UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

| Filed by the Registrant x | Filed by a Party other than the Registrant ¨ |

| Check | the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-2 |

FUSION-IO, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies:

| |

| (2) | Aggregate number of securities to which transaction applies:

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

2855 E. Cottonwood Parkway, Suite 100

Salt Lake City, Utah 84121

(801) 424-5500

October 4, 2011

Dear Stockholder:

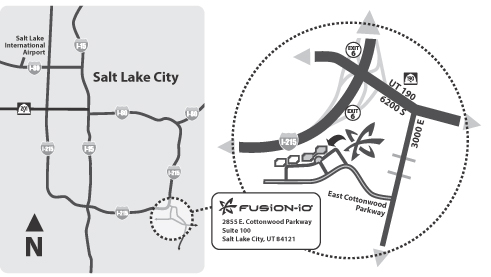

We are pleased to invite you to attend our 2011 annual meeting of stockholders to be held on Friday, November 18, 2011 at 10:30 a.m., Mountain Time, at our corporate headquarters in Salt Lake City, Utah. A map with directions to the meeting is found on the last page of the accompanying proxy statement. The formal meeting notice and proxy statement are attached.

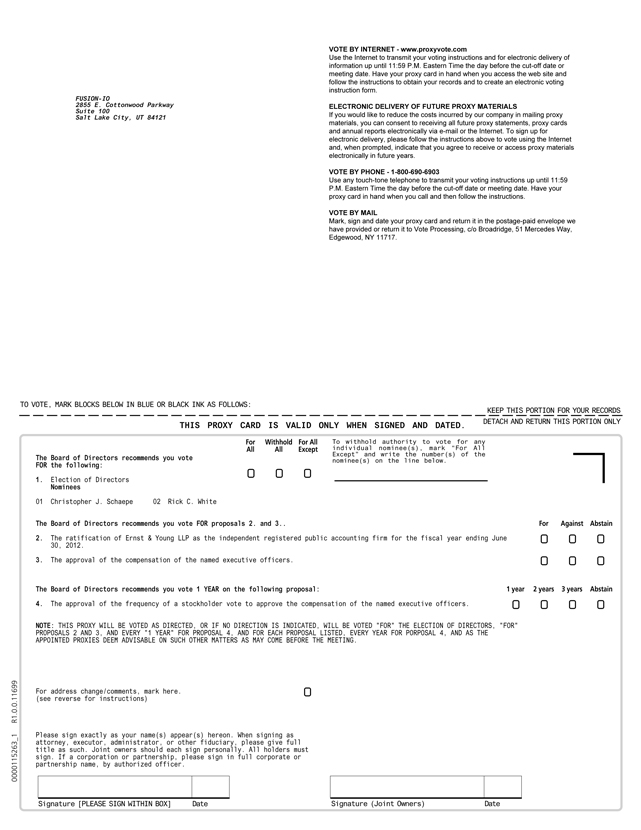

At this year’s annual meeting, our stockholders will be asked to –

| — | elect the two nominees for Class I director named in the proxy statement to the board of directors; |

| — | ratify the selection by the audit committee of our board of directors of Ernst & Young LLP as Fusion-io’s independent registered public accounting firm for the current fiscal year ending June 30, 2012; |

| — | consider an advisory vote on the compensation of the named executive officers of Fusion-io for the fiscal year ended June 30, 2011; and |

| — | consider an advisory vote on the frequency of future stockholder advisory votes on executive compensation. |

Your board of directors recommends that you vote “FOR” each of the proposals listed in the first three bullets above, and for a “ONE YEAR” frequency on the proposal listed in the fourth bullet above. You should carefully read the attached proxy statement, which contains detailed information concerning each of these proposals.

Your vote is important. Whether or not you plan to attend the annual meeting, it is important that your shares be represented, and we hope you will vote as soon as possible. You may vote over the Internet, as well as by telephone, or, if you requested to receive printed proxy materials, by mailing a proxy or voting instruction card. Please review the instructions on each of your voting options described in this proxy statement, as well as in the Notice of Internet Availability of Proxy Materials that you received in the mail. If you hold shares of our common stock through a broker, bank, or other nominee holder, please follow the voting instructions provided on the proxy card or the information forwarded by your bank, broker or other holder of record regarding your voting options.

Thank you for your ongoing support of Fusion-io. We look forward to seeing you at our annual meeting.

Very truly yours,

DAVID A. FLYNN

Chief Executive Officer, President and Chairman

YOUR VOTE IS IMPORTANT

Whether or not you plan to attend the meeting, please vote as soon as possible. Under New York Stock Exchange rules, your broker will NOT be able to vote your shares on proposals 1, 3 or 4 unless they receive specific instructions from you. We strongly encourage you to vote.

We encourage you to vote by Internet. It is convenient for you and saves us postage and processing costs. For specific instructions on how to vote your shares, please refer to the section entitled “Questions and Answers about the Proxy Materials and Annual Meeting” beginning on page 1 of the accompanying proxy statement.

FUSION-IO, INC.

NOTICE OF 2011 ANNUAL MEETING OF STOCKHOLDERS

TO STOCKHOLDERS OF FUSION-IO, INC.:

NOTICE IS HEREBY GIVEN that the 2011 annual meeting of stockholders of Fusion-io, Inc., a Delaware corporation, will be held on Friday, November 18, 2011 at 10:30 a.m., Mountain Time, at our corporate headquarters located at 2855 E. Cottonwood Parkway, Suite 100, Salt Lake City, Utah, for the following purposes:

| 1. | elect the two nominees for Class I director named in the proxy statement to the board of directors, each to serve a term of three years, until our 2014 annual meeting of stockholders, or until their respective successors are duly elected and qualified; |

| 2. | to ratify the selection by the audit committee of our board of directors of Ernst & Young LLP as Fusion-io’s independent registered public accounting firm for the current fiscal year ending June 30, 2012, as described in the proxy statement; |

| 3. | to provide an advisory vote on the compensation of the named executive officers of Fusion-io for the fiscal year ended June 30, 2011, as described in the proxy statement; |

| 4. | to provide an advisory vote on the frequency of future stockholder advisory votes on executive compensation, as described in the proxy statement; and |

| 5. | to transact any and all other business that may properly come before the meeting or at any and all adjournments or postponements of the meeting. |

The foregoing items of business are more fully described in the proxy statement accompanying this notice. We are not aware of any other business to come before the meeting at this time.

The meeting will begin promptly at 10:30 a.m., Mountain Time, and check-in will begin at 10:00 a.m., Mountain Time. Only stockholders of record at the close of business on September 27, 2011, or their valid proxies, are entitled to vote at the meeting and any and all adjournments or postponements of the meeting. If you are not a stockholder of record but hold shares through a broker, bank, trustee or nominee (that is, in “street name”), you will need to provide positive proof of beneficial ownership as of the record date, such as your most recent account statement prior to September 27, 2011, a copy of the voting instruction card provided by your broker, bank, trustee or nominee, or similar evidence of ownership.

A complete list of the stockholders entitled to vote at the meeting will be available and open to the examination of any stockholder for any purpose germane to the meeting for a period of at least 10 days prior to the meeting during normal business hours at our corporate headquarters.

