| EVERY CONNECTION COUNTS TE Connectivity Fourth Quarter 2025 Earnings October 29, 2025 |

| Forward-Looking Statements This presentation contains certain "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations and are subject to risks, uncertainty and changes in circumstances, which may cause actual results, performance, financial condition or achievements to differ materially from anticipated results, performance, financial condition or achievements. All statements contained herein that are not clearly historical in nature are forward-looking and the words "anticipate," "believe," "expect," "estimate," "plan," and similar expressions are generally intended to identify forward-looking statements. We have no intention and are under no obligation to update or alter (and expressly disclaim any such intention or obligation to do so) our forward-looking statements whether as a result of new information, future events or otherwise, except to the extent required by law. The forward-looking statements in this presentation include statements addressing our future financial condition and operating results. Examples of factors that could cause actual results to differ materially from those described in the forward-looking statements include, among others, the extent, severity and duration of business interruption negatively affecting our business operations; business, economic, competitive and regulatory risks, such as conditions affecting demand for products in the automotive and other industries we serve; competition and pricing pressure; fluctuations in foreign currency exchange rates and commodity prices; natural disasters and political, economic and military instability in countries in which we operate, including continuing military conflict in certain parts of the world; developments in the credit markets; future goodwill impairment; compliance with current and future environmental and other laws and regulations; and the possible effects on us of changes in tax laws, tax treaties and other legislation. In addition, our change of incorporation from Switzerland to Ireland is subject to risks, such as the risk that the anticipated advantages might not materialize, as well as the risks that the price of our stock could decline and our position on stock exchanges and indices could change, and Irish corporate governance and regulatory schemes could prove different or more challenging than currently expected. More detailed information about these and other factors is set forth in TE Connectivity plc's Annual Report on Form 10-K for the fiscal year ended Sept. 27, 2024 as well as in our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports filed by us with the U.S. Securities and Exchange Commission. Non-GAAP Financial Measures Where we have used non-GAAP financial measures, reconciliations to the most comparable GAAP measure are provided, along with a disclosure on the usefulness of the non-GAAP financial measure, in this presentation. Effective for fiscal 2026, we will exclude amortization expense on intangible assets and, if applicable, the related tax effects from our calculation of certain non-GAAP financial measures. See description of non-GAAP financial measures effective for fiscal 2026 on slide 35. Forward-Looking Statements and Non-GAAP Financial Measures 2 |

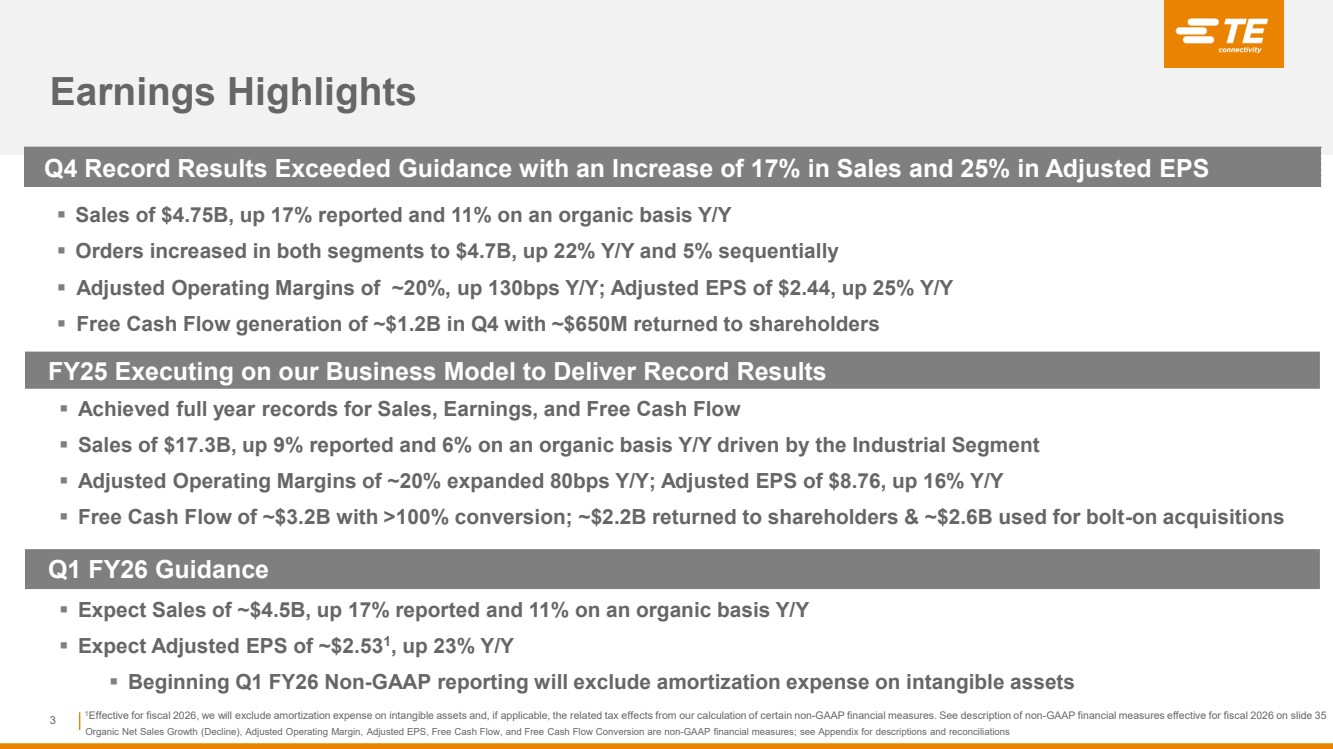

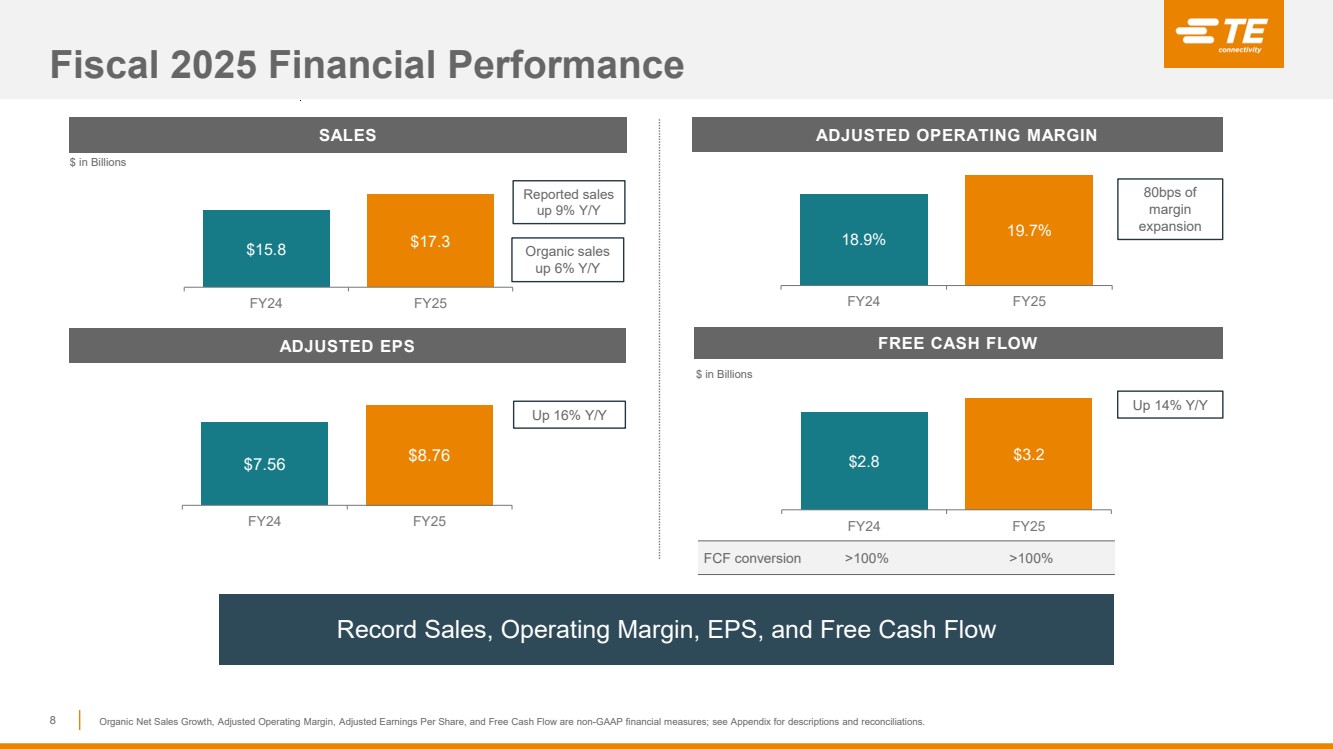

| Q4 Record Results Exceeded Guidance with an Increase of 17% in Sales and 25% in Adjusted EPS ▪ Sales of $4.75B, up 17% reported and 11% on an organic basis Y/Y ▪ Orders increased in both segments to $4.7B, up 22% Y/Y and 5% sequentially ▪ Adjusted Operating Margins of ~20%, up 130bps Y/Y; Adjusted EPS of $2.44, up 25% Y/Y ▪ Free Cash Flow generation of ~$1.2B in Q4 with ~$650M returned to shareholders Earnings Highlights 3 Organic Net Sales Growth (Decline), Adjusted Operating Margin, Adjusted EPS, Free Cash Flow, and Free Cash Flow Conversion are non-GAAP financial measures; see Appendix for descriptions and reconciliations Q1 FY26 Guidance ▪ Expect Sales of ~$4.5B, up 17% reported and 11% on an organic basis Y/Y ▪ Expect Adjusted EPS of ~$2.531 , up 23% Y/Y ▪ Beginning Q1 FY26 Non-GAAP reporting will exclude amortization expense on intangible assets FY25 Executing on our Business Model to Deliver Record Results ▪ Achieved full year records for Sales, Earnings, and Free Cash Flow ▪ Sales of $17.3B, up 9% reported and 6% on an organic basis Y/Y driven by the Industrial Segment ▪ Adjusted Operating Margins of ~20% expanded 80bps Y/Y; Adjusted EPS of $8.76, up 16% Y/Y ▪ Free Cash Flow of ~$3.2B with >100% conversion; ~$2.2B returned to shareholders & ~$2.6B used for bolt-on acquisitions 1Effective for fiscal 2026, we will exclude amortization expense on intangible assets and, if applicable, the related tax effects from our calculation of certain non-GAAP financial measures. See description of non-GAAP financial measures effective for fiscal 2026 on slide 35 |

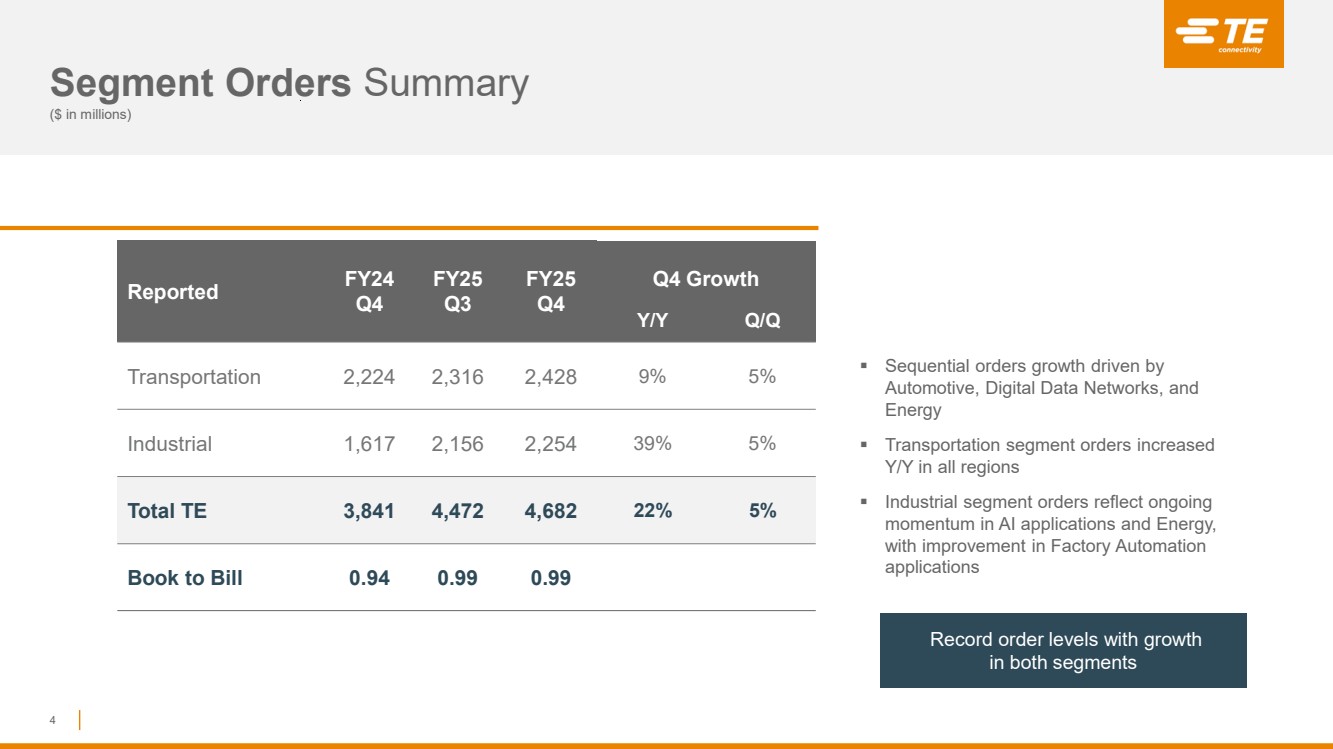

| Reported FY24 Q4 FY25 Q3 FY25 Q4 Q4 Growth Y/Y Q/Q Transportation 2,224 2,316 2,428 9% 5% Industrial 1,617 2,156 2,254 39% 5% Total TE 3,841 4,472 4,682 22% 5% Book to Bill 0.94 0.99 0.99 Segment Orders Summary ($ in millions) 4 ▪ Sequential orders growth driven by Automotive, Digital Data Networks, and Energy ▪ Transportation segment orders increased Y/Y in all regions ▪ Industrial segment orders reflect ongoing momentum in AI applications and Energy, with improvement in Factory Automation applications Record order levels with growth in both segments |

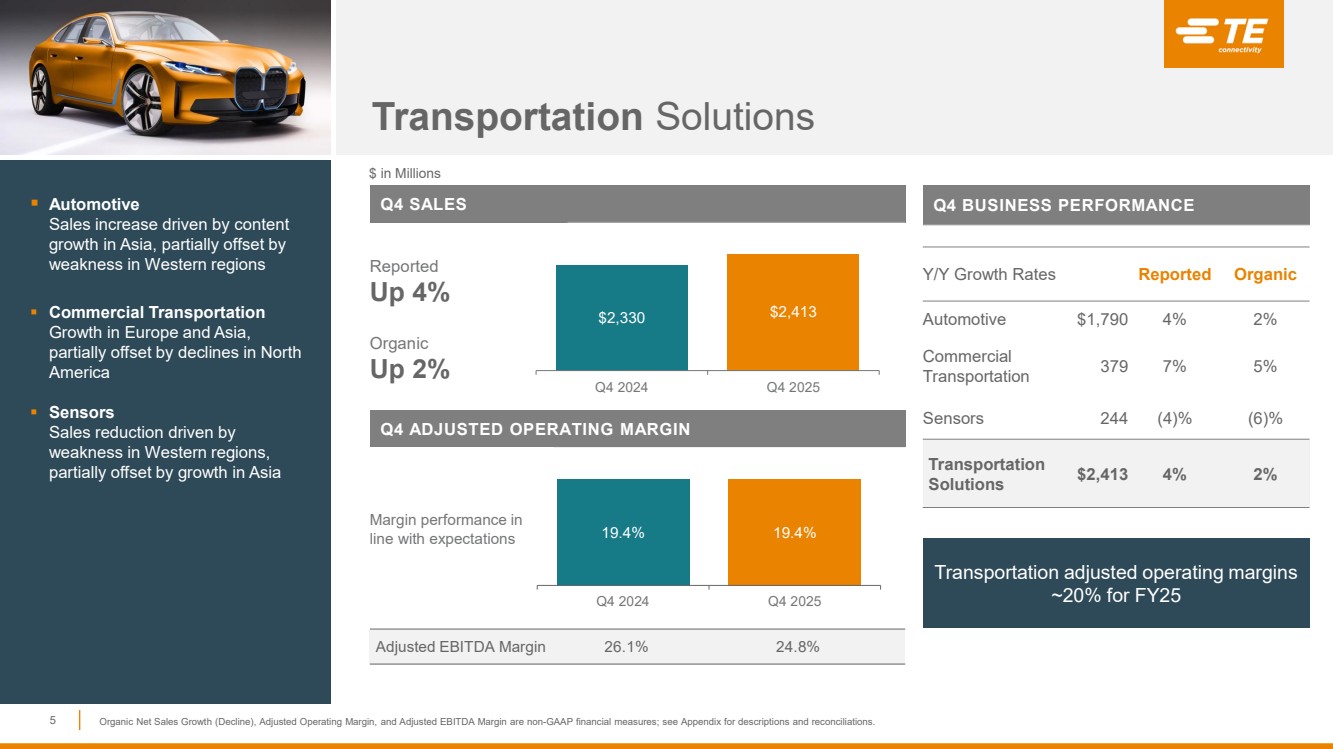

| Transportation Solutions Q4 SALES Reported Up 4% Organic Up 2% Q4 ADJUSTED OPERATING MARGIN Margin performance in line with expectations Adjusted EBITDA Margin 26.1% 24.8% 5 $2,330 $2,413 Q4 2024 Q4 2025 Q4 BUSINESS PERFORMANCE Y/Y Growth Rates Reported Organic Automotive $1,790 4% 2% Commercial Transportation 379 7% 5% Sensors 244 (4)% (6)% Transportation Solutions $2,413 4% 2% $ in Millions 19.4% 19.4% Q4 2024 Q4 2025 ▪ Automotive Sales increase driven by content growth in Asia, partially offset by weakness in Western regions ▪ Commercial Transportation Growth in Europe and Asia, partially offset by declines in North America ▪ Sensors Sales reduction driven by weakness in Western regions, partially offset by growth in Asia Organic Net Sales Growth (Decline), Adjusted Operating Margin, and Adjusted EBITDA Margin are non-GAAP financial measures; see Appendix for descriptions and reconciliations. Transportation adjusted operating margins ~20% for FY25 |

| Industrial Solutions Q4 SALES Reported Up 34% Organic Up 24% Q4 ADJUSTED OPERATING MARGIN Margin expansion of 290bps driven by strong operational performance and benefits of higher volume Adjusted EBITDA Margin 21.8% 25.2% 6 Q4 BUSINESS PERFORMANCE Y/Y Growth Rates Reported Organic Digital Data Networks (DDN) $707 80% 79% Automation & Connected Living (ACL) 585 15% 11% Energy 465 83% 24% Aerospace, Defense and Marine (AD&M) 401 9% 7% Medical 178 (16)% (16)% Industrial Solutions $2,336 34% 24% $ in Millions ▪ Digital Data Networks Strong growth driven by momentum in AI applications ▪ Automation & Connected Living Growth across all regions with improvement in Factory Automation applications ▪ Energy Growth driven by grid hardening & renewable applications ▪ AD&M Growth reflects ongoing market improvement in commercial air and defense ▪ Medical Sales ~flat sequentially, as expected $1,738 $2,336 Q4 2024 Q4 2025 17.4% 20.3% Q4 2024 Q4 2025 Industrial adjusted operating margins ~20% in 2H FY25 Organic Net Sales Growth (Decline), Adjusted Operating Margin, and Adjusted EBITDA Margin are non-GAAP financial measures; see Appendix for descriptions and reconciliations. |

