Niagen Bioscience, Inc. Earnings Presentation Third Quarter 2025 Nasdaq: NAGE | November 4, 2025

SAFE HARBOR STATEMENT 2 This presentation and other written or oral statements made from time to time by representatives of Niagen Bioscience contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements reflect the current view about future events. Statements that are not historical in nature, such as 2025 financial outlook, and which may be identified by the use of words like “expects,” “anticipates,” “intends,” “estimates,” “plans,” “potential,” “possible,” “probable,” “believes,” “seeks,” “may,” “will,” “should,” “could,” “predicts,” “projects,” “continue,” “would” or the negative of these terms and other words of similar meaning, are forward-looking statements. Such statements include, but are not limited to, statements contained in this presentation relating to our expected sales, cash flows, planned investments, and financial performance, business, business strategy, expansion, growth, key drivers (including cost savings and increased investments), products and services we offer and their impact on our performance or products and services we may offer in the future and the timing of their development, sales and marketing strategy and capital outlook. Forward-looking statements are based on management’s current expectations and assumptions regarding our business, the economy and other future conditions and are subject to inherent risks, uncertainties and changes of circumstances that are difficult to predict and may cause actual results to differ materially from those contemplated or expressed. We caution you therefore against relying on any of these forward- looking statements. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the Securities Exchange Commission (the “Commission”), and in subsequent filings with the Commission. Any forward-looking statements are qualified in their entirety by reference to the factors discussed in these filings with the Commission. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned. Important factors that could cause actual results to differ materially from those in the forward looking statements include but are not limited to: our relationships with major customers; our ability to maintain or develop our sales, marketing, and distribution capabilities; a decline in general economic conditions nationally and internationally; the market and size of the vitamin mineral and dietary supplement market and the intravenous market; decreased demand for our products and services; market acceptance of our products; the ability to protect our intellectual property rights; impact of any litigation or infringement actions brought against us; competition from other providers and products; risks in product development; our ability to develop pharmaceutical business; our reliance on a limited number of third-party party suppliers for certain raw materials; inability to raise capital to fund continuing operations or new product development; changes in government regulation or regulatory priorities of government officials; the ability to complete customer transactions and capital raising transactions; inflationary conditions and adverse economic conditions; our history of operating losses and need to obtain additional financing; the growth and profitability of our product sales; our ability to maintain and grow sales, marketing and distribution capabilities; changing consumer perceptions of our products; our reliance on a single or limited number of third-party suppliers; risks of conducting business in China; including unanticipated developments in and risks related to the Company’s ability to secure adequate quantities of pharmaceutical-grade Niagen in a timely manner; the Company’s ability to obtain appropriate contracts and arrangements with U.S. FDA-registered 503B outsourcing facilities required to compound and distribute pharmaceutical-grade Niagen to clinics; the Company’s ability to remain on the U.S. FDA Bulk Drug Substances Nominated for Use in Compounding Under Section 503B of the Federal Food, Drug, and Cosmetic Act Category 1 list; the Company’s ability to maintain and enforce the Company’s existing intellectual property and obtain new patents; whether the potential benefits of NRC can be further supported; further research and development and the results of clinical trials possibly being unsuccessful or insufficient to meet applicable regulatory standards or warrant continued development; the ability to enroll sufficient numbers of subjects in clinical trials; determinations made by the FDA and other governmental authorities, including with respect to products seeking to compete in our market; and the risks and uncertainties associated with our business and financial condition in general. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. About Non-GAAP Financial Measures Niagen Bioscience’s non-GAAP financial measure, Adjusted EBITDA, is defined as net income before interest, provision for income taxes, depreciation, amortization, non- cash share-based compensation costs, severance and restructuring expense and other infrequent items, including the reversal of previously accrued royalties and license maintenance fees, and the recovery of previously recognized credit losses from a legal settlement. Niagen Bioscience used this non-GAAP measures when evaluating its financial results as well as for internal resource management, planning and forecasting purposes. This non-GAAP measure should not be viewed in isolation from or as a substitute for Niagen Bioscience’s financial results in accordance with GAAP. Reconciliation of this non-GAAP measure to the most directly comparable GAAP measure is attached to this presentation. FDA Disclaimer Statements made in this presentation have not been evaluated by the Food and Drug Administration. Niagen Bioscience products are not intended to diagnose, treat, cure, or prevent any disease. The statements in this presentation are for investor relations and educational purposes only and not intended for consumers or vendors.

• Total company and Tru Niagen® net sales: $34.0 million and $26.0 million, up 33%, and 44% YoY, respectively. • Gross margin: 64.5%, up 100bps YoY. • Sales and marketing expense as a percentage of net sales: 25.8%, an improvement of 170 basis points YoY. • Net income: $4.6 million or $0.06 earnings per share, up $2.7 million and $0.04 YoY. • Adjusted EBITDA(1): $6.4 million, up $3.5 million YoY. • Cash provided from operations: $12.8 million year-to-date, ending with $64.3 million in cash and no debt. • In September, the Company launched AboutNAD®, a digital platform to serve as the leading online resource for scientific advancements in NAD+ research and healthy aging. The site provides consumers, clinicians, and researchers access to synthesized content and peer-reviewed literature on emerging science. • In October, Niagen Bioscience expanded distribution of pharmaceutical-grade Niagen Plus™ IV and injectable therapies to over 1,000 clinics nationwide, including more than 50 iCRYO locations, further scaling its clinical-grade NAD+ delivery network and access to healthcare providers. • Reaffirmed increased full year 2025 outlook: ◦ Net sales growth between 25%-30% (previously 22%-27%) driven by strong momentum in Tru Niagen® and Niagen® ingredients. ◦ Updated general and administrative and research and development expense outlook. Q3 2025 & Recent Highlights (1) See slide 11 for the non-GAAP reconciliation Achieved another quarter of strong revenue and earnings growth, driven by continued operational execution, market leadership in NAD+, and effective cost discipline. 3

Leadership Team Rob Fried Chief Executive Officer E-commerce & entertainment industry executive Savoy Pictures, Columbia Pictures, Fried Films, FeeIn, WHN, Healthspan Research Andrew Shao SVP, Global Regulatory & Scientific Affairs Over two decades of global nutrition industry experience at Amway, Herbalife Nutrition, and the Council for Responsible Nutrition Ozan Pamir Chief Financial Officer Over a decade of capital markets and public company experience in the life sciences industry CFA Charterholder Carlos Lopez SVP, General Counsel Over a decade of experience in the dietary supplements industry. Previously served as VP, General Counsel at The Vitamin Shoppe and board member of The Natural Products Association Michiko Kelley Chief Marketing Officer Over two decades of experience in marketing strategy, marketing operation, product management, and leadership at Dexcom and Sony Electronics 4

The information contained in this documents is confidential, privileged and only for the information of the intended recipient and may not be used, published or redistributed without the prior written consent (2019) Financial Highlights

