UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

or

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

or

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 001-35378

GAZIT-GLOBE LTD.

(Exact name of registrant as specified in its charter)

Israel

(Jurisdiction of incorporation or organization)

1 Hashalom Rd.

Tel-Aviv 67892, Israel

(972)(3) 694-8000

(Address of principal executive offices)

Adi Jemini,

Chief Financial Officer

Tel: (972)(3) 694-8000

Email: ajemini@gazitgroup.com

1 Hashalom Rd. Tel-Aviv 67892, Israel

(Name, telephone, email and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Ordinary Shares, par value NIS 1.00 per share | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 195,550,414 Ordinary Shares, par value NIS 1.00 per share (excluding Treasury Shares).

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). N/A

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act (check one).

Large Accelerated Filer ☒ Accelerated Filer ☐ Non-Accelerated Filer ☐ Emerging Growth Company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International

Financial Reporting Standards as issued by the International Accounting Standards Board ☒ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): ☐ Yes ☒ No

GAZIT-GLOBE LTD.

FORM 20-F

ANNUAL REPORT FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016

TABLE OF CONTENTS

i

Introduction and Use of Certain Terms

Unless otherwise indicated, all references to (i) “we,” “us,” or “our,” are to Gazit-Globe Ltd. and, where applicable, its investees, and (ii) “Gazit-Globe” or the “Company” are to Gazit-Globe Ltd., not including any of its investees.

Except where the context otherwise requires, references in this annual report to:

| ● | “Adjusted EPRA Earnings” means EPRA Earnings, as adjusted for: |

| ○ | Consumer Price Index (or “CPI”); |

| ○ | depreciation and amortization; |

| ○ | expenses arising from the termination of engagements with senior Group officers; |

| ○ | expenses and income from extraordinary legal proceeding not related to the reporting periods (including provision for legal proceedings); |

| ○ | income and expenses from operations not related to income producing property (including the results of Luzon Group through January 2016) and the cost of debt with respect thereto; |

| ○ | non-recurring expenses with respect to reorganization; and |

| ○ | internal leasing costs (mainly salary) incurred in the leasing of properties. |

| ● | “Average annualized base rent” refers to the average minimum rent due under the terms of applicable leases on an annualized basis. |

| ● | “Community shopping center” means a center that offers general merchandise or convenience-oriented offerings with gross leasable area (or “GLA”) between 100,000 and 350,000 square feet, between 15 and 40 stores and two or more anchors, which are typically discount stores, supermarkets, drugstores, and large-specialty discount stores, based on the definition published by the International Council of Shopping Centers. |

| ● | “Consolidated” refers to the Company and entities that are consolidated in the Company’s financial statements. |

| ● | “EPRA Earnings” means the net income (loss) attributable to the equity holders of a company with certain adjustments for non-operating items, which are affected by the fair value revaluation of assets and liabilities, primarily adjustments to the fair value of investment property, investment property under development, land and other investments, various capital gains and losses, gain (loss) from early redemption of liabilities and financial derivatives, gains from bargain purchase, the impairment of goodwill, changes in the fair value recognized with respect to financial instruments (including derivatives), deferred taxes and current taxes with respect to disposal of properties, our share in investees and acquisition costs recognized in profit and loss, as well as non-controlling interests’ share with respect to the above items. |

| ● | “Equity-accounted investees” means investments presented on an equity method basis, which are not consolidated in the Company’s financial statements. |

| ● | “GLA” means gross leasable area. |

| ● | “Group” means the Company, its subsidiaries, its equity-accounted investees and jointly-controlled entities. |

| ● | “Investees” means subsidiaries, jointly-controlled entities, equity-accounted investees and, after March 1, 2017, Regency. |

| ● | “Jointly-controlled entities” means joint ventures and joint operations in which the Company or its subsidiaries are engaged, which currently include First Capital’s joint venture with Main and Main Developments LP, Citycon’s joint venture with the Canada Pension Plan Investment Board (“CPPIB”) in the Kista Galleria Shopping Center located in Stockholm, Sweden and Atrium’s joint venture with the Otto family in the Arkády Pankrác Shopping Center located in Prague, the Czech Republic. |

| ● | “Neighborhood shopping center” means a center that is designed to provide convenience shopping for the day-to-day needs of consumers in its immediate neighborhood with GLA between 30,000 and 150,000 square feet and between five and 20 stores and is typically anchored by one or more supermarkets, based on the definition published by the International Council of Shopping Centers. |

| ● | “NOI” means net operating income. |

| ● | “Norstar” means Norstar Holdings Inc. (TASE: NSTR), formerly known as Gazit Inc., which owned 50.6% of our issued ordinary shares as of April 10, 2017. |

ii

| ● | “Regency” means Regency Centers Corporation (NYSE: REG), into which Equity One was merged in March 2017. |

| ● | “Reporting date” or “balance sheet date” means December 31, 2016. |

| ● | “Same property NOI” means the change in net operating income for properties that were owned for the entirety of both the current and prior reporting periods (excluding expanded and redeveloped properties and the impact of currency exchange rates). |

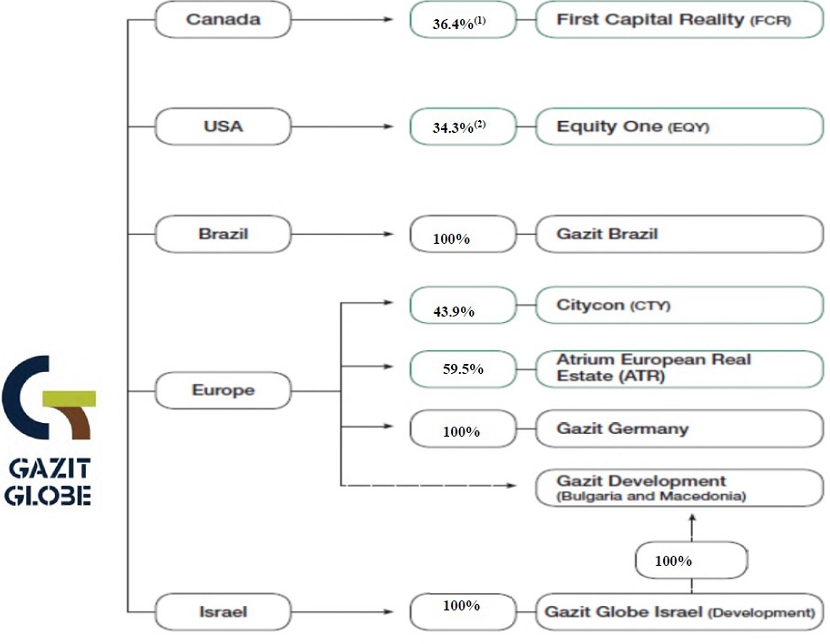

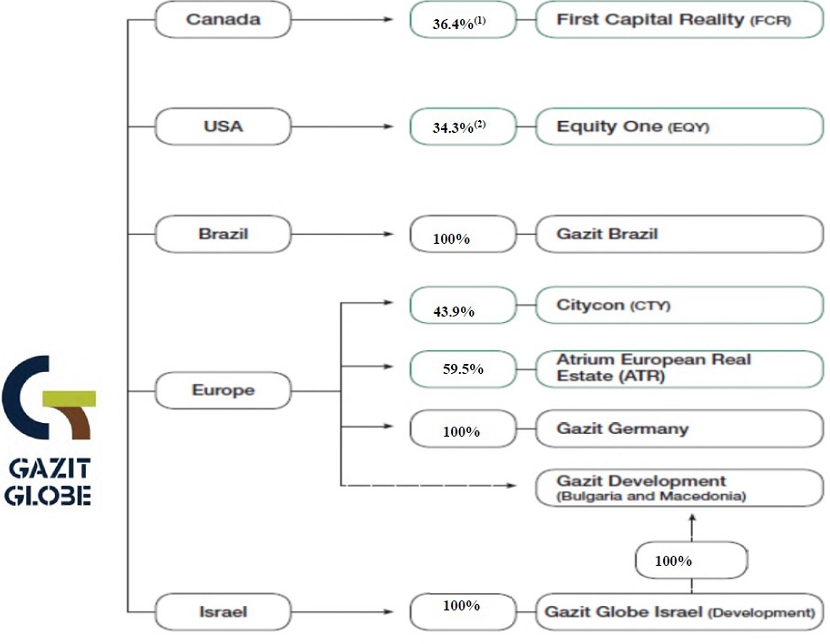

As of December 31, 2016 our principal subsidiaries were:

| ● | “Atrium” means Atrium European Real Estate Limited (VSE/EURONEXT:ATRS), consolidated as of January 2015, which owns and operates shopping centers in Central and Eastern Europe. |

| ● | “Citycon” means Citycon Oyj. (NASDAQ OMX HELSINKI:CTY1S), which owns and operates shopping centers in Northern Europe. |

| ● | “Dori Construction” means U. Dori Construction Ltd. and its subsidiaries. |

| ● | “Luzon Group” means Amos Luzon Development and Energy Group Ltd. (TASE:LUZN) (formerly U. Dori Group Ltd. (TASE: DORI)) and its subsidiaries, which controls Dori Construction and Dori Construction’s subsidiaries and related companies. Gazit Development held approximately 84.9% of Luzon Group until January 2016, when it sold its entire stake. Consequently, commencing in the first quarter of 2016, Luzon Group’s operations are no longer consolidated as an operating segment in our financial statements and are presented in our audited consolidated financial statements included elsewhere in this annual report as discontinued operations. For additional details refer to Note 9(g) to our audited consolidated financial statements included elsewhere in this annual report. |

| ● | “Equity One” means Equity One, Inc., which owns and operates shopping centers in the United States. Effective as of March 1, 2017, Equity One completed its merger with and into Regency (the “Regency Merger”), and is presented in our audited consolidated financial statements included elsewhere in this annual report as a discontinued operation. Regency will not be consolidated into our financial statements in 2017 and instead we will present the investment as an available-for-sale financial asset. |

| ● | “First Capital” means First Capital Realty Inc. (TSX:FCR) which owns and operates shopping centers in Canada. As a result of our sale of common shares of First Capital in March 2017, we deconsolidated First Capital from our financial statements and present the investment on an equity method basis as of March 2017. |

| ● | “Gazit Brasil” means Gazit Brasil Ltda. and Fundo De Investimento Multimercado Norstar Credito Privado which owns and operates shopping centers in Brazil. |

| ● | “Gazit Development” means Gazit-Globe Israel (Development) Ltd., which owns properties in Israel and Eastern Europe, which wholly-owns Gazit Development (Bulgaria) and held 84.9% of Luzon Group until January 2016. |

| ● | “Gazit Germany” means Gazit Germany Beteiligungs GmbH & Co. KG which owns and operates shopping centers in Germany. |

| ● | “ProMed” means ProMed Properties Inc., which owned and operated medical office buildings in the United States until August 2015. |

Presentation of Financial Information

Our audited consolidated financial statements included elsewhere in this annual report have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”).

Unless otherwise noted, all monetary amounts are in New Israeli Shekel (or “NIS”), and for the convenience of the reader certain NIS amounts have been translated into U.S. dollars at the rate of NIS 3.845 = U.S.$ 1.00, based on the daily representative rate of exchange between the NIS and the U.S. dollar reported by the Bank of Israel on December 31, 2016. References herein to (i) “NIS” mean the legal currency of Israel, (ii) “U.S.$,” “$,” “U.S. dollar” or “dollar” mean the legal currency of the United States, (iii) “Euro,” “EUR” or “€” mean the currency of the participating member states in the third stage of the Economic and Monetary Union of the Treaty establishing the European community, (iv) “Canadian dollar” or “C$” mean the legal currency of Canada, and (v) “BRL” mean the legal currency of Brazil.

We also refer in various places within this annual report to non-IFRS measures, including NOI, Adjusted EBITDA, EPRA Earnings, Adjusted EPRA Earnings, EPRA NAV and EPRA NNNAV. For definitions and reconciliations of NOI, Adjusted EBITDA, EPRA Earnings, Adjusted EPRA Earnings, EPRA NAV and EPRA NNNAV and statements disclosing the reasons why our management believes that their presentation provides useful information to investors and, to the extent material, any additional purposes for which our management uses them, see “Item 5—Operating and Financial Review and Prospects”. The presentation of these non-IFRS measures is not meant to be considered in isolation or as a substitute for our consolidated financial results prepared in accordance with IFRS as issued by the IASB.

iii

We make forward-looking statements in this annual report that are subject to risks and uncertainties. These forward-looking statements include, but are not limited to, information about possible or assumed future results of our business, financial condition, results of operations, liquidity, plans and objectives. In some cases, you can identify forward-looking statements by terminology such as “believe,” “may,” “could,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” or the negative of these terms or other similar expressions. The forward-looking statements contained in this annual report reflect our views as of the date of this annual report about future events and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause events or our actual activities or results to differ significantly from those expressed in any forward-looking statement. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guaranty future events, results, actions, levels of activity, performance or achievements. You are cautioned not to place undue reliance on these forward-looking statements. Some of the risks, uncertainties and other important factors that could cause results to differ, or that otherwise could have an impact on us include, but are not limited to, the following:

| ● | the economic performance and value of our shopping centers depend on many factors, each of which could have an adverse impact on our cash flows and operating results; |

| ● | economic conditions may make it difficult to maintain or increase occupancy rates and rents and a deterioration in economic conditions in one or more of our key regions could adversely impact our results of operations; |

| ● | we seek to expand through acquisitions of additional real estate assets, including other businesses. Such expansion may not yield the returns expected, may result in disruptions to our business, may strain management resources and may result in dilution to our shareholders or dilution of our interests in our subsidiaries and other investees; |

| ● | we are particularly dependent upon large tenants that serve as anchors in our shopping centers and decisions made by these tenants or adverse developments in their businesses could have a negative impact on our financial condition; |

| ● | online sales can have an adverse impact on our tenants and our business; |

| ● | we have substantial debt obligations which may negatively affect our results of operations and financial position and put us at a competitive disadvantage; |

| ● | volatility in the credit markets may affect our ability to obtain or re-finance our indebtedness at a reasonable cost; |

| ● | the inability of any of our investees to satisfy their liquidity requirements may materially and adversely impact our results of operations; |

| ● | commencement of operations in new geographic markets and asset classes involves risks and may result in us investing significant resources without realizing a return and may adversely impact our future growth; |

| ● | if we are unable to obtain adequate capital, we may have to limit our operations substantially; |

| ● | future terrorist acts and shooting incidents could harm the demand for, and the value of, our properties; |

| ● | many of our real estate costs are fixed, even if income from our properties decreases; |

| ● | our results of operations may be adversely affected by fluctuations in currency exchange rates and we may not have adequately hedged against them; |

| ● | we are subject to a disproportionate impact on our properties due to concentration in certain areas; |

| ● | certain emerging markets in which we have properties are subject to greater risks than more developed markets, including significant legal, economic and political risks; and |

| ● | the other risks and uncertainties described under “Item 3—Key Information—Risk Factors” and elsewhere in this annual report. |

Readers are urged to read this annual report and carefully consider the risks, uncertainties and other factors that affect our business. The information contained in this annual report is subject to change without notice, and we are not obligated to publicly update or revise forward-looking statements. Readers should review future reports filed by us with the Securities Exchange Commission (“SEC”).