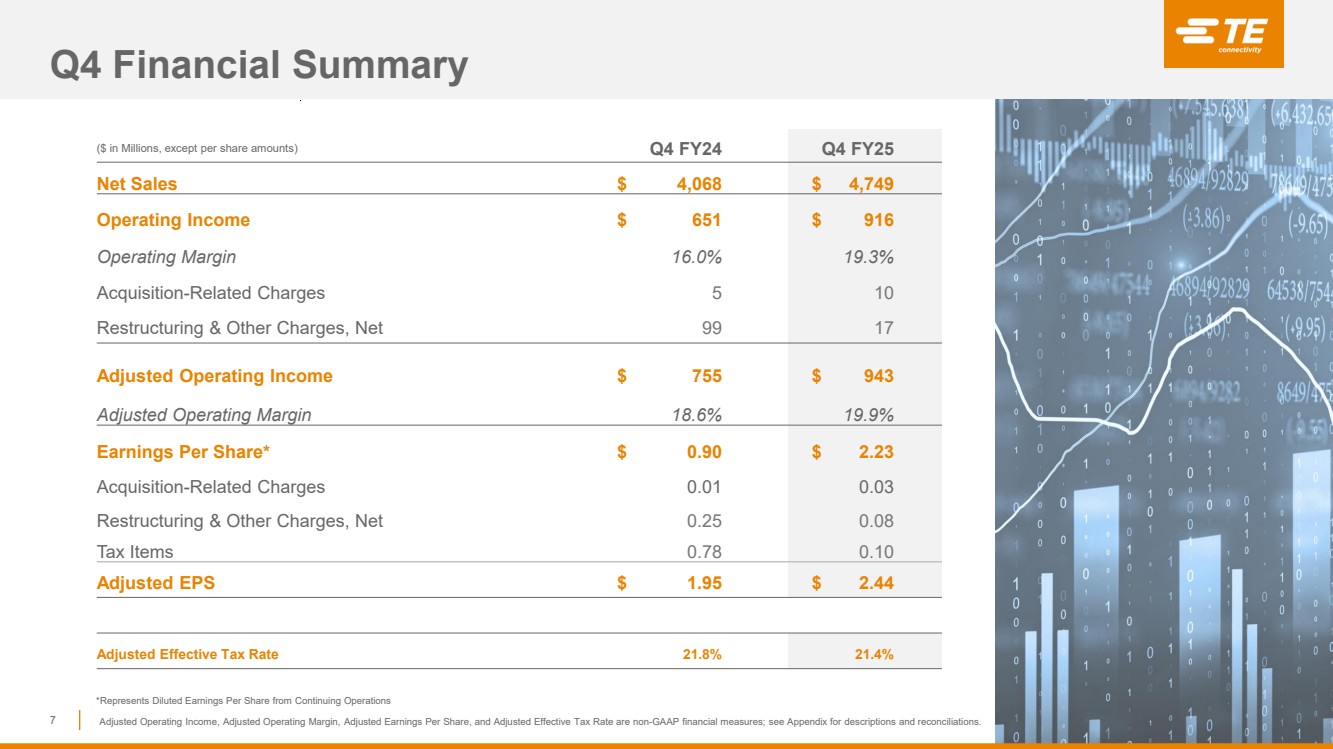

| Q4 Financial Summary 7 ($ in Millions, except per share amounts) Q4 FY24 Q4 FY25 Net Sales $ 4,068 $ 4,749 Operating Income $ 651 $ 916 Operating Margin 16.0% 19.3% Acquisition-Related Charges 5 10 Restructuring & Other Charges, Net 99 17 Adjusted Operating Income $ 755 $ 943 Adjusted Operating Margin 18.6% 19.9% Earnings Per Share* $ 0.90 $ 2.23 Acquisition-Related Charges 0.01 0.03 Restructuring & Other Charges, Net 0.25 0.08 Tax Items 0.78 0.10 Adjusted EPS $ 1.95 $ 2.44 Adjusted Effective Tax Rate 21.8% 21.4% *Represents Diluted Earnings Per Share from Continuing Operations Adjusted Operating Income, Adjusted Operating Margin, Adjusted Earnings Per Share, and Adjusted Effective Tax Rate are non-GAAP financial measures; see Appendix for descriptions and reconciliations. |

| Fiscal 2025 Financial Performance 8 18.9% 19.7% FY24 FY25 SALES ADJUSTED OPERATING MARGIN ADJUSTED EPS FREE CASH FLOW Record Sales, Operating Margin, EPS, and Free Cash Flow $ in Billions $ in Billions Up 14% Y/Y $2.8 $3.2 FY24 FY25 Up 16% Y/Y $15.8 $17.3 FY24 FY25 80bps of margin expansion Organic Net Sales Growth, Adjusted Operating Margin, Adjusted Earnings Per Share, and Free Cash Flow are non-GAAP financial measures; see Appendix for descriptions and reconciliations. Reported sales up 9% Y/Y $7.56 $8.76 FY24 FY25 Organic sales up 6% Y/Y FCF conversion >100% >100% |

| EVERY CONNECTION COUNTS Additional Information |

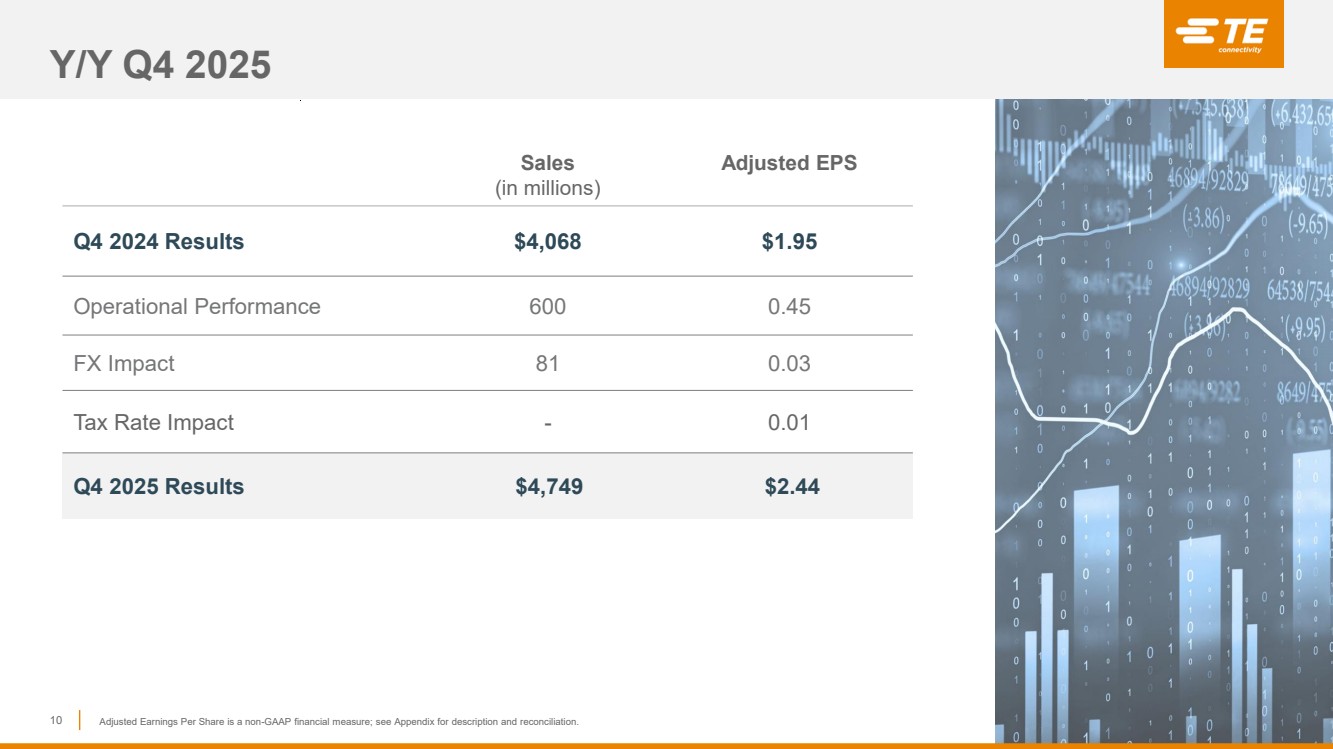

| Y/Y Q4 2025 10 Sales (in millions) Adjusted EPS Q4 2024 Results $4,068 $1.95 Operational Performance 600 0.45 FX Impact 81 0.03 Tax Rate Impact - 0.01 Q4 2025 Results $4,749 $2.44 Adjusted Earnings Per Share is a non-GAAP financial measure; see Appendix for description and reconciliation. |

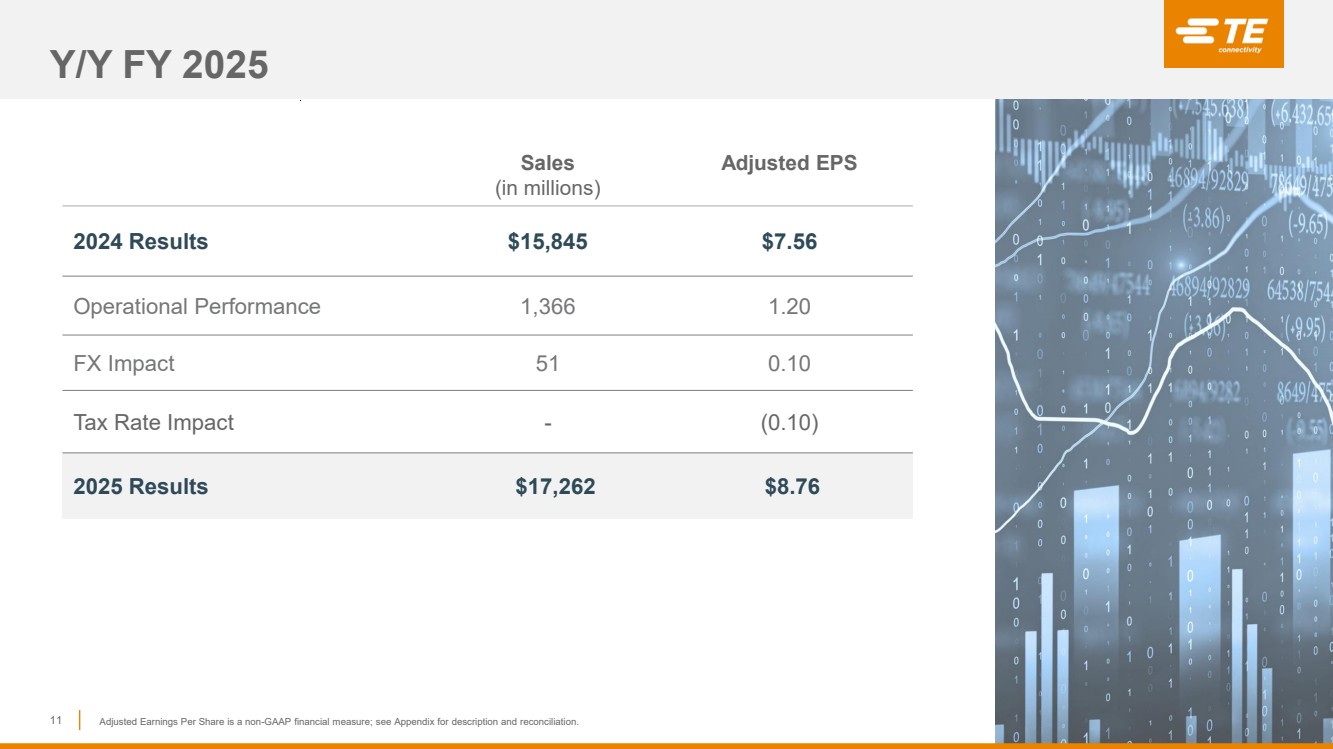

| Y/Y FY 2025 11 Sales (in millions) Adjusted EPS 2024 Results $15,845 $7.56 Operational Performance 1,366 1.20 FX Impact 51 0.10 Tax Rate Impact - (0.10) 2025 Results $17,262 $8.76 Adjusted Earnings Per Share is a non-GAAP financial measure; see Appendix for description and reconciliation. |

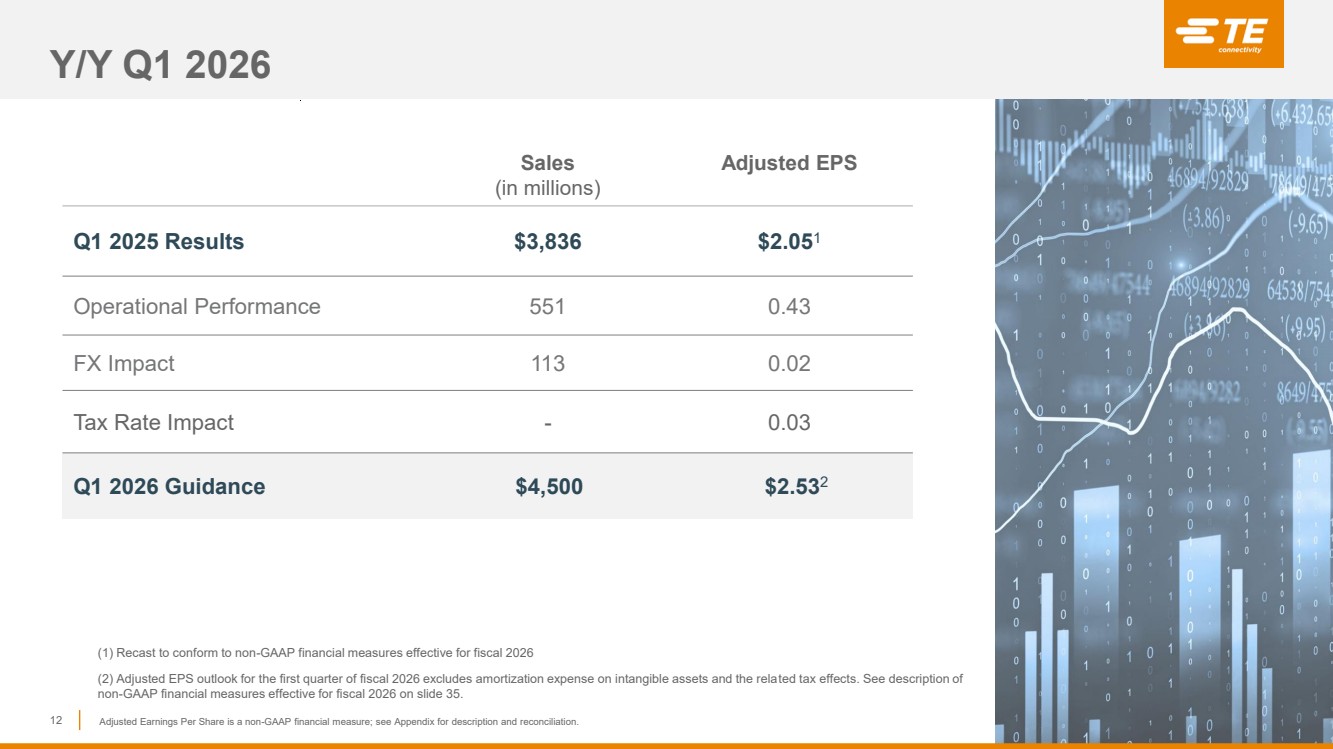

| Y/Y Q1 2026 12 Sales (in millions) Adjusted EPS Q1 2025 Results $3,836 $2.051 Operational Performance 551 0.43 FX Impact 113 0.02 Tax Rate Impact - 0.03 Q1 2026 Guidance $4,500 $2.532 Adjusted Earnings Per Share is a non-GAAP financial measure; see Appendix for description and reconciliation. (1) Recast to conform to non-GAAP financial measures effective for fiscal 2026 (2) Adjusted EPS outlook for the first quarter of fiscal 2026 excludes amortization expense on intangible assets and the related tax effects. See description of non-GAAP financial measures effective for fiscal 2026 on slide 35. |

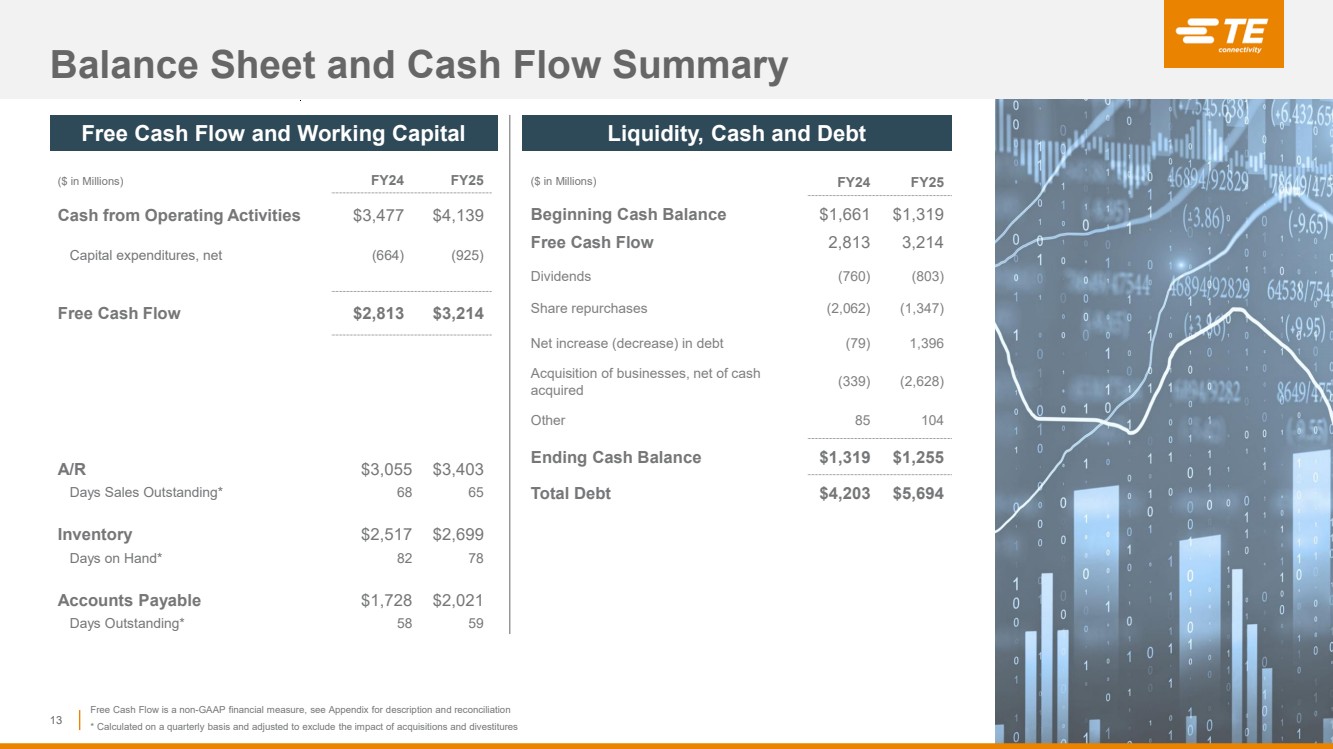

| Balance Sheet and Cash Flow Summary 13 ($ in Millions) FY24 FY25 Beginning Cash Balance $1,661 $1,319 Free Cash Flow 2,813 3,214 Dividends (760) (803) Share repurchases (2,062) (1,347) Net increase (decrease) in debt (79) 1,396 Acquisition of businesses, net of cash acquired (339) (2,628) Other 85 104 Ending Cash Balance $1,319 $1,255 Total Debt $4,203 $5,694 A/R $3,055 $3,403 Days Sales Outstanding* 68 65 Inventory $2,517 $2,699 Days on Hand* 82 78 Accounts Payable $1,728 $2,021 Days Outstanding* 58 59 Free Cash Flow and Working Capital Liquidity, Cash and Debt ($ in Millions) FY24 FY25 Cash from Operating Activities $3,477 $4,139 Capital expenditures, net (664) (925) Free Cash Flow $2,813 $3,214 Free Cash Flow is a non-GAAP financial measure, see Appendix for description and reconciliation * Calculated on a quarterly basis and adjusted to exclude the impact of acquisitions and divestitures |

