| EVERY CONNECTION COUNTS TE Connectivity Third Quarter 2025 Earnings July 23, 2025 |

| Forward-Looking Statements This presentation contains certain "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations and are subject to risks, uncertainty and changes in circumstances, which may cause actual results, performance, financial condition or achievements to differ materially from anticipated results, performance, financial condition or achievements. All statements contained herein that are not clearly historical in nature are forward-looking and the words "anticipate," "believe," "expect," "estimate," "plan," and similar expressions are generally intended to identify forward-looking statements. We have no intention and are under no obligation to update or alter (and expressly disclaim any such intention or obligation to do so) our forward-looking statements whether as a result of new information, future events or otherwise, except to the extent required by law. The forward-looking statements in this presentation include statements addressing our future financial condition and operating results. Examples of factors that could cause actual results to differ materially from those described in the forward-looking statements include, among others, the extent, severity and duration of business interruption negatively affecting our business operations; business, economic, competitive and regulatory risks, such as conditions affecting demand for products in the automotive and other industries we serve; competition and pricing pressure; fluctuations in foreign currency exchange rates and commodity prices; natural disasters and political, economic and military instability in countries in which we operate, including continuing military conflict in certain parts of the world; developments in the credit markets; future goodwill impairment; compliance with current and future environmental and other laws and regulations; and the possible effects on us of changes in tax laws, tax treaties and other legislation. In addition, our change of incorporation from Switzerland to Ireland is subject to risks, such as the risk that the anticipated advantages might not materialize, as well as the risks that the price of our stock could decline and our position on stock exchanges and indices could change, and Irish corporate governance and regulatory schemes could prove different or more challenging than currently expected. More detailed information about these and other factors is set forth in TE Connectivity plc's Annual Report on Form 10-K for the fiscal year ended Sept. 27, 2024 as well as in our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports filed by us with the U.S. Securities and Exchange Commission. Non-GAAP Financial Measures Where we have used non-GAAP financial measures, reconciliations to the most comparable GAAP measure are provided, along with a disclosure on the usefulness of the non-GAAP financial measure, in this presentation. Forward-Looking Statements and Non-GAAP Financial Measures 2 |