Statistical Data

This annual report also includes statistical data regarding the commercial real estate rental industry. We generated some of this data internally, and some was obtained from independent industry publications and reports what we believe to be reliable sources. We have not independently verified this data nor sought the consent of any organizations to refer to their reports in this annual report.

iv

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

| A. | Selected Financial Data |

The following tables set forth our selected consolidated financial data. You should read the following selected consolidated financial data in conjunction with “Item 5—Operating and Financial Review and Prospects” and our audited consolidated financial statements and related notes included elsewhere in this annual report. Historical results are not necessarily indicative of the results that may be expected in the future. Our financial statements have been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB.

The selected consolidated statement of income data set forth below for each of the years ended December 31, 2014, 2015, and 2016 and the selected consolidated balance sheet data set forth below as of December 31, 2015 and 2016 are derived from our audited consolidated financial statements appearing in this annual report. For these periods, Equity One and Luzon Group are presented in the consolidated statements of income data under discontinued operations, giving effect to the Regency Merger in March 2017 and Gazit Development’s sale of its entire holding in Luzon Group in January 2016. Following the Regency Merger, Equity One is presented in the consolidated statements of financial position as of December 31, 2016 under assets and liabilities classified as held for sale. See Note 9(d) to our audited consolidated financial statements included elsewhere in this annual report. The selected consolidated statement of income data for each of the years ended December 31, 2012 and 2013, and the selected consolidated balance sheet data as of December 31, 2012, 2013 and 2014, are derived from our audited consolidated financial statements that are not included in this annual report. The selected consolidated statements of income data for each of the years ended December 31, 2012 and 2013 have been reclassified to present Equity One and Luzon Group as discontinued operations, and such reclassification has not been audited.

The selected consolidated financial data set forth below should be read in conjunction with “Item 5—Operating and Financial Review and Prospects” and our audited consolidated financial statements and notes to those statements for the years ended December 31, 2014, 2015 and 2016 included elsewhere in this annual report. Historical results are not necessarily indicative of future results. The following tables also contain translations of NIS amounts into U.S. dollars for amounts presented as of and for the year ended December 31, 2016. These translations are solely for the convenience of the reader and were calculated at the rate of NIS 3.845 = U.S.$ 1.00, the daily representative rate of exchange between the NIS and the U.S. dollar reported by the Bank of Israel on December 31, 2016. You should not assume that, on that or on any other date, one could have converted these amounts of NIS into dollars at that or any other exchange rate.

| 1 |

| Year Ended December 31, | ||||||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | 2016 | |||||||||||||||||||

| (In millions except for per share data) | NIS | U.S.$ | ||||||||||||||||||||||

| Statement of Income Data: | ||||||||||||||||||||||||

| Rental income | 3,988 | 3,935 | 3,725 | 4,809 | 4,801 | 1,249 | ||||||||||||||||||

| Property operating expenses | 1,363 | 1,352 | 1,269 | 1,613 | 1,607 | 418 | ||||||||||||||||||

| Net operating rental income | 2,625 | 2,583 | 2,456 | 3,196 | 3,194 | 831 | ||||||||||||||||||

| Revenues from sale of buildings (1) | - | 103 | - | - | - | - | ||||||||||||||||||

| Cost of buildings sold (1) | - | 93 | - | - | - | - | ||||||||||||||||||

| Gross profit (loss) from sale of buildings, land and construction work performed | - | 10 | - | - | - | - | ||||||||||||||||||

| Total gross profit | 2,625 | 2,593 | 2,456 | 3,196 | 3,194 | 831 | ||||||||||||||||||

| Fair value gain (loss) on investment property and investment property under development, net (2) | 1,400 | 272 | 400 | (372 | ) | 885 | 230 | |||||||||||||||||

| General and administrative expenses | (456 | ) | (401 | ) | (386 | ) | (568 | ) | (542 | ) | (141 | ) | ||||||||||||

| Other income | 157 | 192 | 52 | 27 | 37 | 9 | ||||||||||||||||||

| Other expenses | (30 | ) | (33 | ) | (57 | ) | (795 | ) | (236 | ) | (61 | ) | ||||||||||||

| Company’s share in earnings of equity-accounted investees, net | 238 | 130 | 3 | 164 | 142 | 37 | ||||||||||||||||||

| Operating income | 3,934 | 2,753 | 2,468 | 1,652 | 3,480 | 905 | ||||||||||||||||||

| Finance expenses | (1,760 | ) | (1,876 | ) | (1,835 | ) | (1,586 | ) | (1,600 | ) | (416 | ) | ||||||||||||

| Finance income | 82 | 514 | 144 | 849 | 325 | 84 | ||||||||||||||||||

| Income before taxes on income | 2,256 | 1,391 | 777 | 915 | 2,205 | 573 | ||||||||||||||||||

| Taxes on income | 476 | 159 | 282 | (79 | ) | 434 | 112 | |||||||||||||||||

| Net income from continuing operations | 1,780 | 1,232 | 495 | 994 | 1,771 | 461 | ||||||||||||||||||

| Income from discontinued operations | 633 | 953 | 588 | 1,312 | 1,409 | 366 | ||||||||||||||||||

| Net income | 2,413 | 2,185 | 1,083 | 2,306 | 3,180 | 827 | ||||||||||||||||||

| Net income attributable to: | ||||||||||||||||||||||||

| Equity holders of the Company | 901 | 927 | 73 | 620 | 787 | 205 | ||||||||||||||||||

| Non-controlling interests | 1,512 | 1,258 | 1,010 | 1,686 | 2,393 | 622 | ||||||||||||||||||

| 2,413 | 2,185 | 1,083 | 2,306 | 3,180 | 827 | |||||||||||||||||||

| Basic net earnings (loss) per share from continuing operations | 4.72 | 3.23 | (0.70 | ) | 1.36 | 2.70 | 0.70 | |||||||||||||||||

| Basic net earnings per share from discontinued operations | 0.74 | 2.18 | 1.11 | 2.11 | 1.33 | 0.35 | ||||||||||||||||||

| Basic net earnings per share | 5.46 | 5.41 | 0.41 | 3.47 | 4.03 | 1.05 | ||||||||||||||||||

| Diluted net earnings (loss) per share from continuing operations | 4.51 | 3.17 | (0.72 | ) | 1.35 | 2.63 | 0.68 | |||||||||||||||||

| Diluted net earnings per share from discontinued operations | 0.74 | 2.18 | 1.11 | 2.10 | 1.33 | 0.35 | ||||||||||||||||||

| Diluted net earnings per share | 5.25 | 5.35 | 0.39 | 3.45 | 3.96 | 1.03 | ||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | ||||||||||||||||

| (In thousands) | ||||||||||||||||||||

| Weighted average number of shares used to calculate: | ||||||||||||||||||||

| Basic earnings per share | 164,912 | 171,103 | 176,459 | 178,426 | 195,493 | |||||||||||||||

| Diluted earnings per share | 165,016 | 171,413 | 176,546 | 178,601 | 195,567 | |||||||||||||||

| (1) | Revenues from sale of buildings consist of revenue from First Capital. |

| (2) | Pursuant to IAS 40 “Investment Property”, gains or losses arising from change in fair value of our investment property and our investment property under development where fair value can be reliably measured are recognized in our income statement at the end of each period. |

| 2 |

| Year Ended December 31, | ||||||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | 2016 | |||||||||||||||||||

| (In millions) | NIS | U.S.$ | ||||||||||||||||||||||

| Selected Balance Sheet Data: | ||||||||||||||||||||||||

| Equity-accounted investees | 4,713 | 5,907 | 6,213 | 2,996 | 2,097 | 545 | ||||||||||||||||||

| Investment property | 55,465 | 53,309 | 56,646 | 70,606 | 55,982 | 14,560 | ||||||||||||||||||

