Please wait

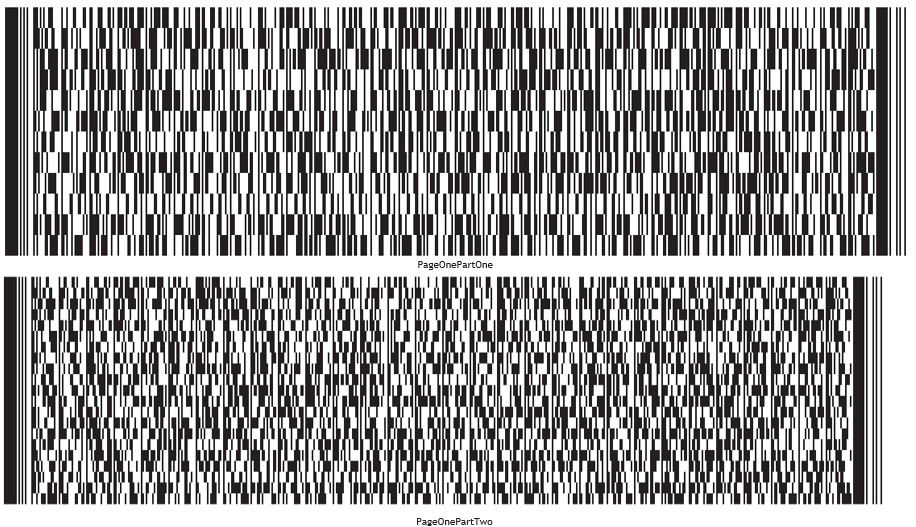

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 1 of 53

Debtor's Name: Marin Software Incorporated Case No. 25-11263

UNITED STATES BANKRUPTCY COURT

___ FOR THE DISTRICT OF DELAWARE

________________________________________________

In Re. Marin Software Incorporated § Case No. 25-11263 ____________

§

______________________________________________§

Debtor(s) §

☐ Jointly Administered

Monthly Operating Report Chapter 11

Reporting Period Ended: 07/31/2025 Petition Date: 07/01/2025

Months Pending: 1 Industry Classification: 5 1 3 2

Reporting Method: Accrual Basis ☒ Cash Basis ☐

Debtor's Full-Time Employees (current): 9

Debtor's Full-Time Employees (as of date of order for relief): 11

Supporting Documentation (check all that are attached):

(For jointly administered debtors, any required schedules must be provided on a non-consolidated basis for each debtor)

☒ Statement of cash receipts and disbursements

☒ Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit

☒ Statement of operations (profit or loss statement)

☒ Accounts receivable aging

☒ Postpetition liabilities aging

☐ Statement of capital assets

☐ Schedule of payments to professionals

☐ Schedule of payments to insiders

☒ All bank statements and bank reconciliations for the reporting period

☐ Description of the assets sold or transferred and the terms of the sale or transfer

/s/ Robert Bertz Robert Bertz

Signature of Responsible Party Printed Name of Responsible Party

08/20/2025 149 New Montgomery Street, 4th Floor, San Francisco Date CA 94105

Address

UST Form 11-MOR (12/23/2022)

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 2 of 53

Debtor's Name: Marin Software Incorporated Case No. 25-11263

STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. § 1320.4(a)(2) applies.

|

|

|

|

|

Part 1: Cash Receipts and Disbursements |

Current Month |

Cumulative |

a. Cash balance beginning of month |

$163,100 |

|

b. Total receipts (net of transfers between accounts) |

$779,791 |

|

|

$779,791 |

c. Total disbursements (netof transfers between accounts) |

$479,968 |

|

|

$479,968 |

d. Cash balance end of month (a+b-c) |

$462,923 |

|

|

|

e. Disbursements made by third partyfor the benefitof the estate |

$0 |

|

|

$0 |

f. Total disbursements for quarterly fee calculation (c+e) |

$479,968 |

|

|

$479,968 |

|

|

|

|

|

Part 2: Asset and Liability Status (Not generally applicable to Individual Debtors. See Instructions.) |

Current Month |

|

|

Cumulative |

a. Accounts receivable (total net of allowance) |

$1,917,291 |

|

b. Accounts receivable over90 days outstanding (net of allowance) |

$157,641 |

c. Inventory ( Book ☐ Market ☐ Other ☒ (attach explanation)) |

$0 |

d Total current assets |

$3,851,038 |

e. Total assets |

$4,853,628 |

f. Postpetition payables (excluding taxes) |

$773,902 |

g. Postpetition payables past due (excluding taxes) |

$0 |

h. Postpetition taxes payable |

$9,862 |

i. Postpetition taxes pastdue |

$0 |

j. Total postpetition debt (f+h) |

$783,764 |

k. Prepetition secured debt |

$300,000 |

l. Prepetition priority debt |

$0 |

m. Prepetition unsecured debt |

$632,892 |

n. Total liabilities (debt) (j+k+l+m) |

$1,716,656 |

o. Ending equity/net worth(e-n) |

$3,136,972 |

Part 3: Assets Sold or Transferred |

Current Month |

Cumulative |

a. Total cash sales price for assets sold/transferred outside the ordinary |

$0 |

$0 |

b. Total payments to third parties incident to assets being sold/transferred |

$0 |

$0 |

c. Net cash proceeds from assets sold/transferred outside the ordinary course of business (a-b) |

$0 |

$0 |

|

|

|

|

Part 4: Income Statement (Statement of Operations) |

Current Month |

Cumulative |

|

(Not generally applicable to Individual Debtors. See Instructions.) |

|

|

a. Gross income/sales (net of returns and allowances) |

$132,755 |

|

b. Cost of goodssold (inclusive of depreciation, if applicable) |

$-11,311 |

|

c. Gross profit (a-b) |

$144,066 |

|

d. Selling expenses |

$0 |

|

e. Generaland administrative expenses |

$177,814 |

|

f. Other expenses |

$16,510 |

|

g. Depreciation and/or amortization (not included in 4b) |

$0 |

|

h. Interest |

$0 |

|

i. Taxes (local, state,and federal) |

$0 |

|

j. Reorganization items |

$0 |

|

k. Profit (loss) |

$-48,165 |

$-48,165 |

UST Form 11-MOR (12/23/2022)