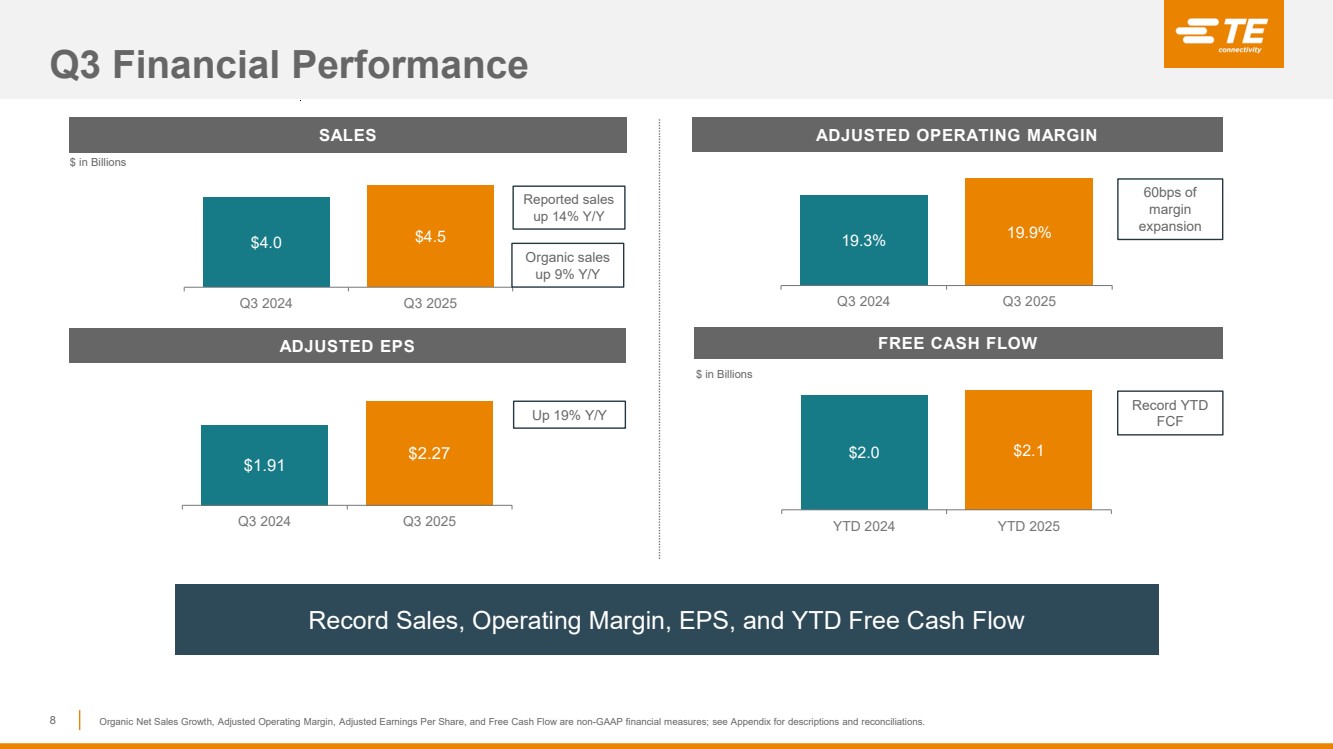

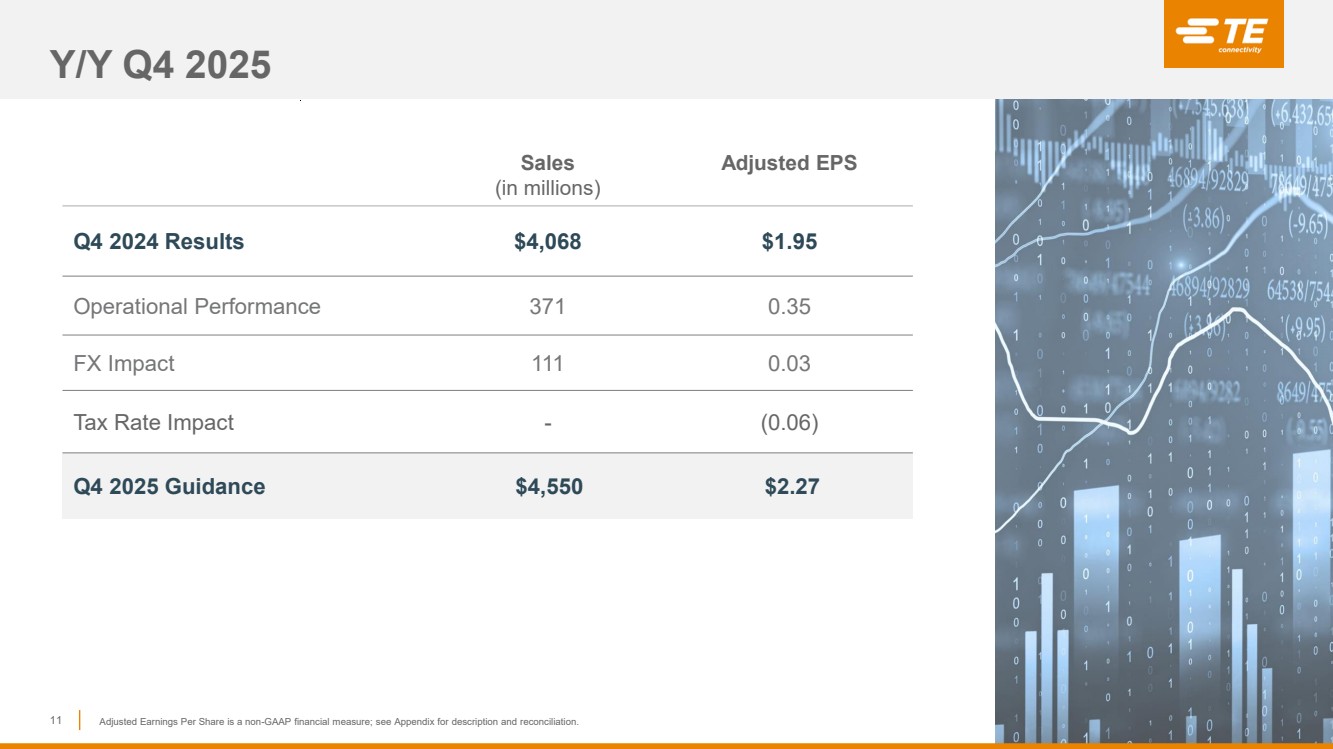

| Q3 Exceeded Guidance with Double Digit Increases in Sales and Adjusted EPS ▪ Sales of $4.53B, increasing 14% reported and 9% organically Y/Y, with growth driven primarily by the Industrial Segment ▪ Orders of $4.5B, up both Y/Y and sequentially ▪ Adjusted Operating Margins of ~20%, expanding 60bps Y/Y driven by strong operational performance ▪ Adjusted EPS of $2.27, increasing 19% Y/Y ▪ YTD Free Cash Flow generation of ~$2.1B with $1.5B returned to shareholders ▪ Q3 Free Cash Flow of ~$1B, a quarterly record ▪ Completed Richards acquisition in the Energy business Earnings Highlights 3 Organic Net Sales Growth (Decline), Adjusted Operating Margin, Adjusted EPS, and Free Cash Flow are non-GAAP financial measures; see Appendix for descriptions and reconciliations Q4 Guidance Reflects Strong Sales and EPS Growth Y/Y ▪ Expect Sales of ~$4.55B, increasing 12% reported and 6% organically Y/Y; Adjusted EPS of ~$2.27, increasing 16% Y/Y ▪ For the full year, Q4 Guidance implies fiscal 2025 Sales growth of 8% reported & 5% organic Y/Y; Adjusted EPS up 13% Y/Y |

| Reported FY24 Q3 FY25 Q2 FY25 Q3 Q3 Growth Y/Y Q/Q Transportation 2,212 2,315 2,316 5% 0% Industrial 1,920 1,931 2,156 12% 12% Total TE 4,132 4,246 4,472 8% 5% Book to Bill 1.04 1.02 0.99 Segment Orders Summary ($ in millions) 4 ▪ Transportation segment orders increased Y/Y driven by growth in Asia, offset by declines in Europe and North America ▪ Industrial segment orders reflect ongoing momentum in artificial intelligence applications, Energy, and AD&M Order patterns support continued strong growth |

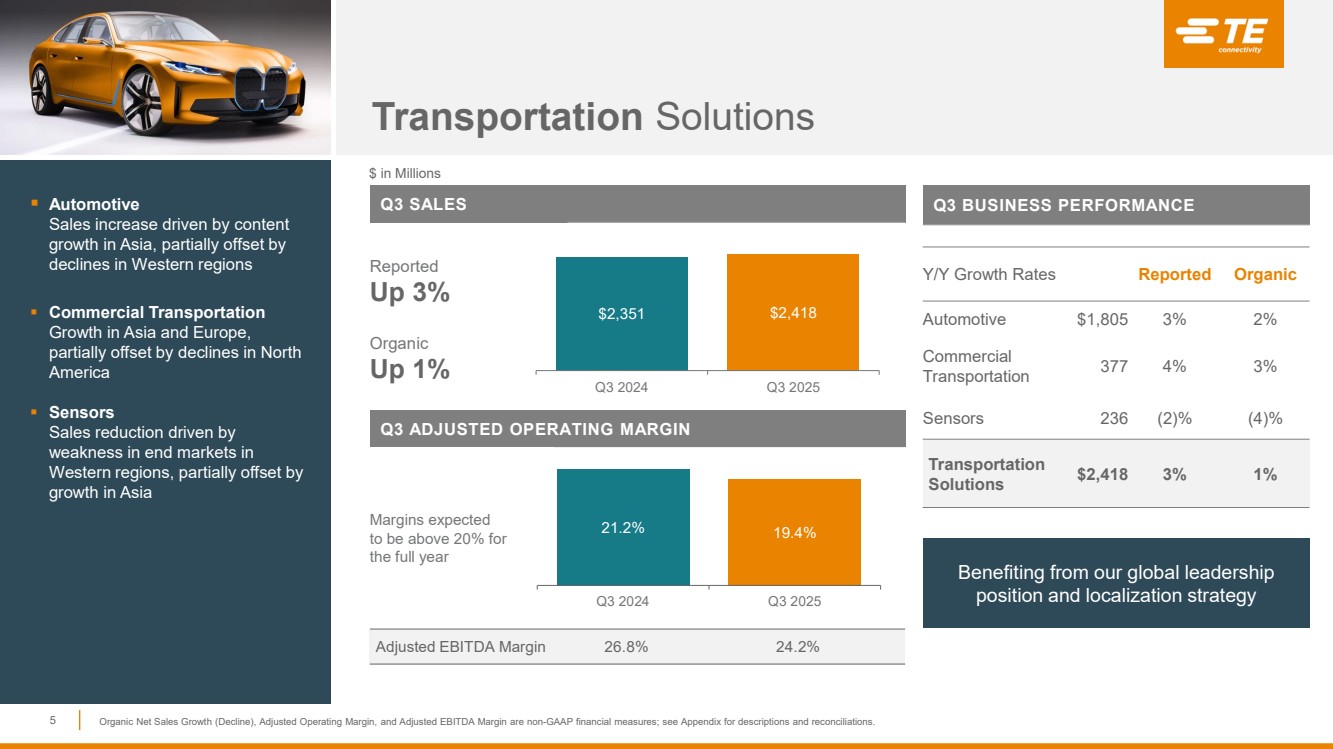

| Transportation Solutions Q3 SALES Reported Up 3% Organic Up 1% Q3 ADJUSTED OPERATING MARGIN Margins expected to be above 20% for the full year Adjusted EBITDA Margin 26.8% 24.2% 5 $2,351 $2,418 Q3 2024 Q3 2025 Q3 BUSINESS PERFORMANCE Y/Y Growth Rates Reported Organic Automotive $1,805 3% 2% Commercial Transportation 377 4% 3% Sensors 236 (2)% (4)% Transportation Solutions $2,418 3% 1% $ in Millions 21.2% 19.4% Q3 2024 Q3 2025 ▪ Automotive Sales increase driven by content growth in Asia, partially offset by declines in Western regions ▪ Commercial Transportation Growth in Asia and Europe, partially offset by declines in North America ▪ Sensors Sales reduction driven by weakness in end markets in Western regions, partially offset by growth in Asia Organic Net Sales Growth (Decline), Adjusted Operating Margin, and Adjusted EBITDA Margin are non-GAAP financial measures; see Appendix for descriptions and reconciliations. Benefiting from our global leadership position and localization strategy |

