Exhibit (c)(17) STRICTLY CONFIDENTIAL Project Merle Discussion Materials December 21, 2021 / Confidential Jefferies LLC Member SIPC

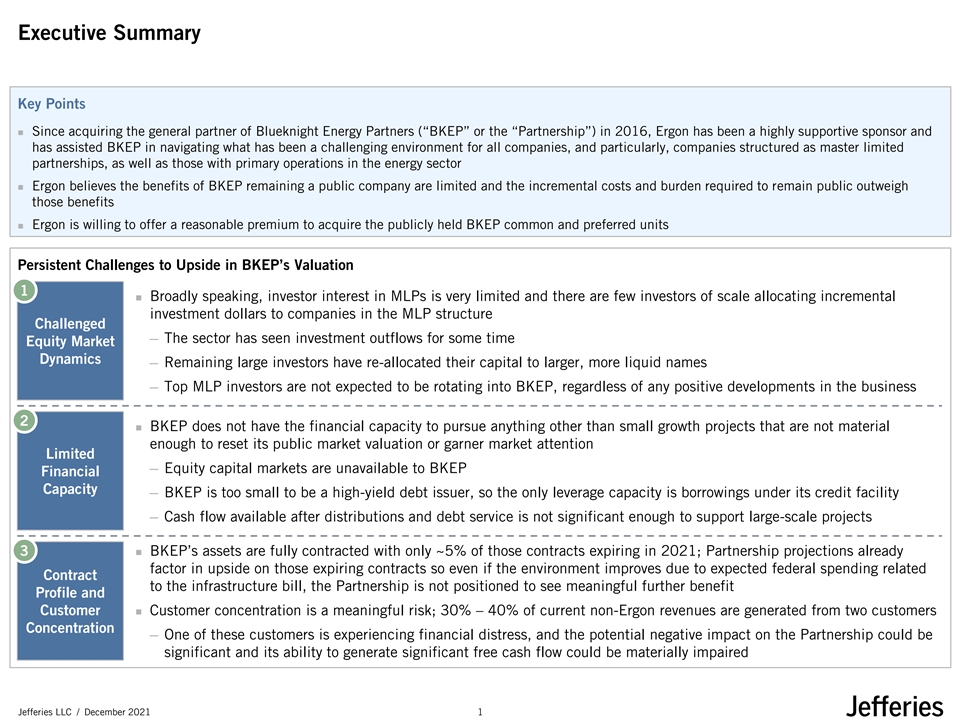

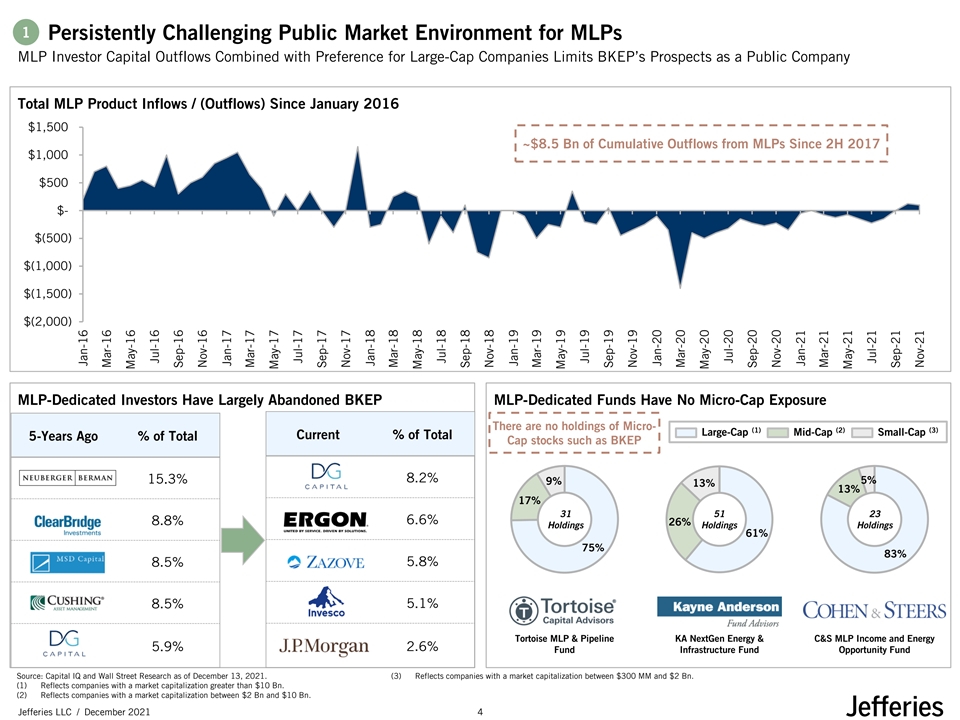

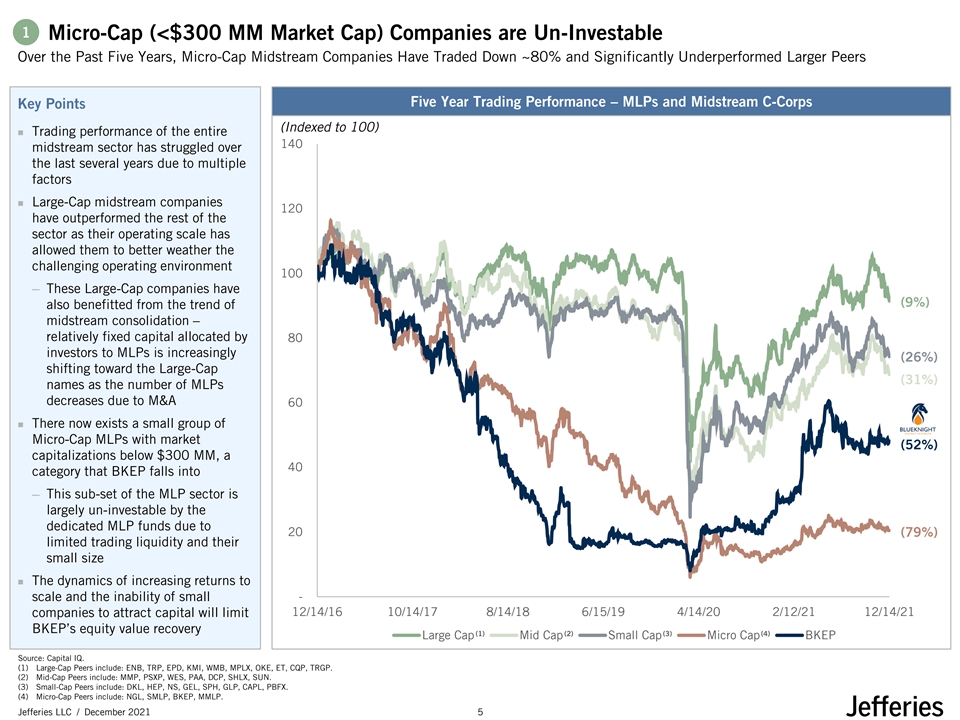

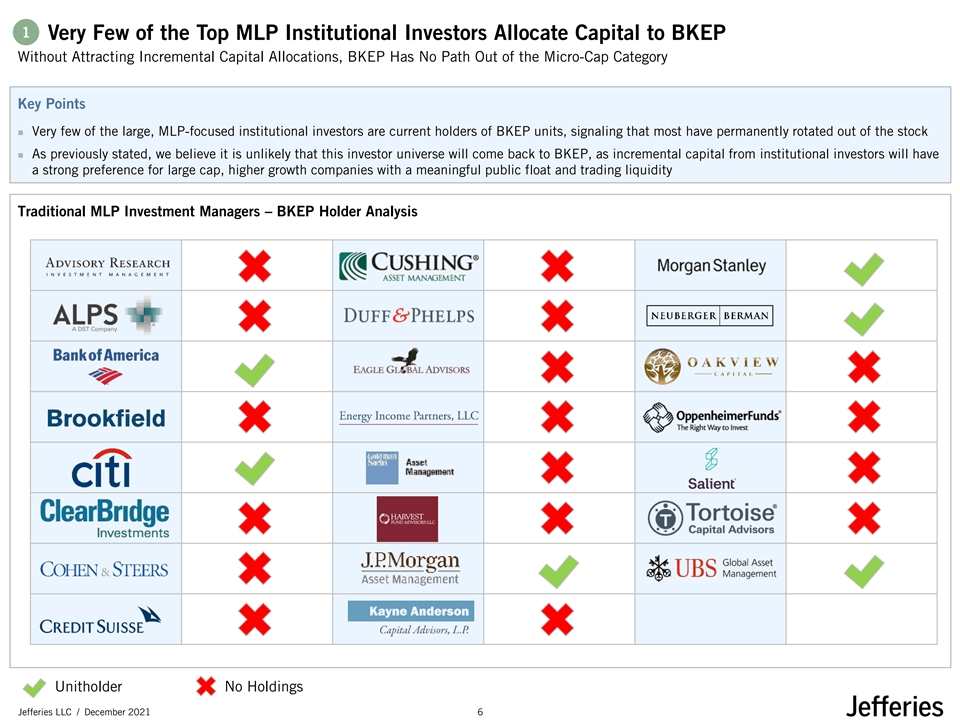

Executive Summary Key Points ◼ Since acquiring the general partner of Blueknight Energy Partners (“BKEP” or the “Partnership”) in 2016, Ergon has been a highly supportive sponsor and has assisted BKEP in navigating what has been a challenging environment for all companies, and particularly, companies structured as master limited partnerships, as well as those with primary operations in the energy sector ◼ Ergon believes the benefits of BKEP remaining a public company are limited and the incremental costs and burden required to remain public outweigh those benefits ◼ Ergon is willing to offer a reasonable premium to