ChromaDex Earnings Conference Call Fourth Quarter 2024 Nasdaq: CDXC | March 4, 2025

2 SAFE HARBOR STATEMENT This presentation and other written or oral statements made from time to time by representatives of ChromaDex contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements reflect the current view about future events. Statements that are not historical in nature, such as 2025 financial outlook, and which may be identified by the use of words like “expects,” “anticipates,” “intends,” “estimates,” “plans,” “potential,” “possible,” “probable,” “believes,” “seeks,” “may,” “will,” “should,” “could,” “predicts,” “projects,” “continue,” “would” or the negative of these terms and other words of similar meaning, are forward-looking statements. Such statements include, but are not limited to, statements contained in this presentation relating to our expected sales, cash flows, planned investments, and financial performance, business, business strategy, expansion, growth, key drivers (including cost savings and increased investments), products and services we offer and their impact on our performance or products and services we may offer in the future and the timing of their development, sales and marketing strategy and capital outlook. Forward-looking statements are based on management’s current expectations and assumptions regarding our business, the economy and other future conditions and are subject to inherent risks, uncertainties and changes of circumstances that are difficult to predict and may cause actual results to differ materially from those contemplated or expressed. We caution you therefore against relying on any of these forward-looking statements. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2024, filed with the Securities Exchange Commission (the “Commission”), and in subsequent filings with the Commission. Any forward-looking statements are qualified in their entirety by reference to the factors discussed in these filings with the Commission. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned. Important factors that could cause actual results to differ materially from those in the forward looking statements include but are not limited to: inflationary conditions and adverse economic conditions; our history of operating losses and need to obtain additional financing; the growth and profitability of our product sales; our ability to maintain and grow sales, marketing and distribution capabilities; changing consumer perceptions of our products; our reliance on a single or limited number of third-party suppliers; risks of conducting business in China; including unanticipated developments in and risks related to the Company’s ability to secure adequate quantities of pharmaceutical-grade Niagen in a timely manner; the Company’s ability to obtain appropriate contracts and arrangements with U.S. FDA-registered 503B outsourcing facilities required to compound and distribute pharmaceutical-grade Niagen to clinics; the Company’s ability to remain on the U.S. FDA Bulk Drug Substances Nominated for Use in Compounding Under Section 503B of the Federal Food, Drug, and Cosmetic Act Category 1 list; the Company’s ability to maintain and enforce the Company’s existing intellectual property and obtain new patents; whether the potential benefits of NRC can be further supported; further research and development and the results of clinical trials possibly being unsuccessful or insufficient to meet applicable regulatory standards or warrant continued development; the ability to enroll sufficient numbers of subjects in clinical trials; determinations made by the FDA and other governmental authorities; and the risks and uncertainties associated with our business and financial condition in general. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. About Non-GAAP Financial Measures ChromaDex’s non-GAAP financial measure, Adjusted EBITDA, is defined as net income before interest, provision for income taxes, depreciation, amortization, non-cash share-based compensation costs, severance and restructuring expense and other infrequent items, including the reversal of previously accrued royalties and license maintenance fees, and the recovery of previously recognized credit losses from a legal settlement. ChromaDex used this non-GAAP measures when evaluating its financial results as well as for internal resource management, planning and forecasting purposes. This non-GAAP measure should not be viewed in isolation from or as a substitute for ChromaDex’s financial results in accordance with GAAP. Reconciliation of this non-GAAP measure to the most directly comparable GAAP measure is attached to this presentation. FDA Disclaimer Statements made in this presentation have not been evaluated by the Food and Drug Administration. ChromaDex products are not intended to diagnose, treat, cure, or prevent any disease. The statements in this presentation are for investor relations and educational purposes only and not intended for consumers or vendors. SAFE HARBOR STATEMENT

3 Q4 2024 & Recent Highlights (1) See slide 11 for the non-GAAP reconciliation Delivered record-breaking financial performance in 2024 through strategic initiatives while strengthening our foundation for sustained growth, positioning us for continued success in 2025 and beyond. Fourth Quarter 2024 • Total company and Tru Niagen® net sales: $29.1 million and $22.7 million, up 37% and 29% YoY, respectively. • Total Niagen® ingredient sales: $5.3 million, up 96% YoY. • Gross margin: 62.5%, up 150 basis points YoY. • Net income: $7.2 million, up $7.1 million YoY. • Adjusted EBITDA(1): $3.4 million, nearly tripling, from $1.2 million in Q4 2023. Full Year 2024 • Grew net sales 19% YoY, alongside strong 61.8% gross margins and increased efficiencies across the P&L. • Net income of $8.6 million, or $0.11 earnings per share, (vs net loss of $4.9 million, or $0.07 loss per share) • Operating cash flows: $12.1 million, ending the year with $44.7 million in cash and no debt. • Adjusted EBITDA(1): $8.5 million, up from $1.9 million in FY 2023. • Exceeded financial outlook, outperforming targets across all key performance metrics 2025 Outlook • Introduced 2025 financial outlook: expect continued revenue growth around 18% year over year, with modest P&L efficiencies with focused investments in innovation and brand awareness to build upon our position as a leader in the NAD+ market.

4 Management Team Rob Fried Chief Executive Officer E-commerce & entertainment industry executive Savoy Pictures, Columbia Pictures, Fried Films, FeeIn, WHN, Healthspan Research Andrew Shao SVP, Global Regulatory & Scientific Affairs Over two decades of global nutrition industry experience at Amway, Herbalife Nutrition, and the Council for Responsible Nutrition Ozan Pamir Chief Financial Officer Over a decade of capital markets and public company experience in the life sciences industry CFA Charterholder Carlos Lopez SVP, General Counsel Over a decade of experience in the dietary supplements industry. Previously served as VP, General Counsel at The Vitamin Shoppe and board member of The Natural Products Association Michiko Kelley Chief Marketing Officer Over two decades of experience in marketing strategy, marketing operation, product management, and leadership at Dexcom and Sony Electronics

