UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

or

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

or

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 001-35378

GAZIT-GLOBE LTD.

(Exact name of registrant as specified in its charter)

Israel

(Jurisdiction of incorporation or organization)

1 Hashalom Rd.

Tel-Aviv 67892, Israel

(972)(3) 694-8000

(Address of principal executive offices)

Adi Jemini,

Chief Financial Officer

Tel: (972)(3) 694-8000

Email: ajemini@gazitgroup.com

1 Hashalom Rd. Tel-Aviv 67892, Israel

(Name, telephone, email and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Ordinary Shares, par value NIS 1.00 per share | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 195,485,322 Ordinary Shares, par value NIS 1.00 per share (excluding Treasury Shares).

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☐ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of accelerated filer and large accelerated filer in Rule 12b-2 of the Exchange Act (check one).

Large Accelerated Filer ☒ Accelerated Filer ☐ Non-Accelerated Filer ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting | Other ☐ |

| Standards Board ☒ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): ☐ Yes ☒ No

GAZIT-GLOBE LTD.

FORM 20-F

ANNUAL REPORT FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015

Introduction and Use of Certain Terms

Unless otherwise indicated, all references to (i) “we,” “us,” or “our,” are to Gazit-Globe Ltd. and those companies that are consolidated in its financial statements or that are jointly controlled entities, and (ii) “Gazit-Globe” or the “Company” are to Gazit-Globe Ltd., not including any of its subsidiaries or affiliates.

Except where the context otherwise requires, references in this annual report to:

| ● | “Adjusted EPRA Earnings” (or “FFO according to the management approach”) means EPRA Earnings (or FFO), as adjusted for: CPI and exchange rate linkage differences; depreciation and amortization; and other adjustments, including adjustments to add back bonus expenses (through 2011) derived as a percentage of net income in respect of the adjustments above and adjustments to net income (loss) attributable to equity holders of the Company for the purposes of computing ” EPRA Earnings”; expenses arising from the termination of engagements with senior Group officers; income from the waiver by our chairman of bonuses and of compensation with respect to the expiration of his employment agreement (through 2011); expenses and income from extraordinary legal proceeding not related to the reporting periods (including the provision for legal proceedings); income and expenses from operations not related to income producing property (including the results of Dori Group) and the cost of debt with respect thereto; non-recurring expenses in respect of reorganization; and internal leasing costs (mainly salary) incurred in the leasing of properties. |

| ● | “Average annualized base rent” refers to the average minimum rent due under the terms of the applicable leases on an annualized basis. |

| ● | “Community” shopping center means a center that offers general merchandise or convenience-oriented offerings with gross leasable area, or GLA between 100,000 and 350,000 square feet, between 15 and 40 stores and two or more anchors, typically discount stores, supermarkets, drugstores, and large-specialty discount stores, based on the definition published by the International Council of Shopping Centers. |

| ● | “Consolidated” refers to the Company and entities that are consolidated in the Company’s financial statements. |

| ● | ”EPRA Earnings” (or “FFO”) means the net income (loss) attributable to the equity holders of a company with certain adjustments for non-operating items, which are affected by the fair value revaluation of assets and liabilities, primarily adjustments to the fair value of investment property, investment property under development, land and other investments, and various capital gains and losses, gain (loss) from early redemption of liabilities and financial derivatives, gains from bargain purchase, the impairment of goodwill, changes in the fair value recognized with respect to financial instruments including derivatives, deferred taxes and current taxes with respect to disposal of properties, our share in equity-accounted investees and acquisition costs recognized in profit and loss, as well as non-controlling interests’ share with respect to the above items. |

| ● | “GLA” means gross leasable area. |

| ● | “Group” – the Company, its subsidiaries and its equity-accounted associates and jointly controlled entities. |

| ● | "Investees" – Subsidiaries, Jointly controlled entities and associates. |

| ● | “IFRS” means International Financial Reporting Standards, as issued by the International Accounting Standards Board. |

| ● | “LEED®” means Leadership in Energy and Environmental Design and refers to an internationally recognized green building certification system designed by the U.S. Green Building Council. |

| ● | “Neighborhood” shopping center means a center that is designed to provide convenience shopping for the day-to-day needs of consumers in the immediate neighborhood with GLA between 30,000 and 150,000 square feet and between five and 20 stores and is typically anchored by one or more supermarkets, based on the definition published by the International Council of Shopping Centers. |

| ● | “NOI” means net operating income. |

| ● | “Reporting date” or “balance sheet date” means December 31, 2015. |

| ● | “Same property NOI” means the change in net operating income for properties that were owned for the entirety of both the current and prior reporting periods (excluding expanded and redeveloped properties and the impact of currency exchange rates). |

| 1 |

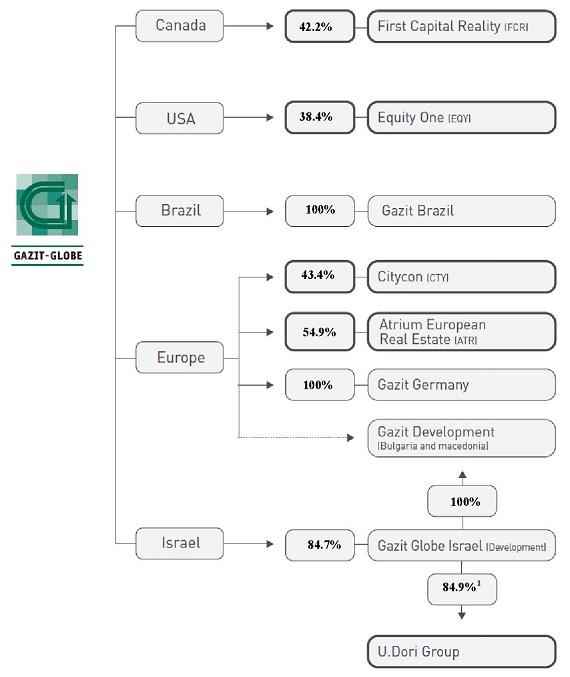

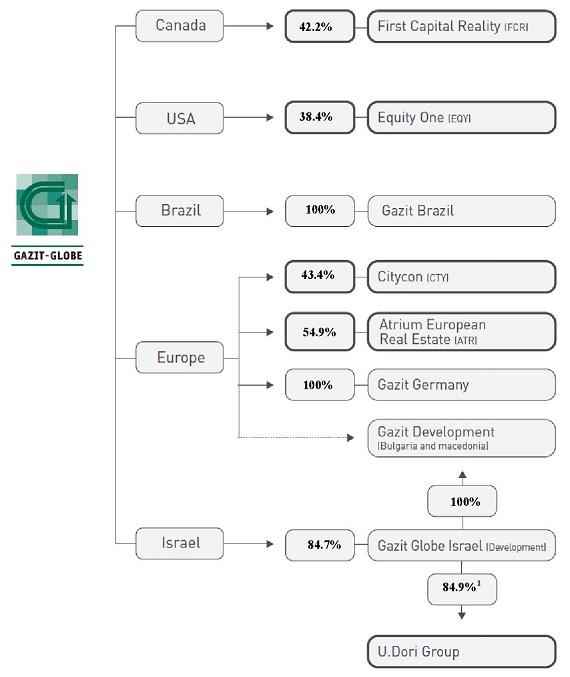

Our principal subsidiaries are:

| ● | “Atrium” means Atrium European Real Estate Limited, consolidated as of January, 2015 (VSE/EURONEXT:ATRS) which owns and operates shopping centers in Central and Eastern Europe. |

| ● | “Citycon” means Citycon Oyj. (NASDAQ OMX HELSINKI:CTY1S) which owns and operates shopping centers in Northern Europe. |

| ● | “Dori Construction” means U. Dori Construction Ltd (TASE:DRCN) and its subsidiaries. |