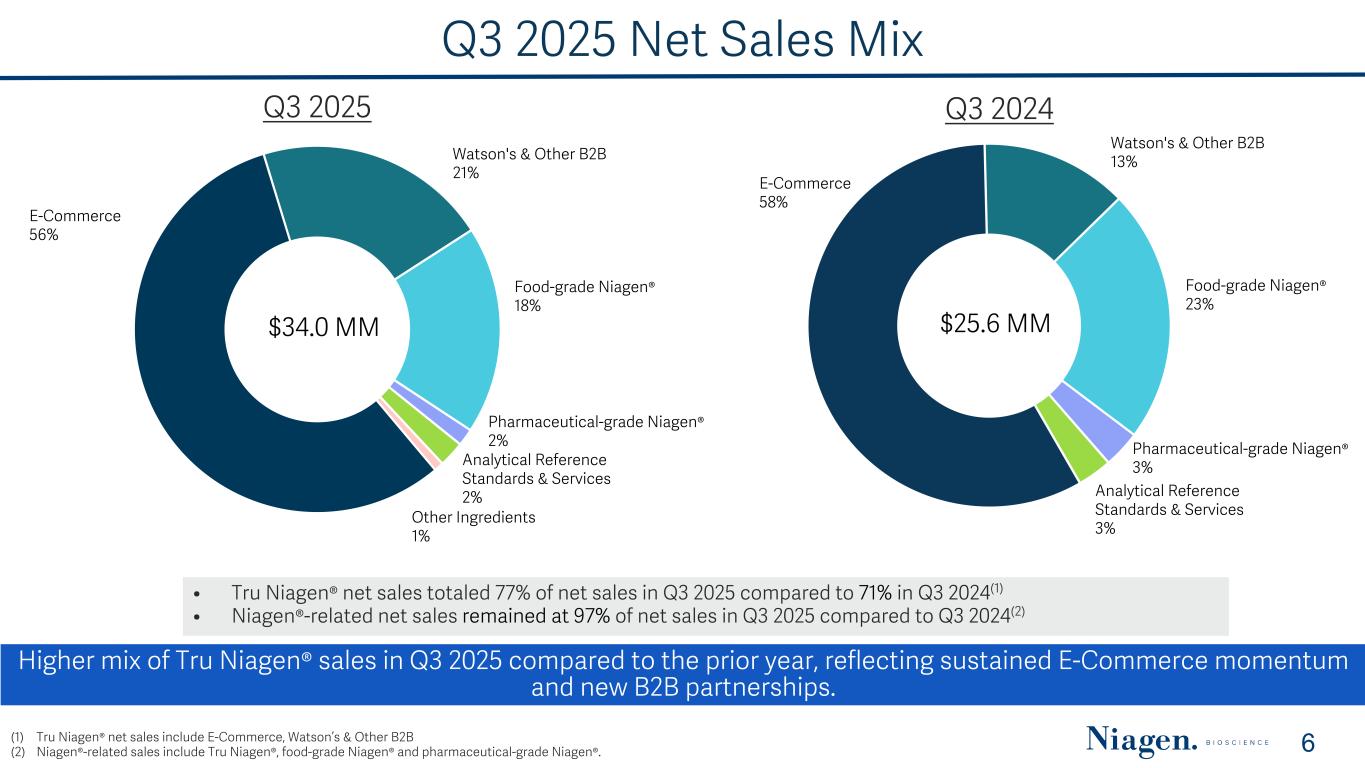

Q3 2025 Net Sales Mix E-Commerce 58% Watson's & Other B2B 13% Food-grade Niagen® 23% Pharmaceutical-grade Niagen® 3% Analytical Reference Standards & Services 3% Q3 2024 $25.6 MM E-Commerce 56% Watson's & Other B2B 21% Food-grade Niagen® 18% Pharmaceutical-grade Niagen® 2% Analytical Reference Standards & Services 2% Other Ingredients 1% $34.0 MM Q3 2025 • Tru Niagen® net sales totaled 77% of net sales in Q3 2025 compared to 71% in Q3 2024(1) • Niagen®-related net sales remained at 97% of net sales in Q3 2025 compared to Q3 2024(2) Higher mix of Tru Niagen® sales in Q3 2025 compared to the prior year, reflecting sustained E-Commerce momentum and new B2B partnerships. (1) Tru Niagen® net sales include E-Commerce, Watson’s & Other B2B (2) Niagen®-related sales include Tru Niagen®, food-grade Niagen® and pharmaceutical-grade Niagen®. 6

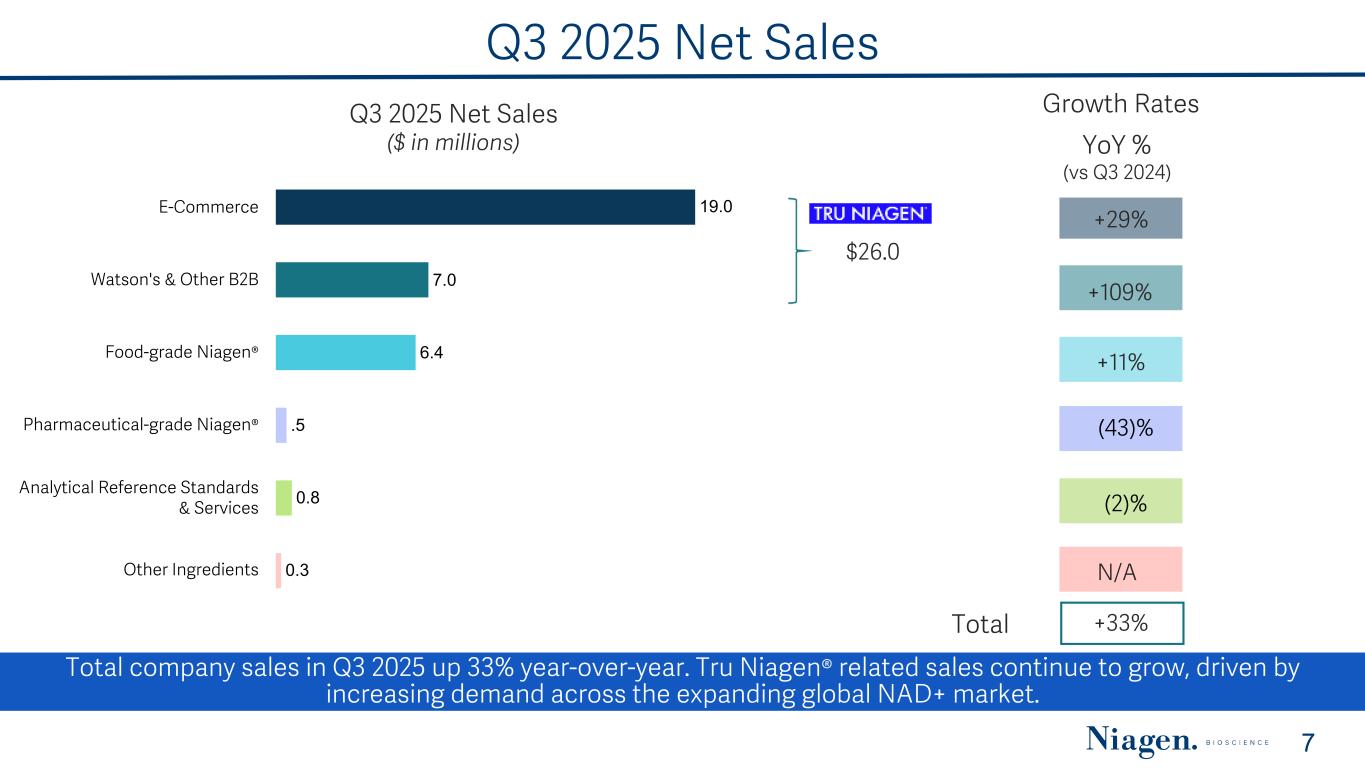

Q3 2025 Net Sales Q3 2025 Net Sales ($ in millions) 19.0 7.0 6.4 .5 0.8 0.3 E-Commerce Watson's & Other B2B Food-grade Niagen® Pharmaceutical-grade Niagen® Analytical Reference Standards & Services Other Ingredients $26.0 YoY % (vs Q3 2024) +29% +109% +11% (2)% +33%Total Growth Rates Total company sales in Q3 2025 up 33% year-over-year. Tru Niagen® related sales continue to grow, driven by increasing demand across the expanding global NAD+ market. 7 N/A (43)%

