NYSE American: REI www.ringenergy.com www.ringenergy.com Q3 2025 EARNINGS & UPDATED GUIDANCE

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Forward – Looking Statements This Presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact included in this Presentation, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, guidance, plans and objectives of management are forward- looking statements. When used in this Presentation, the words “could,” “may,” “will,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “guidance,” “project,” “goal,” “plan,” “potential,” “probably,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward- looking statements contain such identifying words. Forward-looking statements also include assumptions and projections for fourth quarter and full year 2025 guidance for sales volumes, oil mix as a percentage of total sales, capital expenditures, and operating expenses and the projected impacts thereon, and the number of wells expected to be drilled and completed. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. However, whether actual results and developments will conform to expectations is subject to a number of material risks and uncertainties, including but not limited to: declines in oil, natural gas liquids or natural gas prices; the level of success in exploration, development and production activities; adverse weather conditions that may negatively impact development or production activities particularly in the winter; the timing of exploration and development expenditures; inaccuracies of reserve estimates or assumptions underlying them; revisions to reserve estimates as a result of changes in commodity prices; impacts to financial statements as a result of impairment write-downs; risks related to level of indebtedness and periodic redeterminations of the borrowing base and interest rates under the Company’s credit facility; Ring’s ability to generate sufficient cash flows from operations to meet the internally funded portion of its capital expenditures budget; the expected benefits to the Company and its stockholders from the acquisition of oil and gas properties (the “LRR Acquisition”) from Lime Rock Resources IV-A, L.P. and Lime Rock Resources IV-C, L.P. (collectively, “Lime Rock” or “LRR”); the impacts of hedging on results of operations; the effects of future regulatory or legislative actions; cost and availability of transportation and storage capacity as a result of oversupply, changes in U.S. energy, environmental, monetary and trade policies, including with respect to tariffs or other trade barriers, and any resulting trade tensions; and Ring’s ability to replace oil and natural gas reserves. Such statements are subject to certain risks and uncertainties which are disclosed in the Company’s reports filed with the Securities and Exchange Commission (“SEC”), including its Form 10-K for the fiscal year ended December 31, 2024, and its other filings with the SEC. All forward-looking statements, expressed or implied, included in this Presentation are expressly qualified by the cautionary statements and by reference to the underlying assumptions that may prove to be incorrect. The Company undertakes no obligation to revise these forward-looking statements to reflect events or circumstances that arise after the date hereof, except as required by applicable law. The financial and operating estimates contained in this Presentation represent our reasonable estimates as of the date of this Presentation. Neither our independent auditors nor any other third party has examined, reviewed or compiled the estimates and, accordingly, none of the foregoing expresses an opinion or other form of assurance with respect thereto. The assumptions upon which the estimates are based are described in more detail herein. Some of these assumptions inevitably will not materialize, and unanticipated events may occur that could affect our results. Therefore, our actual results achieved during the periods covered by the estimates will vary from the estimated results. Investors are not to place undue reliance on the estimates included herein. 2 Supplemental Non-GAAP Financial Measures This Presentation includes financial measures that are not in accordance with accounting principles generally accepted in the United States (“GAAP”), such as “Adjusted Net Income,” “Adjusted EBITDA,” “PV-10,” “Adjusted Free Cash Flow” or “AFCF,” “Adjusted Cash Flow from Operations” or “ACFFO,” “Cash Return on Capital Employed” or “CROCE,” “Leverage Ratio,” “All- in Cash Operating Costs,” and “Cash Operating Margin.” While management believes that such measures are useful for investors, they should not be used as a replacement for financial measures that are in accordance with GAAP. For definitions of such non- GAAP financial measures and their reconciliations to GAAP measures, please see the Appendix. Forward-Looking Statements and Supplemental Non-GAAP Financial Measures

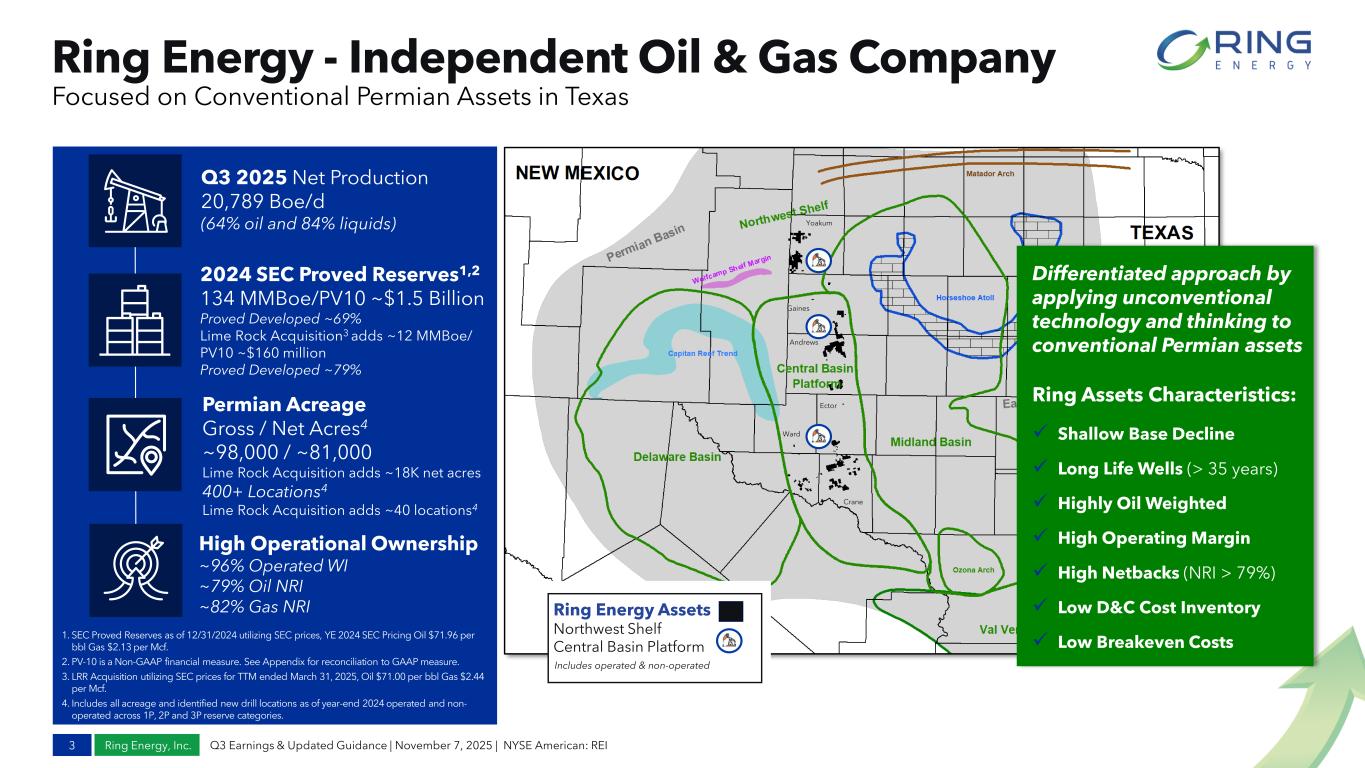

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Ring Energy - Independent Oil & Gas Company 3 Focused on Conventional Permian Assets in Texas Ring Energy Assets Northwest Shelf Central Basin Platform 1. SEC Proved Reserves as of 12/31/2024 utilizing SEC prices, YE 2024 SEC Pricing Oil $71.96 per bbl Gas $2.13 per Mcf. 2. PV-10 is a Non-GAAP financial measure. See Appendix for reconciliation to GAAP measure. 3. LRR Acquisition utilizing SEC prices for TTM ended March 31, 2025, Oil $71.00 per bbl Gas $2.44 per Mcf. 4. Includes all acreage and identified new drill locations as of year-end 2024 operated and non- operated across 1P, 2P and 3P reserve categories. Q3 2025 Net Production 20,789 Boe/d (64% oil and 84% liquids) 2024 SEC Proved Reserves1,2 134 MMBoe/PV10 ~$1.5 Billion Proved Developed ~69% Lime Rock Acquisition3 adds ~12 MMBoe/ PV10 ~$160 million Proved Developed ~79% Permian Acreage Gross / Net Acres4 ~98,000 / ~81,000 Lime Rock Acquisition adds ~18K net acres 400+ Locations4 Lime Rock Acquisition adds ~40 locations4 Includes operated & non-operated Differentiated approach by applying unconventional technology and thinking to conventional Permian assets Ring Assets Characteristics: ✓ Shallow Base Decline ✓ Long Life Wells (> 35 years) ✓ Highly Oil Weighted ✓ High Operating Margin ✓ High Netbacks (NRI > 79%) ✓ Low D&C Cost Inventory ✓ Low Breakeven Costs Yoakum Gaines Andrews Ector Crane Ward High Operational Ownership ~96% Operated WI ~79% Oil NRI ~82% Gas NRI

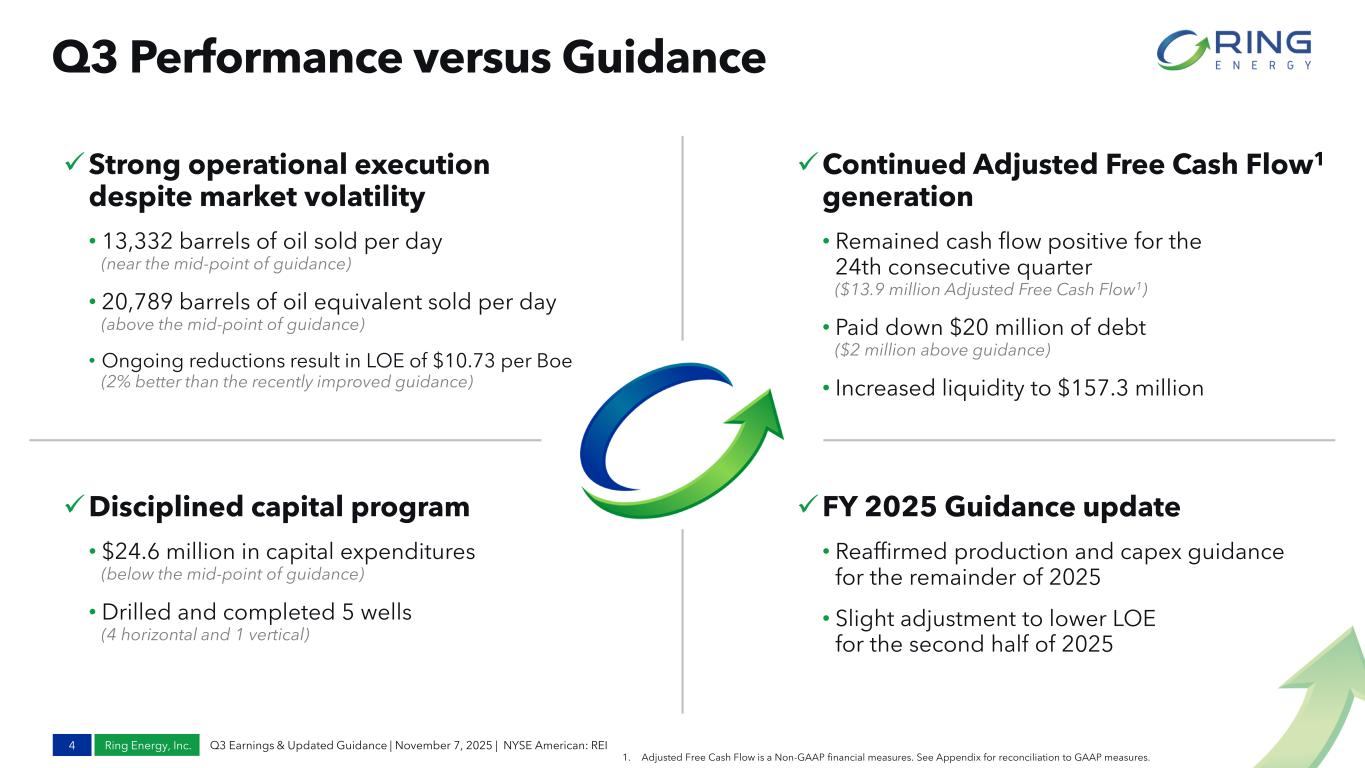

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Q3 Performance versus Guidance 4 1. Adjusted Free Cash Flow is a Non-GAAP financial measures. See Appendix for reconciliation to GAAP measures. ✓FY 2025 Guidance update • Reaffirmed production and capex guidance for the remainder of 2025 • Slight adjustment to lower LOE for the second half of 2025 ✓Disciplined capital program • $24.6 million in capital expenditures (below the mid-point of guidance) • Drilled and completed 5 wells (4 horizontal and 1 vertical) ✓Continued Adjusted Free Cash Flow1 generation • Remained cash flow positive for the 24th consecutive quarter ($13.9 million Adjusted Free Cash Flow1) • Paid down $20 million of debt ($2 million above guidance) • Increased liquidity to $157.3 million ✓Strong operational execution despite market volatility • 13,332 barrels of oil sold per day (near the mid-point of guidance) • 20,789 barrels of oil equivalent sold per day (above the mid-point of guidance) • Ongoing reductions result in LOE of $10.73 per Boe (2% better than the recently improved guidance)

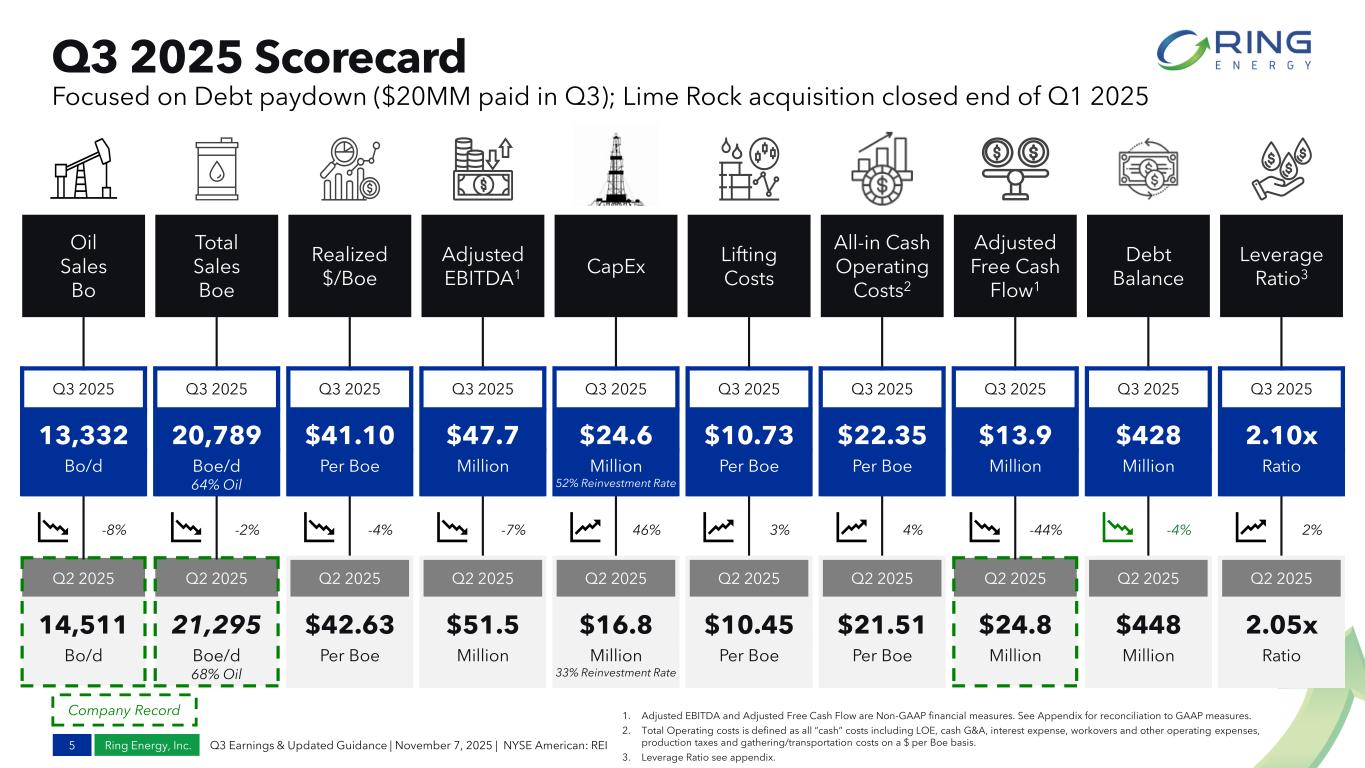

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Oil Sales Bo Total Sales Boe Realized $/Boe Adjusted EBITDA1 CapEx L i Lifting Costs All-in Cash Operating Costs2 Adjusted Free Cash Flow1 Debt Balance Leverage Ratio3 Q3 2025 Q3 2025 Q3 2025 Q3 2025 Q3 2025 Q3 2025 Q3 2025 Q3 2025 Q3 2025 Q3 2025 13,332 20,789 $41.10 $47.7 $24.6 $10.73 $22.35 $13.9 $428 2.10x Bo/d Boe/d 64% Oil Per Boe Million Million 52% Reinvestment Rate Per Boe Per Boe Million Million Ratio -8% -2% -4% -7% 46% 3% 4% -44% -4% 2% Q2 2025 Q2 2025 Q2 2025 Q2 2025 Q2 2025 Q2 2025 Q2 2025 Q2 2025 Q2 2025 Q2 2025 14,511 21,295 $42.63 $51.5 $16.8 $10.45 $21.51 $24.8 $448 2.05x Bo/d Boe/d 68% Oil Per Boe Million Million 33% Reinvestment Rate Per Boe Per Boe Million Million Ratio Q3 2025 Scorecard 5 Focused on Debt paydown ($20MM paid in Q3); Lime Rock acquisition closed end of Q1 2025 1. Adjusted EBITDA and Adjusted Free Cash Flow are Non-GAAP financial measures. See Appendix for reconciliation to GAAP measures. 2. Total Operating costs is defined as all “cash” costs including LOE, cash G&A, interest expense, workovers and other operating expenses, production taxes and gathering/transportation costs on a $ per Boe basis. 3. Leverage Ratio see appendix. Company Record

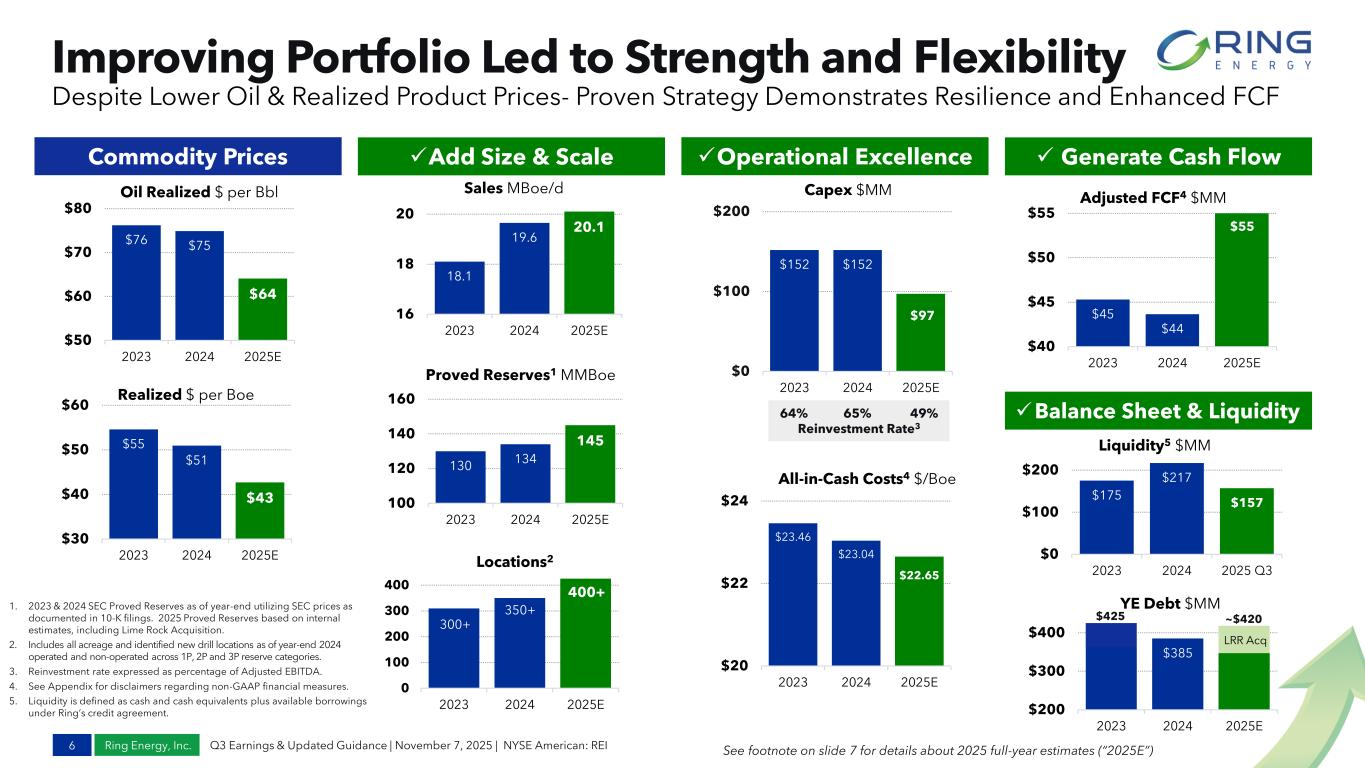

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Improving Portfolio Led to Strength and Flexibility 6 Despite Lower Oil & Realized Product Prices- Proven Strategy Demonstrates Resilience and Enhanced FCF See footnote on slide 7 for details about 2025 full-year estimates (“2025E”) 18.1 19.6 20.1 16 18 20 2023 2024 2025E Sales MBoe/d 0 100 200 300 400 2023 2024 2025E Locations2 130 134 145 100 120 140 160 2023 2024 2025E Proved Reserves1 MMBoe $23.46 $23.04 $22.65 $20 $22 $24 2023 2024 2025E All-in-Cash Costs4 $/Boe $152 $152 $97 $0 $100 $200 2023 2024 2025E Capex $MM ✓Operational Excellence✓Add Size & Scale ✓ Generate Cash Flow $45 $44 $55 $40 $45 $50 $55 2023 2024 2025E Adjusted FCF4 $MM Commodity Prices $76 $75 $64 $50 $60 $70 $80 2023 2024 2025E Oil Realized $ per Bbl $55 $51 $43 $30 $40 $50 $60 2023 2024 2025E Realized $ per Boe $175 $217 $157 $0 $100 $200 2023 2024 2025 Q3 Liquidity5 $MM $385 $200 $300 $400 2023 2024 2025E YE Debt $MM LRR Acq 300+ 350+ 400+ ✓Balance Sheet & Liquidity64% 65% 49% Reinvestment Rate3 $425 ~$420 1. 2023 & 2024 SEC Proved Reserves as of year-end utilizing SEC prices as documented in 10-K filings. 2025 Proved Reserves based on internal estimates, including Lime Rock Acquisition. 2. Includes all acreage and identified new drill locations as of year-end 2024 operated and non-operated across 1P, 2P and 3P reserve categories. 3. Reinvestment rate expressed as percentage of Adjusted EBITDA. 4. See Appendix for disclaimers regarding non-GAAP financial measures. 5. Liquidity is defined as cash and cash equivalents plus available borrowings under Ring’s credit agreement.

