UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

| Filed by the Registrant x | Filed by a Party other than the Registrant ¨ |

| Check | the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-2 |

FUSION-IO, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies:

| |

| (2) | Aggregate number of securities to which transaction applies:

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

2855 East Cottonwood Parkway, Suite 100

Salt Lake City, Utah 84121

(801) 424-5500

September 24, 2012

Dear Stockholder:

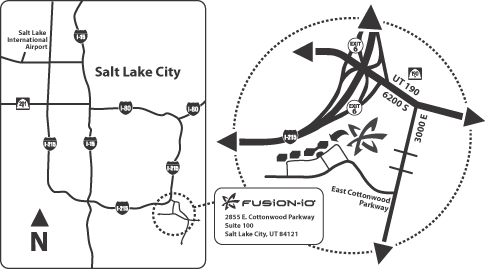

We are pleased to invite you to attend our 2012 annual meeting of stockholders to be held on Tuesday, November 6, 2012, at 10:30 a.m., Mountain Time, at our corporate headquarters in Salt Lake City, Utah. A map with directions to the meeting is found on the last page of the accompanying proxy statement. The formal meeting notice and proxy statement are attached.

At this year’s annual meeting, our stockholders will be asked to:

| • | elect the two nominees for Class II director named in the proxy statement to the board of directors; |

| • | ratify the selection by the audit committee of our board of directors of Ernst & Young LLP as Fusion-io’s independent registered public accounting firm for the current fiscal year ending June 30, 2013; and |

| • | consider an advisory vote on the compensation of the named executive officers of Fusion-io for the fiscal year ended June 30, 2012. |

Your board of directors recommends that you vote “FOR” each of the proposals listed above. You should carefully read the attached proxy statement, which contains detailed information concerning each of these proposals.

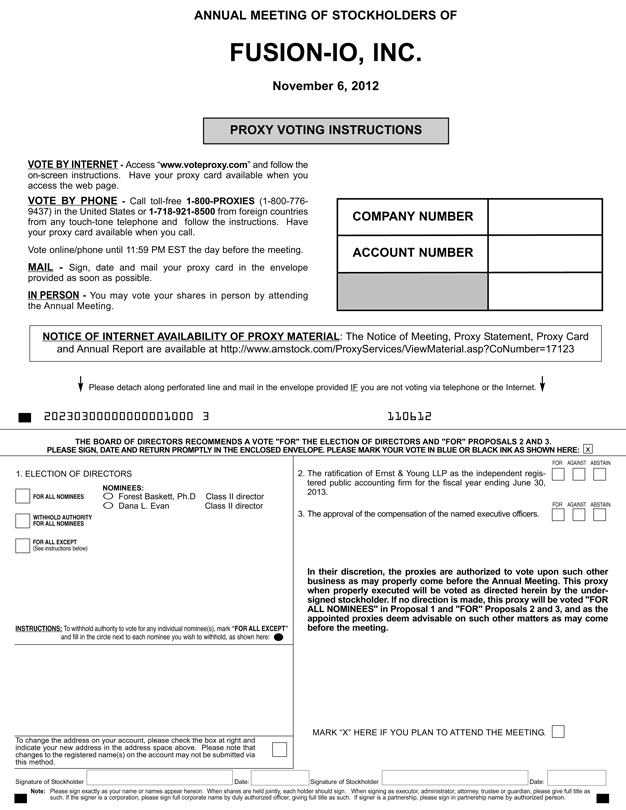

Your vote is important. Whether or not you plan to attend the annual meeting, it is important that your shares be represented, and we hope you will vote as soon as possible. You may vote over the Internet, as well as by telephone, or, if you requested to receive printed proxy materials, by mailing a proxy or voting instruction card. Please review the instructions on each of your voting options described in this proxy statement, as well as in the Notice of Internet Availability of Proxy Materials that you received in the mail. If you hold shares of our common stock through a broker, bank, or other nominee holder, please follow the voting instructions provided on the proxy card or the information forwarded by your bank, broker or other holder of record regarding your voting options.

Thank you for your ongoing support of Fusion-io. We look forward to seeing you at our annual meeting.

Very truly yours,

DAVID A. FLYNN

Chief Executive Officer, President and Chairman

YOUR VOTE IS IMPORTANT

Whether or not you plan to attend the meeting, please vote as soon as possible. Under New York Stock Exchange rules, your broker will NOT be able to vote your shares on proposals 1 or 3 unless they receive specific instructions from you. We strongly encourage you to vote.

We encourage you to vote by Internet. It is convenient for you and saves us postage and processing costs. For specific instructions on how to vote your shares, please refer to the section entitled “Questions and Answers about the Proxy Materials and Annual Meeting” beginning on page 1 of the accompanying proxy statement.

FUSION-IO, INC.

NOTICE OF 2012 ANNUAL MEETING OF STOCKHOLDERS

TO STOCKHOLDERS OF FUSION-IO, INC.:

NOTICE IS HEREBY GIVEN that the 2012 annual meeting of stockholders of Fusion-io, Inc., a Delaware corporation, will be held on Tuesday, November 6, 2012, at 10:30 a.m., Mountain Time, at our corporate headquarters located at 2855 E. Cottonwood Parkway, Suite 100, Salt Lake City, Utah, for the following purposes:

| 1. | elect the two nominees for Class II director named in the proxy statement to the board of directors, each to serve a term of three years, until our 2015 annual meeting of stockholders, or until their respective successors are duly elected and qualified; |

| 2. | to ratify the selection by the audit committee of our board of directors of Ernst & Young LLP as Fusion-io’s independent registered public accounting firm for the current fiscal year ending June 30, 2013, as described in the proxy statement; |

| 3. | to provide an advisory vote on the compensation of the named executive officers of Fusion-io for the fiscal year ended June 30, 2012, as described in the proxy statement; and |

| 4. | to transact any and all other business that may properly come before the meeting or at any and all adjournments or postponements of the meeting. |

The foregoing items of business are more fully described in the proxy statement accompanying this notice. We are not aware of any other business to come before the meeting at this time.

The meeting will begin promptly at 10:30 a.m., Mountain Time, and check-in will begin at 10:00 a.m., Mountain Time. Only stockholders of record at the close of business on September 13, 2012, or their valid proxies, are entitled to vote at the meeting and any and all adjournments or postponements of the meeting. If you are not a stockholder of record but hold shares through a broker, bank, trustee or nominee (that is, in “street name”), you will need to provide positive proof of beneficial ownership as of the record date, such as your most recent account statement prior to September 13, 2012, a copy of the voting instruction card provided by your broker, bank, trustee or nominee, or similar evidence of ownership.

A complete list of the stockholders entitled to vote at the meeting will be available and open to the examination of any stockholder for any purpose germane to the meeting for a period of at least 10 days prior to the meeting during normal business hours at our corporate headquarters.

Your vote is important. Whether or not you plan to attend the annual meeting, we encourage you to read the proxy statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions in the section entitled “Questions and Answers about the Proxy Materials and Annual Meeting” beginning on page 1 of the accompanying proxy statement.

| By order of the Board of Directors | ||

| ||

| SHAWN J. LINDQUIST | ||

| Chief Legal Officer, Executive Vice President and Secretary | ||

Salt Lake City, Utah

September 24, 2012

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 6, 2012: The notice of annual meeting, proxy statement and 2012 annual report are available by visiting http://www.amstock.com/ProxyServices/ViewMaterial.asp?CoNumber=17123.