Your vote is important. Whether or not you plan to attend the annual meeting, we encourage you to read the proxy statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions in the section entitled “Questions and Answers about the Proxy Materials and Annual Meeting” beginning on page 1 of the accompanying proxy statement.

| By order of the Board of Directors | ||

| ||

| SHAWN J. LINDQUIST | ||

| Chief Legal Officer, Executive Vice President and Secretary | ||

Salt Lake City, Utah

October 4, 2011

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 18, 2011: The notice of annual meeting, proxy statement and 2011 annual report are available by visiting https://materials.proxyvote.com/36112J.

PROXY STATEMENT

FOR 2011 ANNUAL MEETING OF STOCKHOLDERS

| Page | ||||

| QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND ANNUAL MEETING |

1 | |||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| Process for Recommending Candidates to the Board of Directors |

14 | |||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| Class II Directors Continuing in Office until the 2012 Annual Meeting |

19 | |||

| Class III Directors Continuing in Office until the 2013 Annual Meeting |

19 | |||

| PROPOSAL 2—RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

21 | |||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

-i-

| Page | ||||

| PROPOSAL 4—ADVISORY VOTE ON THE FREQUENCY OF AN ADVISORY VOTE ON EXECUTIVE COMPENSATION |

25 | |||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 28 | ||||

| 28 | ||||

| 40 | ||||

| 40 | ||||

| Grants of Plan-Based Awards For Fiscal Year Ended June 30, 2011 |

41 | |||

| 42 | ||||

| Option Exercises and Stock Vested in Fiscal Year Ended June 30, 2011 |

43 | |||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 45 | ||||

| Agreements Providing for Severance or Change of Control Benefits |

47 | |||

| 50 | ||||

| RELATED PERSON TRANSACTIONS AND SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE |

52 | |||

| 52 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 54 | ||||

| 54 | ||||

| 54 | ||||

| 55 | ||||

| 55 | ||||

| 57 | ||||

-ii-

FUSION-IO, INC.

2855 E. Cottonwood Parkway, Suite 100

Salt Lake City, Utah 84121

PROXY STATEMENT

For the Annual Meeting of Stockholders

To Be Held Friday, November 18, 2011

ABOUT THE PROXY MATERIALS AND ANNUAL MEETING

-1-

-2-

-3-

-4-

-5-

-6-

-7-

-8-

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

Fusion-io Policies on Business Conduct

We are committed to the highest standards of integrity and ethics in the way we conduct our business. In April 2011 (and effective upon our initial public offering and the listing of our common stock on the New York Stock Exchange, or NYSE, in June 2011), we adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including our chief executive officer, chief financial officer and other executive and senior financial officers. Our code of conduct establishes our policies and expectations with respect to a wide range of business conduct, including preparation and maintenance of financial and accounting information, compliance with laws, and conflicts of interest.

Under our code of conduct, each of our directors and employees is required to report suspected or actual violations to the extent permitted by law. In addition, we have adopted separate procedures concerning the receipt and investigation of complaints relating to accounting or audit matters. These procedures have been adopted and are administered by our audit committee.

Our code of conduct is available at our website by visiting www.fusionio.com and clicking through “Company,” “Investor Relations,” “Corporate Governance,” and “Code of Business Conduct and Ethics.” When required by the rules of NYSE or the SEC, we will disclose any future amendment to, or waiver of, any provision of the code of conduct for our chief executive officer, principal financial officer, or principal accounting officer or any member or members of our board of directors on our website within four business days following the date of such amendment or waiver.

Corporate Governance Principles

In April 2011 (and effective upon our initial public offering and the listing of our common stock on NYSE in June 2011), our board of directors adopted a set of guidelines that establish the corporate governance policies pursuant to which our board of directors intends to conduct its oversight of the business of Fusion-io in accordance with its fiduciary responsibilities. Among other things, these corporate governance guidelines address the establishment and operation of board committees, the role of our chairman, and matters relating to director independence and performance assessments.

Role and Composition of the Board

As identified in our corporate governance guidelines, the role of our board of directors is to oversee the performance of our chief executive officer and other senior management. Our board of directors is responsible for hiring, overseeing, and evaluating management while management is responsible for running our day-to-day operations.

Our board of directors is currently comprised of seven members and is divided into three staggered classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three year term to succeed the class of directors whose terms are then expiring. The terms of the directors will expire upon the election and qualification of successor directors at the annual meeting of stockholders to be held during the years 2012 for the Class II directors, 2013 for the Class III directors, and 2014 for the Class I directors.

Board Leadership Structure

The board of directors currently believes that our company is best served by combining the roles of chairman of the board and chief executive officer, coupled with a lead independent director. As a

-9-

founder of the company, David Flynn, our chief executive officer, is the director most familiar with our business and industry, and most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. Independent directors and management have different perspectives and roles in the development of our strategy. Our independent directors bring experience, oversight and expertise from outside the company, while our chief executive officer brings company-specific experience and expertise. Our board of directors believes that the combined role of chairman and chief executive officer is the best leadership structure for us at the current time as it promotes the efficient and effective development and execution of our strategy and facilitates information flow between management and our board of directors. The board of directors recognizes, however, that no single leadership model is right for all companies at all times. Our corporate governance guidelines provide that the board of directors should be free to choose a chairman of the board based upon the board’s view of what is in the best interests of the company. Accordingly, the board of directors periodically reviews its leadership structure.

Lead Independent Director

In May 2011, our board of directors appointed Scott D. Sandell as lead independent director, and in September 2011, our board reconfirmed Mr. Sandell’s appointment as lead independent director for our fiscal year ending June 30, 2012, or fiscal 2012. As the lead independent director, Mr. Sandell is responsible for coordinating the activities of the independent directors. The lead independent director has the following specific responsibilities:

| — | call special meetings of the independent directors and chair meetings of independent directors; |

| — | act as the principal liaison between the non-employee directors and the chairman of the board on sensitive issues; |

| — | work with the chairman of the board to develop a schedule of meetings for the board and provide input with respect to meeting agendas for the board of directors and its committees; |

| — | advise the chairman of the board with respect to the quality, quantity and timeliness of the flow of information from company management; |

| — | coordinate and moderate executive sessions of the independent directors; and |

| — | perform such other duties as the board of directors may from time to time delegate to the lead independent director. |

Board’s Role in Risk Oversight

Our board of directors oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance, and to enhance stockholder value. A fundamental part of risk management is not only understanding the most significant risks a company faces and what steps management is taking to manage those risks but also understanding what level of risk is appropriate for a given company. The involvement of our full board of directors in reviewing our business is an integral aspect of its assessment of management’s tolerance for risk and also its determination of what constitutes an appropriate level of risk.

-10-

While our board of directors has the ultimate oversight responsibility for the risk management process, various committees of the board also have responsibility for risk management. The charter of our audit committee provides that one of the committee’s responsibilities is oversight of certain compliance matters. In addition, in setting compensation, our compensation committee strives to create incentives that encourage a level of risk-taking consistent with our business strategy and to encourage a focus on building long term value that does not encourage excessive risk-taking.

In connection with its oversight of compensation-related risks, our compensation committee has reviewed our compensation programs and practices for employees, including executive and non-executive programs and practices. In its review, our compensation committee evaluated whether our policies and programs encourage unnecessary or excessive risk taking and controls, and how such policies and programs are structured with respect to risks and rewards, as well as controls designed to mitigate any risks. As a result of this review, our compensation committee determined that any risks that may result from our compensation policies and practices for its employees are not reasonably likely to have a material adverse effect on Fusion-io.