Financial Highlights

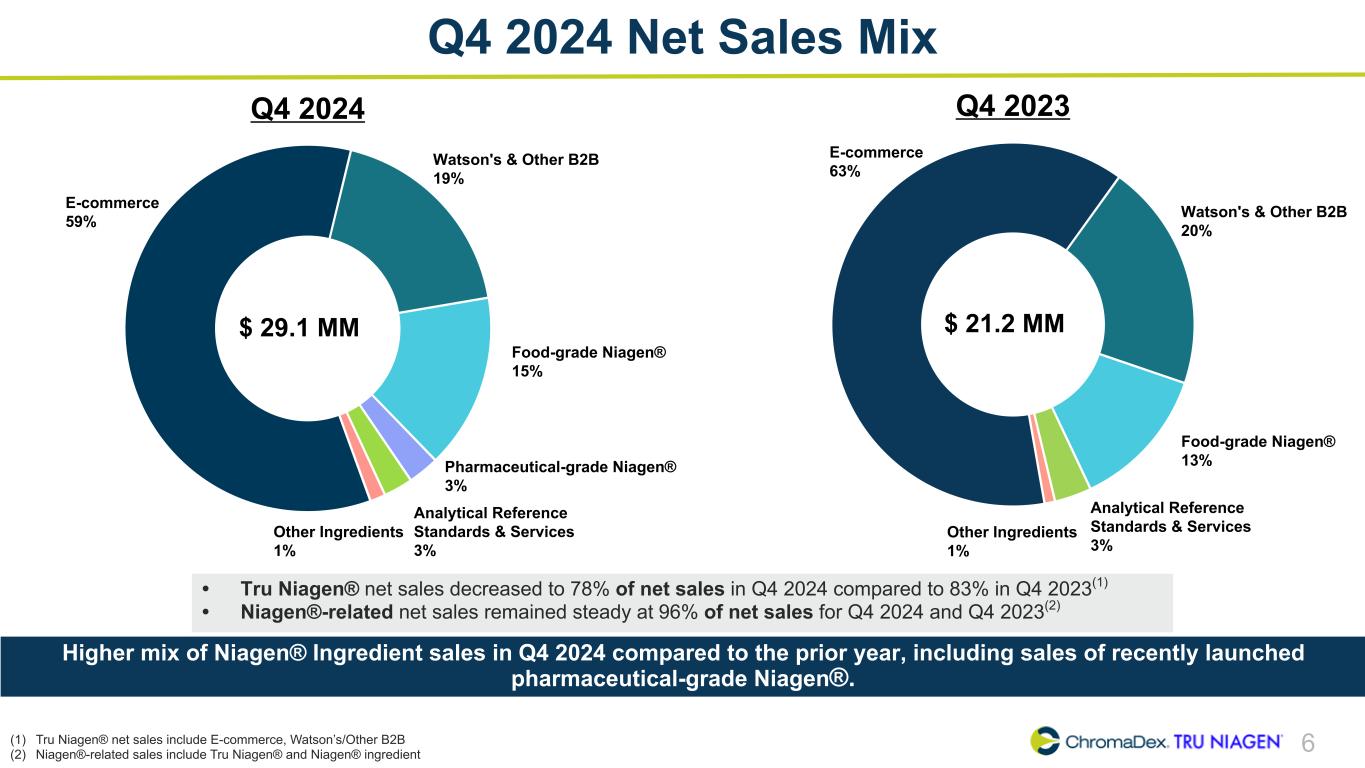

6 Q4 2024 Net Sales Mix E-commerce 63% Watson's & Other B2B 20% Food-grade Niagen® 13% Analytical Reference Standards & Services 3% Other Ingredients 1% Q4 2023Q4 2024 • Tru Niagen® net sales decreased to 78% of net sales in Q4 2024 compared to 83% in Q4 2023(1) • Niagen®-related net sales remained steady at 96% of net sales for Q4 2024 and Q4 2023(2) E-commerce 59% Watson's & Other B2B 19% Food-grade Niagen® 15% Pharmaceutical-grade Niagen® 3% Analytical Reference Standards & Services 3% Other Ingredients 1% $ 29.1 MM Higher mix of Niagen® Ingredient sales in Q4 2024 compared to the prior year, including sales of recently launched pharmaceutical-grade Niagen®. (1) Tru Niagen® net sales include E-commerce, Watson’s/Other B2B (2) Niagen®-related sales include Tru Niagen® and Niagen® ingredient $ 21.2 MM

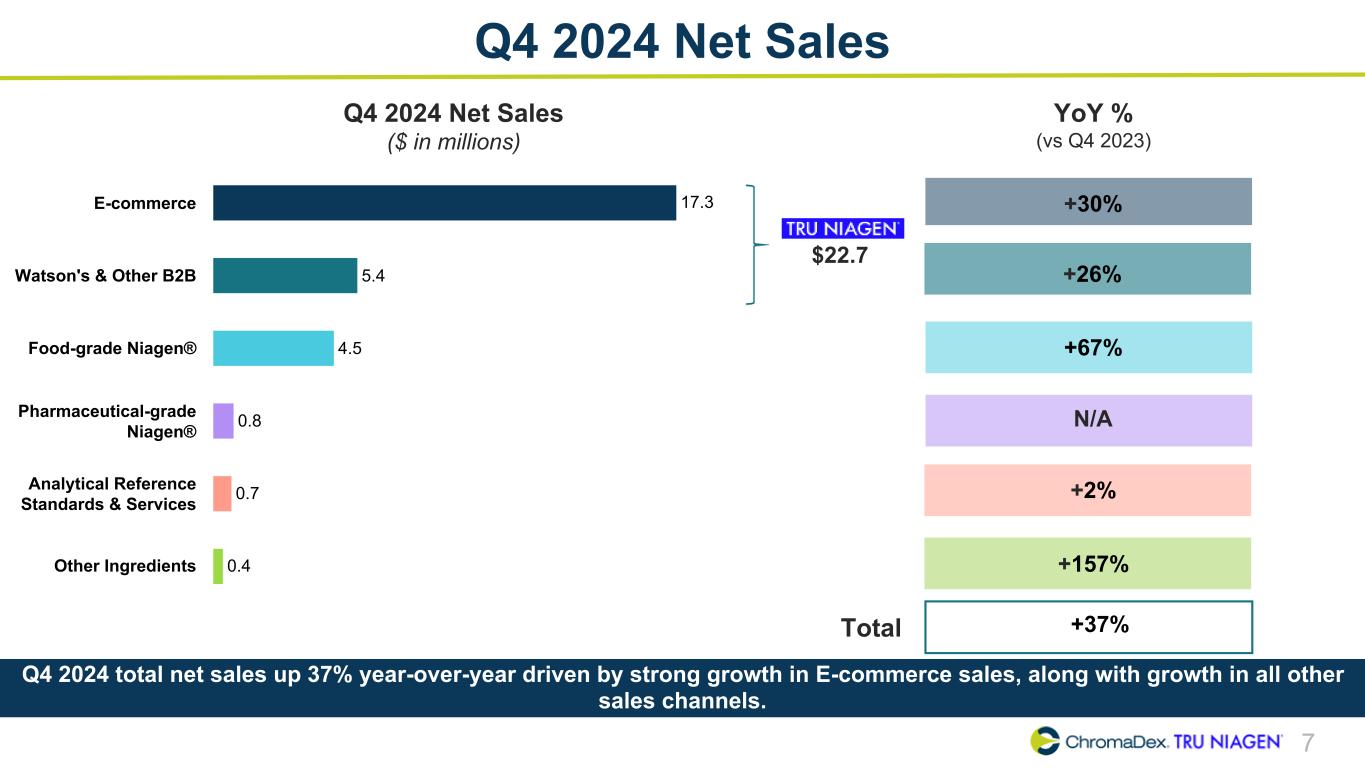

7 Q4 2024 Net Sales Q4 2024 Net Sales ($ in millions) $22.7 17.3 5.4 4.5 0.8 0.7 0.4 E-commerce Watson's & Other B2B Food-grade Niagen® Pharmaceutical-grade Niagen® Analytical Reference Standards & Services Other Ingredients Q4 2024 total net sales up 37% year-over-year driven by strong growth in E-commerce sales, along with growth in all other sales channels. YoY % (vs Q4 2023) +30% +26% +67% +2% N/A +37%Total +157%