PROXY STATEMENT

FOR 2012 ANNUAL MEETING OF STOCKHOLDERS

| Page | ||||

| QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND ANNUAL MEETING |

1 | |||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| Process for Recommending Candidates to the Board of Directors |

15 | |||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| Class III Directors Continuing in Office until the 2013 Annual Meeting |

19 | |||

| Class I Directors Continuing in Office until the 2014 Annual Meeting |

20 | |||

| PROPOSAL 2—RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

21 | |||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

-i-

| Page | ||||

| 25 | ||||

| 28 | ||||

| 28 | ||||

| 44 | ||||

| 45 | ||||

| Grants of Plan-Based Awards For Fiscal Year Ended June 30, 2012 |

46 | |||

| 47 | ||||

| Option Exercises and Stock Vested in Fiscal Year Ended June 30, 2012 |

48 | |||

| 48 | ||||

| 49 | ||||

| 49 | ||||

| 50 | ||||

| 50 | ||||

| Agreements Providing for Severance or Change of Control Benefits |

52 | |||

| 55 | ||||

| RELATED PERSON TRANSACTIONS AND SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE |

57 | |||

| 57 | ||||

| 57 | ||||

| 57 | ||||

| 57 | ||||

| 58 | ||||

| 60 | ||||

| 62 | ||||

-ii-

FUSION-IO, INC.

2855 East Cottonwood Parkway, Suite 100

Salt Lake City, Utah 84121

PROXY STATEMENT

The Board of Directors of Fusion-io, Inc., a Delaware corporation (“we,” “us,” “our” or the “Company”), is soliciting proxies in the accompanying form to be used at our Annual Meeting of Stockholders to be held at our corporate headquarters, located at 2855 E. Cottonwood Parkway, Suite 100, Salt Lake City, Utah on Friday, November 6, 2012 at 10:30 a.m. Mountain Time and for any postponement, adjournment or continuation thereof (the “Annual Meeting”).

ABOUT THE PROXY MATERIALS AND ANNUAL MEETING

-1-

-2-

-3-

-4-

-5-

-6-

-7-

-8-

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

Fusion-io Policies on Business Conduct

We are committed to the highest standards of integrity and ethics in the way we conduct our business. In 2011, we adopted a code of business conduct and ethics, which applies to all of our employees, officers and directors, including our chief executive officer, chief financial officer and other executive and senior financial officers. Our code of conduct establishes our policies and expectations with respect to a wide range of business conduct, including preparation and maintenance of financial and accounting information, compliance with laws, and conflicts of interest.

Under our code of conduct, each of our directors and employees is required to report suspected or actual violations to the extent permitted by law. In addition, we have adopted separate procedures concerning the receipt and investigation of complaints relating to accounting or audit matters. These procedures have been adopted and are administered by our audit committee.

Our code of conduct is available at our website by visiting www.fusionio.com and clicking through “Company,” “Investor Relations,” and “Corporate Governance.” When required by the rules of NYSE or the SEC, we will disclose any future amendment to, or waiver of, any provision of the code of conduct for our chief executive officer, principal financial officer, or principal accounting officer or any member or members of our board of directors on our website within four business days following the date of such amendment or waiver.

Corporate Governance Guidelines

In 2011, our board of directors adopted a set of guidelines that establish the corporate governance policies pursuant to which our board of directors intends to conduct its oversight of the business of Fusion-io in accordance with its fiduciary responsibilities. Among other things, these corporate governance guidelines address the establishment and operation of board committees, the role of our chairman, and matters relating to director independence and performance assessments. Our corporate governance guidelines are available at our website by visiting www.fusionio.com and clicking through “Company,” “Investor Relations,” and “Corporate Governance.”

Role and Composition of the Board

As identified in our corporate governance guidelines, the role of our board of directors is to oversee the performance of our chief executive officer and other senior management. Our board of directors is responsible for hiring, overseeing, and evaluating management while management is responsible for running our day-to-day operations.

Our board of directors is currently comprised of seven members and is divided into three staggered classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three year term to succeed the class of directors whose terms are then expiring. The terms of the directors will expire upon the election and qualification of successor directors at the annual meeting of stockholders to be held during the years 2013 for the Class III directors, 2014 for the Class I directors, and 2015 for Class II directors.

Board Leadership Structure

The board of directors currently believes that our company is best served by combining the roles of chairman of the board and chief executive officer, coupled with a lead independent director. As a founder of the company, David Flynn, our chief executive officer, is the director most familiar with our

-9-

business and industry, and most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. Independent directors and management have different perspectives and roles in the development of our strategy. Our independent directors bring experience, oversight and expertise from outside the company, while our chief executive officer brings company-specific experience and expertise. Our board of directors believes that the combined role of chairman and chief executive officer is the best leadership structure for us at the current time as it promotes the efficient and effective development and execution of our strategy and facilitates information flow between management and our board of directors. The board of directors recognizes, however, that no single leadership model is right for all companies at all times. Our corporate governance guidelines provide that the board of directors should be free to choose a chairman of the board based upon the board’s view of what is in the best interests of the company. Accordingly, the board of directors periodically reviews its leadership structure.

Lead Independent Director

In May 2011, our board of directors first appointed Scott D. Sandell as lead independent director, and in September 2012, our board reconfirmed Mr. Sandell’s appointment as lead independent director for our fiscal year ending June 30, 2013, or fiscal 2013. As the lead independent director, Mr. Sandell is responsible for coordinating the activities of the independent directors. The lead independent director has the following specific responsibilities:

| — | call special meetings of the independent directors and chair meetings of independent directors; |

| — | act as the principal liaison between the non-employee directors and the chairman of the board on sensitive issues; |

| — | work with the chairman of the board to develop a schedule of meetings for the board and provide input with respect to meeting agendas for the board of directors and its committees; |

| — | advise the chairman of the board with respect to the quality, quantity and timeliness of the flow of information from company management; |

| — | coordinate and moderate executive sessions of the independent directors; and |

| — | perform such other duties as the board of directors may from time to time delegate to the lead independent director. |

Board’s Role in Risk Oversight

Our board of directors oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance, and to enhance stockholder value. A fundamental part of risk management is not only understanding the most significant risks a company faces and what steps management is taking to manage those risks but also understanding what level of risk is appropriate for a given company. The involvement of our full board of directors in reviewing our business is an integral aspect of its assessment of management’s tolerance for risk and also its determination of what constitutes an appropriate level of risk.

While our board of directors has the ultimate oversight responsibility for the risk management process, various committees of the board also have responsibility for risk management. The charter of our audit committee provides that the committee’s responsibilities include oversight of our major

-10-

financial risks and certain compliance matters. In addition, in setting compensation, our compensation committee strives to create incentives that encourage a level of risk-taking consistent with our business strategy and to encourage a focus on building long term value that does not encourage excessive risk-taking.

In connection with its oversight of compensation-related risks, our compensation committee has reviewed our compensation programs and practices for employees, including executive and non-executive programs and practices. In its review, our compensation committee evaluated whether our policies and programs encourage unnecessary or excessive risk taking and controls, and how such policies and programs are structured with respect to risks and rewards, as well as controls designed to mitigate any risks. As a result of this review, our compensation committee determined that any risks that may result from our compensation policies and practices for its employees are not reasonably likely to have a material adverse effect on Fusion-io.

At periodic meetings of the board and its committees and in other meetings and discussions, management reports to and seeks guidance from the board and its committees with respect to the most significant risks that could affect our business, such as legal risks and financial, tax and audit related risks. In addition, among other matters, management provides our audit committee periodic reports on our compliance programs and efforts and investment policy and practices.