| ● | “Dori Group” means U. Dori Group Ltd. (TASE: DORI) and its subsidiaries, which as of December 31, 2015, held 83.46% of Dori Construction, which is also traded on the Tel Aviv Stock Exchange, and Dori Construction’s subsidiaries and related companies. Gazit-Globe Israel (Development) Ltd. held approximately 84.9% of Dori Group until January 2016 when it sold its entire stake. For additional details refer to Note 9g of our audited consolidated financial statements included elsewhere in this annual report. |

| ● | “Equity One” means Equity One, Inc. (NYSE:EQY) which owns and operates shopping centers in the United States. |

| ● | “First Capital” means First Capital Realty Inc. (TSX:FCR) which owns and operates shopping centers in Canada. |

| ● | “Gazit America” means Gazit America Inc., a wholly-owned subsidiary, which as of December 31, 2015, held 11.1% of Equity One’s share capital and which prior to August 8, 2012 was the owner of ProMed Canada. |

| ● | “Gazit Brazil” means Gazit Brazil Ltda. and Fundo De Investimento Multimercado Norstar Credito Privado which owns and operates shopping centers in Brazil. |

| ● | “Gazit Development” means Gazit-Globe Israel (Development) Ltd. which wholly-owns Gazit Development (Bulgaria) and held 84.9% of Dori Group until January 2016. |

| ● | “Gazit Germany” means Gazit Germany Beteiligungs GmbH & Co. KG which owns and operates shopping centers in Germany. |

| ● | “Norstar” means Norstar Holdings Inc. (TASE: NSTR), formerly known as Gazit Inc., which had voting power of 50.54% of our issued ordinary shares as of April 10, 2016. |

| ● | “ProMed” means ProMed Properties Inc. which owned and operated medical office buildings in the United States until August 2015. |

| ● | “Royal Senior Care” or “RSC” means Royal Senior Care, LLC which owned and operated senior housing facilities in the United States, which were sold during 2012 and 2013. |

Unless otherwise noted, all monetary amounts are in NIS, and for the convenience of the reader certain NIS amounts have been translated into U.S. dollars at the rate of NIS 3.902 = U.S.$ 1.00, based on the daily representative rate of exchange between the NIS and the U.S. dollar reported by the Bank of Israel on December 31, 2015. References herein to (i) “New Israeli Shekel” or “NIS” mean the legal currency of Israel, (ii) “U.S.$,” “$,” “U.S. dollar” or “dollar” mean the legal currency of the United States, (iii) “Euro,” “EUR” or “€” mean the currency of the participating member states in the third stage of the Economic and Monetary Union of the Treaty establishing the European community, (iv) “Canadian dollar” or “C$” mean the legal currency of Canada, and (v) “BRL” mean the legal currency of Brazil.

| 2 |

We make forward-looking statements in this annual report that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, results of operations, liquidity, plans and objectives. In some cases, you can identify forward-looking statements by terminology such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” or the negative of these terms or other similar expressions. The statements we make regarding the following subject matters are forward-looking by their nature:

| ● | our ability to respond to new market developments; |

| ● | our intent to penetrate further our existing markets and penetrate new markets; |

| ● | our belief that we will have sufficient access to capital; |

| ● | our belief that we will have viable financing and refinancing alternatives that will not materially adversely impact our expected financial results; |

| ● | our belief that continuing to develop high-profile properties will drive growth, increase cash flows and profitability; |

| ● | our belief that repositioning of our properties and our active management will improve our occupancy rates and rental income, lower our costs and increase our cash flows; |

| ● | our plans to invest in developing and redeveloping real estate, in investing in the acquisition of additional properties, portfolios or other real estate companies; |

| ● | our ability to use our successful business model, together with our global presence and corporate structure, to leverage our flexibility to invest in multiple regions in the same asset type to maximize shareholder value; |

| ● | our ability to acquire additional properties or portfolios; |

| ● | our plans to continue to expand our international presence; |

| ● | our expectations that our business approach, combined with the geographic diversity of our current properties and our conservative approach to risk, characterized by the types of properties and markets in which we invest, will provide accretive and/or sustainable long-term returns; and |

| ● | Our expectations regarding our future tenant mix. |

The forward-looking statements contained in this annual report reflect our views as of the date of this annual report about future events and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause events or our actual activities or results to differ significantly from those expressed in any forward-looking statement. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guaranty future events, results, actions, levels of activity, performance or achievements. You are cautioned not to place undue reliance on these forward-looking statements. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements, including, but not limited to, those factors described in “Item 3—Key Information—Risk Factors.”

All of the forward-looking statements we have included in this annual report are based on information available to us on the date of this annual report. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

| 3 |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

| A. | Selected Financial Data |

The following tables set forth our selected consolidated financial data. You should read the following selected consolidated financial data in conjunction with “Item 5. Operating and Financial Review and Prospects” and our consolidated financial statements and related notes included in this annual report. Historical results are not necessarily indicative of the results that may be expected in the future. Our financial statements have been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB.

The selected consolidated statement of income data set forth below for each of the years ended December 31, 2013, 2014 and 2015 and the selected consolidated balance sheet data set forth below as of December 31, 2014 and 2015 are derived from our audited consolidated financial statements appearing in this annual report. The selected consolidated statement of income data for each of the years ended December 31, 2011 and 2012, and the selected consolidated balance sheet data as of December 31, 2011, 2012 and 2013, are derived from our audited consolidated financial statements that are not included in this annual report.

The following tables also contain translations of NIS amounts into U.S. dollars for amounts presented as of and for the year ended December 31, 2015. These translations are solely for the convenience of the reader and were calculated at the rate of NIS 3.902 = U.S.$ 1.00, the daily representative rate of exchange between the NIS and the U.S. dollar reported by the Bank of Israel on December 31, 2015. You should not assume that, on that or on any other date, one could have converted these amounts of NIS into dollars at that or any other exchange rate.

| Year Ended December 31, | ||||||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | |||||||||||||||||||

| (In millions except for per share data) | NIS | U.S.$ | ||||||||||||||||||||||

| Statement of Income Data: | ||||||||||||||||||||||||

| Rental income | 4,718 | 5,249 | 5,146 | 4,913 | 6,150 | 1,576 | ||||||||||||||||||

| Property operating expenses | 1,522 | 1,705 | 1,689 | 1,584 | 1,966 | 504 | ||||||||||||||||||

| Net operating rental income | 3,196 | 3,544 | 3,457 | 3,329 | 4,184 | 1,072 | ||||||||||||||||||

| Revenues from sale of buildings, land and construction work performed (1) | 1,001 | 1,760 | 1,672 | 1,357 | 1,153 | 296 | ||||||||||||||||||

| Cost of buildings sold, land and construction work performed (1) | 967 | 1,720 | 1,688 | 1,660 | 1,249 | 320 | ||||||||||||||||||

| Gross profit (loss) from sale of buildings, land and construction work performed | 34 | 40 | (16 | ) | (303 | ) | (96 | ) | (24 | ) | ||||||||||||||

| Total gross profit | 3,230 | 3,584 | 3,441 | 3,026 | 4,088 | 1,048 | ||||||||||||||||||

| Fair value gain on investment property and investment property under development, net (2) | 1,692 | 1,938 | 962 | 1,053 | 711 | 182 | ||||||||||||||||||

| General and administrative expenses | (755 | ) | (673 | ) | (610 | ) | (619 | ) | (794 | ) | (203 | ) | ||||||||||||

| Other income | 115 | 164 | 218 | 55 | 31 | 8 | ||||||||||||||||||

| Other expenses | (110 | ) | (47 | ) | (74 | ) | (81 | ) | (798 | ) | (205 | ) | ||||||||||||

| Company’s share in earnings of equity-accounted investees, net | 334 | 299 | 149 | 12 | 242 | 62 | ||||||||||||||||||

