Niagen Bioscience, Inc. Earnings Presentation First Quarter 2025 Nasdaq: NAGE | May 7, 2025

SAFE HARBOR STATEMENT 2 This presentation and other written or oral statements made from time to time by representatives of Niagen Bioscience contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements reflect the current view about future events. Statements that are not historical in nature, such as 2025 financial outlook, and which may be identified by the use of words like “expects,” “anticipates,” “intends,” “estimates,” “plans,” “potential,” “possible,” “probable,” “believes,” “seeks,” “may,” “will,” “should,” “could,” “predicts,” “projects,” “continue,” “would” or the negative of these terms and other words of similar meaning, are forward-looking statements. Such statements include, but are not limited to, statements contained in this presentation relating to our expected sales, cash flows, planned investments, and financial performance, business, business strategy, expansion, growth, key drivers (including cost savings and increased investments), products and services we offer and their impact on our performance or products and services we may offer in the future and the timing of their development, sales and marketing strategy and capital outlook. Forward-looking statements are based on management’s current expectations and assumptions regarding our business, the economy and other future conditions and are subject to inherent risks, uncertainties and changes of circumstances that are difficult to predict and may cause actual results to differ materially from those contemplated or expressed. We caution you therefore against relying on any of these forward-looking statements. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the Securities Exchange Commission (the “Commission”), and in subsequent filings with the Commission. Any forward-looking statements are qualified in their entirety by reference to the factors discussed in these filings with the Commission. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned. Important factors that could cause actual results to differ materially from those in the forward looking statements include but are not limited to: inflationary conditions and adverse economic conditions; our history of operating losses and need to obtain additional financing; the growth and profitability of our product sales; our ability to maintain and grow sales, marketing and distribution capabilities; changing consumer perceptions of our products; our reliance on a single or limited number of third-party suppliers; risks of conducting business in China; including unanticipated developments in and risks related to the Company’s ability to secure adequate quantities of pharmaceutical-grade Niagen in a timely manner; the Company’s ability to obtain appropriate contracts and arrangements with U.S. FDA-registered 503B outsourcing facilities required to compound and distribute pharmaceutical-grade Niagen to clinics; the Company’s ability to remain on the U.S. FDA Bulk Drug Substances Nominated for Use in Compounding Under Section 503B of the Federal Food, Drug, and Cosmetic Act Category 1 list; the Company’s ability to maintain and enforce the Company’s existing intellectual property and obtain new patents; whether the potential benefits of NRC can be further supported; further research and development and the results of clinical trials possibly being unsuccessful or insufficient to meet applicable regulatory standards or warrant continued development; the ability to enroll sufficient numbers of subjects in clinical trials; determinations made by the FDA and other governmental authorities; and the risks and uncertainties associated with our business and financial condition in general. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. About Non-GAAP Financial Measures Niagen Bioscience’s non-GAAP financial measure, Adjusted EBITDA, is defined as net income before interest, provision for income taxes, depreciation, amortization, non-cash share-based compensation costs, severance and restructuring expense and other infrequent items, including the reversal of previously accrued royalties and license maintenance fees, and the recovery of previously recognized credit losses from a legal settlement. Niagen Bioscience used this non-GAAP measures when evaluating its financial results as well as for internal resource management, planning and forecasting purposes. This non-GAAP measure should not be viewed in isolation from or as a substitute for Niagen Bioscience’s financial results in accordance with GAAP. Reconciliation of this non-GAAP measure to the most directly comparable GAAP measure is attached to this presentation. FDA Disclaimer Statements made in this presentation have not been evaluated by the Food and Drug Administration. Niagen Bioscience products are not intended to diagnose, treat, cure, or prevent any disease. The statements in this presentation are for investor relations and educational purposes only and not intended for consumers or vendors.

Q1 2025 & Recent Highlights (1) See slide 10 for the non-GAAP reconciliation Q1 2025 marked a strong start to the year, delivering impressive top- and bottom-line results and taking key steps toward building the future of Niagen Bioscience. • Total company and Tru Niagen® net sales: $30.5 million and $21.5 million, up 38%, and 24% YoY, respectively. • Total Niagen® ingredient sales: $8.0 million, up 95% YoY. • Gross margin: 63.4%, up 270 basis points YoY. • Sales and marketing expense as a percentage of net sales: 26.6%, an improvement of 380 basis points YoY. • Net income: $5.1 million or $0.07 earnings per share, up $5.6 million and $0.08 YoY. • Adjusted EBITDA(1): $4.9 million, up $4.2 million YoY. • Cash provided from operations: $7.9 million year-to-date, ending with $55.6 million in cash and no debt. • In March 2025, introduced new brand identity and expanded NAD+ precursor patent portfolio, emphasizing our continued commitment to leading the science of healthy aging. • Adjusted full year 2025 outlook with net sales growth between 20%-25% (previously approximately 18%) to reflect positive trends in the sales as the NAD+ market continues to expand, and adjusted general and administrative expenses outlook to be up $7.0 to $8.0 million (previously up $5.0 to $6.0 million) to reflect updates to share based compensation. 2025 outlook projects continued profitability. 3

Leadership Team Rob Fried Chief Executive Officer E-commerce & entertainment industry executive Savoy Pictures, Columbia Pictures, Fried Films, FeeIn, WHN, Healthspan Research Andrew Shao SVP, Global Regulatory & Scientific Affairs Over two decades of global nutrition industry experience at Amway, Herbalife Nutrition, and the Council for Responsible Nutrition Ozan Pamir Chief Financial Officer Over a decade of capital markets and public company experience in the life sciences industry CFA Charterholder Carlos Lopez SVP, General Counsel Over a decade of experience in the dietary supplements industry. Previously served as VP, General Counsel at The Vitamin Shoppe and board member of The Natural Products Association Michiko Kelley Chief Marketing Officer Over two decades of experience in marketing strategy, marketing operation, product management, and leadership at Dexcom and Sony Electronics 4

The information contained in this documents is confidential, privileged and only for the information of the intended recipient and may not be used, published or redistributed without the prior written consent (2019) Financial Highlights