Our board of directors has three standing committees: an audit committee, a compensation committee, and a nominating and corporate governance committee. The membership and the function of each of the committees are described below. Our board of directors may from time to time establish a new committee or dissolve an existing committee depending on the circumstances.

| Director’s Name |

Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee | |||

| Non-Employee Directors: |

||||||

| Forest Baskett, Ph.D. |

| |||||

| H. Raymond (Ray) Bingham |

|

|

||||

| Dana L. Evan

|

|

|

||||

| Shane V. Robison |

|

| ||||

| Scott D. Sandell |

|

| ||||

| Employee Directors: |

||||||

| David A. Flynn |

||||||

| Rick C. White |

||||||

Chairperson

Chairperson |

Member

Member |

Financial Expert

Financial Expert | ||||

During our fiscal year ended June 30, 2012, or fiscal 2012, our board of directors held 10 meetings. Each of our directors attended or participated in 75% or more of the meetings of the board of directors and 75% or more of the meetings held by all committees of the board of directors on which he or she served during the past fiscal year.

-11-

As a company listed on NYSE, we are required under NYSE listing requirements to maintain a board comprised of a majority of “independent” directors, as determined affirmatively by our board. In addition, NYSE rules require that, subject to specified exceptions, each member of our audit, compensation and nominating and corporate governance committees be independent. In September 2012, our nominating and corporate governance committee and board of directors undertook a review of the independence of our directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our nominating and corporate governance committee and board of directors determined that Ms. Evan, Dr. Baskett and Messrs. Bingham, Robison and Sandell, representing five of our seven directors, were “independent directors” as defined under applicable NYSE rules. Messrs. Flynn and White are not considered independent directors because of their positions as our chief executive officer and chief marketing officer, respectively.

Executive Sessions of Independent Directors

In order to promote open discussion among independent directors, our board of directors has a policy of conducting executive sessions of independent directors during each regularly scheduled board meeting and at such other times as requested by an independent director. These executive sessions are chaired by our lead independent director, Mr. Sandell. Neither Mr. Flynn nor Mr. White participates in such sessions.

Ms. Evan and Messrs. Bingham and Robison, each of whom is a non-employee member of our board of directors, comprise our audit committee. Ms. Evan is the chair of our audit committee. Our board of directors has determined that each of the members of our audit committee satisfies the requirements for independence and financial literacy under the rules and regulations of the NYSE and the SEC. Our board of directors has also determined that Ms. Evan qualifies as an “audit committee financial expert” as defined in the SEC rules and satisfies the financial sophistication requirements of the NYSE.

The audit committee of our board of directors is responsible for, among other things:

| — | selecting and hiring our independent registered public accounting firm, approving the audit and pre-approving any non-audit services to be performed by our independent registered public accounting firm; |

| — | supervising and evaluating the performance and independence of our independent registered public accounting firm; |

| — | reviewing and discussing our financial statements and audits with management, our internal auditors and our independent registered public accounting firm, and monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters; |

| — | reviewing the adequacy and effectiveness of our internal control policies and procedures and our disclosure controls and procedures; |

| — | overseeing procedures for the treatment of complaints on accounting, internal accounting controls or audit matters; |

-12-

| — | overseeing our internal auditors; |

| — | discussing the scope and results of our annual audit with the independent registered public accounting firm and reviewing with management and the independent registered public accounting firm our interim and year-end operating results; |

| — | reviewing and discussing our quarterly earnings releases and quarterly reports from our registered independent public accounting firm concerning our accounting policies and practices; |

| — | reviewing and discussing with management, our internal auditors and our independent registered public accounting firm our major financial risk exposures and steps management has taken to control those exposures; |

| — | reviewing our related party transaction policy; and |

| — | preparing the audit committee report that the SEC will require in our annual proxy statement. |

Our audit committee held seven meetings during fiscal 2012. Our audit committee operates under a written charter approved by our board of directors. The charter is available on our website by visiting www.fusionio.com and clicking through “Company,” “Investor Relations,” and “Corporate Governance.”

Ms. Evan and Messrs. Bingham and Sandell, each of whom is a non-employee member of our board of directors, comprise our compensation committee. Mr. Bingham is the chair of our compensation committee. Our board of directors has determined that each member of our compensation committee meets the requirements for independence under the rules of the NYSE and is an “outside director” for purposes of Section 162(m) of the Internal Revenue Code. The compensation committee is responsible for, among other things:

| — | reviewing and approving our Chief Executive Officer’s and other executive officers’ annual base salaries, equity compensation, annual incentive bonuses and severance, change in control and other compensation arrangements; |

| — | overseeing our overall compensation philosophy and establishing, administering and reviewing our compensation plans and benefits programs, including our equity award programs; and |

| — | preparing the compensation committee report that the SEC will require in our annual proxy statement. |

See “Compensation of Non-Employee Directors” and “Executive Compensation” for a description of our processes and procedures for the consideration and determination of executive and director compensation.

Our compensation committee held seven meetings during fiscal 2012. Our compensation committee operates under a written charter approved by the board of directors, which is available on our website by visiting www.fusionio.com and clicking through “Company,” “Investor Relations,” and “Corporate Governance.”

-13-

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee is an officer or employee of our company. None of our executive officers currently serves, or in the past year has served, as a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of any entity that has one or more executive officers serving on our compensation committee.

Nominating and Corporate Governance Committee

Messrs. Robison, Sandell and Dr. Baskett, each of whom is a non-employee member of our board of directors, comprise our nominating and corporate governance committee. Dr. Baskett is the chair of our nominating and corporate governance committee. Our board of directors has determined that each member of our nominating and corporate governance committee meets the requirements for independence under the rules of the NYSE. The nominating and corporate governance committee is responsible for, among other things:

| — | assisting our board of directors in identifying and evaluating prospective director nominees and recommending nominees for each annual meeting of stockholders to the board of directors; |

| — | reviewing the composition of each committee of our board of directors and making recommendations for the creation of additional committees; |

| — | developing and recommending governance principles applicable to our board of directors; |

| — | overseeing the evaluation of our board of directors and management; |

| — | reviewing and monitoring compliance with our code of business conduct and ethics; and |

| — | recommending potential members for each board committee to our board of directors. |

Our nominating and corporate governance committee will consider recommendations of candidates for the board of directors submitted by stockholders of Fusion-io; see “Process for Recommending Candidates to the Board of Directors” below.

Our nominating and corporate governance committee held four meetings during fiscal 2012. Our nominating and corporate governance committee operates under a written charter approved by the board of directors, which is available on our website by visiting www.fusionio.com and clicking through “Company,” “Investor Relations,” and “Corporate Governance.”

Considerations in Evaluating Director Nominees

Our board of directors has established a policy for evaluating director nominees.

In its evaluation of director candidates, including the members of the board of directors eligible for re-election, our nominating and corporate governance committee will consider the following:

| — | the current size and composition of our board of directors and the needs of the board and its respective committees; |

| — | factors such as character, judgment, diversity, age, independence, expertise, corporate experience, length of service, understanding of our business, other commitments and the like; and |

| — | other factors that our committee may consider appropriate. |

-14-

Our nominating and corporate governance committee evaluates the factors listed above individually and does not assign any particular weighting or priority to any of these factors. The committee has not established any minimum qualifications for director nominees, and instead takes a holistic approach when evaluating the above factors. While not maintaining a specific policy on board diversity requirements, the board and the nominating and corporate governance committee believe that diversity is an important factor in determining the composition of the board and, therefore, seek a variety of occupational and personal backgrounds on the board in order to obtain a range of viewpoints and perspectives and to enhance the diversity of the board.

