Please wait

0001386278DEF 14AFALSEiso4217:USD00013862782024-01-012024-12-310001386278gdot:GreshamMember2024-01-012024-12-310001386278gdot:HenryMember2023-01-012023-12-310001386278gdot:GreshamMember2023-01-012023-12-3100013862782023-01-012023-12-310001386278gdot:GreshamMember2022-01-012022-12-310001386278gdot:HenryMember2022-01-012022-12-3100013862782022-01-012022-12-310001386278gdot:HenryMember2021-01-012021-12-3100013862782021-01-012021-12-310001386278gdot:HenryMember2020-01-012020-12-310001386278gdot:JacobsMember2020-01-012020-12-3100013862782020-01-012020-12-310001386278ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310001386278ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001386278ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2024-01-012024-12-310001386278ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310001386278ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2024-01-012024-12-310001386278ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001386278ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-01-012024-12-310001386278ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-01-012024-12-310001386278ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-01-012024-12-310001386278ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001386278ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2024-01-012024-12-310001386278ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001386278ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2024-01-012024-12-310001386278ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001386278ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310001386278ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001386278ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2024-01-012024-12-310001386278ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2024-01-012024-12-31000138627812024-01-012024-12-31000138627822024-01-012024-12-31000138627832024-01-012024-12-31

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| | | | | | | | |

Filed by the Registrant

| þ |

Filed by a Party other than the Registrant

| o |

Check the appropriate box:

| |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

þ | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under § 240.14a-12 |

| | |

| Green Dot Corporation |

| (Name of Registrant as Specified in Its Charter) |

|

| N/A |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

þ | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

April 11, 2025

Dear Stockholders:

You are cordially invited to attend the 2025 Annual Meeting of Stockholders of Green Dot Corporation. Our 2025 Annual Meeting of Stockholders will be held as a "virtual meeting" of stockholders and stockholders will not be able to attend the meeting in-person. Our Annual Meeting of Stockholders will be conducted exclusively via the internet at a virtual audio web conference at https://meetnow.global/MW562QZ on May 22, 2025, at 12:00 p.m. Mountain Time.

You can attend the Annual Meeting of Stockholders online, vote your shares during the online meeting and submit questions during the online meeting by visiting the above-mentioned internet site. We are committed to ensuring, to the extent possible, that stockholders will be afforded the ability to participate at the virtual meeting like they would at an in-person meeting. Details regarding how to access the virtual meeting via the internet and the business to be conducted at the meeting are more fully described in the accompanying Notice of Annual Meeting of Stockholders and proxy statement.

We have elected to deliver our proxy materials to our stockholders over the internet and will mail to our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement for our 2025 Annual Meeting of Stockholders and 2024 annual report to stockholders. This notice also provides instructions on how to vote by telephone or through the internet and includes instructions on how to receive a paper copy of the proxy materials by mail.

The matters to be acted upon are described in the accompanying Notice of Annual Meeting of Stockholders and proxy statement.

We hope that you will be able to attend this year’s Annual Meeting of Stockholders. Whether or not you plan to attend the meeting, please vote through the internet or by telephone or request, sign and return a proxy card to ensure your representation at the meeting. Your vote is important.

On behalf of the Board of Directors, we would like to express our appreciation for your continued support of Green Dot Corporation.

Sincerely,

| | | |

| |

| William I Jacobs |

| Chairperson of the Board and Interim Chief Executive Officer |

GREEN DOT CORPORATION

________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 22, 2025

________________

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 2025 Annual Meeting of Stockholders of Green Dot Corporation will be held on May 22, 2025 at 12:00 p.m. Mountain Time exclusively via the internet at a virtual audio web conference.

To facilitate greater stockholder access, we have determined that the Annual Meeting of Stockholders will be held exclusively online in a virtual meeting format only, via the internet, with no physical in-person meeting. At our virtual meeting, stockholders will be able to attend, vote and submit questions by visiting https://meetnow.global/MW562QZ. Further information about how to attend the Annual Meeting of Stockholders online, vote your shares online during the meeting and submit questions during the meeting is included in the accompanying proxy statement.

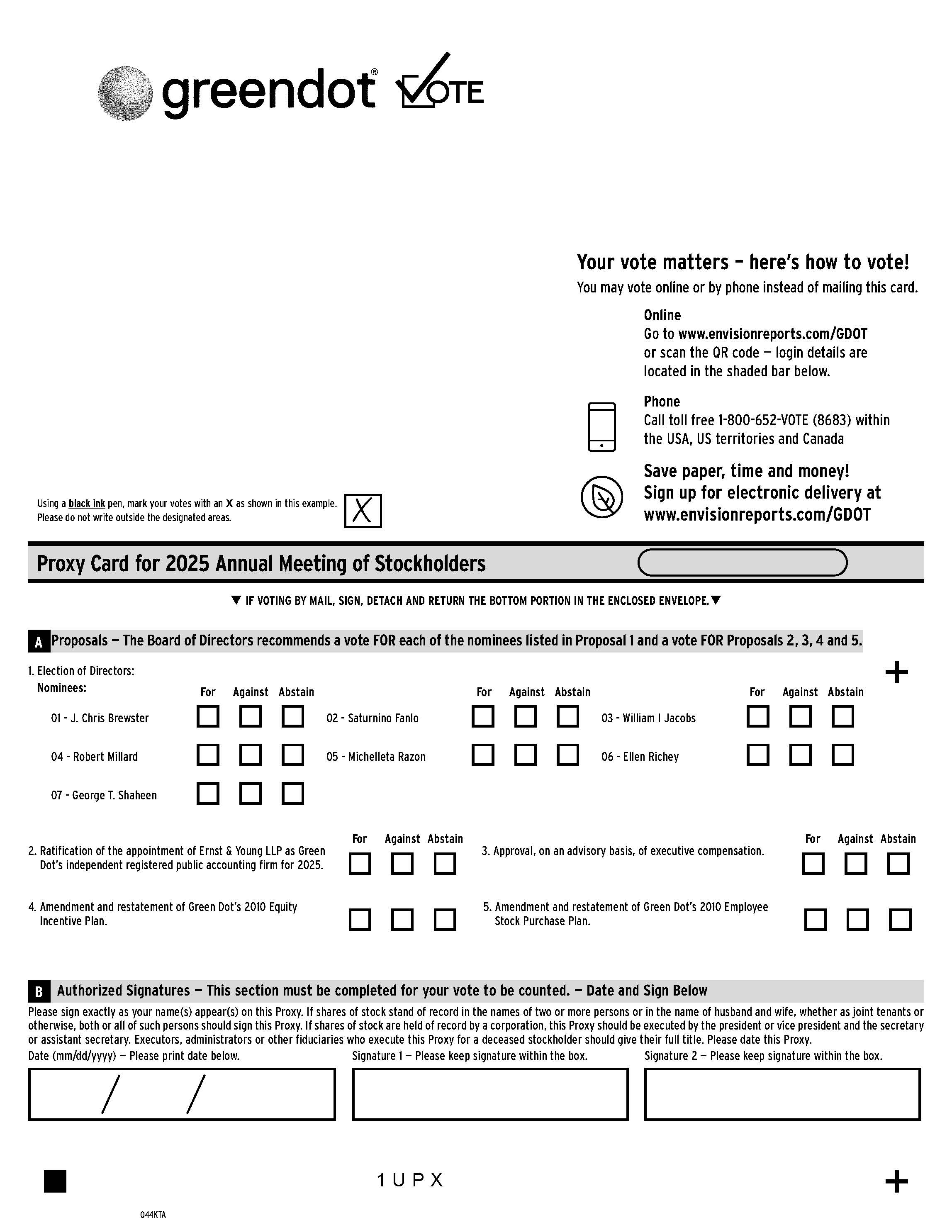

We are holding the meeting for the following purposes, which are more fully described in the accompanying proxy statement:

1.To elect the 7 nominees named in the proxy statement to the Board of Directors;

2.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2025;

3.To vote on a non-binding advisory resolution to approve executive compensation;

4.To approve the amendment and restatement of Green Dot’s 2010 Equity Incentive Plan; and

5.To approve the amendment and restatement of Green Dot's 2010 Employee Stock Purchase Plan.

In addition, stockholders may be asked to consider and vote upon such other business as may properly come before the meeting or any adjournment or postponement thereof.

Only stockholders of record at the close of business on March 31, 2025 are entitled to notice of, and to vote at, the meeting and any adjournments thereof.

Your vote as a Green Dot Corporation stockholder is very important. Each share of Class A common stock that you own represents one vote. For questions regarding your stock ownership, you may contact Investor Relations at (626) 765-2000 or, if you are a registered holder, our transfer agent, Computershare Trust Company, N.A., by email through their website at www.computershare.com/contactus or by phone toll free at (800) 962-4284.

By Order of the Board of Directors,

Amy Pugh

General Counsel and Secretary

Provo, Utah

April 11, 2025

Whether or not you expect to attend the meeting, we encourage you to read the proxy statement and vote by telephone or through the internet or submit your proxy card or voting instructions as soon as possible, so that your shares may be represented at the meeting. For specific instructions on how to vote your shares, please refer to the section entitled "Questions and Answers About the Meeting" beginning on page 8 of the proxy statement and the instructions on the enclosed Notice of Internet Availability of Proxy Materials.

GREEN DOT CORPORATION

PROXY STATEMENT FOR 2025 ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

Proxy Summary

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all information you should consider. Please read the entire proxy statement carefully before voting.

| | | | | | | | | | | | | | | | | | | | |

| | | |

Annual Stockholders Meeting | | |

Record date March 31, 2025

Date of Mailing/Availability The Notice of Internet Availability of Proxy Materials is being mailed, and the proxy statement is being made available, to our stockholders on or about April 11, 2025. |

Meeting agenda The meeting will cover the proposals listed under "Voting matters and vote recommendations" below, and any other business that may properly come before the meeting. |

|

| Date May 22, 2025 Time 12:00 p.m. Mountain Time Place Exclusively via the internet at a virtual audio web conference at https://meetnow.global/MW562QZ. | |

| | Voting Stockholders as of the record date are entitled to vote. Each share of our Class A common stock is entitled to one vote for each director nominee and one vote for each of the proposals. |

Voting matters and vote recommendations

See the actual proposals for more information.

| | | | | | | | | | | | | | |

Management Proposals | Board

recommends | Reasons for

Recommendation | See

page |

| 1. | Election of 7 directors | FOR | Our Board of Directors (“Board”) and its Nominating and Corporate Governance Committee believe the 7 Board nominees possess the skills, and experience to effectively monitor performance, provide oversight, and advise management on our long-term strategy. | |

2.

| Ratification of the selection of Ernst & Young LLP as our independent auditor for fiscal year 2025 | FOR | Based on the Audit Committee’s assessment of Ernst & Young LLP’s qualifications and performance, it believes their retention for fiscal year 2025 is in the best interests of our company. | |

| 3. | Advisory vote to approve executive compensation | FOR | Our executive compensation programs demonstrate our execution on our pay for performance philosophy and reflect corporate governance best practices. | |

| 4. | Approval of the amendment and restatement of our 2010 Equity Incentive Plan | FOR | Our 2010 Equity Incentive Plan addresses the continuing need to provide performance-based restricted stock units, time-based restricted stock units and other equity-based incentives to attract and retain the most qualified personnel and to respond to relevant market changes in equity compensation practices. | |

| 5. | Approval of the amendment and restatement of our 2010 Employee Stock Purchase Plan | FOR | Our 2010 Employee Stock Purchase Plan is designed to provide eligible employees with the opportunity to purchase shares of our Class A common stock through accumulated payroll deductions. The plan is designed to align the interests of our employees with those of our stockholders by encouraging employees to invest in our Class A common stock, and to help our employees share in our success. | |

