UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

| Check the appropriate box: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

People’s United Financial, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) |

Title of each class of securities to which the transaction applies: | |||

|

| ||||

| (2) |

Aggregate number of securities to which the transaction applies: | |||

|

| ||||

| (3) |

Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

|

| ||||

| (4) |

Proposed maximum aggregate value of the transaction: | |||

|

| ||||

| (5) |

Total fee paid: | |||

|

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) |

Amount previously paid: | |||

|

| ||||

| (2) |

Form, Schedule or Registration Statement No.: | |||

|

| ||||

| (3) |

Filing Party: | |||

|

| ||||

| (4) |

Date Filed: | |||

|

| ||||

LETTER FROM OUR CHAIRMAN AND CHIEF EXECUTIVE OFFICER

Dear Shareholder:

People’s United Financial, Inc. • 850 Main Street, P.O. Box 1580 • Bridgeport, Connecticut 06601-1580 • 203-338-7171

Proxy Statement Summary

This summary highlights information contained elsewhere in the Proxy Statement. This Summary does not contain all of the information you should consider, and we encourage you to read the entire Proxy Statement before voting.

2020 Annual Meeting Information

| Date and Time: |

May 21, 2020, at 10:00 a.m. Eastern Time |

| In Person Place: |

850 Main Street, Bridgeport, Connecticut 06604(1) |

| Virtual Meeting Access: |

www.virtualshareholdermeeting.com/PBCT2020. You will need to have the multi-digit Control Number provided in your proxy materials to access the virtual meeting. |

| Record Date: |

March 27, 2020 |

| Voting: |

Holders of common stock are entitled to one vote per share |

| Admission: |

If you plan to attend the annual meeting in person, you will need to bring a form of official photo ID (such as a driver’s license), along with either your Notice, proxy card or other proof of stock ownership with you to the meeting. If you are a beneficial owner but not a shareholder of record, you must present both a form of official photo ID and proof of ownership consisting of a bank or brokerage account statement. If you attend the virtual meeting, you will need to have the multi-digit Control Number to participate. |

| Date of Mailing: |

We are furnishing this proxy statement and the enclosed form of proxy to shareholders beginning on or about April 6, 2020. |

Proposals To Be Voted On At The 2020 Annual Meeting

| Board Recommendation |

Page Reference |

|||||

| Proposal I: Election of Directors |

FOR | 4 | ||||

| Proposal II: Non-Binding Advisory Vote to Approve Compensation of Named Executive Officers |

FOR | 67 | ||||

| Proposal III: Ratification of the Appointment of Independent Registered Public Accounting Firm |

FOR | 69 | ||||

Voting Your Shares

|

Online – as prompted by the menu found at www.proxyvote.com; follow the instructions to obtain your records and submit an electronic ballot. Please have your Notice Regarding the Availability of Proxy Materials (the Notice) or proxy card in hand when you access the voting site. | |

|

By telephone – call 1-800-690-6903 and then follow the voice instructions. Please have your Notice or proxy card in hand when you call. | |

|

By mail – if you received printed proxy materials and would like to vote by mail, complete and sign the accompanying proxy card and return it in the postage paid envelope provided. | |

|

QR Code – by scanning the QR Code on your proxy card or Notice with your mobile device. | |

|

In person – if you attend the annual meeting, you may vote in person at the meeting. | |

|

Virtually online – during the annual meeting by your attendance through the link at www.virtualshareholdermeeting.com/PBCT2020. | |

| (1) | At this time, we intend to hold our annual meeting in person and through remote communication. However, we understand the public health and travel concerns of our shareholders, and the protocols that federal, state and local governments may issue. Accordingly, we are planning for the possibility that the annual meeting may be held solely by means of remote communication via the virtual meeting at www.virtualshareholdermeeting.com/PBCT2020. Please check www.peoples.com for updates and instructions. |

Notice and 2020 Proxy Statement i

Proxy Statement Summary

ii People’s United Financial, Inc.

Proxy Statement Summary

Board Nominees

The nominees for director all currently serve on our Board and are as follows:

| Name |

Director Since |

Independent(1) | Committee Membership | |||||||||

| Enterprise Risk |

Audit | Compensation | Nominating and Corporate Governance | |||||||||

| John P. Barnes, Age 64 |

2010 |

|||||||||||

| Collin P. Baron, Age 72 |

2001 |

✓ |

● |

|||||||||

| George P. Carter, Age 83 |

1976 |

✓ |

● |

● |

● |

Chair | ||||||

| Jane Chwick, Age 57 |

2017 |

✓ |

● |

● | ||||||||

| William F. Cruger, Jr., Age 61 |

2014 |

✓ |

● |

Chair |

● | |||||||

| John K. Dwight, Age 75 |

2008 |

✓ |

Chair |

● |

||||||||

| Jerry Franklin, Age 72 |

1997 |

✓ |

● |

● |

||||||||

| Janet M. Hansen, Age 77 |

2004 |

✓ |

● |

● |

● |

|||||||

| Nancy McAllister, Age 60 |

2013 |

✓ |

● |

● |

||||||||

| Mark W. Richards, Age 74 |

2008 |

✓ |

● |

Chair |

||||||||

| Kirk W. Walters, Age 64 |

2011 |

|||||||||||

Additional information about the director nominees can be found beginning on page 4.

| (1) | Under Applicable NASDAQ and SEC Independence Standards |

Notice and 2020 Proxy Statement iii

Proxy Statement Summary

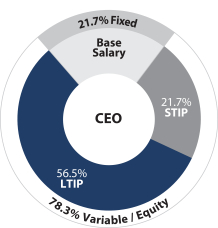

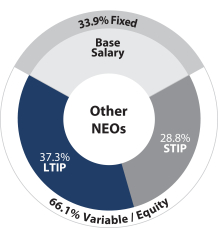

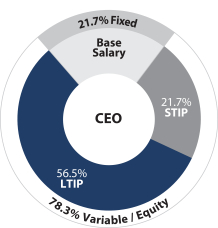

For 2019, direct compensation for our named executive officers (NEOs) was comprised of the following elements:

|

| |

Additional information about executive compensation can be found beginning on page 31.

iv People’s United Financial, Inc.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 21, 2020

| At this time, we intend to hold our annual meeting in person and through remote communication. However, we understand the public health and travel concerns of our shareholders, and the protocols that federal, state and local governments may issue. We are actively monitoring the coronavirus (COVID-19) as part of our precautions. In the event it is not possible or advisable to hold our annual meeting in person, and not in the best interests of our shareholders and the Company, we are planning for the possibility that the annual meeting may be held solely by means of remote communication via the virtual meeting at www.virtualshareholdermeeting.com/PBCT2020. If we take this step, we will announce the decision to do so in advance at www.peoples.com and via a press release, which will be filed with the SEC. If you are planning to attend our annual meeting, please check our website one week prior to the meeting date of May 21, 2020. As always, we encourage you to vote your shares before the meeting.

|

Important Notice Regarding

the Availability of Proxy Materials for the Annual Meeting of Shareholders

to Be Held on May 21, 2020: This Proxy Statement and our Annual Report are available free of charge

at

www.proxyvote.com.

People’s United Financial, Inc. • 850 Main Street, P.O. Box 1580 • Bridgeport, Connecticut 06601-1580 • 203-338-7171

|

|

John P. Barnes since June 2018, is Chairman of the Board and Chief Executive Officer of People’s United. Previously, he served as President and Chief Executive Officer since July 2010. Mr. Barnes previously served as Senior Executive Vice President and Chief Administrative Officer for People’s United following the acquisition of Chittenden Corporation in early 2008. Mr. Barnes served as an Executive Vice President of Chittenden since 1997. He became a member of our board in 2010. Mr. Barnes also serves as the chairman of The People’s United Community Foundation.