Process for Recommending Candidates to the Board of Directors

Our nominating and corporate governance committee is responsible for, among other things, recommending candidates for election to the board of directors. It is the policy of our nominating and corporate governance committee to consider recommendations for candidates to the board of directors from stockholders so long as such recommendations comply with our certificate of incorporation and bylaws and applicable law. Stockholder recommendations for candidates to the board of directors must be directed in writing to Fusion-io, Inc., Attention: Corporate Secretary, 2855 E. Cottonwood Parkway, Suite 100, Salt Lake City, Utah 84121, and should include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed letter from the candidate acknowledging that as a director of Fusion-io, the nominee will owe a fiduciary duty under Delaware law with respect to Fusion-io and its stockholders, information regarding any relationships between the candidate and Fusion-io, and evidence of the recommending stockholder’s ownership of our stock. Such recommendations should also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for board membership, including issues of character, integrity, judgment, diversity of experience, independence, area of expertise, corporate experience, length of service, potential conflicts of interest, other commitments and the like. For details regarding the process to nominate a director directly for election to the board at an annual meeting of the stockholders, under the section entitled “Questions and Answers About the Proxy Materials and Annual Meeting,” please see “What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?”

Director Attendance at Annual Meetings

Although we do not have a formal policy regarding attendance by members of our board of directors at annual meetings of stockholders, we encourage, but do not require, directors to attend. We have scheduled our 2012 annual stockholder meeting on the same day as a regularly scheduled board meeting in order to facilitate attendance by our board members.

Communications with the Board of Directors

Stockholders who wish to communicate with our directors are welcome to do so in writing, at the following address:

Fusion-io, Inc.

Attention: Board of Directors

c/o Corporate Secretary

2855 E. Cottonwood Parkway, Suite 100

Salt Lake City, Utah 84121

Communications are distributed to our board or to the appropriate individual director.

-15-

COMPENSATION OF NON-EMPLOYEE DIRECTORS

Non-employee Director Compensation Program

In May 2011, our board of directors adopted a non-employee director compensation policy regarding cash compensation and grants of equity compensation to non-employee directors. The policy was amended and restated in September 2011 and in September 2012.

Cash Compensation

Non-employee directors are entitled to receive the following cash compensation for their services as follows:

| Annual Cash Retainer ($)* |

||||

| Annual retainer |

50,000 | |||

| Additional retainer for lead independent director(1) |

20,000 | |||

| Additional retainer for audit committee chair(2) |

26,000 | |||

| Additional retainer for audit committee member(3) |

14,500 | |||

| Additional retainer for compensation committee chair(4) |

19,000 | |||

| Additional retainer for compensation committee member(5) |

10,000 | |||

| Additional retainer for nominating and governance committee chair(6) |

11,500 | |||

| Additional retainer for nominating and governance committee member(7) |

5,750 | |||

|

|

||||

| * | Paid quarterly in arrears. |

| (1) | In September 2012, our board of directors approved a retainer for our lead director of $20,000 |

| (2) | In September 2012, our board of directors approved an increase of $5,500 to the annual retainer amount, from $20,500 to $26,000. |

| (3) | In September 2012, our board of directors approved an increase of $4,500 to the annual retainer amount, from $10,000 to $14,500. |

| (4) | In September 2012, our board of directors approved an increase of $3,500 to the annual retainer amount, from $15,500 to $19,000. |

| (5) | In September 2012, our board of directors approved an increase of $1,500 to the annual retainer amount, from $8,500 to $10,000. |

| (6) | In September 2012, our board of directors approved an increase of $2,250 to the annual retainer amount, from $9,250 to $11,500. |

| (7) | In September 2012, our board of directors approved an increase of $1,375 to the annual retainer amount, from $4,375 to $5,750. |

Equity Compensation

Each non-employee director who first joins our board of directors will be granted a restricted stock unit, or RSU, award covering 30,000 shares of common stock and each non-employee director will be granted an annual RSU award covering 15,000 shares of common stock on the date of each of our annual stockholder meetings.

An initial RSU award will vest as to 25% of the shares on the first annual anniversary of the date the non-employee director joins our board of directors, and as to the remaining 75% of the shares in 12 substantially equal quarterly installments thereafter, subject to continued service as a board member through each such vesting date. Annual RSU awards will vest on the earlier of: the annual anniversary of the grant date or the day prior to the annual meeting of stockholders immediately following the annual meeting at which the award is granted, subject to continued service as a board member through the vesting date. In the event of a change in control, the director’s award will immediately vest in full and become fully exercisable.

-16-

2012 Non-employee Director Compensation

The following table sets forth information concerning compensation paid or accrued for services rendered to us by members of our board of directors for fiscal 2012. The table excludes Messrs. Flynn and White, who are named executive officers and did not receive any compensation from us in their role as a director in fiscal 2012.

| Name |

Fees Earned or Paid in Cash ($) |

Option Awards ($)(1) |

Total ($) | |||||||||

| Forest Baskett, Ph.D. |

59,250 | 1,057,339 | 1,116,589 | |||||||||

| H. Raymond Bingham |

75,500 | 1,057,339 | 1,132,839 | |||||||||

| Dana L. Evan |

79,000 | 1,057,339 | 1,136,339 | |||||||||

| Shane V. Robison |

32,188 | 1,278,217 | 1,310,405 | |||||||||

| Scott D. Sandell |

62,875 | 1,057,339 | 1,120,214 | |||||||||

| Christopher J. Schaepe(2) |

32,188 | 1,256,339 | 1,288,527 | |||||||||

|

|

||||||||||||

| (1) | Amounts represent the aggregate grant date fair value of the stock or option award calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation, as amended (“ASC 718”), without regard to estimated forfeitures, or, with respect to repriced options, the incremental fair value as computed in accordance with ASC 718. See Note 8 of the notes to our audited consolidated financial statements included in our annual report on Form 10-K for the fiscal year ended June 30, 2012 for a discussion of valuation assumptions made in determining the grant date fair value and compensation expense of our stock options. |

| (2) | Mr. Schaepe served as a member of the board of directors until December 2011. The option award described in the table above was unvested at the time of his resignation from the board and, in accordance with the terms of the award, was terminated. Mr. Schaepe had also been granted an option to purchase 50,000 shares in February 2011, during fiscal 2011, which was also unvested at the time of his resignation. At the time of Mr. Schaepe’s resignation, the board approved a modification to this award to accelerate the vesting of 25% of the award, with the remaining 75% of the award terminating on his resignation date. There was a $199,000 increase in the grant date fair value as a result of the vesting acceleration of the award. |

Non-employee Director Equity Awards

The aggregate number of shares subject to stock options outstanding at June 30, 2012, for each non-employee director was as follows:

| Name |

Aggregate Number of Stock Options Outstanding as of June 30, 2012 |

|||

| Forest Baskett, Ph.D. |

100,000 | (1) | ||

| H. Raymond Bingham |

150,000 | (2) | ||

| Dana L. Evan |

144,000 | (3) | ||

| Shane V. Robison |

100,000 | (4) | ||

| Scott D. Sandell |

100,000 | (5) | ||

|

|

||||

| (1) | The outstanding options for Dr. Baskett consist of 50,000 from the grant awarded on February 19, 2011, which has an exercise price per share of $5.12 and 50,000 from the grant awarded November 18, 2011, which has an exercise price per share of $39.60. |

| (2) | The outstanding options for Mr. Bingham consist of 100,000 from the grant awarded February 19, 2011, which has an exercise price per share of $5.12 and 50,000 from the grant awarded November 18, 2011, which has an exercise price per share of $39.60. |

| (3) | The outstanding options for Ms. Evan consist of 94,000 from the grant awarded February 19, 2011, which has an exercise price per share of $5.12 and 50,000 from the grant awarded November 18, 2011, which has an exercise price per share of $39.60. |

| (4) | The outstanding options for Mr. Robison consist of 100,000 from the grant awarded December 16, 2011, which has an exercise price per share of $23.07. |

| (5) | The outstanding options for Mr. Sandell consist of 50,000 from the grant awarded February 19, 2011, which has an exercise price per share of $5.12 and 50,000 from the grant awarded November 18, 2011, which has an exercise price per share of $39.60. |