Corporate governance facts

| | | | | | | | | | | |

Independent Board and Board committees | |

| | |

| • | Lead Independent Director

|

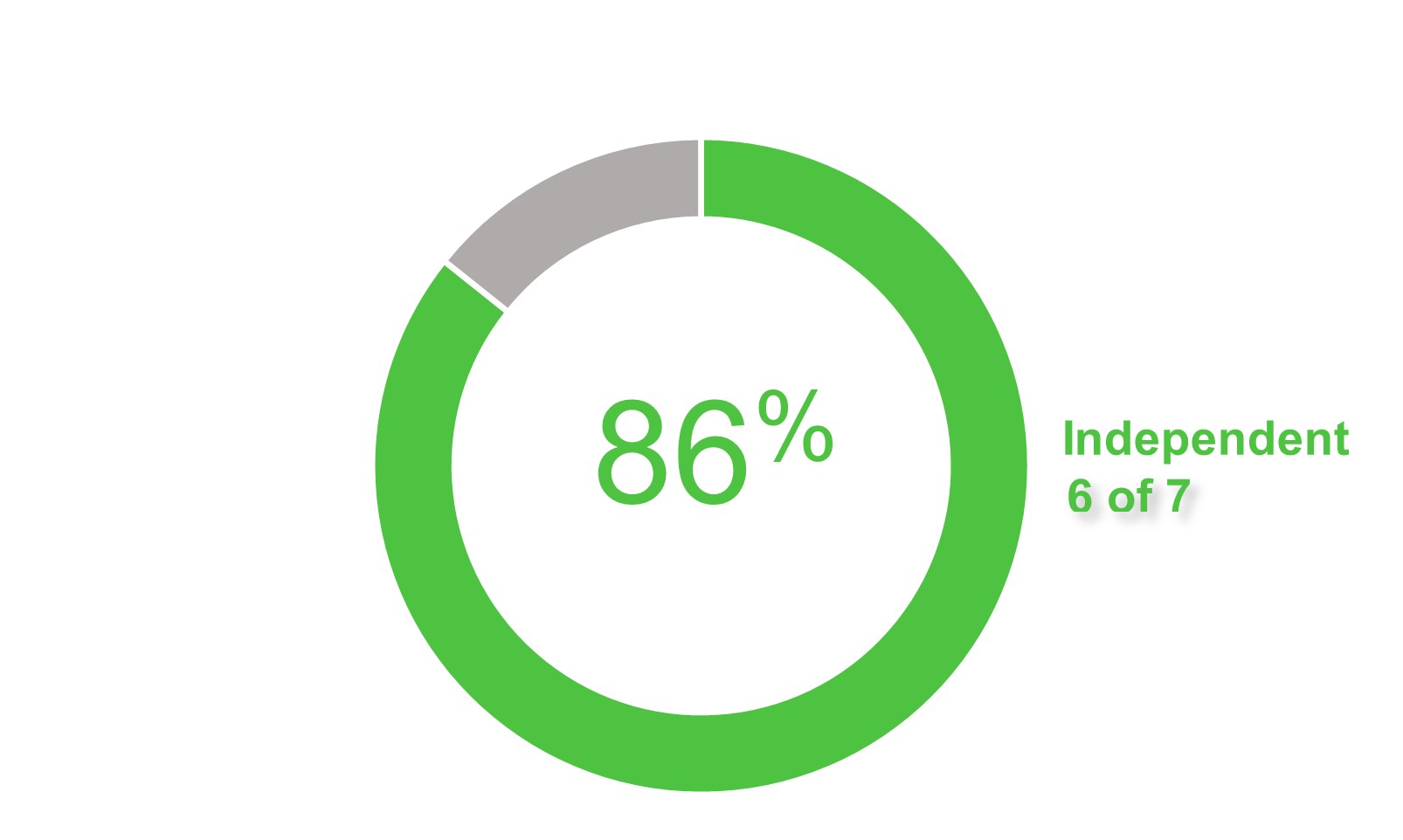

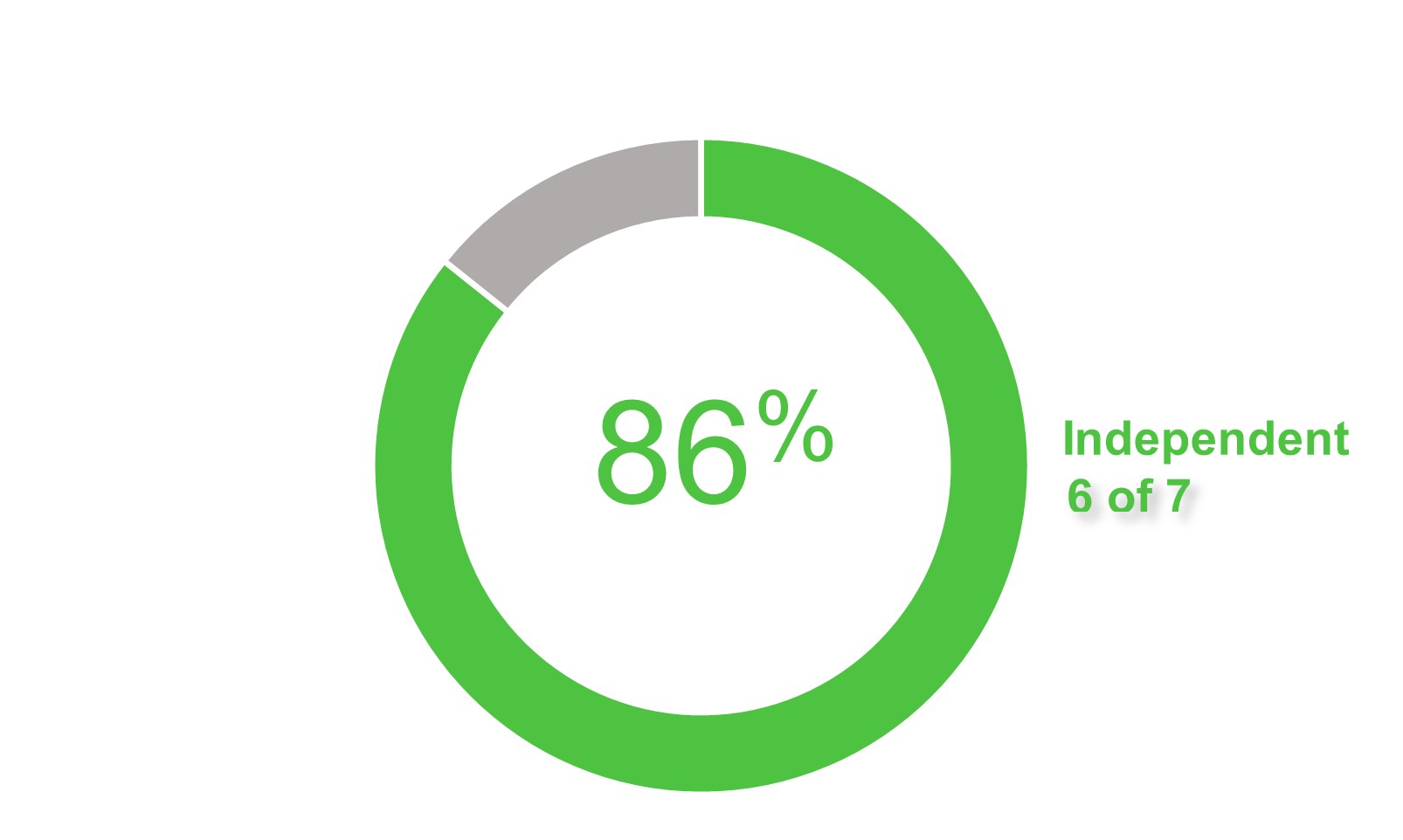

| • | 6 of 7 director nominees are independent

|

| • | 86% of committee members are independent

|

| • | Independent directors meet in executive session regularly

|

| • | We conduct annual board and committee evaluations

|

| • | All of our Audit Committee members are financially literate, and 3 of our Audit Committee members are Audit Committee Financial Experts

|

| • | Our Compensation Committee uses an independent compensation consultant

|

| | | | | | | | | | | |

Best practices stockholder rights | |

| | |

| • | Directors are elected by a majority vote of stockholders in uncontested elections

|

| • | All directors are elected annually

|

| • | Our bylaws provide for proxy access by stockholders

|

| • | No poison-pill

|

| • | No multi-class or non-voting stock

|

| | | | | | | | | | | |

Strong information security oversight | |

| | |

| • | Board and Risk Committee oversight |

| • | Robust information security program and annual independent on-site security audits |

Our director nominees

See “Proposal No. 1 - Election of Directors” for more information.

The following table provides summary information about each director nominee. Each director is elected annually by a majority of the votes cast.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and

Occupation | Age | Director Since | Independent | Other Public Boards | Committee Memberships |

| AC | CC | NGC | RC |

Director Nominees

| | | | | | | | | | | | | | | | |

J. Chris Brewster Former CFO, Cardtronics, Inc. | 75 | 2016 | Yes | — | | | | | | | | | | | | |

| C | | | M | | | | | | M | |

| F | | | | | | | | | | |

Saturnino “Nino” Fanlo Former CFO and COO, Human Longevity, Inc. | 64 | 2016 | Yes | — | | | | | | | | | | | | |

| M | | | M | | | | | | | |

| F | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

William I Jacobs* Interim Chief Executive Officer, Green Dot Corporation | 83 | 2016 | No | 1 | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Robert Millard Chief Financial Officer, CHG Healthcare | 57 | 2024 | Yes | — | | | | | | | | | | | | |

| M | | | | | | C | | | M | |

| F | | | | | | | | | | |

Michelleta "Mich" Razon CTO and Head of Engineering, Legal AI, Thomson Reuters | 49 | 2023 | Yes | — | | | | | | | | | | | | |

| | | | | | | M | | | M | |

| | | | | | | | | | | |

Ellen Richey Former Vice Chairman and Chief Risk Officer, Visa Inc. | 76 | 2020 | Yes | 1 | | | | | | | | | | | | |

| | | | | | | M | | | C | |

| | | | | | | | | | | |

| | | | | | | | | | | |

George T. Shaheen+ Managing Director, Andersen, LLP | 80 | 2013 | Yes | 2 | | | | | | | | | | | | |

| M | | | C | | | | | | | |

| | | | | | | | | | | |

_____________

AC: Audit Committee

CC: Compensation Committee

NGC: Nominating and Corporate Governance Committee

RC: Risk Committee

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | | Chairperson of the Board | | + | | Lead Independent Director | | C | | Chair | | M | | Member | | F | | Financial Expert |

Board Nominee Tenure

| | | | | | | | | | | |

| 0 - 5 Years: | 6 - 8 Years: | 8+ Years: | Average tenure of all director nominees: 5.9 years |