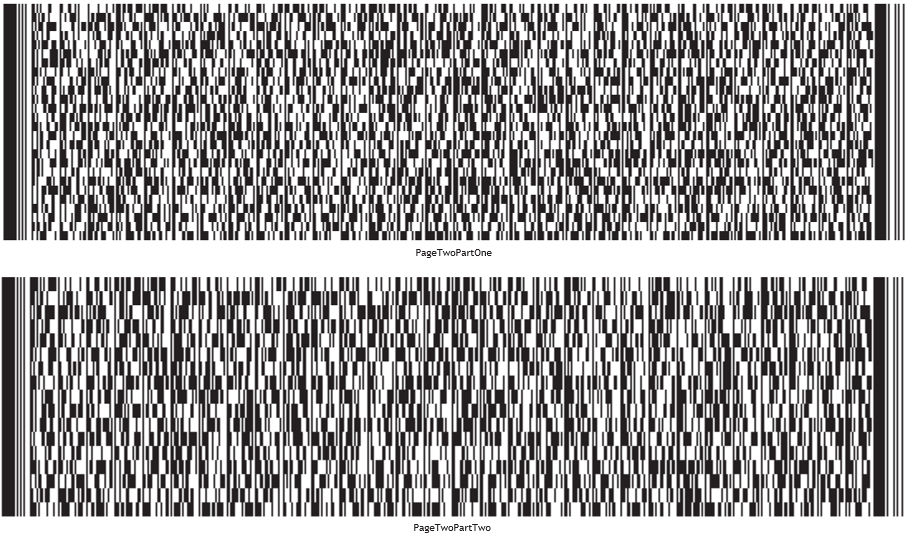

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 3 of 53

Debtor's Name: Marin Software Incorporated Case No. 25-11263

|

|

|

|

|

|

|

|

Part 5: Professional Fees and Expenses |

a. |

|

Approved Current Month |

Approved Cumulative |

Paid Current Month |

Paid Cumulative |

Debtor's professional fees & expenses (bankruptcy) Aggregate Total |

|

|

|

|

Itemized Breakdown by Firm |

|

|

Firm Name |

Role |

i |

|

|

|

|

|

|

ii |

|

|

|

|

|

|

iii |

|

|

|

|

|

|

iv |

|

|

|

|

|

|

v |

|

|

|

|

|

|

vi |

|

|

|

|

|

|

vii |

|

|

|

|

|

|

viii |

|

|

|

|

|

|

ix |

|

|

|

|

|

|

x |

|

|

|

|

|

|

xi |

|

|

|

|

|

|

xii |

|

|

|

|

|

|

xiii |

|

|

|

|

|

|

xiv |

|

|

|

|

|

|

xv |

|

|

|

|

|

|

xvi |

|

|

|

|

|

|

xvii |

|

|

|

|

|

|

xviii |

|

|

|

|

|

|

xix |

|

|

|

|

|

|

xx |

|

|

|

|

|

|

xxi |

|

|

|

|

|

|

xxii |

|

|

|

|

|

|

xxiii |

|

|

|

|

|

|

xxiv |

|

|

|

|

|

|

xxv |

|

|

|

|

|

|

xxvi |

|

|

|

|

|

|

xxvii |

|

|

|

|

|

|

xxviii |

|

|

|

|

|

|

xxix |

|

|

|

|

|

|

xxx |

|

|

|

|

|

|

xxxi |

|

|

|

|

|

|

xxxii |

|

|

|

|

|

|

xxxiii |

|

|

|

|

|

|

xxxiv |

|

|

|

|

|

|

xxxv |

|

|

|

|

|

|

xxxvi |

|

|

|

|

|

|

UST Form 11-MOR (12/23/2022)

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 4 of 53

Debtor's Name: Marin Software Incorporated Case No. 25-11263

|

|

|

|

|

|

|

|

|

xxxvii |

|

|

|

|

|

|

xxxvii |

|

|

|

|

|

|

xxxix |

|

|

|

|

|

|

xl |

|

|

|

|

|

|

xli |

|

|

|

|

|

|

xlii |

|

|

|

|

|

|

xliii |

|

|

|

|

|

|

xliv |

|

|

|

|

|

|

xlv |

|

|

|

|

|

|

xlvi |

|

|

|

|

|

|

xlvii |

|

|

|

|

|

|

xlviii |

|

|

|

|

|

|

xlix |

|

|

|

|

|

|

l |

|

|

|

|

|

|

li |

|

|

|

|

|

|

lii |

|

|

|

|

|

|

liii |

|

|

|

|

|

|

liv |

|

|

|

|

|

|

lv |

|

|

|

|

|

|

lvi |

|

|

|

|

|

|

lvii |

|

|

|

|

|

|

lviii |

|

|

|

|

|

|

lix |

|

|

|

|

|

|

lx |

|

|

|

|

|

|

lxi |

|

|

|

|

|

|

lxii |

|

|

|

|

|

|

lxiii |

|

|

|

|

|

|

lxiv |

|

|

|

|

|

|

lxv |

|

|

|

|

|

|

lxvi |

|

|

|

|

|

|

lxvii |

|

|

|

|

|

|

lxviii |

|

|

|

|

|

|

lxix |

|

|

|

|

|

|

lxx |

|

|

|

|

|

|

lxxi |

|

|

|

|

|

|

lxxii |

|

|

|

|

|

|

lxxiii |

|

|

|

|

|

|

lxxiv |

|

|

|

|

|

|

lxxv |

|

|

|

|

|

|

lxxvi |

|

|

|

|

|

|

lxxvii |

|

|

|

|

|

|

lxxviii |

|

|

|

|

|

|

UST Form 11-MOR (12/23/2022)

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 5 of 53

Debtor's Name: Marin Software Incorporated Case No. 25-11263

|

|

|

|

|

|

|

|

|

lxxix |

|

|

|

|

|

|

lxxx |

|

|

|

|

|

|

lxxxi |

|

|

|

|

|

|

lxxxii |

|

|

|

|

|

|

lxxxiii |

|

|

|

|

|

|

lxxxiv |

|

|

|

|

|

|

lxxxv |

|

|

|

|

|

|

lxxxvi |

|

|

|

|

|

|

lxxxvi |

|

|

|

|

|

|

lxxxvi |

|

|

|

|

|

|

lxxxix |

|

|

|

|

|

|

xc |

|

|

|

|

|

|

xci |

|

|

|

|

|

|

xcii |

|

|

|

|

|

|

xciii |

|

|

|

|

|

|

xciv |

|

|

|

|

|

|

xcv |

|

|

|

|

|

|

xcvi |

|

|

|

|

|

|

xcvii |

|

|

|

|

|

|

xcviii |

|

|

|

|

|

|

xcix |

|

|

|

|

|

|

c |

|

|

|

|

|

|

ci |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. |

|

Approved Current Month |

Approved Cumulative |

Paid Current Month |

Paid Cumulative |

Debtor's professionalfees& expenses (nonbankruptcy) Aggregate Total |

|

|

|

|

Itemized Breakdown by Firm |

|

|

Firm Name |

Role |

i |

|

|

|

|

|

|

ii |

|

|

|

|

|

|

iii |

|

|

|

|

|

|

iv |

|

|

|

|

|

|

v |

|

|

|

|

|

|

vi |

|

|

|

|

|

|

vii |

|

|

|

|

|

|

viii |

|

|

|

|

|

|

ix |

|

|

|

|

|

|

x |

|

|

|

|

|

|

xi |

|

|

|

|

|

|

xii |

|

|

|

|

|

|

xiii |

|

|

|

|

|

|

xiv |

|

|

|

|

|

|

UST Form 11-MOR (12/23/2022)

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 6 of 53

Debtor's Name: Marin Software Incorporated Case No. 25-11263

|

|

|

|

|

|

|

|

|

xv |

|

|

|

|

|

|

xvi |

|

|

|

|

|

|

xvii |

|

|

|

|

|

|

xviii |

|

|

|

|

|

|

xix |

|

|

|

|

|

|

xx |

|

|

|

|

|

|

xxi |

|

|

|

|

|

|

xxii |

|

|

|

|

|

|

xxiii |

|

|

|

|

|

|

xxiv |

|

|

|

|

|

|

xxv |

|

|

|

|

|

|

xxvi |

|

|

|

|

|

|

xxvii |

|

|

|

|

|

|

xxviii |

|

|

|

|

|

|

xxix |

|

|

|

|

|

|

xxx |

|

|

|

|

|

|

xxxi |

|

|

|

|

|

|

xxxii |

|

|

|

|

|

|

xxxiii |

|

|

|

|

|

|

xxxiv |

|

|

|

|

|

|

xxxv |

|

|

|

|

|

|

xxxvi |

|

|

|

|

|

|

xxxvii |

|

|

|

|

|

|

xxxvii |

|

|

|

|

|

|

xxxix |

|

|

|

|

|

|

xl |

|

|

|

|

|

|

xli |

|

|

|

|

|

|

xlii |

|

|

|

|

|

|

xliii |

|

|

|

|

|

|

xliv |

|

|

|

|

|

|

xlv |

|

|

|

|

|

|

xlvi |

|

|

|

|

|

|

xlvii |

|

|

|

|

|

|

xlviii |

|

|

|

|

|

|

xlix |

|

|

|

|

|

|

l |

|

|

|

|

|

|

li |

|

|

|

|

|

|

lii |

|

|

|

|

|

|

liii |

|

|

|

|

|

|

liv |

|

|

|

|

|

|

lv |

|

|

|

|

|

|

lvi |

|

|

|

|

|

|

UST Form 11-MOR (12/23/2022)