Mr. Barnes has worked in the financial services industry since 1983, when he joined Chittenden after five years with the FDIC in Boston. He became Senior Vice President and Chief Credit Policy Officer of Chittenden in 1988. In 1990 he was named to head the Credit Policy and Administration division. In 2002, he was appointed Executive Vice President in charge of the newly formed Chittenden Services Group, which provided all centralized services for the corporation. Mr. Barnes is a graduate of Northeastern University and received his M.B.A. from the University of Vermont.

|

John P. Barnes

Age 64 Director since 2010

Committees: None | ||||||

|

Qualifications: The board believes that Mr. Barnes, as our chief executive officer, has a critical role to play as a representative of management on the board. For this reason, the board expects that for as long as Mr. Barnes serves as our chief executive officer, the board will recommend him for election to our board of directors.

|

||||||||

| Collin P. Baron is a member of the law firm of Pullman & Comley, LLC, a full-service law firm with offices in major Connecticut cities and in White Plains, N.Y. He has been affiliated with the firm since 1973. He serves as a member of the Company’s Enterprise Risk Committee.

A graduate of the University of Virginia and the George Washington University National Law Center, Mr. Baron has more than 40 years of experience in corporate, health care and banking law. He is a member of the Connecticut Health Lawyers Association and American Health Lawyers Association. He is a member of the Banking Law Committee of the American Bar Association. He has also been an active member of the greater Bridgeport business, legal and philanthropic community.

|

Collin P. Baron

Age 72 Director since 2001

Committees: Enterprise Risk | |||||||

|

Qualifications: In evaluating Mr. Baron’s qualifications for board service, the board determined that Mr. Baron’s expertise in corporate and banking law, coupled with his past experience as a member of the Bank’s and the Company’s board of directors and thus his familiarity with our operations and our Connecticut market, qualify him to serve on our board and enhance the overall mix of skills among board members.

|

||||||||

Notice and 2020 Proxy Statement 5

Nominees for Director

|

George P. Carter

Age 83 Director since 1976

Committees: Enterprise Risk, Audit, Compensation, Nominating and Corporate Governance (Chairman) |

|

George P. Carter is the former President of Connecticut Foods, Inc. He currently serves as our Lead Director and also serves as a member of the Company’s Audit, Compensation and Enterprise Risk Committees, and serves as Chairman of the Nominating and Corporate Governance Committee.

Mr. Carter has significant experience as a member of both the board of directors and the audit committee of a financial services company, having served as a member of the Bank’s board of directors since 1976 and as a member of its audit committee since 1981. He became Chairman of the Bank’s audit committee in 1987 and chairman of the Company’s Audit Committee at the time of its formation in 2007 until 2017. Mr. Carter graduated from Michigan State University with a B.S. in business and has been a business owner since 1969. He is active in community and philanthropic affairs and serves as a member of the board of directors of The People’s United Community Foundation. The Board has identified Mr. Carter as an audit committee financial expert.

|

||||||

|

Qualifications: In considering Mr. Carter’s contributions to the board and his skills and qualifications for board service, the board noted that, over his more than 40 years of board service, Mr. Carter has developed a level of expertise in banking matters and an in-depth familiarity with People’s United, our various businesses and the Connecticut market that enhance his contributions to the board. The board also cited the benefit to the board’s deliberative process provided by Mr. Carter’s long-term perspective, noting that Mr. Carter has been a member of the board throughout a number of business cycles.

|

||||||||

|

Jane Chwick

Age 57 Director since 2017

Committees: Enterprise Risk, Nominating and Corporate Governance |

Jane Chwick was elected to the Board of Directors of the Bank and the Company on September 21, 2017. Ms. Chwick was a partner at Goldman Sachs where she had a 30-year career in technology, including most recently as the Co-Head of the technology division. As Co-COO, she was responsible for financial business planning and setting the technical strategy and management of an 8,000-person organization within the firm. While at Goldman, Ms. Chwick served on many governance committees, including the firm’s Finance Committee, the firmwide New Activity Committee and the Technology Risk Committee, and she was co-chair of the Technology Division Operating Committee. Ms. Chwick was also the Co-founder and Co-CEO of Trewtec, Inc., providing corporate directors, chief executive officers and chief technology officers with the information they need to improve their oversight of a company’s technology division. She currently serves on a number of boards including ThoughtWorks, Inc. and Essent Group, Ltd. where she is chair of the Technology, Innovation and Operations Committee. She also serves on the board of Voya Financial and MarketAxess where she is the chair of the Technology, Innovation and Operations Committee and the Risk Committee, respectively. In addition, Ms. Chwick is on the Executive Board of Trustees of the Queens College Foundation and until recently served on the board of Girls Who Code. She earned an undergraduate degree in Mathematics from Queens College, and an M.B.A. with a concentration in quantitative analysis from St. John’s University. Ms. Chwick is a member of the Company’s Enterprise Risk and Nominating and Corporate Governance Committees.

|

|||||||

|

Qualifications: The board believes that Ms. Chwick’s extensive technology leadership experience, gained in a global financial services firm, combined with her in-depth knowledge of the New York market and industry insight, bring valuable skills and strategic perspective to the board.

|

||||||||

6 People’s United Financial, Inc.

Nominees for Director

|

William F. Cruger, Jr. was, until August 2013, Vice Chairman of Investment Banking at J.P. Morgan Chase & Co., a leading global financial services firm. His responsibilities included senior client relationship management and transaction leadership with a primary focus on financial institutions, among other sectors. Mr. Cruger was Managing Director, Financial Institutions Group at J.P. Morgan Chase from 1996 until 2011 when he was elevated to the position of Vice Chairman. He also ran the firm’s investment banking practices in Japan from 1991 to 1996, in Latin America from 1989 to 1991, and in Emerging Asia from 1984 to 1988. He began his career at J.P. Morgan Chase in 1982.

Currently Mr. Cruger is a member of the board of MarketAxess Holdings Inc., serving as a member of the Audit and Investment Committees and the Chairman of the Nominating and Corporate Governance Committee, and of Virtu Financial, Inc., serving as Chairman of the Audit Committee. He has also served on the boards of Archipelago, Capital IQ and Credittrade.

Mr. Cruger has developed extensive experience in the evaluation of financial statements and has a thorough understanding of generally accepted accounting principles and financial reporting procedures. He currently serves as a member of the audit committee of two public companies.

|

William F. Cruger, Jr.

Age 61 Director since 2014

Committees: Audit (Chairman), Corporate Governance, Enterprise Risk | |||||||||

|

Qualifications: Mr. Cruger is a member of the Company’s Enterprise Risk and Nominating and Corporate Governance Committees, and currently serves as Chairman of the Company’s Audit Committee. The board believes that Mr. Cruger’s diverse experience in investment banking at a global financial services firm, his extensive knowledge of financial institutions and financial markets (including the New York market), his leadership roles as a director of other financial services firms, and his international business experience bring critical skills and strategic insight to the board. Based on this background and experience, the board has identified Mr. Cruger as an audit committee financial expert.

|

||||||||||

|

John K. Dwight had served as a director of Chittenden since 1999. He is the founder and Chairman of Dwight Asset Management Company, a registered investment advisor managing over $60 billion in fixed income assets for insurance companies, stable value funds, and other institutional clients. Mr. Dwight is a former director of Old Mutual Asset Management US Holdings, Inc., a founding member of the Stable Value Investment Association and the Vermont Security Analysts Chapter. In addition, Mr. Dwight is a past trustee of St. Lawrence University and the Shelburne Museum.

Mr. Dwight has more than 20 years’ experience as a director of a publicly-held bank holding company, having served as a director and member of the audit committee of Eastern Bancorp, Inc. (parent of Vermont Federal Bank), a director of Vermont Financial Services Corporation (parent of Vermont National Bank), and a director of Chittenden (parent of multiple banks).

|

John K. Dwight

Age 75 Director since 2008

Committees: Audit, Enterprise Risk (Chairman) | |||||||||

|

Qualifications: In evaluating Mr. Dwight’s qualifications as a director, the board considered the contribution that his extensive expertise in the area of asset management and his considerable financial acumen has made to his board service. The board determined that he brings to his role as director a strong proficiency in the area of analyzing and evaluating both company financial statements and complex financial instruments, which enhances his service not only as a member of the board but also as a member of its Audit Committee and as Chairman of the Enterprise Risk Committee. The board determined that the diversity of perspective of the board as a whole benefits from Mr. Dwight’s extensive experience with and knowledge of the greater Burlington, Vermont market and community. The Board has identified Mr. Dwight as an audit committee financial expert.

|

||||||||||

Notice and 2020 Proxy Statement 7

Nominees for Director

| Jerry Franklin

Age 72 Director since 1997

Committees: Audit and Enterprise Risk |

Jerry Franklin was the President and Chief Executive Officer of Connecticut Public Broadcasting Inc., a position he held from 1985 until his retirement in June 2019.

