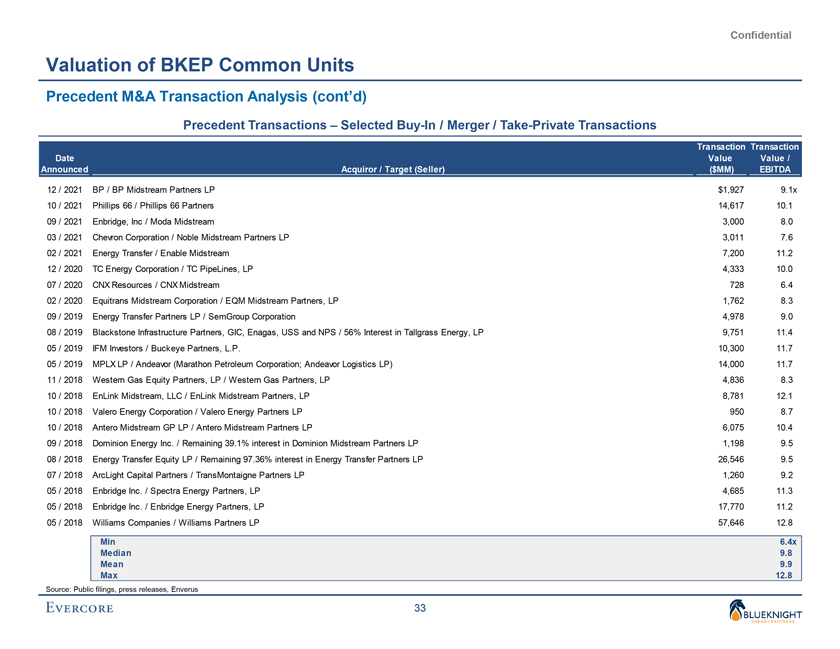

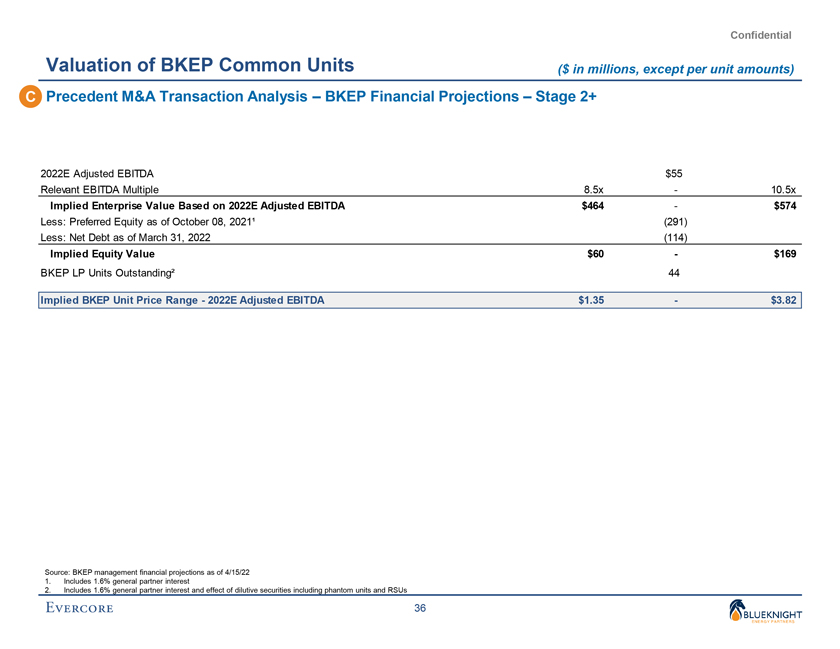

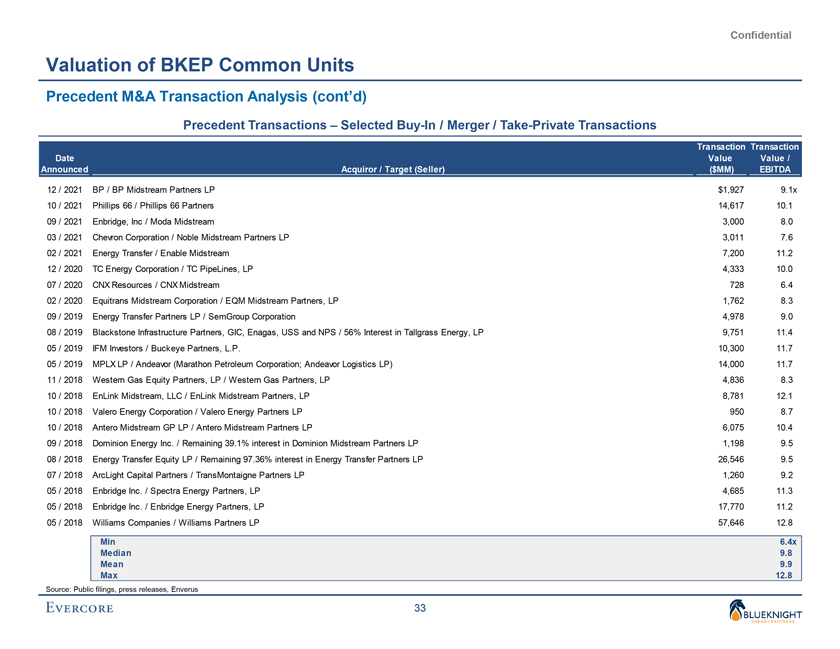

Confidential Valuation of BKEP Common Units Precedent M&A Transaction Analysis (cont’d) Precedent

Transactions – Selected Buy-In / Merger / Take-Private Transactions Transaction Transaction Date Value Value / Announced Acquiror / Target (Seller) ($MM) EBITDA 12 / 2021 BP / BP Midstream Partners LP

$1,927 9.1x 10 / 2021 Phillips 66 / Phillips 66 Partners 14,617 10.1 09 / 2021 Enbridge, Inc / Moda Midstream 3,000 8.0 03 / 2021 Chevron Corporation / Noble Midstream Partners LP 3,011 7.6 02 / 2021 Energy Transfer / Enable Midstream 7,200 11.2 12

/ 2020 TC Energy Corporation / TC PipeLines, LP 4,333 10.0 07 / 2020 CNX Resources / CNX Midstream 728 6.4 02 / 2020 Equitrans Midstream Corporation / EQM Midstream Partners, LP 1,762 8.3 09 / 2019 Energy Transfer Partners LP / SemGroup Corporation

4,978 9.0 08 / 2019 Blackstone Infrastructure Partners, GIC, Enagas, USS and NPS / 56% Interest in Tallgrass Energy, LP 9,751 11.4 05 / 2019 IFM Investors / Buckeye Partners, L.P. 10,300 11.7 05 / 2019 MPLX LP / Andeavor (Marathon Petroleum