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 7 of 53

Debtor's Name: Marin Software Incorporated Case No. 25-11263

|

|

|

|

|

|

|

|

|

lvii |

|

|

|

|

|

|

lviii |

|

|

|

|

|

|

lix |

|

|

|

|

|

|

lx |

|

|

|

|

|

|

lxi |

|

|

|

|

|

|

lxii |

|

|

|

|

|

|

lxiii |

|

|

|

|

|

|

lxiv |

|

|

|

|

|

|

lxv |

|

|

|

|

|

|

lxvi |

|

|

|

|

|

|

lxvii |

|

|

|

|

|

|

lxviii |

|

|

|

|

|

|

lxix |

|

|

|

|

|

|

lxx |

|

|

|

|

|

|

lxxi |

|

|

|

|

|

|

lxxii |

|

|

|

|

|

|

lxxiii |

|

|

|

|

|

|

lxxiv |

|

|

|

|

|

|

lxxv |

|

|

|

|

|

|

lxxvi |

|

|

|

|

|

|

lxxvii |

|

|

|

|

|

|

lxxviii |

|

|

|

|

|

|

lxxix |

|

|

|

|

|

|

lxxx |

|

|

|

|

|

|

lxxxi |

|

|

|

|

|

|

lxxxii |

|

|

|

|

|

|

lxxxiii |

|

|

|

|

|

|

lxxxiv |

|

|

|

|

|

|

lxxxv |

|

|

|

|

|

|

lxxxvi |

|

|

|

|

|

|

lxxxvi |

|

|

|

|

|

|

lxxxvi |

|

|

|

|

|

|

lxxxix |

|

|

|

|

|

|

xc |

|

|

|

|

|

|

xci |

|

|

|

|

|

|

xcii |

|

|

|

|

|

|

xciii |

|

|

|

|

|

|

xciv |

|

|

|

|

|

|

xcv |

|

|

|

|

|

|

xcvi |

|

|

|

|

|

|

xcvii |

|

|

|

|

|

|

xcviii |

|

|

|

|

|

|

UST Form 11-MOR (12/23/2022)

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 8 of 53

Debtor's Name: Marin Software Incorporated Case No. 25-11263

|

|

|

|

|

|

|

|

|

xcix |

|

|

|

|

|

|

c |

|

|

|

|

|

|

c. All professional fees and expenses (debtor & committees) |

|

|

|

|

|

|

|

|

Part 6: Postpetition Taxes |

Current Month |

|

Cumulative |

a. Postpetition income taxes accrued (local, state,and federal) |

$0 |

|

$0 |

b. Postpetition income taxes paid (local, state,and federal) |

$0 |

|

$0 |

c. Postpetition employer payroll taxes accrued |

$0 |

|

$0 |

d. Postpetition employer payroll taxes paid |

$6,408 |

|

$6,408 |

e. Postpetition property taxes paid |

$0 |

|

$0 |

f. Postpetition other taxes accrued (local, state,and federal) |

$9,862 |

|

$9,862 |

g. Postpetition other taxes paid (local, state,and federal) |

$0 |

|

$0 |

|

|

|

|

Part 7: Questionnaire - During this reporting period: |

a. Were any payments made on prepetition debt? (if yes, see Instructions) |

Yes ☐ No ☒ |

b. Were any payments made outside the ordinary course of business without court approval? (if yes, see Instructions) |

Yes ☐ No ☒ |

c. Were any payments made to or on behalf of insiders? |

Yes ☒ No ☐ |

d. Are you current on postpetition tax return filings? |

Yes ☒ No ☐ |

e. Are you current on postpetition estimated tax payments? |

Yes ☒ No ☐ |

f. Were all trust fund taxes remitted on a current basis? |

Yes ☒ No ☐ |

g. Was there any postpetition borrowing, other than trade credit? (if yes, see Instructions) |

Yes ☒ No ☐ |

h. Were all payments made to or on behalf of professionals approved by the court? |

Yes ☐ No ☐ N/A ☒ |

i. Do you have: Worker's compensation insurance? |

Yes ☒ No ☐ |

If yes, are your premiums current? |

Yes ☒ No ☐ N/A ☐ (if no, see Instructions) |

Casualty/property insurance? |

Yes ☒ No ☐ |

If yes, are your premiums current? |

Yes ☒ No ☐ N/A ☐ (if no, see Instructions) |

General liability insurance? |

Yes ☒ No ☐ |

If yes, are your premiums current? |

Yes ☒ No ☐ N/A ☐ (if no, see Instructions) |

j. Has a plan of reorganization been filed with the court? |

Yes ☒ No ☐ |

k. Has a disclosure statement been filed with the court? |

Yes ☒ No ☐ |

l. Are you current with quarterly U.S. Trustee fees as set forth under 28 U.S.C. § 1930? |

Yes ☒ No ☐ |

UST Form 11-MOR (12/23/2022)

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 9 of 53

Debtor's Name: Marin Software Incorporated Case No. 25-11263

|

|

|

Part 8: Individual Chapter 11 Debtors (Only) |

|

a. Gross income (receipts) from salary and wages |

$0 |

|

b. Gross income (receipts)from self-employment |

$0 |

|

c. Gross income from all other sources |

$0 |

|

d. Total income in the reporting period (a+b+c) |

$0 |

|

e. Payroll deductions |

$0 |

|

f. Self-employment related expenses |

$0 |

|

g. Living expenses |

$0 |

|

h. All other expenses |

$0 |

|

i. Total expenses in the reporting period (e+f+g+h) |

$0 |

|

j. Difference between total income and total expenses (d-i) |

$0 |

|

k. List the total amount of all postpetition debts that are past due |

$0 |

|

l. Are you required to pay any Domestic Support Obligations as defined by U.S.C § 101(14A)? |

Yes ☐ No ☒ |

|

m. If yes, have you made all Domestic Support Obligation payments? |

Yes ☐ No ☐ N/A ☒ |

|

Privacy Act Statement

28 U.S.C. § 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C. §§ 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. § 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor's progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee's or examiner's duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee's systems of records notice, UST-001, "Bankruptcy Case Files and Associated Records." See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http://www.justice.gov/ust/ eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. § 1112(b)(4)(F).

I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate.

/s/ Robert Bertz /s/ Robert Bertz

Signature of Responsible Party Printed Name of Responsible Party

Chief Financial Officer 08/20/2025

Title Date

UST Form 11-MOR (12/23/2022)

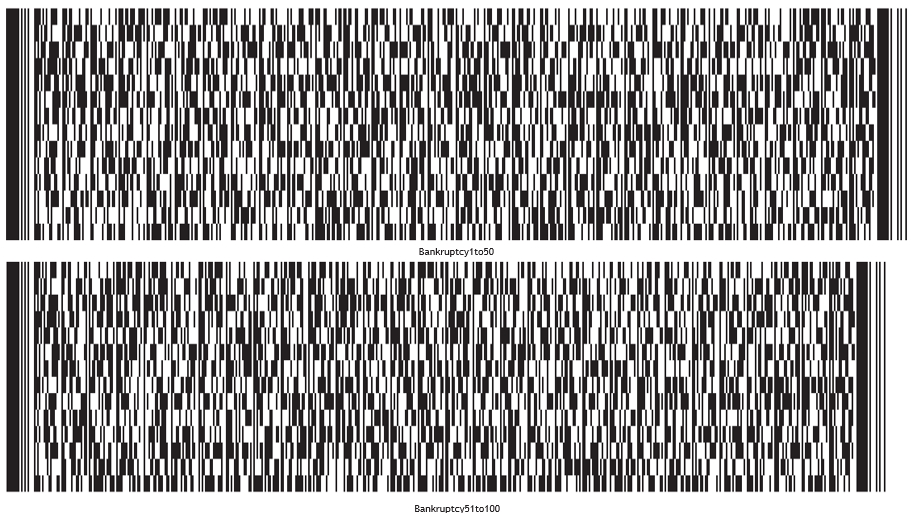

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 10 of 53

Debtor's Name: Marin Software Incorporated Case No. 25-11263

UST Form 11-MOR (12/23/2022)

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 11 of 53

Debtor's Name: Marin Software Incorporated Case No. 25-11263

UST Form 11-MOR (12/23/2022)

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 12 of 53

Debtor's Name: Marin Software Incorporated Case No. 25-11263

UST Form 11-MOR (12/23/2022)

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 13 of 53

UNITED STATES BANKRUPTCY COURT DISTRICT OF DELAWARE

MONTHLY OPERATING REPORT – SUPPORTING DOCUMENTATION

Case No. 25-11263

Marin Software Incorporated

Reporting Period: July 1, 2025 – July 31, 2025

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 14 of 53

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

|

|

In re: |

Chapter 11 |

MARINSOFTWARE INCORPORATED,1 |

Case No. 25-11263 (LSS) |

Debtor. |

|

MONTHLY OPERATING REPORT NOTES FOR JULY 2025

On July 1, 2025 (the “Petition Date”), the above-captioned debtor (the “Debtor”) filed a voluntary petition for relief under chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). The Debtor is operating its business and managing its property as a debtor in possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code. The information provided herein, except as otherwise noted, is reported as of the Petition Date.

