunity Phlebotomy Frequency Dosing of Hydroxyurea Thrombotic Events Key indicators of suboptimal control for a PV patient A high frequency of phlebotomies indicates the intervention is not working to maintain Hct < 45% Frequent phlebotomies may exacerbate iron deficiency and related symptoms 1 High doses of HU (1 - 2 g/day) can indicate difficult - to - control PV, especially when used in combination with phlebotomy Potential serious side effects and adverse events, including leukemic transformation and skin malignancies 2 Occurrence of thrombotic events following treatment initiation can be an indicator of the ineffectiveness of the treatment – a n example of a sub - optimally controlled PV patient 1. McMullin MF, et. al. Br J Haematol . 2019; 184(2): 176 - 191. 2 . Jinna S and Khandar PB. NIH 2022. https://www.ncbi.nlm.nih.gov/books/NBK537209/. 3. Stegelmann F, et al. Leuk. 2021;35(2):628 - 631. 21

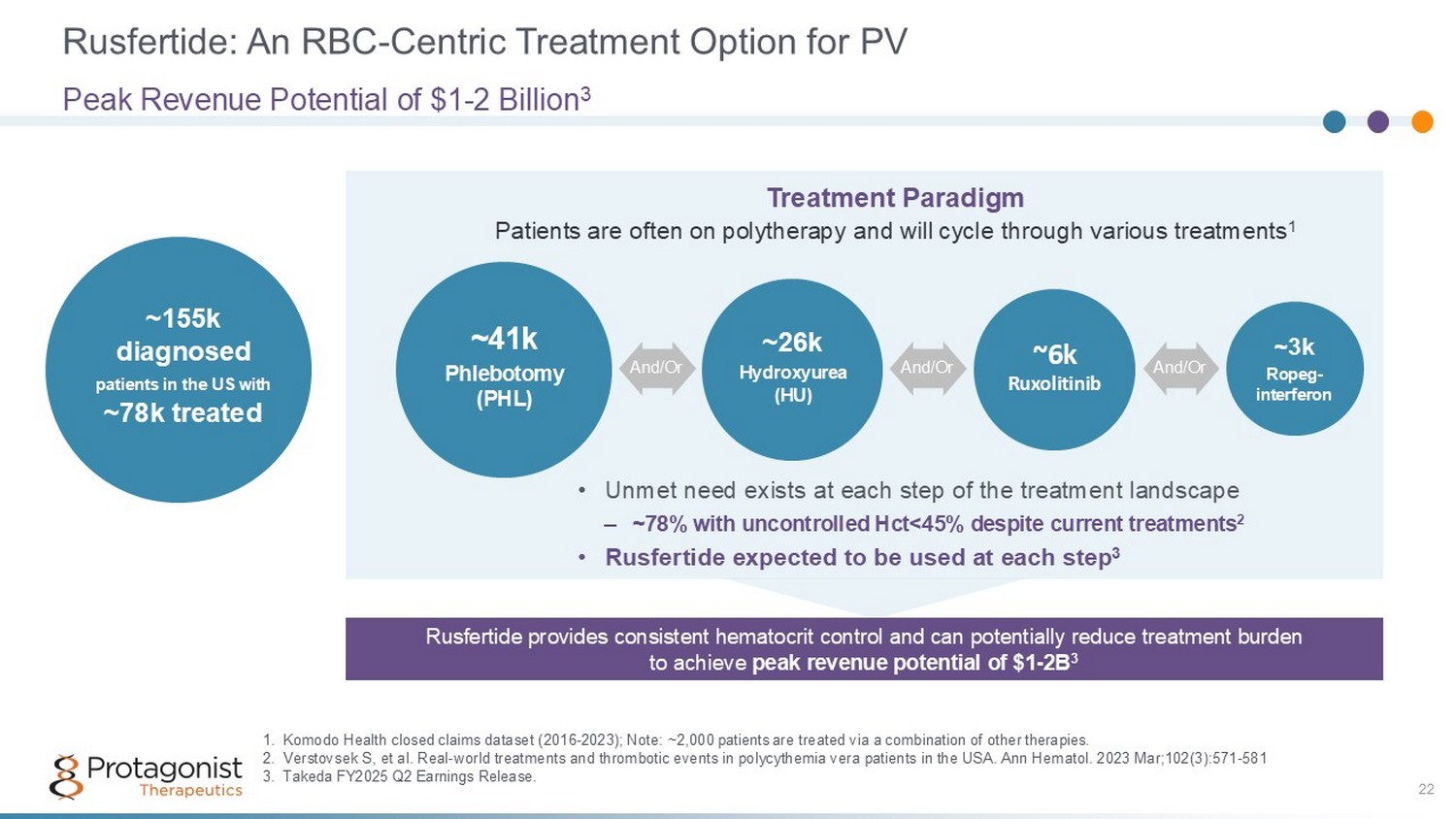

Rusfertide: An RBC - Centric Treatment Option for PV 22 Peak Revenue Potential of $1 - 2 Billion 3 ~155k diagnosed patients in the US with ~78k treated ~41k Phlebotomy (PHL) ~26k Hydroxy u rea (HU) ~6k Ruxolitinib ~3k Ropeg - interferon And/Or And/Or And/Or 1. Komodo Health closed claims dataset (2016 - 2023); Note: ~2,000 patients are treated via a combination of other therapies. 2. Verstovsek S, et al. Real - world treatments and thrombotic events in polycythemia vera patients in the USA. Ann Hematol. 2023 Mar ;102(3):571 - 581 3. Takeda FY2025 Q2 Earnings Release. Treatment Paradigm Patients are often on polytherapy and will cycle through various treatments 1 • Unmet need exists at each step of the treatment landscape – ~78% with uncontrolled Hct<45% despite current treatments 2 • Rusfertide expected to be used at each step 3 Rusfertide provides consistent hematocrit control and can potentially reduce treatment burden to achieve peak revenue potential of $1 - 2B 3

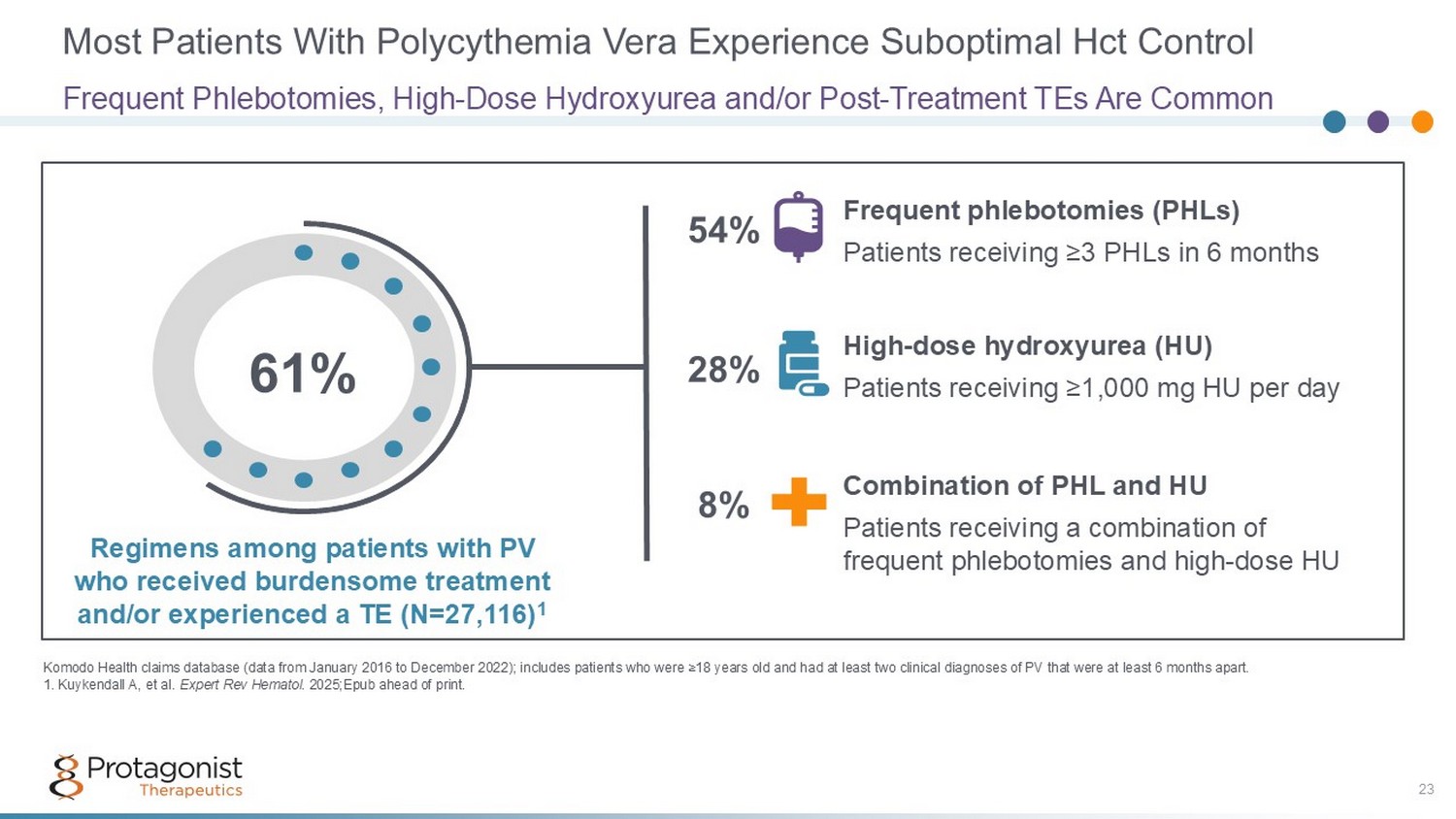

Most Patients With Polycythemia Vera Experience Suboptimal Hct Control Frequent Phlebotomies, High - Dose Hydroxyurea and/or Post - Treatment TEs Are Common Komodo Health claims database (data from January 2016 to December 2022); includes patients who were ≥18 years old and had at lea st two clinical diagnoses of PV that were at least 6 months apart. 1. Kuykendall A, et al. Expert Rev Hematol . 2025;Epub ahead of print. 23 61% Frequent phlebotomies (PHLs) Patients receiving ≥3 PHLs in 6 months High - dose hydroxyurea (HU) Patients receiving ≥1,000 mg HU per day Combination of PHL and HU Patients receiving a combination of frequent phlebotomies and high - dose HU Regimens among patients with PV who received burdensome treatment and/or experienced a TE (N=27,116) 1 54% 28% 8%

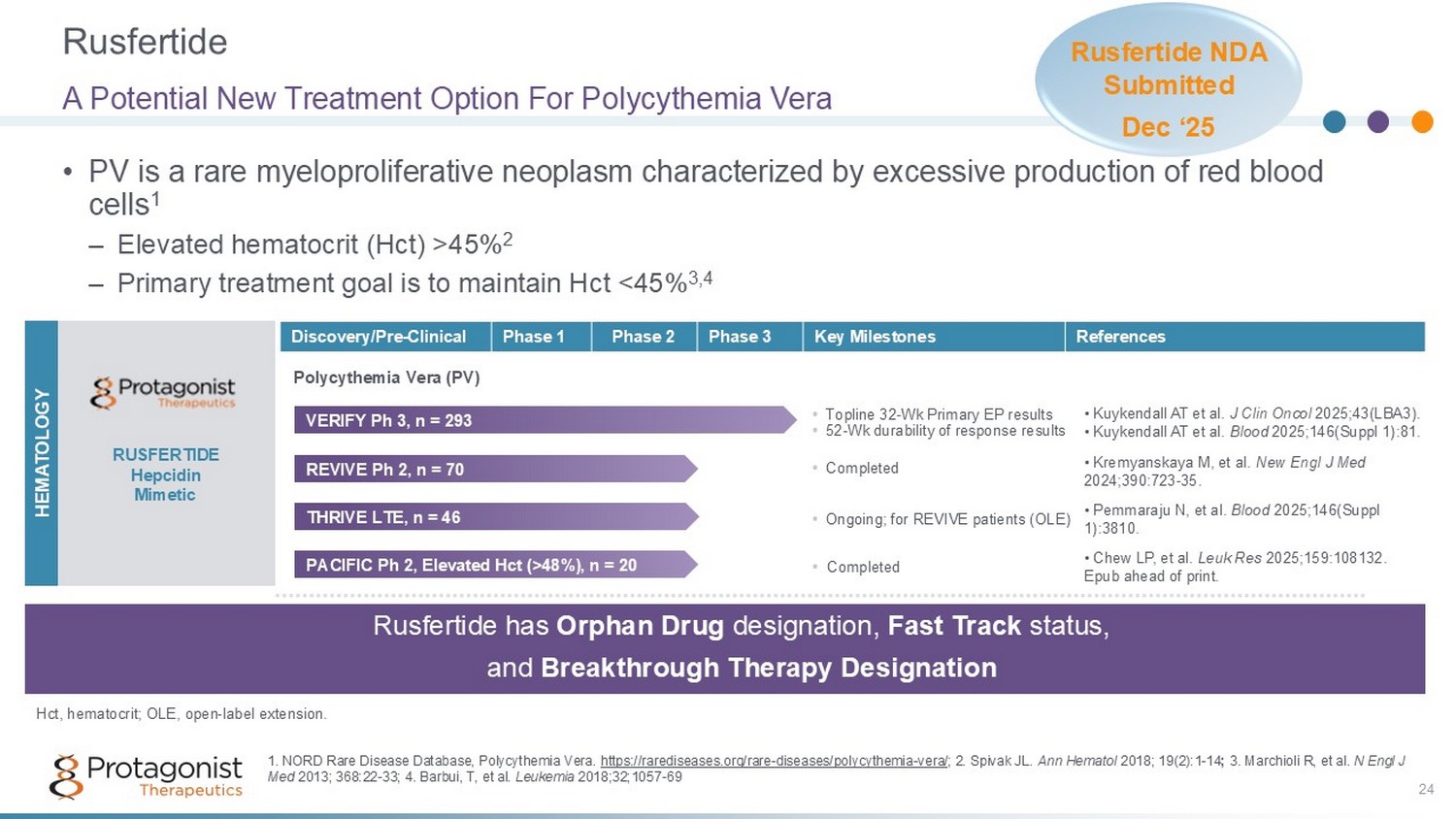

Rusfertide 24 • PV is a rare myeloproliferative neoplasm characterized by excessive production of red blood cells 1 – Elevated hematocrit (Hct) >45% 2 – Primary treatment goal is to maintain Hct <45% 3,4 A Potential New Treatment Option For Polycythemia Vera References Key Milestones Phase 3 Phase 2 Phase 1 Discovery/Pre - Clinical RUSFERTIDE Hepcidin Mimetic Polycythemia Vera (PV) HEMATOLOGY Rusfertide has Orphan Drug designation, Fast Track status, and Breakthrough Therapy Designation 1. NORD Rare Disease Database, Polycythemia Vera. https://rarediseases.org/rare - diseases/polycythemia - vera/ ; 2. Spivak JL. Ann Hematol 2018; 19(2):1 - 14 ; 3. Marchioli R, et al. N Engl J Med 2013; 368:22 - 33; 4. Barbui, T, et al. Leukemia 2018;32;1057 - 69 REVIVE Ph 2, n = 70 • C ompleted • Kremyanskaya M, et al. New Engl J Med 2024;390:723 - 35. PACIFIC Ph 2, Elevated Hct (>48%), n = 20 • Completed • Chew LP, et al. Leuk Res 2025;159:108132. Epub ahead of print. • Topline 32 - Wk Primary EP results • 52 - Wk durability of response results VERIFY Ph 3, n = 293 • Kuykendall AT et al. J Clin Oncol 2025;43(LBA3). • Kuykendall AT et al. Blood 2025;146(Suppl 1):81. THRIVE LTE, n = 46 • Ongoing; for REVIVE patients ( OLE) • Pemmaraju N, et al. Blood 2025;146(Suppl 1):3810. Hct, hematocrit; OLE, open - label extension. Rusfertide NDA Submitted Dec ‘ 25