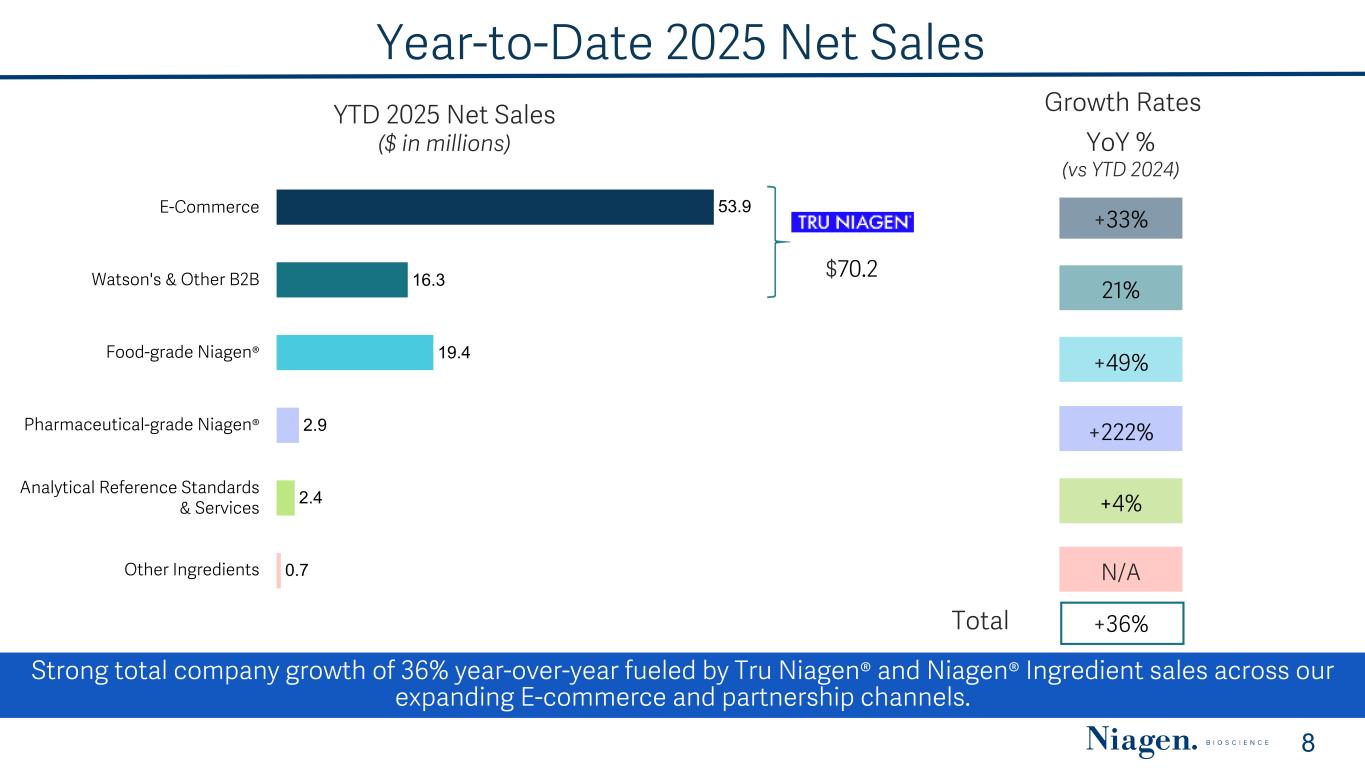

Year-to-Date 2025 Net Sales YTD 2025 Net Sales ($ in millions) Total YoY % (vs YTD 2024) $70.2 53.9 16.3 19.4 2.9 2.4 0.7 E-Commerce Watson's & Other B2B Food-grade Niagen® Pharmaceutical-grade Niagen® Analytical Reference Standards & Services Other Ingredients Growth Rates 8 +33% 21% +49% +4% +36% N/A Strong total company growth of 36% year-over-year fueled by Tru Niagen® and Niagen® Ingredient sales across our expanding E-commerce and partnership channels. +222%