| Industrial Solutions Q3 SALES Reported Up 30% Organic Up 21% Q3 ADJUSTED OPERATING MARGIN Margin expansion of 390bps driven by strong operational performance and benefits of higher volume Adjusted EBITDA Margin 21.1% 25.1% 6 Q3 BUSINESS PERFORMANCE Y/Y Growth Rates Reported Organic Digital Data Networks (DDN) $606 84% 82% Automation & Connected Living (ACL) 571 10% 5% Energy 384 70% 20% Aerospace, Defense and Marine (AD&M) 374 8% 6% Medical 181 (13)% (14)% Industrial Solutions $2,116 30% 21% $ in Millions ▪ Digital Data Networks Strong growth driven by momentum in AI applications across multiple customers ▪ Automation & Connected Living Organic growth driven by Asia and North America ▪ Energy Organic growth driven by renewable applications & grid hardening; Richards acquisition included in reported growth figures ▪ AD&M Organic growth reflects ongoing market improvement in commercial air and defense, including space applications ▪ Medical Sales ~flat sequentially, as expected $1,628 $2,116 Q3 2024 Q3 2025 16.5% 20.4% Q3 2024 Q3 2025 Benefiting from secular growth trends and strong execution Organic Net Sales Growth (Decline), Adjusted Operating Margin, and Adjusted EBITDA Margin are non-GAAP financial measures; see Appendix for descriptions and reconciliations. |

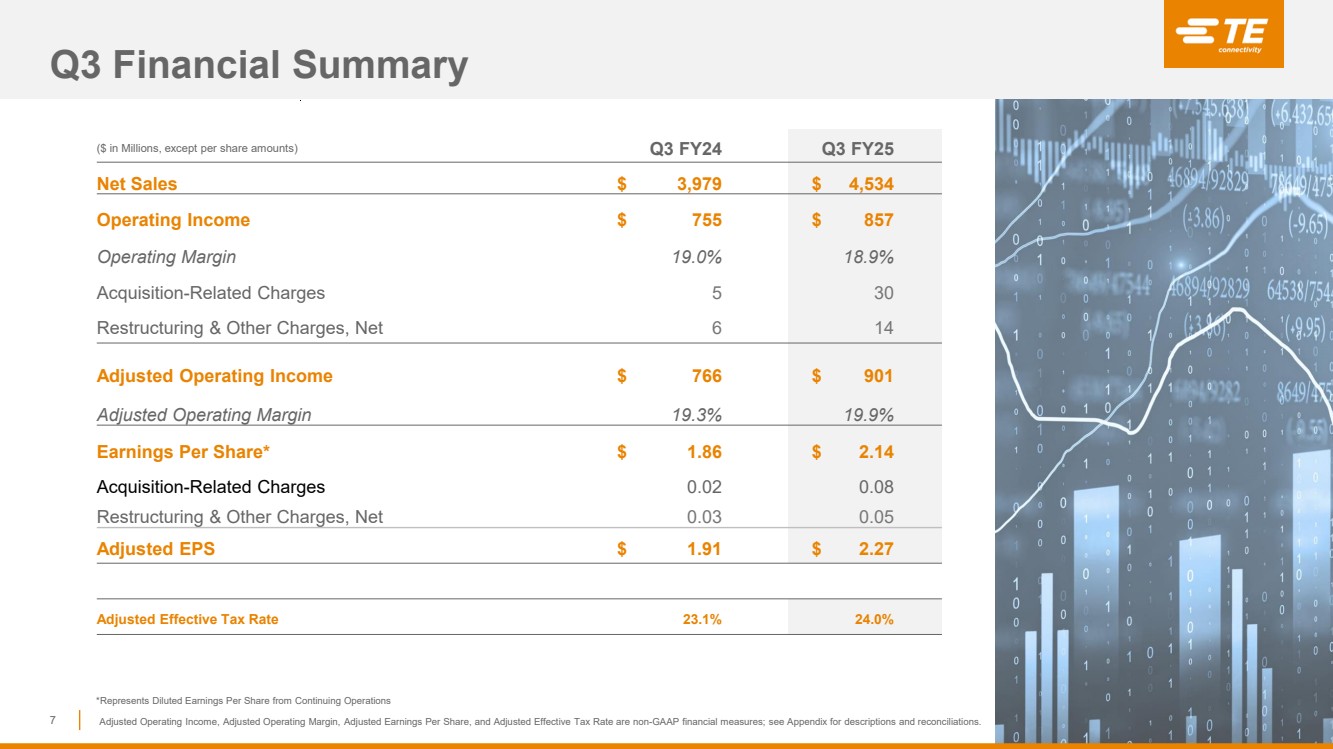

| Q3 Financial Summary 7 ($ in Millions, except per share amounts) Q3 FY24 Q3 FY25 Net Sales $ 3,979 $ 4,534 Operating Income $ 755 $ 857 Operating Margin 19.0% 18.9% Acquisition-Related Charges 5 30 Restructuring & Other Charges, Net 6 14 Adjusted Operating Income $ 766 $ 901 Adjusted Operating Margin 19.3% 19.9% Earnings Per Share* $ 1.86 $ 2.14 Acquisition-Related Charges 0.02 0.08 Restructuring & Other Charges, Net 0.03 0.05 Adjusted EPS $ 1.91 $ 2.27 Adjusted Effective Tax Rate 23.1% 24.0% *Represents Diluted Earnings Per Share from Continuing Operations Adjusted Operating Income, Adjusted Operating Margin, Adjusted Earnings Per Share, and Adjusted Effective Tax Rate are non-GAAP financial measures; see Appendix for descriptions and reconciliations. |

| Q3 Financial Performance 8 19.3% 19.9% Q3 2024 Q3 2025 SALES ADJUSTED OPERATING MARGIN ADJUSTED EPS FREE CASH FLOW Record Sales, Operating Margin, EPS, and YTD Free Cash Flow $ in Billions $ in Billions Record YTD FCF $2.0 $2.1 YTD 2024 YTD 2025 Up 19% Y/Y $4.0 $4.5 Q3 2024 Q3 2025 60bps of margin expansion Organic Net Sales Growth, Adjusted Operating Margin, Adjusted Earnings Per Share, and Free Cash Flow are non-GAAP financial measures; see Appendix for descriptions and reconciliations. Reported sales up 14% Y/Y $1.91 $2.27 Q3 2024 Q3 2025 Organic sales up 9% Y/Y |

| EVERY CONNECTION COUNTS Additional Information |

| Y/Y Q3 2025 10 Sales (in millions) Adjusted EPS Q3 2024 Results $3,979 $1.91 Operational Performance 487 0.33 FX Impact 68 0.05 Tax Rate Impact - (0.02) Q3 2025 Results $4,534 $2.27 Adjusted Earnings Per Share is a non-GAAP financial measure; see Appendix for description and reconciliation. |

| Y/Y Q4 2025 11 Sales (in millions) Adjusted EPS Q4 2024 Results $4,068 $1.95 Operational Performance 371 0.35 FX Impact 111 0.03 Tax Rate Impact - (0.06) Q4 2025 Guidance $4,550 $2.27 Adjusted Earnings Per Share is a non-GAAP financial measure; see Appendix for description and reconciliation. |