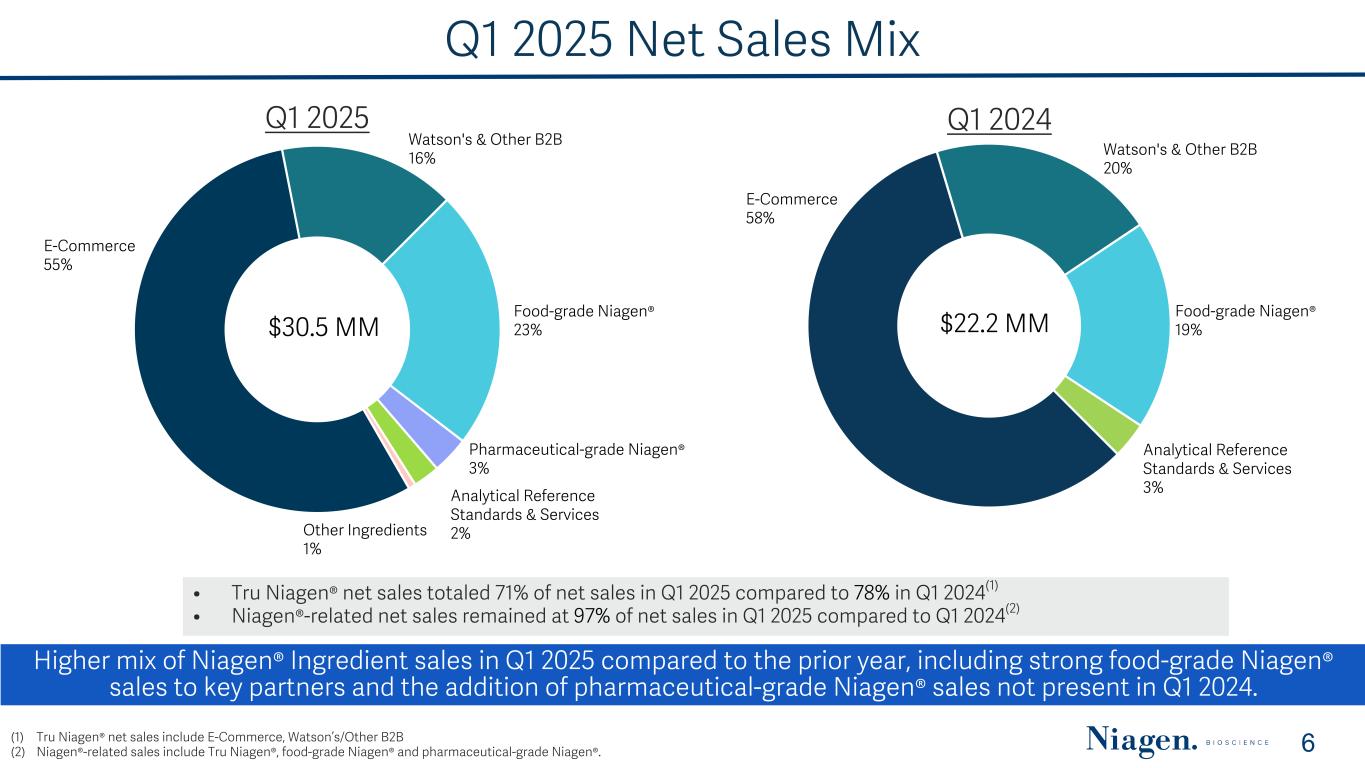

Q1 2025 Net Sales Mix E-Commerce 58% Watson's & Other B2B 20% Food-grade Niagen® 19% Analytical Reference Standards & Services 3% Q1 2024 $22.2 MM E-Commerce 55% Watson's & Other B2B 16% Food-grade Niagen® 23% Pharmaceutical-grade Niagen® 3% Analytical Reference Standards & Services 2%Other Ingredients 1% $30.5 MM Q1 2025 • Tru Niagen® net sales totaled 71% of net sales in Q1 2025 compared to 78% in Q1 2024(1) • Niagen®-related net sales remained at 97% of net sales in Q1 2025 compared to Q1 2024(2) Higher mix of Niagen® Ingredient sales in Q1 2025 compared to the prior year, including strong food-grade Niagen® sales to key partners and the addition of pharmaceutical-grade Niagen® sales not present in Q1 2024. (1) Tru Niagen® net sales include E-Commerce, Watson’s/Other B2B (2) Niagen®-related sales include Tru Niagen®, food-grade Niagen® and pharmaceutical-grade Niagen®. 6

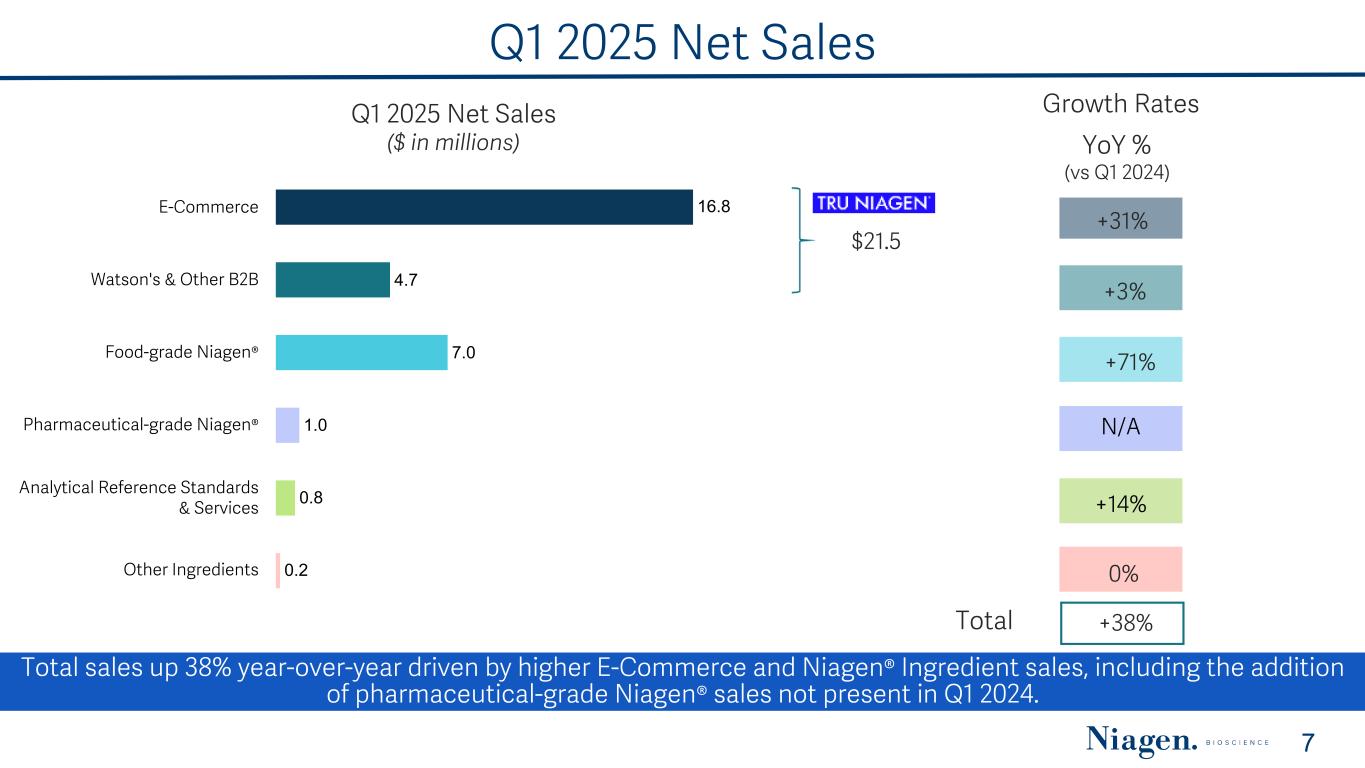

N/A Q1 2025 Net Sales Q1 2025 Net Sales ($ in millions) 16.8 4.7 7.0 1.0 0.8 0.2 E-Commerce Watson's & Other B2B Food-grade Niagen® Pharmaceutical-grade Niagen® Analytical Reference Standards & Services Other Ingredients $21.5 YoY % (vs Q1 2024) +31% +3% +71% +14% +38%Total Growth Rates Total sales up 38% year-over-year driven by higher E-Commerce and Niagen® Ingredient sales, including the addition of pharmaceutical-grade Niagen® sales not present in Q1 2024. 7 0%