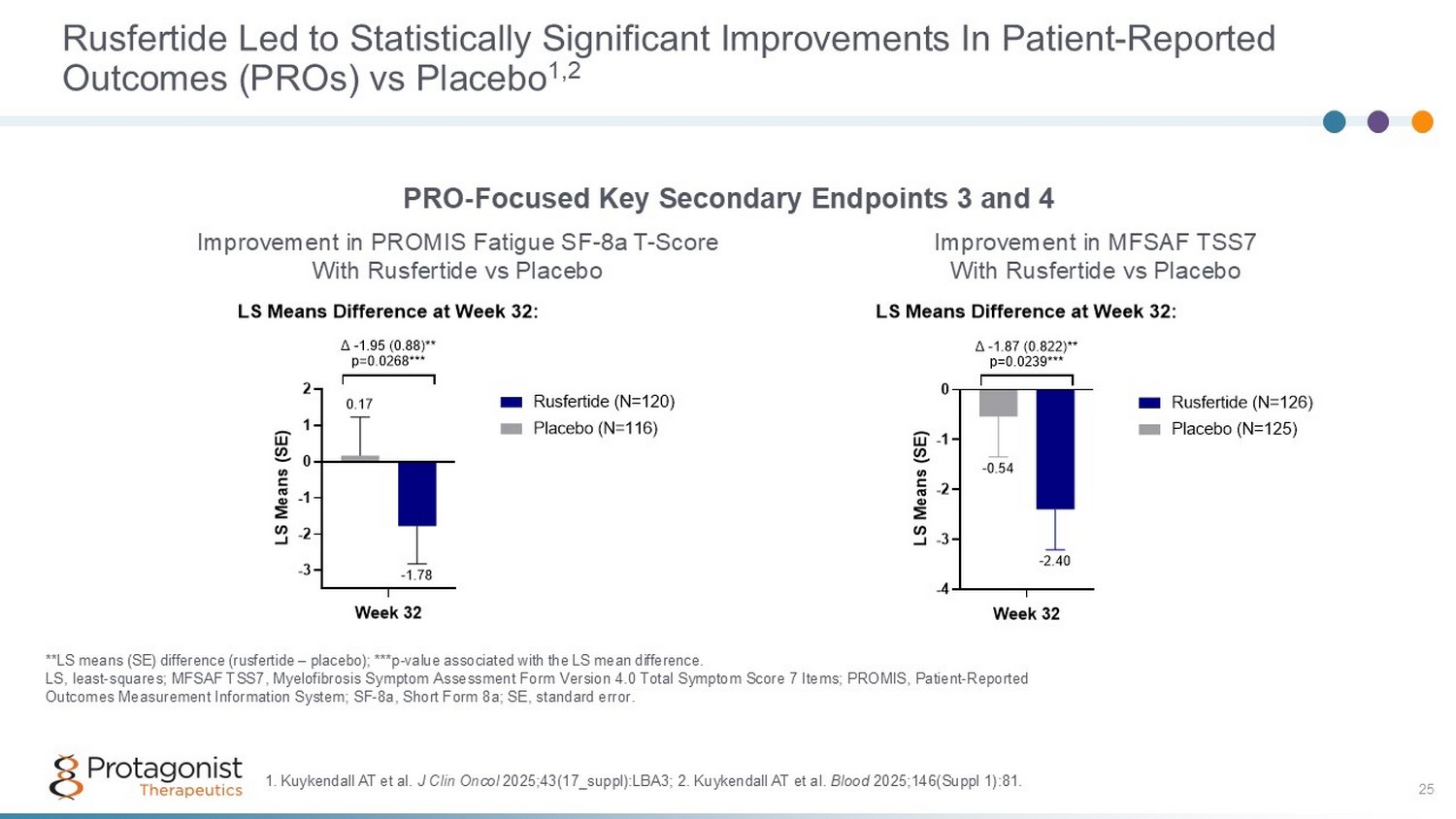

25 Rusfertide Led to Statistically Significant Improvements In Patient - Reported Outcomes (PROs) vs Placebo 1,2 **LS means (SE) difference (rusfertide – placebo); ***p - value associated with the LS mean difference. LS, least - squares; MFSAF TSS7, Myelofibrosis Symptom Assessment Form Version 4.0 Total Symptom Score 7 Items; PROMIS, Patient - Re ported Outcomes Measurement Information System; SF - 8a, Short Form 8a; SE, standard error. PRO - Focused Key Secondary Endpoints 3 and 4 Improvement in MFSAF TSS7 With Rusfertide vs Placebo Improvement in PROMIS Fatigue SF - 8a T - Score With Rusfertide vs Placebo -3 -2 -1 0 1 2 -1.78 0.17 LS Means Difference at Week 32: Week 32 L S M e a n s ( S E ) Δ -1.95 (0.88)** p=0.0268*** Rusfertide (N=120) Placebo (N=116) -4 -3 -2 -1 0 -2.40 -0.54 LS Means Difference at Week 32: Week 32 L S M e a n s ( S E ) Δ -1.87 (0.822)** p=0.0239*** Rusfertide (N=126) Placebo (N=125) 1. Kuykendall AT et al. J Clin Oncol 2025;43(17_suppl):LBA3; 2 . Kuykendall AT et al. Blood 2025;146(Suppl 1):81.

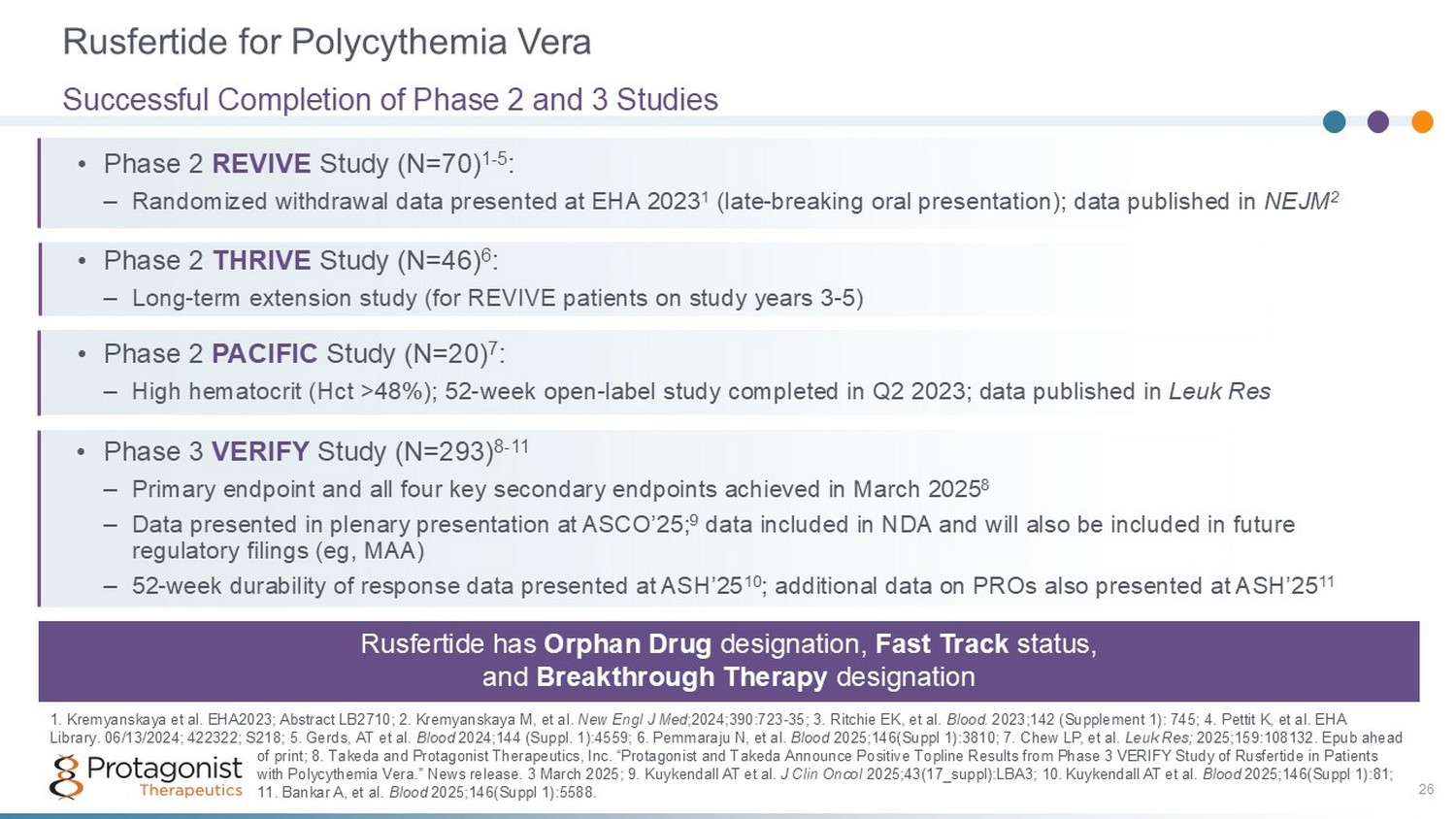

Rusfertide for Polycythemia Vera Successful Completion of Phase 2 and 3 Studies • Phase 2 REVIVE Study (N=70) 1 - 5 : – Randomized withdrawal data presented at EHA 2023 1 (late - breaking oral presentation); data published in NEJM 2 • Phase 2 PACIFIC Study (N=20) 7 : – High hematocrit (Hct >48%); 52 - week open - label study completed in Q2 2023; data published in Leuk Res • Phase 2 THRIVE Study (N=46) 6 : – Long - term extension study (for REVIVE patients on study years 3 - 5) 1. Kremyanskaya et al. EHA2023; Abstract LB2710; 2. Kremyanskaya M, et al. New Engl J Med ;2024;390:723 - 35; 3. Ritchie EK, et al. Blood . 2023;142 (Supplement 1): 745 ; 4. Pettit K, et al. EHA Library. 06/13/2024; 422322; S218 ; 5. Gerds, AT et al. Blood 2024;144 (Suppl. 1):4559 ; 6. Pemmaraju N, et al. Blood 2025;146(Suppl 1):3810; 7 . Chew LP, et al. Leuk Res; 2025;159:108132. Epub ahead of print; 8. Takeda and Protagonist Therapeutics, Inc. “ Protagonist and Takeda Announce Positive Topline Results from Phase 3 VERIFY Study of Rusfertide in Patients with Polycythemia Vera .” News release. 3 March 2025; 9. Kuykendall AT et al. J Clin Oncol 2025;43(17_suppl):LBA3; 10. Kuykendall AT et al. Blood 2025;146(Suppl 1):81; 11. Bankar A, et al. Blood 2025;146(Suppl 1):5588. • Phase 3 VERIFY Study (N=293) 8 - 11 – Primary endpoint and all four key secondary endpoints achieved in March 2025 8 – Data presented in plenary presentation at ASCO’25; 9 data included in NDA and will also be included in future regulatory filings (eg, MAA) – 52 - week durability of response data presented at ASH’25 10 ; additional data on PROs also presented at ASH’25 11 Rusfertide has Orphan Drug designation, Fast Track status, and Breakthrough Therapy designation 26

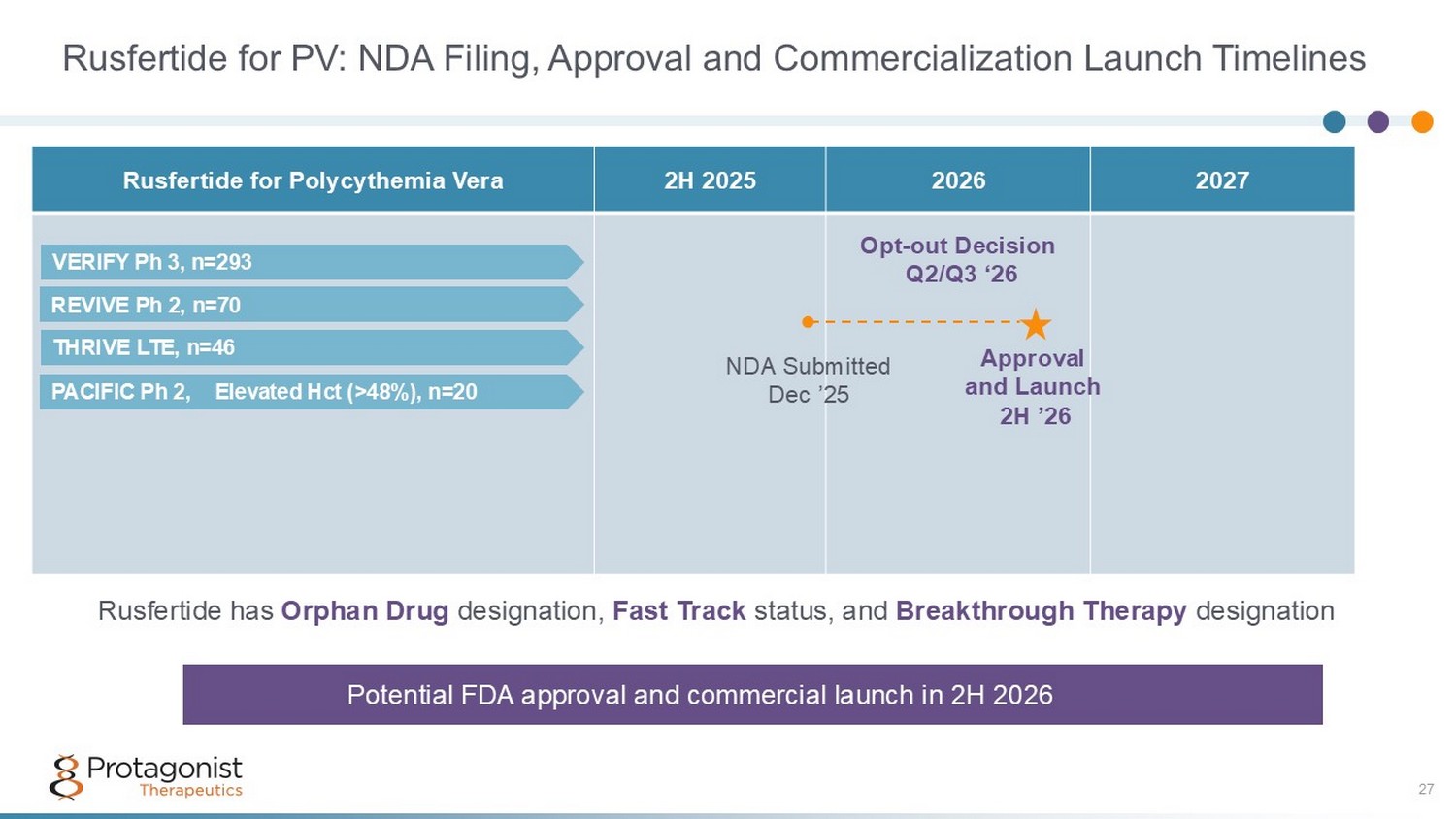

Rusfertide for PV: NDA Filing, Approval and Commercialization Launch Timelines 27 2027 2026 2H 2025 Rusfertide for Polycythemia Vera ● NDA Submitted Dec ’25 Approval and Launch 2H ’26 Opt - out Decision Q2/Q3 ‘26 Potential FDA approval and commercial launch in 2H 2026 Rusfertide has Orphan Drug designation, Fast Track status, and Breakthrough Therapy designation PACIFIC Ph 2, Elevated Hct (>48%), n=20 REVIVE Ph 2, n=70 VERIFY Ph 3, n=293 THRIVE LTE, n=46

R&D Pipeline I&I, Hematology, Obesity PN - 881: Oral IL - 17 Peptide Antagonist 28 Clinically and commercially validated target for multiple inflammatory conditions

