SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

| Filed by the Registrant o | ||

Filed by a Party other than the Registrant ý |

||

Check the appropriate box: |

||

ý |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

o |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-12 |

|

The Mills Corporation |

||||

(Name of Registrant as Specified In Its Charter) |

||||

Gazit-Globe Ltd., Chaim Katzman, M G N (USA) Inc., Gazit (1995) Inc., Hollywood Properties Ltd. and Gazit Canada Inc. |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

Subject To Completion, Dated November 22, 2006

ANNUAL MEETING OF STOCKHOLDERS OF

THE MILLS CORPORATION

PROXY STATEMENT

OF

GAZIT-GLOBE LTD

CHAIM KATZMAN

M G N (USA) INC.

GAZIT (1995), INC.

HOLLYWOOD PROPERTIES LTD.

GAZIT CANADA INC.

TO OUR FELLOW STOCKHOLDERS OF THE MILLS CORPORATION:

This proxy statement and the enclosed GREEN proxy card are being furnished by Gazit-Globe Ltd., Chaim Katzman, M G N (USA) Inc., Gazit (1995) Inc., Hollywood Properties Ltd., and Gazit Canada Inc. (collectively, the "Gazit Group," "we" or "us") for the purpose of soliciting revocable proxies from you, as holders of shares of common stock of The Mills Corporation ("Mills"), to be voted at the Mills 2006 annual meeting of stockholders to be held on December [ ], 2006, at [ ]:00 [ ].m. local time, at [ ].

At the annual meeting, we will seek to elect to the board of directors of Mills (the "Mills Board") a slate of five nominees, comprised of Jon N. Hagan, Keith M. Locker, Joyce Storm, Lee S. Wielansky and [ ].

This proxy statement is provided by the Gazit Group and not the Mills Board.

This proxy statement and the enclosed GREEN proxy card are first being sent or given to stockholders of Mills on or about December [ ], 2006.

The Mills Board Has Presided Over a Staggering Loss of Stockholder Value

The majority of the Mills Board has been in place for over ten years. We believe there needs to be new leadership on the Mills Board that will be accountable for its actions and that can develop a strategic plan to restore value to Mills' stockholders.

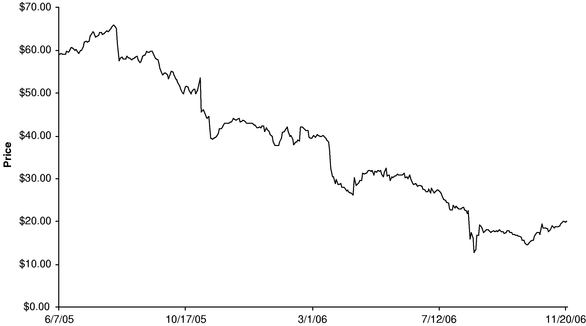

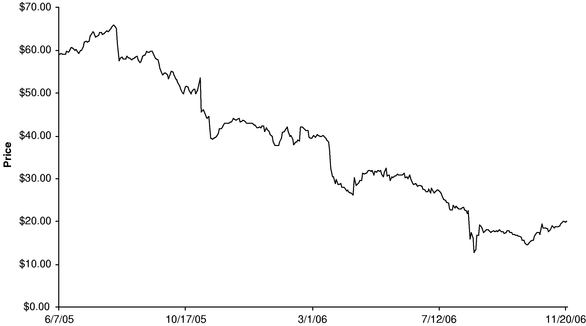

The following chart demonstrates the changes in the closing prices of Mills' common stock from June 7, 2005, the date on which Mills last held an annual meeting, to November 20, 2006.

Seventeen months have born witness to a long, steady decline in the price of the common stock, and we fear that without a coherent plan to re-tool Mills, the next seventeen months will be just as bleak for stockholders. Since the last annual meeting, Mills has experienced the following problems, among others:

As discussed below in the "Background of Our Solicitation" section, we have made a proposal to recapitalize Mills, pursuant to which we would invest up to $1.2 billion of cash in exchange for newly-issued shares of Mills common stock at a per share purchase price of $25.50.

Regardless of whether it is ultimately determined by disinterested members of the Mills Board that our recapitalization proposal—or some other proposal—is in the best interests of stockholders, we have come to believe that there needs to be new leadership on the Mills Board.

2

We believe our nominees will provide the necessary vision to help guide Mills through these difficult times and they are all independent of Mills' current management. For more information about the credentials of our nominees, please see "Proposal 1: Election of Directors."

We believe that the current Mills Board is incapable of providing the guidance necessary to offer a vision of the future that will remedy its past failures. Actions speak louder than words, and the lack of action clearly indicates a board of directors that has embraced inertia. The following highlights additional reasons why we believe there needs to be new leadership on the Mills Board and why our recapitalization proposal is an attractive option for Mills.

Mills Has an Entrenched Board with No Accountability

We Believe Our Recapitalization Proposal is a Better Alternative to an Outright Sale of Mills

3

Our Plan to Restore Value at Mills

We will look to grow Mills' business and drive stockholder value with a plan to:

IF YOU BELIEVE MILLS IS GOING IN THE WRONG DIRECTION AND NEEDS TO BE REVIVED, VOTE THE GREEN CARD FOR OUR NOMINEES TODAY.

PROPOSAL 1: ELECTION OF DIRECTORS

According to the proxy statement filed by Mills with the SEC on [ ], 2006 (the "Mills Proxy Statement."), [four/five] Class III directors are to be elected to the Mills Board at the annual meeting. We propose that Mills stockholders elect Jon N. Hagan, Keith M. Locker, Joyce Storm, Lee S. Wielansky and [ ] as directors of Mills at the annual meeting. Each nominee, if elected, would hold office for a three-year term expiring at the 2009 annual meeting of Mills stockholders. We believe that each of our nominees would be deemed "independent" under the relevant rules of the New York Stock Exchange. In addition, we believe that Messrs. Hagan and Locker and Ms. Storm qualify as "audit committee financial experts," as that term is defined by the SEC. Each of our nominees has consented to serve as a director of Mills if elected.

Set forth below are the name, age, business address, present principal occupation, employment history and directorships of publicly-held companies of each of our nominees for at least the past five years. This information has been furnished to us by the respective nominees. None of the entities referenced below is a parent or subsidiary of the Company. See Annex A for additional information about our nominees, including their beneficial ownership, purchase and sale of securities issued by Mills.

| Name |

Age |

Present Principal Occupation and Five Year Employment History |

||

|---|---|---|---|---|

| Jon N. Hagan | 59 | Mr. Hagan is currently a principal of JN Hagan Consulting, where he has been specializing in assistance with the real estate capital markets since December of 2000. From 1996 to August, 2000, Mr. Hagan was at Cadillac Fairview Corporation, one of North America's largest investors, owners and managers of commercial real estate, where he served as Executive Vice President and Chief Financial Officer. From 1992 to 1996 he was an Executive Vice President of Empire Company Limited. Prior to his employment with Empire Company Limited, Mr. Hagan was employed by Cambridge Shopping Centres Limited from 1980 to 1992, where he served in various capacities, including Vice President, Finance, Senior Vice-President, Finance, and Senior Vice-President, Corporate Group & Chief Financial Officer. Mr. Hagan is affiliated with the Institute of Chartered Accountants (Ontario and British Columbia) and the International Council of Shopping Centers. In addition, he is a Director of Bentall Capital, First Capital Realty Inc. (a publicly-traded Canadian company, which is 53% owned by Gazit-Globe Ltd.), and Teranet Inc. He is also an advisor to the Board of Jones Brown Inc., a member of the Advisory Board of Southwest Properties Limited and a Trustee of Sunrise Senior Living REIT. | ||