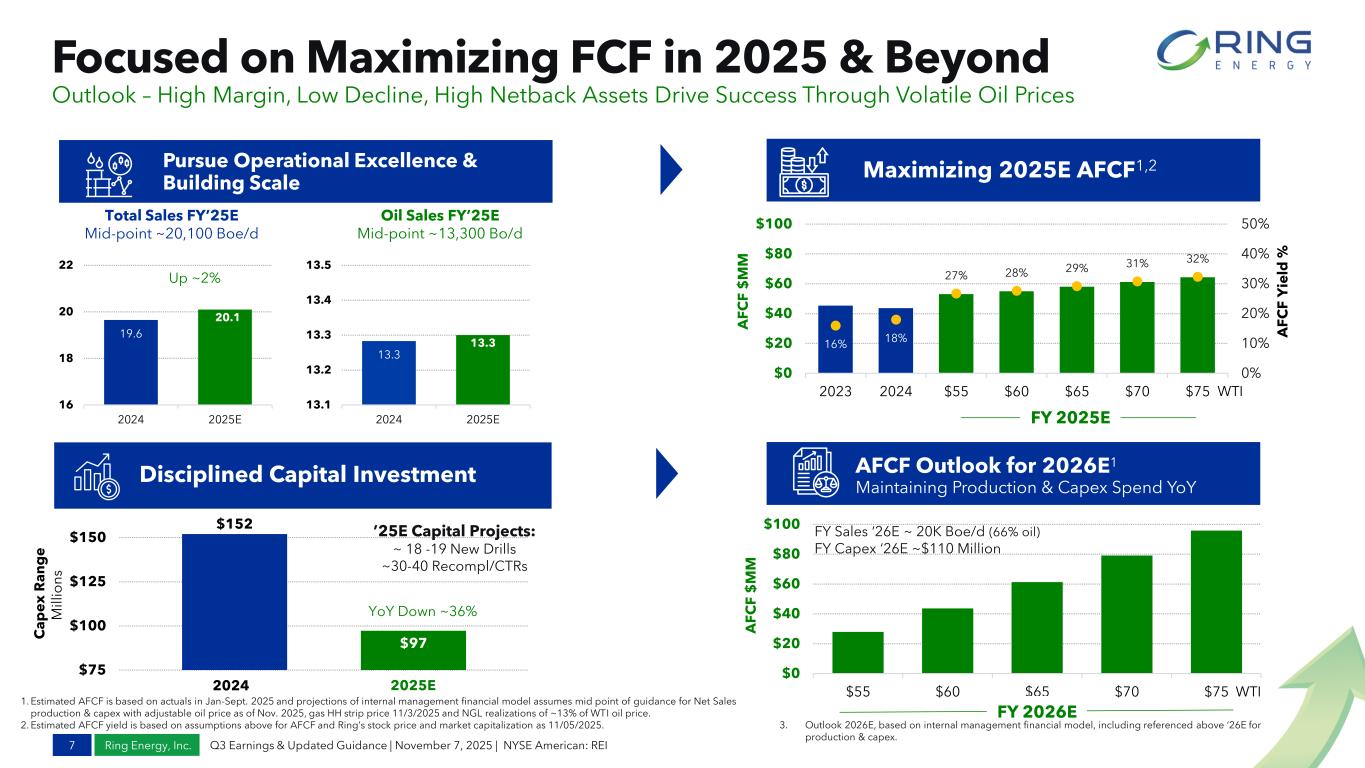

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI FY 2025E WTI $0 $20 $40 $60 $80 $100 $55 $60 $65 $70 $75 A F C F $ M M 13.3 13.3 13.1 13.2 13.3 13.4 13.5 2024 2025E Oil Sales FY’25E Mid-point ~13,300 Bo/d FY 2026E Focused on Maximizing FCF in 2025 & Beyond 7 Outlook – High Margin, Low Decline, High Netback Assets Drive Success Through Volatile Oil Prices 1. Estimated AFCF is based on actuals in Jan-Sept. 2025 and projections of internal management financial model assumes mid point of guidance for Net Sales production & capex with adjustable oil price as of Nov. 2025, gas HH strip price 11/3/2025 and NGL realizations of ~13% of WTI oil price. 2. Estimated AFCF yield is based on assumptions above for AFCF and Ring’s stock price and market capitalization as 11/05/2025. $152 $97 $75 $100 $125 $150 C a p e x R a n g e M il li o n s 2025E 16% 18% 27% 28% 29% 31% 32% 0% 10% 20% 30% 40% 50% $0 $20 $40 $60 $80 $100 2023 2024 $55 $60 $65 $70 $75 A F C F Y ie ld % A F C F $ M M Pursue Operational Excellence & Building Scale Maximizing 2025E AFCF1,2 AFCF Outlook for 2026E1 Maintaining Production & Capex Spend YoY Disciplined Capital Investment ’25E Capital Projects: ~ 18 -19 New Drills ~30-40 Recompl/CTRs FY Sales ‘26E ~ 20K Boe/d (66% oil) FY Capex ‘26E ~$110 Million 2024 Total Sales FY’25E Mid-point ~20,100 Boe/d 19.6 20.1 16 18 20 22 2024 2025E Up ~2% 3. Outlook 2026E, based on internal management financial model, including referenced above ‘26E for production & capex. YoY Down ~36% WTI

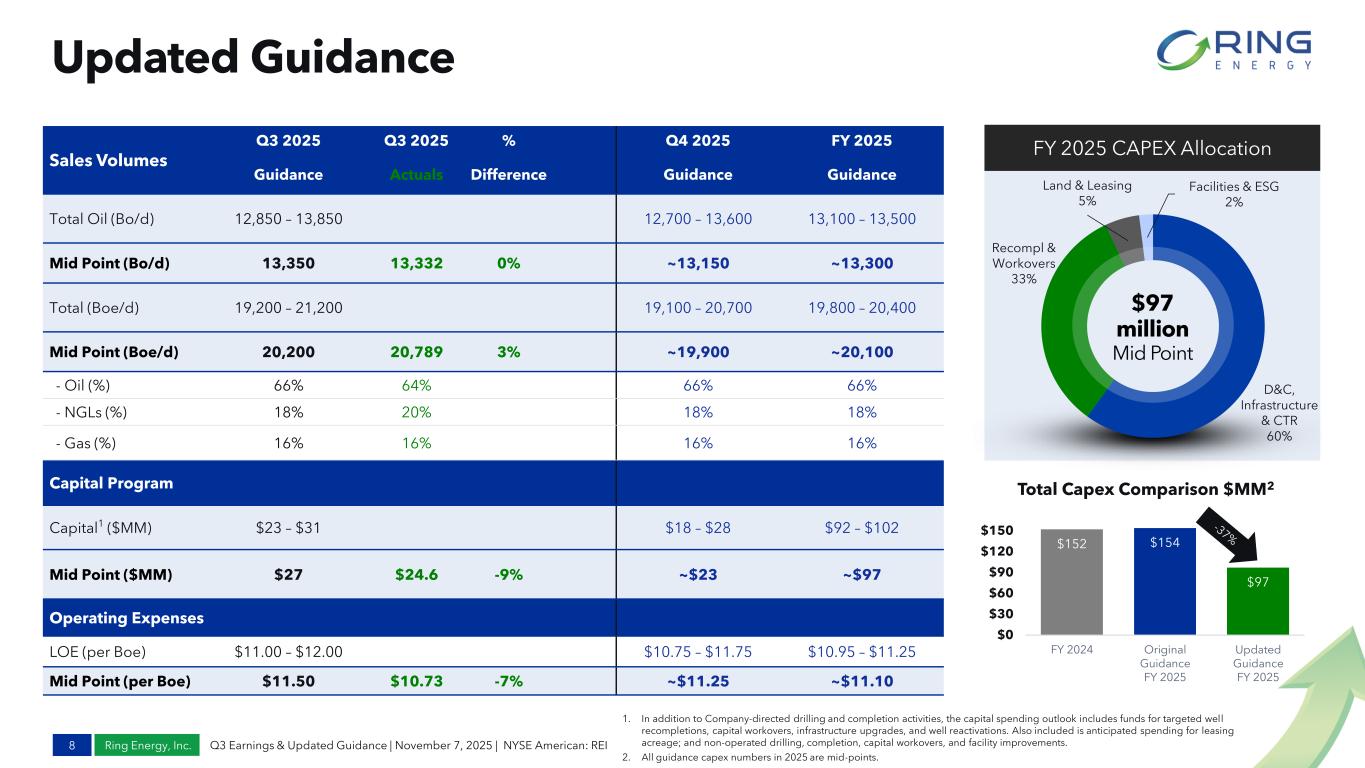

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI D&C, Infrastructure & CTR 60% Recompl & Workovers 33% Land & Leasing 5% Facilities & ESG 2% Sales Volumes Q3 2025 Q3 2025 % Q4 2025 FY 2025 Guidance Actuals Difference Guidance Guidance Total Oil (Bo/d) 12,850 – 13,850 12,700 – 13,600 13,100 – 13,500 Mid Point (Bo/d) 13,350 13,332 0% ~13,150 ~13,300 Total (Boe/d) 19,200 – 21,200 19,100 – 20,700 19,800 – 20,400 Mid Point (Boe/d) 20,200 20,789 3% ~19,900 ~20,100 - Oil (%) 66% 64% 66% 66% - NGLs (%) 18% 20% 18% 18% - Gas (%) 16% 16% 16% 16% Capital Program Capital1 ($MM) $23 – $31 $18 – $28 $92 – $102 Mid Point ($MM) $27 $24.6 -9% ~$23 ~$97 Operating Expenses LOE (per Boe) $11.00 – $12.00 $10.75 – $11.75 $10.95 – $11.25 Mid Point (per Boe) $11.50 $10.73 -7% ~$11.25 ~$11.10 Updated Guidance 8 1. In addition to Company-directed drilling and completion activities, the capital spending outlook includes funds for targeted well recompletions, capital workovers, infrastructure upgrades, and well reactivations. Also included is anticipated spending for leasing acreage; and non-operated drilling, completion, capital workovers, and facility improvements. 2. All guidance capex numbers in 2025 are mid-points. FY 2025 CAPEX Allocation $97 million Mid Point $152 $154 $97 $0 $30 $60 $90 $120 $150 FY 2024 Original Guidance FY 2025 Updated Guidance FY 2025 Total Capex Comparison $MM2

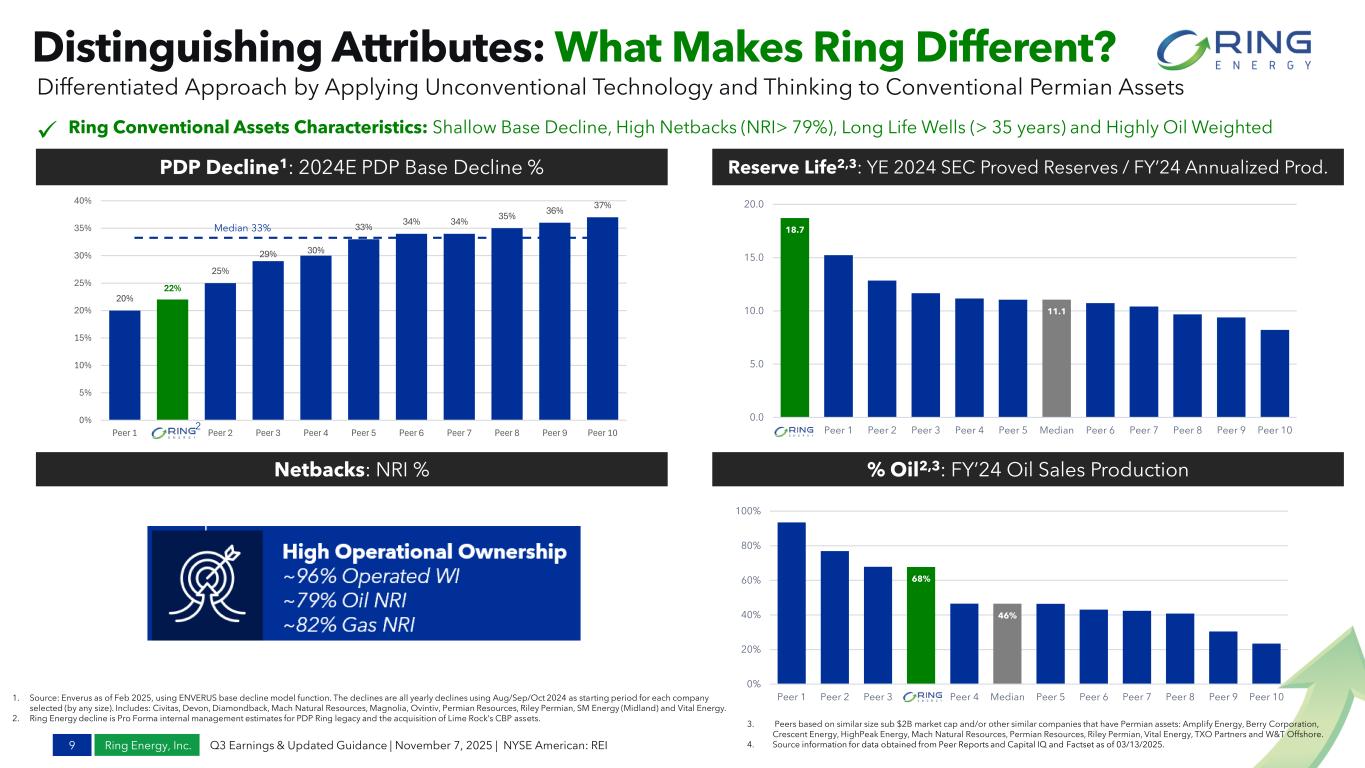

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI 18.7 11.1 0.0 5.0 10.0 15.0 20.0 REI Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Median Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 68% 46% 0% 20% 40% 60% 80% 100% Peer 1 Peer 2 Peer 3 REI Peer 4 Median Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 20% 22% 25% 29% 30% 33% 34% 34% 35% 36% 37% 0% 5% 10% 15% 20% 25% 30% 35% 40% Peer 1 Ring Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Distinguishing Attributes: What Makes Ring Different? 9 Netbacks: NRI % 1. Source: Enverus as of Feb 2025, using ENVERUS base decline model function. The declines are all yearly declines using Aug/Sep/Oct 2024 as starting period for each company selected (by any size). Includes: Civitas, Devon, Diamondback, Mach Natural Resources, Magnolia, Ovintiv, Permian Resources, Riley Permian, SM Energy (Midland) and Vital Energy. 2. Ring Energy decline is Pro Forma internal management estimates for PDP Ring legacy and the acquisition of Lime Rock’s CBP assets. Differentiated Approach by Applying Unconventional Technology and Thinking to Conventional Permian Assets PDP Decline1: 2024E PDP Base Decline % Reserve Life2,3: YE 2024 SEC Proved Reserves / FY’24 Annualized Prod. % Oil2,3: FY’24 Oil Sales Production Median 33% ✓ Ring Conventional Assets Characteristics: Shallow Base Decline, High Netbacks (NRI> 79%), Long Life Wells (> 35 years) and Highly Oil Weighted 3. Peers based on similar size sub $2B market cap and/or other similar companies that have Permian assets: Amplify Energy, Berry Corporation, Crescent Energy, HighPeak Energy, Mach Natural Resources, Permian Resources, Riley Permian, Vital Energy, TXO Partners and W&T Offshore. 4. Source information for data obtained from Peer Reports and Capital IQ and Factset as of 03/13/2025. 2

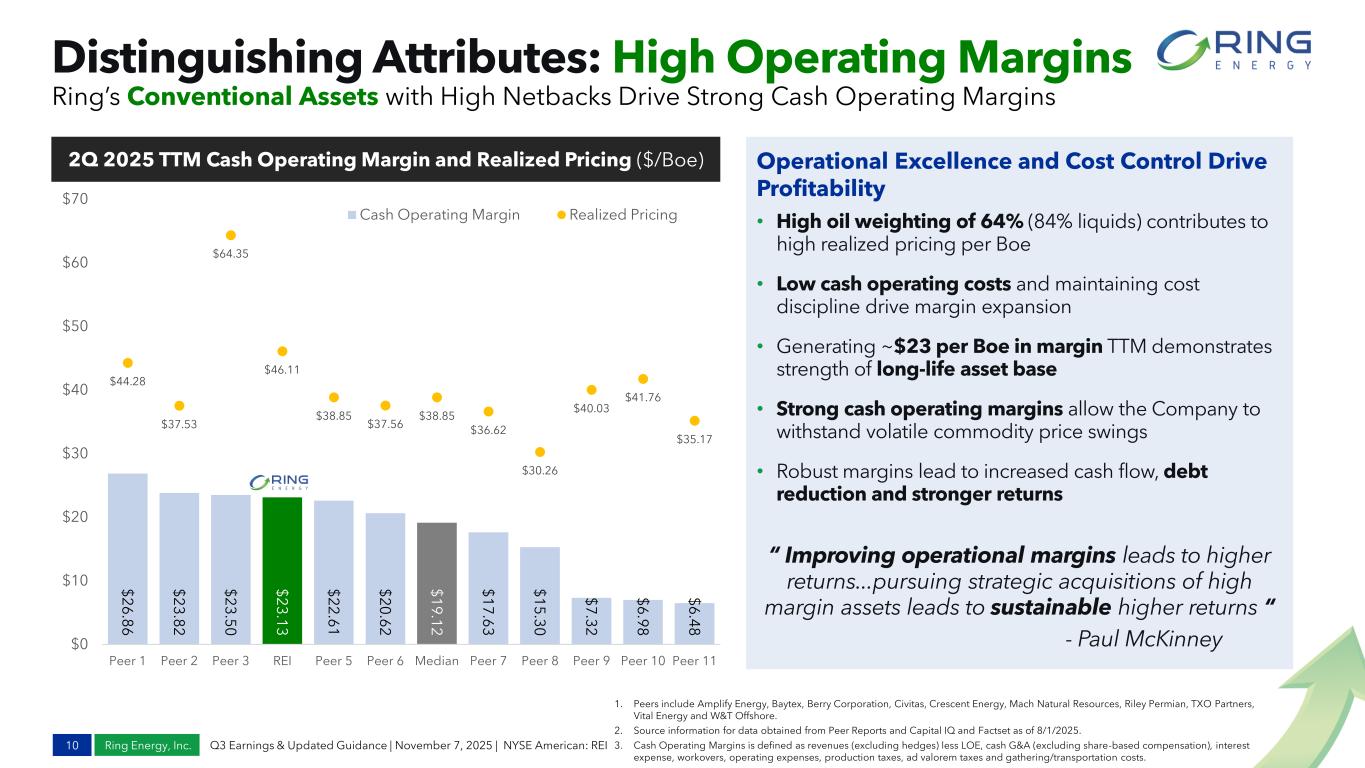

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI $ 6 .4 8 $ 6 .9 8 $ 7 .3 2 $ 1 5 .3 0 $ 1 7 .6 3 $ 1 9 .1 2 $ 2 0 .6 2 $ 2 2 .6 1 $ 2 3 .1 3 $ 2 3 .5 0 $ 2 3 .8 2 $ 2 6 .8 6 $35.17 $41.76 $40.03 $30.26 $36.62 $38.85 $37.56 $38.85 $46.11 $64.35 $37.53 $44.28 $0 $10 $20 $30 $40 $50 $60 $70 Peer 11Peer 10Peer 9Peer 8Peer 7MedianPeer 6Peer 5REIPeer 3Peer 2Peer 1 Cash Operating Margin Realized Pricing Distinguishing Attributes: High Operating Margins 10 Ring’s Conventional Assets with High Netbacks Drive Strong Cash Operating Margins 1. Peers include Amplify Energy, Baytex, Berry Corporation, Civitas, Crescent Energy, Mach Natural Resources, Riley Permian, TXO Partners, Vital Energy and W&T Offshore. 2. Source information for data obtained from Peer Reports and Capital IQ and Factset as of 8/1/2025. 3. Cash Operating Margins is defined as revenues (excluding hedges) less LOE, cash G&A (excluding share-based compensation), interest expense, workovers, operating expenses, production taxes, ad valorem taxes and gathering/transportation costs. 2Q 2025 TTM Cash Operating Margin and Realized Pricing ($/Boe) Operational Excellence and Cost Control Drive Profitability • High oil weighting of 64% (84% liquids) contributes to high realized pricing per Boe • Low cash operating costs and maintaining cost discipline drive margin expansion • Generating ~$23 per Boe in margin TTM demonstrates strength of long-life asset base • Strong cash operating margins allow the Company to withstand volatile commodity price swings • Robust margins lead to increased cash flow, debt reduction and stronger returns “ Improving operational margins leads to higher returns...pursuing strategic acquisitions of high margin assets leads to sustainable higher returns “ - Paul McKinney

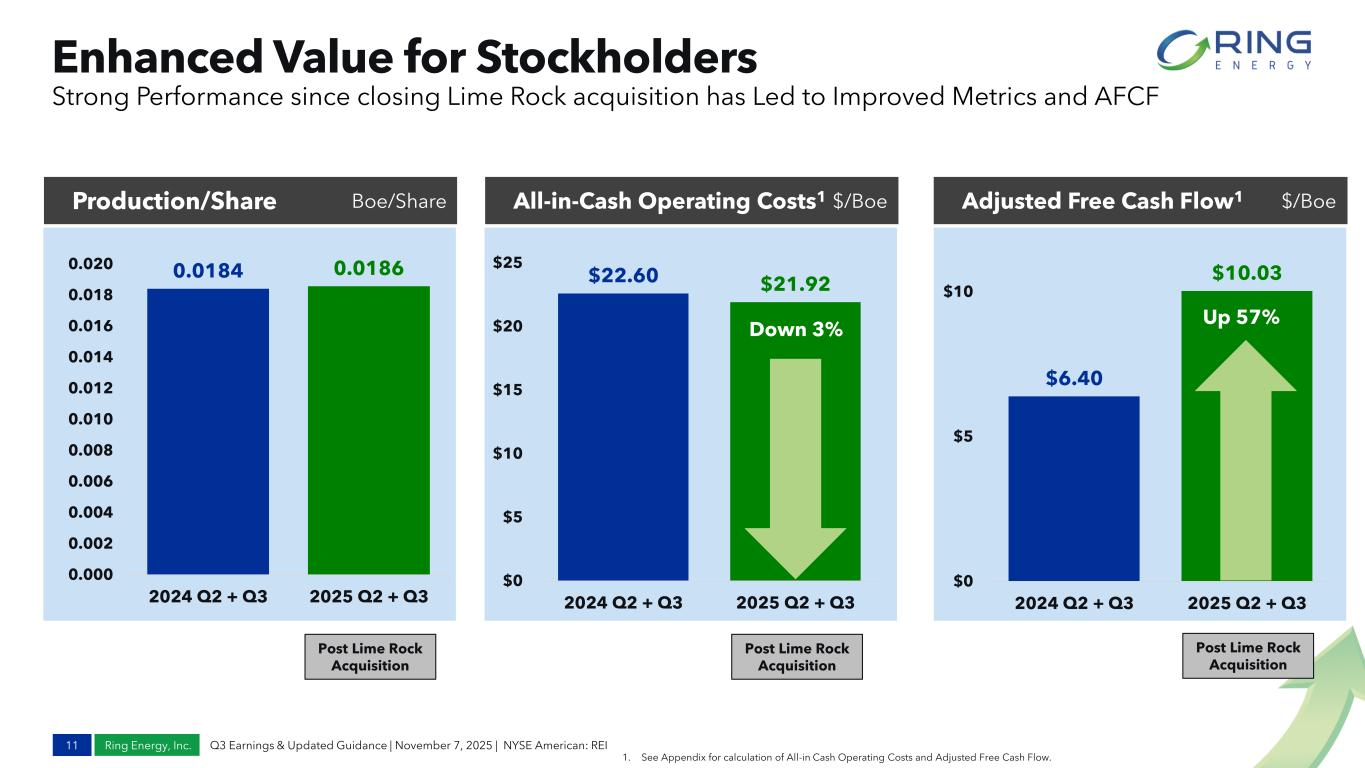

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI 0.0184 0.0186 0.000 0.002 0.004 0.006 0.008 0.010 0.012 0.014 0.016 0.018 0.020 2024 Q2 + Q3 2025 Q2 + Q3 Enhanced Value for Stockholders 11 Strong Performance since closing Lime Rock acquisition has Led to Improved Metrics and AFCF 1. See Appendix for calculation of All-in Cash Operating Costs and Adjusted Free Cash Flow. Production/Share Boe/Share All-in-Cash Operating Costs1 $/Boe Adjusted Free Cash Flow1 $/Boe $22.60 $21.92 $0 $5 $10 $15 $20 $25 2024 Q2 + Q3 2025 Q2 + Q3 $6.40 $10.03 $0 $5 $10 2024 Q2 + Q3 2025 Q2 + Q3 Down 3% Up 57% Post Lime Rock Acquisition Post Lime Rock Acquisition Post Lime Rock Acquisition