| 43% | 43% | 14% |

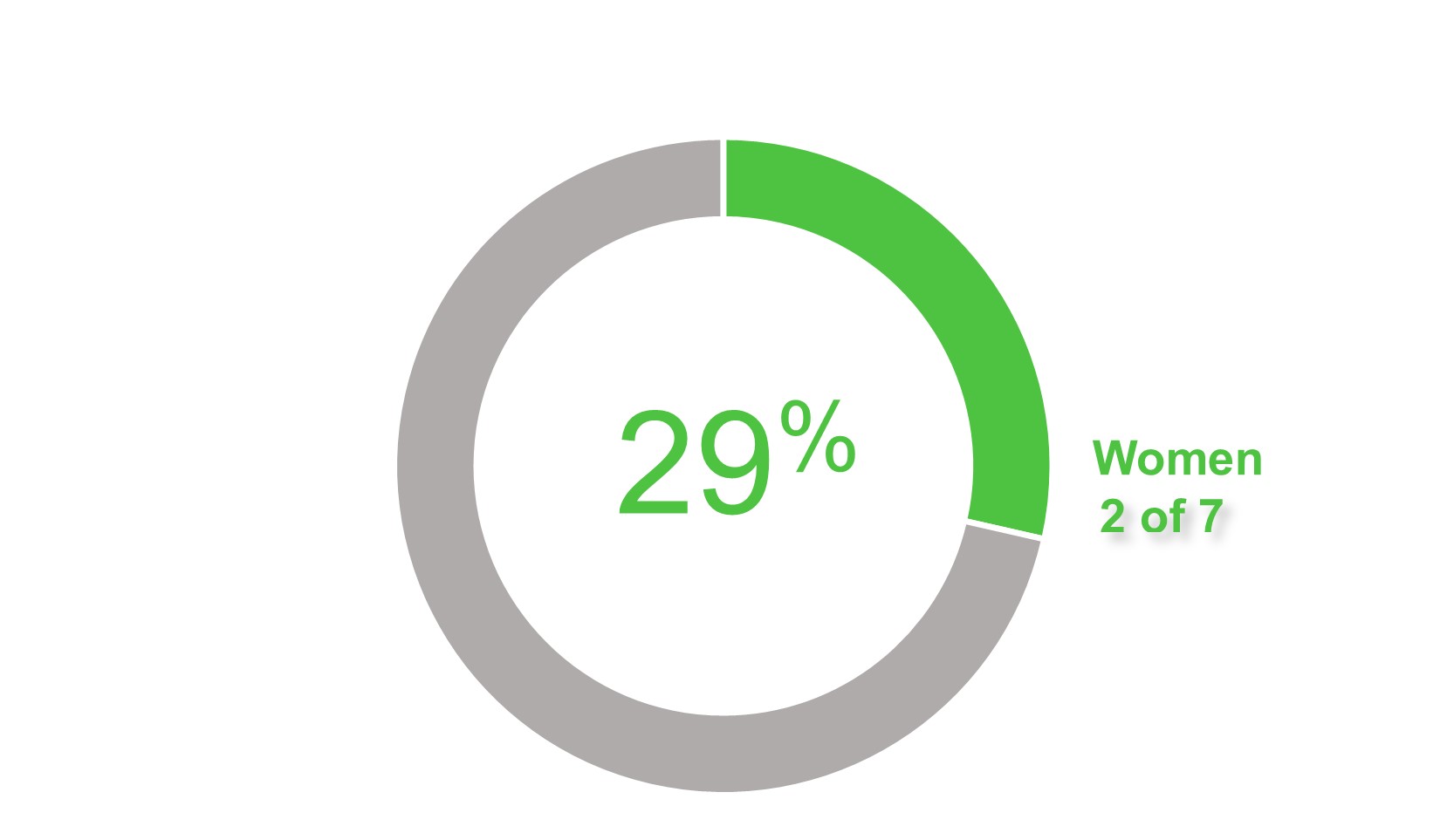

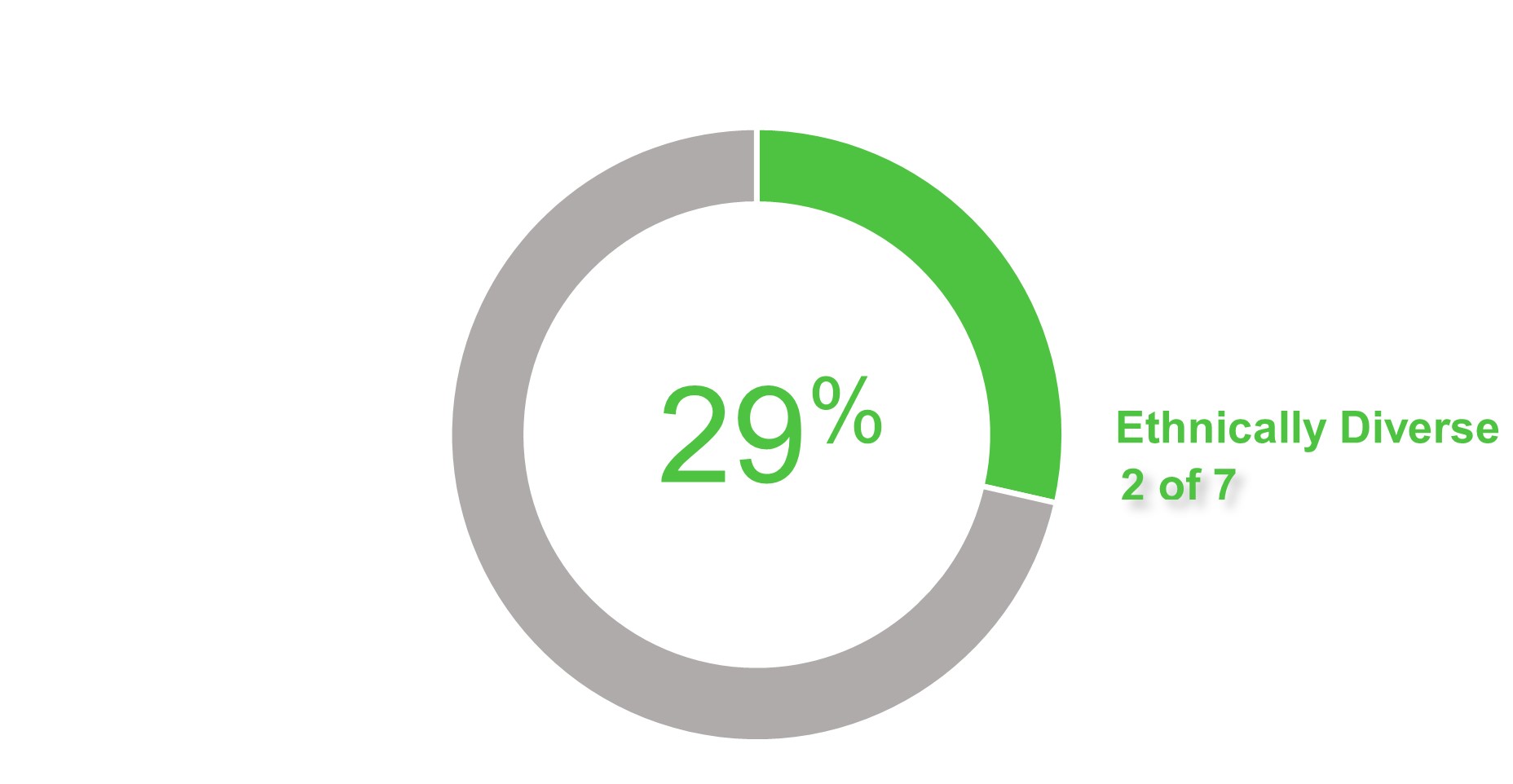

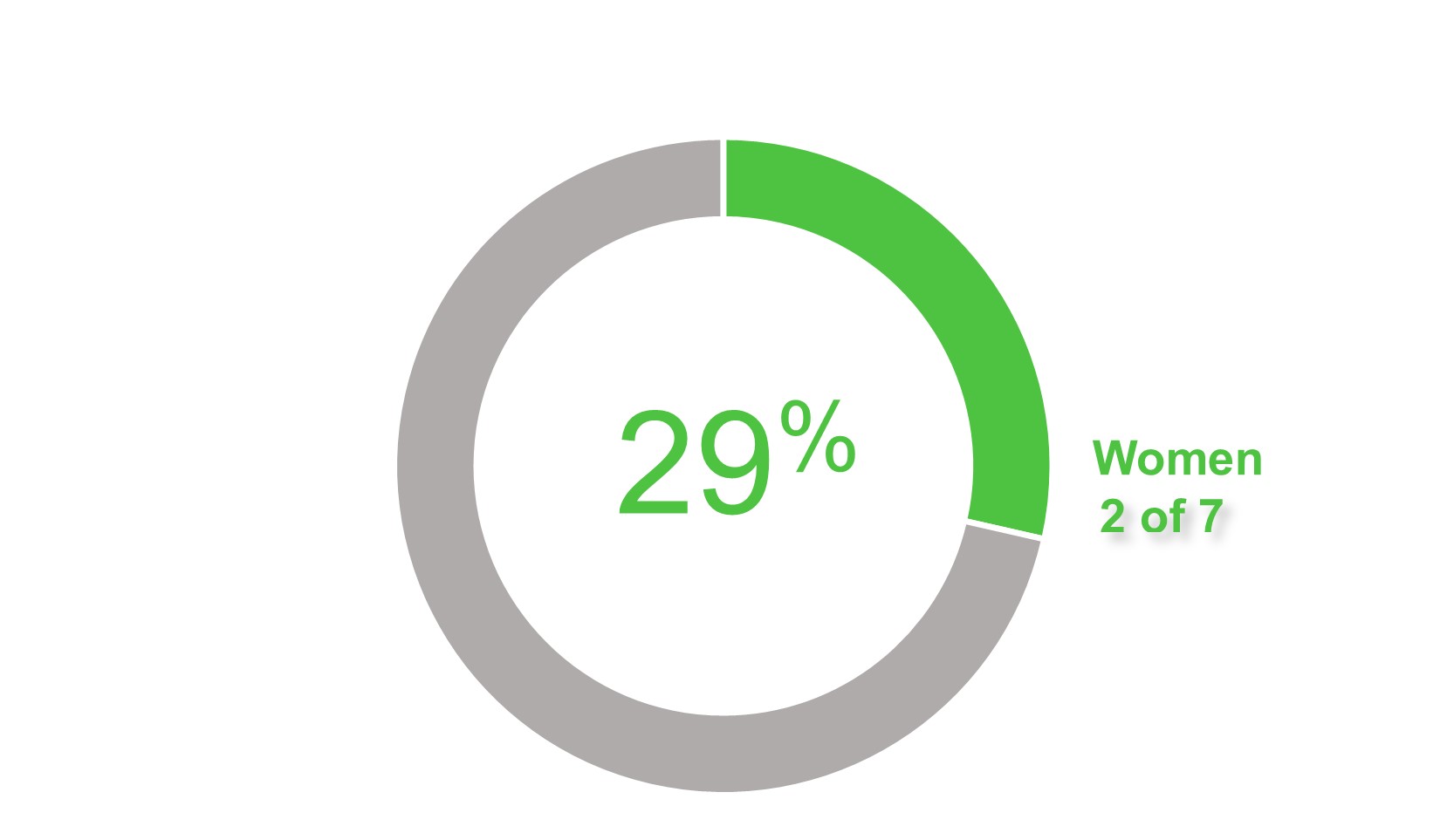

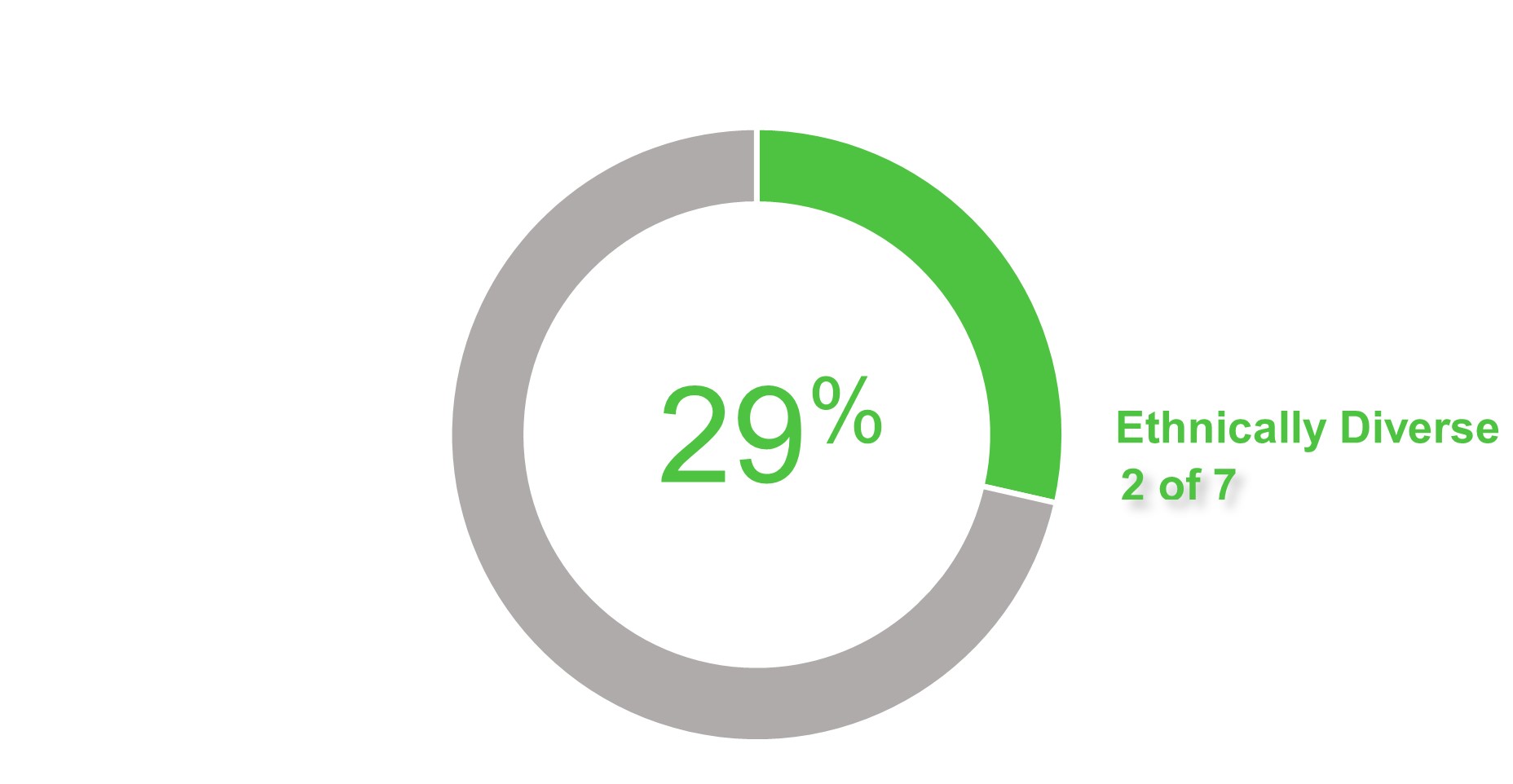

Board Nominee Profile

Board Refreshment

| | | | | | | | |

Executive compensation highlights

See “Proposal No. 3 - Advisory Vote to Approve Executive Compensation” and “Executive Compensation” for more information. |