4

Keith M. Locker |

45 |

Mr. Locker has been President of Inlet Capital LLC, an investment and asset management firm focused on the commercial real estate industry since September 2003. In addition, Mr. Locker has been President of Global Capital Resources LLC since February 2003 and President of GCR Advisors Inc since February 2003. Together, Global Capital Resources LLC and GCR Advisors, Inc. are the Co - General Partner and Co-Advisor, respectively, to the NYLIM-GCR Fund-1 2002 L.P, which provides fixed and variable rate senior and subordinated mortgages. Mr. Locker was previously, until February 2003, a Managing Director in the Real Estate Investment Banking Group at Deutsche Bank Securities, Inc. Prior to joining Deutsche Bank in 2000, Mr. Locker was Senior Managing Director at Bear, Stearns & Co. Inc., responsible for Real Estate Investment Banking. Mr. Locker has served as a director of Glenborough Realty Trust, a publicly traded office REIT, since May 2005, where he is a member of the audit and compensation committees. Mr. Locker has been a Director of IVP Securities, LLC since March 2004. Since September 2003, he has been President and Managing Member of COP Holdings, LLC. COP's assets were focused on passive investments in nine factory retail outlet centers managed by a third party operator, which were sold in 2005. In addition, Mr. Locker has been a director of Sunstone Hotel Investors, Inc., a publicly traded hotel REIT, since May 2006 and is chairman of its audit committee. Mr. Locker is a Trustee of the National Jewish Center, ex-Associate Board member of NAREIT and Assistant Chair of the Urban Land Institute. He is also a member of the International Council of Shopping Centers, Wharton Zell Real Estate Center, the Fisher Center for Real Estate and numerous philanthropic and community organizations. He is a frequent lecturer in Real Estate at New York University. |

||

Joyce Storm |

58 |

Ms. Storm is the founder and a Principal of JSS Advisors, LLC, which was formed in 1996. JSS Advisors specializes in developing retail, entertainment and mixed-use real estate. Prior to forming JSS Advisors, Ms. Storm was Executive Vice President, Development Real Estate and Construction for Sony Theatres. From 1992 to 1995, Ms. Storm was President of the Kaplan Group, responsible for the leasing and merchandising activities of regional malls and strip centers throughout New England. Prior to her employment with the Kaplan group, Ms. Storm held the positions of Director of Development (1977 – 1987) and Senior Vice President, Leasing (1987 – 1992) for The Taubman Company. Ms. Storm is affiliated with the Urban Land Institute, where she was Chairman of the Retail Development Council. Currently, Ms. Storm is a lecturer at The Wharton School of the University of Pennsylvania and the Haas Business School, where she lectures in retail development. Previously, Ms. Storm served on the Executive Committee, Advisory Board and Placement Committees of the Wharton School of the University of Pennsylvania. |

||

5

Lee S. Wielansky |

55 |

Mr. Wielansky is Chairman and Chief Executive Officer of Midland Development Group, Inc., which focuses on the development of retail properties in the Mid-West and South-East. From November 2000 to March 2003, Mr. Wielansky served as Chief Executive Officer and President of JDN Development Company, Inc. and a director of JDN Realty Corporation through its merger with Developers Diversified Realty Corporation in 2003. He was also a founding partner and Chief Executive Officer of Midland Development Group, Inc. from 1983 through 1998 when the company was sold to Regency Centers Corporation. Mr. Wielansky also serves as a Board Member of Pulaski Bank and a member of the Board of Trustees of Acadia Realty Trust, a publicly traded REIT. Mr. Wielansky is also a member of the National Association of Corporate Directors. |

Information about the Mills' nominees may be found in the Mills Proxy Statement. There is no assurance that the Mills nominees will serve if elected with any of our nominees.

Our nominees understand that, if elected as directors of Mills, each of them will have an obligation under Delaware law to discharge his or her duties as a director in good faith, consistent with his fiduciary duties to Mills and its stockholders. We expect that our nominees will fulfill their fiduciary duties. Because we are significant stockholders of Mills, we believe our interests are aligned with all stockholders.

Our nominees will, if elected, constitute a minority of the Mills Board, at least until the 2007 annual meeting or some other change in composition of the Mills Board, such as if Mills accepted our recapitalization proposal. Accordingly, our nominees will not be able to adopt any measures without the support of at least some members of the current Mills Board. Our nominees therefore should be expected to articulate and raise their concerns about Mills' strategic direction with the rest of the Mills Board members. Our nominees would seek to work with the existing members of the Mills Board.

There can be no assurance that the actions our nominees, if elected, would improve Mills business or otherwise enhance stockholder value. Your vote to elect our nominees will have the legal effect of replacing [four/five] incumbent directors of Mills with our nominees.

We do not expect that our nominees will be unable to stand for election, but, in the event that such persons are unable to serve or for good cause will not serve, the shares represented by the enclosed GREEN proxy card will be voted for substitute nominees. In addition, we reserve the right to nominate substitute persons if Mills makes or announces any changes to its bylaws or certificate of incorporation or takes or announces any other action that has, or if consummated would have, the effect of disqualifying our nominees. In any such case, shares represented by the enclosed GREEN proxy card will be voted for such substitute nominees.

6

If you have signed the GREEN proxy card and no marking is made, you will be deemed to have given a direction to vote all the shares of Mills' common stock represented by the GREEN proxy card for each of our nominees.

WE STRONGLY RECOMMEND THAT YOU VOTE

"FOR" THE ELECTION OF OUR NOMINEES

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF MILLS' INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

According to the Mills Proxy Statement, Mills is soliciting proxies with respect to one proposal other than the election of directors. This proposal is discussed briefly below. At the annual meeting, the Mills stockholders will be asked to ratify the appointment of Ernst & Young LLP as Mills' independent registered public accounting firm for the year ended December 31, 2006. The Mills Board has [unanimously] recommended a vote for this proposal. Please refer to the Mills Proxy Statement for a detailed discussion of this proposal. We recommend that stockholders vote FOR this proposal.

If you have signed the GREEN proxy card and no marking is made, you will be deemed to have given a direction to vote all the shares of Mills' common stock represented by the GREEN proxy card for this proposal.

BACKGROUND OF THE SOLICITATION

On February 23, 2006, Mills announced that the Mills Board had decided to explore strategic alternatives to enhance stockholder value and that such alternatives might include a sale of all or part of Mills or a recapitalization. Mills also announced that it had hired Goldman, Sachs & Co. and J.P. Morgan Securities Inc. as its financial advisors to assist in this effort.

On May 3, 2006 Mills announced that it had obtained a commitment from Goldman Sachs Mortgage Company, an affiliate of Goldman Sachs & Co., to provide it with financing of up to $2.23 billion, which consisted of a senior term loan of up to approximately $1.484 billion and first-mortgage facilities totaling approximately $746 million.

On May 23, 2006, Mills announced that on May 19, 2006 it had closed on $1.91 billion of the $2.23 billion in financing obtained from Goldman Sachs Mortgage and that the remaining portion of the financings was expected to be closed over the next several months. Mills also announced that it was seeking indications of interest from prospective buyers and investors by June 13, 2006 and that, as of May 23, 2006, it had entered into confidentiality agreements with more than 30 potential buyers and investors.

On June 15, 2006, Mills announced that it had received indications of interest "from a variety of parties" by the June 13, 2006 deadline for indications of interest and that it did not expect to make any further announcements regarding its exploration of strategic alternatives until the process was completed or abandoned.

On Aug. 14, 2006, Mills announced that it had signed a binding letter of intent to sell its interests in Vaughan Mills (Ontario, Canada), St. Enoch Centre (Glasgow, Scotland) and Madrid Xanadu (Madrid, Spain) to Ivanhoe Cambridge, Inc. for approximately $981 million, before transaction costs. According to its press release, Mills intended on applying the proceeds from the sale to pay down a portion of its senior term loan with Goldman Sachs Mortgage Company as administrative agent.

On several occasions during August through October 2006, Mr. Chaim Katzman, Chairman of the board of directors of Gazit-Globe Ltd., contacted by telephone representatives of Mills. During these discussions, and in a meeting on August 22, 2006 with Laurence C. Siegel, Mills' chairman of the Mills Board and then chief executive officer, Mr. Katzman discussed, among other things, Mills' situation and the idea of Mills being recapitalized as an alternative to its outright sale and requested that additional

7

information about Mills be made publicly available. Mr. Katzman advised that, given our significant investment in Mills' common stock and our need to retain flexibility with respect to our investment, we were unwilling to sign a confidentiality agreement that contained a standstill provision. Mr. Katzman advised that we would sign a confidentiality agreement that did not contain a standstill provision.

