Powering and transforming financial markets Earnings Conference Call Fiscal First Quarter 2026 November 4, 2025 .2

1 Forward-Looking Statements This presentation and other written or oral statements made from time to time by representatives of Broadridge Financial Solutions, Inc. ("Broadridge" or the "Company") contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be,” “on track,” and other words of similar meaning are forward-looking statements. In particular, information appearing in the “Fiscal Year 2026 Guidance” section and statements about our three-year objectives are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors described and discussed in Part I, “Item 1A. Risk Factors” of the Annual Report on Form 10-K for the year ended June 30, 2025 (the “2025 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this presentation and are expressly qualified in their entirety by reference to the factors discussed in the 2025 Annual Report. These risks include: • Changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; • Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; • A material security breach or cybersecurity attack affecting the information of Broadridge's clients; • Declines in participation and activity in the securities markets; • The failure of Broadridge's key service providers to provide the anticipated levels of service; • A disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; • Overall market, economic and geopolitical conditions and their impact on the securities markets; • The success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; • Broadridge’s failure to keep pace with changes in technology and demands of its clients; • Competitive conditions; • Broadridge’s ability to attract and retain key personnel; and • The impact of new acquisitions and divestitures. There may be other factors that may cause our actual results to differ materially from the forward-looking statements. Our actual results, performance or achievements could differ materially from those expressed in, or implied by, the forward-looking statements. We can give no assurances that any of the events anticipated by the forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial condition. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

2 Use of Non-GAAP financial measures, KPIs and foreign exchange rates Use of Non-GAAP Financial Measures This presentation includes certain Non-GAAP financial measures including Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share (“EPS”), Free cash flow, Free cash flow conversion, and Recurring revenue growth constant currency. Please see the “Explanation of Non-GAAP Measures and Reconciliation of GAAP to Non-GAAP Measures” section of this presentation for more information on Broadridge’s use of Non-GAAP measures and reconciliations to GAAP measures. Key Performance Indicators Management focuses on a variety of key indicators to plan, measure and evaluate the Company’s business and financial performance. These performance indicators include Revenues and Recurring revenue, as well as Non-GAAP measures of Adjusted Operating income, Adjusted Net earnings, Adjusted EPS, Free cash flow, Free cash flow conversion, Recurring revenue growth constant currency, and Closed sales. In addition, management focuses on select operating metrics specific to Broadridge of Position Growth, which is comprised of equity position growth and mutual fund/ETF position growth, and Internal Trade Growth. Beginning in the fourth quarter of fiscal year 2025, the Company began presenting information on “equity revenue position growth”. Equity revenue position growth excludes small or fractional equity positions for which the Company does not recognize revenue (“non-revenue positions”). Prior-year period comparative information for this metric is not available. Foreign Exchange Rates Beginning with the first quarter of fiscal year 2023, the Company changed reporting for segment revenues, segment earnings (loss) before income taxes, segment amortization of acquired intangibles and purchased intellectual property, and Closed sales to reflect the impact of actual foreign exchange rates applicable to the individual periods presented. The presentation of these metrics for the prior periods has been changed to conform to the current period presentation. Total consolidated revenues and earnings before income taxes were not impacted. Notes on Presentation Amounts presented in this presentation may not sum due to rounding. All FY’25 and FY’26 Recurring revenue dollar amounts shown in this presentation are GAAP. Recurring revenue growth percentages for FY’25 and FY’26 Guidance are shown as constant currency (Non-GAAP). Use of Material Contained Herein The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to update or revise the information contained in this presentation.

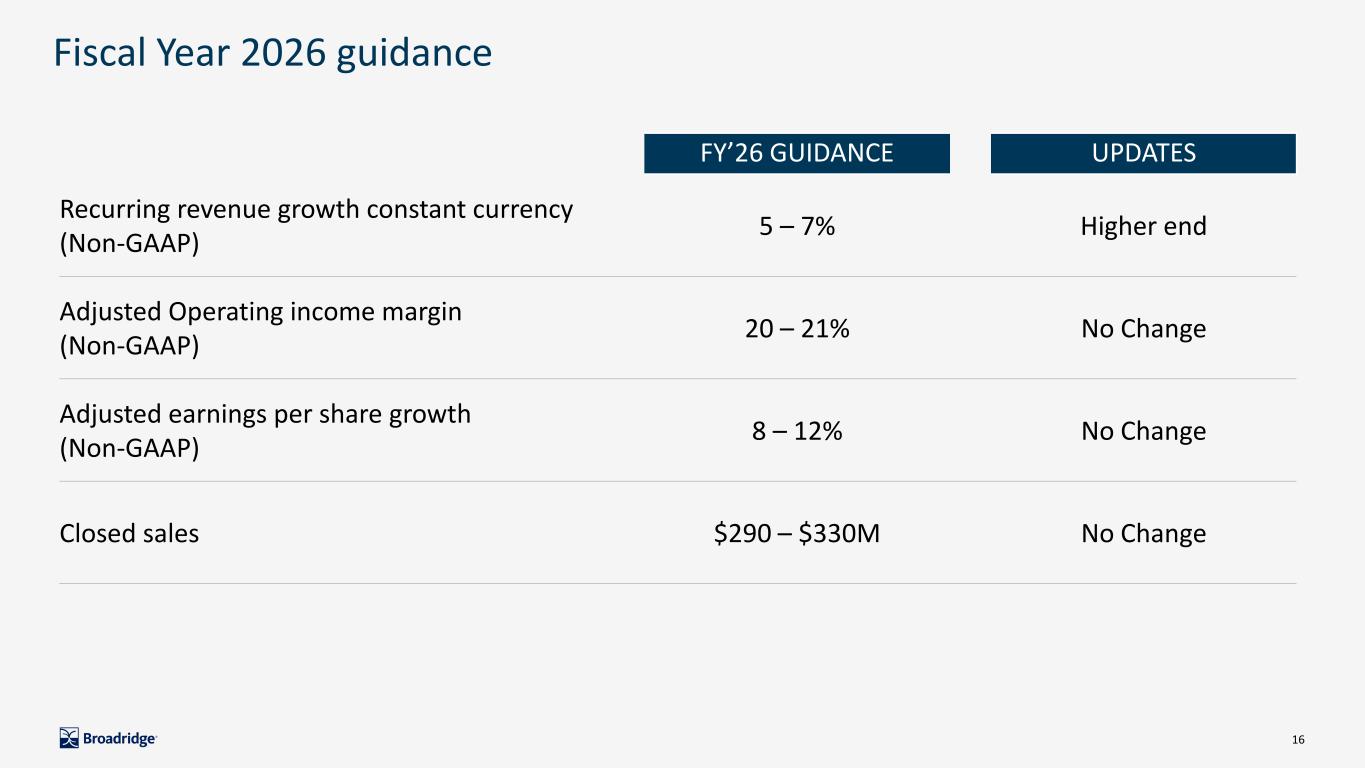

3 Key messages Broadridge delivered strong Q1’26 results, including 8% Recurring revenue growth constant currency, near-record event-driven revenues, and 51% Adjusted EPS growth Broadridge is executing its strategy of democratizing and digitizing governance, simplifying and innovating capital markets, and modernizing wealth management We are using our investment grade balance sheet and strong free cash flow to strengthen our business, including tuck-in M&A and $250 million in share repurchases in the last two quarters Broadridge is on track to deliver strong FY’26 results, including Recurring revenue growth constant currency at the higher end of our 5-7% guidance range, 8-12% Adjusted EPS growth and strong Closed sales 1 2 3 4