| | |

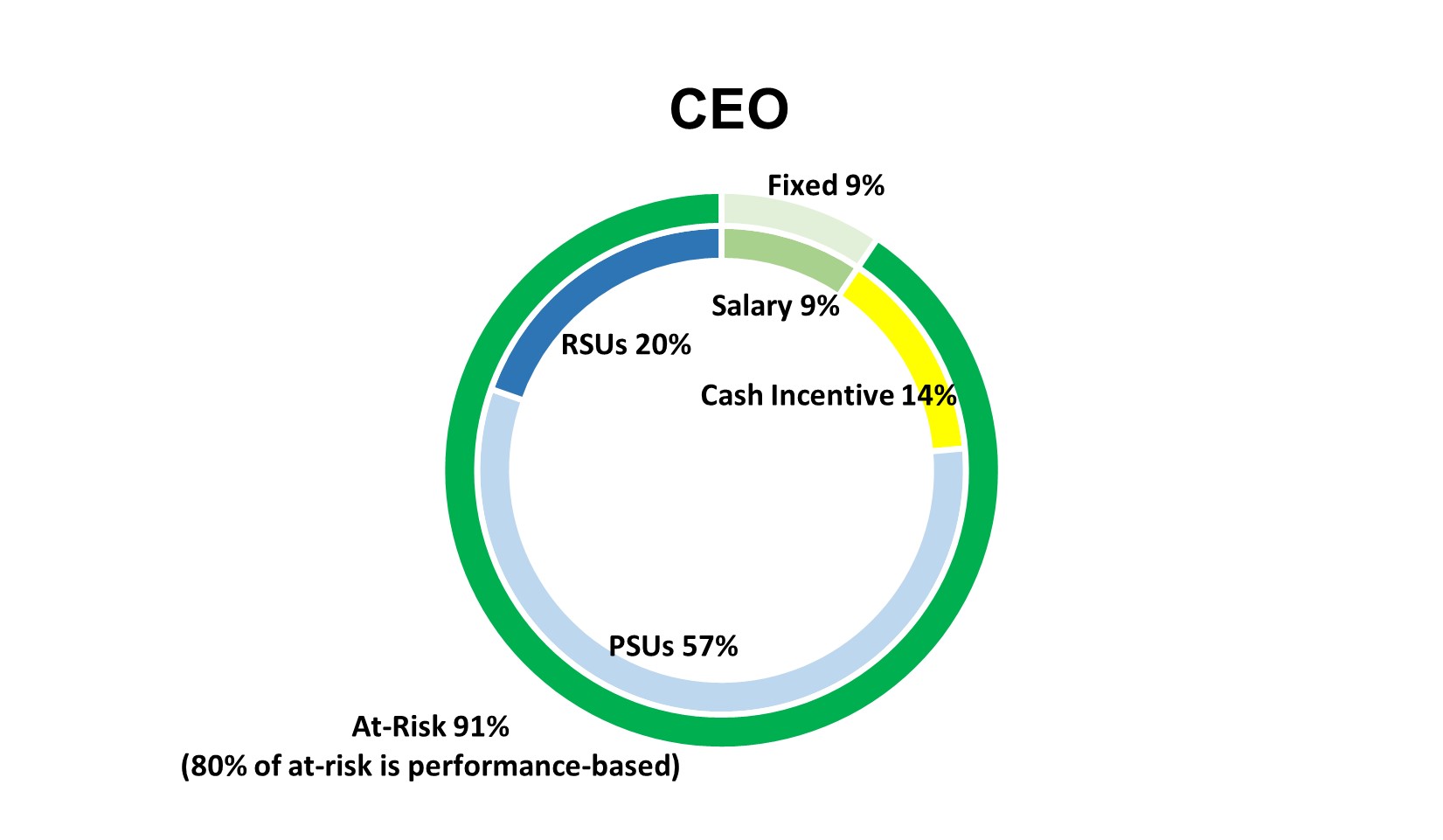

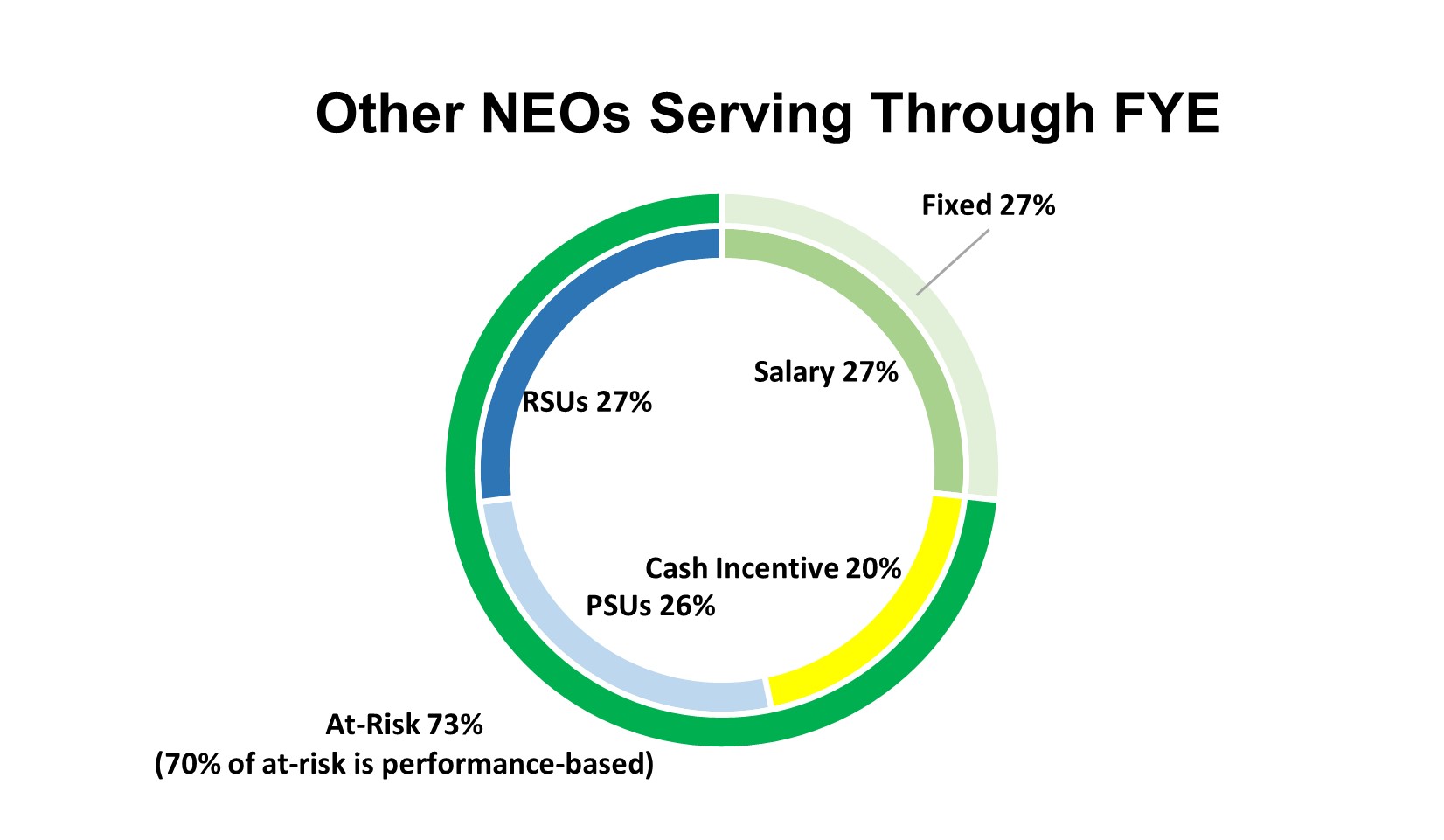

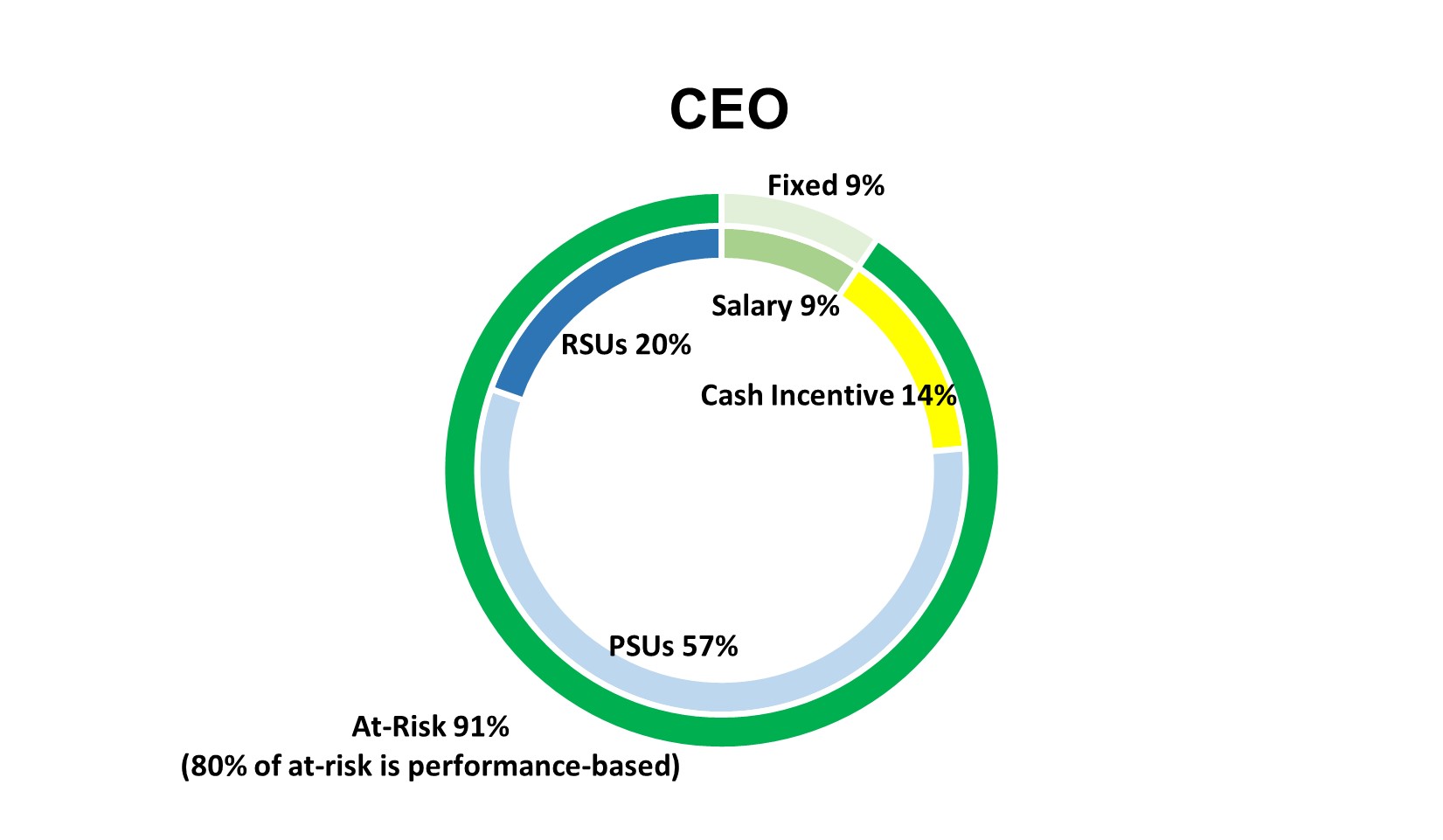

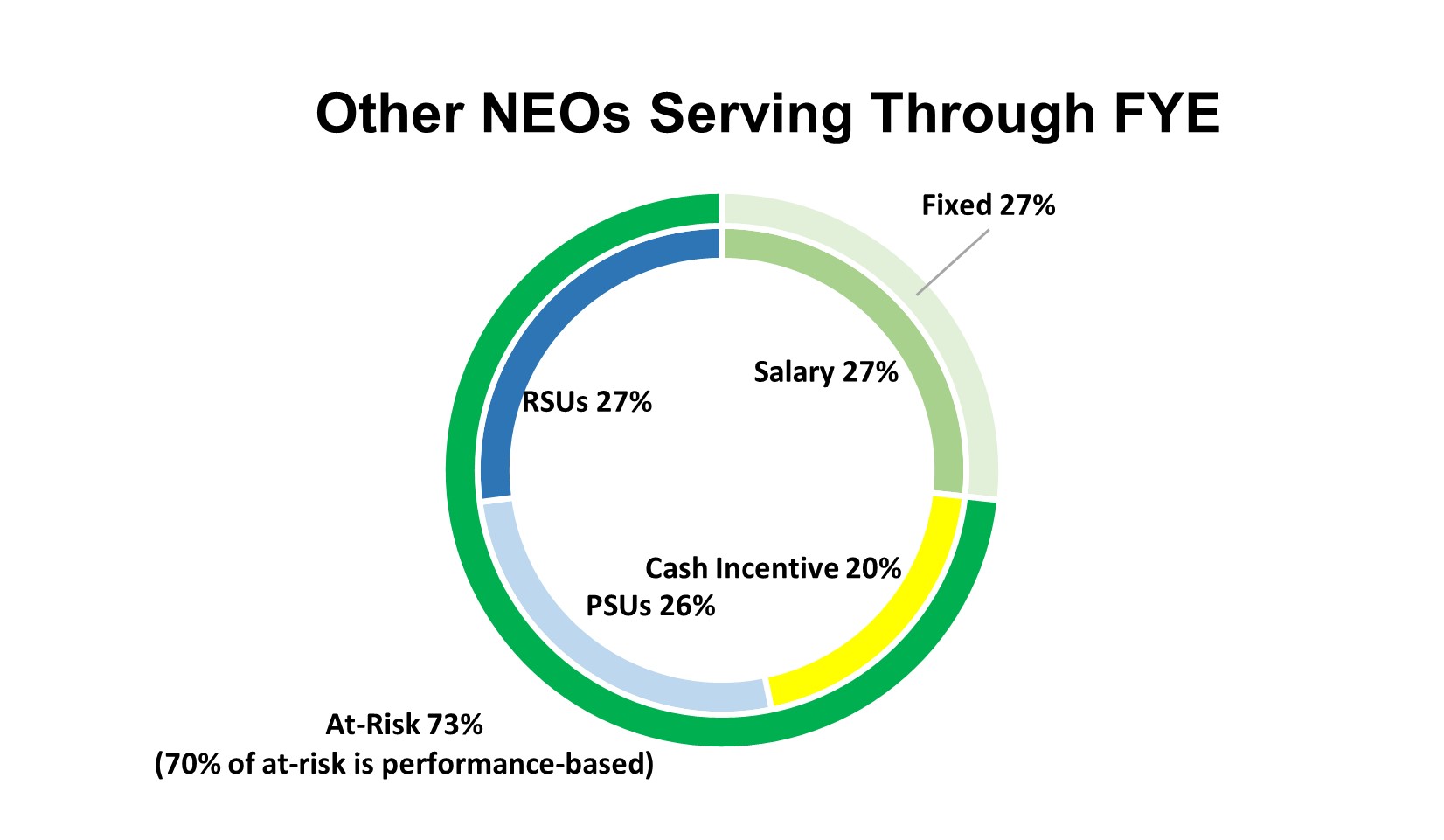

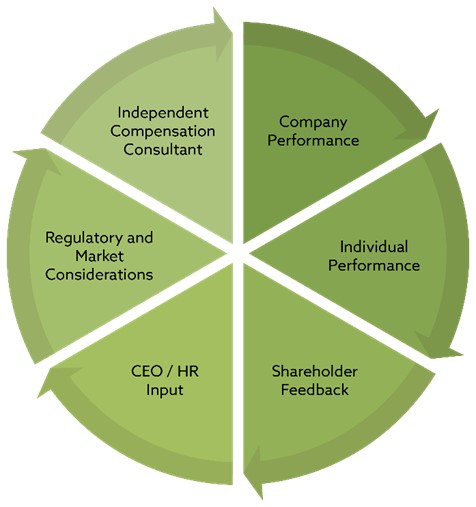

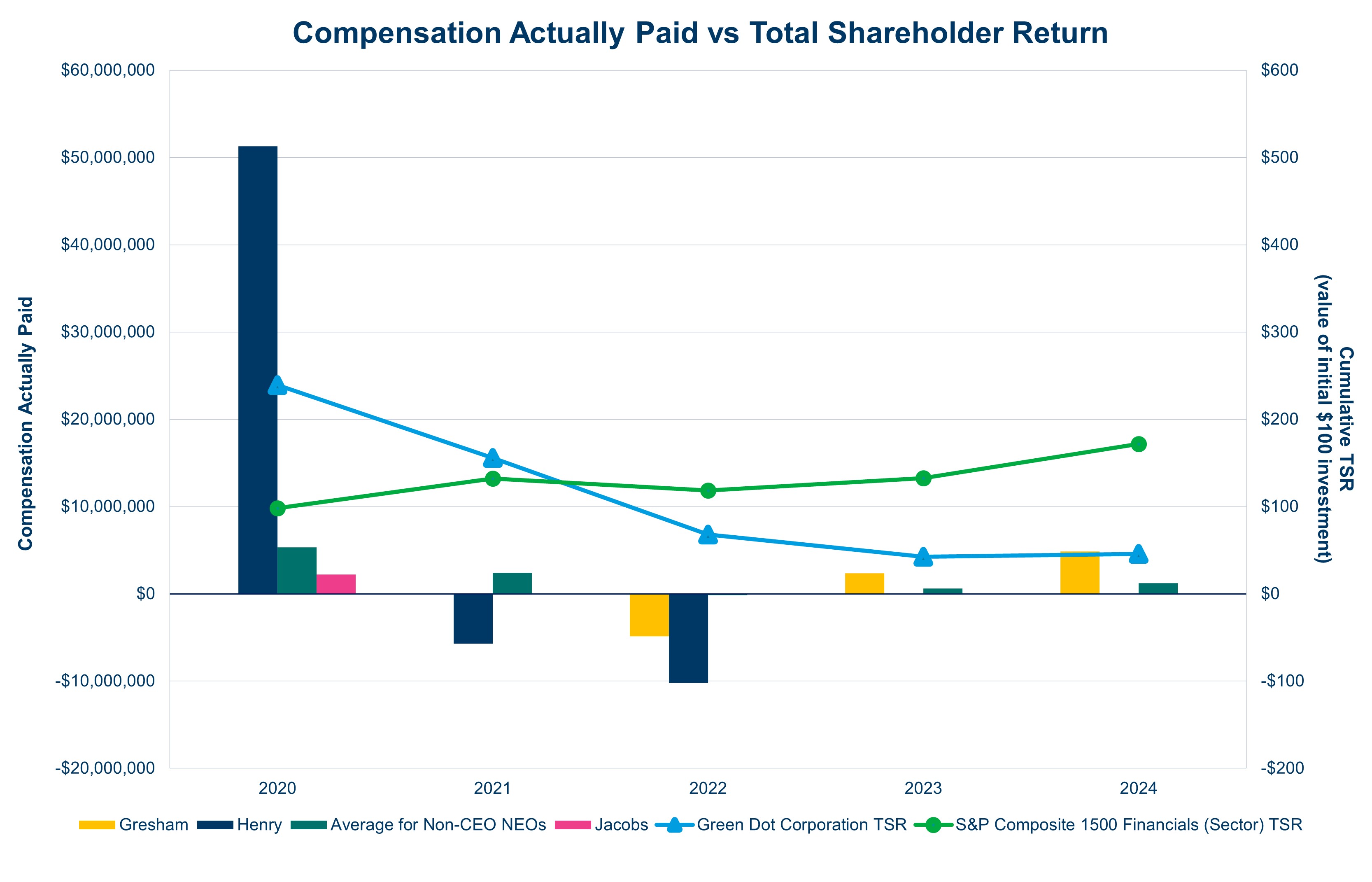

Leadership Transition In March 2025, we announced commencement of a CEO transition process, pursuant to which George Gresham ceased serving as our President and Chief Executive Officer, and as a member of the Board, and William I Jacobs, our Chairperson of the Board, was appointed to serve as our interim Chief Executive Officer, and Chris Ruppel, our Chief Revenue Officer, was appointed to serve as our interim President. Significant Portion of Target Total Direct Compensation is at Risk/Performance-based The following charts provide a breakdown of the annual target total direct compensation of our then-serving CEO and our other NEOs in 2024, who participated in our annual executive compensation program for 2024. 1 | | Key Fiscal 2024 Compensation Decisions •During 2024, we balanced the impact of ongoing headwinds with operational improvements and growth in our business-to-business and embedded finance businesses, aided by new partner wins reflecting the increasing demand and growth opportunity in embedded finance and Green Dot’s unique value proposition. •While we were encouraged by the progress we made during 2024, these financial results did not meet our financial plan for the year. Consistent with our Compensation Committee’s philosophy of linking payment to performance, company performance resulted in below-target payouts (50.4% of target) to our executive officers under the short-term incentive plan for 2024, demonstrating that we do not pay out performance-based cash incentive awards for unmet goals. We continued to grant long-term incentive awards subject to a 3-year performance period with 3-year earnings per share goals and 3-year relative total stockholder return, or TSR, modifier goals to align our executive officers' interests with the long-term interests of our stockholders. •The PRSUs granted to Mr. Gresham in connection with being hired in 2021 did not vest and expired because our stock price did not reach certain specified levels over the performance period. Our Response to our 2024 Say on Pay Vote (related to 2023 compensation) In response to the 2024 say-on-pay vote, in which 95% of votes cast (for or against), voted in favor of our compensation program, we continued to follow rigorous pay for performance principles as demonstrated by reduced payouts for our named executive officers in 2024 as a result of their failure to achieve pre-established performance goals under our programs. |

| |

| |

1 Reflects 2024 salary rates, 2024 target incentive amounts and target value of 2024 PRSUs and RSUs, and not amounts actually earned or paid out. Amounts may not sum to 100% due to rounding. | |

| | | | | | | | | | | |

Sound program design | |

| | |

| We design our executive officer compensation programs to attract, motivate, and retain the key executives who drive our success and industry leadership while considering individual and company performance and alignment with the long-term interests of our stockholders. We achieve our objectives through compensation that: |

| | Provides a competitive target total direct pay opportunity

|

| | Consists primarily of performance-based and/or at-risk compensation

|

| | Provides annual short-term and long-term incentive opportunities that are 100% performance-based and/or at risk

|

| | Enhances retention through multi-year vesting of stock awards

|

| | Does not encourage unnecessary and excessive risk taking

|

| | | | | | | | | | | |

Best practices in executive compensation | |

| | |

| Our leading practices include:

|

| | A claw-back policy

|

| | An executive stock ownership policy

|

| | A policy prohibiting pledging and hedging ownership of Green Dot stock

|

| | Seeking feedback on executive compensation through stockholder engagement

|

| | No tax gross-ups and perquisites

|

| | No single trigger change in control benefits

|

| | No executive-only retirement programs

|

| | No excessive cash severance

|

GREEN DOT CORPORATION

________________

PROXY STATEMENT FOR THE 2025 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 22, 2025

________________

April 11, 2025

Information About Solicitation and Voting

The accompanying proxy is solicited on behalf of the Board of Directors (the “Board”) of Green Dot Corporation for use at Green Dot’s 2025 Annual Meeting of Stockholders (the "2025 Annual Meeting," "Annual Meeting" or “meeting”) to be held exclusively via the internet at a virtual audio web conference at https://meetnow.global/MW562QZ on May 22, 2025, at 12:00 p.m. Mountain Time, and any adjournment or postponement thereof. References in the proxy statement for the Annual Meeting, or the Proxy Statement, to “we,” “us,” “our,” the “company” or “Green Dot” refer to Green Dot Corporation.

Internet Availability of Proxy Materials

Under rules adopted by the U.S. Securities and Exchange Commission (“SEC”), we are furnishing proxy materials to our stockholders primarily via the internet, instead of mailing printed copies of those materials to each stockholder. On or about April 11, 2025, we expect to send our stockholders a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) containing instructions on how to access our proxy materials, including our proxy statement and our annual report. The Notice of Internet Availability also provides instructions on how to vote by telephone or through the internet and includes instructions on how to receive a paper copy of the proxy materials by mail. If you prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability.

Questions and Answers About the Meeting

Why is the 2025 Annual Meeting being held as a virtual, online meeting?

To facilitate greater stockholder attendance, the meeting will be a virtual meeting of stockholders where stockholders will participate by accessing a website using the internet. There will not be a physical meeting location. We believe that hosting a virtual meeting will facilitate stockholder attendance and participation at the 2025 Annual Meeting by enabling stockholders to participate remotely from any location around the world. We have designed the virtual 2025 Annual Meeting to provide the same rights and opportunities to participate as stockholders would have at an in-person meeting, including the right to vote and ask questions through the virtual meeting platform.

Who can vote their shares and attend the 2025 Annual Meeting?