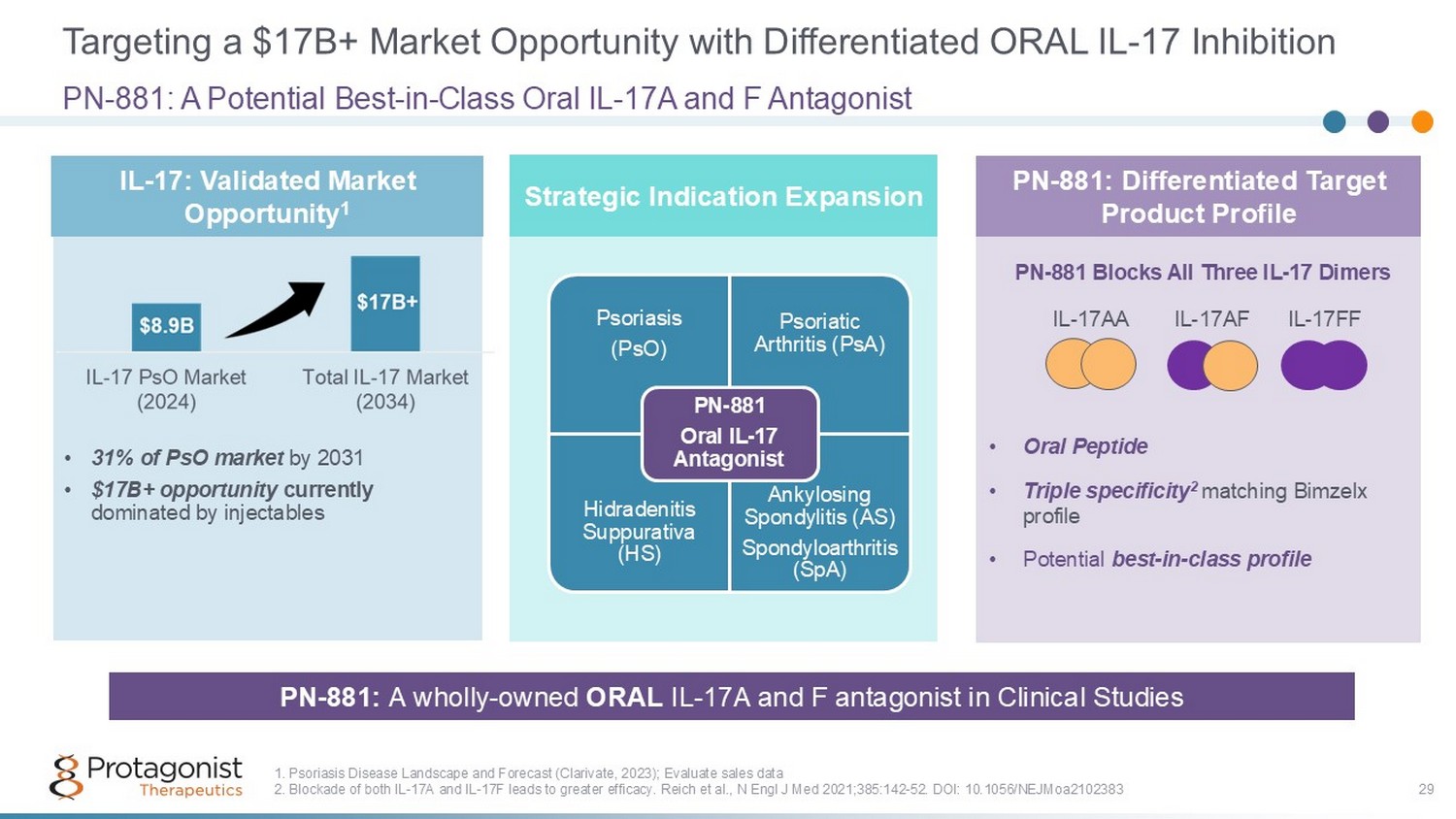

Targeting a $17B+ Market Opportunity with Differentiated ORAL IL - 17 Inhibition 29 • 31% of PsO market by 2031 • $17B+ opportunity currently dominated by injectables PN - 881: A Potential Best - in - Class Oral IL - 17A and F Antagonist 1. Psoriasis Disease Landscape and Forecast (Clarivate, 2023); Evaluate sales data 2. Blockade of both IL - 17A and IL - 17F leads to greater efficacy. Reich et al., N Engl J Med 2021;385:142 - 52. DOI: 10.1056/NEJMoa2102383 PN - 881: A wholly - owned ORAL IL - 17A and F antagonist in Clinical Studies • Oral Peptide • Triple specificity 2 matching Bimzelx profile • Potential best - in - class profile IL - 17: Validated Market Opportunity 1 PN - 881: Differentiated Target Product Profile IL - 17AA IL - 17AF IL - 17FF PN - 881 Blocks All Three IL - 17 Dimers Psoriasis (PsO) Psoriatic Arthritis (PsA) Hidradenitis Suppurativa (HS) Ankylosing Spondylitis (AS) Spondyloarthritis ( SpA) PN - 881 Oral IL - 17 Antagonist Strategic Indication Expansion

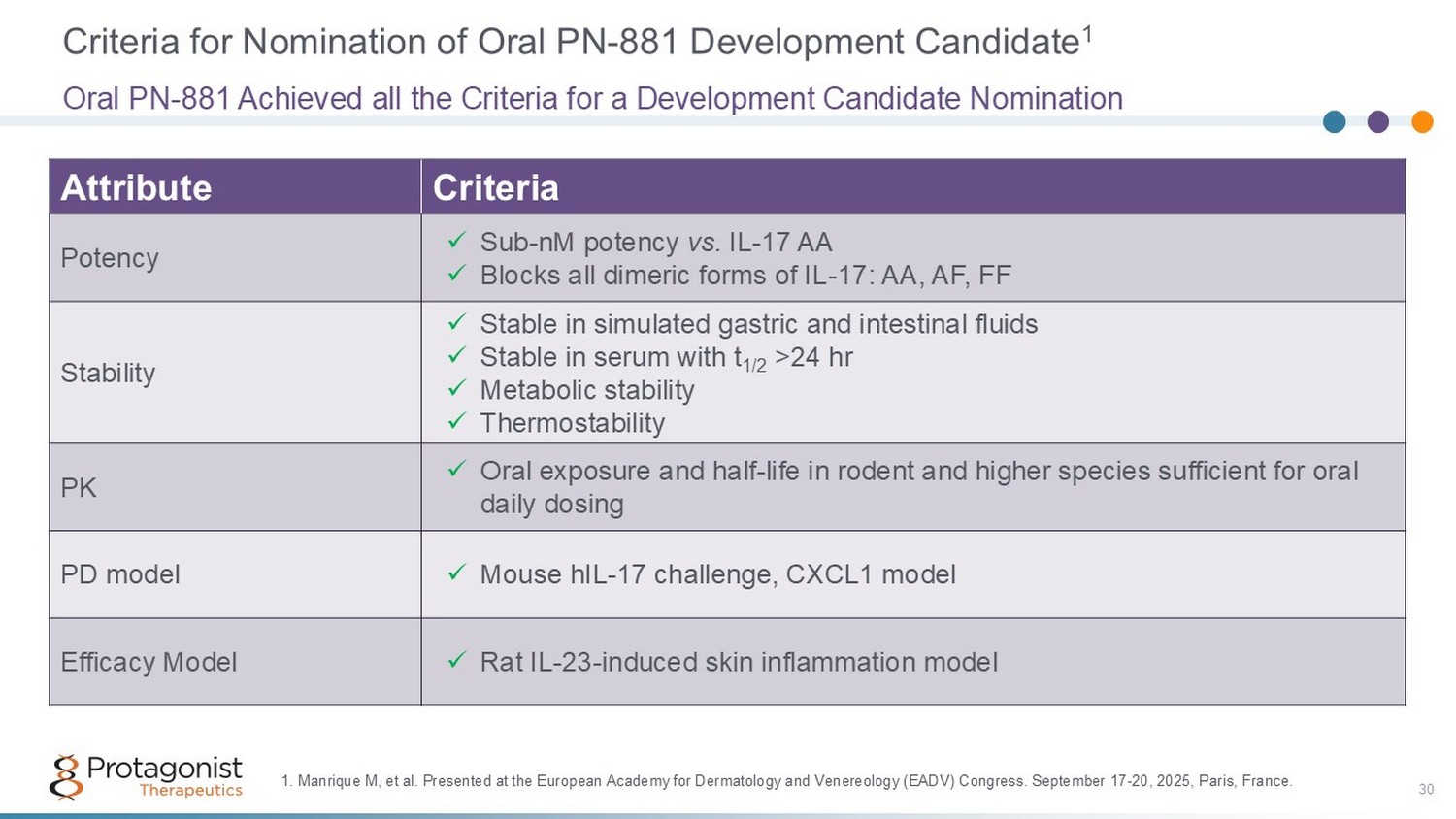

Criteria for Nomination of Oral PN - 881 Development Candidate 1 Criteria Attribute x Sub - nM potency vs. IL - 17 AA x Blocks all dimeric forms of IL - 17: AA, AF, FF Potency x Stable in simulated gastric and intestinal fluids x Stable in serum with t 1/2 >24 hr x Metabolic stability x Thermostability Stability x Oral exposure and half - life in rodent and higher species sufficient for oral daily dosing PK x Mouse hIL - 17 challenge, CXCL1 model PD model x Rat IL - 23 - induced skin inflammation model Efficacy Model Oral PN - 881 Achieved all the Criteria for a Development Candidate Nomination 1. Manrique M, et al. Presented at the European Academy for Dermatology and Venereology (EADV) Congress. September 17 - 20, 2025, Paris, France. 30

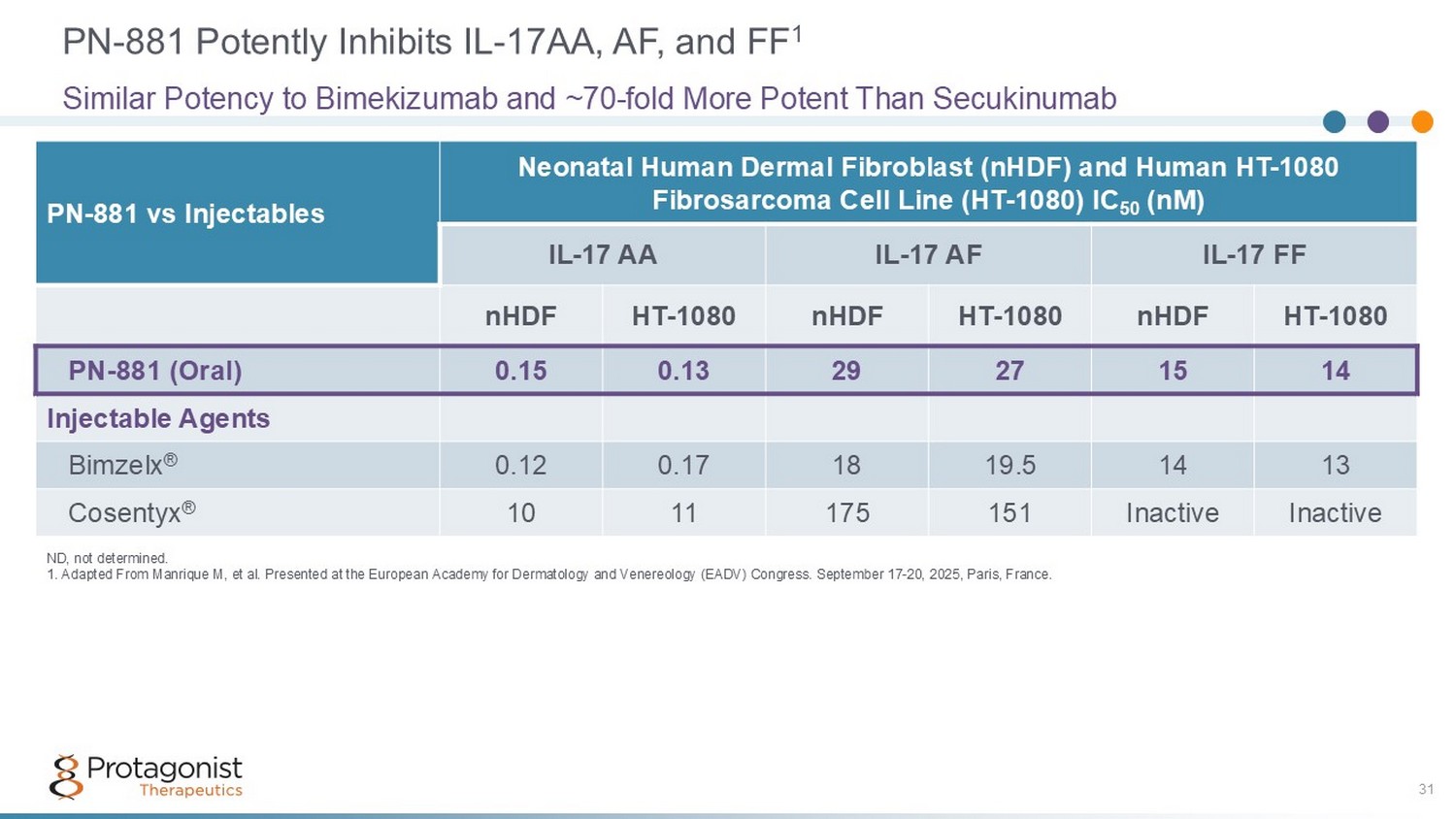

Neonatal Human Dermal Fibroblast (nHDF) and Human HT - 1080 Fibrosarcoma Cell Line (HT - 1080) IC 50 (nM) PN - 881 vs Injectables IL - 17 FF IL - 17 AF IL - 17 AA HT - 1080 nHDF HT - 1080 nHDF HT - 1080 nHDF 14 15 27 29 0.13 0.15 PN - 881 (Oral) Injectable Agents 13 14 19.5 18 0.17 0.12 Bimzelx ® Inactive Inactive 151 175 11 10 Cosentyx ® PN - 881 Potently Inhibits IL - 17AA, AF, and FF 1 31 Similar Potency to Bimekizumab and ~70 - fold More Potent Than Secukinumab ND, not determined. 1. Adapted From Manrique M, et al. Presented at the European Academy for Dermatology and Venereology (EADV) Congress. Septemb er 17 - 20, 2025, Paris, France.

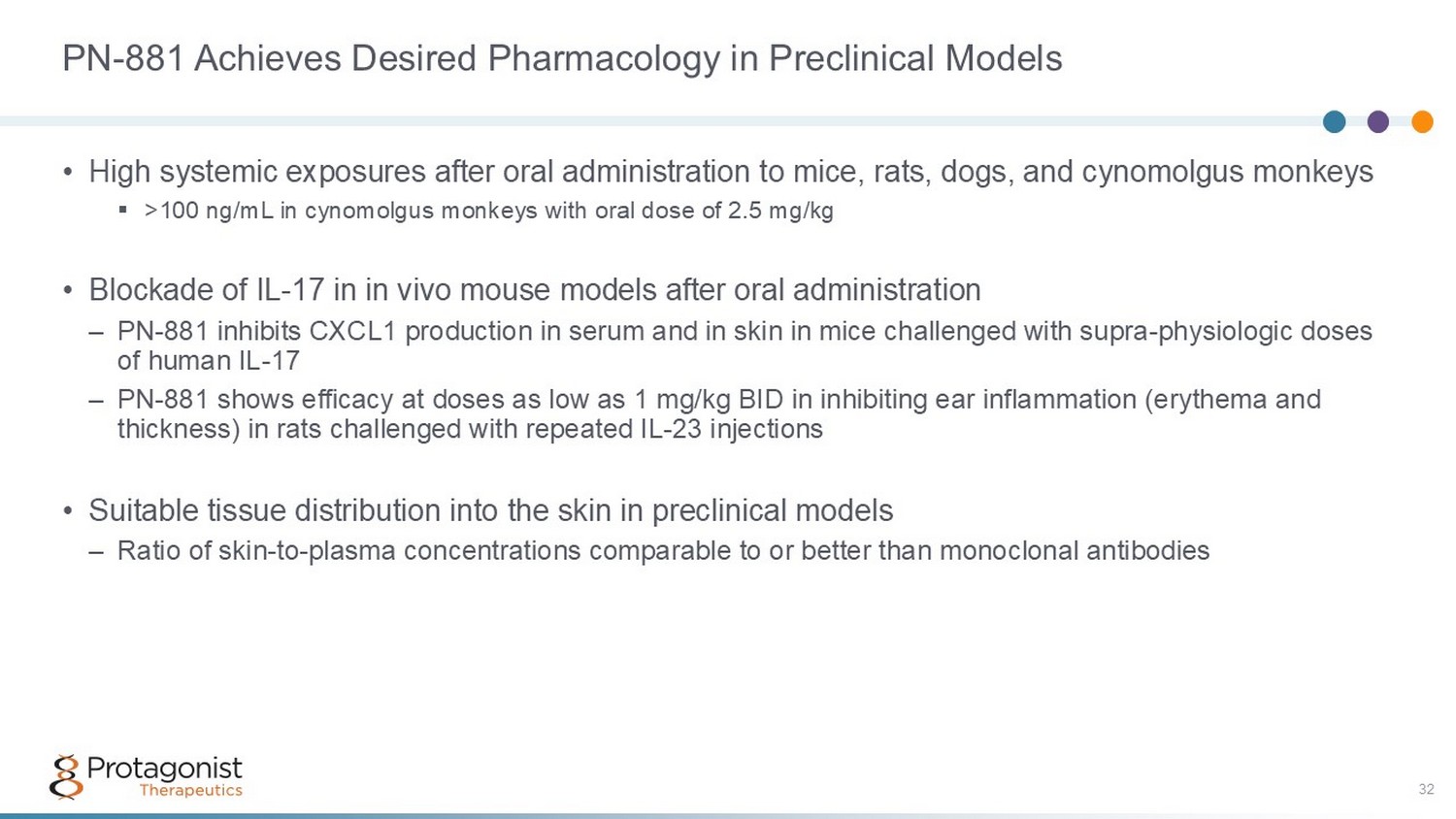

PN - 881 Achieves Desired Pharmacology in Preclinical Models • High systemic exposures after oral administration to mice, rats, dogs, and cynomolgus monkeys ▪ >100 ng/mL in cynomolgus monkeys with oral dose of 2.5 mg/kg • Blockade of IL - 17 in in vivo mouse models after oral administration – PN - 881 inhibits CXCL1 production in serum and in skin in mice challenged with supra - physiologic doses of human IL - 17 – PN - 881 shows efficacy at doses as low as 1 mg/kg BID in inhibiting ear inflammation (erythema and thickness) in rats challenged with repeated IL - 23 injections • Suitable tissue distribution into the skin in preclinical models – Ratio of skin - to - plasma concentrations comparable to or better than monoclonal antibodies 32