| Investment property under development | 2,806 | 2,479 | 1,642 | 2,587 | 2,113 | 550 | ||||||||||||||||||

| Total assets | 71,034 | 67,927 | 69,984 | 84,236 | 86,887 | 22,597 | ||||||||||||||||||

| Long term interest-bearing liabilities from financial institutions and others (1) | 19,433 | 12,692 | 8,552 | 11,457 | 8,183 | 2,128 | ||||||||||||||||||

| Long term debentures (2) | 18,500 | 22,231 | 24,433 | 29,480 | 27,319 | 7,105 | ||||||||||||||||||

| Total liabilities | 48,737 | 45,574 | 44,114 | 53,241 | 53,119 | 13,815 | ||||||||||||||||||

| Equity attributable to equity holders of the Company | 7,681 | 7,802 | 8,023 | 7,512 | 8,158 | 2,122 | ||||||||||||||||||

| Non-controlling interests | 14,616 | 14,551 | 17,847 | 23,483 | 25,610 | 6,660 | ||||||||||||||||||

| Total equity | 22,297 | 22,353 | 25,870 | 30,995 | 33,768 | 8,782 | ||||||||||||||||||

| (1) | As of December 31, 2016, NIS 0.7 billion (U.S.$ 0.2 billion) of our interest-bearing liabilities from financial institutions and others (including current maturities) were unsecured and the remainder were secured. |

| (2) | As of December 31, 2016, NIS 810 million (U.S.$ 211 million) aggregate principal amount of our debentures was secured and the remainder was unsecured. |

| As of December 31, | ||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | ||||||||||||||||

| NIS | ||||||||||||||||||||

| Other Operating Data (1): | ||||||||||||||||||||

| Number of Group operating properties | 622 | 577 | 524 | 451 | 426 | |||||||||||||||

| Total Group GLA (in thousands of sq. ft.) | 73,292 | 71,431 | 68,336 | 70,796 | 70,591 | |||||||||||||||

| Group occupancy (%) | 95.0 | 95.0 | 95.9 | 95.8 | 95.6 | |||||||||||||||

| (1) | Includes jointly-controlled entities. |

| Year Ended December 31, | ||||||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | 2016 | |||||||||||||||||||

| (In millions except for per share data) | NIS | U.S.$ | ||||||||||||||||||||||

| Other Financial Data: | ||||||||||||||||||||||||

| NOI (1) | 2,625 | 2,583 | 2,456 | 3,196 | 3,194 | 831 | ||||||||||||||||||

| Adjusted EBITDA (1) | 3,257 | 3,192 | 2,817 | 3,403 | 3,666 | 953 | ||||||||||||||||||

| Dividends | 264 | 298 | 318 | 328 | 295 | 77 | ||||||||||||||||||

| Dividends per share | 1.60 | 1.72 | 1.80 | 1.84 | 1.51 | 0.39 | ||||||||||||||||||

| EPRA Earnings (1)(2) | 327 | 269 | 345 | 431 | 401 | 104 | ||||||||||||||||||

| Adjusted EPRA Earnings (1)(2) | 533 | 585 | 598 | 627 | 586 | 152 | ||||||||||||||||||

| As of December 31, | ||||||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | 2016 | |||||||||||||||||||

| (In millions) | NIS | U.S.$ | ||||||||||||||||||||||

| EPRA NAV (1) | 10,037 | 10,200 | 10,740 | 10,341 | 11,059 | 2,876 | ||||||||||||||||||

| EPRA NNNAV (1) | 7,157 | 7,361 | 7,209 | 7,583 | 8,479 | 2,205 | ||||||||||||||||||

| (1) | NOI, Adjusted EBITDA, EPRA Earnings, Adjusted EPRA Earnings, EPRA NAV and EPRA NNNAV are non-IFRS measures, and should not be considered as indicators of our financial performance as alternatives to cash flow, as measures of liquidity or as being comparable to other similarly titled measures of other companies. Under IFRS, while there are line items that are customarily included in statements of operations prepared pursuant to IFRS, the display of such line items varies significantly by industry and company according to specific needs. Our NOI, Adjusted EBITDA, EPRA Earnings, Adjusted EPRA Earnings, EPRA NAV and EPRA NNNAV may not be comparable to similarly titled measures reported by other companies due to potential differences in the method of calculation. For definitions and reconciliations of NOI, Adjusted EBITDA, EPRA Earnings, Adjusted EPRA Earnings, EPRA NAV and EPRA NNNAV and statements disclosing the reasons why our management believes that their presentation provides useful information to investors and, to the extent material, any additional purposes for which our management uses them, see “Item 5—Operating and Financial Review and Prospects”. |

| 3 |

| (2) | In European countries using IFRS, it is customary for companies with income-producing property to publish their EPRA Earnings. EPRA Earnings is a measure for presenting the operating results of a company that are attributable to its equity holders. We believe that these measures are consistent with a position paper discussing EPRA Earnings, which states EPRA Earnings is similar to NAREIT FFO. The measures are not exactly the same, as EPRA Earnings has its basis in IFRS while funds from operations, or “FFO,” is based on generally accepted accounting principles in the United States (“U.S. GAAP”). We believe that EPRA Earnings are similar in substance to FFO with adjustments primarily for the attribution of results under IFRS. |

| Year Ended December 31, | ||||||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | 2016 | |||||||||||||||||||

| (In millions) | NIS | U.S.$ | ||||||||||||||||||||||

| Cash flows provided by (used in): | ||||||||||||||||||||||||

| Operating activities | 1,368 | (1,189 | ) | 1,026 | 1,514 | 1,909 | 496 | |||||||||||||||||

| Investing activities | (4,621 | ) | 2,208 | (768 | ) | (4,437 | ) | (3,306 | ) | (860 | ) | |||||||||||||

| Financing activities | 3,490 | (428 | ) | (701 | ) | 4,665 | 927 | 241 | ||||||||||||||||

Exchange Rate Information

The following table sets forth, for each period indicated, the low and high exchange rates for NIS expressed as NIS per U.S. dollar, the exchange rate at the end of such periods and the average of such exchange rates during such periods, based on the daily representative rate of exchange as published by the Bank of Israel. The exchange rates set forth below demonstrate trends in exchange rates, but the actual exchange rates used throughout this annual report may vary.

| Year Ended December 31, | ||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | ||||||||||||||||

| High | 4.08 | 3.79 | 3.99 | 4.05 | 3.98 | |||||||||||||||

| Low | 3.70 | 3.47 | 3.40 | 3.76 | 3.75 | |||||||||||||||

| Period end | 3.73 | 3.47 | 3.89 | 3.90 | 3.85 | |||||||||||||||

| Average Rate | 3.86 | 3.61 | 3.58 | 3.89 | 3.84 | |||||||||||||||

The following table shows, for each of the months indicated, the high and low exchange rates between the NIS and the U.S. dollar, expressed as NIS per U.S. dollar and based upon the daily representative rate of exchange as published by the Bank of Israel:

| High | Low | |||||||

| Month | (NIS) | (NIS) | ||||||

| October 2016 | 3.86 | 3.78 | ||||||

| November 2016 | 3.88 | 3.80 | ||||||

| December 2016 | 3.87 | 3.79 | ||||||

| January 2017 | 3.86 | 3.77 | ||||||

| February 2017 | 3.77 | 3.66 | ||||||

| March 2017 | 3.69 | 3.61 | ||||||

On April 10, 2017, the daily representative rate of exchange between the NIS and U.S. dollar as published by the Bank of Israel was NIS 3.649 to $1.00.

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| 4 |

| D. | Risk Factors |

Our business involves a high degree of risk. Please carefully consider the risks we describe below in addition to the other information set forth elsewhere in this annual report and in our other filings with the SEC. These material risks could adversely affect our business, financial condition and results of operations.