acquire the publicly held BKEP common and preferred units Persistent Challenges to Upside in BKEP’s Valuation 1 ◼ Broadly speaking, investor interest in MLPs is very limited and there are few investors of scale allocating incremental investment dollars to companies in the MLP structure Challenged ─ The sector has seen investment outflows for some time Equity Market Dynamics ─ Remaining large investors have re-allocated their capital to larger, more liquid names ─ Top MLP investors are not expected to be rotating into BKEP, regardless of any positive developments in the business 2 ◼ BKEP does not have the financial capacity to pursue anything other than small growth projects that are not material enough to reset its public market valuation or garner market attention Limited ─ Equity capital markets are unavailable to BKEP Financial Capacity ─ BKEP is too small to be a high-yield debt issuer, so the only leverage capacity is borrowings under its credit facility ─ Cash flow available after distributions and debt service is not significant enough to support large-scale projects 3◼ BKEP’s assets are fully contracted with only ~5% of those contracts expiring in 2021; Partnership projections already factor in upside on those expiring contracts so even if the environment improves due to expected federal spending related Contract to the infrastructure bill, the Partnership is not positioned to see meaningful further benefit Profile and Customer ◼ Customer concentration is a meaningful risk; 30% – 40% of current non-Ergon revenues are generated from two customers Concentration ─ One of these customers is experiencing financial distress, and the potential negative impact on the Partnership could be significant and its ability to generate significant free cash flow could be materially impaired Jefferies LLC / December 2021 1

