| EVERY CONNECTION COUNTS TE Connectivity First Quarter 2026 Earnings January 21, 2026 |

| Forward-Looking Statements and Non-GAAP Financial Measures 2 Forward-Looking Statements This presentation contains certain "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations and are subject to risks, uncertainty and changes in circumstances, which may cause actual results, performance, financial condition or achievements to differ materially from anticipated results, performance, financial condition or achievements. All statements contained herein that are not clearly historical in nature are forward-looking and the words "anticipate," "believe," "expect," "estimate," "plan," and similar expressions are generally intended to identify forward-looking statements. We have no intention and are under no obligation to update or alter (and expressly disclaim any such intention or obligation to do so) our forward-looking statements whether as a result of new information, future events or otherwise, except to the extent required by law. The forward-looking statements in this presentation include statements addressing our future financial condition and operating results. Examples of factors that could cause actual results to differ materially from those described in the forward-looking statements include, among others, the extent, severity and duration of business interruptions negatively affecting our business operations; business, economic, competitive and regulatory risks, such as conditions affecting demand for products in the automotive and other industries we serve; competition and pricing pressure; fluctuations in foreign currency exchange rates and commodity prices; natural disasters and political, economic and military instability in countries in which we operate, including continuing military conflict in certain parts of the world; developments in the credit markets; future goodwill impairment; compliance with current and future environmental and other laws and regulations; and the possible effects on us of changes in tax laws, tax treaties and other legislation. More detailed information about these and other factors is set forth in TE Connectivity plc's Annual Report on Form 10-K for the fiscal year ended Sept. 26, 2025, as well as in our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports filed by us with the U.S. Securities and Exchange Commission. Non-GAAP Financial Measures Where we have used non-GAAP financial measures, reconciliations to the most comparable GAAP measure are provided, along with a disclosure on the usefulness of the non-GAAP financial measure, in this presentation. Effective for fiscal 2026, we exclude amortization expense on intangible assets and, if applicable, the related tax effects from our calculation of certain non-GAAP financial measures. |

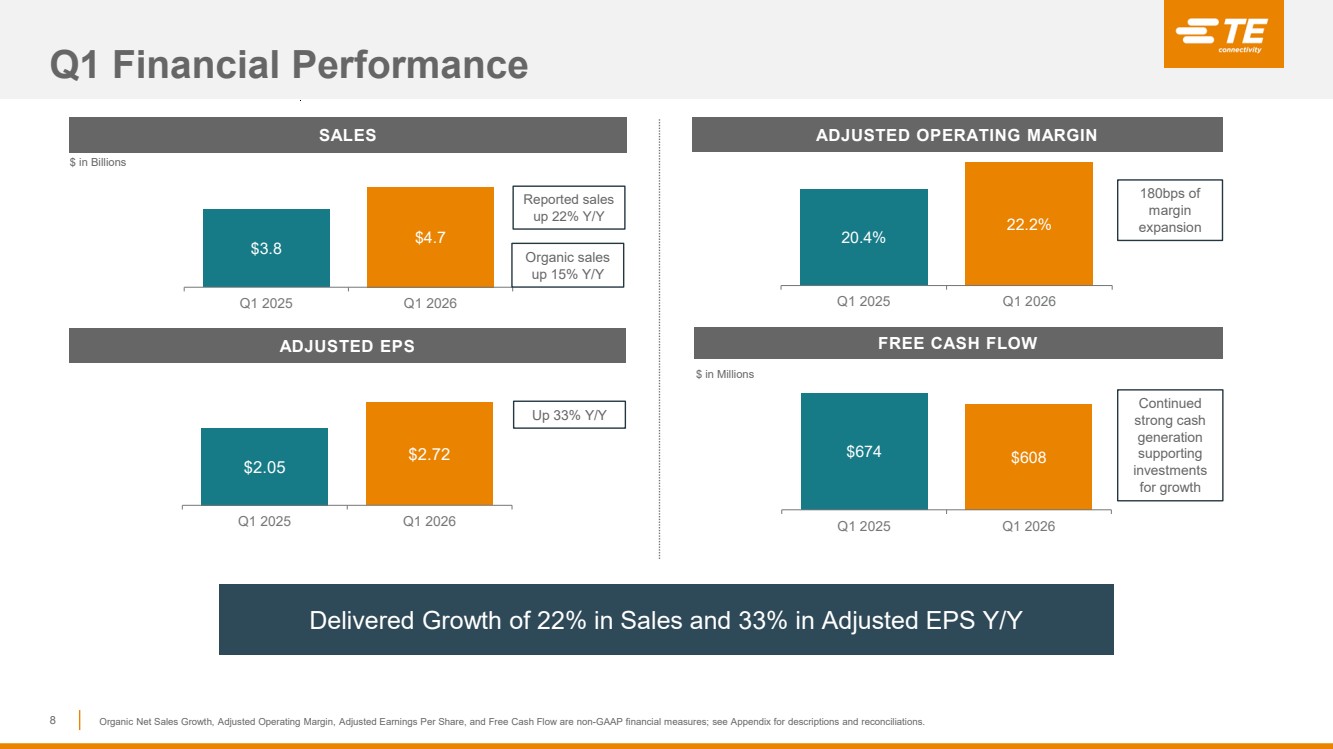

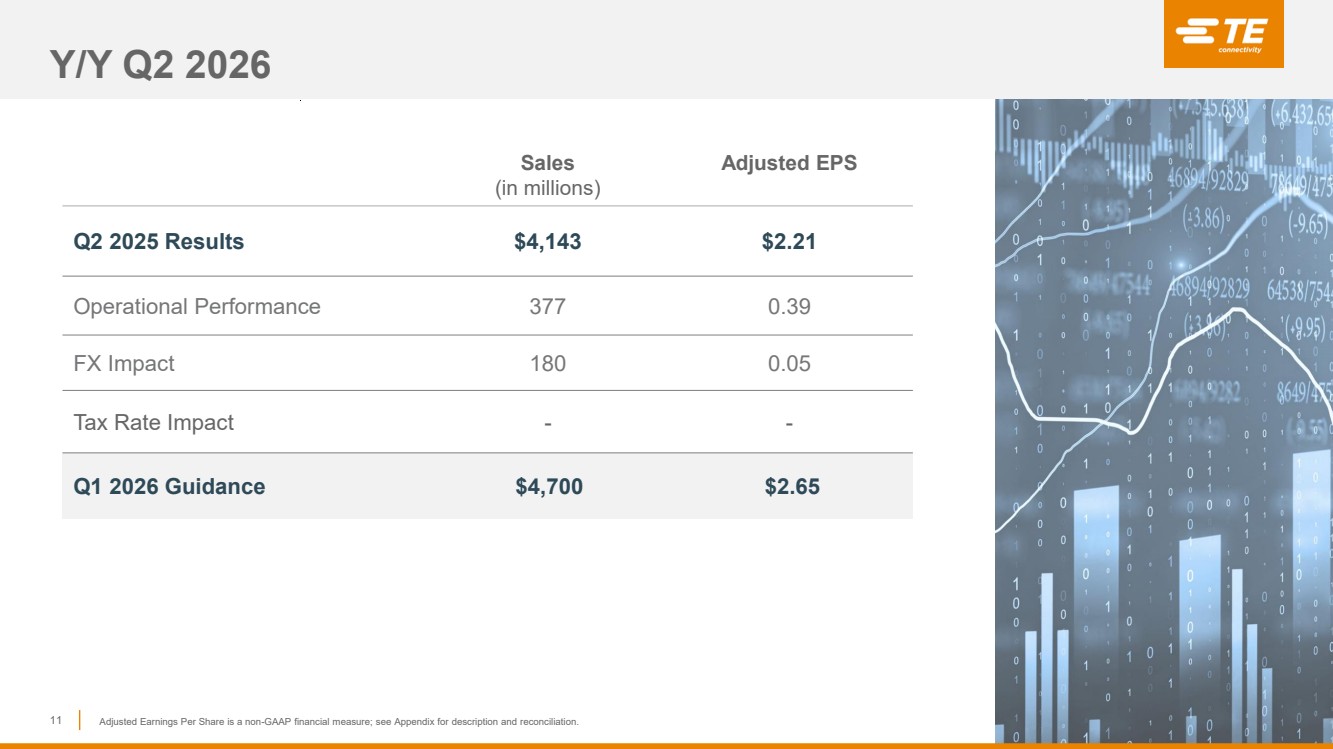

| Q1 Results Exceeded Guidance with an Increase of 22% in Sales and 33% in Adjusted EPS Y/Y ▪ Sales of $4.7B, increased 22% reported and 15% on an organic basis Y/Y ▪ Reported Sales growth in both segments Y/Y ▪ Record Orders of $5.1B, increased 28% Y/Y and 9% sequentially; book to bill of 1.1 ▪ Adjusted Operating Margins of 22%, expanded 180bps Y/Y driven by strong operational performance ▪ Adjusted EPS of $2.72, increased 33% Y/Y ▪ Strong Free Cash Flow generation of $608M with ~100% returned to shareholders Earnings Highlights 3 Organic Net Sales Growth (Decline), Adjusted Operating Margin, Adjusted EPS, and Free Cash Flow are non-GAAP financial measures; see Appendix for descriptions and reconciliations Q2 Guidance Reflects Strong Sales and EPS Growth Y/Y ▪ Expect Sales of ~$4.7B, increasing 13% reported and 6% organically Y/Y ▪ Expect sequential growth in the Industrial Segment, partially offset by seasonality in Transportation ▪ Adjusted EPS of ~$2.65, increasing 20% Y/Y |