| Operating income | 4,506 | 5,265 | 4,086 | 3,446 | 3,480 | 892 | ||||||||||||||||||

| Finance expenses | (2,197 | ) | (2,214 | ) | (2,185 | ) | (2,115 | ) | (1,852 | ) | (475 | ) | ||||||||||||

| Finance income | 72 | 120 | 549 | 157 | 861 | 221 | ||||||||||||||||||

| Income before taxes on income | 2,381 | 3,171 | 2,450 | 1,488 | 2,489 | 638 | ||||||||||||||||||

| Taxes on income | 352 | 758 | 265 | 405 | 183 | 47 | ||||||||||||||||||

| Net income | 2,029 | 2,413 | 2,185 | 1,083 | 2,306 | 591 | ||||||||||||||||||

| Net income attributable to: | ||||||||||||||||||||||||

| Equity holders of the Company | 708 | 901 | 927 | 73 | 620 | 159 | ||||||||||||||||||

| Non-controlling interests | 1,321 | 1,512 | 1,258 | 1,010 | 1,686 | 432 | ||||||||||||||||||

| 2,029 | 2,413 | 2,185 | 1,083 | 2,306 | 591 | |||||||||||||||||||

| Basic net earnings per share | 4.57 | 5.46 | 5.41 | 0.41 | 3.47 | 0.89 | ||||||||||||||||||

| Diluted net earnings per share | 4.23 | 5.25 | 5.35 | 0.39 | 3.45 | 0.88 | ||||||||||||||||||

| (1) | Revenues from sale of buildings, land and construction work performed primarily comprises revenue from construction work performed by Dori Group starting in 2014, and also First Capital starting in 2013. Through April 17, 2011, Dori Group was included in our financial statements as an equity-accounted investee. Since April 17, 2011, Dori Group has been fully consolidated due to our acquisition of an additional 50% interest in Dori Group. In January 2016, we sold our entire stake in Dori Group, primarily in an off-market transaction. For further information see Note 9g of our audited consolidated financial statements included elsewhere in this annual report. |

| 4 |

| (2) | Pursuant to IAS 40 "Investment Property", gains or losses arising from change in fair value of our investment property and our investment property under development where fair value can be reliably measured are recognized in our income statement at the end of each period. |

| Year Ended December 31, | ||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||

| (In thousands) | ||||||||||||||||||||

| Weighted average number of shares used to calculate: | ||||||||||||||||||||

| Basic earnings per share | 154,456 | 164,912 | 171,103 | 176,459 | 178,426 | |||||||||||||||

| Diluted earnings per share | 154,783 | 165,016 | 171,413 | 176,546 | 178,601 | |||||||||||||||

| As of December 31, | ||||||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | |||||||||||||||||||

| (In millions) | NIS | U.S.$ | ||||||||||||||||||||||

| Selected Balance Sheet Data: | ||||||||||||||||||||||||

| Equity-accounted investees | 4,390 | 4,713 | 5,907 | 6,213 | 2,996 | 768 | ||||||||||||||||||

| Investment property | 51,014 | 55,465 | 53,309 | 56,646 | 70,606 | 18,095 | ||||||||||||||||||

| Investment property under development | 2,198 | 2,806 | 2,479 | 1,642 | 2,587 | 663 | ||||||||||||||||||

| Total assets | 64,599 | 71,034 | 67,927 | 69,984 | 84,236 | 21,588 | ||||||||||||||||||

| Long term interest-bearing liabilities from financial institutions and others (1) | 18,973 | 19,433 | 12,692 | 8,552 | 11,457 | 2,936 | ||||||||||||||||||

| Long term debentures (2) | 15,379 | 18,500 | 22,231 | 24,433 | 29,480 | 7,555 | ||||||||||||||||||

| Total liabilities | 45,203 | 48,737 | 45,574 | 44,114 | 53,241 | 13,645 | ||||||||||||||||||

| Equity attributable to equity holders of the Company | 7,199 | 7,681 | 7,802 | 8,023 | 7,512 | 1,925 | ||||||||||||||||||

| Non-controlling interests | 12,197 | 14,616 | 14,551 | 17,847 | 23,483 | 6,018 | ||||||||||||||||||

| Total equity | 19,396 | 22,297 | 22,353 | 25,870 | 30,995 | 7,943 | ||||||||||||||||||

| (1) | As of December 31, 2015, NIS 4.2 billion (U.S.$ 1.1 billion) of our interest-bearing liabilities from financial institutions and others (including current maturities) were unsecured and the remainder were secured. |

| (2) | As of December 31, 2015, NIS 834 million (U.S.$ 214 million) aggregate principal amount of our debentures was secured and the remainder was unsecured. |

| As of December 31, | ||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||

| NIS | ||||||||||||||||||||

| Other Operating Data (1): | ||||||||||||||||||||

| Number of Group operating properties | 642 | 622 | 577 | 524 | 451 | |||||||||||||||

| Total Group GLA (in thousands of sq. ft.) | 72,903 | 73,292 | 71,431 | 68,336 | 70,796 | |||||||||||||||

| Group occupancy (%) | 94.3 | 95.0 | 95.0 | 95.9 | 95.8 | |||||||||||||||

| (1) | Includes equity-accounted jointly controlled companies. |

| Year Ended December 31, | ||||||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | |||||||||||||||||||

| (In millions except for per share data) | NIS | U.S.$ | ||||||||||||||||||||||

| Other Financial Data: | ||||||||||||||||||||||||

| NOI (1) | 3,196 | 3,544 | 3,457 | 3,329 | 4,184 | 1,072 | ||||||||||||||||||

| Adjusted EBITDA (1) | 2,864 | 3,257 | 3,192 | 2,817 | 3,403 | 872 | ||||||||||||||||||

| Dividends | 241 | 264 | 298 | 318 | 328 | 84 | ||||||||||||||||||

| Dividends per share | 1.56 | 1.60 | 1.72 | 1.80 | 1.84 | 0.47 | ||||||||||||||||||

| EPRA Earnings (1)(2) | 80 | 327 | 269 | 345 | 431 | 110 | ||||||||||||||||||

| Adjusted EPRA Earnings (1)(2) | 405 | 533 | 585 | 598 | 627 | 160 | ||||||||||||||||||

| 5 |

| As of December 31, | ||||||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | |||||||||||||||||||

| (In millions) | NIS | U.S.$ | ||||||||||||||||||||||

| EPRA NAV (1) | 8,762 | 10,037 | 10,200 | 10,740 | 10,341 | 2,650 | ||||||||||||||||||

| EPRA NNNAV (1) | 6,781 | 7,157 | 7,361 | 7,209 | 7,583 | 1,943 | ||||||||||||||||||

| (1) | For definitions and reconciliations of NOI, Adjusted EBITDA, EPRA Earnings, Adjusted EPRA Earnings, EPRA NAV and EPRA NNNAV and statements disclosing the reasons why our management believes that their presentation provides useful information to investors and, to the extent material, any additional purposes for which our management uses them see "Item 5—Operating and Financial Review and Prospects". |

| (2) | In European countries using IFRS, it is customary for companies with income-producing property to publish their "EPRA Earnings". EPRA Earnings is a measure for presenting the operating results of a company that are attributable to its equity holders. We believe that these measures are consistent with the position paper of EPRA, which states, "EPRA Earnings is similar to NAREIT FFO. The measures are not exactly the same, as EPRA Earnings has its basis in IFRS and FFO is based on US GAAP." We believe that EPRA Earnings is similar in substance to funds from operations, or FFO, with adjustments primarily for the attribution of results under IFRS. |

| Year Ended December 31, | ||||||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | |||||||||||||||||||

| (In millions) | NIS | U.S.$ | ||||||||||||||||||||||

| Cash flows provided by (used in): | ||||||||||||||||||||||||

| Operating activities | 1,104 | 1,368 | 1,189 | 1,026 | 1,514 | 388 | ||||||||||||||||||

| Investing activities | (4,195 | ) | (4,621 | ) | (2,208 | ) | (768 | ) | (4,437 | ) | (1,137 | ) | ||||||||||||

| Financing activities | 4,017 | 3,490 | 428 | (701 | ) | 4,665 | 1,196 | |||||||||||||||||