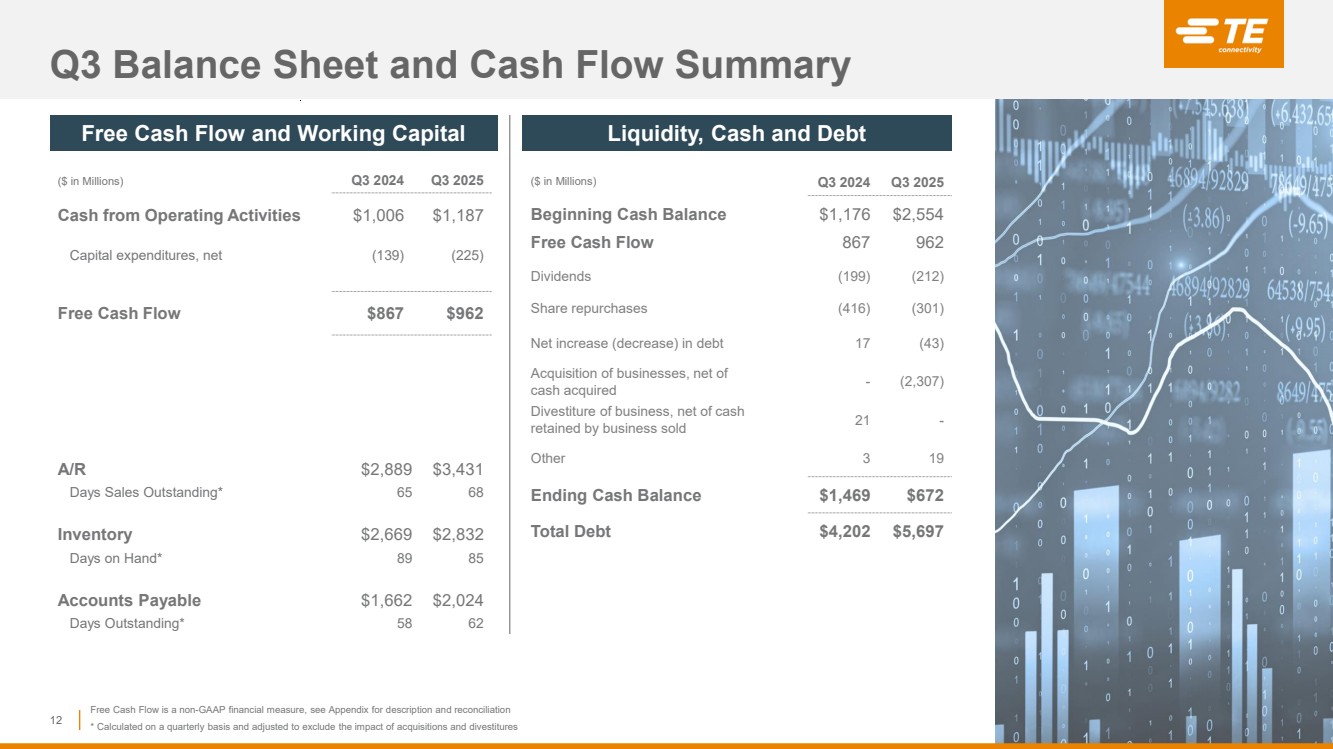

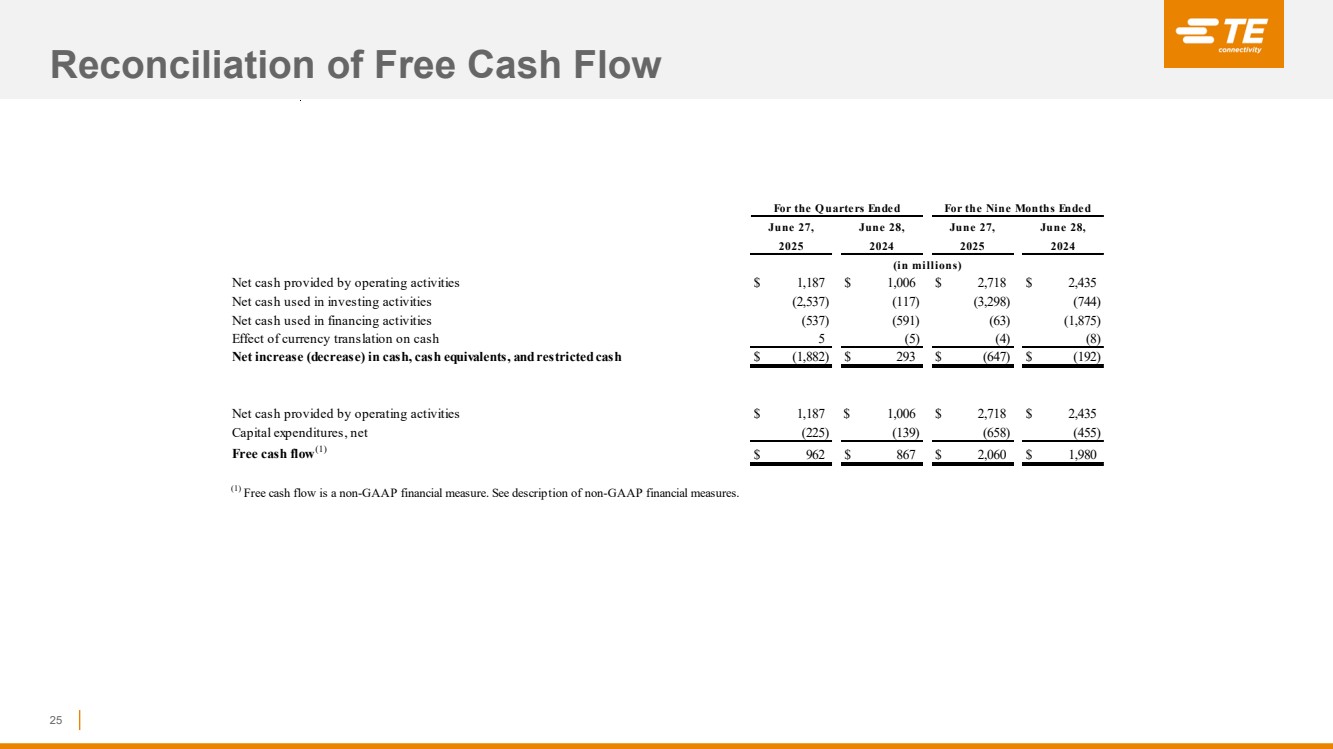

| Q3 Balance Sheet and Cash Flow Summary 12 ($ in Millions) Q3 2024 Q3 2025 Beginning Cash Balance $1,176 $2,554 Free Cash Flow 867 962 Dividends (199) (212) Share repurchases (416) (301) Net increase (decrease) in debt 17 (43) Acquisition of businesses, net of cash acquired - (2,307) Divestiture of business, net of cash retained by business sold 21 - Other 3 19 Ending Cash Balance $1,469 $672 Total Debt $4,202 $5,697 A/R $2,889 $3,431 Days Sales Outstanding* 65 68 Inventory $2,669 $2,832 Days on Hand* 89 85 Accounts Payable $1,662 $2,024 Days Outstanding* 58 62 Free Cash Flow and Working Capital Liquidity, Cash and Debt ($ in Millions) Q3 2024 Q3 2025 Cash from Operating Activities $1,006 $1,187 Capital expenditures, net (139) (225) Free Cash Flow $867 $962 Free Cash Flow is a non-GAAP financial measure, see Appendix for description and reconciliation * Calculated on a quarterly basis and adjusted to exclude the impact of acquisitions and divestitures |