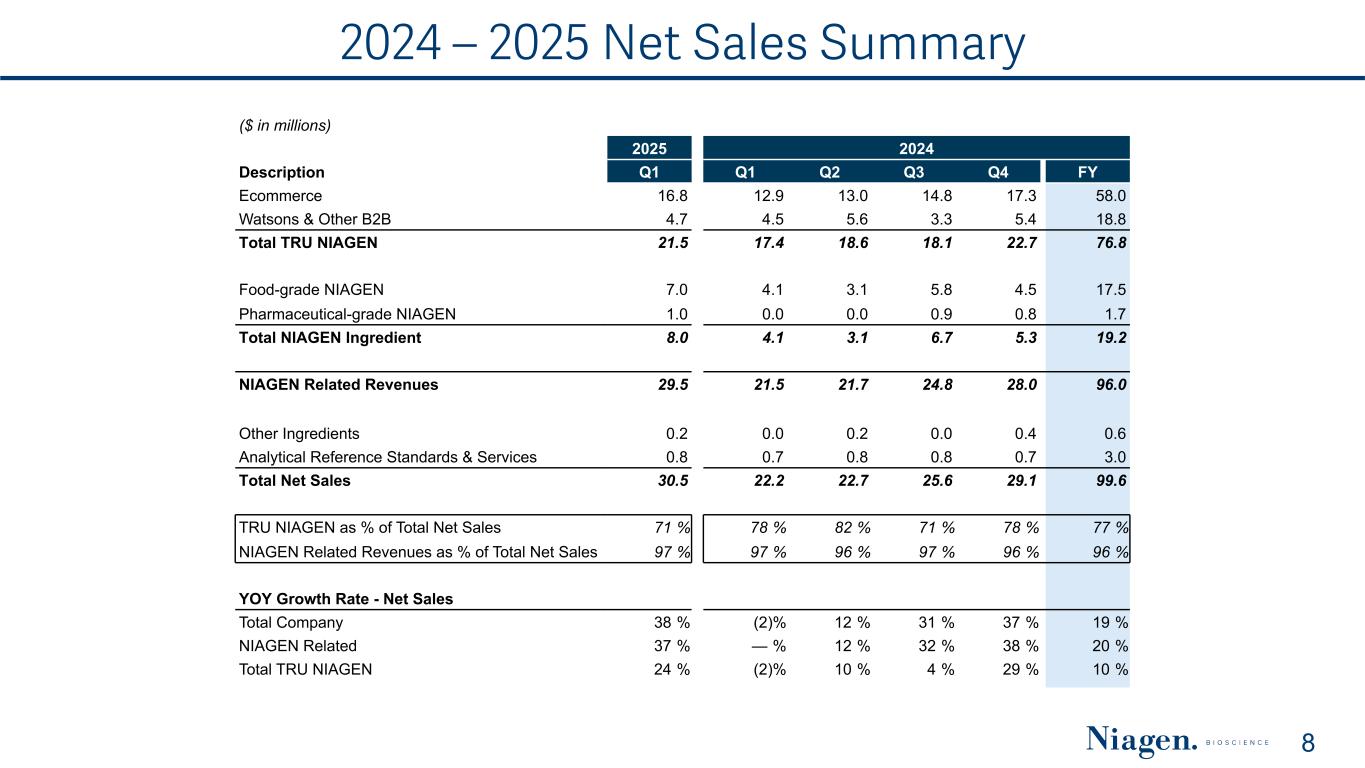

2024 – 2025 Net Sales Summary 8 ($ in millions) 2025 2024 Description Q1 Q1 Q2 Q3 Q4 FY Ecommerce 16.8 12.9 13.0 14.8 17.3 58.0 Watsons & Other B2B 4.7 4.5 5.6 3.3 5.4 18.8 Total TRU NIAGEN 21.5 17.4 18.6 18.1 22.7 76.8 Food-grade NIAGEN 7.0 4.1 3.1 5.8 4.5 17.5 Pharmaceutical-grade NIAGEN 1.0 0.0 0.0 0.9 0.8 1.7 Total NIAGEN Ingredient 8.0 4.1 3.1 6.7 5.3 19.2 NIAGEN Related Revenues 29.5 21.5 21.7 24.8 28.0 96.0 Other Ingredients 0.2 0.0 0.2 0.0 0.4 0.6 Analytical Reference Standards & Services 0.8 0.7 0.8 0.8 0.7 3.0 Total Net Sales 30.5 22.2 22.7 25.6 29.1 99.6 TRU NIAGEN as % of Total Net Sales 71 % 78 % 82 % 71 % 78 % 77 % NIAGEN Related Revenues as % of Total Net Sales 97 % 97 % 96 % 97 % 96 % 96 % YOY Growth Rate - Net Sales Total Company 38 % (2) % 12 % 31 % 37 % 19 % NIAGEN Related 37 % — % 12 % 32 % 38 % 20 % Total TRU NIAGEN 24 % (2) % 10 % 4 % 29 % 10 %