Mr. Franklin has spent his entire professional career in the communications field. Following his honorable discharge from the U.S. Air Force in 1970, Mr. Franklin received a B.S. in political science and journalism from Georgia Southern University and a Masters in telecommunications management from Indiana University. Mr. Franklin’s position with Connecticut Public Broadcasting involves overall responsibility for all aspects of that corporation’s business, including its financial condition and performance. Specifically, Mr. Franklin has responsibility for oversight of that company’s financial management, investment policies, and budget.

|

|||||||

| Qualifications: The board has

concluded that it benefits from Mr. Franklin’s guidance as to the

|

||||||||

8 People’s United Financial, Inc.

Nominees for Director

| Janet M. Hansen was employed as Executive Vice President of Aquarion Company, a diversified water management company, from 1995 until her retirement in March 2005. Ms. Hansen served as Aquarion’s Treasurer and Chief Financial Officer from 1992 through 1999. Aquarion was, until its acquisition by Kelda Group, plc in 2000, a publicly-held company listed on the New York Stock Exchange. Ms. Hansen was President and Chief Executive Officer of Aquarion’s principal operating subsidiary, Aquarion Water Company, from 2000 to 2003. She served in a variety of other financial positions during her 29-year career with Aquarion in addition to the positions specifically noted above.

In her various roles at Aquarion, Ms. Hansen had extensive experience with the preparation and evaluation of financial statements. She has a detailed understanding of generally accepted accounting principles, internal controls, and financial reporting procedures. She is also intimately familiar with the role of a public company audit committee, having not only worked closely with Aquarion’s audit committee, but also having served on our Audit Committee and the audit committees of Pennichuck Corporation and Gateway Bank (acquired in 1994 by a subsidiary of a predecessor to Bank of America Corporation). For these reasons, the board has identified Ms. Hansen as an audit committee financial expert. Ms. Hansen is also active in the Greater Bridgeport community, serving as a member of the audit committee of Bridgeport Hospital.

Ms. Hansen became a member of the board of directors in February 2004. She is a member of the Company’s Audit, Enterprise Risk Committee and Compensation Committees. She also served on the board of directors of Pennichuck Corporation (a publicly-owned holding company for a group of water utilities and related businesses) until its sale in January 2012. Ms. Hansen is a graduate of Salem State College and has an M.B.A. in Finance from the University of Connecticut. She is also a graduate of the Advanced Management Program and the International Senior Management Program at Harvard University.

|

Janet M. Hansen

Age 77 Director since 2004

Committees: Audit, Enterprise Risk and Compensation | |||||||||

| Qualifications: In determining Ms. Hansen’s qualifications for the position of director, and her contributions to the board’s overall mix of skills and attributes, the board noted that Ms. Hansen’s financial background, her knowledge of our Connecticut market and her past experience as Treasurer and Chief Financial Officer of a publicly-held company and as former director and member of the audit committee of Pennichuck Corporation enhance her contribution to the Board’s Committees.

|

||||||||||

Notice and 2020 Proxy Statement 9

Nominees for Director

|

Nancy McAllister

Age 60 Director since 2013

Committees: Enterprise Risk , Audit |

|

|

Ms. McAllister was Americas Co-Head, Financial Institutions Group, Investment Banking, at Credit Suisse Securities (USA) LLC, a diversified financial services firm, until May 2011. Her group covered banks, insurance companies, specialty finance, asset management and financial technology institutions. From 1991 to September 2008, Ms. McAllister was employed by Lehman Brothers, Inc., where she held a variety of executive positions, including Managing Director and co-head of the depository institutions and Debt Capital Markets groups. Ms. McAllister began her career as a commercial banker in 1981 at Bankers Trust. She graduated from the University of Virginia with a degree in Economics.

Since November 2012, Ms. McAllister has served as a member of the Board of Trustees of PennyMac Mortgage Investment Trust (PMT), a specialty finance company that invests primarily in residential mortgage loans and mortgage-related assets. She serves as Chair of PMT’s Finance Committee, and is also a member of both PMT’s Compensation and Risk Committees.

|

| ||||

|

Qualifications: In evaluating Ms. McAllister’s qualifications as a director, the board noted that she is a seasoned business executive with 30 years of banking experience including deep knowledge of the capital markets and significant experience in financial services. In addition, Ms. McAllister is a fifth-generation native New Yorker with strong working knowledge of the New York market, an area of increasing importance to our business. The Board has identified Ms. McAllister as an audit committee financial expert.

|

||||||||

|

Mark W. Richards

Age 74 Director since 2008

Committees: Enterprise Risk, Compensation (Chairman) |

|

|

Mark W. Richards became a member of the board of directors effective January 1, 2008 immediately following completion of the merger of Chittenden into People’s United. Mr. Richards had served as a director of Chittenden from 1999 until its merger with People’s United. He is President of The Richards Group in Brattleboro, Vermont, an independent, full-service insurance and financial services firm specializing in providing risk management, employee benefits and investment advisory services to individuals, families, and businesses primarily in Vermont and New Hampshire. Until 2008, Mr. Richards was also vice president and the majority owner of Lyon Travel Agency, a privately-owned, nationally-recognized provider of travel management services. Mr. Richards is a graduate of Williams College and served as an officer in the U.S. Navy.

Mr. Richards is a member of the Company’s Enterprise Risk Committee and also serves as Chairman of the Compensation Committee.

Mr. Richards is a resident of southern Vermont and an active member of the greater Vermont/New Hampshire community. Mr. Richards brings an element of geographic diversity to his service on the board and is able to provide insight and counsel to the entire board with respect to this portion of the Bank’s market area.

|

| ||||

|

Qualifications: The board has determined that by virtue of his background in insurance-related financial services, Mr. Richards provides the board with an important perspective, especially with respect to the Bank’s commercial banking division, which includes an insurance brokerage subsidiary. The board also considered that Mr. Richards has extensive experience in our Vermont market with more than 20 years’ experience as a director of a public company and director of a financial services organization, having formerly served as a director of Vermont Financial Services Corporation (parent of Vermont National Bank) from 1988 to 1999, and Chittenden (parent of multiple banks) from 1999 until Chittenden’s merger into People’s United effective January 1, 2008.

|

||||||||

10 People’s United Financial, Inc.

Nominees for Director

|

|

Kirk W. Walters joined People’s United as an executive officer and member of the board of directors on March 16, 2011. He served as Chief Financial Officer through December 31, 2014 at which time he became a Senior Executive Vice President with responsibility for corporate development and strategic planning. Prior to joining People’s United, Mr. Walters served as Senior Executive Vice President and a member of the board of directors of Santander Holdings USA, Inc., the parent company of Sovereign (now Santander) Bank. He joined Sovereign in February 2008 as Executive Vice President and Chief Financial Officer and served as interim President and Chief Executive Officer from October 2008 until Banco Santander acquired the bank in February 2009.

Prior to joining Sovereign, Mr. Walters was Executive Vice President and Chief Financial Officer of Chittenden Corporation from 1996 to 2008. From 1989 to 1995, he held a series of executive positions at Northeast Federal Corporation in Hartford, Connecticut, including Chairman, President and Chief Executive Officer. From 1984 to 1989, Mr. Walters worked for CalFed, Inc. in a variety of financial positions, including Senior Vice President and Controller. Before joining CalFed, he worked in the corporate finance group at Atlantic Richfield Corp. from 1981 to 1984.

|

|

|

Kirk W. Walters

Age 64 Director since 2011

Committees: None | ||||||

|

Qualifications: Mr. Walters has worked in the banking industry for more than 35 years, much of it in the Northeast. This experience and his former position as our chief financial officer are significant factors in the board’s evaluation of Mr. Walters’ qualifications for service as a director.

|

||||||||||

During the past five years, except for Messrs. Barnes and Walters, no director or nominee has had a principal occupation or employment with us or any of our subsidiaries or other affiliates. No director or nominee is related by blood, marriage or adoption to any of our executive officers or any executive officer of our subsidiaries or other affiliates.