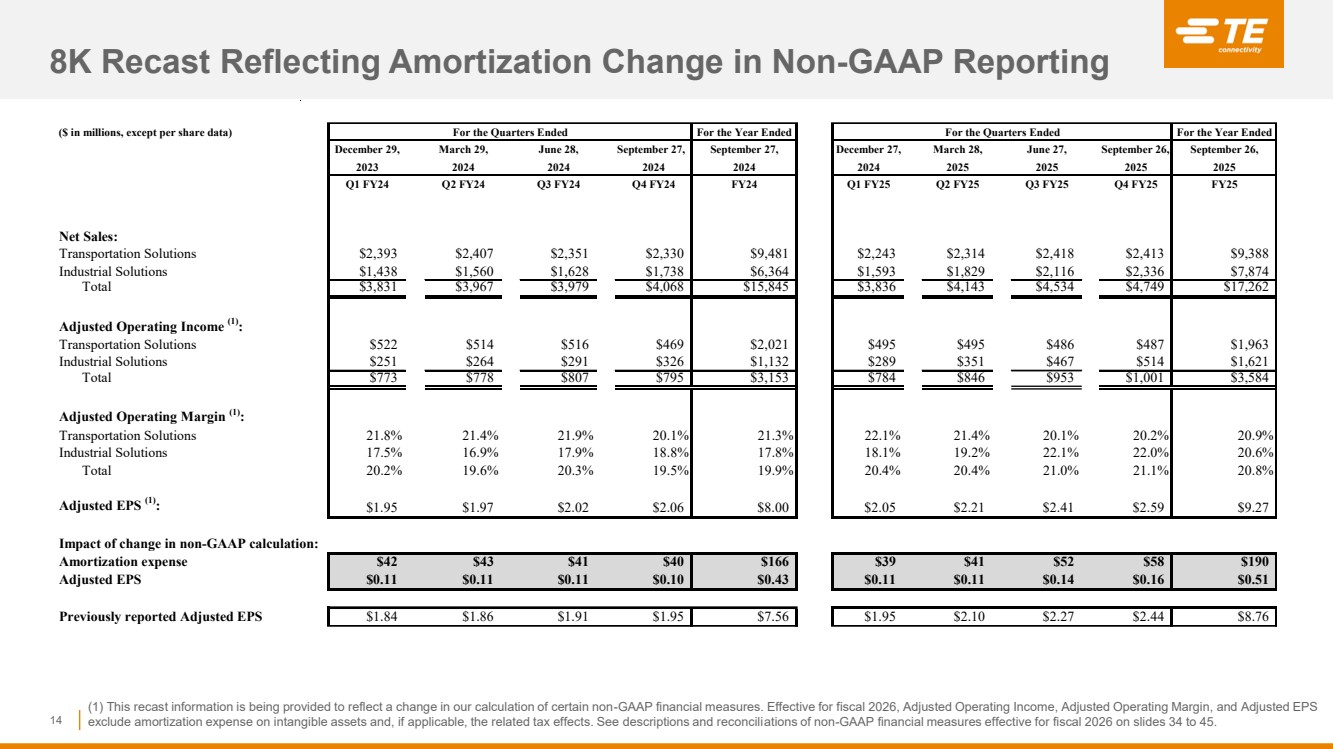

| 8K Recast Reflecting Amortization Change in Non-GAAP Reporting 14 (1) This recast information is being provided to reflect a change in our calculation of certain non-GAAP financial measures. Effective for fiscal 2026, Adjusted Operating Income, Adjusted Operating Margin, and Adjusted EPS exclude amortization expense on intangible assets and, if applicable, the related tax effects. See descriptions and reconciliations of non-GAAP financial measures effective for fiscal 2026 on slides 34 to 45. ($ in millions, except per share data) For the Year Ended For the Year Ended December 29, March 29, June 28, September 27, September 27, December 27, March 28, June 27, September 26, September 26, 2023 2024 2024 2024 2024 2024 2025 2025 2025 2025 Q1 FY24 Q2 FY24 Q3 FY24 Q4 FY24 FY24 Q1 FY25 Q2 FY25 Q3 FY25 Q4 FY25 FY25 Net Sales: Transportation Solutions $2,393 $2,407 $2,351 $2,330 $9,481 $2,243 $2,314 $2,418 $2,413 $9,388 Industrial Solutions $1,438 $1,560 $1,628 $1,738 $6,364 $1,593 $1,829 $2,116 $2,336 $7,874 Total $3,831 $3,967 $3,979 $4,068 $15,845 $3,836 $4,143 $4,534 $4,749 $17,262 Adjusted Operating Income (1) : Transportation Solutions $522 $514 $516 $469 $2,021 $495 $495 $486 $487 $1,963 Industrial Solutions $251 $264 $291 $326 $1,132 $289 $351 $467 $514 $1,621 Total $773 $778 $807 $795 $3,153 $784 $846 $953 $1,001 $3,584 Adjusted Operating Margin (1) : Transportation Solutions 21.8% 21.4% 21.9% 20.1% 21.3% 22.1% 21.4% 20.1% 20.2% 20.9% Industrial Solutions 17.5% 16.9% 17.9% 18.8% 17.8% 18.1% 19.2% 22.1% 22.0% 20.6% Total 20.2% 19.6% 20.3% 19.5% 19.9% 20.4% 20.4% 21.0% 21.1% 20.8% Adjusted EPS (1) : $1.95 $1.97 $2.02 $2.06 $8.00 $2.05 $2.21 $2.41 $2.59 $9.27 Impact of change in non-GAAP calculation: Amortization expense $42 $43 $41 $40 $166 $39 $41 $52 $58 $190 Adjusted EPS $0.11 $0.11 $0.11 $0.10 $0.43 $0.11 $0.11 $0.14 $0.16 $0.51 Previously reported Adjusted EPS $1.84 $1.86 $1.91 $1.95 $7.56 $1.95 $2.10 $2.27 $2.44 $8.76 For the Quarters Ended For the Quarters Ended |

| EVERY CONNECTION COUNTS Appendix |

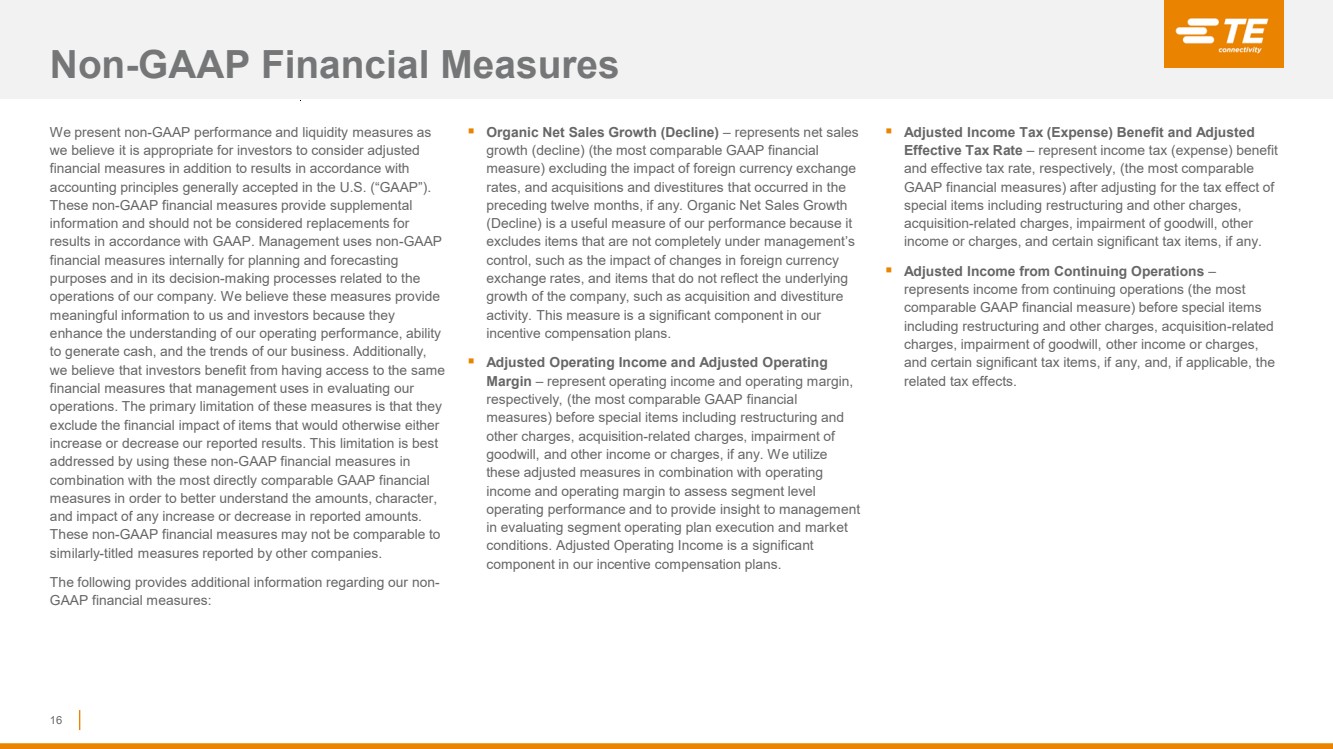

| We present non-GAAP performance and liquidity measures as we believe it is appropriate for investors to consider adjusted financial measures in addition to results in accordance with accounting principles generally accepted in the U.S. (“GAAP”). These non-GAAP financial measures provide supplemental information and should not be considered replacements for results in accordance with GAAP. Management uses non-GAAP financial measures internally for planning and forecasting purposes and in its decision-making processes related to the operations of our company. We believe these measures provide meaningful information to us and investors because they enhance the understanding of our operating performance, ability to generate cash, and the trends of our business. Additionally, we believe that investors benefit from having access to the same financial measures that management uses in evaluating our operations. The primary limitation of these measures is that they exclude the financial impact of items that would otherwise either increase or decrease our reported results. This limitation is best addressed by using these non-GAAP financial measures in combination with the most directly comparable GAAP financial measures in order to better understand the amounts, character, and impact of any increase or decrease in reported amounts. These non-GAAP financial measures may not be comparable to similarly-titled measures reported by other companies. The following provides additional information regarding our non-GAAP financial measures: ▪ Organic Net Sales Growth (Decline) – represents net sales growth (decline) (the most comparable GAAP financial measure) excluding the impact of foreign currency exchange rates, and acquisitions and divestitures that occurred in the preceding twelve months, if any. Organic Net Sales Growth (Decline) is a useful measure of our performance because it excludes items that are not completely under management’s control, such as the impact of changes in foreign currency exchange rates, and items that do not reflect the underlying growth of the company, such as acquisition and divestiture activity. This measure is a significant component in our incentive compensation plans. ▪ Adjusted Operating Income and Adjusted Operating Margin – represent operating income and operating margin, respectively, (the most comparable GAAP financial measures) before special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, and other income or charges, if any. We utilize these adjusted measures in combination with operating income and operating margin to assess segment level operating performance and to provide insight to management in evaluating segment operating plan execution and market conditions. Adjusted Operating Income is a significant component in our incentive compensation plans. ▪ Adjusted Income Tax (Expense) Benefit and Adjusted Effective Tax Rate – represent income tax (expense) benefit and effective tax rate, respectively, (the most comparable GAAP financial measures) after adjusting for the tax effect of special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, other income or charges, and certain significant tax items, if any. ▪ Adjusted Income from Continuing Operations – represents income from continuing operations (the most comparable GAAP financial measure) before special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, other income or charges, and certain significant tax items, if any, and, if applicable, the related tax effects. Non-GAAP Financial Measures 16 |

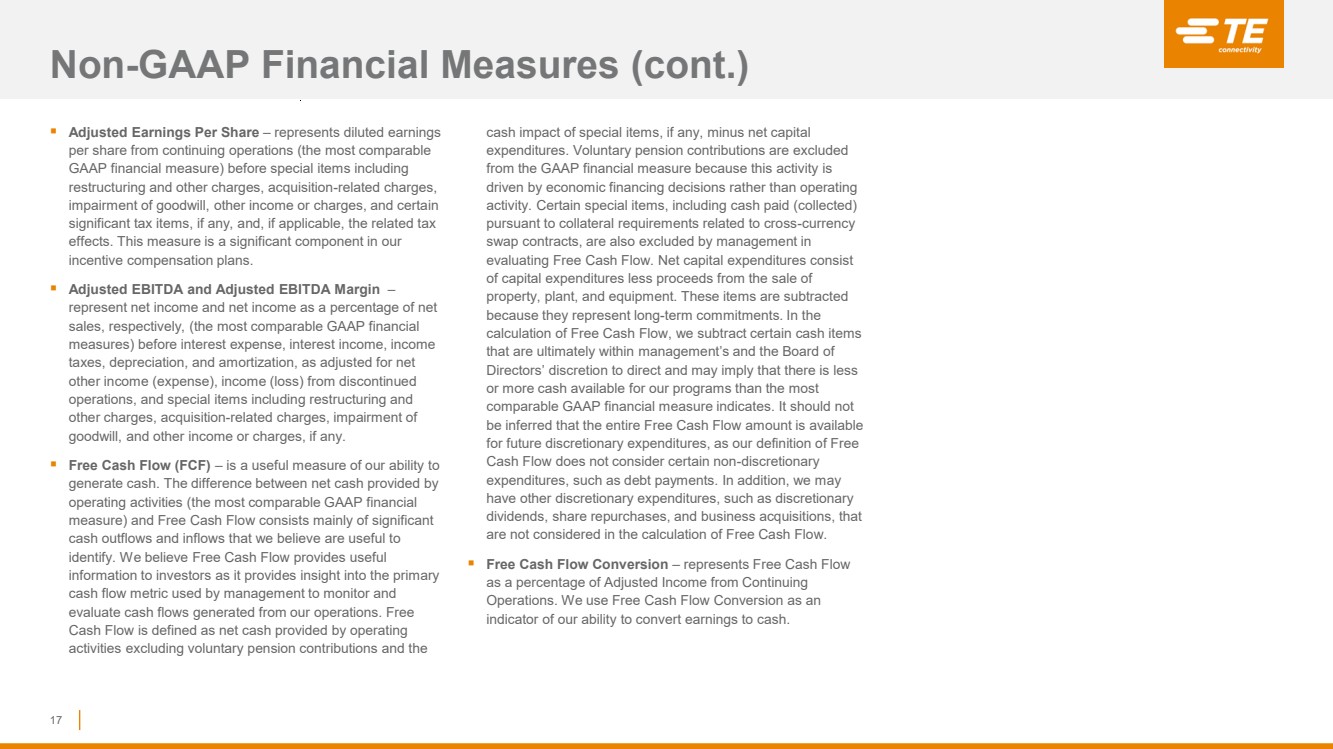

| ▪ Adjusted Earnings Per Share – represents diluted earnings per share from continuing operations (the most comparable GAAP financial measure) before special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, other income or charges, and certain significant tax items, if any, and, if applicable, the related tax effects. This measure is a significant component in our incentive compensation plans. ▪ Adjusted EBITDA and Adjusted EBITDA Margin – represent net income and net income as a percentage of net sales, respectively, (the most comparable GAAP financial measures) before interest expense, interest income, income taxes, depreciation, and amortization, as adjusted for net other income (expense), income (loss) from discontinued operations, and special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, and other income or charges, if any. ▪ Free Cash Flow (FCF) – is a useful measure of our ability to generate cash. The difference between net cash provided by operating activities (the most comparable GAAP financial measure) and Free Cash Flow consists mainly of significant cash outflows and inflows that we believe are useful to identify. We believe Free Cash Flow provides useful information to investors as it provides insight into the primary cash flow metric used by management to monitor and evaluate cash flows generated from our operations. Free Cash Flow is defined as net cash provided by operating activities excluding voluntary pension contributions and the cash impact of special items, if any, minus net capital expenditures. Voluntary pension contributions are excluded from the GAAP financial measure because this activity is driven by economic financing decisions rather than operating activity. Certain special items, including cash paid (collected) pursuant to collateral requirements related to cross-currency swap contracts, are also excluded by management in evaluating Free Cash Flow. Net capital expenditures consist of capital expenditures less proceeds from the sale of property, plant, and equipment. These items are subtracted because they represent long-term commitments. In the calculation of Free Cash Flow, we subtract certain cash items that are ultimately within management’s and the Board of Directors’ discretion to direct and may imply that there is less or more cash available for our programs than the most comparable GAAP financial measure indicates. It should not be inferred that the entire Free Cash Flow amount is available for future discretionary expenditures, as our definition of Free Cash Flow does not consider certain non-discretionary expenditures, such as debt payments. In addition, we may have other discretionary expenditures, such as discretionary dividends, share repurchases, and business acquisitions, that are not considered in the calculation of Free Cash Flow. ▪ Free Cash Flow Conversion – represents Free Cash Flow as a percentage of Adjusted Income from Continuing Operations. We use Free Cash Flow Conversion as an indicator of our ability to convert earnings to cash. Non-GAAP Financial Measures (cont.) 17 |

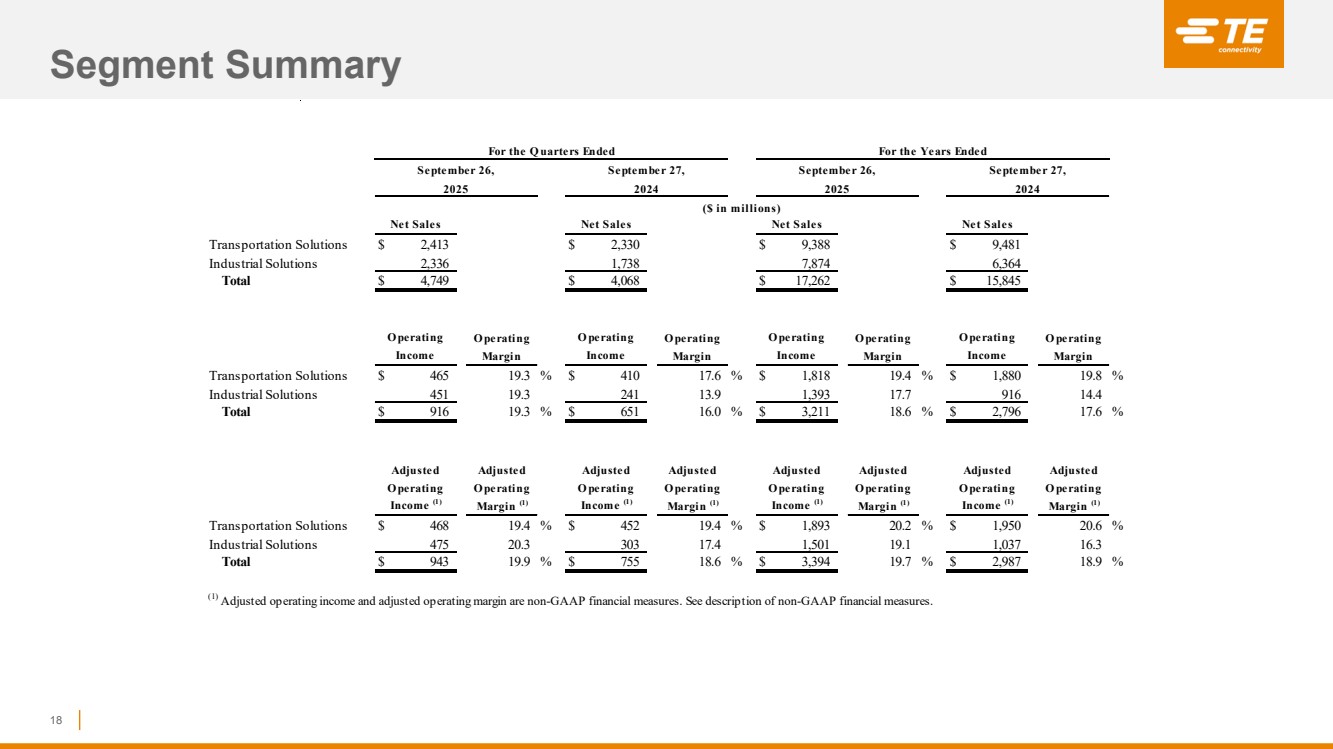

| Segment Summary 18 Transportation Solutions $ 2,413 $ 2,330 $ 9,388 $ 9,481 Industrial Solutions 2,336 1,738 7,874 6,364 Total $ 4,749 $ 4,068 $ 17,262 $ 15,845 O perating O perating O perating O perating Margin Margin Margin Margin Transportation Solutions $ 465 19.3 % $ 410 17.6 % $ 1,818 19.4 % $ 1,880 19.8 % Industrial Solutions 451 19.3 241 13.9 1,393 17.7 916 14.4 Total $ 916 19.3 % $ 651 16.0 % $ 3,211 18.6 % $ 2,796 17.6 % Adjusted Adjusted Adjusted Adjusted O perating O perating O perating O perating Margin (1) Margin (1) Margin (1) Margin (1) Transportation Solutions $ 468 19.4 % $ 452 19.4 % $ 1,893 20.2 % $ 1,950 20.6 % Industrial Solutions 475 20.3 303 17.4 1,501 19.1 1,037 16.3 Total $ 943 19.9 % $ 755 18.6 % $ 3,394 19.7 % $ 2,987 18.9 % (1) Adjusted operating income and adjusted operating margin are non-GAAP financial measures. See description of non-GAAP financial measures. 2025 2024 ($ in millions) Adjusted O perating Income (1) Adjusted O perating Adjusted O perating Income (1) Net Sales Net Sales Net Sales Income (1) Adjusted O perating Income (1) Income O perating O perating Income 2024 For the Q uarters Ended September 26, September 27, September 26, September 27, For the Years Ended Net Sales O perating Income O perating Income 2025 |

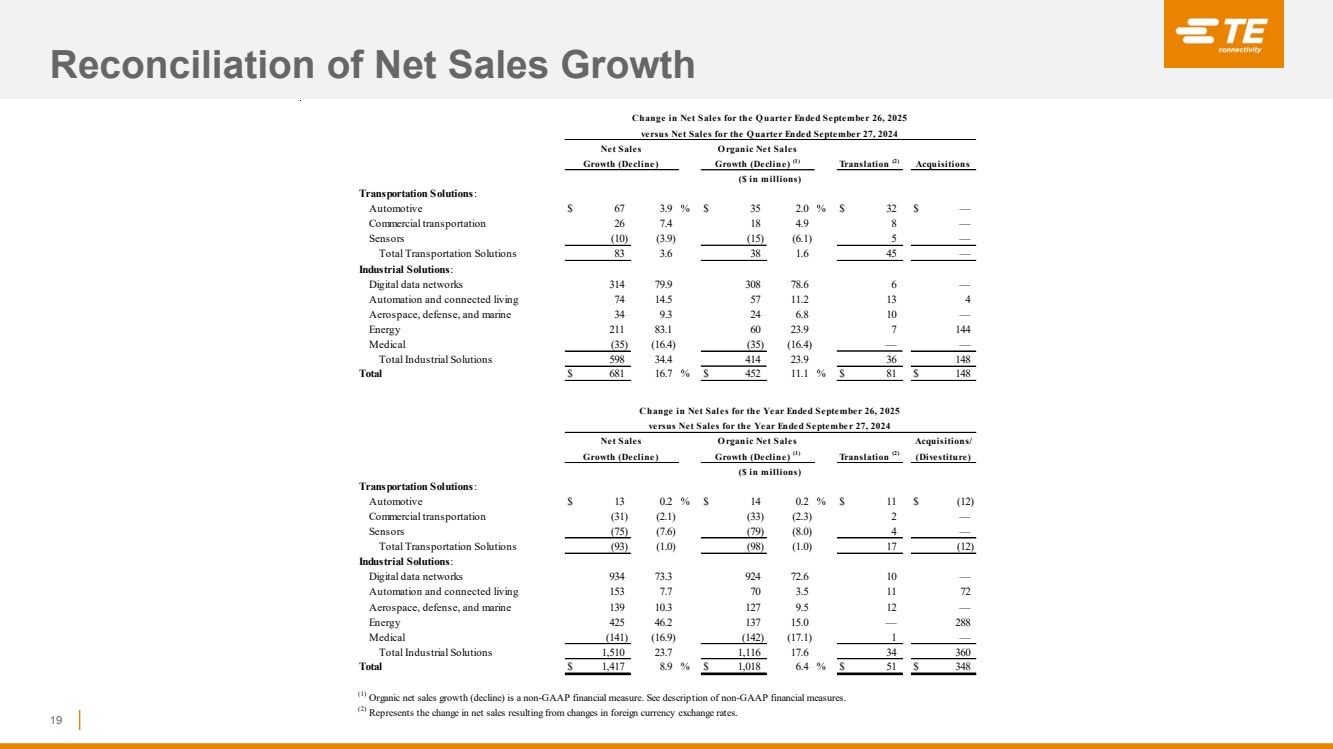

| Reconciliation of Net Sales Growth 19 Transportation Solutions: Automotive $ 67 3.9 % $ 35 2.0 % $ 32 $ — Commercial transportation 26 7.4 18 4.9 8 — Sensors (10) (3.9) (15) (6.1) 5 — Total Transportation Solutions 83 3.6 38 1.6 45 — Industrial Solutions: Digital data networks 314 79.9 308 78.6 6 — Automation and connected living 74 14.5 57 11.2 13 4 Aerospace, defense, and marine 34 9.3 24 6.8 10 — Energy 211 83.1 60 23.9 7 144 Medical (35) (16.4) (35) (16.4) — — Total Industrial Solutions 598 34.4 414 23.9 36 148 Total $ 681 16.7 % $ 452 11.1 % $ 81 $ 148 ($ in millions) Translation (2) Acquisitions Net Sales Growth (Decline) O rganic Net Sales Growth (Decline) (1) Change in Net Sales for the Q uarter Ended September 26, 2025 versus Net Sales for the Q uarter Ended September 27, 2024 Transportation Solutions: Automotive $ 13 0.2 % $ 14 0.2 % $ 11 $ (12) Commercial transportation (31) (2.1) (33) (2.3) 2 — Sensors (75) (7.6) (79) (8.0) 4 — Total Transportation Solutions (93) (1.0) (98) (1.0) 17 (12) Industrial Solutions: Digital data networks 934 73.3 924 72.6 10 — Automation and connected living 153 7.7 70 3.5 11 72 Aerospace, defense, and marine 139 10.3 127 9.5 12 — Energy 425 46.2 137 15.0 — 288 Medical (141) (16.9) (142) (17.1) 1 — Total Industrial Solutions 1,510 23.7 1,116 17.6 34 360 Total $ 1,417 8.9 % $ 1,018 6.4 % $ 51 $ 348 (1) Organic net sales growth (decline) is a non-GAAP financial measure. See description of non-GAAP financial measures. (2) Represents the change in net sales resulting from changes in foreign currency exchange rates. Translation (2) (Divestiture) Change in Net Sales for the Year Ended September 26, 2025 versus Net Sales for the Year Ended September 27, 2024 ($ in millions) Net Sales O rganic Net Sales Acquisitions/ Growth (Decline) Growth (Decline) (1) |

