3Q25 QUARTERLY UPDATE October 16, 2025

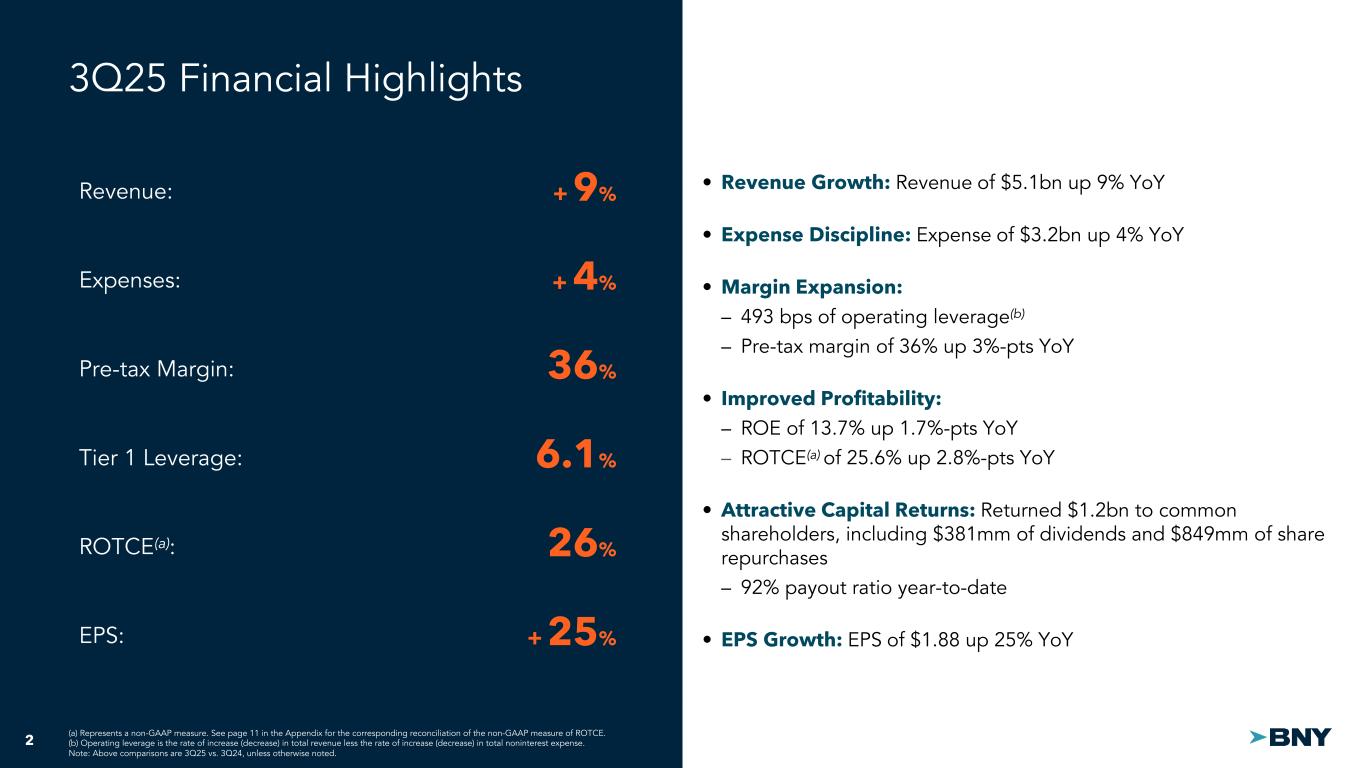

2 • Revenue Growth: Revenue of $5.1bn up 9% YoY • Expense Discipline: Expense of $3.2bn up 4% YoY • Margin Expansion: – 493 bps of operating leverage(b) – Pre-tax margin of 36% up 3%-pts YoY • Improved Profitability: – ROE of 13.7% up 1.7%-pts YoY – ROTCE(a) of 25.6% up 2.8%-pts YoY • Attractive Capital Returns: Returned $1.2bn to common shareholders, including $381mm of dividends and $849mm of share repurchases – 92% payout ratio year-to-date • EPS Growth: EPS of $1.88 up 25% YoY 3Q25 Financial Highlights + 25% Revenue: Pre-tax Margin: EPS: + 9% 36% ROTCE(a): 26% Tier 1 Leverage: 6.1% Expenses: + 4% (a) Represents a non-GAAP measure. See page 11 in the Appendix for the corresponding reconciliation of the non-GAAP measure of ROTCE. (b) Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. Note: Above comparisons are 3Q25 vs. 3Q24, unless otherwise noted.