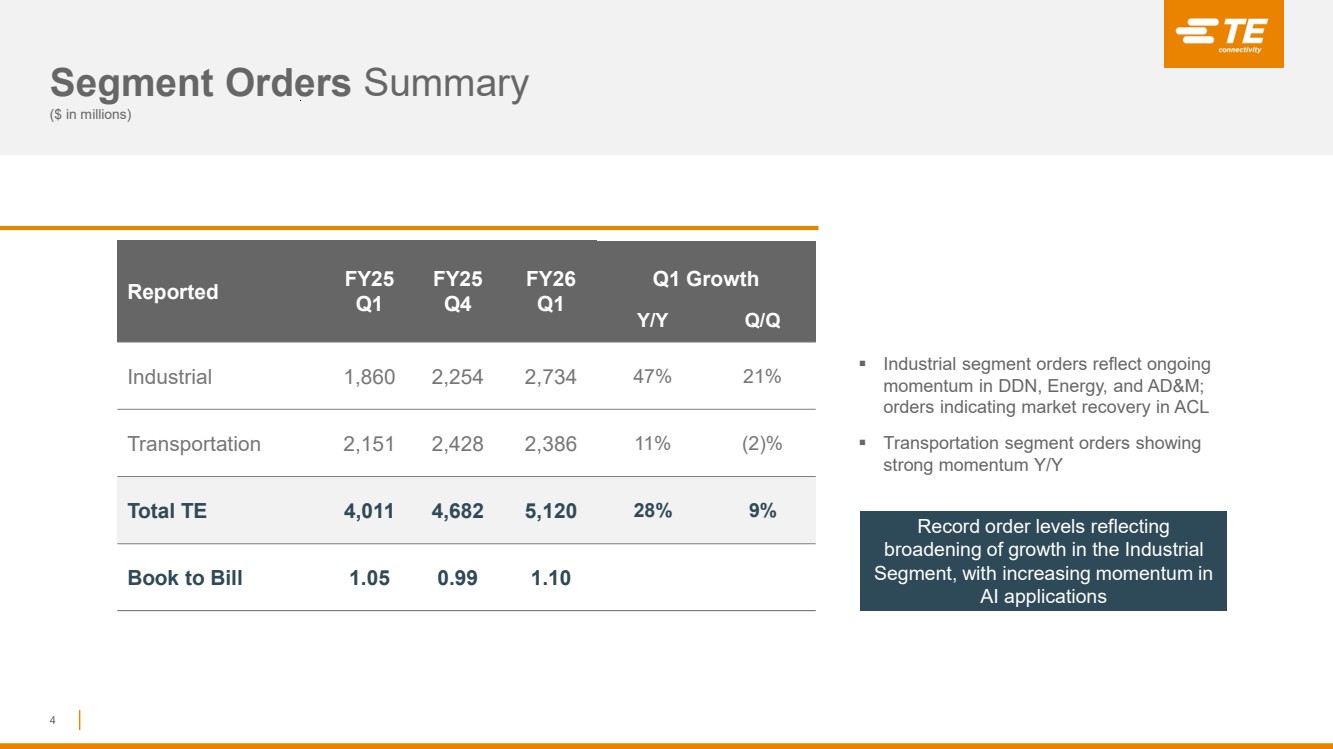

| Reported FY25 Q1 FY25 Q4 FY26 Q1 Q1 Growth Y/Y Q/Q Industrial 1,860 2,254 2,734 47% 21% Transportation 2,151 2,428 2,386 11% (2)% Total TE 4,011 4,682 5,120 28% 9% Book to Bill 1.05 0.99 1.10 Segment Orders Summary ($ in millions) 4 ▪ Industrial segment orders reflect ongoing momentum in DDN, Energy, and AD&M; orders indicating market recovery in ACL ▪ Transportation segment orders showing strong momentum Y/Y Record order levels reflecting broadening of growth in the Industrial Segment, with increasing momentum in AI applications |

| Industrial Solutions Q1 SALES Reported Up 38% Organic Up 26% Q1 ADJUSTED OPERATING MARGIN Margin expansion of 520bps driven by strong operational performance and benefits of higher volume Adjusted EBITDA Margin 21.4% 26.8% 5 Q1 BUSINESS PERFORMANCE Y/Y Growth Rates Reported Organic Digital Data Networks (DDN) $707 71% 70% Automation & Connected Living (ACL) 549 15% 12% Energy 406 88% 15% Aerospace, Defense and Marine (AD&M) 381 14% 11% Medical 159 5% 5% Industrial Solutions $2,202 38% 26% $ in Millions ▪ Digital Data Networks Strong growth driven by momentum in AI applications ▪ Automation & Connected Living Growth across all regions with improvement in Factory Automation applications ▪ Energy Organic growth driven by grid hardening & renewable applications ▪ AD&M Growth reflects ongoing strength in commercial air and defense markets ▪ Medical Sales growth Y/Y as expected $1,593 $2,202 Q1 2025 Q1 2026 18.1% 23.3% Q1 2025 Q1 2026 Continued momentum with all businesses growing Y/Y Organic Net Sales Growth (Decline), Adjusted Operating Margin, and Adjusted EBITDA Margin are non-GAAP financial measures; see Appendix for descriptions and reconciliations. |

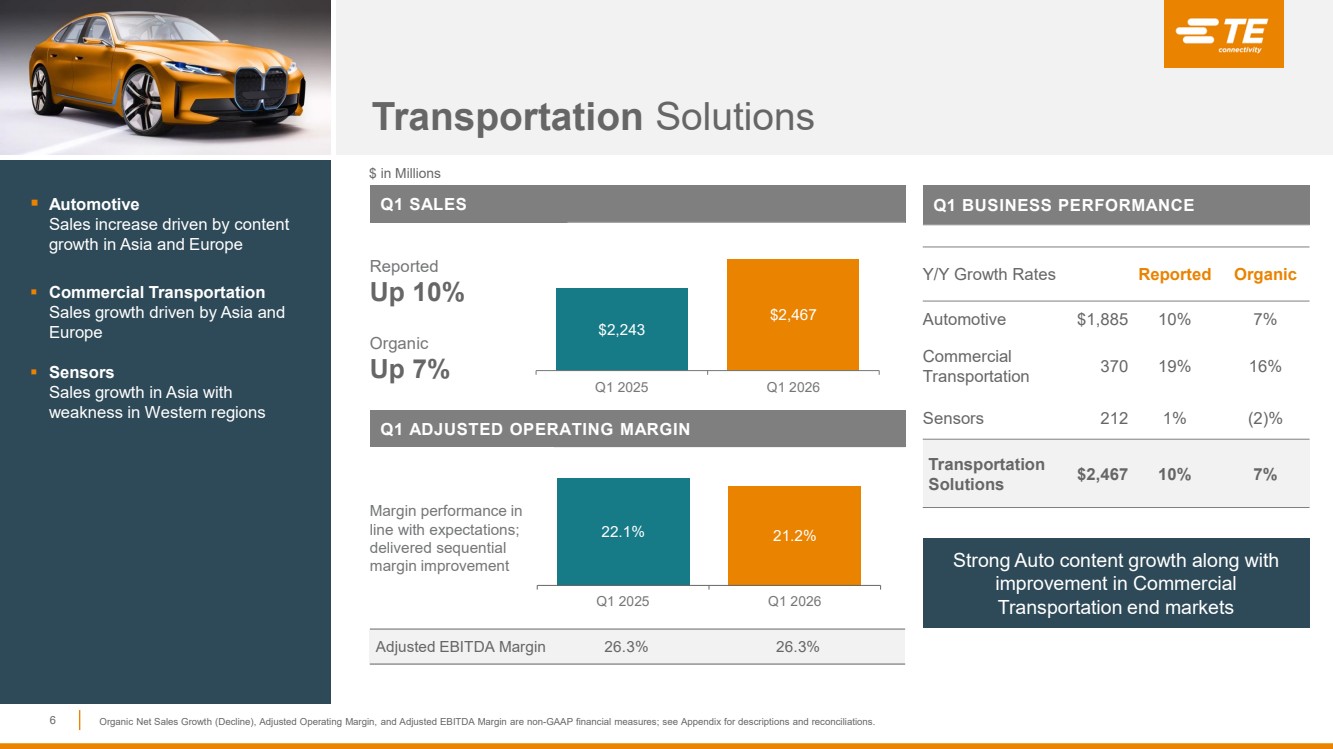

| Transportation Solutions Q1 SALES Reported Up 10% Organic Up 7% Q1 ADJUSTED OPERATING MARGIN Margin performance in line with expectations; delivered sequential margin improvement Adjusted EBITDA Margin 26.3% 26.3% 6 $2,243 $2,467 Q1 2025 Q1 2026 Q1 BUSINESS PERFORMANCE Y/Y Growth Rates Reported Organic Automotive $1,885 10% 7% Commercial Transportation 370 19% 16% Sensors 212 1% (2)% Transportation Solutions $2,467 10% 7% $ in Millions 22.1% 21.2% Q1 2025 Q1 2026 ▪ Automotive Sales increase driven by content growth in Asia and Europe ▪ Commercial Transportation Sales growth driven by Asia and Europe ▪ Sensors Sales growth in Asia with weakness in Western regions Organic Net Sales Growth (Decline), Adjusted Operating Margin, and Adjusted EBITDA Margin are non-GAAP financial measures; see Appendix for descriptions and reconciliations. Strong Auto content growth along with improvement in Commercial Transportation end markets |