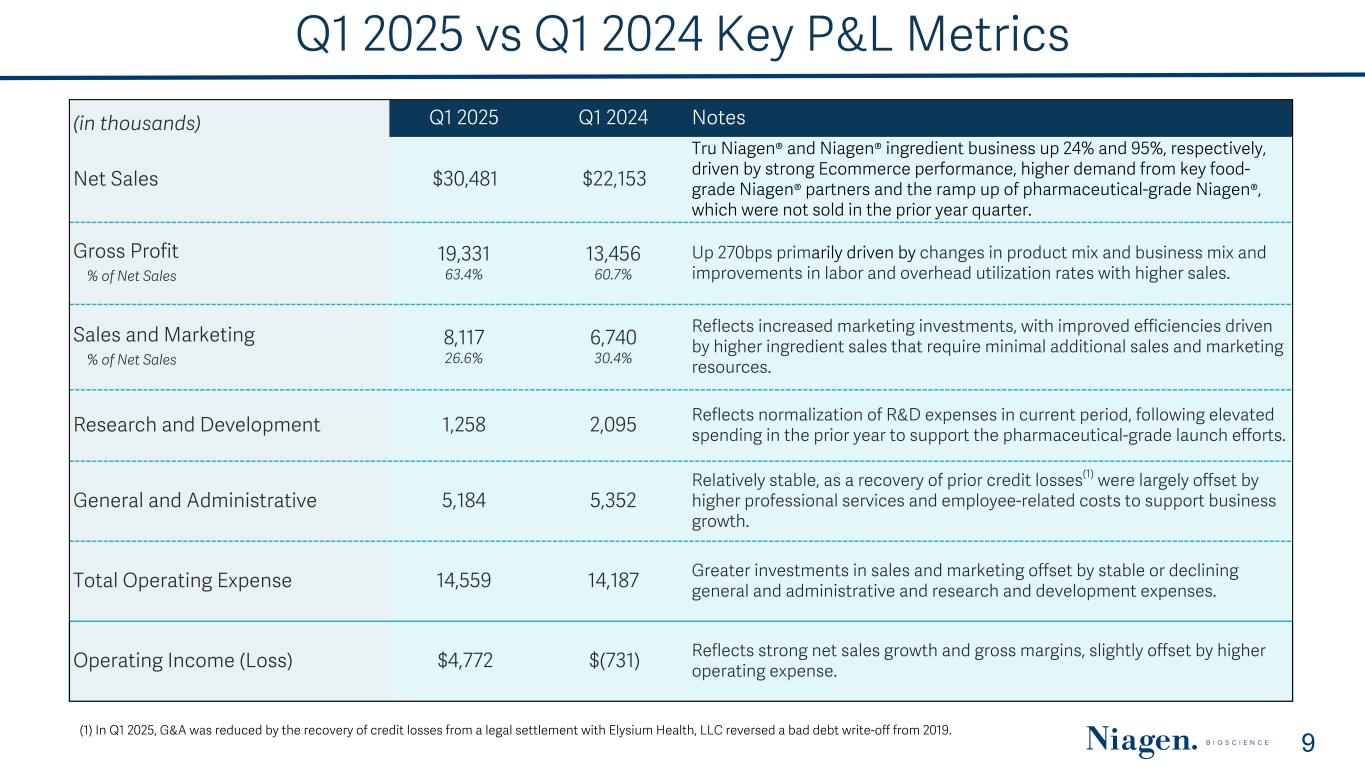

Q1 2025 vs Q1 2024 Key P&L Metrics (in thousands) Q1 2025 Q1 2024 Notes Net Sales $30,481 $22,153 Tru Niagen® and Niagen® ingredient business up 24% and 95%, respectively, driven by strong Ecommerce performance, higher demand from key food- grade Niagen® partners and the ramp up of pharmaceutical-grade Niagen®, which were not sold in the prior year quarter. Gross Profit % of Net Sales 19,331 63.4% 13,456 60.7% Up 270bps primarily driven by changes in product mix and business mix and improvements in labor and overhead utilization rates with higher sales. Sales and Marketing % of Net Sales 8,117 26.6% 6,740 30.4% Reflects increased marketing investments, with improved efficiencies driven by higher ingredient sales that require minimal additional sales and marketing resources. Research and Development 1,258 2,095 Reflects normalization of R&D expenses in current period, following elevated spending in the prior year to support the pharmaceutical-grade launch efforts. General and Administrative 5,184 5,352 Relatively stable, as a recovery of prior credit losses(1) were largely offset by higher professional services and employee-related costs to support business growth. Total Operating Expense 14,559 14,187 Greater investments in sales and marketing offset by stable or declining general and administrative and research and development expenses. Operating Income (Loss) $4,772 $(731) Reflects strong net sales growth and gross margins, slightly offset by higher operating expense. 9 (1) In Q1 2025, G&A was reduced by the recovery of credit losses from a legal settlement with Elysium Health, LLC reversed a bad debt write-off from 2019.