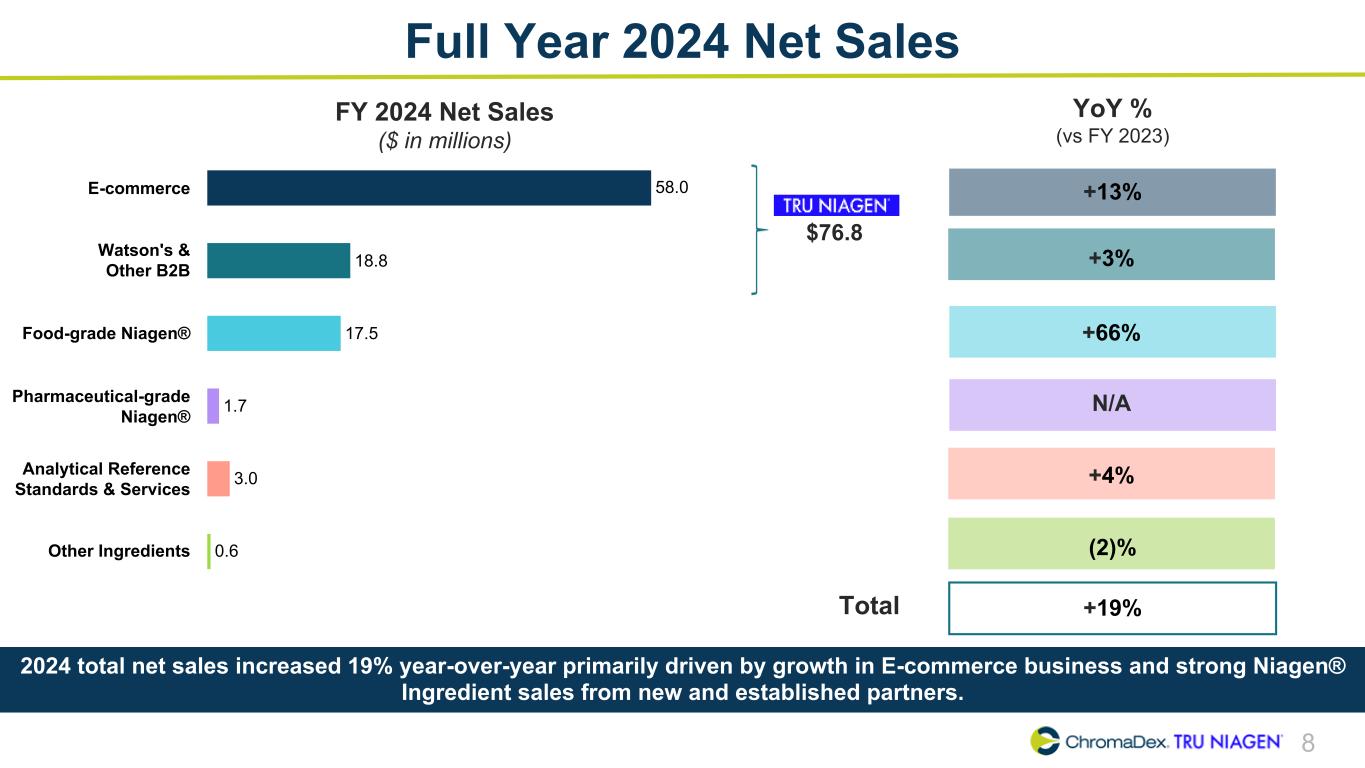

58.0 18.8 17.5 1.7 3.0 0.6 E-commerce Watson's & Other B2B Food-grade Niagen® Pharmaceutical-grade Niagen® Analytical Reference Standards & Services Other Ingredients 8 Full Year 2024 Net Sales FY 2024 Net Sales ($ in millions) Total +19% +13% +3% +66% +4% (2)% YoY % (vs FY 2023) $76.8 2024 total net sales increased 19% year-over-year primarily driven by growth in E-commerce business and strong Niagen® Ingredient sales from new and established partners. N/A

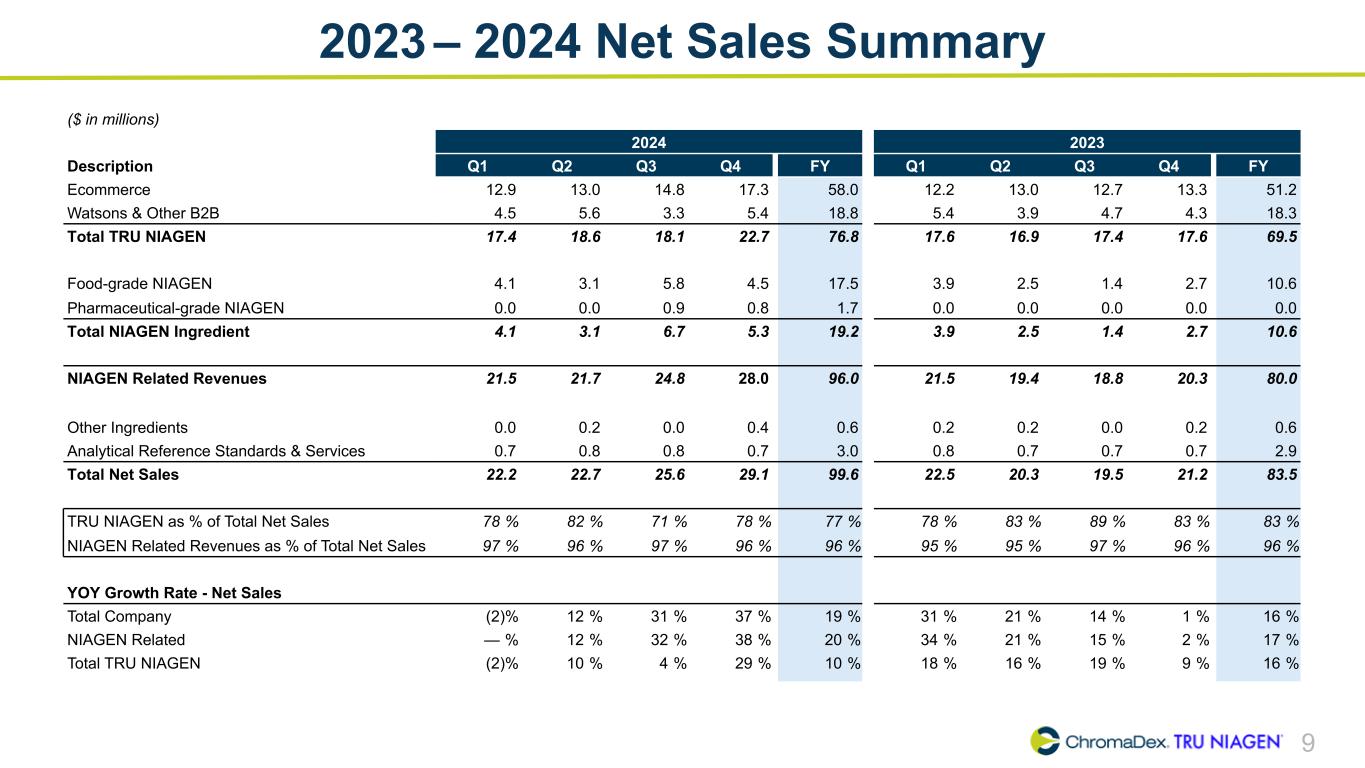

9 2023 – 2024 Net Sales Summary ($ in millions) 2024 2023 Description Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Ecommerce 12.9 13.0 14.8 17.3 58.0 12.2 13.0 12.7 13.3 51.2 Watsons & Other B2B 4.5 5.6 3.3 5.4 18.8 5.4 3.9 4.7 4.3 18.3 Total TRU NIAGEN 17.4 18.6 18.1 22.7 76.8 17.6 16.9 17.4 17.6 69.5 Food-grade NIAGEN 4.1 3.1 5.8 4.5 17.5 3.9 2.5 1.4 2.7 10.6 Pharmaceutical-grade NIAGEN 0.0 0.0 0.9 0.8 1.7 0.0 0.0 0.0 0.0 0.0 Total NIAGEN Ingredient 4.1 3.1 6.7 5.3 19.2 3.9 2.5 1.4 2.7 10.6 NIAGEN Related Revenues 21.5 21.7 24.8 28.0 96.0 21.5 19.4 18.8 20.3 80.0 Other Ingredients 0.0 0.2 0.0 0.4 0.6 0.2 0.2 0.0 0.2 0.6 Analytical Reference Standards & Services 0.7 0.8 0.8 0.7 3.0 0.8 0.7 0.7 0.7 2.9 Total Net Sales 22.2 22.7 25.6 29.1 99.6 22.5 20.3 19.5 21.2 83.5 TRU NIAGEN as % of Total Net Sales 78 % 82 % 71 % 78 % 77 % 78 % 83 % 89 % 83 % 83 % NIAGEN Related Revenues as % of Total Net Sales 97 % 96 % 97 % 96 % 96 % 95 % 95 % 97 % 96 % 96 % YOY Growth Rate - Net Sales Total Company (2) % 12 % 31 % 37 % 19 % 31 % 21 % 14 % 1 % 16 % NIAGEN Related — % 12 % 32 % 38 % 20 % 34 % 21 % 15 % 2 % 17 % Total TRU NIAGEN (2) % 10 % 4 % 29 % 10 % 18 % 16 % 19 % 9 % 16 %