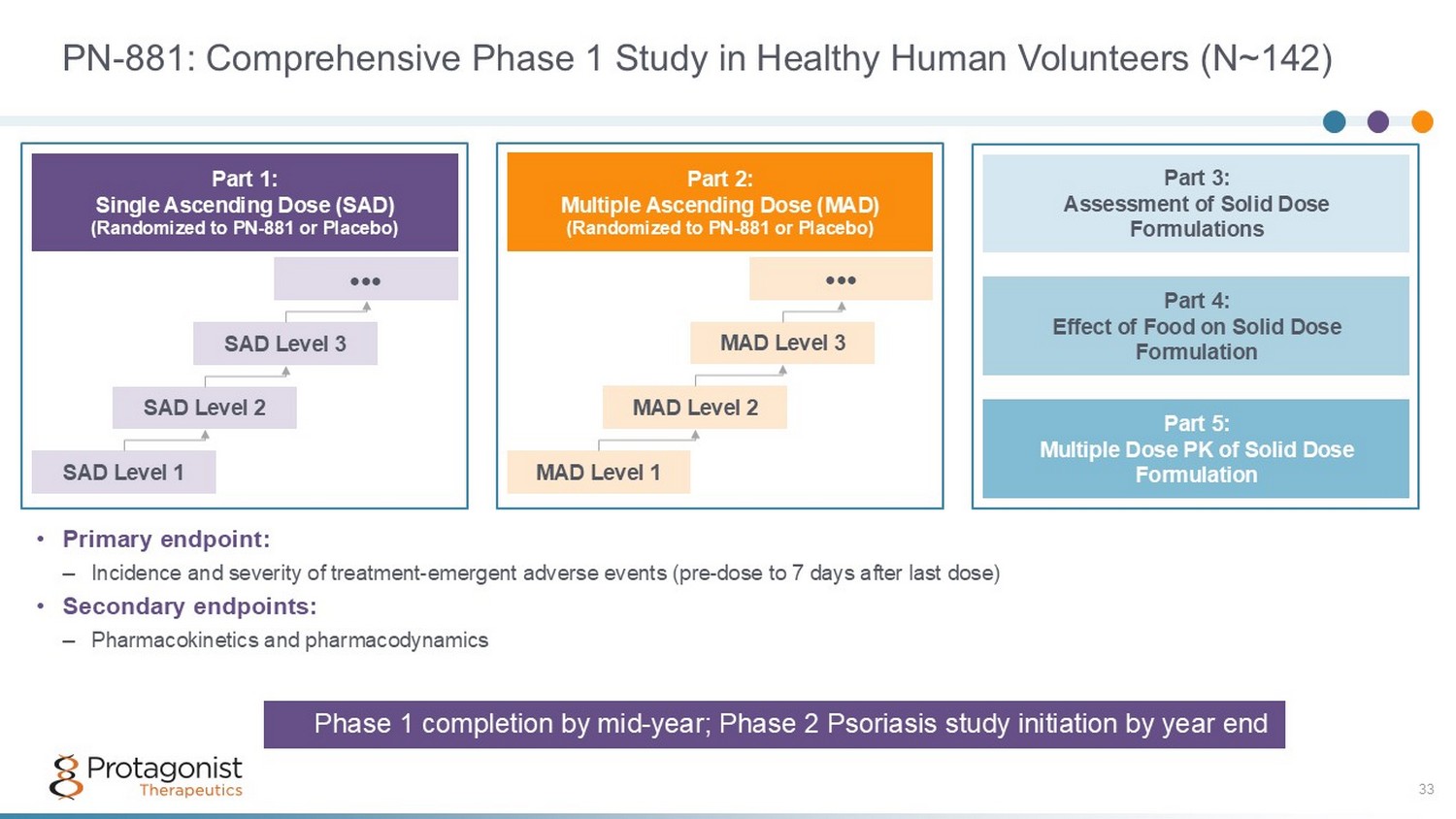

PN - 881: Comprehensive Phase 1 Study in Healthy Human Volunteers (N~142) 33 • Primary endpoint: – Incidence and severity of treatment - emergent adverse events (pre - dose to 7 days after last dose) • Secondary endpoints: – Pharmacokinetics and pharmacodynamics Part 3: Assessment of Solid Dose Formulations Part 5: Multiple Dose PK of Solid Dose Formulation Part 4: Effect of Food on Solid Dose Formulation Part 1: Single Ascending Dose (SAD) (Randomized to PN - 881 or Placebo) SAD Level 1 SAD Level 2 SAD Level 3 ●●● Part 2: Multiple Ascending Dose (MAD) (Randomized to PN - 881 or Placebo) MAD Level 1 MAD Level 2 MAD Level 3 ●●● Phase 1 completion by mid - year; Phase 2 Psoriasis study initiation by year end

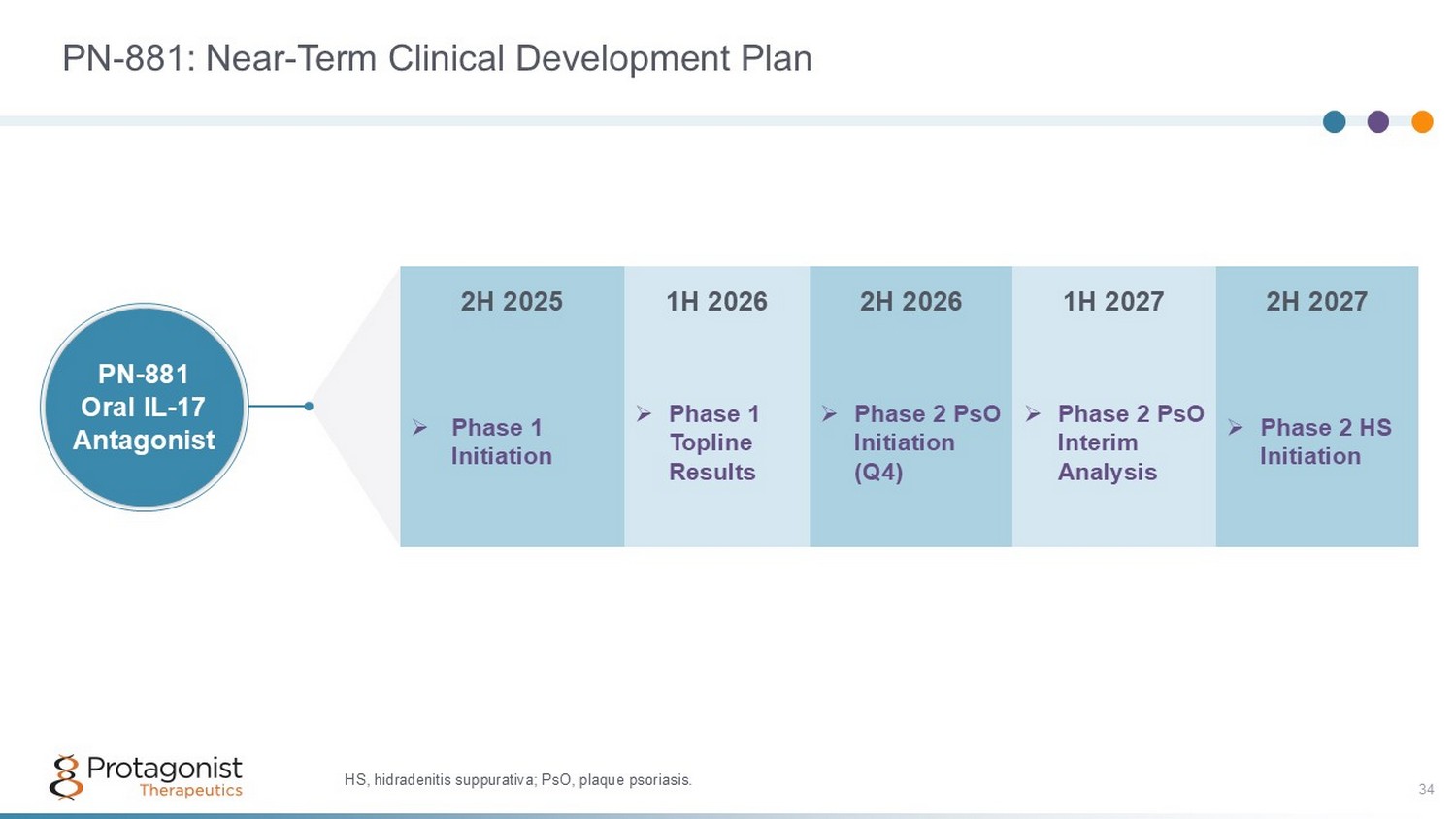

PN - 881: Near - Term Clinical Development Plan 34 2H 2027 1H 2027 2H 2026 1H 2026 2H 2025 » Phase 2 HS Initiation » Phase 2 PsO Interim Analysis » Phase 2 PsO Initiation (Q4) » Phase 1 Topline Results » Phase 1 Initiation PN - 881 Oral IL - 17 Antagonist HS, hidradenitis suppurativa; PsO, plaque psoriasis.

35 PN - 8047: An Oral Hepcidin Functional Mimetic Working towards a Hepcidin pathway based ORAL option in erythrocytosis mediated indications

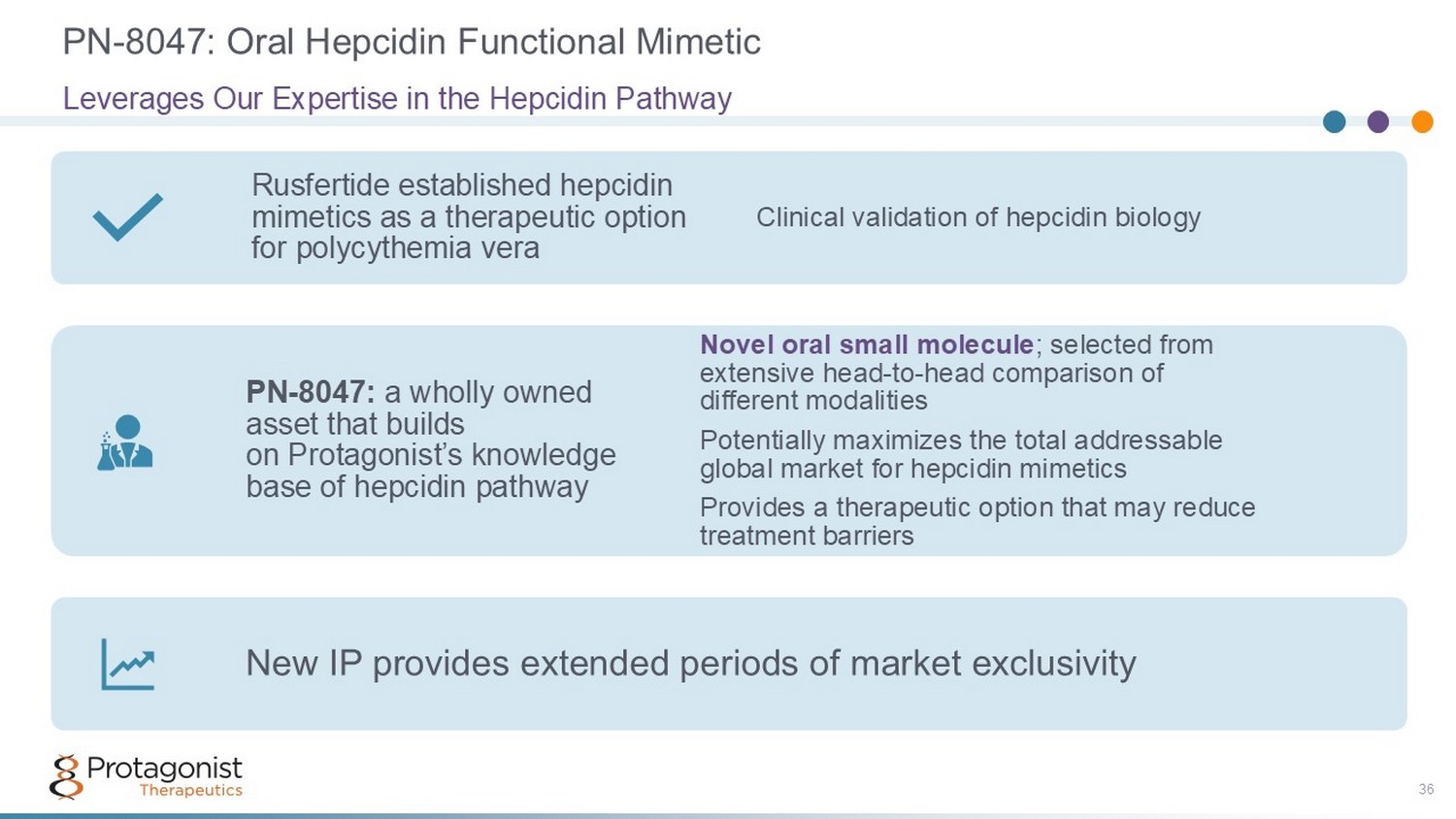

PN - 8047: Oral Hepcidin Functional Mimetic 36 Leverages Our Expertise in the Hepcidin Pathway Rusfertide established hepcidin mimetics as a therapeutic option for polycythemia vera Clinical validation of hepcidin biology PN - 8047: a wholly owned asset that builds on Protagonist’s knowledge base of hepcidin pathway Novel oral small molecule ; selected from extensive head - to - head comparison of different modalities Potentially maximizes the total addressable global market for hepcidin mimetics Provides a therapeutic option that may reduce treatment barriers New IP provides extended periods of market exclusivity

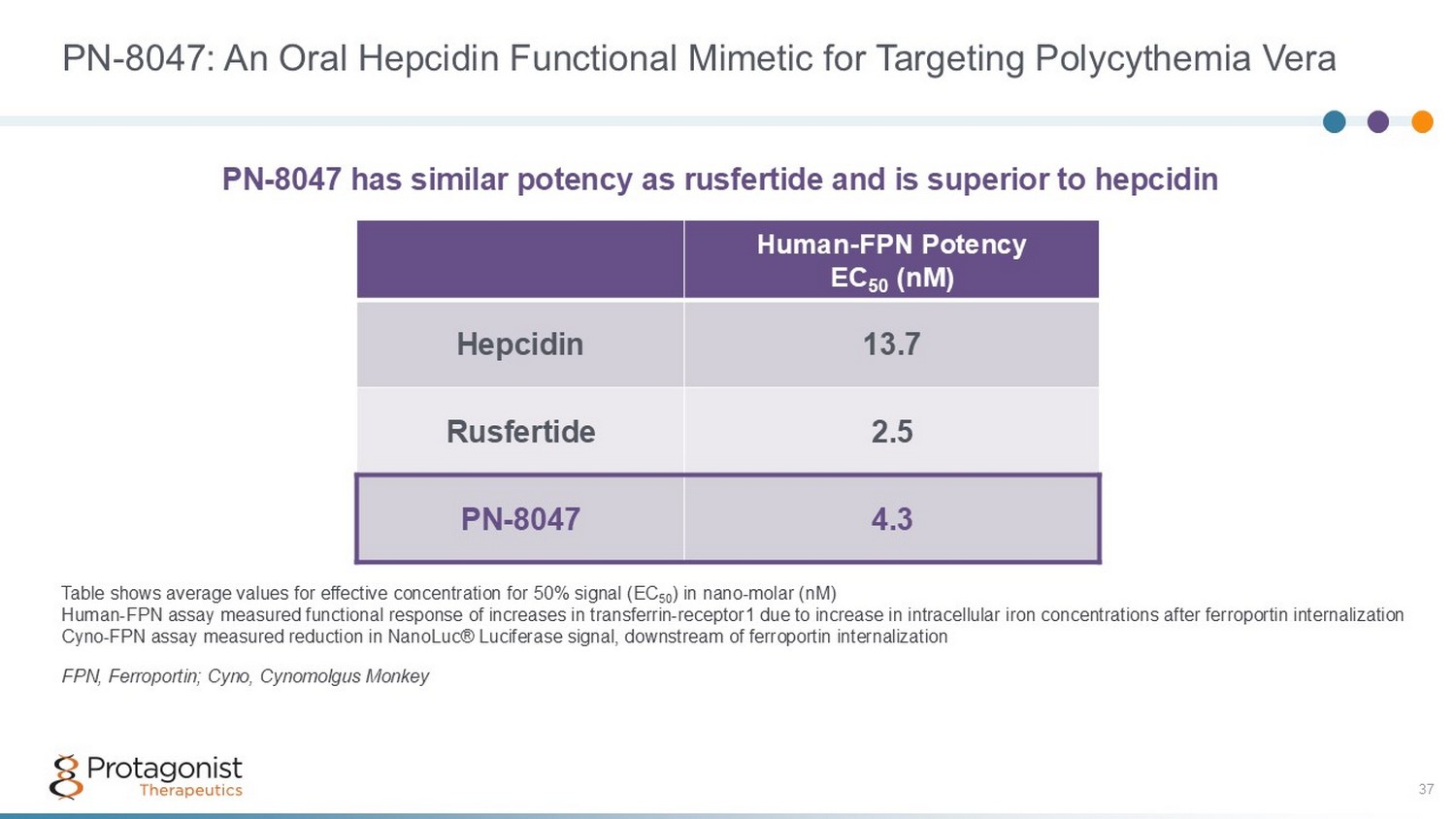

PN - 8047: An Oral Hepcidin Functional Mimetic for Targeting Polycythemia Vera 37 Human - FPN Potency EC 50 (nM) 13.7 Hepcidin 2.5 Rusfertide 4.3 PN - 8047 Table shows average values for effective concentration for 50% signal (EC 50 ) in nano - molar (nM) Human - FPN assay measured functional response of increases in transferrin - receptor1 due to increase in intracellular iron concent rations after ferroportin internalization Cyno - FPN assay measured reduction in NanoLuc® Luciferase signal, downstream of ferroportin internalization FPN, Ferroportin; Cyno, Cynomolgus Monkey PN - 8047 has similar potency as rusfertide and is superior to hepcidin