-17-

ELECTION OF CLASS II DIRECTORS

-18-

-19-

-20-

RATIFICATION OF SELECTION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

-21-

-22-

-23-

ADVISORY VOTE ON EXECUTIVE COMPENSATION

24

The names of our executive officers and a key employee, their ages, their positions with Fusion-io, and other biographical information as of September 13, 2012, are set forth below. There are no family relationships among any of our directors or executive officers.

| Name |

Age | Position | ||

| Executive Officers: |

||||

| David A. Flynn* |

43 | Chief Executive Officer, President and Chairman | ||

| Dennis P. Wolf |

59 | Chief Financial Officer and Executive Vice President | ||

| Richard W. Boberg |

64 | Executive Vice President, Strategic Business Development and General Manager of Caching Solutions | ||

| Neil A. Carson |

36 | Chief Technology Officer and Executive Vice President | ||

| James L. Dawson |

50 | Executive Vice President, Worldwide Sales | ||

| Shawn J. Lindquist |

42 | Chief Legal Officer, Executive Vice President and Secretary | ||

| Lance L. Smith |

48 | Chief Operating Officer and Executive Vice President | ||

| Rick C. White† |

42 | Chief Marketing Officer, Executive Vice President and Director | ||

| Key Employee: |

||||

| Stephen G. Wozniak |

62 | Chief Scientist |

| * | Biographical information for this individual is found above in the section titled “Class III Directors Continuing in Office until the 2013 Annual Meeting.” |

| † | Biographical information for this individual is found above in the section titled “Class I Directors Continuing in Office until the 2014 Annual Meeting.” |

Dennis P. Wolf has served as our Chief Financial Officer and Executive Vice President since October 2010, as our Chief Financial Officer and Senior Vice President from March 2010 to October 2010, and as our Chief Financial Officer from November 2009 to March 2010. From January 2009 to April 2009, Mr. Wolf served as interim chief executive officer and chief financial officer of Finjan Software, Inc., a provider of web security solutions. From March 2005 to June 2008, Mr. Wolf served as executive vice president and chief financial officer of MySQL AB, an open source database software company. Prior to MySQL, Mr. Wolf held financial management positions for public high technology companies, including Apple Inc., Centigram Communications, Inc., Credence Systems Corporation, Omnicell, Inc., Redback Networks Inc. and Sun Microsystems, Inc. Mr. Wolf currently serves as a director of Codexis Inc. and Exponential Interactive, Inc., and is the chair of the audit committees of these companies, and has been a director and chair of the audit committee for other publicly and privately held companies including Quantum Corporation, BigBand Networks, Inc., Registry Magic, Inc., Avanex Corporation, Komag, Inc. and Vitria Technology, Inc. He holds a B.A. from the University of Colorado and an M.B.A. from the University of Denver.

Richard W. Boberg has served as our Executive Vice President, Strategic Business Development and General Manager of Caching Solutions since August 2012, and prior to that, Mr. Boberg served as our Executive Vice President, Corporate Business Development since April 2012 and our Executive Vice President and General Manager of Virtualization Solutions since joining the company following the completion of our acquisition of IO Turbine, Inc. in August 2011. Mr. Boberg was one of the co-founders of IO Turbine. From IO Turbine’s inception in December 2009 until August 2011, Mr. Boberg served as the president and chief executive officer and a director of IO Turbine. From 2005 to 2009, Mr. Boberg served as vice president of InnovationQ, a nonprofit organization that he co-founded, which focused on working with California Polytechnic University, San Luis Obispo to promote innovation and entrepreneurship. Mr. Boberg was the sixth employee at NetApp, Inc., a leading provider of storage and data management solutions, and during his 12 years with NetApp from 1993 to 2005, he held executive positions in marketing, corporate development, and engineering, directed product management, strategic marketing, mergers and acquisitions, several software engineering groups, and strategic alliances and business development. Mr. Boberg has also held

-25-

engineering and engineering management positions at several other technology companies, including Intel Corporation. Mr. Boberg holds a B.S. in Electrical/Electronic Engineering from California Polytechnic State University, San Luis Obispo, and a M.S. in Electrical Engineering from Massachusetts Institute of Technology.

Neil A. Carson has served as our Chief Technology Officer and Executive Vice President since October 2010, and as our Chief Technology Officer from March 2010 to October 2010. From December 2007 to January 2010, Mr. Carson served as chief application architect for Dell services, Dell Inc., a computer hardware, software and peripherals company. From June 2005 to December 2007, Mr. Carson served as chief architect of Everdream Corporation, a software-as-a-service systems management company. From 2003 to June 2005, Mr. Carson served as principal engineer of Remedy software products at BMC Software, Inc., an IT service management company. From 1997 to 2003, Mr. Carson served as principal architect of Liberate Technologies, Inc. From 1995 to 1997, Mr. Carson served as director of Causality Limited, an embedded systems software company. Mr. Carson holds a B.Eng. degree from the Royal Military College of Science at Cranfield University.

James L. Dawson has served as our Executive Vice President, Worldwide Sales since October 2010, and as our Senior Vice President of Sales from April 2009 to October 2010. From 2004 to April 2009, Mr. Dawson served as vice president of worldwide sales of 3PAR Inc., a storage solutions company. From 2002 to 2004, Mr. Dawson served as vice president, strategic sales and business development of Neoscale Systems, Inc., an enterprise storage security company. From 2000 to 2002, Mr. Dawson served as vice president of worldwide sales for Scale Eight, Inc., a storage solutions company. From 1987 to 2000, Mr. Dawson served in various positions with Data General Corporation, a supplier of storage and enterprise computing solutions, most recently as vice president of EMEA and Asia Pacific for its CLARiiON Storage Division. Mr. Dawson holds a B.A. in Economics from Weber State University.

Shawn J. Lindquist has served as our Chief Legal Officer, Executive Vice President and Secretary since October 2010, and as our Chief Legal Officer, Senior Vice President and Secretary from February 2010 to October 2010. From 2005 to January 2010, Mr. Lindquist served as chief legal officer, senior vice president and secretary of Omniture, Inc., an online marketing and web analytics company, through the completion and integration of the merger of Omniture with Adobe Systems Incorporated. Mr. Lindquist was a corporate and securities attorney at Wilson Sonsini Goodrich & Rosati, P.C. from 2001 to 2005 and from 1997 to 1999. Mr. Lindquist has also served as in-house corporate and mergers and acquisitions counsel for Novell, Inc., and as vice president and general counsel of a privately held, venture-backed company. Mr. Lindquist is also an adjunct professor of law at the J. Reuben Clark Law School at Brigham Young University. Mr. Lindquist holds a B.S. in Business Management-Finance and a J.D. from Brigham Young University.

Lance L. Smith has served as our Chief Operating Officer since April 2010, as our Executive Vice President since October 2010, as our Senior Vice President of Engineering from September 2009 to October 2010, and as our Senior Vice President of Product Management and Marketing from May 2008 to September 2009. From January 2003 to May 2008, Mr. Smith served as vice president and general manager of RMI Corporation, a semiconductor company. From 2000 to 2002, Mr. Smith served as senior vice president, business development of Raza Foundries, Inc., a broadband networking and communications investment company, and served in various interim executive roles at Pacific Broadband Communications, Inc., Acirro, Inc. and Omnishift Technologies Inc. He also served as the director of commercial segment marketing and director of technical marketing for the computational products group of Advanced Micro Devices, Inc., the x86 microprocessor and video card maker, and had management roles at technology companies NexGen, Inc. and Chips and Technologies, Inc. Mr. Smith holds a B.S. in Electrical Engineering from Santa Clara University.