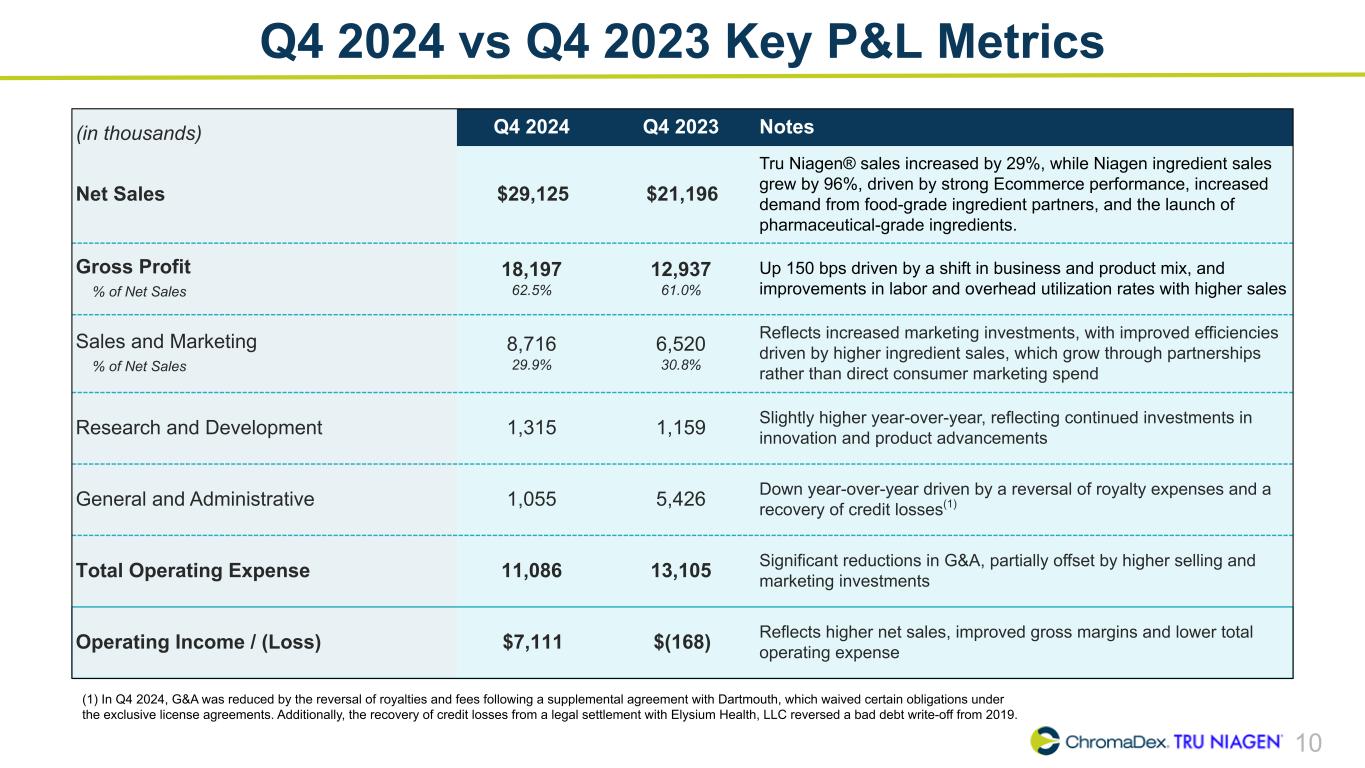

10 Q4 2024 vs Q4 2023 Key P&L Metrics (in thousands) Q4 2024 Q4 2023 Notes Net Sales $29,125 $21,196 Tru Niagen® sales increased by 29%, while Niagen ingredient sales grew by 96%, driven by strong Ecommerce performance, increased demand from food-grade ingredient partners, and the launch of pharmaceutical-grade ingredients. Gross Profit % of Net Sales 18,197 62.5% 12,937 61.0% Up 150 bps driven by a shift in business and product mix, and improvements in labor and overhead utilization rates with higher sales Sales and Marketing % of Net Sales 8,716 29.9% 6,520 30.8% Reflects increased marketing investments, with improved efficiencies driven by higher ingredient sales, which grow through partnerships rather than direct consumer marketing spend Research and Development 1,315 1,159 Slightly higher year-over-year, reflecting continued investments in innovation and product advancements General and Administrative 1,055 5,426 Down year-over-year driven by a reversal of royalty expenses and a recovery of credit losses(1) Total Operating Expense 11,086 13,105 Significant reductions in G&A, partially offset by higher selling and marketing investments Operating Income / (Loss) $7,111 $(168) Reflects higher net sales, improved gross margins and lower total operating expense (1) In Q4 2024, G&A was reduced by the reversal of royalties and fees following a supplemental agreement with Dartmouth, which waived certain obligations under the exclusive license agreements. Additionally, the recovery of credit losses from a legal settlement with Elysium Health, LLC reversed a bad debt write-off from 2019.

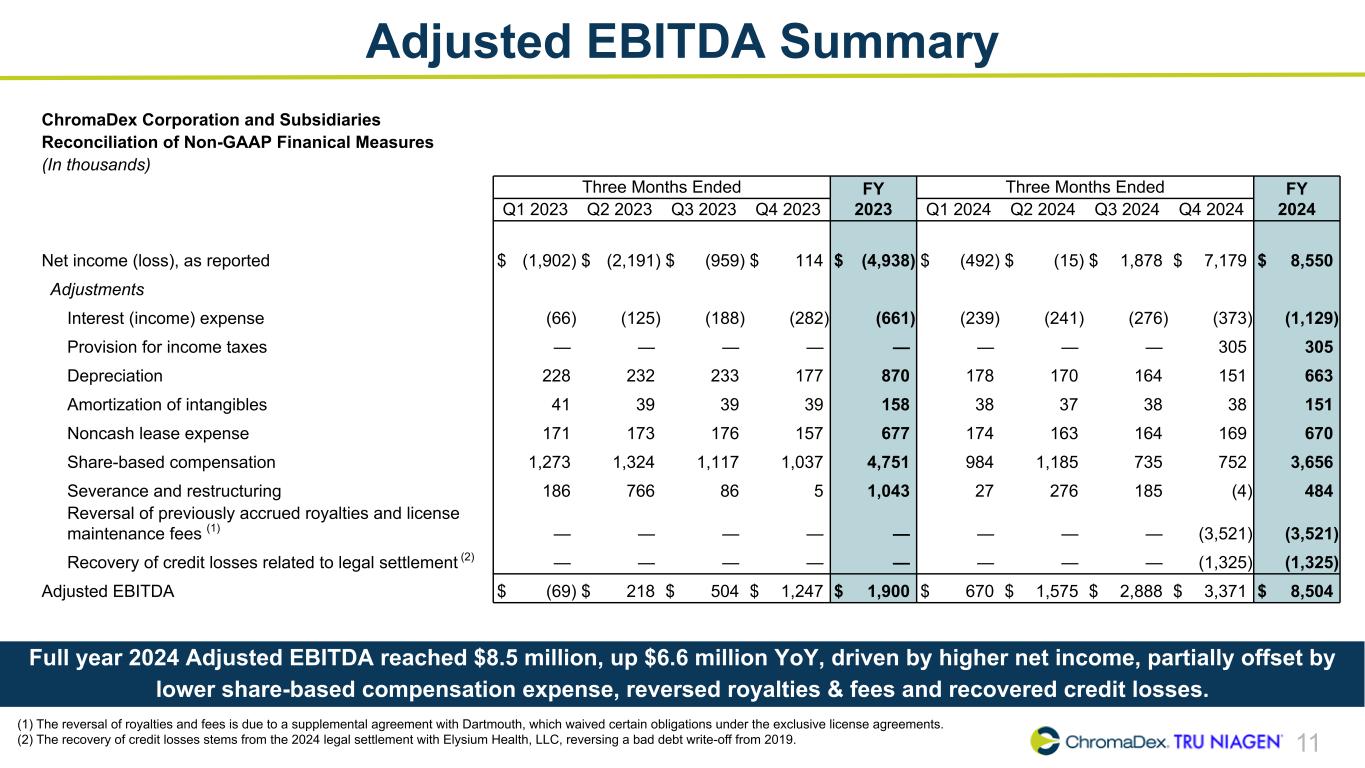

11 Adjusted EBITDA Summary Full year 2024 Adjusted EBITDA reached $8.5 million, up $6.6 million YoY, driven by higher net income, partially offset by lower share-based compensation expense, reversed royalties & fees and recovered credit losses. ChromaDex Corporation and Subsidiaries Reconciliation of Non-GAAP Finanical Measures (In thousands) Three Months Ended FY 2023 Three Months Ended FY 2024Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Net income (loss), as reported $ (1,902) $ (2,191) $ (959) $ 114 $ (4,938) $ (492) $ (15) $ 1,878 $ 7,179 $ 8,550 Adjustments Interest (income) expense (66) (125) (188) (282) (661) (239) (241) (276) (373) (1,129) Provision for income taxes — — — — — — — — 305 305 Depreciation 228 232 233 177 870 178 170 164 151 663 Amortization of intangibles 41 39 39 39 158 38 37 38 38 151 Noncash lease expense 171 173 176 157 677 174 163 164 169 670 Share-based compensation 1,273 1,324 1,117 1,037 4,751 984 1,185 735 752 3,656 Severance and restructuring 186 766 86 5 1,043 27 276 185 (4) 484 Reversal of previously accrued royalties and license maintenance fees (1) — — — — — — — — (3,521) (3,521) Recovery of credit losses related to legal settlement (2) — — — — — — — — (1,325) (1,325) Adjusted EBITDA $ (69) $ 218 $ 504 $ 1,247 $ 1,900 $ 670 $ 1,575 $ 2,888 $ 3,371 $ 8,504 (1) The reversal of royalties and fees is due to a supplemental agreement with Dartmouth, which waived certain obligations under the exclusive license agreements. (2) The recovery of credit losses stems from the 2024 legal settlement with Elysium Health, LLC, reversing a bad debt write-off from 2019.