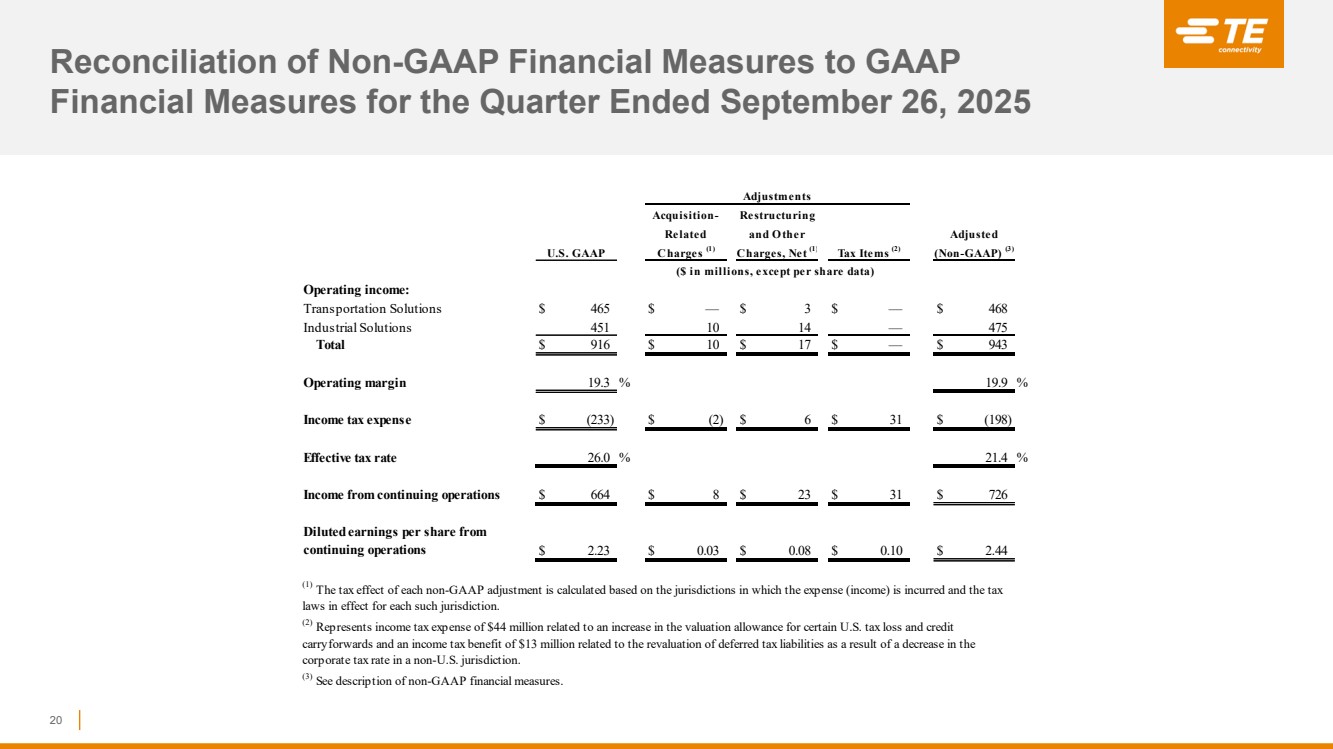

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended September 26, 2025 20 Operating income: Transportation Solutions $ 465 $ — $ 3 $ — $ 468 Industrial Solutions 451 10 14 — 475 Total $ 916 $ 10 $ 17 $ — $ 943 Operating margin 19.3 % 19.9 % Income tax expense $ (233) $ (2) $ 6 $ 31 $ (198) Effective tax rate 26.0 % 21.4 % Income from continuing operations $ 664 $ 8 $ 23 $ 31 $ 726 Diluted earnings per share from continuing operations $ 2.23 $ 0.03 $ 0.08 $ 0.10 $ 2.44 Related and O ther Adjusted Acquisition- Restructuring Adjustments (3) See description of non-GAAP financial measures. (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. U.S. GAAP Charges (1) (Non-GAAP) (3) Charges, Net (1) ($ in millions, except per share data) Tax Items (2) (2) Represents income tax expense of $44 million related to an increase in the valuation allowance for certain U.S. tax loss and credit carryforwards and an income tax benefit of $13 million related to the revaluation of deferred tax liabilities as a result of a decrease in the corporate tax rate in a non-U.S. jurisdiction. |

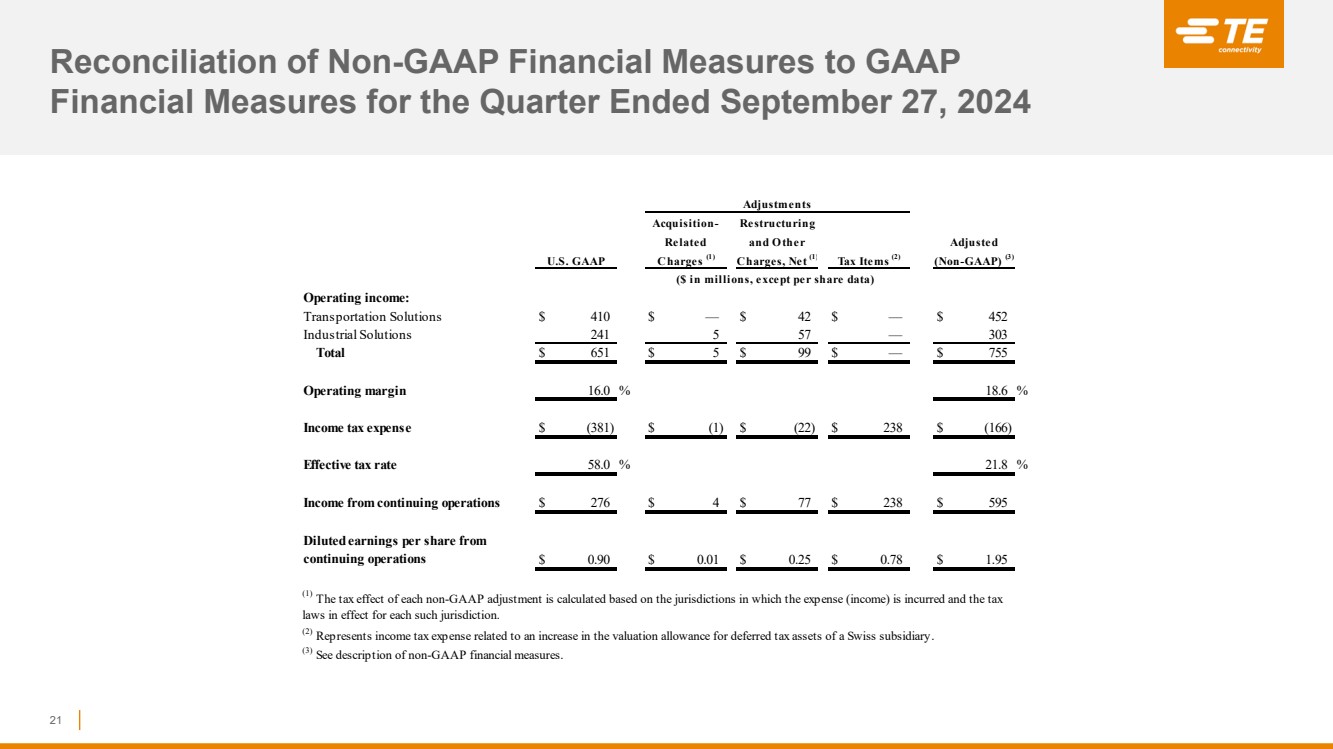

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended September 27, 2024 21 Operating income: Transportation Solutions $ 410 $ — $ 42 $ — $ 452 Industrial Solutions 241 5 57 — 303 Total $ 651 $ 5 $ 99 $ — $ 755 Operating margin 16.0 % 18.6 % Income tax expense $ (381) $ (1) $ (22) $ 238 $ (166) Effective tax rate 58.0 % 21.8 % Income from continuing operations $ 276 $ 4 $ 77 $ 238 $ 595 Diluted earnings per share from continuing operations $ 0.90 $ 0.01 $ 0.25 $ 0.78 $ 1.95 (2) Represents income tax expense related to an increase in the valuation allowance for deferred tax assets of a Swiss subsidiary. Adjustments U.S. GAAP Charges (1) Charges, Net (1) Tax Items (2) (3) See description of non-GAAP financial measures. Adjusted (Non-GAAP) (3) ($ in millions, except per share data) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. Related and O ther Acquisition- Restructuring |

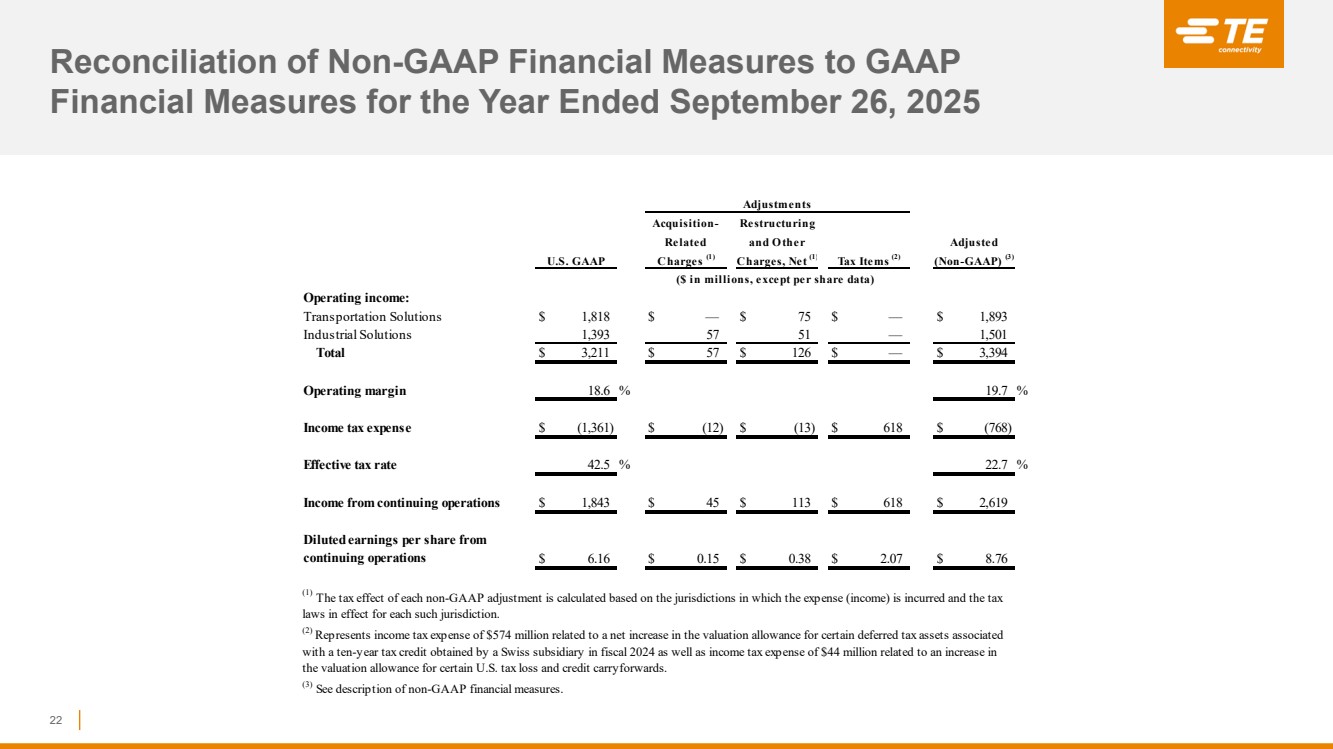

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Year Ended September 26, 2025 22 Operating income: Transportation Solutions $ 1,818 $ — $ 75 $ — $ 1,893 Industrial Solutions 1,393 57 51 — 1,501 Total $ 3,211 $ 57 $ 126 $ — $ 3,394 Operating margin 18.6 % 19.7 % Income tax expense $ (1,361) $ (12) $ (13) $ 618 $ (768) Effective tax rate 42.5 % 22.7 % Income from continuing operations $ 1,843 $ 45 $ 113 $ 618 $ 2,619 Diluted earnings per share from continuing operations $ 6.16 $ 0.15 $ 0.38 $ 2.07 $ 8.76 ($ in millions, except per share data) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (2) Represents income tax expense of $574 million related to a net increase in the valuation allowance for certain deferred tax assets associated with a ten-year tax credit obtained by a Swiss subsidiary in fiscal 2024 as well as income tax expense of $44 million related to an increase in the valuation allowance for certain U.S. tax loss and credit carryforwards. (3) See description of non-GAAP financial measures. Related and O ther Adjusted U.S. GAAP Charges (1) Charges, Net (1) Tax Items (2) (Non-GAAP) (3) Adjustments Acquisition- Restructuring |

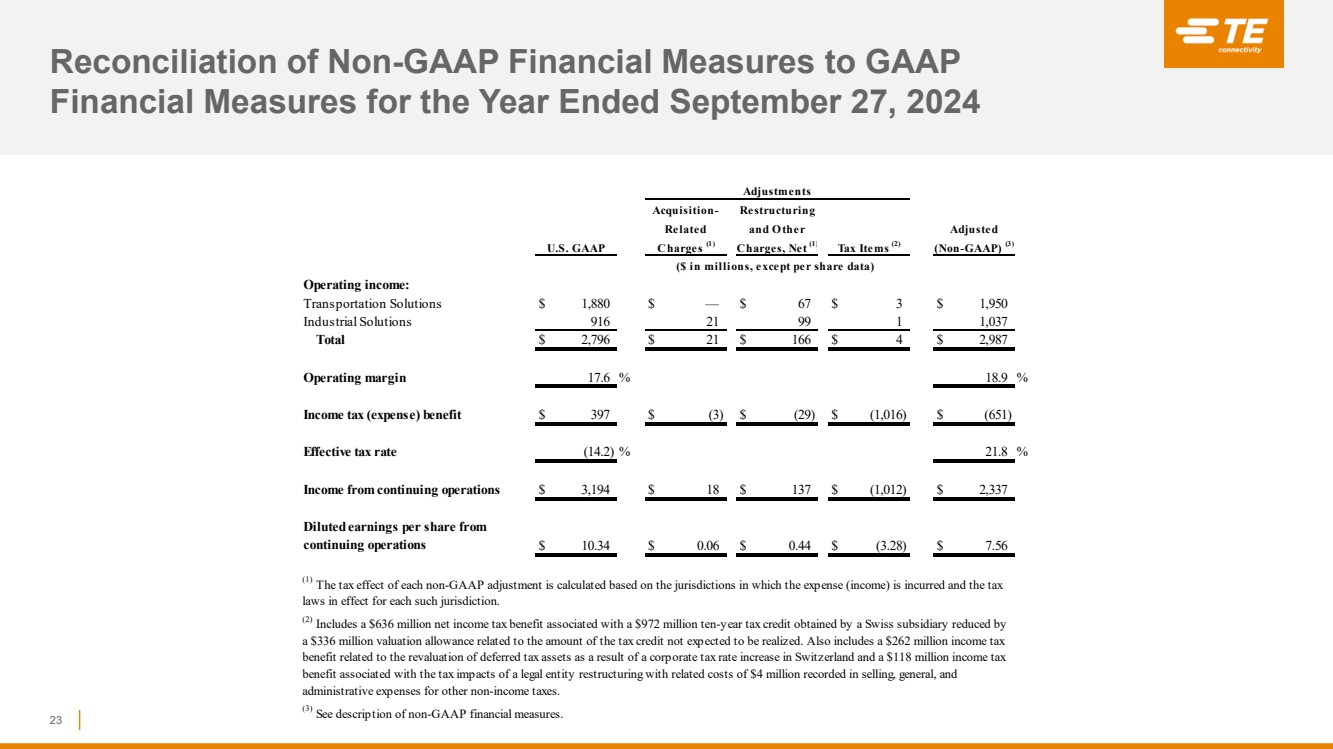

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Year Ended September 27, 2024 23 Operating income: Transportation Solutions $ 1,880 $ — $ 67 $ 3 $ 1,950 Industrial Solutions 916 21 99 1 1,037 Total $ 2,796 $ 21 $ 166 $ 4 $ 2,987 Operating margin 17.6 % 18.9 % Income tax (expense) benefit $ 397 $ (3) $ (29) $ (1,016) $ (651) Effective tax rate (14.2) % 21.8 % Income from continuing operations $ 3,194 $ 18 $ 137 $ (1,012) $ 2,337 Diluted earnings per share from continuing operations $ 10.34 $ 0.06 $ 0.44 $ (3.28) $ 7.56 ($ in millions, except per share data) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (2) Includes a $636 million net income tax benefit associated with a $972 million ten-year tax credit obtained by a Swiss subsidiary reduced by a $336 million valuation allowance related to the amount of the tax credit not expected to be realized. Also includes a $262 million income tax benefit related to the revaluation of deferred tax assets as a result of a corporate tax rate increase in Switzerland and a $118 million income tax benefit associated with the tax impacts of a legal entity restructuring with related costs of $4 million recorded in selling, general, and administrative expenses for other non-income taxes. (3) See description of non-GAAP financial measures. Related and O ther Adjusted U.S. GAAP Charges (1) Charges, Net (1) Tax Items (2) (Non-GAAP) (3) Adjustments Acquisition- Restructuring |