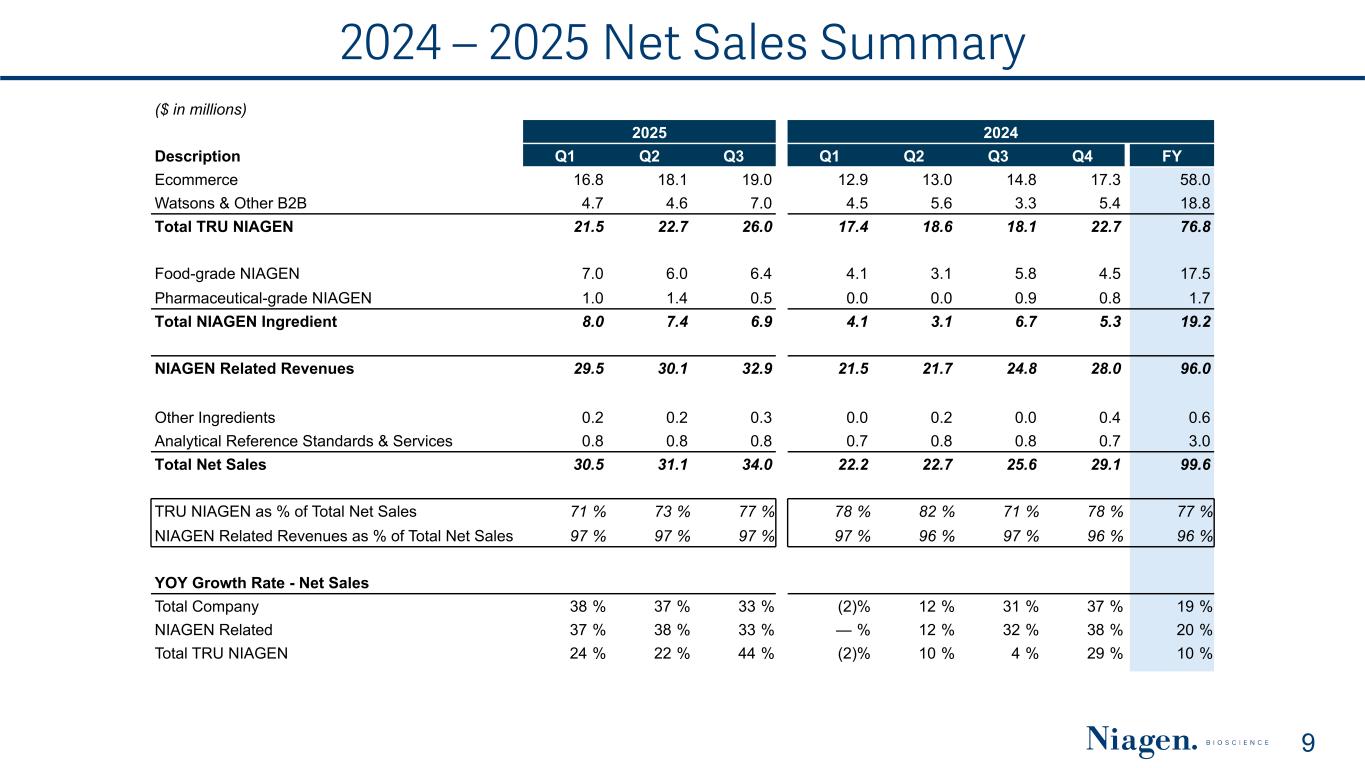

2024 – 2025 Net Sales Summary 9 ($ in millions) 2025 2024 Description Q1 Q2 Q3 Q1 Q2 Q3 Q4 FY Ecommerce 16.8 18.1 19.0 12.9 13.0 14.8 17.3 58.0 Watsons & Other B2B 4.7 4.6 7.0 4.5 5.6 3.3 5.4 18.8 Total TRU NIAGEN 21.5 22.7 26.0 17.4 18.6 18.1 22.7 76.8 Food-grade NIAGEN 7.0 6.0 6.4 4.1 3.1 5.8 4.5 17.5 Pharmaceutical-grade NIAGEN 1.0 1.4 0.5 0.0 0.0 0.9 0.8 1.7 Total NIAGEN Ingredient 8.0 7.4 6.9 4.1 3.1 6.7 5.3 19.2 NIAGEN Related Revenues 29.5 30.1 32.9 21.5 21.7 24.8 28.0 96.0 Other Ingredients 0.2 0.2 0.3 0.0 0.2 0.0 0.4 0.6 Analytical Reference Standards & Services 0.8 0.8 0.8 0.7 0.8 0.8 0.7 3.0 Total Net Sales 30.5 31.1 34.0 22.2 22.7 25.6 29.1 99.6 TRU NIAGEN as % of Total Net Sales 71 % 73 % 77 % 78 % 82 % 71 % 78 % 77 % NIAGEN Related Revenues as % of Total Net Sales 97 % 97 % 97 % 97 % 96 % 97 % 96 % 96 % YOY Growth Rate - Net Sales Total Company 38 % 37 % 33 % (2) % 12 % 31 % 37 % 19 % NIAGEN Related 37 % 38 % 33 % — % 12 % 32 % 38 % 20 % Total TRU NIAGEN 24 % 22 % 44 % (2) % 10 % 4 % 29 % 10 %

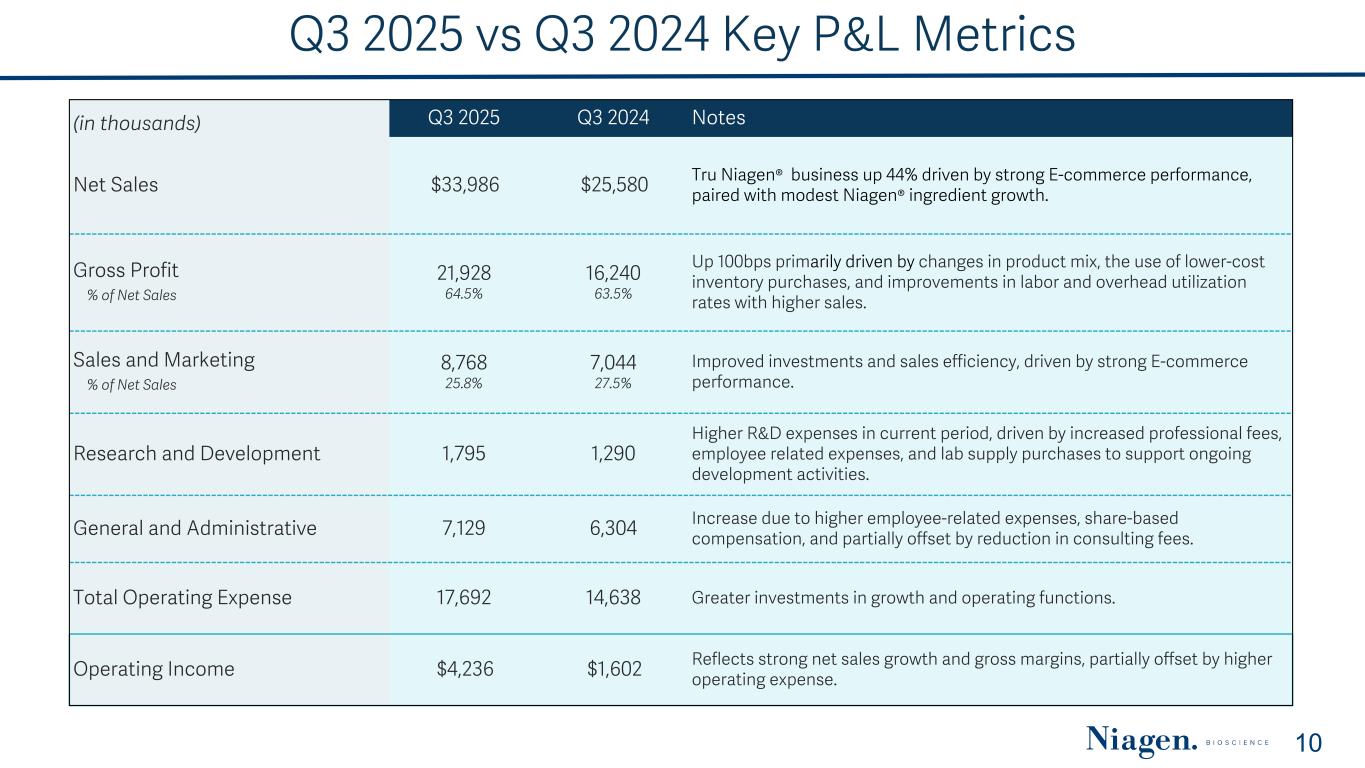

Q3 2025 vs Q3 2024 Key P&L Metrics (in thousands) Q3 2025 Q3 2024 Notes Net Sales $33,986 $25,580 Tru Niagen® business up 44% driven by strong E-commerce performance, paired with modest Niagen® ingredient growth. Gross Profit % of Net Sales 21,928 64.5% 16,240 63.5% Up 100bps primarily driven by changes in product mix, the use of lower-cost inventory purchases, and improvements in labor and overhead utilization rates with higher sales. Sales and Marketing % of Net Sales 8,768 25.8% 7,044 27.5% Improved investments and sales efficiency, driven by strong E-commerce performance. Research and Development 1,795 1,290 Higher R&D expenses in current period, driven by increased professional fees, employee related expenses, and lab supply purchases to support ongoing development activities. General and Administrative 7,129 6,304 Increase due to higher employee-related expenses, share-based compensation, and partially offset by reduction in consulting fees. Total Operating Expense 17,692 14,638 Greater investments in growth and operating functions. Operating Income $4,236 $1,602 Reflects strong net sales growth and gross margins, partially offset by higher operating expense. 10