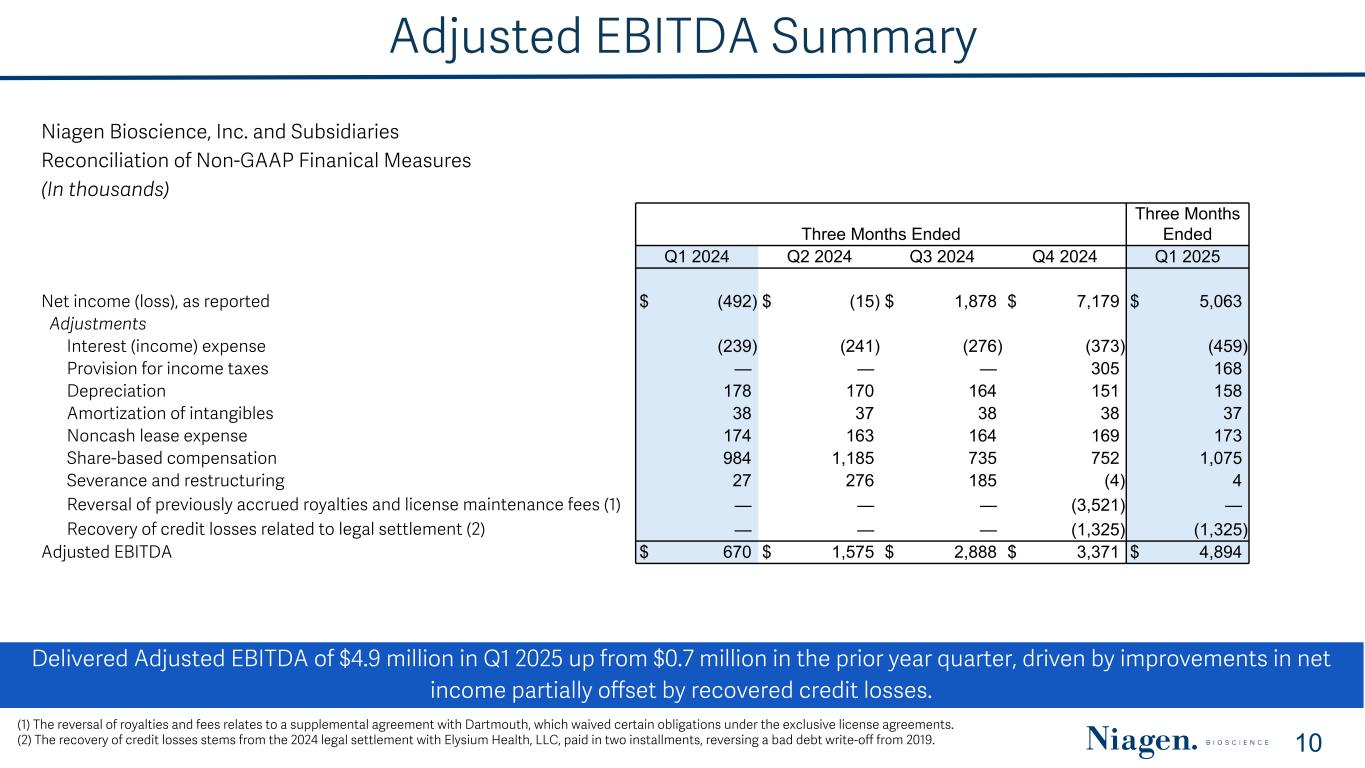

Adjusted EBITDA Summary Delivered Adjusted EBITDA of $4.9 million in Q1 2025 up from $0.7 million in the prior year quarter, driven by improvements in net income partially offset by recovered credit losses. 10 (1) The reversal of royalties and fees relates to a supplemental agreement with Dartmouth, which waived certain obligations under the exclusive license agreements. (2) The recovery of credit losses stems from the 2024 legal settlement with Elysium Health, LLC, paid in two installments, reversing a bad debt write-off from 2019. Niagen Bioscience, Inc. and Subsidiaries Reconciliation of Non-GAAP Finanical Measures (In thousands) Three Months Ended Three Months Ended Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Net income (loss), as reported $ (492) $ (15) $ 1,878 $ 7,179 $ 5,063 Adjustments Interest (income) expense (239) (241) (276) (373) (459) Provision for income taxes — — — 305 168 Depreciation 178 170 164 151 158 Amortization of intangibles 38 37 38 38 37 Noncash lease expense 174 163 164 169 173 Share-based compensation 984 1,185 735 752 1,075 Severance and restructuring 27 276 185 (4) 4 Reversal of previously accrued royalties and license maintenance fees (1) — — — (3,521) — Recovery of credit losses related to legal settlement (2) — — — (1,325) (1,325) Adjusted EBITDA $ 670 $ 1,575 $ 2,888 $ 3,371 $ 4,894

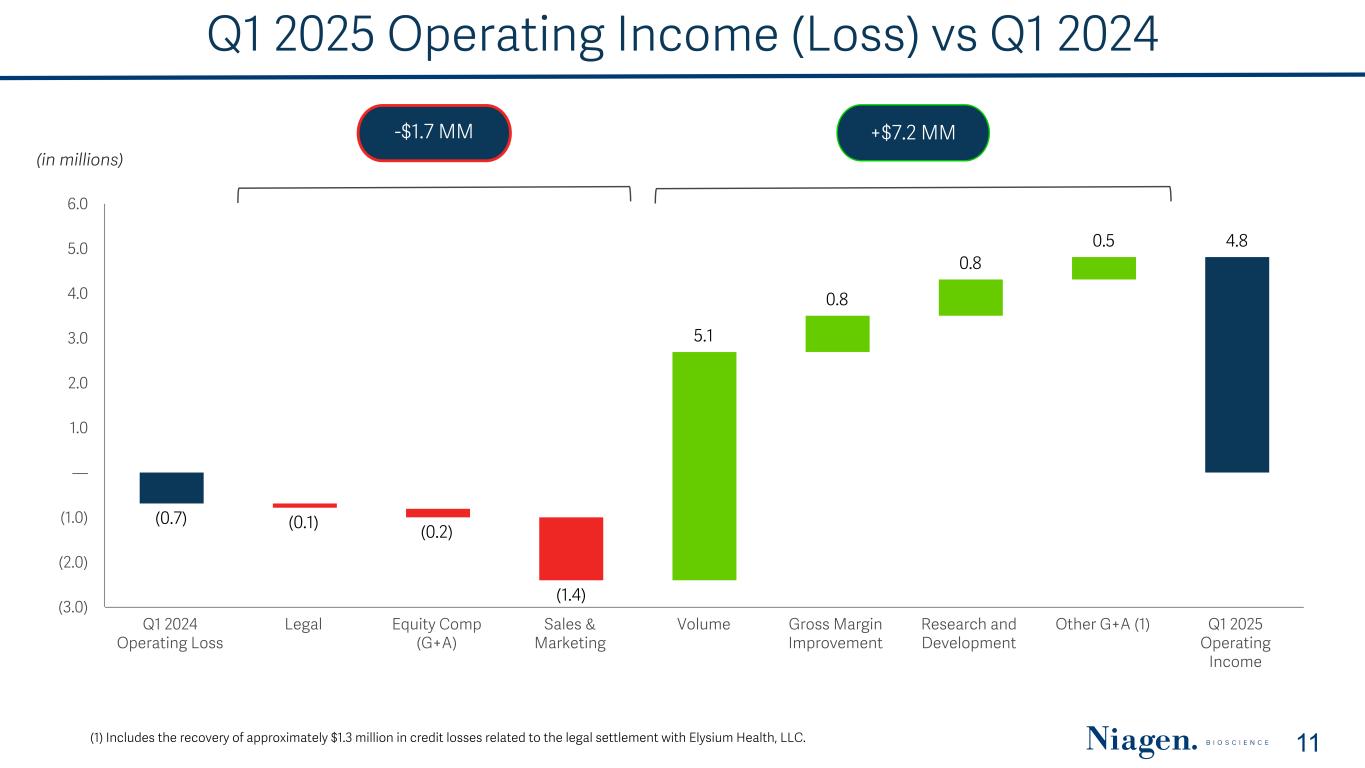

Q1 2025 Operating Income (Loss) vs Q1 2024 (in millions) +$7.2 MM (0.7) (0.1) (0.2) (1.4) 5.1 0.8 0.8 0.5 4.8 Q1 2024 Operating Loss Legal Equity Comp (G+A) Sales & Marketing Volume Gross Margin Improvement Research and Development Other G+A (1) Q1 2025 Operating Income (3.0) (2.0) (1.0) — 1.0 2.0 3.0 4.0 5.0 6.0 11 -$1.7 MM (1) Includes the recovery of approximately $1.3 million in credit losses related to the legal settlement with Elysium Health, LLC.