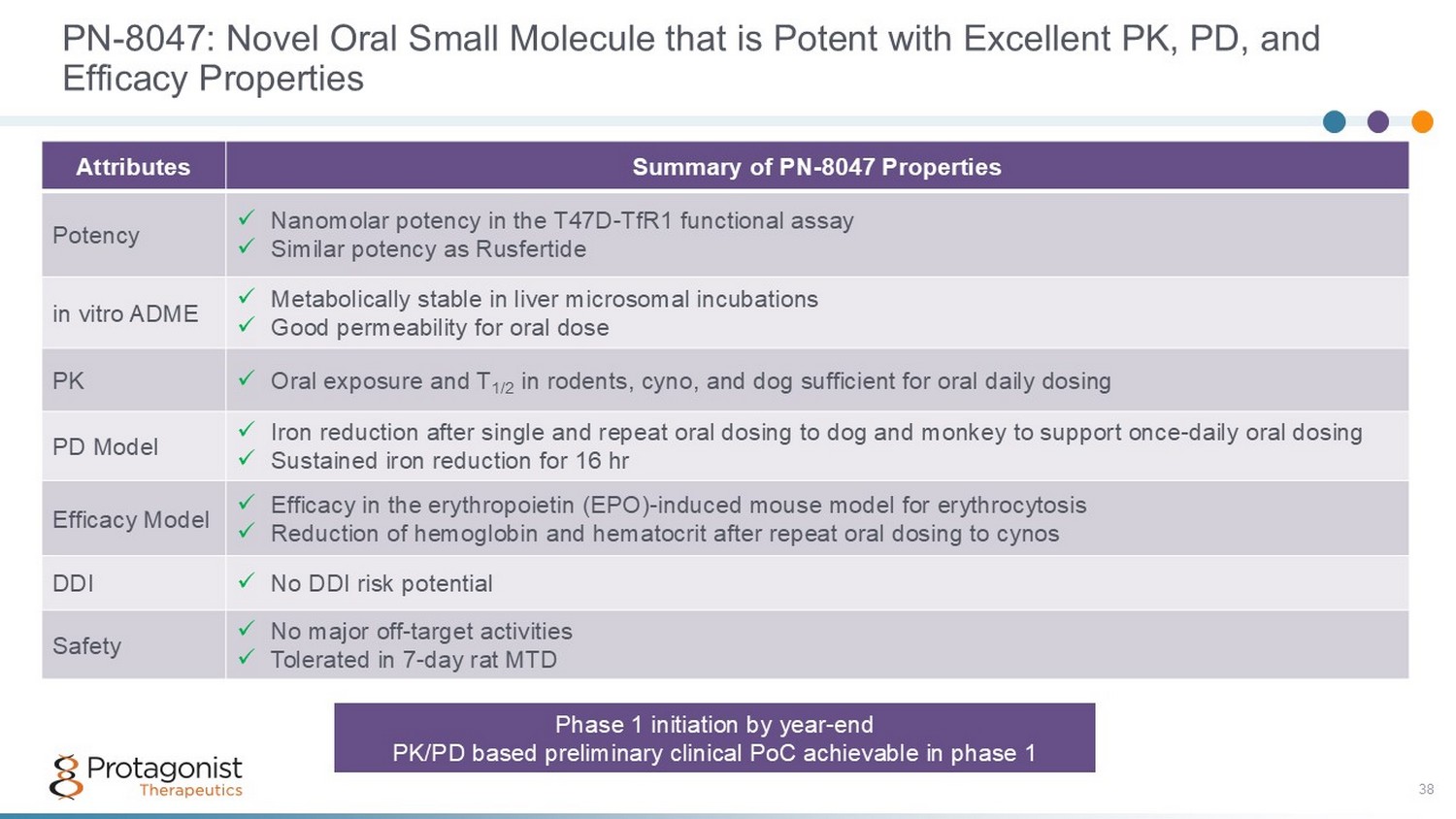

PN - 8047: Novel Oral Small Molecule that is Potent with Excellent PK, PD, and Efficacy Properties 38 Summary of PN - 8047 Properties Attributes x Nanomolar potency in the T47D - TfR1 functional assay x Similar potency as Rusfertide Potency x Metabolically stable in liver microsomal incubations x Good permeability for oral dose in vitro ADME x Oral exposure and T 1/2 in rodents, cyno, and dog sufficient for oral daily dosing PK x Iron reduction after single and repeat oral dosing to dog and monkey to support once - daily oral dosing x Sustained iron reduction for 16 hr PD Model x Efficacy in the erythropoietin (EPO) - induced mouse model for erythrocytosis x Reduction of hemoglobin and hematocrit after repeat oral dosing to cynos Efficacy Model x No DDI risk potential DDI x No major off - target activities x Tolerated in 7 - day rat MTD Safety Phase 1 initiation by year - end PK/PD based preliminary clinical PoC achievable in phase 1

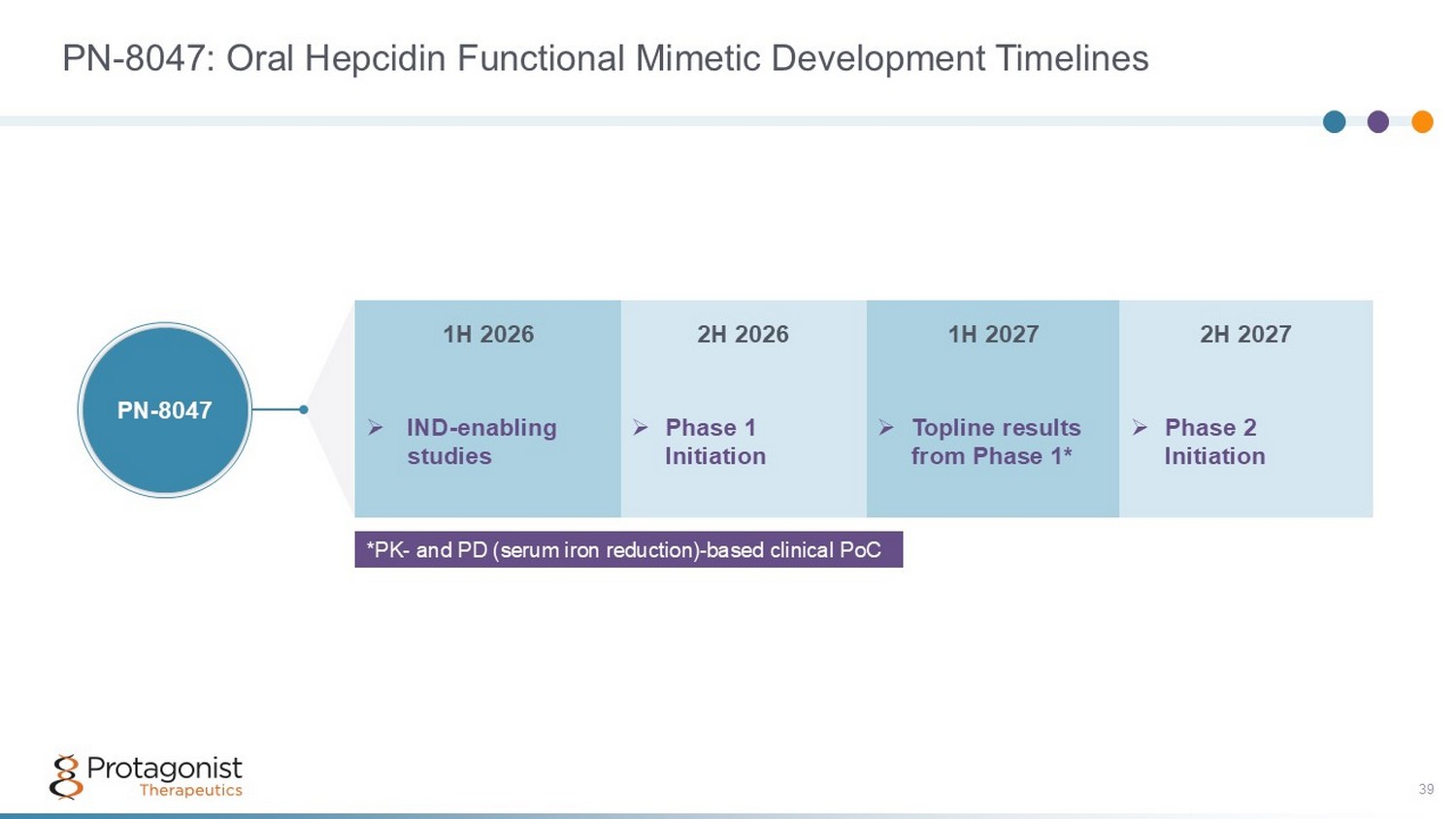

PN - 8047: Oral Hepcidin Functional Mimetic Development Timelines 39 *PK - and PD (serum iron reduction) - based clinical PoC 2H 2027 1H 2027 2H 2026 1H 2026 » Phase 2 Initiation » Topline results from Phase 1* » Phase 1 Initiation » IND - enabling studies PN - 8047

Anti - Obesity Therapeutics: Dominated by injectable appetite - suppressing hormone peptide mimetics Oral Peptide agents offer a strong differentiation and address unmet medical need 40

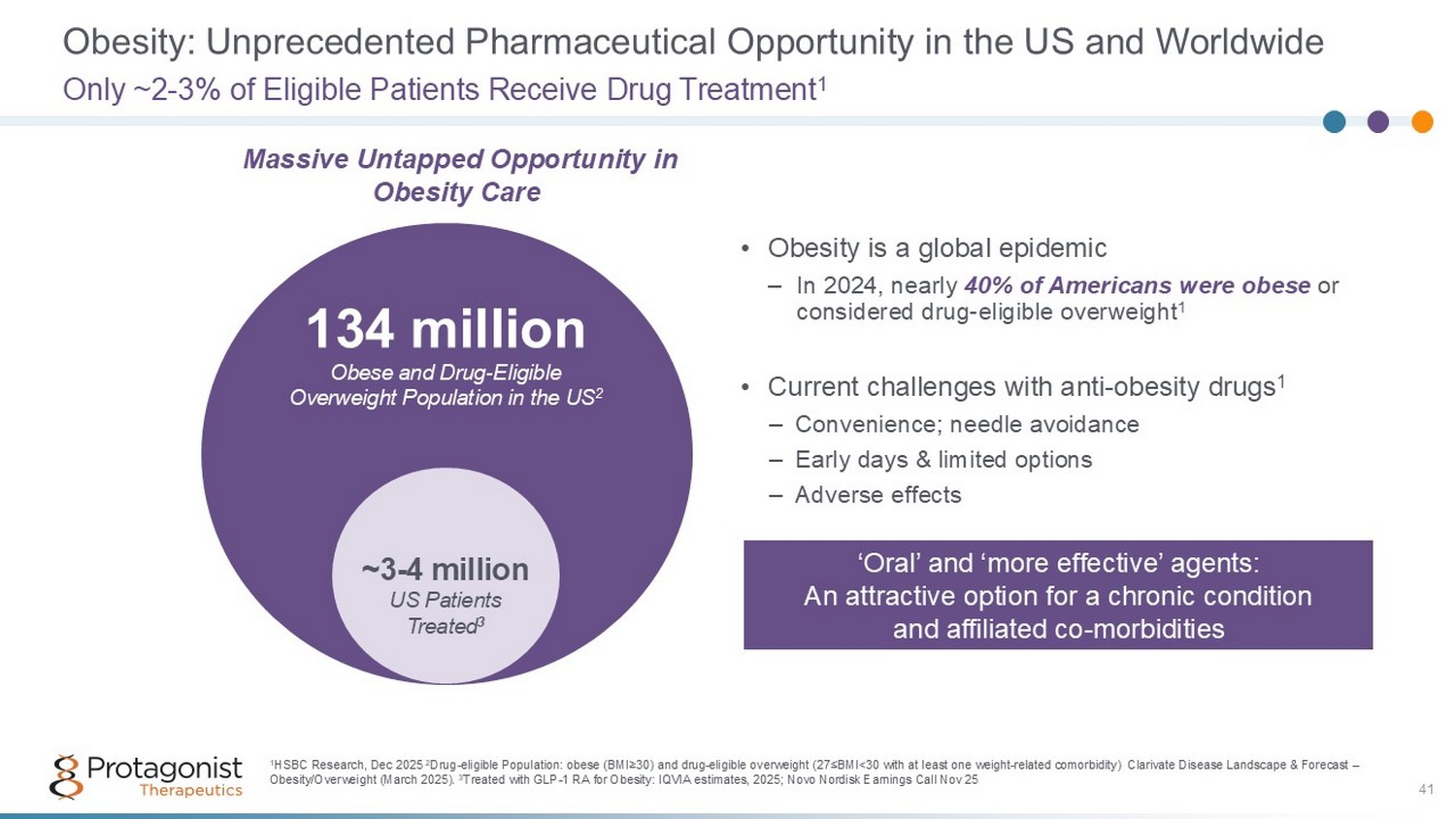

Obesity: Unprecedented Pharmaceutical Opportunity in the US and Worldwide • Obesity is a global epidemic – In 2024, nearly 40% of Americans were obese or considered drug - eligible overweight 1 • Current challenges with anti - obesity drugs 1 – Convenience; needle avoidance – Early days & limited options – Adverse effects Only ~2 - 3% of Eligible Patients Receive Drug Treatment 1 134 million Obese and Drug - Eligible Overweight Population in the US 2 ~3 - 4 million US Patients Treated 3 1 HSBC Research, Dec 2025 2 Drug - eligible Population: obese (BMI ≥ 30) and drug - eligible overweight (27 ≤ BMI<30 with at least one weight - related comorbidity) Clarivate Disease Landscape & Forecast – Obesity/Overweight (March 2025). 3 Treated with GLP - 1 RA for Obesity: IQVIA estimates, 2025; Novo Nordisk Earnings Call Nov 25 41 Massive Untapped Opportunity in Obesity Care ‘Oral’ and ‘more effective’ agents: An attractive option for a chronic condition and affiliated co - morbidities