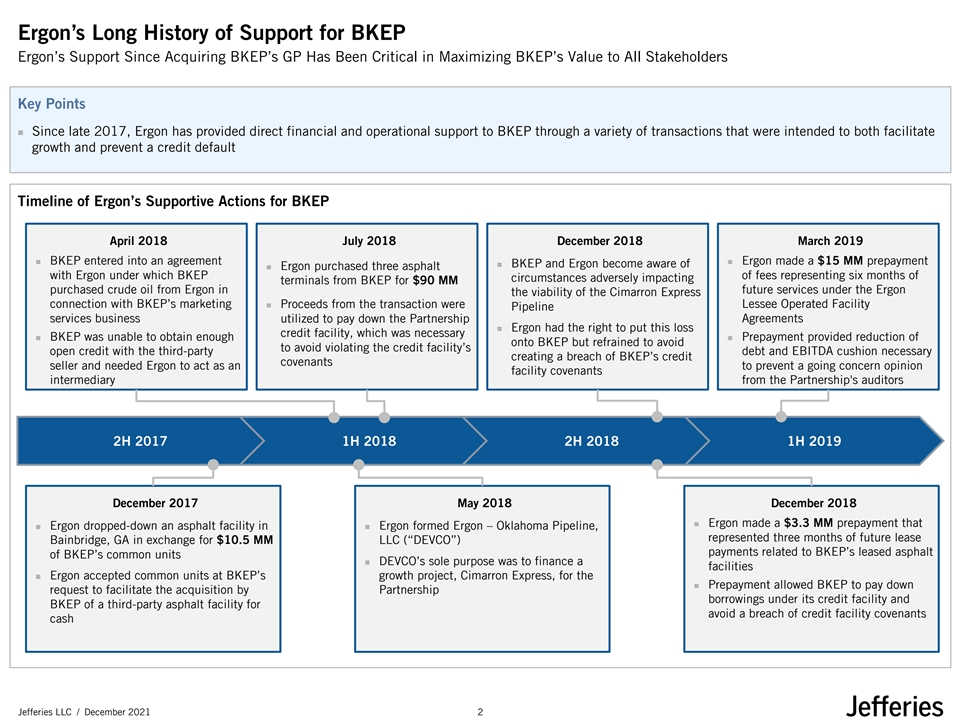

Ergon’s Long History of Support for BKEP Ergon’s Support Since Acquiring BKEP’s GP Has Been Critical in Maximizing BKEP’s Value to All Stakeholders Key Points ◼ Since late 2017, Ergon has provided direct financial and operational support to BKEP through a variety of transactions that were intended to both facilitate growth and prevent a credit default Timeline of Ergon’s Supportive Actions for BKEP April 2018 July 2018 December 2018 March 2019 ◼ BKEP entered into an agreement ◼ Ergon made a $15 MM prepayment ◼ BKEP and Ergon become aware of ◼ Ergon purchased three asphalt with Ergon under which BKEP of fees representing six months of circumstances adversely impacting terminals from BKEP for $90 MM purchased crude oil from Ergon in future services under the Ergon the viability of the Cimarron Express connection with BKEP’s marketing ◼ Proceeds from the transaction were Lessee Operated Facility Pipeline services business utilized to pay down the Partnership Agreements ◼ Ergon had the right to put this loss credit facility, which was necessary ◼ BKEP was unable to obtain enough ◼ Prepayment provided reduction of onto BKEP but refrained to avoid to avoid violating the credit facility’s open credit with the third-party debt and EBITDA cushion necessary creating a breach of BKEP’s credit covenants seller and needed Ergon to act as an to prevent a going concern opinion facility covenants intermediary from the Partnership's auditors 2H 2017 1H 2018 2H 2018 1H 2019 December 2017 May 2018 December 2018 ◼ Ergon made a $3.3 MM prepayment that ◼ Ergon dropped-down an asphalt facility in ◼ Ergon formed Ergon – Oklahoma Pipeline, represented three months of future lease Bainbridge, GA in exchange for $10.5 MM LLC (“DEVCO”) payments related to BKEP’s leased asphalt of BKEP’s common units ◼ DEVCO’s sole purpose was to finance a facilities ◼ Ergon accepted common units at BKEP’s growth project, Cimarron Express, for the ◼ Prepayment allowed BKEP to pay down request to facilitate the acquisition by Partnership borrowings under its credit facility and BKEP of a third-party asphalt facility for avoid a breach of credit facility covenants cash Jefferies LLC / December 2021 2