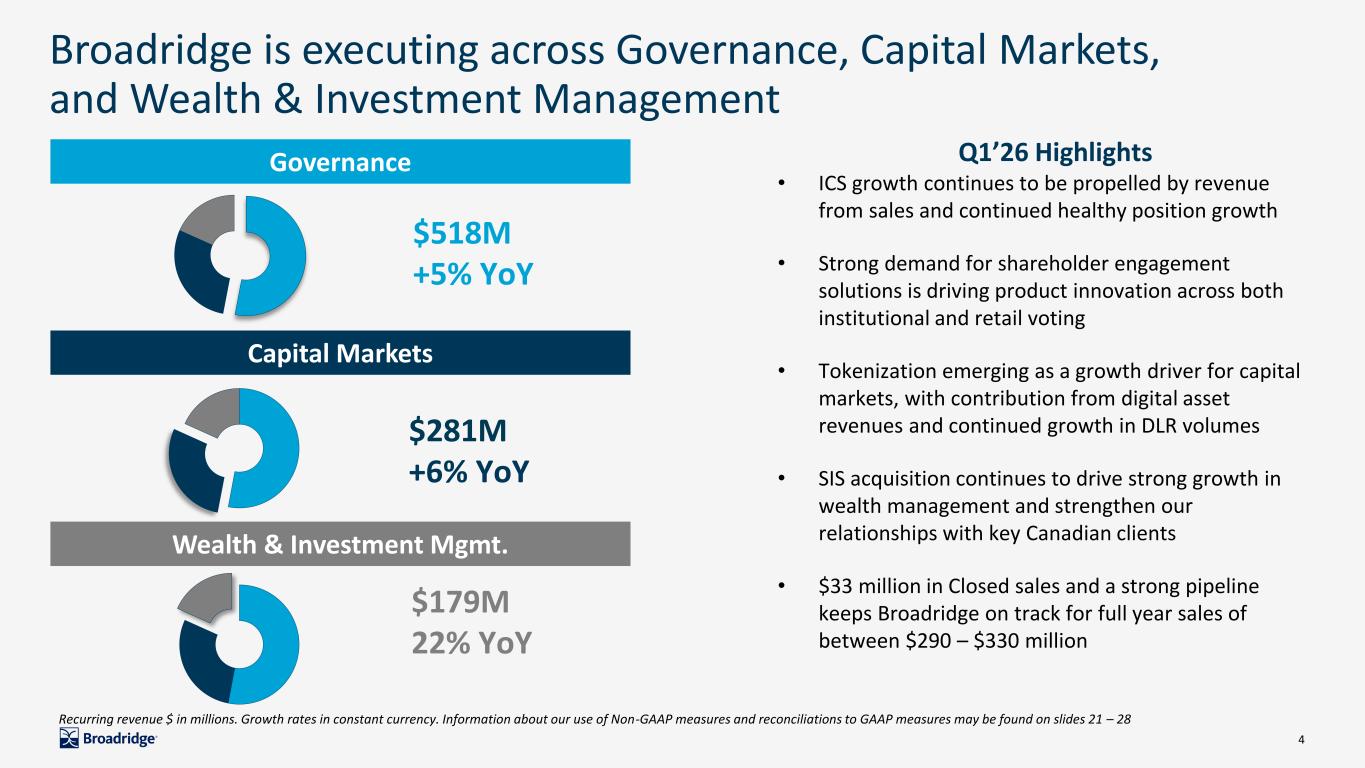

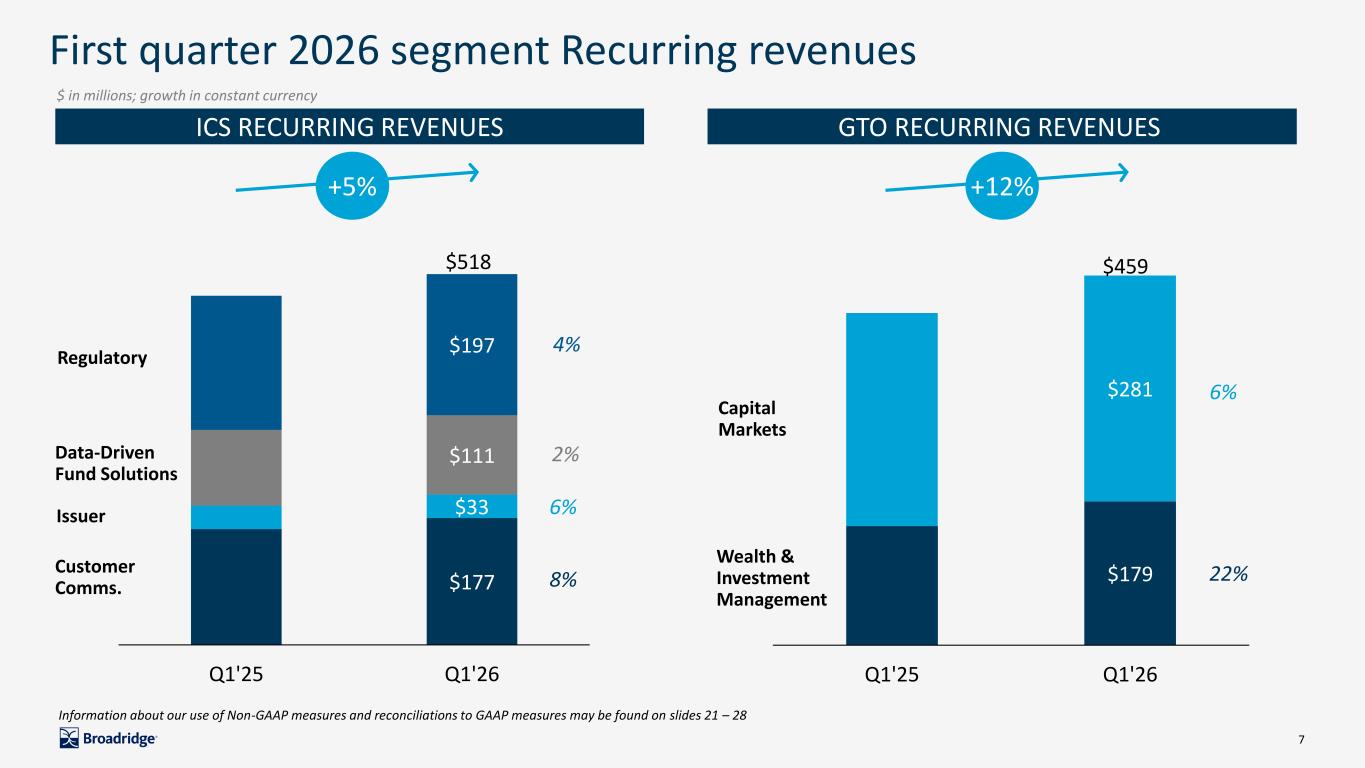

4 Broadridge is executing across Governance, Capital Markets, and Wealth & Investment Management Governance Capital Markets Wealth & Investment Mgmt. $518M +5% YoY $281M +6% YoY $179M 22% YoY • ICS growth continues to be propelled by revenue from sales and continued healthy position growth • Strong demand for shareholder engagement solutions is driving product innovation across both institutional and retail voting • Tokenization emerging as a growth driver for capital markets, with contribution from digital asset revenues and continued growth in DLR volumes • SIS acquisition continues to drive strong growth in wealth management and strengthen our relationships with key Canadian clients • $33 million in Closed sales and a strong pipeline keeps Broadridge on track for full year sales of between $290 – $330 million Recurring revenue $ in millions. Growth rates in constant currency. Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 21 – 28 Q1’26 Highlights

5 Broadridge delivered strong first quarter financial results We are on track to deliver strong fiscal year 2026 results, and have raised our Recurring revenue growth constant currency to the higher end of our 5-7% range and reaffirmed our guidance for 8-12% Adjusted EPS growth Our results are being driven by the execution of our growth strategy across Governance, Capital Markets, and Wealth & Investment Management. Growing demand for digital assets and tokenized trading interest is driving demand for Broadridge solutions across our franchises Broadridge is well positioned to deliver on its three-year financial objectives and drive long-term growth 1 2 3 4 Broadridge remains well-positioned for long-term growth 5

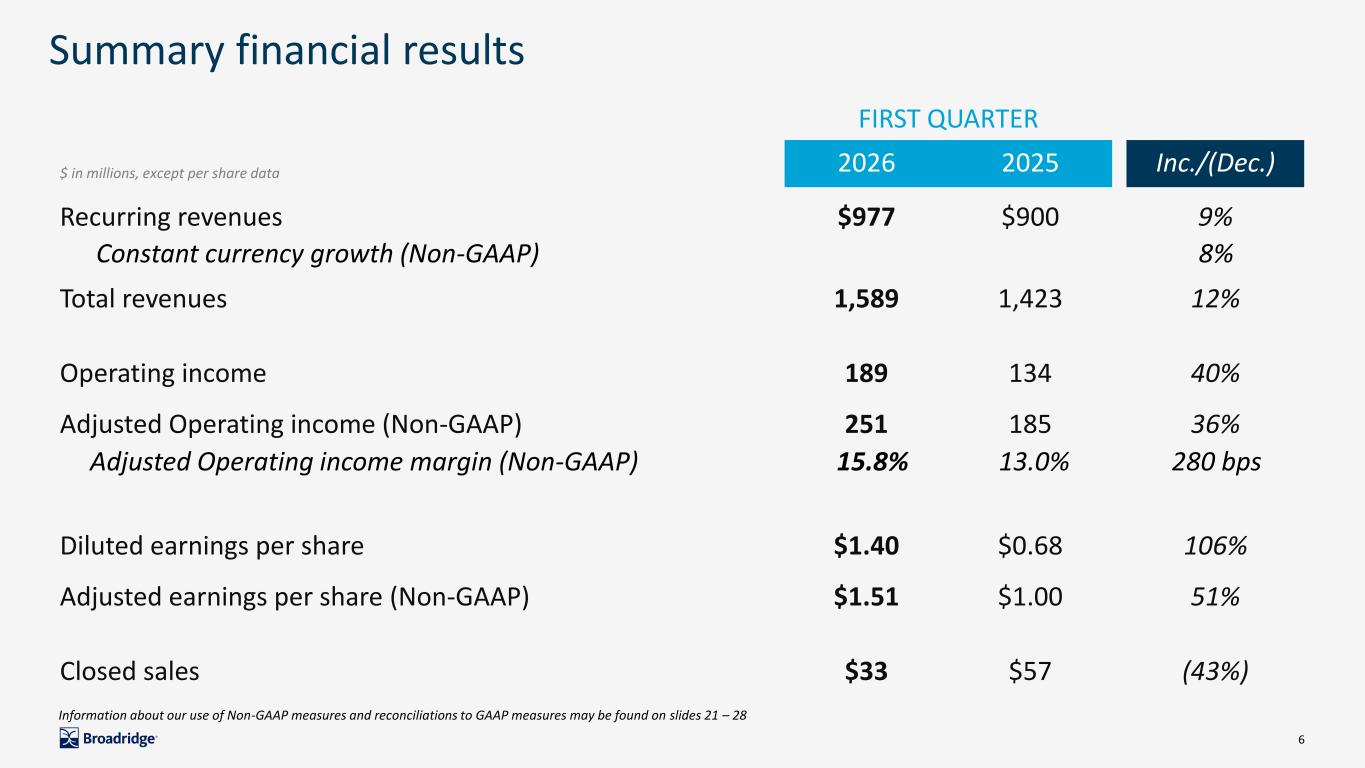

6 Summary financial results FIRST QUARTER $ in millions, except per share data 2026 2025 Inc./(Dec.) Recurring revenues $977 $900 9% Total revenues 1,589 1,423 12% Operating income 189 134 40% Adjusted Operating income (Non-GAAP) 251 185 36% Diluted earnings per share $1.40 $0.68 106% Adjusted earnings per share (Non-GAAP) $1.51 $1.00 51% Closed sales $33 $57 (43%) Constant currency growth (Non-GAAP) 8% Adjusted Operating income margin (Non-GAAP) 15.8% 13.0% 280 bps Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 21 – 28

7 First quarter 2026 segment Recurring revenues $177 $33 $111 $197 Q1'25 Q1'26 Regulatory Customer Comms. Data-Driven Fund Solutions Issuer 6% 8% 2% 4% ICS RECURRING REVENUES GTO RECURRING REVENUES $518 $ in millions; growth in constant currency +5% +12% Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 21 – 28 $179 $281 Q1'25 Q1'26 Capital Markets Wealth & Investment Management $459 6% 22%

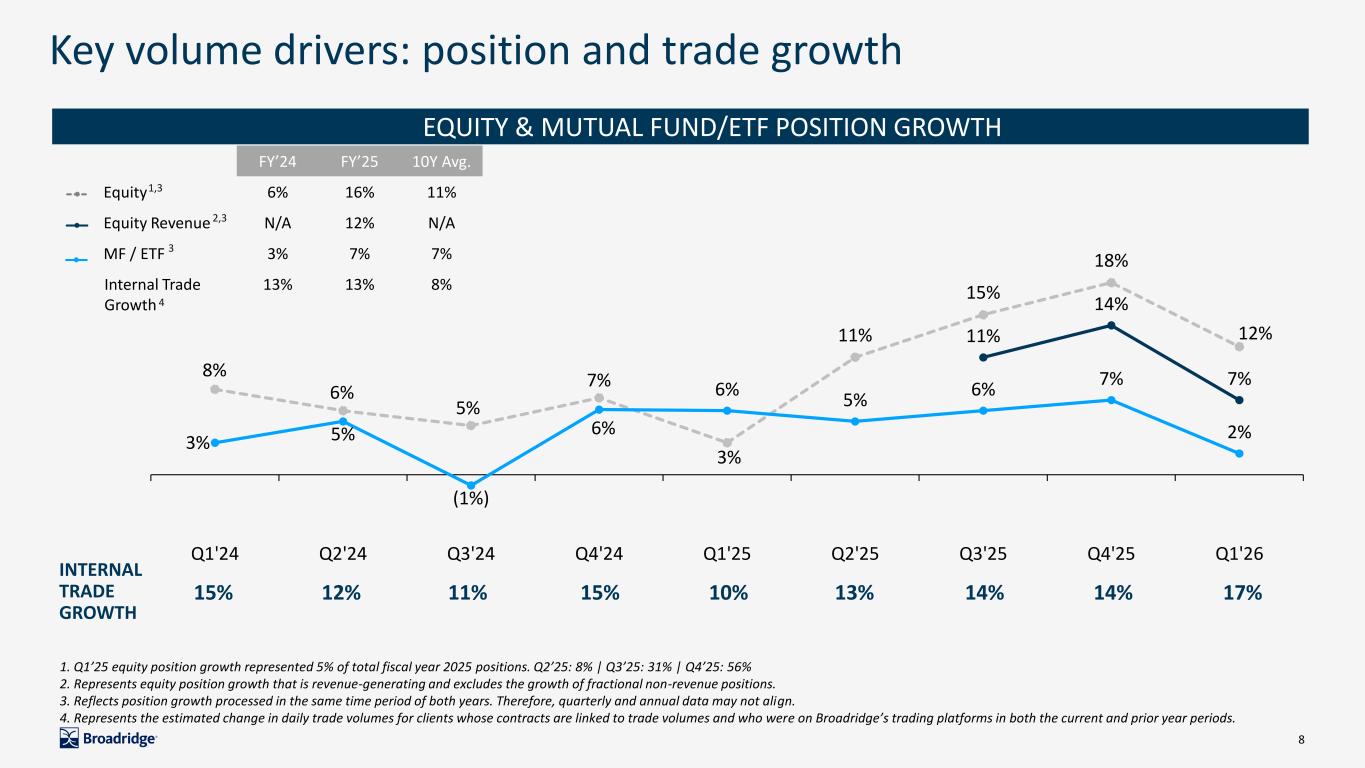

8 8% 6% 5% 7% 3% 11% 15% 18% 12%11% 14% 7% 3% 5% (1%) 6% 6% 5% 6% 7% 2% Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Q4'25 Q1'26 Key volume drivers: position and trade growth 15% 12% 11% 15% 10% 13% 14% 14% 17% INTERNAL TRADE GROWTH EQUITY & MUTUAL FUND/ETF POSITION GROWTH 1. Q1’25 equity position growth represented 5% of total fiscal year 2025 positions. Q2’25: 8% | Q3’25: 31% | Q4’25: 56% 2. Represents equity position growth that is revenue-generating and excludes the growth of fractional non-revenue positions. 3. Reflects position growth processed in the same time period of both years. Therefore, quarterly and annual data may not align. 4. Represents the estimated change in daily trade volumes for clients whose contracts are linked to trade volumes and who were on Broadridge’s trading platforms in both the current and prior year periods. FY’24 FY’25 10Y Avg. Equity 6% 16% 11% Equity Revenue N/A 12% N/A MF / ETF 3% 7% 7% Internal Trade Growth 13% 13% 8% 1,3 2,3 3 4