Risks Related to Our Business and Operations

The economic performance and value of our shopping centers depend on many factors, each of which could have an adverse impact on our cash flows and operating results.

The economic performance and value of our properties can be affected by many factors, including the following:

| ● | Economic uncertainty or downturns in general, or in the areas where our properties are located; |

| ● | Local conditions, such as an oversupply of space, a reduction in demand for retail space or a change in local demographics; |

| ● | The attractiveness of our properties to tenants and competition from other available spaces; |

| ● | The adverse financial condition of some large retail companies and ongoing consolidation within the retail sector; |

| ● | The growth of super-centers and warehouse club retailers and their adverse effect on traditional grocery chains; |

| ● | Changes in the perception of retailers or shoppers regarding the safety, convenience and attractiveness of our shopping centers and changes in the overall climate of the retail industry; |

| ● | Our ability to provide adequate management services and to maintain our properties; |

| ● | Increased operating costs, if these costs cannot be passed through to tenants; |

| ● | The expense of periodically renovating, repairing and re-letting spaces; |

| ● | The impact of increased energy costs and/or extreme weather conditions on consumers and its consequential effect on the number of shopping visits to our properties; |

| ● | The consequences of any armed conflicts or terrorist attacks; |

| ● | The consequences of changing consumer shopping habits due to increased trends in online shopping; |

| ● | The impact of currency fluctuations on our income-producing assets and financing sources; and |

| ● | The impact of legal, economic and political disruptions in the emerging markets in which we have properties, including Russia and Brazil. |

To the extent that any of these conditions occurs or accelerates, it could adversely affect market rents for retail space, portfolio occupancy, our ability to sell, acquire or develop properties, and cash available for distribution to shareholders.

Economic conditions may make it difficult to maintain or increase occupancy rates and rents and a deterioration in economic conditions in one or more of our key regions could adversely impact our results of operations.

In 2016, our rental income (assuming full consolidation of jointly-controlled entities and discontinued operations) was derived as follows: 30.7% from Canada, 22.6% from the United States, 24.9% from Northern and Western Europe, 17.1% from Central and Eastern Europe, 3.3% from Israel, and 1.5% from Brazil. Our operations in the United States were conducted through Equity One, which is presented in our audited consolidated financial statements included elsewhere in this annual report as a discounted operation. During the economic downturn of 2008-2009, general market conditions deteriorated in many of our markets, particularly the United States and Central and Eastern Europe. Lack of financing and a decrease in consumer spending prevented retailers from expanding their activities. As a consequence, occupancy rates declined in some of the regions in which we operate, most significantly in the United States where the occupancy rates for our shopping centers decreased from 93.2% as of December 31, 2007 to 90.7% as of December 31, 2010. In addition, we granted rent concessions to some tenants during this period. The economic downturn adversely affected our net operating income and the value of our assets in all of the regions in which we operate. In addition, currencies in many of our markets were devalued against the NIS during that period. Although general market conditions have improved since 2010, our ability to maintain or increase our occupancy rates and rent levels depends on continued improvements in global and local economic conditions.

While the economies in many of the cities within our markets have continued to gradually improve (with certain exceptions, including Russia), macro-economic challenges, such as low consumer confidence, high unemployment and reduced consumer spending, have adversely affected many retailers and continue to adversely affect the retail sales of many regional and local tenants in some of our markets and our ability to re-lease vacated space at higher rents. Moreover, companies in some of our markets shifted to a more cautionary mode with respect to leasing as a result of the prevailing economic climate and demand for retail space has declined generally, reducing the market rental rates for our properties. As a result, in these markets we may not be able to re-lease vacated space and, if we are able to re-lease vacated space, there is no assurance that rental rates will be equal to or in excess of current rental rates. In addition, we may incur substantial costs in obtaining new tenants, including brokerage commissions paid by us in connection with new leases or lease renewals, and the cost of making leasehold improvements. These events and factors could adversely affect our rental income and overall results of operations.

| 5 |

While most of our shopping centers are anchored by supermarkets, drugstores or other necessity-oriented retailers, which are less susceptible to economic cycles, other tenants have been vulnerable to declining sales and reduced access to capital. Europe in particular remains vulnerable to volatile financial and credit markets due to economic and political uncertainties, including the United Kingdom’s decision to withdraw from the European Union, the ongoing refugee crisis, financial uncertainty in Greece and a lack of confidence in the European Union’s banking system and Finland’s credit rating was downgraded by Fitch in the first quarter of 2016. Additionally, Russia is suffering from significant economic and political turmoil. As a result, some tenants have requested rent adjustments and abatements, while other tenants have not been able to continue in business at all. Our ability to renew or replace these tenants at comparable rents could adversely impact occupancy rates and overall results of operations.

We seek to expand through acquisitions of additional real estate assets. Such expansion may not yield the returns expected, may result in disruptions to our business, may strain management resources and may result in dilution to our shareholders or dilution of our interests in our subsidiaries and other investees.

Our investing strategy and our market selection process may not ultimately be successful, may not provide positive returns on our investments and may result in losses. The acquisition of properties, groups of properties or other businesses entails risks that include the following, any of which could adversely affect our results of operations and financial condition:

| ● | we may not be able to identify suitable properties to acquire or may be unable to complete the acquisition of the properties we identify; |

| ● | there may be a lack of available suitable properties for our portfolio; |

| ● | we may not be able to integrate any acquisitions into our existing operations successfully; |

| ● | properties we acquire may fail to achieve the occupancy or rental rates we project at the time we make the decision to acquire; |

| ● | our pre-acquisition evaluation of the physical condition of each new investment may not detect certain defects or identify necessary repairs or may fail to properly evaluate the costs involved in implementing our plans with respect to such investment; |

| ● | we may experience delays or increased costs in development or redevelopment due to changes in applicable laws or regulations; |

| ● | we may not be able to obtain financing on favorable terms for acquisition, development or redevelopment; and |

| ● | our investigation of a property or building prior to our acquisition, and any representations we may receive from the seller of such building or property, may fail to reveal various liabilities (such as to tenants or vendors or with respect to environmental contamination), which could reduce the cash flow from the property or increase our acquisition cost. |

Together with our acquisition of individual properties and groups of properties, we have been an active business acquirer and, as part of our growth strategy, we expect to seek to acquire real estate-related businesses in the future. The acquisition and integration of each business involves a number of risks and may result in unforeseen operating difficulties and expenditures in assimilating or integrating the businesses, properties, personnel or operations of the acquired business. Our due diligence prior to our acquisition of a business may not uncover certain legal or regulatory issues that could affect such business. Furthermore, future acquisitions may involve difficulties in retaining the tenants or customers of the acquired business, and disrupt our ongoing business, divert our resources and require significant management attention that would otherwise be available for ongoing operation and development of our current business. Moreover, we can provide no assurances that the anticipated benefits of any acquisition, such as operating improvements or anticipated cost savings, would be realized or that we would not be exposed to unexpected liabilities in connection with any acquisition.

To complete a future acquisition, we may determine that it is necessary to use a substantial amount of our available liquidity sources or cash or engage in equity or debt financing. If we raise additional funds through further issuances of equity or convertible debt securities, our existing shareholders could suffer significant dilution, and any new equity securities we or our investees issue could have rights, preferences and privileges senior to those of holders of our ordinary shares. If our public investees raise additional funds through further issuances of equity or convertible debt securities, Gazit-Globe, as the holder of equity securities of our public investees, could suffer significant dilution, and any new equity securities our public investees issue could have rights, preferences and privileges senior to those held by Gazit-Globe. We may not be able to obtain additional financing on terms favorable to us, if at all, which could limit our ability to engage in acquisitions.

We are particularly dependent upon large tenants that serve as anchors in our shopping centers and decisions made by these tenants or adverse developments in their businesses could have a negative impact on our financial condition.