Exchange Rate Information

The following table sets forth, for each period indicated, the low and high exchange rates for NIS expressed as NIS per U.S. dollar, the exchange rate at the end of such period and the average of such exchange rates during such period, based on the daily representative rate of exchange as published by the Bank of Israel. The exchange rates set forth below demonstrate trends in exchange rates, but the actual exchange rates used throughout this annual report may vary.

| Year Ended December 31, | ||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||

| High | 3.82 | 4.08 | 3.79 | 3.99 | 4.05 | |||||||||||||||

| Low | 3.36 | 3.70 | 3.47 | 3.40 | 3.76 | |||||||||||||||

| Period end | 3.82 | 3.73 | 3.47 | 3.89 | 3.90 | |||||||||||||||

| Average Rate | 3.58 | 3.86 | 3.61 | 3.58 | 3.89 | |||||||||||||||

| 6 |

The following table shows, for each of the months indicated, the high and low exchange rates between the NIS and the U.S. dollar, expressed as NIS per U.S. dollar and based upon the daily representative rate of exchange as published by the Bank of Israel:

| High | Low | |||||||

| Month | (NIS) | (NIS) | ||||||

| October 2015 | 3.92 | 3.82 | ||||||

| November 2015 | 3.92 | 3.87 | ||||||

| December 2015 | 3.91 | 3.86 | ||||||

| January 2016 | 3.98 | 3.91 | ||||||

| February 2016 | 3.96 | 3.87 | ||||||

| March 2016 | 3.91 | 3.77 | ||||||

On April 10, 2016 the daily representative rate of exchange between the NIS and U.S. dollar as published by the Bank of Israel was NIS 3.786 to $1.00.

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Our business involves a high degree of risk. Please carefully consider the risks we describe below in addition to the other information set forth elsewhere in this annual report and in our other filings with the SEC. These material risks could adversely affect our business, financial condition and results of operations.

Risks Related to Our Business and Operations

Economic conditions may make it difficult to maintain or increase occupancy rates and rents and a deterioration in economic conditions in one or more of our key regions could adversely impact our results of operations.

In 2015, our rental income (assuming full consolidation of jointly-controlled entities) was derived as follows: 31.5% from Canada, 22.5% from the United States, 22.9% from Northern and Western Europe, 18.8% from Central and Eastern Europe, 3.2% from Israel, and 1.1% from Brazil. During the economic downturn of 2008-2009, general market conditions deteriorated in many of our markets, particularly the United States and Central and Eastern Europe. Lack of financing and a decrease in consumer spending prevented retailers from expanding their activities. As a consequence, occupancy rates declined in some of the regions in which we operate, most significantly in the United States where the occupancy rates for our shopping centers decreased from 93.2% as of December 31, 2007 to 90.7% as of December 31, 2010. As a result, we granted rent concessions to some tenants during this period. The economic downturn adversely affected our net operating income and the value of our assets in all of the regions in which we operate. In addition, currencies in many of our markets were devalued against the NIS during that period. Although general market conditions have improved and currencies have strengthened in those markets since 2010, our ability to maintain or increase our occupancy rates and rent levels depends on continued improvements in global and local economic conditions.

While the economy in many of the cities within our markets has continued to gradually improve (with notable exception of Russia and Brazil), macro-economic challenges, such as low consumer confidence, high unemployment and reduced consumer spending, have adversely affected many retailers and continue to adversely affect the retail sales of many regional and local tenants in some of our markets and our ability to re-lease vacated space at higher rents. Moreover, companies in some of our markets shifted to a more cautionary mode with respect to leasing as a result of the prevailing economic climate and demand for retail space has declined generally, reducing the market rental rates for our properties. As a result, in these markets we may not be able to re-lease vacated space and, if we are able to re-lease vacated space, there is no assurance that rental rates will be equal to or in excess of current rental rates. In addition, we may incur substantial costs in obtaining new tenants, including brokerage commissions paid by us in connection with new leases or lease renewals, and the cost of making leasehold improvements. These events and factors could adversely affect our rental income and overall results of operations.

| 7 |

While most of our shopping centers are anchored by supermarkets, drugstores or other necessity-oriented retailers, which are less susceptible to economic cycles, other tenants of our public subsidiaries, have been vulnerable to declining sales and reduced access to capital. Europe in particular remains vulnerable to volatile financial and credit markets while Russia is suffering from significant economic and political turmoil. As a result, some tenants have requested rent adjustments and abatements, while other tenants have not been able to continue in business at all. Our ability to renew or replace these tenants at comparable rents could adversely impact occupancy rates and overall results of operations.

Revenue from our properties depends on the success of our tenants.

Revenue from our properties depends primarily on the ability of our tenants to pay the full amount of rent and other charges due under their leases on a timely basis. Any reduction in the tenants' abilities to pay rent or other charges on a timely basis, including the filing by the tenants for bankruptcy protection, could adversely affect our financial condition and results of operations. In the event of default by tenants, our subsidiaries and affiliates may experience delays and unexpected costs in enforcing their rights as landlords under the leases, which may also adversely affect our financial condition and results of operations.

The economic performance and value of our shopping centers depend on many factors, each of which could have an adverse impact on our cash flows and operating results.

The economic performance and value of our properties can be affected by many factors, including the following:

| ● | Economic uncertainty or downturns in general, or in the areas where our properties are located; | |

| ● | Local conditions, such as an oversupply of space, a reduction in demand for retail space or a change in local demographics; | |

| ● | The attractiveness of our properties to tenants and competition from other available space; | |

| ● | The adverse financial condition of some large retail companies and ongoing consolidation within the retail sector; | |

| ● | The growth of super-centers and warehouse club retailers and their adverse effect on traditional grocery chains; | |

| ● | Changes in the perception of retailers or shoppers regarding the safety, convenience and attractiveness of our shopping centers and changes in the overall climate of the retail industry; | |

| ● | The ability of our subsidiaries and affiliates to provide adequate management services and to maintain our properties; | |

| ● | Increased operating costs, if these costs cannot be passed through to tenants; | |

| ● | The expense of periodically renovating, repairing and re-letting spaces; | |

| ● | The impact of increased energy costs and/or extreme weather conditions on consumers and its consequential effect on the number of shopping visits to our properties; and | |

| ● | The consequences of any armed conflicts or terrorist attacks. |

To the extent that any of these conditions occur or accelerate, they are likely to impact market rents for retail space, portfolio occupancy, our ability to sell, acquire or develop properties, and cash available for distribution to stockholders.

We seek to expand through acquisitions of additional real estate assets, including other businesses; such expansion may not yield the returns expected, may result in disruptions to our business, may strain management resources and may result in dilution to our shareholders or dilution of our interests in our subsidiaries and affiliates.