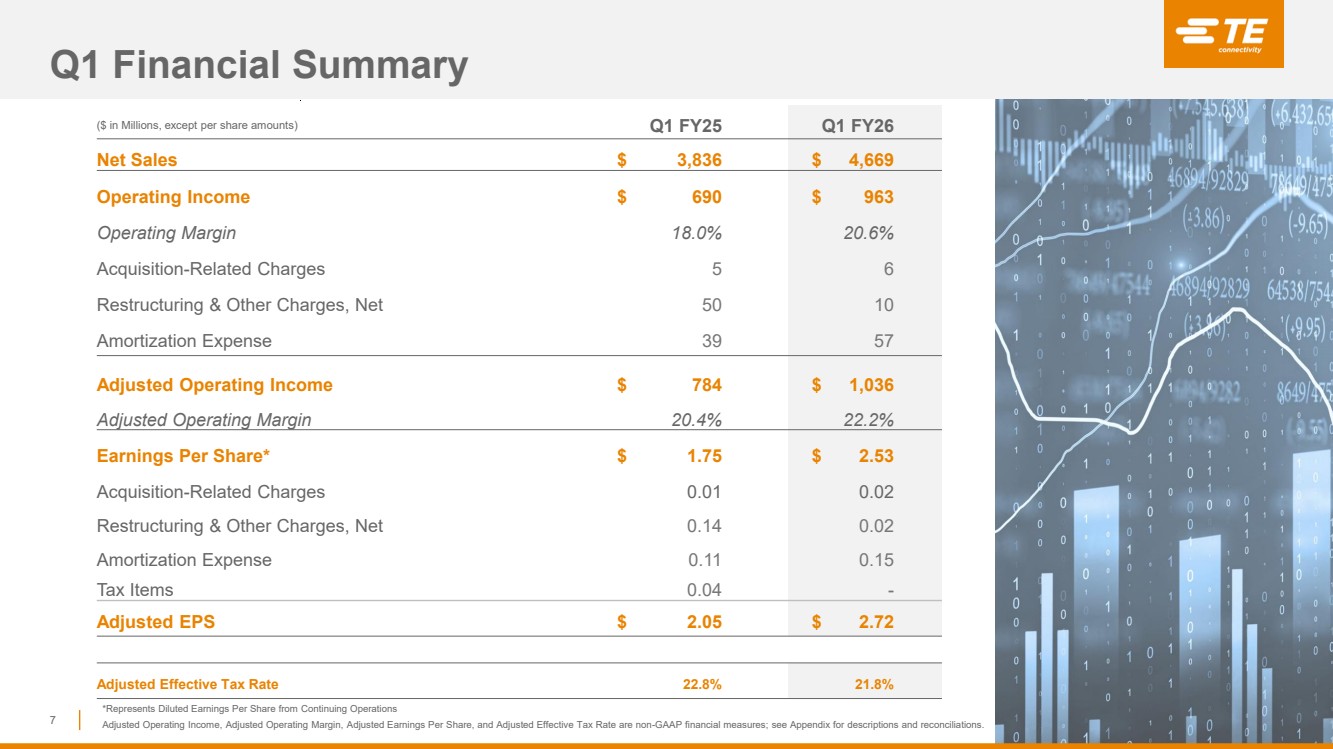

| Q1 Financial Summary 7 ($ in Millions, except per share amounts) Q1 FY25 Q1 FY26 Net Sales $ 3,836 $ 4,669 Operating Income $ 690 $ 963 Operating Margin 18.0% 20.6% Acquisition-Related Charges 5 6 Restructuring & Other Charges, Net 50 10 Amortization Expense 39 57 Adjusted Operating Income $ 784 $ 1,036 Adjusted Operating Margin 20.4% 22.2% Earnings Per Share* $ 1.75 $ 2.53 Acquisition-Related Charges 0.01 0.02 Restructuring & Other Charges, Net 0.14 0.02 Amortization Expense 0.11 0.15 Tax Items 0.04 - Adjusted EPS $ 2.05 $ 2.72 Adjusted Effective Tax Rate 22.8% 21.8% *Represents Diluted Earnings Per Share from Continuing Operations Adjusted Operating Income, Adjusted Operating Margin, Adjusted Earnings Per Share, and Adjusted Effective Tax Rate are non-GAAP financial measures; see Appendix for descriptions and reconciliations. |

| Q1 Financial Performance 8 20.4% 22.2% Q1 2025 Q1 2026 SALES ADJUSTED OPERATING MARGIN ADJUSTED EPS FREE CASH FLOW Delivered Growth of 22% in Sales and 33% in Adjusted EPS Y/Y $ in Billions $ in Millions Continued strong cash generation supporting investments for growth $674 $608 Q1 2025 Q1 2026 Up 33% Y/Y $3.8 $4.7 Q1 2025 Q1 2026 180bps of margin expansion Organic Net Sales Growth, Adjusted Operating Margin, Adjusted Earnings Per Share, and Free Cash Flow are non-GAAP financial measures; see Appendix for descriptions and reconciliations. Reported sales up 22% Y/Y $2.05 $2.72 Q1 2025 Q1 2026 Organic sales up 15% Y/Y ADJUSTED OPERATING MARGIN |

| EVERY CONNECTION COUNTS Additional Information |

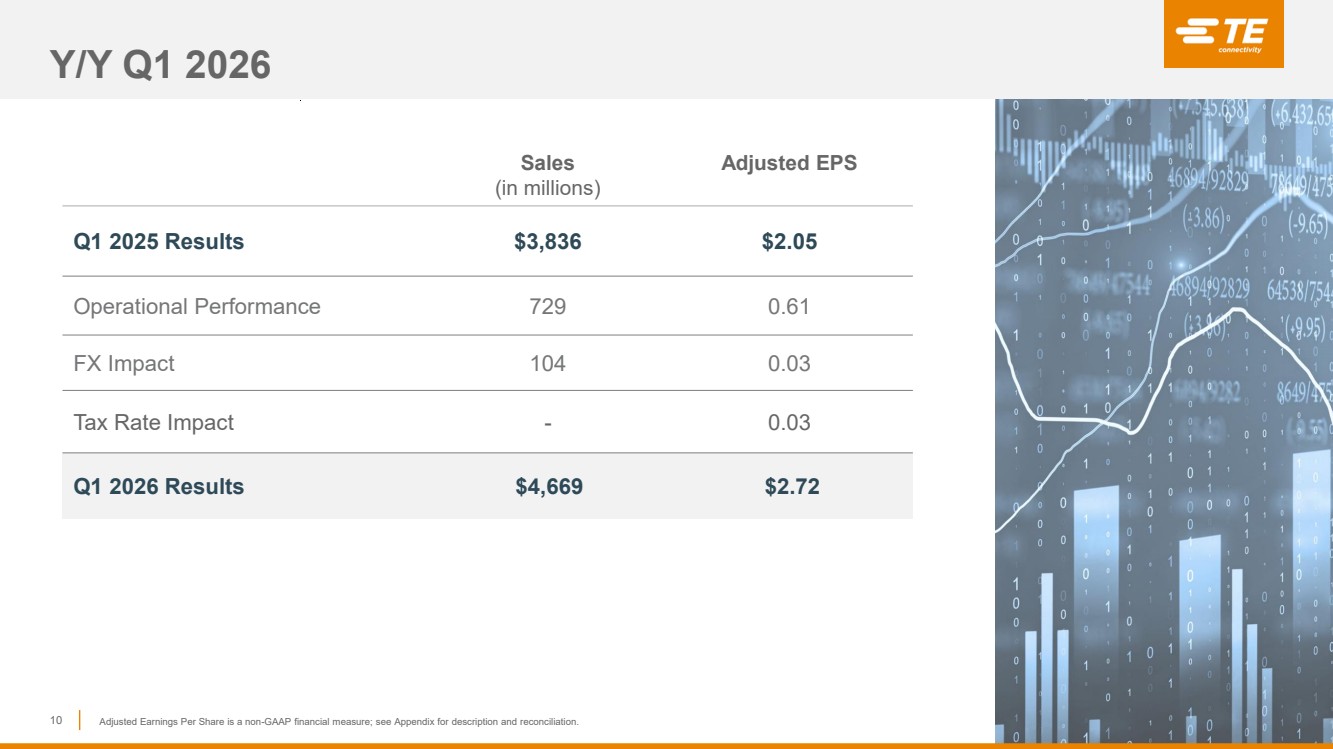

| Y/Y Q1 2026 10 Sales (in millions) Adjusted EPS Q1 2025 Results $3,836 $2.05 Operational Performance 729 0.61 FX Impact 104 0.03 Tax Rate Impact - 0.03 Q1 2026 Results $4,669 $2.72 Adjusted Earnings Per Share is a non-GAAP financial measure; see Appendix for description and reconciliation. |

| Y/Y Q2 2026 11 Sales (in millions) Adjusted EPS Q2 2025 Results $4,143 $2.21 Operational Performance 377 0.39 FX Impact 180 0.05 Tax Rate Impact - - Q1 2026 Guidance $4,700 $2.65 Adjusted Earnings Per Share is a non-GAAP financial measure; see Appendix for description and reconciliation. |