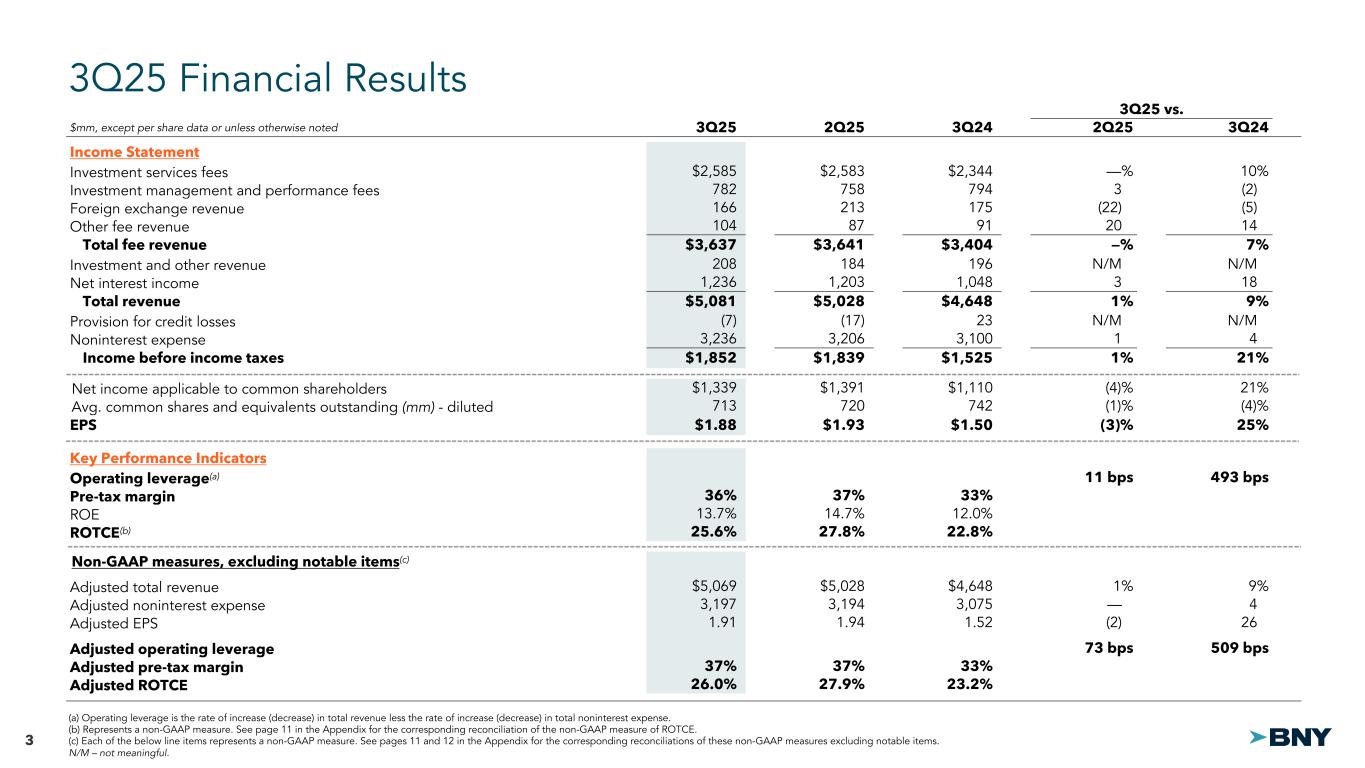

3 3Q25 vs. $mm, except per share data or unless otherwise noted 3Q25 2Q25 3Q24 2Q25 3Q24 Income Statement Investment services fees $2,585 $2,583 $2,344 —% 10% Investment management and performance fees 782 758 794 3 (2) Foreign exchange revenue 166 213 175 (22) (5) Other fee revenue 104 87 91 20 14 Total fee revenue $3,637 $3,641 $3,404 —% 7% Investment and other revenue 208 184 196 N/M N/M Net interest income 1,236 1,203 1,048 3 18 Total revenue $5,081 $5,028 $4,648 1% 9% Provision for credit losses (7) (17) 23 N/M N/M Noninterest expense 3,236 3,206 3,100 1 4 Income before income taxes $1,852 $1,839 $1,525 1% 21% Net income applicable to common shareholders $1,339 $1,391 $1,110 (4)% 21% Avg. common shares and equivalents outstanding (mm) - diluted 713 720 742 (1)% (4)% EPS $1.88 $1.93 $1.50 (3)% 25% Key Performance Indicators Operating leverage(a) 11 bps 493 bps Pre-tax margin 36% 37% 33% ROE 13.7% 14.7% 12.0% ROTCE(b) 25.6% 27.8% 22.8% Non-GAAP measures, excluding notable items(c) Adjusted total revenue $5,069 $5,028 $4,648 1% 9% Adjusted noninterest expense 3,197 3,194 3,075 — 4 Adjusted EPS 1.91 1.94 1.52 (2) 26 Adjusted operating leverage 73 bps 509 bps Adjusted pre-tax margin 37% 37% 33% Adjusted ROTCE 26.0% 27.9% 23.2% 3Q25 Financial Results (a) Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. (b) Represents a non-GAAP measure. See page 11 in the Appendix for the corresponding reconciliation of the non-GAAP measure of ROTCE. (c) Each of the below line items represents a non-GAAP measure. See pages 11 and 12 in the Appendix for the corresponding reconciliations of these non-GAAP measures excluding notable items. N/M – not meaningful.