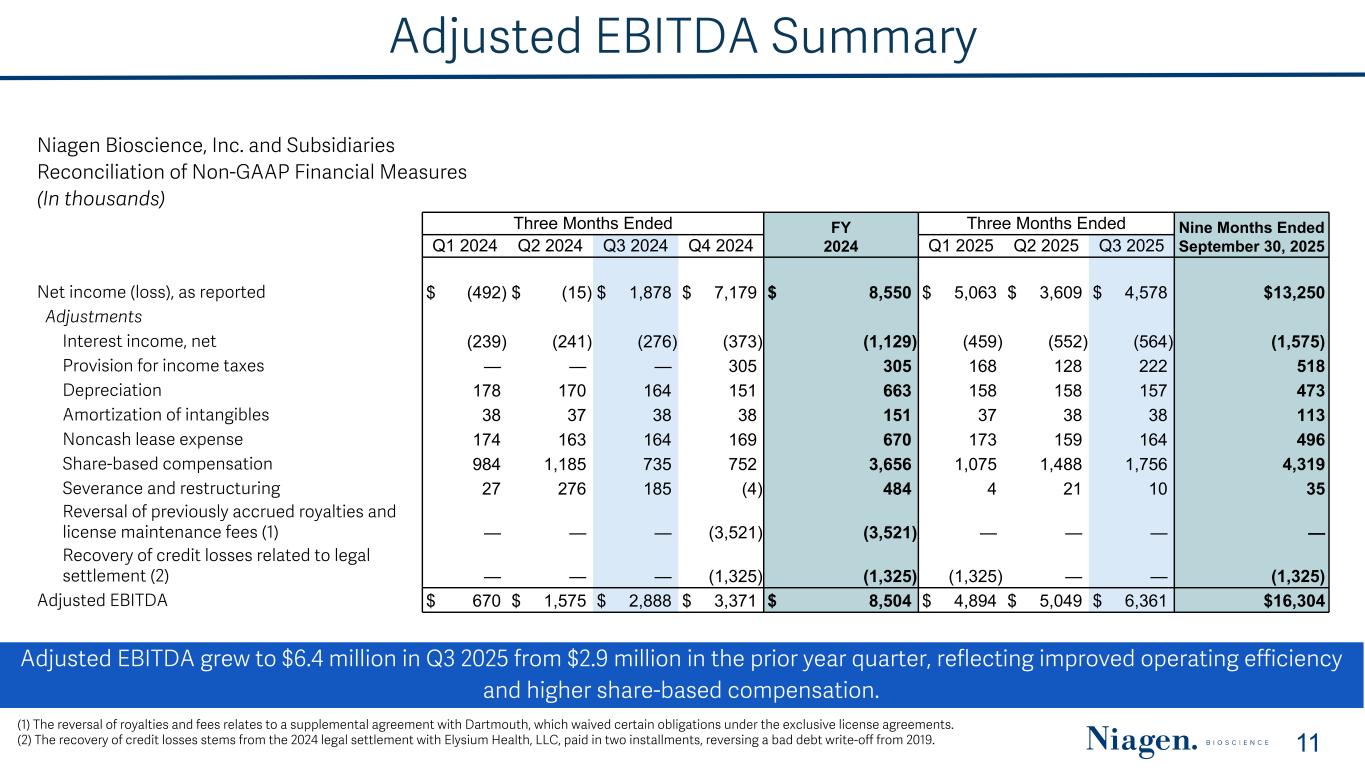

Adjusted EBITDA Summary Adjusted EBITDA grew to $6.4 million in Q3 2025 from $2.9 million in the prior year quarter, reflecting improved operating efficiency and higher share-based compensation. 11 (1) The reversal of royalties and fees relates to a supplemental agreement with Dartmouth, which waived certain obligations under the exclusive license agreements. (2) The recovery of credit losses stems from the 2024 legal settlement with Elysium Health, LLC, paid in two installments, reversing a bad debt write-off from 2019. Niagen Bioscience, Inc. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (In thousands) Three Months Ended FY 2024 Three Months Ended Nine Months Ended September 30, 2025Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Net income (loss), as reported $ (492) $ (15) $ 1,878 $ 7,179 $ 8,550 $ 5,063 $ 3,609 $ 4,578 $13,250 Adjustments Interest income, net (239) (241) (276) (373) (1,129) (459) (552) (564) (1,575) Provision for income taxes — — — 305 305 168 128 222 518 Depreciation 178 170 164 151 663 158 158 157 473 Amortization of intangibles 38 37 38 38 151 37 38 38 113 Noncash lease expense 174 163 164 169 670 173 159 164 496 Share-based compensation 984 1,185 735 752 3,656 1,075 1,488 1,756 4,319 Severance and restructuring 27 276 185 (4) 484 4 21 10 35 Reversal of previously accrued royalties and license maintenance fees (1) — — — (3,521) (3,521) — — — — Recovery of credit losses related to legal settlement (2) — — — (1,325) (1,325) (1,325) — — (1,325) Adjusted EBITDA $ 670 $ 1,575 $ 2,888 $ 3,371 $ 8,504 $ 4,894 $ 5,049 $ 6,361 $16,304

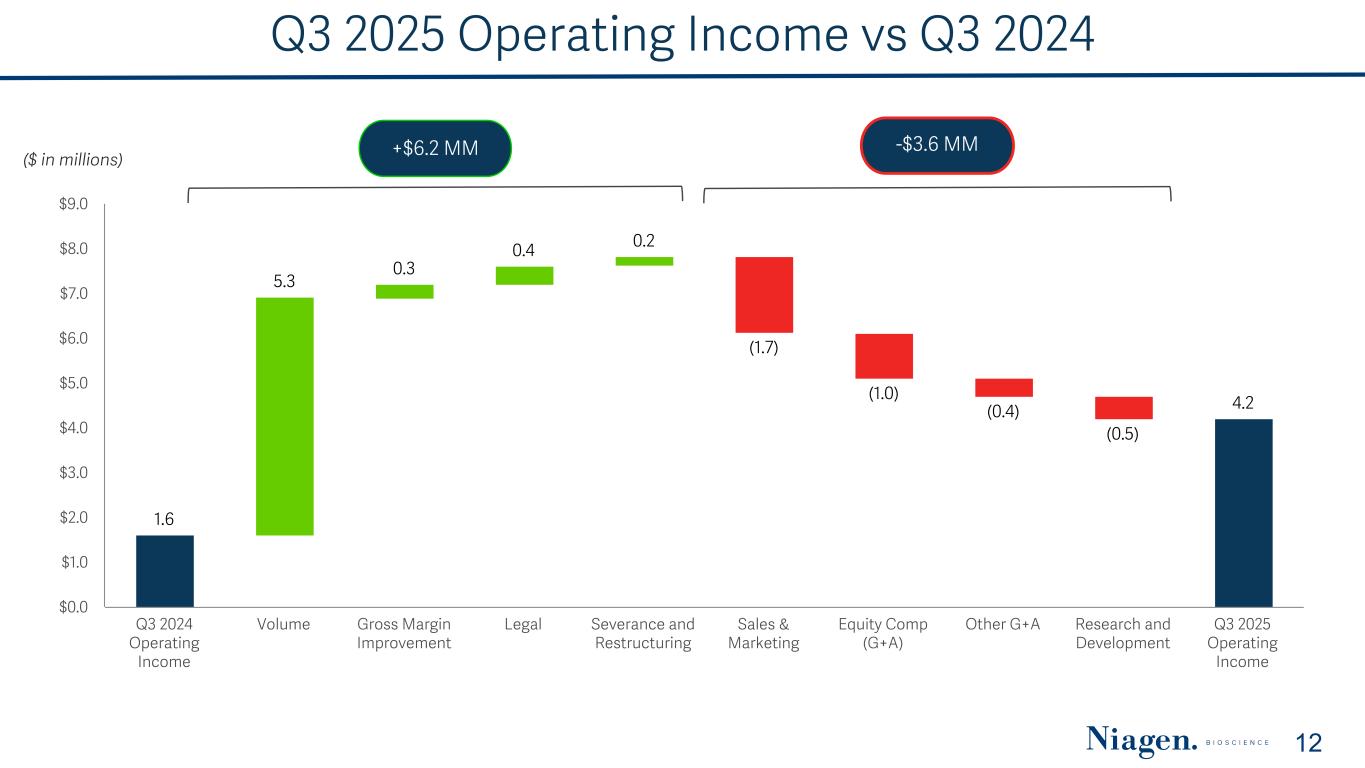

Q3 2025 Operating Income vs Q3 2024 ($ in millions) +$6.2 MM 1.6 5.3 0.3 0.4 0.2 (1.7) (1.0) (0.4) (0.5) 4.2 Q3 2024 Operating Income Volume Gross Margin Improvement Legal Severance and Restructuring Sales & Marketing Equity Comp (G+A) Other G+A Research and Development Q3 2025 Operating Income $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 12 -$3.6 MM