After further internal analysis, external discussions and further study of Mills' assets and financial situation, as stated more fully in a letter, dated September 29, 2006, from Mr. Katzman to Mr. Siegel, we submitted a non-binding indication of interest with respect to a recapitalization of Mills. Under that recapitalization proposal and subject to the terms and conditions therein, we proposed to invest new capital in exchange for newly authorized Series B common stock of Mills. We proposed to invest up to $1.2 billion of cash at a per share purchase price of $24.50, which, at the time, was a 30.7% to 43.7% premium to the 30, 60 and 90 day volume weighted average price of the common stock. The new Series B common stock would have entitled us to a majority of seats on the Mills Board and would have been convertible into Mills' common stock.

On October 12, 2006, Mr. Katzman sent a letter to Mark S. Ordan, Mills' new chief executive officer (with a copy to the Mills Board) regarding Mills' failure to file material agreements with the SEC regarding various joint ventures between Mills and affiliated and third parties, which failure Mr. Katzman believed had resulted in the marketplace not having full disclosure about material information.

On October 20, 2006, Mr. Katzman and a representative of RBC Capital Markets, our financial advisor, met with Mr. Ordan, other senior executives of Mills, and representatives of JP Morgan, Mills' financial advisor, to discuss our recapitalization proposal. Mr. Katzman and Mr. Ordan discussed various aspects of Mills' business and financial condition. In that meeting, Mr. Katzman made a number of observations as to why a recapitalization, rather than a sale, was in the best interests of Mills' stockholders, including the following:

8

Mr. Katzman also noted that, given Mills' significant upside potential, stockholders should be entitled to receive a substantial premium to our proposed $24.50 per share price if Mills were to accept a buy-out offer. This is because a recapitalization leaves Mills with the opportunity in the future to sell itself, whereas a buy-out at this time is irreversible and deprives Mills' stockholders of the opportunity to realize Mills' upside potential. Therefore, for a buy-out offer to be successful, it should be at a higher per share price than the per share price offered in a recapitalization.

Mr. Katzman urged Mills to give our recapitalization proposal more serious consideration. Mr. Ordan advised that our recapitalization proposal had been on the October 19, 2006 Mills Board meeting agenda and was being treated as a bona fide offer. Mr. Katzman requested a meeting with the Mills Board and Mr. Ordan advised that that Mills Board had formed a special committee to review Mills' strategic alternatives and that he would arrange for Mr. Katzman to meet with some or all the members of that committee the week of October 23, 2006.

Mr. Ordan expressed Mills' desire to have us enter into a confidentiality and standstill agreement with Mills as a condition to our receiving any non-public information relating to Mills. Mr. Katzman reiterated our unwillingness to enter into a standstill agreement with Mills. Mr. Katzman also noted that there is no legal requirement for Mills to insist on a standstill in exchange for allowing a stockholder or bidder to review non-public information and that he believed that Mills' insistence on such a requirement, in the context of a bona fide proposal from a significant stockholder, was preventing the Mills Board from fulfilling its fiduciary duty and receiving a potentially higher and better offer for Mills and its stockholders. Mr. Ordan stated that Mills would revisit the issue of the standstill requirement and advise Mr. Katzman of its conclusions.

Mr. Ordan requested that we prepare a specific list of information relating to Mills that we would like to review and provide it to Mills. Mr. Ordan also requested that we provide Mills with a copy of the financial model we were using in connection with our analysis of Mills and our recapitalization proposal. Mr. Ordan stated that Mills would consider providing specific information to us, subject to our signing a confidentiality agreement. Mr. Katzman advised that he would send such a list and make our model available.

Early in the morning of October 24, 2006, Mr. Ordan called Mr. Katzman and expressed an interest in continuing a dialog with respect to our recapitalization proposal and stated that he was working to arrange a meeting between Mr. Katzman and the special committee of the Mills Board as soon as practicable. Later in the day on October 24th, Mr. Katzman sent another letter to Mr. Ordan (with a copy to the Mills Board) requesting, in accordance with Mr. Ordan's request during the October 20th meeting, that we be able to review the following information that had not yet been made publicly available:

On the evening of October 24, 2006, we filed a Schedule 13D with the SEC disclosing, among other things, that we had increased our ownership position in Mills' common stock to 5,100,000 shares

9

(approximately 9% of the outstanding shares). Our Schedule 13D also reported that we had acquired the following positions with respect to Mills' cumulative redeemable preferred stock:

| Series B |

|

|

|

|

|

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Series C |

Series E |

Series G |

|||||||||||||

| Number |

|

||||||||||||||

| %(1) |

Number |

%(2) |

Number |

%(3) |

Number |

%(4) |

|||||||||

| 61,300 | 1.4 | % | 75,600 | 2.2 | % | 201,000 | 2.4 | % | 31,000 | 0.3 | % | ||||

On October 25, 2006, Mills issued a press release stating that the Mills Board would consider our recapitalization proposal as part of the process of exploring strategic alternatives and maximizing value for all Mills stockholders, while, at the time, stating it needed to, among other things, complete the restatement of its financials to position itself to enter into a strategic transaction or transactions.

On October 26, 2006, representatives of Gazit management and representatives of RBC Capital Markets, our financial advisor, participated in a telephonic meeting with members of Mills' management and representatives of JP Morgan, Mills' financial advisor. During this call, RBC Capital Markets verbally provided Mills and JP Morgan with certain financial metrics used to derive our recapitalization proposal.

On October 31, 2006, Mr. Katzman and members of Gazit management along with representatives of RBC, met with Mr. Ordan, members of Mills' management, three members of the Mills Board, including two members of Mills' special committee. At this meeting, Mr. Katzman repeated his observations previously made to Mr. Ordan as to why a recapitalization would be superior to a sale for Mills' stockholders, discussed the background leading up to our recapitalization proposal and our ability to consummate our recapitalization proposal.

Following discussions with Mark Ordan, Mr. Katzman offered to revise our proposed confidentiality agreement to include a limited standstill agreement in which we would agree not to buy or sell any Mills stock until Mills filed its Form 10-K or, if earlier, the date on which Mills announced it had entered into an agreement with respect to strategic alternatives. Despite Mr. Ordan's agreement to arrange a meeting/conference call of the parties and their attorneys to negotiate a compromise with respect to a confidentiality/standstill agreement, Mills has never proposed a time for such meeting. Rather, the last offer made with respect to the confidentiality agreement by Mills was that we agree to enter into a "July standstill" (i.e., for approximately a seven-month period) on the terms set forth in Mills' form confidentiality agreement. Our counsel replied that the offer was non-responsive and an unacceptable compromise.

On November 2, 2006, our counsel sent a letter to Mark Ordan again repeating our request that certain joint venture agreements be filed with the SEC.

On November 8, 2006, Chaim Katzman sent a letter to Mark Ordan informing him that we were filing a lawsuit in the Delaware Court of Chancery pursuant to Section 211 of the Delaware General Corporation Law, demanding that Mills hold its annual meeting of stockholders and informing Mills that we would be proposing our own slate of directors and an amendment to Mills' certificate of

10

incorporation to eliminate the classified board structure, which we believe, in this case, serves to entrench current leadership.(1) The letter expressed Mr. Katzman's belief that Mr. Ordan's purpose was not to bring us into the strategic process, but rather to baffle, frustrate and ultimately to deter our efforts to give the recapitalization proposal the hearing it deserves. In addition, this letter put Mills on notice that it should not enter into any definitive agreement as to a change of control transaction, or the sale of significant assets, before Mills has filed with the SEC its financial statements and joint venture agreements and given all potential bidders, including us, fourteen days to review such materials and submit firm offers to Mills.