The following notes and statements of limitations and disclaimers should be referred to, and referenced in connection with, any review of this Monthly Operating Report (the “MOR”).

1.Introduction. This MOR is unaudited and does not purport to represent financial statements prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), and it is not intended to fully reconcile to the financial statements prepared by the Debtor. Information contained in this MOR has been derived from the Debtor’s books and records, but does not reflect in all circumstances presentation for GAAP or SEC reporting purposes. Therefore, to comply with their obligations to provid e MORs during this chapter 11 case, the Debtor has prepared this MOR using the best information presently available to it, which has been collected, maintained, and prepared in accordance with its historical accounting practices. Accordingly, this MOR is true and accurate to the best of the Debtor’s knowledge, information, and belief, based on currently available data. The results of operations and financial position contained herein are not necessarily indicative of results that may be expected for any period other than the period covered by this MOR, and may not necessarily reflect the Debtor’s future results of operations and financial position.

2.Reservation of Rights. This MOR is limited in scope, and unless otherwise noted, covers the period beginning on July 1, 2025 and ending July 31, 2025, and has been prepared solely for the purpose of complying with the monthly reporting requirements of the Debtor’s chapter 11 case. The unaudited financial information

____________________________

1 The last four digits of the Debtor’s federal tax identification number are 7180. The Debtor’s address is 149 New Montgomery, 4th Floor, San Francisco, CA 94105. Copies of all pleadings filed in this chapter 11 case may be obtained free of charge at www.donlinrecano.com/mrin.

has been derived from the Debtor’s books and records. The information

4919-2035-7216.1 54610.00002

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 15 of 53

presented herein has not been subject to all procedures that typically would be applied to financial information in accordance with GAAP. Upon the application of such procedures, the Debtor believes that the financial information could be subject to material change. The information furnished in this MOR includes normal recurring adjustments but does not include all of the adjustments that typically would be made for interim financial information presented in accordance with GAAP.

Given the complexity of the Debtor’s business, inadvertent errors or omission may occur. Accordingly, the Debtor hereby reserve all of their rights to dispute the nature, validity, status, enforceability, or executory natures of any claim amount, agreement, representation, or other statement set forth in this MOR. Further, the Debtor reserves the right to amend or supplement this MOR, if necessary, but shall be under no obligation to do so.

3.Accounting Principles. The Debtor maintains its financial records according to GAAP, however the MOR does not purport to represent financial statements prepared in accordance with GAAP, nor are they intended to be fully reconciled with the financial statements of the Debtor. Not all tax entries for the period have been completed by the time this report was due to be filed.

4.Currency. Unless otherwise indicated, all amounts in the MOR are reflected in

U.S. dollars.

5.Part 1: Cash Receipts and Disbursements. On July 29, 2025, the Bankruptcy Court entered its order [Docket No. 79] (the “Final DIP Order”) authorizing the Debtor to obtain post petition secured financing on a final basis. The Debtor’s cash position reflects the receipt of proceeds under the debtor in possession credit facility authorized by the Final DIP Order.

The Debtor’s cash receipts and disbursements reflected herein cover the period from July 1, 2025 through July 31, 2025; provided, however, the Debtor’s beginning cash balance and disbursements for this period excludes amounts related to wire transfers that were initiated on June 30, 2025, but which were not processed by the Debtor’s bank until July 1, 2025.

6.Part 2: Asset and Liability Status. Asset values are reported as of July 31, 2025. All liabilities disclosed herein are stated per the Debtor’s balance sheet and underlying records as of July 31, 2025; provided, however, prepetition unsecured debt excludes liabilities marked as contingent, unliquidated, disputed, or undetermined on the Debtor’s schedules of assets and liabilities, as such liabilities are not recorded in the Debtor’s books and records as due and owing as of July 31, 2025. Prepetition and post petition balances of uncompromised liabilities are reported to the best of the Debtor’s knowledge. However, the ultimate amount of the Debtor’s liabilities is undetermined at this time.

Intercompany Claims. The intercompany balances are reported on a consolidated basis as of June 30, 2025. As a result, the intercompany balances net to zero and are not included in the Monthly Operating Report

4919-2035-7216.1 54610.00002

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 16 of 53

or the supporting financial statements.

7.Part 4: Income Statement (Statement of Operations). “Cost of goods sold” reflects a negative balance for the applicable period due to a credit received from the Debtor’s co-location data center lessor.

7c. Were any payments made to or on behalf of insiders? All cash payments made during the period to insiders were made on account of ordinary course wages; provided, however, approximately $1,600 was inadvertently paid to American Express during the period on account of personal charges incurred by the Chief Executive Officer. This payment will be recouped by the Debtor in the form of a setoff against the Debtor’s severance obligations owed to the Chief Executive Officer.

4919-2035-7216.1 54610.00002

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 17 of 53

MARIN SOFTWARE INCORPORATED (Case No. 25-11263)

STATEMENT OF CASH RECEIPTS AND DISBURSEMENTS

Increase/(Decrease) in Cash and Cash Equivalents

For the Period 7/1/25 -7/31/25

|

|

|

Cash Receipts |

1 |

Cash Received From Sales / AR Collections |

$139,791 |

2 |

DIP Loan |

$640,000 |

|

Total Cash Receipts |

$779,791 |

|

|

|

Cash Disbursements |

3 |

Payroll & Benefits |

$127,768 |

4 |

Sales Tax |

$2,586 |

5 |

Bankruptcy Professional Escrow Fee |

$312,000 |

6 |

Insurance Expense |

$13,149 |

7 |

Vendors |

$22,578 |

8 |

Bank Service Charges |

$1,887 |

9 |

Total Cash Disbursements |

$479,968 |

10 |

Net Increase (Decrease) in Cash |

$299,823 |

11 |

Cash Balance, Beginning of Period |

$163,100 |

12 |

Cash Balance, End of Period |

$462,923 |

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 18 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 19 of 53

MARIN SOFTWARE INCORPORATED (Case No. 25-11263)

Income Statement

For the Period 7/1/25 -7/31/25

|

|

Description |

July-25 |

Revenue |

$132,755 |

Cost of goods sold |

(11,311) |

Gross Profit |

144,066 |

General and administrative expenses |

177,814 |

Operating loss |

(33,748) |

Interest Income |

2,093 |

Other Expenses |

16,510 |

Net loss |

($48,165) |

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 20 of 53

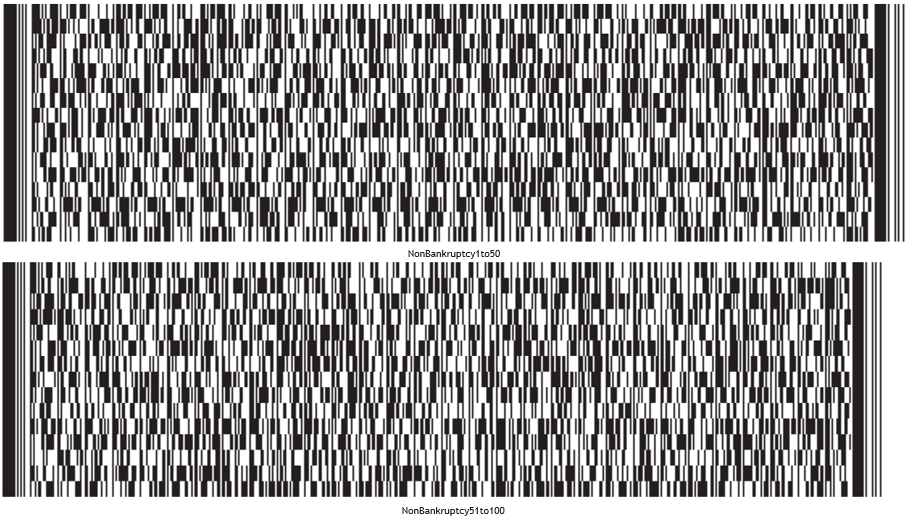

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 21 of 53

MARIN SOFTWARE INCORPORATED (Case No. 25-11263)