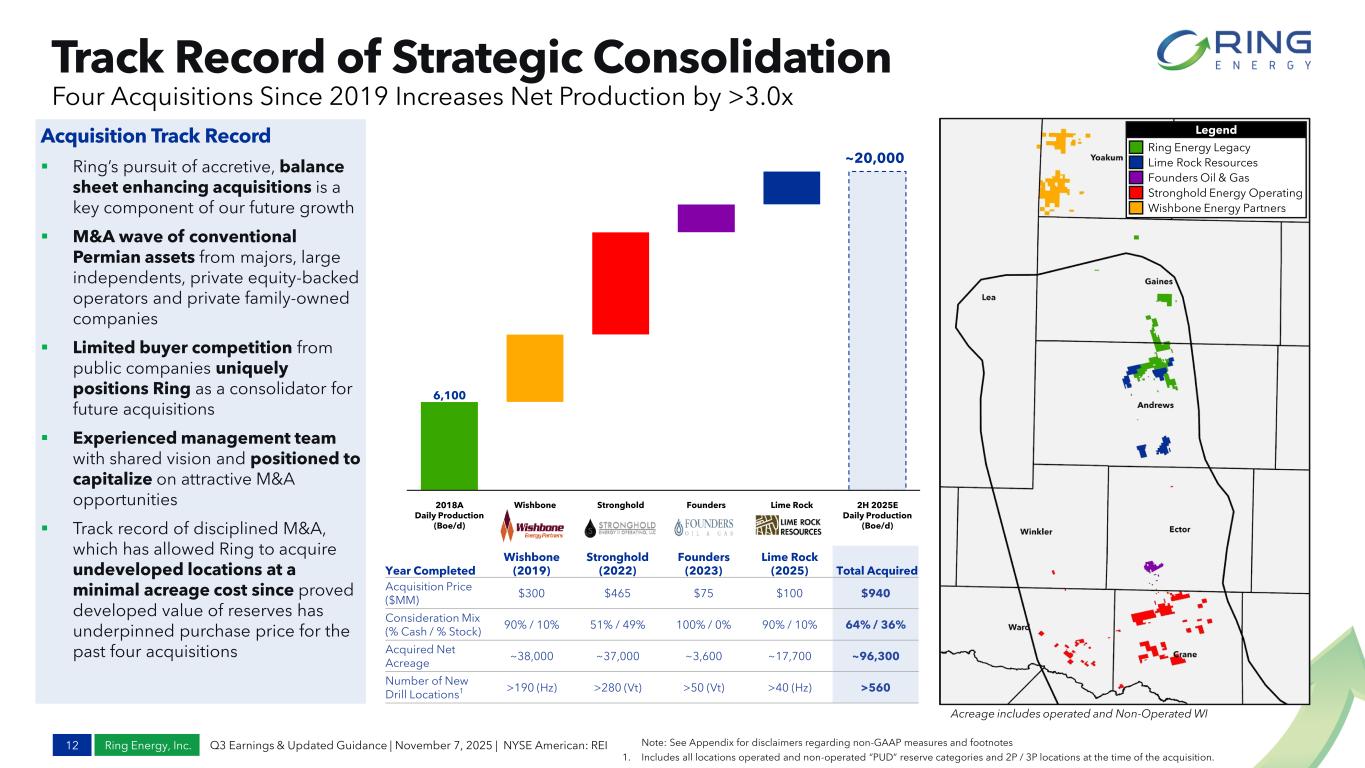

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Track Record of Strategic Consolidation 12 Four Acquisitions Since 2019 Increases Net Production by >3.0x Note: See Appendix for disclaimers regarding non-GAAP measures and footnotes 1. Includes all locations operated and non-operated “PUD” reserve categories and 2P / 3P locations at the time of the acquisition. Acquisition Track Record ▪ Ring’s pursuit of accretive, balance sheet enhancing acquisitions is a key component of our future growth ▪ M&A wave of conventional Permian assets from majors, large independents, private equity-backed operators and private family-owned companies ▪ Limited buyer competition from public companies uniquely positions Ring as a consolidator for future acquisitions ▪ Experienced management team with shared vision and positioned to capitalize on attractive M&A opportunities ▪ Track record of disciplined M&A, which has allowed Ring to acquire undeveloped locations at a minimal acreage cost since proved developed value of reserves has underpinned purchase price for the past four acquisitions Year Completed Wishbone (2019) Stronghold (2022) Founders (2023) Lime Rock (2025) Total Acquired Acquisition Price ($MM) $300 $465 $75 $100 $940 Consideration Mix (% Cash / % Stock) 90% / 10% 51% / 49% 100% / 0% 90% / 10% 64% / 36% Acquired Net Acreage ~38,000 ~37,000 ~3,600 ~17,700 ~96,300 Number of New Drill Locations1 >190 (Hz) >280 (Vt) >50 (Vt) >40 (Hz) >560 Acreage includes operated and Non-Operated WI Legend Ring Energy Legacy Lime Rock Resources Founders Oil & Gas Stronghold Energy Operating Wishbone Energy Partners ~20,000 Updated guidance 6,100 2018A Daily Production (Boe/d) Wishbone Stronghold Founders Lime Rock 2H 2025E Daily Production (Boe/d)

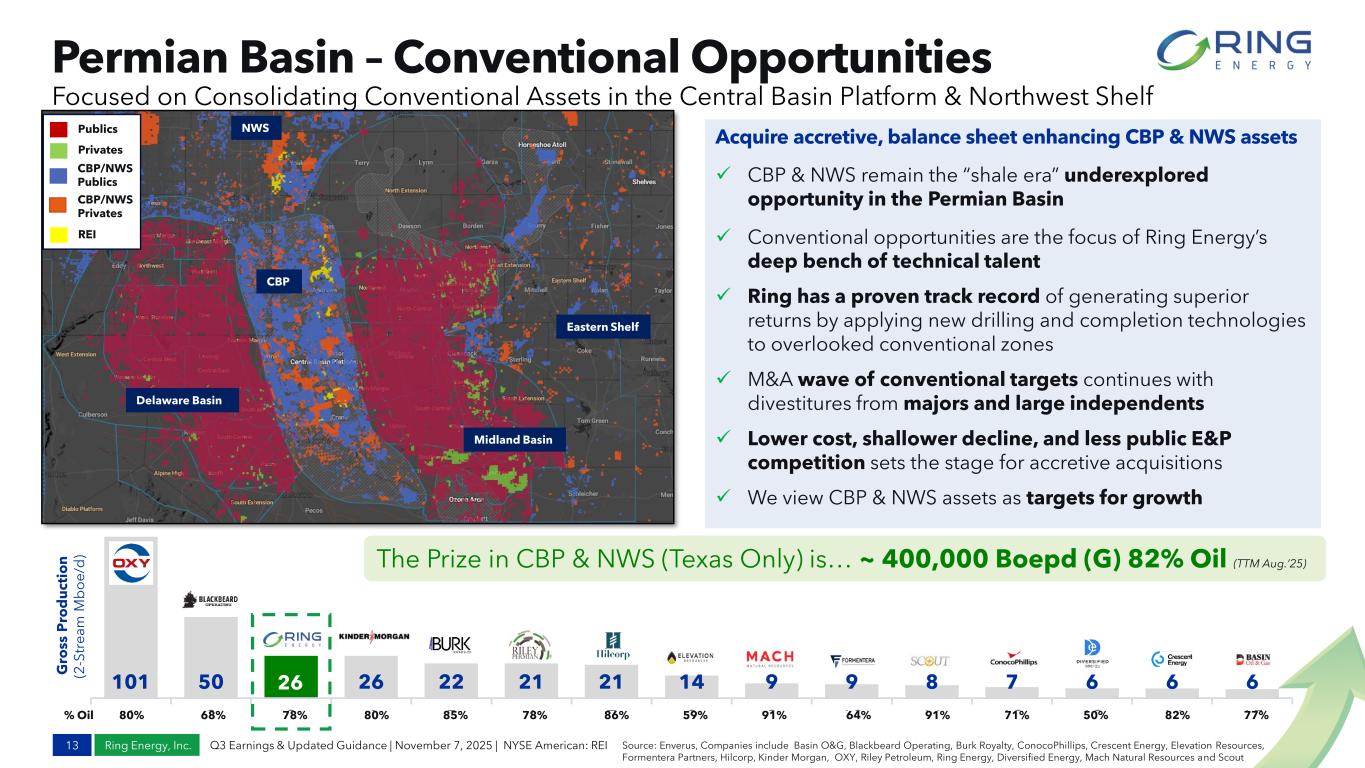

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI G ro ss P ro d u c ti o n (2 -S tr e a m M b o e /d ) Permian Basin – Conventional Opportunities 13 Focused on Consolidating Conventional Assets in the Central Basin Platform & Northwest Shelf Source: Enverus, Companies include Basin O&G, Blackbeard Operating, Burk Royalty, ConocoPhillips, Crescent Energy, Elevation Resources, Formentera Partners, Hilcorp, Kinder Morgan, OXY, Riley Petroleum, Ring Energy, Diversified Energy, Mach Natural Resources and Scout 101 50 26 26 22 21 21 14 9 9 8 7 6 6 6 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Delaware Basin CBP NWS Eastern Shelf Midland Basin Publics Privates REI CBP/NWS Publics CBP/NWS Privates The Prize in CBP & NWS (Texas Only) is… ~ 400,000 Boepd (G) 82% Oil (TTM Aug.’25) % Oil 80% 68% 78% 80% 85% 78% 86% 59% 91% 64% 91% 71% 50% 82% 77% Acquire accretive, balance sheet enhancing CBP & NWS assets ✓ CBP & NWS remain the “shale era” underexplored opportunity in the Permian Basin ✓ Conventional opportunities are the focus of Ring Energy’s deep bench of technical talent ✓ Ring has a proven track record of generating superior returns by applying new drilling and completion technologies to overlooked conventional zones ✓ M&A wave of conventional targets continues with divestitures from majors and large independents ✓ Lower cost, shallower decline, and less public E&P competition sets the stage for accretive acquisitions ✓ We view CBP & NWS assets as targets for growth

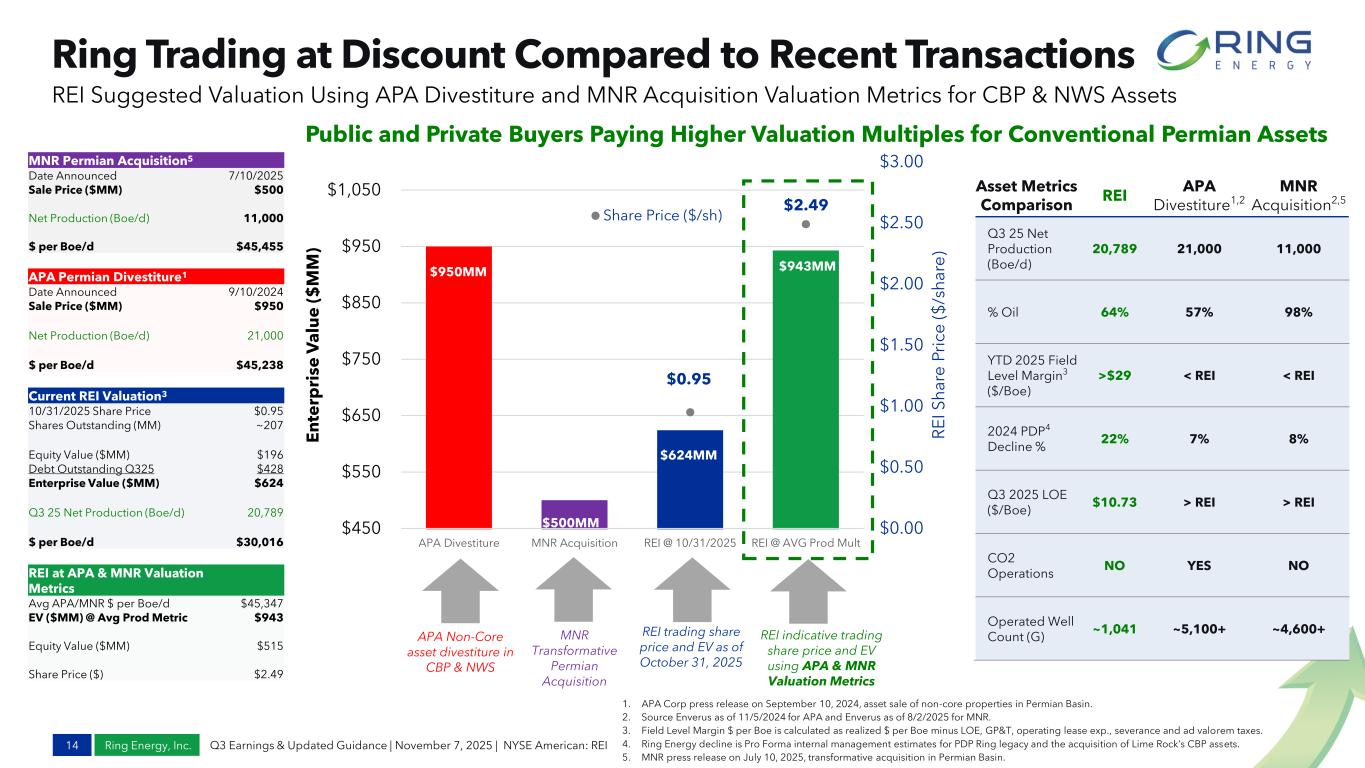

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI $0.95 $2.49 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $450 $550 $650 $750 $850 $950 $1,050 APA Divestiture MNR Acquisition REI @ 10/31/2025 REI @ AVG Prod Mult R E I S h a re P ri ce ( $ /s h a re ) E n te rp ri se V a lu e ( $ M M ) Share Price ($/sh) Ring Trading at Discount Compared to Recent Transactions 14 REI Suggested Valuation Using APA Divestiture and MNR Acquisition Valuation Metrics for CBP & NWS Assets 1. APA Corp press release on September 10, 2024, asset sale of non-core properties in Permian Basin. 2. Source Enverus as of 11/5/2024 for APA and Enverus as of 8/2/2025 for MNR. 3. Field Level Margin $ per Boe is calculated as realized $ per Boe minus LOE, GP&T, operating lease exp., severance and ad valorem taxes. 4. Ring Energy decline is Pro Forma internal management estimates for PDP Ring legacy and the acquisition of Lime Rock’s CBP assets. 5. MNR press release on July 10, 2025, transformative acquisition in Permian Basin. Public and Private Buyers Paying Higher Valuation Multiples for Conventional Permian Assets $950MM $624MM $943MM APA Non-Core asset divestiture in CBP & NWS REI trading share price and EV as of October 31, 2025 REI indicative trading share price and EV using APA & MNR Valuation Metrics $500MM MNR Transformative Permian Acquisition Asset Metrics Comparison REI APA Divestiture1,2 MNR Acquisition2,5 Q3 25 Net Production (Boe/d) 20,789 21,000 11,000 % Oil 64% 57% 98% YTD 2025 Field Level Margin3 ($/Boe) >$29 < REI < REI 2024 PDP4 Decline % 22% 7% 8% Q3 2025 LOE ($/Boe) $10.73 > REI > REI CO2 Operations NO YES NO Operated Well Count (G) ~1,041 ~5,100+ ~4,600+ MNR Permian Acquisition5 Date Announced 7/10/2025 Sale Price ($MM) $500 Net Production (Boe/d) 11,000 $ per Boe/d $45,455 APA Permian Divestiture1 Date Announced 9/10/2024 Sale Price ($MM) $950 Net Production (Boe/d) 21,000 $ per Boe/d $45,238 Current REI Valuation3 10/31/2025 Share Price $0.95 Shares Outstanding (MM) ~207 Equity Value ($MM) $196 Debt Outstanding Q325 $428 Enterprise Value ($MM) $624 Q3 25 Net Production (Boe/d) 20,789 $ per Boe/d $30,016 REI at APA & MNR Valuation Metrics Avg APA/MNR $ per Boe/d $45,347 EV ($MM) @ Avg Prod Metric $943 Equity Value ($MM) $515 Share Price ($) $2.49

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI REI Historical Price Performance1 Price Performance Since January 1, 2021 1. Sources Factset as of 11/5/202515 6.5 MM warrants exercised Stronghold Acquisition Announcement Founders Acquisition Announcement Warburg Pincus sells down 6.2 MM shares Warburg Pincus sells down 2.5 MM shares 8-K disclosing Warburg is out 3.0 MM warrants excercised 4.5 MM warrants excercised 14.5 MM warrants excercised Warburg Pincus sells down 12.6 MM shares Warburg Pincus sells down 4.4 MM shares Warburg Pincus sells down 6.6 MM shares Warburg Pincus sells down 6 MM shares Warburg Pincus owns 5.5MM shares (2.65%) $0 $20 $40 $60 $80 $100 $120 $0 $1 $2 $3 $4 $5 $6 Jan 21 Apr 21 Jul 21 Oct 21 Jan 22 Apr 22 Jul 22 Oct 22 Jan 23 Apr 23 Jul 23 Oct 23 Jan 24 Apr 24 Jul 24 Oct 24 Jan 25 Apr 25 Jul 25 Oct 25 Quarterly Filing Date Ring Energy, Inc. ($/share) - Left WTI Crude Oil ($/bbl) - Right

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Robust Value Proposition Through Commodity Price Cycles 16 2025 and Beyond Target leverage ratio below 1.0x and position Ring to return capital to stockholders Remaining focused on maximizing FCF generation to strengthen the balance sheet Strong Cash Operating margins help deliver superior results & helps manage risk in market downturns Disciplined capital program retains flexibility to respond to changing market conditions, delivering competitive returns Pursuing accretive, balance sheet enhancing acquisitions to increase scale, lower break-even costs, build inventory and accelerate ability to pay down debt

www.ringenergy.com | NYSE American: REI Q3 EARNINGS & UPDATED GUIDANCE | NOVEMBER 7, 2025 FINANCIAL OVERVIEW

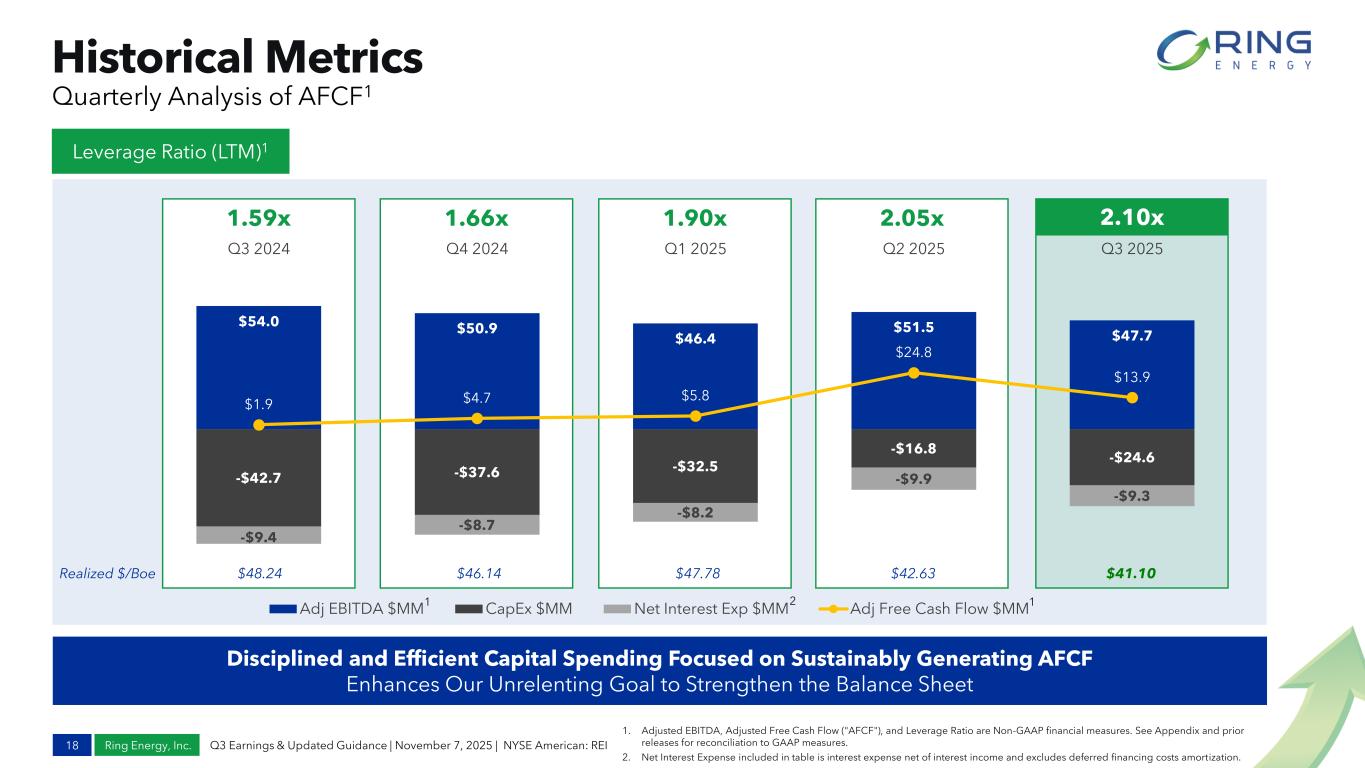

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI 1.59x 1.66x 1.90x 2.05x Historical Metrics 18 Quarterly Analysis of AFCF1 1. Adjusted EBITDA, Adjusted Free Cash Flow ("AFCF"), and Leverage Ratio are Non-GAAP financial measures. See Appendix and prior releases for reconciliation to GAAP measures. 2. Net Interest Expense included in table is interest expense net of interest income and excludes deferred financing costs amortization. Leverage Ratio (LTM)1 Disciplined and Efficient Capital Spending Focused on Sustainably Generating AFCF Enhances Our Unrelenting Goal to Strengthen the Balance Sheet 2.10x $54.0 $50.9 $46.4 $51.5 $47.7 -$42.7 -$37.6 -$32.5 -$16.8 -$24.6 -$9.4 -$8.7 -$8.2 -$9.9 -$9.3 $1.9 $4.7 $5.8 $24.8 $13.9 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Adj EBITDA $MM CapEx $MM Net Interest Exp $MM Adj Free Cash Flow $MM Realized $/Boe $48.24 $46.14 $47.78 $42.63 $41.10 1 12