With the exception of Messrs. Barnes and Walters, our board has affirmatively determined that each person nominated for reelection as a director at the 2020 annual meeting is “independent” for purposes of the applicable listing standards of The Nasdaq Stock Market, including with respect to committee membership. Our board has determined that each of Messrs. Baron, Carter, Cruger, Dwight, Franklin and Richards, and Ms. Chwick, Hansen and McAllister is “independent” for purposes of Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In making its independence determinations, the board considered and reviewed all information known to it (including information identified through annual directors’ questionnaires). In determining that Mr. Baron is independent, the board considered the fact that Mr. Baron is a principal at a law firm that does business with, and which leases office space from, the Bank, and determined that these relationships do not compromise Mr. Baron’s independence or ability to serve effectively as a director of the Company.

Notice and 2020 Proxy Statement 11

Board of Directors and Committees

Notice and 2020 Proxy Statement 13

Board of Directors and Committees

The following chart provides information about our current board committee membership after the changes to the board committee structure in April, 2019 and the number of meetings that each committee held in 2019. In addition, before those changes, the former CNGC held five meetings, and the former Treasury and Finance Committee held two meetings.

| Audit | Compensation | Enterprise Risk |

Nominating & Corporate Governance | |||||

|

John P. Barnes

|

||||||||

| Collin P. Baron

|

Member | |||||||

| Kevin T. Bottomley

|

Member | Member | ||||||

| George P. Carter

|

Member | Member | Member | Chair | ||||

| Jane Chwick

|

Member | Member | ||||||

| William F. Cruger, Jr.

|

Chair | Member | Member | |||||

| John K. Dwight

|

Member | Chair | ||||||

| Jerry Franklin

|

Member | Member | ||||||

| Janet M. Hansen

|

Member | Member | Member | |||||

| Nancy McAllister

|

Member | Member | ||||||

| Mark W. Richards

|

Chair | Member | ||||||

| Kirk W. Walters

|

||||||||

| Number of meetings in 2019

|

9 | 5 | 9 | 3 | ||||

14 People’s United Financial, Inc.

Board of Directors and Committees

Notice and 2020 Proxy Statement 15

Board of Directors and Committees

16 People’s United Financial, Inc.

Corporate Governance

18 People’s United Financial, Inc.

Corporate Governance

Notice and 2020 Proxy Statement 19

Corporate Governance

20 People’s United Financial, Inc.

EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS

|

|

David Berey is Executive Vice President, Chief Credit Officer, responsible for Credit Risk for Commercial and Industrial lending, Commercial Real Estate Finance, Leasing, Residential and Consumer Lending. Mr. Berey joined People’s United in 1992 as a C&I relationship manager and was promoted in 1995 to Hartford regional manager for C&I lending. In 1999, he was promoted to manage Business Banking and Cash management services. In 2001, he became Senior Vice President; Head of C&I Lending and in 2011 was promoted to his current position. Prior to People’s United, Berey spent two-and-a-half years with First Constitution Bank in New Haven, where he managed a loan production office and a loan workout group. Before joining First Constitution, he was with Bank of Boston CT for over seven years in various commercial lending roles. Mr. Berey earned a B.A. in Economics from Trinity College in Hartford, Connecticut and M.B.A. from the University of New Haven.

|

|

|

David Berey

Age 59 Executive Vice President, Chief Credit Officer

| ||||

|

Kristy Berner is Executive Vice President, General Counsel and Corporate Secretary. She joined the Company in September, 2018 and is responsible for the direction and management of the legal operation and legislative affairs. Ms. Berner has spent more than half of her career as in-house counsel to financial institutions. Beginning in 2012, she served as General Counsel and Corporate Secretary of First Niagara Bank until it was acquired by KeyCorp in 2016. Following the acquisition, she joined KeyCorp and served as Deputy General Counsel and Assistant Corporate Secretary until joining the Company in 2018. Ms. Berner holds a bachelor’s degree in Psychology and Political Science, an M.B.A. and a Juris Doctor from the State University of New York Buffalo. She is a member of the New York bar.

|

Kristy Berner

Age 45 Executive Vice President, General Counsel and Corporate Secretary

| |||||||

|

Michael Boardman joined the Company as Executive Vice President, Head of Wealth Management in January 2020. In this position, he is responsible for strategic oversight and management of the Bank’s Wealth Management Groups, including People’s United Advisors—the registered investment advisor of People’s United Bank—and Private Banking and Institutional Asset Management. Mr. Boardman brings more than 30 years’ experience to People’s United at large banks and financial institutions. Prior to joining People’s United, Mr. Boardman was Executive Vice President, Head of U.S. Wealth Management for HSBC. Prior to that, he served as Chief Executive Officer of Chase Wealth Management, and before that, in similar senior leadership roles at U.S. Bank and Charles Schwab. Mr. Boardman received a B.A. in Economics from Middlebury College and earned his M.B.A. from Columbia University.

|

Michael Boardman

Age 56 Executive Vice President, Head of Wealth Management

| |||||||

|

|

Mark Herron is Executive Vice President, Chief Marketing Officer. He is responsible for the strategic positioning of the Company and overseeing enterprise-wide marketing, digital and social media, customer research, data analytics, our website www.peoples.com and corporate communications. Mr. Herron has over 30 years of experience in marketing positions. He joined People’s United Bank in 2016 from BB&T Corporation, in Winston-Salem, NC where he last served as Executive Vice President, Enterprise Sales Manager. At BB&T, he was chiefly responsible for sales and service processes, marketing analytics and marketing automation. Mr. Herron received a B.S. in Business Administration, Marketing from East Carolina University.

|

|

|

Mark Herron

Age 61 Executive Vice President, Chief Marketing Officer

| ||||

Notice and 2020 Proxy Statement 21

Executive Officers Who Are Not Directors

|

|

Sara M. Longobardi is Senior Executive Vice President, Retail Banking. She is responsible for our branch network and residential and consumer lending areas as well as for ensuring the overall customer experience. From 2004 until April 2014, she served as senior vice president for Customer Relationship Development in the Retail and Business Banking division, where she developed, implemented and managed the strategy to drive the expansion and retention of profitable customer relationships. Ms. Longobardi joined People’s United in 1991. Ms. Longobardi holds a B.S. in Finance from the University of Illinois.

|

|

|

Sara M. Longobardi

Age 56 Senior Executive Vice President, Retail Banking

| ||||

|

David K. Norton has been a Senior Executive Vice President and Chief Human Resources Officer since October 2009 and is responsible for all human resources functions. Prior to joining People’s United, Mr. Norton was a Senior Vice President, Human Resources at The New York Times Co. since 2006. For more than five years prior to that date, Mr. Norton was employed as the Executive Vice President, Human Resources by Starwood Hotels and Resorts. He holds a B.A. in Business Administration from Michigan State University and completed the Advanced Management Program at Northwestern University.

|

David K. Norton

Age 64 Senior Executive Vice President and Chief Human Resources Officer

| |||||||

|

Lee C. Powlus has been a Senior Executive Vice President and Chief Administrative Officer since May 2011. He has oversight of Information Technology, Project Management, Information Security, Operations and eBusiness, Business Services and Real Estate Services. Mr. Powlus, who joined People’s United in 2008, previously served as Executive Vice President and Chief Administrative Officer since September 2010. Before joining the Company, he served as Director of Information Technology for Chittenden Corporation. Mr. Powlus received his M.B.A. and bachelor’s degree from the University of Vermont.

|

Lee C. Powlus

Age 59 Senior Executive Vice President and Chief Administrative Officer

| |||||||

|

Daniel G. Roberts is Executive Vice President and Chief Risk Officer since 2018. He is responsible for overall risk management, including the compliance, loan review and operational risk functions. Most recently, Mr. Roberts was the Chief Auditor at People’s United, the role he held since joining the company in 2012. Prior to joining People’s United, he spent 27 years at Citigroup. There, he held roles as Managing Director and Chief Auditor in multiple division and global roles that included: Global Consumer Businesses, Global Compliance/AML, Global Basel Capital Management, and Global Audit Re-engineering. In addition, Mr. Roberts held domestic and international roles in consumer business management, regulatory compliance, credit loan review, credit, risk management and operational re-engineering. Mr. Roberts is a graduate of Gettysburg College where he received his bachelor of science in Accounting. |