Post-Petition Payables Aging

For the Period 7/1/25 -7/31/25

|

|

|

|

|

|

|

|

$783,764 |

$0 |

$0 |

$0 |

$0 $783,764 |

Vendor |

Current |

30 |

60 |

90 |

>90 |

Total |

5Y - DIPFinancing |

640,000 |

- |

- |

- |

- |

640,000 |

Fenwick & WestLLP |

40,825 |

- |

- |

- |

- |

40,825 |

Aetna Health of California Inc |

27,360 |

- |

- |

- |

- |

27,360 |

Changzheng Li |

15,840 |

- |

- |

- |

- |

15,840 |

Switch |

15,164 |

- |

- |

- |

- |

15,164 |

Postpetition taxes payable |

9,862 |

- |

- |

- |

- |

9,862 |

Amazon Web Services |

9,777 |

- |

- |

- |

- |

9,777 |

Riveron Consulting LLC |

8,880 |

- |

- |

- |

- |

8,880 |

AMEX Payable |

7,360 |

- |

- |

- |

- |

7,360 |

Vicki Ng |

2,985 |

- |

- |

- |

- |

2,985 |

Michael Coleman |

1,375 |

- |

- |

- |

- |

1,375 |

Miller Kaplan |

1,225 |

- |

- |

- |

- |

1,225 |

Broadridge |

904 |

- |

- |

- |

- |

904 |

GitHub |

625 |

- |

- |

- |

- |

625 |

Belcher, Smolen &Van Loo, LLP |

575 |

- |

- |

- |

- |

575 |

Iron Mountain Inc. |

509 |

- |

- |

- |

- |

509 |

Provident Life and Accident Insurance Company |

499 |

- |

- |

- |

- |

499 |

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 22 of 53

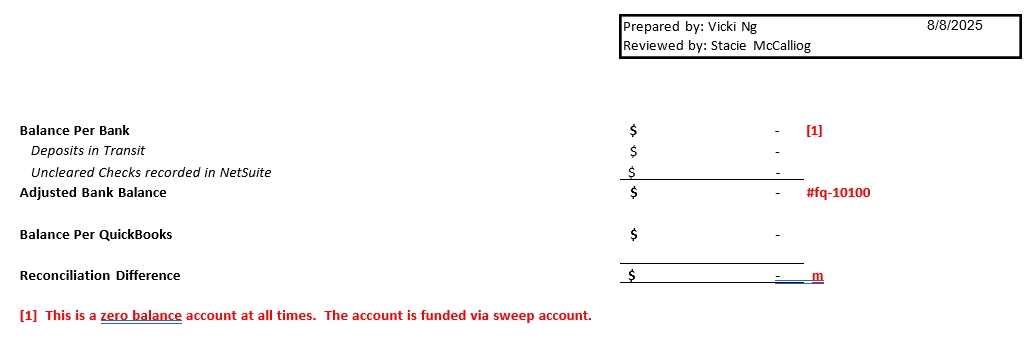

MARIN SOFTWARE INCORPORATED (Case No. 25-11263)