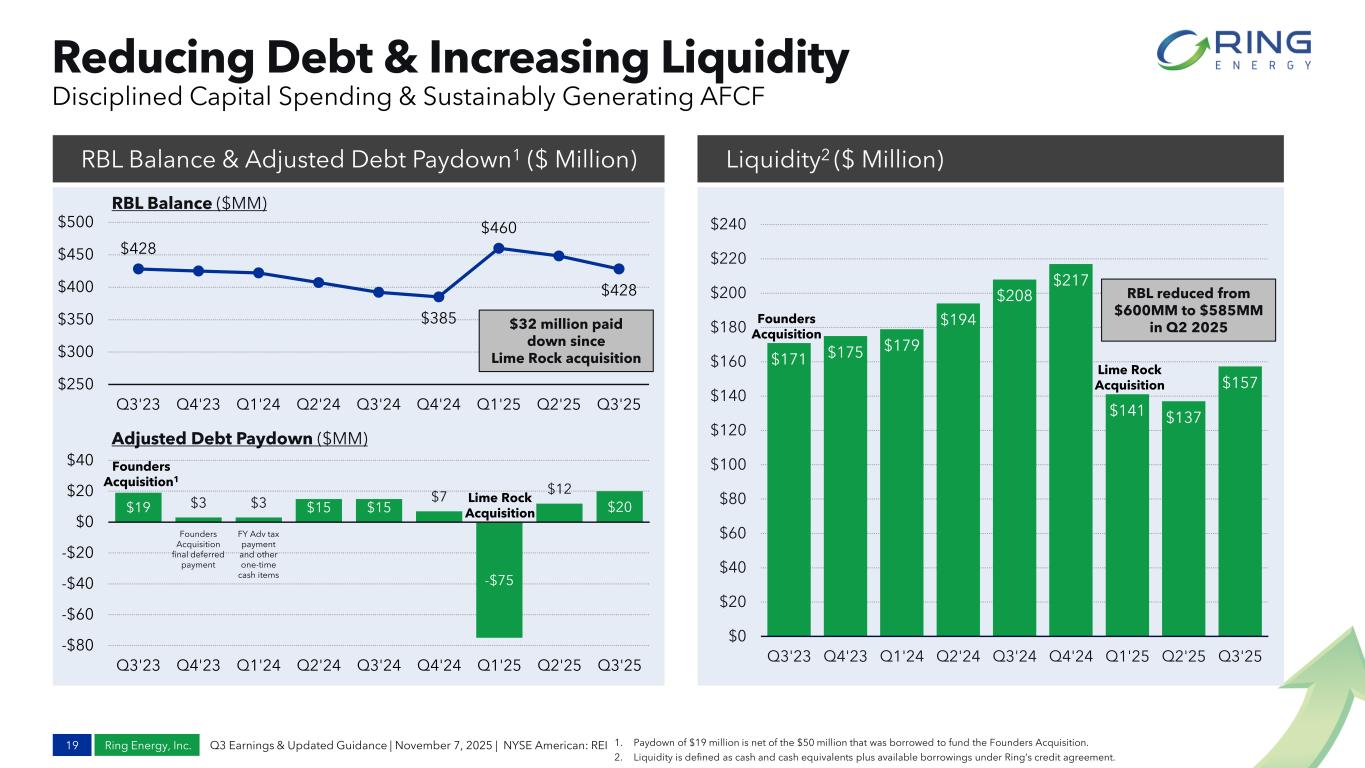

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Reducing Debt & Increasing Liquidity 19 Disciplined Capital Spending & Sustainably Generating AFCF 1. Paydown of $19 million is net of the $50 million that was borrowed to fund the Founders Acquisition. 2. Liquidity is defined as cash and cash equivalents plus available borrowings under Ring’s credit agreement. RBL Balance & Adjusted Debt Paydown1 ($ Million) Liquidity2 ($ Million) $19 $3 $3 $15 $15 $7 -$75 $12 $20 -$80 -$60 -$40 -$20 $0 $20 $40 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 $171 $175 $179 $194 $208 $217 $141 $137 $157 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 $220 $240 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Founders Acquisition1 Founders Acquisition Founders Acquisition final deferred payment FY Adv tax payment and other one-time cash items $428 $385 $460 $428 $250 $300 $350 $400 $450 $500 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Adjusted Debt Paydown ($MM) RBL Balance ($MM) Lime Rock Acquisition Lime Rock Acquisition $32 million paid down since Lime Rock acquisition RBL reduced from $600MM to $585MM in Q2 2025

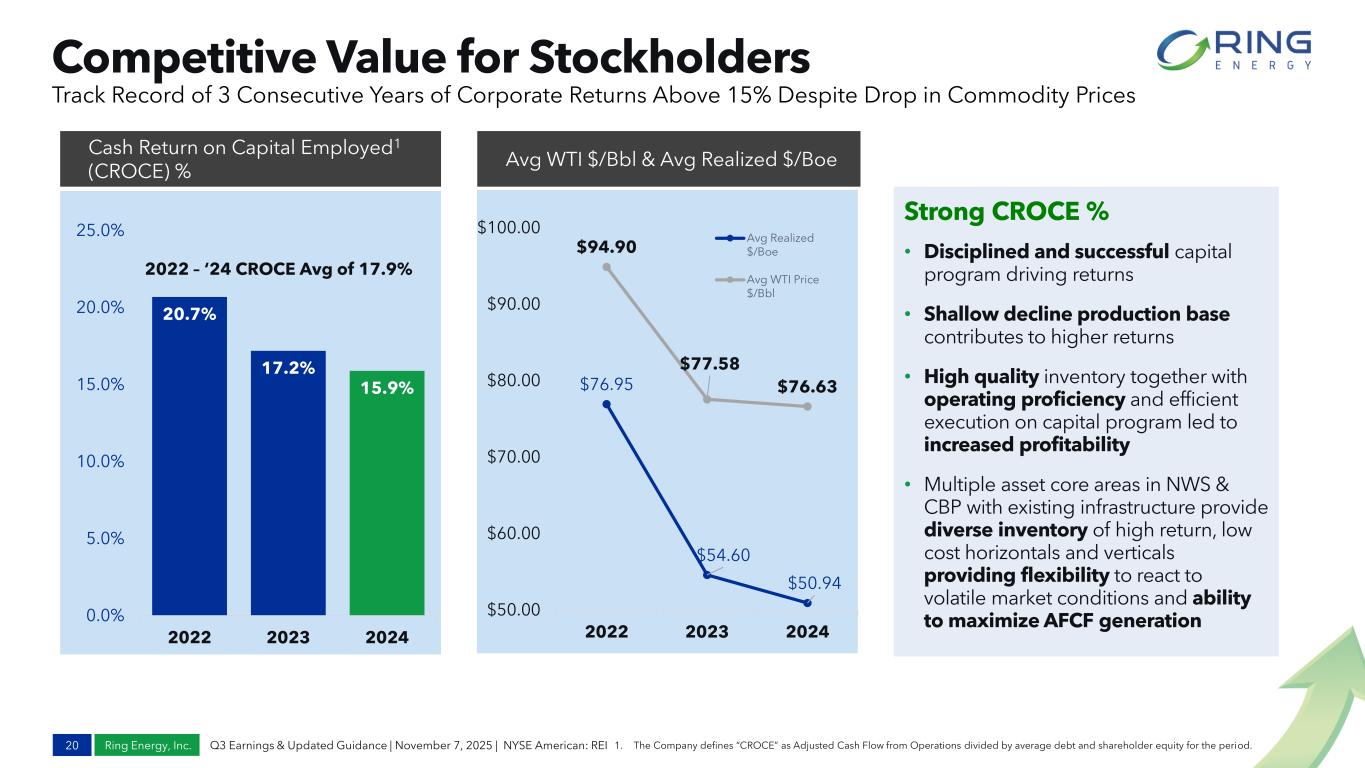

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Competitive Value for Stockholders 20 Track Record of 3 Consecutive Years of Corporate Returns Above 15% Despite Drop in Commodity Prices 1. The Company defines “CROCE” as Adjusted Cash Flow from Operations divided by average debt and shareholder equity for the period. 20.7% 17.2% 15.9% 2022 2023 2024 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% Cash Return on Capital Employed1 (CROCE) % Strong CROCE % • Disciplined and successful capital program driving returns • Shallow decline production base contributes to higher returns • High quality inventory together with operating proficiency and efficient execution on capital program led to increased profitability • Multiple asset core areas in NWS & CBP with existing infrastructure provide diverse inventory of high return, low cost horizontals and verticals providing flexibility to react to volatile market conditions and ability to maximize AFCF generation 2022 – ‘24 CROCE Avg of 17.9% $76.95 $54.60 $50.94 $94.90 $77.58 $76.63 $50.00 $60.00 $70.00 $80.00 $90.00 $100.00 2022 2023 2024 Avg Realized $/Boe Avg WTI Price $/Bbl Avg WTI $/Bbl & Avg Realized $/Boe

www.ringenergy.com | NYSE American: REI Q3 EARNINGS & UPDATED GUIDANCE | NOVEMBER 7, 2025 ASSET OVERVIEW

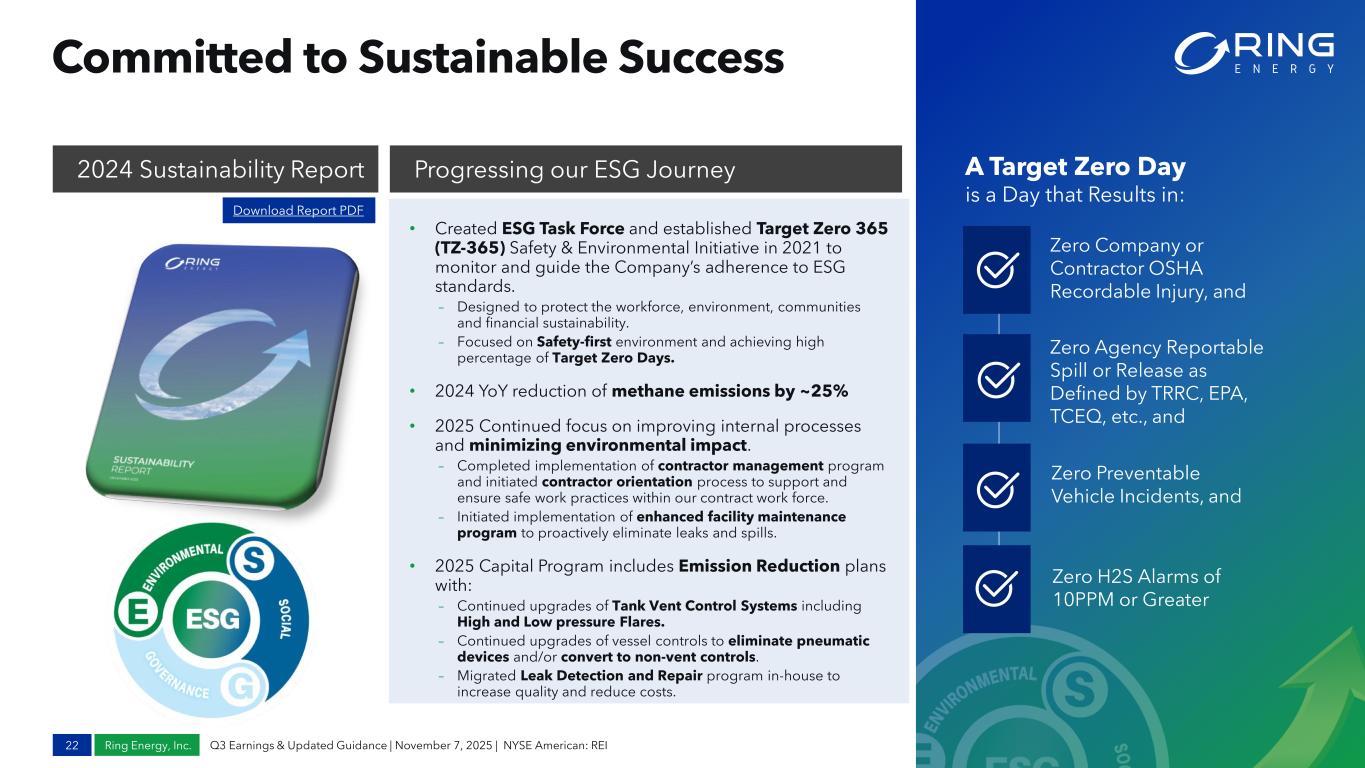

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Committed to Sustainable Success 22 2024 Sustainability Report Progressing our ESG Journey A Target Zero Day is a Day that Results in: Zero Company or Contractor OSHA Recordable Injury, and Zero Agency Reportable Spill or Release as Defined by TRRC, EPA, TCEQ, etc., and Zero Preventable Vehicle Incidents, and Zero H2S Alarms of 10PPM or Greater • Created ESG Task Force and established Target Zero 365 (TZ-365) Safety & Environmental Initiative in 2021 to monitor and guide the Company’s adherence to ESG standards. – Designed to protect the workforce, environment, communities and financial sustainability. – Focused on Safety-first environment and achieving high percentage of Target Zero Days. • 2024 YoY reduction of methane emissions by ~25% • 2025 Continued focus on improving internal processes and minimizing environmental impact. – Completed implementation of contractor management program and initiated contractor orientation process to support and ensure safe work practices within our contract work force. – Initiated implementation of enhanced facility maintenance program to proactively eliminate leaks and spills. • 2025 Capital Program includes Emission Reduction plans with: – Continued upgrades of Tank Vent Control Systems including High and Low pressure Flares. – Continued upgrades of vessel controls to eliminate pneumatic devices and/or convert to non-vent controls. – Migrated Leak Detection and Repair program in-house to increase quality and reduce costs. Download Report PDF

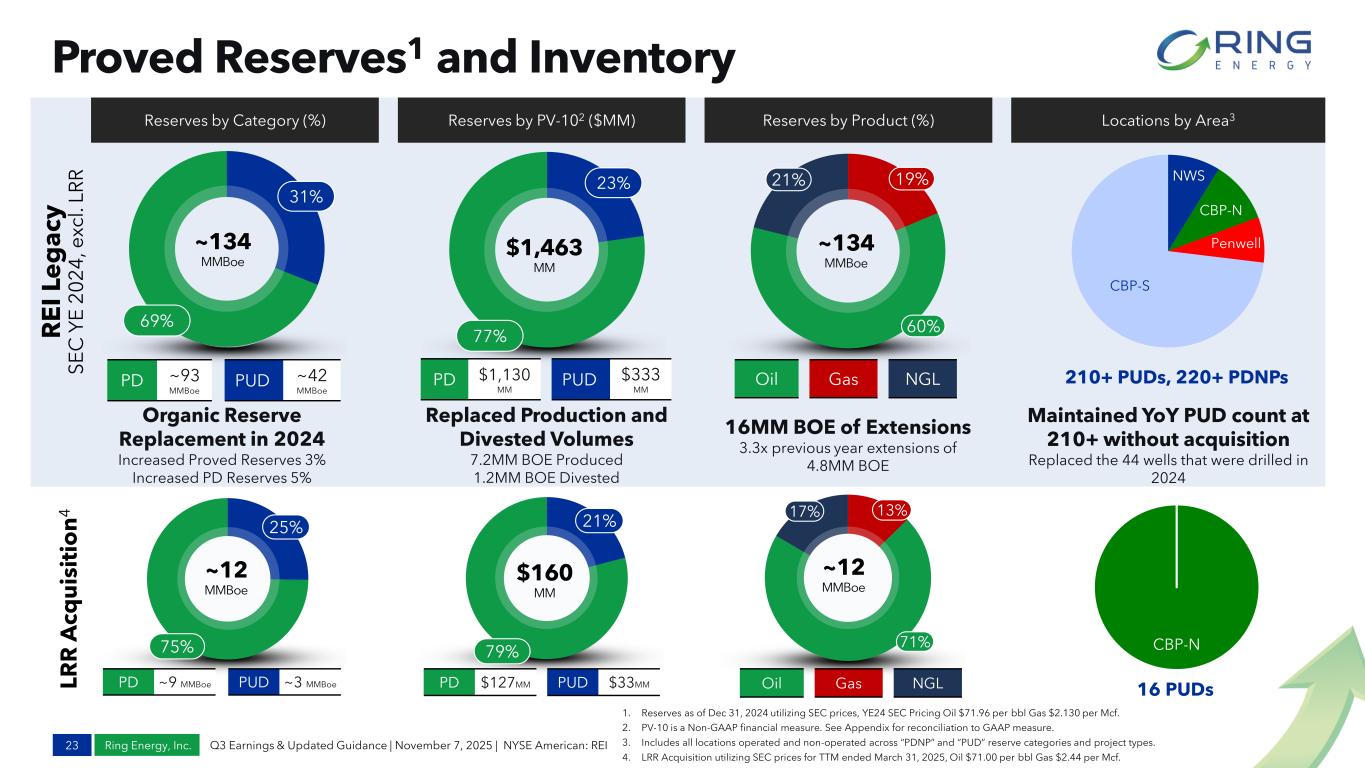

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI 13% 71% 17% 19% 60% 21% 31% 69% 23% 77% CBP-N 25% 75% ~12 MMBoe 21% 79% $160 MM PD $127MM PUD $33MM Oil Gas NGL ~12 MMBoe 16 PUDs Proved Reserves1 and Inventory 23 1. Reserves as of Dec 31, 2024 utilizing SEC prices, YE24 SEC Pricing Oil $71.96 per bbl Gas $2.130 per Mcf. 2. PV-10 is a Non-GAAP financial measure. See Appendix for reconciliation to GAAP measure. 3. Includes all locations operated and non-operated across “PDNP” and “PUD” reserve categories and project types. 4. LRR Acquisition utilizing SEC prices for TTM ended March 31, 2025, Oil $71.00 per bbl Gas $2.44 per Mcf. Reserves by Category (%) Reserves by PV-102 ($MM) Reserves by Product (%) Locations by Area3 PD ~93 MMBoe PUD ~42 MMBoe Organic Reserve Replacement in 2024 Increased Proved Reserves 3% Increased PD Reserves 5% ~134 MMBoe $1,463 MM PD $1,130 MM PUD $333 MM Oil Gas NGL ~134 MMBoe 210+ PUDs, 220+ PDNPs Replaced Production and Divested Volumes 7.2MM BOE Produced 1.2MM BOE Divested 16MM BOE of Extensions 3.3x previous year extensions of 4.8MM BOE Maintained YoY PUD count at 210+ without acquisition Replaced the 44 wells that were drilled in 2024 NWS CBP-N Penwell CBP-S R E I L e g a c y S E C Y E 2 0 2 4 , e xc l. L R R L R R A c q u is it io n 4 PD ~9 MMBoe PUD ~3 MMBoe

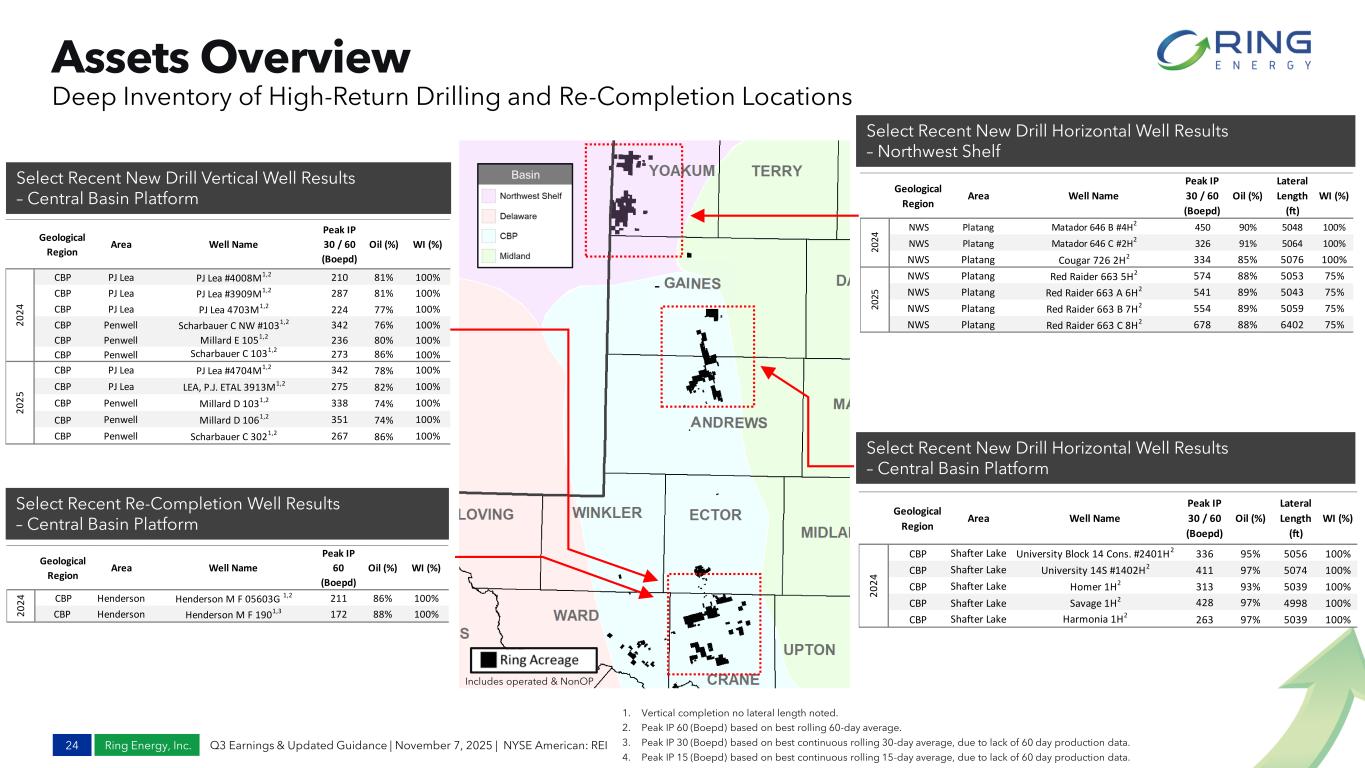

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Assets Overview 24 Deep Inventory of High-Return Drilling and Re-Completion Locations 1. Vertical completion no lateral length noted. 2. Peak IP 60 (Boepd) based on best rolling 60-day average. 3. Peak IP 30 (Boepd) based on best continuous rolling 30-day average, due to lack of 60 day production data. 4. Peak IP 15 (Boepd) based on best continuous rolling 15-day average, due to lack of 60 day production data. Select Recent New Drill Vertical Well Results – Central Basin Platform Select Recent Re-Completion Well Results – Central Basin Platform Select Recent New Drill Horizontal Well Results – Northwest Shelf Select Recent New Drill Horizontal Well Results – Central Basin Platform Includes operated & NonOP Geological Region Area Well Name Peak IP 30 / 60 (Boepd) Oil (%) Lateral Length (ft) WI (%) CBP Shafter Lake University Block 14 Cons. #2401H2 336 95% 5056 100% CBP Shafter Lake University 14S #1402H2 411 97% 5074 100% CBP Shafter Lake Homer 1H2 313 93% 5039 100% CBP Shafter Lake Savage 1H2 428 97% 4998 100% CBP Shafter Lake Harmonia 1H2 263 97% 5039 100% 2 0 2 4 Geological Region Area Well Name Peak IP 60 (Boepd) Oil (%) WI (%) CBP Henderson Henderson M F 05603G 1,2 211 86% 100% CBP Henderson Henderson M F 1901,3 172 88% 100%2 0 2 4 Geological Region Area Well Name Peak IP 30 / 60 (Boepd) Oil (%) Lateral Length (ft) WI (%) NWS Platang Matador 646 B #4H 2 450 90% 5048 100% NWS Platang Matador 646 C #2H2 326 91% 5064 100% NWS Platang Cougar 726 2H2 334 85% 5076 100% NWS Platang Red Raider 663 5H2 574 88% 5053 75% NWS Platang Red Raider 663 A 6H2 541 89% 5043 75% NWS Platang Red Raider 663 B 7H2 554 89% 5059 75% NWS Platang Red Raider 663 C 8H2 678 88% 6402 75% 20 24 20 25 Geological Region Area Well Name Peak IP 30 / 60 (Boepd) Oil (%) WI (%) CBP PJ Lea PJ Lea #4008M1,2 210 81% 100% CBP PJ Lea PJ Lea #3909M1,2 287 81% 100% CBP PJ Lea PJ Lea 4703M1,2 224 77% 100% CBP Penwell Scharbauer C NW #1031,2 342 76% 100% CBP Penwell Millard E 1051,2 236 80% 100% CBP Penwell Scharbauer C 1031,2 273 86% 100% CBP PJ Lea PJ Lea #4704M1,2 342 78% 100% CBP PJ Lea LEA, P.J. ETAL 3913M1,2 275 82% 100% CBP Penwell Millard D 1031,2 338 74% 100% CBP Penwell Millard D 1061,2 351 74% 100% CBP Penwell Scharbauer C 3021,2 267 86% 100% 2 0 2 4 2 0 2 5