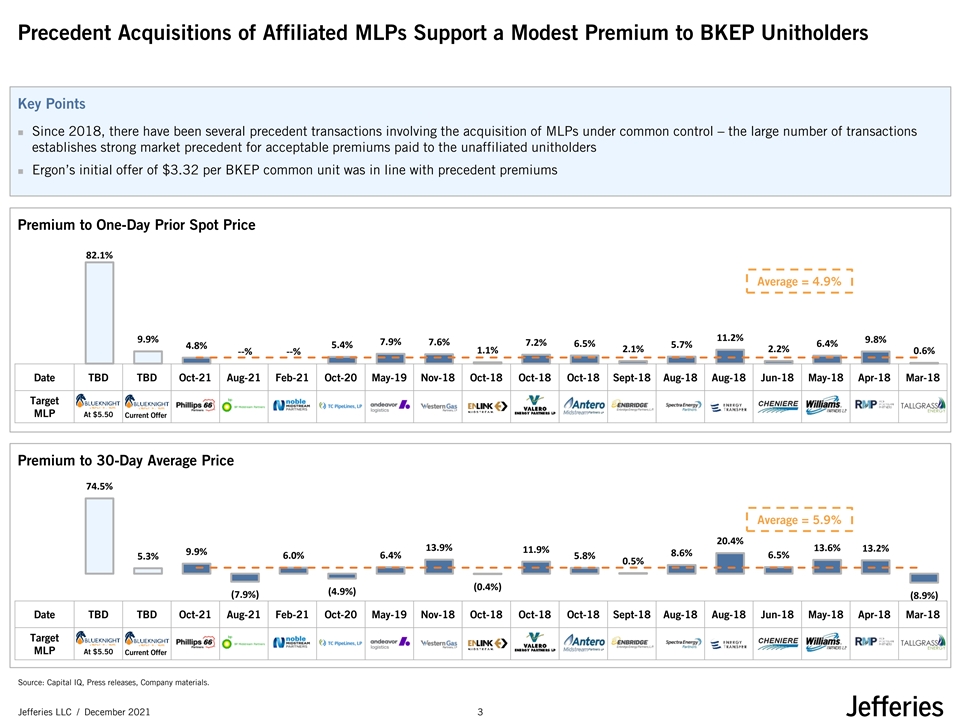

Precedent Acquisitions of Affiliated MLPs Support a Modest Premium to BKEP Unitholders Key Points ◼ Since 2018, there have been several precedent transactions involving the acquisition of MLPs under common control – the large number of transactions establishes strong market precedent for acceptable premiums paid to the unaffiliated unitholders ◼ Ergon’s initial offer of $3.32 per BKEP common unit was in line with precedent premiums Premium to One-Day Prior Spot Price 82.1% Average = 4.9% 11.2% 9.9% 9.8% 7.9% 7.6% 7.2% 6.5% 6.4% 5.4% 5.7% 4.8% 2.1% 2.2% 1.1% --% --% 0.6% Date TBD TBD Oct-21 Aug-21 Feb-21 Oct-20 May-19 Nov-18 Oct-18 Oct-18 Oct-18 Sept-18 Aug-18 Aug-18 Jun-18 May-18 Apr-18 Mar-18 Target MLP At $5.50 Current Offer Premium to 30-Day Average Price 74.5% Average = 5.9% 20.4% 13.9% 13.6% 13.2% 11.9% 9.9% 8.6% 6.0% 6.4% 5.8% 6.5% 5.3% 0.5% (0.4%) (4.9%) (7.9%) (8.9%) Date TBD TBD Oct-21 Aug-21 Feb-21 Oct-20 May-19 Nov-18 Oct-18 Oct-18 Oct-18 Sept-18 Aug-18 Aug-18 Jun-18 May-18 Apr-18 Mar-18 Target MLP At $5.50 Current Offer Source: Capital IQ, Press releases, Company materials. Jefferies LLC / December 2021 3

1 Persistently Challenging Public Market Environment for MLPs MLP Investor Capital Outflows Combined with Preference for Large-Cap Companies Limits BKEP’s Prospects as a Public Company Total MLP Product Inflows / (Outflows) Since January 2016 $1,500 ~$8.5 Bn of Cumulative Outflows from MLPs Since 2H 2017 $1,000 $500 $- $(500) $(1,000) $(1,500) $(2,000) MLP-Dedicated Investors Have Largely Abandoned BKEP MLP-Dedicated Funds Have No Micro-Cap Exposure There are no holdings of Micro- (1) (2) (3) Large-Cap Mid-Cap Small-Cap Current % of Total 5-Years Ago % of Total Cap stocks such as BKEP 8.2% 15.3% 5% 9% 13% 13% 17% 31 51 23 6.6% 8.8% 26% Holdings Holdings Holdings 61% 75% 83% 8.5% 5.8% 8.5% 5.1% Tortoise MLP & Pipeline KA NextGen Energy & C&S MLP Income and Energy 2.6% 5.9% Fund Infrastructure Fund Opportunity Fund Source: Capital IQ and Wall Street Research as of December 13, 2021. (3) Reflects companies with a market capitalization between $300 MM and $2 Bn. (1) Reflects companies with a market capitalization greater than $10 Bn. (2) Reflects companies with a market capitalization between $2 Bn and $10 Bn. Jefferies LLC / December 2021 4 Jan-16 Mar-16 May-16 Jul-16 Sep-16 Nov-16 Jan-17 Mar-17 May-17 Jul-17 Sep-17 Nov-17 Jan-18 Mar-18 May-18 Jul-18 Sep-18 Nov-18 Jan-19 Mar-19 May-19 Jul-19 Sep-19 Nov-19 Jan-20 Mar-20 May-20 Jul-20 Sep-20 Nov-20 Jan-21 Mar-21 May-21 Jul-21 Sep-21 Nov-21