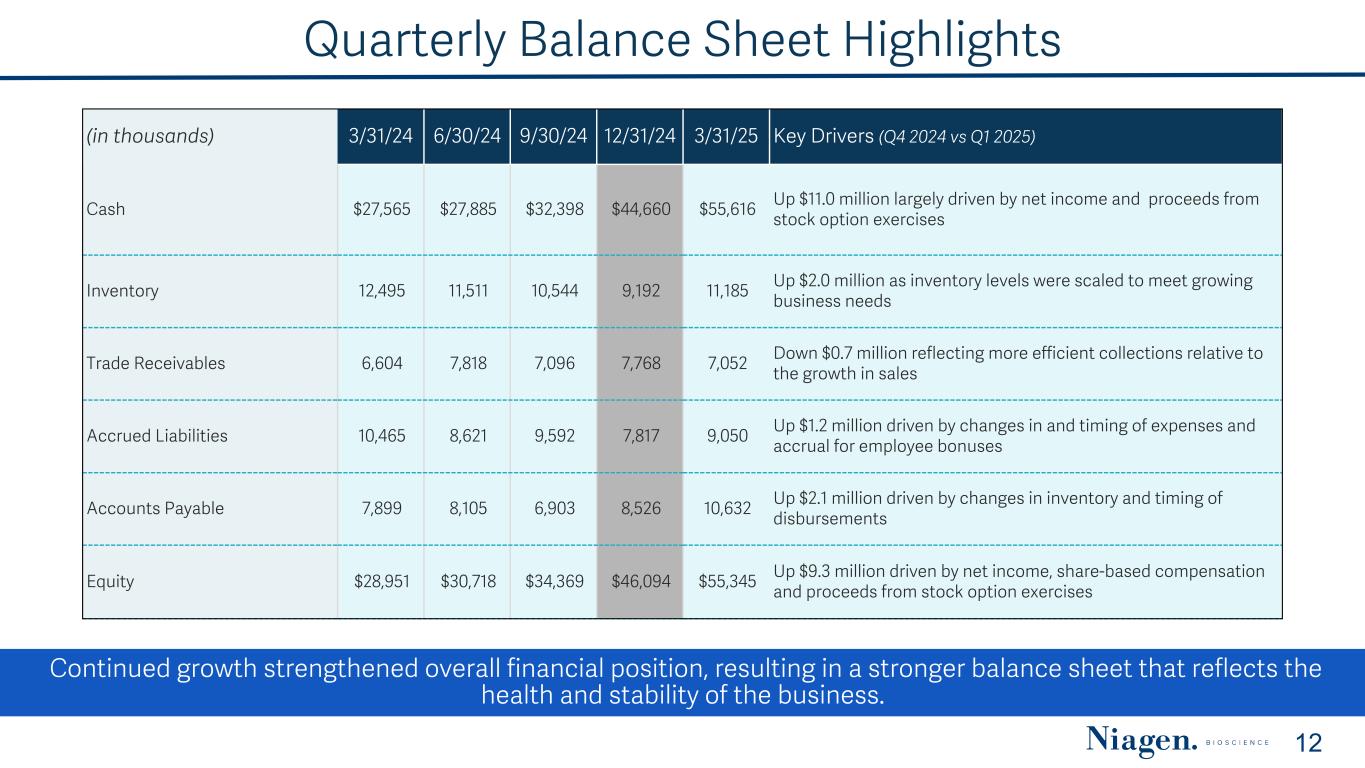

Quarterly Balance Sheet Highlights (in thousands) 3/31/24 6/30/24 9/30/24 12/31/24 3/31/25 Key Drivers (Q4 2024 vs Q1 2025) Cash $27,565 $27,885 $32,398 $44,660 $55,616 Up $11.0 million largely driven by net income and proceeds from stock option exercises Inventory 12,495 11,511 10,544 9,192 11,185 Up $2.0 million as inventory levels were scaled to meet growing business needs Trade Receivables 6,604 7,818 7,096 7,768 7,052 Down $0.7 million reflecting more efficient collections relative to the growth in sales Accrued Liabilities 10,465 8,621 9,592 7,817 9,050 Up $1.2 million driven by changes in and timing of expenses and accrual for employee bonuses Accounts Payable 7,899 8,105 6,903 8,526 10,632 Up $2.1 million driven by changes in inventory and timing of disbursements Equity $28,951 $30,718 $34,369 $46,094 $55,345 Up $9.3 million driven by net income, share-based compensation and proceeds from stock option exercises Continued growth strengthened overall financial position, resulting in a stronger balance sheet that reflects the health and stability of the business. 12