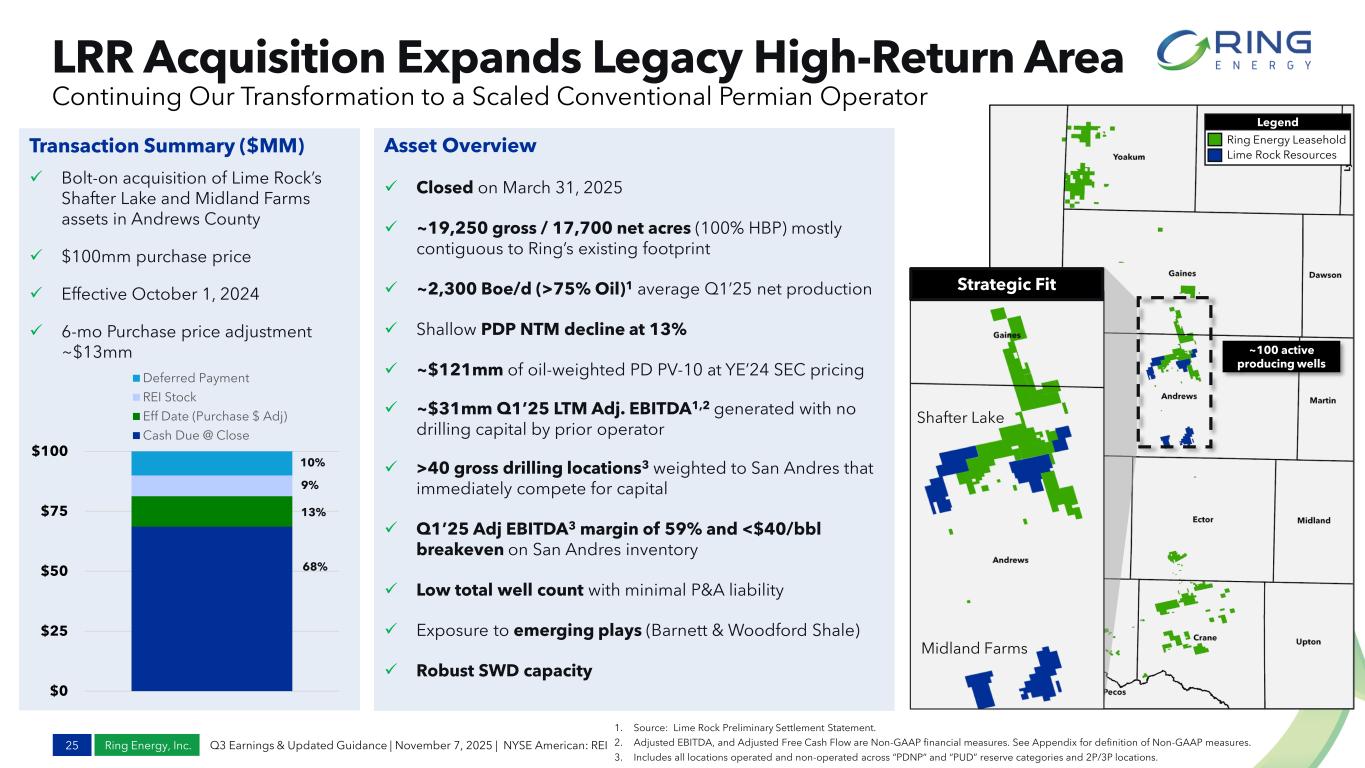

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI LRR Acquisition Expands Legacy High-Return Area 25 Continuing Our Transformation to a Scaled Conventional Permian Operator 1. Source: Lime Rock Preliminary Settlement Statement. 2. Adjusted EBITDA, and Adjusted Free Cash Flow are Non-GAAP financial measures. See Appendix for definition of Non-GAAP measures. 3. Includes all locations operated and non-operated across “PDNP” and “PUD” reserve categories and 2P/3P locations. Asset Overview ✓ Closed on March 31, 2025 ✓ ~19,250 gross / 17,700 net acres (100% HBP) mostly contiguous to Ring’s existing footprint ✓ ~2,300 Boe/d (>75% Oil)1 average Q1’25 net production ✓ Shallow PDP NTM decline at 13% ✓ ~$121mm of oil-weighted PD PV-10 at YE’24 SEC pricing ✓ ~$31mm Q1’25 LTM Adj. EBITDA1,2 generated with no drilling capital by prior operator ✓ >40 gross drilling locations3 weighted to San Andres that immediately compete for capital ✓ Q1’25 Adj EBITDA3 margin of 59% and <$40/bbl breakeven on San Andres inventory ✓ Low total well count with minimal P&A liability ✓ Exposure to emerging plays (Barnett & Woodford Shale) ✓ Robust SWD capacity Transaction Summary ($MM) ✓ Bolt-on acquisition of Lime Rock’s Shafter Lake and Midland Farms assets in Andrews County ✓ $100mm purchase price ✓ Effective October 1, 2024 ✓ 6-mo Purchase price adjustment ~$13mm Legend Ring Energy Leasehold Lime Rock Resources Strategic Fit Midland Farms Shafter Lake ~100 active producing wells $0 $25 $50 $75 $100 Deferred Payment REI Stock Eff Date (Purchase $ Adj) Cash Due @ Close 68% 13% 9% 10%

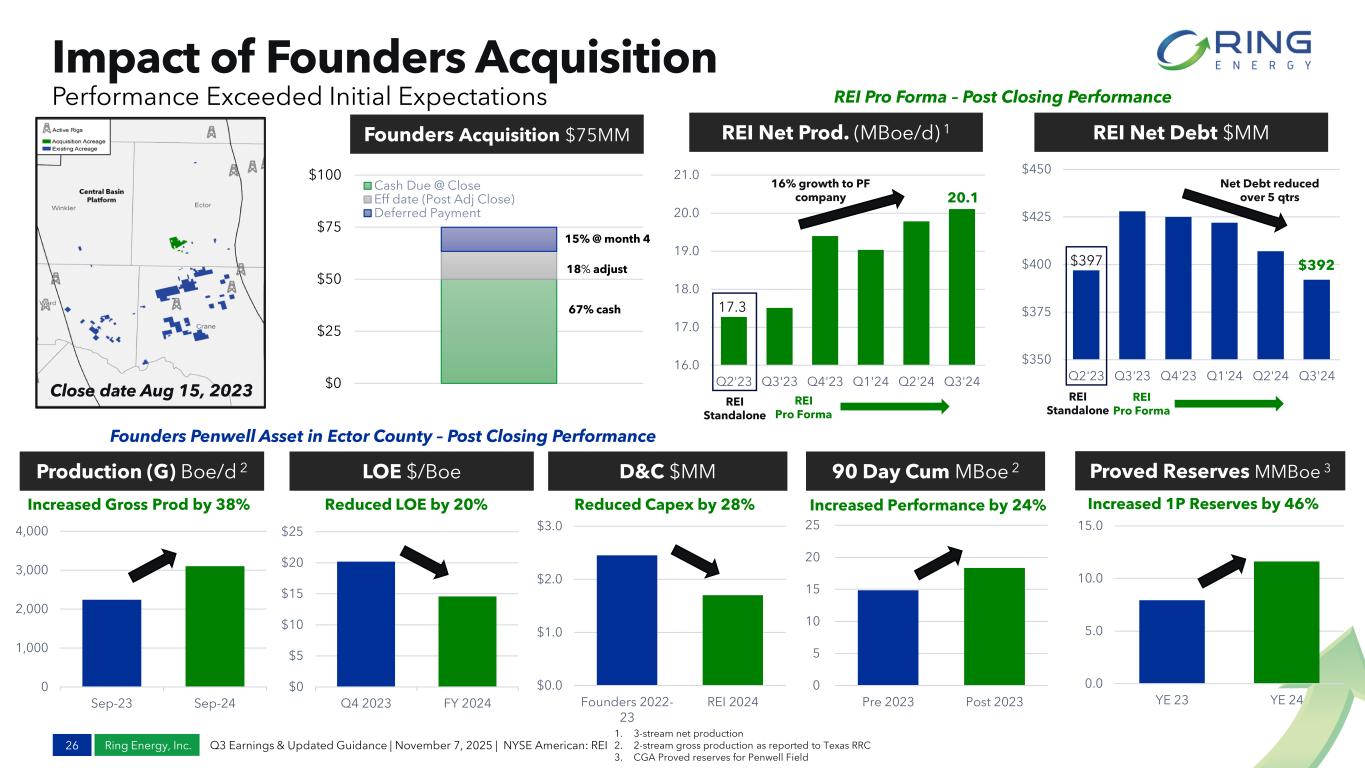

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI 0 1,000 2,000 3,000 4,000 Sep-23 Sep-24 Impact of Founders Acquisition 26 Performance Exceeded Initial Expectations 1. 3-stream net production 2. 2-stream gross production as reported to Texas RRC 3. CGA Proved reserves for Penwell Field $0.0 $1.0 $2.0 $3.0 Founders 2022- 23 REI 2024 Sept. 2023 Sept 2024 Boe 1,887 2,654 41% 1,497 1,821 22% Lift Cost $/ $14.84 -17% ( YE 2023 Q3 2024 7.9 8.0 1% 0.9 4.2 5.3 26% 0 12 ~50 ~50 Reduced Capex by 28% Founders Acquisition $75MM REI Net Prod. (MBoe/d) 1 REI Net Debt $MM 16.0 17.0 18.0 19.0 20.0 21.0 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 $350 $375 $400 $425 $450 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Production (G) Boe/d 2 LOE $/Boe D&C $MM 90 Day Cum MBoe 2 Proved Reserves MMBoe 3 Close date Aug 15, 2023 $0 $25 $50 $75 $100 Cash Due @ Close Eff date (Post Adj Close) Deferred Payment 67% cash 18% adjust 15% @ month 4 17.3 REI Standalone REI Pro Forma 20.1 16% growth to PF company REI Standalone $397 $392 Net Debt reduced over 5 qtrs $0 $5 $10 $15 $20 $25 Q4 2023 FY 2024 Reduced LOE by 20% Founders Penwell Asset in Ector County – Post Closing Performance REI Pro Forma – Post Closing Performance Increased Gross Prod by 38% 0.0 5.0 10.0 15.0 YE 23 YE 24 Increased 1P Reserves by 46% 0 5 10 15 20 25 Pre 2023 Post 2023 Increased Performance by 24% REI Pro Forma

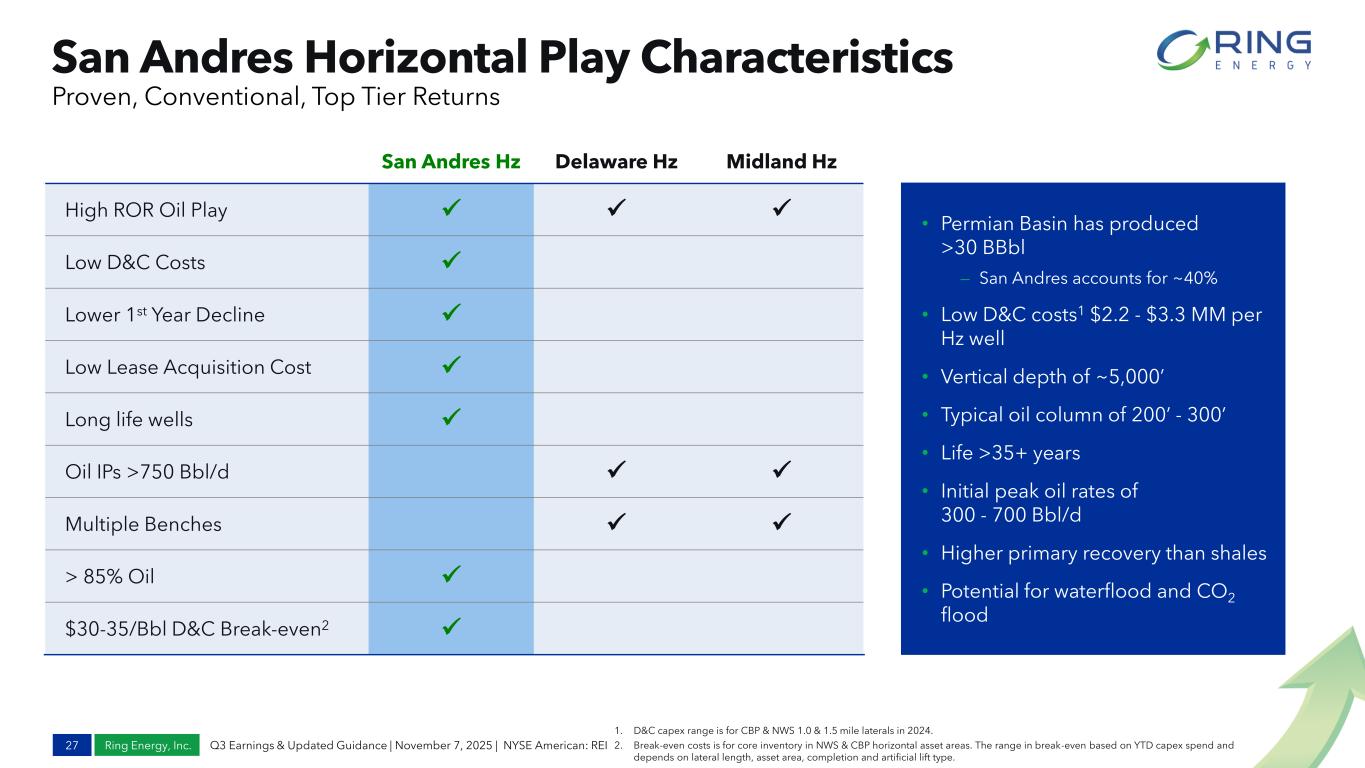

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI San Andres Horizontal Play Characteristics 27 Proven, Conventional, Top Tier Returns 1. D&C capex range is for CBP & NWS 1.0 & 1.5 mile laterals in 2024. 2. Break-even costs is for core inventory in NWS & CBP horizontal asset areas. The range in break-even based on YTD capex spend and depends on lateral length, asset area, completion and artificial lift type. San Andres Hz Delaware Hz Midland Hz High ROR Oil Play ✓ ✓ ✓ Low D&C Costs ✓ Lower 1st Year Decline ✓ Low Lease Acquisition Cost ✓ Long life wells ✓ Oil IPs >750 Bbl/d ✓ ✓ Multiple Benches ✓ ✓ > 85% Oil ✓ $30-35/Bbl D&C Break-even2 ✓ • Permian Basin has produced >30 BBbl — San Andres accounts for ~40% • Low D&C costs1 $2.2 - $3.3 MM per Hz well • Vertical depth of ~5,000’ • Typical oil column of 200’ - 300’ • Life >35+ years • Initial peak oil rates of 300 - 700 Bbl/d • Higher primary recovery than shales • Potential for waterflood and CO2 flood

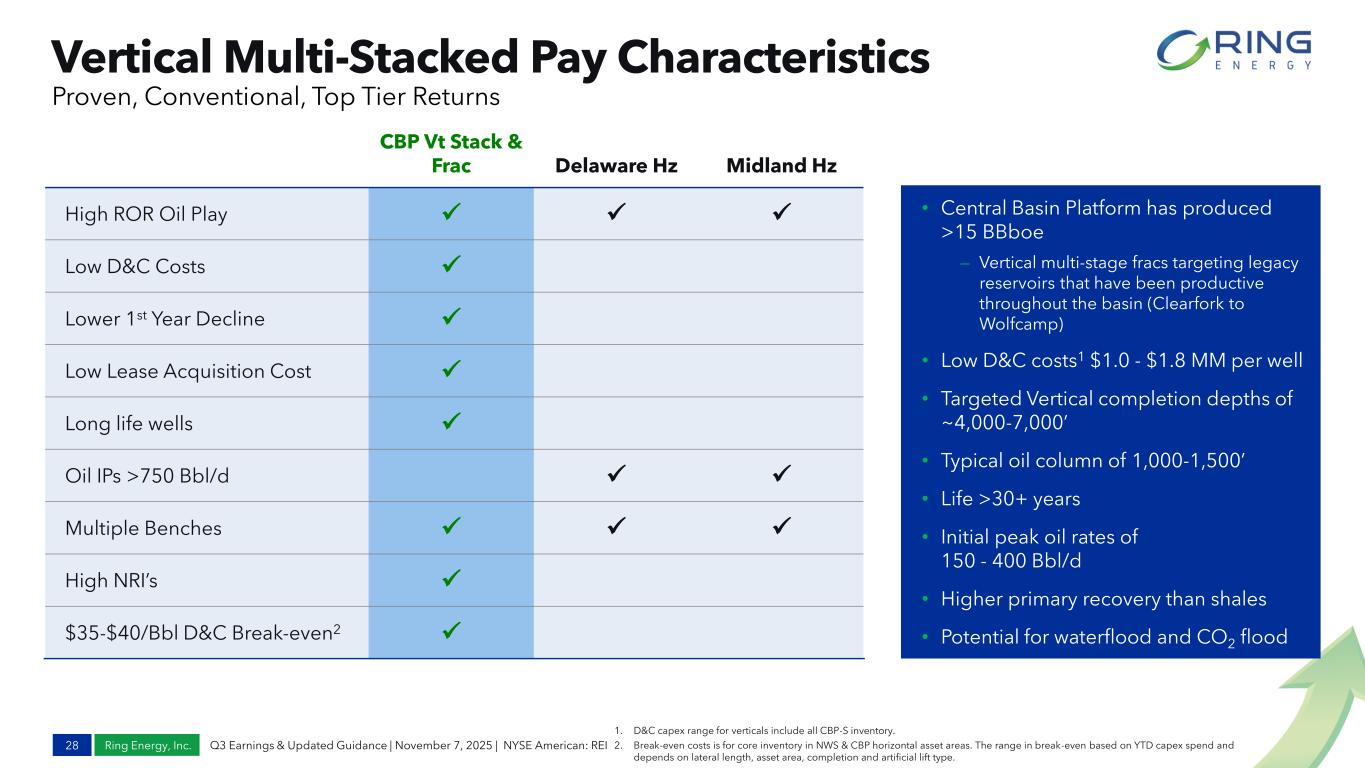

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Vertical Multi-Stacked Pay Characteristics 28 Proven, Conventional, Top Tier Returns 1. D&C capex range for verticals include all CBP-S inventory. 2. Break-even costs is for core inventory in NWS & CBP horizontal asset areas. The range in break-even based on YTD capex spend and depends on lateral length, asset area, completion and artificial lift type. CBP Vt Stack & Frac Delaware Hz Midland Hz High ROR Oil Play ✓ ✓ ✓ Low D&C Costs ✓ Lower 1st Year Decline ✓ Low Lease Acquisition Cost ✓ Long life wells ✓ Oil IPs >750 Bbl/d ✓ ✓ Multiple Benches ✓ ✓ ✓ High NRI’s ✓ $35-$40/Bbl D&C Break-even2 ✓ • Central Basin Platform has produced >15 BBboe — Vertical multi-stage fracs targeting legacy reservoirs that have been productive throughout the basin (Clearfork to Wolfcamp) • Low D&C costs1 $1.0 - $1.8 MM per well • Targeted Vertical completion depths of ~4,000-7,000’ • Typical oil column of 1,000-1,500’ • Life >30+ years • Initial peak oil rates of 150 - 400 Bbl/d • Higher primary recovery than shales • Potential for waterflood and CO2 flood

www.ringenergy.com www.ringenergy.com Q3 EARNINGS & UPDATED GUIDANCE | NOVEMBER 7, 2025 THANK YOU Company Contact Al Petrie (281) 975-2146 apetrie@ringenergy.com Wes Harris (281) 975-2146 wharris@ringenergy.com Analyst Coverage Tuohy Bothers Investment Noel Parks (215) 913-7320 nparks@tuohybrothers.com Water Tower Research Jeff Robertson (469) 343-9962 jeff@watertowerresearch.com Ring Headquarters 1725 Hughes Landing Blvd Ste 900 The Woodlands, TX 77830 Phone: 281-397-3699 Alliance Global Partners (AGP) Poe Fratt (314) 719-6084 pfratt@allianceg.com

www.ringenergy.com | NYSE American: REI Q3 EARNINGS & UPDATED GUIDANCE | NOVEMBER 7, 2025 APPENDIX

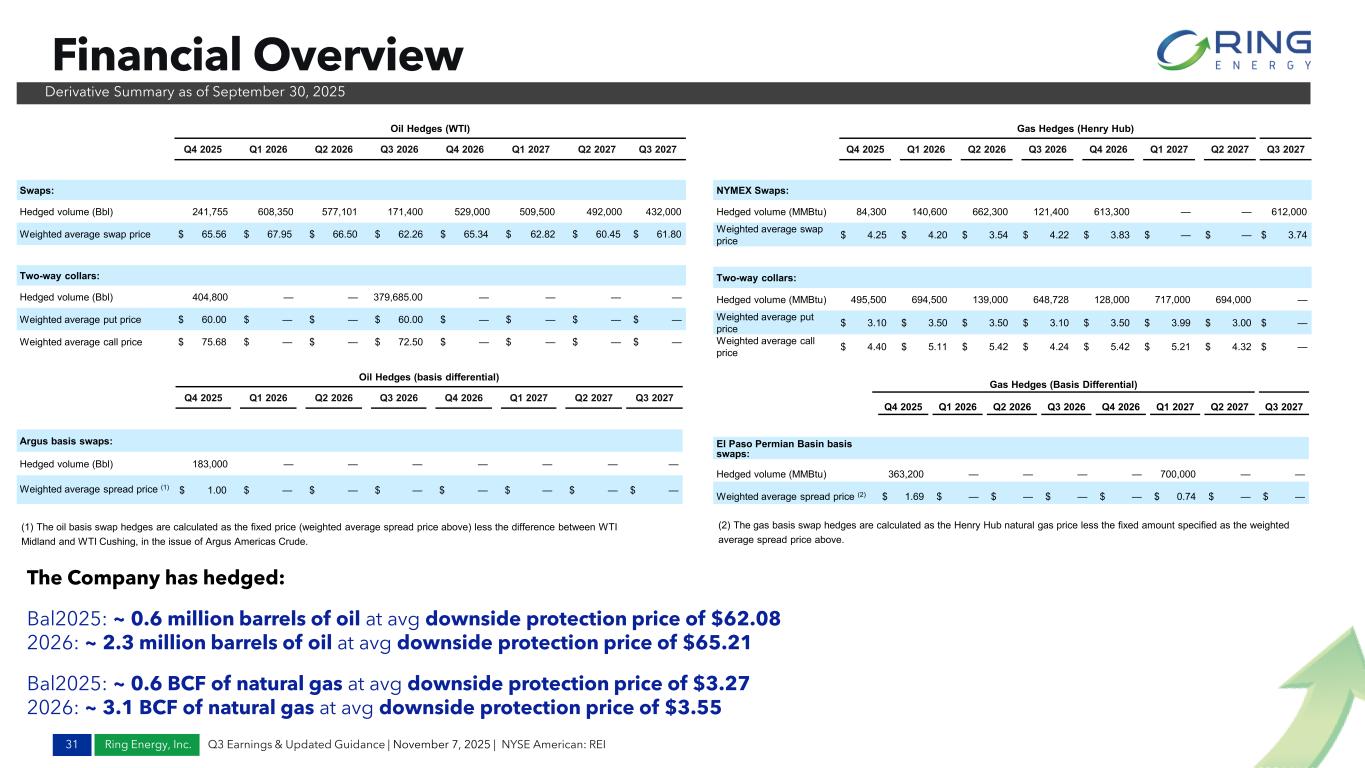

Ring Energy, Inc. Financial Overview 31 Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI (1) The oil basis swap hedges are calculated as the fixed price (weighted average spread price above) less the difference between WTI Midland and WTI Cushing, in the issue of Argus Americas Crude. Gas Hedges (Henry Hub) Q4 2025 Q1 2026 Q2 2026 Q3 2026 Q4 2026 Q1 2027 Q2 2027 Q3 2027 NYMEX Swaps: Hedged volume (MMBtu) 84,300 140,600 662,300 121,400 613,300 — — 612,000 Weighted average swap price $ 4.25 $ 4.20 $ 3.54 $ 4.22 $ 3.83 $ — $ — $ 3.74 Two-way collars: Hedged volume (MMBtu) 495,500 694,500 139,000 648,728 128,000 717,000 694,000 — Weighted average put price $ 3.10 $ 3.50 $ 3.50 $ 3.10 $ 3.50 $ 3.99 $ 3.00 $ — Weighted average call price $ 4.40 $ 5.11 $ 5.42 $ 4.24 $ 5.42 $ 5.21 $ 4.32 $ — Oil Hedges (WTI) Q4 2025 Q1 2026 Q2 2026 Q3 2026 Q4 2026 Q1 2027 Q2 2027 Q3 2027 Swaps: Hedged volume (Bbl) 241,755 608,350 577,101 171,400 529,000 509,500 492,000 432,000 Weighted average swap price $ 65.56 $ 67.95 $ 66.50 $ 62.26 $ 65.34 $ 62.82 $ 60.45 $ 61.80 Two-way collars: Hedged volume (Bbl) 404,800 — — 379,685.00 — — — — Weighted average put price $ 60.00 $ — $ — $ 60.00 $ — $ — $ — $ — Weighted average call price $ 75.68 $ — $ — $ 72.50 $ — $ — $ — $ — Oil Hedges (basis differential) Q4 2025 Q1 2026 Q2 2026 Q3 2026 Q4 2026 Q1 2027 Q2 2027 Q3 2027 Argus basis swaps: Hedged volume (Bbl) 183,000 — — — — — — — Weighted average spread price (1) $ 1.00 $ — $ — $ — $ — $ — $ — $ — Derivative Summary as of September 30, 2025 Gas Hedges (Basis Differential) Q4 2025 Q1 2026 Q2 2026 Q3 2026 Q4 2026 Q1 2027 Q2 2027 Q3 2027 El Paso Permian Basin basis swaps: Hedged volume (MMBtu) 363,200 — — — — 700,000 — — Weighted average spread price (2) $ 1.69 $ — $ — $ — $ — $ 0.74 $ — $ — The Company has hedged: Bal2025: ~ 0.6 million barrels of oil at avg downside protection price of $62.08 2026: ~ 2.3 million barrels of oil at avg downside protection price of $65.21 Bal2025: ~ 0.6 BCF of natural gas at avg downside protection price of $3.27 2026: ~ 3.1 BCF of natural gas at avg downside protection price of $3.55 (2) The gas basis swap hedges are calculated as the Henry Hub natural gas price less the fixed amount specified as the weighted average spread price above.