Our investing strategy and our market selection process may not ultimately be successful, may not provide positive returns on our investments and may result in losses. The acquisition of properties, groups of properties or other businesses entails risks that include the following, any of which could adversely affect our results of operations and financial condition:

| ● | we may not be able to identify suitable properties to acquire or may be unable to complete the acquisition of the properties we identify; | |

| ● | we may not be able to integrate any acquisitions into our existing operations successfully; | |

| ● | properties we acquire may fail to achieve the occupancy or rental rates we project at the time we make the decision to acquire; and | |

| ● | our pre-acquisition evaluation of the physical condition of each new investment may not detect certain defects or identify necessary repairs or may fail to properly evaluate the costs involved in implementing our plans with respect to such investment. |

| 8 |

Together with our acquisition of individual properties and groups of properties, we have been an active business acquirer and, as part of our growth strategy, we expect to seek to acquire real estate-related businesses in the future. The acquisition and integration of each business involves a number of risks and may result in unforeseen operating difficulties and expenditures in assimilating or integrating the businesses, properties, personnel or operations of the acquired business. Our due diligence prior to our acquisition of a business may not uncover certain legal or regulatory issues that could affect such business. Furthermore, future acquisitions may involve difficulties in retaining the tenants or customers of the acquired business, and disrupt our ongoing business, divert our resources and require significant management attention that would otherwise be available for ongoing operation and development of our current business. Moreover, we can make no assurances that the anticipated benefits of any acquisition, such as operating improvements or anticipated cost savings, would be realized or that we would not be exposed to unexpected liabilities in connection with any acquisition.

To complete a future acquisition, we may determine that it is necessary to use a substantial amount of our available liquidity sources or cash or engage in equity or debt financing. If we raise additional funds through further issuances of equity or convertible debt securities, our existing shareholders could suffer significant dilution, and any new equity securities we or our subsidiaries or affiliates issue could have rights, preferences and privileges senior to those of holders of our ordinary shares. If our subsidiaries or affiliates raise additional funds through further issuances of equity or convertible debt securities, Gazit-Globe, as the holder of equity securities of our subsidiaries and affiliates, could suffer significant dilution, and any new equity securities our subsidiaries or affiliates issue could have rights, preferences and privileges senior to those held by Gazit-Globe. We may not be able to obtain additional financing on terms favorable to us, if at all, which could limit our ability to engage in acquisitions.

We are particularly dependent upon large tenants that serve as anchors in our shopping centers and decisions made by these tenants or adverse developments in their businesses could have a negative impact on our financial condition.

We own shopping centers that are anchored by large tenants. Because of their reputation or other factors, these large tenants are particularly important in attracting shoppers and other tenants to our centers. Our rental income depends upon the ability of the tenants of our properties and, in particular, these anchor tenants, to generate enough income to make their lease payments to us. Certain of our anchor tenants may make up a significant percentage of our rental income in certain markets. For example, Kesko accounted for 7.8% of Citycon's rental income in 2015, Ahold accounted for 4.6% of Atrium's rental income in 2015, Albertsons (and other affiliated brands) accounted for 3.5% of Equity One's total annual minimum rent as of December 31, 2015 and Loblaws and Sobey's accounted for 10.4% and 6.6% respectively of First Capital's total annual minimum rent as of December 31, 2015. In addition, supermarkets and other grocery stores, many of which are anchor tenants, accounted for approximately 16.6% of our total rental income in 2015, assuming full consolidation of equity-accounted jointly-controlled entities. We generally develop or redevelop our shopping centers based on an agreement with an anchor tenant. Changes beyond our control may adversely affect the tenants' ability to make lease payments or could result in them terminating their leases. These changes include, among others:

| ● | downturns in national or regional economic conditions where our properties are located, which generally will negatively impact the rental rates; | |

| ● | changes in the buying habits of consumers in the regions surrounding those shopping centers including a shift to preference for online shopping and e-commerce; | |

| ● | changes in local market conditions such as an oversupply of properties, including space available by sublease or new construction, or a reduction in demand for our properties; | |

| ● | competition from other available properties; and | |

| ● | changes in federal, state or local regulations and controls affecting rents, prices of goods, interest rates, fuel and energy consumption. |

As a result, tenants may determine not to renew leases, delay lease commencement or adjust their square footage needs downward. In addition, anchor tenants often have more favorable lease provisions and significant negotiating power. In some instances, we may need to seek their permission to lease to other, smaller tenants. Anchor tenants, particularly retail chains, may also change their operating policies for their stores (such as the size of their stores) and the regions in which they operate. As a result, anchor tenants may determine not to renew leases or delay lease commencement. An anchor tenant may decide that a particular store is unprofitable and close its operations in our center, and, while the tenant may continue to make rental payments, such a failure to occupy its premises could have an adverse effect on the property. A lease termination by an anchor tenant or a failure by that anchor tenant to occupy the premises could result in lease terminations or reductions in rent by other tenants in the same shopping center. In addition, we are subject to the risk of defaults by tenants or the failure of any lease guarantors to fulfill their obligations, tenant bankruptcies and other early termination of leases or non-renewal of leases. Any of these developments could materially and adversely affect our financial condition and results of operations.

| 9 |

Commencement of operations in new geographic markets and asset classes involves risks and may result in us investing significant resources without realizing a return and may adversely impact our future growth.

The commencement of operations in new geographic markets or asset classes in which we have little or no prior experience involves costs and risks. In the past, we expanded into new regions, including Central and Eastern Europe and Brazil, and into other asset classes, such as medical office buildings and senior care facilities. While we currently have no specific plans to commence operations in new geographic markets or asset classes, we may decide to enter into new markets or asset classes in the future when an opportunity presents itself. When commencing such operations, we need to learn and become familiar with the various aspects of operating in these new geographic markets or asset classes, including regulatory aspects, the business and macro-economic environment, new currency exposure, as well as the necessity of establishing new systems and administrative headquarters at substantial costs. Additionally, it may take many years for an acquisition to achieve desired results as factors such as obtaining regulatory permits, construction, signing the right mix of tenants and assembling the right management team take time to implement. In some cases, we may commence such operations by means of a joint venture which often offers the advantage of a partner with superior experience, but also has the risks associated with any activity conducted jointly with a non-controlled third party. In addition, entry into new geographic markets may also lead to difficulty managing geographically separated organizations and assets, difficulty integrating personnel with diverse business backgrounds and organizational cultures and compliance with foreign regulatory requirements applicable to acquisitions. Our failure to successfully expand into new geographies and asset classes may result in us investing significant resources without realizing a return and may adversely impact our future growth.

If we or our public subsidiaries are unable to obtain adequate capital, we may have to limit our operations substantially.

Our acquisition and development of properties and our acquisition of other businesses and equity interests in real estate companies are financed in part by loans received from banks, insurance companies and other financing sources, as well as from the sale of shares, notes, debentures and convertible debentures in public and private offerings. Our public subsidiaries satisfy their capital requirements through debt and equity financings in their respective local markets. The practices in these markets vary significantly, for example, with some of the markets based partly on bank lending and others depending significantly on accessing the capital markets. Our ability to obtain, economically desirable financing terms could be affected by unavailability or a shortage of external financing sources, changes in existing financing terms, changes in our financial condition and results of operations, legislative changes, changes in the public or private markets in our operating regions and deterioration of the economic situation in our operating regions. Should our ability to obtain financing be impaired, our operations could be limited significantly. Our business results are dependent on our ability to obtain loans or capital in the future in order to repay our loans, notes, debentures and convertible debentures.

Internet sales can have an impact on our tenants and our business.

The use of the internet by consumers continues to gain in popularity and growth in internet sales is likely to continue in the future. The increase in internet sales could result in a downturn in the business of some of our current tenants and could affect the way other current and future tenants lease space. For example, the migration towards internet sales has led many retailers to reduce the number and size of their traditional "bricks and mortar" locations in order to increasingly rely on e-commerce and alternative distribution channels. Many tenants also permit merchandise purchased on their websites to be picked up at, or returned to, their physical store locations, which may have the effect of decreasing the reported amount of their in-store sales and the amount of rent we are able to collect from them (particularly with respect to those tenants who pay rent based on a percentage of their in-store sales). We cannot predict with certainty how growth in internet sales will impact the demand for space at our properties or how much revenue will be generated at traditional store locations in the future. If we are unable to anticipate and respond promptly to trends in retailer and consumer behavior, our occupancy levels and financial results could be negatively impacted.