At periodic meetings of the board and its committees and in other meetings and discussions, management reports to and seeks guidance from the board and its committees with respect to the most significant risks that could affect our business, such as legal risks and financial, tax and audit related risks. In addition, among other matters, management provides our audit committee periodic reports on our compliance programs and efforts and investment policy and practices.

Our board of directors has three standing committees: an audit committee, a compensation committee, and a nominating and corporate governance committee. The membership and the function of each of the committees are described below. Our board of directors may from time to time establish a new committee or dissolve an existing committee depending on the circumstances.

| Director’s Name |

Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee | |||

| Non-Employee Directors: |

||||||

| Forest Baskett, Ph.D. |

| |||||

| H. Raymond (Ray) Bingham |

|

|

||||

| Dana L. Evan

|

|

|

||||

| Scott D. Sandell |

|

| ||||

| Christopher J. Schaepe |

|

| ||||

| Employee Directors: |

||||||

| David A. Flynn |

||||||

| Rick C. White |

||||||

Chairperson

Chairperson |

Member

Member |

Financial Expert

Financial Expert | ||||

During our fiscal year ended June 30, 2011, or fiscal 2011, our board of directors held 10 meetings. Each of our directors attended or participated in 75% or more of the meetings of the board of directors and 75% or more of the meetings held by all committees of the board of directors on which he or she served during the past fiscal year.

-11-

As a company listed on NYSE, we are required under NYSE listing requirements to maintain a board comprised of a majority of “independent” directors, as determined affirmatively by our board. In addition, NYSE rules require that, subject to specified exceptions, each member of our audit, compensation and nominating and corporate governance committees be independent. In March 2011, and again in September 2011, our board of directors undertook a review of the independence of our directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of these reviews, our board of directors determined that Ms. Evan, Dr. Baskett and Messrs. Bingham, Sandell and Schaepe, representing five of our seven directors, were “independent directors” as defined under applicable NYSE rules. Messrs. Flynn and White are not considered independent directors because of their positions as our chief executive officer and chief marketing officer, respectively.

Executive Sessions of Independent Directors

In order to promote open discussion among independent directors, our board of directors has a policy of conducting executive sessions of independent directors during each regularly scheduled board meeting and at such other times as requested by an independent director. These executive sessions are chaired by our lead independent director. Neither Mr. Flynn nor Mr. White participates in such sessions.

Ms. Evan and Messrs. Bingham and Schaepe, each of whom is a non-employee member of our board of directors, comprise our audit committee. Ms. Evan is the chair of our audit committee. Our board of directors has determined that each of the members of our audit committee satisfies the requirements for independence and financial literacy under the rules and regulations of the NYSE and the SEC. Our board of directors has also determined that Ms. Evan qualifies as an “audit committee financial expert” as defined in the SEC rules and satisfies the financial sophistication requirements of the NYSE. In addition to his service on our audit committee, Mr. Bingham also serves on the audit committees of three other public companies. Our board of directors has determined that such simultaneous service by Mr. Bingham on the audit committees of four public companies will not impair his ability to effectively serve on the audit committee of our board of directors.

The audit committee of our board of directors is responsible for, among other things:

| — | selecting and hiring our independent registered public accounting firm, and approving the audit and pre-approving any non-audit services to be performed by our independent registered public accounting firm; |

| — | evaluating the performance and independence of our independent registered public accounting firm; |

| — | monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters; |

| — | reviewing the adequacy and effectiveness of our internal control policies and procedures and our disclosure controls and procedures; |

| — | overseeing procedures for the treatment of complaints on accounting, internal accounting controls or audit matters; |

-12-

| — | overseeing our internal auditors; |

| — | discussing the scope and results of our annual audit with the independent registered public accounting firm and reviewing with management and the independent registered public accounting firm our interim and year-end operating results; and |

| — | preparing the audit committee report that the SEC will require in our annual proxy statement. |

Our audit committee held 2 meetings during fiscal 2011. Our audit committee operates under a written charter approved by our board of directors. The charter is available on our website by visiting www.fusionio.com and clicking through “Company,” “Investor Relations,” and “Corporate Governance.”

Ms. Evan and Messrs. Bingham and Sandell, each of whom is a non-employee member of our board of directors, comprise our compensation committee. Mr. Bingham is the chair of our compensation committee. Our board of directors has determined that each member of our compensation committee meets the requirements for independence under the rules of the NYSE and is an “outside director” for purposes of Section 162(m) of the Internal Revenue Code. The compensation committee is responsible for, among other things:

| — | reviewing and approving our Chief Executive Officer’s and other executive officers’ annual base salaries, equity compensation, annual incentive bonuses and severance, change in control and other compensation arrangements; |

| — | overseeing our overall compensation philosophy, compensation plans and benefits programs; and |

| — | preparing the compensation committee report that the SEC will require in our annual proxy statement. |

See “Compensation of Non-Employee Directors” and “Executive Compensation” for a description of our processes and procedures for the consideration and determination of executive and director compensation.

Our compensation committee held 4 meetings during fiscal 2011. Our compensation committee operates under a written charter approved by the board of directors, which is available on our website by visiting www.fusionio.com and clicking through “Company,” “Investor Relations,” and “Corporate Governance.”

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee is an officer or employee of our company. None of our executive officers currently serves, or in the past year has served, as a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of any entity that has one or more executive officers serving on our compensation committee.

Nominating and Corporate Governance Committee

Messrs. Sandell and Schaepe and Dr. Baskett, each of whom is a non-employee member of our board of directors, comprise our nominating and corporate governance committee. Dr. Baskett is the chair of our nominating and corporate governance committee. Our board of directors has determined

-13-

that each member of our nominating and corporate governance committee meets the requirements for independence under the rules of the NYSE. The nominating and corporate governance committee is responsible for, among other things:

| — | assisting our board of directors in identifying prospective director nominees and recommending nominees for each annual meeting of stockholders to the board of directors; |

| — | developing and recommending governance principles applicable to our board of directors; |

| — | overseeing the evaluation of our board of directors and management; |

| — | reviewing and monitoring compliance with our code of business conduct and ethics; and |

| — | recommending potential members for each board committee to our board of directors. |

Our nominating and corporate governance committee will consider recommendations of candidates for the board of directors submitted by stockholders of Fusion-io; see “Process for Recommending Candidates to the Board of Directors” below.

Our nominating and corporate governance committee did not hold any meetings during fiscal 2011. Our nominating and corporate governance committee operates under a written charter approved by the board of directors, which is available on our website by visiting www.fusionio.com and clicking through “Company,” “Investor Relations,” and “Corporate Governance.”

Considerations in Evaluating Director Nominees

Our board of directors has established a policy for evaluating director nominees.

In its evaluation of director candidates, including the members of the board of directors eligible for re-election, our committee will consider the following:

| — | the current size and composition of our board of directors and the needs of the board and its respective committees; |

| — | factors such as character, judgment, diversity, age, independence, expertise, corporate experience, length of service, understanding of our business, other commitments and the like; and |

| — | other factors that our committee may consider appropriate. |

Our committee evaluates the factors listed above individually and does not assign any particular weighting or priority to any of these factors. While not maintaining a specific policy on board diversity requirements, the board and the nominating and corporate governance committee believe that diversity is an important factor in determining the composition of the board and, therefore, seek a variety of occupational and personal backgrounds on the board in order to obtain a range of viewpoints and perspectives and to enhance the diversity of the board.