We also filed Amendment No. 1 to our Schedule 13D on November 8, 2006 announcing that we had increased our ownership position in the common stock to 5,500,000 shares (approximately 9.7% of the outstanding shares) and that we had increased our positions in the preferred stock to the amounts listed in the following table:

| Series B |

|

|

|

|

|

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Series C |

Series E |

Series G |

|||||||||||||

| Number |

|

||||||||||||||

| %(1) |

Number |

%(2) |

Number |

%(3) |

Number |

%(4) |

|||||||||

| 81,400 | 1.9 | % | 88,000 | 2.5 | % | 225,700 | 2.6 | % | 68,900 | 0.8 | % | ||||

On November 9, 2006, Chaim Katzman sent a letter to Mark Ordan expressing his concern about media reports that Mills is selling the retail component of its 108 North State Street property in Chicago and expressing his belief that selling what appears to be a trophy development property and other trophy properties in a distressed situation is a catastrophic mistake for the following reasons:

11

In the letter, Mr. Katzman also urged Mills to consult disinterested financial advisors as to the impact that selling Mills' trophy properties will have on its enterprise value. Mr. Katzman also stated, "The decision-making process you pursue needs to include advisors and board members that lack conflicts of interest and understand the significant negative impact that the decision to sell highly attractive assets can have on overall value—and whose sole interest, uncluttered by multiple roles, is maximizing value for stockholders." Mr. Katzman further stated that "we would like to ensure that… Mills' strategic process results in its stockholders achieving the highest value possible [and that s]elling trophy properties is not the way to maximize stockholder value…"

On November 13, 2006, we demanded a stockholder list from Mills pursuant to Section 220 of the Delaware General Corporation Law ("Section 220"), which permits stockholders to obtain a stockholder list for any proper purpose. A proper purpose under the Delaware General Corporation Law is a purpose reasonably related to a person's interest as a stockholder, which generally includes communication with other stockholders.

On November 17, 2006, Mr. Ordan sent a reply letter to Mr. Katzman stating, among other things, that he could not comment on rumors of a potential sale of 108 North State Street and that decisions made by Mills to sell its properties are made after careful consideration and consultation with the Mills Board, management of Mills and its strategic advisors. Mr. Ordan stated further that Mills is in close consultation with all interested parties who have entered into Mills' process and spent months diligently working to understand the value of Mills. Mr. Ordan also stated that, if we wish to be an "interested party" on the same footing as other bidders, and to have our preferences considered in the strategic alternatives process, Mills would ask again that we sign a confidentiality and standstill agreement to ensure we are competing on an equal and fair footing with other interested parties, enter the process, and perform the work necessary to produce a serious proposal for Mills.

On November 20, 2006, counsel for Mills informed us that Mills was not willing to provide us with a stockholder list unless and until we prevailed in our December 1, 2006 hearing in Delaware Chancery Court to determine whether we will be permitted to nominate candidates at the annual meeting. On November 21, 2006, we filed a complaint in Delaware Chancery Court pursuant to Section 220 due to Mills' refusal to provide us with a list of its stockholders. The Court granted us a scheduling conference on the same day at which the Court stated that it was inclined to order Mills to provide the list, that Mills should resolve the matter promptly, and that if Mills did not, the Court would hold a final hearing on the matter on Thanksgiving Day. On November 22, 2006, Mills agreed to provide us with the stockholder list and related information we had requested.

On November 21, 2006, Mr. Katzman sent a letter responding to Mr. Ordan's November 17, 2006 letter. The letter, among other things, inquired as to why Mr. Ordan had not addressed questions raised in Mr. Katzman's earlier correspondence regarding Mills' failure to file joint venture agreements and Mr. Katzman's request that Mills allow at least two weeks after the filing of its Form 10-K and Form 10-Qs before accepting any offer, in order to allow us (and any other interested parties) to make a proposal and not risk subjecting Mills to the unnecessary payment of a break up fee.

On November 21, 2006, Mr. Katzman also sent a letter to Mr. Ordan (with a copy to the Mills Board) informing him that we had revised our recapitalization proposal and that we are now offering to invest up to $1.2 billion of cash in exchange for newly-issued shares of Mills common stock at a per share purchase price of $25.50, as opposed to $24.50 in our prior offer. This new offer eliminates the requirement that we receive a separate class of common stock and represents a premium of 44.6% to the 30-day volume weighted average price of Mills' common stock as of the close of trading on September 28, 2006 (the day before the date of our original recapitalization proposal). The new

12

recapitalization proposal eliminates our closing conditions and assumptions from our prior proposal subject only to a short due diligence period and the following:

The letter informed Mr. Ordan that we will need only 15 business days to perform our confirmatory due diligence and to review the financial and other information to be filed in Mills' Form 10-K and Form 10-Qs, during which time we are prepared to contemporaneously negotiate and sign a definitive agreement. In addition, the letter informed Mr. Ordan that we would not need a financing contingency in our definitive agreement and that the Gazit-Globe Ltd. board had approved our entering into the proposed recapitalization, subject only to the same due diligence opportunity noted above. Mr. Katzman added "We remain willing to sign a confidentiality agreement and standstill pursuant to which we will refrain from buying and selling any stock for as long as the information in your Form 10-K and 10-Qs is not publicly available."

The Gazit Group is comprised of Chaim Katzman, Gazit-Globe Ltd. and its subsidiaries. Gazit-Globe Ltd. is a real estate investment company listed on the Tel Aviv Stock Exchange as part of the TA-25 Index and has a significant presence in the United States, Canada and Europe. Gazit-Globe, directly and through subsidiaries and affiliates acquires, develops and operates income producing properties including shopping centers, retirement homes and medical office buildings in urban growth areas in North America, Europe and Israel. Its primary investment objective is the creation of value through long-term maximization of cash flow and capital appreciation from its growing real estate investments. With total assets (in market value) as of the date of this proxy statement of over $8.5 billion, Gazit-Globe has interests in 474 properties. This includes 22 properties currently under development that consist of approximately 46 million square feet of gross leasable area.

Why am I receiving this proxy statement?

You are receiving this proxy statement and the accompanying GREEN proxy card because you own shares of Mills' common stock. This proxy statement contains information related to the solicitation of proxies for use at the 2006 annual meeting of stockholders, to be held on December [ ], 2006 at [ ]:00 a.m., local time, at [ ].

Who is entitled to vote at the annual meeting?

You may vote if you were the record owner of common stock at the close of business on December 1, 2006, the record date for the annual meeting. The common stock constitutes the only class of securities entitled to vote at the annual meeting. According to the most recent information provided by Mills, on November 4, 2005, Mills had 56,603,203 shares of common stock and no shares of non-voting common stock outstanding. As of the date of this proxy statement, Mills has not disclosed the number of shares of common stock that are outstanding as of the record date.

13

What are the voting rights of stockholders?

Each share of common stock outstanding on the record date entitles its holder to cast one vote on each matter to be voted on. There is no cumulative voting.

What will constitute a quorum at the annual meeting?

Pursuant to Section 211 of the Delaware General Corporation Law, the shares of common stock represented, in person or by proxy, at the annual meeting will constitute a quorum, permitting the stockholders to conduct business at the meeting. Mills will include abstentions and broker non-votes in the calculation of the number of shares considered to be present at the meeting. Broker non-votes are shares held by a broker or nominee that are represented at the meeting, but with respect to which the broker or nominee is not voting on a particular proposal.

How do I vote by proxy if I am a record holder?

To vote by proxy, you should complete, sign and date the enclosed GREEN proxy card and return it promptly in the enclosed postage-paid envelope. To be able to vote your shares in accordance with your instructions at the annual meeting, we must receive your proxy as soon as possible but in any event prior to the meeting. You may vote your shares without submitting a proxy to us if you vote in person or submit a proxy to the secretary of Mills.

How do I vote if I am not the record holder of my shares?