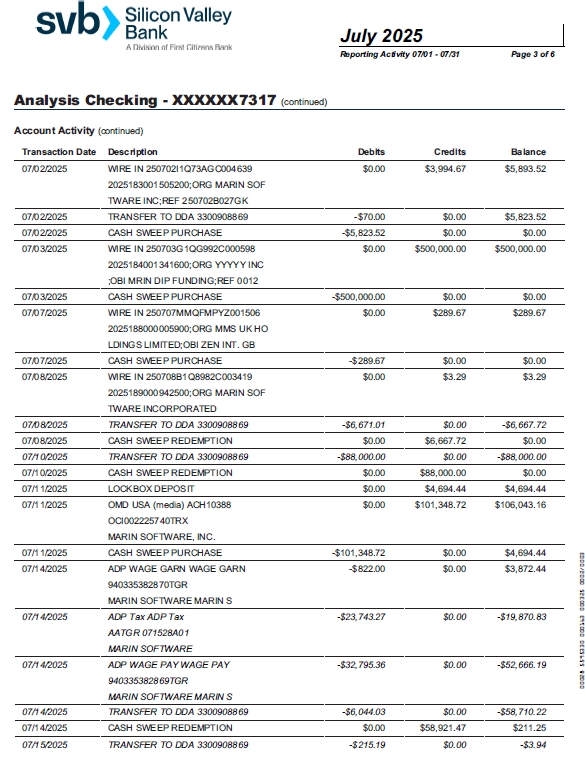

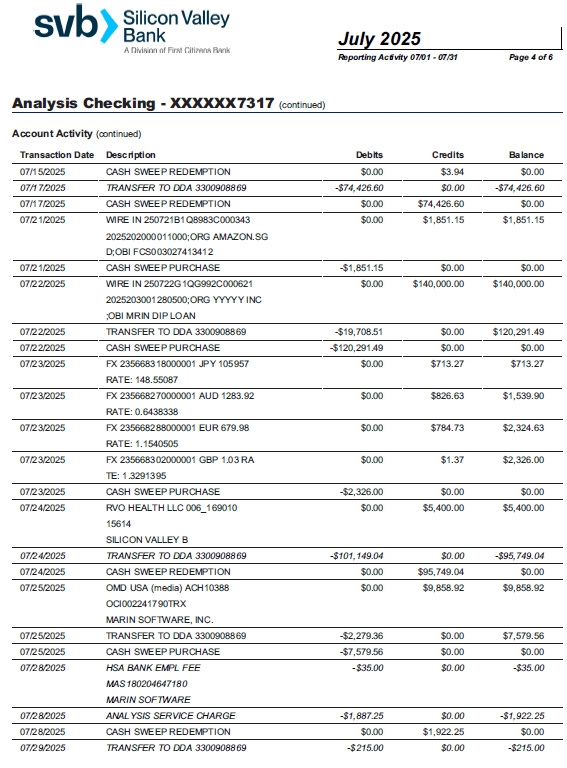

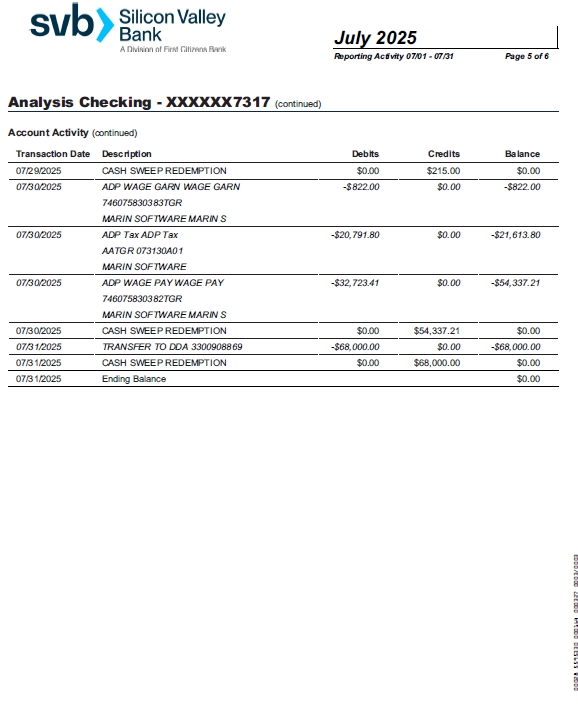

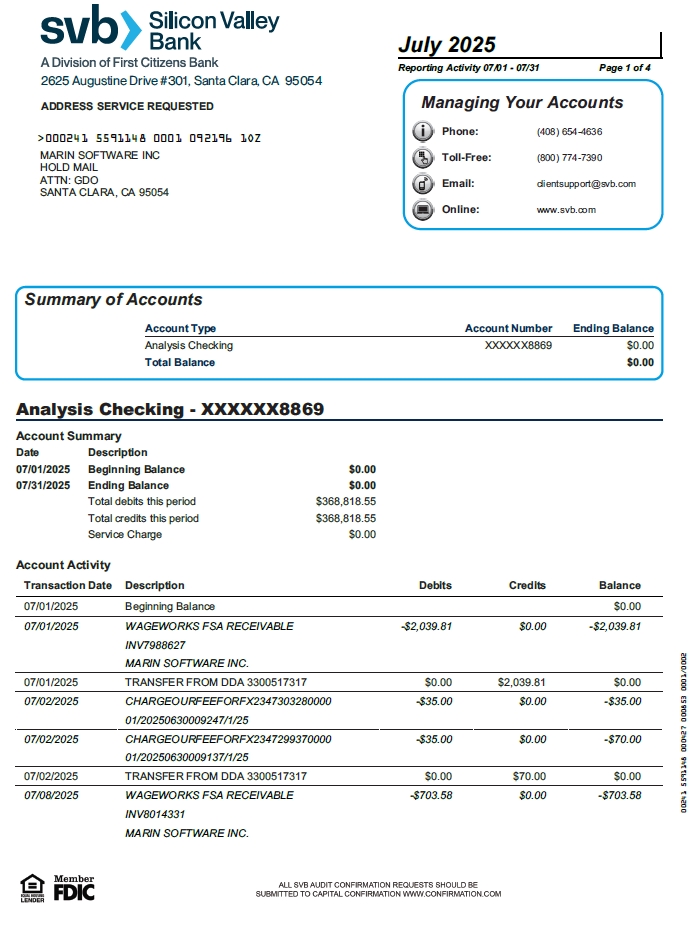

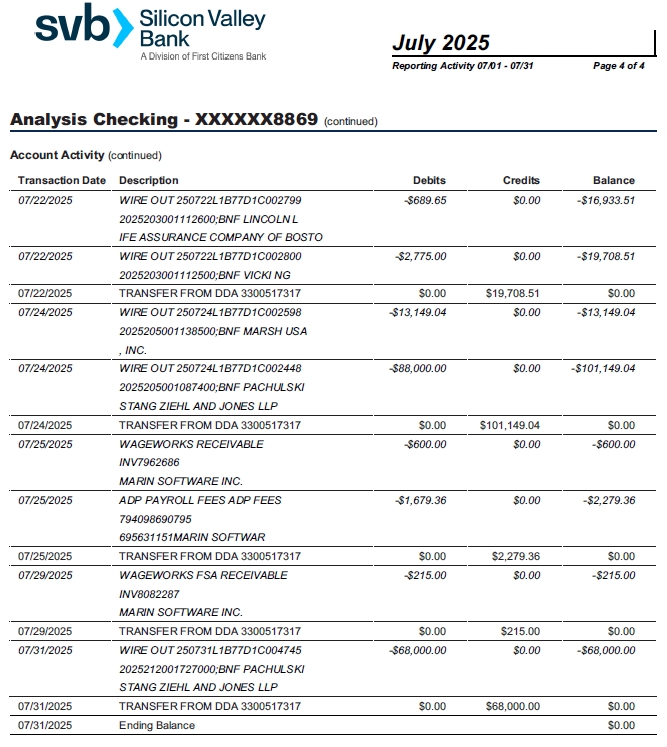

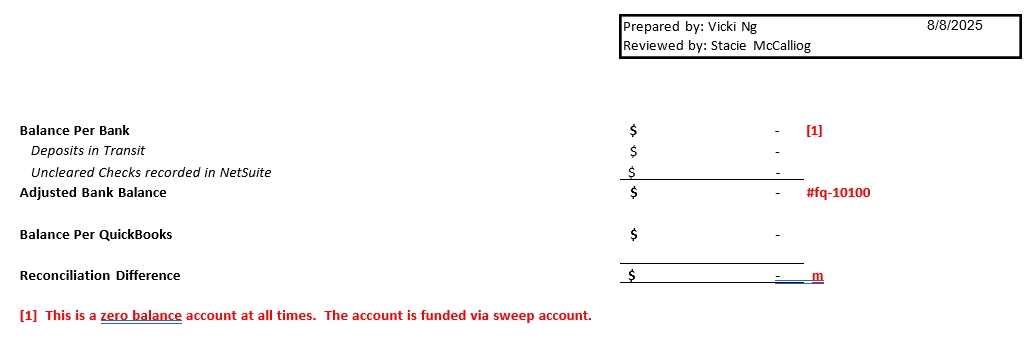

10100 - SVB Checking (USD) - Reconciliation

As of July 31, 2025

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 23 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 24 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 25 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 26 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 27 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 28 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 29 of 53

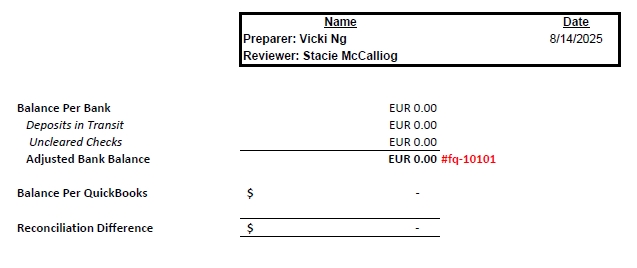

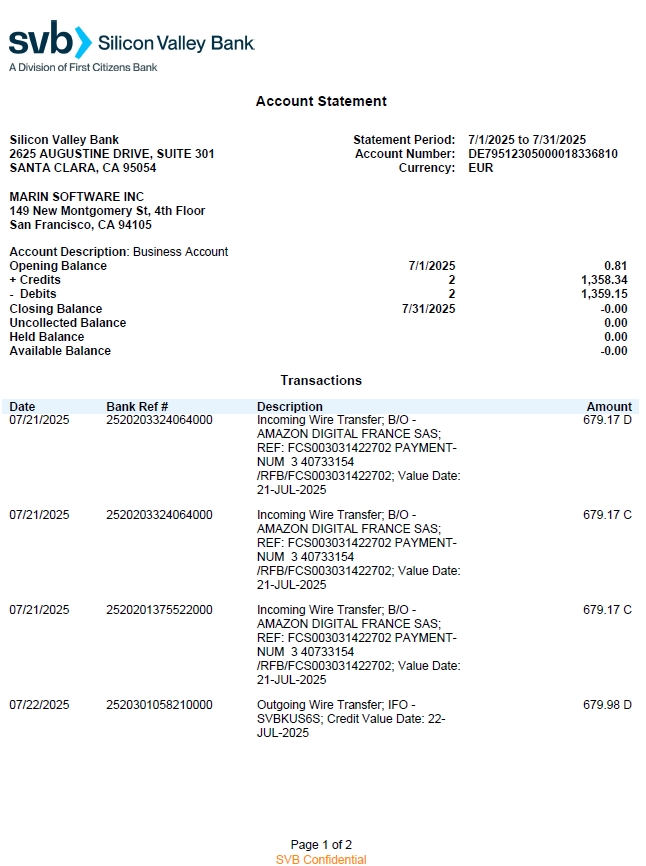

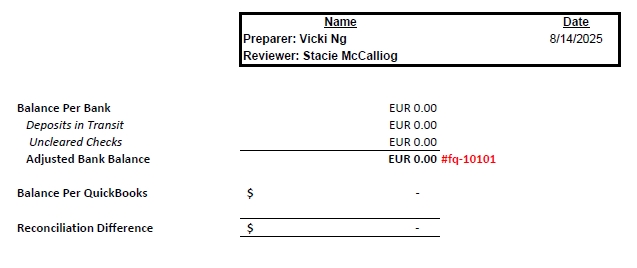

MARIN SOFTWARE INCORPORATED (Case No. 25-11263)

10101 - SVB Checking (EUR) - Reconciliation

As of July 31, 2025

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 30 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 31 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 32 of 53