1 Micro-Cap (<$300 MM Market Cap) Companies are Un-Investable Over the Past Five Years, Micro-Cap Midstream Companies Have Traded Down ~80% and Significantly Underperformed Larger Peers Five Year Trading Performance – MLPs and Midstream C-Corps Key Points (Indexed to 100) ◼ Trading performance of the entire 140 midstream sector has struggled over the last several years due to multiple factors ◼ Large-Cap midstream companies 120 have outperformed the rest of the sector as their operating scale has allowed them to better weather the challenging operating environment 100 ─ These Large-Cap companies have (9%) also benefitted from the trend of midstream consolidation – relatively fixed capital allocated by 80 investors to MLPs is increasingly (26%) shifting toward the Large-Cap (31%) names as the number of MLPs decreases due to M&A 60 ◼ There now exists a small group of Micro-Cap MLPs with market (52%) capitalizations below $300 MM, a 40 category that BKEP falls into ─ This sub-set of the MLP sector is largely un-investable by the dedicated MLP funds due to 20 (79%) limited trading liquidity and their small size ◼ The dynamics of increasing returns to scale and the inability of small - 12/14/16 10/14/17 8/14/18 6/15/19 4/14/20 2/12/21 12/14/21 companies to attract capital will limit BKEP’s equity value recovery (1) (2) (3) (4) Large Cap Mid Cap Small Cap Micro Cap BKEP Source: Capital IQ. (1) Large-Cap Peers include: ENB, TRP, EPD, KMI, WMB, MPLX, OKE, ET, CQP, TRGP. (2) Mid-Cap Peers include: MMP, PSXP, WES, PAA, DCP, SHLX, SUN. (3) Small-Cap Peers include: DKL, HEP, NS, GEL, SPH, GLP, CAPL, PBFX. (4) Micro-Cap Peers include: NGL, SMLP, BKEP, MMLP. Jefferies LLC / December 2021 5

1 Very Few of the Top MLP Institutional Investors Allocate Capital to BKEP Without Attracting Incremental Capital Allocations, BKEP Has No Path Out of the Micro-Cap Category Key Points ◼ Very few of the large, MLP-focused institutional investors are current holders of BKEP units, signaling that most have permanently rotated out of the stock ◼ As previously stated, we believe it is unlikely that this investor universe will come back to BKEP, as incremental capital from institutional investors will have a strong preference for large cap, higher growth companies with a meaningful public float and trading liquidity Traditional MLP Investment Managers – BKEP Holder Analysis Unitholder No Holdings Jefferies LLC / December 2021 6