If your shares are held in the name of a brokerage firm, bank nominee or other institution (i.e., in "street name"), only it can give a proxy with respect to your shares. You may have received either a GREEN proxy card from the record holder (which you can complete and send directly to MacKenzie Partners, Inc.) or an instruction card (which you can complete and return to the record holder to direct its voting of your shares). If the record holder has not sent you either a GREEN proxy card or an instruction card, you may contact the record holder directly to provide it with instructions.

You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which shares are held. You should complete, sign, date and return each GREEN proxy card and voting instruction card you receive.

You may also receive a white proxy or voting instruction card, which is being solicited by the Mills Board. We urge you to discard any white proxy or voting instruction cards sent to you by Mills. If you have previously signed a white proxy or voting instruction card sent by Mills, we urge you to sign, date and promptly mail the enclosed GREEN proxy card or voting instruction card for the annual meeting, which will revoke any earlier dated proxy or voting instruction cards solicited by the Mills Board that you may have signed. It is very important that you date your proxy. It is not necessary to contact Mills for your revocation to be effective.

If you need assistance, please contact MacKenzie Partners, Inc. by telephone at 1-800-322-2885 or 1-212-929-5500.

How do I vote in person if I am a record holder?

If you are a stockholder of record of Mills common stock on the December 1, 2006 record date, you may attend the annual meeting and vote in person.

How do I vote in person if my shares are held in street name or I am voting for someone else?

If you do not have record ownership of your shares and want to vote in person at the annual meeting or if you are voting for someone else at the annual meeting, you may obtain a document called a "legal proxy" from the record holder of the shares or such other person and bring it to the annual meeting. If you need assistance, please contact our solicitor, MacKenzie Partners, Inc., by telephone at 1-800-322-2885 or 1-212-929-5500.

14

What should I do if I receive a white proxy card from Mills' management?

Proxies on the white proxy card are being solicited by Mills' management. If you submit a proxy to us by signing and returning the enclosed GREEN proxy card, do not sign or return the white proxy card or follow any voting instructions provided by Mills unless you intend to change your vote, because only your latest-dated proxy will be counted.

If you have already sent a white proxy card to Mills, you may revoke it simply by signing, dating and returning the enclosed GREEN proxy card.

If I plan to attend the annual meeting, should I still submit a proxy or voting instruction card?

Yes. Whether you plan to attend the annual meeting or not, we urge you to submit a proxy or voting instruction card. Returning the enclosed proxy or voting instruction card will not affect your right to attend the annual meeting and vote.

How are proxy card votes counted?

If you properly sign the GREEN proxy card and return it to MacKenzie Partners, Inc., Chaim Katzman, Michael L. Zuppone and Daniel H. Burch will be appointed as your representatives to vote your shares of common stock at the annual meeting. At the annual meeting, Chaim Katzman, Michael L. Zuppone and Daniel H. Burch, or any of them, will vote your shares as you instruct on your proxy card. If you return a properly signed GREEN proxy card without instructing your representatives how to vote, your representatives will vote your shares FOR the election of our nominees named in this proxy statement and FOR the appointment of Mills' independent registered public accounting firm.

If you withhold your vote with respect to any director nominee, your shares will be counted as present for purposes of the quorum, but will have no effect on the election of that nominee. If you abstain from voting on the appointment of Mills' independent registered public accounting firm, your shares will be counted as present for purposes of the quorum, but will have no effect on the ratification.

Will my shares be voted if I do not provide my proxy and I do not attend the annual meeting?

If you do not provide a proxy or vote your shares held in your name, your shares will not be voted. If you hold your shares in street name, your broker may be able to vote your shares for routine matters even if you do not provide the broker with voting instructions. The ratification of the appointment of Mills' independent registered public accounting firm is considered a routine matter. However, since we are contesting the election of Mills' director nominees, the election of directors is not considered to be routine, and your broker will not have the authority to vote with respect to the election of directors.

What if I want to revoke my proxy or change my voting instructions?

If you give a proxy, you may revoke it at any time before it is voted on your behalf. You may do so by:

15

If you hold your shares in street name, you may change your vote by:

If you choose to revoke a proxy by giving written notice or a later-dated proxy to Mills or by submitting new voting instructions to your broker or nominee, we would appreciate if you would assist us in representing the interests of stockholders on an informed basis by sending us a copy of your revocation, proxy or new voting instructions or by calling MacKenzie Partners, Inc. at 1-800-322-2885 or 1-212-929-5500. Remember, your latest-dated proxy is the only one that counts.

How many votes are needed to approve each of the proposals?

Directors are elected by a plurality of the votes cast; therefore, the [four/five] nominees for election to the Mills Board who receive the most votes will be elected. The ratification of the appointment of Ernst & Young LLP requires the approval of a majority of the votes cast at the annual meeting. Abstentions and broker non-votes will have no effect on the outcome of the proposals.

Will any other matters be voted on?

As of the date of this proxy statement, we know of no other matters that will be presented for consideration at the meeting other than those matters discussed in this proxy statement. If any other matters properly come before the meeting and call for a stockholder vote, the persons named as proxy holders, Chaim Katzman, Michael L. Zuppone and Daniel H. Burch, will have discretion with respect to those matters.

Can the meeting be adjourned or postponed?

Mills has announced that it may adjourn the annual meeting to December 29, 2006. Mills has not stated whether or not it will adjourn or postpone the annual meeting further. We have requested an order from the Court of Chancery of the State of Delaware requiring that Mills hold the meeting on December 21, 2006. We have also asked that Mills be required to obtain court approval for any adjournment or postponement.

Who can provide me with more information about the process?

If you have any questions, please contact MacKenzie Partners, Inc. toll-free at 1-800-322-2885 or write to MacKenzie Partners, Inc., 105 Madison Avenue, New York, NY 10016.

OUR OWNERSHIP OF MILLS CAPITAL STOCK

As of the December 1, 2006 record date, the Gazit Group beneficially owned an aggregate of [5,500,000] shares of Mills' common stock, representing approximately [9.7]% of the outstanding shares of common stock. We intend to vote our shares FOR the election of each of our nominees and FOR the proposal to ratify the appointment of Ernst & Young LLP as Mills' independent registered public accounting firm for 2006. For additional information relating to our ownership of Mills capital stock, including Mills' cumulative redeemable preferred stock, please see Annex A.

Executed proxies may be solicited in person, by mail, advertisement, telephone, telecopier, telegraph or email. Solicitation may be made by the Gazit Group, including our nominees, employees of the Gazit Group and their affiliates, none of whom will receive additional compensation for such

16

solicitation. Proxies will be solicited from individuals, brokers, banks, bank nominees and other institutional holders. We have requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares they hold of record. We will reimburse these record holders for their reasonable out-of-pocket expenses for doing so.

In addition, we have retained MacKenzie Partners, Inc. to solicit proxies on our behalf in connection with the annual meeting. MacKenzie Partners, Inc. will employ approximately [ ] people in its efforts. We have agreed to reimburse MacKenzie Partners, Inc. for its reasonable expenses and to pay MacKenzie Partners, Inc. a fee of up to $[ ].

The entire expense of our proxy solicitation is being borne by the Gazit Group. We do not intend to seek reimbursement from Mills for any of these costs or expenses. In addition to the engagement of Mackenzie Partners, Inc. described above, costs related to the solicitation of proxies include expenditures for printing, postage, legal and related expenses are expected to be approximately $[ ], of which approximately $[ ] has been paid to date.

Gazit-Globe Ltd. has agreed to indemnify our nominees against any liabilities in connection with this proxy solicitation.

RBC Capital Markets is acting as financial advisor for the us in connection with our proposed recapitalization of Mills. We have agreed to pay RBC Capital Markets customary fees for its services. We have also agreed to reimburse RBC Capital Markets for its reasonable expenses, including the reasonable fees and expenses of its legal counsel, resulting from or arising out of their engagements, and to indemnify RBC Capital Markets and certain related persons against certain liabilities and expenses, including liabilities and expenses under the federal securities laws arising out of their respective engagements. In addition, RBC Capital Markets has, in the past, provided financial services to us, for which services it has received customary compensation.