-26-

Stephen G. Wozniak has served as our Chief Scientist since December 2008. From 1971 to 1976, Mr. Wozniak held engineering positions within HP. In 1976, Mr. Wozniak co-founded Apple Computer, Inc., now Apple Inc. In 1985, Mr. Wozniak was awarded the National Medal of Technology, for his role in the development and introduction of the personal computer. After leaving Apple in 1985, Mr. Wozniak was involved in various business and philanthropic ventures, focusing primarily on computer capabilities in schools, stressing hands-on learning and encouraging creativity for students. In 2000, Mr. Wozniak was inducted into the National Inventors Hall of Fame, and he was awarded the Heinz Award in Technology, the Economy and Employment. He also co-founded the Electronic Frontier Foundation, and was a founding sponsor of the Tech Museum, Silicon Valley Ballet and Children’s Discovery Museum of San Jose. Mr. Wozniak holds a B.S. in Electrical Engineering and Computer Sciences from the University of California, Berkeley.

-27-

Compensation Discussion and Analysis

This Compensation Discussion and Analysis provides an overview of the material components of our executive compensation program and discusses the amounts shown in the executive compensation tables that follow for our named executive officers, or NEOs. Our NEOs are the following executive officers:

| — | David A. Flynn, our Chief Executive Officer, or CEO, and President; |

| — | Dennis P. Wolf, our Chief Financial Officer, or CFO, and Executive Vice President; |

| — | Lance L. Smith, our Chief Operating Officer and Executive Vice President; |

| — | James L. Dawson, our Executive Vice President, Worldwide Sales; and |

| — | Richard W. Boberg, our Executive Vice President, Strategic Business Development and General Manager of Caching Solutions. |

Specifically, this Compensation Discussion and Analysis provides an overview of our executive compensation philosophy, the overall objectives of our executive compensation program and each component of compensation that we provide. In addition, we explain how and why the compensation committee of our board of directors arrived at the specific compensation policies and decisions involving our executive officers during fiscal 2012.

Executive Summary

Overview

We seek to pay for performance, and we believe our record for fiscal 2012 indicates that we have accomplished this objective.

-28-

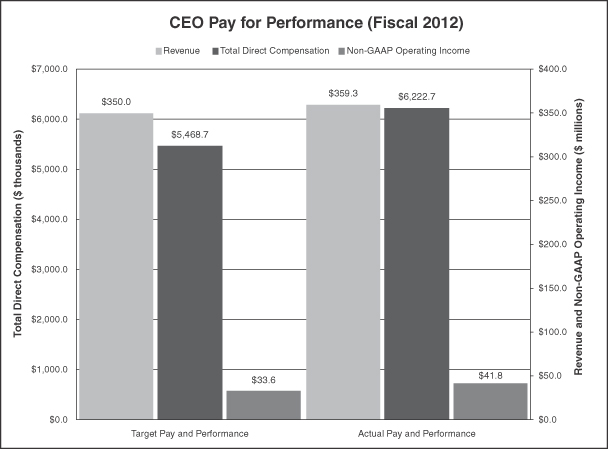

The following graph shows the strong correlation between our pay and performance by comparing (1) our CEO’s target total direct compensation (that is, the sum of the base salary, target short-term incentive award, and equity awards granted in fiscal 2012) against fiscal 2012 revenue and non-GAAP operating income* targets and (2) our CEO’s actual total direct compensation (that is, the sum of the base salary, actual short-term incentive payments, and equity awards granted in fiscal 2012) against our achievements in revenue and non-GAAP operating income in fiscal 2012.

We provide equity compensation as the primary component of our executive compensation program because we believe it links the interests of our executive officers with our stockholders and provides financial incentives for our executive officers to remain with the company and expand our business. With the equity awards subject to time-based vesting, the compensation an executive officer realizes in connection with the equity awards is spread over several years, which we believe assists in motivating him to drive the growth of our business. The following graph further illustrates our CEO’s fiscal 2012 realizable pay as compared to his fiscal 2012 target pay.

| * | Non-GAAP operating income is defined as GAAP income from operations excluding the effects of stock-based compensation expense, amortization of intangible assets and acquisition related costs. A reconciliation of this non-GAAP measure can be found in exhibit 99.1 to the current report on Form 8-K furnished to the Securities and Exchange Commission on August 9, 2012. GAAP is defined as U.S. generally accepted accounting principles. |

-29-

| * | Target Pay—includes annualized base salary, target short-term incentive compensation award, and the “fair value” at grant of equity awards (that is, Black Scholes for stock options). |

| ** | Realizable Pay—includes annualized base salary, actual incentive compensation paid, and the “in-the-money” value of all equity awards issued during fiscal 2012 using the closing price of our common stock on June 29, 2012 of $20.89. Realizable Pay assumes equity awards are 100% vested upon grant, even though such awards vest over a period of four years. |

Fiscal 2012 Business Highlights

We provide next generation datacenter solutions that accelerate databases, virtualization, cloud computing, big data, and the applications that help drive business from the smallest e-tailers to some of the world’s largest data centers, social media leaders, and Fortune Global 500 businesses. Our integrated hardware and software platform enables the decentralization of data from legacy architectures and specialized hardware. Our core technology leverages flash memory to significantly increase datacenter efficiency, with enterprise grade performance, reliability, availability, and manageability. We sell our solutions through a global direct sales force, original equipment manufacturers, or OEMs, including Cisco, Dell, HP, and IBM, and other channel partners.

In fiscal 2012, we achieved several significant financial results:

| — | Recorded fiscal year revenues of approximately $359.3 million, an 82% increase over our fiscal 2011 revenues; |

-30-

| — | Recorded fiscal year gross margin of 55.7%; and |

| — | Generated $34.8 million in operating cash flow in fiscal 2012, compared to use of $9.9 million in fiscal 2011. |

In addition, we experienced a number of significant business milestones:

| — | In August 2011, we completed the acquisition of IO Turbine, Inc., which was a key part of our strategy in enabling enterprise customers to increase the utilization, performance and efficiency of their datacenter resources and extract greater value from their information assets. |

| — | In August 2011, we announced ioCache solution featuring ioTurbine software and customized ioMemory accelerator to deliver affordable performance for virtualizing data-intensive enterprise applications. |

| — | In October 2011, we announced our next generation ioMemory platform, the ioDrive 2. |

| — | In November 2011, we completed a follow-on public offering in which we issued and sold three million shares of our common stock, resulting in net proceeds of approximately $94.0 million. |

| — | In April 2012, we announced ioFX, a new product for the single user workstation market, which accelerates key content creation software, including Adobe Creative Suite 6. |

| — | In April 2012, we announced our software development kit (SDK) to enable customers and software developers to optimize enterprise, web, and big data applications through direct programmatic access to Fusion-io’s ioMemory subsystem. |

Fiscal 2012 Corporate Governance Highlights

We endeavor to maintain good governance standards in our executive compensation policies and practices. The following policies and practices were either adopted or in effect during fiscal 2012:

| — | The compensation committee is comprised solely of independent directors. |

| — | The compensation committee’s compensation consultant, Compensia, Inc., is retained directly by the committee and performs no other consulting or other services for us. |

| — | The compensation committee has conducted an annual review of our compensation strategy, including a review of our compensation-related risk profile to ensure that our compensation-related risks are not reasonably likely to have a material adverse effect on the company. The compensation committee intends to conduct such a review annually. |

| — | Our compensation philosophy and related corporate governance features are complemented by several specific elements that are designed to align our executive compensation with long-term stockholder interests, including: |

| ¡ | Our change-in-control payments and benefits are reasonable and are based on a “double trigger” (that is, our executive officers are eligible to receive payments and benefits only in connection with a change in control of the company and the termination of the executive without cause or for good reasons within a specified period before or after the change in control). |

-31-

| ¡ | As a general policy, we do not favor non-cash benefits or perquisites (such as guaranteed retirement arrangements or pension plan benefits) for our executive officers that are not available to our employees generally. |

| — | Revised equity grant guidelines to establish a pre-set schedule for granting equity awards and avoid the appearance that grants are made to take advantage of material nonpublic information. |

Compensation Philosophy, Objectives and Design

Compensation Environment and Philosophy

We operate in a new and rapidly evolving market. To succeed in this environment, we must continually refine our business strategy, grow our customer base, increase the attractiveness and capabilities of our products and expand and enhance our product development and sales operations. To achieve these objectives, we need to attract and retain a highly talented and experienced team of design, engineering, sales, marketing, business development, and finance professionals. We expect these individuals to possess and demonstrate strong leadership and management capabilities.