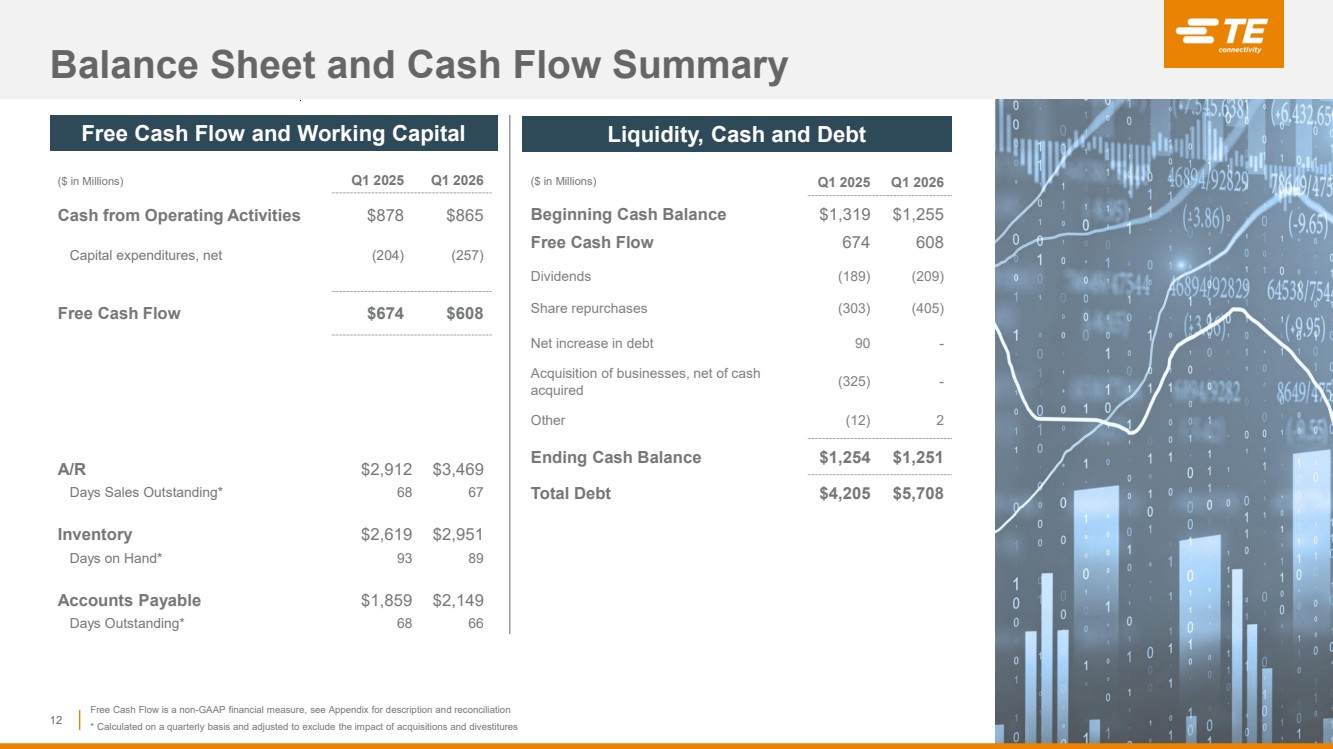

| Balance Sheet and Cash Flow Summary 12 ($ in Millions) Q1 2025 Q1 2026 Beginning Cash Balance $1,319 $1,255 Free Cash Flow 674 608 Dividends (189) (209) Share repurchases (303) (405) Net increase in debt 90 - Acquisition of businesses, net of cash acquired (325) - Other (12) 2 Ending Cash Balance $1,254 $1,251 Total Debt $4,205 $5,708 A/R $2,912 $3,469 Days Sales Outstanding* 68 67 Inventory $2,619 $2,951 Days on Hand* 93 89 Accounts Payable $1,859 $2,149 Days Outstanding* 68 66 Free Cash Flow and Working Capital Liquidity, Cash and Debt ($ in Millions) Q1 2025 Q1 2026 Cash from Operating Activities $878 $865 Capital expenditures, net (204) (257) Free Cash Flow $674 $608 Free Cash Flow is a non-GAAP financial measure, see Appendix for description and reconciliation * Calculated on a quarterly basis and adjusted to exclude the impact of acquisitions and divestitures |

| EVERY CONNECTION COUNTS Appendix |

| We present non-GAAP performance and liquidity measures as we believe it is appropriate for investors to consider adjusted financial measures in addition to results in accordance with accounting principles generally accepted in the U.S. (“GAAP”). These non-GAAP financial measures provide supplemental information and should not be considered replacements for results in accordance with GAAP. Management uses non-GAAP financial measures internally for planning and forecasting purposes and in its decision-making processes related to the operations of our company. We believe these measures provide meaningful information to us and investors because they enhance the understanding of our operating performance, ability to generate cash, and the trends of our business. Additionally, we believe that investors benefit from having access to the same financial measures that management uses in evaluating our operations. The primary limitation of these measures is that they exclude the financial impact of items that would otherwise either increase or decrease our reported results. This limitation is best addressed by using these non-GAAP financial measures in combination with the most directly comparable GAAP financial measures in order to better understand the amounts, character, and impact of any increase or decrease in reported amounts. These non-GAAP financial measures may not be comparable to similarly-titled measures reported by other companies. The following provides additional information regarding our non-GAAP financial measures: ▪ Organic Net Sales Growth (Decline) – represents net sales growth (decline) (the most comparable GAAP financial measure) excluding the impact of foreign currency exchange rates, and acquisitions and divestitures that occurred in the preceding twelve months, if any. Organic Net Sales Growth (Decline) is a useful measure of our performance because it excludes items that are not completely under management’s control, such as the impact of changes in foreign currency exchange rates, and items that do not reflect the underlying growth of the company, such as acquisition and divestiture activity. This measure is a significant component in our incentive compensation plans. ▪ Adjusted Operating Income and Adjusted Operating Margin – represent operating income and operating margin, respectively, (the most comparable GAAP financial measures) before special items including restructuring and other charges, acquisition-related charges, amortization expense on intangible assets, impairment of goodwill, and other income or charges, if any. We utilize these adjusted measures in combination with operating income and operating margin to assess segment level operating performance and to provide insight to management in evaluating segment operating plan execution and market conditions. Adjusted Operating Income is a significant component in our incentive compensation plans. ▪ Adjusted Income Tax (Expense) Benefit and Adjusted Effective Tax Rate – represent income tax (expense) benefit and effective tax rate, respectively, (the most comparable GAAP financial measures) after adjusting for the tax effect of special items including restructuring and other charges, acquisition-related charges, amortization expense on intangible assets, impairment of goodwill, other income or charges, and certain significant tax items, if any. ▪ Adjusted Income from Continuing Operations – represents income from continuing operations (the most comparable GAAP financial measure) before special items including restructuring and other charges, acquisition-related charges, amortization expense on intangible assets, impairment of goodwill, other income or charges, and certain significant tax items, if any, and, if applicable, the related tax effects Non-GAAP Financial Measures 14 |

| ▪ Adjusted Earnings Per Share – represents diluted earnings per share from continuing operations (the most comparable GAAP financial measure) before special items including restructuring and other charges, acquisition-related charges, amortization expense on intangible assets, impairment of goodwill, other income or charges, and certain significant tax items, if any, and, if applicable, the related tax effects. This measure is a significant component in our incentive compensation plans. ▪ Adjusted EBITDA and Adjusted EBITDA Margin – represent net income and net income as a percentage of net sales, respectively, (the most comparable GAAP financial measures) before interest expense, interest income, income taxes, depreciation, and amortization, as adjusted for net other income (expense), income (loss) from discontinued operations, and special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, and other income or charges, if any. ▪ Free Cash Flow (FCF) – is a useful measure of our ability to generate cash. The difference between net cash provided by operating activities (the most comparable GAAP financial measure) and Free Cash Flow consists mainly of significant cash outflows and inflows that we believe are useful to identify. We believe Free Cash Flow provides useful information to investors as it provides insight into the primary cash flow metric used by management to monitor and evaluate cash flows generated from our operations. Free Cash Flow is defined as net cash provided by operating activities excluding voluntary pension contributions and the cash impact of special items, if any, minus net capital expenditures. Voluntary pension contributions are excluded from the GAAP financial measure because this activity is driven by economic financing decisions rather than operating activity. Certain special items, including cash paid (collected) pursuant to collateral requirements related to cross-currency swap contracts, are also excluded by management in evaluating Free Cash Flow. Net capital expenditures consist of capital expenditures less proceeds from the sale of property, plant, and equipment. These items are subtracted because they represent long-term commitments. In the calculation of Free Cash Flow, we subtract certain cash items that are ultimately within management’s and the Board of Directors’ discretion to direct and may imply that there is less or more cash available for our programs than the most comparable GAAP financial measure indicates. It should not be inferred that the entire Free Cash Flow amount is available for future discretionary expenditures, as our definition of Free Cash Flow does not consider certain non-discretionary expenditures, such as debt payments. In addition, we may have other discretionary expenditures, such as discretionary dividends, share repurchases, and business acquisitions, that are not considered in the calculation of Free Cash Flow. Non-GAAP Financial Measures (cont.) 15 |