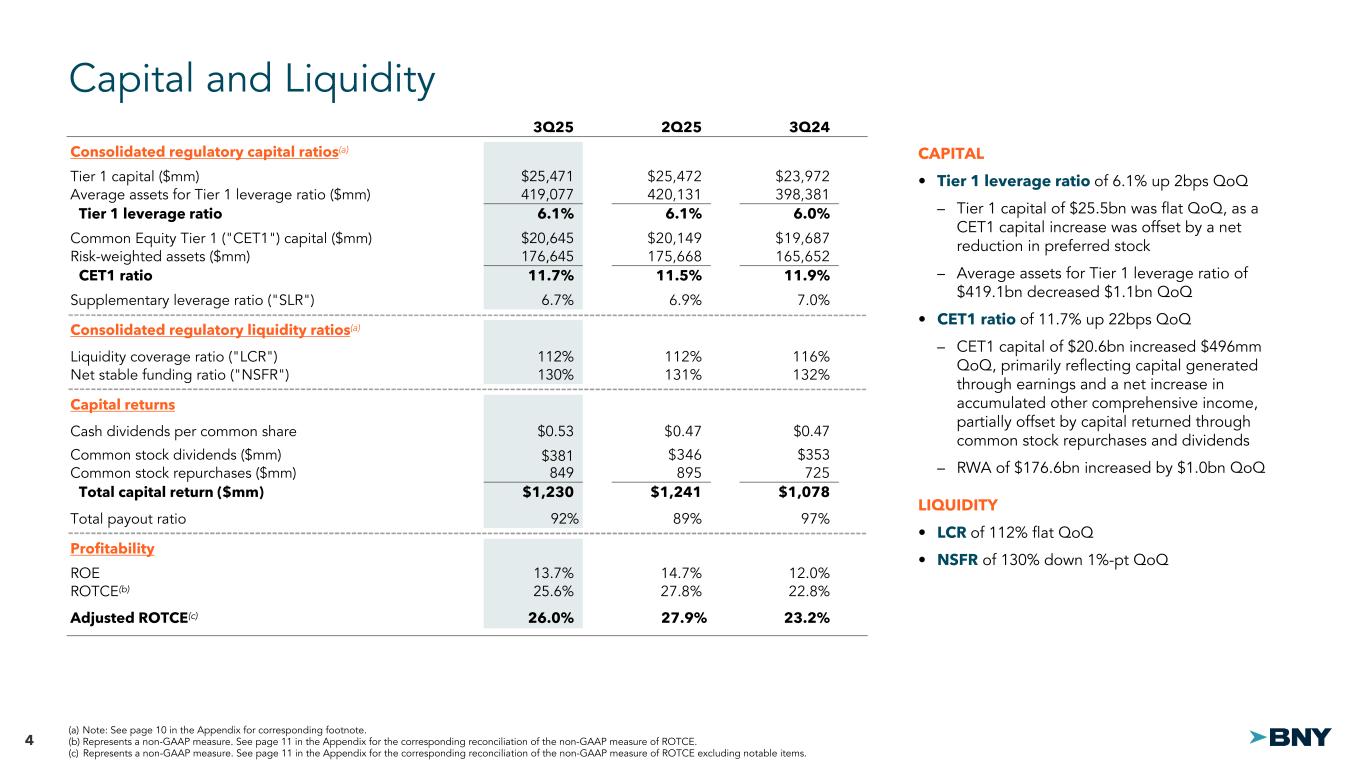

4 3Q25 2Q25 3Q24 Consolidated regulatory capital ratios(a) Tier 1 capital ($mm) $25,471 $25,472 $23,972 Average assets for Tier 1 leverage ratio ($mm) 419,077 420,131 398,381 Tier 1 leverage ratio 6.1% 6.1% 6.0% Common Equity Tier 1 ("CET1") capital ($mm) $20,645 $20,149 $19,687 Risk-weighted assets ($mm) 176,645 175,668 165,652 CET1 ratio 11.7% 11.5% 11.9% Supplementary leverage ratio ("SLR") 6.7% 6.9% 7.0% Consolidated regulatory liquidity ratios(a) Liquidity coverage ratio ("LCR") 112% 112% 116% Net stable funding ratio ("NSFR") 130% 131% 132% Capital returns Cash dividends per common share $0.53 $0.47 $0.47 Common stock dividends ($mm) $381 $346 $353 Common stock repurchases ($mm) 849 895 725 Total capital return ($mm) $1,230 $1,241 $1,078 Total payout ratio 92% 89% 97% Profitability ROE 13.7% 14.7% 12.0% ROTCE(b) 25.6% 27.8% 22.8% Adjusted ROTCE(c) 26.0% 27.9% 23.2% Capital and Liquidity CAPITAL • Tier 1 leverage ratio of 6.1% up 2bps QoQ – Tier 1 capital of $25.5bn was flat QoQ, as a CET1 capital increase was offset by a net reduction in preferred stock – Average assets for Tier 1 leverage ratio of $419.1bn decreased $1.1bn QoQ • CET1 ratio of 11.7% up 22bps QoQ – CET1 capital of $20.6bn increased $496mm QoQ, primarily reflecting capital generated through earnings and a net increase in accumulated other comprehensive income, partially offset by capital returned through common stock repurchases and dividends – RWA of $176.6bn increased by $1.0bn QoQ LIQUIDITY • LCR of 112% flat QoQ • NSFR of 130% down 1%-pt QoQ (a) Note: See page 10 in the Appendix for corresponding footnote. (b) Represents a non-GAAP measure. See page 11 in the Appendix for the corresponding reconciliation of the non-GAAP measure of ROTCE. (c) Represents a non-GAAP measure. See page 11 in the Appendix for the corresponding reconciliation of the non-GAAP measure of ROTCE excluding notable items.