Process for Recommending Candidates to the Board of Directors

Our nominating and corporate governance committee is responsible for, among other things, recommending candidates for election to the board of directors. It is the policy of our nominating and corporate governance committee to consider recommendations for candidates to the board of directors

-14-

from stockholders so long as such recommendations comply with our certificate of incorporation and bylaws and applicable law, holding no less than one percent (1%) of the outstanding shares of our common stock continuously for at least 12 months prior to the date of submission of the recommendation or nomination. Stockholder recommendations for candidates to the board of directors must be directed in writing to Fusion-io, Inc., Attention: Corporate Secretary, 2855 E. Cottonwood Parkway, Suite 100, Salt Lake City, Utah 84121, and should include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between the candidate and Fusion-io, and evidence of the recommending stockholder’s ownership of our stock. Such recommendations should also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for board membership, including issues of character, integrity, judgment, diversity of experience, independence, area of expertise, corporate experience, length of service, potential conflicts of interest, other commitments and the like, and personal references. For details regarding the process to nominate a director directly for election to the board at an annual meeting of the stockholders, under the section entitled “Questions and Answers About the Proxy Materials and Annual Meeting,” please see “What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?”

Director Attendance at Annual Meetings

Although we do not have a formal policy regarding attendance by members of our board of directors at annual meetings of stockholders, we encourage, but do not require, directors to attend. We have scheduled our 2011 annual stockholder meeting on the same day as a regularly scheduled board meeting in order to facilitate attendance by our board members.

Communications with the Board of Directors

Stockholders who wish to communicate with our board are welcome to do so in writing, at the following address:

Fusion-io, Inc.

Attention: Corporate Secretary

2855 E. Cottonwood Parkway, Suite 100

Salt Lake City, Utah 84121

Communications are distributed to our board, or to any individual directors as appropriate, depending on the facts and circumstances outlined in the communication.

COMPENSATION OF NON-EMPLOYEE DIRECTORS

Compensation Program Prior to Initial Public Offering

Prior to our initial public offering in June 2011, our directors did not receive any cash compensation for their services as directors or as board committee members. Other than reimbursement of reasonable travel and related expenses incurred by non-employee directors in connection with their attendance at meetings of the board of directors and its committees, we did not pay any other fees or make any non-equity awards to or pay any other compensation to our non-employee directors in fiscal 2010. This compensation policy was superseded in connection with our initial public offering, as described below.

-15-

In May 2011, our board of directors approved the following annual compensation package for our non-employee directors:

| Annual Cash Retainer* |

||||

| Annual retainer† |

$ | 50,000 | ||

| Additional retainer for audit committee chair |

$ | 20,500 | ||

| Additional retainer for audit committee member |

$ | 10,000 | ||

| Additional retainer for compensation committee chair |

$ | 15,500 | ||

| Additional retainer for compensation committee member |

$ | 8,500 | ||

| Additional retainer for nominating and governance committee chair |

$ | 9,250 | ||

| Additional retainer for nominating and governance committee member |

$ | 4,375 | ||

|

|

||||

| * | Paid quarterly in arrears. |

| † | In September 2011, our board of directors approved an increase of $11,500 to the annual retainer amount, from $38,500 to $50,000. |

In addition, each non-employee director who first joins our board of directors will be granted a stock option to purchase 100,000 shares of common stock and each non-employee director will be granted an annual stock option award to purchase 50,000 shares of common stock on the date of each of our annual stockholder meetings. Each stock option will have an exercise price equal to the fair market value on the grant date.

An initial stock option award will vest on each of the first four anniversaries of the date the non-employee director joins our board of directors, subject to continued service as a board member through each such date. Annual stock option awards will vest on the day prior to annual meeting immediately following the annual meeting at which the award is granted, subject to continued service as a board member through the vesting date. If a director’s service is terminated on or following a change in control other than as the result of a voluntary resignation that is not at the request of the buyer, then the director’s award will immediately vest in full.

The following table sets forth information concerning compensation paid or accrued for services rendered to us by members of our board of directors for the year ended June 30, 2011. The table excludes Messrs. Flynn and White, who are named executive officers and did not receive any compensation from us in their role as a director in 2011.

| Name |

Fees Earned or Paid in Cash ($) |

Option Awards ($)(1) |

Total ($) | |||||||||

| Forest Baskett, Ph.D. |

11,938 | 125,047 | 136,985 | |||||||||

| H. Raymond Bingham |

16,000 | 250,094 | 266,094 | |||||||||

| Dana L. Evan |

16,875 | 250,094 | 266,969 | |||||||||

| Scott D. Sandell |

12,844 | 125,047 | 137,891 | |||||||||

| Christopher J. Schaepe |

13,219 | 125,047 | 138,266 | |||||||||

|

|

||||||||||||

| (1) | Amounts represent the aggregate grant date fair value of the stock or option award calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation, as amended (“ASC 718”), without regard to estimated forfeitures, or, with respect to re-priced options, the incremental fair value as computed in accordance with ASC 718. See Note 7 of the notes to our audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2011 for a discussion of valuation assumptions made in determining the grant date fair value and compensation expense of our stock options. |

-16-

The aggregate number of shares subject to stock options outstanding at June 30, 2011 for each non-employee director was as follows:

| Name |

Aggregate Number of Stock Options Outstanding as of June 30, 2011 |

|||

| Forest Baskett, Ph.D. |

50,000 | |||

| H. Raymond Bingham |

100,000 | |||

| Dana L. Evan |

100,000 | |||

| Scott D. Sandell |

50,000 | |||

| Christopher J. Schaepe |

50,000 | |||

-17-

ELECTION OF CLASS I DIRECTORS

-18-

-19-

-20-

RATIFICATION OF SELECTION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

-21-

-22-

-23-

ADVISORY VOTE ON EXECUTIVE COMPENSATION

-24-

ADVISORY VOTE ON THE FREQUENCY OF AN ADVISORY VOTE ON EXECUTIVE

COMPENSATION

-25-

The names of our executive officers and a key employee, their ages, their positions with Fusion-io, and other biographical information as of September 27, 2011, are set forth below. There are no family relationships among any of our directors or executive officers.

| Name |

Age | Position | ||

| Executive Officers: |

||||

| David A. Flynn* |

42 | Chief Executive Officer, President and Chairman | ||

| Dennis P. Wolf |

58 | Chief Financial Officer and Executive Vice President | ||

| Richard W. Boberg |

63 | Executive Vice President, General Manager, Virtualization Solutions | ||

| Neil A. Carson |

34 | Chief Technology Officer and Executive Vice President | ||

| James L. Dawson |

49 | Executive Vice President, Worldwide Sales | ||

| Shawn J. Lindquist |

41 | Chief Legal Officer, Executive Vice President and Secretary | ||

| Lance L. Smith |

48 | Chief Operating Officer and Executive Vice President | ||

| Rick C. White† |

41 | Chief Marketing Officer, Executive Vice President and Director | ||

| Key Employee: |

||||

| Stephen G. Wozniak |

61 | Chief Scientist |

| * | Biographical information for this individual is found above in the section titled “Class III Directors Continuing in Office until the 2013 Annual Meeting.” |

| † | Biographical information for this individual is found above in the section titled “Biographical Information Concerning the Class I Director Nominees.” |