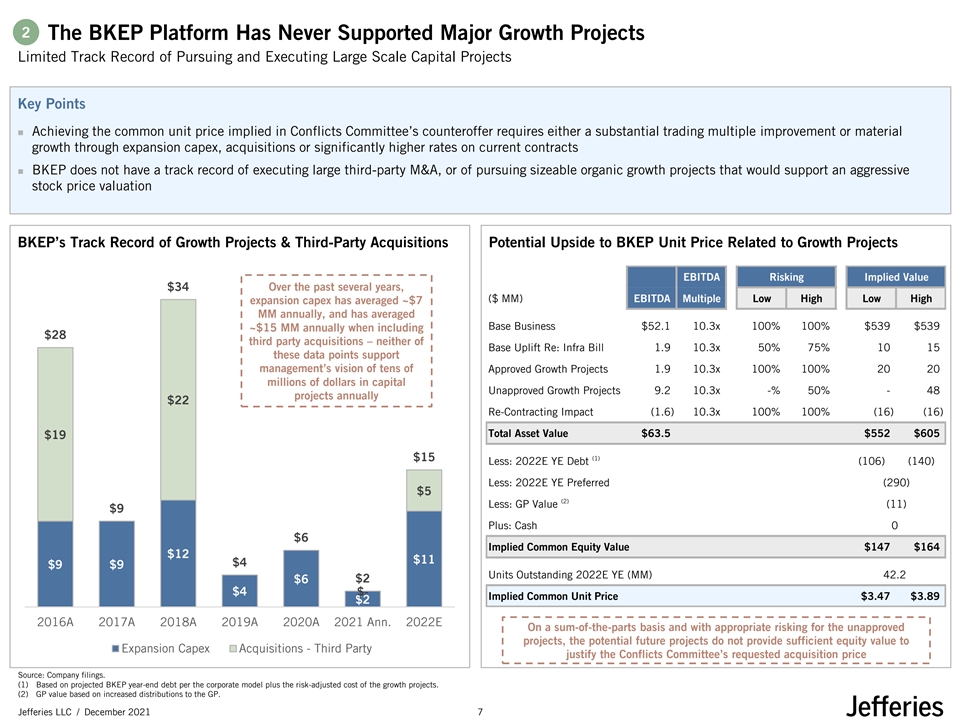

2 The BKEP Platform Has Never Supported Major Growth Projects Limited Track Record of Pursuing and Executing Large Scale Capital Projects Key Points ◼ Achieving the common unit price implied in Conflicts Committee’s counteroffer requires either a substantial trading multiple improvement or material growth through expansion capex, acquisitions or significantly higher rates on current contracts ◼ BKEP does not have a track record of executing large third-party M&A, or of pursuing sizeable organic growth projects that would support an aggressive stock price valuation BKEP’s Track Record of Growth Projects & Third-Party Acquisitions Potential Upside to BKEP Unit Price Related to Growth Projects EBITDA Risking Implied Value $34 Over the past several years, ($ MM) EBITDA Multiple Low High Low High expansion capex has averaged ~$7 MM annually, and has averaged Base Business $52.1 10.3x 100% 100% $539 $539 ~$15 MM annually when including $28 third party acquisitions – neither of Base Uplift Re: Infra Bill 1.9 10.3x 50% 75% 10 15 these data points support management’s vision of tens of Approved Growth Projects 1.9 10.3x 100% 100% 20 20 millions of dollars in capital Unapproved Growth Projects 9.2 10.3x -% 50% - 48 projects annually $22 Re-Contracting Impact (1.6) 10.3x 100% 100% (16) (16) Total Asset Value $63.5 $552 $605 $19 (1) $15 Less: 2022E YE Debt (106) (140) Less: 2022E YE Preferred (290) $5 (2) Less: GP Value (11) $9 Plus: Cash 0 $6 Implied Common Equity Value $147 $164 $12 $11 $4 $9 $9 Units Outstanding 2022E YE (MM) 42.2 $2 $6 $4 $- Implied Common Unit Price $3.47 $3.89 $2 2016A 2017A 2018A 2019A 2020A 2021 Ann. 2022E On a sum-of-the-parts basis and with appropriate risking for the unapproved projects, the potential future projects do not provide sufficient equity value to Expansion Capex Acquisitions - Third Party justify the Conflicts Committee’s requested acquisition price Source: Company filings. (1) Based on projected BKEP year-end debt per the corporate model plus the risk-adjusted cost of the growth projects. (2) GP value based on increased distributions to the GP. Jefferies LLC / December 2021 7