Daniel G. Roberts

Age 60 Executive Vice President and Chief Risk Officer | |||||||

22 People’s United Financial, Inc.

Executive Officers Who Are Not Directors

|

R. David Rosato is Senior Executive Vice President and Chief Financial Officer (CFO). Mr. Rosato has been CFO of People’s United Bank since April 2014 and CFO of People’s United Financial, Inc. since January 2015. Mr. Rosato joined People’s United in 2007 as Senior Vice President and Treasurer responsible for all treasury functions including interest-rate risk management and modeling, fixed income portfolio management, derivative activities, capital management, as well as wholesale funding and liquidity. Prior to joining People’s United, he was Treasurer at Webster Financial Corp. Mr. Rosato earned both his M.B.A. and a bachelor’s degree in business and economics from The University of Maryland and is a Chartered Financial Analyst.

|

R. David Rosato

Age 58 Senior Executive Vice President and Chief Financial Officer

| |||||||

|

Jeffrey J. Tengel is President of People’s United Financial, Inc. and People’s United Bank. He joined People’s United in February 2010 and served as Senior Executive Vice President, Commercial Banking until he was promoted to President in May 2018. As President, he has responsibility for Commercial Banking, Retail Banking and Wealth Management. Prior to joining People’s United, Mr. Tengel was an Executive Vice President at PNC Financial Services Group since January 2009 and previously at National City Corporation. Mr. Tengel holds a bachelor’s degree from Marquette University and received his M.B.A. from Case Western Reserve University.

|

Jeffrey J. Tengel

Age 57 President

| |||||||

Notice and 2020 Proxy Statement 23

Compensation of the Board of Directors is established by the Board, upon recommendation of the Compensation Committee. Directors who are employed by us or any of our affiliates are not entitled to additional compensation for board or committee service. Effective with the April 2019 Board and Committee meetings, our Board compensation was revised and those retainer fees are reflected in the table below. The non-employee directors receive compensation according to the following table:

| Annual Compensation: Board, Lead Director and Committee Chairs: |

Annual Retainers: | |||

| Directors’ Cash Retainer (all members) |

$ | 94,000 | ||

| Directors’ Annual Equity Compensation (all members) |

95,000 | |||

| Additional Lead Director Compensation |

165,000 | |||

| Additional Committee Chairperson Compensation: |

||||

| Audit Committee |

$ | 20,000 | ||

| Enterprise Risk Committee |

20,000 | |||

| Compensation Committee |

20,000 |

24 People’s United Financial, Inc.

The following table sets forth information relating to the compensation of our directors during 2019. Amounts shown in the table include compensation paid to the named individuals as directors of the Bank.

Director Compensation(1)

|

Fees Earned or Paid in Cash ($)(2) |

Stock Awards ($)(3) |

Total ($) | |||||||||||||

| Collin P. Baron |

$ | 94,000 | $ | 95,138 | $ | 189,138 | |||||||||

| Kevin T. Bottomley |

94,000 | 95,138 | 189,138 | ||||||||||||

| George P. Carter |

259,000 | 95,138 | 354,138 | ||||||||||||

| Jane Chwick |

94,000 | 95,138 | 189,138 | ||||||||||||

| William F. Cruger, Jr. |

114,000 | 95,138 | 209,138 | ||||||||||||

| John K. Dwight |

114,000 | 95,138 | 209,138 | ||||||||||||

| Jerry Franklin |

94,000 | 95,138 | 189,138 | ||||||||||||

| Janet M. Hansen |

94,000 | 95,138 | 189,138 | ||||||||||||

| Nancy McAllister |

94,000 | 95,138 | 188,138 | ||||||||||||

| Mark W. Richards |

114,000 | 95,138 | 209,138 | ||||||||||||

| (1) | The columns disclosing option awards, non-equity incentive plan compensation, all other compensation and changes in pension value and nonqualified deferred compensation earnings have been omitted from the table because no director earned any compensation during 2019 of a type required to be disclosed in those columns. |

| (2) | Includes annual cash retainer and Committee chair retainer (if applicable). |

| (3) | Reflects grant-date value ($16.31 per share) of 5,834 shares awarded on May 16, 2019, pursuant to the Directors’ Equity Compensation Plan, to each director. |

Notice and 2020 Proxy Statement 25

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following table sets forth information as of March 27, 2020 with respect to beneficial ownership of our common stock by any person or group as defined in Section 13(d)(3) of the Securities Exchange Act of 1934 who is known by us to be the beneficial owner of more than five percent of the common stock.

| Name and Address of Beneficial Owners |

Number of Shares; Nature of Beneficial Ownership(1) |

Percent of Common Stock Owned(2) |

||||||

| BlackRock, Inc. 55 East 52nd Street New York, NY 10055 |

40,072,743(3) | 9.4% | ||||||

| State Street Corporation State Street Financial Center One Lincoln Street Boston, MA 02111 |

49,426,116(4) | 11.6% | ||||||

| The Vanguard Group, Inc. 100 Vanguard Boulevard Malvern, PA 19355 |

51,228,595(5) | 12.1% | ||||||

| (1) | Based on information in the most recent Schedule 13D or 13G filed with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, unless otherwise indicated. |

| (2) | Shares reported as owned as of the date indicated on the Schedule as filed, expressed as a percentage of shares outstanding as of March 27, 2020. |

| (3) | BlackRock, Inc. reports having sole voting power with respect to 35,394,077 of these shares, and sole dispositive power with respect to all of these shares. |

| (4) | State Street Corporation reports having shared voting power with respect to 47,170,032 of these shares and shared dispositive power with respect to 49,426,116 of these shares. |

| (5) | The Vanguard Group, Inc. reports having sole voting power with respect to 688,303 of these shares, shared voting power with respect to 118,948 of these shares, sole dispositive power with respect to 50,493,310 of these shares, and shared dispositive power with respect to 735,285 of these shares. |

We do not know of any other person who is the beneficial owner of more than 5% of our common stock as of the specified date.

26 People’s United Financial, Inc.

STOCK OWNERSHIP GUIDELINES FOR DIRECTORS

AND EXECUTIVE OFFICERS

Security Ownership of Management

The following table sets forth, as of March 27, 2020, the beneficial ownership of common stock and preferred stock by each director, each nominee for election as a director, each named executive officer (as defined below) who is not also a director, and by all directors and executive officers as a group. Except as indicated in the notes following the table, each person has sole voting and investment power with respect to the shares listed as being beneficially owned by such person.

| Common Stock | Series A Preferred Stock | |||||||||||||||||||

|

Amount and Nature of Beneficial Ownership(d) |

Percent of Class |

Amount and Nature of Beneficial Ownership(e) |

Percent of Class |

|||||||||||||||||

| Directors and Nominees |

||||||||||||||||||||

| John P. Barnes |

|

3,094,471 |

|

|

0.7 |

% |

|

— |

|

|

— |

| ||||||||

| Collin P. Baron |

|

249,295 |

|

|

* |

|

— |

|

|

— |

| |||||||||

| Kevin T. Bottomley |

|

148,855 |

|

* |

|

2,000 |

|

* |

||||||||||||

| George P. Carter |

|

195,322 |

|

* |

|

— |

|

|

— |

| ||||||||||

| Jane Chwick |

|

11,002 |

|

* |

|

— |

|

|

— |

| ||||||||||

| William F. Cruger, Jr. |

|

35,248 |

|

* |

|

— |

|

|

— |

| ||||||||||

| John K. Dwight(a) |

|

205,469 |

|

* |

|

— |

|

|

— |

| ||||||||||

| Jerry Franklin |

|

99,151 |

|

* |

|

— |

|

|

— |

| ||||||||||

| Janet M. Hansen |

|

146,709 |

|

* |

|

— |

|

|

— |

| ||||||||||

| Nancy McAllister |

|

40,434 |

|

* |

|

8,000 |

|

* |

||||||||||||

| Mark W. Richards(a) |

|

212,799 |

|

* |

|

8,000 |

|

* |

||||||||||||

| Kirk W. Walters(b) |

|

1,233,352 |

|

* |

|

40,000 |

|

* |

||||||||||||

| Named Executive Officers Who Are Not Directors(c) |

||||||||||||||||||||

| Lee C. Powlus |

|

864,772 |

|

* |

|

— |

|

|

— |

| ||||||||||

| R. David Rosato |

|

694,984 |

|

|

* |

|

3,232 |

|

|

* |

| |||||||||

| Jeffrey J. Tengel |

|

680,030 |

|

* |

|

— |

|

|

— |

| ||||||||||

| All Directors, Nominees and Executive

Officers |

|

9,274,434 |

|

2.2 |

% |

|

61,232 |

|

0.6 |

% | ||||||||||

| * | Denotes beneficial ownership of less than one-half of one percent of the outstanding shares of common stock or preferred stock. |