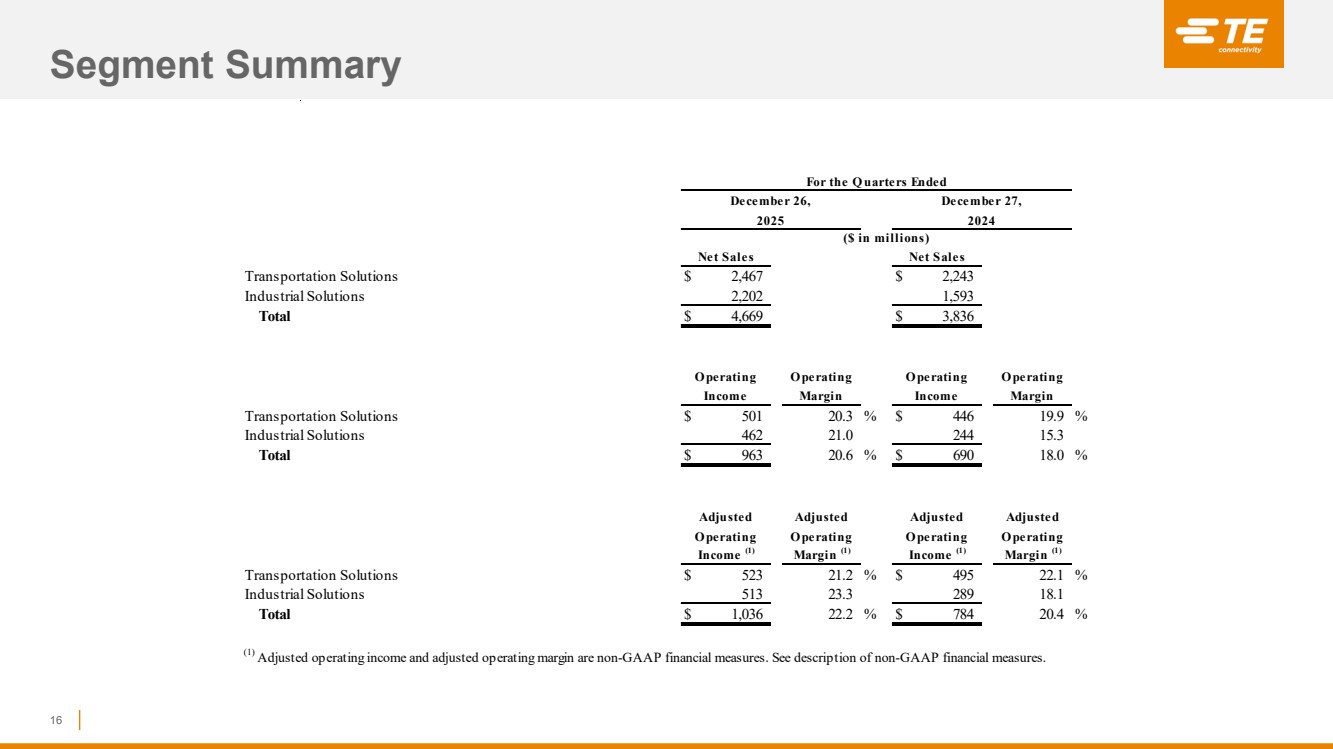

| Segment Summary 16 Transportation Solutions $ 2,467 $ 2,243 Industrial Solutions 2,202 1,593 Total $ 4,669 $ 3,836 O perating O perating Margin Margin Transportation Solutions $ 501 20.3 % $ 446 19.9 % Industrial Solutions 462 21.0 244 15.3 Total $ 963 20.6 % $ 690 18.0 % Adjusted Adjusted O perating O perating Margin (1) Margin (1) Transportation Solutions $ 523 21.2 % $ 495 22.1 % Industrial Solutions 513 23.3 289 18.1 Total $ 1,036 22.2 % $ 784 20.4 % (1) Adjusted operating income and adjusted operating margin are non-GAAP financial measures. See description of non-GAAP financial measures. 2025 2024 ($ in millions) Adjusted O perating Net Sales Net Sales Income (1) Adjusted O perating Income (1) Income O perating O perating Income For the Q uarters Ended December 26, December 27, |

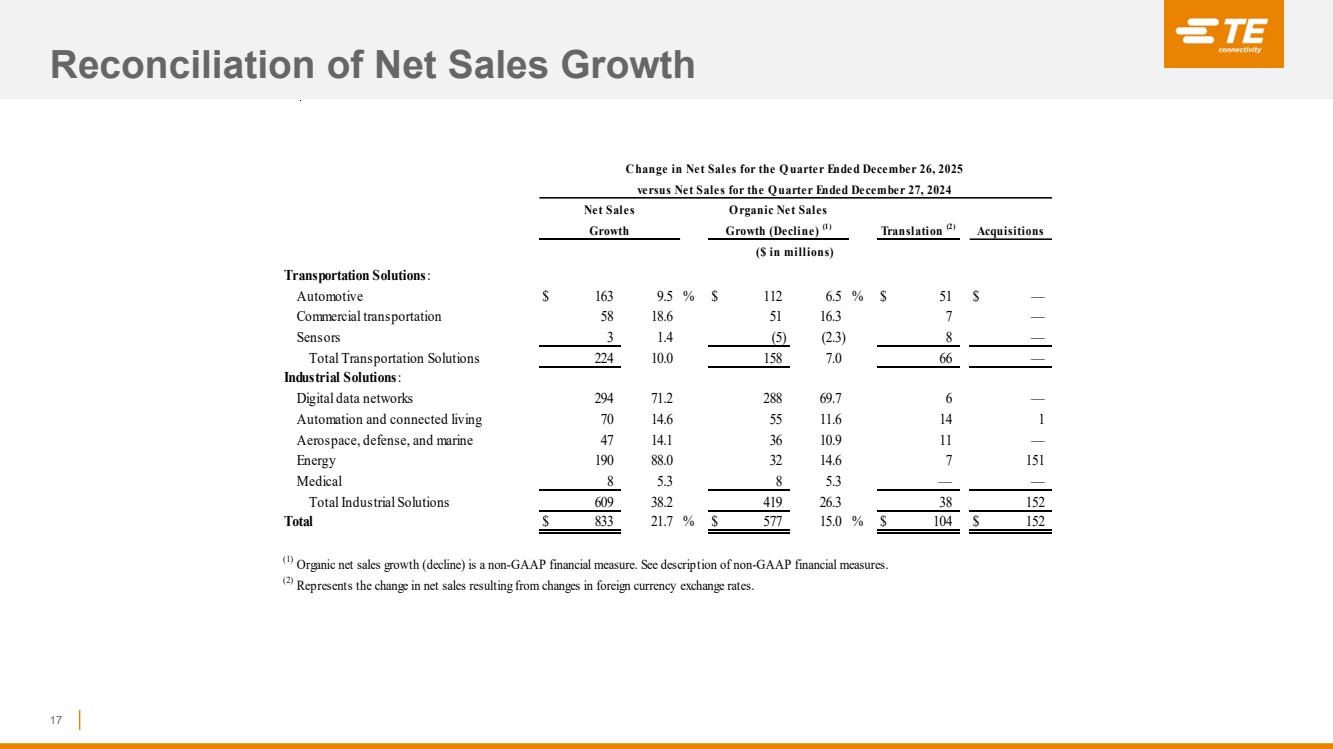

| Reconciliation of Net Sales Growth 17 Transportation Solutions: Automotive $ 163 9.5 % $ 112 6.5 % $ 51 $ — Commercial transportation 58 18.6 51 16.3 7 — Sensors 3 1.4 (5) (2.3) 8 — Total Transportation Solutions 224 10.0 158 7.0 66 — Industrial Solutions: Digital data networks 294 71.2 288 69.7 6 — Automation and connected living 70 14.6 55 11.6 14 1 Aerospace, defense, and marine 47 14.1 36 10.9 11 — Energy 190 88.0 32 14.6 7 151 Medical 8 5.3 8 5.3 — — Total Industrial Solutions 609 38.2 419 26.3 38 152 Total $ 833 21.7 % $ 577 15.0 % $ 104 $ 152 ($ in millions) Translation (2) Acquisitions Net Sales Growth O rganic Net Sales Growth (Decline) (1) Change in Net Sales for the Q uarter Ended December 26, 2025 versus Net Sales for the Q uarter Ended December 27, 2024 (1) Organic net sales growth (decline) is a non-GAAP financial measure. See description of non-GAAP financial measures. (2) Represents the change in net sales resulting from changes in foreign currency exchange rates. |