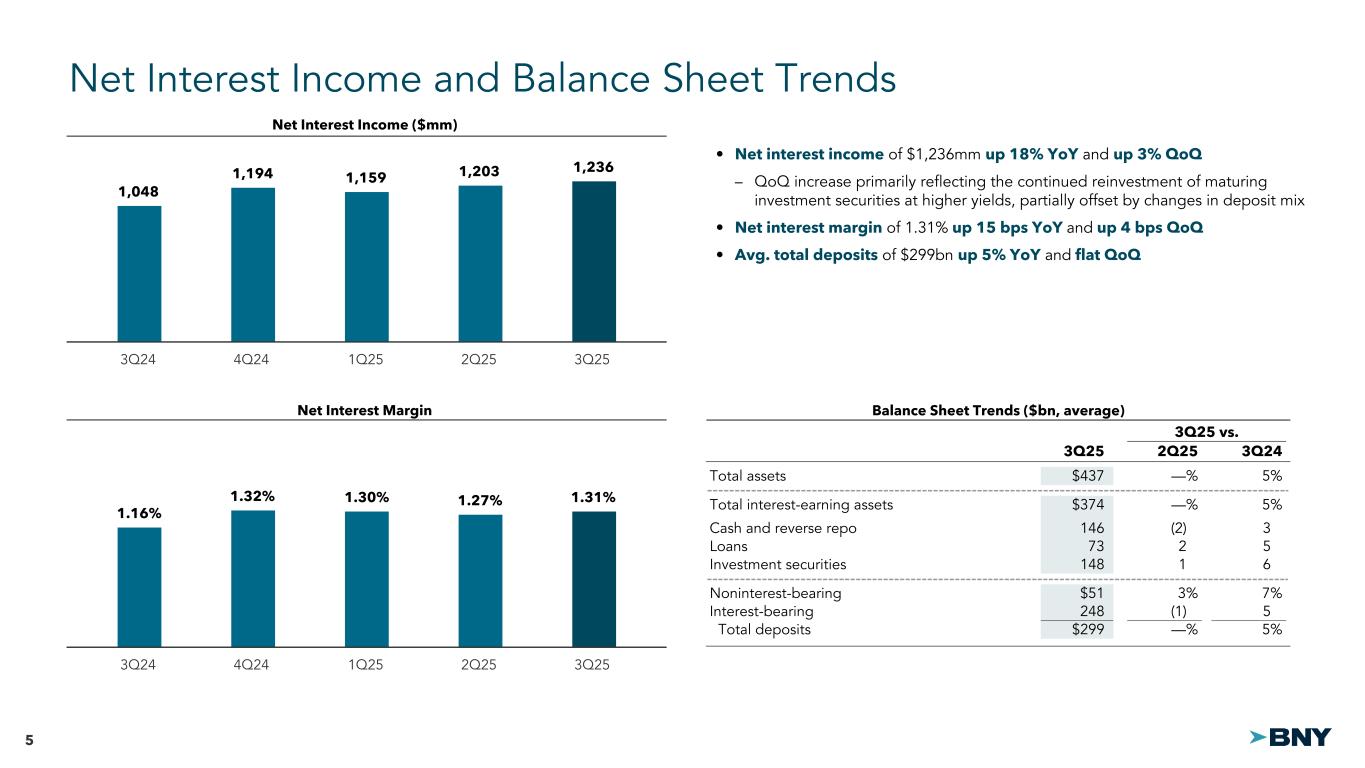

5 1,048 1,194 1,159 1,203 1,236 3Q24 4Q24 1Q25 2Q25 3Q25 3Q25 vs. 3Q25 2Q25 3Q24 Total assets $437 —% 5% Total interest-earning assets $374 —% 5% Cash and reverse repo 146 (2) 3 Loans 73 2 5 Investment securities 148 1 6 Noninterest-bearing $51 3% 7% Interest-bearing 248 (1) 5 Total deposits $299 —% 5% Net Interest Income and Balance Sheet Trends Net Interest Income ($mm) 1.16% 1.32% 1.30% 1.27% 1.31% 3Q24 4Q24 1Q25 2Q25 3Q25 Net Interest Margin Balance Sheet Trends ($bn, average) • Net interest income of $1,236mm up 18% YoY and up 3% QoQ – QoQ increase primarily reflecting the continued reinvestment of maturing investment securities at higher yields, partially offset by changes in deposit mix • Net interest margin of 1.31% up 15 bps YoY and up 4 bps QoQ • Avg. total deposits of $299bn up 5% YoY and flat QoQ

6 3Q25 vs. $mm, unless otherwise noted 3Q25 2Q25 3Q24 Asset Servicing $1,141 4% 12% Issuer Services 313 (17) 10 Total investment services fees $1,454 (1)% 11% Foreign exchange revenue 143 (18) 4 Other fees(a) 73 22 28 Investment and other revenue 119 N/M N/M Net interest income 670 (1) 10 Total revenue $2,459 (1)% 11% Provision for credit losses (3) N/M N/M Noninterest expense 1,656 2 6 Income before income taxes $806 (7)% 26% $bn, unless otherwise noted 3Q25 2Q25 3Q24 Pre-tax margin 33% 35% 29% Assets under custody and/or administration ("AUC/A")(trn) $41.7 $40.1 $37.5 Deposits (average) $183 $186 $181 Issuer Services Total debt serviced (trn) $14.5 $14.3 $14.3 Number of sponsored Depositary Receipts programs 477 482 507 Securities Services Select Income Statement Data Note: See page 10 in the Appendix for corresponding footnotes. N/M – not meaningful. Select Income Statement Data Key Performance Indicators (b)(c) • Total revenue of $2,459mm up 11% YoY – Investment services fees up 11% YoY > Asset Servicing up 12% YoY, primarily reflecting higher client activity and market values > Issuer Services up 10% YoY, primarily reflecting higher Depositary Receipts fees – Foreign exchange revenue up 4% YoY – Net interest income up 10% YoY • Noninterest expense of $1,656mm up 6% YoY, primarily reflecting higher investments, severance expense and revenue-related expenses, and employee merit increases, partially offset by efficiency savings • Income before income taxes of $806mm up 26% YoY

7 3Q25 vs. $mm, unless otherwise noted 3Q25 2Q25 3Q24 Pershing $508 (1)% 7% Clearance and Collateral Management 398 3 12 Treasury Services 214 2 7 Total investment services fees $1,120 1% 9% Foreign exchange revenue 31 3 35 Other fees(a) 70 11 21 Investment and other revenue 22 N/M N/M Net interest income 524 4 26 Total revenue $1,767 1% 14% Provision for credit losses (3) N/M N/M Noninterest expense 895 — 7 Income before income taxes $875 3% 24% $bn, unless otherwise noted 3Q25 2Q25 3Q24 Pre-tax margin 50% 49% 46% AUC/A (trn)(b)(c) $15.8 $15.4 $14.3 Deposits (average) $97 $97 $89 Pershing AUC/A (trn)(b) $3.0 $2.8 $2.7 Net new assets (U.S. platform)(d) 3 (10) (22) Daily average revenue trades ("DARTs") (U.S. platform) ('000) 269 334 251 Average active clearing accounts ('000) 8,387 8,405 8,085 Treasury Services U.S. dollar payment volumes (daily average) 246,286 246,250 242,243 Clearance and Collateral Management Average collateral balances $7,275 $7,061 $6,380 Market and Wealth Services Select Income Statement Data Key Performance Indicators Select Income Statement Data • Total revenue of $1,767mm up 14% YoY – Investment services fees up 9% YoY > Pershing up 7% YoY, primarily reflecting higher market values and client activity > Clearance and Collateral Management up 12% YoY, primarily reflecting higher collateral management balances and clearance volumes > Treasury Services up 7% YoY, primarily reflecting net new business – Foreign exchange revenue up 35% YoY – Net interest income up 26% YoY • Noninterest expense of $895mm up 7% YoY, primarily reflecting higher investments, employee merit increases and higher revenue-related expenses, partially offset by efficiency savings • Income before income taxes of $875mm up 24% YoY Note: See page 10 in the Appendix for corresponding footnotes. N/M – not meaningful.

