Preliminary Draft – Confidential Project Thunder Discussion Materials Case Study: American Midstream

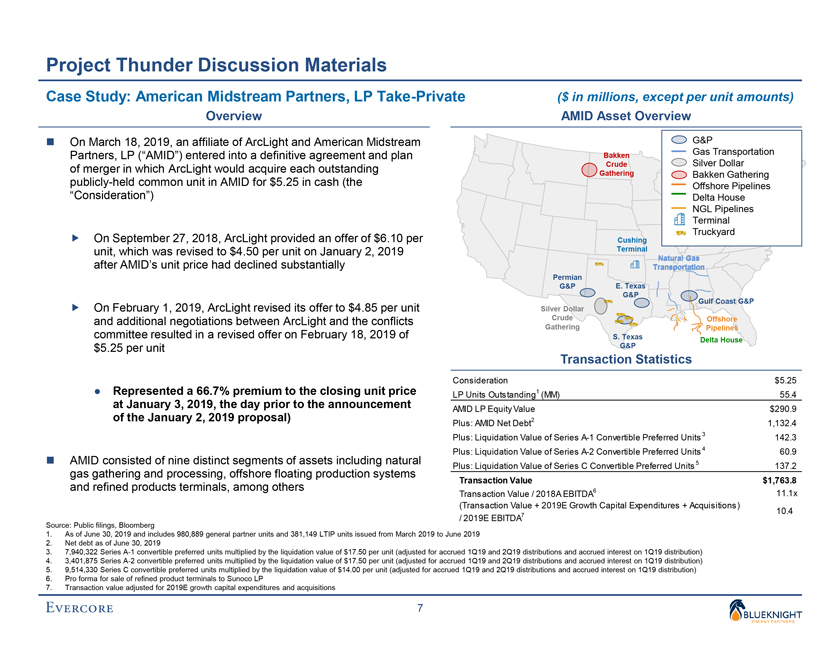

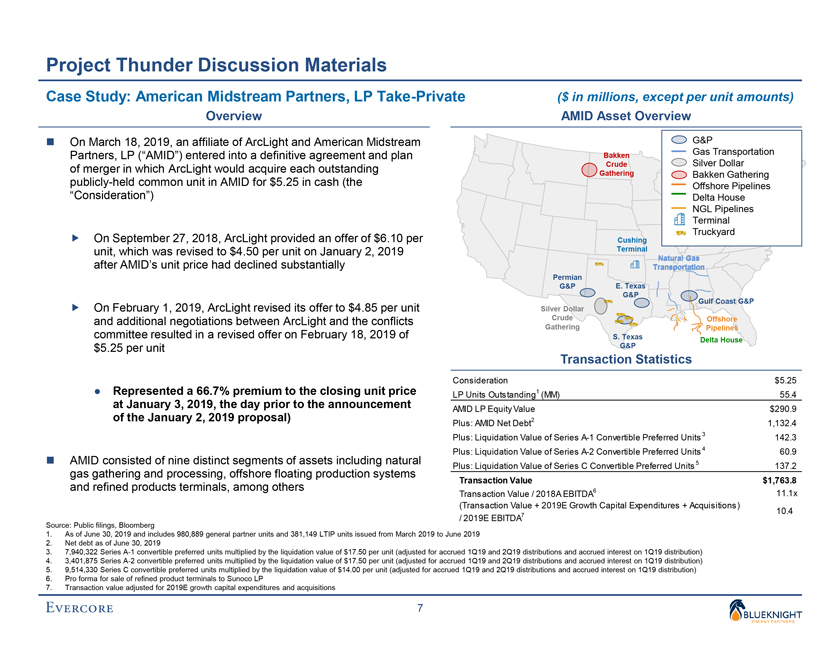

Partners, LP Take-Private ($ in millions, except per unit amounts) Overview AMID Asset Overview ï® On March 18, 2019, an affiliate of ArcLight and American Midstream G&P Partners, LP (“AMID”) entered into a definitive

agreement and plan Bakken Gas Transportation Crude Silver Dollar of merger in which ArcLight would acquire each outstanding Gathering Bakken Gathering publicly-held common unit in AMID for $5.25 in cash (the Offshore Pipelines