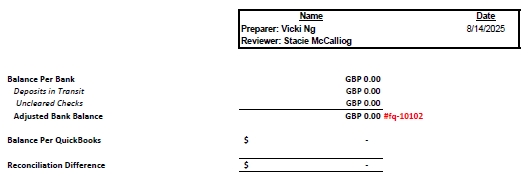

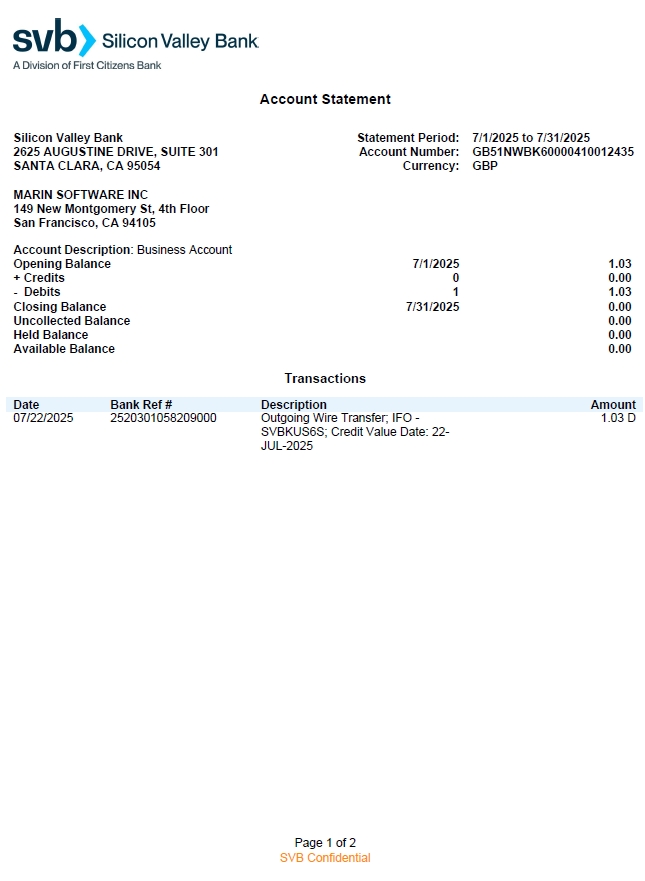

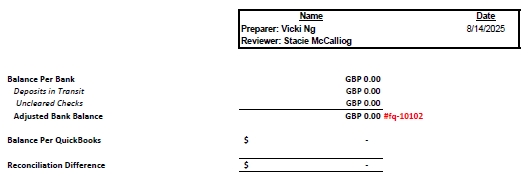

MARIN SOFTWARE INCORPORATED (Case No. 25-11263)

10102 - SVB Checking (GBP) - Reconciliation

As of July 31, 2025

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 33 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 34 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 35 of 53

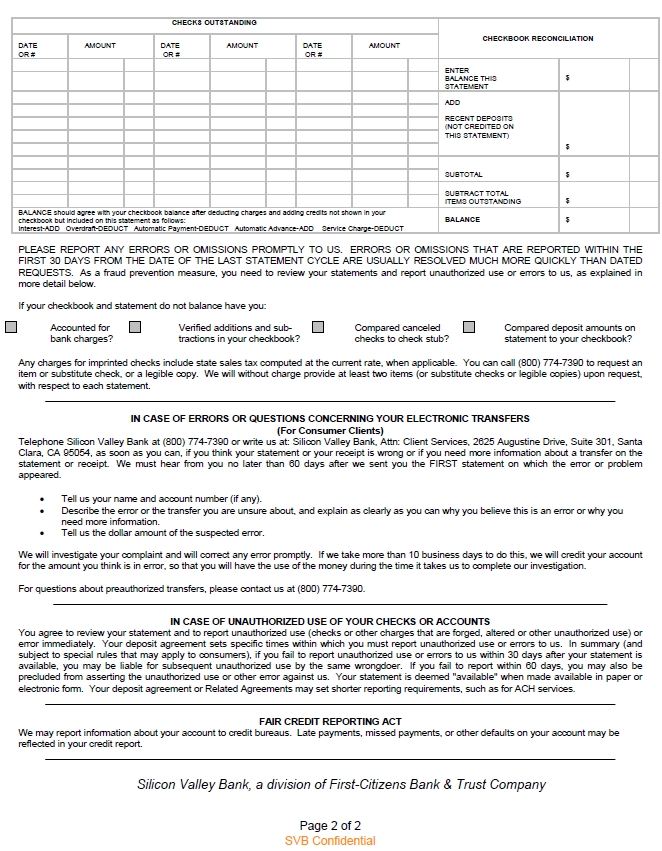

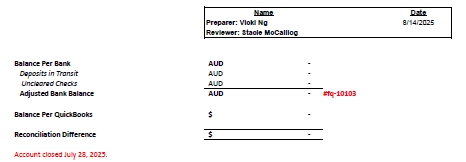

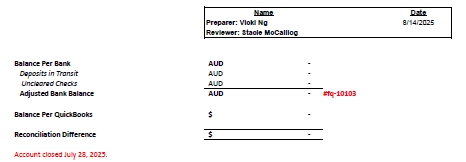

MARIN SOFTWARE INCORPORATED (Case No. 25-11263)

10103 - SVB Checking (AUD) - Reconciliation

As of July 31, 2025

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 36 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 37 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 38 of 53

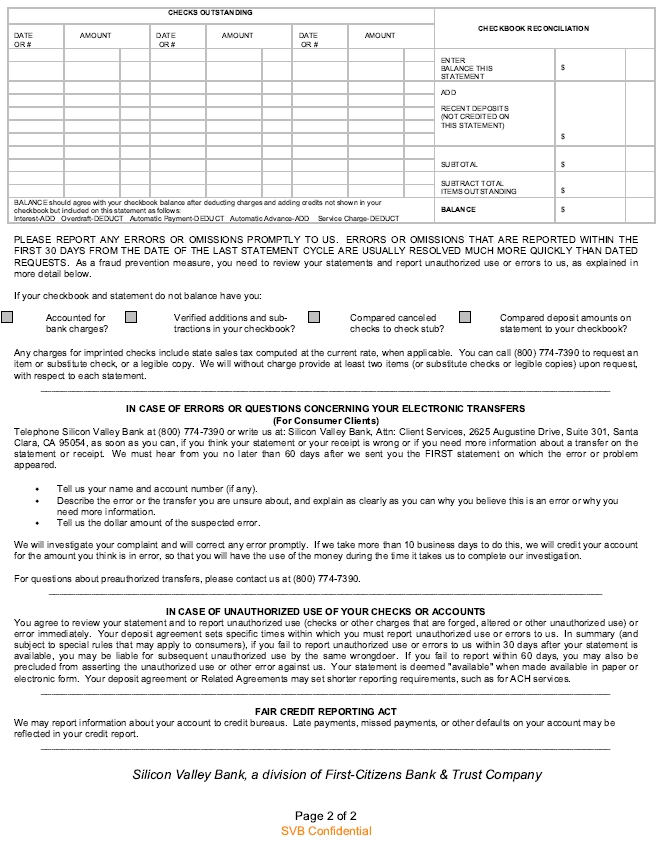

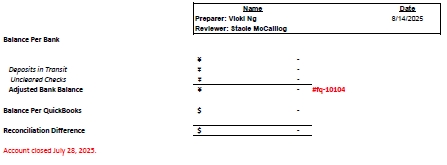

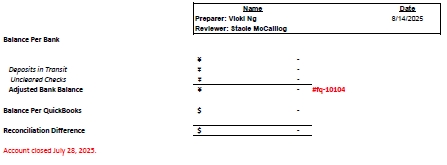

MARIN SOFTWARE INCORPORATED (Case No. 25-11263)

10104 - SVB Checking (JPY) - Reconciliation

As of July 31, 2025

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 39 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 40 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 41 of 53

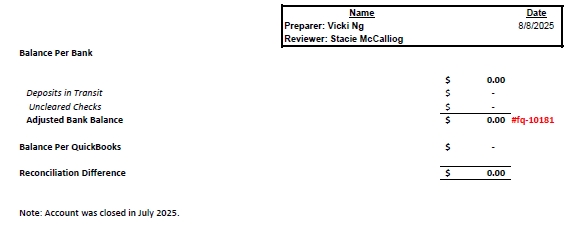

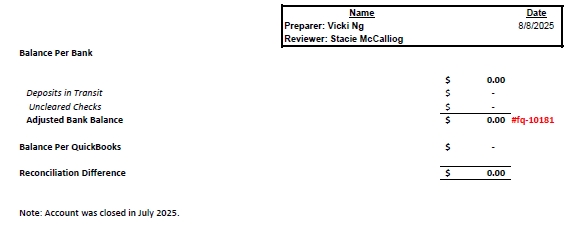

MARIN SOFTWARE INCORPORATED (Case No. 25-11263)