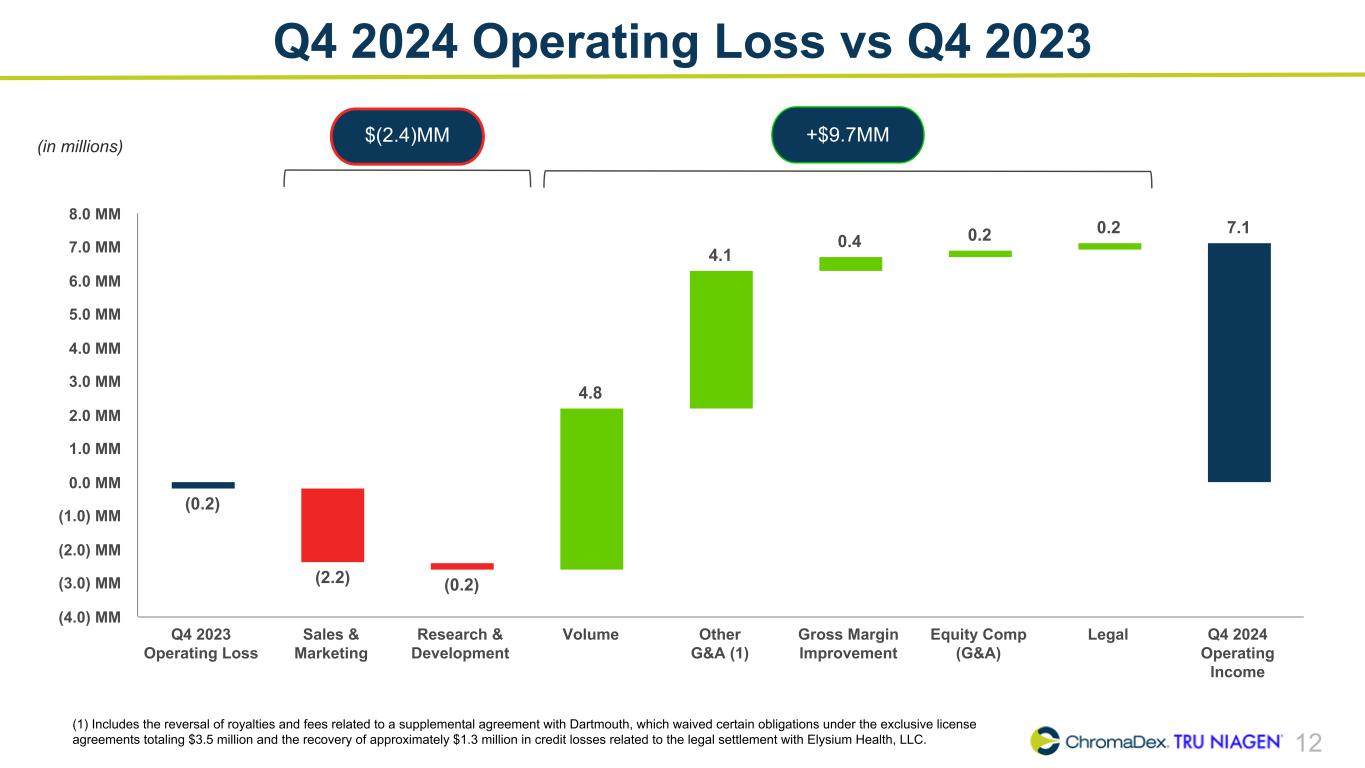

12 Q4 2024 Operating Loss vs Q4 2023 (0.2) (2.2) (0.2) 4.8 4.1 0.4 0.2 0.2 7.1 Q4 2023 Operating Loss Sales & Marketing Research & Development Volume Other G&A (1) Gross Margin Improvement Equity Comp (G&A) Legal Q4 2024 Operating Income (4.0) MM (3.0) MM (2.0) MM (1.0) MM 0.0 MM 1.0 MM 2.0 MM 3.0 MM 4.0 MM 5.0 MM 6.0 MM 7.0 MM 8.0 MM (in millions) +$9.7MM $(2.4)MM (1) Includes the reversal of royalties and fees related to a supplemental agreement with Dartmouth, which waived certain obligations under the exclusive license agreements totaling $3.5 million and the recovery of approximately $1.3 million in credit losses related to the legal settlement with Elysium Health, LLC.