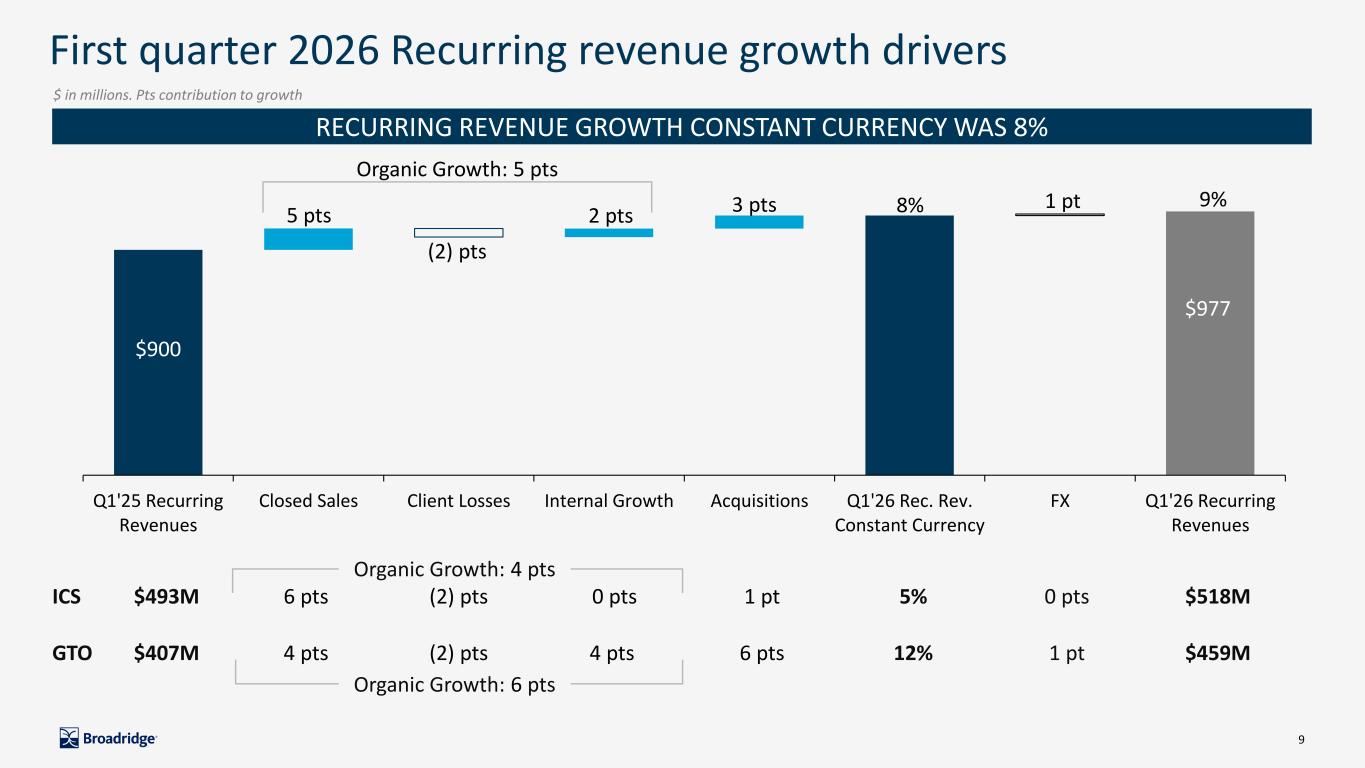

9 $900 Q1'25 Recurring Revenues Closed Sales Client Losses Internal Growth Acquisitions Q1'26 Rec. Rev. Constant Currency FX Q1'26 Recurring Revenues RECURRING REVENUE GROWTH CONSTANT CURRENCY WAS 8% First quarter 2026 Recurring revenue growth drivers ICS $493M 6 pts (2) pts 0 pts 1 pt 5% 0 pts $518M GTO $407M 4 pts (2) pts 4 pts 6 pts 12% 1 pt $459M 5 pts (2) pts 2 pts 3 pts 9%1 pt8% Organic Growth: 4 pts $ in millions. Pts contribution to growth Organic Growth: 6 pts Organic Growth: 5 pts $977

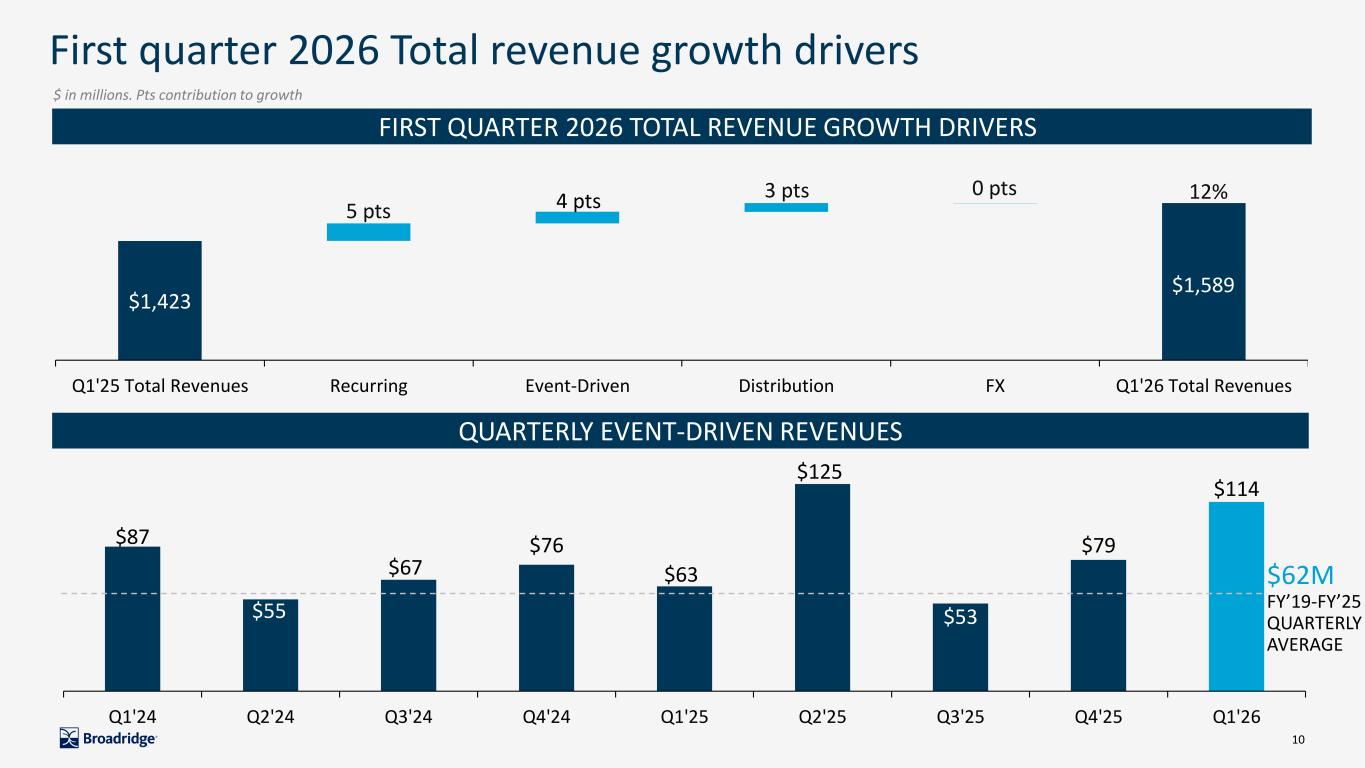

10 FIRST QUARTER 2026 TOTAL REVENUE GROWTH DRIVERS $87 $55 $67 $76 $63 $125 $53 $79 $114 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Q4'25 Q1'26 $62M FY’19-FY’25 QUARTERLY AVERAGE First quarter 2026 Total revenue growth drivers QUARTERLY EVENT-DRIVEN REVENUES $ in millions. Pts contribution to growth $1,423 Q1'25 Total Revenues Recurring Event-Driven Distribution FX Q1'26 Total Revenues 5 pts 4 pts 3 pts 12%0 pts $1,589

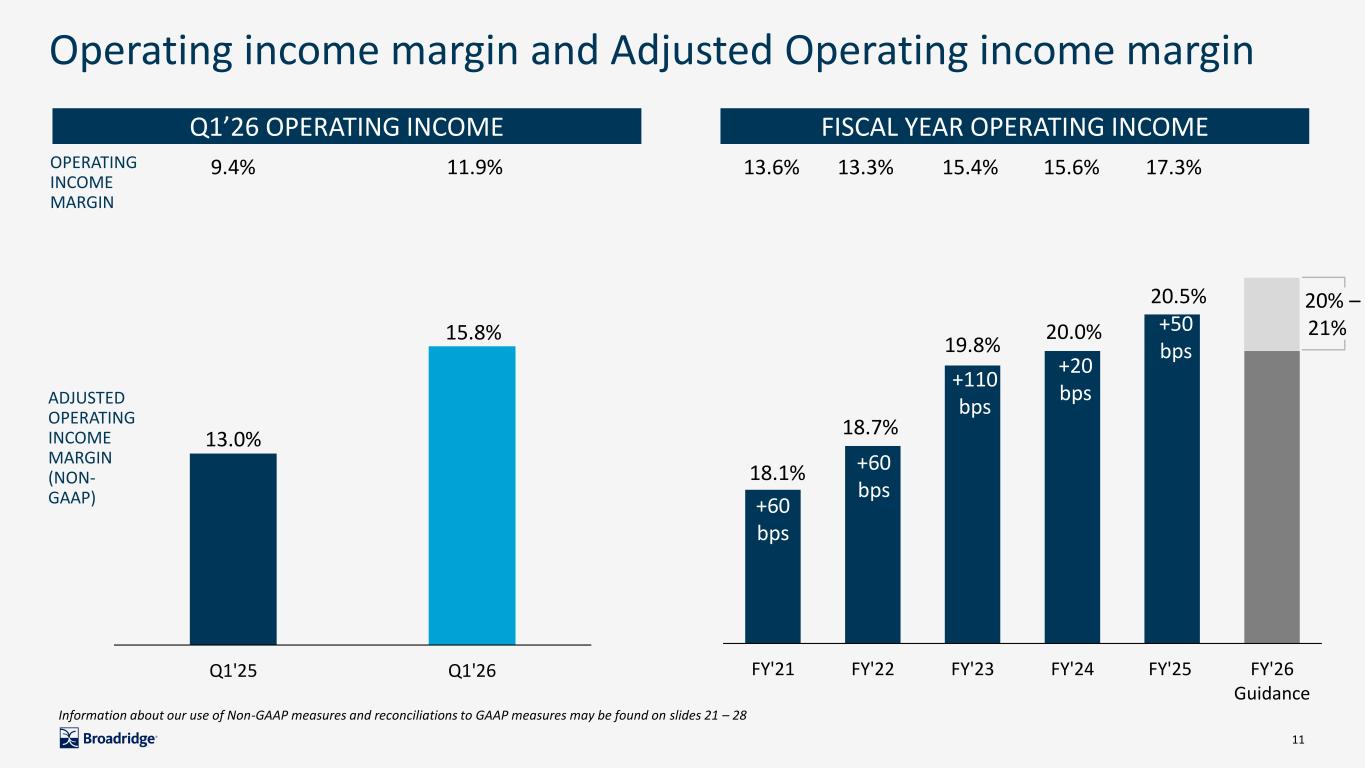

11 18.1% 18.7% 19.8% 20.0% FY'21 FY'22 FY'23 FY'24 FY'25 FY'26 Guidance Operating income margin and Adjusted Operating income margin 15.4% 15.6% 17.3%11.9%9.4% Q1'25 Q1'26 +60 bps +110 bps OPERATING INCOME MARGIN ADJUSTED OPERATING INCOME MARGIN (NON- GAAP) 15.8% +20 bps 13.0% Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 21 – 28 +50 bps Q1’26 OPERATING INCOME FISCAL YEAR OPERATING INCOME 20.5% 13.3%13.6% +60 bps 20% – 21%