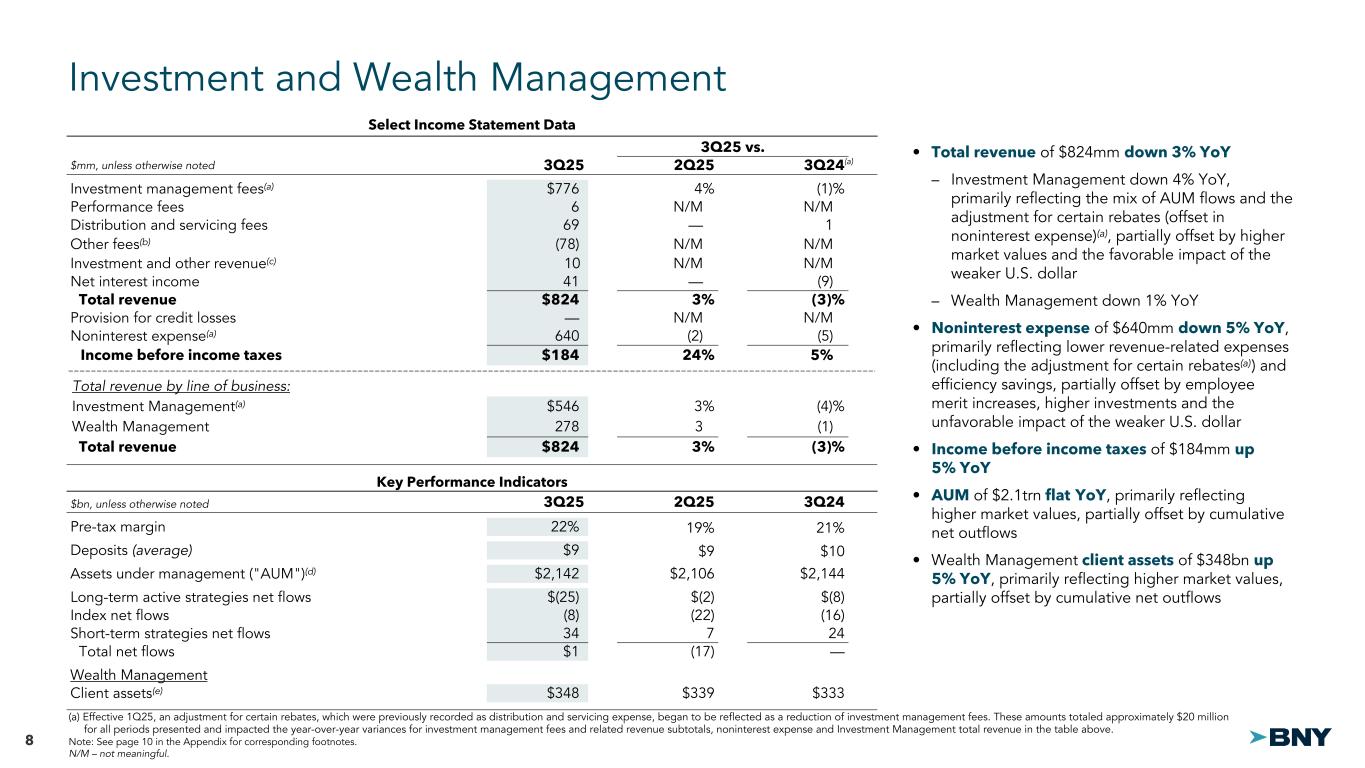

8 3Q25 vs. $mm, unless otherwise noted 3Q25 2Q25 3Q24 Investment management fees(a) $776 4% (1)% Performance fees 6 N/M N/M Distribution and servicing fees 69 — 1 Other fees(b) (78) N/M N/M Investment and other revenue(c) 10 N/M N/M Net interest income 41 — (9) Total revenue $824 3% (3)% Provision for credit losses — N/M N/M Noninterest expense(a) 640 (2) (5) Income before income taxes $184 24% 5% Total revenue by line of business: Investment Management(a) $546 3% (4)% Wealth Management 278 3 (1) Total revenue $824 3% (3)% $bn, unless otherwise noted 3Q25 2Q25 3Q24 Pre-tax margin 22% 19% 21% Deposits (average) $9 $9 $10 Assets under management ("AUM")(d) $2,142 $2,106 $2,144 Long-term active strategies net flows $(25) $(2) $(8) Index net flows (8) (22) (16) Short-term strategies net flows 34 7 24 Total net flows $1 (17) — Wealth Management Client assets(e) $348 $339 $333 Investment and Wealth Management Select Income Statement Data Key Performance Indicators Select Income Statement Data • Total revenue of $824mm down 3% YoY – Investment Management down 4% YoY, primarily reflecting the mix of AUM flows and the adjustment for certain rebates (offset in noninterest expense)(a), partially offset by higher market values and the favorable impact of the weaker U.S. dollar – Wealth Management down 1% YoY • Noninterest expense of $640mm down 5% YoY, primarily reflecting lower revenue-related expenses (including the adjustment for certain rebates(a) ) and efficiency savings, partially offset by employee merit increases, higher investments and the unfavorable impact of the weaker U.S. dollar • Income before income taxes of $184mm up 5% YoY • AUM of $2.1trn flat YoY, primarily reflecting higher market values, partially offset by cumulative net outflows • Wealth Management client assets of $348bn up 5% YoY, primarily reflecting higher market values, partially offset by cumulative net outflows (a) Effective 1Q25, an adjustment for certain rebates, which were previously recorded as distribution and servicing expense, began to be reflected as a reduction of investment management fees. These amounts totaled approximately $20 million llllllfor all periods presented and impacted the year-over-year variances for investment management fees and related revenue subtotals, noninterest expense and Investment Management total revenue in the table above. Note: See page 10 in the Appendix for corresponding footnotes. N/M – not meaningful. (a)

9 $mm, unless otherwise noted 3Q25 2Q25 3Q24 Fee revenue $(27) $(15) $(1) Investment and other revenue 45 33 55 Net interest income (expense) 1 (19) (21) Total revenue $19 $(1) $33 Provision for credit losses (1) 2 — Noninterest expense 45 36 37 (Loss) before income taxes $(25) $(39) $(4) Other Segment Select Income Statement Data • Total revenue includes corporate treasury and other investment activity, including hedging activity which has an offsetting impact between fee and other revenue and net interest expense – YoY decrease was primarily driven by higher net securities losses – QoQ increase primarily reflecting gains realized on the sale of real estate • Noninterest expense increased YoY, primarily reflecting higher staff expense; QoQ increase primarily reflects higher litigation reserves Select Income Statement Data