| EVERY CONNECTION COUNTS Appendix |

| We present non-GAAP performance and liquidity measures as we believe it is appropriate for investors to consider adjusted financial measures in addition to results in accordance with accounting principles generally accepted in the U.S. (“GAAP”). These non-GAAP financial measures provide supplemental information and should not be considered replacements for results in accordance with GAAP. Management uses non-GAAP financial measures internally for planning and forecasting purposes and in its decision-making processes related to the operations of our company. We believe these measures provide meaningful information to us and investors because they enhance the understanding of our operating performance, ability to generate cash, and the trends of our business. Additionally, we believe that investors benefit from having access to the same financial measures that management uses in evaluating our operations. The primary limitation of these measures is that they exclude the financial impact of items that would otherwise either increase or decrease our reported results. This limitation is best addressed by using these non-GAAP financial measures in combination with the most directly comparable GAAP financial measures in order to better understand the amounts, character, and impact of any increase or decrease in reported amounts. These non-GAAP financial measures may not be comparable to similarly-titled measures reported by other companies. The following provides additional information regarding our non-GAAP financial measures: ▪ Organic Net Sales Growth (Decline) – represents net sales growth (decline) (the most comparable GAAP financial measure) excluding the impact of foreign currency exchange rates, and acquisitions and divestitures that occurred in the preceding twelve months, if any. Organic Net Sales Growth (Decline) is a useful measure of our performance because it excludes items that are not completely under management’s control, such as the impact of changes in foreign currency exchange rates, and items that do not reflect the underlying growth of the company, such as acquisition and divestiture activity. This measure is a significant component in our incentive compensation plans. ▪ Adjusted Operating Income and Adjusted Operating Margin – represent operating income and operating margin, respectively, (the most comparable GAAP financial measures) before special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, and other income or charges, if any. We utilize these adjusted measures in combination with operating income and operating margin to assess segment level operating performance and to provide insight to management in evaluating segment operating plan execution and market conditions. Adjusted Operating Income is a significant component in our incentive compensation plans. ▪ Adjusted Income Tax (Expense) Benefit and Adjusted Effective Tax Rate – represent income tax (expense) benefit and effective tax rate, respectively, (the most comparable GAAP financial measures) after adjusting for the tax effect of special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, other income or charges, and certain significant tax items, if any. ▪ Adjusted Income from Continuing Operations – represents income from continuing operations (the most comparable GAAP financial measure) before special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, other income or charges, and certain significant tax items, if any, and, if applicable, the related tax effects. Non-GAAP Financial Measures 14 |