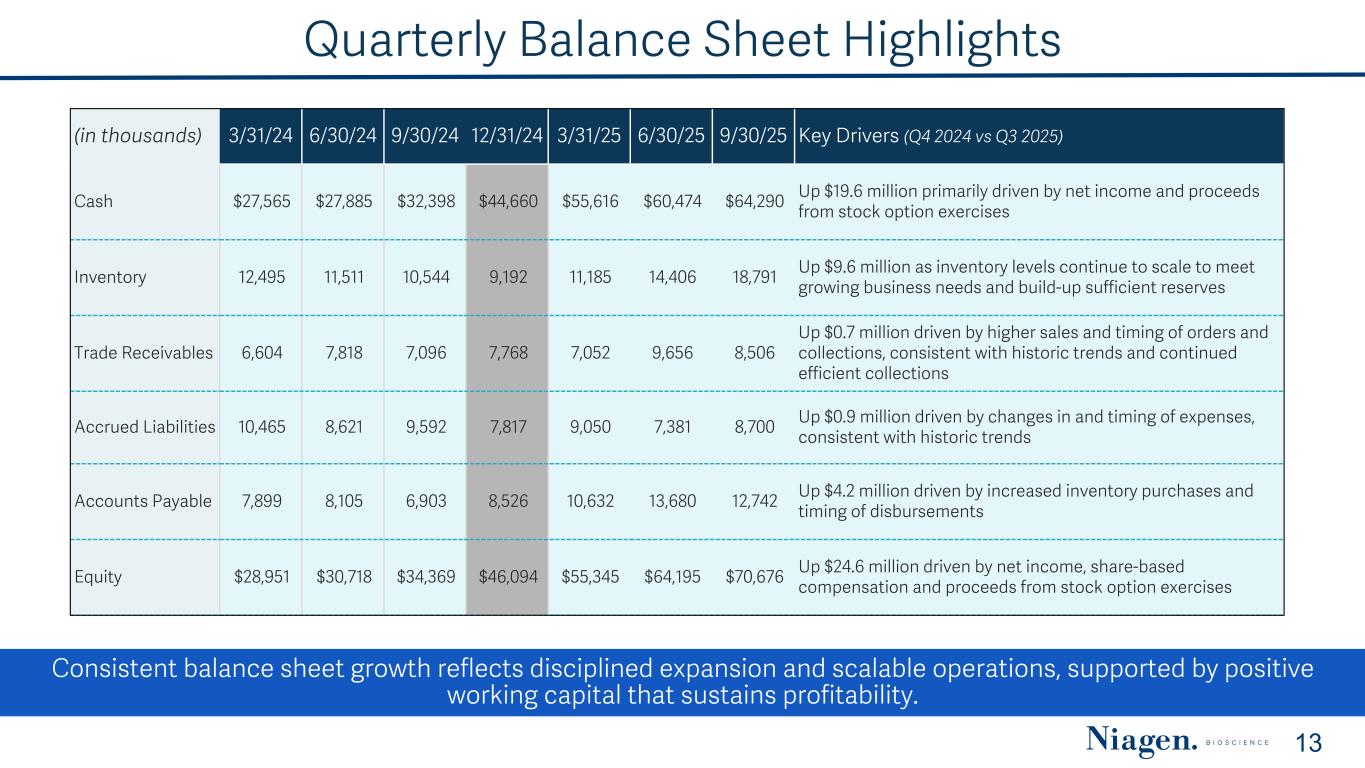

Quarterly Balance Sheet Highlights (in thousands) 3/31/24 6/30/24 9/30/24 12/31/24 3/31/25 6/30/25 9/30/25 Key Drivers (Q4 2024 vs Q3 2025) Cash $27,565 $27,885 $32,398 $44,660 $55,616 $60,474 $64,290 Up $19.6 million primarily driven by net income and proceeds from stock option exercises Inventory 12,495 11,511 10,544 9,192 11,185 14,406 18,791 Up $9.6 million as inventory levels continue to scale to meet growing business needs and build-up sufficient reserves Trade Receivables 6,604 7,818 7,096 7,768 7,052 9,656 8,506 Up $0.7 million driven by higher sales and timing of orders and collections, consistent with historic trends and continued efficient collections Accrued Liabilities 10,465 8,621 9,592 7,817 9,050 7,381 8,700 Up $0.9 million driven by changes in and timing of expenses, consistent with historic trends Accounts Payable 7,899 8,105 6,903 8,526 10,632 13,680 12,742 Up $4.2 million driven by increased inventory purchases and timing of disbursements Equity $28,951 $30,718 $34,369 $46,094 $55,345 $64,195 $70,676 Up $24.6 million driven by net income, share-based compensation and proceeds from stock option exercises Consistent balance sheet growth reflects disciplined expansion and scalable operations, supported by positive working capital that sustains profitability. 13