Given our reputation for innovation and our recent success in developing and marketing our data decentralization platform, our executive officers are highly sought after by our competitors and other large organizations. Accordingly, we have had to develop an executive compensation program that not only rewards these individuals for their achievements but also provides sufficient incentives to ensure their continued employment with us.

Compensation Objectives

We strive to provide a total compensation package to our executive officers through a combination of base salary, short-term and long-term incentive opportunities and severance and change-of-control benefits. Our executive compensation program is designed to achieve the following objectives:

| — | attract, motivate, reward, and retain highly-qualified executive officers, whose knowledge, skills and performance are critical to our success; |

| — | motivate these executive officers to pursue our business objectives while encouraging the creation of long-term value for our stockholders; |

| — | provide market-competitive compensation that is designed to provide a foundation of fixed compensation (base salary) and a significant portion of performance-based compensation (short-term and long-term incentive opportunities); and |

| — | align the interests of our executive officers and stockholders. |

Impact of November 2011 Stockholder Advisory Vote on Named Executive Officer Compensation

At our annual meeting of stockholders on November 18, 2011, or our 2011 annual meeting, our first stockholder advisory vote was conducted on the compensation of our executive officers for whom compensation information was disclosed in the proxy statement relating to the 2011 annual meeting, who we refer to as the 2011 named executive officers. This advisory vote is commonly referred to as a “say-on-pay” vote. At our 2011 annual meeting, our stockholders approved the compensation of the 2011 named executive officers, with over 99% of shareholder votes cast in favor of the 2011 named executive officer compensation program. By the time this vote was conducted, most of the decisions

-32-

relating to the compensation of our named executive officers for fiscal 2012 had already been made. For example, base salaries and the cash incentive compensation structure for fiscal 2012 had been established in September 2011. As a result, although carefully reviewed and considered by the compensation committee of our board of directors, the 2011 say-on-pay vote did not have a significant impact on the 2012 compensation of our NEOs. However, in determining 2013 compensation programs for our executive officers, the compensation committee has considered, and will continue to consider in future years, the results of the annual say-on-pay vote. Moreover, in determining how often to hold a stockholder advisory vote on executive compensation, our board of directors took into account our stockholders’ preference (over 98% of votes cast) for an annual vote at the 2011 annual meeting. Specifically, our board of directors determined that we will hold an annual advisory stockholder vote on our named executive officer compensation until our next say-on-pay frequency vote.

Compensation Design

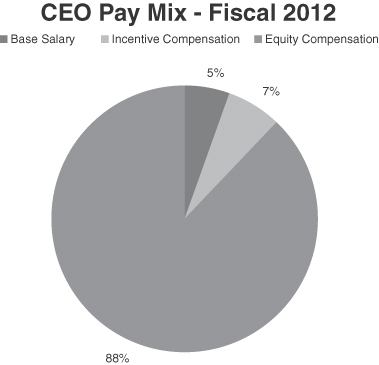

As a new publicly held company, our executive compensation program has been heavily weighted towards equity, primarily in the form of stock options, with cash compensation that generally fell below the median of comparable publicly held companies. We believe that relying primarily on equity compensation has focused our executive officers on driving achievement of our financial and strategic goals while conserving cash during our early years. We continue to believe that making equity awards a key component of executive compensation aligns the executive team with the long-term interests of our stockholders. We also have offered cash compensation in the form of base salaries to reward individual contributions and compensate our executive officers for their day-to-day responsibilities, and short-term (annual) incentive awards to drive excellence and leadership and reward our executives for the achievement of our short-term financial objectives. The following graph shows for our CEO the percentage of each element of his compensation based on the total direct compensation paid to him in fiscal 2012.

-33-

At the beginning of fiscal 2012, with the assistance of Compensia, Inc., a national compensation consulting firm, we evaluated the compensation of each executive officer against our compensation peer group, noting that the total target cash opportunity (that is, base salary and target short-term incentive compensation award) for each of our executive officers in fiscal 2011 was below the 25th percentile of our compensation peer group. As we continue our transition as a publicly held company, we believe it is important to begin aligning our executive compensation against our compensation peer group in order to further our goals of attracting, rewarding, and retaining highly talented individuals, and providing our current and future executives with compensation that is market-competitive. In addition to its review of market competitive compensation levels, the compensation committee of our board of directors also considers executive officer’s job performance, skill set, prior experience, and time in his position, as well as internal equity, pressures to attract and retain talent, and business conditions when determining our executive officers’ pay levels. The actual compensation each executive officer receives also may vary depending on the extent to which we achieve our performance goals each fiscal year.

Compensation-Setting Process

Role of the Compensation Committee

Pursuant to its charter, the compensation committee is responsible for reviewing, evaluating and approving the compensation arrangements for our executive officers and for establishing and maintaining our executive compensation policies and practices. For additional information on the compensation committee, including the scope of its authority, see “Corporate Governance and Board of Directors—Compensation Committee” elsewhere in this proxy statement.

At the beginning of each fiscal year, the compensation committee, after consulting with our CEO, establishes the company’s corporate performance objectives, and, after consulting with our CEO and Compensia, makes decisions with respect to any base salary adjustments, individual performance objectives and individual target short-term incentive award opportunities for our executive officers for the upcoming year, and new equity awards. The compensation committee conducts a bi-annual assessment of the company’s performance and the performance of our executive officers to determine the payouts, if any, for the short-term cash incentive award opportunities.

The compensation committee reviews on an annual basis our executive compensation program, including any incentive compensation plans, to determine whether they are appropriate, properly coordinated and likely to achieve their intended purposes and to make any necessary modifications or adopt any new plans or arrangements.

Role of Management

In carrying out its responsibilities, the compensation committee works with members of our management, including our CEO. Typically, our management assists the compensation committee by providing information on corporate and individual performance, market data and management’s perspective and recommendations on compensation matters.

Historically, the initial compensation arrangements with our executive officers have been determined in negotiations with each individual executive. Typically, our CEO has been responsible for negotiating these arrangements, with the oversight and final approval of our board of directors or, since July 2010, the compensation committee.

Typically, our CEO will make recommendations to the compensation committee regarding compensation matters, including the compensation of our executive officers (except with respect to his own compensation). He also typically attends compensation committee meetings, except with respect to discussions involving his own compensation.

-34-

While the compensation committee solicits and reviews our CEO’s recommendations and proposals with respect to compensation-related matters, the compensation committee only uses these recommendations and proposals as one factor in making compensation decisions.

Role of Compensation Consultant

We engaged Compensia to review our executive compensation policies and practices and to conduct an executive compensation market analysis.