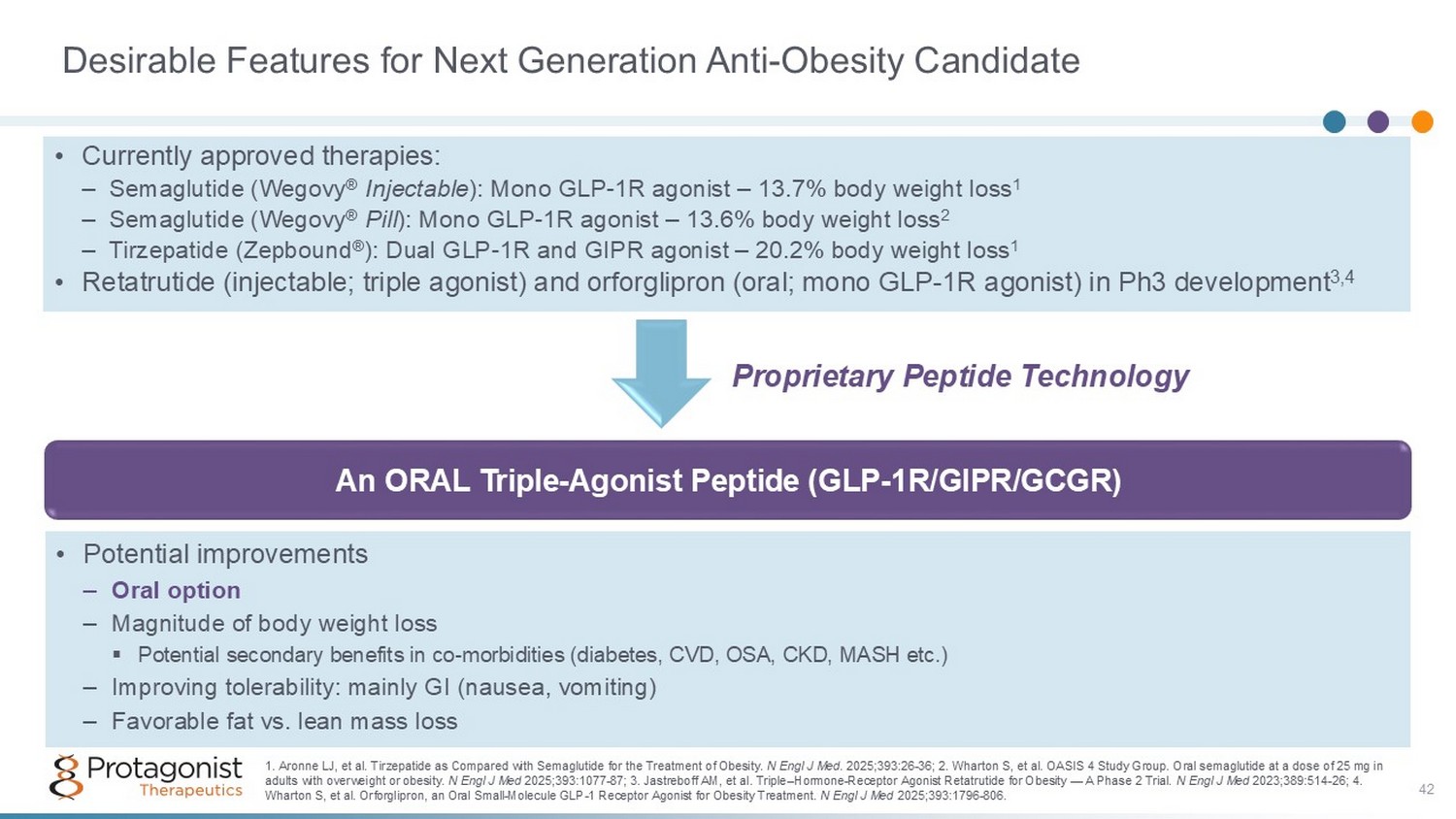

Desirable Features for Next Generation Anti - Obesity Candidate An ORAL Triple - Agonist Peptide (GLP - 1R/GIPR/GCGR) • Potential improvements – Oral option – Magnitude of body weight loss ▪ Potential secondary benefits in co - morbidities (diabetes, CVD, OSA, CKD, MASH etc.) – Improving tolerability: mainly GI (nausea, vomiting) – Favorable fat vs. lean mass loss 1. Aronne LJ, et al. Tirzepatide as Compared with Semaglutide for the Treatment of Obesity. N Engl J Med . 2025;393:26 - 36; 2. Wharton S, et al. OASIS 4 Study Group. Oral semaglutide at a dose of 25 mg in adults with overweight or obesity. N Engl J Med 2025;393:1077 - 87; 3. Jastreboff AM, et al. Triple – Hormone - Receptor Agonist Retatrutide for Obesity — A Phase 2 Trial. N Engl J Med 2023;389:514 - 26; 4. Wharton S, et al. Orforglipron, an Oral Small - Molecule GLP - 1 Receptor Agonist for Obesity Treatment. N Engl J Med 2025;393:1796 - 806. • Currently approved therapies: – Semaglutide (Wegovy ® Injectable ): Mono GLP - 1R agonist – 13.7% body weight loss 1 – Semaglutide (Wegovy ® Pill ): Mono GLP - 1R agonist – 13.6% body weight loss 2 – Tirzepatide (Zepbound ® ): Dual GLP - 1R and GIPR agonist – 20.2% body weight loss 1 • Retatrutide (injectable; triple agonist) and orforglipron (oral; mono GLP - 1R agonist) in Ph3 development 3,4 Proprietary Peptide Technology 42

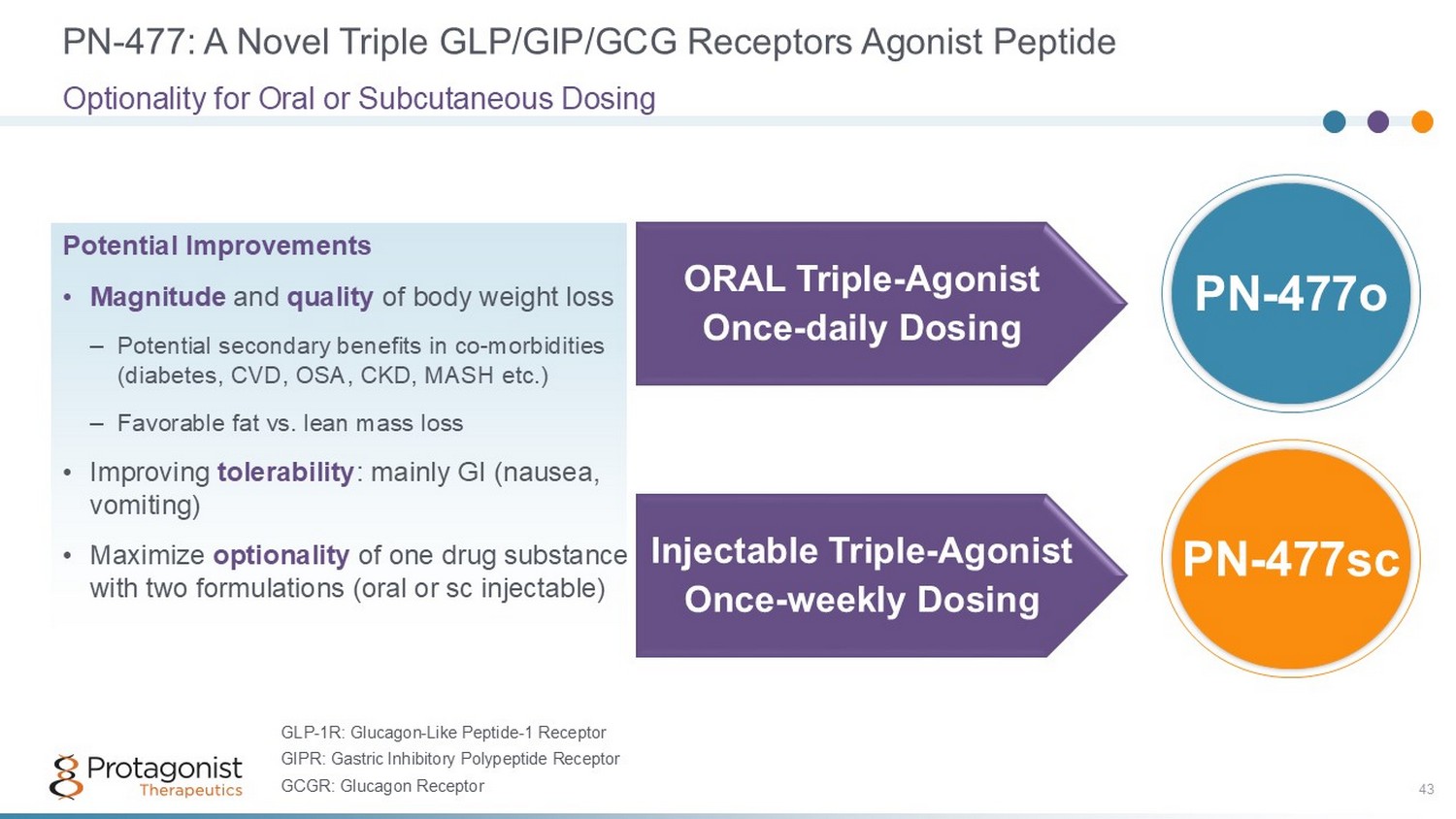

PN - 477: A Novel Triple GLP/GIP/GCG Receptors Agonist Peptide 43 Optionality for Oral or Subcutaneous Dosing ORAL Triple - Agonist Once - daily Dosing Injectable Triple - Agonist Once - weekly Dosing PN - 477sc PN - 477o Potential Improvements • Magnitude and quality of body weight loss – Potential secondary benefits in co - morbidities (diabetes, CVD, OSA, CKD, MASH etc.) – Favorable fat vs. lean mass loss • Improving tolerability : mainly GI (nausea, vomiting) • Maximize optionality of one drug substance with two formulations (oral or sc injectable) GLP - 1R: Glucagon - Like Peptide - 1 Receptor GIPR: Gastric Inhibitory Polypeptide Receptor GCGR: Glucagon Receptor

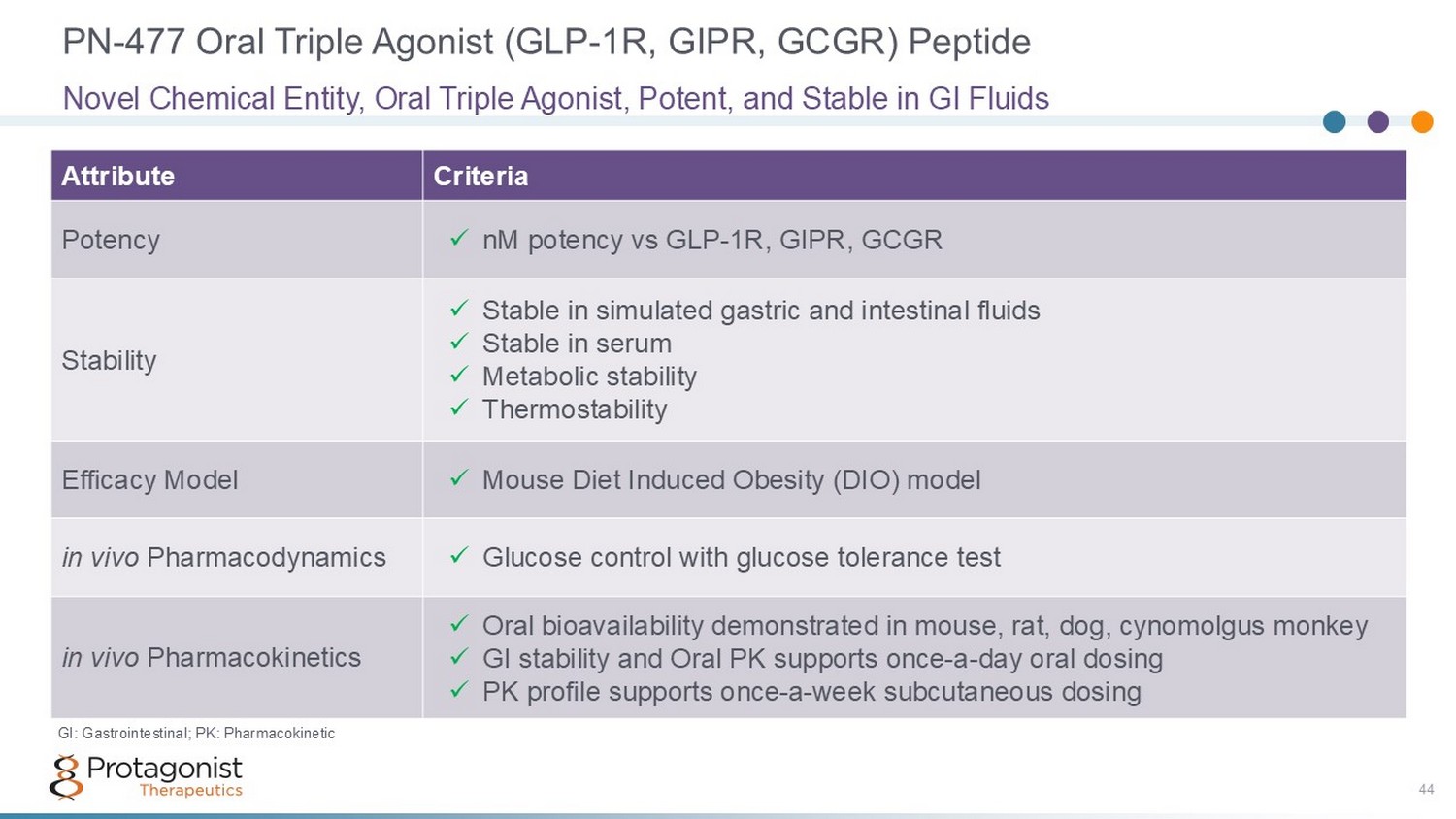

PN - 477 Oral Triple Agonist (GLP - 1R, GIPR, GCGR) Peptide 44 Criteria Attribute x nM potency vs GLP - 1R, GIPR, GCGR Potency x Stable in simulated gastric and intestinal fluids x Stable in serum x Metabolic stability x Thermostability Stability x Mouse Diet Induced Obesity (DIO) model Efficacy Model x Glucose control with glucose tolerance test in vivo Pharmacodynamics x Oral bioavailability demonstrated in mouse, rat, dog, cynomolgus monkey x GI stability and Oral PK supports once - a - day oral dosing x PK profile supports once - a - week subcutaneous dosing in vivo Pharmacokinetics Novel Chemical Entity, Oral Triple Agonist, Potent, and Stable in GI Fluids GI: Gastrointestinal; PK: Pharmacokinetic

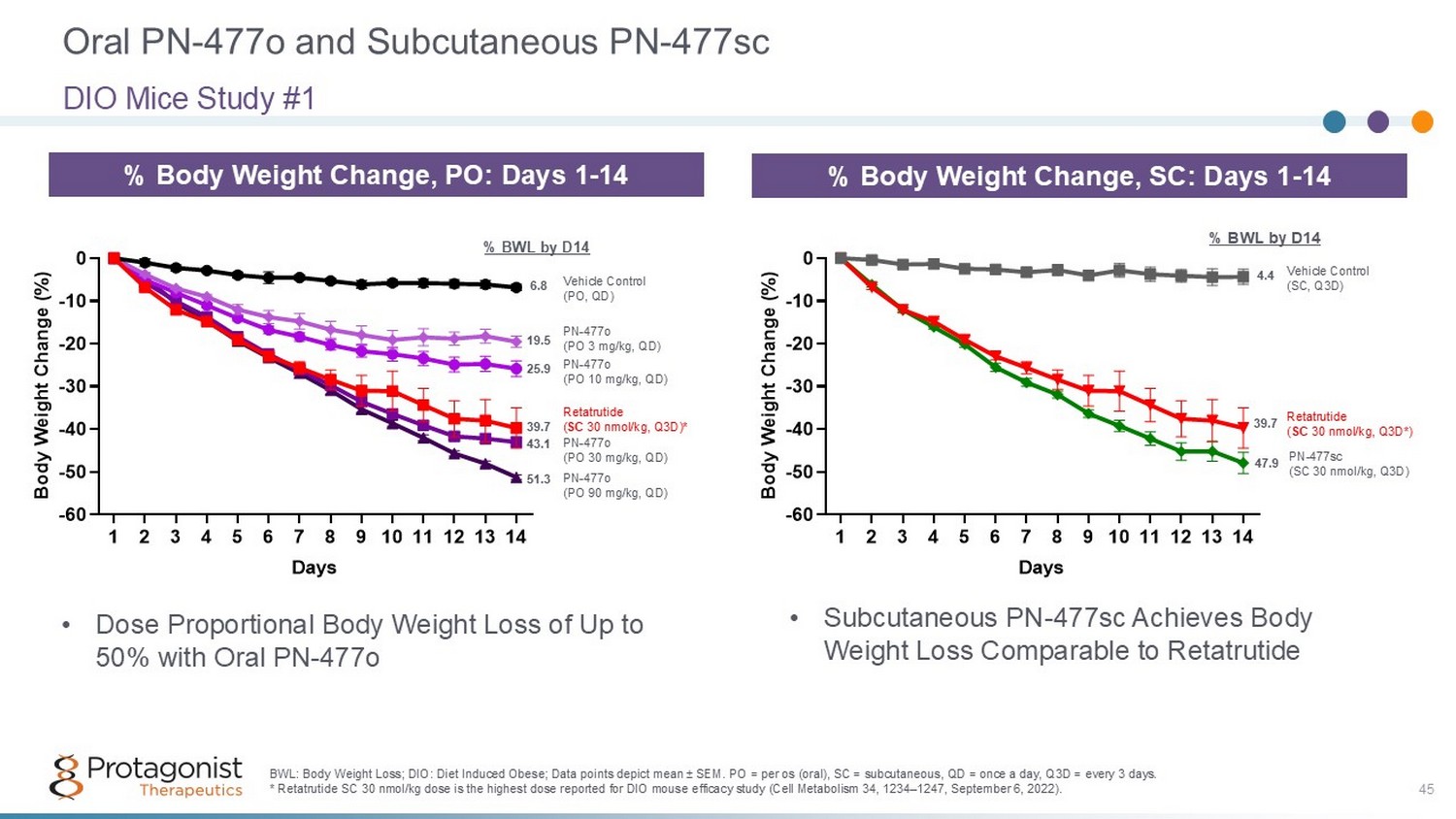

Oral PN - 477o and Subcutaneous PN - 477sc DIO Mice Study #1 % Body Weight Change, SC: Days 1 - 14 1 2 3 4 5 6 7 8 9 1011121314 -60 -50 -40 -30 -20 -10 0 Days B o d y W e i g h t C h a n g e ( % ) Vehicle Control (SC, Q3D) Retatrutide ( SC 30 nmol/kg, Q3D*) PN - 477sc (SC 30 nmol/kg, Q3D) 4.4 39.7 47.9 % BWL by D14 BWL: Body Weight Loss; DIO: Diet Induced Obese; Data points depict mean ± SEM. PO = per os (oral), SC = subcutaneous, QD = once a day, Q3D = every 3 days. * Retatrutide SC 30 nmol/kg dose is the highest dose reported for DIO mouse efficacy study (Cell Metabolism 34, 1234 – 1247, Septe mber 6, 2022). 45 % Body Weight Change, PO: Days 1 - 14 1 2 3 4 5 6 7 8 9 1011121314 -60 -50 -40 -30 -20 -10 0 Days B o d y W e i g h t C h a n g e ( % ) Vehicle Control (PO, QD) PN - 477o (PO 3 mg/kg, QD) PN - 477o (PO 10 mg/kg, QD) PN - 477o (PO 30 mg/kg, QD) PN - 477o (PO 90 mg/kg, QD) Retatrutide ( SC 30 nmol/kg, Q3D)* 6.8 19.5 25.9 43.1 51.3 % BWL by D14 39.7 • Dose Proportional Body Weight Loss of Up to 50% with Oral PN - 477o • Subcutaneous PN - 477sc Achieves Body Weight Loss Comparable to Retatrutide