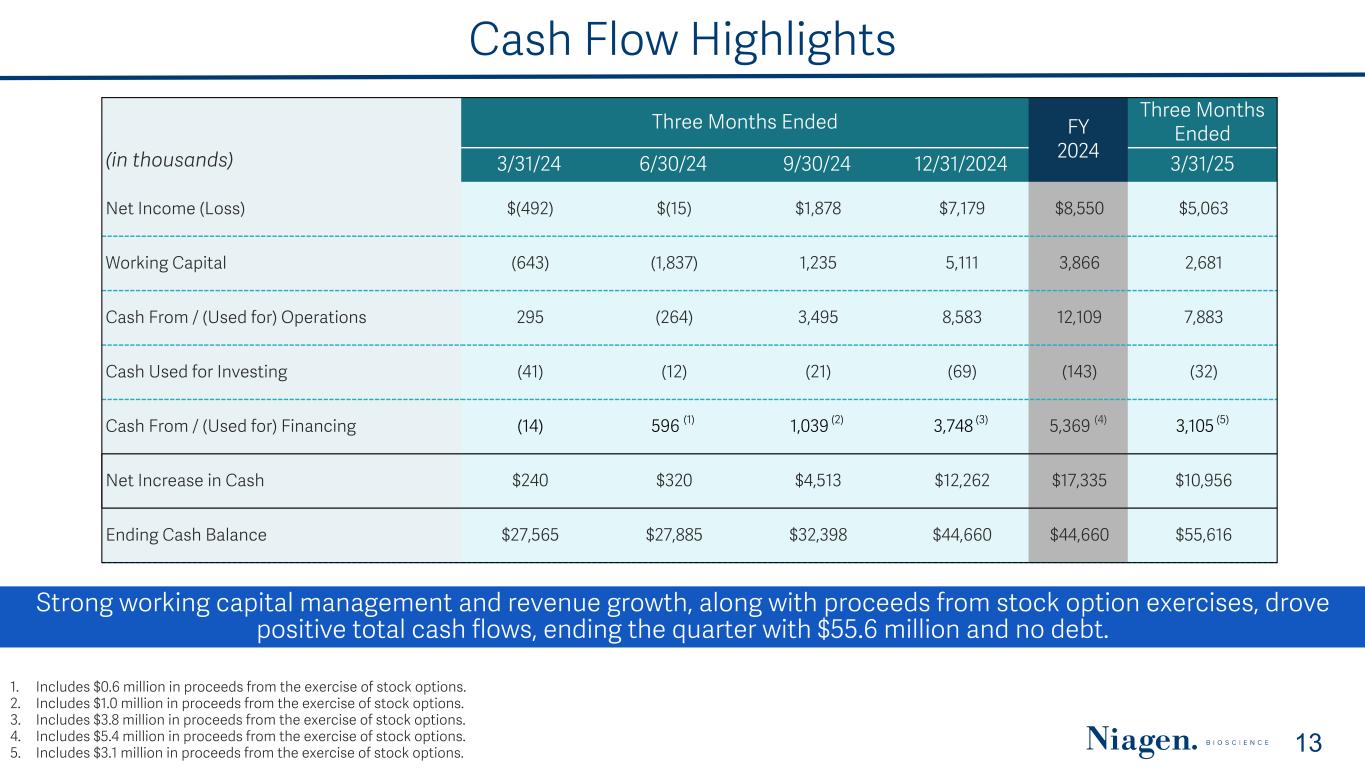

Cash Flow Highlights Three Months Ended FY 2024 Three Months Ended (in thousands) 3/31/24 6/30/24 9/30/24 12/31/2024 3/31/25 Net Income (Loss) $(492) $(15) $1,878 $7,179 $8,550 $5,063 Working Capital (643) (1,837) 1,235 5,111 3,866 2,681 Cash From / (Used for) Operations 295 (264) 3,495 8,583 12,109 7,883 Cash Used for Investing (41) (12) (21) (69) (143) (32) Cash From / (Used for) Financing (14) 596 (1) 1,039 (2) 3,748 (3) 5,369 (4) 3,105 (5) Net Increase in Cash $240 $320 $4,513 $12,262 $17,335 $10,956 Ending Cash Balance $27,565 $27,885 $32,398 $44,660 $44,660 $55,616 Strong working capital management and revenue growth, along with proceeds from stock option exercises, drove positive total cash flows, ending the quarter with $55.6 million and no debt. 13 1. Includes $0.6 million in proceeds from the exercise of stock options. 2. Includes $1.0 million in proceeds from the exercise of stock options. 3. Includes $3.8 million in proceeds from the exercise of stock options. 4. Includes $5.4 million in proceeds from the exercise of stock options. 5. Includes $3.1 million in proceeds from the exercise of stock options.

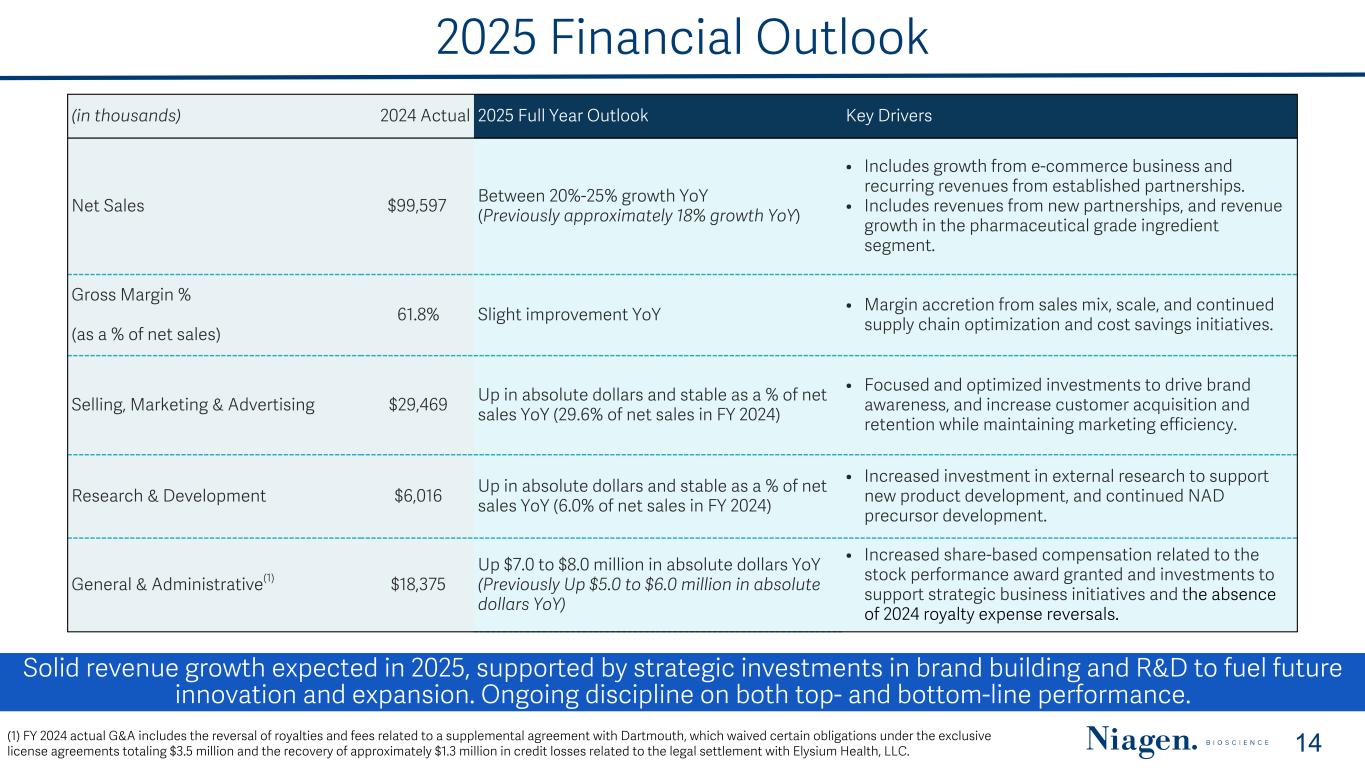

2025 Financial Outlook (in thousands) 2024 Actual 2025 Full Year Outlook Key Drivers Net Sales $99,597 Between 20%-25% growth YoY (Previously approximately 18% growth YoY) • Includes growth from e-commerce business and recurring revenues from established partnerships. • Includes revenues from new partnerships, and revenue growth in the pharmaceutical grade ingredient segment. Gross Margin % (as a % of net sales) 61.8% Slight improvement YoY • Margin accretion from sales mix, scale, and continued supply chain optimization and cost savings initiatives. Selling, Marketing & Advertising $29,469 Up in absolute dollars and stable as a % of net sales YoY (29.6% of net sales in FY 2024) • Focused and optimized investments to drive brand awareness, and increase customer acquisition and retention while maintaining marketing efficiency. Research & Development $6,016 Up in absolute dollars and stable as a % of net sales YoY (6.0% of net sales in FY 2024) • Increased investment in external research to support new product development, and continued NAD precursor development. General & Administrative(1) $18,375 Up $7.0 to $8.0 million in absolute dollars YoY (Previously Up $5.0 to $6.0 million in absolute dollars YoY) • Increased share-based compensation related to the stock performance award granted and investments to support strategic business initiatives and the absence of 2024 royalty expense reversals. Solid revenue growth expected in 2025, supported by strategic investments in brand building and R&D to fuel future innovation and expansion. Ongoing discipline on both top- and bottom-line performance. 14(1) FY 2024 actual G&A includes the reversal of royalties and fees related to a supplemental agreement with Dartmouth, which waived certain obligations under the exclusive license agreements totaling $3.5 million and the recovery of approximately $1.3 million in credit losses related to the legal settlement with Elysium Health, LLC.