Certain employees of RBC Capital Markets may also assist us in the solicitation of proxies, including by communicating in person, by telephone or otherwise, with a limited number of institutions, brokers or other persons who are stockholders of Mills. RBC Capital Markets does not believe that any of its directors, officers, employees or affiliates are a "participant" as defined in Schedule 14A promulgated under the Securities Exchange Act of 1934 by the SEC, or that Schedule 14A requires the disclosure of certain information concerning RBC Capital Markets. RBC Capital Markets will not receive any additional fee for or in connection with such solicitation activities by its representatives apart from the fees it is otherwise entitled to receive as described above.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Information regarding stock held by each person known by Mills to be the beneficial owner of more than five percent of its outstanding common stock, each of Mills' directors, each of Mills' executive officers named in the summary compensation table of the Mills Proxy Statement, and Mills' directors executive officers as a group is set forth on Annex B to this proxy statement.

The following description for proposing business and director nominations was taken from the Mills Proxy Statement.

[To Come]

17

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Members of the Gazit Group and our nominees are participants in the solicitation of proxies for the annual meeting within the meaning of the federal securities laws. Certain other individuals identified in Annex A to this proxy statement may also be deemed to be participants in such solicitation. Information concerning the Gazit Group and other persons who may be deemed to be participants in the solicitation of proxies for the annual meeting, including their beneficial ownership of Mills common stock, is set fort in Annex A to this proxy statement and is incorporated into this proxy statement by reference. Information in this proxy statement about each of our nominees and each person who is or may be deemed a participant was provided by that person.

The principal executive offices of Mills are located at 5425 Wisconsin Avenue, Suite 500, Chevy Chase, MD 20815. Except as otherwise noted herein, the information concerning Mills has been taken from or is based upon documents and records on file with the SEC and other publicly available information.

18

A-1

The Gazit Group

The names and business addresses of the members of the Gazit Group are listed in Table 1 below. The number of shares of common stock owned as of November 21, 2006 by each member of the Gazit Group is set forth below in this Annex A. Chaim Katzman's principal occupation is Chairman of Gazit-Globe Ltd, President and chairman of the board of Gazit Inc. and chairman of the board of Equity One, Inc. Other than as set forth in this Annex A, no member of the Gazit Group or any of their associates owns of record, directly or indirectly, or beneficially, any securities of Mills or any parent or subsidiary of Mills. No member of the Gazit Group has any relationships that would require disclosure pursuant to Item 404(a) of Regulation S-K. No member of the Gazit Group is, or was, within the past year, a party to any contract, arrangements or understandings with any person with respect to any securities of Mills.

TABLE 1

| Gazit Group Member |

Business Address |

|

|---|---|---|

| Chaim Katzman | c/o Gazit Group USA, Inc. 1660 N.E. Miami Gardens Drive, Suite 1 North Miami Beach, FL 33179 |

|

Gazit-Globe Ltd. ("Gazit") |

1 Derech-Hashalom Street Tel-Aviv, 67892, Israel |

|

Gazit (1995), Inc. ("1995") |

c/o Gazit Group USA, Inc. 1660 N.E. Miami Gardens Drive, Suite 1 North Miami Beach, FL 33179 |

|

Gazit Canada Inc. ("Canada") |

85 Hanna Avenue Toronto, Canada M6K3S3 P.O. Box 1569 |

|

M G N (USA) Inc. ("MGN") |

c/o Gazit Group USA, Inc. 1660 N.E. Miami Gardens Drive, Suite 1 North Miami Beach, FL 33179 |

|

Hollywood Properties Ltd. ("Hollywood") |

P.O. Box 1569 Ground Floor Harbour Centre Grand Cayman, Cayman Islands British West Indies |

Beneficial Ownership of Mills Common Stock by the Members of the Gazit Group

The aggregate percentage of shares reported beneficially owned by each member of the Gazit Group as of the date of filing of this proxy statement is based upon 56,603,203 shares of Mills common stock (the "Shares") issued and outstanding as reported by the Mills in its most recent Quarterly Report of Form 10-Q for the Quarterly Period Ended September 30, 2005 filed with the SEC on November 9, 2005.

Chaim Katzman

A-2

Mr. Katzman may be deemed to control Gazit. Of the shares beneficially owned by Mr. Katzman as of the date of this filing:

Gazit

Of the shares beneficially owned by Gazit as of the date of this filing:

MGN

A-3

MGN shares voting and dispositive authority over Shares it beneficially owns with Mr. Katzman, Gazit and 1995, as such Shares are held directly by 1995, a wholly-owned subsidiary of MGN, which in turn is a wholly-owned subsidiary of Gazit, which Mr. Katzman may be deemed to control.

1995

1995 shares voting and dispositive authority over all Shares it beneficially owns with Mr. Katzman, Gazit and MGN, as such Shares are held directly by 1995, a wholly-owned subsidiary of MGN, which in turn is wholly-owned subsidiary of Gazit, which Mr. Katzman may be deemed to control.

Hollywood

Hollywood shares voting and dispositive authority over all the Shares it beneficially owns with Mr. Katzman, Gazit and Canada, as Such shares are held directly by Canada, a subsidiary of Hollywood, which in turn is wholly-owned subsidiary of Gazit, which Mr. Katzman may be deemed to control.

Canada

Canada shares voting and dispositive authority over all the Shares it beneficially owns with Mr. Katzman, Gazit and Hollywood, as such Shares are held directly by Canada, a subsidiary of Hollywood, which in turn is wholly-owned subsidiary of Gazit, which Mr. Katzman may be deemed to control.

A-4

Ownership of Mills Preferred Stock by Canada

The following table discloses the number of shares of each class Mills' cumulative redeemable preferred stock and the percentage of each class of Mills' preferred stock held by Canada. Other than as stated in the table below with respect to Canada, no participant in the solicitation owns any shares of Mills cumulative redeemable preferred stock. Canada shares dispositive power with respect to these non-voting preferred shares in the same manner as disclosed above with respect to its dispositive power over Mills' common stock.

| Series B |

|

|

|

|

|

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Series C |

Series E |

Series G |

|||||||||||||

| Number |

|

||||||||||||||

| %(1) |

Number |

%(2) |

Number |

%(3) |

Number |

%(4) |

|||||||||

| 81,400 | 1.9 | % | 88,000 | 2.5 | % | 225,700 | 2.6 | % | 68,900 | 0.8 | % | ||||

A-5

Transactions by the Gazit Group in Securities of Mills During the Past Two Years

The following Table 2 discloses, with respect to all of Mills' securities purchased and sold by the Gazit Group within the last two years, the dates on which such securities were purchased or sold and the amounts purchased or sold on each such date. All purchases and sales were made in the open market. The consideration for the Gazit Group's acquisitions of Mills stock was obtained from the Gazit Group's working capital and borrowings under existing revolving credit facilities.

| Owner |

Transaction |

Trade Date |

No. of Shares |

Class |

||||

|---|---|---|---|---|---|---|---|---|

| Gazit 1995, Inc. | Purchase | 11/14/2005 | 56,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 11/15/2005 | 21,600 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 11/16/2005 | 32,400 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 11/17/2005 | 37,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 11/18/2005 | 4,600 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 11/21/2005 | 70,500 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 11/22/2005 | 21,400 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 11/28/2005 | 142,700 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 11/29/2005 | 13,800 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 12/12/2005 | 20,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 12/13/2005 | 20,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 12/19/2005 | 69,600 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 12/20/2005 | 91,800 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 12/21/2005 | 2,500 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 12/22/2005 | 13,700 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 12/23/2005 | 5,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 12/27/2005 | 52,400 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 12/28/2005 | 70,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 12/29/2005 | 110,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 1/9/2006 | 10,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 1/10/2006 | 500 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 1/11/2006 | 5,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 1/12/2006 | 25,200 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 1/13/2006 | 59,300 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 1/17/2006 | 30,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 1/18/2006 | 54,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 1/19/2006 | 121,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 1/20/2006 | 3,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 1/23/2006 | 7,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 1/24/2006 | 20,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 2/9/2006 | 2,800 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 2/10/2006 | 1,500 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 2/24/2006 | 14,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 3/17/2006 | 55,700 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 3/20/2006 | 281,300 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 3/21/2006 | 146,700 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 3/22/2006 | 118,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 3/23/2006 | 90,000 | Common Stock | ||||