Future terrorist acts and shooting incidents could harm the demand for, and the value of, our properties.

Over the past few years, a number of terrorist acts and shootings have occurred at retail properties throughout the world, including highly publicized incidents in Arizona, New Jersey, Maryland, Oregon, Kenya and Tel-Aviv. In the event concerns regarding safety were to alter shopping habits or deter customers from visiting shopping centers, our tenants would be adversely affected as would the general demand for retail space. Additionally, if such incidents were to continue, insurance for such acts may become limited or subject to substantial cost increases.

| 10 |

Many of our real estate costs are fixed, even if income from our properties decreases.

Our financial results depend in part on leasing space in the properties to tenants on favorable financial terms. Costs associated with real estate investment, such as real estate taxes, insurance and maintenance costs, generally are not reduced even when a property is not fully occupied, rental rates decrease, or other circumstances cause a reduction in income from the property. As a result, cash flow from the operations of the properties may be reduced if a tenant does not pay its rent or we are unable to fully lease the properties on favorable terms. Additionally, properties that we develop or redevelop may not produce any significant revenue immediately, and the cash flow from existing operations may be insufficient to pay the operating expenses and debt service associated with such projects until they are fully occupied.

We have substantial debt obligations which may negatively affect our results of operations and financial position and put us at a competitive disadvantage.

Our organizational documents do not limit the amount of debt that we may incur and we do not have a policy that limits our debt to any particular level. As of December 31, 2015, we and our private subsidiaries had outstanding interest-bearing debt in the aggregate amount of NIS 15,473 million (U.S.$ 3,965 million) and other liabilities outstanding in the aggregate amount of NIS 659 million (U.S.$ 169 million), of which approximately 9% matures during 2016. On a consolidated basis, we had debt and other liabilities outstanding as of December 31, 2015 in the aggregate amount of NIS 53,241 million (U.S.$ 13,645 million), of which 11.7% matures during 2016. We are subject to covenant compliance obligations and each of our public subsidiaries is subject to its own covenant compliance obligations. Furthermore, the indebtedness of each of our public subsidiaries is independent of each other public subsidiary and is not subject to any guaranty by Gazit-Globe or its wholly-owned subsidiaries.

The amount of debt outstanding from time to time could have important consequences to us and our public subsidiaries. For example, it could

| ● | require that we dedicate a substantial portion of cash flow from operations to payments on debt, thereby reducing funds available for operations, property acquisitions, redevelopments and other business opportunities that may arise in the future; | |

| ● | limit the ability to make distributions on equity securities, including the payment of dividends; | |

| ● | make it difficult to satisfy debt service requirements; | |

| ● | limit flexibility in planning for, or reacting to, changes in business and the factors that affect profitability, which may place us at a disadvantage compared to competitors with less debt or debt with less restrictive terms; | |

| ● | adversely affect financial ratios and debt and operational coverage levels monitored by rating agencies and adversely affect the ratings assigned to our or our public subsidiaries' debt, which could increase the cost of capital; and | |

| ● | limit our or our public subsidiaries' ability to obtain any additional debt or equity financing that may be needed in the future for working capital, debt refinancing, capital expenditures, acquisitions, redevelopment or other general corporate purposes or to obtain such financing on favorable terms. |

If our or our public subsidiaries' internally generated cash is inadequate to repay indebtedness upon an event of default or upon maturity, then we or our public subsidiaries will be required to repay or refinance the debt. If we or our public subsidiaries are unable to refinance our indebtedness on acceptable terms or if the amount of refinancing proceeds is insufficient to fully repay the existing debt, we or our public subsidiaries might be forced to dispose of properties, potentially upon disadvantageous terms, which might result in losses and might adversely affect our cash available for distribution. If prevailing interest rates or other factors at the time of refinancing result in higher interest rates on refinancing, our interest expense would increase without a corresponding increase in our rental rates, which would adversely affect our results of operations.

In addition, our debt financing agreements and the debt financing agreements of our public subsidiaries contain representations, warranties and covenants, including financial covenants that, among other things, require the maintenance of certain financial ratios. Certain of the covenants that apply to Gazit-Globe depend upon the performance of our public subsidiaries and we therefore have less control over our compliance with those covenants. For example, covenants that apply to Gazit-Globe require Citycon to maintain a minimum ratio of equity to total assets less advances received and a minimum ratio of EBITDA to net finance expenses. Another covenant requires First Capital to maintain a minimum ratio of EBITDA to finance expenses.

| 11 |

Should we or our public subsidiaries breach any such representations, warranties or covenants contained in any such loan or other financing agreement, or otherwise be unable to service interest payments or principal repayments, we or our public subsidiaries may be required immediately to repay such borrowings in whole or in part, together with any related costs and a default under the terms of certain of our other indebtedness may result from such breach. For example, a decline in the property market or a wide scale tenant default may result in a failure to meet any loan to value or debt service coverage ratios, thereby causing an event of default and we or our public subsidiaries, as the case may be, may be required to prepay the relevant loan. A significant portion of Gazit-Globe's equity interests in its subsidiaries are pledged as collateral for Gazit-Globe's revolving credit facilities and other indebtedness incurred by Gazit-Globe directly and by its private subsidiaries. As of December 31, 2015, the principal amount of such indebtedness was NIS 2,202 million (U.S.$ 564 million), which constituted 4.9% of our consolidated indebtedness as of such date. In the event that Gazit-Globe is required to prepay its loans, the lenders under such loans may determine to pursue remedies against and cause the sale of those equity interests. In addition, since certain of our properties were mortgaged to secure payment of indebtedness with a principal amount of NIS 6,777 million (U.S.$ 1,737 million) as of December 31, 2015, which constituted 15.0% of our consolidated indebtedness as of such date, in the event we are unable to refinance or repay our borrowing, we may be unable to meet mortgage payments, or we may default under the related mortgage, deed of trust or other pledge and such property could be transferred to the mortgagee or pledgee, or the mortgagee or pledgee could foreclose upon the property, appoint a receiver and receive an assignment of rents and leases or pursue other remedies, all with a consequent loss of income and asset value. Moreover, any restrictions on cash distributions as a result of breaching financial ratios, failure to repay such borrowings or, in certain circumstances, other breaches of covenants, representations and warranties under our debt financing agreements could result in us being prevented from paying dividends to our investors and have an adverse effect on our liquidity.

Volatility in the credit markets may affect our ability to obtain or re-finance our indebtedness at a reasonable cost.

At times during the last decade, global credit markets have experienced significant price volatility, dislocations and liquidity disruptions, which at times caused the spreads on prospective debt financings to widen considerably. If a downturn or dislocation in credit markets were to occur or if interest rates were to dramatically increase from their current low levels, we may experience difficulty refinancing our upcoming debt maturities at a reasonable cost or with desired financing alternatives. For example, it may be hard to raise new unsecured financing in the form of additional bank debt or corporate bonds at interest rates that are appropriate for our long term objectives. Any change in our credit ratings could further impact our access to capital and our cost of capital, including the cost of borrowings under our revolving lines of credit. To the extent we are unable to efficiently access the credit markets, we may need to repay maturing debt with proceeds from the issuance of equity or the sale of assets. In addition, lenders may impose more restrictive covenants, events of default and other conditions.

The inability of any of our public subsidiaries to satisfy their liquidity requirements may materially and adversely impact our results of operations.