Notice and 2020 Proxy Statement 27

Stock Ownership Guidelines for Directors and Executive Officers

| (a) | Does not include additional shares of common stock owned by a non-qualified benefit trust for the benefit of Messrs. Dwight (68,330 shares) and Richards (96,552 shares) with respect to which the named directors have neither investment nor voting authority. |

| (b) | Common stock total includes shares held in entities owned by trusts in which Mr. Walters is a trustee. |

| (c) | The named executive officers consist of (1) the Chief Executive Officer (Mr. Barnes) and the Chief Financial Officer (Mr. Rosato), and (2) the three most highly compensated executive officers of the Company (Messrs. Powlus, Tengel and Walters) other than the Chief Executive Officer and Chief Financial Officer who were serving as executive officers at December 31, 2019. Mr. Walters is listed above because he is also a nominee for director. |

| (d) | Does not include performance share awards granted in 2019, which are discussed later in this proxy statement under the Compensation Discussion and Analysis section and as listed in the Executive Compensation Tables. Does include performance shares granted in 2017 that vested on March 1, 2020, as discussed in this proxy statement under the Compensation Discussion and Analysis section. |

| (e) | Applicable percentage ownership of preferred stock is based on 10,000,000 shares of Series A preferred stock outstanding as of March 27, 2020. |

Stock ownership totals include shares of common stock that are: subject to forfeiture if certain conditions are not satisfied (Column A); held indirectly through benefit plans (Column B); or subject to acquisition whether upon the exercise of stock options or otherwise within 60 days from March 27, 2020 (Column C), as follows:

| A | B | C | ||||||||||

| Directors: |

||||||||||||

| John P. Barnes |

|

85,025 |

|

9,654 |

|

|

2,461,068 |

|||||

| Collin P. Baron |

|

5,834 |

|

— |

|

|

— |

| ||||

| Kevin T. Bottomley |

|

5,834 |

|

— |

|

|

— |

| ||||

| George P. Carter |

|

5,834 |

|

— |

|

|

— |

| ||||

| Jane Chwick |

|

5,834 |

|

— |

|

|

— |

| ||||

| William F. Cruger, Jr. |

|

5,834 |

|

— |

|

|

— |

| ||||

| John K. Dwight |

|

5,834 |

— | — | ||||||||

| Jerry Franklin |

|

5,834 |

|

— |

|

|

— |

| ||||

| Janet M. Hansen |

|

5,834 |

|

— |

|

|

— |

| ||||

| Nancy McAllister |

|

5,834 |

|

— |

|

|

— |

| ||||

| Mark W. Richards |

|

5,834 |

|

— |

|

|

— |

| ||||

| Kirk W. Walters |

|

15,295 |

|

11,683 |

|

913,991 |

||||||

| Named Executive Officers Who Are Not Directors: |

||||||||||||

| Lee C. Powlus |

|

16,567 |

|

6,783 |

|

730,302 |

||||||

| R. David Rosato |

|

16,432 |

|

4,415 |

|

581,534 |

||||||

| Jeffrey J. Tengel |

|

21,016 |

|

3,226 |

|

516,781 |

||||||

| All Directors, Nominees and Executive

Officers as a Group |

|

311,831 |

|

135,050 |

|

6,190,427 |

||||||

28 People’s United Financial, Inc.

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Discussion and Analysis Table of Contents

The contents of the Compensation Discussion and Analysis are organized as follows:

This section includes information about our executive compensation practices, and includes information about compensation paid to our executives by our subsidiaries and affiliates, including our named executive officers (“NEOs”) who appear in the Summary Compensation Table. Our NEOs are:

Named Executive Officers

| • John P. Barnes, Chairman and Chief Executive Officer

• Lee C. Powlus, Senior Executive Vice President and Chief Administrative Officer

• R. David Rosato, Senior Executive Vice President and Chief Financial Officer

|

• Jeffrey J. Tengel, President

• Kirk W. Walters, Senior Executive Vice President, Corporate Development and Strategic Planning |

Notice and 2020 Proxy Statement 31

Compensation Discussion and Analysis

|

| |

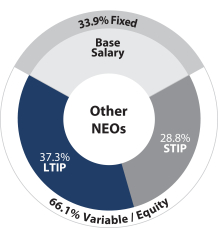

2019 was a noteworthy year for the company. We reported operating earnings of $552 million or $1.39 per common share, a year-over-year increase of 6%. The company has taken specific actions to enhance financial performance, such as the closing of three successful acquisitions, enhancements in our suite of banking technology and the strengthening of our core capabilities. The result of these efforts was an increase in our net interest margin, improvement in operating leverage and increases in profitability metrics. Financial highlights for 2019 included:

For the year, the company had strong financial performance. Our executives’ compensation is closely aligned with our performance, and our incentive compensation payouts for 2019 reflected our performance over the past year.

32 People’s United Financial, Inc.

Compensation Discussion and Analysis

For 2019, direct compensation for our NEOs was comprised of the following elements:

|

Base Salary

|

Short-Term Incentive Plan

|

Performance Share Units

|

Stock Options

|

Restricted Stock

| ||||||

| Participants |

| |||||||||

| Purpose | Provide competitive compensation opportunities to reward, motivate and retain | |||||||||

| Competitive | Pay for Short-Term Performance

|

Pay for Long-Term Performance

| ||||||||

|

Aligned with Shareholder Interests

| ||||||||||

| Fixed / Variable

|

Fixed

|

| ||||||||

| Type of Performance

|

|

| ||||||||

| Time Horizon

|

Ongoing

|

1 Year

|

3-Year Performance Period

|

3 Year Vest 10 Year Life

|

3 Year Vest

| |||||

| Form

|

|

| ||||||||

| Timing of Payment / Grant

|

Ongoing

|

In March for prior year |

| |||||||

| Most recent performance measures

|

N/A

|

Combination of EPS and various individual goals

|

Net Income ROATCE Relative TSR |

Share price appreciation

Share price appreciation

| ||||||

Payout of 2019 Short Term Incentive Plan Awards.

Funding for organization-wide payouts under the Short Term Incentive Plan for 2019 was based on the achievement against a pre-established operating EPS goal of $1.36. With an operating EPS result of $1.39, the incentive payout pool was funded at 105%(1). After the overall incentive plan funding was determined, each individual executive’s payout was finalized to reflect performance against his or her individual goals. The table below outlines key information on our Short-Term Incentive Plan and the range of incentive payouts for the NEOs.

| 2019 STIP Funding Range | ||||||||||||||||||

| Performance Metric for Plan Funding |

Level of Achievement |

EPS | Funding Payout(1) |

Actual Result |

Funding | Determining NEO Incentive Payout |

Range of NEO Incentive Opportunity |

Incentive Payouts as % of NEO Targets | ||||||||||

| Operating EPS |

|

Maximum Target Threshold |

|

$1.63 $1.36 $1.09 |

150% 100% 50% |

$1.39 | 105% | 1) Plan funding 2) Individual performance against goals |

0 - 200% | 105% - 122% | ||||||||

| (1) | For achievement between threshold and target and target and maximum, funding payout is determined based on linear interpolation. |

Payout of 2017 Performance Share Awards.

On February 16, 2017, each NEO received a grant of performance shares as part of his or her long-term incentive opportunity under the 2014 Long-Term Incentive Plan. The NEO could earn between 0% and 150% of the performance shares based on the achievement of the performance metrics over the performance time period of January 1, 2017 through December 31, 2019.