10181 - HSBC (USD) - Reconciliation

As of July 31, 2025

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 42 of 53

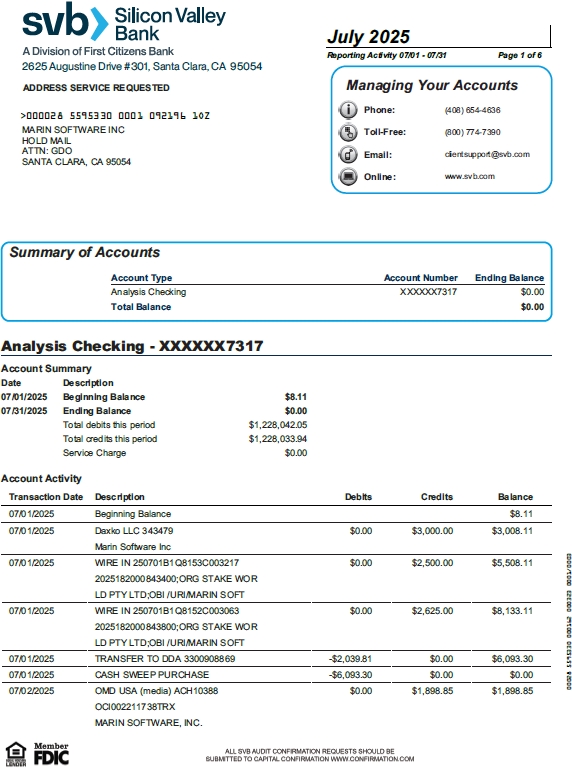

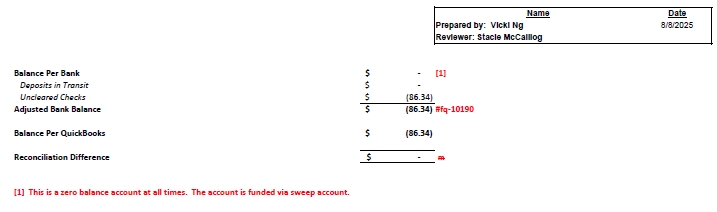

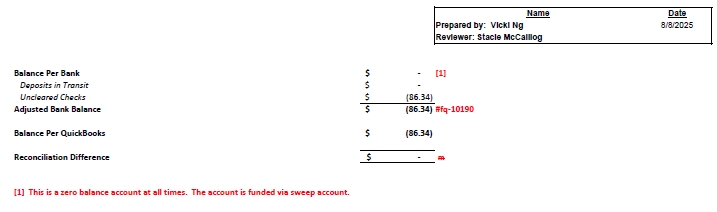

MARIN SOFTWARE INCORPORATED (Case No. 25-11263)

10190 - SVB Payables (USD) - Reconciliation

As of July 31, 2025

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 43 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 44 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 45 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 46 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 47 of 53

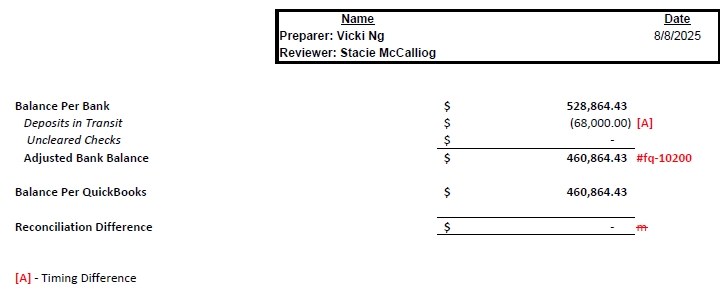

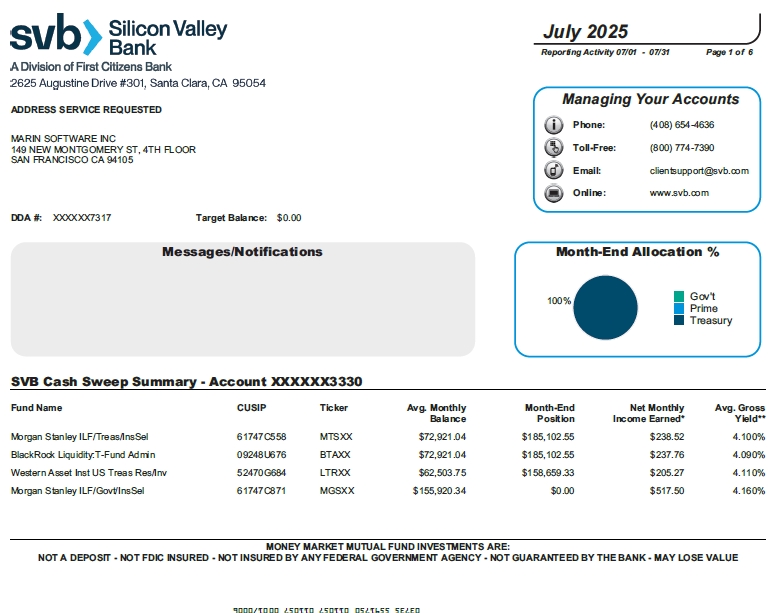

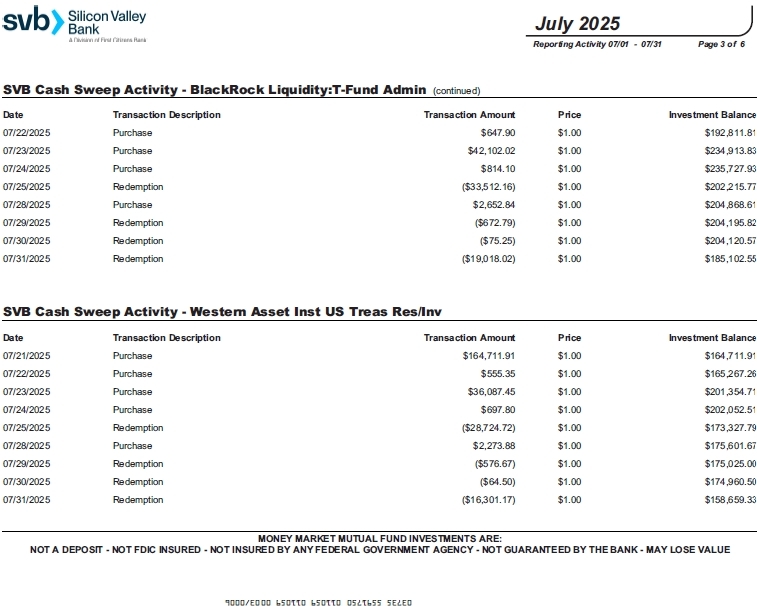

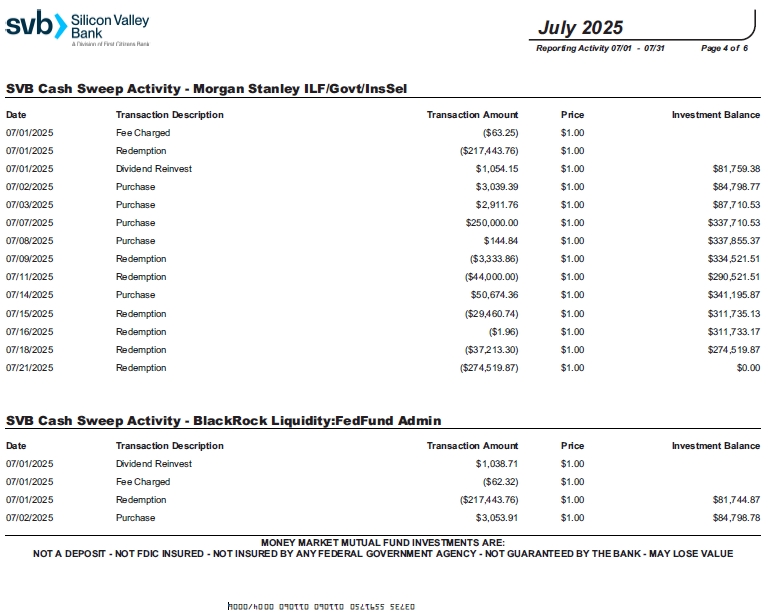

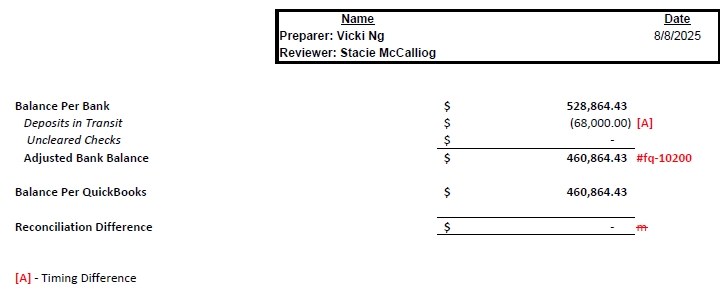

MARIN SOFTWARE INCORPORATED (Case No. 25-11263)

10200 - SVB Money Market - Reconciliation

As of July 31, 2025

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 48 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 49 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 50 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 51 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 52 of 53

Case 25-11263-LSS Doc 108 Filed 08/20/25 Page 53 of 53