Corporation; Andeavor Logistics LP) 14,000 11.7 11 / 2018 Western Gas Equity Partners, LP / Western Gas Partners, LP 4,836 8.3 10 / 2018 EnLink Midstream, LLC / EnLink Midstream Partners, LP 8,781 12.1 10 / 2018 Valero Energy Corporation / Valero

Energy Partners LP 950 8.7 10 / 2018 Antero Midstream GP LP / Antero Midstream Partners LP 6,075 10.4 09 / 2018 Dominion Energy Inc. / Remaining 39.1% interest in Dominion Midstream Partners LP 1,198 9.5 08 / 2018 Energy Transfer Equity LP /

Remaining 97.36% interest in Energy Transfer Partners LP 26,546 9.5 07 / 2018 ArcLight Capital Partners / TransMontaigne Partners LP 1,260 9.2 05 / 2018 Enbridge Inc. / Spectra Energy Partners, LP 4,685 11.3 05 / 2018 Enbridge Inc. / Enbridge Energy

Partners, LP 17,770 11.2 05 / 2018 Williams Companies / Williams Partners LP 57,646 12.8 Min 6.4x Median 9.8 Mean 9.9 Max 12.8 Source: Public filings, press releases, Enverus 33

[***] = Certain

information has been excluded from this exhibit because it is both not material and would likely

cause harm to the company if publicly

disclosed.