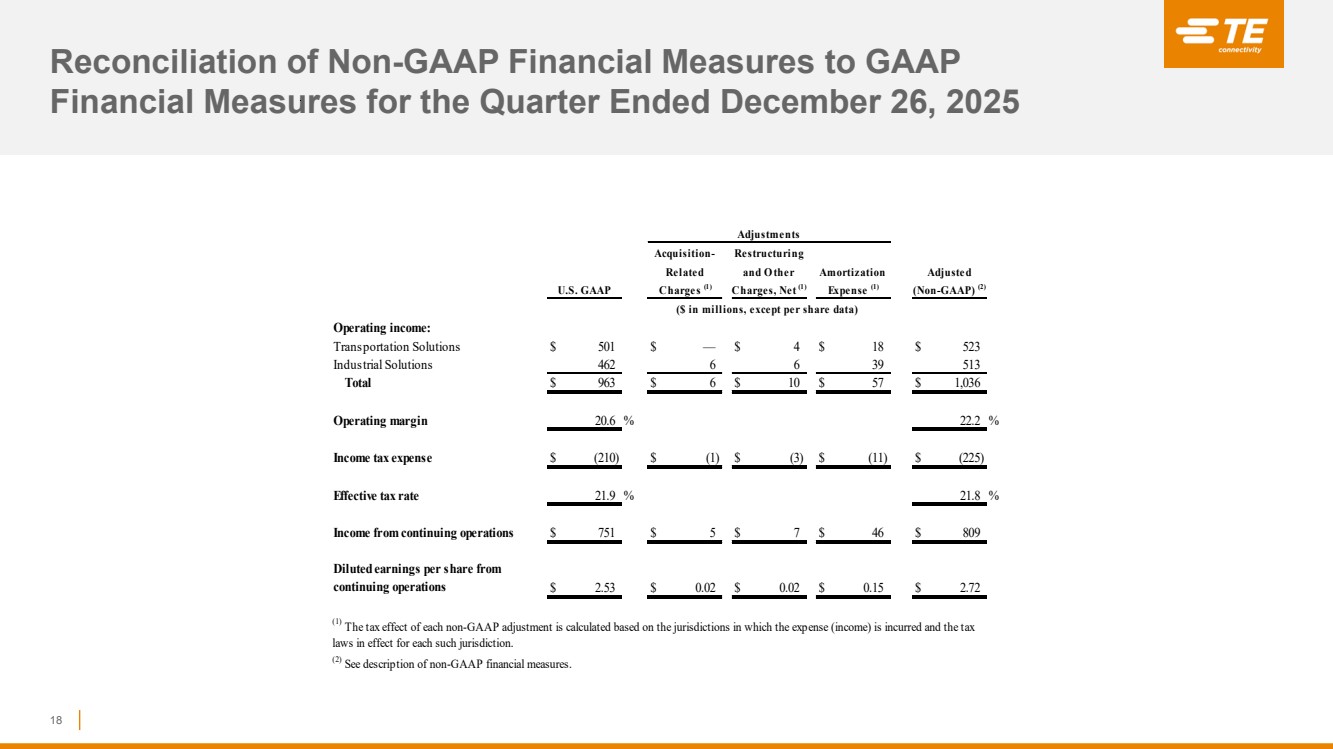

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended December 26, 2025 18 Operating income: Transportation Solutions $ 501 $ — $ 4 $ 18 $ 523 Industrial Solutions 462 6 6 39 513 Total $ 963 $ 6 $ 10 $ 57 $ 1,036 Operating margin 20.6 % 22.2 % Income tax expense $ (210) $ (1) $ (3) $ (11) $ (225) Effective tax rate 21.9 % 21.8 % Income from continuing operations $ 751 $ 5 $ 7 $ 46 $ 809 Diluted earnings per share from continuing operations $ 2.53 $ 0.02 $ 0.02 $ 0.15 $ 2.72 Related and O ther Adjusted Acquisition- Restructuring Amortization Adjustments (2) See description of non-GAAP financial measures. (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. U.S. GAAP Charges (1) (Non-GAAP) (2) Charges, Net (1) ($ in millions, except per share data) Expense (1) |

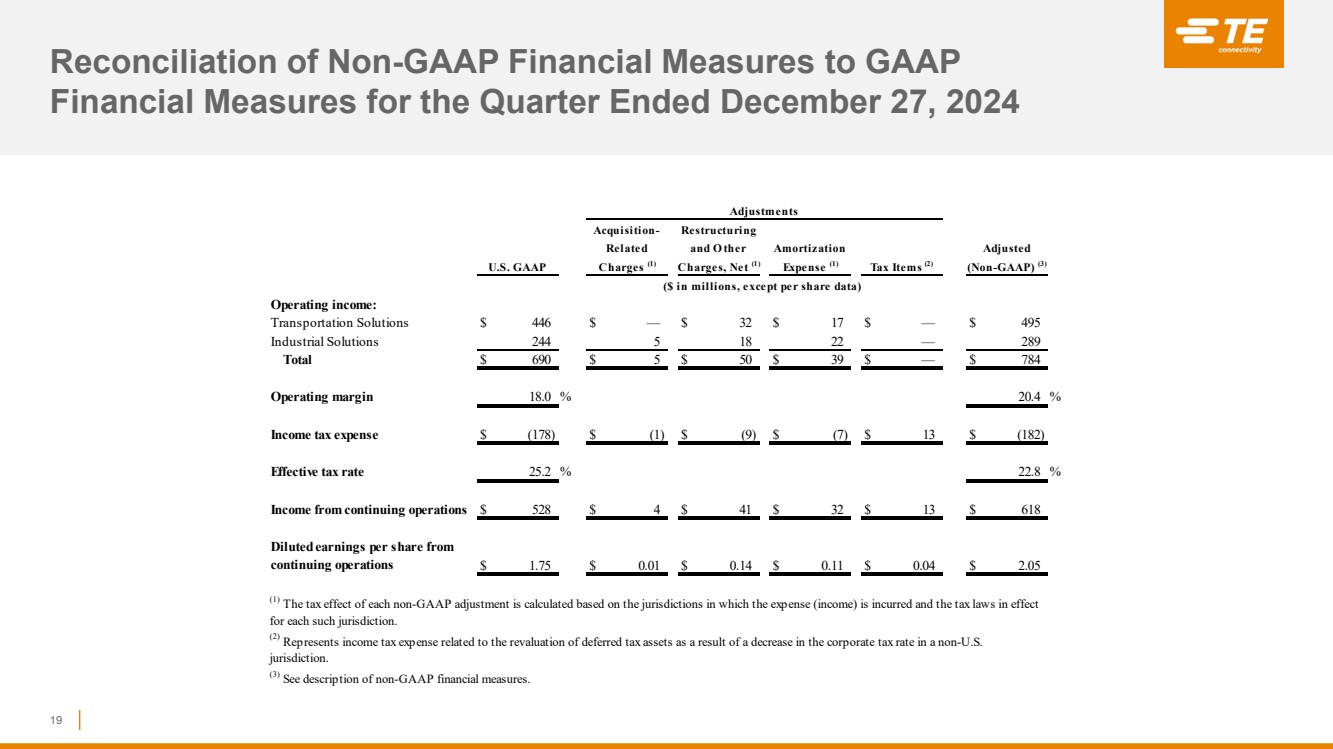

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended December 27, 2024 19 Operating income: Transportation Solutions $ 446 $ — $ 32 $ 17 $ — $ 495 Industrial Solutions 244 5 18 22 — 289 Total $ 690 $ 5 $ 50 $ 39 $ — $ 784 Operating margin 18.0 % 20.4 % Income tax expense $ (178) $ (1) $ (9) $ (7) $ 13 $ (182) Effective tax rate 25.2 % 22.8 % Income from continuing operations $ 528 $ 4 $ 41 $ 32 $ 13 $ 618 Diluted earnings per share from continuing operations $ 1.75 $ 0.01 $ 0.14 $ 0.11 $ 0.04 $ 2.05 (3) See description of non-GAAP financial measures. Adjusted (Non-GAAP) (3) ($ in millions, except per share data) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. Acquisition- Restructuring Expense (1) (2) Represents income tax expense related to the revaluation of deferred tax assets as a result of a decrease in the corporate tax rate in a non-U.S. jurisdiction. U.S. GAAP Charges (1) Adjustments Charges, Net (1) Tax Items (2) Related and O ther Amortization |