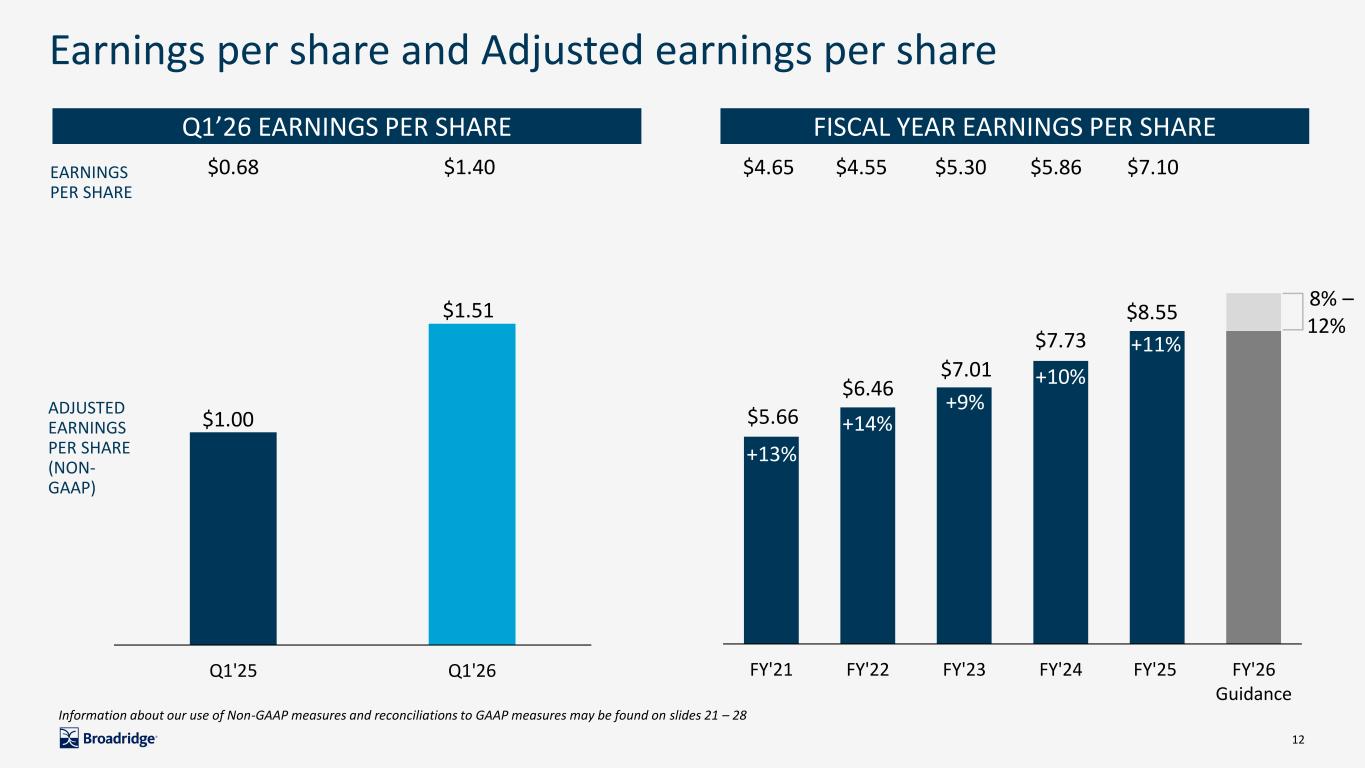

12 $5.66 $6.46 $7.01 $7.73 FY'21 FY'22 FY'23 FY'24 FY'25 FY'26 Guidance Earnings per share and Adjusted earnings per share $5.30 $5.86 $7.10$1.40$0.68 Q1'25 Q1'26 +14% +9% EARNINGS PER SHARE ADJUSTED EARNINGS PER SHARE (NON- GAAP) $1.51 +10% $1.00 Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 21 – 28 +11% Q1’26 EARNINGS PER SHARE FISCAL YEAR EARNINGS PER SHARE $8.55 $4.55$4.65 +13% 8% – 12%

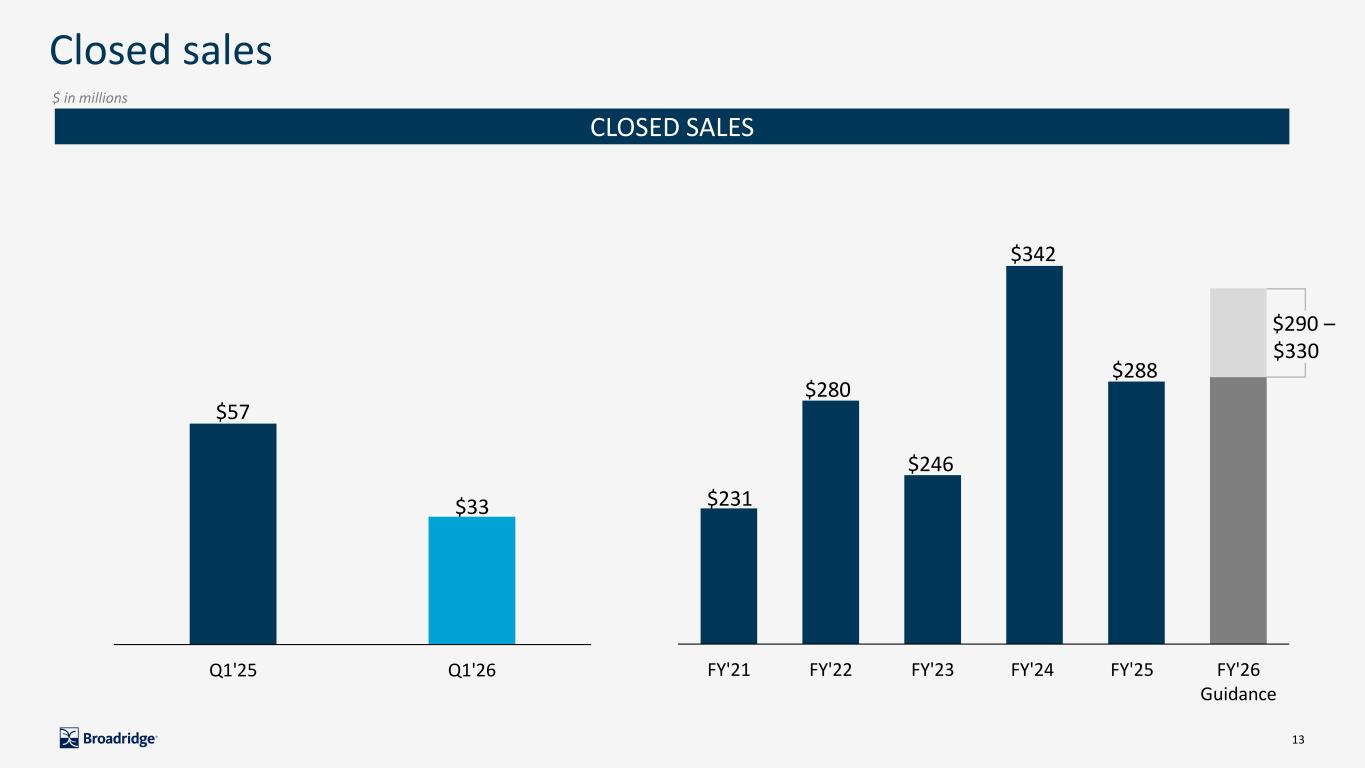

13 FY'21 FY'22 FY'23 FY'24 FY'25 FY'26 Guidance Closed sales $ in millions $342 Q1'25 Q1'26 $57 $33 $288 $246 CLOSED SALES $280 $290 – $330 $231

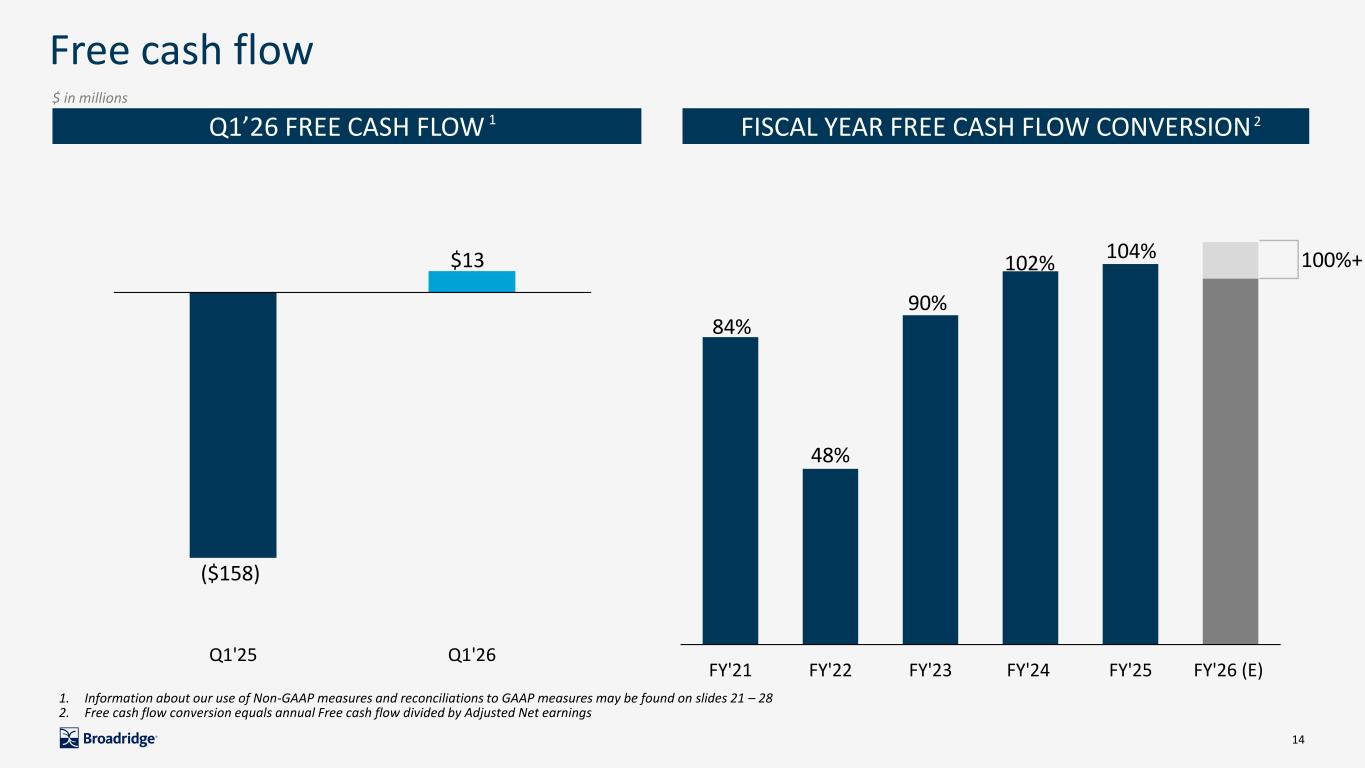

14 84% 48% 90% 102% 104% FY'21 FY'22 FY'23 FY'24 FY'25 FY'26 (E) 100%+ Free cash flow $ in millions ($158) $13 Q1'25 Q1'26 Q1’26 FREE CASH FLOW FISCAL YEAR FREE CASH FLOW CONVERSION 1. Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 21 – 28 2. Free cash flow conversion equals annual Free cash flow divided by Adjusted Net earnings 1 2