Even though we present the assets and liabilities of our public subsidiaries on a consolidated basis and equity method for an affiliate, they satisfy their short-term liquidity and long-term capital requirements through cash generated from their respective operations and through debt and equity financings in their respective local markets. Our liquidity and available borrowings presented on a consolidated basis may not therefore be reflective of the position of any one of our public subsidiaries since the liquidity and available borrowings of each of our public subsidiaries are not available to support the others' operations. Although we have from time to time purchased equity or convertible debt securities of our public subsidiaries, we have not generally made shareholder loans to them (with a notable exception during 2014 and 2015 being our loans to Gazit Development, please see Note 9g to our audited consolidated financial statements included elsewhere in this annual report) and may have insufficient resources to do so even if our overall financial position on a consolidated basis is positive. Each public subsidiary is subject to its own covenant compliance obligations and the failure of any public subsidiary to comply with its obligations could result in the acceleration of its indebtedness which could have a material adverse effect on our financial position and results of operations.

Our results of operations may be adversely affected by fluctuations in currency exchange rates and we may not have adequately hedged against them.

Because we own and operate assets in many regions throughout the world, our results of operations are affected by fluctuations in currency exchange rates. For the year ended December 31, 2015, 31.5% of our rental income (assuming full consolidation of jointly-controlled entities) was earned in Canadian dollars, 27.9% in Euros, 22.9% in U.S. dollars, 6.9% in Swedish Krona, 4.1% in Norwegian Krone, 3.2% in NIS and 3.5% in other currencies. Our income from development and construction of residential projects activity is primarily generated in NIS (NIS 96 million of gross loss during 2015). In addition, our reporting currency is the New Israeli Shekel, or NIS, and the functional currency is separately determined for each of our subsidiaries. When a subsidiary's functional currency differs from our reporting currency, the financial statements of such subsidiary are translated to NIS so that they can be included in our financial statements. As a result, fluctuations of the currencies in which we conduct business relative to the NIS impact our results of operations and the impact may be material. For example, the average annual rate in NIS of the Canadian dollar and the Euro weakened 5.9% and 9.1%, respectively, and the U.S. Dollar strengthened 8.6%, for 2015 compared to 2014, which resulted in our net operating income decreasing by a total amount of NIS 190 million, or 4.5%. We continually monitor our exposure to currency risk and pursue a company-wide foreign exchange risk management policy, which includes seeking to hold our equity in the currencies of the various markets in which we operate in the same proportions as the assets in each such currency bear to our total assets. We have in the past and expect to continue in the future to at least partly hedge such risks with certain financial instruments. Future currency exchange rate fluctuations that we have not adequately hedged could adversely affect our profitability. We also face risks arising from the imposition of exchange controls and currency devaluations. Exchange controls may limit our ability to convert foreign currencies into NIS or to remit dividends and other payments by our foreign subsidiaries or businesses located in or conducted within a country imposing controls. Currency devaluations result in a diminished value of funds denominated in the currency of the country instituting the devaluation.

| 12 |

Furthermore, the Company has currency and interest swap transactions, with respect to some of which the Company has entered into agreements that provide for mechanisms for the current settling of accounts in connection with the fair value of the swap transactions. Consequently, the Company could be required, from time to time, to transfer material amounts to the banking institution based on the fair value of the aforesaid transactions.

We are subject to a disproportionate impact on our properties due to concentration in certain areas.

As of December 31, 2015, approximately 10.5%, 9.3%, 6.9%, 4.2% and 3.8% of our total GLA was located in Florida (U.S.), the greater Toronto area (Canada), the greater Montreal area (Canada), Northeastern United States and metropolitan Helsinki (Finland), respectively. A regional recession or other major, localized economic disruption or a natural disaster, such as an earthquake or hurricane, in any of these areas could adversely affect our ability to generate or increase operating revenues from our properties, attract new tenants to our properties or dispose of unproductive properties. Any reduction in the revenues from our properties would effectively reduce the income we generate from them, which would adversely affect our results of operations and financial condition. Conversely, strong economic conditions in a region could lead to increased building activity and increased competition for tenants.

Certain emerging markets in which we have properties are subject to greater risks than more developed markets, including significant legal, economic and political risks.

Some of our current and planned investments are located in emerging markets, primarily within Central and Eastern Europe and Brazil, which as of December 31, 2015 comprised 18.6% and 1.2% of our total GLA, respectively, and in India, where we have an investment commitment in Hiref International LLC, a real estate fund, for U.S.$ 110 million (of which we had invested U.S.$ 95.2 million through December 31, 2015) and, as such, are subject to greater risks than those in markets in Northern and Western Europe and North America, including greater legal, economic and political risks. Our performance could be adversely affected by events beyond our control in these markets, such as a general downturn in the economy of countries in which these markets are located, conflicts between states, changes in regulatory requirements and applicable laws (including in relation to taxation and planning), adverse conditions in local financial markets and significant currency volatility or devaluation interest and inflation rate fluctuations. In addition, adverse political or economic developments in these or in neighboring countries could have a significant negative impact on, among other things, individual countries' gross domestic products, foreign trade or economies in general. Recent examples of potentially detrimental developments in emerging markets include the economic downturn in Brazil and the geopolitical tension between Russia and its neighbors. While we currently have no plans to enter new emerging markets, some emerging economies in which we currently operate have historically experienced substantial rates of inflation, an unstable currency, high government debt relative to gross domestic products, a weak banking system providing limited liquidity to domestic enterprises, high levels of loss-making enterprises that continue to operate due to the lack of effective bankruptcy proceedings, significant increases in unemployment and underemployment and the impoverishment of a large portion of the population. This may have a material adverse effect on our business, financial condition or results of operations.

Our reported financial condition and results of operations under IFRS are impacted by changes in value of our real estate assets, which is inherently subjective and subject to conditions outside of our control.

Our consolidated financial statements have been prepared in accordance with IFRS. There are significant differences between IFRS and U.S. GAAP which lead to different results under the two systems of accounting. Currently, one of the most significant differences between IFRS and U.S. GAAP is an option under IFRS to record our real estate assets at fair market value in our financial statements on a quarterly basis, which we have adopted. Accordingly, our financial statements have been significantly impacted in the past by fluctuations due to changes in fair market value of our properties even if no actual disposition of assets took place. For example, in 2015 and 2014, we increased the fair value of our properties on a consolidated basis by NIS 711 million and NIS 1,053 million, respectively.

The valuation of property is inherently subjective due to the individual nature of each property as well as to macro- economic conditions. As a result, valuations are subject to uncertainty. Fair value of investment property including development and land was determined by accredited independent appraisers with respect to 71.0% of such investment properties during the year ended December 31, 2015 (55.2% of which were performed at December 31, 2015). A significant proportion of the valuations of our properties were not performed by appraisers at the balance sheet date, based on materiality thresholds and other considerations that we have applied across our properties. As a result of these factors, there is no assurance that the valuations of our interests in the properties reflected in our financial statements would reflect actual sale prices even where any such sales occur shortly after the financial statements are prepared.

Other real estate companies that are publicly traded in the United States use U.S. GAAP to report their financial statements, and are therefore, not currently required to record the fair market value of their real estate assets on a quarterly basis. As a result, significant declines or fluctuations in the value of their real estate could impact us disproportionately compared to these other companies.

| 13 |

In addition, in recent years several amendments have been made to IFRS standards, including those that affect us, and we have had to revise our accounting policies in order to comply with such amended standards. Commonly, the transition provisions of these amendments require us to implement the amendments on comparative figures as well. Figures with respect to prior periods that are not required to be included in our financial statements are therefore not adjusted retrospectively. As a result, the utility of the comparative figures for certain years may be limited.

Real estate is generally an illiquid investment.

Real estate is generally an illiquid investment as compared to investments in securities. While we do not currently anticipate a need to dispose of a significant number of real estate assets in the short-term, such illiquidity may affect our ability to dispose of or liquidate real estate assets in a timely manner and at satisfactory prices in response to changes in economic, real estate market or other conditions.

We may be obliged to dispose of our interest in a property or properties at a time, for a price or on terms not of our choosing. In addition, some of our anchor tenants have rights of first refusal or rights of first offer to purchase the properties in which they lease space in the event that we seek to dispose of such properties. The presence of these rights of first refusal and rights of first offer could make it more difficult for us to sell these properties in response to market conditions. These limitations on our ability to sell our properties could have an adverse effect on our financial condition and results of operations.