Dennis P. Wolf has served as our Chief Financial Officer and Executive Vice President since October 2010, as our Chief Financial Officer and Senior Vice President from March 2010 to October 2010, and as our Chief Financial Officer from November 2009 to March 2010. From January 2009 to April 2009, Mr. Wolf served as interim chief executive officer and chief financial officer of Finjan Software, Inc., a provider of web security solutions. From March 2005 to June 2008, Mr. Wolf served as executive vice president and chief financial officer of MySQL AB, an open source database software company. Prior to MySQL, Mr. Wolf held financial management positions for public high technology companies, including Apple Computer, Inc., Centigram Communications, Inc., Credence Systems Corporation, Omnicell, Inc., Redback Networks Inc. and Sun Microsystems, Inc. Mr. Wolf currently serves as a director of Codexis Inc., and is the chair of the audit committee, and has been a director and chair of the audit committee for other publicly and privately held companies including Quantum Corporation, BigBand Networks, Inc., Registry Magic, Inc., Avanex Corporation, Komag, Inc. and Vitria Technology, Inc. He holds a B.A. from the University of Colorado and an M.B.A. from the University of Denver.

Richard W. Boberg has served as our Executive Vice President, General Manager of Virtualization Solutions since the completion of our acquisition of IO Turbine, Inc. in August 2011. Mr. Boberg was one of the co-founders of IO Turbine. From IO Turbine’s inception in December 2009 until August 2011, Mr. Boberg served as the president and chief executive officer and a director of IO Turbine. From 2005 to 2009, Mr. Boberg served as vice president of InnovationQ, a nonprofit organization that he co-founded, which focused on working with California Polytechnic University, San Luis Obispo to promote innovation and entrepreneurship. Mr. Boberg was the sixth employee at NetApp, Inc., a leading provider of storage and data management solutions, and during his 12 years with NetApp from 1993 to 2005, he held executive positions in marketing, corporate development, and engineering; directed product management, strategic marketing, mergers and acquisitions, several software engineering groups, and strategic alliances and business development. Mr. Boberg has also held engineering and engineering management positions at several other technology companies, including Intel Corporation. Mr. Boberg holds a B.S. in Electrical/Electronic Engineering from California Polytechnic State University, San Luis Obispo, and a M.S. in Electrical Engineering from Massachusetts Institute of Technology.

-26-

Neil A. Carson has served as our Chief Technology Officer and Executive Vice President since October 2010, and as our Chief Technology Officer from March 2010 to October 2010. From December 2007 to January 2010, Mr. Carson served as chief application architect for Dell services, Dell Inc., a computer hardware, software and peripherals company. From June 2005 to December 2007, Mr. Carson served as chief architect of Everdream Corporation, a software-as-a-service systems management company. From 2003 to June 2005, Mr. Carson served as principal engineer of Remedy software products at BMC Software, Inc., an IT service management company. From 1997 to 2003, Mr. Carson served as principal architect of Liberate Technologies, Inc. From 1995 to 1997, Mr. Carson served as director of Causality Limited, an embedded systems software company. Mr. Carson holds a B.Eng. degree from the Royal Military College of Science at Cranfield University.

James L. Dawson has served as our Executive Vice President, Worldwide Sales since October 2010, and as our Senior Vice President of Sales from April 2009 to October 2010. From 2004 to April 2009, Mr. Dawson served as vice president of worldwide sales of 3PAR Inc., a storage solutions company. From 2002 to 2004, Mr. Dawson served as vice president, strategic sales and business development of Neoscale Systems, Inc., an enterprise storage security company. From 2000 to 2002, Mr. Dawson served as vice president of worldwide sales for Scale Eight, Inc., a storage solutions company. From 1987 to 2000, Mr. Dawson served in various positions with Data General Corporation, a supplier of storage and enterprise computing solutions, most recently as vice president of EMEA and Asia Pacific for its CLARiiON Storage Division. Mr. Dawson holds a B.A. in Economics from Weber State University.

Shawn J. Lindquist has served as our Chief Legal Officer, Executive Vice President and Secretary since October 2010, and as our Chief Legal Officer, Senior Vice President and Secretary from February 2010 to October 2010. From 2005 to January 2010, Mr. Lindquist served as chief legal officer, senior vice president and secretary of Omniture, Inc., an online marketing and web analytics company, through the completion and integration of the merger of Omniture with Adobe Systems Incorporated. Mr. Lindquist was a corporate and securities attorney at Wilson Sonsini Goodrich & Rosati, P.C. from 2001 to 2005 and from 1997 to 1999. Mr. Lindquist has also served as in-house corporate and mergers and acquisitions counsel for Novell, Inc., and as vice president and general counsel of a privately held, venture-backed company. Mr. Lindquist is also an adjunct professor of law at the J. Reuben Clark Law School at Brigham Young University. Mr. Lindquist holds a B.S. in Business Management-Finance and a J.D. from Brigham Young University.

Lance L. Smith has served as our Chief Operating Officer since April 2010, as our Executive Vice President since October 2010, as our Senior Vice President of Engineering from September 2009 to October 2010, and as our Senior Vice President of Product Management and Marketing from May 2008 to September 2009. From January 2003 to May 2008, Mr. Smith served as vice president and general manager of RMI Corporation, a semiconductor company. From 2000 to 2002, Mr. Smith served as senior vice president, business development of Raza Foundries, Inc., a broadband networking and communications investment company, and served in various interim executive roles at Pacific Broadband Communications, Inc., Acirro, Inc. and Omnishift Technologies Inc. He also served as the director of commercial segment marketing and director of technical marketing for the computational products group of Advanced Micro Devices, Inc., the x86 microprocessor and video card maker, and had management roles at technology companies NexGen, Inc. and Chips and Technologies, Inc. Mr. Smith holds a B.S. in Electrical Engineering from Santa Clara University.

Stephen G. Wozniak has served as our Chief Scientist since December 2008. From 1971 to 1976, Mr. Wozniak held engineering positions within HP. In 1976, Mr. Wozniak co-founded Apple Computer, Inc., now Apple Inc. In 1985, Mr. Wozniak was awarded the National Medal of Technology, for his role in the development and introduction of the personal computer. After leaving Apple in 1985, Mr. Wozniak was involved in various business and philanthropic ventures, focusing primarily on

-27-

computer capabilities in schools, stressing hands-on learning and encouraging creativity for students. In 2000, Mr. Wozniak was inducted into the National Inventors Hall of Fame, and he was awarded the Heinz Award in Technology, the Economy and Employment. He also co-founded the Electronic Frontier Foundation, and was a founding sponsor of the Tech Museum, Silicon Valley Ballet and Children’s Discovery Museum of San Jose. Mr. Wozniak holds a B.S. in Electrical Engineering and Computer Sciences from the University of California, Berkeley.