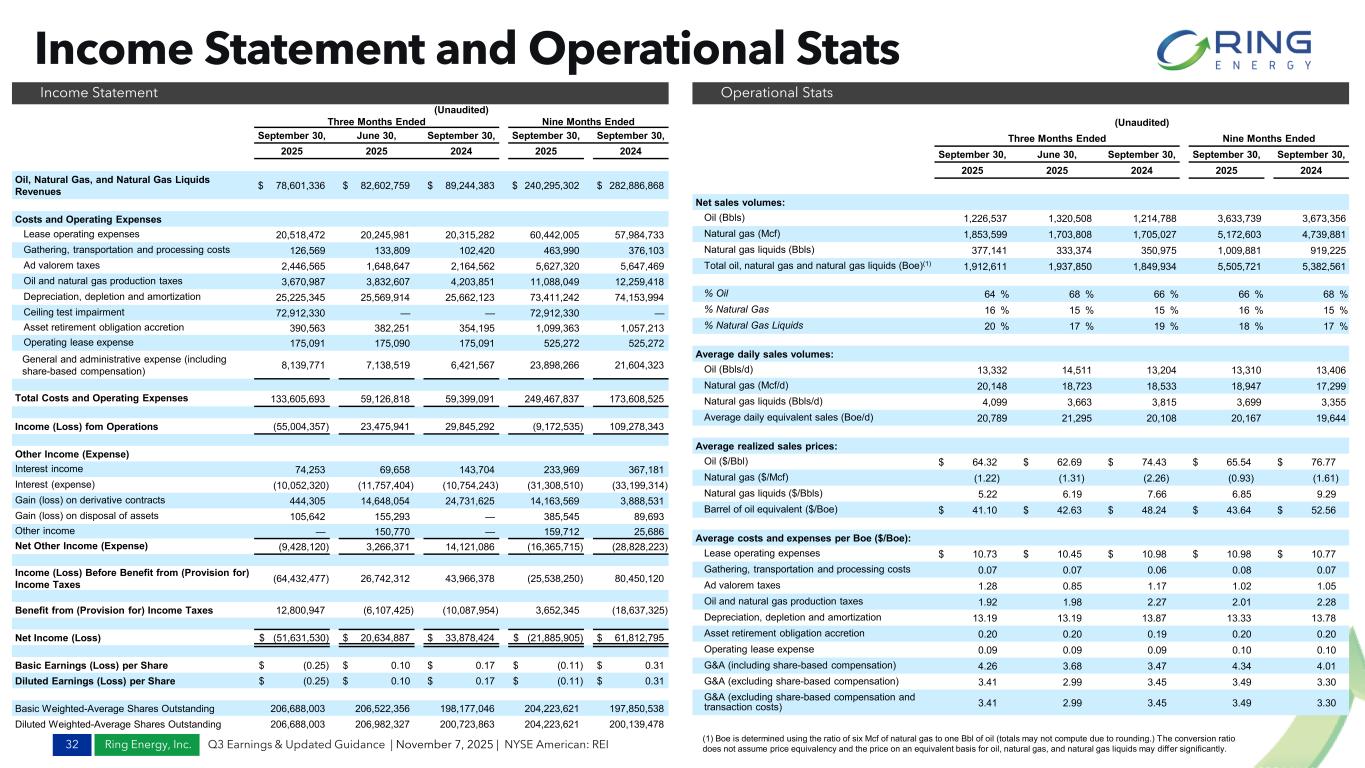

Ring Energy, Inc. Income Statement and Operational Stats 32 Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Income Statement Operational Stats (1) Boe is determined using the ratio of six Mcf of natural gas to one Bbl of oil (totals may not compute due to rounding.) The conversion ratio does not assume price equivalency and the price on an equivalent basis for oil, natural gas, and natural gas liquids may differ significantly. (Unaudited) Three Months Ended Nine Months Ended September 30, June 30, September 30, September 30, September 30, 2025 2025 2024 2025 2024 Oil, Natural Gas, and Natural Gas Liquids Revenues $ 78,601,336 $ 82,602,759 $ 89,244,383 $ 240,295,302 $ 282,886,868 Costs and Operating Expenses Lease operating expenses 20,518,472 20,245,981 20,315,282 60,442,005 57,984,733 Gathering, transportation and processing costs 126,569 133,809 102,420 463,990 376,103 Ad valorem taxes 2,446,565 1,648,647 2,164,562 5,627,320 5,647,469 Oil and natural gas production taxes 3,670,987 3,832,607 4,203,851 11,088,049 12,259,418 Depreciation, depletion and amortization 25,225,345 25,569,914 25,662,123 73,411,242 74,153,994 Ceiling test impairment 72,912,330 — — 72,912,330 — Asset retirement obligation accretion 390,563 382,251 354,195 1,099,363 1,057,213 Operating lease expense 175,091 175,090 175,091 525,272 525,272 General and administrative expense (including share-based compensation) 8,139,771 7,138,519 6,421,567 23,898,266 21,604,323 Total Costs and Operating Expenses 133,605,693 59,126,818 59,399,091 249,467,837 173,608,525 Income (Loss) fom Operations (55,004,357) 23,475,941 29,845,292 (9,172,535) 109,278,343 Other Income (Expense) Interest income 74,253 69,658 143,704 233,969 367,181 Interest (expense) (10,052,320) (11,757,404) (10,754,243) (31,308,510) (33,199,314) Gain (loss) on derivative contracts 444,305 14,648,054 24,731,625 14,163,569 3,888,531 Gain (loss) on disposal of assets 105,642 155,293 — 385,545 89,693 Other income — 150,770 — 159,712 25,686 Net Other Income (Expense) (9,428,120) 3,266,371 14,121,086 (16,365,715) (28,828,223) Income (Loss) Before Benefit from (Provision for) Income Taxes (64,432,477) 26,742,312 43,966,378 (25,538,250) 80,450,120 Benefit from (Provision for) Income Taxes 12,800,947 (6,107,425) (10,087,954) 3,652,345 (18,637,325) Net Income (Loss) $ (51,631,530) $ 20,634,887 $ 33,878,424 $ (21,885,905) $ 61,812,795 Basic Earnings (Loss) per Share $ (0.25) $ 0.10 $ 0.17 $ (0.11) $ 0.31 Diluted Earnings (Loss) per Share $ (0.25) $ 0.10 $ 0.17 $ (0.11) $ 0.31 Basic Weighted-Average Shares Outstanding 206,688,003 206,522,356 198,177,046 204,223,621 197,850,538 Diluted Weighted-Average Shares Outstanding 206,688,003 206,982,327 200,723,863 204,223,621 200,139,478 (Unaudited) Three Months Ended Nine Months Ended September 30, June 30, September 30, September 30, September 30, 2025 2025 2024 2025 2024 Net sales volumes: Oil (Bbls) 1,226,537 1,320,508 1,214,788 3,633,739 3,673,356 Natural gas (Mcf) 1,853,599 1,703,808 1,705,027 5,172,603 4,739,881 Natural gas liquids (Bbls) 377,141 333,374 350,975 1,009,881 919,225 Total oil, natural gas and natural gas liquids (Boe)(1) 1,912,611 1,937,850 1,849,934 5,505,721 5,382,561 % Oil 64 % 68 % 66 % 66 % 68 % % Natural Gas 16 % 15 % 15 % 16 % 15 % % Natural Gas Liquids 20 % 17 % 19 % 18 % 17 % Average daily sales volumes: Oil (Bbls/d) 13,332 14,511 13,204 13,310 13,406 Natural gas (Mcf/d) 20,148 18,723 18,533 18,947 17,299 Natural gas liquids (Bbls/d) 4,099 3,663 3,815 3,699 3,355 Average daily equivalent sales (Boe/d) 20,789 21,295 20,108 20,167 19,644 Average realized sales prices: Oil ($/Bbl) $ 64.32 $ 62.69 $ 74.43 $ 65.54 $ 76.77 Natural gas ($/Mcf) (1.22) (1.31) (2.26) (0.93) (1.61) Natural gas liquids ($/Bbls) 5.22 6.19 7.66 6.85 9.29 Barrel of oil equivalent ($/Boe) $ 41.10 $ 42.63 $ 48.24 $ 43.64 $ 52.56 Average costs and expenses per Boe ($/Boe): Lease operating expenses $ 10.73 $ 10.45 $ 10.98 $ 10.98 $ 10.77 Gathering, transportation and processing costs 0.07 0.07 0.06 0.08 0.07 Ad valorem taxes 1.28 0.85 1.17 1.02 1.05 Oil and natural gas production taxes 1.92 1.98 2.27 2.01 2.28 Depreciation, depletion and amortization 13.19 13.19 13.87 13.33 13.78 Asset retirement obligation accretion 0.20 0.20 0.19 0.20 0.20 Operating lease expense 0.09 0.09 0.09 0.10 0.10 G&A (including share-based compensation) 4.26 3.68 3.47 4.34 4.01 G&A (excluding share-based compensation) 3.41 2.99 3.45 3.49 3.30 G&A (excluding share-based compensation and transaction costs) 3.41 2.99 3.45 3.49 3.30

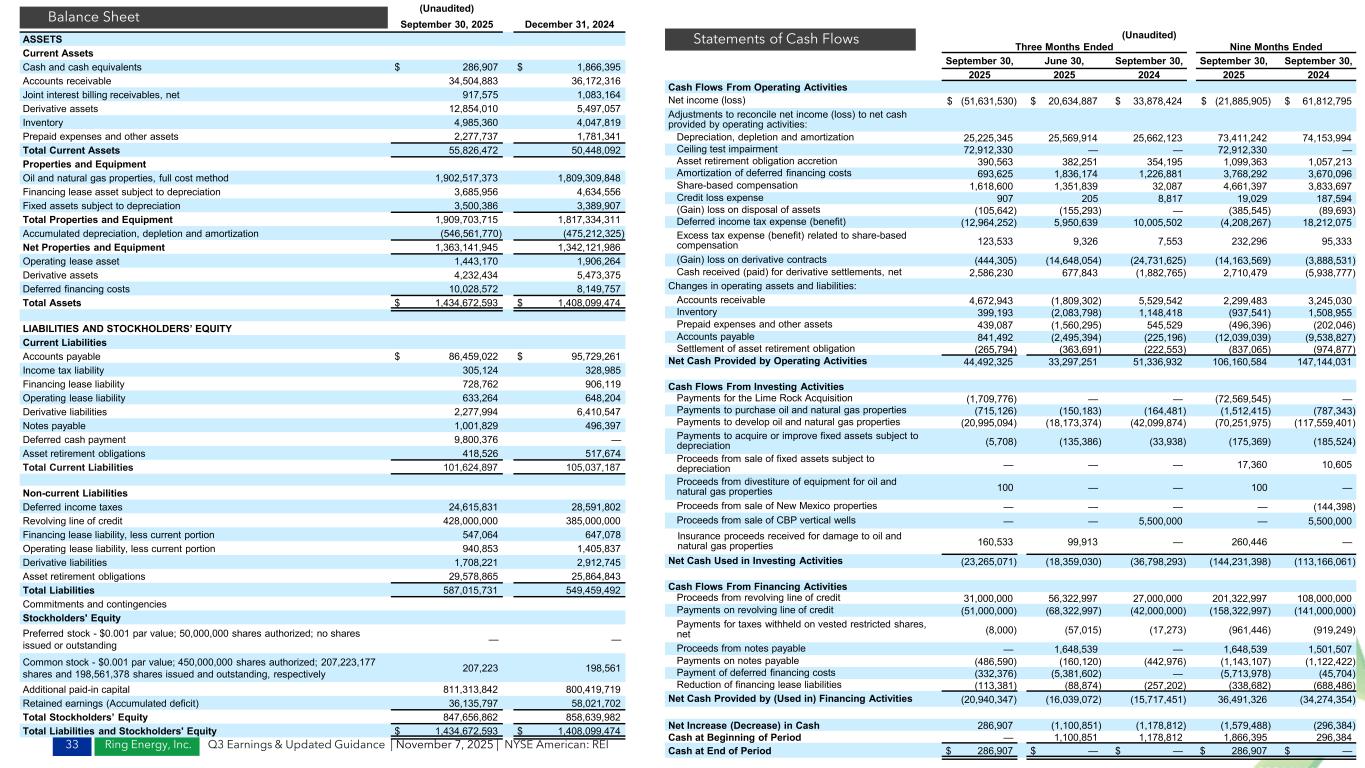

Ring Energy, Inc.33 Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI (Unaudited) Three Months Ended Nine Months Ended September 30, June 30, September 30, September 30, September 30, 2025 2025 2024 2025 2024 Cash Flows From Operating Activities Net income (loss) $ (51,631,530) $ 20,634,887 $ 33,878,424 $ (21,885,905) $ 61,812,795 Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation, depletion and amortization 25,225,345 25,569,914 25,662,123 73,411,242 74,153,994 Ceiling test impairment 72,912,330 — — 72,912,330 — Asset retirement obligation accretion 390,563 382,251 354,195 1,099,363 1,057,213 Amortization of deferred financing costs 693,625 1,836,174 1,226,881 3,768,292 3,670,096 Share-based compensation 1,618,600 1,351,839 32,087 4,661,397 3,833,697 Credit loss expense 907 205 8,817 19,029 187,594 (Gain) loss on disposal of assets (105,642) (155,293) — (385,545) (89,693) Deferred income tax expense (benefit) (12,964,252) 5,950,639 10,005,502 (4,208,267) 18,212,075 Excess tax expense (benefit) related to share-based compensation 123,533 9,326 7,553 232,296 95,333 (Gain) loss on derivative contracts (444,305) (14,648,054) (24,731,625) (14,163,569) (3,888,531) Cash received (paid) for derivative settlements, net 2,586,230 677,843 (1,882,765) 2,710,479 (5,938,777) Changes in operating assets and liabilities: Accounts receivable 4,672,943 (1,809,302) 5,529,542 2,299,483 3,245,030 Inventory 399,193 (2,083,798) 1,148,418 (937,541) 1,508,955 Prepaid expenses and other assets 439,087 (1,560,295) 545,529 (496,396) (202,046) Accounts payable 841,492 (2,495,394) (225,196) (12,039,039) (9,538,827) Settlement of asset retirement obligation (265,794) (363,691) (222,553) (837,065) (974,877) Net Cash Provided by Operating Activities 44,492,325 33,297,251 51,336,932 106,160,584 147,144,031 Cash Flows From Investing Activities Payments for the Lime Rock Acquisition (1,709,776) — — (72,569,545) — Payments to purchase oil and natural gas properties (715,126) (150,183) (164,481) (1,512,415) (787,343) Payments to develop oil and natural gas properties (20,995,094) (18,173,374) (42,099,874) (70,251,975) (117,559,401) Payments to acquire or improve fixed assets subject to depreciation (5,708) (135,386) (33,938) (175,369) (185,524) Proceeds from sale of fixed assets subject to depreciation — — — 17,360 10,605 Proceeds from divestiture of equipment for oil and natural gas properties 100 — — 100 — Proceeds from sale of New Mexico properties — — — — (144,398) Proceeds from sale of CBP vertical wells — — 5,500,000 — 5,500,000 Insurance proceeds received for damage to oil and natural gas properties 160,533 99,913 — 260,446 — Net Cash Used in Investing Activities (23,265,071) (18,359,030) (36,798,293) (144,231,398) (113,166,061) Cash Flows From Financing Activities Proceeds from revolving line of credit 31,000,000 56,322,997 27,000,000 201,322,997 108,000,000 Payments on revolving line of credit (51,000,000) (68,322,997) (42,000,000) (158,322,997) (141,000,000) Payments for taxes withheld on vested restricted shares, net (8,000) (57,015) (17,273) (961,446) (919,249) Proceeds from notes payable — 1,648,539 — 1,648,539 1,501,507 Payments on notes payable (486,590) (160,120) (442,976) (1,143,107) (1,122,422) Payment of deferred financing costs (332,376) (5,381,602) — (5,713,978) (45,704) Reduction of financing lease liabilities (113,381) (88,874) (257,202) (338,682) (688,486) Net Cash Provided by (Used in) Financing Activities (20,940,347) (16,039,072) (15,717,451) 36,491,326 (34,274,354) Net Increase (Decrease) in Cash 286,907 (1,100,851) (1,178,812) (1,579,488) (296,384) Cash at Beginning of Period — 1,100,851 1,178,812 1,866,395 296,384 Cash at End of Period $ 286,907 $ — $ — $ 286,907 $ — (Unaudited) September 30, 2025 December 31, 2024 ASSETS Current Assets Cash and cash equivalents $ 286,907 $ 1,866,395 Accounts receivable 34,504,883 36,172,316 Joint interest billing receivables, net 917,575 1,083,164 Derivative assets 12,854,010 5,497,057 Inventory 4,985,360 4,047,819 Prepaid expenses and other assets 2,277,737 1,781,341 Total Current Assets 55,826,472 50,448,092 Properties and Equipment Oil and natural gas properties, full cost method 1,902,517,373 1,809,309,848 Financing lease asset subject to depreciation 3,685,956 4,634,556 Fixed assets subject to depreciation 3,500,386 3,389,907 Total Properties and Equipment 1,909,703,715 1,817,334,311 Accumulated depreciation, depletion and amortization (546,561,770) (475,212,325) Net Properties and Equipment 1,363,141,945 1,342,121,986 Operating lease asset 1,443,170 1,906,264 Derivative assets 4,232,434 5,473,375 Deferred financing costs 10,028,572 8,149,757 Total Assets $ 1,434,672,593 $ 1,408,099,474 LIABILITIES AND STOCKHOLDERS’ EQUITY Current Liabilities Accounts payable $ 86,459,022 $ 95,729,261 Income tax liability 305,124 328,985 Financing lease liability 728,762 906,119 Operating lease liability 633,264 648,204 Derivative liabilities 2,277,994 6,410,547 Notes payable 1,001,829 496,397 Deferred cash payment 9,800,376 — Asset retirement obligations 418,526 517,674 Total Current Liabilities 101,624,897 105,037,187 Non-current Liabilities Deferred income taxes 24,615,831 28,591,802 Revolving line of credit 428,000,000 385,000,000 Financing lease liability, less current portion 547,064 647,078 Operating lease liability, less current portion 940,853 1,405,837 Derivative liabilities 1,708,221 2,912,745 Asset retirement obligations 29,578,865 25,864,843 Total Liabilities 587,015,731 549,459,492 Commitments and contingencies Stockholders' Equity Preferred stock - $0.001 par value; 50,000,000 shares authorized; no shares issued or outstanding — — Common stock - $0.001 par value; 450,000,000 shares authorized; 207,223,177 shares and 198,561,378 shares issued and outstanding, respectively 207,223 198,561 Additional paid-in capital 811,313,842 800,419,719 Retained earnings (Accumulated deficit) 36,135,797 58,021,702 Total Stockholders’ Equity 847,656,862 858,639,982 Total Liabilities and Stockholders' Equity $ 1,434,672,593 $ 1,408,099,474 Statements of Cash Flows Balance Sheet