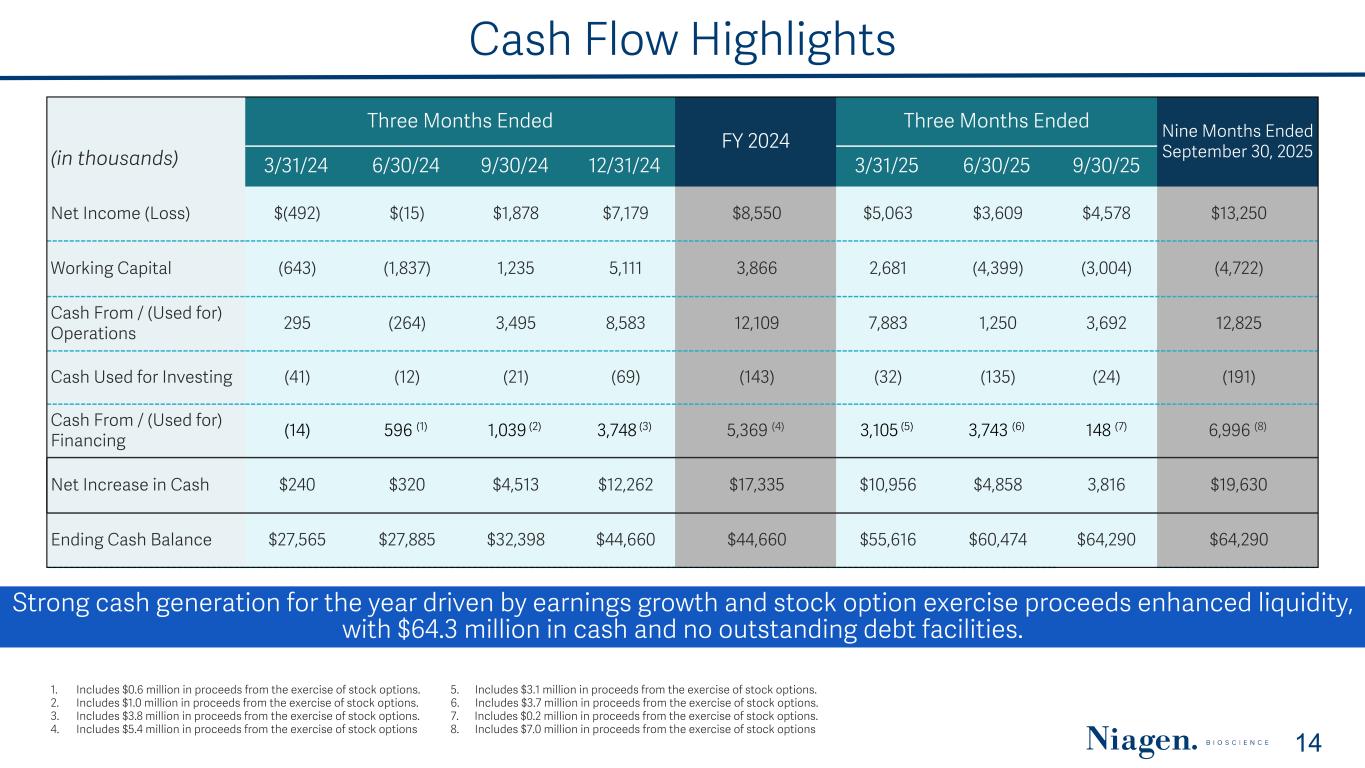

Cash Flow Highlights Three Months Ended FY 2024 Three Months Ended Nine Months Ended September 30, 2025(in thousands) 3/31/24 6/30/24 9/30/24 12/31/24 3/31/25 6/30/25 9/30/25 Net Income (Loss) $(492) $(15) $1,878 $7,179 $8,550 $5,063 $3,609 $4,578 $13,250 Working Capital (643) (1,837) 1,235 5,111 3,866 2,681 (4,399) (3,004) (4,722) Cash From / (Used for) Operations 295 (264) 3,495 8,583 12,109 7,883 1,250 3,692 12,825 Cash Used for Investing (41) (12) (21) (69) (143) (32) (135) (24) (191) Cash From / (Used for) Financing (14) 596 (1) 1,039 (2) 3,748 (3) 5,369 (4) 3,105 (5) 3,743 (6) 148 (7) 6,996 (8) Net Increase in Cash $240 $320 $4,513 $12,262 $17,335 $10,956 $4,858 3,816 $19,630 Ending Cash Balance $27,565 $27,885 $32,398 $44,660 $44,660 $55,616 $60,474 $64,290 $64,290 Strong cash generation for the year driven by earnings growth and stock option exercise proceeds enhanced liquidity, with $64.3 million in cash and no outstanding debt facilities. 14 1. Includes $0.6 million in proceeds from the exercise of stock options. 2. Includes $1.0 million in proceeds from the exercise of stock options. 3. Includes $3.8 million in proceeds from the exercise of stock options. 4. Includes $5.4 million in proceeds from the exercise of stock options 5. Includes $3.1 million in proceeds from the exercise of stock options. 6. Includes $3.7 million in proceeds from the exercise of stock options. 7. Includes $0.2 million in proceeds from the exercise of stock options. 8. Includes $7.0 million in proceeds from the exercise of stock options

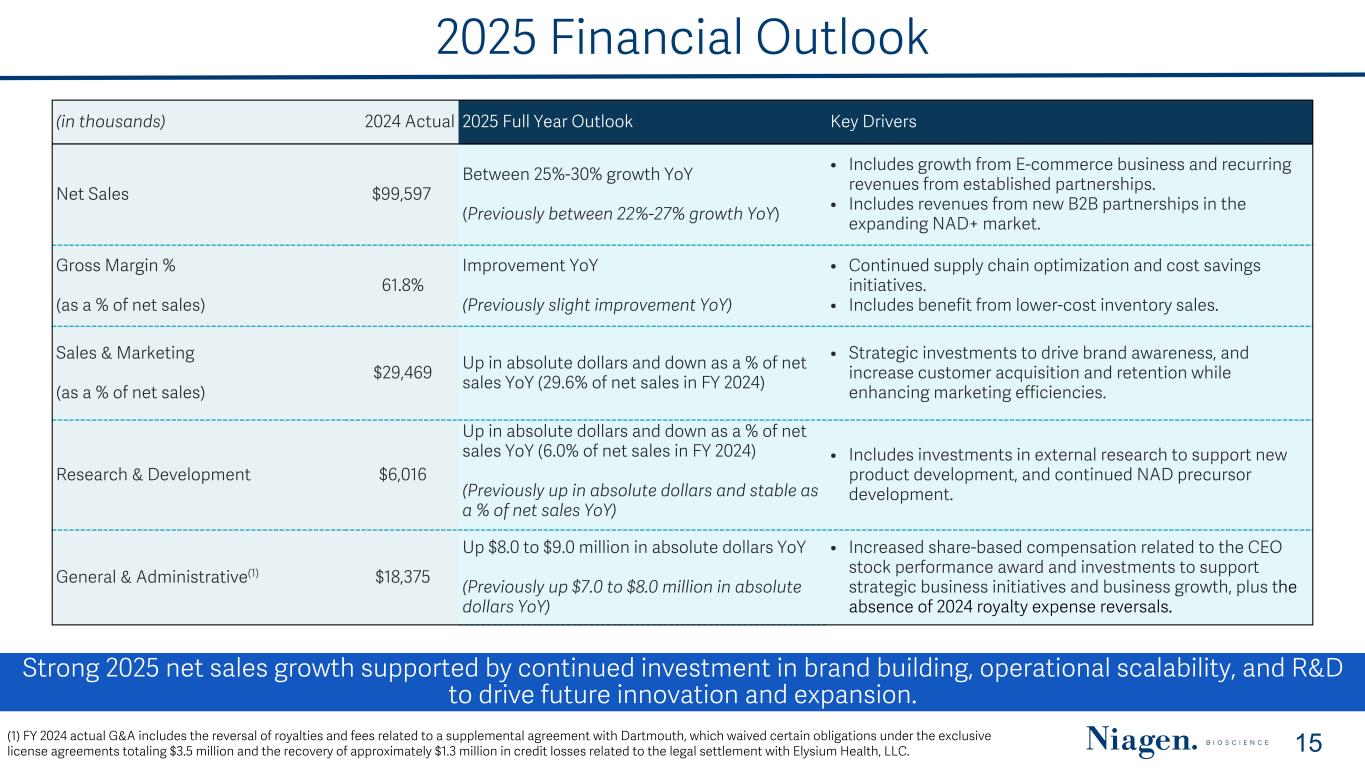

2025 Financial Outlook Strong 2025 net sales growth supported by continued investment in brand building, operational scalability, and R&D to drive future innovation and expansion. 15(1) FY 2024 actual G&A includes the reversal of royalties and fees related to a supplemental agreement with Dartmouth, which waived certain obligations under the exclusive license agreements totaling $3.5 million and the recovery of approximately $1.3 million in credit losses related to the legal settlement with Elysium Health, LLC. (in thousands) 2024 Actual 2025 Full Year Outlook Key Drivers Net Sales $99,597 Between 25%-30% growth YoY (Previously between 22%-27% growth YoY) • Includes growth from E-commerce business and recurring revenues from established partnerships. • Includes revenues from new B2B partnerships in the expanding NAD+ market. Gross Margin % (as a % of net sales) 61.8% Improvement YoY (Previously slight improvement YoY) • Continued supply chain optimization and cost savings initiatives. • Includes benefit from lower-cost inventory sales. Sales & Marketing (as a % of net sales) $29,469 Up in absolute dollars and down as a % of net sales YoY (29.6% of net sales in FY 2024) • Strategic investments to drive brand awareness, and increase customer acquisition and retention while enhancing marketing efficiencies. Research & Development $6,016 Up in absolute dollars and down as a % of net sales YoY (6.0% of net sales in FY 2024) (Previously up in absolute dollars and stable as a % of net sales YoY) • Includes investments in external research to support new product development, and continued NAD precursor development. General & Administrative(1) $18,375 Up $8.0 to $9.0 million in absolute dollars YoY (Previously up $7.0 to $8.0 million in absolute dollars YoY) • Increased share-based compensation related to the CEO stock performance award and investments to support strategic business initiatives and business growth, plus the absence of 2024 royalty expense reversals.