Compensation Discussion and Analysis

This Compensation Discussion and Analysis provides an overview of the material components of our executive compensation program and discusses the amounts shown in the executive compensation tables that follow for our named executive officers, or NEOs. Our NEOs are the following executive officers:

| — | David A. Flynn, our Chief Executive Officer, or CEO, and President; |

| — | Dennis P. Wolf, our Chief Financial Officer, or CFO, and Executive Vice President; |

| — | Neil A. Carson, our Chief Technology Officer and Executive Vice President; |

| — | Lance L. Smith, our Chief Operating Officer and Executive Vice President; and |

| — | Rick C. White, our Chief Marketing Officer and Executive Vice President. |

Specifically, this Compensation Discussion and Analysis provides an overview of our executive compensation philosophy, the overall objectives of our executive compensation program and each component of compensation that we provide. In addition, we explain how and why the compensation committee of our board of directors arrived at the specific compensation policies and decisions involving our executive officers during fiscal 2011.

Executive Summary

Fiscal 2011 Business Highlights

We are the pioneer and leading provider of a next generation storage memory platform for data decentralization. We sell our solutions through our global direct sales force, original equipment manufacturers, including Dell, Hewlett-Packard and International Business Machines, and other channel partners.

Although the volatility in the global economic environment over the past two years has presented several challenges for us, in fiscal 2011 we achieved several significant financial results:

| — | Recorded fiscal year revenues of approximately $197.2 million, a 444.5% increase over our fiscal 2010 revenues; and |

| — | Recorded fiscal year net income from operations of $4.6 million. |

In addition, in June 2011, we completed an initial public offering of our common stock resulting in net proceeds of approximately $218.9 million.

-28-

Fiscal 2011 Executive Compensation Actions

As reflected in our compensation philosophy, we link the financial interests of our executive officers to the attainment and furtherance of our long-term business strategy, which, we believe, furthers the interests of our stockholders. Accordingly, our fiscal 2011 compensation actions and decisions were based on our executive officers’ accomplishments that advanced this objective.

For fiscal 2011, the compensation committee of our board of directors took the following actions with respect to the compensation of our executive officers:

| — | Maintained their base salaries at their fiscal 2010 level; |

| — | Approved short-term (annual) incentive awards that were, on average, 107% of each executive officer’s target short-term incentive opportunity, which was generally consistent with the awards paid for fiscal 2010; and |

| — | Approved equity awards (consisting entirely of stock options) at levels that met competitive market concerns, satisfied our retention objectives and rewarded individual performance during fiscal 2010. |

Fiscal 2011 Corporate Governance Highlights

We endeavor to maintain good governance standards in our executive compensation policies and practices. The following policies and practices were either adopted or in effect during fiscal 2011:

| — | The compensation committee is comprised solely of independent directors. |

| — | The compensation committee’s compensation consultant, Compensia, Inc., is retained directly by the committee and performs no other consulting or other services for us. |

| — | Beginning in fiscal 2010, the compensation committee has conducted an annual review of our compensation strategy, including a review of our compensation-related risk profile to ensure that our compensation-related risks are not reasonably likely to have a material adverse effect on the company. The compensation committee intends to conduct such a review annually. |

| — | Our compensation philosophy and related corporate governance features are complemented by several specific elements that are designed to align our executive compensation with long-term stockholder interests, including: |

| ¡ | Our change-in-control payments and benefits are reasonable and are based on a “double trigger” (that is, our executive officers are eligible to receive payments and benefits only in connection with a change in control of the company and the termination of the executive without cause or for good reasons within a specified period before or after the change in control). |

| ¡ | As a general policy, we do not favor non-cash benefits or perquisites (such as guaranteed retirement arrangements or pension plan benefits) for our executive officers that are not available to our employees generally. |

| — | Established equity grant guidelines to establish a pre-set schedule for granting equity awards and avoid the appearance that grants are made to take advantage of material nonpublic information. |

-29-

Compensation Philosophy, Objectives and Design

Compensation Environment and Philosophy

We operate in a new and rapidly evolving market. To succeed in this environment, we must continually refine our business strategy, grow our customer base, increase the attractiveness and capabilities of our products and expand and enhance our product development and sales operations. To achieve these objectives, we need to attract and retain a highly talented and experienced team of design, engineering, sales, marketing, business development, and finance professionals. We expect these individuals to possess and demonstrate strong leadership and management capabilities.

Given our reputation for innovation and our recent success in developing and marketing our data decentralization platform, our executive officers are highly sought after by our competitors and other large organizations. Accordingly, we have had to develop an executive compensation program that not only rewards these individuals for their achievements but also provides sufficient incentives to ensure their continued employment with us.

Compensation Objectives

We strive to provide a total compensation package to our executive officers through a combination of base salary, short-term and long-term incentive opportunities and severance and change-of-control benefits. Our executive compensation program is designed to achieve the following objectives:

| — | attract, motivate, reward, and retain highly-qualified executive officers, whose knowledge, skills and performance are critical to our success; |

| — | motivate these executive officers to pursue our business objectives while encouraging the creation of long-term value for our stockholders; |

| — | provide market-competitive compensation that is designed to provide a foundation of fixed compensation (base salary) and a significant portion of performance-based compensation (short-term and long-term incentive opportunities); and |

| — | align the interests of our executive officers and stockholders. |

Compensation Design

As a new publicly held company, our executive compensation program has been heavily weighted towards equity, primarily in the form of stock options, with cash compensation that generally fell below the median of comparable publicly held companies. We believe that relying primarily on equity compensation has focused our executive officers on driving achievement of our financial and strategic goals while conserving cash during our early years. We continue to believe that making equity awards a key component of executive compensation aligns the executive team with the long-term interests of our stockholders. We have also offered cash compensation in the form of base salaries to reward individual contributions and compensate our executive officers for their day-to-day responsibilities, and short-term (annual) incentive awards to drive excellence and leadership and reward our executives for the achievement of our short-term financial objectives.

To date, we have not affirmatively set out in any given fiscal year to apportion compensation in any specific ratio between cash and equity, fixed and variable pay or short-term and long-term incentives. Rather, total compensation may skew more heavily toward either cash or equity, or short-term or long-term incentives, as a result of negotiations to recruit an individual executive officer or to achieve a specific financial or strategic objective in a given fiscal year. As we continue the transition

-30-

from being a privately held to a publicly held company, we will continue to evaluate our compensation philosophy, objectives and design as circumstances require. At a minimum, we expect that the compensation committee will review these areas annually.

Compensation-Setting Process

Role of the Compensation Committee

Pursuant to its charter, the compensation committee of our board of directors is responsible for reviewing, evaluating and approving the compensation arrangements for our executive officers and for establishing and maintaining our executive compensation policies and practices. The compensation committee assumed these responsibilities from our board of directors beginning in July 2010. For additional information on the compensation committee, including the scope of its authority, see “Corporate Governance and Board of Directors—Compensation Committee” elsewhere in this proxy statement.

At the beginning of each fiscal year, the compensation committee, after consulting with our CEO, establishes the corporate performance objectives for the company and makes decisions with respect to any base salary adjustments and approves the individual performance objectives and individual target short-term incentive award opportunities for our executive officers for the upcoming year. After the end of the fiscal year, the compensation committee assesses the performance of our executive officers to determine the payouts, if any, for the short-term cash incentive award opportunities for the previous fiscal year and to make equity awards to our executive officers.