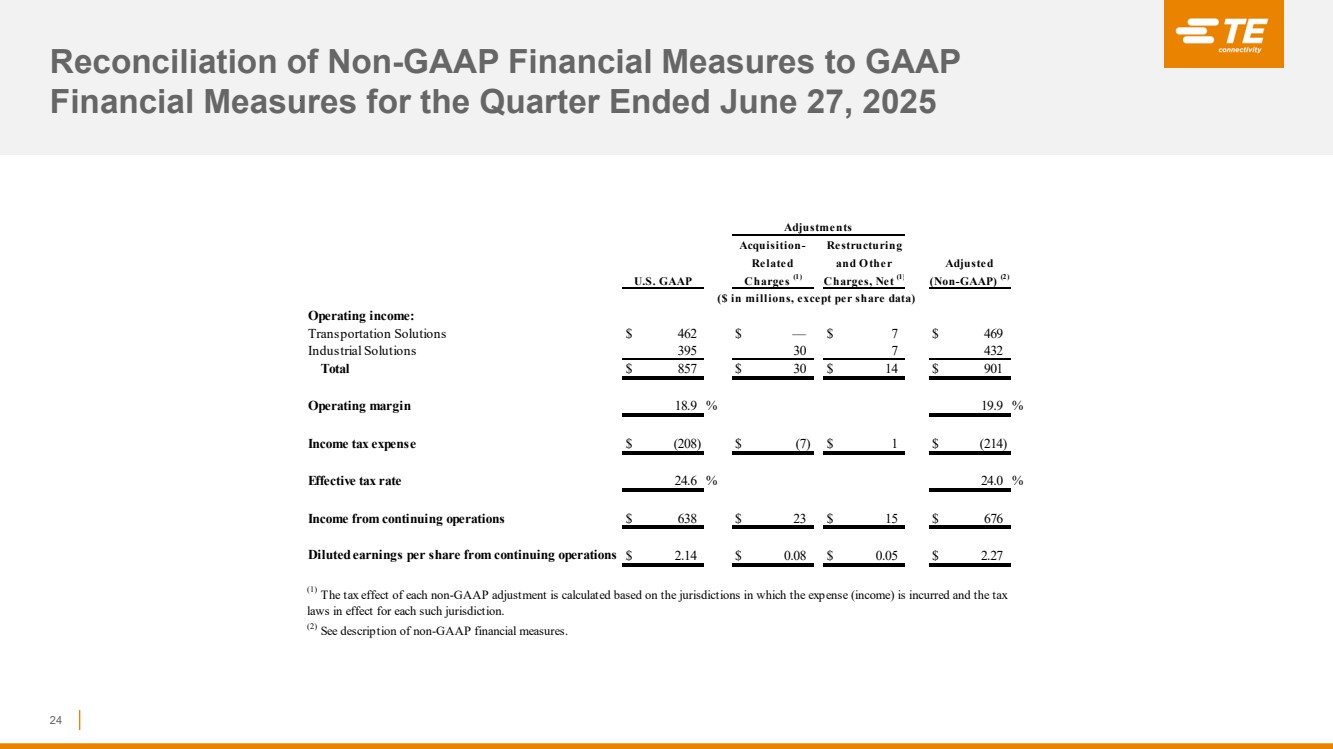

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended June 27, 2025 24 Operating income: Transportation Solutions $ 462 $ — $ 7 $ 469 Industrial Solutions 395 30 7 432 Total $ 857 $ 30 $ 14 $ 901 Operating margin 18.9 % 19.9 % Income tax expense $ (208) $ (7) $ 1 $ (214) Effective tax rate 24.6 % 24.0 % Income from continuing operations $ 638 $ 23 $ 15 $ 676 Diluted earnings per share from continuing operations $ 2.14 $ 0.08 $ 0.05 $ 2.27 ($ in millions, except per share data) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (2) See description of non-GAAP financial measures. Related and O ther Adjusted U.S. GAAP Charges (1) Charges, Net (1) (Non-GAAP) (2) Acquisition- Restructuring Adjustments |

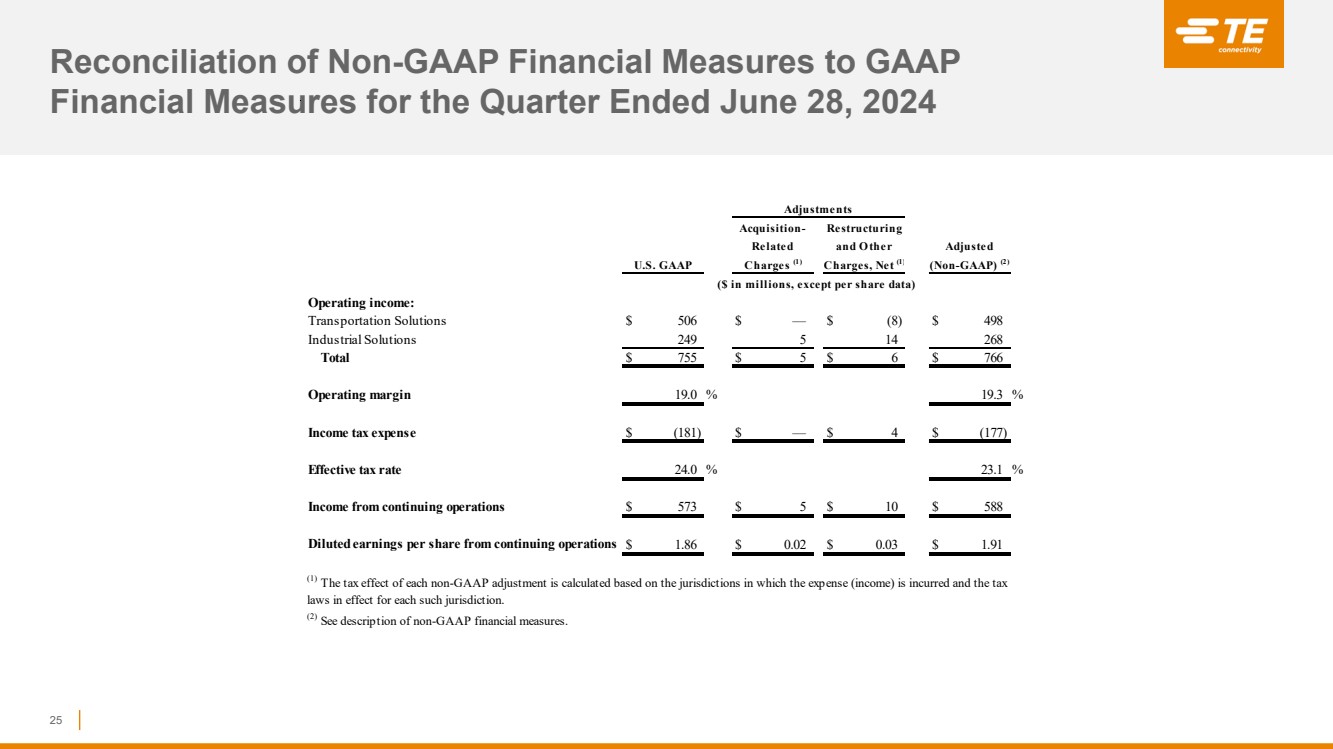

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended June 28, 2024 25 Operating income: Transportation Solutions $ 506 $ — $ (8) $ 498 Industrial Solutions 249 5 14 268 Total $ 755 $ 5 $ 6 $ 766 Operating margin 19.0 % 19.3 % Income tax expense $ (181) $ — $ 4 $ (177) Effective tax rate 24.0 % 23.1 % Income from continuing operations $ 573 $ 5 $ 10 $ 588 Diluted earnings per share from continuing operations $ 1.86 $ 0.02 $ 0.03 $ 1.91 U.S. GAAP Charges (1) Charges, Net (1) (Non-GAAP) (2) (2) See description of non-GAAP financial measures. ($ in millions, except per share data) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. Adjustments Related and O ther Adjusted Acquisition- Restructuring |

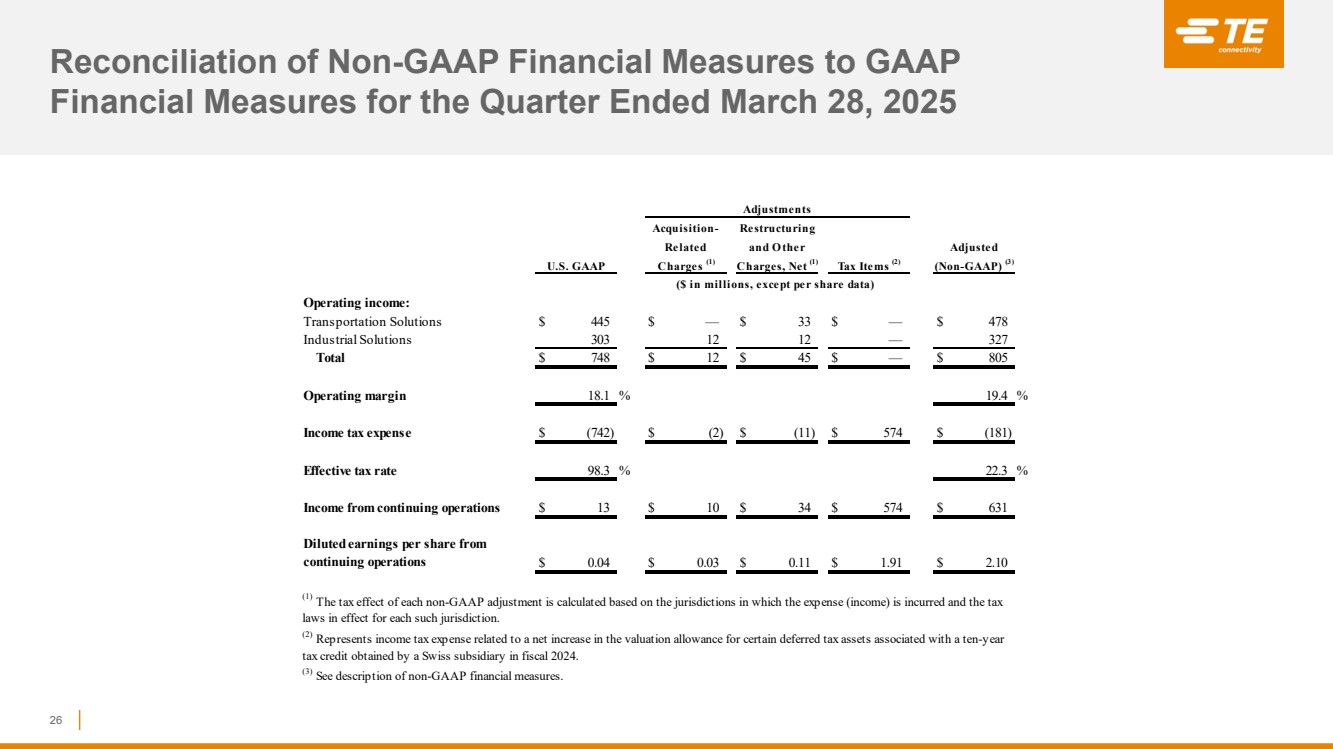

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended March 28, 2025 26 Operating income: Transportation Solutions $ 445 $ — $ 33 $ — $ 478 Industrial Solutions 303 12 12 — 327 Total $ 748 $ 12 $ 45 $ — $ 805 Operating margin 18.1 % 19.4 % Income tax expense $ (742) $ (2) $ (11) $ 574 $ (181) Effective tax rate 98.3 % 22.3 % Income from continuing operations $ 13 $ 10 $ 34 $ 574 $ 631 Diluted earnings per share from continuing operations $ 0.04 $ 0.03 $ 0.11 $ 1.91 $ 2.10 (3) See description of non-GAAP financial measures. (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. U.S. GAAP Charges (1) (Non-GAAP) (3) Charges, Net (1) ($ in millions, except per share data) Tax Items (2) (2) Represents income tax expense related to a net increase in the valuation allowance for certain deferred tax assets associated with a ten-year tax credit obtained by a Swiss subsidiary in fiscal 2024. Adjustments Related and O ther Adjusted Acquisition- Restructuring |

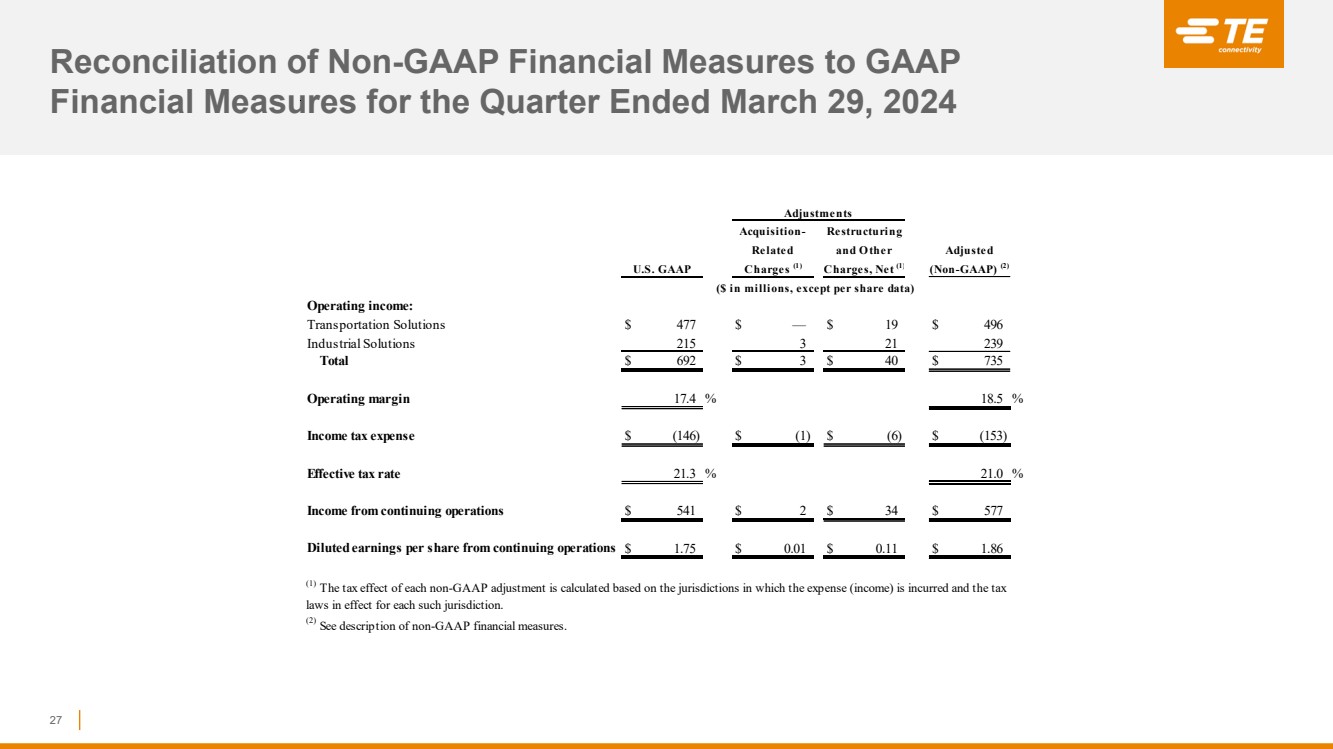

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended March 29, 2024 27 Operating income: Transportation Solutions $ 477 $ — $ 19 $ 496 Industrial Solutions 215 3 21 239 Total $ 692 $ 3 $ 40 $ 735 Operating margin 17.4 % 18.5 % Income tax expense $ (146) $ (1) $ (6) $ (153) Effective tax rate 21.3 % 21.0 % Income from continuing operations $ 541 $ 2 $ 34 $ 577 Diluted earnings per share from continuing operations $ 1.75 $ 0.01 $ 0.11 $ 1.86 U.S. GAAP Charges (1) Charges, Net (1) (Non-GAAP) (2) (2) See description of non-GAAP financial measures. ($ in millions, except per share data) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. Adjustments Related and O ther Adjusted Acquisition- Restructuring |

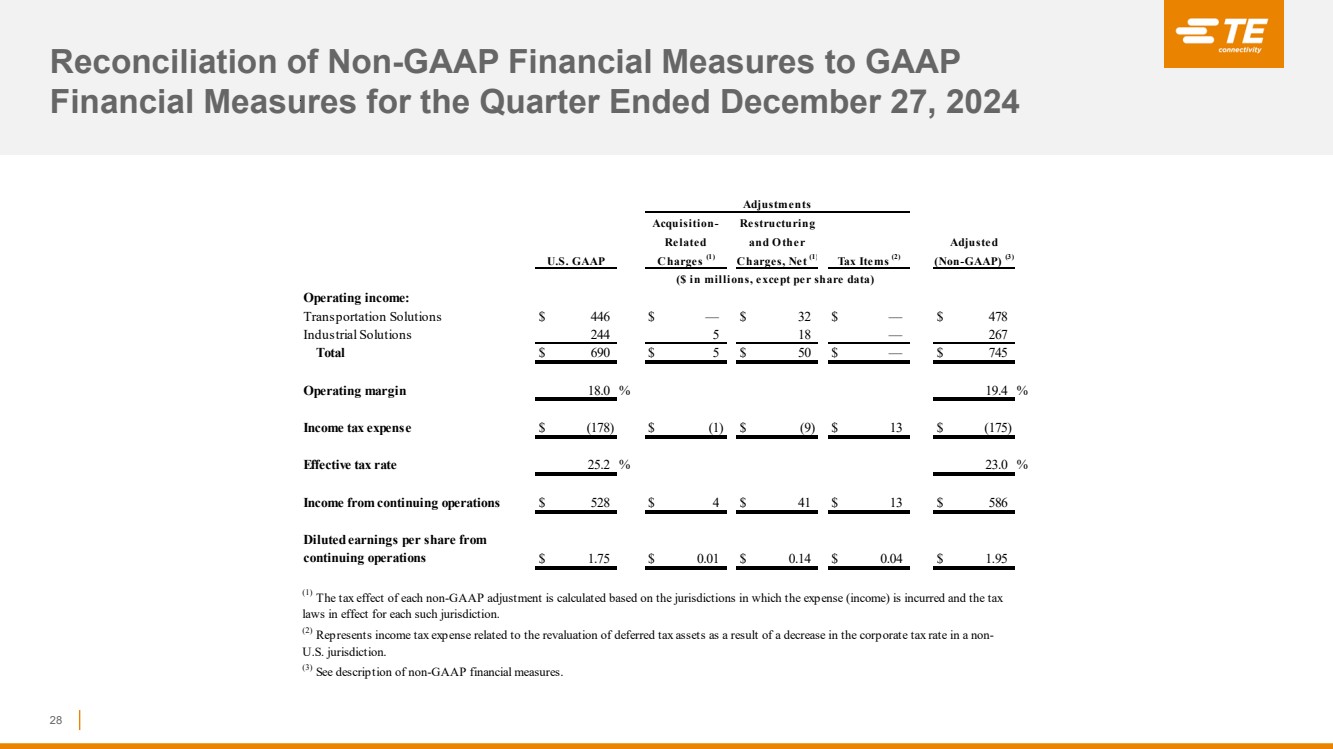

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended December 27, 2024 28 Operating income: Transportation Solutions $ 446 $ — $ 32 $ — $ 478 Industrial Solutions 244 5 18 — 267 Total $ 690 $ 5 $ 50 $ — $ 745 Operating margin 18.0 % 19.4 % Income tax expense $ (178) $ (1) $ (9) $ 13 $ (175) Effective tax rate 25.2 % 23.0 % Income from continuing operations $ 528 $ 4 $ 41 $ 13 $ 586 Diluted earnings per share from continuing operations $ 1.75 $ 0.01 $ 0.14 $ 0.04 $ 1.95 (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (3) See description of non-GAAP financial measures. Related and O ther Adjusted U.S. GAAP Charges (1) Charges, Net (1) (Non-GAAP) (3) (2) Represents income tax expense related to the revaluation of deferred tax assets as a result of a decrease in the corporate tax rate in a non-U.S. jurisdiction. ($ in millions, except per share data) Tax Items (2) Acquisition- Restructuring Adjustments |

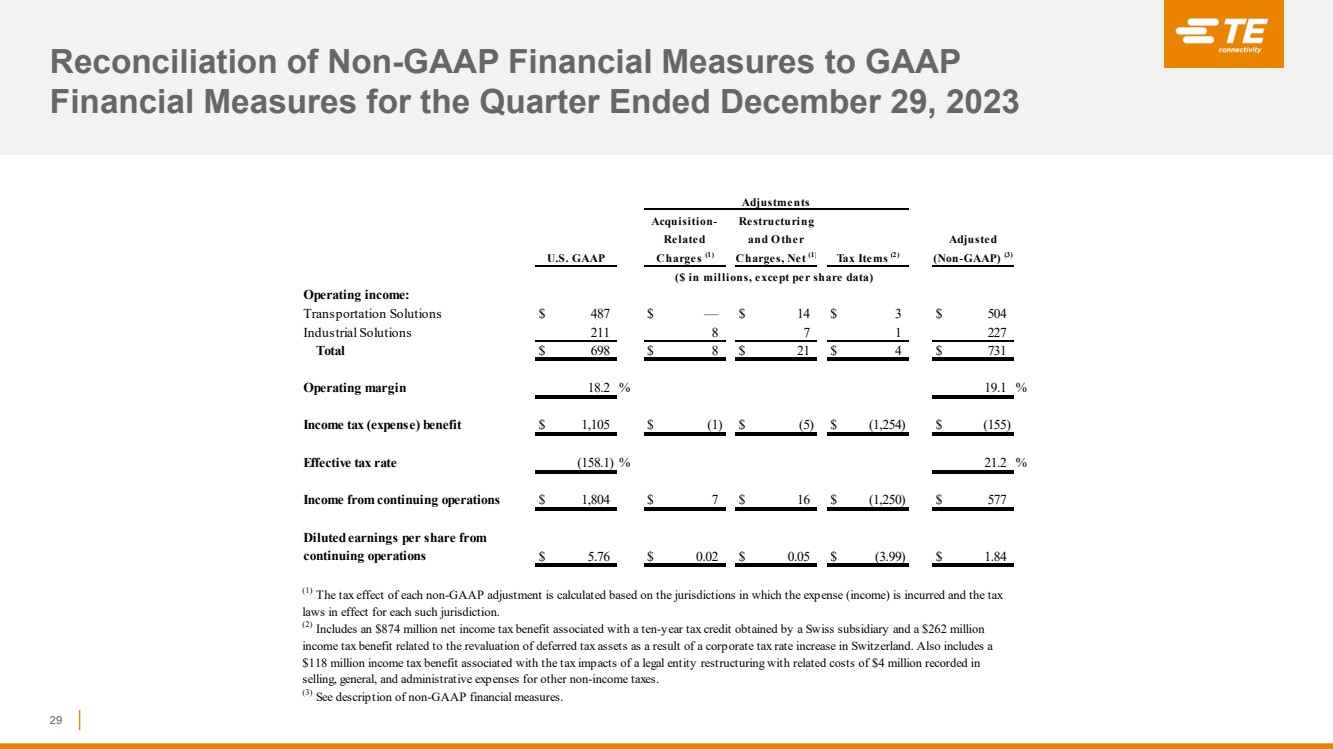

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended December 29, 2023 29 Operating income: Transportation Solutions $ 487 $ — $ 14 $ 3 $ 504 Industrial Solutions 211 8 7 1 227 Total $ 698 $ 8 $ 21 $ 4 $ 731 Operating margin 18.2 % 19.1 % Income tax (expense) benefit $ 1,105 $ (1) $ (5) $ (1,254) $ (155) Effective tax rate (158.1) % 21.2 % Income from continuing operations $ 1,804 $ 7 $ 16 $ (1,250) $ 577 Diluted earnings per share from continuing operations $ 5.76 $ 0.02 $ 0.05 $ (3.99) $ 1.84 (2) Includes an $874 million net income tax benefit associated with a ten-year tax credit obtained by a Swiss subsidiary and a $262 million income tax benefit related to the revaluation of deferred tax assets as a result of a corporate tax rate increase in Switzerland. Also includes a $118 million income tax benefit associated with the tax impacts of a legal entity restructuring with related costs of $4 million recorded in selling, general, and administrative expenses for other non-income taxes. (3) See description of non-GAAP financial measures. Adjustments Related and O ther Adjusted Acquisition- Restructuring ($ in millions, except per share data) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. U.S. GAAP Charges (1) Charges, Net (1) (Non-GAAP) (3) Tax Items (2) |