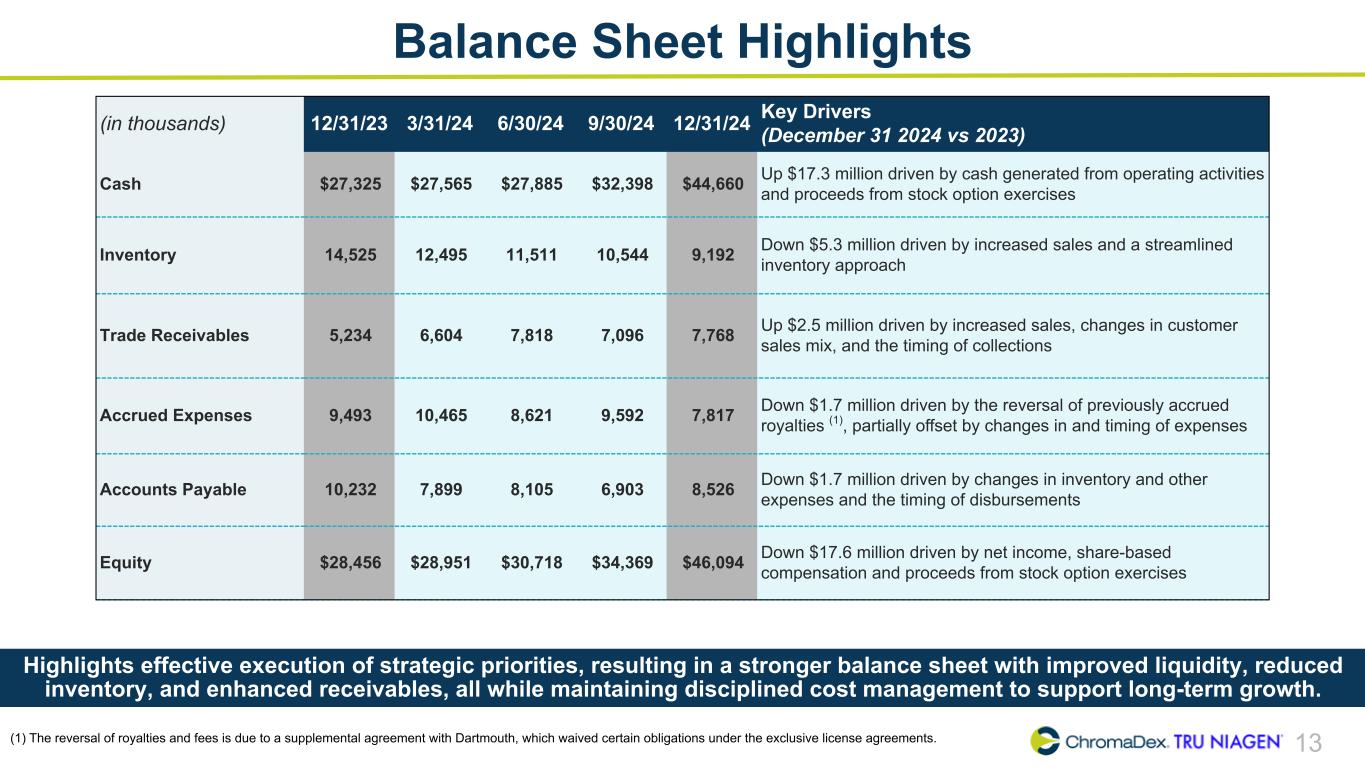

13 Balance Sheet Highlights Highlights effective execution of strategic priorities, resulting in a stronger balance sheet with improved liquidity, reduced inventory, and enhanced receivables, all while maintaining disciplined cost management to support long-term growth. (in thousands) 12/31/23 3/31/24 6/30/24 9/30/24 12/31/24 Key Drivers (December 31 2024 vs 2023) Cash $27,325 $27,565 $27,885 $32,398 $44,660 Up $17.3 million driven by cash generated from operating activities and proceeds from stock option exercises Inventory 14,525 12,495 11,511 10,544 9,192 Down $5.3 million driven by increased sales and a streamlined inventory approach Trade Receivables 5,234 6,604 7,818 7,096 7,768 Up $2.5 million driven by increased sales, changes in customer sales mix, and the timing of collections Accrued Expenses 9,493 10,465 8,621 9,592 7,817 Down $1.7 million driven by the reversal of previously accrued royalties (1), partially offset by changes in and timing of expenses Accounts Payable 10,232 7,899 8,105 6,903 8,526 Down $1.7 million driven by changes in inventory and other expenses and the timing of disbursements Equity $28,456 $28,951 $30,718 $34,369 $46,094 Down $17.6 million driven by net income, share-based compensation and proceeds from stock option exercises (1) The reversal of royalties and fees is due to a supplemental agreement with Dartmouth, which waived certain obligations under the exclusive license agreements.

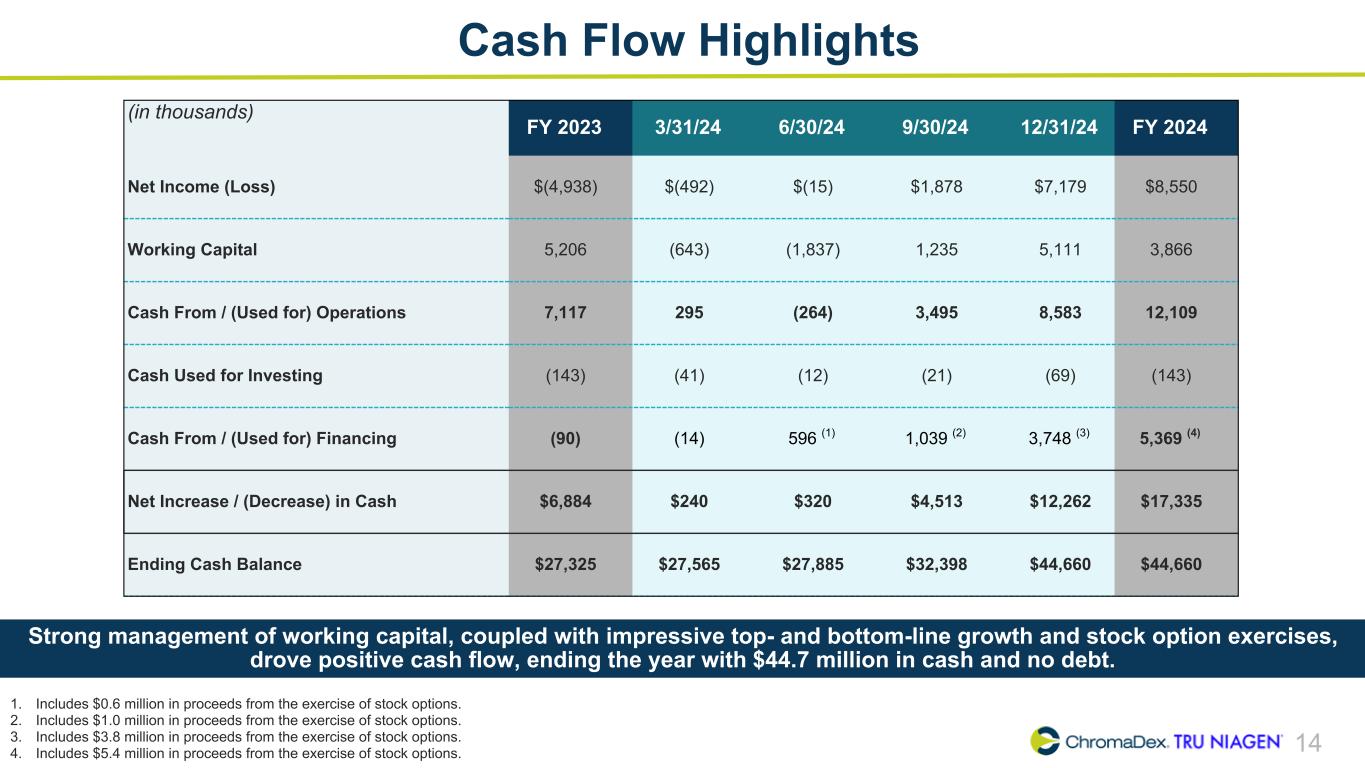

14 Cash Flow Highlights (in thousands) FY 2023 3/31/24 6/30/24 9/30/24 12/31/24 FY 2024 Net Income (Loss) $(4,938) $(492) $(15) $1,878 $7,179 $8,550 Working Capital 5,206 (643) (1,837) 1,235 5,111 3,866 Cash From / (Used for) Operations 7,117 295 (264) 3,495 8,583 12,109 Cash Used for Investing (143) (41) (12) (21) (69) (143) Cash From / (Used for) Financing (90) (14) 596 (1) 1,039 (2) 3,748 (3) 5,369 (4) Net Increase / (Decrease) in Cash $6,884 $240 $320 $4,513 $12,262 $17,335 Ending Cash Balance $27,325 $27,565 $27,885 $32,398 $44,660 $44,660 Strong management of working capital, coupled with impressive top- and bottom-line growth and stock option exercises, drove positive cash flow, ending the year with $44.7 million in cash and no debt. 1. Includes $0.6 million in proceeds from the exercise of stock options. 2. Includes $1.0 million in proceeds from the exercise of stock options. 3. Includes $3.8 million in proceeds from the exercise of stock options. 4. Includes $5.4 million in proceeds from the exercise of stock options.