| Gazit 1995, Inc. | Purchase | 3/24/2006 | 100,000 | Common Stock | ||||

| Gazit Canada | Purchase | 3/27/2006 | 90,000 | Common Stock | ||||

A-6

| Gazit Canada | Purchase | 3/28/2006 | 18,000 | Common Stock | ||||

| Gazit Canada | Purchase | 3/29/2006 | 12,000 | Common Stock | ||||

| Gazit Canada | Purchase | 3/30/2006 | 60,000 | Common Stock | ||||

| Gazit Canada | Purchase | 3/31/2006 | 28,200 | Common Stock | ||||

| Gazit Canada | Purchase | 4/3/2006 | 33,900 | Common Stock | ||||

| Gazit Canada | Purchase | 4/4/2006 | 56,900 | Common Stock | ||||

| Gazit Canada | Purchase | 4/5/2006 | 21,000 | Common Stock | ||||

| Gazit Canada | Purchase | 4/6/2006 | 51,000 | Common Stock | ||||

| Gazit Canada | Purchase | 4/7/2006 | 42,000 | Common Stock | ||||

| Gazit Canada | Purchase | 4/10/2006 | 29,000 | Common Stock | ||||

| Gazit Canada | Purchase | 4/12/2006 | 83,000 | Common Stock | ||||

| Gazit Canada | Purchase | 4/13/2006 | 10,000 | Common Stock | ||||

| Gazit Canada | Purchase | 4/17/2006 | 15,000 | Common Stock | ||||

| Gazit Canada | Purchase | 5/22/2006 | 2,000 | Common Stock | ||||

| Gazit Canada | Purchase | 6/6/2006 | 1,000 | Common Stock | ||||

| Gazit Canada | Purchase | 6/8/2006 | 12,000 | Common Stock | ||||

| Gazit Canada | Purchase | 6/13/2006 | 12,000 | Common Stock | ||||

| Gazit Canada | Purchase | 6/14/2006 | 7,000 | Common Stock | ||||

| Gazit Canada | Purchase | 6/15/2006 | 2,000 | Common Stock | ||||

| Gazit Canada | Purchase | 6/16/2006 | 2,000 | Common Stock | ||||

| Gazit Canada | Purchase | 6/19/2006 | 8,000 | Common Stock | ||||

| Gazit Canada | Purchase | 6/20/2006 | 1,000 | Common Stock | ||||

| Gazit Canada | Purchase | 6/22/2006 | 1,000 | Common Stock | ||||

| Gazit Canada | Purchase | 6/23/2006 | 17,000 | Common Stock | ||||

| Gazit Canada | Purchase | 6/26/2006 | 3,000 | Common Stock | ||||

| Gazit Canada | Purchase | 6/27/2006 | 52,000 | Common Stock | ||||

| Gazit Canada | Purchase | 6/28/2006 | 7,000 | Common Stock | ||||

| Gazit Canada | Purchase | 6/30/2006 | 2,300 | Common Stock | ||||

| Gazit Canada | Purchase | 7/3/2006 | 3,700 | Common Stock | ||||

| Gazit Canada | Purchase | 7/6/2006 | 8,000 | Common Stock | ||||

| Gazit Canada | Purchase | 7/7/2006 | 2,000 | Common Stock | ||||

| Gazit Canada | Purchase | 7/12/2006 | 1,000 | Common Stock | ||||

| Gazit Canada | Purchase | 7/13/2006 | 3,000 | Common Stock | ||||

| Gazit Canada | Purchase | 7/14/2006 | 13,000 | Common Stock | ||||

| Gazit Canada | Purchase | 7/17/2006 | 19,000 | Common Stock | ||||

| Gazit Canada | Purchase | 7/18/2006 | 5,000 | Common Stock | ||||

| Gazit Canada | Purchase | 7/19/2006 | 3,000 | Common Stock | ||||

| Gazit Canada | Purchase | 7/20/2006 | 8,000 | Common Stock | ||||

| Gazit Canada | Purchase | 7/21/2006 | 43,000 | Common Stock | ||||

| Gazit Canada | Purchase | 7/24/2006 | 12,000 | Common Stock | ||||

| Gazit Canada | Purchase | 8/7/2006 | 100,000 | Common Stock | ||||

| Gazit 1995, Inc. | Sale | 8/7/2006 | (100,000 | ) | Common Stock | |||

| Gazit Canada | Purchase | 8/9/2006 | 115,000 | Common Stock | ||||

| Gazit 1995, Inc. | Sale | 8/9/2006 | (115,000 | ) | Common Stock | |||

| Gazit Canada | Purchase | 8/10/2006 | 100,000 | Common Stock | ||||

| Gazit 1995, Inc. | Sale | 8/10/2006 | (100,000 | ) | Common Stock | |||

| Gazit Canada | Purchase | 8/11/2006 | 200,000 | Common Stock | ||||

| Gazit 1995, Inc. | Sale | 8/11/2006 | (200,000 | ) | Common Stock | |||

| Gazit Canada | Purchase | 8/14/2006 | 235,000 | Common Stock | ||||

| Gazit 1995, Inc. | Sale | 8/14/2006 | (235,000 | ) | Common Stock | |||

A-7

| Gazit Canada | Purchase | 8/16/2006 | 250,000 | Common Stock | ||||

| Gazit 1995, Inc. | Sale | 8/16/2006 | (250,000 | ) | Common Stock | |||

| Gazit Canada | Purchase | 10/16/2006 | 450,000 | Common Stock | ||||

| Gazit Canada | Purchase | 10/17/2006 | 375,000 | Common Stock | ||||

| Gazit Canada | Purchase | 10/18/2006 | 800,000 | Common Stock | ||||

| Gazit Canada | Purchase | 10/19/2006 | 400,000 | Common Stock | ||||

| Gazit Canada | Purchase | 10/20/2006 | 275,000 | Common Stock | ||||

| Gazit Canada | Purchase | 11/3/2006 | 200,000 | Common Stock | ||||

| Gazit Canada | Purchase | 11/6/2006 | 200,000 | Common Stock | ||||

| Gazit Canada | Purchase | 10/16/2006 | 23,000 | Series B Preferred | ||||

| Gazit Canada | Purchase | 10/17/2006 | 27,000 | Series B Preferred | ||||

| Gazit Canada | Purchase | 10/18/2006 | 5,500 | Series B Preferred | ||||

| Gazit Canada | Purchase | 10/19/2006 | 5,000 | Series B Preferred | ||||

| Gazit Canada | Purchase | 10/23/2006 | 800 | Series B Preferred | ||||

| Gazit Canada | Purchase | 11/3/2006 | 9,400 | Series B Preferred | ||||

| Gazit Canada | Purchase | 11/6/2006 | 10,700 | Series B Preferred | ||||

| Gazit Canada | Purchase | 10/16/2006 | 35,000 | Series C Preferred | ||||

| Gazit Canada | Purchase | 10/17/2006 | 10,000 | Series C Preferred | ||||

| Gazit Canada | Purchase | 10/18/2006 | 4,000 | Series C Preferred | ||||

| Gazit Canada | Purchase | 10/19/2006 | 3,100 | Series C Preferred | ||||

| Gazit Canada | Purchase | 10/23/2006 | 23,500 | Series C Preferred | ||||

| Gazit Canada | Purchase | 11/3/2006 | 2,000 | Series C Preferred | ||||

| Gazit Canada | Purchase | 11/6/2006 | 10,400 | Series C Preferred | ||||

| Gazit Canada | Purchase | 10/16/2006 | 12,000 | Series E Preferred | ||||

| Gazit Canada | Purchase | 10/17/2006 | 6,200 | Series E Preferred | ||||

| Gazit Canada | Purchase | 10/18/2006 | 4,800 | Series E Preferred | ||||

| Gazit Canada | Purchase | 10/19/2006 | 80,400 | Series E Preferred | ||||

| Gazit Canada | Purchase | 10/20/2006 | 25,600 | Series E Preferred | ||||

| Gazit Canada | Purchase | 10/23/2006 | 72,000 | Series E Preferred | ||||

| Gazit Canada | Purchase | 11/3/2006 | 700 | Series E Preferred | ||||

| Gazit Canada | Purchase | 11/6/2006 | 24,000 | Series E Preferred | ||||

| Gazit Canada | Purchase | 10/17/2006 | 15,000 | Series G Preferred | ||||

| Gazit Canada | Purchase | 10/18/2006 | 15,000 | Series G Preferred | ||||

| Gazit Canada | Purchase | 10/19/2006 | 1,000 | Series G Preferred | ||||

| Gazit Canada | Purchase | 11/3/2006 | 5,000 | Series G Preferred | ||||

| Gazit Canada | Purchase | 11/6/2006 | 32,900 | Series G Preferred |

A-8

No Arrangements With Respect to Mills' Securities

No participant in this solicitation is, or was within the last year, a party to any contract, arrangement or understanding relating to any securities of Mills.