On January 15, 2020, the Compensation Committee reviewed the performance against the performance metrics, and approved the funding described below in the table. The funding for performance shares for the 2017-2019 performance period was based on the company’s achievement against pre-established goals for Net Income, Return on Average Tangible Common Equity (ROATCE), and relative Total Shareholder Return (TSR) over the performance period. The performance metrics used were:

| • | Net Income: Average annual percentage change in Net Income over performance period, compared to a designated target percentage |

| (1) | With respect to Non-GAAP financial measures, please see the section at page 20 of our 2019 Annual Report on Form 10-K (Non-GAAP Financial Measures and Reconciliation to GAAP). |

Notice and 2020 Proxy Statement 33

Compensation Discussion and Analysis

| • | ROATCE: Average annual return on average tangible common equity over performance period, compared to a designated target percentage |

| • | TSR: The Company’s total shareholder return (TSR) relative to the TSR for a peer group of financial institutions selected by the Committee prior to or within 90 days following commencement of the performance period, excluding any peer companies that are no longer in existence at the end of the performance period |

The table below summarizes these metrics at the minimum, target and maximum levels for the 2017-2019 performance period, as well as the company’s achievement and resulting funding and payout.

| 2017-2019 Performance Share

Funding Range |

||||||||||||||||||||||||||||

| Performance Metric for Plan Funding |

Level of Achievement |

Scale | Funding Payout(1) |

Actual Result |

Funding | Weighting | Payout Result |

|||||||||||||||||||||

| Net Income |

|

Maximum Target Threshold |

|

|

9% 6% 3% |

|

|

150% 100% 50% |

|

25% | 150% | 331⁄3% | 119% | |||||||||||||||

| ROATCE |

|

Maximum Target Threshold |

|

|

11% 9% 7% |

|

|

150% 100% 50% |

|

14% | 150% | 331⁄3% | ||||||||||||||||

| Relative TSR |

|

Maximum Target Threshold |

|

|

80th 50th 20th |

|

|

150% 100% 50% |

|

|

25th percentile |

|

58% | 331⁄3% | ||||||||||||||

| (1) | For achievement between threshold and target and target and maximum, funding payout is determined based on linear interpolation. |

Each of the NEOs received performance shares under the 2014 Long-Term Incentive Plan, and based on the above results and funding, each Named Executive Officer earned 119% of the shares granted in 2017, which shares vested on March 1, 2020.

See “Committee Actions Affecting 2019 Compensation – Rating Past Performance” for more information regarding 2019 STIP payouts to our NEOs, including individual goals for each executive.

34 People’s United Financial, Inc.

Compensation Discussion and Analysis

Our compensation program reflects the following principles:

| What We Do | ||||||

|

Pay for Performance. A majority of each senior executive’s target compensation is at risk. Actual compensation is dependent on company-wide and individual performance. |

||||||

| Balanced Approach. The at-risk portion of our senior executives’ compensation is appropriately balanced to encourage them to consider the impact their decisions have over both short and long-term time horizons. | ||||||

| Stock Ownership Guidelines. We have adopted guidelines for stock ownership by our senior executive officers. See “Stock Ownership Guidelines for Directors and Executive Officers” for more detail. | ||||||

| Clawback Provisions. Our short and long-term incentive plans allow us to recoup incentive compensation paid to an executive if circumstances warrant. We have adopted an incentive clawback policy aligned with proposed SEC regulations. | ||||||

| “Double Trigger” for Change in Control Benefits. Our Change in Control agreements have a “double trigger,” meaning that an executive must experience a qualifying termination event after occurrence of a change in control to receive severance benefits. In addition, there is a “double trigger” provision in our stock plan documents. | ||||||

| Compensation-Related Risk. On an annual basis, the Company’s Chief Risk Officer oversees a risk assessment of the Company’s incentive compensation programs. | ||||||

| Peer Group Review. To ensure that the peer group continues to be a valid reference point for making executive compensation decisions, the Compensation Committee reviews the composition of the peer group annually and makes adjustments as needed. In October 2018, the company reevaluated and updated the peer group for compensation decisions made in 2019. | ||||||

| Independent Consultant. The Compensation Committee retains an independent compensation consultant to provide expertise and information about competitive trends in the employment marketplace, including established and emerging compensation practices at other companies. | ||||||

| Minimum Vesting Requirements. There is a minimum of at least one-year vesting of all awards with no exceptions other than a Change in Control, death/disability or a maximum 5% award carve-out. | ||||||

| Dividend Equivalent Payout/Vesting. The payout of dividends or dividend equivalents is now subject to the same vesting and performance conditions of the underlying award. | ||||||

| What We Don’t Do | ||||||

|

Excise Tax Gross-Ups. There are no excise tax gross-ups on change in control benefits. |

||||||

| Employment Agreements. We do not have any employment agreements with any of our senior executives. | ||||||

| Stock Option Practices. We do not grant discounted stock options, and we do not reprice or backdate stock options. Repricing through substitution of awards is specifically prohibited. | ||||||

| Pledging and Hedging. Senior executives are prohibited from engaging in pledging and hedging activities. See “Governance Principles and Related Matters – Prohibition on Hedging and Pledging” for more detail. | ||||||

Notice and 2020 Proxy Statement 35

Compensation Discussion and Analysis

| Chief Executive Officer | • Regularly participates in the Committee’s compensation-setting process

• Provides information about individual performance assessments for the other named executive officers

• Expresses to the Committee his view on the appropriate levels of compensation for the other named executive officers for the ensuing year

• Makes recommendations, but does not have a vote in the Committee’s decision-making process

• Does not attend those portions of Committee meetings during which his performance is evaluated (except to present his self-evaluation to the Committee) or his compensation is being determined | |||

| Chief Human Resources Officer |

• Attends the Committee meetings to provide insight into the organization’s executive compensation programs and incentive plans

• Provides updates on the organization’s benefit and retirement programs, as well as other Human Resources policies | |||

| Chief Financial Officer | • May participate to a limited extent in connection with the establishment of financially-driven performance goals | |||

| Chief Risk Officer | • Participates in at least one meeting annually to discuss the assessment of risk in the design and execution of the compensation programs | |||

| Senior EVP, Corporate Development and Strategic Planning |

• Participates in at least one meeting annually to discuss the Company’s peer group |

36 People’s United Financial, Inc.

Compensation Discussion and Analysis

Notice and 2020 Proxy Statement 37

Compensation Discussion and Analysis

38 People’s United Financial, Inc.

Compensation Discussion and Analysis

Notice and 2020 Proxy Statement 39

Compensation Discussion and Analysis

40 People’s United Financial, Inc.

Compensation Discussion and Analysis

Notice and 2020 Proxy Statement 41

Compensation Discussion and Analysis

From that list, banks were removed from consideration if they were too large or small, had significant insider ownership, had different business models, or operated in unique geographies. Using these criteria and objectives, in October 2018, the Committee approved the following changes to the peer group to be used in 2019:

| 2018 Peer Group | Additions | 2019 Peer Group | ||||||

|

Associated Banc-Corp. Citizens Financial Group, Inc. Comerica Inc. Cullen/Frost Bankers, Inc. East West Bancorp First Horizon National Corp Huntington Bancshares Inc. KeyCorp M&T Bank Corp. New York Community Bancorp, Inc. Signature Bank Synovus Financial Corp. Umpqua Holdings Corporation Webster Financial Corp. Zions Bancorporation

|

BankUnited, Inc. F. N. B . Corporation Sterling Bancorp Valley National Bancorp |

Associated Banc-Corp. BankUnited, Inc. Citizens Financial Group, Inc. Comerica Inc. First Horizon National Corp F. N. B. Corporation Huntington Bancshares Inc. KeyCorp M&T Bank Corp. New York Community Bancorp, Inc. Signature Bank Sterling Bancorp Valley National Bancorp Webster Financial Corp. Zions Bancorporation

| ||||||

| Subtractions | ||||||||

|

Cullen/Frost Bankers, Inc. East West Bancorp Synovus Financial Corp. Umpqua Holdings Corporation

|

42 People’s United Financial, Inc.

Compensation Discussion and Analysis

The CNGC compared its preliminary compensation decisions for the four named executive officers with the benchmark data to ensure that those preliminary decisions did not deviate significantly from market practice.