Stockholders as of the record date for the meeting, March 31, 2025, are entitled to vote their shares and attend the meeting. At the close of business on the record date, there were 54,873,357 shares of Green Dot Class A common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on March 31, 2025, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A. (“Computershare”), then you are considered the stockholder of record with respect to those shares. As a stockholder of record, you may vote at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to vote by telephone or through the internet, or if you request or receive paper proxy materials by mail, by filling out and returning a proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Other Nominee

If on March 31, 2025, your shares were held in an account with a brokerage firm, bank or other nominee, then you are the beneficial owner of the shares held in street name. As a beneficial owner, you have the right to direct your nominee on how to vote the shares held in your account, and your nominee has enclosed or provided voting instructions for you to use in directing it on how to vote your shares. However, the organization that holds your shares is considered the stockholder of record for purposes of voting at the meeting. Because you are not the stockholder of record, you may not attend or vote your shares at the meeting unless you (i) request and obtain a legal proxy giving you the right to vote the shares at the meeting from the organization that holds your shares and

(ii) register to attend the 2025 Annual Meeting. Please see “How do I register to attend the virtual 2025 Annual Meeting?” below for information on how to register to attend the 2025 Annual Meeting.

How do I virtually attend the 2025 Annual Meeting?

We will host the 2025 Annual Meeting live online via audio webcast. You may attend the 2025 Annual Meeting live online by visiting https://meetnow.global/MW562QZ. The webcast will start at 12:00 p.m. Mountain Time on May 22, 2025. If you are a stockholder of record, you will need to enter the control number included on your proxy card in order to be able to enter the 2025 Annual Meeting online. If you are a beneficial owner and have registered in advance to participate in the 2025 Annual Meeting, you will need to enter the control number that you received from Computershare. Online check-in will begin at 11:30 a.m. Mountain Time on May 22, 2025, and you should allow ample time for the online check-in proceedings. If you encounter any difficulties accessing the virtual meeting, please see the instructions on the virtual meeting website for technical support.

How do I register to attend the virtual 2025 Annual Meeting?

If you are a stockholder of record, you do not need to register to attend the 2025 Annual Meeting. However, if you are the beneficial owner of your shares, you must register in advance to attend the 2025 Annual Meeting. To register to attend the virtual 2025 Annual Meeting online, you must obtain a legal proxy from your brokerage firm, bank or other nominee and submit proof of your legal proxy reflecting your holdings of our stock, along with your legal name and email address, to our virtual meeting provider, Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. Eastern Time on May 19, 2025. You will receive a confirmation of your registration by email and a control number after we receive your registration materials. Requests for registration should be directed to the following:

By email: Forward the email from your brokerage firm, bank or other nominee, or attach an image of your legal proxy, to legalproxy@computershare.com.

By mail: Mail to Computershare, Green Dot Legal Proxy, P.O. Box 43001 Providence, RI 02940-3001.

What if I have trouble accessing the Annual Meeting virtually?

The virtual meeting platform is fully supported across modern browsers and devices running the most up-to-date version of applicable software and plugins. Participants should ensure that they have a strong internet connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. For further assistance should you need it you may call 1-888-724-2416.

What is the purpose of the meeting?

At the meeting, stockholders will act upon the proposals described in this proxy statement. In addition, following the meeting, management will be available to respond to questions from stockholders.

What proposals are scheduled to be voted on at the meeting?

Stockholders will be asked to vote on four proposals. The proposals are:

1.To elect the 7 nominees named in this proxy statement to the Board;

2.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2025;

3.To vote on a non-binding advisory resolution to approve executive compensation;

4.To approve the amendment and restatement of Green Dot's 2010 Equity Incentive Plan; and

5.To approve the amendment and restatement of Green Dot's 2010 Employee Stock Purchase Plan.

Could matters other than Proposal Nos. 1-5 be decided at the meeting?

Our bylaws require that we receive advance notice of any proposal to be brought before the meeting by stockholders of Green Dot, and we have not received notice of any such proposals. If any other matter were to come before the meeting, the proxy holders appointed by the Board would have the discretion to vote on those matters for you.

What is the recommendation of the Board of Directors on each of the proposals scheduled to be voted on at the meeting?

The Board recommends that you vote FOR each of the nominees named in this proxy statement (Proposal No. 1), FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2025 (Proposal No. 2), FOR the non-binding advisory resolution to approve executive compensation (Proposal No. 3), FOR the amendment and restatement of our 2010 Equity Incentive Plan (Proposal No. 4), and FOR the amendment and restatement of our 2010 Employee Stock Purchase Plan (Proposal No. 5).

How do I vote?

You may vote by internet, by mail or follow any alternative voting procedure (such as telephone or internet voting) described on your proxy card or your voting instruction card. To use an alternative voting procedure, follow the instructions on each proxy card or your voting instruction card that you receive. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote before the 2025 Annual Meeting:

•by telephone or through the internet - in order to do so, please follow the instructions shown on your Notice of Internet Availability or proxy card; or

•by mail - if you request or receive a paper proxy card and voting instructions by mail, simply complete, sign and date the enclosed proxy card and return it before the meeting in the pre-paid envelope provided.

You may also vote during the 2025 Annual Meeting through the internet.