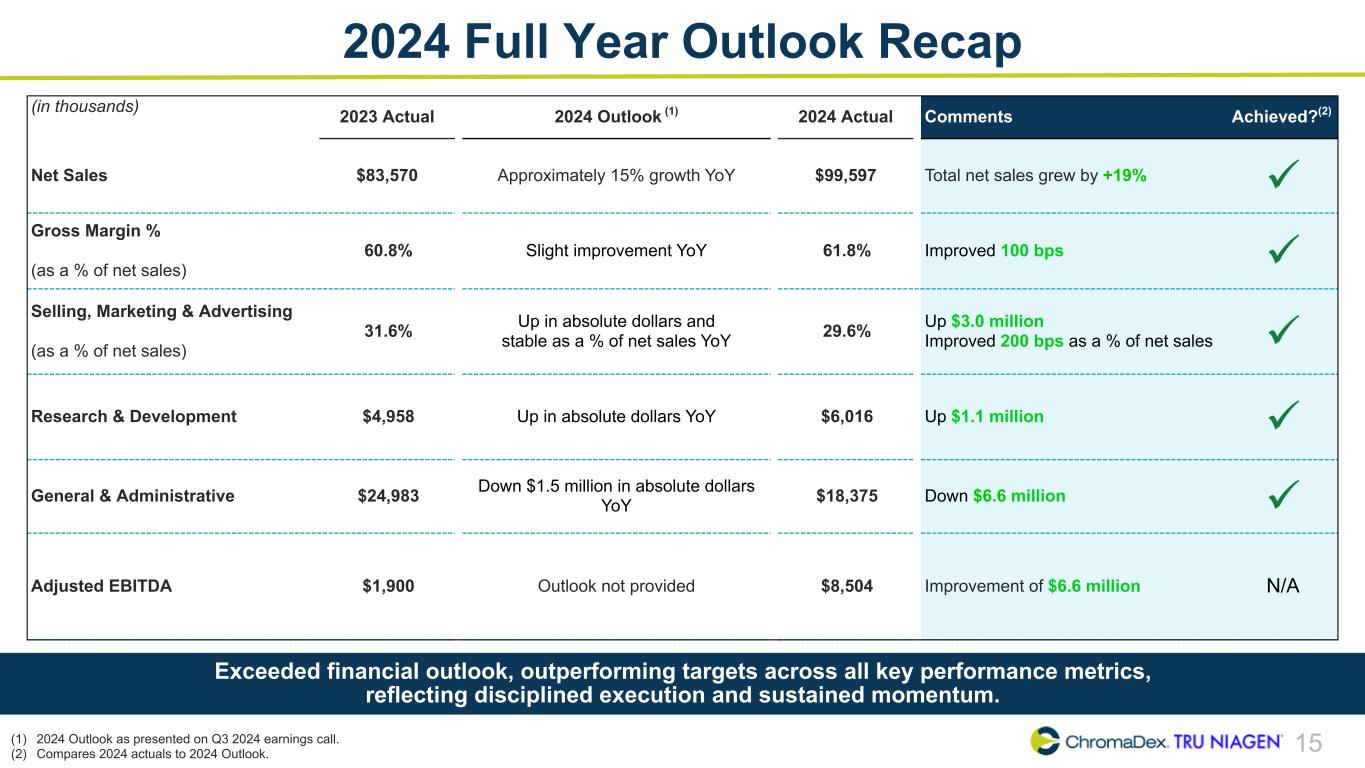

15 2024 Full Year Outlook Recap (in thousands) 2023 Actual 2024 Outlook (1) 2024 Actual Comments Achieved?(2) Net Sales $83,570 Approximately 15% growth YoY $99,597 Total net sales grew by +19% ü Gross Margin % (as a % of net sales) 60.8% Slight improvement YoY 61.8% Improved 100 bps ü Selling, Marketing & Advertising (as a % of net sales) 31.6% Up in absolute dollars and stable as a % of net sales YoY 29.6% Up $3.0 million Improved 200 bps as a % of net sales ü Research & Development $4,958 Up in absolute dollars YoY $6,016 Up $1.1 million ü General & Administrative $24,983 Down $1.5 million in absolute dollars YoY $18,375 Down $6.6 million ü Adjusted EBITDA $1,900 Outlook not provided $8,504 Improvement of $6.6 million N/A Exceeded financial outlook, outperforming targets across all key performance metrics, reflecting disciplined execution and sustained momentum. (1) 2024 Outlook as presented on Q3 2024 earnings call. (2) Compares 2024 actuals to 2024 Outlook.

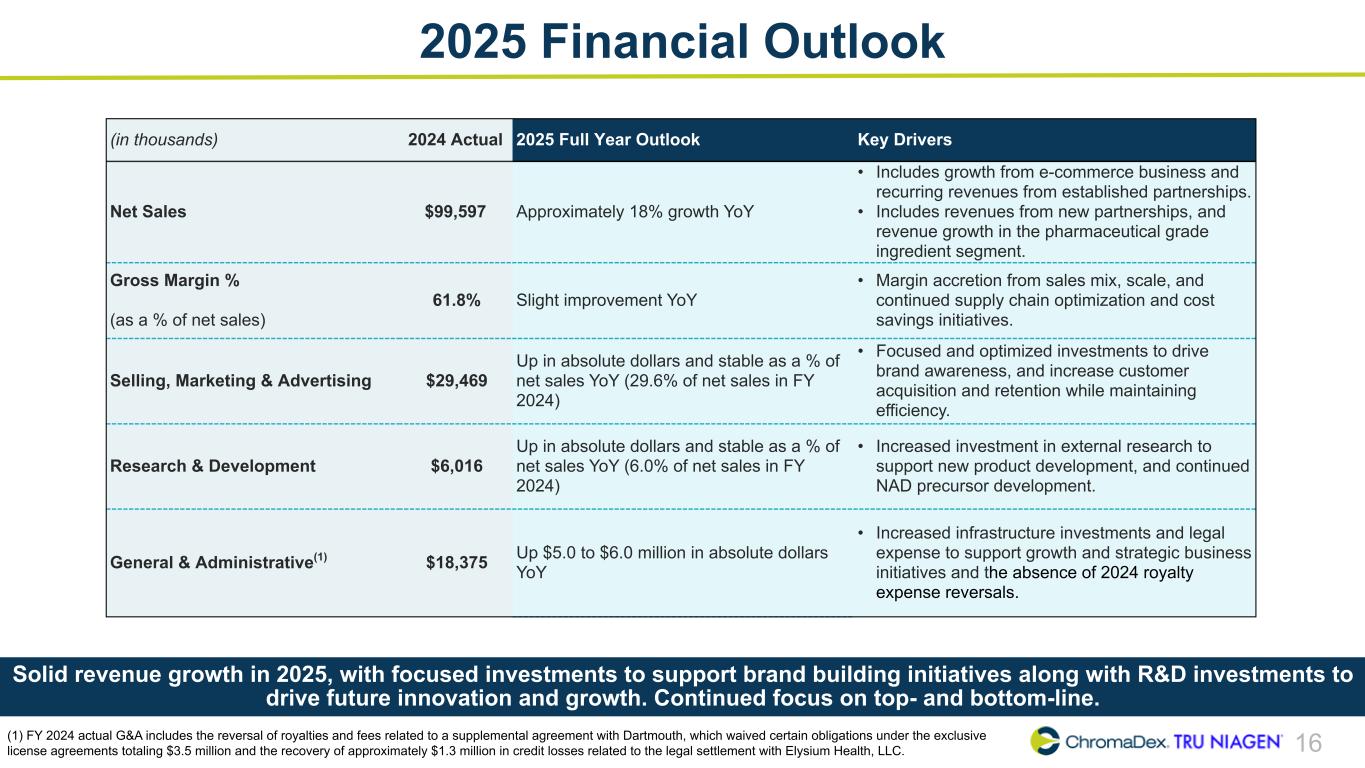

16 (in thousands) 2024 Actual 2025 Full Year Outlook Key Drivers Net Sales $99,597 Approximately 18% growth YoY • Includes growth from e-commerce business and recurring revenues from established partnerships. • Includes revenues from new partnerships, and revenue growth in the pharmaceutical grade ingredient segment. Gross Margin % (as a % of net sales) 61.8% Slight improvement YoY • Margin accretion from sales mix, scale, and continued supply chain optimization and cost savings initiatives. Selling, Marketing & Advertising $29,469 Up in absolute dollars and stable as a % of net sales YoY (29.6% of net sales in FY 2024) • Focused and optimized investments to drive brand awareness, and increase customer acquisition and retention while maintaining efficiency. Research & Development $6,016 Up in absolute dollars and stable as a % of net sales YoY (6.0% of net sales in FY 2024) • Increased investment in external research to support new product development, and continued NAD precursor development. General & Administrative(1) $18,375 Up $5.0 to $6.0 million in absolute dollars YoY • Increased infrastructure investments and legal expense to support growth and strategic business initiatives and the absence of 2024 royalty expense reversals. 2025 Financial Outlook Solid revenue growth in 2025, with focused investments to support brand building initiatives along with R&D investments to drive future innovation and growth. Continued focus on top- and bottom-line. (1) FY 2024 actual G&A includes the reversal of royalties and fees related to a supplemental agreement with Dartmouth, which waived certain obligations under the exclusive license agreements totaling $3.5 million and the recovery of approximately $1.3 million in credit losses related to the legal settlement with Elysium Health, LLC.