The target value of the four named executive officers’ direct compensation packages, as established by the CNGC for 2019 following the steps outlined above and based on equity valuation assumptions as of a date reasonably close to the Committee’s action, each fell within the second or third quartile for direct compensation paid to executive officers performing similar duties within the relevant market comparisons.

The target value of each named executive officer’s 2019 direct compensation, and the percentage change from the target value of each officer’s 2018 direct compensation is as follows:

| Total Direct Compensation |

% change |

|||||||

| Mr. Barnes |

$ | 5,078,649 | 4.8 | % | ||||

| Mr. Powlus |

$ | 1,466,302 | 2.5 | % | ||||

| Mr. Rosato |

$ | 1,454,290 | 2.5 | % | ||||

| Mr. Tengel |

$ | 1,860,000 | 22.8 | % | ||||

| Mr. Walters |

$ | 1,489,082 | 2.5 | % | ||||

After establishing the target value for the overall direct compensation packages for Mr. Barnes and the other four named executive officers, the CNGC made detailed determinations for each element of those packages in order to arrive at the desired overall result for each officer. Detailed information regarding the components of each named executive officer’s 2019 direct compensation package and the percentage change from the target value of each component of 2018 direct compensation packages is as follows:

| Base Salary |

% change |

STIP Bonus Target |

% change |

Long-Term Incentive Target |

% change |

|||||||||||||||||||

| Mr. Barnes |

$ | 1,104,054 | 2.5 | % | $ | 1,104,054 | 2.5 | % | $ | 2,870,541 | 6.6 | % | ||||||||||||

| Mr. Powlus |

$ | 505,621 | 2.5 | % | $ | 404,497 | 2.5 | % | $ | 556,184 | 2.5 | % | ||||||||||||

| Mr. Rosato |

$ | 501,479 | 2.5 | % | $ | 401,183 | 2.5 | % | $ | 551,627 | 2.5 | % | ||||||||||||

| Mr. Tengel |

$ | 600,000 | 18.9 | % | $ | 540,000 | 33.7 | % | $ | 720,000 | 18.9 | % | ||||||||||||

| Mr. Walters |

$ | 513,476 | 2.5 | % | $ | 462,129 | 2.5 | % | $ | 513,476 | 2.5 | % | ||||||||||||

Notice and 2020 Proxy Statement 43

Compensation Discussion and Analysis

44 People’s United Financial, Inc.

Compensation Discussion and Analysis

Notice and 2020 Proxy Statement 45

Compensation Discussion and Analysis

Each of the named executive officers is a member of the management committee and has a broad range of responsibilities, which include providing leadership and collaboration across business lines in order to positively impact the overall results of the Company. In addition to the individual objectives identified below, each is charged with ensuring compliance with all regulatory requirements, including BSA/AML. For 2019, the performance goals for our named executive officers were as follows:

Summary of 2019 Objectives and Results

|

John P. Barnes

Mr. Barnes leads the strategic direction of People’s United. For 2019, he was responsible for overseeing the Company’s efforts to drive revenue, grow loans and deposits, increase fee revenue, control expenses and improve asset quality. |

2019 Results. Under Mr. Barnes’ direction, the Company grew loans and deposits, strengthened fee businesses, implemented various technology enhancements and furthered progress on customer development and penetration initiatives. Company results for the year included:

• Operating EPS of $1.39 per common share (6% increase)

• 15% increase in total revenues

• 14% increase in net interest income

• 24% increase in total loans

• 21% increase in total deposits

• 160 basis point improvement in efficiency ratio

• Best in class asset quality

• Net loan charge-offs of 0.06%, compared to 0.07% in 2018

• Completed the acquisition of BSB Bancorp, the holding company of Belmont Savings Bank.

• Acquired VAR Technology Finance, a Mesquite, Texas-based nationwide provider of equipment financing to suppliers and vendors primarily in the technology industry.

• Completed the acquisition of United Financial Bancorp Inc., the holding company of United Bank

• Focused on digitalization for both client facing applications and back-office processes

• Launched and continued to build out additional Commercial Banking specialties such as Healthcare Finance, Franchise Finance, Fund Banking, Nonprofit Finance and the Lender Finance practice within the ABL group.

• Successfully divested non-core businesses in order to ensure operational efficiency and focus resources on key growth areas

|

|||||||

46 People’s United Financial, Inc.

Compensation Discussion and Analysis

|

Lee C. Powlus

Mr. Powlus directs the Administrative Services Division with oversight of Information Technology, Project Management, Information Security, Operations and eBusiness, Business Services and Real Estate Services. He was responsible for managing a significant portion of the Company’s total operating expense budget. For 2019, Mr. Powlus’ goals were to maintain stable technology platforms with sufficient scale to meet our growth objectives, control expenses, and execute on a variety of initiatives, projects and product launches. |

2019 Results. Mr. Powlus’ strong leadership resulted in improvements in operational efficiencies, continued expense control efforts and various technological upgrades.

• Operating EPS of $1.39 per common share (6% increase)

• 160 basis point improvement in efficiency ratio

• Continued to develop infrastructure, analyze current processes, and implement procedural or policy changes to improve operations

• Re-negotiated major vendor agreements

• Oversaw various system enhancements and upgrades, including strengthening cyber security

• Identified, evaluated and executed on opportunities for site consolidations

• Completed the conversion of First Connecticut Bancorp Inc.’s core system to People’s United’s core system

• Successfully integrated VAR Technology Finance into LEAF Commercial Capital, Inc.

• Successfully completed the integration and conversion of BSB Bancorp, the holding company of Belmont Savings Bank

• Planned the integration and conversion of United Financial Bancorp Inc., the holding company of United Bank

• Successfully transitioned non-core business divestitures

• Focused on digitalization for both client facing applications and back-office processes

|

|||||||

|

R. David Rosato

Mr. Rosato directs the organization’s overall financial policies, and oversees all financial functions including accounting, investor relations, treasury, tax, budget and corporate finance. For 2019, Mr. Rosato’s goals included achieving the Company’s EPS target, growing revenue, controlling expenses, increasing deposits and completing various projects. |

2019 Results. Mr. Rosato’s leadership was critical to the Company’s strong financial results. He remained focused on revenue and deposit growth, as well as expense control, by partnering with the business lines.

• Operating EPS of $1.39 per common share (6% increase)

• Successfully completed the acquisitions of VAR Technology Finance, BSB Bancorp, and United Financial Bancorp Inc.

• 15% increase in total revenues

• 21% increase in total deposits

• 160 basis point improvement in efficiency ratio

• Enhanced analyst and investor relationships

• Continued build-out of the stress testing and modeling groups

• Successfully divested non-core businesses in order to ensure operational efficiency and focus resources on key growth areas

|

|||||||

Notice and 2020 Proxy Statement 47

Compensation Discussion and Analysis

|

Jeffrey J. Tengel

As President, Mr. Tengel leads the full complement of business lines at People’s United, with enterprise-level responsibility for Commercial Banking Division, Retail Banking, and Wealth Management. Previously, Mr. Tengel was responsible for the Commercial Banking division, including Commercial and Industrial lending, Commercial Real Estate Finance and all leasing activities, as well as People’s United Insurance Agency, Inc.

His goals included revenue, fee, loan and deposit growth, expense control and continued asset quality improvement. |

2019 Results. Mr. Tengel led Commercial Banking to strong performance in 2019, as exhibited by the following:

• Operating EPS of $1.39 per common share (6% increase)

• 15% increase in total revenues

• 14% increase in net interest income

• 24% increase in total loans

• 21% increase in total deposits

• 160 basis point improvement in efficiency ratio

• Best in class asset quality

• Net loan charge-offs of 0.06%, compared to 0.07% in 2018

• Successfully integrated First Connecticut Bancorp and BSB Bancorp

• Successfully integrated VAR Technology Finance into LEAF Commercial Capital, Inc..

• Successfully acquired United Financial Bancorp Inc., the holding company of United Bank

• Focused on digitalization for both client facing applications and back-office processes

• Launched and continued to build out additional Commercial Banking specialties such as Healthcare Finance, Franchise Finance, Fund Banking, Nonprofit Finance and the Lender Finance practice within the ABL group