We own shopping centers that are anchored by large tenants. Because of their reputation or other factors, these large tenants are particularly important in attracting shoppers and other tenants to our centers. Our rental income depends upon the ability of the tenants of our properties and, in particular, these anchor tenants, to generate enough income to make their lease payments to us. Certain of our anchor tenants may make up a significant percentage of our rental income in certain markets. For example, Kesko accounted for 6.6% of Citycon’s rental income in 2016, AFM (and other affiliated brands) accounted for 4.0% of Atrium’s rental income in 2016, and Loblaws and Sobey’s accounted for 10.2% and 6.6% respectively, of First Capital’s total annual minimum rent as of December 31, 2016. In addition, supermarkets and other grocery stores, many of which are anchor tenants, accounted for approximately 16.2% of our total rental income in 2016.

| 6 |

Revenue from our properties depends primarily on the ability of our tenants to pay the full amount of rent and other charges due under their leases on a timely basis. Any reduction in our tenants’ abilities to pay rent or other charges on a timely basis, including tenants filing for bankruptcy protection, could adversely affect our financial condition and results of operations. In the event of default by tenants, we may experience delays and unexpected costs in enforcing our rights as landlords under the leases, which may also adversely affect our financial condition and results of operations.

We generally develop or redevelop our shopping centers based on an agreement with an anchor tenant. Changes beyond our control may adversely affect the tenants’ ability to make lease payments or could result in them terminating their leases. These changes include, among others:

| ● | downturns in national or regional economic conditions where our properties are located, which generally will negatively impact the rental rates; |

| ● | changes in the buying habits of consumers in the regions surrounding those shopping centers including a shift to preference for online shopping and e-commerce; |

| ● | changes in local market conditions such as an oversupply of properties, including space available by sublease or new construction, or a reduction in demand for our properties; |

| ● | competition from other available properties; and |

| ● | changes in federal, state or local regulations and controls affecting rents, prices of goods, interest rates, fuel and energy consumption. |

As a result, tenants may determine not to renew leases, delay lease commencement or reduce their square footage needs. In addition, anchor tenants often have more favorable lease provisions and significant negotiating power. In some instances, we may need to seek their permission to lease to other, smaller tenants. Anchor tenants, particularly retail chains, may also change their operating policies for their stores (such as the size of their stores) and the regions in which they operate. As a result, anchor tenants may determine not to renew leases or delay lease commencement. An anchor tenant may decide that a particular store is unprofitable and close its operations in our center, and, while the tenant may continue to make rental payments, such a failure to occupy its premises could have an adverse effect on the property. A lease termination by an anchor tenant or a failure by that anchor tenant to occupy the premises could result in lease terminations or reductions in rent by other tenants in the same shopping center. In addition, we are subject to the risk of defaults by tenants or the failure of any lease guarantors to fulfill their obligations, tenant bankruptcies and other early termination of leases or non-renewal of leases. Any of these developments could materially and adversely affect our financial condition and results of operations.

Online sales can have an adverse impact on our tenants and our business.

The use of the internet by consumers continues to gain in popularity and growth in online sales is likely to continue in the future. The increase in online sales could result in a downturn in the business of some of our current tenants and could affect the way other current and future tenants lease space. For example, the migration towards online sales has led many retailers to reduce the number and size of their traditional “brick and mortar” locations in order to increasingly rely on e-commerce and alternative distribution channels. Many tenants also permit merchandise purchased on their websites to be picked up at, or returned to, their physical store locations, which may have the effect of decreasing the reported amount of their in-store sales and the amount of rent we are able to collect from them (particularly with respect to those tenants who pay rent based on a percentage of their in-store sales). We cannot predict with certainty how growth in online sales will impact the demand for space at our properties or how much revenue will be generated at traditional store locations in the future. If we are unable to anticipate and respond promptly to trends in retailer and consumer behavior, our occupancy levels and financial results could be negatively impacted.

We have substantial debt obligations which may negatively affect our results of operations and financial position and put us at a competitive disadvantage.

Our organizational documents do not limit the amount of debt that we may incur and we do not have a policy that limits our debt to any particular level. As of December 31, 2016, Gazit-Globe and its private subsidiaries had outstanding interest-bearing debt in the aggregate amount of NIS 15,146 million (U.S.$ 3,939 million) and other liabilities outstanding in the aggregate amount of NIS 1,113 million (U.S.$ 289 million) of which approximately 10.3% matures during 2017. On a consolidated basis, we had debt and other liabilities outstanding as of December 31, 2016 in the aggregate amount of NIS 53,119 million (U.S.$ 13,815 million), of which 12.1% matures during 2017. We are subject to covenant compliance obligations and each of our public subsidiaries and certain other investees is subject to its own covenant compliance obligations. Furthermore, the indebtedness of each of our public investees is independent of each other investee and is not subject to any guaranty by Gazit-Globe or its wholly-owned subsidiaries.

The amount of debt outstanding from time to time could have important consequences to us and our public investees. For example, it could:

| ● | require that we dedicate a substantial portion of cash flow from operations to payments on debt, thereby reducing funds available for operations, property acquisitions, redevelopments and other business opportunities that may arise in the future; |

| 7 |

| ● | limit our public investees’ ability to make distributions on equity securities held by us, including the payment of dividends to us; |

| ● | make it difficult to satisfy debt service requirements; |

| ● | limit flexibility in planning for, or reacting to, changes in business and the factors that affect profitability, which may place us at a disadvantage compared to competitors with less debt or debt with less restrictive terms; |

| ● | adversely affect financial ratios and debt and operational coverage levels monitored by rating agencies and adversely affect the ratings assigned to our or our public investees’ debt, which could increase the cost of capital; and |

| ● | limit our or our public investees’ ability to obtain any additional debt or equity financing that may be needed in the future for working capital, debt refinancing, capital expenditures, acquisitions, redevelopment or other general corporate purposes or to obtain such financing on favorable terms. |

If our or our public investees’ internally generated cash is inadequate to repay indebtedness upon an event of default or upon maturity, then we or our public investees will be required to repay or refinance the debt. If we or our public investees are unable to refinance our or their indebtedness on acceptable terms or if the amount of refinancing proceeds is insufficient to fully repay the existing debt, we or our public investees might be forced to dispose of properties, potentially upon disadvantageous terms, which might result in losses and might adversely affect our or their cash available for distribution. If prevailing interest rates or other factors at the time of refinancing result in higher interest rates on refinancing, our interest expense would increase without a corresponding increase in our rental rates, which would adversely affect our results of operations.

In addition, our debt financing agreements and the debt financing agreements of our public investees contain representations, warranties and covenants, including financial covenants that, among other things, require the maintenance of certain financial ratios. Certain of the covenants that apply to Gazit-Globe depend upon the performance of our public investees, and we, therefore, have less control over our compliance with those covenants. For example, covenants that apply to Gazit-Globe require Citycon to maintain a minimum ratio of equity to total assets less advances received and a minimum ratio of EBITDA to net finance expenses. Another covenant requires First Capital to maintain a minimum ratio of EBITDA to finance expenses. If the performance of any of our public investees causes us to breach such covenants in our debt financing agreements or the debt financing agreements of public investees, we or they may be required to prepay amounts of indebtedness that we or they may be unable to pay at such time, which would cause us or them to default under such agreements.