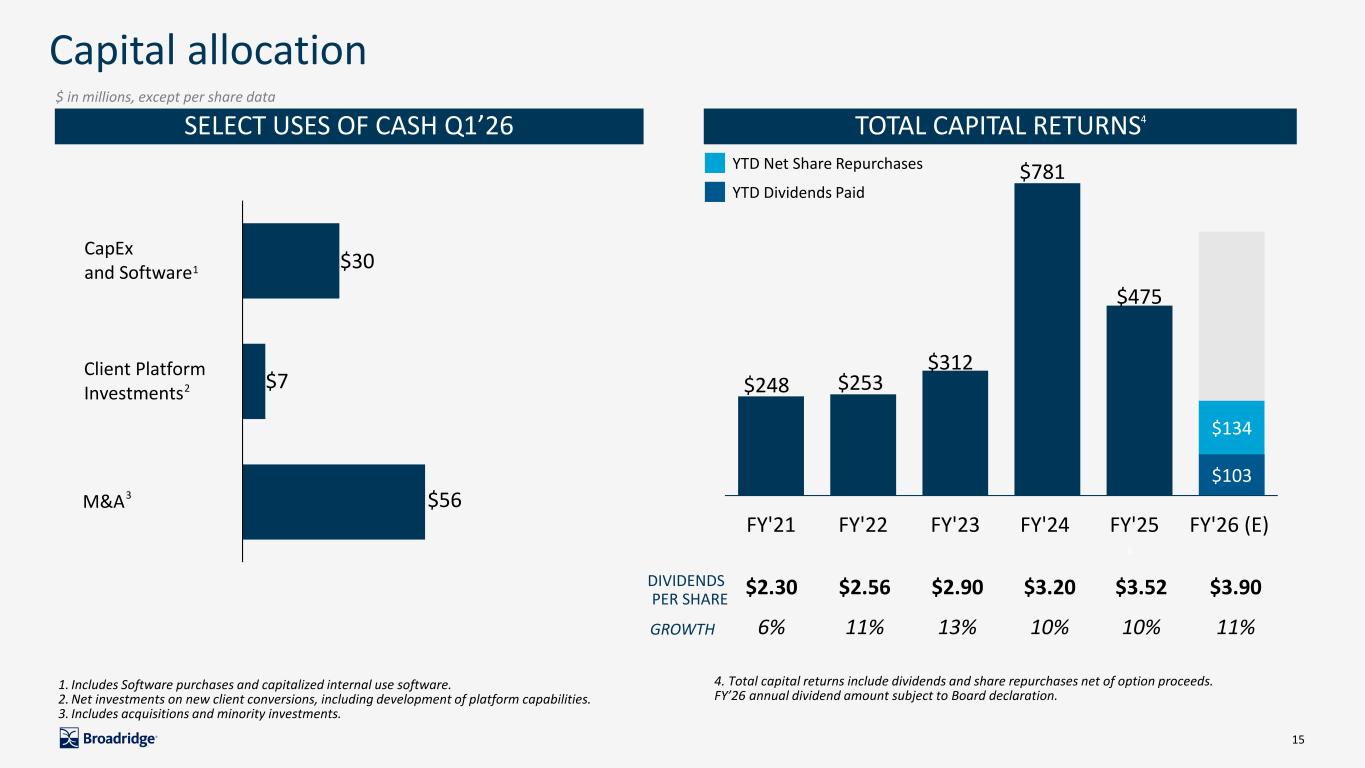

15 $103 $134 FY'21 FY'22 FY'23 FY'24 FY'25 FY'26 (E) $56 M&A Client Platform Investments CapEx and Software SELECT USES OF CASH Q1’26 TOTAL CAPITAL RETURNS Capital allocation $ in millions, except per share data $2.30 $2.56 $2.90 $3.20 $3.52 $3.90 6% 11% 13% 10% 10% 11% DIVIDENDS PER SHARE 2 1. Includes Software purchases and capitalized internal use software. 2. Net investments on new client conversions, including development of platform capabilities. 3. Includes acquisitions and minority investments. 1 $7 $30 3 6 4. Total capital returns include dividends and share repurchases net of option proceeds. FY’26 annual dividend amount subject to Board declaration. GROWTH $312 $253 $781 4 $475 YTD Net Share Repurchases $248 YTD Dividends Paid

16 Fiscal Year 2026 guidance FY’26 GUIDANCE UPDATES Recurring revenue growth constant currency (Non-GAAP) 5 – 7% Higher end Adjusted Operating income margin (Non-GAAP) 20 – 21% No Change Adjusted earnings per share growth (Non-GAAP) 8 – 12% No Change Closed sales $290 – $330M No Change

Appendix

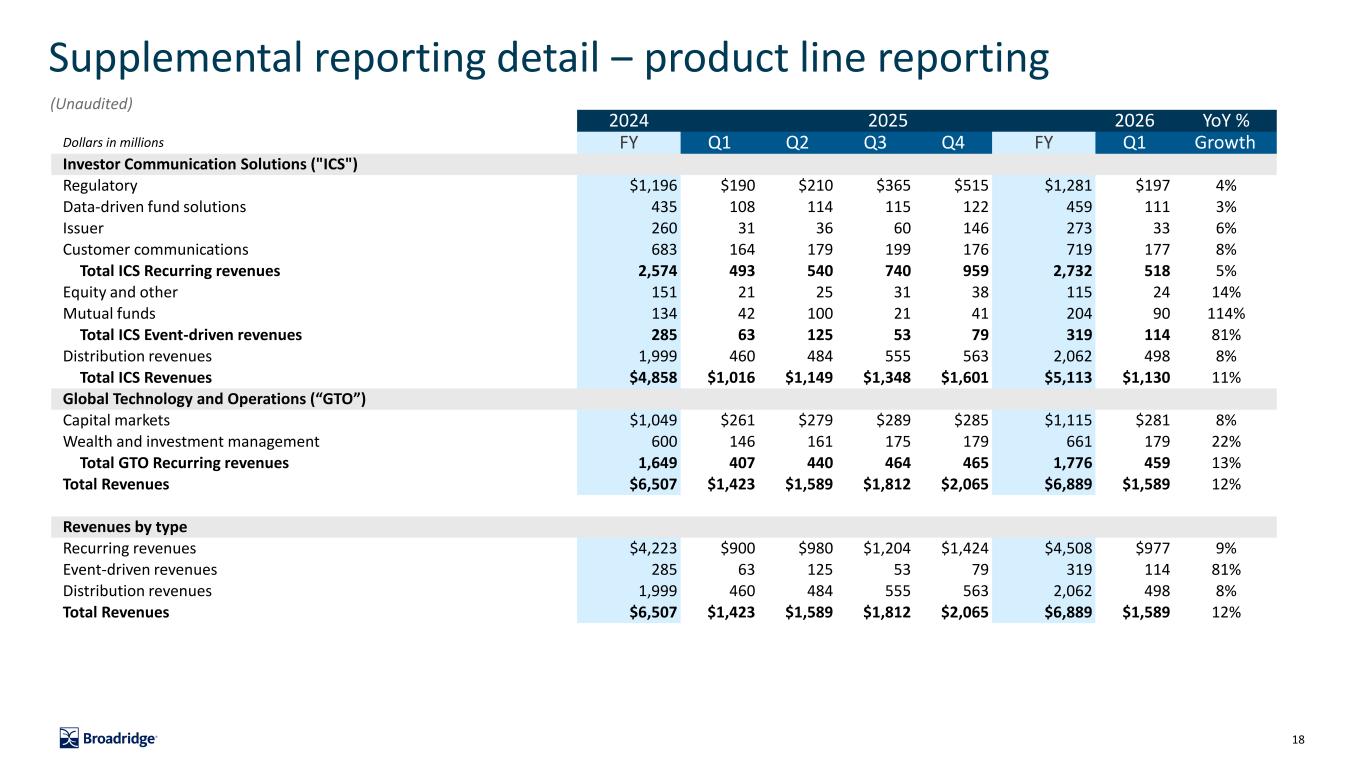

18 Supplemental reporting detail ‒ product line reporting (Unaudited) 2024 2025 2026 YoY % Dollars in millions FY Q1 Q2 Q3 Q4 FY Q1 Growth Investor Communication Solutions ("ICS") Regulatory $1,196 $190 $210 $365 $515 $1,281 $197 4% Data-driven fund solutions 435 108 114 115 122 459 111 3% Issuer 260 31 36 60 146 273 33 6% Customer communications 683 164 179 199 176 719 177 8% Total ICS Recurring revenues 2,574 493 540 740 959 2,732 518 5% Equity and other 151 21 25 31 38 115 24 14% Mutual funds 134 42 100 21 41 204 90 114% Total ICS Event-driven revenues 285 63 125 53 79 319 114 81% Distribution revenues 1,999 460 484 555 563 2,062 498 8% Total ICS Revenues $4,858 $1,016 $1,149 $1,348 $1,601 $5,113 $1,130 11% Global Technology and Operations (“GTO”) Capital markets $1,049 $261 $279 $289 $285 $1,115 $281 8% Wealth and investment management 600 146 161 175 179 661 179 22% Total GTO Recurring revenues 1,649 407 440 464 465 1,776 459 13% Total Revenues $6,507 $1,423 $1,589 $1,812 $2,065 $6,889 $1,589 12% Revenues by type Recurring revenues $4,223 $900 $980 $1,204 $1,424 $4,508 $977 9% Event-driven revenues 285 63 125 53 79 319 114 81% Distribution revenues 1,999 460 484 555 563 2,062 498 8% Total Revenues $6,507 $1,423 $1,589 $1,812 $2,065 $6,889 $1,589 12%

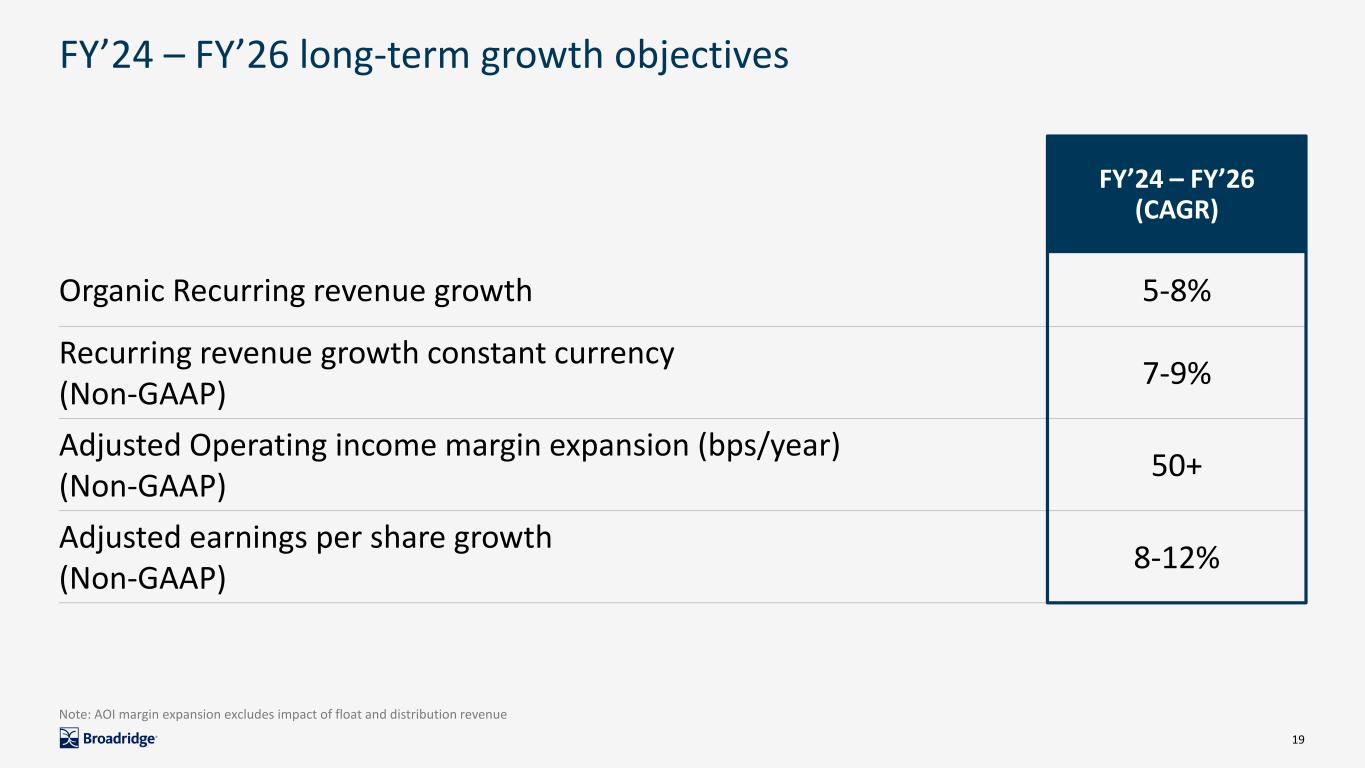

19 FY’24 – FY’26 long-term growth objectives FY’24 – FY’26 (CAGR) Organic Recurring revenue growth 5-8% Recurring revenue growth constant currency (Non-GAAP) 7-9% Adjusted Operating income margin expansion (bps/year) (Non-GAAP) 50+ Adjusted earnings per share growth (Non-GAAP) 8-12% Note: AOI margin expansion excludes impact of float and distribution revenue