The information contained in this documents is confidential, privileged and only for the information of the intended recipient and may not be used, published or redistributed without the prior written consent (2019) The Science 17

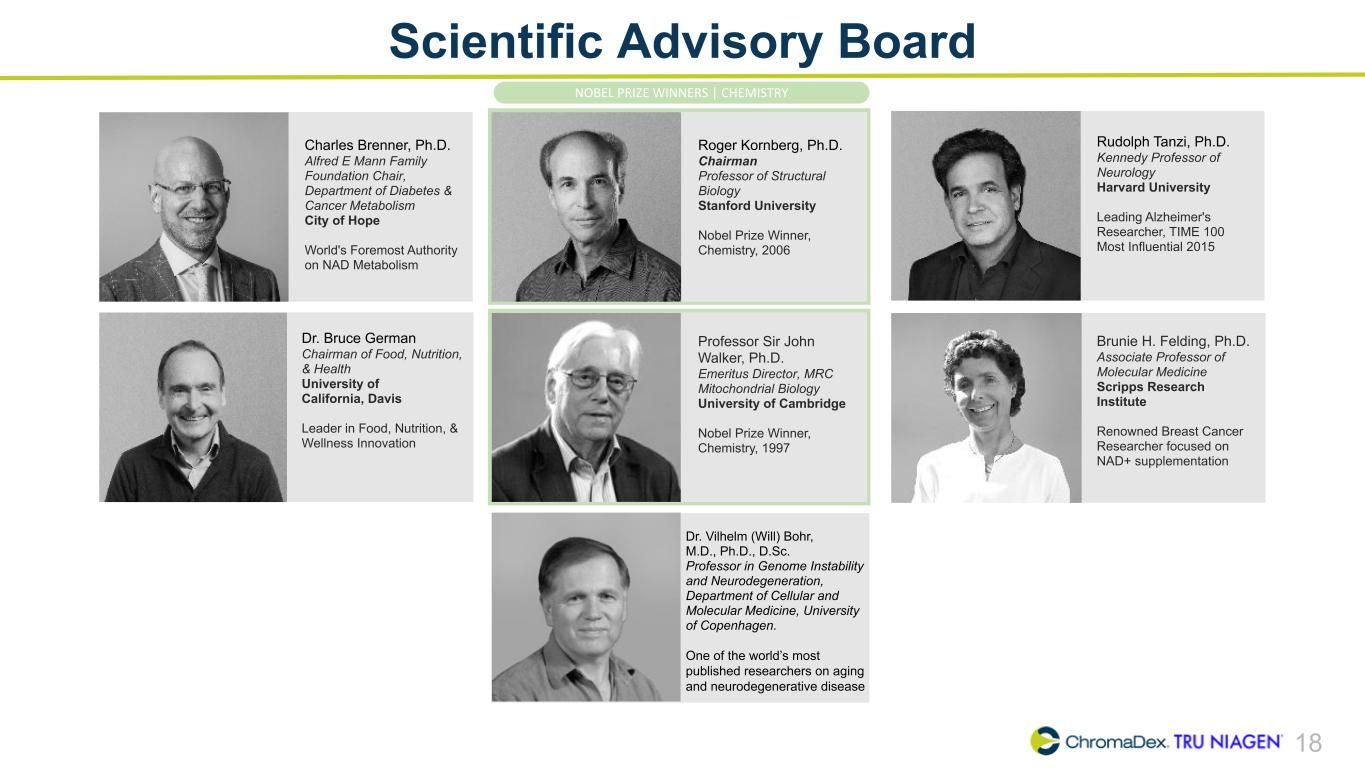

18 Scientific Advisory Board Charles Brenner, Ph.D. Alfred E Mann Family Foundation Chair, Department of Diabetes & Cancer Metabolism City of Hope World's Foremost Authority on NAD Metabolism Roger Kornberg, Ph.D. Chairman Professor of Structural Biology Stanford University Nobel Prize Winner, Chemistry, 2006 Rudolph Tanzi, Ph.D. Kennedy Professor of Neurology Harvard University Leading Alzheimer's Researcher, TIME 100 Most Influential 2015 Dr. Bruce German Chairman of Food, Nutrition, & Health University of California, Davis Leader in Food, Nutrition, & Wellness Innovation Professor Sir John Walker, Ph.D. Emeritus Director, MRC Mitochondrial Biology University of Cambridge Nobel Prize Winner, Chemistry, 1997 Brunie H. Felding, Ph.D. Associate Professor of Molecular Medicine Scripps Research Institute Renowned Breast Cancer Researcher focused on NAD+ supplementation Dr. Vilhelm (Will) Bohr, M.D., Ph.D., D.Sc. Professor in Genome Instability and Neurodegeneration, Department of Cellular and Molecular Medicine, University of Copenhagen. One of the world’s most published researchers on aging and neurodegenerative disease NOBEL PRIZE WINNERS | CHEMISTRY

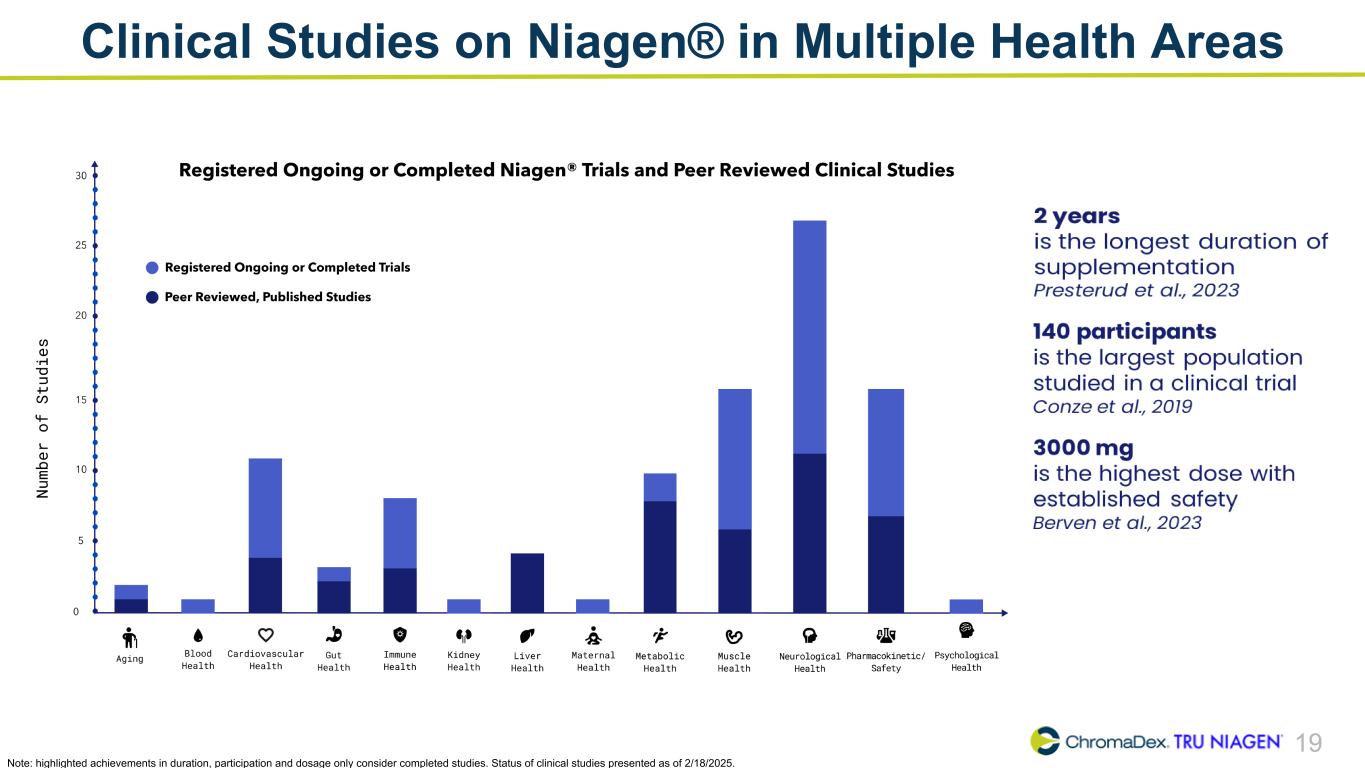

19 Clinical Studies on Niagen® in Multiple Health Areas Note: highlighted achievements in duration, participation and dosage only consider completed studies. Status of clinical studies presented as of 2/18/2025.

20 Contact Info: Ben Shamsian Lytham Partners T: +1(646) 829-9701 Shamsian@LythamPartners.com www.ChromaDex.com Where to purchase Tru Niagen® TruNiagen.com Find Health Clinics Offering Niagen® Plus NiagenPlus.com