10 Footnotes Page 4 – Capital and Liquidity (a) Regulatory capital and liquidity ratios for September 30, 2025 are preliminary. For our CET1 ratio, our effective capital ratios under the U.S. capital rules are the lower of the ratios as calculated under the Standardized and Advanced Approaches, which for September 30, 2025, June 30, 2025 and September 30, 2024 was the Standardized Approach. Page 6 – Securities Services (a) Other fees primarily include financing-related fees. (b) September 30, 2025 information is preliminary. (c) Consists of AUC/A primarily from the Asset Servicing line of business and, to a lesser extent, the Issuer Services line of business. Includes the AUC/A of CIBC Mellon Trust Company (“CIBC Mellon”), a joint venture with the Canadian Imperial Bank of Commerce, of $2.1 trillion at September 30, 2025, $2.0 trillion at June 30, 2025 and $1.9 trillion at September 30, 2024. Page 7 – Market and Wealth Services (a) Other fees primarily include financing-related fees. (b) September 30, 2025 information is preliminary. (c) Consists of AUC/A from the Clearance and Collateral Management and Pershing lines of business. (d) Net new assets represent net flows of assets (e.g., net cash deposits and net securities transfers, including dividends and interest) in customer accounts in Pershing LLC, a U.S. broker-dealer. Page 8 – Investment and Wealth Management (a) (b) Other fees primarily include investment services fees. (c) Investment and other revenue is net of income (loss) attributable to noncontrolling interests related to consolidated investment management funds. (d) September 30, 2025 information is preliminary. Represents assets managed in the Investment and Wealth Management business segment. (e) September 30, 2025 information is preliminary. Includes AUM and AUC/A in the Wealth Management line of business.

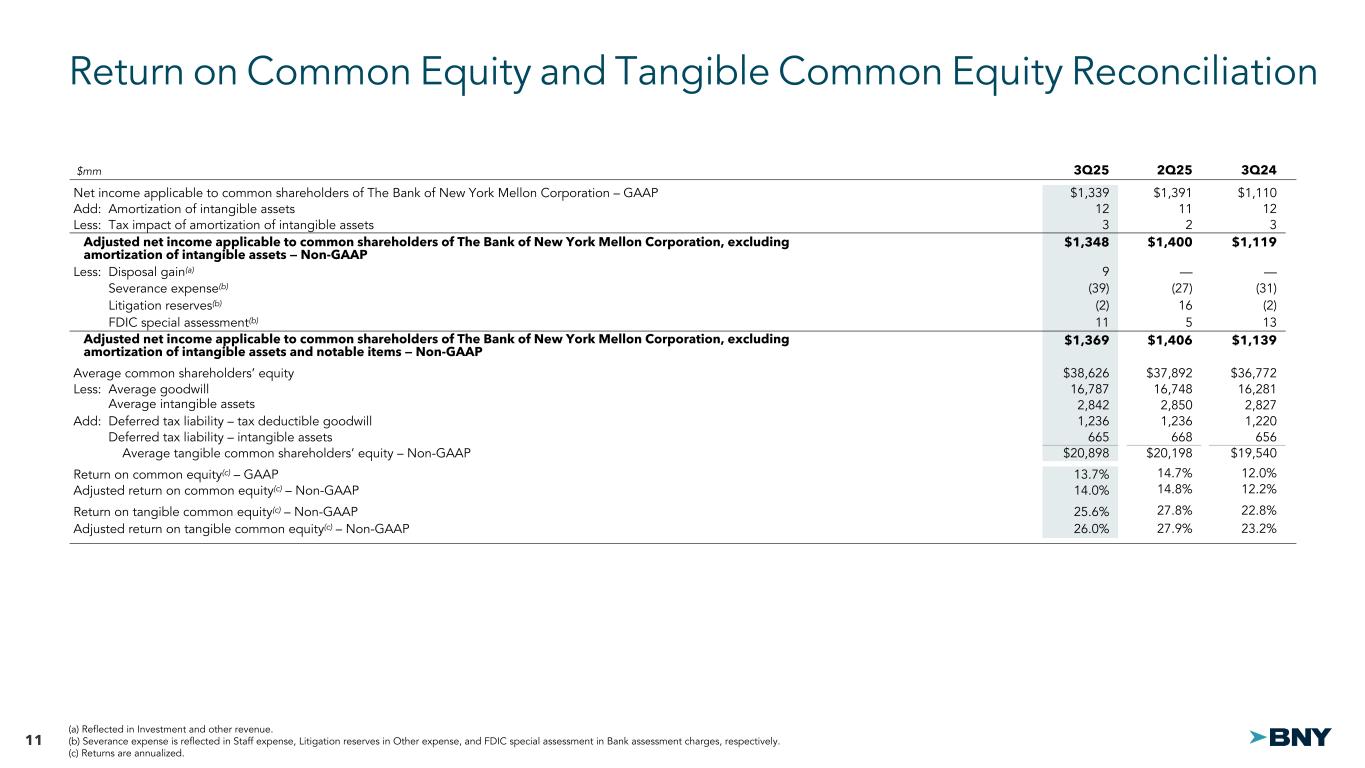

11 $mm 3Q25 2Q25 3Q24 Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP $1,339 $1,391 $1,110 Add: Amortization of intangible assets 12 11 12 Less: Tax impact of amortization of intangible assets 3 2 3 Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation, excluding amortization of intangible assets — Non-GAAP $1,348 $1,400 $1,119 Less: Disposal gain(a) 9 — — Less: Severance expense(b) (39) (27) (31) Less: Litigation reserves(b) (2) 16 (2) Less: FDIC special assessment(b) 11 5 13 Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation, excluding amortization of intangible assets and notable items — Non-GAAP $1,369 $1,406 $1,139 Average common shareholders’ equity $38,626 $37,892 $36,772 Less: Average goodwill 16,787 16,748 16,281 Less: Average intangible assets 2,842 2,850 2,827 Add: Deferred tax liability – tax deductible goodwill 1,236 1,236 1,220 Add: Deferred tax liability – intangible assets 665 668 656 Average tangible common shareholders’ equity – Non-GAAP $20,898 $20,198 $19,540 Return on common equity(c) – GAAP 13.7% 14.7% 12.0% Adjusted return on common equity(c) – Non-GAAP 14.0% 14.8% 12.2% Return on tangible common equity(c) – Non-GAAP 25.6% 27.8% 22.8% Adjusted return on tangible common equity(c) – Non-GAAP 26.0% 27.9% 23.2% Return on Common Equity and Tangible Common Equity Reconciliation (a) Reflected in Investment and other revenue. (b) Severance expense is reflected in Staff expense, Litigation reserves in Other expense, and FDIC special assessment in Bank assessment charges, respectively. (c) Returns are annualized.