Explanation of Non-GAAP measures and reconciliation of GAAP to Non- GAAP measures

21 Non-GAAP measures Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures The Company’s results in this presentation are presented in accordance with U.S. generally accepted accounting principles ("GAAP") except where otherwise noted. In certain circumstances, results have been presented that are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP measures are Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share, Free cash flow, Free cash flow conversion, and Recurring revenue growth constant currency. These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results. The Company believes our Non-GAAP financial measures help investors understand how management plans, measures and evaluates the Company’s business performance. Management believes that Non-GAAP measures provide consistency in its financial reporting and facilitates investors’ understanding of the Company’s operating results and trends by providing an additional basis for comparison. Management uses these Non-GAAP financial measures to, among other things, evaluate our ongoing operations, and for internal planning and forecasting purposes. In addition, and as a consequence of the importance of these Non-GAAP financial measures in managing our business, the Company’s Compensation Committee of the Board of Directors incorporates Non-GAAP financial measures in the evaluation process for determining management compensation. Reconciliations of Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this presentation. Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted Net Earnings, and Adjusted Earnings Per Share These Non-GAAP measures are adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items, the exclusion of which management believes provides insight regarding our ongoing operating performance. Depending on the period presented, these adjusted measures exclude the impact of certain of the following items: (i) Amortization of Acquired Intangibles and Purchased Intellectual Property, which represent non-cash amortization expenses associated with the Company's acquisition activities. (ii) Acquisition and Integration Costs, which represent certain transaction and integration costs associated with the Company’s acquisition activities. (iii) Restructuring and Other Related Costs. which represent costs associated with the Company’s Corporate Restructuring Initiative to exit and/or realign some of our businesses, streamline the Company’s management structure, reallocate work to lower cost locations, and reduce headcount in deprioritized areas. (iv) Unrealized Gains or Losses on Digital Assets, which represents the quarterly mark to market gain or loss recorded to remeasure the Company’s digital asset holdings in the form of Canton Coins to fair market value. (v) Litigation Settlement Charges, which represent the reserve established during the third and fourth quarter of fiscal year 2024 related to the settlement of claims. (vi) Russia-Related Exit Costs, which are direct and incremental costs associated with the Company’s wind down of business activities in Russia in response to Russia’s invasion of Ukraine, including relocation-related expenses of impacted associates. (vii) Real Estate Realignment and Covid-19 Related Expenses. Real Estate Realignment Expenses are expenses associated with the exit of certain of the Company’s leased facilities in response to the Covid-19 pandemic, which consist of the impairment of certain right of use assets, leasehold improvements and equipment, as well as other related facility exit expenses directly resulting from, and attributable to, the exit of these leased facilities. Covid-19 Related Expense are direct and incremental expenses incurred by the Company to protect the health and safety of Broadridge associates during the Covid-19 outbreak, including expenses associated with monitoring the temperatures for associates entering our facilities, enhancing the safety of our office environment in preparation for workers to return to Company facilities on a more regular basis, ensuring proper social distancing in our production facilities, personal protective equipment, enhanced cleaning measures in our facilities, and other safety related expenses (viii) Investment Gains, which represent non-operating, non-cash gains on privately held investments. (ix) Software Charge, which represents a charge related to an internal use software product that is no longer expected to be used (x) Gain on Acquisition-Related Financial Instrument, which represents a non-operating gain on a financial instrument designed to minimize the Company's foreign exchange risk associated with the Itiviti acquisition, as well as certain other non-operating financing costs associated with the Itiviti acquisition.

22 Non-GAAP measures We exclude Acquisition and Integration Costs, Restructuring and Other Related Costs, Unrealized Gains or Losses on Digital Assets, Litigation Settlement Charges, Russia-Related Exit Costs, Real Estate Realignment and Covid-19 Related Expenses, Investment Gains, the Software Charge, and Gain on Acquisition-Related Financial Instrument from our Adjusted Operating income (as applicable) and other adjusted earnings measures because excluding such information provides us with an understanding of the results from the primary operations of our business and enhances comparability across fiscal reporting periods, as these items are not reflective of our underlying operations or performance. We also exclude the impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, as these non-cash amounts are significantly impacted by the timing and size of individual acquisitions and do not factor into the Company's capital allocation decisions, management compensation metrics or multi-year objectives. Furthermore, management believes that this adjustment enables better comparison of our results as Amortization of Acquired Intangibles and Purchased Intellectual Property will not recur in future periods once such intangible assets have been fully amortized. Although we exclude Amortization of Acquired Intangibles and Purchased Intellectual Property from our adjusted earnings measures, our management believes that it is important for investors to understand that these intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in the amortization of additional intangible assets. Free cash flow and Free cash flow conversion In addition to the Non-GAAP financial measures discussed above, we provide Free cash flow information because we consider Free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated that could be used for dividends, share repurchases, strategic acquisitions, other investments, as well as debt servicing. Free cash flow is a Non- GAAP financial measure and is defined by the Company as Net cash flows provided by operating activities plus Proceeds from asset sales, less Capital expenditures as well as Software purchases and capitalized internal use software. Free cash flow conversion is calculated as Free cash flow divided by Adjusted Net earnings for the given period. Recurring revenue growth constant currency As a multi-national company, we are subject to variability of our reported U.S. dollar results due to changes in foreign currency exchange rates. The exclusion of the impact of foreign currency exchange fluctuations from our Recurring revenue growth, or what we refer to as amounts expressed “on a constant currency basis”, is a Non-GAAP measure. We believe that excluding the impact of foreign currency exchange fluctuations from our Recurring revenue growth provides additional information that enables enhanced comparison to prior periods. Changes in Recurring revenue growth expressed on a constant currency basis are presented excluding the impact of foreign currency exchange fluctuations. To present this information, current period results for entities reporting in currencies other than the U.S. dollar are translated into U.S. dollars at the average exchange rates in effect during the corresponding period of the comparative year, rather than at the actual average exchange rates in effect during the current fiscal year. Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this presentation.

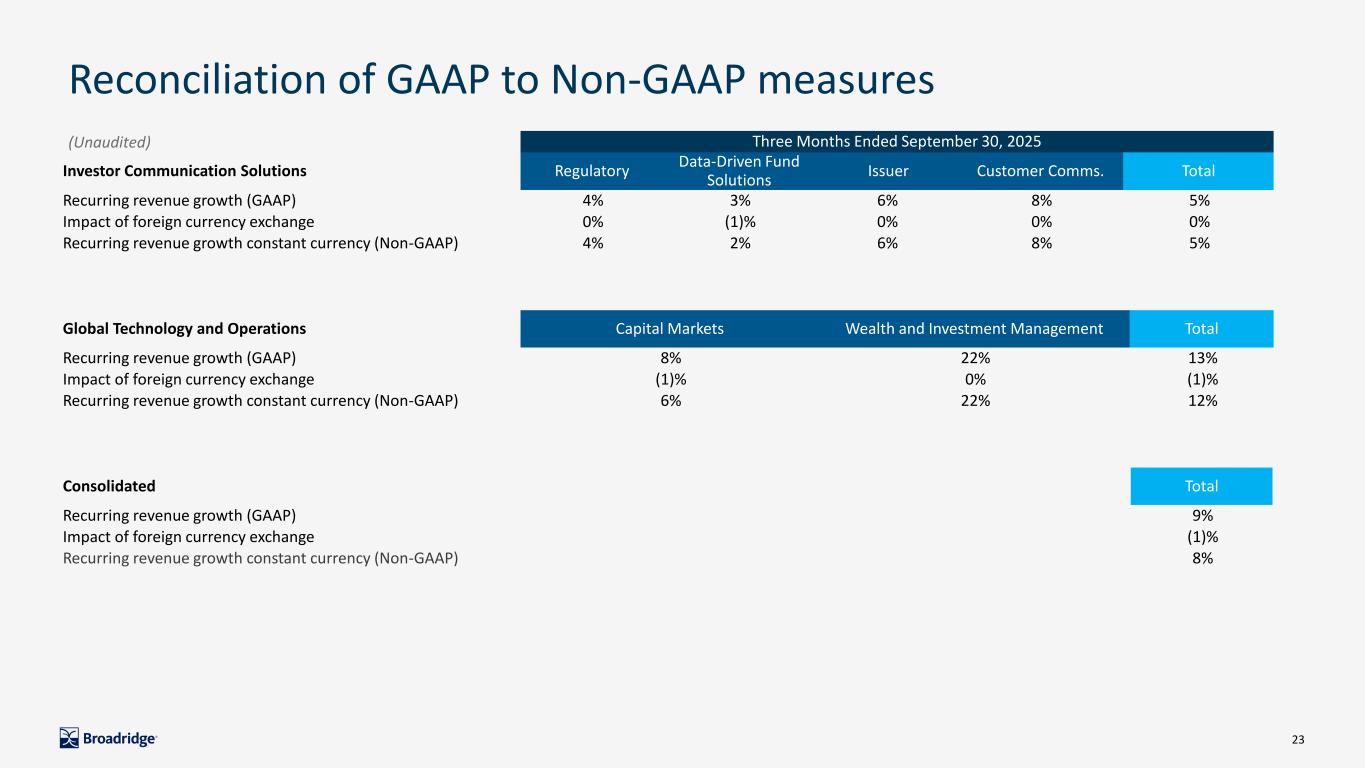

23 Reconciliation of GAAP to Non-GAAP measures (Unaudited) Global Technology and Operations Capital Markets Wealth and Investment Management Total Recurring revenue growth (GAAP) 8% 22% 13% Impact of foreign currency exchange (1)% 0% (1)% Recurring revenue growth constant currency (Non-GAAP) 6% 22% 12% Three Months Ended September 30, 2025 Investor Communication Solutions Regulatory Data-Driven Fund Solutions Issuer Customer Comms. Total Recurring revenue growth (GAAP) 4% 3% 6% 8% 5% Impact of foreign currency exchange 0% (1)% 0% 0% 0% Recurring revenue growth constant currency (Non-GAAP) 4% 2% 6% 8% 5% Consolidated Total Recurring revenue growth (GAAP) 9% Impact of foreign currency exchange (1)% Recurring revenue growth constant currency (Non-GAAP) 8%

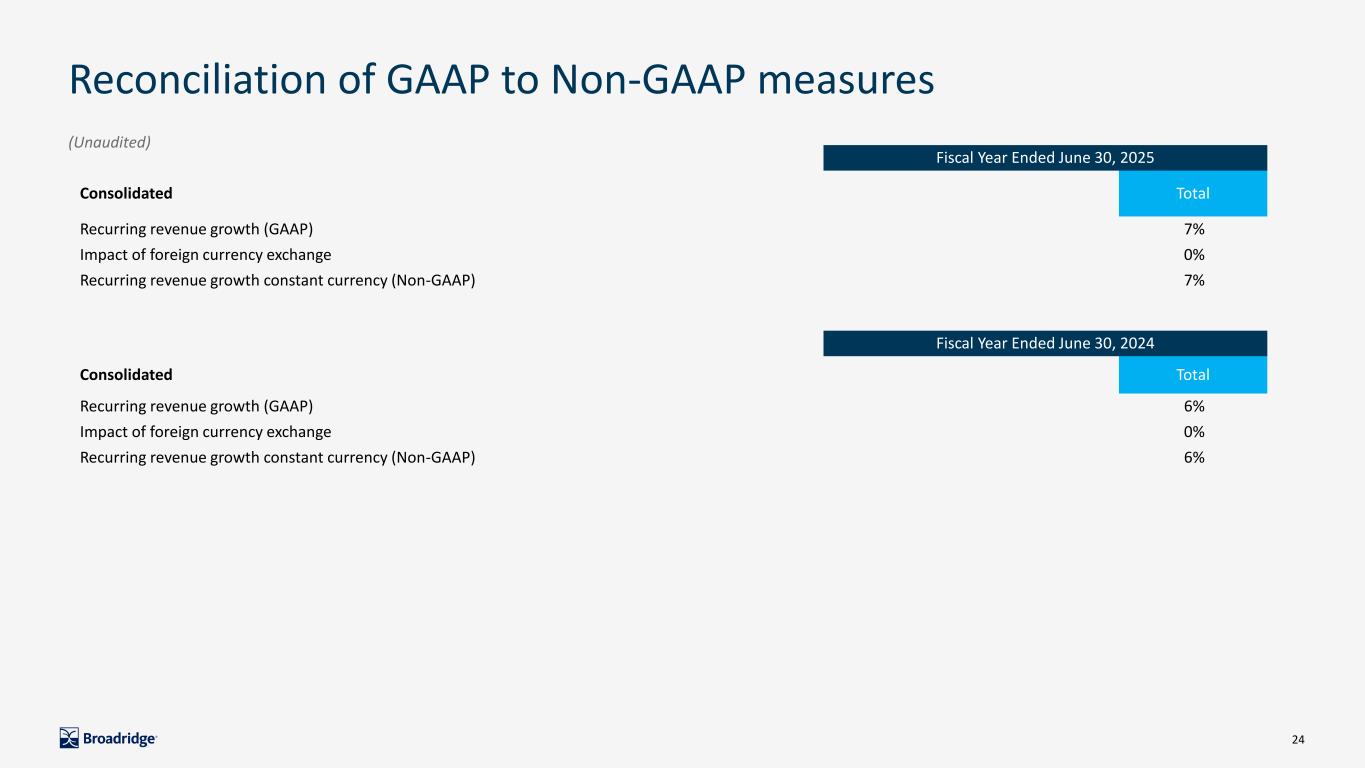

24 Reconciliation of GAAP to Non-GAAP measures (Unaudited) Fiscal Year Ended June 30, 2025 Consolidated Total Recurring revenue growth (GAAP) 7% Impact of foreign currency exchange 0% Recurring revenue growth constant currency (Non-GAAP) 7% Fiscal Year Ended June 30, 2024 Consolidated Total Recurring revenue growth (GAAP) 6% Impact of foreign currency exchange 0% Recurring revenue growth constant currency (Non-GAAP) 6%