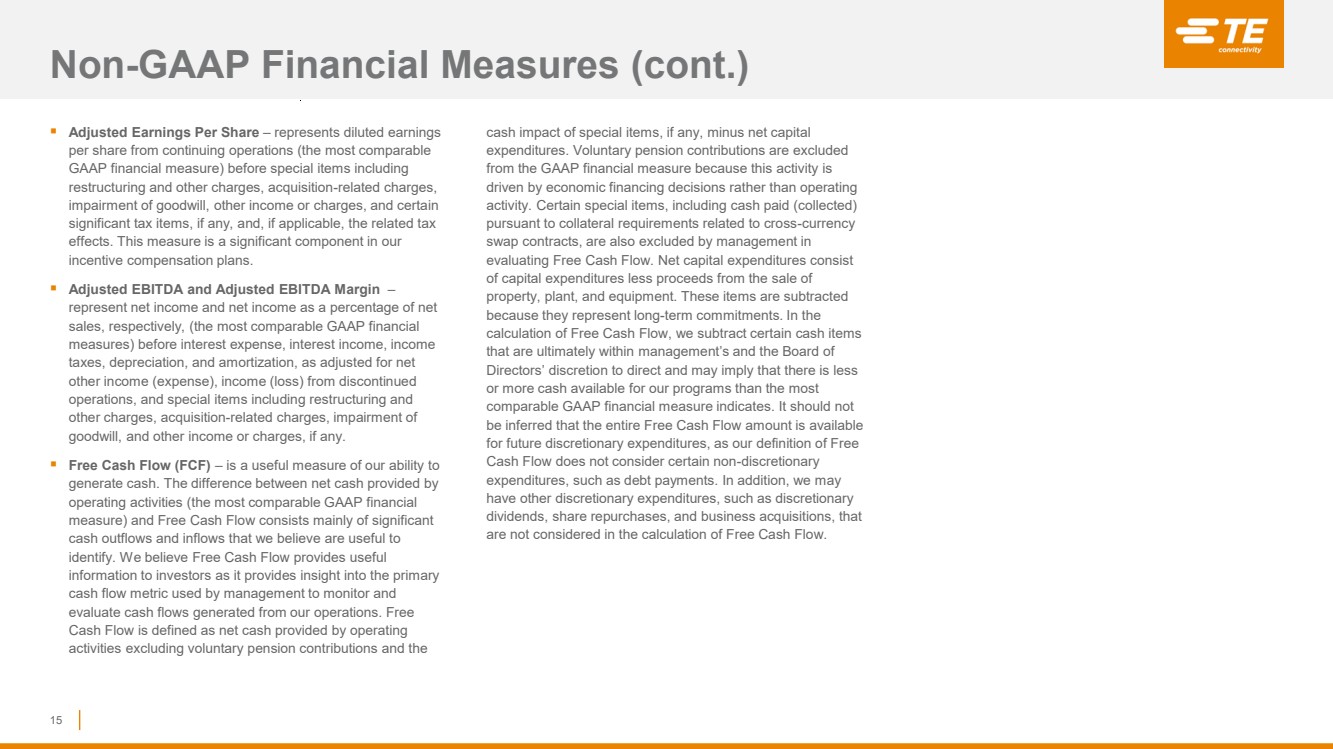

| ▪ Adjusted Earnings Per Share – represents diluted earnings per share from continuing operations (the most comparable GAAP financial measure) before special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, other income or charges, and certain significant tax items, if any, and, if applicable, the related tax effects. This measure is a significant component in our incentive compensation plans. ▪ Adjusted EBITDA and Adjusted EBITDA Margin – represent net income and net income as a percentage of net sales, respectively, (the most comparable GAAP financial measures) before interest expense, interest income, income taxes, depreciation, and amortization, as adjusted for net other income (expense), income (loss) from discontinued operations, and special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, and other income or charges, if any. ▪ Free Cash Flow (FCF) – is a useful measure of our ability to generate cash. The difference between net cash provided by operating activities (the most comparable GAAP financial measure) and Free Cash Flow consists mainly of significant cash outflows and inflows that we believe are useful to identify. We believe Free Cash Flow provides useful information to investors as it provides insight into the primary cash flow metric used by management to monitor and evaluate cash flows generated from our operations. Free Cash Flow is defined as net cash provided by operating activities excluding voluntary pension contributions and the cash impact of special items, if any, minus net capital expenditures. Voluntary pension contributions are excluded from the GAAP financial measure because this activity is driven by economic financing decisions rather than operating activity. Certain special items, including cash paid (collected) pursuant to collateral requirements related to cross-currency swap contracts, are also excluded by management in evaluating Free Cash Flow. Net capital expenditures consist of capital expenditures less proceeds from the sale of property, plant, and equipment. These items are subtracted because they represent long-term commitments. In the calculation of Free Cash Flow, we subtract certain cash items that are ultimately within management’s and the Board of Directors’ discretion to direct and may imply that there is less or more cash available for our programs than the most comparable GAAP financial measure indicates. It should not be inferred that the entire Free Cash Flow amount is available for future discretionary expenditures, as our definition of Free Cash Flow does not consider certain non-discretionary expenditures, such as debt payments. In addition, we may have other discretionary expenditures, such as discretionary dividends, share repurchases, and business acquisitions, that are not considered in the calculation of Free Cash Flow. Non-GAAP Financial Measures (cont.) 15 |

| Segment Summary 16 Transportation Solutions $ 2,418 $ 2,351 $ 6,975 $ 7,151 Industrial Solutions 2,116 1,628 5,538 4,626 Total $ 4,534 $ 3,979 $ 12,513 $ 11,777 O perating O perating O perating O perating Margin Margin Margin Margin Transportation Solutions $ 462 19.1 % $ 506 21.5 % $ 1,353 19.4 % $ 1,470 20.6 % Industrial Solutions 395 18.7 249 15.3 942 17.0 675 14.6 Total $ 857 18.9 % $ 755 19.0 % $ 2,295 18.3 % $ 2,145 18.2 % Adjusted Adjusted Adjusted Adjusted O perating O perating O perating O perating Margin (1) Margin (1) Margin (1) Margin (1) Transportation Solutions $ 469 19.4 % $ 498 21.2 % $ 1,425 20.4 % $ 1,498 20.9 % Industrial Solutions 432 20.4 268 16.5 1,026 18.5 734 15.9 Total $ 901 19.9 % $ 766 19.3 % $ 2,451 19.6 % $ 2,232 19.0 % (1) Adjusted operating income and adjusted operating margin are non-GAAP financial measures. See description of non-GAAP financial measures. 2025 2024 ($ in millions) Adjusted O perating Income (1) Adjusted O perating Adjusted O perating Income (1) Net Sales Net Sales Net Sales Income (1) Adjusted O perating Income (1) Income O perating O perating Income 2024 For the Q uarters Ended June 27, June 28, June 27, June 28, For the Nine Months Ended Net Sales O perating Income O perating Income 2025 |

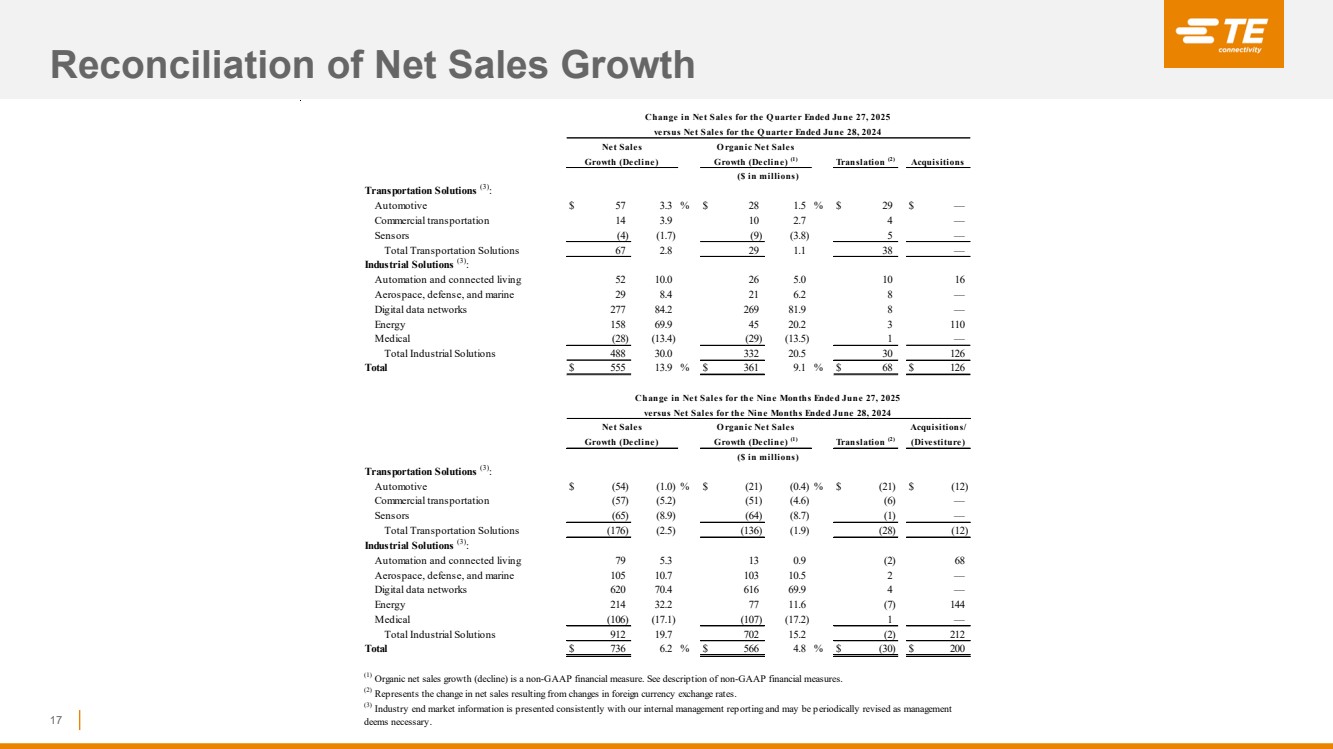

| Reconciliation of Net Sales Growth 17 Transportation Solutions (3) : Automotive $ 57 3.3 % $ 28 1.5 % $ 29 $ — Commercial transportation 14 3.9 10 2.7 4 — Sensors (4) (1.7) (9) (3.8) 5 — Total Transportation Solutions 67 2.8 29 1.1 38 — Industrial Solutions (3) : Automation and connected living 52 10.0 26 5.0 10 16 Aerospace, defense, and marine 29 8.4 21 6.2 8 — Digital data networks 277 84.2 269 81.9 8 — Energy 158 69.9 45 20.2 3 110 Medical (28) (13.4) (29) (13.5) 1 — Total Industrial Solutions 488 30.0 332 20.5 30 126 Total $ 555 13.9 % $ 361 9.1 % $ 68 $ 126 ($ in millions) Translation (2) Acquisitions Net Sales Growth (Decline) O rganic Net Sales Growth (Decline) (1) Change in Net Sales for the Q uarter Ended June 27, 2025 versus Net Sales for the Q uarter Ended June 28, 2024 Transportation Solutions (3) : Automotive $ (54) (1.0) % $ (21) (0.4) % $ (21) $ (12) Commercial transportation (57) (5.2) (51) (4.6) (6) — Sensors (65) (8.9) (64) (8.7) (1) — Total Transportation Solutions (176) (2.5) (136) (1.9) (28) (12) Industrial Solutions (3): Automation and connected living 79 5.3 13 0.9 (2) 68 Aerospace, defense, and marine 105 10.7 103 10.5 2 — Digital data networks 620 70.4 616 69.9 4 — Energy 214 32.2 77 11.6 (7) 144 Medical (106) (17.1) (107) (17.2) 1 — Total Industrial Solutions 912 19.7 702 15.2 (2) 212 Total $ 736 6.2 % $ 566 4.8 % $ (30) $ 200 (3) Industry end market information is presented consistently with our internal management reporting and may be periodically revised as management deems necessary. ($ in millions) Net Sales O rganic Net Sales Acquisitions/ Growth (Decline) Growth (Decline) (1) (1) Organic net sales growth (decline) is a non-GAAP financial measure. See description of non-GAAP financial measures. (2) Represents the change in net sales resulting from changes in foreign currency exchange rates. Translation (2) (Divestiture) Change in Net Sales for the Nine Months Ended June 27, 2025 versus Net Sales for the Nine Months Ended June 28, 2024 |