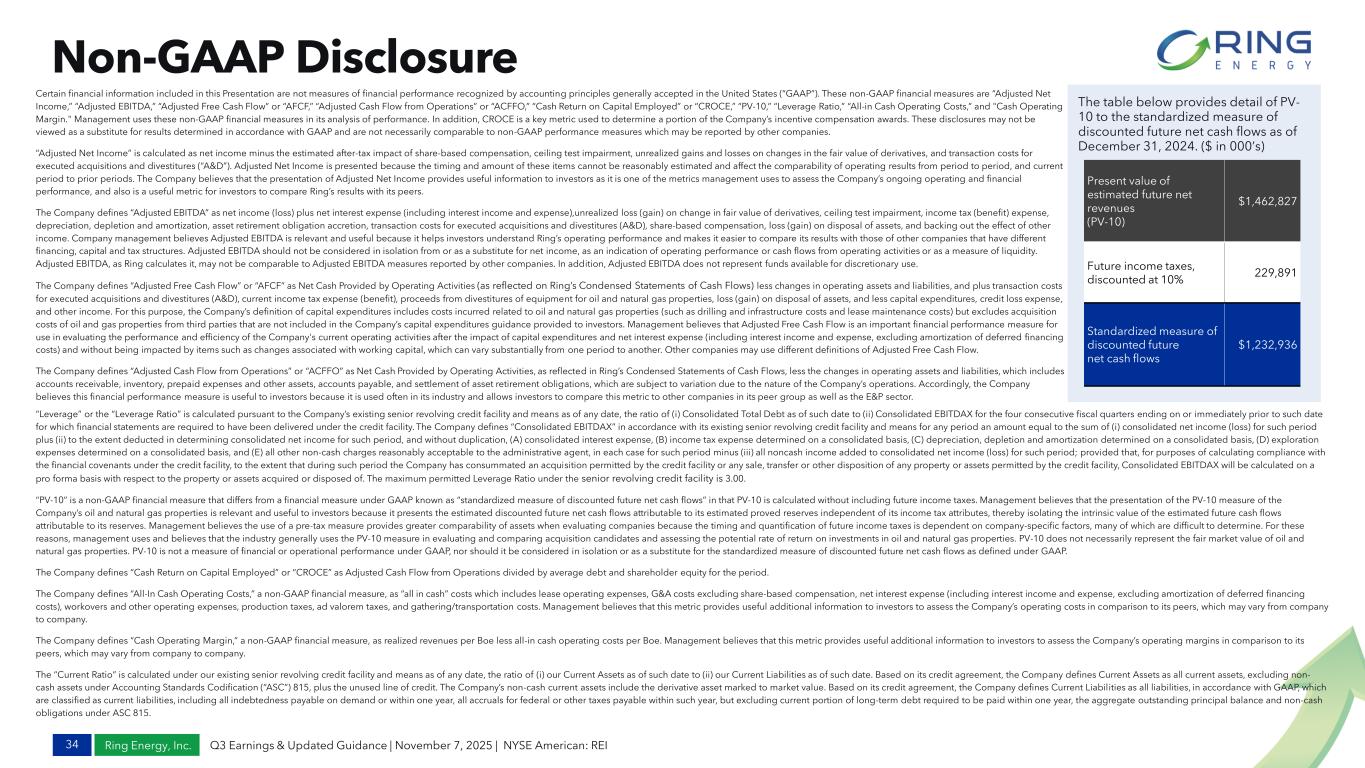

Ring Energy, Inc. Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Non-GAAP Disclosure 34 Certain financial information included in this Presentation are not measures of financial performance recognized by accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures are “Adjusted Net Income,” “Adjusted EBITDA,” “Adjusted Free Cash Flow” or “AFCF,” “Adjusted Cash Flow from Operations” or “ACFFO,” “Cash Return on Capital Employed” or “CROCE,” “PV-10,” “Leverage Ratio,” “All-in Cash Operating Costs,” and "Cash Operating Margin." Management uses these non-GAAP financial measures in its analysis of performance. In addition, CROCE is a key metric used to determine a portion of the Company’s incentive compensation awards. These disclosures may not be viewed as a substitute for results determined in accordance with GAAP and are not necessarily comparable to non-GAAP performance measures which may be reported by other companies. “Adjusted Net Income” is calculated as net income minus the estimated after-tax impact of share-based compensation, ceiling test impairment, unrealized gains and losses on changes in the fair value of derivatives, and transaction costs for executed acquisitions and divestitures (“A&D”). Adjusted Net Income is presented because the timing and amount of these items cannot be reasonably estimated and affect the comparability of operating results from period to period, and current period to prior periods. The Company believes that the presentation of Adjusted Net Income provides useful information to investors as it is one of the metrics management uses to assess the Company’s ongoing operating and financial performance, and also is a useful metric for investors to compare Ring’s results with its peers. The Company defines “Adjusted EBITDA” as net income (loss) plus net interest expense (including interest income and expense),unrealized loss (gain) on change in fair value of derivatives, ceiling test impairment, income tax (benefit) expense, depreciation, depletion and amortization, asset retirement obligation accretion, transaction costs for executed acquisitions and divestitures (A&D), share-based compensation, loss (gain) on disposal of assets, and backing out the effect of other income. Company management believes Adjusted EBITDA is relevant and useful because it helps investors understand Ring’s operating performance and makes it easier to compare its results with those of other companies that have different financing, capital and tax structures. Adjusted EBITDA should not be considered in isolation from or as a substitute for net income, as an indication of operating performance or cash flows from operating activities or as a measure of liquidity. Adjusted EBITDA, as Ring calculates it, may not be comparable to Adjusted EBITDA measures reported by other companies. In addition, Adjusted EBITDA does not represent funds available for discretionary use. The Company defines “Adjusted Free Cash Flow” or “AFCF” as Net Cash Provided by Operating Activities (as reflected on Ring’s Condensed Statements of Cash Flows) less changes in operating assets and liabilities, and plus transaction costs for executed acquisitions and divestitures (A&D), current income tax expense (benefit), proceeds from divestitures of equipment for oil and natural gas properties, loss (gain) on disposal of assets, and less capital expenditures, credit loss expense, and other income. For this purpose, the Company’s definition of capital expenditures includes costs incurred related to oil and natural gas properties (such as drilling and infrastructure costs and lease maintenance costs) but excludes acquisition costs of oil and gas properties from third parties that are not included in the Company’s capital expenditures guidance provided to investors. Management believes that Adjusted Free Cash Flow is an important financial performance measure for use in evaluating the performance and efficiency of the Company's current operating activities after the impact of capital expenditures and net interest expense (including interest income and expense, excluding amortization of deferred financing costs) and without being impacted by items such as changes associated with working capital, which can vary substantially from one period to another. Other companies may use different definitions of Adjusted Free Cash Flow. The Company defines “Adjusted Cash Flow from Operations” or “ACFFO” as Net Cash Provided by Operating Activities, as reflected in Ring’s Condensed Statements of Cash Flows, less the changes in operating assets and liabilities, which includes accounts receivable, inventory, prepaid expenses and other assets, accounts payable, and settlement of asset retirement obligations, which are subject to variation due to the nature of the Company’s operations. Accordingly, the Company believes this financial performance measure is useful to investors because it is used often in its industry and allows investors to compare this metric to other companies in its peer group as well as the E&P sector. The table below provides detail of PV- 10 to the standardized measure of discounted future net cash flows as of December 31, 2024. ($ in 000’s) Present value of estimated future net revenues (PV-10) $1,462,827 Future income taxes, discounted at 10% 229,891 Standardized measure of discounted future net cash flows $1,232,936 “Leverage” or the “Leverage Ratio” is calculated pursuant to the Company’s existing senior revolving credit facility and means as of any date, the ratio of (i) Consolidated Total Debt as of such date to (ii) Consolidated EBITDAX for the four consecutive fiscal quarters ending on or immediately prior to such date for which financial statements are required to have been delivered under the credit facility. The Company defines “Consolidated EBITDAX” in accordance with its existing senior revolving credit facility and means for any period an amount equal to the sum of (i) consolidated net income (loss) for such period plus (ii) to the extent deducted in determining consolidated net income for such period, and without duplication, (A) consolidated interest expense, (B) income tax expense determined on a consolidated basis, (C) depreciation, depletion and amortization determined on a consolidated basis, (D) exploration expenses determined on a consolidated basis, and (E) all other non-cash charges reasonably acceptable to the administrative agent, in each case for such period minus (iii) all noncash income added to consolidated net income (loss) for such period; provided that, for purposes of calculating compliance with the financial covenants under the credit facility, to the extent that during such period the Company has consummated an acquisition permitted by the credit facility or any sale, transfer or other disposition of any property or assets permitted by the credit facility, Consolidated EBITDAX will be calculated on a pro forma basis with respect to the property or assets acquired or disposed of. The maximum permitted Leverage Ratio under the senior revolving credit facility is 3.00. “PV-10” is a non-GAAP financial measure that differs from a financial measure under GAAP known as “standardized measure of discounted future net cash flows” in that PV-10 is calculated without including future income taxes. Management believes that the presentation of the PV-10 measure of the Company’s oil and natural gas properties is relevant and useful to investors because it presents the estimated discounted future net cash flows attributable to its estimated proved reserves independent of its income tax attributes, thereby isolating the intrinsic value of the estimated future cash flows attributable to its reserves. Management believes the use of a pre-tax measure provides greater comparability of assets when evaluating companies because the timing and quantification of future income taxes is dependent on company-specific factors, many of which are difficult to determine. For these reasons, management uses and believes that the industry generally uses the PV-10 measure in evaluating and comparing acquisition candidates and assessing the potential rate of return on investments in oil and natural gas properties. PV-10 does not necessarily represent the fair market value of oil and natural gas properties. PV-10 is not a measure of financial or operational performance under GAAP, nor should it be considered in isolation or as a substitute for the standardized measure of discounted future net cash flows as defined under GAAP. The Company defines “Cash Return on Capital Employed” or “CROCE” as Adjusted Cash Flow from Operations divided by average debt and shareholder equity for the period. The Company defines “All-In Cash Operating Costs,” a non-GAAP financial measure, as “all in cash” costs which includes lease operating expenses, G&A costs excluding share-based compensation, net interest expense (including interest income and expense, excluding amortization of deferred financing costs), workovers and other operating expenses, production taxes, ad valorem taxes, and gathering/transportation costs. Management believes that this metric provides useful additional information to investors to assess the Company’s operating costs in comparison to its peers, which may vary from company to company. The Company defines “Cash Operating Margin,” a non-GAAP financial measure, as realized revenues per Boe less all-in cash operating costs per Boe. Management believes that this metric provides useful additional information to investors to assess the Company’s operating margins in comparison to its peers, which may vary from company to company. The “Current Ratio” is calculated under our existing senior revolving credit facility and means as of any date, the ratio of (i) our Current Assets as of such date to (ii) our Current Liabilities as of such date. Based on its credit agreement, the Company defines Current Assets as all current assets, excluding non- cash assets under Accounting Standards Codification (“ASC”) 815, plus the unused line of credit. The Company’s non-cash current assets include the derivative asset marked to market value. Based on its credit agreement, the Company defines Current Liabilities as all liabilities, in accordance with GAAP, which are classified as current liabilities, including all indebtedness payable on demand or within one year, all accruals for federal or other taxes payable within such year, but excluding current portion of long-term debt required to be paid within one year, the aggregate outstanding principal balance and non-cash obligations under ASC 815.

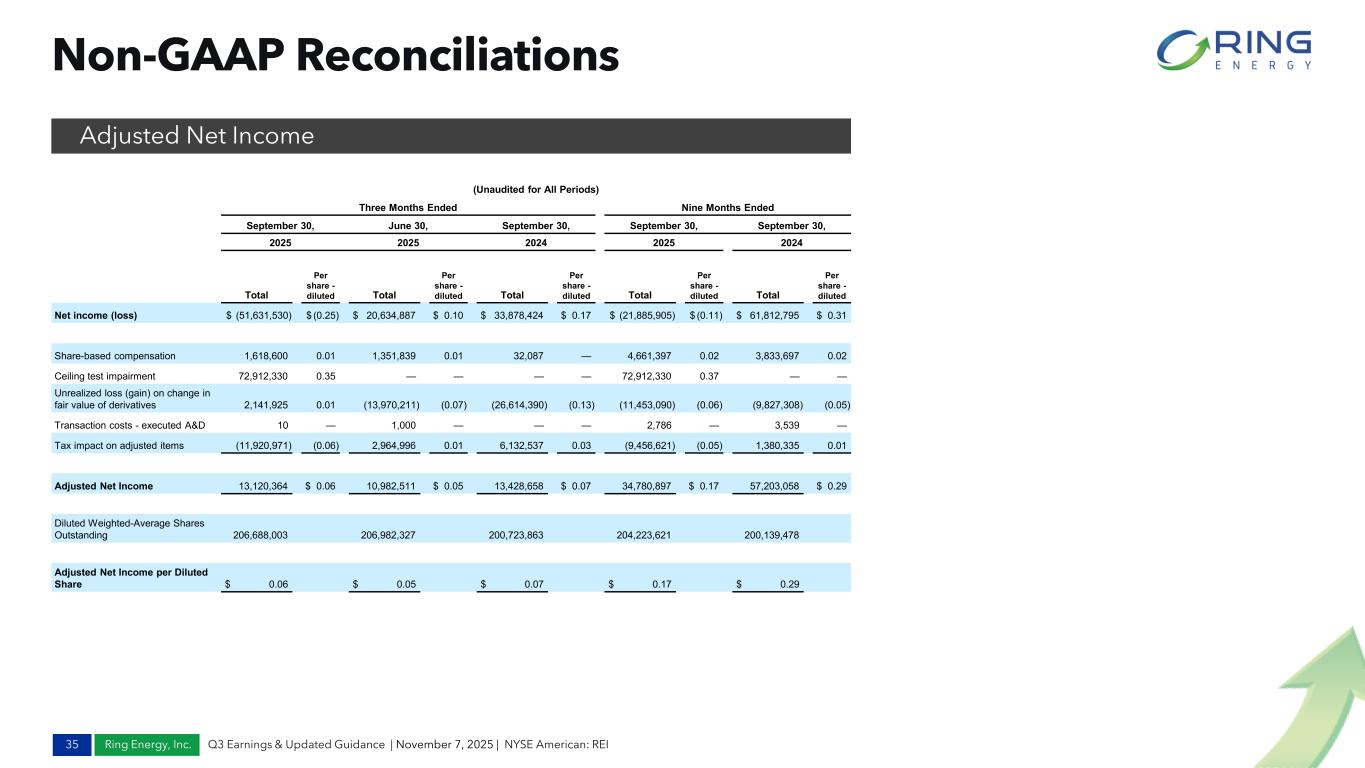

Ring Energy, Inc. Non-GAAP Reconciliations 35 Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Adjusted Net Income (Unaudited for All Periods) Three Months Ended Nine Months Ended September 30, June 30, September 30, September 30, September 30, 2025 2025 2024 2025 2024 Total Per share - diluted Total Per share - diluted Total Per share - diluted Total Per share - diluted Total Per share - diluted Net income (loss) $ (51,631,530) $ (0.25) $ 20,634,887 $ 0.10 $ 33,878,424 $ 0.17 $ (21,885,905) $ (0.11) $ 61,812,795 $ 0.31 Share-based compensation 1,618,600 0.01 1,351,839 0.01 32,087 — 4,661,397 0.02 3,833,697 0.02 Ceiling test impairment 72,912,330 0.35 — — — — 72,912,330 0.37 — — Unrealized loss (gain) on change in fair value of derivatives 2,141,925 0.01 (13,970,211) (0.07) (26,614,390) (0.13) (11,453,090) (0.06) (9,827,308) (0.05) Transaction costs - executed A&D 10 — 1,000 — — — 2,786 — 3,539 — Tax impact on adjusted items (11,920,971) (0.06) 2,964,996 0.01 6,132,537 0.03 (9,456,621) (0.05) 1,380,335 0.01 Adjusted Net Income 13,120,364 $ 0.06 10,982,511 $ 0.05 13,428,658 $ 0.07 34,780,897 $ 0.17 57,203,058 $ 0.29 Diluted Weighted-Average Shares Outstanding 206,688,003 206,982,327 200,723,863 204,223,621 200,139,478 Adjusted Net Income per Diluted Share $ 0.06 $ 0.05 $ 0.07 $ 0.17 $ 0.29

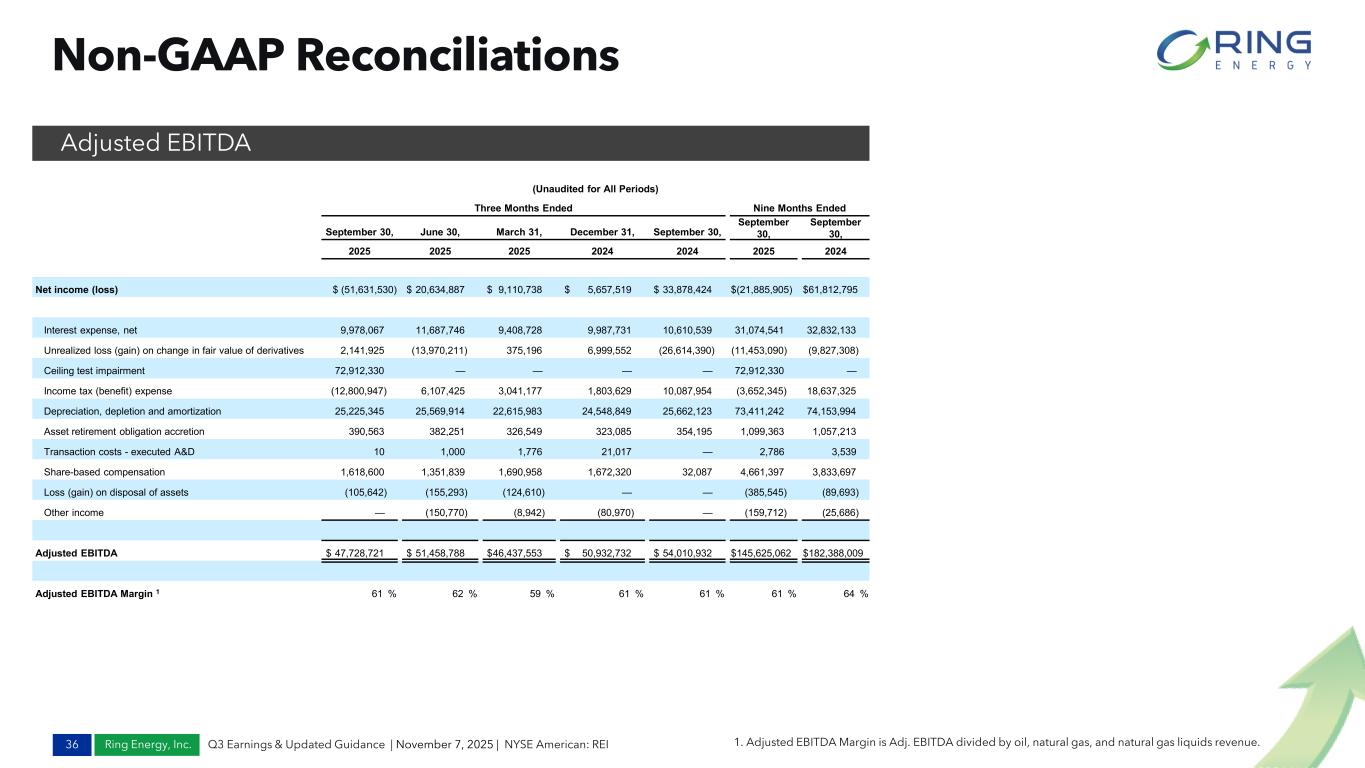

Ring Energy, Inc. Non-GAAP Reconciliations 36 Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Adjusted EBITDA 1. Adjusted EBITDA Margin is Adj. EBITDA divided by oil, natural gas, and natural gas liquids revenue. (Unaudited for All Periods) Three Months Ended Nine Months Ended September 30, June 30, March 31, December 31, September 30, September 30, September 30, 2025 2025 2025 2024 2024 2025 2024 Net income (loss) $ (51,631,530) $ 20,634,887 $ 9,110,738 $ 5,657,519 $ 33,878,424 $(21,885,905) $61,812,795 Interest expense, net 9,978,067 11,687,746 9,408,728 9,987,731 10,610,539 31,074,541 32,832,133 Unrealized loss (gain) on change in fair value of derivatives 2,141,925 (13,970,211) 375,196 6,999,552 (26,614,390) (11,453,090) (9,827,308) Ceiling test impairment 72,912,330 — — — — 72,912,330 — Income tax (benefit) expense (12,800,947) 6,107,425 3,041,177 1,803,629 10,087,954 (3,652,345) 18,637,325 Depreciation, depletion and amortization 25,225,345 25,569,914 22,615,983 24,548,849 25,662,123 73,411,242 74,153,994 Asset retirement obligation accretion 390,563 382,251 326,549 323,085 354,195 1,099,363 1,057,213 Transaction costs - executed A&D 10 1,000 1,776 21,017 — 2,786 3,539 Share-based compensation 1,618,600 1,351,839 1,690,958 1,672,320 32,087 4,661,397 3,833,697 Loss (gain) on disposal of assets (105,642) (155,293) (124,610) — — (385,545) (89,693) Other income — (150,770) (8,942) (80,970) — (159,712) (25,686) Adjusted EBITDA $ 47,728,721 $ 51,458,788 $46,437,553 $ 50,932,732 $ 54,010,932 $145,625,062 $182,388,009 Adjusted EBITDA Margin 1 61 % 62 % 59 % 61 % 61 % 61 % 64 %

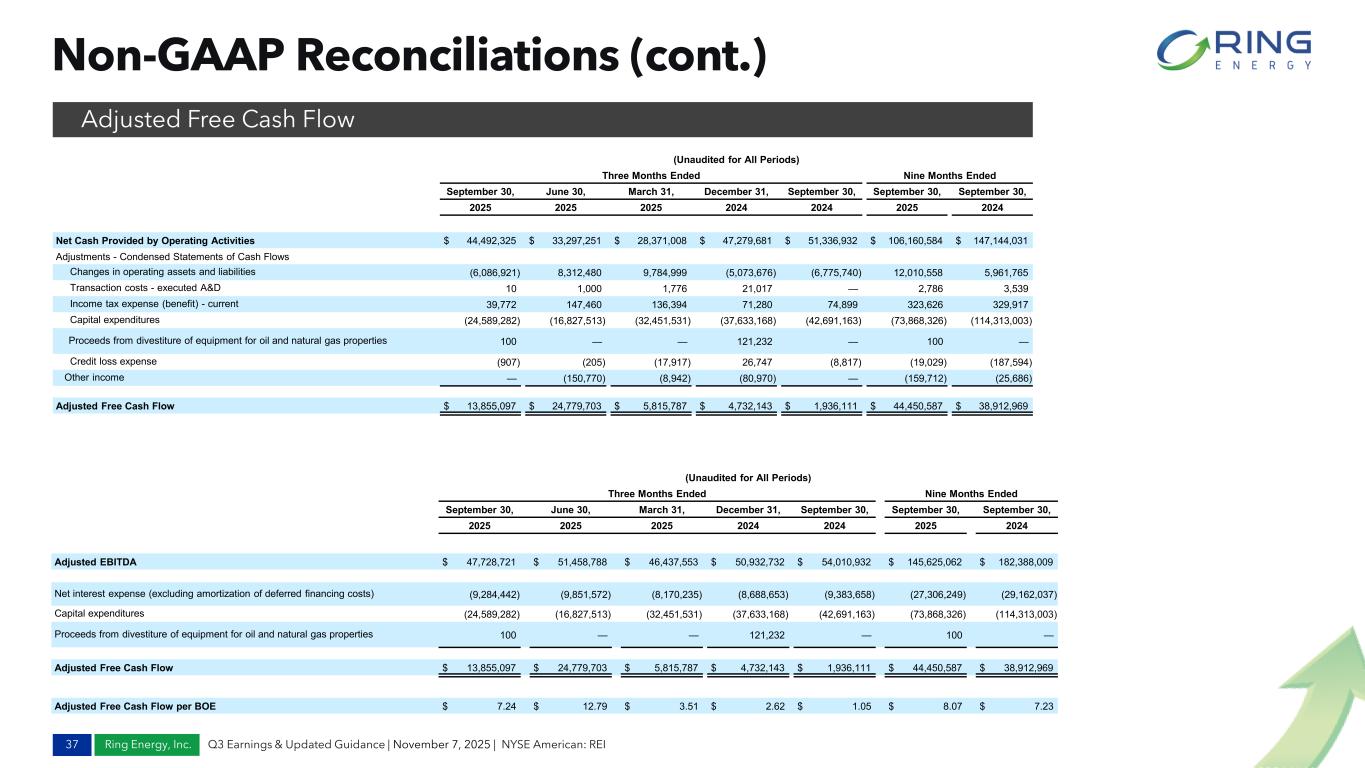

Ring Energy, Inc. Non-GAAP Reconciliations (cont.) 37 Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Adjusted Free Cash Flow (Unaudited for All Periods) Three Months Ended Nine Months Ended September 30, June 30, March 31, December 31, September 30, September 30, September 30, 2025 2025 2025 2024 2024 2025 2024 Net Cash Provided by Operating Activities $ 44,492,325 $ 33,297,251 $ 28,371,008 $ 47,279,681 $ 51,336,932 $ 106,160,584 $ 147,144,031 Adjustments - Condensed Statements of Cash Flows Changes in operating assets and liabilities (6,086,921) 8,312,480 9,784,999 (5,073,676) (6,775,740) 12,010,558 5,961,765 Transaction costs - executed A&D 10 1,000 1,776 21,017 — 2,786 3,539 Income tax expense (benefit) - current 39,772 147,460 136,394 71,280 74,899 323,626 329,917 Capital expenditures (24,589,282) (16,827,513) (32,451,531) (37,633,168) (42,691,163) (73,868,326) (114,313,003) Proceeds from divestiture of equipment for oil and natural gas properties 100 — — 121,232 — 100 — Credit loss expense (907) (205) (17,917) 26,747 (8,817) (19,029) (187,594) Other income — (150,770) (8,942) (80,970) — (159,712) (25,686) Adjusted Free Cash Flow $ 13,855,097 $ 24,779,703 $ 5,815,787 $ 4,732,143 $ 1,936,111 $ 44,450,587 $ 38,912,969 (Unaudited for All Periods) Three Months Ended Nine Months Ended September 30, June 30, March 31, December 31, September 30, September 30, September 30, 2025 2025 2025 2024 2024 2025 2024 Adjusted EBITDA $ 47,728,721 $ 51,458,788 $ 46,437,553 $ 50,932,732 $ 54,010,932 $ 145,625,062 $ 182,388,009 Net interest expense (excluding amortization of deferred financing costs) (9,284,442) (9,851,572) (8,170,235) (8,688,653) (9,383,658) (27,306,249) (29,162,037) Capital expenditures (24,589,282) (16,827,513) (32,451,531) (37,633,168) (42,691,163) (73,868,326) (114,313,003) Proceeds from divestiture of equipment for oil and natural gas properties 100 — — 121,232 — 100 — Adjusted Free Cash Flow $ 13,855,097 $ 24,779,703 $ 5,815,787 $ 4,732,143 $ 1,936,111 $ 44,450,587 $ 38,912,969 Adjusted Free Cash Flow per BOE $ 7.24 $ 12.79 $ 3.51 $ 2.62 $ 1.05 $ 8.07 $ 7.23