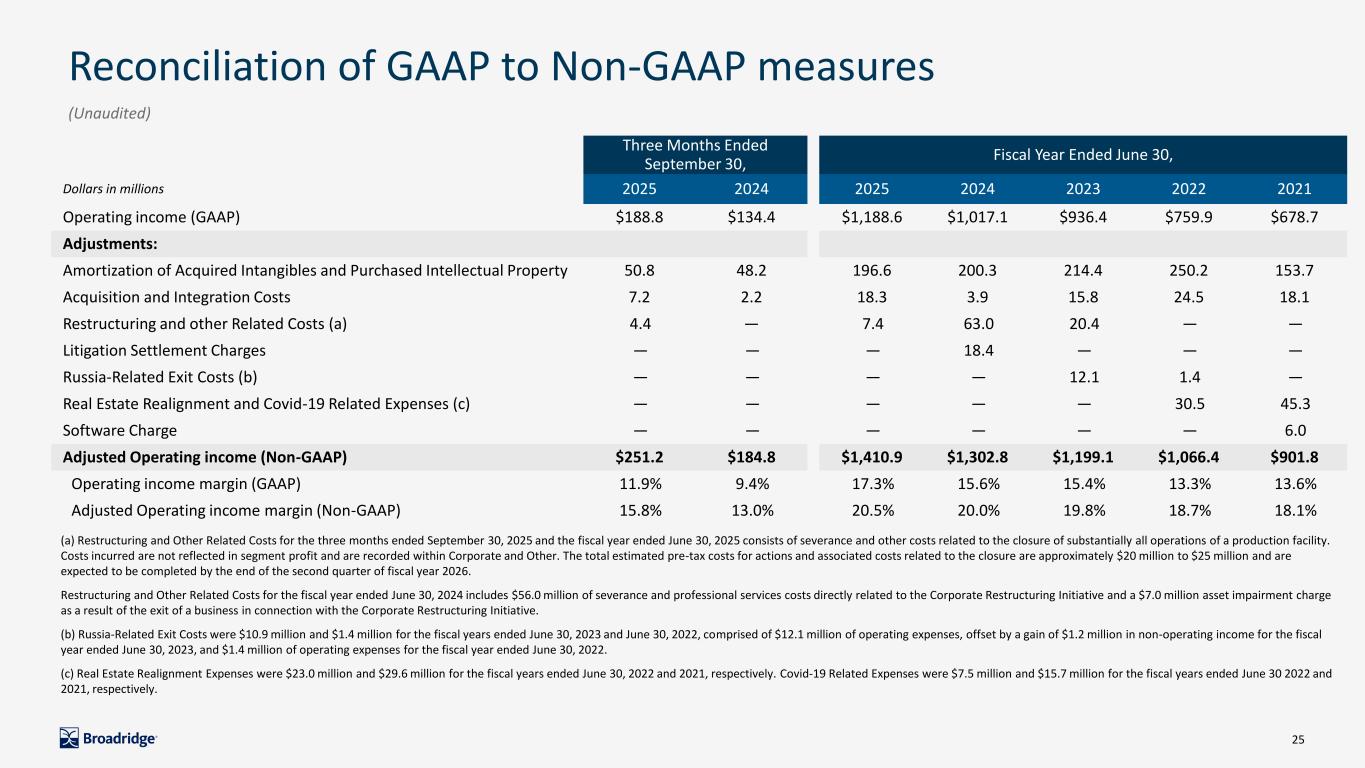

25 Reconciliation of GAAP to Non-GAAP measures (Unaudited) Three Months Ended September 30, Fiscal Year Ended June 30, Dollars in millions 2025 2024 2025 2024 2023 2022 2021 Operating income (GAAP) $188.8 $134.4 $1,188.6 $1,017.1 $936.4 $759.9 $678.7 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 50.8 48.2 196.6 200.3 214.4 250.2 153.7 Acquisition and Integration Costs 7.2 2.2 18.3 3.9 15.8 24.5 18.1 Restructuring and other Related Costs (a) 4.4 — 7.4 63.0 20.4 — — Litigation Settlement Charges — — — 18.4 — — — Russia-Related Exit Costs (b) — — — — 12.1 1.4 — Real Estate Realignment and Covid-19 Related Expenses (c) — — — — — 30.5 45.3 Software Charge — — — — — — 6.0 Adjusted Operating income (Non-GAAP) $251.2 $184.8 $1,410.9 $1,302.8 $1,199.1 $1,066.4 $901.8 Operating income margin (GAAP) 11.9% 9.4% 17.3% 15.6% 15.4% 13.3% 13.6% Adjusted Operating income margin (Non-GAAP) 15.8% 13.0% 20.5% 20.0% 19.8% 18.7% 18.1% (a) Restructuring and Other Related Costs for the three months ended September 30, 2025 and the fiscal year ended June 30, 2025 consists of severance and other costs related to the closure of substantially all operations of a production facility. Costs incurred are not reflected in segment profit and are recorded within Corporate and Other. The total estimated pre-tax costs for actions and associated costs related to the closure are approximately $20 million to $25 million and are expected to be completed by the end of the second quarter of fiscal year 2026. Restructuring and Other Related Costs for the fiscal year ended June 30, 2024 includes $56.0 million of severance and professional services costs directly related to the Corporate Restructuring Initiative and a $7.0 million asset impairment charge as a result of the exit of a business in connection with the Corporate Restructuring Initiative. (b) Russia-Related Exit Costs were $10.9 million and $1.4 million for the fiscal years ended June 30, 2023 and June 30, 2022, comprised of $12.1 million of operating expenses, offset by a gain of $1.2 million in non-operating income for the fiscal year ended June 30, 2023, and $1.4 million of operating expenses for the fiscal year ended June 30, 2022. (c) Real Estate Realignment Expenses were $23.0 million and $29.6 million for the fiscal years ended June 30, 2022 and 2021, respectively. Covid-19 Related Expenses were $7.5 million and $15.7 million for the fiscal years ended June 30 2022 and 2021, respectively.