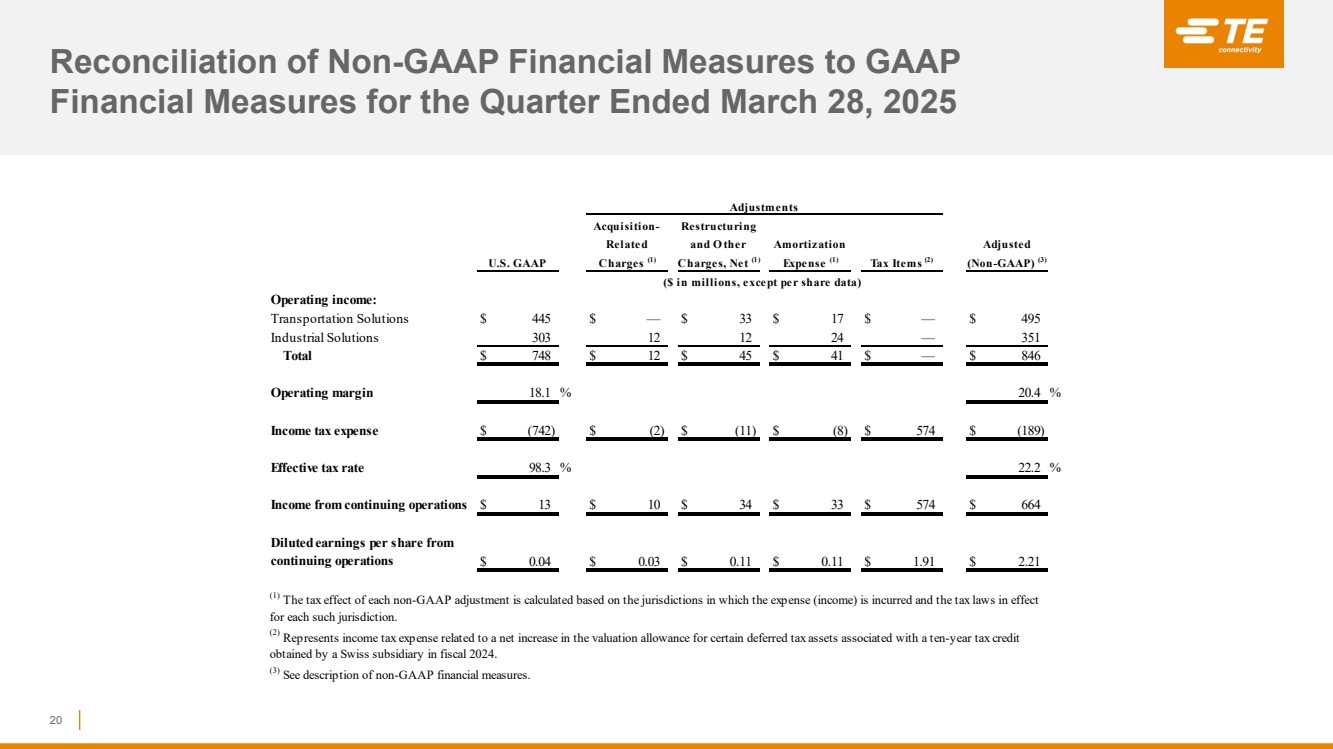

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended March 28, 2025 20 Operating income: Transportation Solutions $ 445 $ — $ 33 $ 17 $ — $ 495 Industrial Solutions 303 12 12 24 — 351 Total $ 748 $ 12 $ 45 $ 41 $ — $ 846 Operating margin 18.1 % 20.4 % Income tax expense $ (742) $ (2) $ (11) $ (8) $ 574 $ (189) Effective tax rate 98.3 % 22.2 % Income from continuing operations $ 13 $ 10 $ 34 $ 33 $ 574 $ 664 Diluted earnings per share from continuing operations $ 0.04 $ 0.03 $ 0.11 $ 0.11 $ 1.91 $ 2.21 Adjusted Tax Items (2) (Non-GAAP) (3) Adjustments U.S. GAAP Charges (1) Charges, Net (1) Expense (1) ($ in millions, except per share data) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (2) Represents income tax expense related to a net increase in the valuation allowance for certain deferred tax assets associated with a ten-year tax credit obtained by a Swiss subsidiary in fiscal 2024. (3) See description of non-GAAP financial measures. Related and O ther Amortization Acquisition- Restructuring |

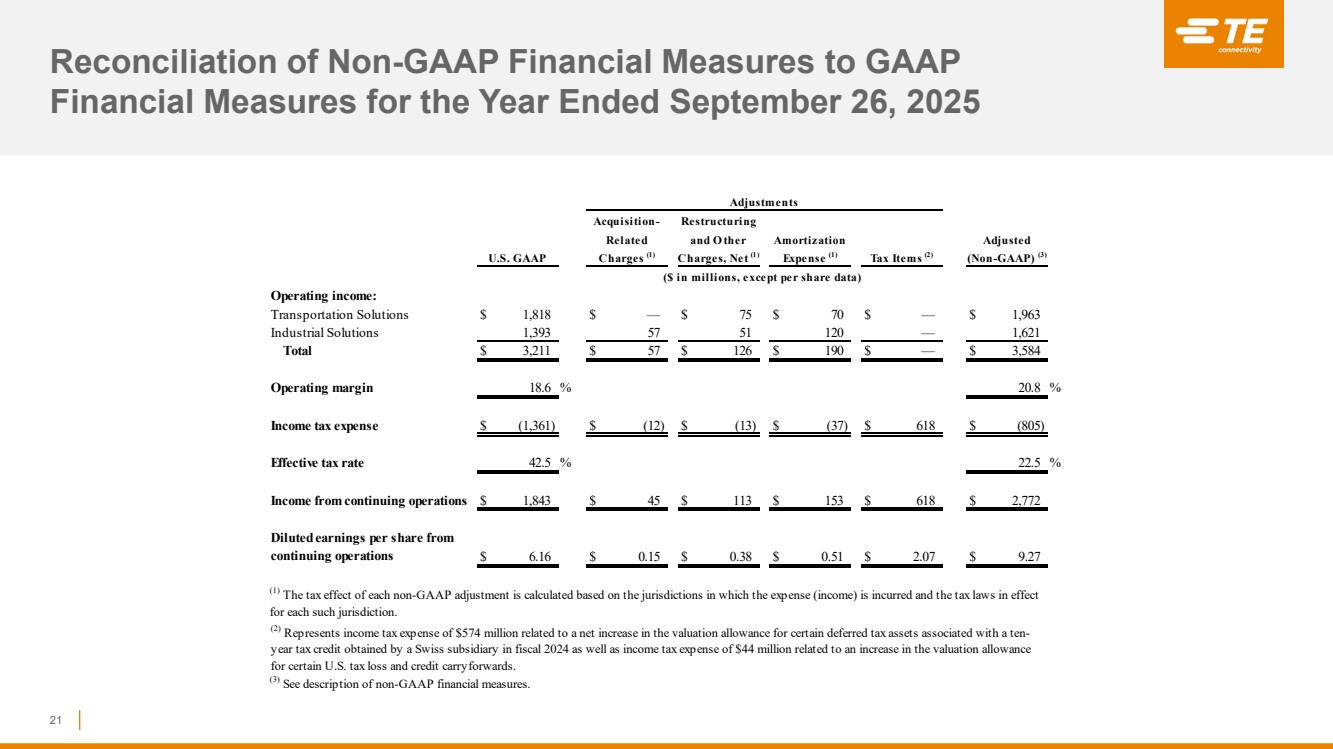

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Year Ended September 26, 2025 21 Operating income: Transportation Solutions $ 1,818 $ — $ 75 $ 70 $ — $ 1,963 Industrial Solutions 1,393 57 51 120 — 1,621 Total $ 3,211 $ 57 $ 126 $ 190 $ — $ 3,584 Operating margin 18.6 % 20.8 % Income tax expense $ (1,361) $ (12) $ (13) $ (37) $ 618 $ (805) Effective tax rate 42.5 % 22.5 % Income from continuing operations $ 1,843 $ 45 $ 113 $ 153 $ 618 $ 2,772 Diluted earnings per share from continuing operations $ 6.16 $ 0.15 $ 0.38 $ 0.51 $ 2.07 $ 9.27 Adjusted (Non-GAAP) (3) ($ in millions, except per share data) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. U.S. GAAP Charges (1) Charges, Net (1) Tax Items (2) Expense (1) Acquisition- Restructuring Adjustments (2) Represents income tax expense of $574 million related to a net increase in the valuation allowance for certain deferred tax assets associated with a ten-year tax credit obtained by a Swiss subsidiary in fiscal 2024 as well as income tax expense of $44 million related to an increase in the valuation allowance for certain U.S. tax loss and credit carryforwards. (3) See description of non-GAAP financial measures. Related and O ther Amortization |