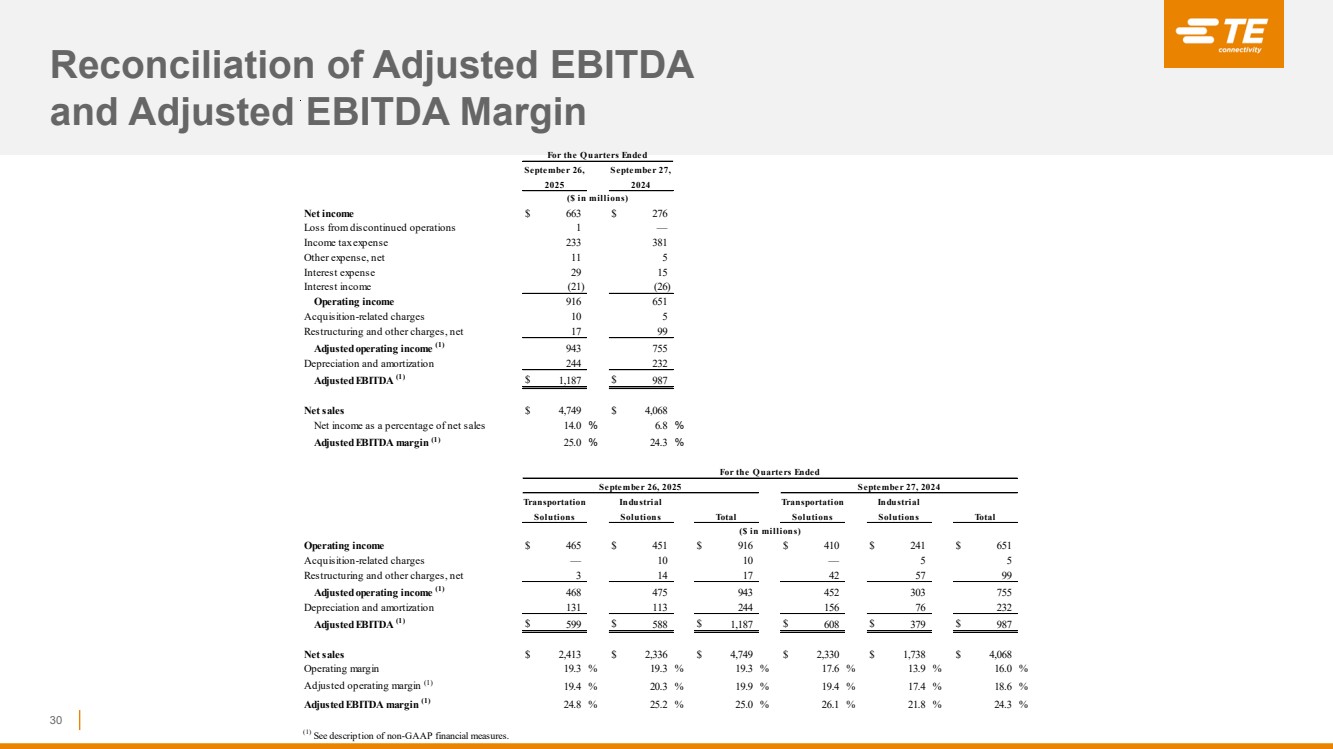

| Reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin 30 Net income $ 663 $ 276 Loss from discontinued operations 1 — Income tax expense 233 381 Other expense, net 11 5 Interest expense 29 15 Interest income (21) (26) Operating income 916 651 Acquisition-related charges 10 5 Restructuring and other charges, net 17 99 Adjusted operating income (1) 943 755 Depreciation and amortization 244 232 Adjusted EBITDA (1) $ 1,187 $ 987 Net sales $ 4,749 $ 4,068 Net income as a percentage of net sales 14.0 % 6.8 % Adjusted EBITDA margin (1) 25.0 % 24.3 % Operating income $ 465 $ 451 $ 916 $ 410 $ 241 $ 651 Acquisition-related charges — 10 10 — 5 5 Restructuring and other charges, net 3 14 17 42 57 99 Adjusted operating income (1) 468 475 943 452 303 755 Depreciation and amortization 131 113 244 156 76 232 Adjusted EBITDA (1) $ 599 $ 588 $ 1,187 $ 608 $ 379 $ 987 Net sales $ 2,413 $ 2,336 $ 4,749 $ 2,330 $ 1,738 $ 4,068 Operating margin 19.3 % 19.3 % 19.3 % 17.6 % 13.9 % 16.0 % Adjusted operating margin (1) 19.4 % 20.3 % 19.9 % 19.4 % 17.4 % 18.6 % Adjusted EBITDA margin (1) 24.8 % 25.2 % 25.0 % 26.1 % 21.8 % 24.3 % (1) See description of non-GAAP financial measures. ($ in millions) Transportation Industrial Solutions Solutions Total Solutions Solutions Total ($ in millions) September 26, 2025 September 27, 2024 Transportation Industrial For the Q uarters Ended September 26, 2025 September 27, 2024 For the Q uarters Ended |

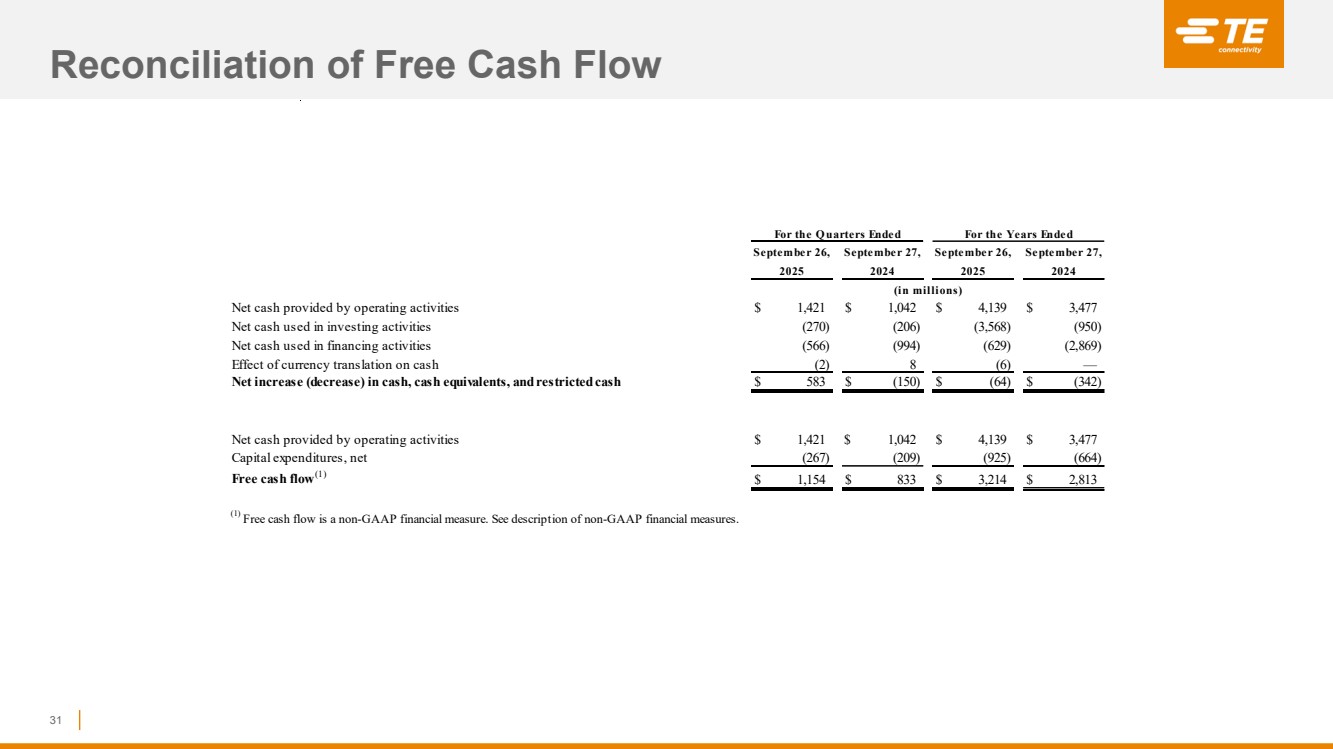

| Reconciliation of Free Cash Flow 31 Net cash provided by operating activities $ 1,421 $ 1,042 $ 4,139 $ 3,477 Net cash used in investing activities (270) (206) (3,568) (950) Net cash used in financing activities (566) (994) (629) (2,869) Effect of currency translation on cash (2) 8 (6) — Net increase (decrease) in cash, cash equivalents, and restricted cash $ 583 $ (150) $ (64) $ (342) Net cash provided by operating activities $ 1,421 $ 1,042 $ 4,139 $ 3,477 Capital expenditures, net (267) (209) (925) (664) Free cash flow (1) $ 1,154 $ 833 $ 3,214 $ 2,813 (1) Free cash flow is a non-GAAP financial measure. See description of non-GAAP financial measures. 2025 2024 2025 2024 (in millions) For the Q uarters Ended September 26, September 27, September 26, September 27, For the Years Ended |

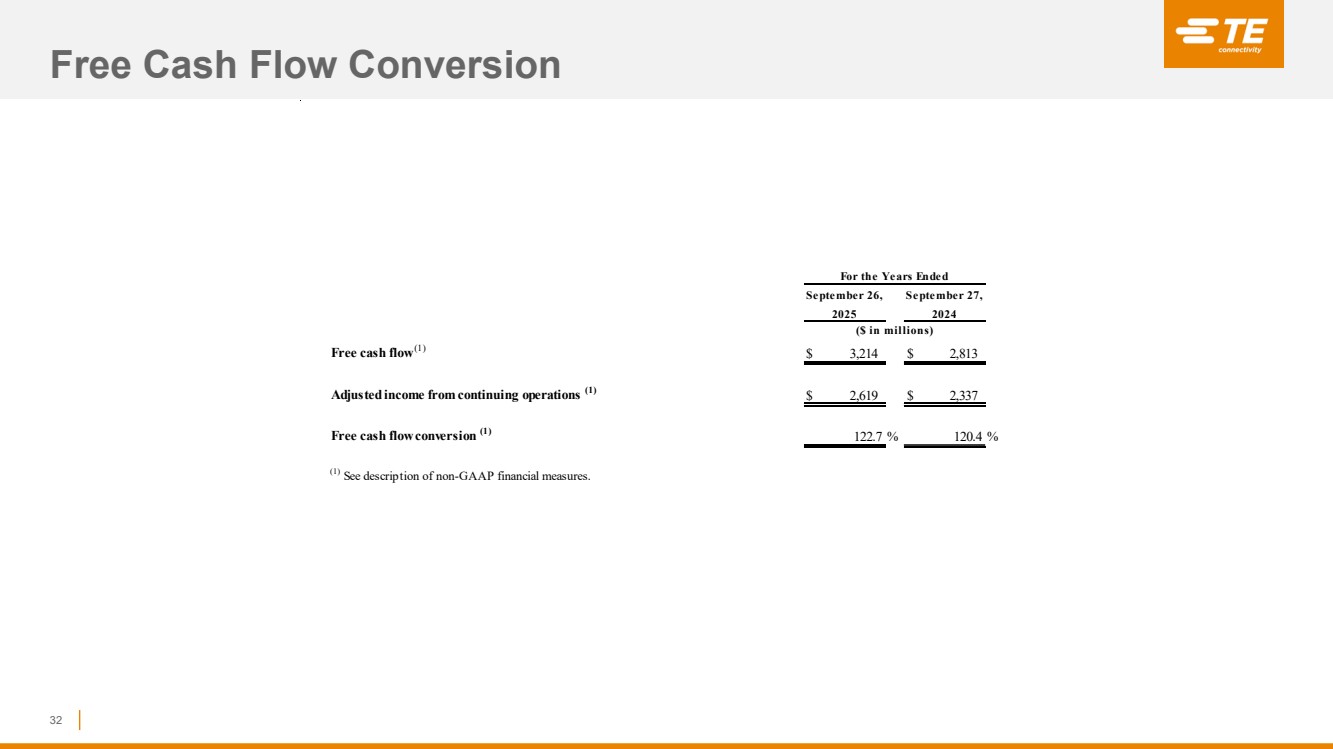

| Free Cash Flow Conversion 32 Free cash flow (1) $ 3,214 $ 2,813 Adjusted income from continuing operations (1) $ 2,619 $ 2,337 Free cash flow conversion (1) 122.7 % 120.4 % (1) See description of non-GAAP financial measures. ($ in millions) For the Years Ended September 26, September 27, 2025 2024 |

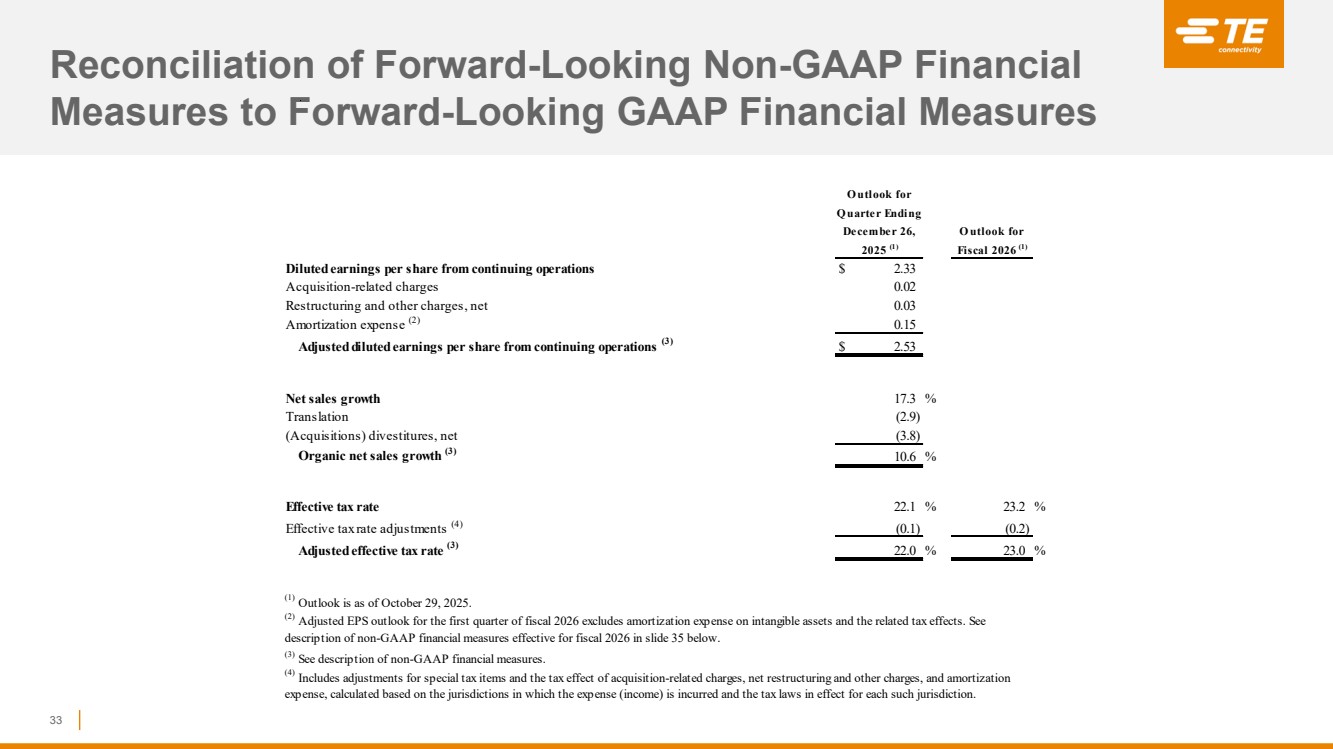

| Reconciliation of Forward-Looking Non-GAAP Financial Measures to Forward-Looking GAAP Financial Measures 33 Diluted earnings per share from continuing operations $ 2.33 Acquisition-related charges 0.02 Restructuring and other charges, net 0.03 Amortization expense (2) 0.15 Adjusted diluted earnings per share from continuing operations (3) $ 2.53 Net sales growth 17.3 % Translation (2.9) (Acquisitions) divestitures, net (3.8) Organic net sales growth (3) 10.6 % Effective tax rate 22.1 % 23.2 % Effective tax rate adjustments (4) (0.1) (0.2) Adjusted effective tax rate (3) 22.0 % 23.0 % (4) Includes adjustments for special tax items and the tax effect of acquisition-related charges, net restructuring and other charges, and amortization expense, calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (1) Outlook is as of October 29, 2025. (3) See description of non-GAAP financial measures. Q uarter Ending O utlook for (2) Adjusted EPS outlook for the first quarter of fiscal 2026 excludes amortization expense on intangible assets and the related tax effects. See description of non-GAAP financial measures effective for fiscal 2026 in slide 35 below. 2025 (1) December 26, O utlook for Fiscal 2026 (1) |

| EVERY CONNECTION COUNTS Recast Appendix Reflects Non-GAAP Financial Measures Effective for Fiscal 2026 |

| Non-GAAP Financial Measures Effective for Fiscal 2026 We present non-GAAP performance and liquidity measures as we believe it is appropriate for investors to consider adjusted financial measures in addition to results in accordance with accounting principles generally accepted in the U.S. (“GAAP”). These non-GAAP financial measures provide supplemental information and should not be considered replacements for results in accordance with GAAP. Management uses non-GAAP financial measures internally for planning and forecasting purposes and in its decision-making processes related to the operations of our company. We believe these measures provide meaningful information to us and investors because they enhance the understanding of our operating performance, ability to generate cash, and the trends of our business. Additionally, we believe that investors benefit from having access to the same financial measures that management uses in evaluating our operations. The primary limitation of these measures is that they exclude the financial impact of items that would otherwise either increase or decrease our reported results. This limitation is best addressed by using these non-GAAP financial measures in combination with the most directly comparable GAAP financial measures in order to better understand the amounts, character, and impact of any increase or decrease in reported amounts. These non-GAAP financial measures may not be comparable to similarly-titled measures reported by other companies. The following provides additional information regarding certain of our non-GAAP financial measures effective for fiscal 2026: ▪ Adjusted Operating Income and Adjusted Operating Margin – represent operating income and operating margin, respectively, (the most comparable GAAP financial measures) before special items including restructuring and other charges, acquisition-related charges, amortization expense on intangible assets, impairment of goodwill, and other income or charges, if any. We utilize these adjusted measures in combination with operating income and operating margin to assess segment level operating performance and to provide insight to management in evaluating segment operating plan execution and market conditions. Adjusted Operating Income is a significant component in our incentive compensation plans. ▪ Adjusted Income Tax (Expense) Benefit and Adjusted Effective Tax Rate – represent income tax (expense) benefit and effective tax rate, respectively, (the most comparable GAAP financial measures) after adjusting for the tax effect of special items including restructuring and other charges, acquisition-related charges, amortization expense on intangible assets, impairment of goodwill, other income or charges, and certain significant tax items, if any. ▪ Adjusted Income from Continuing Operations – represents income from continuing operations (the most comparable GAAP financial measure) before special items including restructuring and other charges, acquisition-related charges, amortization expense on intangible assets, impairment of goodwill, other income or charges, and certain significant tax items, if any, and, if applicable, the related tax effects. ▪ Adjusted Earnings Per Share – represents diluted earnings per share from continuing operations (the most comparable GAAP financial measure) before special items including restructuring and other charges, acquisition-related charges, amortization expense on intangible assets, impairment of goodwill, other income or charges, and certain significant tax items, if any, and, if applicable, the related tax effects. This measure is a significant component in our incentive compensation plans. 35 |