The compensation committee reviews on an annual basis our executive compensation program, including any incentive compensation plans, to determine whether they are appropriate, properly coordinated and achieve their intended purposes and to make any necessary modifications or adopt any new plans or arrangements.

Role of Management

In carrying out its responsibilities, the compensation committee works with members of our management, including our CEO. Typically, our management assists the compensation committee by providing information on corporate and individual performance, market data and management’s perspective and recommendations on compensation matters.

Historically, the initial compensation arrangements with our executive officers have been determined in negotiations with each individual executive. Typically, our CEO has been responsible for negotiating these arrangements, with the oversight and final approval of our board of directors or, since July 2010, the compensation committee.

Typically, our CEO will make recommendations to the compensation committee regarding compensation matters, including the compensation of our executive officers (except with respect to his own compensation). He also periodically attends compensation committee meetings, except with respect to discussions involving his own compensation.

While the compensation committee solicits and reviews our CEO’s recommendations and proposals with respect to compensation-related matters, the compensation committee only uses these recommendations and proposals as one factor in making compensation decisions.

-31-

Role of Compensation Consultant

Previously, we engaged Compensia, Inc., a national compensation consulting firm, to review our executive compensation policies and practices and to conduct an executive compensation market analysis.

The compensation committee is authorized to retain the services of one or more executive compensation advisors from time to time, as it sees fit, in connection with carrying out its duties and the oversight of our executive compensation program. In 2011, Compensia was engaged by the compensation committee to assist it in preparing for the transition to publicly held company status and evaluating the competitiveness of our executive compensation strategy and design. Accordingly, Compensia now serves at the discretion of the compensation committee.

Competitive Positioning

During fiscal 2011, the compensation committee, assisted by our management and Compensia, began to develop a compensation peer group comprised of comparable publicly held companies, taking into consideration size and growth potential, to be used as a reference source in connection with future executive compensation deliberations. This compensation peer group consisted of both technology companies that had conducted an initial public offering of their equity securities within the past four years, referred to as the IPO peers, and similarly-sized companies in the same industry sector, referred to as the core peers.

The following companies comprised the IPO peers portion of the peer group:

| 3Par* |

Isilon Systems* | |

| A123 Systems |

Netezza* | |

| Acme Packet* |

NetSuite | |

| ArcSight* |

Omniture | |

| Aruba Networks* |

Opentable | |

| CommVault Systems* |

Rackspace Hosting | |

| Compellent Technologies* |

Riverbed Technology* | |

| Constant Contact |

Solarwinds | |

| Data Domain |

Solyandra | |

| Fortinet* |

SuccessFactors | |

| Infinera* |

||

|

|

* Also a member of the core peers portion of the peer group.

The following companies comprised the core peers portion of the peer group:

| Bluecoat Systems |

SonicWALL | |

| F5 Networks |

STEC |

In addition, the compensation committee began to develop guidelines and establish reference points with respect to individual compensation components, including equity compensation and severance and change-of-control arrangements.

Executive Compensation Program Components

The following describes each component of our executive compensation program, the rationale for each, and how compensation amounts and awards are determined.

-32-

Base Salary

Base salary is the primary fixed component of our executive compensation program. We use base salary to compensate our executive officers for services rendered during the year and to recognize the experience, skills, knowledge and responsibilities required of each executive officer. We do not apply a specific formula to determine adjustments to base salary. Rather, the base salaries of our executive officers have been reviewed on a periodic basis and adjustments have been made to reflect our economic condition and future expected performance, as well as what our executive officers could be expected to receive if employed at companies similarly situated to ours and our overall subjective assessment of appropriate base salary levels, while being mindful of the need to conserve cash resources.

In September 2010, the compensation committee reviewed the base salaries of our executive officers taking into consideration a compensation analysis performed by Compensia and the recommendations of our CEO, as well as the other factors described above, and determined that the annual base salaries of our executive officers, except for Mr. Carson, would remain at their fiscal 2010 levels. In the case of Mr. Carson, the compensation committee determined to increase his base salary from $190,000 to $210,000 to reflect an increase in his job responsibilities and to harmonize his base salary opportunity with that of our similarly situated senior executive officers. In the case of our CEO, the compensation committee recommended, and the independent members of our board of directors approved, that his annual base salary remain at its fiscal 2010 level.

The base salaries paid to the NEOs during fiscal 2011 are set forth in the Summary Compensation Table below.

Short-Term Incentive Compensation

Consistent with our objective of linking a significant portion of each of our executive officer’s total compensation to performance, we provide performance-based short-term incentive opportunities to our executive officers that are based on corporate or individual performance, to achieve our annual financial and operational objectives, while making progress towards our longer-term growth and other goals. Generally, the compensation committee has made short-term incentive awards to our executive officers in its discretion after the end of the fiscal year based on its evaluation of the achievement of one or more corporate objectives as established in our annual operating plan and the individual performance of each executive officer.

-33-

Target Short-Term Incentive Award Opportunities

In fiscal 2011, the short-term incentive awards were designed to reward our executive officers based on our overall performance and the individual executive officer’s contribution to that performance. As in prior years, the compensation committee determined that the target short-term

incentive award opportunities for each executive officer should be determined as a percentage of such executive officer’s base salary. The target short-term incentive award opportunities for the NEOs, which were expressed as a percentage of base salary, were as follows:

| Named Executive Officer |

Fiscal 2011 Base Salary |

Fiscal 2011 Target Short- Term Incentive Award Opportunity (% of Base Salary) |

||||||

| Mr. Flynn |

$ | 240,000 | 66.7 | % | ||||

| Mr. Wolf |

$ | 220,000 | 50.0 | % | ||||

| Mr. Carson (1) |

$ | 210,000 | 50.0 | % | ||||

| Mr. Smith |

$ | 220,000 | 50.0 | % | ||||

| Mr. White |

$ | 220,000 | 50.0 | % | ||||

| (1) | Mr. Carson’s base salary was $190,000 for the first half of fiscal 2011 and increased by $20,000 to $210,000 for the second half of fiscal 2011, however, his target short-term incentive award opportunity for fiscal 2011 was effectively 50% of the $210,000 base salary amount. |

With respect to each NEO, the amount of his or her target short-term incentive award opportunity was established by the compensation committee in consultation with our CEO (except with respect to his own target short-term incentive award opportunity) and was based on several factors, including the scope of his or her performance, contributions, responsibilities, experience, prior years’ target short-term incentive award opportunities, position (in the case of a promotion) and market conditions.

Award Decisions and Analysis

In July 2011, the compensation committee determined the amount of the short-term incentive awards to be paid to our executive officers for fiscal 2011. In making these awards, the compensation committee consulted with our CEO with respect to each NEO’s performance (other than his own performance) and evaluated our financial performance for the year. Specifically, the compensation committee reviewed our financial and operational performance for the year against the pre-approved financial metrics described below, and the contributions of our executive officers to that performance. There was no specific formula used for weighing these components.