The compensation committee is authorized to retain the services of one or more executive compensation advisors from time to time, as it sees fit, in connection with carrying out its duties and the oversight of our executive compensation program. Compensia serves at the discretion of the compensation committee. In fiscal 2012, Compensia was engaged by the compensation committee to assist in summarizing our executive compensation program, providing its observations regarding our current executive compensation levels versus executive compensation practices of our compensation peer group, highlighting “gaps” to market and offering a framework for potential compensation adjustments, and developing a framework for go-forward equity awards.

Competitive Positioning

The compensation committee compares and analyzes our executive officers’ compensation with those of a peer group of companies. In 2011, the compensation committee, assisted by our management and Compensia, selected a peer group of comparable companies, taking into consideration size and growth potential. This compensation peer group generally consisted of technology companies that had conducted an initial public offering of their equity securities within the last four years and other technology companies of similar size with which we compete in attracting talent. In fiscal 2012, the compensation committee, in consultation with Compensia, made adjustments to the compensation peer group, adding other technology companies that recently conducted initial public offerings and removing companies that had been acquired during the previous 12 months. The median market capitalization of the fiscal 2012 peer group was $2,364.2 million as of August 11, 2011. At the end of fiscal 2011, our market capitalization was approximately $2,441.8 million. We intend to review the compensation peer group at least annually.

The following companies comprised the compensation peer group for fiscal 2012:

| A123 Systems |

Fortinet | |

| Acme Packet |

Infinera | |

| Ancestry.com |

Netsuite | |

| ArcSight |

Qlik Technologies | |

| Aruba Networks |

QuinStreet | |

| Blue Coat Systems |

Rackspace Hosting | |

| CommVault Systems |

Red Hat | |

| Constant Contact |

SuccessFactors | |

| F5 Networks |

-35-

For fiscal 2012, the compensation committee also analyzed the executive compensation programs of certain other larger technology companies with whom the company competes for talent. The compensation committee used this data as a reference point for recruiting and retaining executives but did not factor the executive compensation of these companies into its analysis of the competitiveness of our executive officers’ compensation levels. These companies include the following for fiscal 2012:

| EMC |

salesforce.com | |

| NetApp |

Symantec | |

| Oracle |

VMware |

Compensia used the compensation information reported in the public filings of compensation peer group companies to make its comparisons. Compensia compiled the compensation data from the compensation peer group and prepared assessments to use for benchmarking our executive officer compensation. To remain competitive, we sought to develop a transition plan for our executive compensation program such that by fiscal 2013 the total cash compensation of each executive officer was increased to approximately the 50th percentile of similarly situated executives at our peer group, and equity compensation of each executive officer was decreased to approximately the 75th percentile of similarly situated executives at our peer group. The compensation committee believed these levels were appropriate because they allowed a greater portion of each executive’s compensation to be in the form of equity awards, which link the executive’s financial interests with the long-term interests of our stockholders, while moving toward more market competitive levels of cash compensation. The compensation committee analyzed the data provided by Compensia and used it to set compensation for fiscal 2012 for executive officers (other than Mr. Boberg, whose compensation was determined in negotiations in connection with the purchase of IO Turbine, Inc. in August 2011). The compensation committee also took into consideration its assessment of each executive officer’s job performance and the company’s overall business objectives for fiscal 2012. In particular, the compensation committee set each executive officer’s fiscal 2012 total target cash compensation below the 50th percentile of our peer group and fiscal 2012 equity compensation above the 75th percentile in order to conserve cash resources, while at the same time incentivizing our executive officers through equity compensation that provides them with a financial interest to grow our company.

Executive Compensation Program Components

The following describes each component of our executive compensation program, the rationale for each, and how compensation amounts and awards are determined.

Base Salary

Base salary is the primary fixed component of our executive compensation program. We use base salary to compensate our executive officers for services rendered during the year and to recognize the experience, skills, knowledge and responsibilities required of each executive officer. Historically, we have not applied a specific formula to determine adjustments to base salary. Rather, the base salaries of our executive officers were reviewed on a periodic basis and adjustments made to reflect our economic condition and future expected performance, as well as what our executive officers could be expected to receive if employed at companies similarly situated to ours and our overall subjective assessment of appropriate base salary levels, while being mindful of the need to conserve cash resources.

In September 2011, the compensation committee reviewed the base salaries of our executive officers, taking into consideration Compensia’s compensation analysis and the recommendations of our CEO (except with respect to his own base salary and Mr. Boberg’s base salary), as well as the other factors described above. Compensia’s analysis showed that the fiscal 2011 annual base salaries

-36-

of our executive officers were below the 25th percentile of our compensation peer group. After taking into account the factors described above, the compensation committee increased the base salaries of our executive officers (other than Mr. Boberg) to a level that was market-competitive with our peers and would place each executive officer’s target total cash compensation (cash and short-term incentive compensation opportunity) closer to the 50th percentile of similarly situated executives in our compensation peer group. Each executive officer’s total target cash compensation remained below the 50th percentile of similarly situated executives at our peer group, as we sought to conserve cash resources and fully transition total target cash compensation to the 50th percentile of our peer group by fiscal 2013. We did not benchmark any executive officer’s base salary to a specific percentile.

The base salaries paid to the NEOs during fiscal 2012 are set forth in the table below:

| Named Executive Officer |

Fiscal 2012 Base Salary(1) |

|||

|

Mr. Flynn(1) |

$ | 360,000 | ||

|

Mr. Wolf(2) |

$ | 270,000 | ||

|

Mr. Smith(3) |

$ | 300,000 | ||

|

Mr. Dawson(4) |

$ | 255,000 | ||

|

Mr. Boberg(5) |

$ | 210,000 | ||

| (1) | Mr. Flynn’s base salary was $240,000 for the first two months of fiscal 2012 and increased by $120,000 to $360,000 effective September 1, 2011. |

| (2) | Mr. Wolf’s base salary was $220,000 for the first two months of fiscal 2012 and increased by $50,000 to $270,000 effective September 1, 2011. |

| (3) | Mr. Smith’s base salary was $220,000 for the first two months of fiscal 2012 and increased by $80,000 to $300,000 effective September 1, 2011. |

| (4) | Mr. Dawson’s base salary was $225,000 for the first two months of fiscal 2012 and increased by $30,000 to $255,000 effective September 1, 2011. |

| (5) | Mr. Boberg’s base salary was negotiated in connection with his hiring in August 2011 and was not adjusted in September 2011. |

Short-Term Incentive Compensation

Consistent with our objective of linking a significant portion of each of our executive officer’s total compensation to performance, we provide performance-based short-term incentive opportunities to our executive officers that are based on corporate and individual performance, to achieve our annual financial and operational objectives, while making progress towards our longer-term growth and other goals. Historically, the compensation committee has made short-term incentive awards to our executive officers in its discretion after the end of the fiscal year based on its evaluation of the achievement of one or more corporate objectives as established in our annual operating plan and the individual performance of each executive officer.

Target Short-Term Incentive Award Opportunities

In fiscal 2012, the short-term incentive awards were designed to reward our executive officers based on our overall performance in achieving our financial and business objectives.

Each executive officer (other than Mr. Dawson) participated in the Executive Incentive Compensation Plan. As a participant in this plan, each executive officer’s short-term incentive award was payable bi-annually, based on our achievement against revenue and non-GAAP operating income goals, which were selected by our compensation committee, with input from our CEO and management at the beginning of fiscal 2012. For fiscal 2012, our target annual revenue goal was $350 million and target annual non-GAAP operating income goal was $33.6 million, which were equally weighted metrics under the plan. These performance metrics were selected to motivate our

-37-

management team and encourage growth in our business, and the targets were intentionally challenging and expected to be achieved only with significant effort and leadership from our management team. There was no minimum or maximum threshold for payment.