No Arrangements Involving Mills

No participant in this solicitation nor any associate of a participant in this solicitation has any arrangement or understanding with any person regarding the future employment by Mills or its affiliates or with respect to any future transactions to which Mills or any of its affiliates will or may be a party.

Information with Respect to Our Nominees

Other than as set forth below, none of our nominees or their associates owns, of record, directly or indirectly, or beneficially, any securities of Mills or any parent or subsidiary of Mills. None of our nominees has any relationships that would require disclosure pursuant to Item 404(a) of Regulation S-K. None of our nominees is, or was, within the past year, a party to any contract, arrangements or understandings with any person with respect to any securities of Mills.

Jon N. Hagan

Mr. Hagan's business address is 47 Summerhill Avenue, Toronto, Ontario, M4T IB1. Mr. Hagan has not purchased or sold any securities of Mills in the last two years.

Keith M. Locker

Mr. Locker's business address is 400 Park Avenue, 14th Floor, New York, New York 10022. Mr. Locker beneficially owns 5,000 shares of Mills common stock. Mr. Locker purchased 10,000 shares of Mills common stock on January 1, 2006 and sold 5,000 shares of Mills common stock on March 20, 2006. Mr. Locker had no other transactions in Mills' securities within the past two years.

Joyce Storm

Mr. Storm's business address is 120 E. 56th Street, Suite 500, New York, New York 10022. Ms. Storm has not purchased or sold any securities of Mills in the last two years.

Lee S. Wielansky

Mr. Wielansky's business address is 721 Emerson Road, Suite 100, Saint Louis, Missouri 63141. The table below sets forth Mr. Wielansky's transactions in Mills' securities within the past two years.

| Date |

Type of Transaction |

Number of Shares |

Class |

|||

|---|---|---|---|---|---|---|

| January 5, 2006 | Purchase | 1,000 | Common Stock | |||

| March 7, 2006 | Sale | 1,000 | Common Stock | |||

| April 11, 2006 | Purchase | 1,000 | Common Stock | |||

| April 25, 2006 | Sale | 1,000 | Common Stock |

Other Persons Who May Assist in the Solicitation of Proxies

In connection with the engagement of RBC Capital Markets as a financial advisor, certain RBC personnel may communicating in person, by telephone or otherwise with certain institutions, brokers or other persons who are stockholders of the purpose of assisting in the solicitation of proxies for the nominees. As of the date of this proxy statement, the following employees or principals of RBC, who

A-9

may assist in the solicitation of proxies, had the interests in the election, by security holdings or otherwise, set forth opposite his name.

| Name |

Position |

Interest in Mills |

||

|---|---|---|---|---|

| Michael Coster | Managing Director | None | ||

| Ian MacLure | Managing Director | None |

RBC Capital Markets owns 2,500 shares of Mills common stock. RBC Capital Partners, an affiliate of RBC Capital Markets, owns 7,716 shares of Mills common stock. These share amounts do not include shares that may be held by RBC Capital Markets and its affiliates on an agency basis for their clients. RBC Capital Markets does not admit that it or any of its principals, directors, officers, employees, affiliates or controlling persons, if any, is a "participant," as defined in Schedule 14A promulgated under the Securities exchange Act of 1934, in the solicitation of proxies or that Schedule 14A requires the disclosure of certain information regarding it or them. RBC Capital Markets' principal business address is RBC Capital Markets, One Liberty Plaza, New York, NY 10006.

A-10

Voting Securities and Principal Holders Thereof

[To come from the Mills Proxy Statement]

B-1

[Back Cover]

Tell the Mills Board what you think! Your vote is important. No matter how many shares you own, please give the Gazit Group your proxy FOR the election of our nominees and FOR Proposal 2 by taking three steps:

If any of your shares are held in the name of a brokerage firm, bank, nominee or other institution, only it can vote such shares and only upon receipt of your specific instructions. Accordingly, please contact the person responsible for your account and instruct that person to execute the GREEN proxy card representing your shares. We urge you to confirm to MacKenzie Partners, Inc. in writing at the address provided below the instructions the instructions you give to your bank, broker, nominee or other institution so that we will be aware of all instructions given and can attempt to ensure that such instructions are followed.

If you have any questions, require assistance in voting your shares, or need additional copies of our proxy materials, please call MacKenzie Partners at the phone numbers listed below.

105 Madison Avenue

New York, NY 10016

revivemills@mackenziepartners.com

(212) 929-5500 (call collect)

or

TOLL-FREE (800) 322-2885

THE MILLS CORPORATION

PROXY FOR THE 2006 ANNUAL MEETING OF STOCKHOLDERS

THIS PROXY IS SOLICITED BY GAZIT-GLOBE LTD., CHAIM KATZMAN, M G N (USA) INC., GAZIT (1995) INC., HOLLYWOOD

PROPERTIES LTD., & GAZIT CANADA INC. (THE "GAZIT GROUP") AND NOT BY THE BOARD OF DIRECTORS OF THE MILLS CORPORATION

The undersigned stockholder of The Mills Corporation hereby appoints Chaim Katzman, Michael L. Zuppone and Daniel H. Burch, and each of them, as attorneys and proxies, each with power of substitution and revocation, to represent the undersigned at the 2006 Annual Meeting of Stockholders of The Mills Corporation and at any adjournment or postponement thereof, with authority to vote all shares held or owned by the undersigned in accordance with the directions indicated herein.

This proxy, when properly executed, will cause your shares to be voted as you direct. If you return this proxy, properly executed, without specifying a choice, your shares will be voted FOR ALL of the nominees in Proposal 1 and FOR Proposal 2.

| SEE REVERSE SIDE |

SEE REVERSE SIDE |

|||

| (Continued and to be signed on the reverse side) |

THE GAZIT GROUP RECOMMENDS YOU VOTE "FOR ALL" NOMINEES IN PROPOSAL 1 BELOW AND "FOR" PROPOSAL 2 BELOW.

(01) Jon

N. Hagan

(02) Keith M. Locker

(03) Joyce Storm

(04) Lee S. Wielansky

(05) [ ]

| o FOR ALL nominees listed above |

o WITHHOLD AUTHORITY to vote for all nominees listed above |

o FOR ALL EXCEPT (indicate exceptions as noted below) |

(Authority to vote for any individual Nominee(s) may be withheld by striking out the name(s) of such Nominee(s) above or by writing the Nominee's name in the space provided below.)

| o FOR | o AGAINST | o ABSTAIN |

Please sign exactly as your name appears to the left. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by president or other authorized officer. If a partnership, please sign in partnership name by authorized person. The signer hereby revokes all proxies previously given by the signer to vote at the 2006 Annual Meeting of The Mills Corporation, and any adjournment or postponement thereof. |

| Date: | , 2006 | Title | Signature | Additional Signature | ||||||||||||

| (Please sign exactly as your name appears to the left) | (if held jointly) |