Votes submitted by telephone before the meeting must be received by 11:59 p.m. Eastern Time, on May 21, 2025. If you want to vote through the internet, your votes can be submitted before and during the 2025 Annual Meeting. If you vote by mail, your proxy card must be received by May 21, 2025. Submitting your proxy before the meeting, whether by telephone, through the internet or by mail if you request or received a paper proxy card, will not affect your right to vote at the meeting should you decide to attend and participate in the 2025 Annual Meeting virtually online at https://meetnow.global/MW562QZ and vote your shares electronically before the polls close during the meeting.

Beneficial Owner: Shares Registered in the Name of a Broker or Other Nominee

If you are not the stockholder of record, please refer to the voting instructions provided by your nominee regarding how to vote your shares. Your vote is important. To ensure that your vote is counted, complete and mail the voting instruction card provided by your brokerage firm, bank, or other nominee as directed by your nominee. To vote at the 2025 Annual Meeting, you must obtain a legal proxy from your nominee and register to attend the meeting. Please see “How do I register to attend the virtual 2025 Annual Meeting?” above for information on how to register to attend the 2025 Annual Meeting. Whether or not you plan to attend the meeting, we urge you to vote your voting instruction card to ensure that your vote is counted.

How do I vote by internet or telephone before the meeting?

If you wish to vote by internet or telephone, you may do so by following the voting instructions included on your Notice of Internet Availability or proxy card. Please have each Notice of Internet Availability or proxy card you received in hand when you vote over the internet or by telephone as you will need information specified in those documents to submit your vote. The giving of such a telephonic or internet proxy will not affect your right to vote virtually (as detailed above) should you decide to attend the 2025 Annual Meeting virtually.

The telephone and internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly.

What shares can I vote?

Each share of Green Dot Class A common stock issued and outstanding as of the close of business on March 31, 2025 is entitled to vote on all items being voted on at the meeting. You may vote all shares owned by you as of March 31, 2025, including (1) shares held directly in your name as the stockholder of record, and (2) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee.

How many votes am I entitled to per share?

Each holder of shares of Class A common stock is entitled to one vote for each share of Class A common stock held as of March 31, 2025.

What is the quorum requirement for the meeting?

The holders of a majority of the voting power of the shares of stock entitled to vote at the meeting as of the record date must be present virtually at the meeting or represented by proxy at the meeting in order to hold the meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the meeting if you are present virtually and vote at the meeting or if you have properly submitted a proxy. Shares present virtually during the 2025 Annual Meeting will be considered shares of Class A common stock represented in person at the meeting.

How are abstentions and broker non-votes treated and which proposals are considered “routine” or “non-routine”?

Abstentions (shares present at the meeting and voted “abstain”) are counted for purposes of determining whether a quorum is present and have no effect on the outcome of the matters voted upon.

A broker non-vote occurs when the beneficial owner of shares fails to provide the broker, bank or other nominee that holds the shares with specific instructions on how to vote on any “non-routine” matters brought to a vote at the stockholders meeting. In this situation, the broker, bank or other nominee will not vote on the “non-routine” matter. Broker non-votes are counted for purposes of determining whether a quorum is present and have no effect on the outcome of the matters voted upon.

Note that if you are a beneficial holder, brokers and other nominees will be entitled to vote your shares on “routine” matters without instructions from you. The only proposal that would be considered “routine” in such event is the proposal for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2025 (Proposal No. 2). A broker or other nominee will not be entitled to vote your shares on any “non-routine” matters, absent instructions from you. “Non-routine” matters include all proposals other than Proposal No. 2, including the election of directors. Accordingly, we encourage you to provide voting instructions to your broker or other nominee whether or not you plan to attend the meeting.

What is the vote required for each proposal?

The votes required to approve each proposal are as follows:

•Proposal No. 1. Each director nominee must be elected by a majority of the votes cast, meaning that the number of shares entitled to vote on the election of directors and represented virtually at the meeting or by proxy at the meeting casting their votes “FOR” a director must exceed the number of votes “AGAINST” a director.

•Proposal Nos. 2, 3, 4 and 5. Approval of each of Proposal Nos. 2, 3, 4 and 5 will be obtained if a majority of the votes cast are “FOR” the proposal.

What if I return a proxy card but do not make specific choices?

If you return a validly executed proxy card but do not indicate your voting preferences, your shares will be voted in the manner recommended by the Board on all matters presented in this proxy statement for which no instruction was provided and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the meeting.

If you hold your shares in street name and do not indicate to your broker or other nominee your voting preferences, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes” (as described above) and will not be counted in determining the number of shares necessary for approval of the proposals. However, shares that constitute broker non-votes will be counted for the purpose of establishing a quorum for the meeting. Voting results will be tabulated and certified by the inspector of elections appointed for the meeting.

Who is soliciting my proxy and paying for this proxy solicitation?

The expenses of soliciting proxies will be paid by Green Dot. Following the original mailing of the soliciting materials, Green Dot and its agents may solicit proxies by mail, electronic mail, telephone, facsimile or by other similar means. Our directors, officers and other employees, without additional compensation, may solicit proxies personally or in writing, by telephone, email, or otherwise. Following the original mailing of the soliciting materials, Green Dot will request brokers, custodians, nominees and other record holders to forward copies of the soliciting materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, Green Dot, upon the request of the record holders, will reimburse such holders for their reasonable expenses. If you choose to access the proxy materials and/or vote through the internet, you are responsible for any internet access charges you may incur.

What does it mean if I receive more than one proxy card or Notice of Internet Availability?

If you receive more than one proxy card or Notice of Internet Availability, your shares are registered in more than one name or are registered in different accounts. For example, you may own some shares directly as a stockholder of record and other shares through a brokerage firm, or you may own shares through more than one brokerage firm. In these situations, you may receive multiple sets of proxy materials. To make certain all of your shares are voted, please follow the instructions included on the Notice of Internet Availability on how to access each proxy card and vote each proxy card by telephone or through the internet. If you requested or received paper proxy materials by mail, please complete, sign and return each proxy card to ensure that all of your shares are voted.

How can I change my vote after submitting my proxy?

A stockholder who has given a proxy may revoke it at any time before it is exercised at the meeting by:

•delivering to the Corporate Secretary of Green Dot a written notice stating that the proxy is revoked;

•signing and delivering a proxy bearing a later date;

•voting again by telephone or through the internet; or

•attending and voting at the meeting (although attendance at the meeting will not, by itself, revoke a proxy).

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Only the latest-dated validly executed proxy that you submit will be counted.

How can I get electronic access to the proxy materials?

The Notice of Internet Availability will provide you with instructions regarding how to:

•view our proxy materials for the meeting through the internet; and

•instruct us to send our future proxy materials to you electronically by email.

If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

Will you make a list of the stockholders of record entitled to vote at the 2025 Annual Meeting available through electronic means?

We will make available an electronic list of stockholders of record as of the record date for inspection by stockholders from May 12, 2025 through May 21, 2025. To access the electronic list during this time, please send your request, along with proof of ownership, by email to IR@greendot.com. You will receive confirmation of your request and instructions on how to view the electronic list. The list will also be available to stockholders at https://meetnow.global/MW562QZ during the live audio webcast of the 2025 Annual Meeting.

Where can I find the voting results?

The results will be tallied by the inspector of elections and filed with the SEC in a current report on Form 8-K within four business days of the meeting.

CORPORATE GOVERNANCE AND DIRECTOR INDEPENDENCE

Green Dot is strongly committed to good corporate governance practices. These practices provide an important framework within which our Board and management can pursue our strategic objectives for the benefit of our stockholders.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines that set forth expectations for directors, director independence standards, board committee structure and functions and other policies for the governance of our company. Our Corporate Governance Guidelines are available on the Investor Relations section of our website, which is located at http://ir.greendot.com, by clicking on “Governance” and then selecting “Corporate Governance Guidelines” underneath “Governance Documents.” Our Nominating and Corporate Governance Committee reviews the Corporate Governance Guidelines at least annually and recommends changes to our Board, as warranted.

Board Leadership Structure

Our Board retains the flexibility to determine on a case-by-case basis whether the Chief Executive Officer or an independent director should serve as Chairperson of the Board. This flexibility permits our Board to organize its functions and conduct its business in a manner it deems most effective under then-prevailing circumstances.

During those periods in which the positions of Chairperson and Chief Executive Officer are combined, the independent directors appoint an independent director as a Lead Independent Director, and we separate the responsibilities of the Chairperson and the Lead Independent Director as follows:

| | | | | | | | |

| Lead Independent Director | | Chairperson |

•Presides over executive sessions of independent directors | | •Schedules and sets the agenda for meetings of the Board |

•Serves as a liaison between the Chairman and the independent directors | | •Chairs meetings of the full Board |

•Available, for consultation and direct communication with stockholders and performs such other functions and responsibilities as requested by the Board from time to time | | •Contributes to Board governance and Board processes |

•Encourages direct dialogue between all directors (particularly those with dissenting views) and management | | •Communicates with all directors on key issues and concerns outside of Board meetings |

| | •Presides over meetings of stockholders |

| | |

Currently, our Board of Directors believes that we and our stockholders currently are best served by having William I Jacobs serve as our interim Chief Executive Officer as well as Chairperson of the Board through the CEO transition process. The Board believes that having an independent director serve as the Lead Independent Director is the appropriate leadership structure for our company at this time because it allows our interim Chief Executive Officer to focus on executing our company’s strategic plan and managing our company’s operations and performance as the company explores its strategic alternatives. During the CEO transition process, our Board of Directors has appointed George T. Shaheen to serve as lead independent director.

Our Board of Directors' Role in Risk Oversight

Management continually monitors the material risks we face, including financial risk, strategic risk, enterprise and operational risk (including cybersecurity) and legal and compliance risk. The Board is responsible for exercising oversight of management’s identification and management of, and planning for, those risks. In fulfilling this oversight role, our Board focuses on understanding the nature of our enterprise risks, including our operations and strategic direction, as well as the adequacy of our risk management process and overall risk management system. While the full Board has overall responsibility for risk oversight, the Board has delegated oversight responsibility related to certain risks to the Risk Committee and to other committees of our Board, including responsibility for oversight and review of risk areas for our company and its subsidiary bank.

| | |

| The Board |

| Our Board, as a whole, has responsibility for risk oversight, and through its committees oversees and reviews risk areas for our company and its subsidiary bank. At its regularly scheduled meetings, the Board receives management updates and committee reports regarding business operations, financial results, committee activities, strategy, and discusses risks related to the business. |

|

| The Board and its committees' areas of focus when conducting risk assessments include, but are not limited to, strategic, economic, operational (including cybersecurity), financial (accounting, credit, liquidity and tax), legal, regulatory, compliance and reputational risks. |

| | | | | | | | |

| Risk Committee | | Audit Committee |

| The Risk Committee oversees the enterprise-wide risk management framework and the corporate risk function for Green Dot and its subsidiary bank. The Risk Committee also reviews key risk types that face Green Dot and its subsidiary bank including financial crimes risk (including Bank Secrecy Act/anti-money laundering risk), information security risk (including cyber defense management), model risk, operational risk, credit risk, regulatory compliance risk, reputation risk, strategic risk, technology risk, significant cross-functional risk areas, and other current matters that may present material risk to our company. The Risk Committee receives periodic reports from our Chief Risk Officer and Chief Compliance Officer on our enterprise risk management program. | | The Audit Committee is responsible for oversight of the integrity of our financial statements. The Audit Committee discusses with management and our independent registered public accounting firm our major financial risk exposures and the steps management has taken to limit, monitor and control such exposures. Additionally, the Audit Committee oversees our internal audit function. |

| | |

| | | | | | | | |

Nominating and

Corporate Governance Committee | | Compensation Committee |

| The Nominating and Corporate Governance Committee reviews risks and exposures relating to corporate governance and related legal compliance risks and monitors the steps management has taken to mitigate these exposures. | | The Compensation Committee reviews risks and exposures associated with leadership assessment and executive compensation programs and arrangements, including incentive plans. |

| | |

| | |

| The Role of Management |

| The risk oversight responsibility of our Board and its committees is supported by our management reporting processes, which are designed to provide our Board with information regarding the identification, assessment and management of critical risks and management’s risk mitigation strategies. |

|

|

Independence of Directors

Our Board determines the independence of our directors by applying the independence principles and standards established by the New York Stock Exchange, or NYSE. These provide that a director is independent only if the board affirmatively determines that the director has no direct or indirect material relationship with our company. They also specify various relationships that preclude a determination of director independence. Material relationships may include commercial, industrial, consulting, legal, accounting, charitable, family and other business, professional and personal relationships.

Applying these standards, the board annually reviews the independence of our directors, taking into account all relevant facts and circumstances. In its most recent review, the board considered, among other things, the absence of any current employment relationships between the company and our directors or their families (except in the case of William I Jacobs, who has served as our interim Chief Executive Officer since March 2025); the absence of any of the other specific relationships that would preclude a determination of independence under the rules of the NYSE; the absence of transactions with non-employee directors and members of their families that would require

disclosure in this proxy statement under SEC rules regarding related person transactions; and the absence of any other material relationships between the non-employee directors and Green Dot.

Based upon this review, our Board has determined that the following persons who served as directors in 2024 and current directors were or are independent as determined under the rules of the NYSE:

•J. Chris Brewster

•Saturnino Fanlo

•Robert Millard

•Michelleta Razon

•Ellen Richey

•George T. Shaheen

All members of our Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Risk Committee must be independent directors as defined by our Corporate Governance Guidelines. Members of the Audit Committee must also satisfy a separate SEC independence requirement, which provides that they may not accept directly or indirectly any consulting, advisory or other compensatory fee from Green Dot or any of its subsidiaries other than their directors’ compensation. No member of any committee may be a partner, member or principal of a law firm, accounting firm or investment banking firm that accepts consulting or advisory fees from Green Dot or any of its subsidiaries. Our Board has determined that all members of our Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Risk Committee are independent, and all members of our Audit Committee satisfy the relevant SEC additional independence requirements for the members of such committee.