The information contained in this documents is confidential, privileged and only for the information of the intended recipient and may not be used, published or redistributed without the prior written consent (2019) 15 The Science

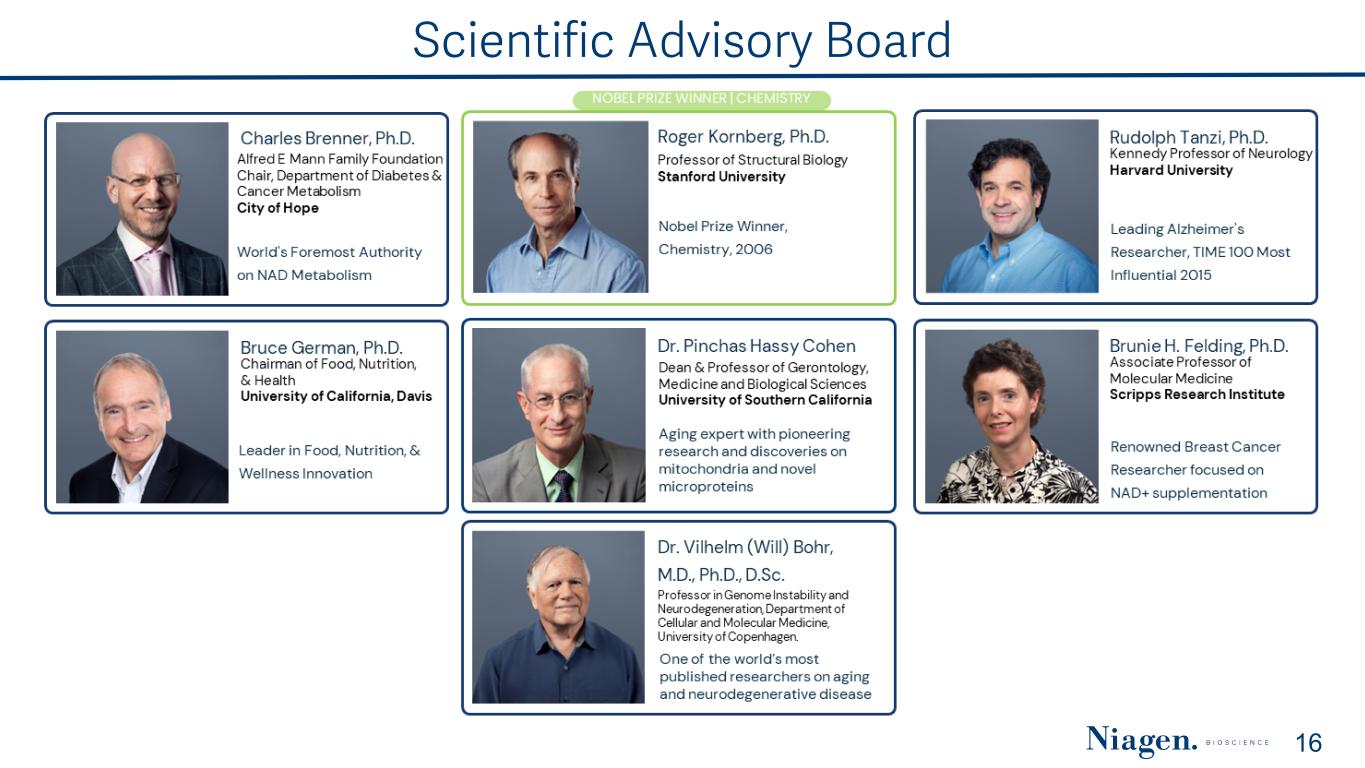

Scientific Advisory Board 16

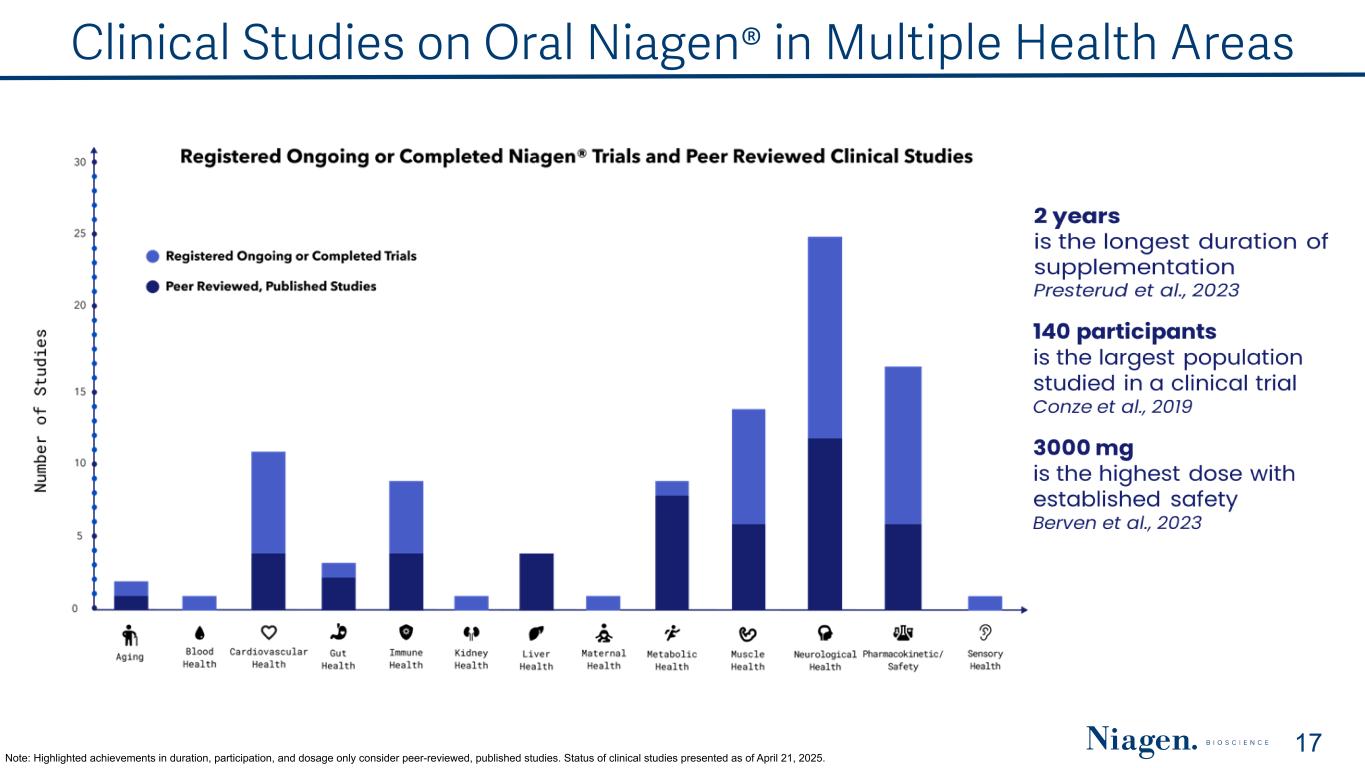

Clinical Studies on Oral Niagen® in Multiple Health Areas Note: Highlighted achievements in duration, participation, and dosage only consider peer-reviewed, published studies. Status of clinical studies presented as of April 21, 2025. 17

The information contained in this documents is confidential, privileged and only for the information of the intended recipient and may not be used, published or redistributed without the prior written consent (2019) Contact Info: Ben Shamsian Lytham Partners T: +1(646) 829-9701 Shamsian@LythamPartners.com www.NiagenBioscience.com Where to purchase Tru Niagen® TruNiagen.com Find Health Clinics Offering Niagen® Plus NiagenPlus.com 18