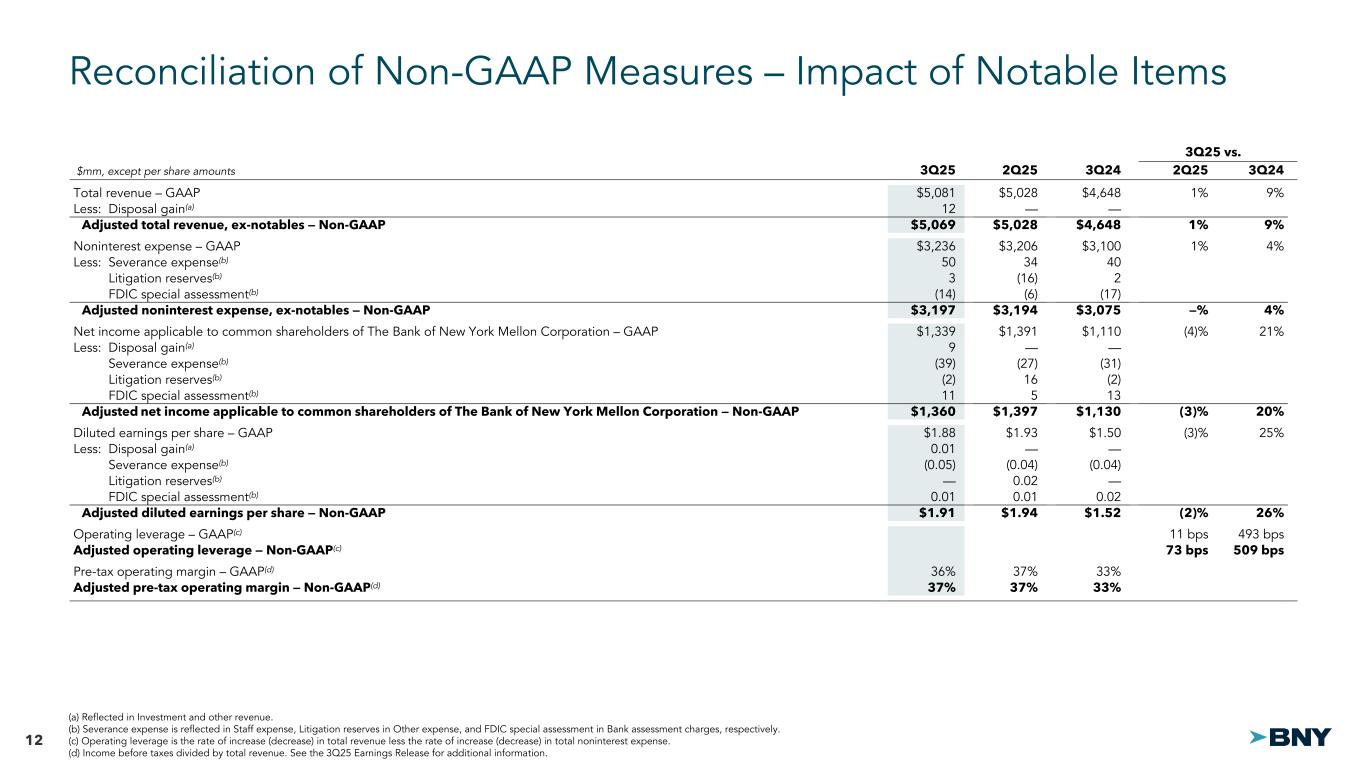

12 Select Income Statement Data Reconciliation of Non-GAAP Measures – Impact of Notable Items 3Q25 vs. $mm, except per share amounts 3Q25 2Q25 3Q24 2Q25 3Q24 Total revenue – GAAP $5,081 $5,028 $4,648 1% 9% Less: Disposal gain(a) 12 — — Adjusted total revenue, ex-notables — Non-GAAP $5,069 $5,028 $4,648 1% 9% Noninterest expense – GAAP $3,236 $3,206 $3,100 1% 4% Less: Severance expense(b) 50 34 40 Less: Litigation reserves(b) 3 (16) 2 Less: FDIC special assessment(b) (14) (6) (17) Adjusted noninterest expense, ex-notables — Non-GAAP $3,197 $3,194 $3,075 —% 4% Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP $1,339 $1,391 $1,110 (4)% 21% Less: Disposal gain(a) 9 — — Less: Severance expense(b) (39) (27) (31) Less: Litigation reserves(b) (2) 16 (2) Less: FDIC special assessment(b) 11 5 13 Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation — Non-GAAP $1,360 $1,397 $1,130 (3)% 20% Diluted earnings per share – GAAP $1.88 $1.93 $1.50 (3)% 25% Less: Disposal gain(a) 0.01 — — Less: Severance expense(b) (0.05) (0.04) (0.04) Less: Litigation reserves(b) — 0.02 — Less: FDIC special assessment(b) 0.01 0.01 0.02 Adjusted diluted earnings per share — Non-GAAP $1.91 $1.94 $1.52 (2)% 26% Operating leverage – GAAP(c) 11 bps 493 bps Adjusted operating leverage — Non-GAAP(c) 73 bps 509 bps Pre-tax operating margin – GAAP(d) 36% 37% 33% Adjusted pre-tax operating margin — Non-GAAP(d) 37% 37% 33% (a) Reflected in Investment and other revenue. (b) Severance expense is reflected in Staff expense, Litigation reserves in Other expense, and FDIC special assessment in Bank assessment charges, respectively. (c) Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. (d) Income before taxes divided by total revenue. See the 3Q25 Earnings Release for additional information.