Committees of Our Board of Directors

Our Board has established an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and a Risk Committee. Each of these committees has a written charter approved by our Board. The composition and responsibilities of each committee are described below. Copies of the charters for each committee are available, without charge, upon request in writing to Green Dot Corporation, 4675 Cornell Road, Suite 280, Cincinnati, Ohio 45241, Attn: Corporate Secretary or in the section entitled, “Committee Charters” on our website that is accessible by clicking on “Governance” in the investor relations section of our website, http://ir.greendot.com. Members serve on these committees until their resignation or until otherwise determined by our Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| INDEPENDENT DIRECTORS | | Audit

Committee | | Compensation

Committee | | Nominating

And Corporate

Governance

Committee | | Risk

Committee |

| J. Chris Brewster | | | | | | | | |

| Saturnino Fanlo | | | | | | | | |

| Robert Millard | | | | | | | | |

| Michelleta Razon | | | | | | | | |

| Ellen Richey | | | | | | | | |

| George T. Shaheen | + | | | | | | | |

| | | | | | | | | | | | | | |

| + | Lead Independent Director | | | Financial Expert |

| | | | |

| Committee Chairperson | | | Committee Member |

| | | | |

| | | | |

Board and Committee Meetings and Attendance

The Board and its committees meet throughout the year on a set schedule and hold special meetings and act by written consent from time to time. During 2024, the Board met 18 times, including telephonic meetings, the Audit Committee held 8 meetings, the Risk Committee held 8 meetings, the Compensation Committee held 5 meetings and the Nominating and Corporate Governance Committee held 4 meetings. Members of committees also provided oversight of company initiatives through periodic discussions with management, which in the case of the Risk Committee occurred regularly. During 2024, all of our incumbent directors attended more than 90% of the aggregate of the total number of meetings held by the Board and the total number of meetings held by all committees of the Board on which such director served (during the period which such director served).

Board Attendance at Annual Stockholders' Meeting

Our policy is to invite and encourage each member of our Board to be present at our annual meetings of stockholders. All 8 of the then-serving directors who were nominated for re-election attended the 2024 Annual Meeting of Stockholders.

Presiding Director of Non-Employee Director Meetings

The non-employee directors meet in regularly scheduled executive sessions without management to promote open and honest discussion. The Chairperson of the Board serves as the presiding director at these meetings when the Chairperson is a non-employee director. When the Chairperson of the Board is an employee, as is currently the case, the Lead Independent Director will serve as the presiding director at these meetings instead of the Chairperson of the Board.

Audit Committee

| | | | | | | | |

| Current Members: | | Responsibilities: |

| J. Chris Brewster (Chair) | | Pursuant to its charter, our Audit Committee, among other things: •appoints our independent auditors; •pre-approves the audit and non-audit services to be performed by our independent auditors; •assesses the qualifications, performance and independence of our independent auditors; •monitors the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters; •reviews the integrity, adequacy and effectiveness of our accounting and financial reporting processes and the adequacy and effectiveness of our systems of internal control; •discusses the results of the audit with the independent auditors and reviews with management and the independent auditors our interim and year-end operating results; and •prepares the Audit Committee report that the SEC requires in our annual proxy statement. |

| Saturnino Fanlo | |

| Robert Millard | |

| George T. Shaheen | |

| |

| Independence: | |

| The composition of our Audit Committee meets the requirements for independence under current NYSE and SEC rules and regulations. | |

| |

| Meetings: | |

8 meetings during 2024. | |

| |

| | |

| | Audit Committee Financial Experts |

| | |

| | Each member of our Audit Committee is financially literate as required by current NYSE listing standards. In addition, our Board has determined that Mr. Brewster is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K based on his experience as Chief Financial Officer of various companies, Mr. Fanlo is an audit committee financial expert based on his experience as Chief Financial Officer of various companies and extensive experience in financial services and capital markets and Mr. Millard is an audit committee financial expert based on his experience as a certified public accountant auditing private and public companies, his previous accounting policy and controller roles and his experience as Chief Financial Officer of various companies. |

| |

Compensation Committee

| | | | | | | | |

| Current Members: | | Responsibilities: |

| George T. Shaheen (Chair) | | Pursuant to its charter, our Compensation Committee, among other things: •reviews, approves and makes recommendations to our Board (as our Compensation Committee deems appropriate) regarding the compensation of our executive officers; •administers and interprets our stock and equity incentive plans; •reviews, approves and makes recommendations to our Board (as our Compensation Committee deems appropriate) with respect to equity and non-equity incentive compensation plans; and •establishes and reviews general strategies relating to compensation and benefits of our employees. |

| Saturnino Fanlo | |

| J. Chris Brewster | |

| |

| Mr. Jacobs served on the Compensation Committee until 2025. | |

| |

| Mr. Brewster joined the Compensation Committee in 2025. | |

| |

| Independence: | |

| The composition of our Compensation Committee meets the requirements for independence under current NYSE and SEC rules and regulations. | |

| |

| Meetings: | |

5 meetings during 2024. | | |

| | |

From time to time, in accordance with the provisions of its charter, our Compensation Committee reviews and makes recommendations to the Board regarding compensation for non-employee directors using a process similar to the one used for determining compensation for our executive officers, which is discussed in detail in “Executive Compensation — Compensation Discussion and Analysis” below. Our Compensation Committee periodically reviews the market practice for non-employee director compensation at companies in our peer group in consultation with its independent compensation consultant.

Under its charter, our Compensation Committee has the authority to retain outside counsel or other advisors. Our Compensation Committee oversees the engagement of its independent compensation consultant and any other consultants it engages in addition to or in replacement of its independent consultant. The independent compensation consultant selected by our Compensation Committee works directly with our Compensation Committee (and not on behalf of management) to assist our Compensation Committee in satisfying its responsibilities and will not undertake projects for management without our Compensation Committee’s approval. Our Compensation Committee selected Mercer, LLC (“Mercer”) as its independent compensation consultant to provide advice and ongoing recommendations on executive compensation matters for 2024 as described in more detail under “Compensation Discussion and Analysis - Role of Consultant”. During 2024, Mercer also provided non-executive compensation services to the company and served as an investment advisor to our 401(k) plan. The decision to engage Mercer for these non-executive compensation services was made by management; however, all such services were ultimately approved by the Compensation Committee. No individual consultant or personnel who provided executive compensation services received any additional compensation as a result of Mercer providing these other services. In the process of selecting Mercer as its compensation consultant, our Compensation Committee considered Mercer’s independence by taking into account the factors prescribed by the NYSE listing rules. Based on this evaluation, the Committee determined that no conflict of interest existed with respect to Mercer.

Nominating and Corporate Governance Committee

| | | | | | | | |

| Current Members: | | Responsibilities: |

| Robert Millard (Chair) | | Pursuant to its charter, our Nominating and Corporate Governance Committee, among other things: •identifies, evaluates and recommends nominees and considers and evaluates stockholder nominees for election to our Board and its committees; •oversees the evaluation of the performance of our Board and its committees and of individual directors; •considers and makes recommendations to our Board regarding the composition of our Board and its committees; •reviews our legal compliance policies; and •makes recommendations to our Board concerning our corporate governance guidelines and other corporate governance matters.

|

| Michelleta Razon | |

| Ellen Richey | |

| |

| Mr. Jacobs served on the Nominating and Corporate Governance Committee until 2025. | |

| |

| Mr. Millard joined the Nominating and Corporate Governance Committee in 2025. | |

| |

| Independence: | |

| The composition of our Nominating and Corporate Governance Committee meets the requirements for independence under current NYSE and SEC rules and regulations. | |

| |

| Meetings: | |

4 meetings during 2024. | |

| | |

Risk Committee

| | | | | | | | |

| Current Members: | | Responsibilities: |

| Ellen Richey (Chair) | | Pursuant to its charter, our Risk Committee, among other things: •approves and periodically reviews the risk management framework for our company; •oversees and receives reports on the operation of our enterprise-wide risk management framework and corporate risk function; •reviews and discusses key risk types facing our company, including financial crimes risk (including Bank Secrecy Act/anti-money laundering risk), information security risk (including cyber defense management), model risk, operational risk, credit risk, regulatory compliance risk, reputation risk, strategic risk, technology risk, significant cross-functional risk areas, and other current matters that may present material risk to our company, and reviews and discusses management’s assessment of the company’s aggregate enterprise-wide risk profile, as well as the alignment of the risk profile with the company’s strategic plan, goals, objectives, and risk appetite; •annually reviews and recommends to our Board the articulation and establishment of our company’s risk appetite; and •reviews and receives regular reports from the Chief Risk Officer and other members of management regarding management’s assessment of the effectiveness of our enterprise-wide risk program. |

| J. Chris Brewster | |

Robert Millard | |

| Michelleta Razon | |

| |

| |

| Independence: | |

| The composition of our Risk Committee meets the requirements for independence under current NYSE and SEC rules and regulations. | |

| |

| Meetings: | |

8 meetings during 2024. | |

| | |

Communication with Directors

Stockholders and interested parties who wish to communicate with our Board, non-employee members of our Board as a group, a committee of the Board or a specific member of our Board (including our Lead Independent Director) may do so by letters addressed to the attention of our Corporate Secretary.

All communications are reviewed by the Corporate Secretary and provided to the members of the Board consistent with a screening policy providing that unsolicited items, sales materials and other routine items and items unrelated to the duties and responsibilities of the Board may not be relayed on to directors. Any communication that is not relayed is recorded in a log and made available to our Board.

The address for these communications is: Corporate Secretary, Green Dot Corporation, 4675 Cornell Road, Suite 280, Cincinnati, Ohio 45241.

Proxy Access

Our Bylaws permit a stockholder, or a group of up to 20 stockholders, owning continuously for at least three years a number of shares of our Class A common stock that constitutes at least 3% of our outstanding shares of Class A common stock, to nominate and include in our proxy materials director nominees constituting up to the greater of two individuals or 20% of the Board, provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in the Bylaws. The Bylaws specifically allow funds under common management to be treated as a single stockholder, and permit share lending with a five-day recall. The Bylaws do not contain any post-meeting holding requirements, do not have any limits on resubmission of failed nominees, and do not contain restrictions on third-party compensation.

Stockholder Engagement

Our Board values the input of our stockholders, and we are committed to engaging with our stockholders when appropriate. In the chart below, we detail the features of our stockholder engagement program.

| | | | | | | | |

| Before the Annual Meeting | | Annual Stockholder Meeting |

•Discuss stockholder proposals (if any). | | •Conduct engagements with stockholders (as necessary). |

•Publish our Annual Report and Proxy Statement. | | •Receive voting results for Board and stockholder proposals. |

| | |

| | |

| | | | | | | | |

| After the Annual Meeting | | Off-Season Engagement |

•Discuss voting results from the Annual Meeting. | | •If appropriate or requested, one-on-one meetings with stockholders. |

•Review recent regulatory developments, and the company’s own corporate governance documents, policies, and procedures. | | •Attend and participate in investor and corporate governance-related events. |

| | •Evaluate and respond to stockholder feedback. |

| | |

Code of Business Conduct and Ethics

We have adopted codes of business conduct and ethics that, on a combined basis, apply to all of our board members, officers and employees (the “Code”). Our Audit Committee is responsible for annually reviewing and reporting to the Board on the adequacy of the Code and discussing with the Nominating and Corporate Governance Committee updating the Code and relevant policies. The Audit Committee considers waivers of the Code (other than transactions that are subject to review by the Board as a whole or any other committee of the Board), including waivers requested for executive officers and directors (other than where the potential waiver involves a member of the Audit Committee, in which event, such waiver shall be subject to the review of the Board), and has authority to grant any such waivers.

Our Code of Business Conduct and Ethics and our Director Code of Business Conduct and Ethics are posted on the Investor Relations section of our website located at http://ir.greendot.com, by clicking on “Governance” and

then selecting “Code of Business Conduct and Ethics” or “Director Code of Business Conduct and Ethics,” respectively. Any amendments or waivers of our Code of Business Conduct and Ethics and our Director Code of Business Conduct and Ethics pertaining to a member of our Board or one of our executive officers will be disclosed on our website at the above-referenced address.

Insider Trading Policy

We have adopted an Insider Trading Policy governing the purchase, sale, and other dispositions of our securities by our directors, officers, employees and other individuals associated with us, as well as by Green Dot itself, that we believe is reasonably designed to promote compliance with insider trading laws, rules and regulations, and listing standards applicable to us. A copy of our Insider Trading Policy was filed as Exhibit 19.1 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2024.

Information Security and Privacy Risk Oversight

The Green Dot Information Security Program applies to all our business operations and activities as well as those of our subsidiaries and seeks to:

•Ensure the security, confidentiality, and integrity of Green Dot’s information assets, including customer information, and to ensure the proper disposal of customer and consumer information;

•Protect all electronic information systems maintained by Green Dot and/or connected to Green Dot’s network against any anticipated threats or hazards to the security or integrity of the systems;

•Promote and achieve a strong culture of safeguarding customer information throughout Green Dot by implementing a training program for employees and senior management so they have a working knowledge of the Green Dot policies associated with their responsibilities; and

•Ensure adequate senior management and Board oversight of Green Dot’s Information Security Program.