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended June 27, 2025 18 Operating income: Transportation Solutions $ 462 $ — $ 7 $ 469 Industrial Solutions 395 30 7 432 Total $ 857 $ 30 $ 14 $ 901 Operating margin 18.9 % 19.9 % Income tax expense $ (208) $ (7) $ 1 $ (214) Effective tax rate 24.6 % 24.0 % Income from continuing operations $ 638 $ 23 $ 15 $ 676 Diluted earnings per share from continuing operations $ 2.14 $ 0.08 $ 0.05 $ 2.27 Related and O ther Adjusted Acquisition- Restructuring Adjustments (2) See description of non-GAAP financial measures. (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. U.S. GAAP Charges (1) (Non-GAAP) (2) Charges, Net (1) ($ in millions, except per share data) |

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended June 28, 2024 19 Operating income: Transportation Solutions $ 506 $ — $ (8) $ 498 Industrial Solutions 249 5 14 268 Total $ 755 $ 5 $ 6 $ 766 Operating margin 19.0 % 19.3 % Income tax expense $ (181) $ — $ 4 $ (177) Effective tax rate 24.0 % 23.1 % Income from continuing operations $ 573 $ 5 $ 10 $ 588 Diluted earnings per share from continuing operations $ 1.86 $ 0.02 $ 0.03 $ 1.91 U.S. GAAP Charges (1) Charges, Net (1) (Non-GAAP) (2) (2) See description of non-GAAP financial measures. ($ in millions, except per share data) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. Adjustments Related and O ther Adjusted Acquisition- Restructuring |

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Nine Months Ended June 27, 2025 20 Operating income: Transportation Solutions $ 1,353 $ — $ 72 $ — $ 1,425 Industrial Solutions 942 47 37 — 1,026 Total $ 2,295 $ 47 $ 109 $ — $ 2,451 Operating margin 18.3 % 19.6 % Income tax expense $ (1,128) $ (10) $ (19) $ 587 $ (570) Effective tax rate 48.9 % 23.1 % Income from continuing operations $ 1,179 $ 37 $ 90 $ 587 $ 1,893 Diluted earnings per share from continuing operations $ 3.93 $ 0.12 $ 0.30 $ 1.96 $ 6.31 ($ in millions, except per share data) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (2) Includes income tax expense of $574 million related to a net increase in the valuation allowance for certain deferred tax assets associated with a ten-year tax credit obtained by a Swiss subsidiary in fiscal 2024 as well as income tax expense of $13 million related to the revaluation of deferred tax assets as a result of a decrease in the corporate tax rate in a non-U.S. jurisdiction. (3) See description of non-GAAP financial measures. Related and O ther Adjusted U.S. GAAP Charges (1) Charges, Net (1) Tax Items (2) (Non-GAAP) (3) Adjustments Acquisition- Restructuring |

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Nine Months Ended June 28, 2024 21 Operating income: Transportation Solutions $ 1,470 $ — $ 25 $ 3 $ 1,498 Industrial Solutions 675 16 42 1 734 Total $ 2,145 $ 16 $ 67 $ 4 $ 2,232 Operating margin 18.2 % 19.0 % Income tax (expense) benefit $ 778 $ (2) $ (7) $ (1,254) $ (485) Effective tax rate (36.4) % 21.8 % Income from continuing operations $ 2,918 $ 14 $ 60 $ (1,250) $ 1,742 Diluted earnings per share from continuing operations $ 9.41 $ 0.05 $ 0.19 $ (4.03) $ 5.62 ($ in millions, except per share data) (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (2) Includes an $874 million net income tax benefit associated with a ten-year tax credit obtained by a Swiss subsidiary and a $262 million income tax benefit related to the revaluation of deferred tax assets as a result of a corporate tax rate increase in Switzerland. Also includes a $118 million income tax benefit associated with the tax impacts of a legal entity restructuring with related costs of $4 million recorded in selling, general, and administrative expenses for other non-income taxes. (3) See description of non-GAAP financial measures. Related and O ther Adjusted U.S. GAAP Charges (1) Charges, Net (1) Tax Items (2) (Non-GAAP) (3) Adjustments Acquisition- Restructuring |