13 A number of statements in our presentations, the accompanying slides and the responses to questions on our conference call discussing our quarterly results may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about The Bank of New York Mellon Corporation’s (the “Corporation,” “we,” “us,” or “our”) capital plans including dividends and repurchases, total payout ratio, financial performance, fee revenue, net interest income, expenses, cost discipline, efficiency savings, operating leverage, pre-tax margin, capital ratios, organic growth, pipeline, deposits, interest rates and yield curves, securities portfolio, taxes, investments, including in technology and product development, innovation in products and services, artificial intelligence, digital assets, client experience, strategic priorities and initiatives, acquisitions, related integration and divestiture activity, transition to a platforms operating model, capabilities, resiliency, risk profile, human capital management and the effects of the current and near-term market and macroeconomic outlook on us, including on our business, operations, financial performance and prospects. Preliminary business metrics and regulatory capital ratios are subject to change, possibly materially as we complete our Quarterly Report on Form 10-Q for the quarter ended September 30, 2025. Forward-looking statements may be expressed in a variety of ways, including the use of future or present tense language. Words such as “estimate,” “forecast,” “project,” “anticipate,” “likely,” “target,” “expect,” “intend,” “continue,” “seek,” “believe,” “plan,” “goal,” “could,” “should,” “would,” “may,” “might,” “will,” “strategy,” “synergies,” “opportunities,” “trends,” “momentum,” “ambition,” “aspiration,” “objective,” “aim,” “future,” “potentially,” “outlook” and words of similar meaning may signify forward-looking statements. These statements are not guarantees of future results or occurrences, are inherently uncertain and are based upon current beliefs and expectations of future events, many of which are, by their nature, difficult to predict, outside of our control and subject to change. By identifying these statements for you in this manner, we are alerting you to the possibility that our actual results may differ, possibly materially, from the anticipated results expressed or implied in these forward-looking statements as a result of a number of important factors. These factors include: escalating tariff and other trade policies and the resulting impacts on market volatility and global trade; growing fiscal deficits; changing levels of inflation and the corresponding impacts on macroeconomic conditions, client behavior and our funding costs; liquidity and interest rate volatility; potential recessions or slowing of growth in the U.S., Europe and other regions; developments in the Middle East; the economic impacts of an extended government shutdown; political uncertainty regarding operational and policy changes at U.S. government agencies; our ability to execute against our strategic initiatives; and the risk factors and other uncertainties set forth in our Annual Report on Form 10-K for the year ended Dec. 31, 2024 (the “2024 Annual Report”) and our other filings with the Securities and Exchange Commission (the “SEC”). Forward-looking statements about the timing, profitability, benefits and other prospective aspects of business and expense initiatives, our financial outlook and our medium-term financial targets, and how they can be achieved, are based on our current expectations regarding our ability to execute against our strategic initiatives, as well as our balance sheet size and composition, and may change, possibly materially, from what is currently expected. Statements about our outlook on net interest income are subject to various factors, including interest rates, continued quantitative tightening, re-investment yields and the size, mix and duration of our balance sheet, including with respect to deposits, loan balances and the securities portfolio. Statements about our outlook on fee revenue are subject to various factors, including market levels, client activity, our ability to win and onboard new business, lost business, pricing pressure and our ability to launch new products to, and expand relationships with, existing clients. Statements about our outlook on expenses are subject to various factors, including investments, revenue- related expenses, efficiency savings, merit increases, inflation and currency fluctuations. Statements about our medium-term financial targets at our business segments are similarly subject to the factors described above, but may be more significantly impacted by positive or negative events or trends that have a disproportionate impact on a particular business segment. Statements about our target Tier 1 leverage ratio and CET1 ratio are subject to various factors, including capital requirements, interest rates, capital levels, risk-weighted assets and the size of our balance sheet, including deposit levels. Statements about the timing, manner and amount of any future common stock dividends or repurchases, as well as our outlook on total payout ratio, are subject to various factors, including our capital position, capital deployment opportunities, prevailing market conditions, legal and regulatory considerations and our outlook for the economic environment. Statements about our future effective tax rate are subject to various factors including, changes in the tax rates applicable to us, changes in our earnings mix, our profitability, the assumptions we have made in forecasting our expected tax rate, the interpretation or application of existing tax statutes and regulations, as well as any corporate tax legislation that may be enacted or any guidance that may be issued by the U.S. Internal Revenue Service. You should not place undue reliance on any forward-looking statement. All forward-looking statements speak only as of the date on which they were made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after such date or to reflect the occurrence of unanticipated events. Non-GAAP Measures. In this presentation, the accompanying slides and our responses to questions, we may discuss certain non-GAAP measures in detailing our performance, which exclude certain items or otherwise include components that differ from GAAP. We believe these measures are useful to the investment community in analyzing the financial results and trends of ongoing operations. We believe they facilitate comparisons with prior periods and reflect the principal basis on which our management monitors financial performance. Additional disclosures relating to non-GAAP measures are contained in our reports filed with the SEC, including the 2024 Annual Report, the third quarter 2025 earnings release and the third quarter 2025 financial supplement, which are available at www.bny.com/investorrelations. Forward-Looking Non-GAAP Financial Measures. From time to time we may discuss forward-looking non-GAAP financial measures, such as forward-looking estimates or targets for expenses excluding notable items and for return on tangible common equity. We are unable to provide a reconciliation of forward-looking non-GAAP financial measures to their most directly comparable GAAP financial measures because we are unable to provide, without unreasonable effort, a meaningful or accurate calculation or estimation of amounts that would be necessary for the reconciliation due to the complexity and inherent difficulty in forecasting and quantifying future amounts or when they may occur. Such unavailable information could be significant to future results. Cautionary Statement