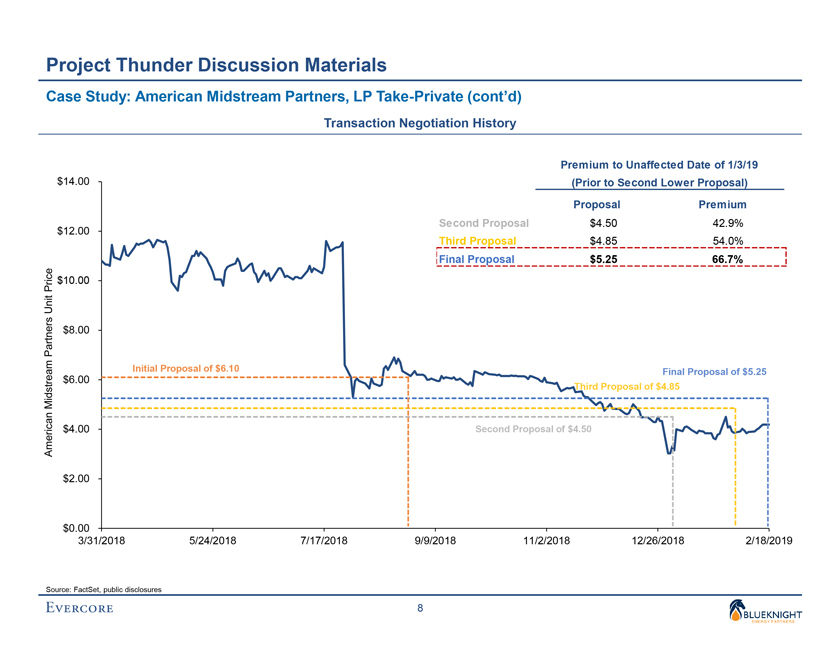

“Consideration”) Delta House NGL Pipelines Terminal Truckyard ï,„ On September 27, 2018, ArcLight provided an offer of $6.10 per Cushing unit, which was revised to $4.50 per unit on January 2, 2019 Terminal Natural Gas

after AMID’s unit price had declined substantially Transportation io Permian G&P E. Texas G&P Gulf Coast G&P ï,„ On February 1, 2019, ArcLight revised its offer to $4.85 per unit Silver Dollar and additional

negotiations between ArcLight and the conflicts Crude Offshore Gathering Pipelines committee resulted in a revised offer on February 18, 2019 of S. Texas Delta House $5.25 per unit G&P Transaction Statistics Consideration $5.25 •

Represented a 66.7% premium to the closing unit price LP Units Outstanding1 (MM) 55.4 at January 3, 2019, the day prior to the announcement AMID LP Equity Value $290.9 of the January 2, 2019 proposal) 2 Plus: AMID Net Debt 1,132.4 Plus:

Liquidation Value of Series A-1 Convertible Preferred Units 3 142.3 Plus: Liquidation Value of Series A-2 Convertible Preferred Units 4 60.9 ï® AMID consisted

of nine distinct segments of assets including natural 5 Plus: Liquidation Value of Series C Convertible Preferred Units 137.2 gas gathering and processing, offshore floating production systems Transaction Value $1,763.8 and refined products

terminals, among others 6 Transaction Value / 2018A EBITDA 11.1x (Transaction Value + 2019E Growth Capital Expenditures + Acquisitions) 10.4 / 2019E EBITDA7 Source: Public filings, Bloomberg 1. As of June 30, 2019 and includes 980,889 general

partner units and 381,149 LTIP units issued from March 2019 to June 2019 2. Net debt as of June 30, 2019 3. 7,940,322 Series A-1 convertible preferred units multiplied by the liquidation value of $17.50

per unit (adjusted for accrued 1Q19 and 2Q19 distributions and accrued interest on 1Q19 distribution) 4. 3,401,875 Series A-2 convertible preferred units multiplied by the liquidation value of $17.50 per unit

(adjusted for accrued 1Q19 and 2Q19 distributions and accrued interest on 1Q19 distribution) 5. 9,514,330 Series C convertible preferred units multiplied by the liquidation value of $14.00 per unit (adjusted for accrued 1Q19 and 2Q19 distributions

and accrued interest on 1Q19 distribution) 6. Pro forma for sale of refined product terminals to Sunoco LP 7. Transaction value adjusted for 2019E growth capital expenditures and acquisitions 7

[***] = Certain

information has been excluded from this exhibit because it is both not material and would likely

cause harm to the company if publicly

disclosed.