Should we or our public investees breach any such representations, warranties or covenants contained in any such loan or other financing agreement, or otherwise be unable to service interest payments or principal repayments, we or our public investees may be required immediately to repay such borrowings in whole or in part, together with any related costs and a default under the terms of certain of our other indebtedness may result from such breach. For example, a decline in the property market or a wide scale tenant default may result in a failure to meet any loan to value or debt service coverage ratios, thereby causing an event of default and we or our public investees, as applicable, may be required to prepay the relevant loan. A significant portion of Gazit-Globe’s equity interests in its subsidiaries and other investees are pledged as collateral for Gazit-Globe’s revolving credit facilities and other indebtedness incurred by Gazit-Globe and its private subsidiaries. As of December 31, 2016, the principal amount of such indebtedness was NIS 2,839 million (U.S.$ 738 million), which constituted 6.3% of our consolidated indebtedness as of such date. In the event that Gazit-Globe is required to prepay its loans and is unable to do so, the lenders under such loans may determine to pursue remedies against Gazit-Globe and cause the sale of those equity interests, which could have an adverse effect on our financial condition and results of operations. In addition, since certain of our properties were mortgaged to secure payment of indebtedness with a principal amount of NIS 5,853 million (U.S.$ 1,522 million) as of December 31, 2016, which constituted 13.0% of our consolidated indebtedness as of such date, in the event we are unable to refinance or repay our borrowing, we may be unable to meet mortgage payments, or we may default under the related mortgage, deed of trust or other pledge and such property could be transferred to the mortgagee or pledgee, or the mortgagee or pledgee could foreclose upon the property, appoint a receiver and receive an assignment of rents and leases or pursue other remedies, all with a consequent loss of income and asset value. Moreover, any restrictions on cash distributions as a result of breaching financial ratios, failure to repay such borrowings or, in certain circumstances, other breaches of covenants, representations and warranties under our debt financing agreements could result in us being prevented from paying dividends to our investors and have an adverse effect on our liquidity.

Volatility in the credit markets may affect our ability to obtain or re-finance our indebtedness at a reasonable cost.

At times during the last decade, global credit markets have experienced significant price volatility, dislocations and liquidity disruptions, which at times caused the spreads on debt financings to widen considerably. Additionally, the U.S. Federal Reserve System increased short-term interest rates in December 2015, December 2016 and March 2017, and expressed intentions to further increase rates in the near future. If a downturn or dislocation in credit markets were to occur or if interest rates were to dramatically increase from their current low levels, we may experience difficulty refinancing our upcoming debt maturities at a reasonable cost or with desired financing alternatives. For example, it may be difficult to raise new unsecured financing in the form of additional bank debt or corporate bonds at interest rates that are appropriate for our long term objectives. Any change in our credit ratings could further impact our access to capital and our cost of capital. Additionally, we may be unable to further diversify our lending portfolio so as not to depend substantially on Israeli financial institutions for our financing requirements due to market conditions or other factors, which may limit our ability to efficiently access credit markets. To the extent we are unable to efficiently access the credit markets, we may need to repay maturing debt with proceeds from the issuance of equity or the sale of assets. In addition, lenders may impose upon us more restrictive covenants, events of default and other conditions.

| 8 |

The inability of any of our public investees to satisfy their liquidity requirements may materially and adversely impact our results of operations.

Even though we present the assets and liabilities of our public subsidiaries on a consolidated basis and on the equity method for certain public investees, our public investees satisfy their short-term liquidity and long-term capital requirements through cash generated from their respective operations and through debt and equity financings in their respective local markets. Our liquidity and available borrowings presented on a consolidated basis may not, therefore, be reflective of the position of our public investees since the liquidity and available borrowings of each of them are not available to support the others’ operations. Although we have from time to time purchased equity securities of our public investees, we have not generally made shareholder loans to them (with exceptions during 2014 and 2015, when we made loans to Luzon Group, see Note 9(g) to our audited consolidated financial statements included elsewhere in this annual report) and may have insufficient resources to do so even if our overall financial position on a consolidated basis is positive. Each public investee is subject to its own covenant compliance obligations and the failure of any public investee to comply with its obligations could result in the acceleration of its indebtedness which could have a material adverse effect on our financial position and results of operations.

Commencement of operations in new geographic markets and asset classes involves risks and may result in us investing significant resources without realizing a return and may adversely impact our future growth.

The commencement of operations in new geographic markets or asset classes in which we have little or no prior experience involves costs and risks. In the past, we expanded into new regions, including Central and Eastern Europe and Brazil, and into other asset classes, such as medical office buildings and senior care facilities. We may decide to enter into new markets or asset classes in the future when an opportunity presents itself. When commencing such operations, we need to learn and become familiar with the various aspects of operating in these new geographic markets or asset classes, including regulatory aspects, the business and macro-economic environment, new currency exposure, as well as the necessity of establishing new systems and administrative headquarters potentially at substantial costs. Additionally, it may take many years for an acquisition to achieve desired results as factors such as obtaining regulatory permits, construction, signing the right mix of tenants and assembling the right management team take time to implement. In some cases, we may commence such operations by means of a joint venture which often offers the advantage of a partner with superior experience, but also has the risks associated with any activity conducted jointly with a non-controlled third party. In addition, entry into new geographic markets may also lead to difficulty managing geographically separated organizations and assets, difficulty integrating personnel with diverse business backgrounds and organizational cultures and compliance with foreign regulatory requirements applicable to acquisitions. Our failure to successfully expand into new geographies and asset classes may result in our investment of significant resources without realizing a return and may adversely impact our future growth.

If we are unable to obtain adequate capital, we may have to limit our operations substantially.

Our acquisition and development of properties and our acquisition of other businesses and equity interests in real estate companies are financed in part by loans received from banks, insurance companies and other financing sources, as well as from the sale of shares, notes, debentures and convertible debentures in public and private offerings. Our public investees satisfy their capital requirements through debt and equity financings in their respective local markets. The practices in these markets vary significantly, for example, with some of the markets based partly on bank lending and others depending significantly on accessing the capital markets. Our ability to obtain economically desirable financing terms could be affected by unavailability or a shortage of external financing sources, changes in existing financing terms, changes in our financial condition and results of operations, legislative changes, changes in the public or private markets in our operating regions and deterioration of the economic situation in our operating regions. Should our ability to obtain financing be impaired, our operations could be limited significantly.

Future terrorist acts and shooting incidents could harm the demand for, and the value of, our properties.

Over the past few years, a number of terrorist acts and shootings have occurred at retail properties throughout the world, including highly publicized incidents in the U.S., Europe and Israel. In the event concerns regarding safety were to alter shopping habits or deter customers from visiting shopping centers, our tenants would be adversely affected, as would the general demand for retail space. Additionally, if such incidents were to continue, insurance for such acts may become limited or subject to substantial cost increases.

Many of our real estate costs are fixed, even if income from our properties decreases.

Our financial results depend in part on leasing space to tenants on favorable financial terms. Costs associated with real estate investment, such as real estate taxes, insurance and maintenance costs generally are not reduced even when a property is not fully occupied, or when rental rates decrease, or when other circumstances cause a reduction in income from the property. As a result, cash flow from the operations of the properties may be reduced if a tenant does not pay its rent or we are unable to fully lease the properties on favorable terms. Additionally, properties that we develop or redevelop may not produce any significant revenue immediately, and the cash flow from existing operations may be insufficient to pay the operating expenses and debt service associated with such projects until they are fully occupied.

| 9 |

Our results of operations may be adversely affected by fluctuations in currency exchange rates and we may not have adequately hedged against them.