Governance, Roles and Responsibilities

Our Chief Information Security Officer (“CISO”) is responsible for maintaining and implementing the Information Security Program. The CISO and his staff are also tasked with establishing and maintaining adequate IT standards, system architecture standards, and internal controls. The Risk Committee oversees our Information Security Program and reviews and approves the program no less than annually. The Risk Committee works with our CISO to help validate that our technology direction is consistent with business objectives and that IT resources are used in an effective, efficient and risk appropriate manner. As discussed above, our Risk Committee is comprised entirely of independent directors, and Mr. Brewster, Ms. Razon, Ms. Richey and Mr. Millard have significant work experience related to information security issues and oversight.

The CISO reports to the Risk Committee quarterly on the overall status of the Information Security Program and Green Dot’s compliance with the program. At least annually, the CISO reviews the Information Security Program and any related policies and procedures and recommends any necessary changes. This review includes consideration of applicable law, feedback on the effectiveness of the program, and any supervisory or Internal Audit input. Any substantive changes to the program are recommended by the CISO to the Risk Committee and the Risk Committee reviews and approves the Information Security Program.

The Risk Committee regularly briefs the full Board on these matters, and the Board receives regular updates on all significant matters discussed, reviewed, considered and approved by the committee since the last regularly scheduled Board meeting.

Risk Identification and Assessment

Our information security department routinely identifies foreseeable internal and external threats that could result in unauthorized disclosure, misuse, alteration, or destruction of customer information or customer information systems. The CISO establishes specific procedures to assess the likelihood and potential damage of these threats, taking into consideration the sensitivity of customer, employee and business information and the adequacy of policies, procedures, information systems and other arrangements to control risk. Risk identification and assessment procedures address risks inherent in Green Dot’s operations, including the operations of Green Dot’s service providers, as well as risks arising from proposed changes to Green Dot’s operations.

Our information security department performs a risk assessment no less than annually, evaluating all information systems and identifying and assessing the risks to Green Dot’s assets and the impact these risks pose

to Green Dot. Our information security department identifies information and the information systems to be protected including electronic and physical systems used to access, store, and transmit information. The risk assessment may be updated upon the acquisition of a new information system or the identification of a previously unidentified security risk. Based on the risk assessment(s) results, the program is evaluated to ensure it addresses the identified risks commensurate with information sensitivity as well as the complexity and scope of Green Dot’s activities. Risk assessments are presented to the Risk Committee for review.

Information Security Risk Insurance

Green Dot maintains information security risk insurance coverage to help defray the costs of an information security breach. This policy is currently active and is reviewed at least annually to ensure the amount of coverage we carry meets or exceeds our peer group. In the last three years, we have not experienced any incidences of information security breach, nor have we incurred any expenses, penalties or settlements as a result.

Service Provider Arrangements

Our Vendor Management Program is designed to ensure that sourcing decisions are made after evaluating the risks and performing robust due diligence. Our vendor management department works with internal business owners and third-party service providers to identify the access that a service provider may have to our systems and data and then collects the necessary documentation to obtain reasonable assurance of appropriate service provider controls. This documentation is provided to our information security department prior to engagement with the service provider, and their approval is required prior to vendor onboarding and, using a risk-based approach, annually thereafter.

Training

The CISO, the Chief Compliance Officer and the Director of Human Resources develop annual training related to information security and the effective use of Green Dot’s information systems. New employees and contractors are required to attend information security training as part of their orientation, acknowledging in writing that they have read and understand our Information Security Policy. All employees are required annually to take information security training and annually acknowledge that they have read and understand the Information Security Policy. Training awareness topics include authentication procedures, email security precautions, phishing awareness and regulatory and policy compliance. Training completion is tracked and reported on by the Compliance department.

The information security department is staffed with a qualified, technical team of engineers. Priority is given to scheduling training for the team throughout the year. All members of the security response team and those with security breach responsibilities are trained to ensure they are aware and capable of their responsibilities.

PCI Compliance

Green Dot is a Level 1 Service Provider. The designation “Level 1 Service Provider” is reserved for large volume organizations like Green Dot that must pass annual independent on-site security audits that apply to the entire company. Such audits are performed by qualified security assessors that have been qualified by the PCI Security Standards Council and are intended to validate compliance and promote adherence to the PCI information security standards. The company is additionally externally audited to ensure SOC 2 compliance. These audits are conducted annually against multiple trust service principles.

NOMINATIONS PROCESS AND DIRECTOR QUALIFICATIONS

Nomination to the Board of Directors

Candidates for nomination to our Board are selected by our Board based on the recommendation of the Nominating and Corporate Governance Committee in accordance with the committee’s charter, our certificate of incorporation and bylaws and our corporate governance guidelines. In recommending candidates for nomination, the Nominating and Corporate Governance Committee considers candidates recommended by directors, officers, employees, stockholders and others, using the same criteria to evaluate all candidates. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates as appropriate and, in addition, the committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

Pursuant to the proxy access provisions of our Bylaws, an eligible stockholder or group of up to 20 stockholders may nominate one or more director candidates to be included in our proxy materials for our next annual meeting of stockholders. The nomination notice and other materials required by these provisions must be delivered or mailed to and received by our Corporate Secretary in writing at the following address: Corporate Secretary, Green Dot Corporation, 4675 Cornell Road, Suite 280, Cincinnati, Ohio 45241, with a copy to Green Dot Corporation, Attn: General Counsel at the same address. When submitting nominees for inclusion in our proxy materials pursuant to the proxy access provisions of our Bylaws, stockholders must follow the notice procedures and provide the information required by our Bylaws.

Additional information regarding the process for properly submitting stockholder nominations for candidates for membership on our Board, including the deadlines for submitting a nominee for inclusion in our proxy materials for our next annual meeting of stockholders pursuant to the proxy access provisions of our Bylaws, is set forth below under “Additional Information - Stockholder Proposals to be Presented at Next Annual Meeting.”

Director Qualifications

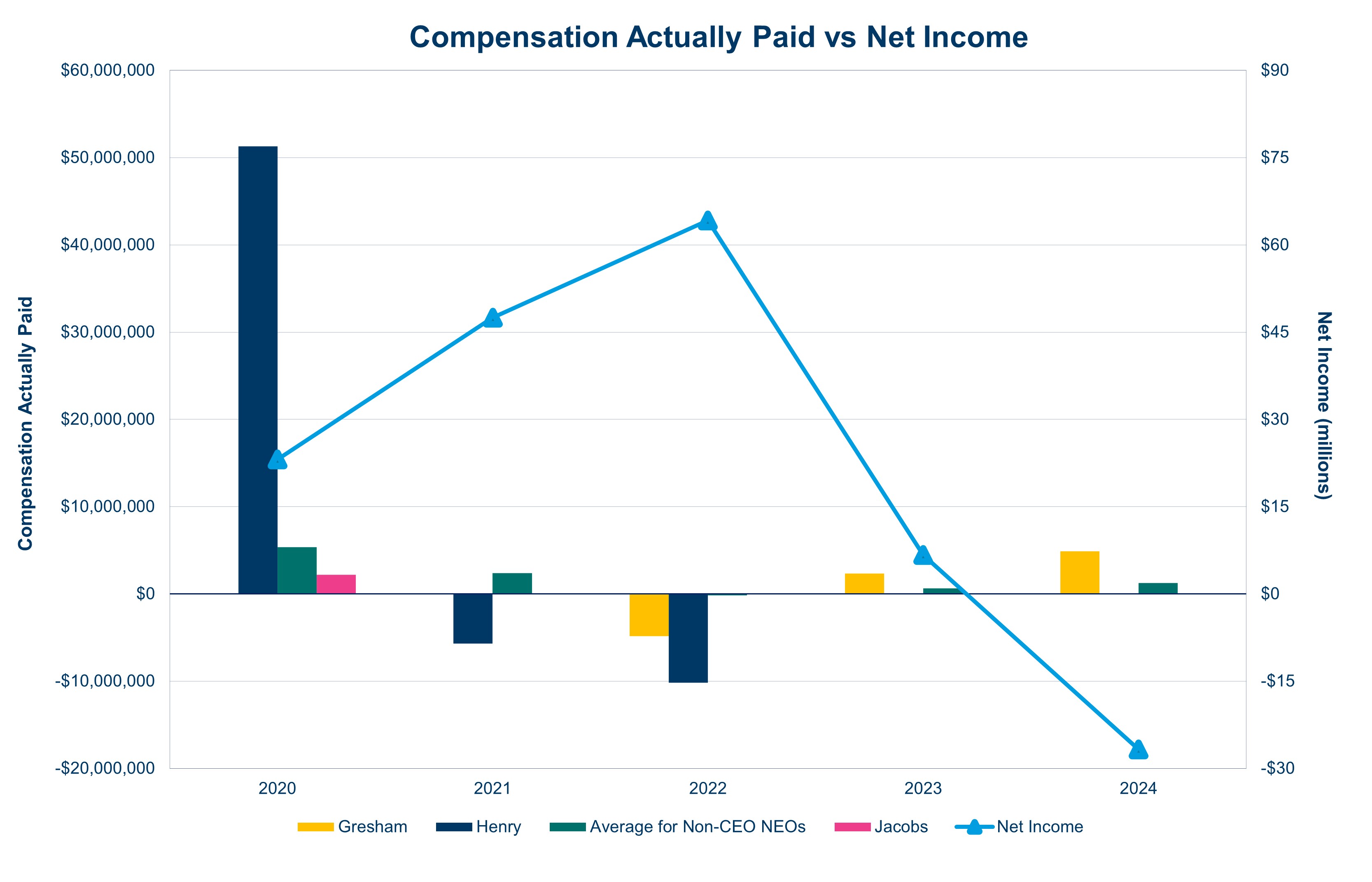

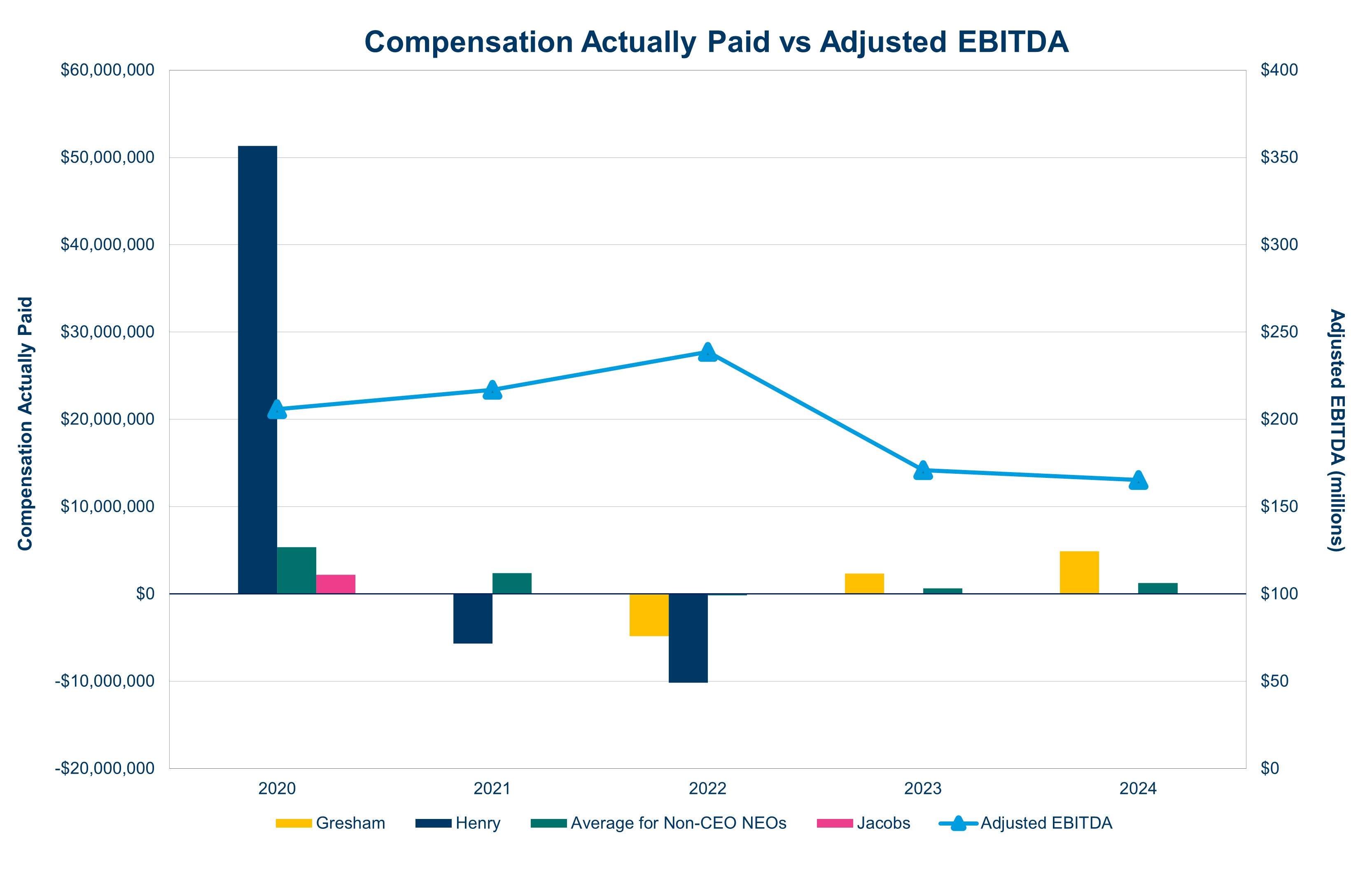

With the goal of developing an experienced and highly-qualified Board, the Nominating and Corporate Governance Committee is responsible for developing and recommending to the Board the desired qualifications, expertise and characteristics of members of our Board, including the specific minimum qualifications that the committee believes must be met by a committee-recommended nominee for membership on the Board and any specific qualities or skills that the committee believes are necessary for one or more of the members of the Board to possess.