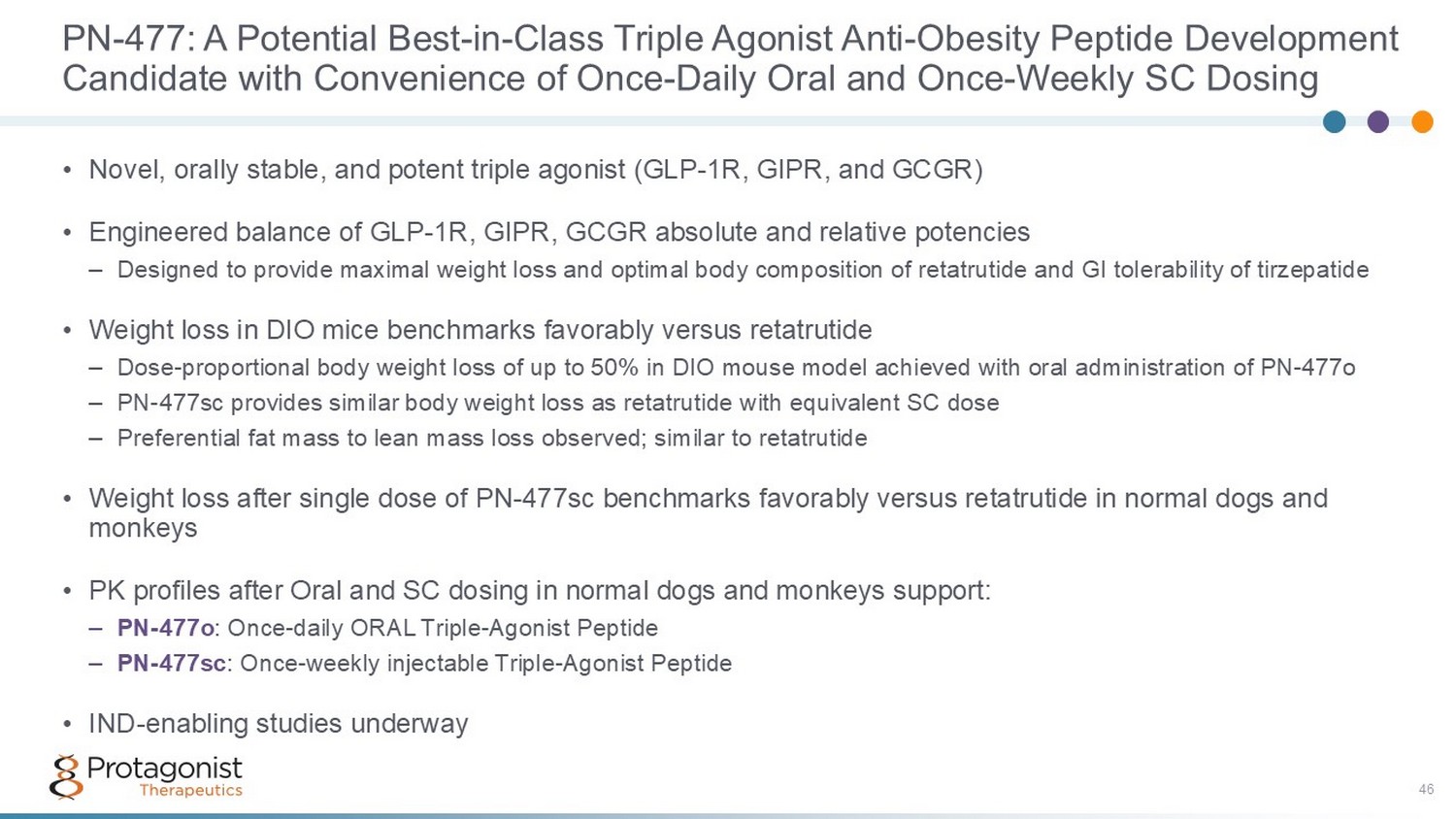

PN - 477: A Potential Best - in - Class Triple Agonist Anti - Obesity Peptide Development Candidate with Convenience of Once - Daily Oral and Once - Weekly SC Dosing • Novel, orally stable, and potent triple agonist (GLP - 1R, GIPR, and GCGR) • Engineered balance of GLP - 1R, GIPR, GCGR absolute and relative potencies – Designed to provide maximal weight loss and optimal body composition of retatrutide and GI tolerability of tirzepatide • Weight loss in DIO mice benchmarks favorably versus retatrutide – Dose - proportional body weight loss of up to 50% in DIO mouse model achieved with oral administration of PN - 477o – PN - 477sc provides similar body weight loss as retatrutide with equivalent SC dose – Preferential fat mass to lean mass loss observed; similar to retatrutide • Weight loss after single dose of PN - 477sc benchmarks favorably versus retatrutide in normal dogs and monkeys • PK profiles after Oral and SC dosing in normal dogs and monkeys support: – PN - 477o : Once - daily ORAL Triple - Agonist Peptide – PN - 477sc : Once - weekly injectable Triple - Agonist Peptide • IND - enabling studies underway 46

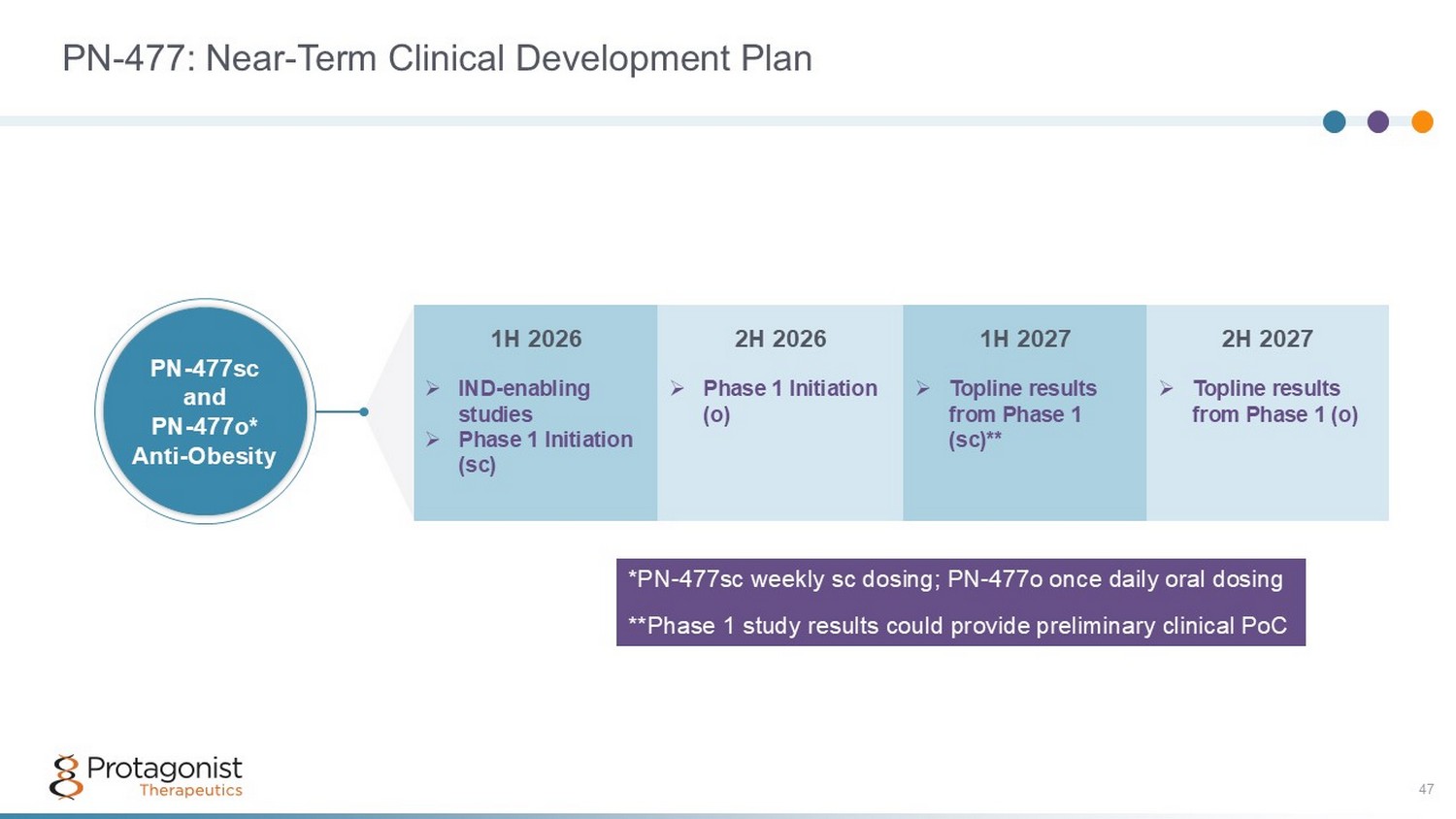

PN - 477: Near - Term Clinical Development Plan 47 2H 2027 1H 2027 2H 2026 1H 2026 » Topline results from Phase 1 (o) » Topline results from Phase 1 (sc)** » Phase 1 Initiation (o) » IND - enabling studies » Phase 1 Initiation (sc) PN - 477sc and PN - 477o* Anti - Obesity *PN - 477sc weekly sc dosing; PN - 477o once daily oral dosing **Phase 1 study results could provide preliminary clinical PoC

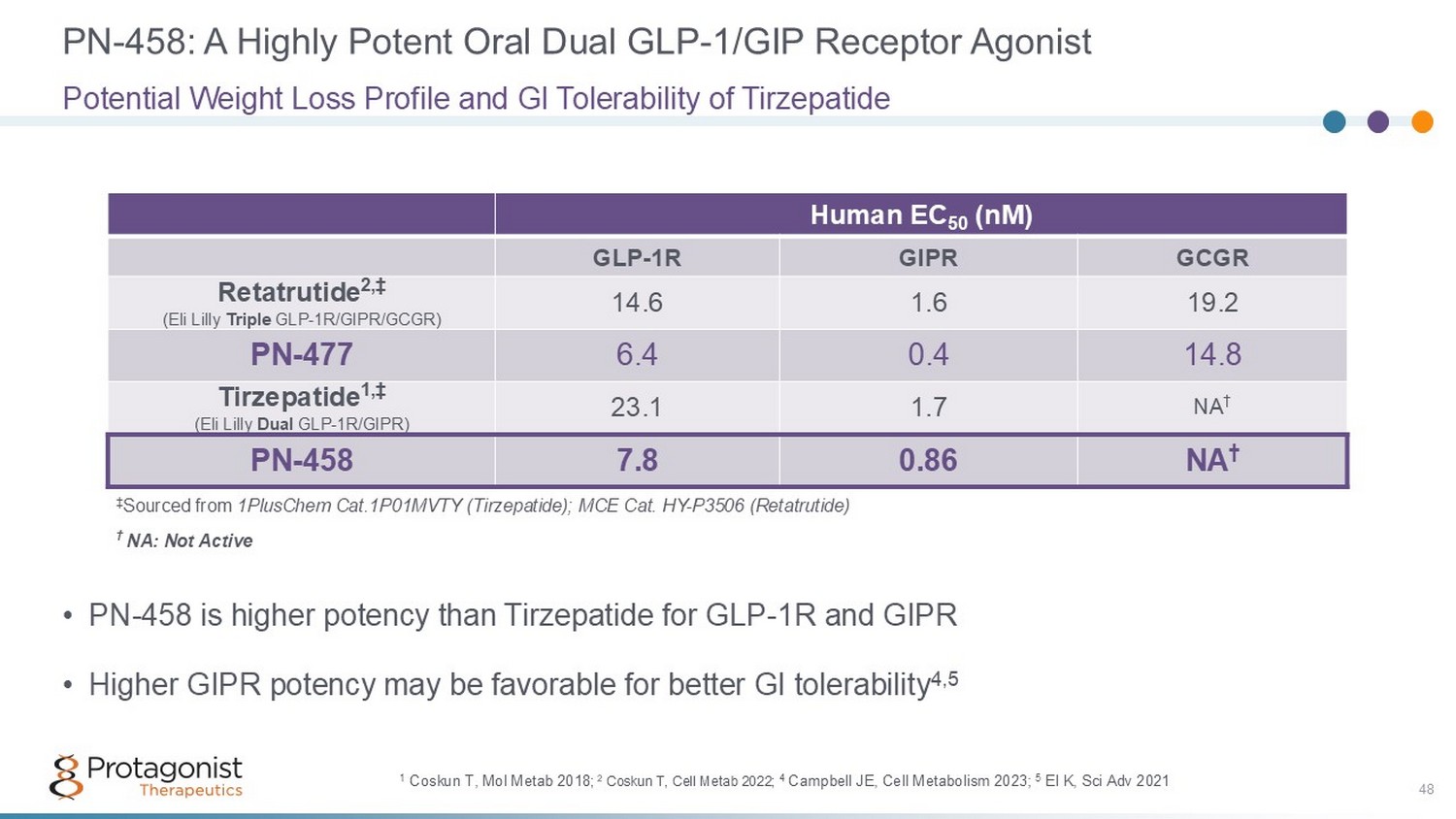

PN - 458: A Highly Potent Oral Dual GLP - 1/GIP Receptor Agonist 48 • PN - 458 is higher potency than Tirzepatide for GLP - 1R and GIPR • Higher GIPR potency may be favorable for better GI tolerability 4,5 Potential Weight Loss Profile and GI Tolerability of Tirzepatide Human EC 50 (nM) GCGR GIPR GLP - 1R 19.2 1.6 14.6 Retatrutide 2,‡ (Eli Lilly Triple GLP - 1R/GIPR/GCGR) 14.8 0.4 6.4 PN - 477 NA † 1.7 23.1 Tirzepatide 1,‡ (Eli Lilly Dual GLP - 1R/GIPR) NA † 0.86 7.8 PN - 458 † NA: Not Active ‡ Sourced from 1PlusChem Cat.1P01MVTY (Tirzepatide); MCE Cat. HY - P3506 (Retatrutide) 1 Coskun T, Mol Metab 2018 ; 2 Coskun T, Cell Metab 2022; 4 Campbell JE, Cell Metabolism 2023; 5 El K, Sci Adv 2021