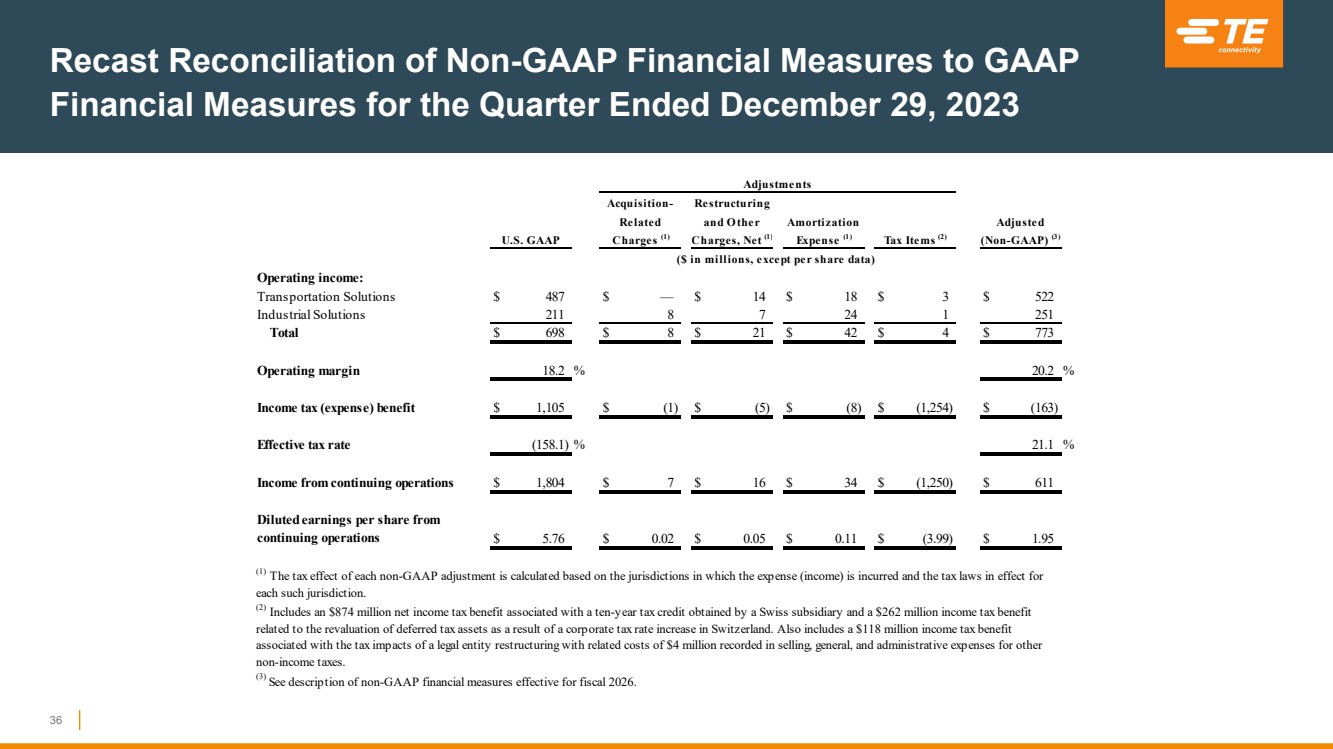

| Recast Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended December 29, 2023 Operating income: Transportation Solutions $ 487 $ — $ 14 $ 18 $ 3 $ 522 Industrial Solutions 211 8 7 24 1 251 Total $ 698 $ 8 $ 21 $ 42 $ 4 $ 773 Operating margin 18.2 % 20.2 % Income tax (expense) benefit $ 1,105 $ (1) $ (5) $ (8) $ (1,254) $ (163) Effective tax rate (158.1) % 21.1 % Income from continuing operations $ 1,804 $ 7 $ 16 $ 34 $ (1,250) $ 611 Diluted earnings per share from continuing operations $ 5.76 $ 0.02 $ 0.05 $ 0.11 $ (3.99) $ 1.95 Adjustments (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (2) Includes an $874 million net income tax benefit associated with a ten-year tax credit obtained by a Swiss subsidiary and a $262 million income tax benefit related to the revaluation of deferred tax assets as a result of a corporate tax rate increase in Switzerland. Also includes a $118 million income tax benefit associated with the tax impacts of a legal entity restructuring with related costs of $4 million recorded in selling, general, and administrative expenses for other non-income taxes. (3) See description of non-GAAP financial measures effective for fiscal 2026. Acquisition- Restructuring Related and O ther Amortization Adjusted ($ in millions, except per share data) U.S. GAAP Charges (1) Charges, Net (1) (Non-GAAP) (3) Expense (1) Tax Items (2) 36 |

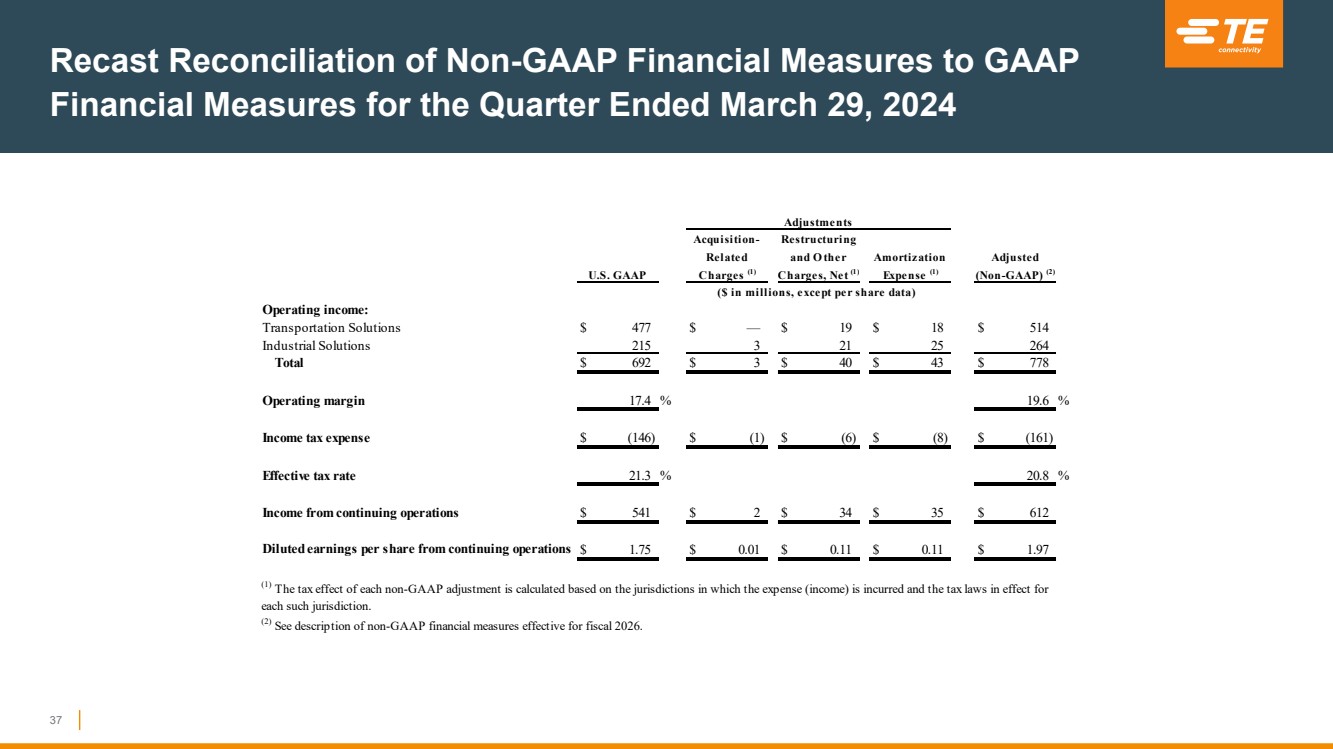

| Recast Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended March 29, 2024 Operating income: Transportation Solutions $ 477 $ — $ 19 $ 18 $ 514 Industrial Solutions 215 3 21 25 264 Total $ 692 $ 3 $ 40 $ 43 $ 778 Operating margin 17.4 % 19.6 % Income tax expense $ (146) $ (1) $ (6) $ (8) $ (161) Effective tax rate 21.3 % 20.8 % Income from continuing operations $ 541 $ 2 $ 34 $ 35 $ 612 Diluted earnings per share from continuing operations $ 1.75 $ 0.01 $ 0.11 $ 0.11 $ 1.97 Charges, Net (1) (Non-GAAP) (2) Adjustments (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (2) See description of non-GAAP financial measures effective for fiscal 2026. ($ in millions, except per share data) Expense (1) Related and O ther Adjusted Acquisition- Restructuring Amortization U.S. GAAP Charges (1) 37 |

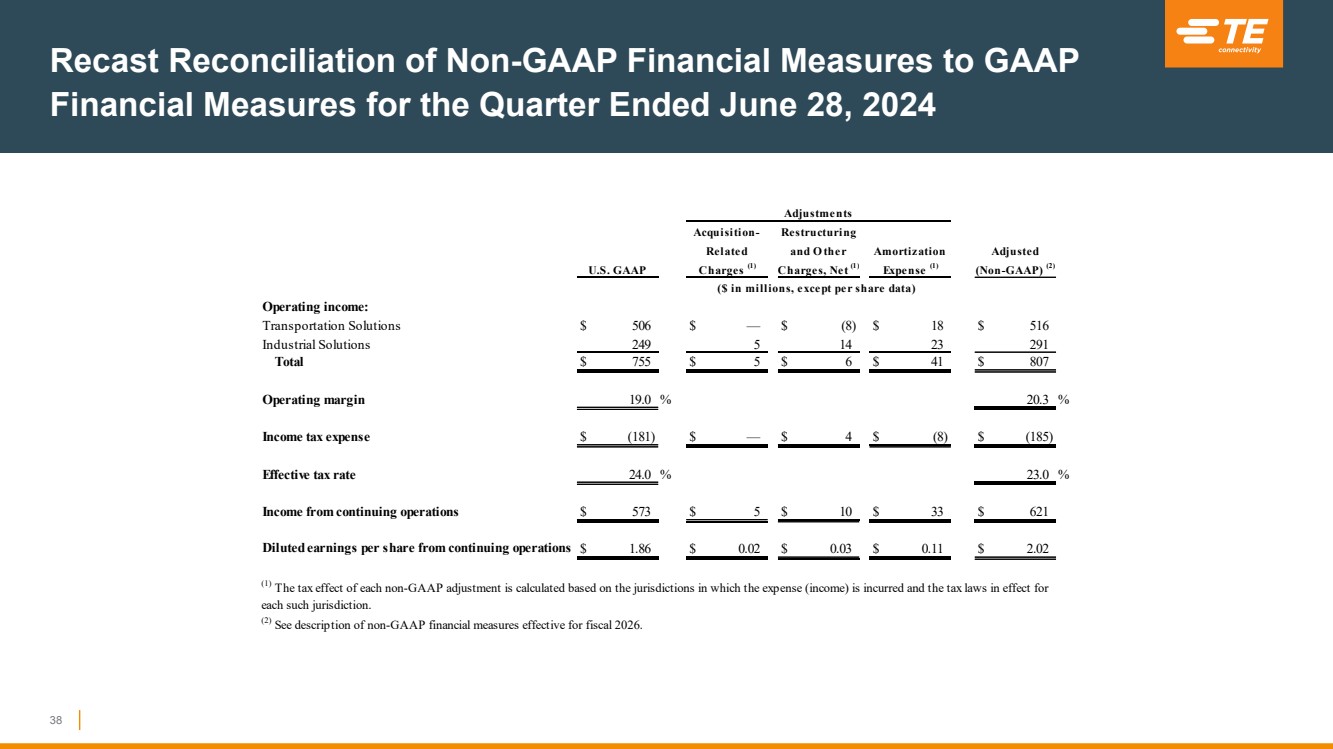

| Recast Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended June 28, 2024 Operating income: Transportation Solutions $ 506 $ — $ (8) $ 18 $ 516 Industrial Solutions 249 5 14 23 291 Total $ 755 $ 5 $ 6 $ 41 $ 807 Operating margin 19.0 % 20.3 % Income tax expense $ (181) $ — $ 4 $ (8) $ (185) Effective tax rate 24.0 % 23.0 % Income from continuing operations $ 573 $ 5 $ 10 $ 33 $ 621 Diluted earnings per share from continuing operations $ 1.86 $ 0.02 $ 0.03 $ 0.11 $ 2.02 Related and O ther Adjusted Acquisition- Restructuring Amortization Adjustments (Non-GAAP) (2) ($ in millions, except per share data) Expense (1) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (2) See description of non-GAAP financial measures effective for fiscal 2026. U.S. GAAP Charges (1) Charges, Net (1) 38 |

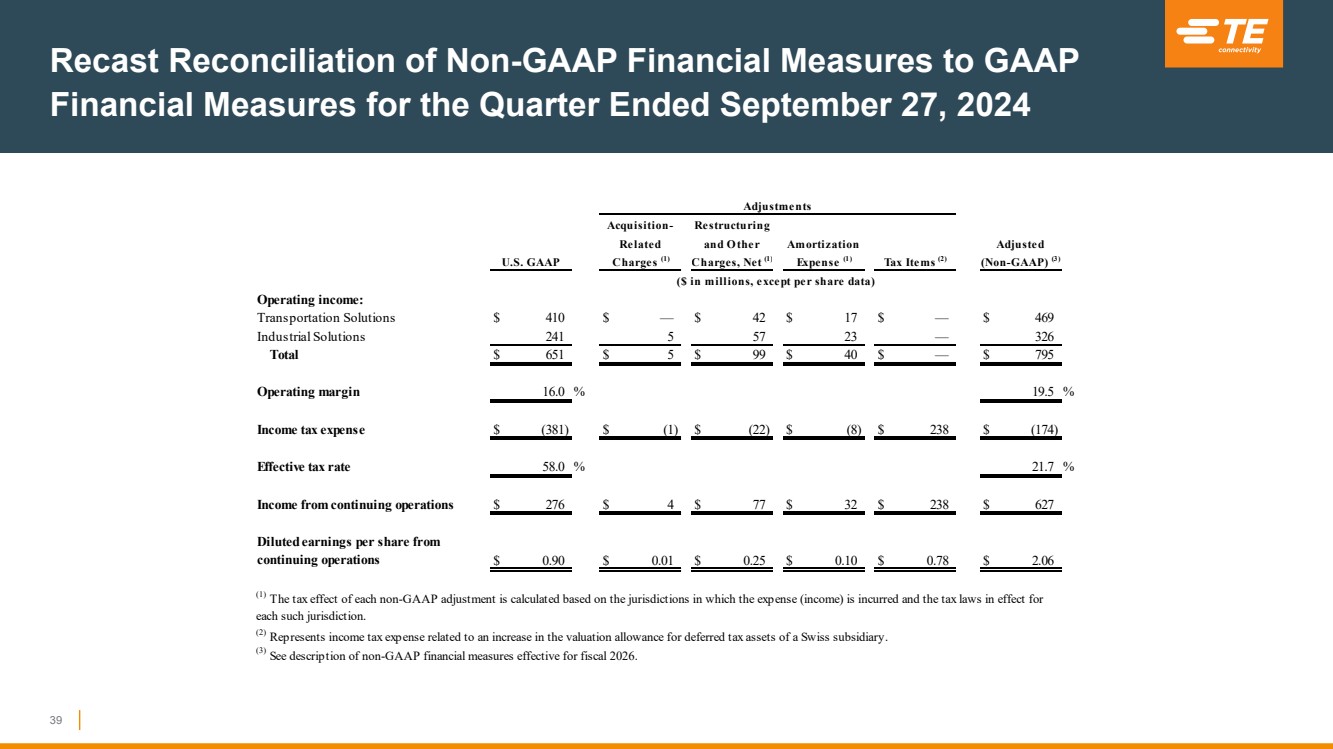

| Recast Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended September 27, 2024 Operating income: Transportation Solutions $ 410 $ — $ 42 $ 17 $ — $ 469 Industrial Solutions 241 5 57 23 — 326 Total $ 651 $ 5 $ 99 $ 40 $ — $ 795 Operating margin 16.0 % 19.5 % Income tax expense $ (381) $ (1) $ (22) $ (8) $ 238 $ (174) Effective tax rate 58.0 % 21.7 % Income from continuing operations $ 276 $ 4 $ 77 $ 32 $ 238 $ 627 Diluted earnings per share from continuing operations $ 0.90 $ 0.01 $ 0.25 $ 0.10 $ 0.78 $ 2.06 (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (2) Represents income tax expense related to an increase in the valuation allowance for deferred tax assets of a Swiss subsidiary. (3) See description of non-GAAP financial measures effective for fiscal 2026. Amortization Expense (1) ($ in millions, except per share data) U.S. GAAP Charges (1) Charges, Net (1) (Non-GAAP) (3) Tax Items (2) Related and O ther Adjusted Adjustments Acquisition- Restructuring 39 |

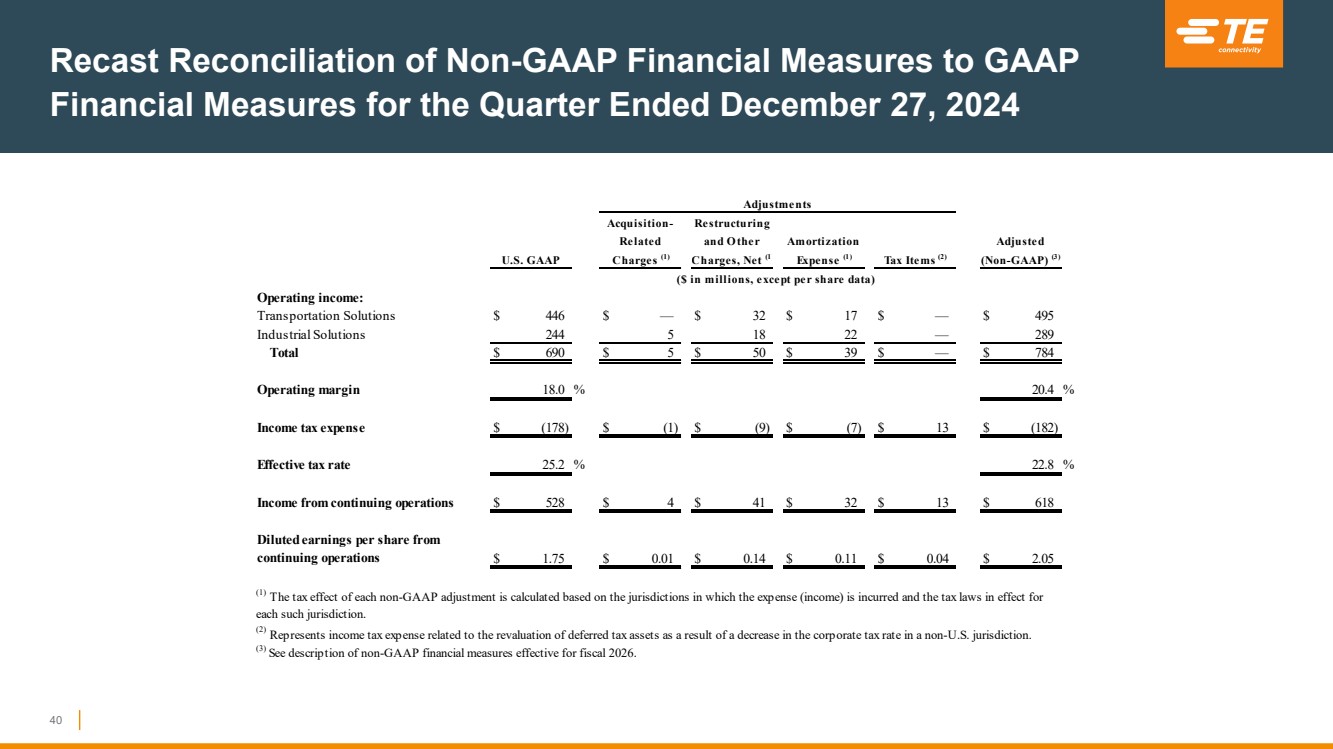

| Recast Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended December 27, 2024 Operating income: Transportation Solutions $ 446 $ — $ 32 $ 17 $ — $ 495 Industrial Solutions 244 5 18 22 — 289 Total $ 690 $ 5 $ 50 $ 39 $ — $ 784 Operating margin 18.0 % 20.4 % Income tax expense $ (178) $ (1) $ (9) $ (7) $ 13 $ (182) Effective tax rate 25.2 % 22.8 % Income from continuing operations $ 528 $ 4 $ 41 $ 32 $ 13 $ 618 Diluted earnings per share from continuing operations $ 1.75 $ 0.01 $ 0.14 $ 0.11 $ 0.04 $ 2.05 Adjustments Restructuring Related and O ther Adjusted Acquisition-Amortization (3) See description of non-GAAP financial measures effective for fiscal 2026. (2) Represents income tax expense related to the revaluation of deferred tax assets as a result of a decrease in the corporate tax rate in a non-U.S. jurisdiction. U.S. GAAP Charges (1) Charges, Net (1) (Non-GAAP) (3) ($ in millions, except per share data) Tax Items (2) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. Expense (1) 40 |