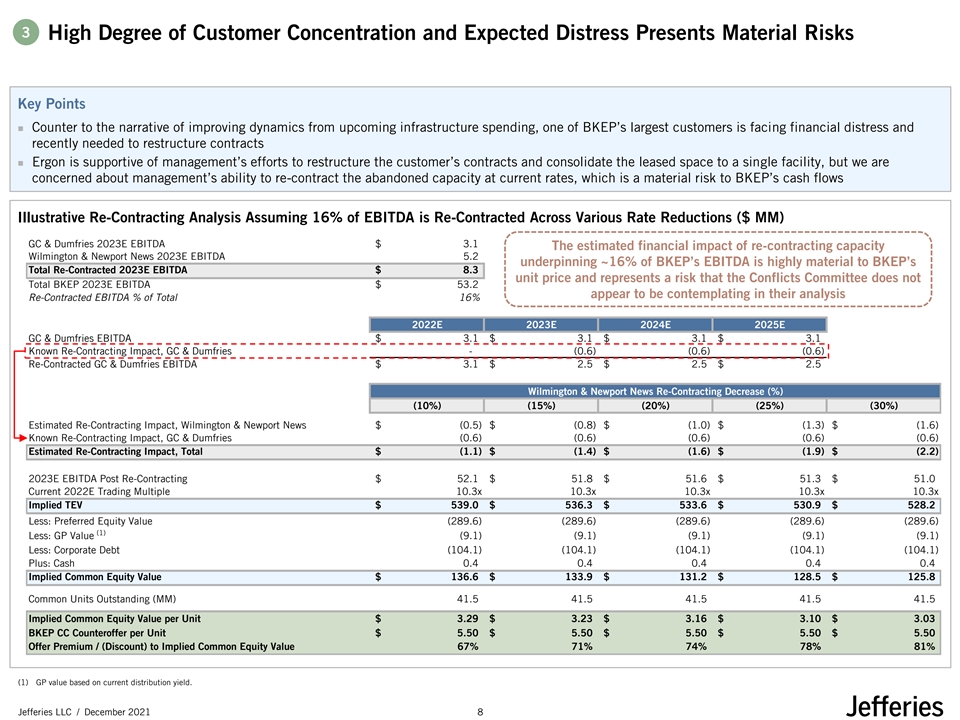

3 High Degree of Customer Concentration and Expected Distress Presents Material Risks Key Points ◼ Counter to the narrative of improving dynamics from upcoming infrastructure spending, one of BKEP’s largest customers is facing financial distress and recently needed to restructure contracts ◼ Ergon is supportive of management’s efforts to restructure the customer’s contracts and consolidate the leased space to a single facility, but we are concerned about management’s ability to re-contract the abandoned capacity at current rates, which is a material risk to BKEP’s cash flows Illustrative Re-Contracting Analysis Assuming 16% of EBITDA is Re-Contracted Across Various Rate Reductions ($ MM) GC & Dumfries 2023E EBITDA $ 3.1 The estimated financial impact of re-contracting capacity Wilmington & Newport News 2023E EBITDA 5.2 underpinning ~16% of BKEP’s EBITDA is highly material to BKEP’s Total Re-Contracted 2023E EBITDA $ 8.3 unit price and represents a risk that the Conflicts Committee does not Total BKEP 2023E EBITDA $ 53.2 appear to be contemplating in their analysis Re-Contracted EBITDA % of Total 16% 2022E 2023E 2024E 2025E GC & Dumfries EBITDA $ 3.1 $ 3.1 $ 3.1 $ 3.1 Known Re-Contracting Impact, GC & Dumfries - (0.6) (0.6) (0.6) Re-Contracted GC & Dumfries EBITDA $ 3.1 $ 2.5 $ 2.5 $ 2.5 Wilmington & Newport News Re-Contracting Decrease (%) (10%) (15%) (20%) (25%) (30%) Estimated Re-Contracting Impact, Wilmington & Newport News $ (0.5) $ (0.8) $ (1.0) $ (1.3) $ (1.6) Known Re-Contracting Impact, GC & Dumfries (0.6) (0.6) (0.6) (0.6) (0.6) Estimated Re-Contracting Impact, Total $ (1.1) $ (1.4) $ (1.6) $ (1.9) $ (2.2) 2023E EBITDA Post Re-Contracting $ 52.1 $ 51.8 $ 51.6 $ 51.3 $ 51.0 Current 2022E Trading Multiple 10.3x 10.3x 10.3x 10.3x 10.3x Implied TEV $ 539.0 $ 536.3 $ 533.6 $ 530.9 $ 528.2 Less: Preferred Equity Value (289.6) (289.6) (289.6) (289.6) (289.6) (1) Less: GP Value (9.1) (9.1) (9.1) (9.1) (9.1) Less: Corporate Debt (104.1) (104.1) (104.1) (104.1) (104.1) Plus: Cash 0.4 0.4 0.4 0.4 0.4 Implied Common Equity Value $ 136.6 $ 133.9 $ 131.2 $ 128.5 $ 125.8 Common Units Outstanding (MM) 41.5 41.5 41.5 41.5 41.5 Implied Common Equity Value per Unit $ 3.29 $ 3.23 $ 3.16 $ 3.10 $ 3.03 BKEP CC Counteroffer per Unit $ 5.50 $ 5.50 $ 5.50 $ 5.50 $ 5.50 Offer Premium / (Discount) to Implied Common Equity Value 67% 71% 74% 78% 81% (1) GP value based on current distribution yield. Jefferies LLC / December 2021 8