Our competitive position and future prospects depend on our senior management and the senior management of our subsidiaries and affiliates.

The success of our property development and investment activities depend, among other things, on the expertise of our board of directors, our executive team and other key personnel in identifying appropriate opportunities and managing such activities, as well as the executive teams of our subsidiaries and affiliates. The employment agreements pursuant to which Messrs. Katzman and Segal provide such services to Gazit-Globe have expired. Even though their employment agreements have expired, Messrs. Katzman and Segal are continuing to serve as our executive chairman and executive vice chairman, respectively (as of January 2016, Mr. Segal receives directors fees for his services). Mr. Katzman currently also serves as the chairman of the board of Equity One, Citycon, Atrium, and Norstar, and as a director of First Capital while Mr. Segal currently also serves as the vice chairman of the board of Gazit-Globe, chairman of the board of First Capital, the vice chairman of the board of Equity One and the vice chairman of the board and CEO of Norstar. With respect to some of these positions, Messrs. Katzman and Segal have written engagement and remuneration agreements with such public subsidiaries which remain in effect. In addition, recent legislation in Israel, specifically Amendment 20 to the Israeli Companies Law, requires in certain circumstances that the Company's compensation plan for officers as well as the employment agreement of its CEO be approved by a special majority shareholder vote. The loss of some or all of these individuals or an inability to attract, retain and maintain additional personnel, including due to the possible failure to attain special majority shareholder approval mentioned above, could prevent us from implementing our business strategy and could adversely affect our business and our future financial condition or results of operations. We do not carry key man insurance with respect to any of these individuals. We cannot guaranty that we will be able to retain all of our existing senior management personnel or to attract additional qualified personnel when needed.

We face significant competition for the acquisition of real estate assets, which may impede our ability to make future acquisitions or may increase the cost of these acquisitions.

We compete with many other entities for acquisitions of necessity-driven real estate, including institutional pension funds, real estate investment trusts and other owner-operators of shopping centers. This competition may affect us in various ways, including:

| ● | reducing properties available for acquisition; | |

| ● | increasing the cost of properties available for acquisition; | |

| ● | reducing the rate of return on these properties; | |

| ● | reducing rents payable to us; | |

| ● | interfering with our ability to attract and retain tenants; | |

| ● | increasing vacancy rates at our properties; and | |

| ● | adversely affecting our ability to minimize expenses of operation. |

The number of entities and the amount of funds competing for suitable properties and companies may increase. Such competition may reduce the number of suitable properties and companies available for purchase and increase the bargaining position of their owners. We may lose acquisition opportunities in the future if we do not match prices, structures and terms offered by competitors and if we match our competitors, we may experience decreased rates of return and increased risks of loss. If we must pay higher prices, our profitability may be reduced.

| 14 |

Our competitors may enjoy significant competitive advantages that result from, among other things, a lower cost of capital and enhanced operating efficiencies. Some of these competitors may also have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of acquisitions. Furthermore, companies that are potential acquisition targets may find competitors to be more attractive because they may have greater resources, may be willing to pay more or may have a more compatible operating philosophy. These factors may create competitive disadvantages for us with respect to acquisition opportunities.

Our investments in development and redevelopment projects may not yield anticipated returns, and we are subject to general construction risks which may increase costs and delay or prevent the construction of our projects.

An important component of our growth strategy is the redevelopment of properties we own and the development of new projects. Some of our assets, representing 1.7% and 4.0% of the value of our properties (including of our equity-accounted joint ventures) as of December 31, 2015, are at various stages of development and redevelopment (including expansions), respectively. These developments and redevelopments may not be as successful as currently expected. Expansion, renovation and development projects and the related construction entail the following considerable risks:

| ● | significant time lag between commencement and completion subjects us to risks of fluctuations in the general economy; | |

| ● | failure or inability to obtain construction or permanent financing on favorable terms; | |

| ● | inability to achieve projected rental rates or anticipated pace of lease-up; | |

| ● | delay of completion of projects, which may require payment of penalties under lease agreements and subject us to claims for breach of contract; | |

| ● | incurrence of construction costs for a development project in excess of original estimates; | |

| ● | expenditure of time and resources on projects that may never be completed; | |

| ● | acts of nature, such as harsh climate conditions in the winter, earthquakes and floods, that may damage or delay construction of properties; and | |

| ● | delays and costs relating to required zoning or other regulatory approvals. |

The inability to complete the construction of a property on schedule or at all for any of the above reasons could have a material adverse effect on our business, financial condition and results of operations.

Insurance on real estate may not cover all losses.

We currently carry insurance on our properties. Certain of our policies contain coverage limitations, including exclusions for certain catastrophic perils and certain aggregate loss limits. For example, we have a portfolio of properties, representing 3.9% of our total GLA, located in California, including several properties in the San Francisco Bay and Los Angeles areas. These properties may be subject to the risk that an earthquake or other similar peril would affect the operation of these properties. We currently do not have comprehensive insurance covering losses from these perils due to the properties being uninsurable, not justifiable and/or commercially reasonable to insure, or for which any insurance that may be available would be insufficient to repair or replace a damaged or destroyed property. In addition, we have a number of properties in Florida and the northeastern U.S. states representing 14.7% of our total GLA, that are susceptible to hurricanes, floods and tropical storms. While we generally carry windstorm coverage with respect to these properties, the policies contain per occurrence deductibles and aggregate loss limits that limit the amount of proceeds that we may be able to recover. In addition, our properties in Central and Eastern Europe are generally not subject to flood insurance. Further, due to inflation, changes in codes and ordinances, environmental considerations and other factors, it may not be feasible to use insurance proceeds to replace a building after it has been damaged or destroyed.

The availability of insurance coverage may decrease and the prices for insurance may increase as a consequence of significant losses incurred by the insurance industry. In the event of future industry losses, we may be unable to renew or duplicate our current insurance coverage in adequate amounts or at reasonable prices. In addition, insurance companies may no longer offer coverage against certain types of losses, or, if offered, the expense of obtaining these types of insurance may not be justified. We therefore may cease to have insurance coverage against certain types of losses and/or there may be decreases in the limits of insurance available.

Should an uninsured loss, a loss over insured limits or a loss with respect to which insurance proceeds would be insufficient to repair or replace the property occur, we may lose capital invested in the affected property as well as anticipated income and capital appreciation from that property, while we may remain liable for any debt or other financial obligation related to that property.

| 15 |

A failure by Equity One to be treated as a REIT could have an adverse effect on our investment in Equity One.

As of December 31, 2015, Equity One has been treated as a REIT for U.S. federal income tax purposes. Subject to certain exceptions, a REIT generally is able to avoid entity-level tax on income it distributes to its shareholders, provided certain requirements are met, including certain income, asset, and distribution requirements. If Equity One ceases to be treated as a REIT and cannot qualify for any relief provisions under the Internal Revenue Code of 1986, as amended, or the Code, Equity One would generally be subject to an entity-level tax on its income at the graduated rates applicable to corporations. Such tax would reduce Equity One's profitability and would have an adverse effect on our investment in Equity One.

If we or third-party managers fail to efficiently manage our properties, tenants may not renew their leases or we may become subject to unforeseen liabilities.

If we fail to efficiently manage a property or properties, increased costs could result with respect to maintenance and improvement of properties, loss of opportunities to improve income and yield and a decline in the value of the properties. In addition, we sometimes engage third parties to provide management services for our properties. We may not be able to locate and enter into agreements with qualified management service providers. If any third parties providing us with management services do not comply with their agreements or otherwise do not provide services at the level that we expect, our tenant relationships and rental rates for such properties, and therefore, their condition and value, could be negatively affected.