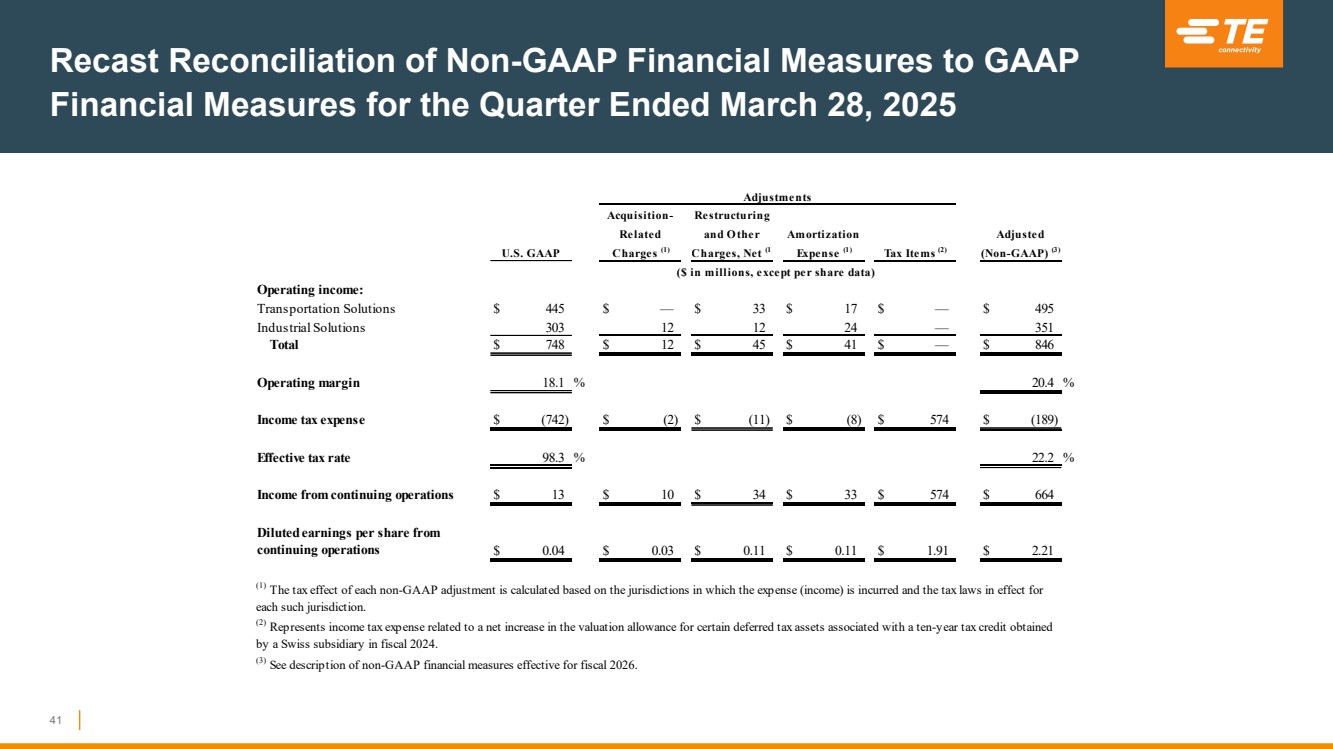

| Recast Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended March 28, 2025 Operating income: Transportation Solutions $ 445 $ — $ 33 $ 17 $ — $ 495 Industrial Solutions 303 12 12 24 — 351 Total $ 748 $ 12 $ 45 $ 41 $ — $ 846 Operating margin 18.1 % 20.4 % Income tax expense $ (742) $ (2) $ (11) $ (8) $ 574 $ (189) Effective tax rate 98.3 % 22.2 % Income from continuing operations $ 13 $ 10 $ 34 $ 33 $ 574 $ 664 Diluted earnings per share from continuing operations $ 0.04 $ 0.03 $ 0.11 $ 0.11 $ 1.91 $ 2.21 (2) Represents income tax expense related to a net increase in the valuation allowance for certain deferred tax assets associated with a ten-year tax credit obtained by a Swiss subsidiary in fiscal 2024. (3) See description of non-GAAP financial measures effective for fiscal 2026. Adjustments Restructuring Related and O ther Adjusted Acquisition- (Non-GAAP) (3) ($ in millions, except per share data) Tax Items (2) Expense (1) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. Amortization U.S. GAAP Charges (1) Charges, Net (1) 41 |

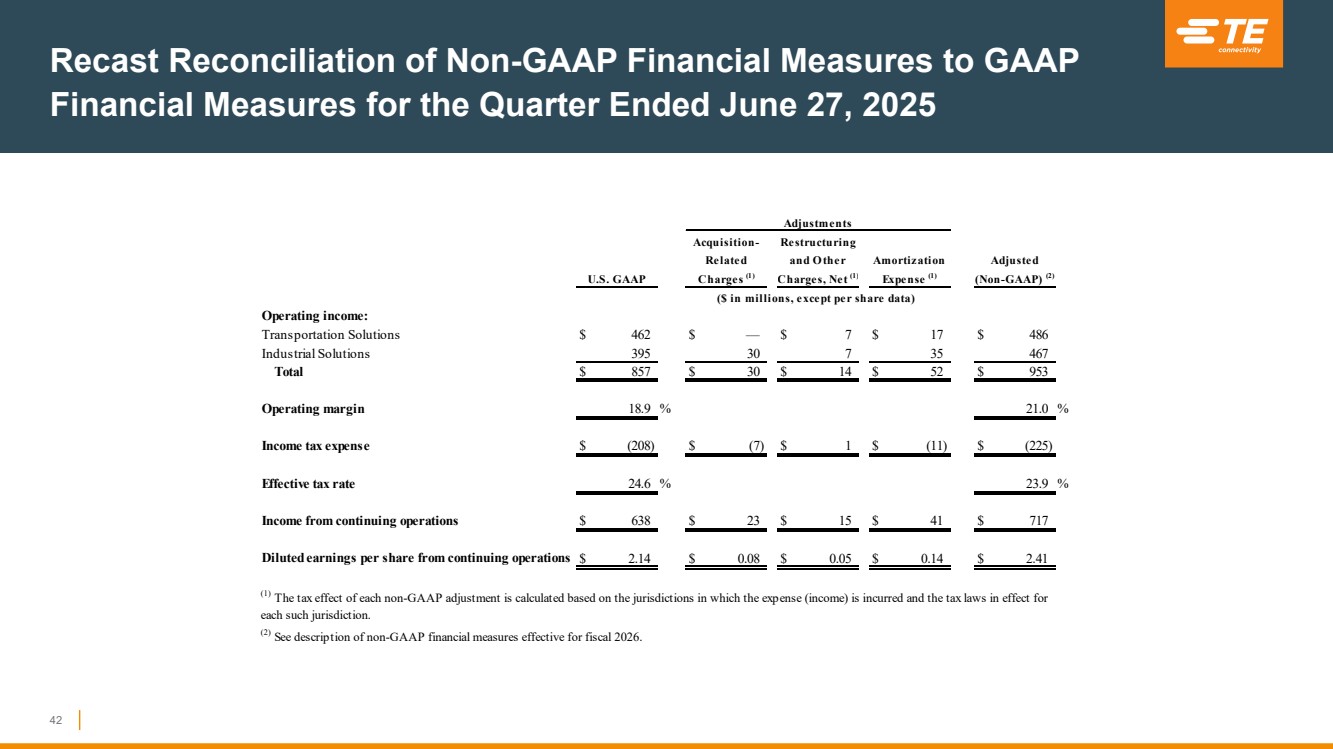

| Recast Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended June 27, 2025 Operating income: Transportation Solutions $ 462 $ — $ 7 $ 17 $ 486 Industrial Solutions 395 30 7 35 467 Total $ 857 $ 30 $ 14 $ 52 $ 953 Operating margin 18.9 % 21.0 % Income tax expense $ (208) $ (7) $ 1 $ (11) $ (225) Effective tax rate 24.6 % 23.9 % Income from continuing operations $ 638 $ 23 $ 15 $ 41 $ 717 Diluted earnings per share from continuing operations $ 2.14 $ 0.08 $ 0.05 $ 0.14 $ 2.41 Adjustments Restructuring Related and O ther Adjusted Acquisition-Amortization U.S. GAAP Charges (1) Charges, Net (1) (Non-GAAP) (2) ($ in millions, except per share data) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (2) See description of non-GAAP financial measures effective for fiscal 2026. Expense (1) 42 |

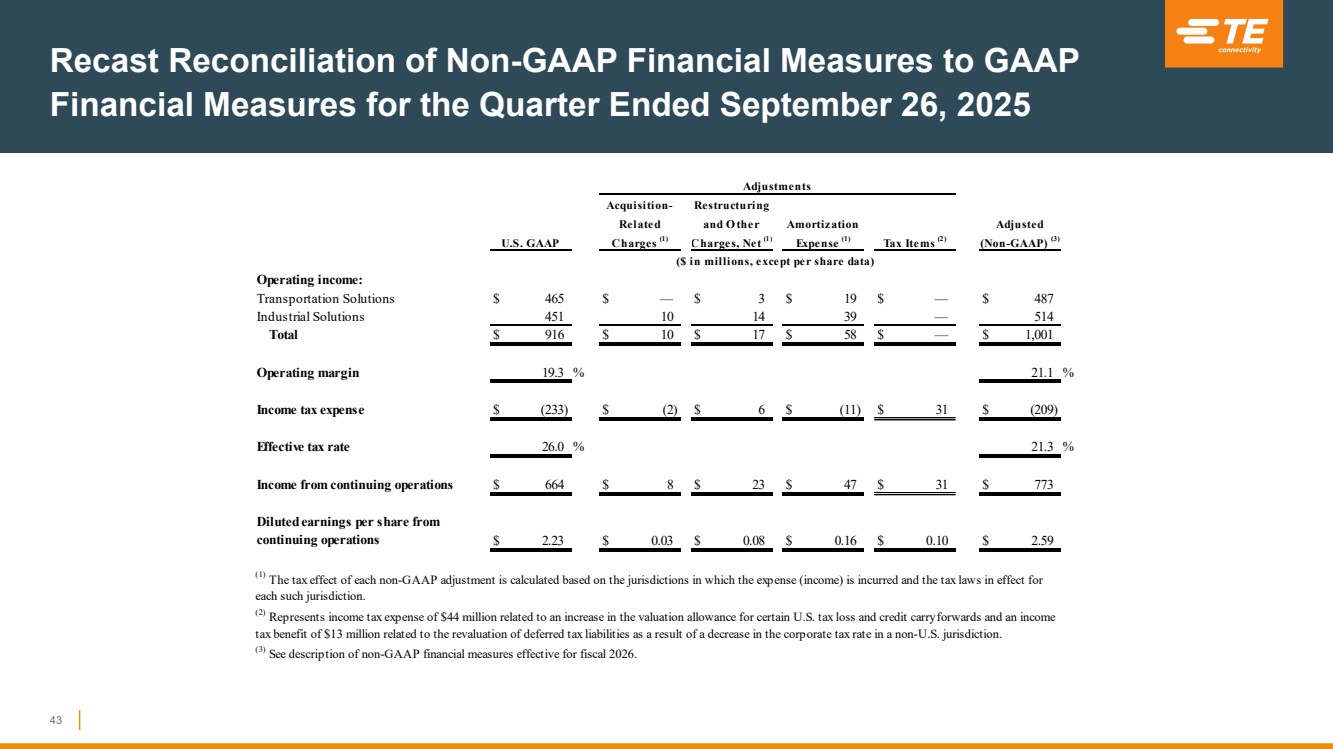

| Recast Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended September 26, 2025 Operating income: Transportation Solutions $ 465 $ — $ 3 $ 19 $ — $ 487 Industrial Solutions 451 10 14 39 — 514 Total $ 916 $ 10 $ 17 $ 58 $ — $ 1,001 Operating margin 19.3 % 21.1 % Income tax expense $ (233) $ (2) $ 6 $ (11) $ 31 $ (209) Effective tax rate 26.0 % 21.3 % Income from continuing operations $ 664 $ 8 $ 23 $ 47 $ 31 $ 773 Diluted earnings per share from continuing operations $ 2.23 $ 0.03 $ 0.08 $ 0.16 $ 0.10 $ 2.59 (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (2) Represents income tax expense of $44 million related to an increase in the valuation allowance for certain U.S. tax loss and credit carryforwards and an income tax benefit of $13 million related to the revaluation of deferred tax liabilities as a result of a decrease in the corporate tax rate in a non-U.S. jurisdiction. (3) See description of non-GAAP financial measures effective for fiscal 2026. Tax Items (2) Adjustments Related and O ther Restructuring ($ in millions, except per share data) U.S. GAAP Charges (1) Charges, Net (1) (Non-GAAP) (3) Adjusted Acquisition-Amortization Expense (1) 43 |

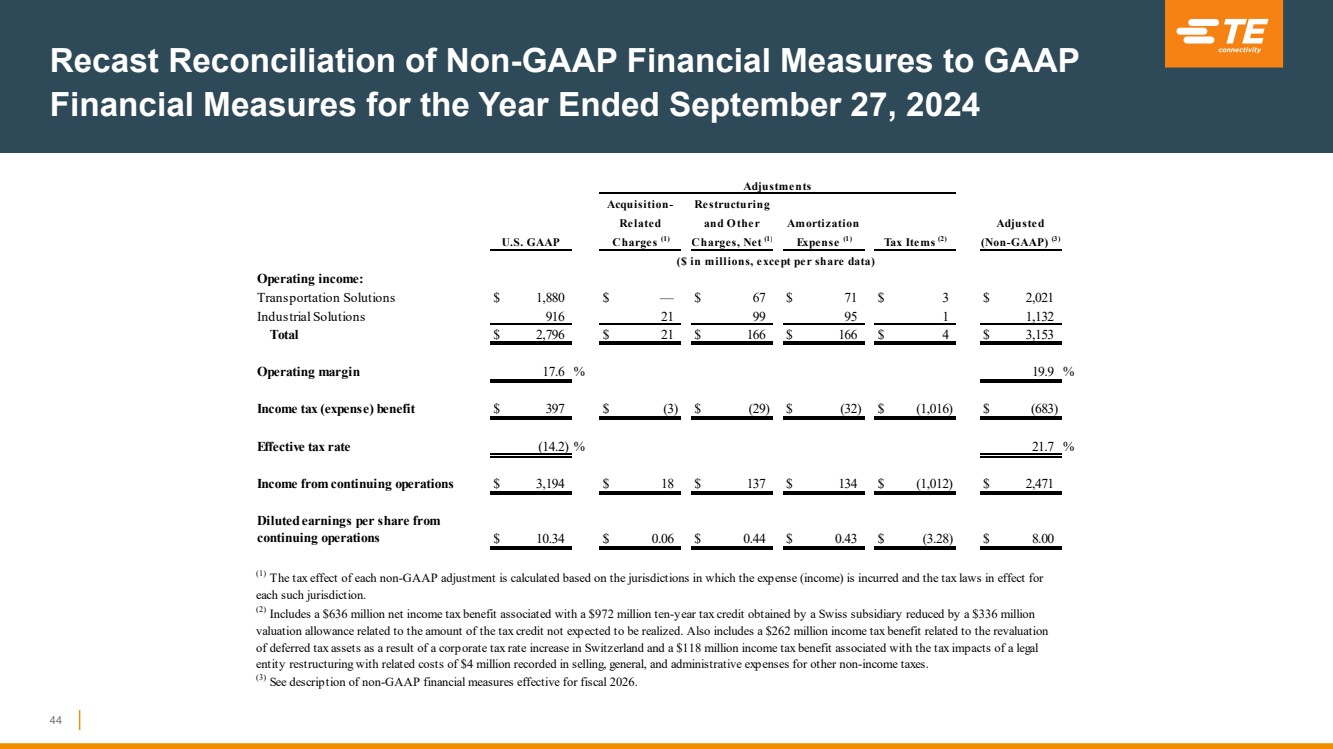

| Recast Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Year Ended September 27, 2024 Operating income: Transportation Solutions $ 1,880 $ — $ 67 $ 71 $ 3 $ 2,021 Industrial Solutions 916 21 99 95 1 1,132 Total $ 2,796 $ 21 $ 166 $ 166 $ 4 $ 3,153 Operating margin 17.6 % 19.9 % Income tax (expense) benefit $ 397 $ (3) $ (29) $ (32) $ (1,016) $ (683) Effective tax rate (14.2) % 21.7 % Income from continuing operations $ 3,194 $ 18 $ 137 $ 134 $ (1,012) $ 2,471 Diluted earnings per share from continuing operations $ 10.34 $ 0.06 $ 0.44 $ 0.43 $ (3.28) $ 8.00 ($ in millions, except per share data) U.S. GAAP Charges (1) Adjusted Acquisition- Restructuring Related and O ther Charges, Net (1) (3) See description of non-GAAP financial measures effective for fiscal 2026. Adjustments Tax Items (2) (Non-GAAP) (3) Amortization Expense (1) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (2) Includes a $636 million net income tax benefit associated with a $972 million ten-year tax credit obtained by a Swiss subsidiary reduced by a $336 million valuation allowance related to the amount of the tax credit not expected to be realized. Also includes a $262 million income tax benefit related to the revaluation of deferred tax assets as a result of a corporate tax rate increase in Switzerland and a $118 million income tax benefit associated with the tax impacts of a legal entity restructuring with related costs of $4 million recorded in selling, general, and administrative expenses for other non-income taxes. 44 |

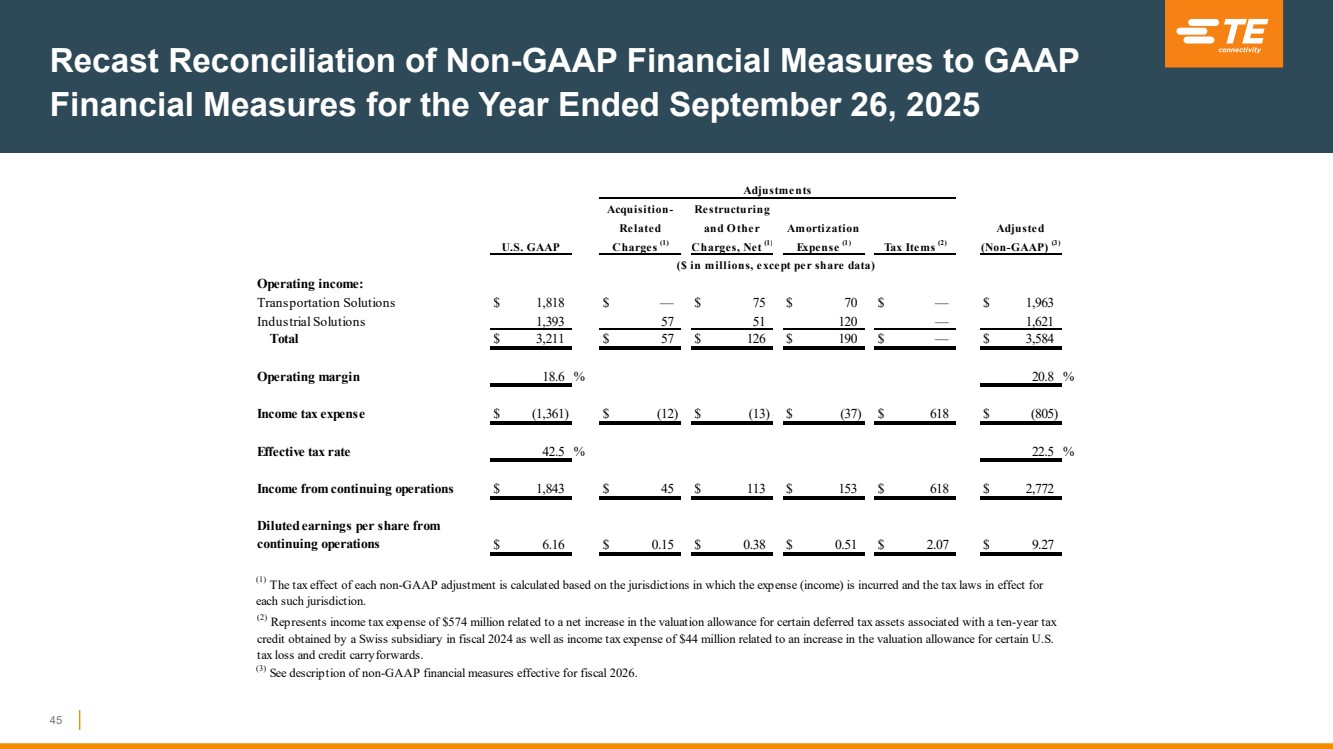

| Recast Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Year Ended September 26, 2025 Operating income: Transportation Solutions $ 1,818 $ — $ 75 $ 70 $ — $ 1,963 Industrial Solutions 1,393 57 51 120 — 1,621 Total $ 3,211 $ 57 $ 126 $ 190 $ — $ 3,584 Operating margin 18.6 % 20.8 % Income tax expense $ (1,361) $ (12) $ (13) $ (37) $ 618 $ (805) Effective tax rate 42.5 % 22.5 % Income from continuing operations $ 1,843 $ 45 $ 113 $ 153 $ 618 $ 2,772 Diluted earnings per share from continuing operations $ 6.16 $ 0.15 $ 0.38 $ 0.51 $ 2.07 $ 9.27 Tax Items (2) Adjustments (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. Related and O ther U.S. GAAP Charges (1) Charges, Net (1) Adjusted (2) Represents income tax expense of $574 million related to a net increase in the valuation allowance for certain deferred tax assets associated with a ten-year tax credit obtained by a Swiss subsidiary in fiscal 2024 as well as income tax expense of $44 million related to an increase in the valuation allowance for certain U.S. tax loss and credit carryforwards. (3) See description of non-GAAP financial measures effective for fiscal 2026. ($ in millions, except per share data) Acquisition- Restructuring Amortization Expense (1) (Non-GAAP) (3) 45 |