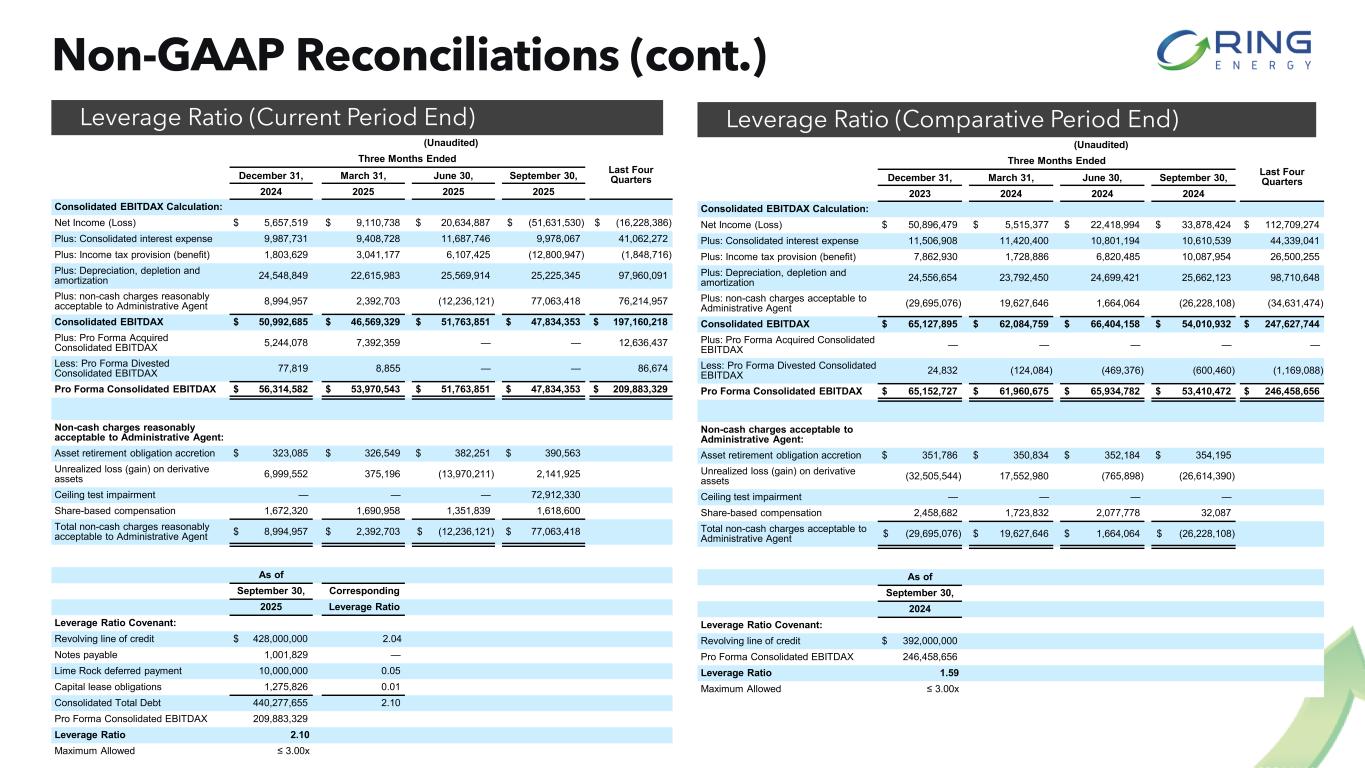

Ring Energy, Inc. Non-GAAP Reconciliations (cont.) 38 Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Leverage Ratio (Current Period End) Leverage Ratio (Comparative Period End) (Unaudited) Three Months Ended Last Four QuartersDecember 31, March 31, June 30, September 30, 2024 2025 2025 2025 Consolidated EBITDAX Calculation: Net Income (Loss) $ 5,657,519 $ 9,110,738 $ 20,634,887 $ (51,631,530) $ (16,228,386) Plus: Consolidated interest expense 9,987,731 9,408,728 11,687,746 9,978,067 41,062,272 Plus: Income tax provision (benefit) 1,803,629 3,041,177 6,107,425 (12,800,947) (1,848,716) Plus: Depreciation, depletion and amortization 24,548,849 22,615,983 25,569,914 25,225,345 97,960,091 Plus: non-cash charges reasonably acceptable to Administrative Agent 8,994,957 2,392,703 (12,236,121) 77,063,418 76,214,957 Consolidated EBITDAX $ 50,992,685 $ 46,569,329 $ 51,763,851 $ 47,834,353 $ 197,160,218 Plus: Pro Forma Acquired Consolidated EBITDAX 5,244,078 7,392,359 — — 12,636,437 Less: Pro Forma Divested Consolidated EBITDAX 77,819 8,855 — — 86,674 Pro Forma Consolidated EBITDAX $ 56,314,582 $ 53,970,543 $ 51,763,851 $ 47,834,353 $ 209,883,329 Non-cash charges reasonably acceptable to Administrative Agent: Asset retirement obligation accretion $ 323,085 $ 326,549 $ 382,251 $ 390,563 Unrealized loss (gain) on derivative assets 6,999,552 375,196 (13,970,211) 2,141,925 Ceiling test impairment — — — 72,912,330 Share-based compensation 1,672,320 1,690,958 1,351,839 1,618,600 Total non-cash charges reasonably acceptable to Administrative Agent $ 8,994,957 $ 2,392,703 $ (12,236,121) $ 77,063,418 As of September 30, Corresponding 2025 Leverage Ratio Leverage Ratio Covenant: Revolving line of credit $ 428,000,000 2.04 Notes payable 1,001,829 — Lime Rock deferred payment 10,000,000 0.05 Capital lease obligations 1,275,826 0.01 Consolidated Total Debt 440,277,655 2.10 Pro Forma Consolidated EBITDAX 209,883,329 Leverage Ratio 2.10 Maximum Allowed ≤ 3.00x (Unaudited) Three Months Ended Last Four QuartersDecember 31, March 31, June 30, September 30, 2023 2024 2024 2024 Consolidated EBITDAX Calculation: Net Income (Loss) $ 50,896,479 $ 5,515,377 $ 22,418,994 $ 33,878,424 $ 112,709,274 Plus: Consolidated interest expense 11,506,908 11,420,400 10,801,194 10,610,539 44,339,041 Plus: Income tax provision (benefit) 7,862,930 1,728,886 6,820,485 10,087,954 26,500,255 Plus: Depreciation, depletion and amortization 24,556,654 23,792,450 24,699,421 25,662,123 98,710,648 Plus: non-cash charges acceptable to Administrative Agent (29,695,076) 19,627,646 1,664,064 (26,228,108) (34,631,474) Consolidated EBITDAX $ 65,127,895 $ 62,084,759 $ 66,404,158 $ 54,010,932 $ 247,627,744 Plus: Pro Forma Acquired Consolidated EBITDAX — — — — — Less: Pro Forma Divested Consolidated EBITDAX 24,832 (124,084) (469,376) (600,460) (1,169,088) Pro Forma Consolidated EBITDAX $ 65,152,727 $ 61,960,675 $ 65,934,782 $ 53,410,472 $ 246,458,656 Non-cash charges acceptable to Administrative Agent: Asset retirement obligation accretion $ 351,786 $ 350,834 $ 352,184 $ 354,195 Unrealized loss (gain) on derivative assets (32,505,544) 17,552,980 (765,898) (26,614,390) Ceiling test impairment — — — — Share-based compensation 2,458,682 1,723,832 2,077,778 32,087 Total non-cash charges acceptable to Administrative Agent $ (29,695,076) $ 19,627,646 $ 1,664,064 $ (26,228,108) As of September 30, 2024 Leverage Ratio Covenant: Revolving line of credit $ 392,000,000 Pro Forma Consolidated EBITDAX 246,458,656 Leverage Ratio 1.59 Maximum Allowed ≤ 3.00x

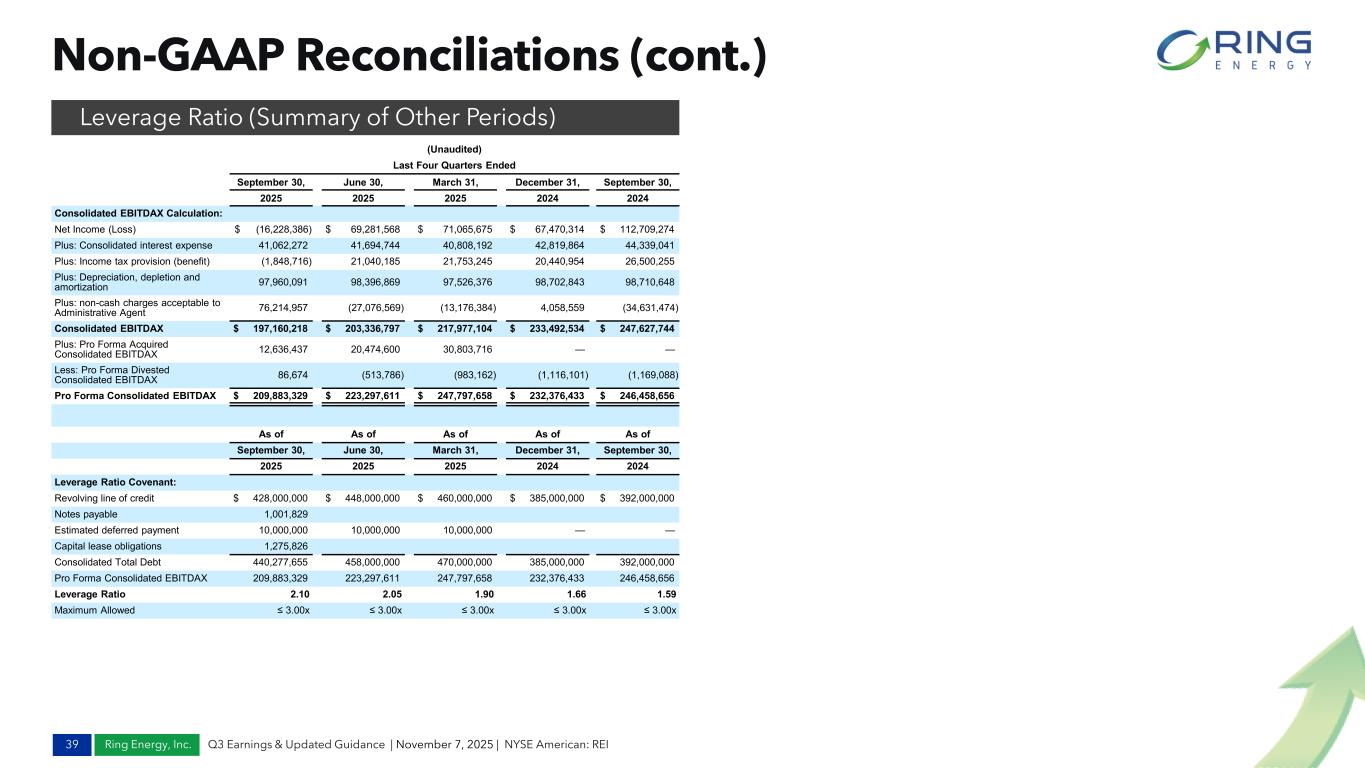

Ring Energy, Inc. Non-GAAP Reconciliations (cont.) 39 Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Leverage Ratio (Summary of Other Periods) (Unaudited) Last Four Quarters Ended September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 Consolidated EBITDAX Calculation: Net Income (Loss) $ (16,228,386) $ 69,281,568 $ 71,065,675 $ 67,470,314 $ 112,709,274 Plus: Consolidated interest expense 41,062,272 41,694,744 40,808,192 42,819,864 44,339,041 Plus: Income tax provision (benefit) (1,848,716) 21,040,185 21,753,245 20,440,954 26,500,255 Plus: Depreciation, depletion and amortization 97,960,091 98,396,869 97,526,376 98,702,843 98,710,648 Plus: non-cash charges acceptable to Administrative Agent 76,214,957 (27,076,569) (13,176,384) 4,058,559 (34,631,474) Consolidated EBITDAX $ 197,160,218 $ 203,336,797 $ 217,977,104 $ 233,492,534 $ 247,627,744 Plus: Pro Forma Acquired Consolidated EBITDAX 12,636,437 20,474,600 30,803,716 — — Less: Pro Forma Divested Consolidated EBITDAX 86,674 (513,786) (983,162) (1,116,101) (1,169,088) Pro Forma Consolidated EBITDAX $ 209,883,329 $ 223,297,611 $ 247,797,658 $ 232,376,433 $ 246,458,656 As of As of As of As of As of September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 Leverage Ratio Covenant: Revolving line of credit $ 428,000,000 $ 448,000,000 $ 460,000,000 $ 385,000,000 $ 392,000,000 Notes payable 1,001,829 Estimated deferred payment 10,000,000 10,000,000 10,000,000 — — Capital lease obligations 1,275,826 Consolidated Total Debt 440,277,655 458,000,000 470,000,000 385,000,000 392,000,000 Pro Forma Consolidated EBITDAX 209,883,329 223,297,611 247,797,658 232,376,433 246,458,656 Leverage Ratio 2.10 2.05 1.90 1.66 1.59 Maximum Allowed ≤ 3.00x ≤ 3.00x ≤ 3.00x ≤ 3.00x ≤ 3.00x

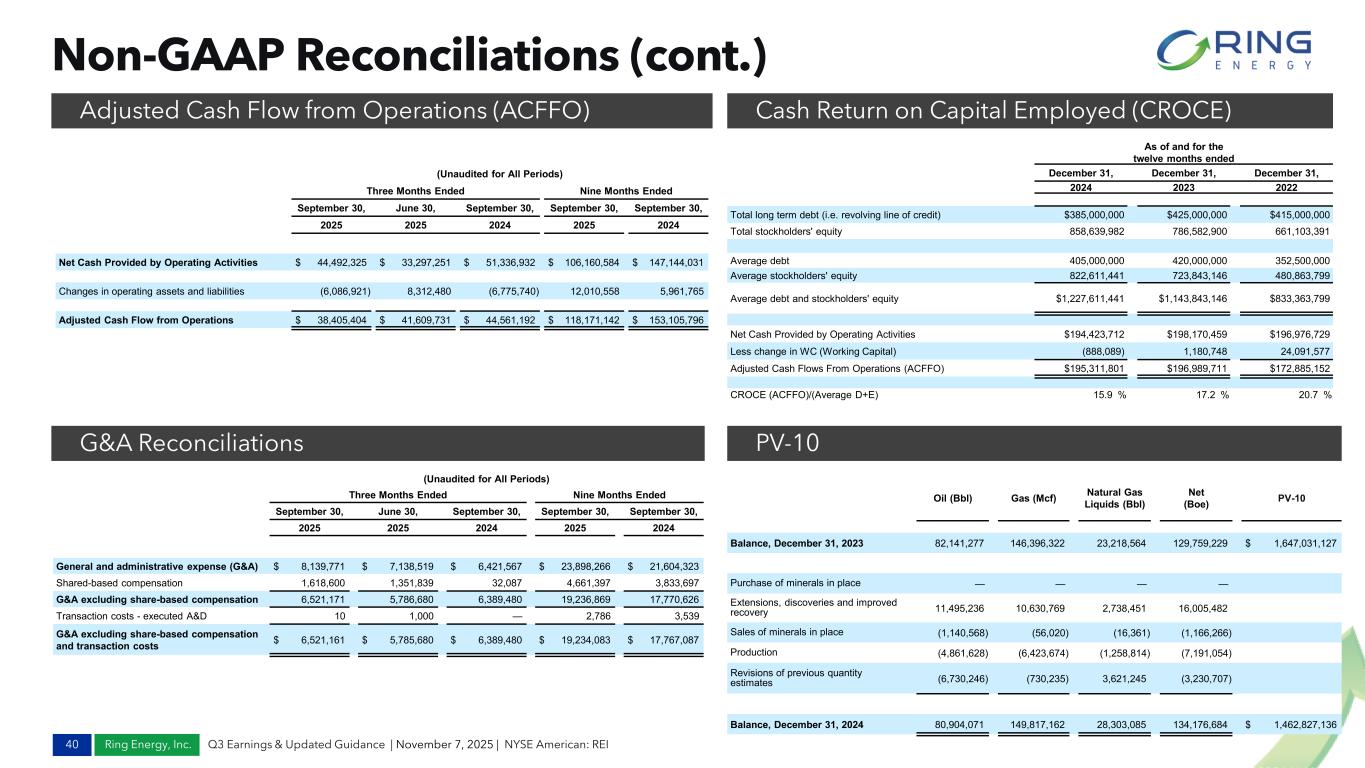

Ring Energy, Inc. Non-GAAP Reconciliations (cont.) 40 Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI Adjusted Cash Flow from Operations (ACFFO) Cash Return on Capital Employed (CROCE) G&A Reconciliations PV-10 (Unaudited for All Periods) Three Months Ended Nine Months Ended September 30, June 30, September 30, September 30, September 30, 2025 2025 2024 2025 2024 Net Cash Provided by Operating Activities $ 44,492,325 $ 33,297,251 $ 51,336,932 $ 106,160,584 $ 147,144,031 Changes in operating assets and liabilities (6,086,921) 8,312,480 (6,775,740) 12,010,558 5,961,765 Adjusted Cash Flow from Operations $ 38,405,404 $ 41,609,731 $ 44,561,192 $ 118,171,142 $ 153,105,796 (Unaudited for All Periods) Three Months Ended Nine Months Ended September 30, June 30, September 30, September 30, September 30, 2025 2025 2024 2025 2024 General and administrative expense (G&A) $ 8,139,771 $ 7,138,519 $ 6,421,567 $ 23,898,266 $ 21,604,323 Shared-based compensation 1,618,600 1,351,839 32,087 4,661,397 3,833,697 G&A excluding share-based compensation 6,521,171 5,786,680 6,389,480 19,236,869 17,770,626 Transaction costs - executed A&D 10 1,000 — 2,786 3,539 G&A excluding share-based compensation and transaction costs $ 6,521,161 $ 5,785,680 $ 6,389,480 $ 19,234,083 $ 17,767,087 Oil (Bbl) Gas (Mcf) Natural Gas Liquids (Bbl) Net (Boe) PV-10 Balance, December 31, 2023 82,141,277 146,396,322 23,218,564 129,759,229 $ 1,647,031,127 Purchase of minerals in place — — — — Extensions, discoveries and improved recovery 11,495,236 10,630,769 2,738,451 16,005,482 Sales of minerals in place (1,140,568) (56,020) (16,361) (1,166,266) Production (4,861,628) (6,423,674) (1,258,814) (7,191,054) Revisions of previous quantity estimates (6,730,246) (730,235) 3,621,245 (3,230,707) Balance, December 31, 2024 80,904,071 149,817,162 28,303,085 134,176,684 $ 1,462,827,136 As of and for the twelve months ended December 31, December 31, December 31, 2024 2023 2022 Total long term debt (i.e. revolving line of credit) $385,000,000 $425,000,000 $415,000,000 Total stockholders' equity 858,639,982 786,582,900 661,103,391 Average debt 405,000,000 420,000,000 352,500,000 Average stockholders' equity 822,611,441 723,843,146 480,863,799 Average debt and stockholders' equity $1,227,611,441 $1,143,843,146 $833,363,799 Net Cash Provided by Operating Activities $194,423,712 $198,170,459 $196,976,729 Less change in WC (Working Capital) (888,089) 1,180,748 24,091,577 Adjusted Cash Flows From Operations (ACFFO) $195,311,801 $196,989,711 $172,885,152 CROCE (ACFFO)/(Average D+E) 15.9 % 17.2 % 20.7 %

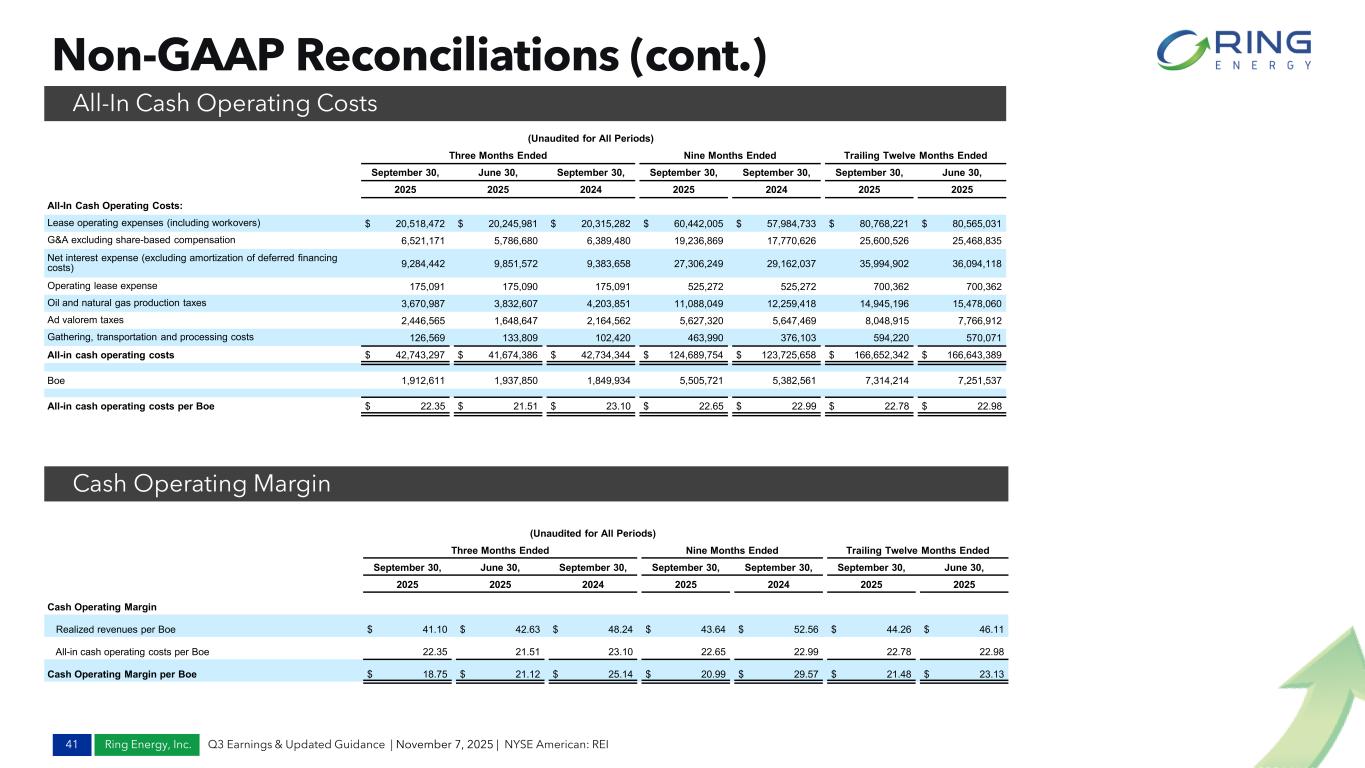

Ring Energy, Inc. Non-GAAP Reconciliations (cont.) 41 Q3 Earnings & Updated Guidance | November 7, 2025 | NYSE American: REI All-In Cash Operating Costs (Unaudited for All Periods) Three Months Ended Nine Months Ended Trailing Twelve Months Ended September 30, June 30, September 30, September 30, September 30, September 30, June 30, 2025 2025 2024 2025 2024 2025 2025 All-In Cash Operating Costs: Lease operating expenses (including workovers) $ 20,518,472 $ 20,245,981 $ 20,315,282 $ 60,442,005 $ 57,984,733 $ 80,768,221 $ 80,565,031 G&A excluding share-based compensation 6,521,171 5,786,680 6,389,480 19,236,869 17,770,626 25,600,526 25,468,835 Net interest expense (excluding amortization of deferred financing costs) 9,284,442 9,851,572 9,383,658 27,306,249 29,162,037 35,994,902 36,094,118 Operating lease expense 175,091 175,090 175,091 525,272 525,272 700,362 700,362 Oil and natural gas production taxes 3,670,987 3,832,607 4,203,851 11,088,049 12,259,418 14,945,196 15,478,060 Ad valorem taxes 2,446,565 1,648,647 2,164,562 5,627,320 5,647,469 8,048,915 7,766,912 Gathering, transportation and processing costs 126,569 133,809 102,420 463,990 376,103 594,220 570,071 All-in cash operating costs $ 42,743,297 $ 41,674,386 $ 42,734,344 $ 124,689,754 $ 123,725,658 $ 166,652,342 $ 166,643,389 Boe 1,912,611 1,937,850 1,849,934 5,505,721 5,382,561 7,314,214 7,251,537 All-in cash operating costs per Boe $ 22.35 $ 21.51 $ 23.10 $ 22.65 $ 22.99 $ 22.78 $ 22.98 (Unaudited for All Periods) Three Months Ended Nine Months Ended Trailing Twelve Months Ended September 30, June 30, September 30, September 30, September 30, September 30, June 30, 2025 2025 2024 2025 2024 2025 2025 Cash Operating Margin Realized revenues per Boe $ 41.10 $ 42.63 $ 48.24 $ 43.64 $ 52.56 $ 44.26 $ 46.11 All-in cash operating costs per Boe 22.35 21.51 23.10 22.65 22.99 22.78 22.98 Cash Operating Margin per Boe $ 18.75 $ 21.12 $ 25.14 $ 20.99 $ 29.57 $ 21.48 $ 23.13 Cash Operating Margin