In September 2010, the compensation committee approved the following financial and operational objectives for purposes of evaluating the company’s performance and determining the short-term incentive awards to be paid to each NEO (other than our CEO) for fiscal 2011:

| — | Achieve the target revenue goal of $190 million; |

| — | Increase the company’s presence in the market and position as innovative leaders through product development; |

| — | Prepare the company to be in a position to undertake an initial public offering of common stock; |

| — | Enhance relationships with the company’s major OEM partners; |

-34-

| — | Continue to attract and retain employee talent and seek to add additional independent directors with exceptional qualifications to serve on our board of directors; |

| — | Improve the company’s manufacturing process; and |

| — | Adhere to expense budgets. |

These objectives were intended to motivate our NEOs to identify and capitalize on opportunities to grow our business and maximize stockholder value. No specific weighting was given to them. Instead, the compensation committee based its decisions on our positive operating results, such as the increase in revenue from fiscal 2010, the expansion and enhancement of our product lines and the growth in our customer base, as well as its evaluation of each executive officer’s performance during the year.

With respect to our CEO, the compensation committee approved a short-term incentive award payout in recognition of his leadership of the company and our overall strong performance. With respect to our other executive officers, our CEO recommended individual short-term incentive award payouts to the compensation committee, which then approved the payouts reported in the Summary Compensation Table below. The amounts reported vary among the NEOs because of the different levels of responsibilities and performance, as well as differences among base salaries.

Long-Term Incentive Compensation

We believe that strong long-term corporate performance is achieved with a corporate culture that encourages a long-term focus by our executive officers through the use of equity-based awards, the value of which depends on the performance of our common stock. To date, our long-term incentive compensation has been provided largely in the form of equity awards. We have used stock options to provide our executive officers with incentives to help align their interests with the interests of our stockholders and to enable them to participate in the long-term appreciation of the value of our common stock. Additionally, stock options provide an important tool for us to retain our executive officers, as the options are subject to vesting over a multi-year period subject to continued service with the company.

Historically, we have not had an established set of criteria for granting equity awards. Instead, our board of directors has exercised its judgment and discretion, in consultation with our CEO, and considered, among other factors, the role and responsibility of each executive officer, competitive factors, the amount of stock-based equity compensation already held by the executive officer and the cash compensation to be received by the executive officer, to determine the size of its equity awards.

We do not have, nor do we plan to establish, any program, plan or practice to time stock option grants in coordination with the release of material non-public information. In general, however, the exercise price of options granted to our executive officers will equal the closing price of our common stock on the last day of the month on which the New York Stock Exchange is open for trading in which the grant was approved. In the cases of options granted when an executive officer first joins us, the vesting commencement date for such award will generally be the date on which such executive officer commences employment. For all other options, the vesting commencement date will generally be the date on which such awards were approved.

-35-

In September 2010, the compensation committee approved stock options to purchase shares of our common stock to certain of our NEOs. These stock options were granted with an exercise price equal to $1.96 per share, the fair market value of our common stock as determined by our board of directors on September 12, 2010, and a 10-year maximum term. The stock option grants made to the NEOs were as follows:

| Named Executive Officer |

Number of Shares Underlying Stock Option Grant |

|||

| Mr. Wolf |

100,000 | |||

| Mr. Carson |

200,000 | |||

| Mr. Smith |

300,000 | |||

| Mr. White |

600,000 | |||

In determining the amount of each NEOs stock option grant, the compensation committee took into consideration a compensation analysis performed by our Human Resources Department and the equity award recommendations of our CEO, as well as each executive officer’s performance, contributions, responsibilities, experience, existing equity holdings (including the current economic value of his or her unvested equity and the ability of these unvested holdings to satisfy our retention objectives), market conditions and internal equity.

In January 2011, after consulting with Compensia to understand each NEOs equity position, the compensation committee approved additional grants of stock option awards for our NEOs. In order to align our NEOs’ long-term interests with those of our stockholders, as well as incentivize them to remain employed with the company, the compensation committee set the vesting schedules of these options not to start vesting until January 2015, at which time, the options vest in equal monthly installments over the subsequent 24-month period. In the case of our CEO, the compensation committee formulated a recommendation based upon the factors described above, which was then submitted to the independent members of our board of directors for approval. These stock options were granted with an exercise price equal to $5.12 per share, the fair market value of our common stock as determined by our board of directors on January 25, 2011, and a 10-year maximum term. The stock option grants made to the NEOs were as follows:

| Named Executive Officer |

Number of Shares Underlying Stock Option Grant |

|||

| Mr. Flynn |

500,000 | |||

| Mr. Wolf |

200,000 | |||

| Mr. Carson |

200,000 | |||

| Mr. Smith |

300,000 | |||

| Mr. White |

200,000 | |||

The stock options granted to the NEOs during fiscal 2011 are set forth in the Summary Compensation Table and the Grants of Plan-Based Awards Table below.

Welfare and Other Benefits

We have established a tax-qualified Section 401(k) retirement plan for all employees who satisfy certain eligibility requirements, including requirements relating to age and length of service. We currently do not match any contributions made to the plan by our employees, including our executive

-36-

officers. We intend for the plan to qualify under Section 401(a) of the Internal Revenue Code so that contributions by employees to the plan, and income earned on plan contributions, are not taxable to employees until withdrawn from the plan.

In addition, we provide other benefits to our executive officers on the same basis as all of our full-time salaried employees in the country in which they are resident.

Perquisites and Other Personal Benefits

Currently, we do not view perquisites or other personal benefits as a significant component of our executive compensation program. Accordingly, we do not provide perquisites to our executive officers except in limited situations where we believe it is appropriate to assist an individual in the performance of his or her duties, to make our executive officers more efficient and effective and for recruitment, motivation or retention purposes.

All future practices with respect to perquisites or other personal benefits are approved and subject to periodic review by the compensation committee.

Employment Agreements

We have entered into employment agreements with our CEO and with Mr. White and have extended employment offers to our other NEOs. Each of these arrangements, which were approved on our behalf by our board of directors, sets forth the initial terms and conditions of employment of each of the NEOs. We believe that these arrangements were critical to induce these individuals to accept their position with us or to forego other employment opportunities or leave their then-employer for the uncertainty of a demanding position in a new and unfamiliar organization.

In filling these positions, our board of directors was aware that it would be necessary to recruit candidates with the requisite experience and skills to manage a growing business in a unique market niche. Accordingly, it recognized that it would need to develop competitive compensation packages to attract qualified candidates in a dynamic labor market. At the same time, our board of directors was sensitive to the need to integrate new executives into the executive compensation structure that it was seeking to develop, balancing both competitive and internal equity considerations.

Each of these arrangements provided for an initial base salary, an annual short-term incentive opportunity payable in cash and/or an equity award in the form of a stock option to purchase shares of our common stock.

For a summary of the material terms and conditions of employment for the NEOs, see “Employment Agreements and Offer Letters” below.

Post-Employment Compensation

Our board of directors considers maintaining a stable and effective management team to be essential in protecting and enhancing the best interests of the company and our stockholders. We have established severance and change of control arrangements with the NEOs to provide assurances of specified severance payments and benefits if their employment is subject to involuntary termination or voluntary termination for good reason other than for death, disability or cause, including following a change of control of the company.

We believe that it is imperative to provide these individuals with severance payments and benefits upon certain types of terminations of employment, which we recognize can be triggered at any time, to

-37-

secure their continued dedication to their work, notwithstanding the possibility of a termination of employment by us, and provide these individuals with an incentive to continue their employment with us. We further believe that the severance payments and benefits are competitive relative to the severance protection provided to similarly situated individuals at companies with which we compete for talent and appropriate because the payments and benefits are subject to the executive officer’s entry into a release of claims in favor of the company.