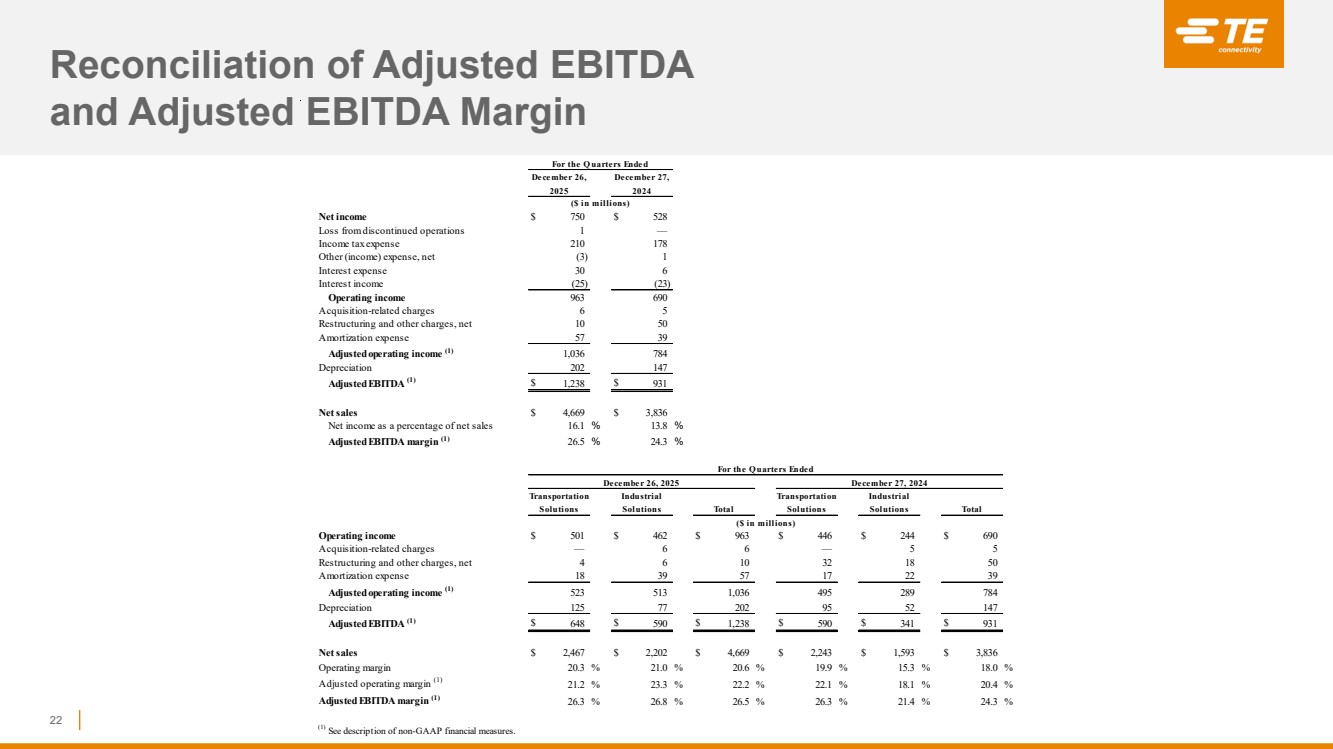

| Reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin 22 Net income $ 750 $ 528 Loss from discontinued operations 1 — Income tax expense 210 178 Other (income) expense, net (3) 1 Interest expense 30 6 Interest income (25) (23) Operating income 963 690 Acquisition-related charges 6 5 Restructuring and other charges, net 10 50 Amortization expense 57 39 Adjusted operating income (1) 1,036 784 Depreciation 202 147 Adjusted EBITDA (1) $ 1,238 $ 931 Net sales $ 4,669 $ 3,836 Net income as a percentage of net sales 16.1 % 13.8 % Adjusted EBITDA margin (1) 26.5 % 24.3 % Operating income $ 501 $ 462 $ 963 $ 446 $ 244 $ 690 Acquisition-related charges — 6 6 — 5 5 Restructuring and other charges, net 4 6 10 32 18 50 Amortization expense 18 39 57 17 22 39 Adjusted operating income (1) 523 513 1,036 495 289 784 Depreciation 125 77 202 95 52 147 Adjusted EBITDA (1) $ 648 $ 590 $ 1,238 $ 590 $ 341 $ 931 Net sales $ 2,467 $ 2,202 $ 4,669 $ 2,243 $ 1,593 $ 3,836 Operating margin 20.3 % 21.0 % 20.6 % 19.9 % 15.3 % 18.0 % Adjusted operating margin (1) 21.2 % 23.3 % 22.2 % 22.1 % 18.1 % 20.4 % Adjusted EBITDA margin (1) 26.3 % 26.8 % 26.5 % 26.3 % 21.4 % 24.3 % (1) See description of non-GAAP financial measures. ($ in millions) Transportation Industrial Solutions Solutions Total Solutions Solutions Total December 26, 2025 December 27, 2024 For the Q uarters Ended ($ in millions) December 26, 2025 December 27, 2024 Transportation Industrial For the Q uarters Ended |

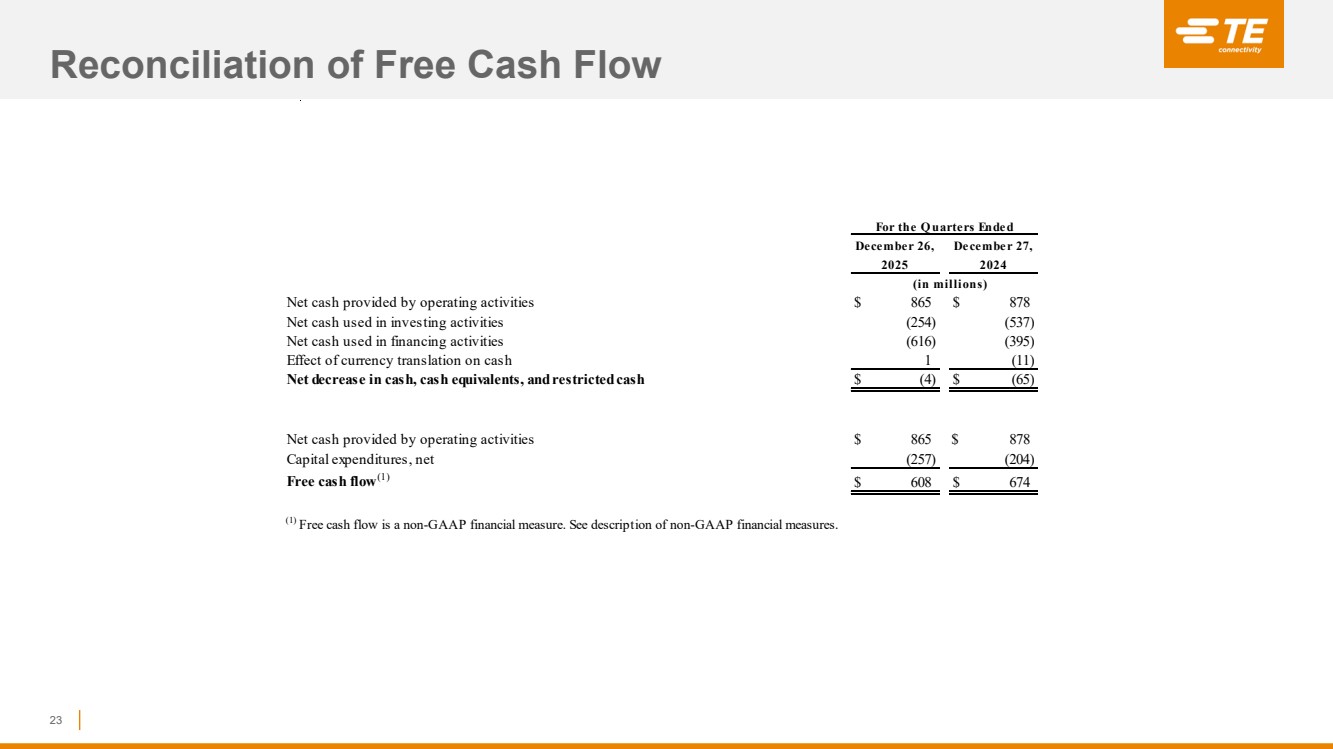

| Reconciliation of Free Cash Flow 23 Net cash provided by operating activities $ 865 $ 878 Net cash used in investing activities (254) (537) Net cash used in financing activities (616) (395) Effect of currency translation on cash 1 (11) Net decrease in cash, cash equivalents, and restricted cash $ (4) $ (65) Net cash provided by operating activities $ 865 $ 878 Capital expenditures, net (257) (204) Free cash flow (1) $ 608 $ 674 (1) Free cash flow is a non-GAAP financial measure. See description of non-GAAP financial measures. 2025 2024 (in millions) For the Q uarters Ended December 26, December 27, |

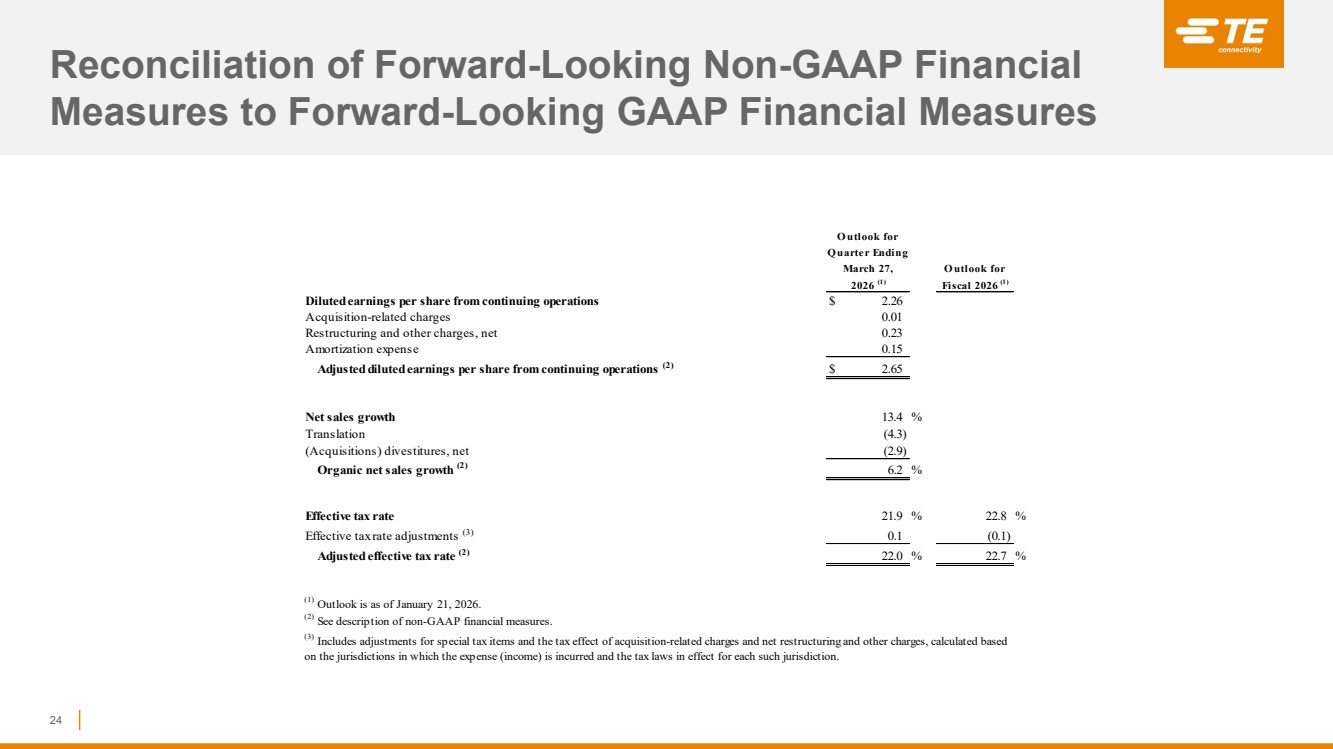

| Reconciliation of Forward-Looking Non-GAAP Financial Measures to Forward-Looking GAAP Financial Measures 24 Diluted earnings per share from continuing operations $ 2.26 Acquisition-related charges 0.01 Restructuring and other charges, net 0.23 Amortization expense 0.15 Adjusted diluted earnings per share from continuing operations (2) $ 2.65 Net sales growth 13.4 % Translation (4.3) (Acquisitions) divestitures, net (2.9) Organic net sales growth (2) 6.2 % Effective tax rate 21.9 % 22.8 % Effective tax rate adjustments (3) 0.1 (0.1) Adjusted effective tax rate (2) 22.0 % 22.7 % Q uarter Ending O utlook for 2026 (1) March 27, O utlook for Fiscal 2026 (1) (3) Includes adjustments for special tax items and the tax effect of acquisition-related charges and net restructuring and other charges, calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (1) Outlook is as of January 21, 2026. (2) See description of non-GAAP financial measures. |