The information contained in this documents is confidential, privileged and only for the information of the intended recipient and may not be used, published or redistributed without the prior written consent (2019) 16 The Science

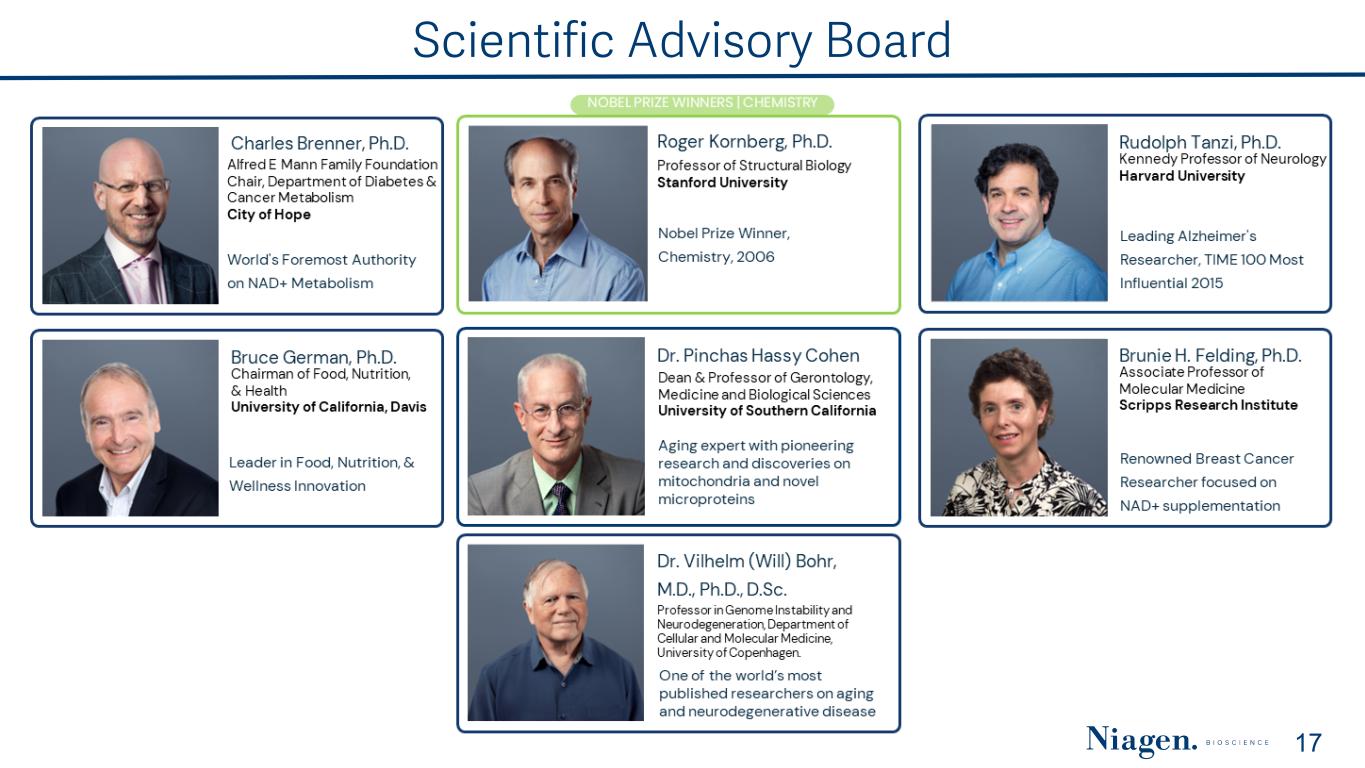

Scientific Advisory Board 17

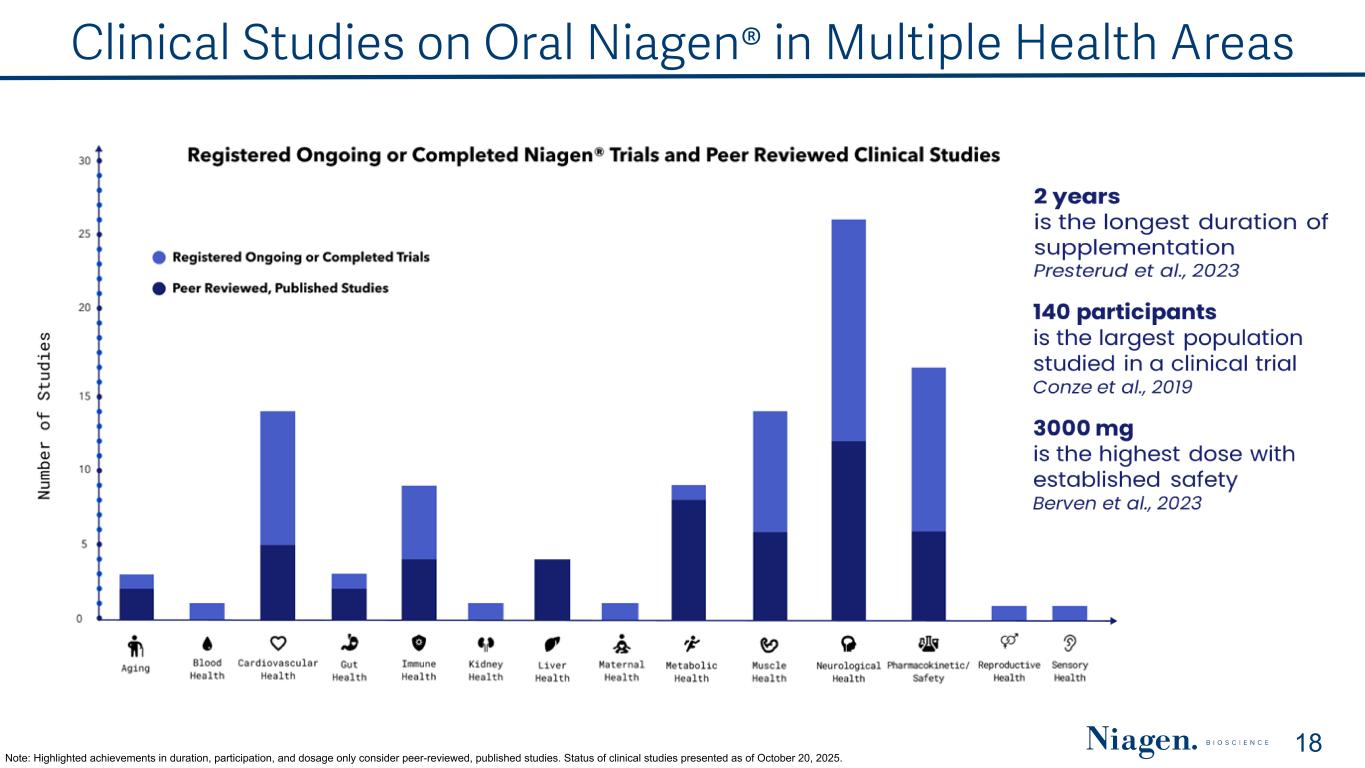

Clinical Studies on Oral Niagen® in Multiple Health Areas Note: Highlighted achievements in duration, participation, and dosage only consider peer-reviewed, published studies. Status of clinical studies presented as of October 20, 2025. 18

The information contained in this documents is confidential, privileged and only for the information of the intended recipient and may not be used, published or redistributed without the prior written consent (2019) Contact Info: Niagen Bioscience Investor Relations: ICR, LLC Reed Anderson T: +1 (626) 277-1260 Stephanie Carrington T: +1 (626) 277-1282 NiagenIR@ICRInc.com www.niagenbioscience.com Where to purchase Tru Niagen® TruNiagen.com Find Health Clinics Offering Niagen® Plus NiagenPlus.com 19