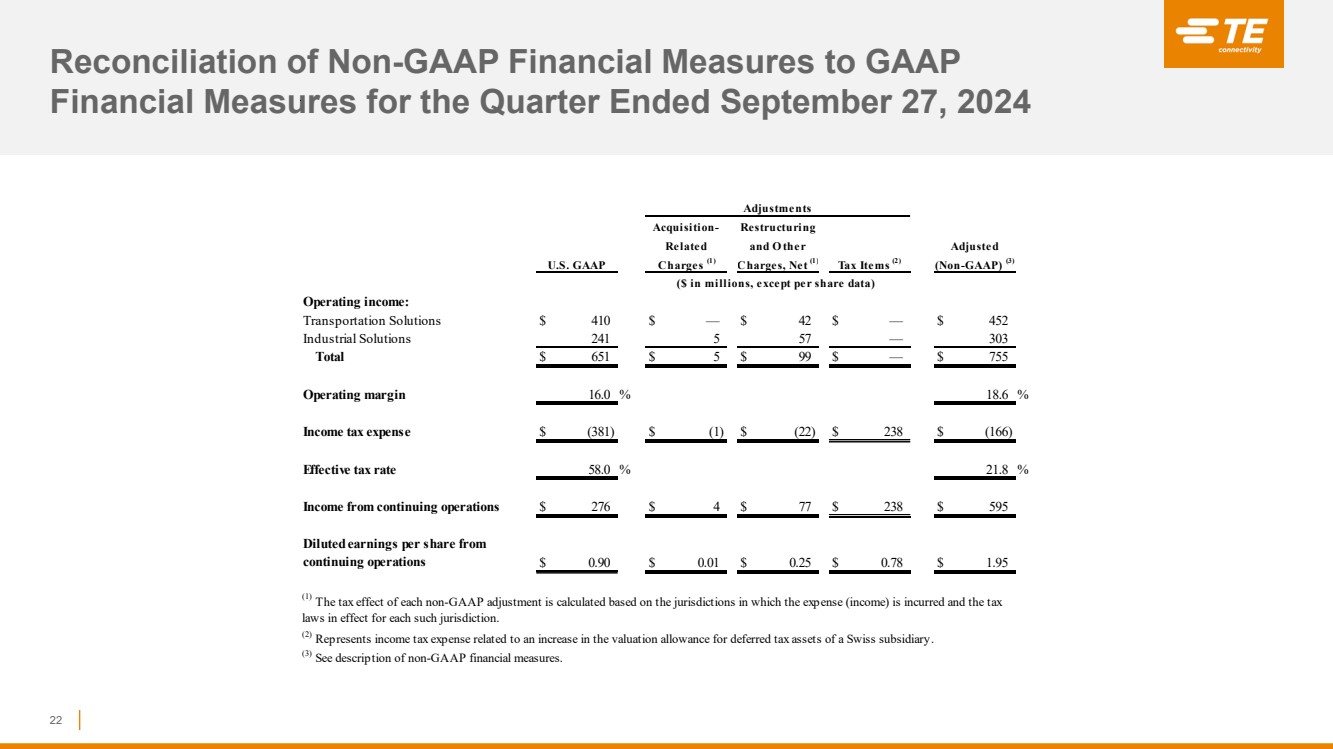

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Quarter Ended September 27, 2024 22 Operating income: Transportation Solutions $ 410 $ — $ 42 $ — $ 452 Industrial Solutions 241 5 57 — 303 Total $ 651 $ 5 $ 99 $ — $ 755 Operating margin 16.0 % 18.6 % Income tax expense $ (381) $ (1) $ (22) $ 238 $ (166) Effective tax rate 58.0 % 21.8 % Income from continuing operations $ 276 $ 4 $ 77 $ 238 $ 595 Diluted earnings per share from continuing operations $ 0.90 $ 0.01 $ 0.25 $ 0.78 $ 1.95 (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (3) See description of non-GAAP financial measures. Related and O ther Adjusted U.S. GAAP Charges (1) Charges, Net (1) (Non-GAAP) (3) (2) Represents income tax expense related to an increase in the valuation allowance for deferred tax assets of a Swiss subsidiary. ($ in millions, except per share data) Tax Items (2) Acquisition- Restructuring Adjustments |

| Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures for the Year Ended September 27, 2024 23 Operating income: Transportation Solutions $ 1,880 $ — $ 67 $ 3 $ 1,950 Industrial Solutions 916 21 99 1 1,037 Total $ 2,796 $ 21 $ 166 $ 4 $ 2,987 Operating margin 17.6 % 18.9 % Income tax (expense) benefit $ 397 $ (3) $ (29) $ (1,016) $ (651) Effective tax rate (14.2) % 21.8 % Income from continuing operations $ 3,194 $ 18 $ 137 $ (1,012) $ 2,337 Diluted earnings per share from continuing operations $ 10.34 $ 0.06 $ 0.44 $ (3.28) $ 7.56 (3) See description of non-GAAP financial measures. ($ in millions, except per share data) Related and O ther Adjusted U.S. GAAP Charges (1) Charges, Net (1) (Non-GAAP) (3) Tax Items (2) (2) Includes a $636 million net income tax benefit associated with a $972 million ten-year tax credit obtained by a Swiss subsidiary reduced by a $336 million valuation allowance related to the amount of the tax credit not expected to be realized. Also includes a $262 million income tax benefit related to the revaluation of deferred tax assets as a result of a corporate tax rate increase in Switzerland and a $118 million income tax benefit associated with the tax impacts of a legal entity restructuring with related costs of $4 million recorded in selling, general, and administrative expenses for other non-income taxes. (1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. Acquisition- Restructuring Adjustments |

| Reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin 24 Net income $ 638 $ 573 Income tax expense 208 181 Other expense, net — 3 Interest expense 28 18 Interest income (17) (20) Operating income 857 755 Acquisition-related charges 30 5 Restructuring and other charges, net 14 6 Adjusted operating income (1) 901 766 Depreciation and amortization 216 208 Adjusted EBITDA (1) $ 1,117 $ 974 Net sales $ 4,534 $ 3,979 Net income as a percentage of net sales 14.1 % 14.4 % Adjusted EBITDA margin (1) 24.6 % 24.5 % Operating income $ 462 $ 395 $ 857 $ 506 $ 249 $ 755 Acquisition-related charges — 30 30 — 5 5 Restructuring and other charges, net 7 7 14 (8) 14 6 Adjusted operating income (1) 469 432 901 498 268 766 Depreciation and amortization 117 99 216 132 76 208 Adjusted EBITDA (1) $ 586 $ 531 $ 1,117 $ 630 $ 344 $ 974 Net sales $ 2,418 $ 2,116 $ 4,534 $ 2,351 $ 1,628 $ 3,979 Operating margin 19.1 % 18.7 % 18.9 % 21.5 % 15.3 % 19.0 % Adjusted operating margin (1) 19.4 % 20.4 % 19.9 % 21.2 % 16.5 % 19.3 % Adjusted EBITDA margin (1) 24.2 % 25.1 % 24.6 % 26.8 % 21.1 % 24.5 % (1) See description of non-GAAP financial measures. ($ in millions) Transportation Industrial Solutions Solutions Total Solutions Solutions Total June 27, 2025 June 28, 2024 For the Q uarters Ended ($ in millions) June 27, 2025 June 28, 2024 Transportation Industrial For the Q uarters Ended |

| Reconciliation of Free Cash Flow 25 Net cash provided by operating activities $ 1,187 $ 1,006 $ 2,718 $ 2,435 Net cash used in investing activities (2,537) (117) (3,298) (744) Net cash used in financing activities (537) (591) (63) (1,875) Effect of currency translation on cash 5 (5) (4) (8) Net increase (decrease) in cash, cash equivalents, and restricted cash $ (1,882) $ 293 $ (647) $ (192) Net cash provided by operating activities $ 1,187 $ 1,006 $ 2,718 $ 2,435 Capital expenditures, net (225) (139) (658) (455) Free cash flow (1) $ 962 $ 867 $ 2,060 $ 1,980 (1) Free cash flow is a non-GAAP financial measure. See description of non-GAAP financial measures. 2025 2024 2025 2024 (in millions) For the Q uarters Ended June 27, June 28, June 27, June 28, For the Nine Months Ended |

| Reconciliation of Forward-Looking Non-GAAP Financial Measures to Forward-Looking GAAP Financial Measures 26 Diluted earnings per share from continuing operations $ 2.18 $ 6.12 Restructuring and other charges, net 0.05 0.35 Acquisition-related charges 0.04 0.15 Tax items — 1.96 Adjusted diluted earnings per share from continuing operations (2) $ 2.27 $ 8.58 Net sales growth 11.9 % 7.7 % Translation (2.8) (0.5) (Acquisitions) divestitures, net (3.6) (2.2) Organic net sales growth (2) 5.5 % 5.0 % Effective tax rate 24.5 % 42.2 % Effective tax rate adjustments (3) (0.5) (18.8) Adjusted effective tax rate (2) 24.0 % 23.4 % 2025 (1) September 26, O utlook for Fiscal 2025 (1) (3) Includes adjustments for special tax items and the tax effect of acquisition-related charges and net restructuring and other charges, calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. (1) Outlook is as of July 23, 2025. (2) See description of non-GAAP financial measures. Q uarter Ending O utlook for |