Because we own and operate assets in many regions throughout the world, our results of operations are affected by fluctuations in currency exchange rates. For the year ended December 31, 2016, 30.7% of our rental income (assuming full consolidation of jointly-controlled entities and discontinued operation) was earned in Canadian dollars, 29.7% in Euros, 22.9% in U.S. dollars, 3.0% in Swedish Krona, 5.7% in Norwegian Krone, 3.3% in NIS and 4.7% in other currencies. In addition, our reporting currency is the NIS, and the functional currency is separately determined for each of our subsidiaries and certain of our investees. When an investee’s functional currency differs from our reporting currency, the financial statements of such investee are translated to NIS so that they can be included in our financial statements. As a result, fluctuations of the currencies in which we conduct business relative to the NIS impact our results of operations and the impact may be material. For example, the average annual rate in NIS of the U.S. Dollar, the Canadian Dollar and the Euro weakened by 1.2%, 4.9% and 1.5%, respectively, for 2016 compared to 2015, which resulted in our net operating income decreasing by 2.1% or a total amount of NIS 89 million. We continually monitor our exposure to currency risk and pursue a company-wide foreign exchange risk management policy, which includes seeking to hold our equity in the currencies of the various markets in which we operate in the same proportions as the assets in each such currency bear to our total assets. We have in the past and expect to continue in the future to at least partly hedge such risks with certain financial instruments. Future currency exchange rate fluctuations that we have not adequately hedged could adversely affect our profitability. We also face risks arising from the imposition of exchange controls and currency devaluations. Exchange controls may limit our ability to convert foreign currencies into NIS or to remit dividends and other payments by certain of our investees or businesses located in or conducted within a country imposing controls. Currency devaluations result in a diminished value of funds denominated in the currency of the country instituting the devaluation.

Furthermore, the Company engages in currency and interest rate swap transactions, some of which are governed by agreements entered into by the Company that provide for mechanisms for the current settling of accounts in connection with the fair value of the swap transactions. Consequently, the Company could be required, from time to time, to transfer material amounts to the banking institutions based on the fair value of such transactions.

Our ability to manage risks through derivatives may be negatively affected by the Dodd-Frank Act and legislation initiatives of the European Commission, which provide for a new framework of regulation of over-the-counter derivatives markets. These new regulations may require us to clear certain types of transactions currently traded in the over-the-counter derivative markets through a central clearing organization and may limit our ability to customize derivative transactions for our needs. As a result, we may experience additional collateral requirements and costs associated with derivative transactions.

We are subject to a disproportionate impact on our properties due to concentration in certain areas.

As of December 31, 2016, approximately 10.3%, 6.9% and 3.9% of our total GLA was located in the greater Toronto area (Canada), the greater Montreal area (Canada) and metropolitan Helsinki (Finland), respectively. A regional recession or other major, localized economic disruption or a natural disaster, such as an earthquake or hurricane, in any of these areas could adversely affect our ability to generate or increase operating revenues from our properties, attract new tenants to our properties or dispose of unproductive properties. Any reduction in the revenues from our properties would effectively reduce the income we generate from them, which would adversely affect our results of operations and financial condition. Conversely, strong economic conditions in a region could lead to increased building activity and increased competition for tenants.

Certain emerging markets in which we have properties are subject to greater risks than more developed markets, including significant legal, economic and political risks.

Some of our current and planned investments are located in emerging markets, primarily within Russia and Brazil, which as of December 31, 2016 comprised 16.7% and 2.1% of our total GLA, respectively, and in India, where we have an investment commitment in Hiref International LLC (“Hiref”), a real estate fund, for U.S.$ 110 million (of which we had invested U.S.$ 95 million through December 31, 2016) and, as such, are subject to greater risks than those in markets in Northern and Western Europe and North America, including greater legal, economic and political risks. Our performance could be adversely affected by events beyond our control in these markets, such as a general downturn in the economy of countries in which these markets are located, conflicts between states, changes in regulatory requirements (including Market Abuse Regulation in the European Union) and applicable laws (including in relation to taxation and planning), adverse conditions in local financial markets and interest and inflation rate fluctuations. In addition, adverse political or economic developments in these or in neighboring countries could have a significant negative impact on, among other things, individual countries’ gross domestic products, foreign trade or economies in general. Recent examples of potentially detrimental developments in emerging markets include the economic downturn and political developments in Brazil (including the impeachment of president Dilma Rousseff in 2016) and the geopolitical tension between Russia and its neighbors. While we currently have no plans to enter new emerging markets, some emerging economies in which we currently operate have historically experienced substantial rates of inflation, an unstable currency, high government debt relative to gross domestic products, a weak banking system providing limited liquidity to domestic enterprises, high levels of loss-making enterprises that continue to operate due to the lack of effective bankruptcy proceedings, significant increases in unemployment and underemployment and the impoverishment of a large portion of the population. This may have a material adverse effect on our business, financial condition or results of operations.

| 10 |

Furthermore, we are subject to the U.S. Foreign Corrupt Practices Act (“FCPA”) and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties for the purpose of obtaining or retaining business. We currently and may in the future conduct business in countries and regions in which we may face, directly or indirectly, corrupt demands by officials, tribal or insurgent organizations, or private entities. Thus, we face the risk of unauthorized payments or offers of payments by one of our employees or consultants, even though these parties are not always subject to our control. Our existing safeguards and any future improvements may prove to be less than effective, and our employees and consultants may engage in conduct for which we might be held responsible. Violations of the FCPA may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could have a material adverse effect on our business, financial condition or results of operations. In addition, governments may seek to hold us liable for successor liability anti-corruption violations committed by our investees.

Our reported financial condition and results of operations under IFRS are impacted by changes in value of our real estate assets, which is inherently subjective and subject to conditions outside of our control.

Our audited consolidated financial statements have been prepared in accordance with IFRS. There are significant differences between IFRS and U.S. GAAP which lead to different results under the two systems of accounting. Currently, one of the most significant differences between IFRS and U.S. GAAP is an option under IFRS to record the fair market value of our real estate assets in our financial statements on a quarterly basis, which we have adopted. Accordingly, our financial statements have been significantly impacted in the past by fluctuations due to changes in fair market value of our properties even if no actual disposition of assets took place. For example, in 2016, we increased the fair value of our properties on a consolidated basis by NIS 885 million and in 2015 we decreased the fair value of our properties on a consolidated basis by NIS 372 million.

The valuation of property is inherently subjective due to the individual nature of each property as well as exposure to macro-economic conditions. As a result, valuations are subject to uncertainty. Fair value of investment property including development and land was determined by accredited independent appraisers with respect to 68.5% of such investment properties during the year ended December 31, 2016 (53.5% of which were performed at December 31, 2016). A significant proportion of the valuations of our properties were not performed by appraisers at the balance sheet date, based on materiality thresholds and other considerations that we have applied across our properties. As a result of these factors, there is no assurance that the valuations of our interests in the properties reflected in our financial statements would reflect actual sale prices even where any such sales occur shortly after the financial statements are prepared.

Other real estate companies that are publicly traded in the United States use U.S. GAAP to report their financial statements and are therefore not currently required to record the fair market value of their real estate assets on a quarterly basis. As a result, significant declines or fluctuations in the value of their real estate could impact us disproportionately compared to these other companies.

In addition, in recent years several amendments have been made to IFRS standards, including those that affect us, and we have had to revise our accounting policies in order to comply with such amended standards. Commonly, the transition provisions of these amendments require us to implement the amendments with respect to comparative figures as well. Figures with respect to prior periods that are not required to be included in our financial statements are therefore not adjusted retrospectively. As a result, the utility of the comparative figures for certain years may be limited.

Real estate is generally an illiquid investment.

Real estate is generally an illiquid investment as compared to investments in securities. While we do not currently anticipate a need to dispose of a significant number of real estate assets in the short-term, such illiquidity may affect our ability to dispose of or liquidate real estate assets in a timely manner and at satisfactory prices in response to changes in economic, real estate market or other conditions.

We may be obliged to dispose of our interest in a property or properties at a time, for a price or on terms not of our choosing. In addition, some of our anchor tenants have rights of first refusal or rights of first offer to purchase the properties in which they lease space in the event that we seek to dispose of such properties. The presence of these rights of first refusal and rights of first offer could make it more difficult for us to sell these properties in response to market conditions. These limitations on our ability to sell our properties could have an adverse effect on our financial condition and results of operations.

Our competitive position and future prospects depend on our senior management and the senior management of our investees.