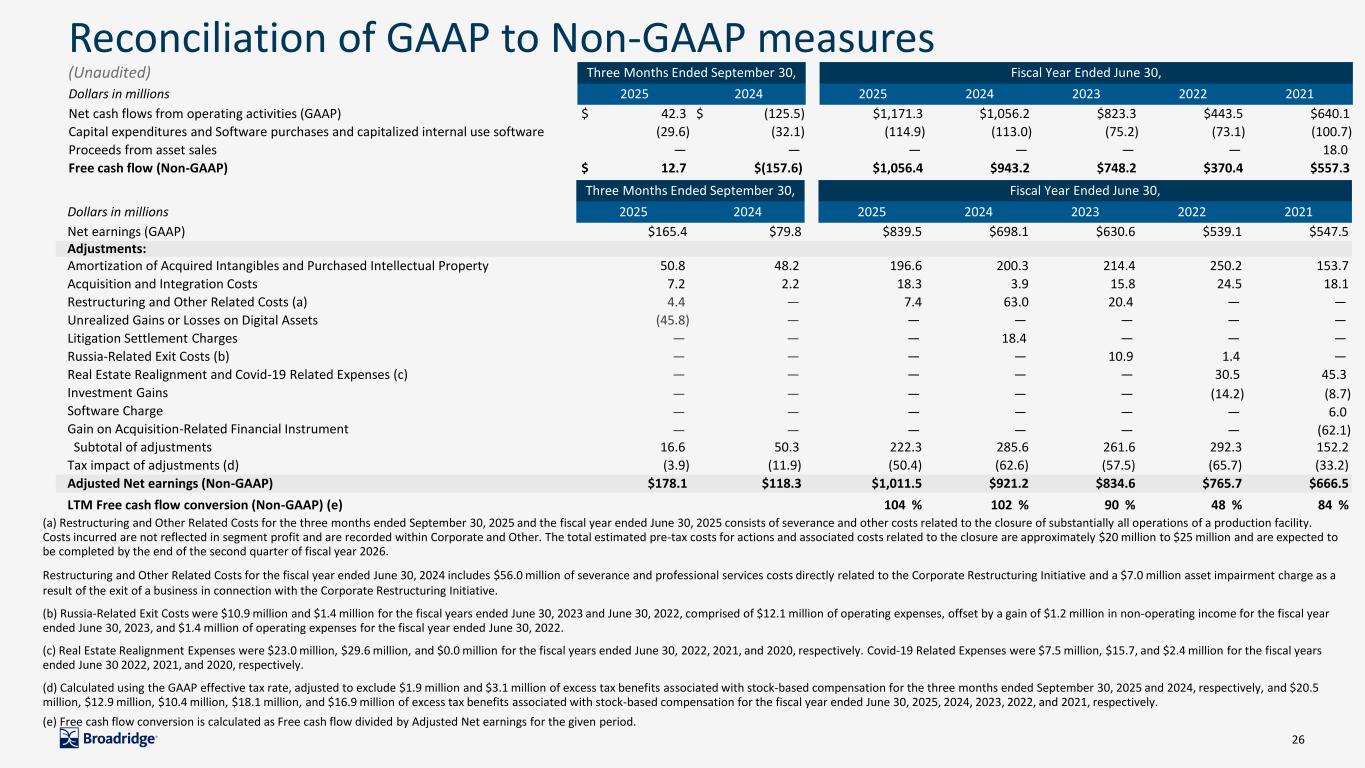

26 Reconciliation of GAAP to Non-GAAP measures (Unaudited) Three Months Ended September 30, Fiscal Year Ended June 30, Dollars in millions 2025 2024 2025 2024 2023 2022 2021 Net cash flows from operating activities (GAAP) $ 42.3 $ (125.5) $1,171.3 $1,056.2 $823.3 $443.5 $640.1 Capital expenditures and Software purchases and capitalized internal use software (29.6) (32.1) (114.9) (113.0) (75.2) (73.1) (100.7) Proceeds from asset sales — — — — — — 18.0 Free cash flow (Non-GAAP) $ 12.7 $(157.6) $1,056.4 $943.2 $748.2 $370.4 $557.3 Three Months Ended September 30, Fiscal Year Ended June 30, Dollars in millions 2025 2024 2025 2024 2023 2022 2021 Net earnings (GAAP) $165.4 $79.8 $839.5 $698.1 $630.6 $539.1 $547.5 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 50.8 48.2 196.6 200.3 214.4 250.2 153.7 Acquisition and Integration Costs 7.2 2.2 18.3 3.9 15.8 24.5 18.1 Restructuring and Other Related Costs (a) 4.4 — 7.4 63.0 20.4 — — Unrealized Gains or Losses on Digital Assets (45.8) — — — — — — Litigation Settlement Charges — — — 18.4 — — — Russia-Related Exit Costs (b) — — — — 10.9 1.4 — Real Estate Realignment and Covid-19 Related Expenses (c) — — — — — 30.5 45.3 Investment Gains — — — — — (14.2) (8.7) Software Charge — — — — — — 6.0 Gain on Acquisition-Related Financial Instrument — — — — — — (62.1) Subtotal of adjustments 16.6 50.3 222.3 285.6 261.6 292.3 152.2 Tax impact of adjustments (d) (3.9) (11.9) (50.4) (62.6) (57.5) (65.7) (33.2) Adjusted Net earnings (Non-GAAP) $178.1 $118.3 $1,011.5 $921.2 $834.6 $765.7 $666.5 LTM Free cash flow conversion (Non-GAAP) (e) 104 % 102 % 90 % 48 % 84 % (a) Restructuring and Other Related Costs for the three months ended September 30, 2025 and the fiscal year ended June 30, 2025 consists of severance and other costs related to the closure of substantially all operations of a production facility. Costs incurred are not reflected in segment profit and are recorded within Corporate and Other. The total estimated pre-tax costs for actions and associated costs related to the closure are approximately $20 million to $25 million and are expected to be completed by the end of the second quarter of fiscal year 2026. Restructuring and Other Related Costs for the fiscal year ended June 30, 2024 includes $56.0 million of severance and professional services costs directly related to the Corporate Restructuring Initiative and a $7.0 million asset impairment charge as a result of the exit of a business in connection with the Corporate Restructuring Initiative. (b) Russia-Related Exit Costs were $10.9 million and $1.4 million for the fiscal years ended June 30, 2023 and June 30, 2022, comprised of $12.1 million of operating expenses, offset by a gain of $1.2 million in non-operating income for the fiscal year ended June 30, 2023, and $1.4 million of operating expenses for the fiscal year ended June 30, 2022. (c) Real Estate Realignment Expenses were $23.0 million, $29.6 million, and $0.0 million for the fiscal years ended June 30, 2022, 2021, and 2020, respectively. Covid-19 Related Expenses were $7.5 million, $15.7, and $2.4 million for the fiscal years ended June 30 2022, 2021, and 2020, respectively. (d) Calculated using the GAAP effective tax rate, adjusted to exclude $1.9 million and $3.1 million of excess tax benefits associated with stock-based compensation for the three months ended September 30, 2025 and 2024, respectively, and $20.5 million, $12.9 million, $10.4 million, $18.1 million, and $16.9 million of excess tax benefits associated with stock-based compensation for the fiscal year ended June 30, 2025, 2024, 2023, 2022, and 2021, respectively. (e) Free cash flow conversion is calculated as Free cash flow divided by Adjusted Net earnings for the given period.

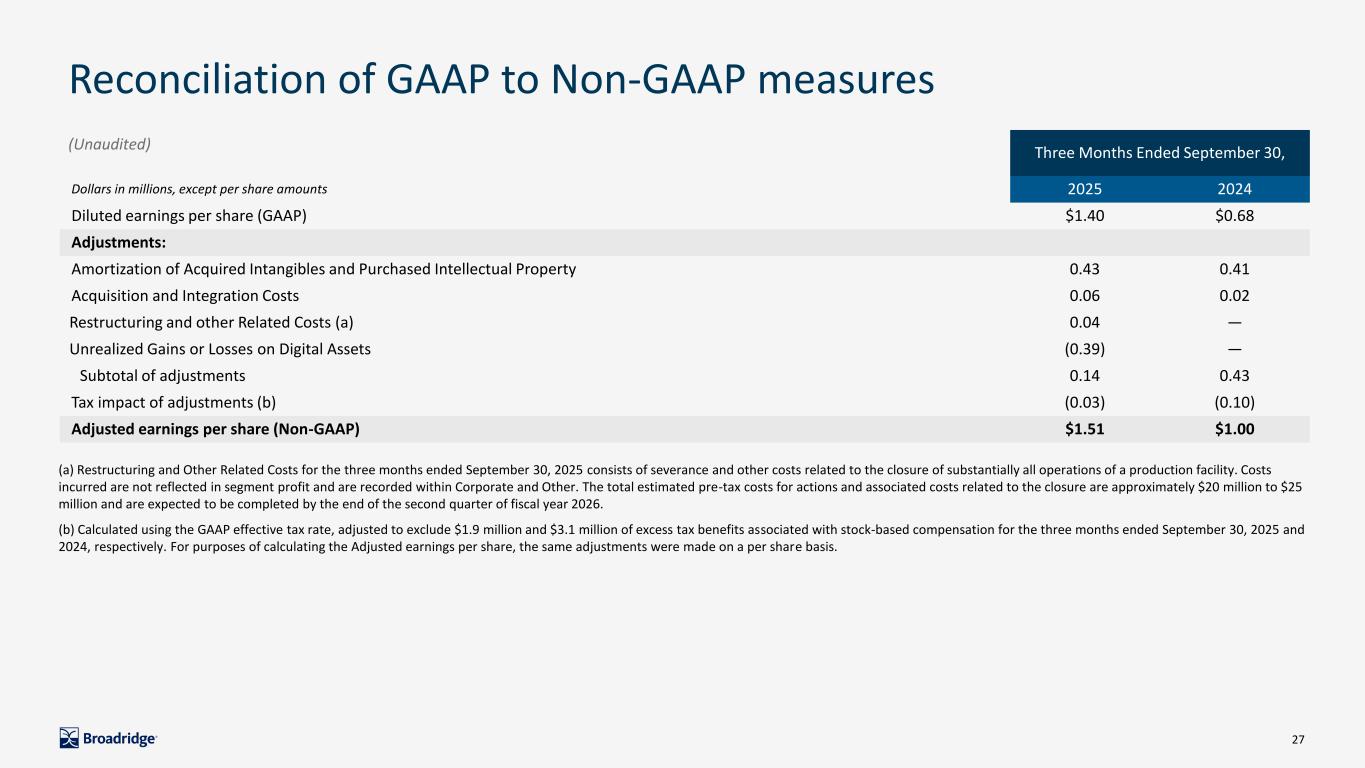

27 Reconciliation of GAAP to Non-GAAP measures (Unaudited) Three Months Ended September 30, Dollars in millions, except per share amounts 2025 2024 Diluted earnings per share (GAAP) $1.40 $0.68 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 0.43 0.41 Acquisition and Integration Costs 0.06 0.02 Restructuring and other Related Costs (a) 0.04 — Unrealized Gains or Losses on Digital Assets (0.39) — Subtotal of adjustments 0.14 0.43 Tax impact of adjustments (b) (0.03) (0.10) Adjusted earnings per share (Non-GAAP) $1.51 $1.00 (a) Restructuring and Other Related Costs for the three months ended September 30, 2025 consists of severance and other costs related to the closure of substantially all operations of a production facility. Costs incurred are not reflected in segment profit and are recorded within Corporate and Other. The total estimated pre-tax costs for actions and associated costs related to the closure are approximately $20 million to $25 million and are expected to be completed by the end of the second quarter of fiscal year 2026. (b) Calculated using the GAAP effective tax rate, adjusted to exclude $1.9 million and $3.1 million of excess tax benefits associated with stock-based compensation for the three months ended September 30, 2025 and 2024, respectively. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis.

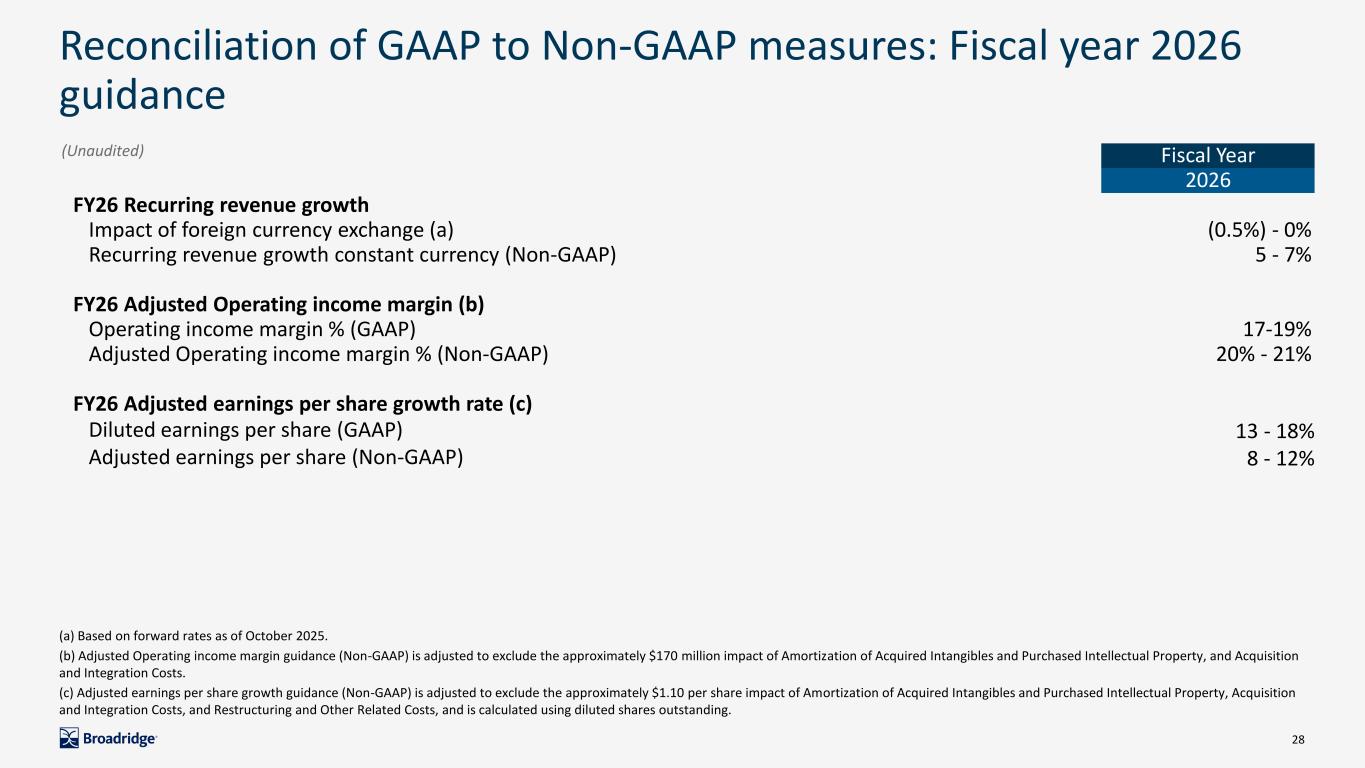

28 Reconciliation of GAAP to Non-GAAP measures: Fiscal year 2026 guidance Fiscal Year 2026 FY26 Recurring revenue growth Impact of foreign currency exchange (a) (0.5%) - 0% Recurring revenue growth constant currency (Non-GAAP) 5 - 7% FY26 Adjusted Operating income margin (b) Operating income margin % (GAAP) 17-19% Adjusted Operating income margin % (Non-GAAP) 20% - 21% FY26 Adjusted earnings per share growth rate (c) Diluted earnings per share (GAAP) 13 - 18% Adjusted earnings per share (Non-GAAP) 8 - 12% (Unaudited) (a) Based on forward rates as of October 2025. (b) Adjusted Operating income margin guidance (Non-GAAP) is adjusted to exclude the approximately $170 million impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs. (c) Adjusted earnings per share growth guidance (Non-GAAP) is adjusted to exclude the approximately $1.10 per share impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs, and Restructuring and Other Related Costs, and is calculated using diluted shares outstanding.

Broadridge Fiscal First Quarter 2026 Earnings Conference Call Contacts W. Edings Thibault Sean Silva broadridgeir@broadridge.com Live Call Information Date: November 4, 2025 Start Time: 8:30 A.M. ET Toll-Free: 1-877-328-2502 International: 1-412-317-5419 Webcast: broadridge-ir.com Replay Options Online replay available at broadridge-ir.com Telephone replay available through November 11, 2025 Domestic Dial-In: 1-855-669-9658 Access Code: 5459356 International Toll Dial-In: 1-412-317-0088 Passcode: 5459356 Click here for dial-ins by country