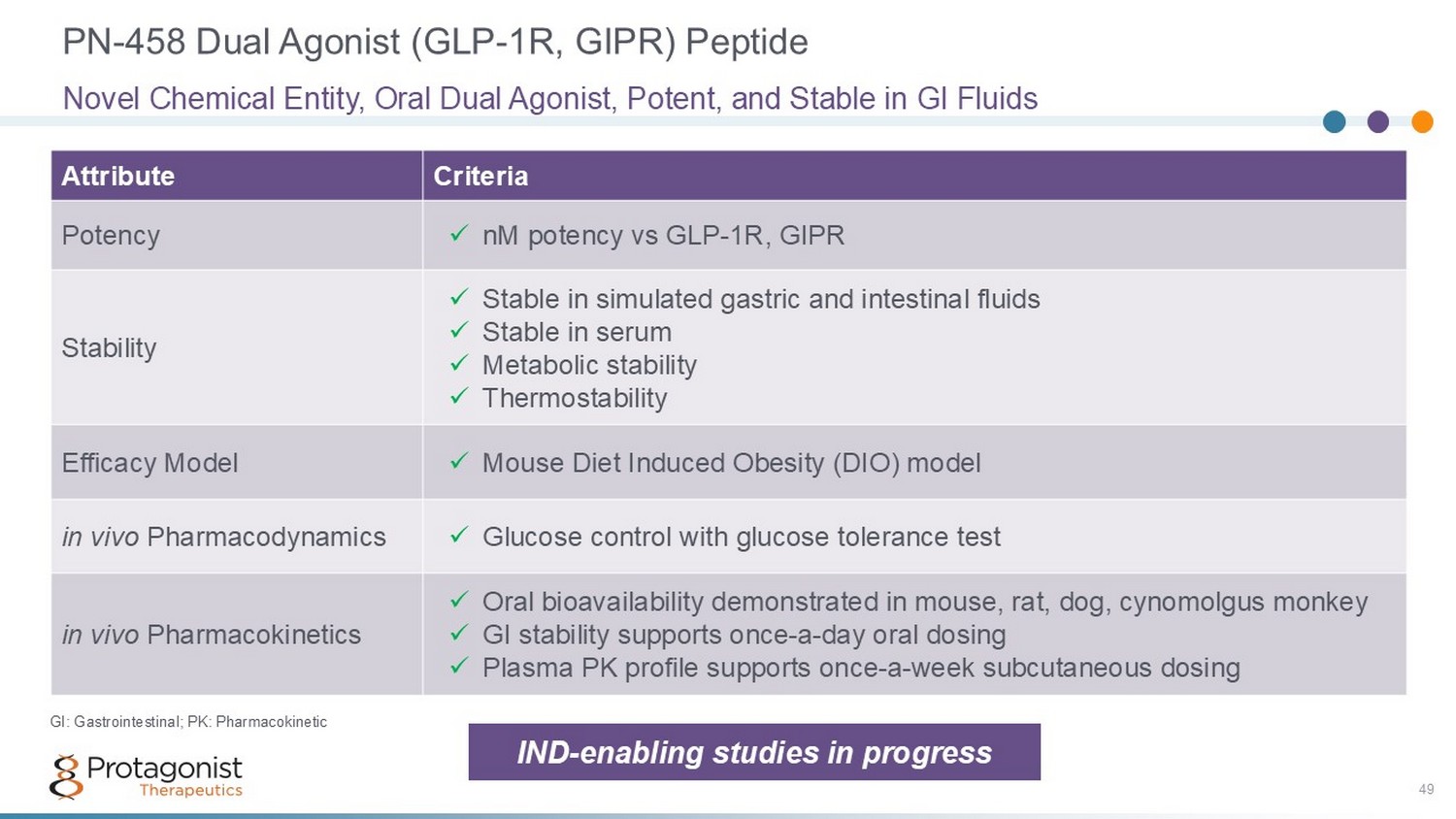

PN - 458 Dual Agonist (GLP - 1R, GIPR) Peptide 49 Criteria Attribute x nM potency vs GLP - 1R, GIPR Potency x Stable in simulated gastric and intestinal fluids x Stable in serum x Metabolic stability x Thermostability Stability x Mouse Diet Induced Obesity (DIO) model Efficacy Model x Glucose control with glucose tolerance test in vivo Pharmacodynamics x Oral bioavailability demonstrated in mouse, rat, dog, cynomolgus monkey x GI stability supports once - a - day oral dosing x Plasma PK profile supports once - a - week subcutaneous dosing in vivo Pharmacokinetics Novel Chemical Entity, Oral Dual Agonist, Potent, and Stable in GI Fluids GI: Gastrointestinal; PK: Pharmacokinetic IND - enabling studies in progress

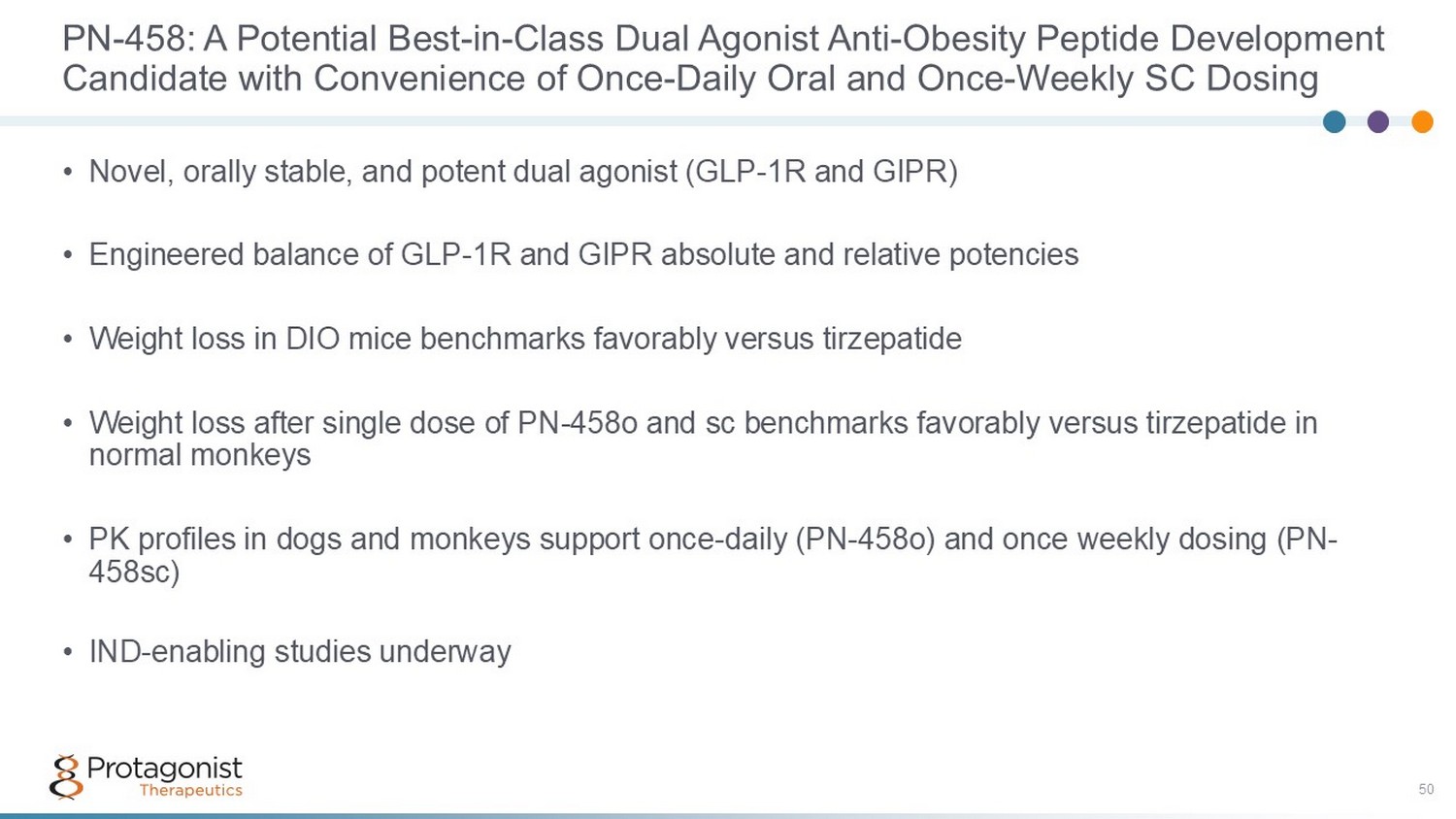

PN - 458: A Potential Best - in - Class Dual Agonist Anti - Obesity Peptide Development Candidate with Convenience of Once - Daily Oral and Once - Weekly SC Dosing 50 • Novel, orally stable, and potent dual agonist (GLP - 1R and GIPR) • Engineered balance of GLP - 1R and GIPR absolute and relative potencies • Weight loss in DIO mice benchmarks favorably versus tirzepatide • Weight loss after single dose of PN - 458o and sc benchmarks favorably versus tirzepatide in normal monkeys • PK profiles in dogs and monkeys support once - daily (PN - 458o) and once weekly dosing (PN - 458sc) • IND - enabling studies underway

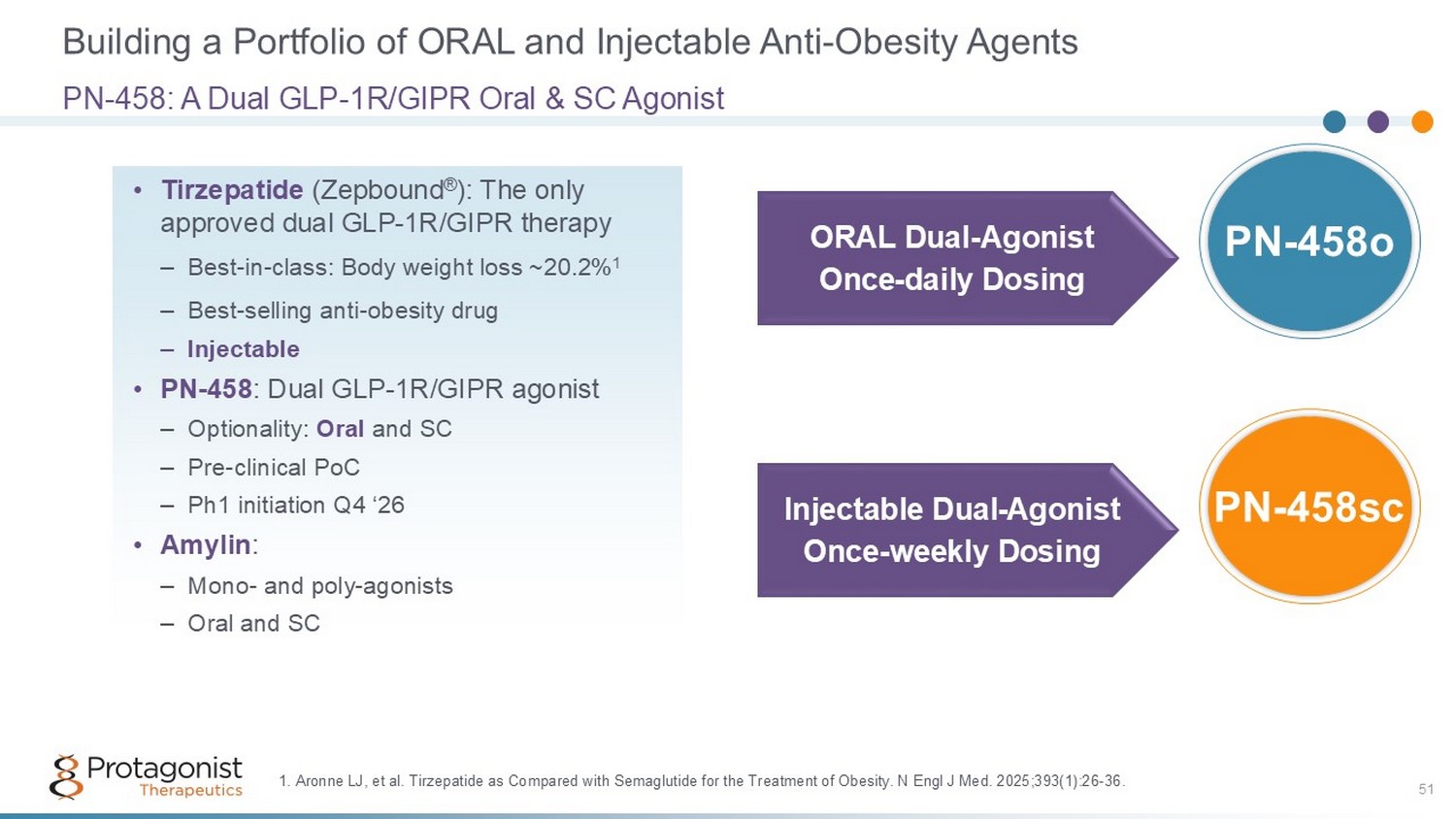

Building a Portfolio of ORAL and Injectable Anti - Obesity Agents 51 PN - 458: A Dual GLP - 1R/GIPR Oral & SC Agonist • Tirzepatide (Zepbound ® ): The only approved dual GLP - 1R/GIPR therapy – Best - in - class: Body weight loss ~20.2% 1 – Best - selling anti - obesity drug – Injectable • PN - 458 : Dual GLP - 1R/GIPR agonist – Optionality: Oral and SC – Pre - clinical PoC – Ph1 initiation Q4 ‘26 • Amylin : – Mono - and poly - agonists – Oral and SC ORAL Dual - Agonist Once - daily Dosing Injectable Dual - Agonist Once - weekly Dosing PN - 458sc PN - 458o 1. Aronne LJ, et al. Tirzepatide as Compared with Semaglutide for the Treatment of Obesity. N Engl J Med. 2025;393(1):26 - 36.

52 52 What’s Next?

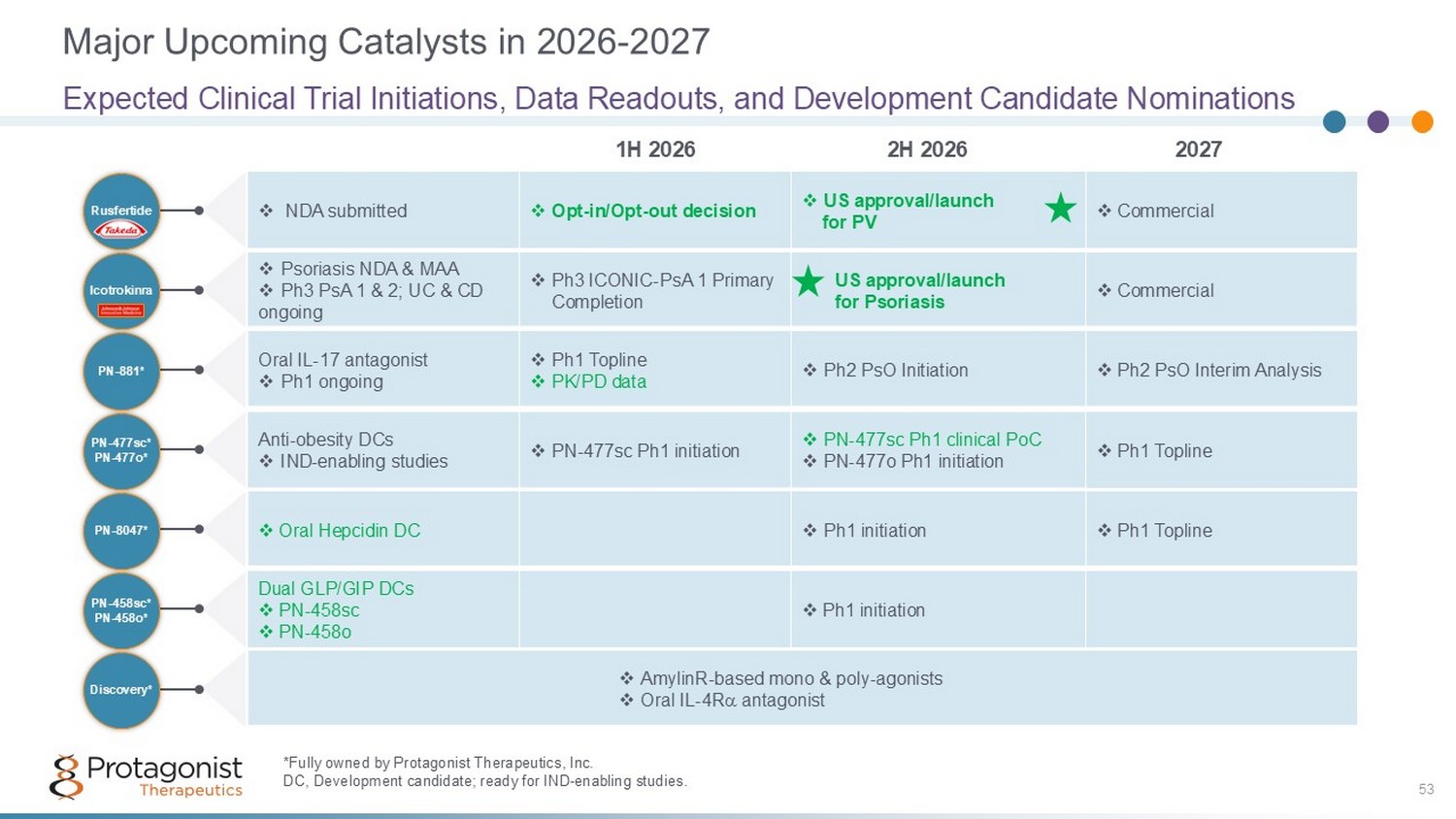

Major Upcoming Catalysts in 2026 - 2027 53 Expected Clinical Trial Initiations, Data Readouts, and Development Candidate Nominations 2027 2H 2026 1H 2026 PN - 8047* PN - 458sc* PN - 458o* PN - 477sc* PN - 477o* PN - 881* Icotrokinra Rusfertide Discovery* *Fully owned by Protagonist Therapeutics, Inc . DC, Development candidate; ready for IND - enabling studies. □ Commercial □ US approval/launch for PV □ Opt - in/Opt - out decision □ NDA submitted □ Commercial □ US approval/launch for Psoriasis □ Ph3 ICONIC - PsA 1 Primary Completion □ Psoriasis NDA & MAA □ Ph3 PsA 1 & 2; UC & CD ongoing □ Ph2 PsO Interim Analysis □ Ph2 PsO Initiation □ Ph1 Topline □ PK/PD data Oral IL - 17 antagonist □ Ph1 ongoing □ Ph1 Topline □ PN - 477sc Ph1 clinical PoC □ PN - 477o Ph1 initiation □ PN - 477sc Ph1 initiation Anti - obesity DCs □ IND - enabling studies □ Ph1 Topline □ Ph1 initiation □ Oral Hepcidin DC □ Ph1 initiation Dual GLP/GIP DCs □ PN - 458sc □ PN - 458o □ AmylinR - based mono & poly - agonists □ Oral IL - 4R antagonist

Thank you 54